VIA EDGAR CORRESPONDENCE

June 26, 2018

United States Securities and Exchange Commission

Division of Corporation Finance

Washington, D.C. 20549

Form 10-K for the Fiscal Year Ended December 31, 2017

Filed February 23, 2018

File No. 001-16095

Ladies and Gentlemen:

We are in receipt of the letter from the Securities and Exchange Commission to Aetna Inc. (“Aetna”) dated June 6, 2018, referenced above (references in this letter and enclosure to the terms “we,” “our,” or “us” refer to Aetna and its subsidiaries). With respect to the Staff’s comments, enclosed herewith please find Aetna’s response. For ease of reference, the Staff’s comments have been reprinted in the enclosure to this letter immediately prior to our response thereto.

Please call Heather Dixon at 860-273-2473 if you or other members of the Staff have questions regarding our response.

Very truly yours,

AETNA INC.

|

| |

| By: | /s/ Heather Dixon |

| Name: | Heather Dixon |

| Title: | Vice President, Controller and |

| | Chief Accounting Officer |

Enclosure - Response to the Staff’s comments to Aetna contained in a letter dated June 6, 2018

Staff comment reprinted in Italic Text - Aetna response follows

Aetna Inc. Response to SEC Staff Letter dated June 6, 2018

Aetna Inc. Form 10-K for the year ended December 31, 2017 (the “10-K”)

Notes to Consolidated Financial Statements

3. Acquisition, Divestiture, Terminated Acquisition and Terminated Divestiture

Divestiture of Group Life Insurance, Group Disability Insurance, and Absence Management Businesses, page 105

| |

| 1. | We acknowledge your response to our prior comment one. Please provide us an overview of the transaction with HLAIC that specifies what you received and what you gave up, the nature and extent of your continuing involvement and the business purpose and economics of the transaction. |

Our Response:

Overview of the transaction with HLAIC

On November 1, 2017 (the “Closing Date”), we completed the sale of our domestic group life insurance, group disability insurance and absence management businesses (the “Group Insurance sale”) to Hartford Life and Accident Insurance Company (“HLAIC”). Because it was impractical to either (i) sell the Aetna legal entities that wrote the Group Insurance business (since these legal entities also wrote insurance and other contracts for other businesses that were outside the scope of this transaction), or (ii) seek policyholder consent to assign or novate to HLAIC each of the thousands of relevant insurance policies written over the span of several decades, the transaction was structured as a 100% coinsurance indemnity reinsurance agreement. Under the terms of the reinsurance agreement, Aetna transferred to HLAIC 100% of the insurance risk under the applicable Group Insurance business insurance policies, although Aetna remains liable to the policyholders of the reinsured policies. HLAIC did not acquire any legal entity from Aetna as part of the Group Insurance sale.

At the closing of the Group Insurance sale, pursuant to the agreements described below:

| |

| • | Aetna deposited in a comfort trust account established by HLAIC investment assets and cash with a value of approximately $3.33 billion to secure HLAIC’s obligations to Aetna under the reinsurance agreement. |

| |

| • | Aetna transferred to HLAIC (i) an immaterial amount of software assets, (ii) all employees supporting the divested businesses (effective January 1, 2018) and (iii) certain real estate leases and other contracts related to the Group Insurance business. |

| |

| • | HLAIC paid Aetna a ceding commission of $1.45 billion, which was determined through a competitive auction bidding process. |

| |

| • | Aetna ceded to HLAIC, and HLAIC assumed, net insurance liabilities of approximately $2.97 billion. |

The Group Insurance sale was accomplished through a series of agreements, including the following:

| |

| • | Master Transaction Agreement - Agreement that governs the overall transaction between Aetna and HLAIC. |

| |

| • | Reinsurance Agreement - Agreement that transfers 100% of the insurance risk from Aetna to HLAIC for the insurance liabilities under the policies that are within the scope of the transaction. |

| |

| • | Trust Agreement - Agreement governing the comfort trust account established by HLAIC into which Aetna deposited the investment assets and cash referenced above at the closing of the Group Insurance sale. The assets in the trust account secure HLAIC’s obligations to Aetna under the reinsurance agreement. HLAIC is entitled to withdraw assets from the trust account as the reinsured liabilities run off and to withdraw all remaining assets from the trust account when the reinsured liabilities are $350 million or less. |

| |

| • | Administrative Services Agreement - Agreement that details the administrative services HLAIC will provide to Aetna (e.g., administration of claims under the reinsured policies) with respect to the reinsured business from the Closing Date through the termination of the reinsurance agreement. This agreement also authorizes HLAIC to renew existing business and write new business on Aetna (rather than HLAIC) contracts during certain transition periods. See the discussion below under “Remaining customer contract period”. Neither Aetna nor HLAIC are separately compensated for any services performed under the Administrative Services Agreement. Any renewal business or new business written by HLAIC on Aetna contracts post-closing is subject to the Reinsurance Agreement (and therefore HLAIC bears 100% of the insurance risk under such contracts). |

| |

| • | Transition Services Agreement - Agreement that details the transition services Aetna will perform for HLAIC related to the reinsured business for a period of up to 36 months from the closing of the Group Insurance sale. Aetna is reimbursed for these services at its actual cost. |

| |

| • | Distribution Agreement - Agreement pursuant to which, among other things, HLAIC appointed an Aetna affiliate to solicit applications for Group Insurance business issued by HLAIC post-closing. The purpose of this agreement is to permit HLAIC and its sales force to cross-sell Group Insurance products to Aetna medical insurance customers by working together with certain Aetna commercial medical insurance sales teams post-closing. The Distribution Agreement has an initial term of three years. Aetna’s affiliate is reimbursed for these services at its actual cost. |

As described above, at the closing of the Group Insurance sale, HLAIC paid Aetna a cash ceding commission of $1.45 billion and assumed net insurance liabilities of approximately $2.97 billion. Simultaneously, Aetna deposited in the comfort trust account established by HLAIC investment assets and cash related to and supporting the reinsured life and disability insurance policies. At the time of the closing, the deposited investment assets and cash had a value of approximately $3.33 billion, which exceeded the value of the net insurance liabilities assumed by HLAIC by $360 million. As a result, the net ceding commission or “reinsurance premium”1 was approximately $1.1 billion ($1.45 billion - $360 million) and constitutes the consideration paid by HLAIC for the rights to the existing

1 To avoid confusion, please note that although the relevant accounting literature refers to this amount as a “reinsurance premium” it is not an amount paid by Aetna to HLAIC in exchange for assuming the risk of the Group Insurance business. HLAIC is compensated for assuming this risk through the delivery of the investment assets and cash into the comfort trust account. Instead, this ceding commission or “reinsurance premium” is a payment from HLAIC to Aetna and represents the consideration paid by HLAIC for the rights to the existing and future profits of the reinsured business. Although it theoretically would have been possible to net the ceding commission from HLAIC against the investment assets and cash deposited by Aetna into the comfort trust account as part of determining the closing deliveries, this approach would have created valuation complexity and required the parties to agree on exactly which investments in the pre-identified portfolio would be retained by Aetna and which of such investments would be deposited in the comfort trust account. Given the complexity of these issues, it was decided (as in precedent transactions) not to net the relevant transfers against each other at the closing of the transaction.

and future profits of the reinsured business. In order to simplify our disclosure and in our prior response, we used the term “deferred gain” to broadly describe the approximately $1.1 billion reinsurance premium paid by HLAIC to Aetna. The allocation of the reinsurance premium between the prospective and retroactive provisions of the reinsurance contract is discussed in further detail under “Overview of reinsurance accounting for the transaction” below.

The business purpose of the transaction was to allow Aetna to focus on its strategy of creating a personalized approach to improving member health. In addition, the proceeds from the transaction, and the related regulatory capital relief, will allow Aetna to accelerate spending on other priority growth initiatives related to its Health Care business.

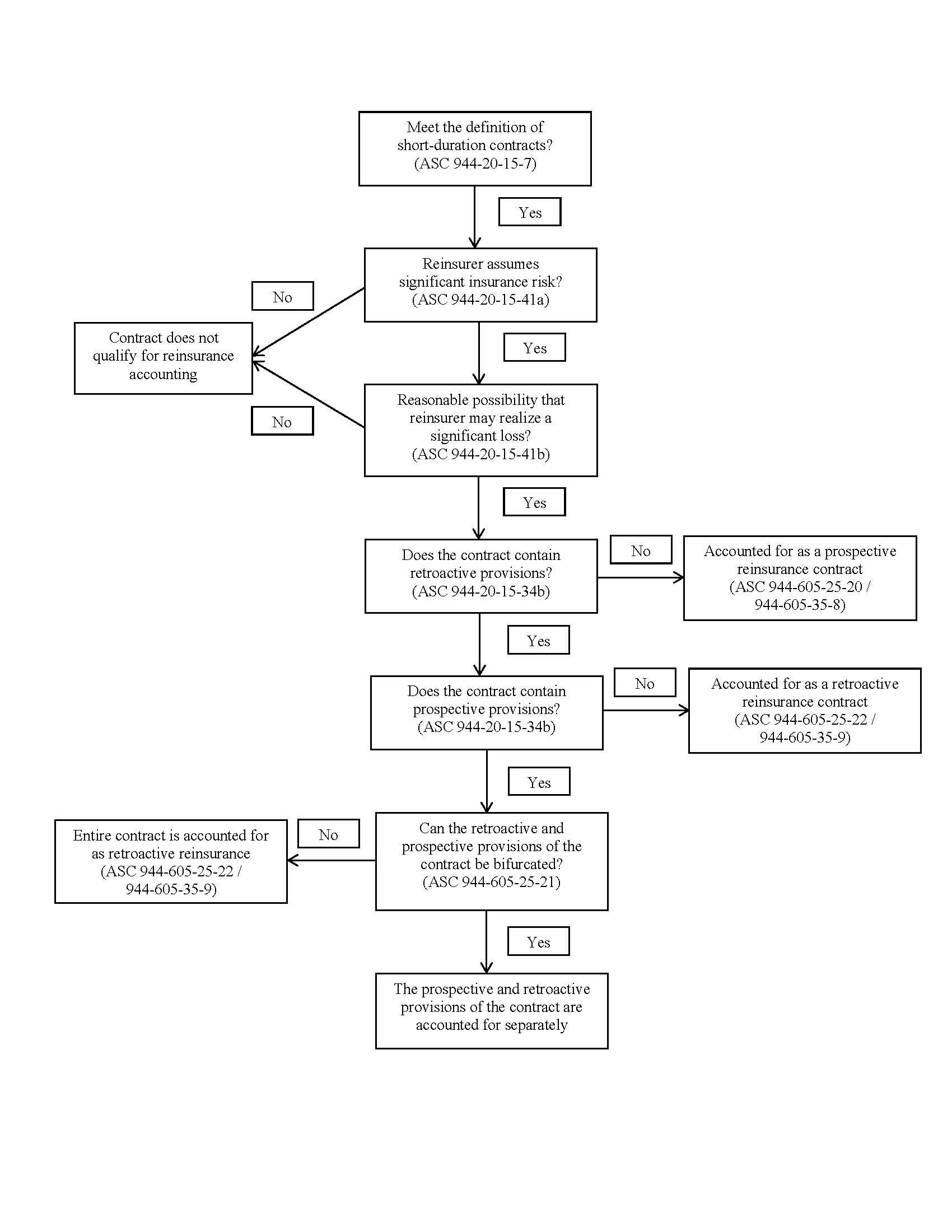

Overview of reinsurance accounting for the transaction

The substantial majority of the insurance contracts reinsured to HLAIC are classified as short-duration contracts as (a) the contract provides insurance protection for a fixed period of short duration and (b) the contract enables the insurer to cancel the contract or to adjust the provisions of the contract at the end of any contract period. Pursuant to Accounting Standards Codification (“ASC”) 944-20-15-41, in order for a short-duration contract to qualify for reinsurance accounting the following two criteria must be met: (i) the reinsurer assumes significant insurance risk under the reinsured portions of the underlying insurance contract; and (ii) it is reasonably possible that the reinsurer may realize a significant loss from the transaction. Since the transaction is accomplished through a 100% coinsurance indemnity reinsurance agreement that transfers 100% of the insurance liabilities under the reinsured contracts to HLAIC, we concluded that both of these criteria were met and therefore the Group Insurance sale qualifies for reinsurance accounting. Further, as outlined in ASC 944-20-15-37, the reinsurance subsections of ASC 944 apply to transactions whose individual terms indemnify an insurer against loss or liability relating to insurance risk, including reinsurance contracts used to, in effect, sell a line of business by coinsuring all or substantially all of the risks related to the line of business.

Aetna's reinsurance contract with HLAIC provides Aetna with reinsurance for insurance liabilities existing as of the Closing Date (accounted for as retroactive reinsurance) and reinsurance for liabilities to be incurred from future insurable events (accounted for as prospective reinsurance). ASC 944-605-25-21 specifies that, when practicable, separate accounting should be followed for prospective and retroactive provisions within the same reinsurance contract. The guidance requires that a reasonable basis be used to allocate reinsurance premiums to the prospective and retroactive provisions of a contract, but does not require any specific method for accomplishing the allocation. In order to allocate the approximately $1.1 billion reinsurance premium between the retroactive and prospective reinsurance provisions of the contract, we obtained an independent third party actuarial appraisal of both (a) the total value of the businesses ceded to HLAIC, which included future renewals, new business projections and projected liabilities from future insurable events (the “Total Appraisal Value”) and (b) the value of the runoff of reserves ceded to HLAIC on the Closing Date that related to past insurable events (the “Appraised Runoff Value”). We then compared the Appraised Runoff Value to the Total Appraisal Value as our basis for allocating the approximately $1.1 billion between the retroactive and prospective provisions of the reinsurance contract. The Appraised Runoff Value represented 13.6% of the Total Appraisal Value. Accordingly, (i) 13.6% of the reinsurance premium ($149 million) was allocated to the retroactive provisions of the reinsurance contract; and (ii) the remaining 86.4% of the reinsurance premium ($947 million) was allocated to the prospective provisions of the reinsurance contract. We also assessed the value of the long duration insurance contracts ceded to HLAIC and concluded that the value associated with those contracts was a de minimis portion of the total value of the businesses ceded to HLAIC.

Under ASC 944-40-25-33, when a reinsurance contract does not extinguish the ceding entity’s liability to the policyholder, the ceding entity is not permitted to immediately recognize the reinsurance gains related to the reinsurance contract, and those gains should be deferred and earned over time. The reinsurance agreement does not extinguish Aetna’s liability to its policyholders. In order to simplify our disclosure and in our prior response, we used the term “deferred gain” to broadly describe both (i) the deferred gain related to the retroactive provisions of the reinsurance contract and (ii) the prepaid reinsurance premium paid by HLAIC related to the prospective provisions of the reinsurance contract. We accounted for these components separately, as described in greater detail below.

Prepaid reinsurance premium related to the prospective provisions of the reinsurance contract

We recorded the reinsurance premium relating to the prospective provisions of the reinsurance contract in accordance with ASC 944-605-25-20 as prepaid reinsurance premium received from HLAIC.2 The guidance in ASC 944-605-35-8 further specifies the methodology to be used in amortizing the prepaid reinsurance premium received from HLAIC into our earnings:

“Prepaid reinsurance premiums recognized under paragraph 944-605-25-20 shall be amortized over the remaining contract period in proportion to the amount of insurance protection provided.”

Accordingly, the $947 million prepaid reinsurance premium received from HLAIC relating to the prospective provisions of the reinsurance contract is being amortized into our earnings over our expected remaining customer contract period (estimated to be approximately 3 years) in proportion to the amount of insurance protection provided. For additional information on the “remaining customer contract period”, please see the discussion under “Remaining customer contract period” below.

Deferred gain related to the retroactive provisions of the reinsurance contract

Under ASC 944-605-25-22, when the insurance liabilities reinsured under a retroactive contract exceed the consideration paid, the ceding company is not permitted to immediately recognize the gain related to the difference between those two amounts, and the gain should be deferred. ASC 944-605-35-9 requires the ceding company to amortize the deferred gain over the estimated settlement period of the insurance liabilities reinsured. Accordingly, at closing, we deferred the $149 million deferred gain related to the retroactive reinsurance provisions of the reinsurance contract, and we will recognize that gain over the estimated settlement period of the reserves that existed as of the Closing Date, which is expected to be up to approximately 30 years due to the long-tail nature of certain of the insurance liabilities ceded to HLAIC.

For ease of reference, we have included a flowchart that is annotated with the relevant authoritative literature that supports our accounting for the transaction in Exhibit A.

Also please address the following questions:3

| |

| • | Why no amount was recorded in accordance with ASC 944-605-25-20 for prepaid reinsurance premiums related to the prospective reinsurance? |

| |

| • | Why is there a gain related to the prospective reinsurance portion? ASC 944-605-35-8 regarding prospective reinsurance makes no mention of deferred gain, rather only ASC 944-605-35-9 regarding retroactive reinsurance mentions deferred gain. |

2 The relevant accounting literature refers to this amount as a "prepaid reinsurance premium". It is the unearned ceding commission paid by HLAIC to Aetna related to the prospective provisions of the reinsurance contract.

3 We have reordered the questions in your letter to facilitate the structure of the discussion below.

Our Response:

As described in “Overview of reinsurance accounting for the transaction” above, in order simplify our disclosure and in our prior response, we used the term “deferred gain” to broadly describe both (i) the deferred gain related to the retroactive provisions of the reinsurance contract and (ii) the prepaid reinsurance premium paid by HLAIC related to the prospective provisions of the reinsurance contract. We recorded the prepaid reinsurance premium relating to the prospective provisions of the reinsurance contract in accordance with ASC 944-605-25-20 as prepaid reinsurance premium received from HLAIC (i.e., it was not accounted for as a deferred gain pursuant to ASC 944-605-35-9). The prepaid reinsurance premium received from HLAIC is being amortized into our earnings over our expected remaining customer contract period in proportion to the amount of insurance protection provided. For additional information on the “remaining customer contract period”, please see the discussion under “Remaining customer contract period” below.

| |

| • | What specifically does the $1.45 billion ceding commission represent and why does it, as adjusted for items discussed in your response, represent a gain? |

| |

| • | What is the basis in the accounting literature for allocating the gain between prospective and retroactive portions of the reinsurance contract? |

| |

| • | Why was an allocation not made of a premium paid to HLAIC between the prospective and retroactive portions in accordance with ASC 944-605-25-21? |

Our Response:

Please refer to “Overview of the transaction with HLAIC” above for further discussion of the $1.45 billion ceding commission and a description of what that payment represents. In order to simplify our disclosure and in our prior response, we used the term “deferred gain” to broadly describe the approximately $1.1 billion reinsurance premium paid by HLAIC to Aetna. In “Overview of reinsurance accounting for the transaction” above, we discuss the basis in the accounting literature (including ASC 944-605-25-21) for our allocation of the approximately $1.1 billion of reinsurance premium paid by HLAIC4 between the prospective and retroactive provisions of the reinsurance contract.

On page 4 of your response under the section “Prospective reinsurance deferred gain recognition methodology:”

| |

| ◦ | What is meant by the “remaining customer contract period?” |

| |

| ◦ | What is meant by “We expect Aetna customers whose insurance contracts have been reinsured to HLAIC to migrate from Aetna insurance contracts to HLAIC insurance contracts?” |

| |

| ◦ | What is the basis for the expectation in the preceding bullet? |

| |

| ◦ | Are Aetna customers obligated to migrate to HLAIC insurance contracts and, if they do not, are you obligated to continue to provide the insurance? |

Our Response:

Remaining customer contract period

In this context, the “remaining customer contract period” is the expected remaining coverage period for Aetna insurance contracts following the closing of the Group Insurance sale. Aetna is liable to the policy holders for insured events that occur during the coverage period. While the reinsured insurance contracts have a one year term, many of these contracts are subject to multi-year rate guarantees. The

4 Note that the reinsurance premium was paid by HLAIC, not to HLAIC. For additional information, see footnote 1.

guarantees generally apply for three years, although the guarantees may extend as long as five years. Moreover, we note the following considerations:

| |

| 1. | At the time of the closing of the Group Insurance sale in late 2017, Aetna already had entered into agreements with many customers for calendar year 2018. |

| |

| 2. | At the time of the closing of the Group Insurance sale (approximately one week after the signing of the Master Transaction Agreement), HLAIC did not yet have filed and approved Group Insurance products that closely matched Aetna’s policy terms that HLAIC could offer customers. Accordingly, HLAIC would not be able to offer customers suitable, regulator-approved HLAIC policies until mid-2018 at the earliest. |

| |

| 3. | To minimize the customer churn that often accompanies a re-contracting process, HLAIC wished to delay migrating customers from Aetna contracts to HLAIC contracts as long as possible. |

| |

| 4. | Aetna did not wish to permit HLAIC to continue to contract with customers using Aetna contracts past the end of 2020. |

As a result, Aetna and HLAIC agreed on the following terms:

| |

| A. | For one year after the closing of the transaction, HLAIC is authorized to issue, in Aetna’s name and on Aetna contracts, new or renewal contracts, each with a one-year term (note that this provision would permit HLAIC to issue a contract in Aetna’s name in October 2018 that would not expire until October 2019). |

| |

| B. | Subject to the following clause C., HLAIC is authorized to issue, in Aetna’s name, renewal (but not new) contracts to customers that have received a rate guarantee that extends past the first anniversary of the closing of the Group Insurance sale. |

| |

| C. | HLAIC may not issue any renewal contracts in Aetna’s name that would expire after the fourth quarter of 2020. |

For purposes of determining the “remaining customer contract period”, we assumed that customers with multi-year rate guarantees will remain on Aetna insurance contracts through the earlier of the expiration of the rate guarantee or the fourth quarter of 2020. For those customers without multi-year rate guarantees, we assumed they will remain on Aetna insurance contracts until their first contract renewal date after January 1, 2019.

After the relevant deadlines negotiated with HLAIC have expired, Aetna will no longer be required (or, for a limited period, permitted) to issue new or renewal policies to the relevant customers. At that point, the customer will have the ability to either migrate to an HLAIC insurance contract or choose another insurance carrier (other than Aetna). As noted above, although Aetna will remain liable to the policyholders for the insurable events that occur during the coverage period for policies issued in Aetna’s name prior to such deadlines, under the terms of the reinsurance agreement, Aetna transferred to HLAIC 100% of the insurance risk under such policies.

We estimated the amortization period for the $947 million prepaid reinsurance premium paid by HLAIC to Aetna at the Closing Date based on our best estimate of the remaining customer contract period at that time. We will update our best estimate of the amortization period on a quarterly basis to reflect actual activity (sales, lapses, changes in renewal dates, etc.) and record adjustments to our recognition of the prepaid reinsurance premium as appropriate.

Conclusion:

We believe our accounting for the Group Insurance sale is in accordance with the authoritative literature included in ASC 944 and is appropriately disclosed in our Form 10-K for the fiscal year ended December 31, 2017.

Exhibit A