Exhibit 13.1

2014 Aetna Annual Report, Financial Report to Shareholders

Unless the context otherwise requires, references to the terms we, our, or us used throughout this 2014 Annual Report, Financial Report to Shareholders (the “Annual Report”) refer to Aetna Inc. (a Pennsylvania corporation) (“Aetna”) and its subsidiaries.

For your reference, we provide the following index to the Annual Report:

|

| |

| Page | Description |

| 2 - 72 | Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) - The MD&A provides a review of our operating results for the years 2012 through 2014, as well as our financial condition at December 31, 2014 and 2013. The MD&A should be read in conjunction with our consolidated financial statements and notes thereto. The MD&A includes the following: |

| 2 | Overview - We begin our MD&A with an overview of earnings, cash flows and significant developments for the last three years and our outlook for 2015. |

| 6 | Health Care - We discuss the factors affecting Health Care revenues and operating earnings in this section. |

| 11 | Group Insurance - We discuss the factors affecting Group Insurance operating earnings in this section. |

| 12 | Large Case Pensions - We discuss the factors affecting Large Case Pensions operating earnings and premiums, including the results of our discontinued products, in this section. |

| 14 | Investments - As an insurer, we have a significant investment portfolio to support our liabilities and capital. In this section, we discuss our investments and describe our evaluation of the risk of our market-sensitive instruments. |

| 16 | Liquidity and Capital Resources - In this section, we discuss our cash flows, financing resources, contractual obligations and other matters that may affect our liquidity and cash flows. |

| 20 | Critical Accounting Estimates - In this section, we discuss the accounting estimates we consider critical in preparing our financial statements. |

| 26 | Regulatory Environment - In this section, we discuss the regulatory environment in which we operate. |

| 42 | Forward-Looking Information/Risk Factors - We conclude our MD&A with a discussion of certain risks and uncertainties that, if developed into actual events, could have a material adverse impact on our business, cash flows, financial condition and/or operating results. |

| 73 | Selected Financial Data - We provide selected annual financial data for the most recent five years. |

| 74 | Consolidated Financial Statements - We include our consolidated balance sheets at December 31, 2014 and 2013 and the related consolidated statements of income, comprehensive income, shareholders’ equity and cash flows for each of the years 2012 through 2014. |

| 79 | Notes to Consolidated Financial Statements |

| 139 | Reports of Management and our Independent Registered Public Accounting Firm - We include a report on our responsibilities for internal control over financial reporting and financial statements, the oversight of our Audit Committee and KPMG LLP’s opinion on our consolidated financial statements and internal control over financial reporting. |

| 141 | Quarterly Data (unaudited) - We provide selected quarterly financial data for each of the last eight quarters. |

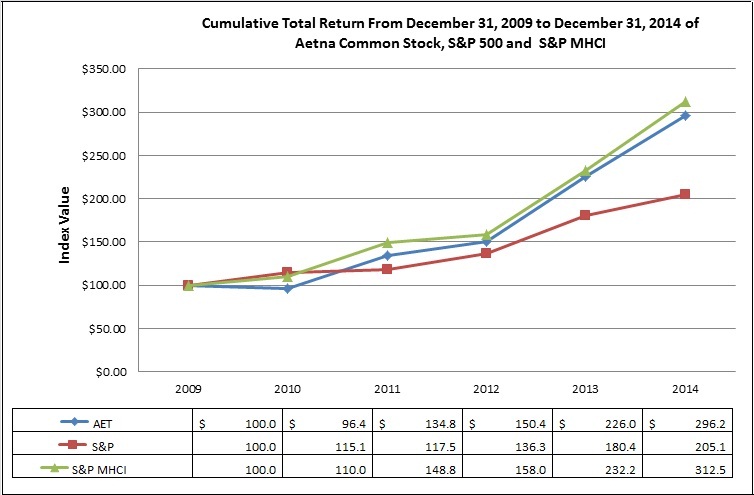

| 142 | Corporate Performance Graph - We provide a graph comparing the cumulative total shareholder return on our common stock to the cumulative total return on certain published indices for the years 2009 through 2014. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”)

OVERVIEW

We are one of the nation’s leading diversified health care benefits companies, serving an estimated 46 million people with information and resources to help them in consultation with their health care professionals make better informed decisions about their health care. We offer a broad range of traditional, voluntary and consumer-directed health insurance products and related services, including medical, pharmacy, dental, behavioral health, group life and disability plans, medical management capabilities, Medicaid health care management services, Medicare Advantage and Medicare supplement plans, workers’ compensation administrative services and health information technology products and services, such as Accountable Care Solutions (“ACS”). On May 7, 2013 (the “Acquisition Date”), we acquired Coventry Health Care, Inc. (“Coventry”). Our customers include employer groups, individuals, college students, part-time and hourly workers, health plans, health care providers (“providers”), governmental units, government-sponsored plans, labor groups and expatriates. Our operations are conducted in three business segments: Health Care, Group Insurance and Large Case Pensions.

The following MD&A provides a review of our financial condition at December 31, 2014 and December 31, 2013 and operating results for the years ended December 31, 2014, 2013 and 2012. Coventry’s results are recorded within our Health Care segment on and after the Acquisition Date for the year ended December 31, 2013 and for the entire year ended December 31, 2014. The Coventry acquisition significantly impacts the comparability of our results for 2014 to both 2013 and 2012, as only approximately eight months of Coventry’s results were included in 2013. This Overview should be read in conjunction with the entire MD&A, which contains detailed information that is important to understanding our operating results and financial condition, the consolidated financial statements and other data presented in this Annual Report. This Overview is qualified in its entirety by the full MD&A.

Summarized Results

|

| | | | | | | | | | | |

| (Millions) | 2014 |

| | 2013 |

| | 2012 |

|

| Revenue: | | | | | |

| Health Care | $ | 55,108.6 |

| | $ | 44,397.2 |

| | $ | 33,005.8 |

|

| Group Insurance | 2,489.8 |

| | 2,341.2 |

| | 2,147.5 |

|

| Large Case Pensions | 404.8 |

| | 556.2 |

| | 1,446.5 |

|

| Total revenue | 58,003.2 |

| | 47,294.6 |

| | 36,599.8 |

|

| Net income attributable to Aetna | 2,040.8 |

| | 1,913.6 |

| | 1,657.9 |

|

Operating earnings: (1) | | | | | |

| Health Care | 2,376.5 |

| | 2,267.4 |

| | 1,841.5 |

|

| Group Insurance | 171.0 |

| | 130.9 |

| | 164.4 |

|

| Large Case Pensions | 20.7 |

| | 21.2 |

| | 17.8 |

|

| Cash flows from operations | 3,372.8 |

| | 2,278.7 |

| | 1,824.9 |

|

| | | | | | |

| |

(1) | Our discussion of operating results for our reportable business segments is based on operating earnings, which is a non-GAAP measure of net income attributable to Aetna (the term “GAAP” refers to U.S. generally accepted accounting principles). Non-GAAP financial measures we disclose, such as operating earnings, should not be considered a substitute for, or superior to, financial measures determined or calculated in accordance with GAAP. Refer to “Segment Results and Use of Non-GAAP Measures in this Document” beginning on page 5 for a discussion of non-GAAP measures. Refer to pages 8, 12 and 13 for a reconciliation of operating earnings to net income attributable to Aetna for Health Care, Group Insurance and Large Case Pensions, respectively. |

We analyze our operating results based on operating earnings, which excludes from net income attributable to Aetna net realized capital gains and losses, amortization of other acquired intangible assets as well as other items, if any, that, neither relate to the ordinary course of our business nor reflect our underlying business performance. Operating earnings for the past three years were primarily generated from our Health Care segment.

Operating earnings in 2014 were higher than 2013 primarily due to the full-year effect of the inclusion of results from the May 2013 acquisition of Coventry, as well as higher underwriting margins (calculated as premiums less health care costs) in our Health Care segment and higher underwriting margins (calculated as premiums less current

and future benefits) in our Group Insurance segment, partially offset by increased investment spend to support our growth initiatives. Operating earnings in 2013 were higher than 2012 primarily due to the inclusion of results from the May 2013 acquisition of Coventry, as well as higher underwriting margins primarily in our Commercial Health Care business, partially offset by lower underwriting margins in our Government and Group Life businesses.

Total revenue increased in 2014 compared to 2013 primarily as a result of membership growth in our Health Care businesses and the effects of pricing actions designed to recover the fees and taxes mandated by the ACA (as defined below), as well as higher Health Care premiums from the May 2013 acquisition of Coventry. Total revenue increased in 2013 compared to 2012 primarily due to higher Health Care premiums from the May 2013 acquisition of Coventry as well as growth in our Medicare membership and increased Commercial Insured premiums, partially offset by lower group annuity conversion premium in our Large Case Pensions segment.

In 2014, our Health Care segment experienced higher medical Insured membership (where we assume all or a majority of the risk for medical and dental care costs) as well as higher medical membership in our administrative services contract (“ASC”) products (where the plan sponsor assumes all or a majority of the risk for medical and dental care costs). At December 31, 2014, we served approximately 23.5 million medical members (consisting of approximately 39% Insured members and 61% ASC members), 15.5 million dental members and 15.3 million pharmacy benefit management services members. At December 31, 2013, we served approximately 22.2 million medical members (consisting of approximately 39% Insured members and 61% ASC members), 14.1 million dental members and 14.2 million pharmacy benefit management services members. Refer to “Health Care - Membership” on page 10 for further information.

During the past three years our cash flows supported both new and ongoing initiatives.

We generated substantial cash flows in the past three years, which we used to support our ordinary course operating activities; growth strategies, including partially funding the Coventry acquisition, funding other acquisitions, and investing in our Government, Healthagen® and Consumer businesses; repurchasing our common stock; repurchasing our long-term debt; and increasing our shareholder dividend. During 2014, 2013 and 2012, we repurchased approximately 16 million, 23 million and 32 million shares of our common stock, respectively, at a cost of $1.2 billion in 2014 and $1.4 billion in both 2013 and 2012 under share repurchase programs authorized by Aetna’s Board of Directors (our “Board”).

Refer to “Liquidity and Capital” resources beginning on page 16 for additional information on our primary sources and uses of cash flows.

Health Care Reform

The Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 (collectively, “Health Care Reform” or “ACA”) has changed and will continue to make broad-based changes to the U.S. health care system which could significantly affect the U.S. economy and we expect will continue to significantly impact our business operations and financial results, including our pricing, our medical benefit ratios (“MBRs”) and the geographies in which our products are available. Health Care Reform presents us with new business opportunities, but also with new financial and regulatory challenges. It is reasonably possible that Health Care Reform, in the aggregate, could have a material adverse effect on our business operations and financial results.

On October 1, 2013, public health insurance exchanges (“Public Exchanges”) became available for consumers to access and begin the enrollment process for coverage beginning January 1, 2014.

We paid both our approximately $605 million portion of the ACA’s non tax-deductible health insurer fee and an approximately $298 million portion of our estimated 2014 ACA reinsurance contribution in 2014. Substantially all of these fees were recorded ratably each month within operating expenses. We project that our share of the 2015 Health Care Reform fees, assessments and taxes will be approximately $1.1 billion, which includes our share of the ACA’s health insurer fee, which we project will be approximately $900 million. Refer to Notes 2 and 5 of Notes to Consolidated Financial Statements beginning on pages 80 and 92, respectively, for additional information on the ACA’s health insurer fee and reinsurance program.

Federal budget negotiations, ongoing regulatory changes to Health Care Reform (such as the November 2013 action permitting renewal through 2014 of individual and small group insurance policies that do not comply with Health Care Reform and the March 2014 action permitting such renewal through 2017), pending efforts in the U.S. Congress to amend or restrict funding for various aspects of Health Care Reform and litigation challenging aspects of the law continue to create uncertainty about the ultimate impact of Health Care Reform. An example of this uncertainty is the litigation pending before the U.S. Supreme Court concerning whether the Internal Revenue Service may make tax credits available as a form of subsidy to individuals who purchase health insurance through Public Exchanges established by the federal government (“Federal Exchanges”). We will continue to enroll and insure members through the Federal Exchanges pending the resolution of this and other pending cases. If the payment of subsidies with respect to members who enroll through the Federal Exchanges ultimately is invalidated, it could result in a significant reduction in Aetna’s Public Exchange membership because almost all of Aetna’s Public Exchange membership is through Federal Exchanges, and most of those members benefit from a tax subsidy.

The availability of funding for the ACA’s risk corridor program is a second example of this uncertainty. In May 2014, the Centers for Medicare & Medicaid Services (“CMS”) published a final rule on Public Exchanges. The final rule provides that payments to health plans under the risk corridor program required by Health Care Reform will no longer be limited to the aggregate amount of the risk corridor collections received by the U.S. Department of Health and Human Services (“HHS”) over the duration of the risk corridor program. However, it is possible that payments to health plans under the risk corridor program will require additional appropriation legislation to be passed by the U.S. Congress. Additionally, in December 2014, the Consolidated and Further Continuing Appropriations Act was enacted, which among other things, prohibits HHS’s use of certain funds to pay HHS’s potential obligation under the ACA’s risk corridor program. As a result, we did not record any receivable under the ACA’s risk corridor program at December 31, 2014.

We cannot predict whether pending or future federal or state legislation or court proceedings, including future U.S. Congressional appropriations and the proceedings relating to tax credits for Federal Exchange members described above, will change various aspects of Health Care Reform or state level health care reform, nor can we predict the impact those changes will have on our business operations and/or financial results, but the effects could be materially adverse.

For additional information on Health Care Reform, refer to “Regulatory Environment” beginning on page 26, and for a discussion of certain factors that may cause our actual results to differ from currently anticipated results in connection with Health Care Reform, refer to “Forward-Looking Information/Risk Factors” beginning on page 42.

Outlook for 2015

2014 was a year of significant change for us and our industry, and we expect to continue to face significant business challenges and uncertainties in 2015. These challenges and uncertainties include: the continued collection in our premiums and fees or solving for the impact of the increase in 2015 fees, taxes and assessments imposed by Health Care Reform; the 2015 pricing of our Medicaid and Group Insurance businesses, which could negatively impact our 2015 underwriting margins as the 2015 pricing takes into account the strong performance we experienced in 2014; and the outcome of the pending U.S. Supreme Court case concerning the availability of tax credits for people who purchased health insurance through Public Exchanges established by the federal government. There is also the risk and uncertainty that medical cost trends could increase more than we project, including among other things, as a result of a more severe flu season than expected, as well as continued uncertainty around the operating results of our Health Care Reform compliant business.

On the other hand, we also believe there are opportunities for operating earnings growth in 2015, primarily from the continued impact of Coventry-related synergies; higher Medicare underwriting margins as a result of our investments made in the Medicare Advantage business; additional fixed cost leverage as we expect revenue to increase in 2015 and we continue to manage our operating expenses; and the potential for growth and underwriting margin improvement in our individual business.

Our primary goals for 2015 are to: continue to appropriately price our business and grow membership while continuing to solve for the financial impacts of the significant fees, taxes and assessments imposed on us by Health Care Reform; further simplify our products and processes; continue to execute on our Public Exchange and private health insurance exchange (“Private Exchange”) strategies; transform the provider business model through provider collaboration (including accountable care organizations (“ACOs”)), and continue to migrate the Coventry business and operations and achieve the related synergies.

Refer to “Forward-Looking Information/Risk Factors” beginning on page 42 for information regarding other important factors that may cause our actual results to differ from those currently projected in “Outlook for 2015” and/or otherwise materially affect us.

Board of Directors Update

Olympia J. Snowe was appointed to our Board in July 2014, for a term that will run until our 2015 Annual Meeting of Shareholders. Ms. Snowe is a former United States Senator and currently is Chairman and Chief Executive Officer of Olympia Snowe, LLC, a policy and communications consulting firm. She also serves on our Board’s Audit Committee and Medical Affairs Committee. With the addition of Ms. Snowe, our Board now consists of thirteen directors.

Management Update

In July 2014, Harold L. Paz, M.D., M.S., joined Aetna as Executive Vice President, Chief Medical Officer.

Effective January 1, 2015, Karen S. Rohan was appointed President of Aetna. In this role, Ms. Rohan will continue to lead our Local and Regional businesses, in addition to our National Accounts, Government and Specialty businesses.

2014 Acquisitions

During 2014, we completed the acquisitions of the InterGlobal group (“InterGlobal”) and bSwift LLC (“bSwift”).

•The InterGlobal group

In April 2014, we acquired InterGlobal, a company that specializes in international private medical insurance for groups and individuals in the Middle East, Asia, Africa and Europe. The purchase price was not material.

•bSwift LLC

In November 2014, we acquired bSwift for approximately $400 million. bSwift provides a technology platform that offers a retail shopping experience for health insurance exchanges and employees nationwide and benefit administration technology and services to employers.

Refer to Notes 3 and 7 of Notes to Consolidated Financial Statements beginning on pages 90 and 93, respectively for additional information.

Segment Results and Use of Non-GAAP Measures in this Document

The following discussion of operating results is presented based on our reportable segments in accordance with the accounting guidance for segment reporting and is consistent with our segment disclosure included in Note 19 of Notes to Consolidated Financial Statements beginning on page 132. Our operations are conducted in three business segments: Health Care, Group Insurance and Large Case Pensions. Our Corporate Financing segment is not a business segment; it is added to our business segments to reconcile our segment reporting to our consolidated results. The Corporate Financing segment includes interest expense on our outstanding debt and the financing components of our pension and other postretirement employee benefit plans (“OPEB”) expense (the service cost and prior service cost components of this expense are allocated to our business segments).

Our discussion of operating results is based on operating earnings. Operating earnings exclude from net income attributable to Aetna reported in accordance with GAAP, net realized capital gains or losses, amortization of other acquired intangible assets and other items, if any, that neither relate to the ordinary course of our business nor reflect our underlying business performance. Although the excluded items may recur, we believe excluding them from net income attributable to Aetna to arrive at operating earnings provides more meaningful information about our underlying business performance. Net realized capital gains and losses arise from various types of transactions, primarily in the course of managing a portfolio of assets that support the payment of liabilities. Amortization of other acquired intangible assets relates to our acquisition activities, including Coventry, InterGlobal and bSwift. These transactions and amortization do not directly relate to the underwriting or servicing of products for our customers and are not directly related to the core performance of our business operations. Operating earnings is the measure reported to our Chief Executive Officer for purposes of assessing financial performance and making operating decisions, such as the allocation of resources among our business segments. In each business segment discussion in this MD&A, we provide a table that reconciles operating earnings to net income attributable to Aetna. Each table details the net realized capital gains or losses, amortization of other acquired intangible assets and any other items excluded from net income attributable to Aetna, and the footnotes to each table describe the nature of each other item and why we believe it is appropriate to exclude that item from net income attributable to Aetna. Non-GAAP financial measures we disclose, such as operating earnings, should not be considered a substitute for, or superior to, financial measures determined or calculated in accordance with GAAP.

HEALTH CARE

Health Care consists of medical, pharmacy benefit management services, dental, behavioral health and vision plans offered on both an Insured basis and an ASC basis and Healthagen® products and services, such as ACS, that complement and enhance our medical products. Medical products include point-of-service (“POS”), preferred provider organization (“PPO”), health maintenance organization (“HMO”) and indemnity benefit plans. Medical products also include health savings accounts (“HSAs”) and Aetna HealthFund®, consumer-directed health plans that combine traditional POS or PPO and/or dental coverage, subject to a deductible, with an accumulating benefit account (which may be funded by the plan sponsor and/or the member in the case of HSAs). We also offer Medicare and Medicaid products and services and other medical products, such as medical management and data analytics services, medical stop loss insurance, workers’ compensation administrative services and products that provide access to our provider networks in select geographies. We separately track premiums and health care costs for Government businesses (which represents our combined Medicare and Medicaid products). All other medical, dental and other Health Care products are referred to as Commercial.

Operating Summary

|

| | | | | | | | | | | |

| (Millions) | 2014 |

| | 2013 |

| | 2012 |

|

| Premiums: | | | | | |

| Commercial | $ | 28,563.2 |

| | $ | 24,481.2 |

| | $ | 20,944.4 |

|

| Government | 20,999.0 |

| | 15,178.5 |

| | 7,927.6 |

|

| Total premiums | 49,562.2 |

| | 39,659.7 |

| | 28,872.0 |

|

| Fees and other revenue | 5,114.4 |

| | 4,425.5 |

| | 3,736.9 |

|

| Net investment income | 367.6 |

| | 309.3 |

| | 310.4 |

|

| Net realized capital gains | 64.4 |

| | 2.7 |

| | 86.5 |

|

| Total revenue | 55,108.6 |

| | 44,397.2 |

| | 33,005.8 |

|

| Health care costs | 40,746.7 |

| | 32,896.0 |

| | 23,728.9 |

|

| Operating expenses: | | | | | |

| Selling expenses | 1,536.9 |

| | 1,242.8 |

| | 1,015.7 |

|

| General and administrative expenses | 8,801.1 |

| | 7,061.8 |

| | 5,480.3 |

|

| Total operating expenses | 10,338.0 |

| | 8,304.6 |

| | 6,496.0 |

|

| Amortization of other acquired intangible assets | 242.2 |

| | 210.2 |

| | 137.6 |

|

| Total benefits and expenses | 51,326.9 |

| | 41,410.8 |

| | 30,362.5 |

|

| Income before income taxes | 3,781.7 |

| | 2,986.4 |

| | 2,643.3 |

|

| Income taxes | 1,587.2 |

| | 1,078.4 |

| | 950.5 |

|

| Net income including non-controlling interests | 2,194.5 |

| | 1,908.0 |

| | 1,692.8 |

|

| Less: Net income (loss) attributable to non-controlling interests | 1.1 |

| | (4.5 | ) | | .3 |

|

| Net income attributable to Aetna | $ | 2,193.4 |

| | $ | 1,912.5 |

| | $ | 1,692.5 |

|

| | | | | | |

The table presented below reconciles net income attributable to Aetna to operating earnings (1):

|

| | | | | | | | | | | |

| (Millions) | 2014 |

| | 2013 |

| | 2012 |

|

| Net income attributable to Aetna | $ | 2,193.4 |

| | $ | 1,912.5 |

| | $ | 1,692.5 |

|

| Net realized capital gains, net of tax | (41.5 | ) | | (.7 | ) | | (56.6 | ) |

| Amortization of other acquired intangible assets, net of tax | 157.4 |

| | 136.6 |

| | 89.4 |

|

| Transaction, integration-related and restructuring costs, net of tax | 134.2 |

| | 219.0 |

| | 14.1 |

|

| Release of litigation-related reserve, net of tax | (67.0 | ) | | — |

| | — |

|

| Litigation-related settlement, net of tax | — |

| | — |

| | 78.0 |

|

| Severance charge, net of tax | — |

| | — |

| | 24.1 |

|

| Operating earnings | $ | 2,376.5 |

| | $ | 2,267.4 |

| | $ | 1,841.5 |

|

| | | | | | |

| |

(1) | In addition to net realized capital gains and amortization of other acquired intangible assets, the following other items are excluded from operating earnings because we believe they neither relate to the ordinary course of our business nor reflect our underlying business performance: |

| |

| • | In 2014, we incurred transaction and integration-related costs related to the acquisitions of Coventry, InterGlobal and bSwift of $134.2 million ($200.7 million pretax), which was entirely recorded in the Health Care segment. In 2013 and 2012, we incurred transaction, integration-related and restructuring costs related to the acquisition of Coventry of $233.5 million ($332.8 million pretax) and $25.4 million ($32.6 million pretax), respectively, of which $219.0 million ($310.5 million pretax) and $14.1 million ($15.2 million pretax), respectively, were recorded in the Health Care segment. Restructuring costs, primarily comprised of severance and real estate consolidation costs, are related to the acquisition of Coventry and Aetna’s expense management and cost control initiatives. Transaction costs include advisory, legal and other professional fees which are not deductible for tax purposes and are reflected in our GAAP Consolidated Statements of Income in general and administrative expenses. Transaction costs also include transaction-related payments as well as expenses related to the negative cost of carry associated with the permanent financing that we obtained in November 2012 for the Coventry acquisition. Prior to the Acquisition Date, that negative cost of carry associated with the permanent financing was excluded from operating earnings. The components of the negative cost of carry are reflected in our GAAP Consolidated Statements of Income in interest expense, net investment income, and general and administrative expenses. On and after the Acquisition Date, the interest expense and general and administrative expenses associated with the permanent financing are no longer excluded from operating earnings. |

| |

| • | In 2012, we recorded a charge of $78.0 million ($120.0 million pretax) related to the settlement of purported class action litigation regarding Aetna’s payment practices related to out-of-network health care providers. That charge included the estimated cost of legal fees of plaintiffs’ counsel and the costs of administering the settlement. In 2014, we exercised our right to terminate the settlement agreement. As a result, we released the reserve established in connection with the settlement agreement, net of amounts due to the settlement administrator, which reduced 2014 other general and administrative expenses by $67.0 million ($103.0 million pretax). Refer to Note 18 beginning on page 127 for additional information on the termination of the settlement agreement. |

| |

| • | In 2012, we recorded a severance charge of $24.1 million ($37.0 million pretax) related to actions taken in 2012 and 2013. |

Operating earnings in 2014 increased compared to 2013.

In 2014, operating earnings increased compared to the corresponding period in 2013, primarily due to the May 2013 acquisition of Coventry, as well as higher underwriting margins in both our Government and Commercial businesses, partially offset by increased investment spend to support our growth initiatives, primarily in our Government, Healthagen® and Consumer businesses. In 2013, operating earnings increased compared to the corresponding period in 2012, primarily due to the acquisition of Coventry in May 2013, as well as higher underwriting margins primarily in our Commercial business, partially offset by lower underwriting margins in our Government business. Refer to our discussion of Commercial and Government results below for additional information.

We calculate our medical benefit ratio (“MBR”) by dividing health care costs by health care premiums. Our MBRs by product for the last three years were:

|

| | | | | | | | |

| | 2014 |

| | 2013 |

| | 2012 |

|

| Commercial | 80.2 | % | | 80.1 | % | | 81.1 | % |

| Government | 84.9 | % | | 87.5 | % | | 84.9 | % |

| Total | 82.2 | % | | 82.9 | % | | 82.2 | % |

| | | | | | |

Refer to our discussion of Commercial and Government results below for an explanation of the changes in our premiums and MBRs. In addition, the calculation of Health Care Costs Payable is a critical accounting estimate (refer to “Critical Accounting Estimates - Health Care Costs Payable” beginning on page 20 for additional information).

Commercial operating results for 2014 reflected improved underwriting margins as well as the full-year impact of the May 2013 acquisition of Coventry.

Commercial premiums were $4.1 billion higher in 2014 than 2013, primarily as a result of higher membership in our Commercial Insured business, the effects of pricing actions designed to recover fees and taxes mandated by the ACA and higher premium rates, as well as the full-year impact of the May 2013 acquisition of Coventry. Commercial premiums were $3.5 billion higher in 2013 than 2012, primarily from the acquisition of Coventry and higher premium rates in our Commercial Insured business.

Our Commercial MBRs were 80.2%, 80.1% and 81.1% for 2014, 2013 and 2012, respectively. Our Commercial MBR increased in 2014 compared to 2013, primarily due to costs associated with new hepatitis C treatments, the performance of our individual business, which reflects the impact of programs mandated by the ACA in 2014, and performance in the smaller middle-market business, partially offset by higher premiums driven in part by pricing actions designed to recover fees and taxes mandated by the ACA. In addition, we did not record any Health Care Reform risk corridor receivables at December 31, 2014. The improvement in our Commercial MBR in 2013 compared to 2012 is primarily due to the impact of increased favorable development of prior-years’ health care cost estimates in 2013.

Government operating results for 2014 reflect improved underwriting margins and the full-year impact of the May 2013 acquisition of Coventry.

Government premiums were $5.8 billion higher in 2014 than 2013 primarily as a result of membership growth in both our Medicare and Medicaid Insured products, as well as the full-year impact of the May 2013 acquisition of Coventry. Government premiums were $7.3 billion higher in 2013 compared to 2012 primarily due to membership growth in our Medicare business, the addition of Coventry membership, as well as Medicaid in-state expansions and growth in high acuity Medicaid populations.

Our Government MBRs were 84.9%, 87.5% and 84.9% for 2014, 2013 and 2012, respectively. The improvement in our Government MBR in 2014 compared with 2013 is primarily due to actions impacting revenue and medical costs designed to solve for the gap between Medicare premiums and medical costs and other expenses, including the health insurer fee, as well as increased favorable development of prior-year health care cost estimates in 2014. The increase in our Government MBR in 2013 compared with 2012 is primarily due to the effects of favorable 2012 experience being reflected in customer renewal premiums in 2013 as well as underperformance in two specific Medicare product offerings and the impacts of sequestration on Medicare reimbursement rates, partially offset by the inclusion of Coventry, which added geographies carrying relatively lower MBRs in our Medicaid products.

Fees and Other Revenue

Health Care fees and other revenue for 2014 increased approximately $689 million compared to 2013 due primarily to higher average fee yields and growth in our Commercial ASC membership, as well as the inclusion of Coventry’s service businesses for the full year. Health Care fees and other revenue for 2013 increased $689 million compared to 2012 due primarily to the inclusion of Coventry’s service businesses.

General and Administrative Expenses

General and administrative expenses increased by approximately $1.7 billion during 2014 compared to 2013 due primarily to the inclusion of fees mandated by the ACA in 2014, the inclusion of Coventry’s general and administrative expenses for the full year and increased investment spend to support our growth initiatives, primarily in our Government, Healthagen® and Consumer businesses, partially offset by continued execution of our expense initiatives, including execution on our Coventry-related cost synergies, and the favorable impact of releasing a litigation-related reserve during 2014, which reduced general and administrative expenses by $103 million pretax. General and administrative expenses increased by approximately $1.6 billion during 2013 compared to 2012 due

primarily to the inclusion of Coventry’s general and administrative expenses as well as transaction, integration-related and restructuring costs and growth in each of our businesses which were partially offset by continued execution of our expense reduction initiatives, including execution on our Coventry-related cost synergies.

Income taxes

Our effective tax rate was 42 percent in 2014 and 36 percent in both 2013 and 2012. The increase in our effective tax rate during 2014 reflects the impact of the ACA, including the non-deductibility of the health insurer fee.

Membership

Health Care’s membership at December 31, 2014 and 2013 was as follows:

|

| | | | | | | | | | | | | | | | | |

| | 2014 | | 2013 |

| (Thousands) | Insured | | ASC | | Total | | Insured | | ASC | | Total |

| Medical: | | | | | | | | | | | |

| Commercial | 6,314 |

| | 13,508 |

| | 19,822 |

| | 6,045 |

| | 12,776 |

| | 18,821 |

|

| Medicare | 1,140 |

| | — |

| | 1,140 |

| | 968 |

| | — |

| | 968 |

|

| Medicare Supplement | 462 |

| | — |

| | 462 |

| | 386 |

| | — |

| | 386 |

|

| Medicaid | 1,370 |

| | 754 |

| | 2,124 |

| | 1,216 |

| | 799 |

| | 2,015 |

|

| Total Medical Membership | 9,286 |

| | 14,262 |

| | 23,548 |

| | 8,615 |

| | 13,575 |

| | 22,190 |

|

| | | | | | | | | | | | |

Consumer-Directed Health Plans (1) | |

| | |

| | 3,830 |

| | | | | | 3,254 |

|

| | | | | | | | | | | | |

| Dental: | |

| | |

| | |

| | | | | | |

| Total Dental Membership | 6,138 |

| | 9,356 |

| | 15,494 |

| | 5,472 |

| | 8,673 |

| | 14,145 |

|

| | | | | | | | | | | | |

| Pharmacy: | |

| | |

| | |

| | |

| | |

| | |

| Commercial | |

| | |

| | 10,731 |

| | |

| | |

| | 10,191 |

|

| Medicare PDP (stand-alone) | |

| | |

| | 1,572 |

| | |

| | |

| | 2,166 |

|

| Medicare Advantage PDP | |

| | |

| | 754 |

| | |

| | |

| | 588 |

|

| Medicaid | |

| | |

| | 2,262 |

| | |

| | |

| | 1,214 |

|

| Total Pharmacy Benefit Management Services | | | | 15,319 |

| | | | | | 14,159 |

|

| | | | | | | | | | | | |

| |

(1) | Represents members in consumer-directed health plans who also are included in Commercial medical membership above. |

Total medical membership at December 31, 2014 increased compared to December 31, 2013, primarily reflecting growth in our Commercial, Medicare and Insured Medicaid products, which was partially offset by a reduction in our Medicaid ASC products.

Total dental membership at December 31, 2014 increased compared to December 31, 2013 primarily reflecting growth in our Medicaid ASC products as well as growth in our Insured dental products which was partially offset by a reduction in our Commercial ASC dental products.

Total pharmacy benefit management services membership increased at December 31, 2014 compared to December 31, 2013 primarily reflecting growth in both our Medicaid and Commercial products which was partially offset by a decline in our Medicare products.

GROUP INSURANCE

Group Insurance primarily includes group life insurance and group disability products. Group life insurance products are offered on an Insured basis and include basic and supplemental group term life, group universal life, supplemental or voluntary programs and accidental death and dismemberment coverage. Group disability products primarily consist of short-term and long-term disability products (and products which combine both), which are offered to employers on both an Insured and an ASC basis, and absence management services offered to employers, which include short-term and long-term disability administration and leave management. Group Insurance also includes long-term care products that were offered primarily on an Insured basis, which provide benefits covering the cost of care in private home settings, adult day care, assisted living or nursing facilities. We no longer solicit or accept new long-term care customers.

Operating Summary

|

| | | | | | | | | | | |

| (Millions) | 2014 |

| | 2013 |

| | 2012 |

|

| Premiums: | | | | | |

| Life | $ | 1,240.7 |

| | $ | 1,150.6 |

| | $ | 1,066.8 |

|

| Disability | 824.9 |

| | 742.4 |

| | 623.6 |

|

| Long-term care | 44.3 |

| | 44.9 |

| | 45.9 |

|

| Total premiums | 2,109.9 |

| | 1,937.9 |

| | 1,736.3 |

|

| Fees and other revenue | 104.3 |

| | 115.4 |

| | 105.7 |

|

| Net investment income | 261.2 |

| | 286.6 |

| | 282.8 |

|

| Net realized capital gains | 14.4 |

| | 1.3 |

| | 22.7 |

|

| Total revenue | 2,489.8 |

| | 2,341.2 |

| | 2,147.5 |

|

| Current and future benefits | 1,798.3 |

| | 1,811.2 |

| | 1,532.6 |

|

| Operating expenses: | | | | | |

| Selling expenses | 116.1 |

| | 105.8 |

| | 89.8 |

|

| General and administrative expenses | 337.2 |

| | 301.7 |

| | 280.5 |

|

| Reversal of allowance on reinsurance recoverable | — |

| | (42.2 | ) | | — |

|

| Total operating expenses | 453.3 |

| | 365.3 |

| | 370.3 |

|

| Amortization of other acquired intangible assets | 1.2 |

| | 4.4 |

| | 4.4 |

|

| Total benefits and expenses | 2,252.8 |

| | 2,180.9 |

| | 1,907.3 |

|

| Income before income taxes | 237.0 |

| | 160.3 |

| | 240.2 |

|

| Income taxes | 57.4 |

| | 32.3 |

| | 62.3 |

|

| Net income including non-controlling interests | 179.6 |

| | 128.0 |

| | 177.9 |

|

| Less: Net income attributable to non-controlling interests | — |

| | 2.8 |

| | 1.6 |

|

| Net income attributable to Aetna | $ | 179.6 |

| | $ | 125.2 |

| | $ | 176.3 |

|

The table presented below reconciles net income attributable to Aetna to operating earnings (1):

|

| | | | | | | | | | | |

| (Millions) | 2014 |

| | 2013 |

| | 2012 |

|

| Net income attributable to Aetna | $ | 179.6 |

| | $ | 125.2 |

| | $ | 176.3 |

|

| Net realized capital gains, net of tax | (9.4 | ) | | (.8 | ) | | (14.8 | ) |

| Amortization of other acquired intangible assets, net of tax | .8 |

| | 2.9 |

| | 2.9 |

|

| Charge for changes in life insurance claim payment practices, net of tax | — |

| | 35.7 |

| | — |

|

| Reversal of allowance and gain on sale of reinsurance recoverable, net of tax | — |

| | (32.1 | ) | | — |

|

| Operating earnings | $ | 171.0 |

| | $ | 130.9 |

| | $ | 164.4 |

|

| | | | | | |

| |

(1) | In addition to net realized capital gains and amortization of other acquired intangible assets, the following other items are excluded from operating earnings because we believe they neither relate to the ordinary course of our business nor reflect our underlying business performance: |

| |

| • | In the fourth quarter of 2013, we increased our estimated liability for unpaid life insurance claims with respect to insureds who passed away on or before December 31, 2013, and recorded in current and future benefits a charge of $35.7 million ($55.0 million pretax) as a result of changes during the fourth quarter of 2013 in our life insurance claim payment practices (including related escheatment practices) based on evolving industry practices and regulatory expectations and interpretations. Refer to Note 18 of Notes to Consolidated Financial Statements beginning on page 127 for additional information on the changes in our life insurance claim payment practices. |

| |

| • | In 2008, as a result of the liquidation proceedings of Lehman Re Ltd. (“Lehman Re”), a subsidiary of Lehman Brothers Holdings Inc., we recorded an allowance against our reinsurance recoverable from Lehman Re of $27.4 million ($42.2 million pretax). This reinsurance was placed in 1999 and was on a closed book of paid-up group whole life insurance business. In 2013, we sold our claim against Lehman Re to an unrelated third party (including the reinsurance recoverable) and terminated the reinsurance arrangement. Upon the sale of the claim and termination of the arrangement, we reversed the related allowance thereby reducing other general and administrative expenses by $27.4 million ($42.2 million pretax) and recognized a $4.7 million ($7.2 million pretax) gain on the sale in fees and other revenue. |

Operating earnings for 2014 increased by $40.1 million compared to 2013, primarily due to higher underwriting margins, reflecting improved experience in both our life and disability products, partially offset by lower net investment income due primarily to lower yields on debt securities. Operating earnings for 2013 declined by $33.5 million compared to 2012, primarily reflecting lower underwriting margins in our group life insurance products due to higher claim incidence, partially offset by higher underwriting margins in our disability products.

Our group benefit ratios, which represent current and future benefits divided by premiums, were 85.2% for 2014, 93.5% for 2013, and 88.3% for 2012. The improvement in our group benefit ratio in 2014 is primarily due to higher underwriting margins, reflecting improved experience in both our life and disability products. The increase in our group benefit ratio in 2013 is primarily due to the fourth quarter 2013 charge related to changes in our life insurance claim payment practices (including related escheatment practices) and lower underwriting margins in our group life insurance products from higher claim incidence, partially offset by higher underwriting margins in our disability products.

LARGE CASE PENSIONS

Large Case Pensions manages a variety of retirement products (including pension and annuity products) primarily for tax-qualified pension plans. These products provide a variety of funding and benefit payment distribution options and other services. The Large Case Pensions segment includes certain discontinued products.

Operating Summary

|

| | | | | | | | | | | |

| (Millions) | 2014 |

| | 2013 |

| | 2012 |

|

| Premiums | $ | 76.4 |

| | $ | 140.0 |

| | $ | 165.7 |

|

Group annuity contract conversion premium (1) | — |

| | 99.0 |

| | 941.4 |

|

| Net investment income | 317.1 |

| | 320.4 |

| | 329.0 |

|

| Other revenue | 9.7 |

| | 9.6 |

| | 10.9 |

|

| Net realized capital gains (losses) | 1.6 |

| | (12.8 | ) | | (.5 | ) |

| Total revenue | 404.8 |

| | 556.2 |

| | 1,446.5 |

|

| Current and future benefits | 366.7 |

| | 440.2 |

| | 477.5 |

|

Benefit expense on group annuity contract conversion (1) | — |

| | 99.0 |

| | 941.4 |

|

| General and administrative expenses | 12.4 |

| | 12.4 |

| | 12.6 |

|

| Reduction of reserve for anticipated future losses on discontinued products | — |

| | (86.0 | ) | | — |

|

| Total benefits and expenses | 379.1 |

| | 465.6 |

| | 1,431.5 |

|

| Income before income taxes | 25.7 |

| | 90.6 |

| | 15.0 |

|

| Income taxes (benefits) | .7 |

| | 21.8 |

| | (2.4 | ) |

| Net income including non-controlling interests | 25.0 |

| | 68.8 |

| | 17.4 |

|

| Less: Net income attributable to non-controlling interests | 3.3 |

| | — |

| | — |

|

| Net income attributable to Aetna | $ | 21.7 |

| | $ | 68.8 |

| | $ | 17.4 |

|

| | | | | | |

| |

(1) | In 2013 and 2012, pursuant to contractual rights exercised by the contract holders, certain existing group annuity contracts converted from participating to non-participating contracts. Upon conversion, we recorded $99.0 million and $941.4 million of non-cash group annuity conversion premium for these contracts and a corresponding $99.0 million and $941.4 million non-cash benefit expense on group annuity conversion for these contracts during 2013 and 2012, respectively. |

The table presented below reconciles net income attributable to Aetna to operating earnings:

|

| | | | | | | | | | | |

| (Millions) | 2014 |

| | 2013 |

| | 2012 |

|

| Net income attributable to Aetna | $ | 21.7 |

| | $ | 68.8 |

| | $ | 17.4 |

|

| Net realized capital (gains) losses, net of tax | (1.0 | ) | | 8.3 |

| | .4 |

|

Reduction of reserve for anticipated future losses on discontinued products, net of tax (1) | — |

| | (55.9 | ) | | — |

|

| Operating earnings | $ | 20.7 |

| | $ | 21.2 |

| | $ | 17.8 |

|

| | | | | | |

| |

(1) | In 1993, we discontinued the sale of our fully guaranteed large case pension products and established a reserve for anticipated future losses on these products, which we review quarterly. In 2013, we reduced the reserve for anticipated future losses on discontinued products by $55.9 million ($86.0 million pretax). We believe excluding any changes in the reserve for anticipated future losses on discontinued products from operating earnings provides more useful information as to our continuing products and is consistent with the treatment of the operating results of these discontinued products, which are credited or charged to the reserve and do not affect our operating results. Refer to Note 20 of Notes to Consolidated Financial Statements beginning on page 135 for additional information on the reduction of the reserve for anticipated future losses on discontinued products. |

Premiums decreased in 2014 when compared to the corresponding period in 2013, primarily as a result of the discontinuance of certain services under an existing customer contract in 2014, which also reduced current and future benefits by an equivalent amount for 2014.

Discontinued Products

Prior to 1993, we sold single-premium annuities (“SPAs”) and guaranteed investment contracts (“GICs”), primarily to employer sponsored pension plans. In 1993, we discontinued selling these products to Large Case Pensions customers, and now we refer to these products as discontinued products.

We discontinued selling these products because they were generating losses for us, and we projected that they would continue to generate losses over their life (which is currently greater than 30 years for SPAs); so we established a reserve for anticipated future losses at the time of discontinuance. At both December 31, 2014 and 2013, our remaining GIC liability was not material. We provide additional information on the reserve for anticipated future losses, including key assumptions and other important information, in Note 20 of Notes to Consolidated Financial Statements beginning on page 135.

The operating summary for Large Case Pensions above includes revenues and expenses related to our discontinued products, with the exception of net realized capital gains and losses which are recorded as part of current and future benefits. Since we established a reserve for anticipated future losses on discontinued products, as long as our expected future losses remain consistent with prior projections, the results of our discontinued products are applied against the reserve and do not impact net income attributable to Aetna. If actual or expected future losses are greater than we currently estimate, we may increase the reserve, which could adversely impact net income attributable to Aetna. If actual or expected future losses are less than we currently estimate, we may decrease the reserve, which could favorably impact net income attributable to Aetna. In those cases, we disclose such adjustment separately in the operating summary. Management reviews the adequacy of the discontinued products reserve quarterly. As a result of this review, $55.9 million ($86.0 million pretax) of the reserve was released in 2013. This reserve release was primarily due to favorable investment performance as well as favorable retirement experience compared to assumptions we previously made in estimating the reserve. The current reserve reflects management’s best estimate of anticipated future losses, and is included in future policy benefits on our balance sheet.

Refer to Note 20 of Notes to Consolidated Financial Statements beginning on page 135 for additional information on the activity in the reserve for anticipated future losses on discontinued products during 2014, 2013 and 2012.

INVESTMENTS

Our investment portfolio supported the following products at December 31, 2014 and 2013:

|

| | | | | | | |

| (Millions) | 2014 |

| | 2013 |

|

Experience-rated products (1) | $ | 1,492.4 |

| | $ | 1,458.1 |

|

Discontinued products (1) | 3,425.2 |

| | 3,443.5 |

|

| Remaining products | 19,871.5 |

| | 18,097.2 |

|

| Total investments | $ | 24,789.1 |

| | $ | 22,998.8 |

|

| | | | |

| |

(1) | Investment risks associated with our experience-rated and discontinued products generally do not impact our operating results. |

The risks associated with investments supporting experience-rated pension and annuity products in our Large Case Pensions business are assumed by the contract holders and not by us (subject to, among other things, certain minimum guarantees). Assets supporting experience-rated products may be subject to contract holder or participant withdrawals. Experience-rated contract holder and participant-directed withdrawals for the last three years were as follows:

|

| | | | | | | | | | | |

| (Millions) | 2014 |

| | 2013 |

| | 2012 |

|

Scheduled contract maturities and benefit payments (1) | $ | 145.4 |

| | $ | 237.1 |

| | $ | 236.2 |

|

| Contract holder withdrawals other than scheduled contract | |

| | | | |

| maturities and benefit payments | 7.6 |

| | 35.4 |

| | 4.7 |

|

Participant-directed withdrawals (2) | 4.1 |

| | 4.0 |

| | 2.3 |

|

| | | | | | |

| |

(1) | Includes payments made upon contract maturity and other amounts distributed in accordance with contract schedules. |

| |

(2) | Approximately $565.4 million, $556.9 million and $569.1 million at December 31, 2014, 2013 and 2012, respectively, of experience-rated pension contracts allowed for unscheduled contract holder withdrawals, subject to timing restrictions and formula-based market value adjustments. Further, approximately $77.4 million, $77.9 million and $84.8 million at December 31, 2014, 2013 and 2012, respectively, of experience-rated pension contracts supported by our general account assets could be withdrawn or transferred to other plan investment options at the direction of plan participants, without market value adjustment, subject to plan, contractual and income tax provisions. |

Debt and Equity Securities

The debt securities in our investment portfolio had an average credit quality rating of A at both December 31, 2014 and 2013, with approximately $4.6 billion and $4.5 billion at December 31, 2014 and 2013, respectively, rated AAA. The debt securities that were rated below investment grade (that is, having a credit quality rating below BBB-/Baa3) were $1.4 billion and $1.2 billion at December 31, 2014 and 2013, respectively (of which 14% and 17% at December 31, 2014 and 2013, respectively, supported our experience-rated and discontinued products).

At December 31, 2014 and 2013, we held approximately $811 million and $747 million, respectively, of municipal debt securities that were guaranteed by third parties, representing approximately 3% of our total investments at each date. These securities had an average credit quality rating of AA- and A at December 31, 2014 and 2013, respectively, with the guarantee. These securities had an average credit quality rating of A- and A at December 31, 2014 and 2013, respectively, without the guarantee. We do not have any significant concentration of investments with third party guarantors (either direct or indirect).

At both December 31, 2014 and 2013, less than 1% of our investment portfolio was comprised of investments that were either European sovereign, agency, or local government debt of countries which, in our judgment based on an analysis of market-yields, are experiencing economic, fiscal or political strains such that the likelihood of default may be higher than if those factors did not exist.

We classify our debt and equity securities as available for sale, and carry them at fair value on our balance sheet. Approximately 1% of our debt and equity securities at both December 31, 2014 and 2013 were valued using inputs that reflect our own assumptions (categorized as Level 3 inputs in accordance with GAAP). Refer to Note 10 of Notes to Consolidated Financial Statements beginning on page 102 for additional information on the methodologies and key assumptions we use to determine the fair value of investments.

Refer to Note 8 of Notes to Consolidated Financial Statements beginning on page 94 for details related to:

| |

| • | Our investment portfolio balances at December 31, 2014 and 2013; |

| |

| • | Gross unrealized capital gains and losses by major security type; |

| |

| • | Debt securities with unrealized capital losses (including the amounts related to experience-rated and discontinued products); |

| |

| • | Our net realized capital gains and losses; and |

| |

| • | Our mortgage loan portfolio. |

We regularly review our debt securities to determine if a decline in fair value below the carrying value is other-than-temporary. If we determine a decline in fair value is other-than-temporary, we will write down the carrying value of the security. The amount of the credit-related impairment is included in our operating results, and the non-credit component is included in other comprehensive income unless we intend to sell the security or it is more likely than not that we will be required to sell the debt security prior to its anticipated recovery of its amortized cost basis. Accounting for other-than-temporary impairment (“OTTI”) of our debt securities is considered a critical accounting estimate. Refer to “Critical Accounting Estimates - Other-Than-Temporary Impairment of Debt Securities” on page 25 for additional information.

Risk Management and Market-Sensitive Instruments

We manage interest rate risk by seeking to maintain a tight match between the durations of our assets and liabilities when appropriate. We manage credit risk by seeking to maintain high average credit quality ratings and diversified sector exposure within our debt securities portfolio. In connection with our investment and risk management objectives, we also use derivative financial instruments whose market value is at least partially determined by, among other things, levels of or changes in interest rates (short-term or long-term), duration, prepayment rates, equity markets or credit ratings/spreads. Our use of these derivatives is generally limited to hedging risk and has principally consisted of using interest rate swaps, forward contracts, futures contracts, warrants, put options and credit default swaps. These instruments, viewed separately, subject us to varying degrees of interest rate, equity price and credit risk. However, when used for hedging, we expect these instruments to reduce overall risk.

We regularly evaluate our risk from market-sensitive instruments by examining, among other things, levels of or changes in interest rates (short-term or long-term), duration, prepayment rates, equity markets or credit ratings/spreads. We also regularly evaluate the appropriateness of investments relative to our management-approved investment guidelines (and operate within those guidelines) and the business objectives of our portfolios.

On a quarterly basis, we review the impact of hypothetical net losses in our investment portfolio on our consolidated near-term financial position, operating results and cash flows assuming the occurrence of certain reasonably possible changes in near-term market rates and prices. Interest rate changes (whether resulting from changes in Treasury yields or credit spreads or other factors) represent the most material risk exposure category for us. We have estimated the impact on the fair value of our market sensitive instruments based on the net present value of cash flows using a representative set of likely future interest rate scenarios. The assumptions used were as follows: an immediate increase of 100 basis points in interest rates (which we believe represents a moderately adverse scenario and is approximately equal to the historical annual volatility of interest rate movements for our intermediate-term available-for-sale debt securities) and an immediate decrease of 15% in prices for domestic equity securities.

Assuming an immediate 100 basis point increase in interest rates and immediate decrease of 15% in the prices for domestic equity securities, the theoretical decline in the fair values of our market sensitive instruments at December 31, 2014 is as follows:

| |

| • | The fair value of our long-term debt would decline by approximately $479 million ($737 million pretax). Changes in the fair value of our long-term debt do not impact our financial position or operating results. |

| |

| • | The theoretical reduction in the fair value of our investment securities partially offset by the theoretical reduction in the fair value of interest rate sensitive liabilities would result in a net decline in fair value of approximately $272 million ($418 million pretax) related to our non-experience-rated products. Reductions in the fair value of our investment securities would be reflected as an unrealized loss in equity, as we classify these securities as available for sale. We do not record our liabilities at fair value. |

Based on our overall exposure to interest rate risk and equity price risk, we believe that these changes in market rates and prices would not materially affect our consolidated near-term financial position, operating results or cash flows as of December 31, 2014.

LIQUIDITY AND CAPITAL RESOURCES

Cash Flows

We meet our operating cash requirements by maintaining liquidity in our investment portfolio, using overall cash flows from premiums, fees and other revenue, deposits and income received on investments, issuing commercial paper and entering into repurchase agreements from time to time. We monitor the duration of our investment portfolio of highly marketable debt securities and mortgage loans, and execute purchases and sales of these investments with the objective of having adequate funds available to satisfy our maturing liabilities. Overall cash flows are used primarily for claim and benefit payments, operating expenses, share and debt repurchases, repayment of debt, acquisitions, contract withdrawals and shareholder dividends. We have committed short-term borrowing capacity of $2.0 billion through a revolving credit facility agreement that expires in March 2019.

Presented below is a condensed statement of cash flows for each of the last three years. On May 7, 2013, we completed the acquisition of Coventry, which is reflected in our cash flows for the full-year in 2014 and on and after the Acquisition Date for 2013. We present net cash flows used for operating activities and net cash flows provided by investing activities separately for our Large Case Pensions segment because changes in the insurance reserves for the Large Case Pensions segment (which are reported as cash used for operating activities) are funded from the sale of investments (which are reported as cash provided by investing activities). Refer to the Consolidated Statements of Cash Flows on page 78 for additional information.

|

| | | | | | | | | | | |

| (Millions) | 2014 |

| | 2013 |

| | 2012 |

|

| Cash flows from operating activities | | | | | |

| Health Care and Group Insurance | $ | 3,601.3 |

| | $ | 2,625.0 |

| | $ | 2,054.7 |

|

| Large Case Pensions | (228.5 | ) | | (346.3 | ) | | (229.8 | ) |

| Net cash provided by operating activities | 3,372.8 |

| | 2,278.7 |

| | 1,824.9 |

|

| Cash flows from investing activities | | | | | |

| Health Care and Group Insurance | (2,453.1 | ) | | (2,261.4 | ) | | (477.7 | ) |

| Large Case Pensions | 323.4 |

| | 341.6 |

| | 246.4 |

|

| Net cash used for investing activities | (2,129.7 | ) | | (1,919.8 | ) | | (231.3 | ) |

| Net cash (used for) provided by financing activities | (1,235.0 | ) | | (1,525.8 | ) | | 305.9 |

|

| Net increase (decrease) in cash and cash equivalents | $ | 8.1 |

| | $ | (1,166.9 | ) | | $ | 1,899.5 |

|

Cash Flow Analysis

Cash flows provided by operating activities for Health Care and Group Insurance were approximately $3.6 billion in 2014, $2.6 billion in 2013 and $2.1 billion in 2012. The increase during 2014 compared to 2013 is primarily attributable to the effect of growth in our Insured membership and the inclusion of results from the Coventry acquisition for the full-year in 2014, partially offset by the payment of both our portion of the ACA’s health insurer fee and a portion of our estimated 2014 ACA reinsurance contribution in 2014. The increase during 2013 compared to 2012 is primarily attributable to the inclusion of results from the Coventry acquisition, proceeds from the termination of a reinsurance arrangement with Lehman Re and sale of the related claim, as well as lower benefit payments under our 2011 voluntary early retirement program, offset somewhat by transaction, integration-related and restructuring costs associated with the Coventry acquisition (refer to Note 17 of the Notes to Consolidated Financial Statements on page 126 for more information on the Lehman Re reinsurance arrangement).

Cash flows used for investing activities were approximately $2.1 billion, $1.9 billion and $231.3 million for 2014, 2013 and 2012, respectively. The increase in cash used for investing activities in 2014 compared to 2013 was primarily a result of an increase in net purchases of investments in 2014 compared to net proceeds from the sales of investments in 2013, which was partially offset by a decline in cash used for acquisitions, as we completed the acquisition of Coventry during 2013. The increase in cash used for investing activities in 2013 compared to 2012 is primarily attributable to cash used to fund the Coventry acquisition, net of the cash acquired in connection with the acquisition, partially offset by an increase in net proceeds from sales and maturities of investments. Refer to Note 3 and 7 of Notes to Consolidated Financial Statements beginning on pages 90 and 93, respectively, for additional information.

Cash flows used for financing activities in 2014 and 2012 primarily reflected the issuance and repayment of debt, and cash used for financing activities in all periods reflected share repurchases and dividend payments. Refer to Note 14 and 15 of Notes to Consolidated Financial Statements beginning on pages 123 and 125, respectively, for additional information about debt issuances and repayments, share repurchases and dividend payments.

Long-Term and Short-Term Debt and Revolving Credit Facility

In support of our capital management goals, during 2014 we redeemed a portion of our long-term debt, issued new long-term and short-term debt, repaid maturing long-term debt and extended the maturity date of our revolving credit facility by one additional year. Refer to Note 14 of Notes to Consolidated Financial Statements beginning on page 123 for additional information on these transactions.

Other Liquidity Information

From time to time, we use short-term commercial paper borrowings and repurchase agreements to address timing differences between cash receipts and disbursements. At December 31, 2014, we had approximately $500 million of commercial paper outstanding with a weighted-average interest rate of .30%. At December 31, 2013, we did not have any commercial paper outstanding. The maximum amount of commercial paper borrowings outstanding during 2014 was approximately $766 million. Refer to Notes 2 and 10 of Notes to Consolidated Financial Statements beginning on pages 80 and 102, respectively, for additional information about our repurchase agreements.

Our debt to capital ratio (calculated as the sum of all short- and long-term debt outstanding (“total debt”) divided by the sum of total Aetna shareholders’ equity plus total debt) was approximately 37% at both December 31, 2014 and 2013, respectively. Our existing ratings and outlooks from the nationally recognized statistical ratings organizations that rate us include the consideration of our intention to lower our debt to capital ratio to approximately 35% during the 2015 calendar year. We continually monitor existing and alternative financing sources to support our capital and liquidity needs, including, but not limited to, debt issuance, preferred or common stock issuance, reinsurance and pledging or selling of assets.

Interest expense was $329 million, $334 million and $269 million for 2014, 2013 and 2012, respectively. The decrease in interest expense during 2014 compared to 2013 reflects interest expense savings from debt refinancings, partially offset by the full-year impact of Coventry’s debt that we assumed. The increase in interest expense during 2013 compared to 2012 reflects the inclusion of Coventry’s long-term debt on and after the Acquisition Date as well as higher average long-term debt levels as a result of the Coventry-related senior notes that were issued in November 2012.

We are a member of the Federal Home Loan Bank of Boston (“FHLBB”), and as a member we have the ability to obtain cash advances, subject to certain minimum collateral requirements. Our maximum borrowing capacity available from the FHLBB at December 31, 2014 was approximately $882 million. At December 31, 2014, we did not have any outstanding borrowings from the FHLBB.

Our current funding strategy for our tax-qualified noncontributory defined benefit pension plan (the “Aetna Pension Plan”) is to contribute an amount at least equal to the minimum funding requirement as determined under applicable law with consideration of factors such as the maximum tax deductibility of such amounts. Refer to Note 11 of Notes to Consolidated Financial Statements beginning on page 109 for additional information regarding our current funding strategy for the Aetna Pension Plan.

We paid both our approximately $605 million portion of the ACA’s non tax-deductible health insurer fee and an approximately $298 million portion of our estimated 2014 ACA reinsurance contribution in 2014. We project that our share of the 2015 Health Care Reform fees, assessments and taxes will be approximately $1.1 billion, which includes our share of the ACA’s health insurer fee, which we project will be approximately $900 million. Refer to Note 2 beginning on page 80 for additional information on fees mandated by the ACA and “Overview-Health Care Reform” beginning on page 3 for additional information.

Contractual Obligations

The following table summarizes certain estimated future obligations by period under our various contractual obligations at December 31, 2014. The table below does not include future payments of claims to health care providers or pharmacies because certain terms of these payments are not determinable at December 31, 2014 (for example, the timing and volume of future services provided under fee-for-service arrangements and future membership levels for capitated arrangements). We believe that funds from future operating cash flows, together with cash, investments and other funds available under the Facility or from public or private financing sources, will be sufficient to meet our existing commitments as well as our liquidity needs associated with future operations, including our strategic growth initiatives.

|

| | | | | | | | | | | | | | | |

| (Millions) | 2015 |

| 2016-2017 |

| 2018-2019 |

| Thereafter |

| Total |

|

| Long-term debt obligations, including interest | $ | 557.4 |

| $ | 1,766.8 |

| $ | 954.4 |

| $ | 9,476.8 |

| $ | 12,755.4 |

|

| Operating lease obligations | 139.3 |

| 177.1 |

| 94.6 |

| 66.7 |

| 477.7 |

|

| Purchase obligations | 314.8 |

| 340.2 |

| 87.0 |

| 2.8 |

| 744.8 |

|

Other liabilities reflected on our balance sheet: (1) | | | | | |

Future policy benefits (2) | 705.9 |

| 1,313.9 |

| 1,037.3 |

| 4,076.2 |

| 7,133.3 |

|

Unpaid claims (2) | 745.3 |

| 520.3 |

| 355.5 |

| 774.8 |

| 2,395.9 |

|

Policyholders’ funds (2) (3) | 1,984.5 |

| 71.7 |

| 80.8 |

| 617.5 |

| 2,754.5 |

|

Other liabilities (4) | 3,954.9 |

| 211.5 |

| 86.8 |

| 206.0 |

| 4,459.2 |

|

| Total | $ | 8,402.1 |

| $ | 4,401.5 |

| $ | 2,696.4 |

| $ | 15,220.8 |

| $ | 30,720.8 |

|

| | | | | | |

| |

(1) | Payments of other long-term liabilities exclude Separate Accounts liabilities of approximately $4.3 billion because these liabilities are supported by assets that are legally segregated and are not subject to claims that arise out of our business. |

| |

(2) | Total payments of future policy benefits, unpaid claims and policyholders’ funds include $544.5 million, $37.9 million and $152.1 million, respectively, of reserves for contracts subject to reinsurance. We expect the assuming reinsurance carrier to fund these obligations and have reflected these amounts as reinsurance recoverable assets on our consolidated balance sheet. |

| |

(3) | Customer funds associated with group life and health contracts of $278.4 million have been excluded from the table above because such funds may be used primarily at the customer’s discretion to offset future premiums and/or for refunds, and the timing of the related cash flows cannot be determined. Additionally, net unrealized capital gains on debt and equity securities supporting experience-rated products of $114.8 million, before tax, have been excluded from the table above. |

| |

(4) | Other liabilities in the table above include general expense accruals and other related payables and exclude the following: |

| |

| • | Employee-related benefit obligations of $732.6 million, including our pension and other postretirement and post-employment benefit obligations and certain deferred compensation arrangements. These liabilities do not necessarily represent future cash payments we will be required to make, or such payment patterns cannot be determined. However, other long-term liabilities include expected benefit payments of $353.5 million over the next ten years for our non-qualified supplemental pension plan and our postretirement benefit plans, which we primarily fund when paid by the plans. |

| |

| • | Deferred gains of $45.1 million which will be recognized in our earnings in the future in accordance with GAAP. |

| |

| • | Net unrealized capital gains of $316.1 million, before tax, supporting discontinued products. |

| |

| • | Non-controlling interests supporting our discontinued products of $70.8 million consisting of third party interests in our investment holdings. This amount does not represent future cash payments we will be required to make. |

| |

| • | Other payables of $64.3 million. |

Restrictions on Certain Payments

In addition to general state law restrictions on payments of dividends and other distributions to shareholders applicable to all corporations, HMOs and insurance companies are subject to further regulations that, among other things, may require those companies to maintain certain levels of equity (referred to as surplus) and restrict the amount of dividends and other distributions that may be paid to their equity holders. These regulations are not directly applicable to Aetna as a holding company, since Aetna is not an HMO or an insurance company. The additional regulations applicable to our HMO and insurance company subsidiaries are not expected to affect our ability to service our debt, meet our other financing obligations or pay dividends, or the ability of any of our subsidiaries to service other financing obligations. Under applicable regulatory requirements, at December 31, 2014, the amount of dividends that may be paid by our insurance and HMO subsidiaries without prior approval by regulatory authorities was approximately $2.2 billion in the aggregate.

We maintain capital levels in our operating subsidiaries at or above targeted and/or required capital levels and dividend amounts in excess of these levels to meet our liquidity requirements, including the payment of interest on debt and shareholder dividends. In addition, at our discretion, we use these funds for other purposes such as

funding share and debt repurchase programs, investments in new businesses and other purposes we consider advisable.

At December 31, 2014 and 2013, we held investments of approximately $778 million and $794 million, respectively, related to the 2012 conversion of an existing group annuity contract from a participating to a non-participating contract. These investments are included in the total investments of our Large Case Pensions segment supporting non-experience-rated products. Although these investments are not accounted for as separate accounts assets, they are legally segregated and are not subject to claims that arise out of our business and only support Aetna’s future policy benefits obligations under that group annuity contract.

Off-Balance Sheet Arrangements