EXHIBIT 99.2

Investor communication

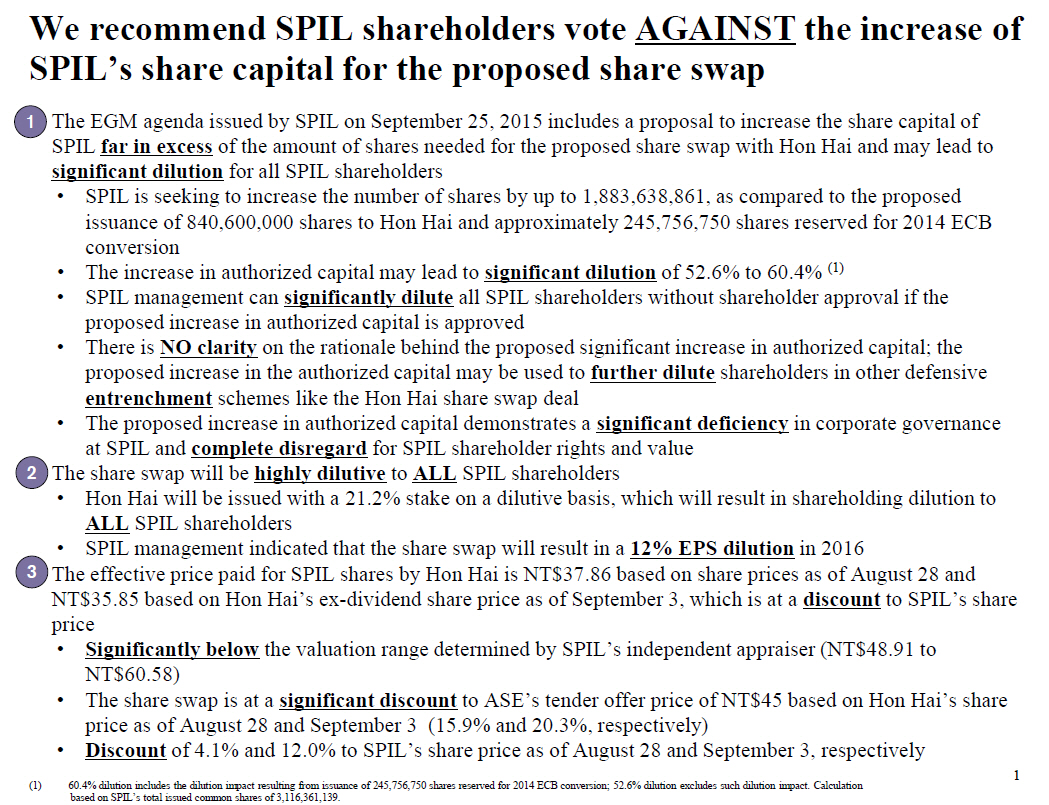

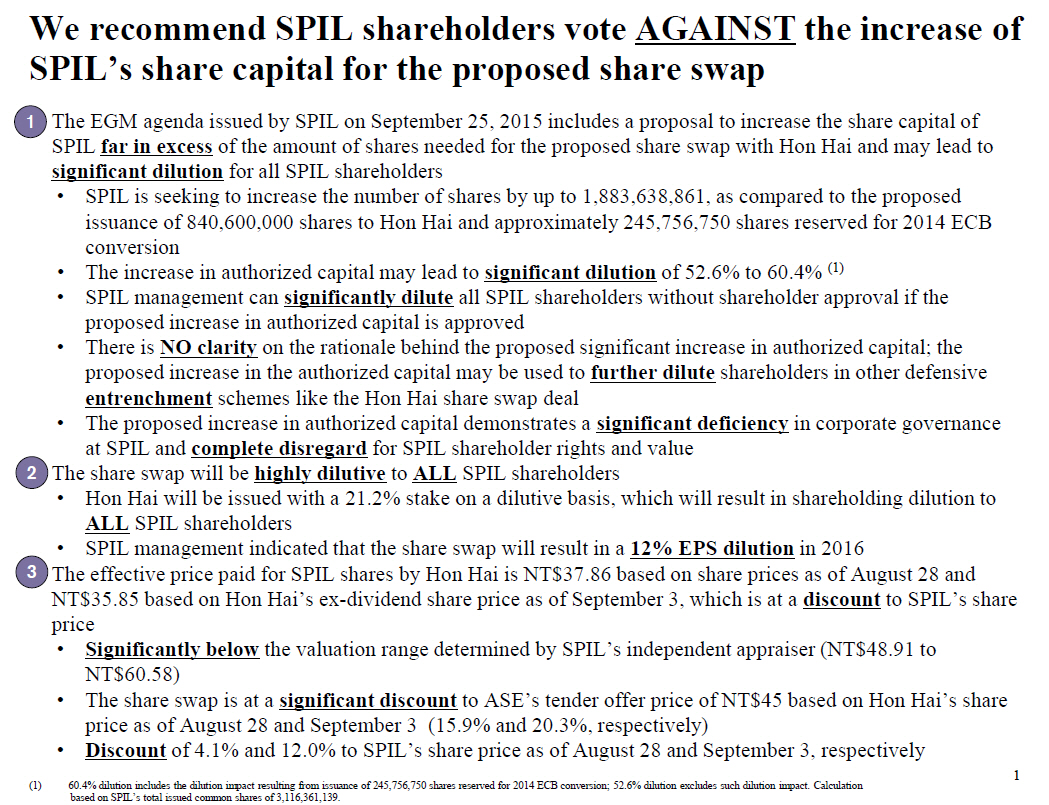

The EGM agenda issued by SPIL on September 25, 2015 includes a proposal to increase the share capital of SPIL far in excess of the amount of shares needed for the proposed share swap with Hon Hai and may lead to significant dilution for all SPIL shareholders • SPIL is seeking to increase the number of shares by up to 1,883,638,861, as compared to the proposed issuance of 840,600,000 shares to Hon Hai and approximately 245,756,750 shares reserved for 2014 ECB conversion • The increase in authorized capital may lead to significant dilution of 52.6% to 60.4% (1) • SPIL management can significantly dilute all SPIL shareholders without shareholder approval if the proposed increase in authorized capital is approved • There is NO clarity on the rationale behind the proposed significant increase in authorized capital; the proposed increase in the authorized capital may be used to further dilute shareholders in other defensive entrenchment schemes like the Hon Hai share swap deal • The proposed increase in authorized capital demonstrates a significant deficiency in corporate governance at SPIL and complete disregard for SPIL shareholder rights and value The share swap will be highly dilutive to ALL SPIL shareholders • Hon Hai will be issued with a 21.2% stake on a dilutive basis, which will result in shareholding dilution to ALL SPIL shareholders • SPIL management indicated that the share swap will result in a 12% EPS dilution in 2016 The effective price paid for SPIL shares by Hon Hai is NT$37.86 based on share prices as of August 28 and NT$35.85 based on Hon Hai’s ex - dividend share price as of September 3, which is at a discount to SPIL’s share price • Significantly below the valuation range determined by SPIL’s independent appraiser (NT$48.91 to NT$60.58) • The share swap is at a significant discount to ASE’s tender offer price of NT$45 based on Hon Hai’s share price as of August 28 and September 3 (15.9% and 20.3%, respectively) • Discount of 4.1% and 12.0% to SPIL’s share price as of August 28 and September 3, respectively 1 We recommend SPIL shareholders vote AGAINST the increase of SPIL’s share capital for the proposed share swap 1 2 3 (1) 60.4 % dilution includes the dilution impact resulting from issuance of 245,756,750 shares reserved for 2014 ECB conversion; 52.6% di lution excludes such dilution impact. Calculation based on SPIL’s total issued common shares of 3,116,361,139.

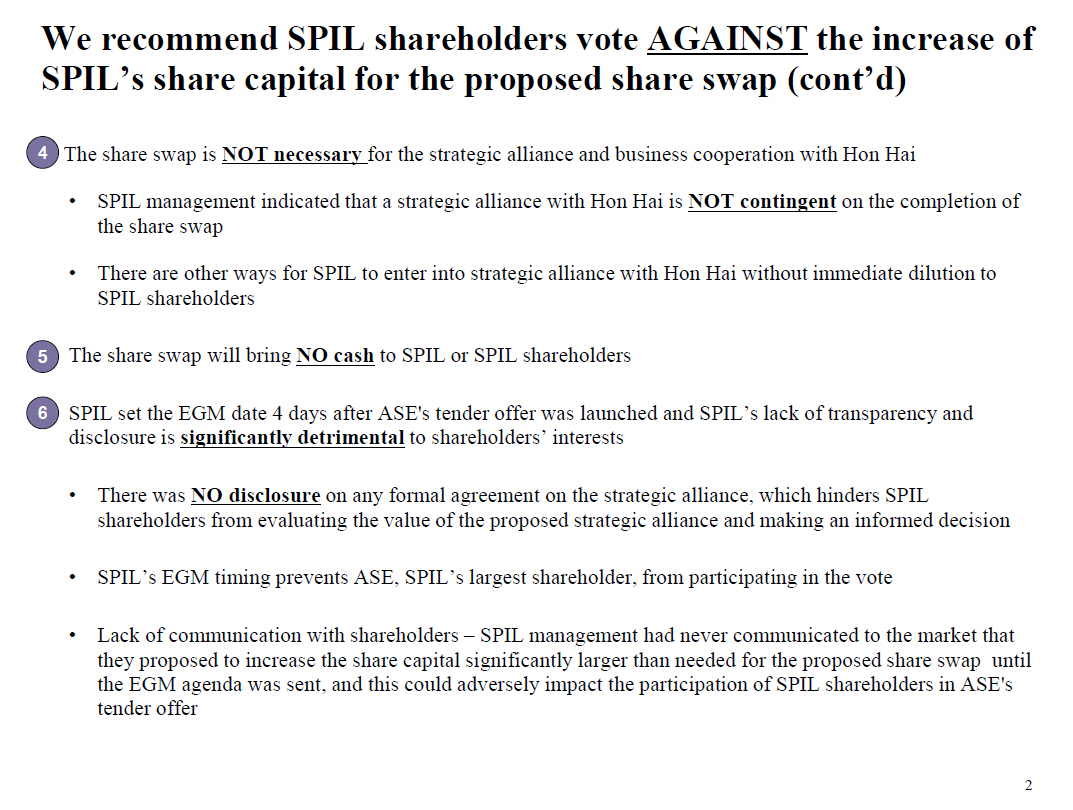

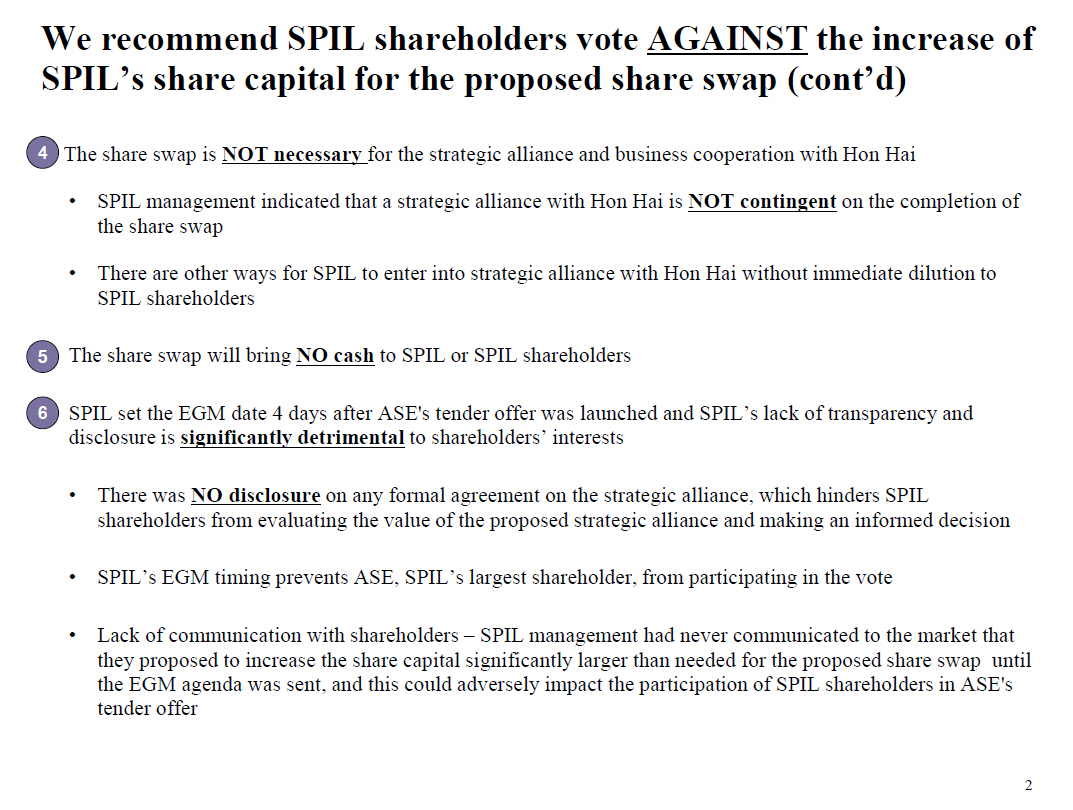

The share swap is NOT necessary for the strategic alliance and business cooperation with Hon Hai • SPIL management indicated that a strategic alliance with Hon Hai is NOT contingent on the completion of the share swap • There are other ways for SPIL to enter into strategic alliance with Hon Hai without immediate dilution to SPIL shareholders The share swap will bring NO cash to SPIL or SPIL shareholders SPIL set the EGM date 4 days after ASE's tender offer was launched and SPIL’s lack of transparency and disclosure is significantly detrimental to shareholders’ interests • There was NO disclosure on any formal agreement on the strategic alliance, which hinders SPIL shareholders from evaluating the value of the proposed strategic alliance and making an informed decision • SPIL’s EGM timing prevents ASE, SPIL’s largest shareholder, from participating in the vote • Lack of communication with shareholders – SPIL management had never communicated to the market that they proposed to increase the share capital significantly larger than needed for the proposed share swap until the EGM agenda was sent, and this could adversely impact the participation of SPIL shareholders in ASE's tender offer 2 We recommend SPIL shareholders vote AGAINST the increase of SPIL’s share capital for the proposed share swap (cont’d) 4 5 6

3 ASE has successfully completed the tender offer for SPIL Source: Company announcement. (1) Compared to the share price of SPIL as of 21 Aug 2015 (closing immediately prior to the announcement of the ASE tender offer) (2) Each ADS represents 5 common shares. Summary Offer price Taiwan Offer: NT$45 per common share (representing an offer premium of 34.3% (1) ) US Offer: NT$225 per ADS (2) in equivalent USD and NT$45 per common share held by US holders Number of SPIL shares tendered by investors A total of 1,147,898,165 shares validly tendered by investors in the Taiwan Offer and US Offer (approximately 36.83% of SPIL’s total issued and outstanding shares) Number of SPIL shares purchased 779,000,000 shares (approximately 24.99% of SPIL’s total issued and outstanding shares) SPIL EGM participation ASE is the largest single shareholder of SPIL with 24.99% of SPIL’s total issued and outstanding shares However, SPIL management timed the record date for the EGM to approve the share issuance for the proposed share swap with Hon Hai such that ASE will NOT be able to vote in the SPIL EGM

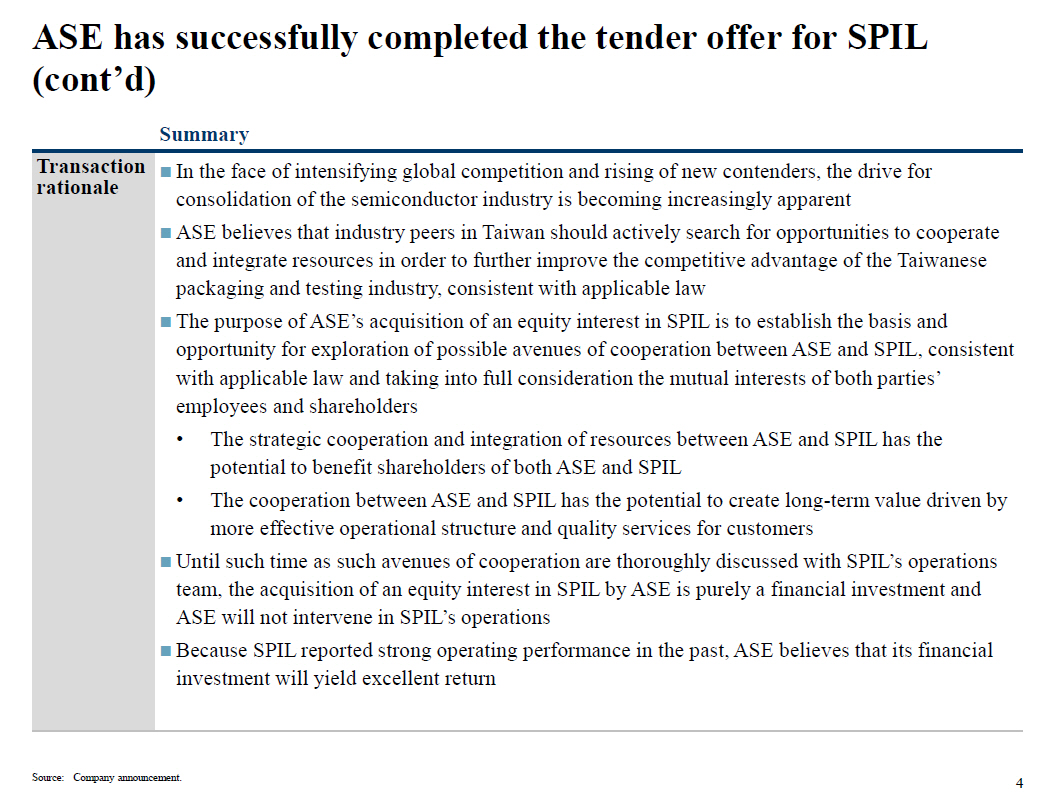

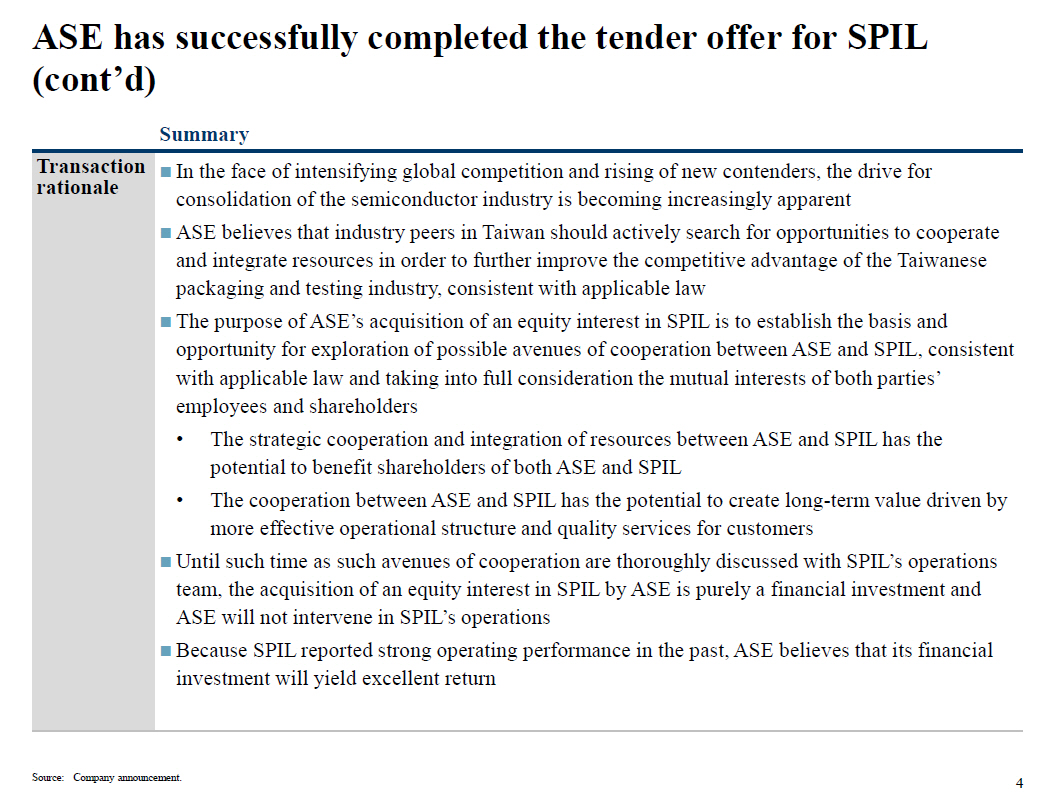

4 ASE has successfully completed the tender offer for SPIL (cont’d) Source: Company announcement. Summary Transaction rationale In the face of intensifying global competition and rising of new contenders, the drive for consolidation of the semiconductor industry is becoming increasingly apparent ASE believes that industry peers in Taiwan should actively search for opportunities to cooperate and integrate resources in order to further improve the competitive advantage of the Taiwanese packaging and testing industry, consistent with applicable law The purpose of ASE’s acquisition of an equity interest in SPIL is to establish the basis and opportunity for exploration of possible avenues of cooperation between ASE and SPIL, consistent with applicable law and taking into full consideration the mutual interests of both parties’ employees and shareholders • The strategic cooperation and integration of resources between ASE and SPIL has the potential to benefit shareholders of both ASE and SPIL • The cooperation between ASE and SPIL has the potential to create long - term value driven by more effective operational structure and quality services for customers Until such time as such avenues of cooperation are thoroughly discussed with SPIL’s operations team, the acquisition of an equity interest in SPIL by ASE is purely a financial investment and ASE will not intervene in SPIL’s operations Because SPIL reported strong operating performance in the past, ASE believes that its financial investment will yield excellent return

5 This presentation contains "forward - looking statements" within the meaning of Section 27 A of the United States Securities Act of 1933 , as amended, and Section 21 E of the United States Securities Exchange Act of 1934 , as amended, including statements regarding our future results of operations and business prospects . Although these forward - looking statements, which may include statements regarding our future results of operations, financial condition or business prospects, are based on our own information and information from other sources we believe to be reliable, you should not place undue reliance on these forward - looking statements, which apply only as of the date of this press release . The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and similar expressions, as they relate to us, are intended to identify these forward - looking statements in this press release . Our actual results of operations, financial condition or business prospects may differ materially from those expressed or implied in these forward - looking statements for a variety of reasons, including risks associated with cyclicality and market conditions in the semiconductor or electronic industry ; changes in our regulatory environment, including our ability to comply with new or stricter environmental regulations and to resolve environmental liabilities ; demand for the outsourced semiconductor packaging, testing and electronic manufacturing services we offer and for such outsourced services generally ; the highly competitive semiconductor or manufacturing industry we are involved in ; our ability to introduce new technologies in order to remain competitive ; international business activities ; our business strategy ; our future expansion plans and capital expenditures ; the strained relationship between the Republic of China and the People’s Republic of China ; general economic and political conditions ; the recent global economic crisis ; possible disruptions in commercial activities caused by natural or human - induced disasters ; fluctuations in foreign currency exchange rates ; and other factors . For a discussion of these risks and other factors, please see the documents we file from time to time with the Securities and Exchange Commission, including our 2014 Annual Report on Form 20 - F filed on March 18 , 2015 . Safe Harbor Notice