SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2008 |

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-16125

日月光半導體製造股份有限公司

(Exact Name of Registrant as Specified in Its Charter)

Advanced Semiconductor Engineering, Inc.

(Translation of Registrant’s Name into English)

REPUBLIC OF CHINA

(Jurisdiction of Incorporation or Organization)

26 Chin Third Road

Nantze Export Processing Zone

Nantze, Kaohsiung, Taiwan

Republic of China

(Address of Principal Executive Offices)

Joseph Tung

Room 1901, No. 333, Section 1 Keelung Rd.

Taipei, Taiwan, 110

Republic of China

Tel: 886-2-8780-5489

Fax: 882-2-2757-6121

Email: ir@aseglobal.com

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class Common Shares, par value NT$10.00 each | Name of Each Exchange on which Registered The New York Stock Exchange* |

*Traded in the form of American Depositary Receipts evidencing American Depositary Shares, each representing five Common Shares

(Title of Class)

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

5,690,427,734 Common Shares, par value NT$10 each**

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes þ No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ Other þ

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ¨ Item 18 þ

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

** As a result of the exercise of employee stock options and the cancellation of treasury stock subsequent to December 31, 2008, as of May 31, 2009, we had 5,547,064,694 shares outstanding.

Page

| 1 |

| 1 |

| 3 |

| 3 |

| 3 |

| 3 |

| 3 |

| 6 |

| 6 |

| 6 |

| 19 |

| 19 |

| 21 |

| 41 |

| 44 |

| 46 |

| 46 |

| 46 |

| 59 |

| 62 |

| 63 |

| 63 |

| 64 |

| 64 |

| 67 |

| 68 |

| 69 |

| 70 |

| 70 |

| 71 |

| 71 |

| 72 |

| 72 |

| 72 |

| 73 |

| 74 |

| 74 |

| 74 |

| 76 |

| 76 |

| 76 |

| 76 |

| 76 |

| 76 |

| 76 |

| 76 |

| 82 |

| 83 |

| 84 |

| 87 |

| 87 |

| 87 |

| 88 |

| 88 |

| 90 |

| 90 |

| 90 |

| 90 |

| 90 |

| 92 |

| 92 |

| 92 |

| 92 |

| 93 |

| 93 |

| 93 |

| 93 |

| 97 |

| 97 |

| 97 |

| 97 |

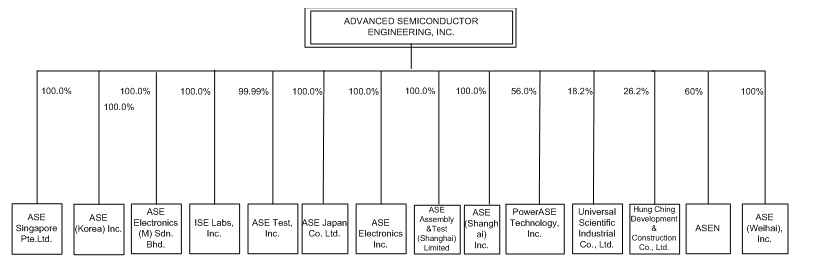

All references herein to (i) the “Company”, “ASE Group”, “ASE Inc.”, “we”, “us”, or “our” are to Advanced Semiconductor Engineering, Inc. and, unless the context requires otherwise, its subsidiaries, (ii) “ASE Test” are to ASE Test Limited, a company incorporated under the laws of Singapore, and its subsidiaries, (iii) “ASE Test Taiwan” are to ASE Test, Inc., a company incorporated under the laws of the ROC, (iv) “ASE Test Malaysia” are to ASE Electronics (M) Sdn. Bhd., a company incorporated under the laws of Malaysia, (v) “ISE Labs” are to ISE Labs, Inc., a corporation incorporated under the laws of the State of California, (vi) “ASE Korea” are to ASE (Korea) Inc., a company incorporated under the laws of the Republic of Korea, (vii) “ASE Japan” are to ASE Japan Co. Ltd., a company incorporated under the laws of Japan, (viii) “ASE Shanghai” are to ASE (Shanghai) Inc., a company incorporated under the laws of the PRC, (ix) “ASE Electronics” are to ASE Electronics Inc., a company incorporated under the laws of the ROC, (x) “PowerASE” are to PowerASE Technology, Inc., a company incorporated under the laws of the ROC, (xi) “ASESH AT” are to ASE Assembly & Test (Shanghai) Limited, formerly known as Global Advanced Packaging Technology Limited, a company incorporated under the laws of the PRC, or GAPT, (xii) “ASEN” are to Suzhou ASEN Semiconductors Co., Ltd., a company incorporated under the laws of the PRC, (xiii) “ASEWH” are to ASE (Weihai), Inc., a company incorporated under the laws of the PRC, (xiv) “Universal Scientific” are to Universal Scientific Industrial Co., Ltd., a company incorporated under the laws of the ROC, (xv) “Hung Ching” are to Hung Ching Development & Construction Co. Ltd., a company incorporated under the laws of the ROC, (xvi) “ASE Material” are to ASE Material Inc., a company previously incorporated under the laws of the ROC that merged into ASE Inc. on August 1, 2004, (xvii) “ASE Chung Li” are to ASE (Chung Li) Inc., a company previously incorporated under the laws of the ROC that merged into ASE Inc. on August 1, 2004, (xviii) the “Securities Act” are to the U.S. Securities Act of 1933, as amended, and (xix) the “Exchange Act” are to the U.S. Securities Exchange Act of 1934, as amended.

All references to the “Republic of China”, the “ROC” and “Taiwan” are to the Republic of China, including Taiwan and certain other possessions. All references to “Korea” or “South Korea” are to the Republic of Korea. All references to the “PRC” are to the People’s Republic of China and exclude Taiwan, Macau and Hong Kong.

We publish our financial statements in New Taiwan dollars, the lawful currency of the ROC. In this annual report, references to “United States dollars”, “U.S. dollars” and “US$” are to the currency of the United States; references to “New Taiwan dollars”, “NT dollars” and “NT$” are to the currency of the ROC; references to “RMB” are to the currency of the PRC; references to “JP¥” are to the currency of Japan; references to “EUR” are to the currency of the European Union; and references to “KRW” are to the currency of the Republic of Korea. Unless otherwise noted, all translations from NT dollars to U.S. dollars were made at the noon buying rate in The City of New York for cable transfers in NT dollars per U.S. dollar as certified for customs purposes by the Federal Reserve Bank of New York as of December 31, 2008, which was NT$32.76=US$1.00. All amounts translated into U.S. dollars in this annual report are provided solely for your convenience and no representation is made that the NT dollar or U.S. dollar amounts referred to herein could have been or could be converted into U.S. dollars or NT dollars, as the case may be, at any particular rate or at all. On June 1, 2009, the noon buying rate was NT$32.36=US$1.00.

This annual report on Form 20-F contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, including statements regarding our future results of operations and business prospects. Although these forward-looking statements, which may include statements regarding our future results of operations, financial condition or business prospects, are based on our own information and information from other sources we believe to be reliable, you should not place undue reliance on these forward-looking statements, which apply only as of the date of this annual report. We were not involved in the preparation of these projections. The words “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan” and similar expressions, as they relate to us, are intended to identify these forward-looking statements in this annual report. Our actual results of operations, financial condition or business prospects may differ materially from those expressed or implied in these forward-looking statements for a variety of reasons, including risks associated with cyclicality and market conditions in the semiconductor industry; demand for the outsourced semiconductor

packaging and testing services we offer and for such outsourced services generally; the highly competitive semiconductor industry; our ability to introduce new packaging and testing technologies in order to remain competitive; international business activities; our business strategy; our future expansion plans and capital expenditures; the strained relationship between the ROC and the PRC; general economic and political conditions; the recent global economic crisis; possible disruptions in commercial activities caused by natural or human-induced disasters; fluctuations in foreign currency exchange rates; and other factors. For a discussion of these risks and other factors, see “Item 3. Key Information—Risk Factors.”

Not applicable.

Not applicable.

The selected consolidated statement of operations data and cash flow data for the years ended December 31, 2006, 2007 and 2008, and the selected consolidated balance sheet data as of December 31, 2007 and 2008, set forth below are derived from our audited consolidated financial statements included in this annual report and should be read in conjunction with, and are qualified in their entirety by reference to, these consolidated financial statements, including the notes thereto. The selected consolidated statement of operations data and cash flow data for the years ended December 31, 2004 and 2005 and the selected consolidated balance sheet data as of December 31, 2004, 2005 and 2006, set forth below, are derived from our audit consolidated financial statements not included herein.Our consolidated financial statements have been prepared and presented in accordance with accounting principles generally accepted in the ROC, or ROC GAAP, which differ in some material respects from accounting principles generally accepted in the United States of America, or U.S. GAAP. See note 32 to our consolidated financial statements for a description of the significant differences between ROC GAAP and U.S. GAAP for the periods covered by these consolidated financial statements.

| | | As of and for the Year Ended December 31, | |

| | | | | | | | | | | | | | | | |

| | | NT$ | | | NT$ | | | NT$ | | | NT$ | | | NT$ | | | US$ | |

| | | (in millions, except earnings per share and per ADS data) | |

| ROC GAAP: | | | | | | | | | | | | | | | | | | |

| Statement of Operations Data: | | | | | | | | | | | | | | | | | | |

| Net revenues | | | 75,237.7 | | | | 84,035.8 | | | | 100,423.6 | | | | 101,163.1 | | | | 94,430.9 | | | | 2,882.5 | |

| Cost of revenues | | | (59,641.1 | ) | | | (69,518.0 | ) | | | (71,643.3 | ) | | | (72,074.7 | ) | | | (71,901.7 | ) | | | (2,194.8 | ) |

| Gross profit | | | 15,596.6 | | | | 14,517.8 | | | | 28,780.3 | | | | 29,088.4 | | | | 22,529.2 | | | | 687.7 | |

| Total operating expenses | | | (8,639.8 | ) | | | (8,698.6 | ) | | | (8,333.9 | ) | | | (9,791.2 | ) | | | (10,729.7 | ) | | | (327.5 | ) |

| Income from operations | | | 6,956.8 | | | | 5,819.2 | | | | 20,446.4 | | | | 19,297.2 | | | | 11,799.5 | | | | 360.2 | |

| Non-operating income (expense) | | | (3,993.9 | ) | | | (11,493.0 | ) | | | 1,805.0 | | | | (1,945.3 | ) | | | (2,323.7 | ) | | | (71.0 | ) |

| Income (loss) before income tax | | | 2,962.9 | | | | (5,673.8 | ) | | | 22,251.4 | | | | 17,351.9 | | | | 9,475.8 | | | | 289.2 | |

| Income tax benefit (expense) | | | 1,397.0 | | | | 118.6 | | | | (2,084.8 | ) | | | (3,357.4 | ) | | | (2,268.3 | ) | | | (69.2 | ) |

| Income (loss) from continuing operations | | | 4,359.9 | | | | (5,555.2 | ) | | | 20,166.6 | | | | 13,994.5 | | | | 7,207.5 | | | | 220.0 | |

Discontinued operations(1) | | | 568.2 | | | | 353.7 | | | | — | | | | — | | | | — | | | | — | |

| Cumulative effect of change in accounting principle | | | (26.8 | ) (2) | | | — | | | | (342.5 | ) (3) | | | — | | | | — | | | | — | |

| Minority interest in net loss (income) of subsidiaries | | | (691.6 | ) | | | 510.3 | | | | (2,407.9 | ) | | | (1,829.2 | ) | | | (1,047.4 | ) | | | (32.0 | ) |

| Net income (loss) attributable to shareholders of parent company | | | 4,209.7 | | | | (4,691.2 | ) | | | 17,416.2 | | | | 12,165.3 | | | | 6,160.1 | | | | 188.0 | |

| Income from operations per common share | | | 1.36 | | | | 1.11 | | | | 3.86 | | | | 3.58 | | | | 2.19 | | | | 0.07 | |

| Income (loss) from continuing operations per common share | | | 0.71 | | | | (0.96 | ) | | | 3.36 | | | | 2.26 | | | | 1.14 | | | | 0.03 | |

Earnings (loss) per common share(4): | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 0.82 | | | | (0.89 | ) | | | 3.29 | | | | 2.26 | | | | 1.14 | | | | 0.03 | |

| Diluted | | | 0.80 | | | | (0.89 | ) | | | 3.14 | | | | 2.18 | | | | 1.12 | | | | 0.03 | |

Dividends per common share(5) | | | 0.57 | | | | 1.10 | | | | — | | | | 2.96 | | | | 2.00 | | | | 0.06 | |

Earnings (loss) per equivalent ADS(4): | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 4.11 | | | | (4.47 | ) | | | 16.46 | | | | 11.28 | | | | 5.71 | | | | 0.17 | |

| Diluted | | | 4.01 | | | | (4.47 | ) | | | 15.69 | | | | 10.90 | | | | 5.59 | | | | 0.17 | |

| | | As of and for the Year Ended December 31, | |

| | | | | | | | | | | | | | | | |

| | | NT$ | | | NT$ | | | NT$ | | | NT$ | | | NT$ | | | US$ | |

| | | (in millions, except earnings per share and per ADS data) | |

Number of common shares(6): | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 5,121.9 | | | | 5,248.9 | | | | 5,291.6 | | | | 5,390.9 | | | | 5,392.9 | | | | 5,392.9 | |

| Diluted | | | 5,459.4 | | | | 5,248.9 | | | | 5,603.5 | | | | 5,633.1 | | | | 5,457.4 | | | | 5,457.4 | |

| Number of equivalent ADSs: | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 1,024.4 | | | | 1,049.8 | | | | 1,058.3 | | | | 1,078.2 | | | | 1,078.6 | | | | 1,078.6 | |

| Diluted | | | 1,091.9 | | | | 1,049.8 | | | | 1,120.7 | | | | 1,126.6 | | | | 1,091.5 | | | | 1,091.5 | |

| Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Current assets | | | 35,894.9 | | | | 47,544.0 | | | | 48,762.8 | | | | 56,902.0 | | | | 46,366.9 | | | | 1,415.3 | |

| Long-term investments | | | 4,907.4 | | | | 4,898.1 | | | | 5,734.5 | | | | 4,850.2 | | | | 4,327.0 | | | | 132.1 | |

| Property, plant and equipment, net | | | 82,339.9 | | | | 68,040.8 | | | | 73,543.8 | | | | 81,788.3 | | | | 84,758.0 | | | | 2,587.2 | |

| Intangible assets | | | 3,959.8 | | | | 3,589.1 | | | | 3,449.0 | | | | 4,732.3 | | | | 12,592.0 | | | | 384.4 | |

| Other assets | | | 6,848.9 | | | | 7,053.5 | | | | 5,550.8 | | | | 4,104.6 | | | | 4,146.1 | | | | 126.6 | |

| Total assets | | | 133,950.9 | | | | 131,125.5 | | | | 137,040.9 | | | | 152,377.4 | | | | 152,190.0 | | | | 4,645.6 | |

Short-term borrowings(7) | | | 6,852.8 | | | | 10,523.1 | | | | 8,499.1 | | | | 15,773.9 | | | | 11,473.2 | | | | 350.2 | |

Long-term debts(8) | | | 46,529.6 | | | | 42,862.1 | | | | 29,398.3 | | | | 23,936.0 | | | | 51,622.2 | | | | 1,575.8 | |

Other liabilities(9) | | | 20,851.9 | | | | 22,890.0 | | | | 22,016.7 | | | | 22,927.6 | | | | 17,133.8 | | | | 523.0 | |

| Total liabilities | | | 74,234.3 | | | | 76,275.2 | | | | 59,914.1 | | | | 62,637.5 | | | | 80,229.2 | | | | 2,449.0 | |

| Capital stock | | | 41,000.0 | | | | 45,573.7 | | | | 45,925.1 | | | | 54,475.6 | | | | 56,904.3 | | | | 1,737.0 | |

| Minority interest in consolidated subsidiaries | | | 8,404.8 | | | | 7,902.0 | | | | 11,106.9 | | | | 14,566.5 | | | | 2,288.7 | | | | 69.9 | |

| Total shareholders’ equity | | | 59,716.6 | | | | 54,850.3 | | | | 77,126.8 | | | | 89,739.9 | | | | 71,960.8 | | | | 2,196.6 | |

| Cash Flow Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net cash outflow from acquisition of property, plant and equipment | | | (28,521.4 | ) | | | (15,611.5 | ) | | | (17,764.2 | ) | | | (17,190.4 | ) | | | (18,583.3 | ) | | | (567.3 | ) |

| Depreciation and amortization | | | 14,786.3 | | | | 15,032.8 | | | | 14,488.2 | | | | 16,626.2 | | | | 17,244.9 | | | | 526.4 | |

| Net cash inflow from operating activities | | | 19,206.7 | | | | 18,751.1 | | | | 37,310.8 | | | | 28,310.6 | | | | 30,728.8 | | | | 938.0 | |

| Net cash outflow from investing activities | | | (31,048.9 | ) | | | (11,632.0 | ) | | | (22,104.5 | ) | | | (18,108.4 | ) | | | (36,359.2 | ) | | | (1,109.9 | ) |

| Net cash inflow (outflow) from financing activities | | | 9,164.2 | | | | (91.8 | ) | | | (12,581.9 | ) | | | (8,492.7 | ) | | | 13,862.4 | | | | 423.2 | |

| Segment Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net revenues: | | | | | | | | | | | | | | | | | | | | | | | | |

| Packaging | | | 58,261.8 | | | | 66,022.9 | | | | 76,820.5 | | | | 78,516.3 | | | | 73,391.6 | | | | 2,240.3 | |

| Testing | | | 16,473.9 | | | | 17,122.0 | | | | 21,429.6 | | | | 20,007.8 | | | | 19,021.4 | | | | 580.6 | |

| Others | | | 502.0 | | | | 890.9 | | | | 2,173.5 | | | | 2,639.0 | | | | 2,017.9 | | | | 61.6 | |

| Gross profit (loss): | | | | | | | | | | | | | | | | | | | | | | | | |

| Packaging | | | 11,146.0 | | | | 10,128.7 | | | | 19,280.8 | | | | 20,589.7 | | | | 14,700.1 | | | | 448.7 | |

| Testing | | | 4,332.7 | | | | 4,433.1 | | | | 8,728.2 | | | | 7,602.9 | | | | 6,467.4 | | | | 197.4 | |

| Others | | | 117.9 | | | | (44.0 | ) | | | 771.3 | | | | 895.8 | | | | 1,361.7 | | | | 41.6 | |

| | | As of and for the Year Ended December 31, | |

| | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | |

| | | NT$ | | | NT$ | | | NT$ | | | NT$ | | | NT$ | | | US$ | |

| | | (in millions, except earnings per share and per ADS data) | |

| U.S. GAAP: | | | | | | | | | | | | | | | | | | |

| Statement of Operations Data: | | | | | | | | | | | | | | | | | | |

| Net revenues | | | 75,237.7 | | | | 84,035.8 | | | | 100,423.6 | | | | 101,163.1 | | | | 94,430.9 | | | | 2,882.5 | |

| Cost of revenues | | | (60,030.0 | ) | | | (70,544.4 | ) | | | (73,366.9 | ) | | | (75,134.7 | ) | | | (73,109.9 | ) | | | (2,231.7 | ) |

| Gross profit | | | 15,207.7 | | | | 13,491.4 | | | | 27,056.7 | | | | 26,028.4 | | | | 21,321.0 | | | | 650.8 | |

| Total operating expenses | | | (7,227.6 | ) | | | (21,882.8 | ) | | | (10,113.8 | ) | | | (11,108.7 | ) | | | (10,820.7 | ) | | | (330.3 | ) |

| Income (loss) from operations | | | 7,980.1 | | | | (8,391.4 | ) | | | 16,942.9 | | | | 14,919.7 | | | | 10,500.3 | | | | 320.5 | |

| Non-operating income (expense) | | | (5,127.2 | ) | | | 1,958.5 | | | | 1,448.4 | | | | 71.4 | | | | (1,351.2 | ) | | | (41.2 | ) |

| Income tax benefit (expense) | | | 1,506.1 | | | | 190.3 | | | | (1,980.7 | ) | | | (3,262.5 | ) | | | (2,503.5 | ) | | | (76.4 | ) |

Discontinued operations(1) | | | 568.2 | | | | 353.7 | | | | — | | | | — | | | | — | | | | — | |

| Cumulative effect of change in accounting principle | | | (26.8 | )(2) | | | — | | | | (296.5 | )(10) | | | — | | | | — | | | | — | |

| Minority interest in net loss (income) of subsidiaries | | | (603.3 | ) | | | 358.4 | | | | (1,991.4 | ) | | | (1,797.5 | ) | | | (1,153.5 | ) | | | (35.2 | ) |

| Net income (loss) | | | 4,297.1 | | | | (5,530.5 | ) | | | 14,122.7 | | | | 9,931.1 | | | | 5,492.1 | | | | 167.7 | |

| | | As of and for the Year Ended December 31, | |

| | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | |

| | | NT$ | | | NT$ | | | NT$ | | | NT$ | | | NT$ | | | US$ | |

| | | (in millions, except earnings per share and per ADS data) | |

Earnings (loss) per common share(4): | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 0.86 | | | | (1.08 | ) | | | 2.71 | | | | 1.87 | | | | 1.02 | | | | 0.03 | |

| Diluted | | | 0.84 | | | | (1.08 | ) | | | 2.60 | | | | 1.81 | | | | 1.01 | | | | 0.03 | |

Earnings (loss) per equivalent ADS(4): | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 4.29 | | | | (5.38 | ) | | | 13.57 | | | | 9.34 | | | | 5.11 | | | | 0.16 | |

| Diluted | | | 4.18 | | | | (5.38 | ) | | | 12.98 | | | | 9.03 | | | | 5.04 | | | | 0.16 | |

Number of common shares(11): | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 5,009.9 | | | | 5,141.1 | | | | 5,202.7 | | | | 5,317.7 | | | | 5,368.7 | | | | 5,368.7 | |

| Diluted | | | 5,340.1 | | | | 5,141.1 | | | | 5,505.5 | | | | 5,566.1 | | | | 5,405.3 | | | | 5,405.3 | |

Number of equivalent ADSs(11): | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 1,002.0 | | | | 1,028.2 | | | | 1,040.5 | | | | 1,063.5 | | | | 1,073.7 | | | | 1,073.7 | |

| Diluted | | | 1,068.1 | | | | 1,028.2 | | | | 1,101.1 | | | | 1,113.2 | | | | 1,081.1 | | | | 1,081.1 | |

| Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Current assets | | | 35,899.1 | | | | 47,560.3 | | | | 48,762.8 | | | | 56,902.0 | | | | 46,366.9 | | | | 1,415.3 | |

| Long-term investments | | | 3,377.6 | | | | 3,469.2 | | | | 4,266.9 | | | | 3,045.4 | | | | 2,842.7 | | | | 86.8 | |

| Property, plant and equipment, net | | | 81,849.1 | | | | 67,547.9 | | | | 70,894.1 | | | | 80,036.6 | | | | 82,694.5 | | | | 2,524.3 | |

| Intangible assets | | | 3,954.4 | | | | 4,112.6 | | | | 3,972.4 | | | | 5,255.8 | | | | 12,940.6 | | | | 395.0 | |

| Other assets | | | 7,008.5 | | | | 7,284.7 | | | | 5,834.9 | | | | 3,766.7 | | | | 3,963.5 | | | | 121.0 | |

| Total assets | | | 132,088.7 | | | | 129,974.7 | | | | 133,731.1 | | | | 149,006.5 | | | | 148,808.2 | | | | 4,542.4 | |

Short-term borrowings(7) | | | 6,852.8 | | | | 10,523.1 | | | | 8,499.1 | | | | 15,773.9 | | | | 11,473.2 | | | | 350.2 | |

Long-term debts(8) | | | 46,529.6 | | | | 42,862.1 | | | | 29,398.3 | | | | 23,936.0 | | | | 51,622.2 | | | | 1,575.8 | |

Other liabilities(9) | | | 21,465.2 | | | | 23,397.2 | | | | 24,228.3 | | | | 24,746.0 | | | | 18,307.1 | | | | 558.8 | |

| Total liabilities | | | 74,847.6 | | | | 76,782.4 | | | | 62,125.7 | | | | 64,455.9 | | | | 81,402.5 | | | | 2,484.8 | |

| Minority interest | | | 8,584.0 | | | | 8,233.0 | | | | 11,021.3 | | | | 14,449.2 | | | | 2,102.7 | | | | 64.2 | |

| Capital stock | | | 41,000.0 | | | | 45,573.7 | | | | 45,925.1 | | | | 54,475.6 | | | | 56,904.3 | | | | 1,737.0 | |

| Total shareholders’ equity | | | 48,657.1 | | | | 44,959.3 | | | | 60,584.1 | | | | 70,101.4 | | | | 65,303.0 | | | | 1,993.4 | |

| (1) | In October 2005, we disposed of our camera module assembly operations in Malaysia. Amount for 2005 includes income from discontinued operations of NT$121.0 million and gain on disposal of discontinued operations of NT$232.7 million, net of income tax expense. Such operations were formerly classified as part of our packaging operations. Information in this annual report from our consolidated statements of operations for the years ended December 31, 2004 and 2005 has been adjusted to reflect the reclassification of our camera module assembly operations as discontinued operations. Information from our consolidated statements of cash flows was appropriately not adjusted. |

| (2) | Represents the cumulative effect of our change from using the weighted-average method to using the moving-average method to price our raw materials and supplies. |

| (3) | Represents the cumulative effect of our adoption of ROC Statement of Financial Accounting Standards, or SFAS, No. 34 “Financial Instrument: Recognition and Measurement” and ROC SFAS, No. 36 “Financial Instruments: Disclosure and Presentation.” See note 3 to our consolidated financial statements included in this annual report. |

| (4) | The denominators for diluted earnings per common share and diluted earnings per equivalent ADS are calculated to account for the potential exercise of options and conversion of our convertible bonds into our common shares and American depositary shares, or ADSs. |

| (5) | Dividends per common share issued as a cash dividend and a stock dividend. |

| (6) | Represents the weighted average number of shares after retroactive adjustments to give effect to stock dividends and employee stock bonuses. Beginning in 2002, common shares held by consolidated subsidiaries are classified as “treasury stock”, and are deducted from the number of common shares outstanding. |

| (7) | Includes current portions of bonds payable, long-term bank loans and capital lease obligations. |

| (8) | Excludes current portions of bonds payable, long-term bank loans and capital lease obligations. |

| (9) | Includes current liabilities other than short-term borrowings. |

| (10) | Represents the cumulative effect of our adoption of U.S. SFAS No. 123R, “Share-Based Payment.” See note 33 to our consolidated financial statements included in this annual report. |

| (11) | Represents the weighted average number of common shares after retroactive adjustments to give effect to stock dividends. |

Exchange Rates

Fluctuations in the exchange rate between NT dollars and U.S. dollars will affect the U.S. dollar equivalent of the NT dollar price of the common shares on the Taiwan Stock Exchange and, as a result, will likely affect the market price of the ADSs. Fluctuations will also affect the U.S. dollar conversion by the depositary under our ADS deposit agreement referred to below of cash dividends paid in NT dollars on, and the NT dollar proceeds received by

the depositary from any sale of, common shares represented by ADSs, in each case, according to the terms of the deposit agreement dated September 29, 2000 and as amended and supplemented from time to time among us, Citibank N.A., as depositary, and the holders and beneficial owners from time to time of the ADSs, which we refer to as the deposit agreement.

The following table sets forth, for the periods indicated, information concerning the number of NT dollars for which one U.S. dollar could be exchanged based on the noon buying rate for cable transfers in NT dollars as certified for customs purposes by the Federal Reserve Bank of New York.

| | | NT Dollars per U.S. Dollar Noon Buying Rate | |

| | | | | | | | | | | | | |

| 2004 | | | 33.37 | | | | 34.16 | | | | 33.10 | | | | 33.24 | |

| 2005 | | | 32.13 | | | | 33.77 | | | | 30.65 | | | | 32.80 | |

| 2006 | | | 32.51 | | | | 33.31 | | | | 31.28 | | | | 32.59 | |

| 2007 | | | 32.85 | | | | 33.41 | | | | 32.26 | | | | 32.43 | |

| 2008 | | | 31.52 | | | | 33.58 | | | | 29.99 | | | | 32.76 | |

| December | | | 33.16 | | | | 33.58 | | | | 32.45 | | | | 32.76 | |

| 2009 | | | | | | | | | | | | | | | | |

| January | | | 33.37 | | | | 33.70 | | | | 32.82 | | | | 33.70 | |

| February | | | 34.24 | | | | 35.00 | | | | 33.61 | | | | 35.00 | |

| March | | | 34.30 | | | | 35.21 | | | | 33.75 | | | | 33.87 | |

| April | | | 33.60 | | | | 33.88 | | | | 32.99 | | | | 33.06 | |

| May | | | 32.87 | | | | 33.14 | | | | 32.55 | | | | 32.57 | |

Source: Federal Reserve Statistical Release, Board of Governors of the Federal Reserve System.

On June 1, 2009, the noon buying rate was NT$32.36=US$1.00.

Not applicable.

Not applicable.

Risks Relating to Our Business

The current global economic crisis has adversely affected the semiconductor industry and the demand for our products and services, and a protracted global economic crisis would have a material adverse effect on us.

Our customers include a range of companies in the semiconductor industry, whose success is linked to the health of the economy. As widely reported, the global financial markets have recently been experiencing extreme volatility and disruptions, which have severely diminished liquidity and credit availability. This market turmoil and tightening of credit have led to an increased level of commercial and consumer delinquencies, lack of consumer confidence, increased market volatility and widespread reduction of business activity generally. There can be no assurance that there will be no further deterioration in the global financial markets.

Our fourth quarter 2008 revenue decreased 36.8% over the prior year which reflected the contraction in demand for our services as a result of the global economic crisis. The protracted decline in the global economy and semiconductor industry may also cause our customers to do the following:

| · | cancel or reduce planned expenditures for our products and services; |

| · | seek to lower their costs by renegotiating their contracts with us; |

| · | consolidate the number of suppliers they use which may result in our loss of customers; and |

| · | switch to lower-priced products or services provided by our competitors. |

The current uncertainty in global economic conditions may also make it difficult for our customers to accurately forecast and plan future business activities. We cannot predict the timing, strength, or duration of the global economic slowdown and downturn in the semiconductor industry or subsequent recovery. There can be no assurance that the continuing or deteriorating trends in global economic conditions will not further adversely impact our results of operations, cash flow, financial position and/or prospects.

Since we are dependent on the highly cyclical semiconductor industry and conditions in the markets for the end-use applications of our products, our revenues and net income may fluctuate significantly.

Our semiconductor packaging and testing business is affected by market conditions in the highly cyclical semiconductor industry. All of our customers operate in this industry, and variations in order levels from our customers and service fee rates may result in volatility in our revenues and net income. From time to time, the semiconductor industry has experienced significant, and sometimes prolonged, downturns. As our business is, and will continue to be, dependent on the requirements of semiconductor companies for independent packaging and testing services, any future downturn in the semiconductor industry would reduce demand for our services. For example, in the fourth quarter of 2008, the global economic crisis resulted in a significant deterioration in demand for our customers’ products, which in turn affected demand for our services and adversely affected our operating results. Although demand has begun to recover in the second quarter of 2009, we expect there to be continued downward pressure on our average selling prices and continued volatility with respect to our sales volumes. If we cannot reduce our costs or adjust our product mix to sufficiently offset any decline in average selling prices, our profitability will suffer and we may incur losses.

Market conditions in the semiconductor industry depend to a large degree on conditions in the markets for the end-use applications of semiconductor products, such as communications, computer and consumer electronics products. Any deterioration of conditions in the markets, including the recent severe deterioration of global economic conditions, for the end-use applications of the semiconductors we package and test would reduce demand for our services, and would likely have a material adverse effect on our financial condition and results of operations. In 2006, approximately 37.2%, 24.7% and 37.3% of our net revenues were attributed to the packaging and testing of semiconductors used in communications, computer, and consumer electronics applications, respectively. In 2007, approximately 44.5%, 22.8% and 32.1% of our net revenues were attributed to the packaging and testing of semiconductors used in communications, computer, and consumer electronics applications, respectively. In 2008, approximately 44.7%, 22.8% and 32.1% of our net revenues were attributed to the packaging and testing of semiconductors used in communications, computer, and consumer electronics applications, respectively. Each of the markets for end-use applications is subject to intense competition and significant shifts in demand, which could put pricing pressure on the packaging and testing services provided by us and adversely affect our revenues and net income.

A reversal or slowdown in the outsourcing trend for semiconductor packaging and testing services could adversely affect our growth prospects and profitability.

In recent years, semiconductor manufacturers that have their own in-house packaging and testing capabilities, known as integrated device manufacturers, have increasingly outsourced stages of the semiconductor production process, including packaging and testing, to independent companies in order to reduce costs and shorten production cycles. In addition, the availability of advanced independent semiconductor manufacturing services has also enabled the growth of so-called “fabless” semiconductor companies that focus exclusively on design and marketing and outsource their manufacturing, packaging and testing requirements to independent companies. We cannot assure you that these integrated device manufacturers and fabless semiconductor companies will continue to outsource their packaging and testing requirements to third parties like us. Furthermore, during an economic downturn, these integrated device manufacturers typically rely more on their own in-house packaging and testing capabilities, therefore decreasing their need to outsource. A reversal of, or a slowdown in, this outsourcing trend could result in reduced demand for our services and adversely affect our growth prospects and profitability.

If we are unable to compete favorably in the highly competitive semiconductor packaging and testing markets, our revenues and net income may decrease.

The semiconductor packaging and testing markets are very competitive. We face competition from a number of sources, including other independent semiconductor packaging and testing companies, especially those that offer turnkey packaging and testing services. We believe that the principal competitive factors in the packaging and testing markets are:

| · | technological expertise; |

| · | the ability to provide total solutions to our customers; |

| · | range of package types and testing platforms available; |

| · | the ability to work closely with our customers at the product development stage; |

| · | responsiveness and flexibility; |

| · | diversity in facility locations; and |

We face increasing competition from other packaging and testing companies, as most of our customers obtain packaging or testing services from more than one source. In addition, some of our competitors may have access to more advanced technologies and greater financial and other resources than we do. Any erosion in the prices for our packaging and testing services could cause our revenues and net income to decrease and have a material adverse effect on our financial condition and results of operations.

Our profitability depends on our ability to respond to rapid technological changes in the semiconductor industry.

The semiconductor industry is characterized by rapid increases in the diversity and complexity of semiconductors. As a result, we expect that we will need to constantly offer more sophisticated packaging and testing technologies and processes in order to respond to competitive industry conditions and customer requirements. If we fail to develop, or obtain access to, advances in packaging or testing technologies or processes, we may become less competitive and less profitable. In addition, advances in technology typically lead to declining average selling prices for semiconductors packaged or tested with older technologies or processes. As a result, if we cannot reduce the costs associated with our services, the profitability of a given service and our overall profitability may decrease over time.

Our operating results are subject to significant fluctuations, which could adversely affect the market value of your investment.

Our operating results have varied significantly from period to period and may continue to vary in the future. Downward fluctuations in our operating results may result in decreases in the market price of our common shares and the ADSs. Among the more important factors affecting our quarterly and annual operating results are the following:

| · | changes in general economic and business conditions, particularly given the recent global economic crisis and the cyclical nature of the semiconductor industry and the markets served by our customers; |

| · | our ability to quickly adjust to unanticipated declines or shortfalls in demand and market prices for our packaging and testing services, due to our high percentage of fixed costs; |

| · | changes in prices for our packaging and testing services; |

| · | volume of orders relative to our packaging and testing capacity; |

| · | changes in costs and availability of raw materials, equipment and labor; |

| · | timing of capital expenditures in anticipation of future orders; |

| · | our ability to acquire or design and produce advanced and cost-competitive interconnect materials; |

| | fluctuations in the exchange rate between the NT dollar and foreign currencies, especially the U.S. dollar; and |

| | earthquakes, drought, epidemics and other natural disasters, as well as industrial and other incidents such as fires and power outages. |

Due to the factors listed above, our future operating results or growth rates may be below the expectations of research analysts and investors. If so, the market price of our common shares and the ADSs, and thus the market value of your investment, may fall.

If we are not successful in maintaining our in-house interconnect materials capabilities, our margins and profitability may be adversely affected.

We expect that we will need to maintain our interconnect materials designs and production processes in order to respond to competitive industry conditions and customer requirements. In particular, our competitive position will depend on our ability to design and produce interconnect materials that are comparable to or better than those produced by independent suppliers and others. Many of these independent suppliers have dedicated greater resources than we have for the research and development and design and production of interconnect materials. In addition, we may not be able to acquire the technology and personnel that would enable us to maintain our in-house expertise and our design and production capabilities. For more information on our interconnect materials operations, see “Item 4. Information on the Company—Business Overview—Principal Products and Services—Packaging Services—Interconnect Materials.” If we are unable to maintain our in-house interconnect materials expertise to offer interconnect materials that meet the requirements of our customers, we may become less competitive and our margins and profitability may suffer as a result.

Due to our high percentage of fixed costs, we will be unable to maintain our gross margin at past levels if we are unable to achieve relatively high capacity utilization rates.

Our operations, in particular our testing operations, are characterized by relatively high fixed costs. We expect to continue to incur substantial depreciation and other expenses in connection with our acquisitions of packaging and testing equipment and facilities. Our profitability depends not only on the pricing levels for our services, but also on utilization rates for our packaging and testing machinery and equipment, commonly referred to as “capacity utilization rates.” In particular, increases or decreases in our capacity utilization rates can significantly affect gross margins since the unit cost of packaging and testing services generally decreases as fixed costs are allocated over a larger number of units. In periods of low demand, we experience relatively low capacity utilization rates in our operations, which leads to reduced margins. For example, in the fourth quarter of 2008, we experienced lower than anticipated utilization rates in our operations due to a significant decline in worldwide demand for our packaging and testing services, which resulted in reduced margins during that period. We cannot assure you that we will be able to maintain or surpass our past gross margin levels if we cannot consistently achieve or maintain relatively high capacity utilization rates.

If we are unable to manage our expansion effectively, our growth prospects may be limited and our future profitability may be affected.

We have significantly expanded our packaging and testing operations in recent years, and expect to continue to expand our operations in the future. In particular, we intend to provide total solutions for the packaging and testing of semiconductors in order to attract new customers and broaden our product range to include products packaged

and tested for a variety of end-use applications. In the past, we have expanded through both internal growth and the acquisition of new operations. Rapid expansion puts strain on our managerial, technical, financial, operational and other resources. As a result of our expansion, we have implemented and will continue to implement additional operational and financial controls and hire and train additional personnel. Any failure to manage our growth effectively could lead to inefficiencies and redundancies and result in reduced growth prospects and profitability.

Because of the highly cyclical nature of our industry, our capital requirements are difficult to plan. If we cannot obtain additional capital when we need it, our growth prospects and future profitability may be adversely affected.

Our capital requirements are difficult to plan in our highly cyclical and rapidly changing industry. We will need capital to fund the expansion of our facilities as well as fund our research and development activities in order to remain competitive. We believe that our existing cash, marketable securities, expected cash flow from operations and existing credit lines under our loan facilities will be sufficient to meet our capital expenditures, working capital, cash obligations under our existing debt and lease arrangements, and other requirements for at least the next twelve months. However, future capacity expansions or market or other developments may cause us to require additional funds. Our ability to obtain external financing in the future is subject to a variety of uncertainties, including:

| · | our future financial condition, results of operations and cash flows; |

| · | general market conditions for financing activities by semiconductor companies; and |

| · | economic, political and other conditions in Taiwan and elsewhere. |

Furthermore, if global economic conditions in 2009 continue to deteriorate, we may incur significant net losses in 2009. This may in turn affect our ability to meet certain financial covenants contained in our loan agreements and thereby restrict our ability to access unutilized credit facilities or the global capital markets to meet our liquidity needs. If we are unable to obtain funding in a timely manner or on acceptable terms, our growth prospects and future profitability may decline.

Restrictive covenants and broad default provisions in our existing debt agreements may materially restrict our operations as well as adversely affect our liquidity, financial condition and results of operations.

We are a party to numerous loan and other agreements relating to the incurrence of debt, many of which include restrictive covenants and broad default provisions. In general, covenants in the agreements governing our existing debt, and debt we may incur in the future, may materially restrict our operations, including our ability to incur debt, pay dividends, make certain investments and payments, other than in connection with restructurings of consolidated entities, and encumber or dispose of assets. In the event of a prolonged downturn in the demand for our services as a result of a downturn in the worldwide semiconductor industry or otherwise, we cannot assure you that we will be able to remain in compliance with our financial covenants which, as a result, may lead to a default. Furthermore, a default under one agreement by us or one of our subsidiaries may also trigger cross-defaults under our other agreements. In the event of default, we may not be able to cure the default or obtain a waiver on a timely basis. An event of default under any agreement governing our existing or future debt, if not cured or waived, could have a material adverse effect on our liquidity, financial condition and results of operations.

We have on occasion failed to comply with certain financial covenants in some of our loan agreements. Such non-compliance may also have, through broadly worded cross-default provisions, resulted in default under some of the agreements governing our other existing debt. For example, we failed to comply with certain debt ratios in some of our loan agreements as a result of additional borrowings to fund our privatization of ASE Test in May 2008 and the distribution of cash dividends in August 2008. See “Item 4. Information on the Company—History and Development of the Company—ASE Test Share Acquisition and Privatization” for more information on ASE Test. By August 2008, we had either obtained waivers for, or refinanced on a long-term basis, all of the relevant loans, and are not in default under any of our existing debt. For these and other reasons, including our financial condition and our relationship with our lenders, no lender has to date sought and we do not believe that any of our lenders would seek to declare a default or enforce remedies in respect of our existing debt as a result of cross-default provisions or otherwise, although we cannot provide any assurance in this regard.

We depend on select personnel and could be affected by the loss of their services.

We depend on the continued service of our executive officers and skilled technical and other personnel. Our business could suffer if we lose the services of any of these personnel and cannot adequately replace them. Although some of these management personnel have entered into employment agreements with us, they may nevertheless leave before the expiration of these agreements. We are not insured against the loss of any of our personnel. In addition, we may be required to increase substantially the number of these employees in connection with our expansion plans, and there is intense competition for their services in the semiconductor industry. We may not be able to either retain our present personnel or attract additional qualified personnel as and when needed. In addition, we may need to increase employee compensation levels in order to attract and retain our existing officers and employees and the additional personnel that we expect to require. Furthermore, a portion of the workforce at our facilities in Taiwan are foreign workers employed by us under work permits which are subject to government regulations on renewal and other terms. Consequently, our business could also suffer if the Taiwan regulations relating to the employment of foreign workers were to become significantly more restrictive or if we are otherwise unable to attract or retain these workers at a reasonable cost.

If we are unable to obtain additional packaging and testing equipment or facilities in a timely manner and at a reasonable cost, our competitiveness and future profitability may be adversely affected.

The semiconductor packaging and testing businesses are capital intensive and require significant investment in expensive equipment manufactured by a limited number of suppliers. The market for semiconductor packaging and testing equipment is characterized, from time to time, by intense demand, limited supply and long delivery cycles. Our operations and expansion plans depend on our ability to obtain a significant amount of such equipment from a limited number of suppliers. From time to time we have also leased certain equipment. We have no binding supply agreements with any of our suppliers and acquire our packaging and testing equipment on a purchase order basis, which exposes us to changing market conditions and other substantial risks. For example, shortages of capital equipment could result in an increase in the price of equipment and longer delivery times. Semiconductor packaging and testing also require us to operate sizeable facilities. If we are unable to obtain equipment or facilities in a timely manner, we may be unable to fulfill our customers’ orders, which could adversely affect our growth prospects as well as financial condition and results of operations. See “Item 4. Information on the Company—Business Overview—Equipment.”

Fluctuations in exchange rates could result in foreign exchange losses.

Currently, the majority of our revenues from packaging and testing services are denominated in U.S. dollars, with a portion denominated in NT dollars and Japanese yen. Our cost of revenues and operating expenses associated with packaging and testing services, on the other hand, are incurred in several currencies, primarily NT dollars and U.S. dollars, as well as, to a lesser extent, Korean won, Japanese yen, Malaysian ringgit and Chinese yuan. In addition, a substantial portion of our capital expenditures, primarily for the purchase of packaging and testing equipment, has been, and is expected to continue to be, denominated in U.S. dollars, with much of the remainder in Japanese yen. Fluctuations in exchange rates, primarily among the U.S. dollar, the NT dollar, the Japanese yen and the Chinese yuan, will affect our costs and operating margins. In addition, these fluctuations could result in exchange losses and increased costs in NT dollar and other local currency terms. Despite hedging and mitigating techniques implemented by us, fluctuations in exchange rates have affected, and may continue to affect, our financial condition and results of operations. We incurred net foreign exchange gains of NT$92.8 million, NT$403.5 million and NT$282.0 million (US$8.6 million) in 2006, 2007 and 2008, respectively. See “Item 11. Quantitative and Qualitative Disclosures about Market Risk—Market Risk—Foreign Currency Exchange Rate Risk.”

The loss of a large customer or disruption of our strategic alliance or other commercial arrangements with semiconductor foundries and providers of other complementary semiconductor manufacturing services may result in a decline in our revenues and profitability.

Although we have over 200 customers, we have derived and expect to continue to derive a large portion of our revenues from a small group of customers during any particular period due in part to the concentration of market share in the semiconductor industry. Our five largest customers together accounted for approximately 26.0%, 24.8%

and 27.1% of our net revenues in 2006, 2007 and 2008, respectively. No customer accounted for more than 10% of our net revenues in 2006, 2007 and 2008. The demand for our services from a customer is directly dependent upon that customer’s level of business activity, which could vary significantly from year to year. Our key customers typically operate in the cyclical semiconductor business and, in the past, have varied, and may vary in the future, order levels significantly from period to period. Some of these companies are relatively small, have limited operating histories and financial resources, and are highly exposed to the cyclicality of the industry. We cannot assure you that these customers or any other customers will continue to place orders with us in the future at the same levels as in past periods. The loss of one or more of our significant customers, or reduced orders by any one of them, and our inability to replace these customers or make up for such orders could adversely affect our revenues and profitability. In addition, we have in the past reduced, and may in the future be requested to reduce, our prices to limit the level of order cancellations. Any price reduction would likely reduce our margins and profitability.

Since 1997, we have maintained a strategic alliance with Taiwan Semiconductor Manufacturing Company Limited, or TSMC, one of the world’s largest dedicated semiconductor foundries. TSMC designates us as their non-exclusive preferred provider of packaging and testing services for semiconductors manufactured by TSMC. In addition, on February 23, 2009, we and Advanced Microelectronic Products, Inc., or AMPI, a provider of foundry services, signed a memorandum of understanding to enter into a strategic alliance focused on providing semiconductor manufacturing turnkey services. These strategic alliances, as well as our other commercial arrangements with providers of other complementary semiconductor manufacturing services, enable us to offer total semiconductor manufacturing solutions to our customers. These strategic alliances and any of our other commercial arrangements may be terminated at any time. Any such termination, and our failure to enter into substantially similar strategic alliances or commercial arrangements, may adversely affect our competitiveness and our revenues and profitability.

Our revenues and profitability may decline if we are unable to obtain adequate supplies of raw materials in a timely manner and at a reasonable price.

Our packaging operations require that we obtain adequate supplies of raw materials on a timely basis. Shortages in the supply of raw materials experienced by the semiconductor industry have in the past resulted in occasional price increases and delivery delays. Raw materials such as advanced substrates are prone to supply shortages since such materials are produced by a limited number of suppliers such as Phoenix Precision Technology Corporation, Kinsus Interconnect Technology Corporation, SMI Electronic Devices Inc. and Nanya Printed Circuit Board Corporation. Our operations conducted through our wholly-owned subsidiary ASE Electronics and ASE Shanghai have improved our ability to obtain advanced substrates on a timely basis and at a reasonable cost. However, we do not expect that our internal interconnect materials operations will be able to meet all of our interconnect materials requirements. Consequently, we will remain dependent on market supply and demand for our raw materials. Recent fluctuations in gold prices have also affected the price at which we have been able to purchase gold wire, one of the principal raw materials we use in our packaging processes. We cannot guarantee that we will not experience shortages in the near future or that we will be able to obtain adequate supplies of raw materials in a timely manner or at a reasonable price. Our revenues and net income could decline if we are unable to obtain adequate supplies of high quality raw materials in a timely manner or if there are significant increases in the costs of raw materials that we cannot pass on to our customers.

Any environmental claims or failure to comply with any present or future environmental regulations, as well as any fire or other industrial accident, may require us to spend additional funds and may materially and adversely affect our financial condition and results of operations.

We are subject to various laws and regulations relating to the use, storage, discharge and disposal of chemical by-products of, and water used in, our packaging and interconnect materials production processes. Although we have not suffered material environmental claims in the past, the failure to comply with any present or future regulations could result in the assessment of damages or imposition of fines against us, suspension of production or a cessation of our operations. New regulations could require us to acquire costly equipment or to incur other significant expenses that we may not be able to pass on to our customers. See “Item 4. Information on the Company—Business Overview—Raw Materials and Suppliers—Packaging.” Additionally, any failure on our part to control the use, or adequately restrict the discharge, of hazardous substances could subject us to future liabilities that may have a material adverse effect on our financial condition and results of operations.

Our controlling shareholders may take actions that are not in, or may conflict with, our public shareholders’ best interest.

Members of the Chang family own, directly or indirectly, a controlling interest in our outstanding common shares. See “Item 7. Major Shareholders and Related Party Transactions—Major Shareholders.” Accordingly, these shareholders will continue to have the ability to exercise a controlling influence over our business, including matters relating to:

| · | our management and policies; |

| · | the timing and distribution of dividends; and |

| · | the election of our directors and supervisors. |

Members of the Chang family may take actions that you may not agree with or that are not in our or our public shareholders’ best interests.

We may be subject to intellectual property rights disputes, which could materially adversely affect our business.

Our ability to compete successfully and achieve future growth depends, in part, on our ability to develop and protect our proprietary technologies and to secure on commercially acceptable terms certain technologies that we do not own. We cannot assure you that we will be able to independently develop, obtain patents for, protect or secure from any third party, the technologies required for our packaging and testing services.

Our ability to compete successfully also depends, in part, on our ability to operate without infringing the proprietary rights of others. The semiconductor industry is characterized by frequent litigation regarding patent and other intellectual property rights. In January 2006, Tessera Inc. filed a suit against us and others alleging patent infringement. See “Item 8. Financial Information—Legal Proceedings.” Any litigation, whether as plaintiff or defendant and regardless of the outcome, is costly and diverts company resources.

Any of the foregoing could harm our competitive position and render us unable to provide some of our services operations.

We are an ROC company and, because the rights of shareholders under ROC law differ from those under U.S. law and the laws of certain other countries, you may have difficulty protecting your shareholder rights.

Our corporate affairs are governed by our Articles of Incorporation and by the laws governing corporations incorporated in the ROC. The rights of shareholders and the responsibilities of management and the members of the board of directors under ROC law are different from those applicable to a corporation incorporated in the United States and certain other countries. As a result, public shareholders of ROC companies may have more difficulty in protecting their interests in connection with actions taken by management or members of the board of directors than they would as public shareholders of a corporation in the United States or certain other countries.

We face risks associated with uncertainties in PRC laws and regulations.

We operate, among other things, packaging and testing facilities in the PRC through our subsidiaries and joint ventures incorporated in the PRC. Under PRC laws and regulations, foreign investment projects, such as our subsidiaries and joint ventures, must obtain certain approvals from the relevant governmental authorities in the provinces or special economic zones in which they are located and, in some circumstances, from the relevant authorities in the PRC’s central government. Foreign investment projects must also comply with certain regulatory requirements. However, PRC laws and regulations are often subject to varying interpretations and means of enforcement, and additional approvals from the relevant governmental authorities may be required for the operations of our PRC subsidiaries and joint ventures. If required, we cannot assure you that we will be able to obtain these approvals in a timely manner, if at all. Because the PRC government holds significant discretion in determining matters relating to foreign investment, we cannot assure you that the relevant governmental authorities will not take action that is materially adverse to our PRC operations.

Any impairment charges may have a material adverse effect on our net income.

Under ROC GAAP and U.S. GAAP, we are required to evaluate our assets, such as equipment, goodwill and investments, for possible impairment at least annually or whenever there is an indication of impairment. If certain criteria are met, we are required to record an impairment charge.

With respect to assets, in 2005 we recognized a loss of NT$13,479.1 million on damage to our property, plant and equipment caused by a fire at our facilities in Chung Li, Taiwan. In 2006, we reversed NT$2,190.6 million of the impairment loss recognized in 2005 under ROC GAAP due to an increase in the estimated service potential of the relevant assets. In 2007, we recognized an impairment charge of NT$994.7 million, primarily as a result of idle capacity in our flip-chip substrate production line caused by a lack of demand for certain applications. In 2008, we recognized impairment charges of NT$293.3 million (US$9.0 million) related to our other-than-temporary loss in our financial assets and impaired idle equipment. As of December 31, 2008, goodwill under ROC GAAP and U.S. GAAP amounted to NT$9,456.1 million (US$288.6 million) and NT$9,804.7 million (US$299.3 million), respectively. See “Item 5. Operating and Financial Review and Prospects—Operating Results and Trend Information—Critical Accounting Policies and Estimates—Realizability of Long-Lived Assets” and “—Goodwill.”

In addition, we may be required to record substantial impairment charges with respect to our subsidiary, PowerASE, a joint venture between us and Powerchip Semiconductor Corp., or Powerchip. Powerchip operates in the dynamic random access memory, or DRAM, industry and has suffered extensive losses recently. A substantial portion of PowerASE’s revenues are derived from Powerchip. In addition, we have also invested NT$450 million in Powerchip’s unsecured corporate bonds. Powerchip’s financial position and operations could render us unable to recover PowerASE’s accounts receivable and cause us to record an impairment charge with respect to PowerASE’s property, plant and equipment and corporate bonds, which could have a material adverse effect on our net income.

We are unable to estimate the extent and timing of any impairment charges for future years under ROC GAAP or U.S. GAAP, and we cannot give any assurance that impairment charges will not be required in periods subsequent to December 31, 2008. Any impairment charge could have a material adverse effect on our net income. The determination of an impairment charge at any given time is based significantly on our expected results of operations over a number of years in the future. As a result, an impairment charge is more likely to occur during a period in which our operating results and outlook are otherwise already depressed.

Risks Relating to Taiwan, ROC

Strained relations between the ROC and the PRC could negatively affect our business and the market value of your investment.

Our principal executive offices and our principal packaging and testing facilities are located in Taiwan and approximately 74.4%, 68.6% and 64.9% of our net revenues in 2006, 2007 and 2008, respectively, were derived from our operations in Taiwan. The ROC has a unique international political status. The government of the PRC asserts sovereignty over all of China, including Taiwan, and does not recognize the legitimacy of the ROC government. Although significant economic and cultural relations have been established in recent years between the ROC and the PRC, relations have often been strained and the PRC government has indicated that it may use military force to gain control over Taiwan in some circumstances, such as the declaration of independence by the ROC. Political uncertainty could adversely affect the prices of our common shares and ADSs. Relations between the ROC and the PRC and other factors affecting the political or economic conditions in Taiwan could have a material adverse effect on our financial condition and results of operations, as well as the market price and the liquidity of our common shares and ADSs.

Currently, we manufacture interconnect materials in the PRC through our wholly-owned subsidiary ASE Shanghai. We also provide wire bond packaging and testing services in the PRC through our subsidiaries, ASESH AT, ASEN and ASEWH. See “Item 4. Information on the Company—Organizational Structure—Our Consolidated Subsidiaries.” The ROC government currently restricts certain types of investments by ROC companies, including ourselves, in the PRC, including certain types of investments in facilities for the packaging and testing of semiconductors. In April 2006, these restrictions were amended to permit investments in facilities for certain less advanced wire bond packaging and testing services. We do not know when or if such laws and policies governing

investment in the PRC will be amended, and we cannot assure you that such ROC investment laws and policies will permit us to make further investments in the PRC in the future that we consider beneficial to us. Our growth prospects and profitability may be adversely affected if we are restricted from making certain additional investments in the PRC and are not able to fully capitalize on the growth of the semiconductor industry in the PRC.

As a substantial portion of our business and operations is located in Taiwan, we are vulnerable to earthquakes, typhoons, drought and other natural disasters, as well as power outages and other industrial incidents, which could severely disrupt the normal operation of our business and adversely affect our results of operations.

Taiwan is susceptible to earthquakes and has experienced severe earthquakes which caused significant property damage and loss of life, particularly in the central and eastern parts of Taiwan. Earthquakes have damaged production facilities and adversely affected the operations of many companies involved in the semiconductor and other industries. We have never experienced structural damage to our facilities or damage to our machinery and equipment as a result of these earthquakes. In the past, however, we have experienced interruptions to our production schedule primarily as a result of power outages caused by earthquakes.

Taiwan is also susceptible to typhoons, which may cause damage and business interruptions to companies with facilities located in Taiwan. In the third quarter of 2004, a typhoon caused a partial interruption for approximately two weeks in our water supply at ASE Chung Li’s substrate operations.

Taiwan has experienced severe droughts in the past. Although we have not been directly affected by droughts, we are dependent upon water for our packaging and substrates operations and a drought could interrupt such operations. In addition, a drought could interrupt the manufacturing process of the foundries located in Taiwan, in turn disrupting some of our customers’ production, which could result in a decline in the demand for our services. In addition, the supply of electrical power in Taiwan, which is primarily provided by Taiwan Power Company, the state-owned electric utility, is susceptible to disruption that could be prolonged and frequent, caused by overload as a result of high demand or other reasons.

Our production facilities as well as many of our suppliers and customers and providers of complementary semiconductor manufacturing services, including foundries, are located in Taiwan. If our customers are affected by an earthquake, a typhoon, a drought or any other natural disasters, or power outage or other industrial incidents, it could result in a decline in the demand for our packaging and testing services. If our suppliers or providers of complementary semiconductor manufacturing services are affected, our production schedule could be interrupted or delayed. As a result, a major earthquake, typhoon, drought, or other natural disaster in Taiwan, or a power outage or other industrial incident could severely disrupt the normal operation of our business and have a material adverse effect on our financial condition and results of operations.

Any outbreak of swine flu, avian flu or a recurrence of SARS or other contagious disease may have an adverse effect on the economies and financial markets of certain Asian countries and may adversely affect our results of operations.

In April 2009, outbreaks of swine flu caused by the H1N1 virus were first reported in Mexico and, subsequently, in several other locations including the U.S., the PRC and the ROC. Many of these cases were fatal and more cases have since been reported. In addition, the World Health Organization reported in January 2005 that “during 2004, large parts of Asia experienced unprecedented outbreaks of highly pathogenic avian influenza, caused by the H5N1 virus”, which moved the world closer than at any time since 1968 to an influenza pandemic “with high morbidity, excess mortality, and social and economic disruption.” There have continued to be cases of outbreaks of avian flu in certain regions of Asia, Europe and Africa with human casualties reported in countries such as Azerbaijan, Cambodia, Egypt, Indonesia, Iraq, the PRC, Thailand, Turkey and Vietnam. Additionally, in the first half of 2003, the PRC, Hong Kong, Taiwan, Singapore, Vietnam and certain other countries encountered an outbreak of severe acute respiratory syndrome, or SARS, which is a highly contagious form of atypical pneumonia. The SARS outbreak had an adverse effect on our results of operations for the first half of 2003, primarily due to the lower than expected demand for our packaging and testing services that resulted from the adverse effect of such SARS outbreak on the level of economic activity in the affected regions. There is no guarantee that an outbreak of swine flu, avian flu, SARS or other contagious disease will not occur again in the future and that any future outbreak of swine flu, avian flu, SARS or other contagious disease or the measures taken by the governments of the ROC,

Hong Kong, the PRC or other countries against such potential outbreaks, will not seriously interrupt our production operations or those of our suppliers and customers, which may have a material adverse effect on our results of operations. The perception that an outbreak of swine flu, avian flu, SARS or other contagious disease may occur again may have an adverse effect on the economic conditions of certain countries in Asia.

Risks Relating to Ownership of the ADSs

The market for the common shares and the ADSs may not be liquid.

Active, liquid trading markets generally result in lower price volatility and more efficient execution of buy and sell orders for investors, compared to less active and less liquid markets. Liquidity of a securities market is often a function of the volume of the underlying shares that are publicly held by unrelated parties.

There has been no trading market for the common shares outside the ROC and the only trading market for the common shares will be the Taiwan Stock Exchange. The outstanding ADSs are listed on the New York Stock Exchange. There is no assurance that the market for the common shares or the ADSs will be active or liquid.

Although ADS holders are entitled to withdraw the common shares underlying the ADSs from the depositary at any time, ROC law requires that the common shares be held in an account in the ROC or sold for the benefit of the holder on the Taiwan Stock Exchange. In connection with any withdrawal of common shares from our ADS facility, the ADSs evidencing these common shares will be cancelled. Unless additional ADSs are issued, the effect of withdrawals will be to reduce the number of outstanding ADSs. If a significant number of withdrawals are effected, the liquidity of our ADSs will be substantially reduced. We cannot assure you that the ADS depositary will be able to arrange for a sale of deposited shares in a timely manner or at a specified price, particularly during periods of illiquidity or volatility.

If a non-ROC holder of ADSs withdraws common shares, such holder of ADSs will be required to appoint a tax guarantor, local agent and custodian bank in the ROC and register with the Taiwan Stock Exchange in order to buy and sell securities on the Taiwan Stock Exchange.

When a non-ROC holder of ADSs elects to withdraw common shares represented by ADSs, such holder of the ADSs will be required to appoint an agent for filing tax returns and making tax payments in the ROC. Such agent will be required to meet the qualifications set by the ROC Ministry of Finance and, upon appointment, becomes the guarantor of the withdrawing holder’s tax payment obligations. Evidence of the appointment of a tax guarantor, the approval of such appointment by the ROC tax authorities and tax clearance certificates or evidentiary documents issued by such tax guarantor may be required as conditions to such holder repatriating the profits derived from the sale of common shares. We cannot assure you that a withdrawing holder will be able to appoint and obtain approval for a tax guarantor in a timely manner.

In addition, under current ROC law, such withdrawing holder is required to register with the Taiwan Stock Exchange and appoint a local agent in the ROC to, among other things, open a bank account and open a securities trading account with a local securities brokerage firm, pay taxes, remit funds and exercise such holder’s rights as a shareholder. Furthermore, such withdrawing holder must appoint a local bank to act as custodian for confirmation and settlement of trades, safekeeping of securities and cash proceeds and reporting and declaration of information. Without satisfying these requirements, non-ROC withdrawing holders of ADSs would not be able to hold or otherwise subsequently sell the common shares on the Taiwan Stock Exchange or otherwise.

The market value of your investment may fluctuate due to the volatility of the ROC securities market.

The trading price of our ADSs may be affected by the trading price of our common shares on the Taiwan Stock Exchange. The ROC securities market is smaller and more volatile than the securities markets in the United States and in many European countries. The Taiwan Stock Exchange has experienced substantial fluctuations in the prices and volumes of sales of listed securities and there are currently limits on the range of daily price movements on the Taiwan Stock Exchange. The Taiwan Stock Exchange Index peaked at 12,495.3 in February 1990, and subsequently fell to a low of 2,560.5 in October 1990. On March 13, 2000, the Taiwan Stock Exchange Index experienced a 617-point drop, which represented the single largest decrease in the Taiwan Stock Exchange Index in

its history. During the period from January 1, 2008 to December 31, 2008, the Taiwan Stock Exchange Index peaked at 9,295.2 on May 19, 2008, and reached a low of 4,089.9 on November 20, 2008. Over the same period, the trading price of our common shares ranged from NT$9.6 per share to NT$34.7 per share. On June 5, 2009, the Taiwan Stock Exchange Index closed at 6,767.10, and the closing value of our common shares was NT$20.05 per share.

The Taiwan Stock Exchange is particularly volatile during times of political instability, including when relations between Taiwan and the PRC are strained. Several investment funds affiliated with the ROC government have also from time to time purchased securities from the Taiwan Stock Exchange to support the trading level of the Taiwan Stock Exchange. Moreover, the Taiwan Stock Exchange has experienced problems such as market manipulation, insider trading and settlement defaults. The recurrence of these or similar problems could have an adverse effect on the market price and liquidity of the securities of ROC companies, including our common shares and ADSs, in both the domestic and international markets.

Holders of common shares and ADSs may incur dilution as a result of the practice among ROC technology companies of issuing stock bonuses and stock options to employees.