Cautionary Statement

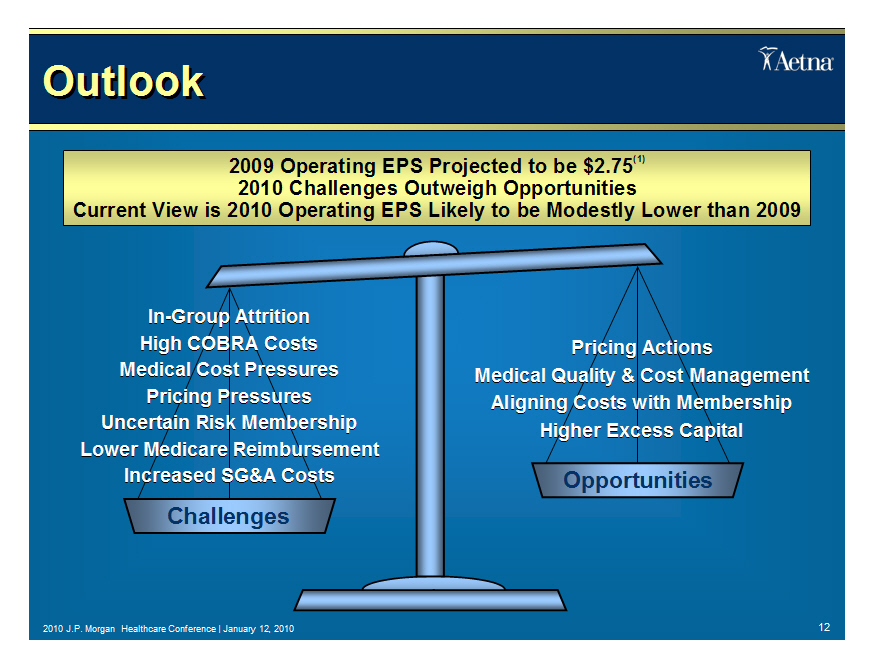

CAUTIONARY STATEMENT; ADDITIONAL INFORMATION -- Certain information in this

presentation is forward-looking, including our current estimates, projections

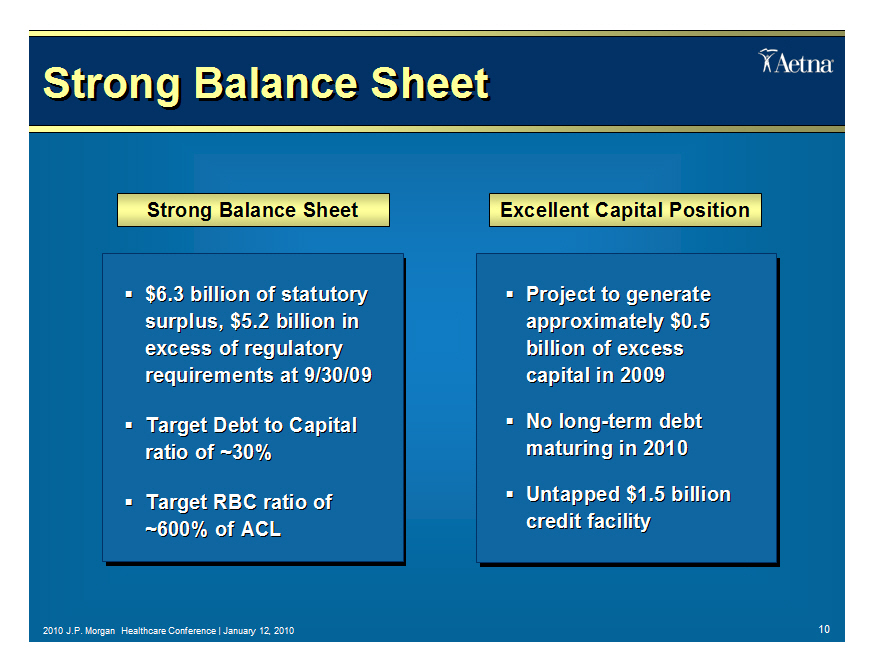

and views as to 2009 excess capital generation; 2009 operating earnings per

share; 2010 operating earnings per share; weighted average diluted shares; our

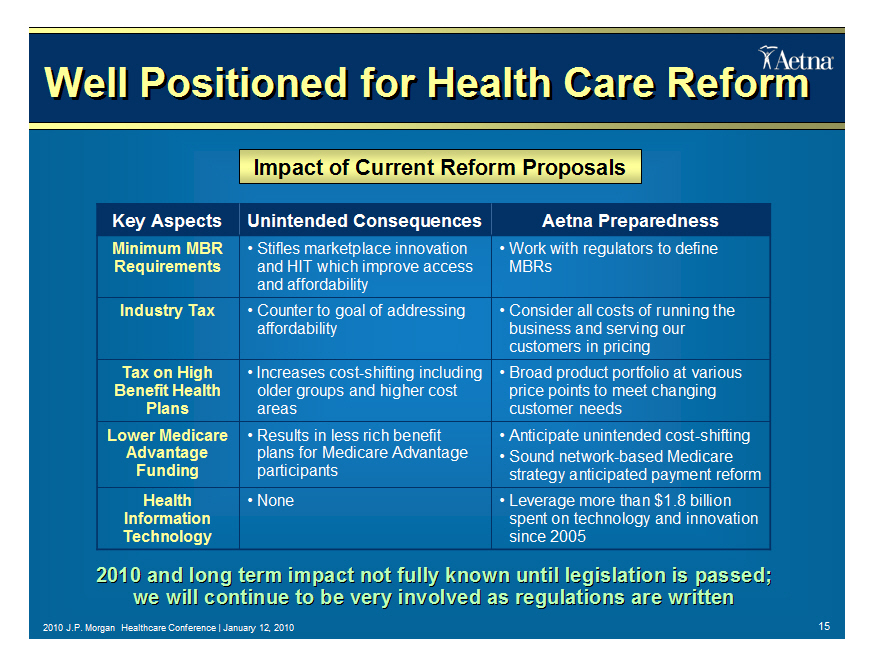

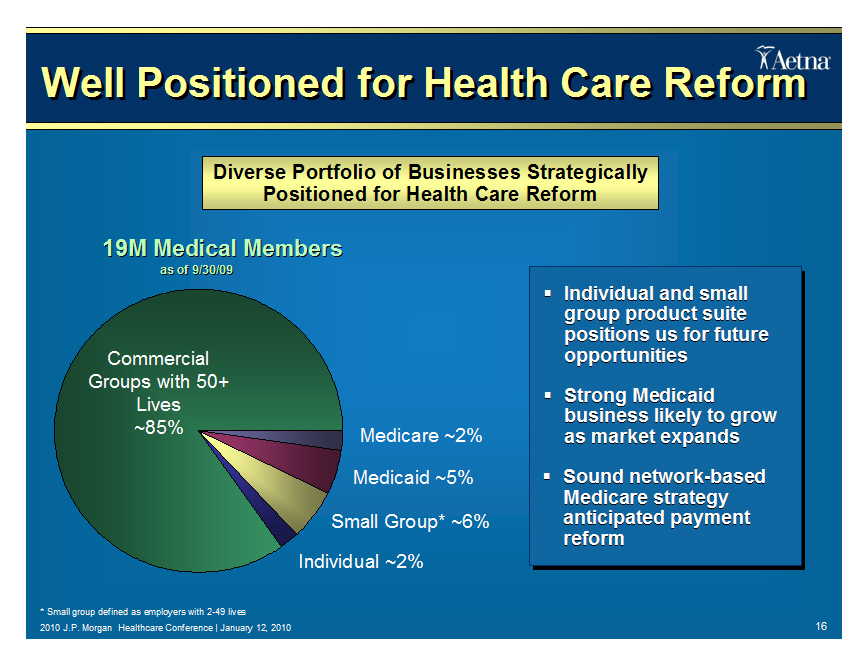

challenges and opportunities for 2010; our ability to respond to health care

reform; our ability to hold assets to maturity; our ability to grow our Medicaid

business; pre-tax operating margin; and fourth quarter 2009 severance and

facility charge. Forward-looking information is based on management's estimates,

assumptions and projections, and is subject to significant uncertainties and

other factors, many of which are beyond Aetna's control. Important risk factors

could cause actual future results and other future events to differ materially

from those currently estimated by management, including unanticipated increases

in medical costs (including increased intensity or medical utilization as a

result of the H1N1 flu, increased COBRA participation rates or otherwise;

changes in membership mix to higher cost or lower-premium products or

membership-adverse selection; changes in medical cost estimates due to the

necessary extensive judgment that is used in the medical cost estimation

process, the considerable variability inherent in such estimates, and the

sensitivity of such estimates to changes in medical claims payment patterns and

changes in medical cost trends; increases resulting from unfavorable changes in

contracting or re-contracting with providers; and increased pharmacy costs);

adverse and less predictable economic conditions in the U.S. and abroad

(including unanticipated levels of or rate of increase in the unemployment rate)

which can significantly and adversely affect Aetna's business and profitability;

failure to achieve desired rate increases and/or profitable membership growth

due to the slowing economy and/or significant competition, especially in key

geographic markets where membership is concentrated; adverse changes in federal

or state government laws, policies or regulations (including legislative

proposals that would affect our business model and/or limit our ability to price

for the risk we assume and/or reflect reasonable costs or profits in our pricing

and other proposals, such as initiatives to mandate minimum medical benefit

ratios or eliminate or reduce ERISA pre-emption of state laws, that would

increase potential litigation exposure or mandate coverage of certain health

benefits); continued volatility and further deterioration of the U.S. and global

capital markets, including fluctuations in interest rates, fixed income and

equity prices and the value of financial assets, along with the general

deterioration in the commercial paper, capital and credit markets, which can

adversely impact the value of Aetna's investment portfolio, Aetna's

profitability by reducing net investment income and/or Aetna's financial

position by causing us to realize additional impairments on our investments;

adverse pricing or funding actions by federal or state government payors; the

ability to improve relations with providers while taking actions to reduce

medical costs and/or expand the services we offer; and changes in Aetna's actual

tax rate, the number of severed employees, the amounts payable to severed

employees, expenditures associated with vacating leased properties, our ability

to sublease leased properties and the timing of future workforce reductions, in

each case compared to the amounts we assumed in estimating the expected fourth

quarter 2009 severance and facility charge. Other important risk factors

include, but are not limited to: adverse changes in size, product mix or medical

cost experience of membership; increases in medical costs or Group Insurance

claims resulting from any epidemics, acts of terrorism or other extreme events;

the ability to reduce administrative expenses while maintaining targeted levels

of service and operating performance; the ability to successfully integrate our

businesses (including acquired businesses) and implement multiple strategic and

operational initiatives simultaneously; our ability to integrate, simplify, and

enhance our existing information technology systems and platforms to keep pace

with changing customer and regulatory needs; the outcome of various litigation

and regulatory matters, including litigation concerning, and ongoing reviews by

various regulatory authorities of, certain of our payment practices with respect

to out-of-network providers; and reputational issues arising from data security

breaches or other means. For more discussion of important risk factors that may

materially affect Aetna, please see the risk factors contained in Aetna's 2008

Annual Report on Form 10-K on file with the Securities and Exchange Commission

("SEC"), and Aetna's 2009 Quarterly Report on Form 10-Q for the quarter ended

September 30, 2009 (Aetna's "Third Quarter 10-Q") on file with the SEC. You also

should read Aetna's Third Quarter 10-Q for a discussion of Aetna's historical

results of operations and financial condition.

2010 J.P. Morgan Healthcare Conference | January 12, 2010

| | |