EXHIBIT 99.1

Stock code:2311

| Advanced Semiconductor Engineering,Inc. Prospectus | |

(2016 Statement of Issuance of New Shares Through Capital Increase)

| I. | Name of Company: Advanced Semiconductor Engineering, Inc. |

| II. | Purpose for the publication of this prospectus: 2016 Statement of Issuance of New Shares Through Capital Increase |

| (I) | Source of new shares: Cash capital increase. |

| (II) | New share type: Registered as ordinary shares, each share has the face value of NT$10. |

| (III) | Number of new shares: 300,000,000 shares. |

| (IV) | Amount of shares issued: NT$3,000,000,000. |

1. This is an issuance of 300,000,000 new shares through cash capital increase, with a par value of NT$10 per share. The price of each new share is NT$34.3. The amount of funds that can be raised is estimated at NT$10,290,000,000.

2. Pursuant to the provisions provided by Article 267 of the Company Act, 10% of the newly issued shares; or 30,000,000 shares; are reserved for employee subscription. In compliant with Article 28-1 of the Securities Exchange Act, 10% of the newly issued shares; or 30,000,000 shares; will be publicly offered. The remaining 80% of the newly issued shares; or 240,000,000 shares; will be subscribed by the existing shareholders based on the shareholding percentages on the base date. Shareholders will independently combine fractional shares within five days starting from the ex-dividend date for subscription. Existing shareholder and employee who have waived their right to subscribe or who hold fractional shares failing to combine will authorize the Chairman to contact a designated party for subscription.

3. The new shares issued by this cash capital increase shall have the same rights and obligations as those of the ordinary shares originally issued.

| (VI) | Publication underwriting ratio: 10% of the newly issued shares, or 30,000,000 shares will be publicly underwritten. |

| (VII) | Underwriting and rationing method: Method of underwriting is underwriting on a commitment basis, and the shares will be publicly offered for public underwriting. |

| III. | Summary of the purpose for the fund application plan and the potential benefits that may be generated: Please read page 144 of this prospectus. |

| IV. | Costs associated to this issuance |

| (I) | Underwriting costs: NT$5,000,000. |

| (II) | Other expenses: Approx. NT$1,000,000, including accountant fees, attorney fees, and printing fees. |

| V. | The effectiveness of the securities cannot be used as proof for declarations or as propaganda to guarantee the value of the securities. |

| VI. | In the event of any false statement or non-disclosure in this Prospectus, the issuer, its representative or any other persons who sign or endorses its name on the Prospectus shall be held liable therefor. |

| VII. | Investors shall read the contents of this prospectus in detail from the information reporting website designated by the Financial Supervisory Commission (FSC) and pay attention to risk related matters for the company: Please read page 8 of this prospectus. |

| VIII. | The par value of ordinary shares of the Company is NT$10 per share. |

| IX. | The review website for this prospectus: Market Observation Post System:http://mops.twse.com.tw |

Company website:http://www.aseglobal.com

Compiled by Advanced Semiconductor Engineering, Inc.

| Printed on | February 2,2017 |

| I. | Source of paid-up capital before this publication |

| capital source | Amount | As a percentage of paid-in capital |

| Startup | 100,000,000 | 0.12% |

| Capital increase by cash | 3,416,902,520 | 4.30% |

| Capital increase by earnings | 57,709,883,680 | 72.59% |

| Capital increase by employee bonus | 2,831,488,480 | 3.56% |

| Capital increase by capital reserve | 10,998,134,680 | 13.83% |

| Ordinary share converted from foreign convertible corporate bonds | 640,492,830 | 0.81% |

| Ordinary share converted from employee stock option | 4,584,181,900 | 5.77% |

| Consolidated capital increase | 2,823,154,370 | 3.55% |

| Treasury shares canceled | (3,604,490,000) | (4.53)% |

| Paid-up capital (total) | 79,499,748,460 | 100.00% |

| II. | Distribution of the Prospectus |

| (I) | Display locations: The Prospectus shall be distributed to regulatory authorities according to regulations, and it shall be stored in the Company and the Company's shareholder service agency. |

| (II) | Distribution method: In accordance with Article 31 of the Securities and Exchange Act |

| (III) | Obtaining method: Please visit the aforementioned display locations or visit the Market Observation Post System to download the electronic file.(http://mops.twse.com.tw) |

| III. | Securities underwriter's name, address, website, and telephone |

| Name: | KGI Securities Co., Ltd. | Website: | www.kgieworld.com.tw |

| Address: | No. 700, Mingshui Rd, Zhongshan District, Taipei City | Telephone: | (02)2181-8888 |

| IV. | Name, address, website, and telephone of the corporate bond guarantee institution: Not applicable. |

| V. | Name, address, website, and telephone of the corporate bond consigned institution: Not applicable. |

| VI. | Name, address, website, and telephone of the stock or corporate bond authenticating institution:Not applicable. |

| VII. | Name, address, website, and telephone of the stock transfer handling institution: |

| Name: | President Securities Corp. Department of Stock Affairs | Website: | www.uni-psg.com |

| Address: | B1, No. 8 Dongxing Road, Songshan District, Taipei City | Telephone: | (02)2746-3797 |

| VIII. | Name, address, website, and telephone of the credit rating institution: Not applicable. |

| IX. | Name, address, website, and telephone of the corporate bond authenticating certified public accountant, attorney, and firm: Not applicable. |

| X. | Name, address, website, and telephone of the firm and certified public accountant who issued the financial report for the most recent year. |

| Account name: | CPAs Chen Zhen-li and Jiang Jia-lin | | |

| Name of CPA firm: | Deloitte Touche | Website: | www.deloitte.com.tw |

| Address: | 3F., No. 88, Chenggong 2nd Rd, Qianzhen District, Kaohsiung City | Telephone: | (07)530-1888 |

| XI. | Name, law firm name, address, website, and telephone of the review attorney |

| Name of lawyer: | Qiu Ya-Wen | | |

| Name of law firm: | Handsome Attorneys-at-Law | Website: | www.fsi-law.com |

| Address: | 8F, No. 6, Songde Road, Xinyi District, Taipei City | Telephone: | (02)2345-0016 |

| | | | | |

| XII. | Name, job title, contact telephone, and Email address of the spokesperson as well as the deputy spokesperson |

| Spokesperson name: | Tien Wu | Deputy Spokesperson name: | Joseph Tung |

| Title: | Chief Operating Officer | Title: | Chief Financial Officer |

| Telephone: | (02)8780-5489 | Telephone: | (02)8780-5489 |

| Email: | ir@aseglobal.com | Email: | ir@aseglobal.com |

| XIII. | Company website: http://www.aseglobal.com |

Prospectus Summary of Advanced Semiconductor Engineering, Inc.

| Paid-up Capital: NT$79,499,748,460 | Company address: No.26, Jing 3rd Rd., Nantz Processing Export Zone, Kaohsiung City | Telephone: (07)361-7131 |

| Date of establishment March 23, 1984 | Website:www.aseglobal.com |

| Listing date: July 19, 1989 | Over the counter date: N/A | Public offering date: May 1988 | Stock management date: N/A |

| Responsible person: | Chairman, Jason C.S. Chang President, Richard H.P. Chang | Spokesperson: Deputy Spokesperson: | Tien Wu Joseph Tung | (Title: Chief Operating Officer) (Title: Chief Financial Officer) |

| Stock transfer agency: | Telephone:(02)2746-3797 | Website:www.uni-psg.com |

| Stock Affairs Agent for Advanced Semiconductor Engineering, Inc. | Address: B1, No. 8 Dongxing Road, Songshan District, Taipei City |

| Stock underwriting agency: | Telephone:(02)2181-8888 | Website:www.kgieworld.com.tw |

| KGI Securities Co., Ltd. | Address: No. 700, Mingshui Rd, Zhongshan District, Taipei City |

| Certified public accountant for the most recent year: Chen Zhen-li and Jiang Jia-lin | Telephone:(07)530-1888 | Website:www.deloitte.com.tw |

| Name of law firm: Deloitte Touche | Address: 3F., No. 88, Chenggong 2nd Rd, Qianzhen District, Kaohsiung City |

| Review attorney: Qiu Ya-Wen | Telephone:(02)2345-0016 | Website:www.fsi-law.com |

| Name of law firm: Handsome Attorneys-at-Law | Address: 8F, No. 6, Songde Road, Xinyi District, Taipei City |

| Credit rating agency: N/A Telephone: N/A | Website: N/A | Address: N/A |

| The rating of the subject | Issuing company:- | Noþ; Yes □, Rating date: - | Rating level:- |

| This corporate bond issuance:- | Noþ; Yes □, Rating date:- | Rating level:- |

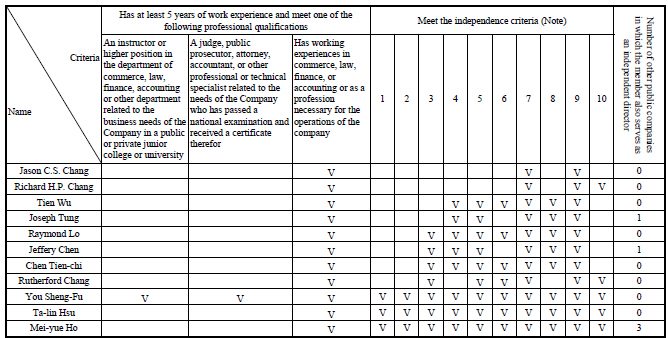

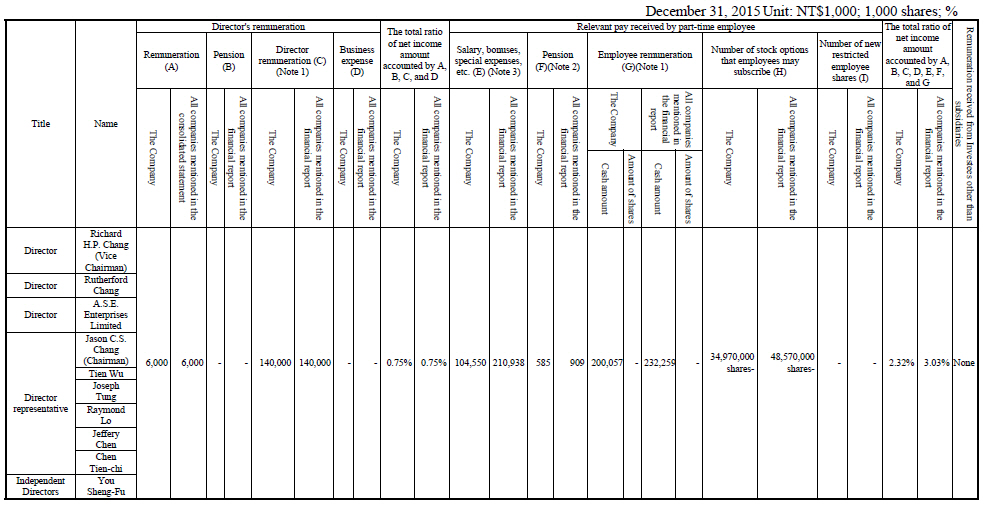

| Director election date: June 23, 2015; term of office: 3 years | Supervisor election date: N/A (Currently the Company has no audit committee) |

| Shareholding ratio by all directors: 18.04% (December 31, 2016) | Shareholding ratio by all supervisors: N/A |

| Director, supervisor, shareholders holding over 10% of shares; and other shareholding ratios: (December 31, 2016) |

| Title | Name | Percentage of shares | Remarks | Title | Name | Percentage of shares | Remarks |

| Chairman | Jason C.S. Chang | 16.71% | Representative, ASE Enterprises Ltd. | Director | Rutherford Chang | 0.02% | - |

| Vice Chairman | Richard H.P. Chang | 1.31% | - | Director | Chen Tien-chi | 16.71% | Representative, ASE Enterprises Ltd. |

| Director | Tien Wu | 16.71% | Representative, ASE Enterprises Ltd. | Independent Directors | You Sheng-Fu | - | - |

| Director | Joseph Tung | 16.71% | Representative, ASE Enterprises Ltd. | Independent Directors | Ta-lin Hsu | - | - |

| Director | Raymond Lo | 16.71% | Representative, ASE Enterprises Ltd. | Independent Directors | Mei-yue Ho | - | - |

| Director | Jeffery Chen | 16.71% | Representative, ASE Enterprises Ltd. | Major shareholders holding over 10% of shares | A.S.E. Enterprises Limited | 16.71% | - |

| Factory Address: Please refer to page 1 of the prospectus | Telephone: Please refer to page 1 of the prospectus |

Main Products: Manufacture, assembly, reprocessing, testing and export of integrated circuits of various types Market structure: Domestic sales 11.52%, export sales 88.48% | Refer to page 77 of the prospectus |

| Risk items | Please read this prospectus. | Refer to page 8 of the prospectus |

| .Last (2015) year | Operating revenue: NT$283,302,536,000 Net income (loss) before tax: NT$25,288,253,000 (note) Earnings per share: NT$2.55 (note) | Refer to page 163 of the prospectus. |

| The type and amount of the securities issued during this fund raising | Please refer to the cover page of this prospectus |

| Condition of issuance | Please refer to the cover page of this prospectus. |

| Purpose of fund raising and overview of the expected production benefits | Please refer to page 144 of the prospectus. |

| Date of printing for this prospectus: February 2, 2017 | Purpose of printing: Statement of Issuance of New Shares Through Capital Increase. |

| Brief description of other important matters and the pages of this text referenced: Please refer to the table of contents of this prospectus |

Note: As of September 30, 2016, the Company has identified the investment cost and the difference in the net fair value of assets and liabilities that can be recognized by SPIL, and these amounts were retroactively adjusted in the 2015 financial statement. Pre-tax net profit was NT$25,006,896,000 and earnings per share was retroactively adjusted to NT$2.51.

| | | Prospectus Table of Contents | |

| I. Company Overview | 1 |

| 1. | Company Profile | 1 |

| | (1) | Date of establishment: March 23, 1984 | 1 |

| | (2) | Addresses and telephone numbers of the headquarter, branch companies, and | |

| | | factories | 1 |

| | (3) | Company History | 1 |

| 2. | Risk items | 9 |

| | (1) | Risk factors | 9 |

| | (2) | Litigation or non-litigation events | 15 |

| | (3) | Company directors, supervisors, managers, or major shareholders holding over | |

| | | 10% of the company's shares have involved in financial turnover difficulties or | |

| | | suffer credit losses within the last two years and as of the printing of this | |

| | | prospectus; and the effects on the company's financial conditions must be | |

| | | specified: None. | 16 |

| | (4) | Other important issues: None. | 16 |

| 3. | Company Organization | 17 |

| | (1) | Organization system | 17 |

| | (2) | Affiliation chart | 21 |

| | (3) | Background information of President, Vice Presidents, Assistant Vice | |

| | | Presidents, and heads of various departments and branches | 28 |

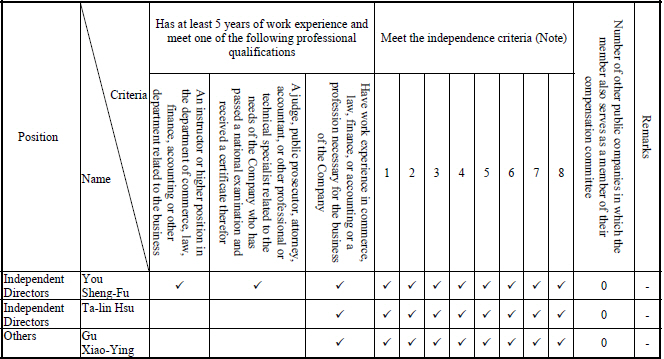

| | (4) | Directors and Supervisors | 33 |

| | (5) | Sponsor: Not applicable.. | 37 |

| | (6) | Remunerations to directors, supervisors, president, and vice presidents in the | |

| | | most recent year | 38 |

| 4. | Capital and Shares | 44 |

| | (1) | Type of stock | 44 |

| | Note: The above table does not include the number of shares converted for | |

| | | employee stock options from October to November, 2016. | 44 |

| | (2) | Share capital formation process | 44 |

| | (3) | Recent equity ownership dispersion status | 49 |

| | (4) | Stock price, net worth, earnings, dividends and related information for the | |

| | | previous two years | 53 |

| | (5) | Dividend policy and implementation status | 53 |

| | (6) | Effect of the proposed stock dividends in the current year on company | |

| | | operating performance and earnings per share: Not applicable. | 54 |

| | (7) | Remuneration of employees, directors and supervisors | 54 |

| | (8) | Stock buyback | 55 |

| 5. | Issuance of corporate bonds (including overseas corporate bonds) | 57 |

| 6. | Issuance of preferred stocks: None. | 62 |

| 7. | Issuance of global depositary receipts (GDR) | 62 |

| 8. | Exercise of employee stock option plan (ESOP): | 63 |

| 9. | Restricted stock awards: None. | 66 |

| 10 | Acquisitions and mergers: None. | 66 |

| 11. Any issue of new shares in connection with any acquisition of shares of another | |

| company, where still in process: None. | 66 |

| II. Business Overview | 67 |

| 1. Company profile | 67 |

| (I) Business Content | 67 |

| (II) Market, production and sales | 99 |

| (3) Number of employees during the past 2 years | 118 |

| (4) Spending on environmental protection | 118 |

| (5) Employees-employer relations | 141 |

| 2. Property, plants and equipment and other real estate: | 145 |

| (1) Self-owned assets: | 145 |

| (2) Rental properties: | 146 |

| (3) Each plant's current condition and facility productivity ratio in the most recent | |

| 2 fiscal years: | 150 |

| 3. Reinvestment business | 152 |

| (1) Overview of reinvestment business: | 152 |

| (B) Comprehensive shareholding ratio: | 162 |

| (3) The status of the subsidiaries who have held or disposed of shares of this | |

| company during the most recent 2 fiscal years and up to the prospectus' | |

| publishing date and the status of the shares pledged, and setting forth the | |

| origin of capital and other influences on the company's financial performance | |

| and financial condition. There was no major impact on the company's financial | |

| performance and financial status. | 164 |

| (4) Any occurrences of the situations of Article 185 of the Company Act, or | |

| transferring part of the business operation or results of the research and | |

| development to a subsidiary during the most recent 2 fiscal years and up to the | |

| prospectus' publishing date, the status of waiving subscription rights to the | |

| cash capital increase in the subsidiary company, the name of the subscribing | |

| counter party, and the relationship with the company, the directors, | |

| supervisors and shareholders who hold more than 10 percent of the | |

| outstanding shares, and the number of the subscribed shares shall be disclosed. | |

| None | 165 |

| 4. Important contracts | 165 |

| III. Issuance Plans and Implementation | 167 |

| 1. I. The items that shall be included in the analysis regarding the allocation plan for capital raised through the previous cash capital increase, issuance of new shares to carry out a merger or acquisition, or to accept transfer of shares of another company; or issuance of corporate bonds: | 167 |

| |

| 3. Assignment of new shares issued by other companies: Not applicable. | 195 |

| Matters that should be reported for the current issuance of new shares in connection with | |

| acquisition or merger: Not applicable. | 195 |

| IV. Financial Summary | 196 |

| 1. Financial information for the most recent 5 fiscal years (note) | 196 |

| (1) Condensed balance sheet and consolidated profit and loss statement | 196 |

| Current assets | 198 |

| Fund and investment | 198 |

| (2) Changes which affect the above condensed financial statements' consistency | |

| such as accounting changes, merger of companies or cessation of business | |

| units and their impact on the current year's financial reports: None | 203 |

| (3) Names of auditors and audit opinions of the most recent 5 fiscal years | 203 |

| (4) Financial analysis | 203 |

| (6) Description of material changes in accounts Compare the accounts of the | |

| balance sheet and income statement of the most recent two fiscal years. If the | |

| change in the amount is 10% or more and the amount is 1% of the total assets | |

| of the current fiscal year, the reasons for the change should be analyzed in | |

| details. | 210 |

| II. Items that should be included in the financial report | 212 |

| (1) The financial statements and CPA audit reports for the two preceding fiscal | |

| years as of the time when the issuer registered the offering and issuance of | |

| securities, and the financial report for the most recent quarter publicly | |

| announced and reported: | 212 |

| (2) The issuer's parent company financial reports for the two most recent fiscal | |

| years, audited and certified by a CPA: | 213 |

| (3) If there are CPA audited and certified, or reviewed financial reports and parent | |

| company financial reports for the most recent period during the time after the | |

| issuer has registered the offering and issuance of securities and up to the date | |

| of publication of the prospectus, disclose these reports: None. | 213 |

| III. The information that should be included in the financial summary and other important | |

| matters | 213 |

| (1) If the company and its affiliated enterprises have experienced any financial | |

| difficulties in the most recent two fiscal years, or in the current year up to the | |

| date of publication of the prospectus, indicate the impact on the company's | |

| financial position. None. | 213 |

| (2) The information shall be disclosed, in case of occurrence of the events under | |

| Article 185 of the Company Act in the most recent two years and up to the | |

| date of publication of the prospectus: None. | 213 |

| (3) Subsequent events: None | 213 |

| (4) Others: None | 213 |

| IV. Review and analysis of the company's financial condition and operating performance .. 213 | |

| (1) Financial status | 213 |

| (2) Financial Performance | 213 |

| (3) Cash flow | 214 |

| (4) Impact of major capital spending on financial position and business operation | |

| in the previous year | 215 |

| (5) Reinvestment policy in the most recent year, the main reason for profit or loss, | |

| improvement plan, and investment plan for the coming year: | 215 |

| (6) Other material issues: None. | 216 |

| V. Special Notes | 217 |

| 1. Implementation of internal control system | 217 |

| 2. Those who have retained an FSC-approved or -recognized credit rating institution to | |

| conduct a credit rating/evaluation shall disclose the credit rating/evaluation report | |

| issued by the credit rating institution: Not applicable | 217 |

| 3. Summary opinion from the securities underwriter's assessment: Please read Page 100 | |

| of this Prospectus. | 217 |

| 4. Attorney's legal opinion: Please read Page 101 of this Prospectus. | 217 |

| 5. Summary opinion stated in the case checklist schedule written by the issuer and | |

| reviewed by a CPA: Not applicable. | 217 |

| 6. The improvement status of the items notified to be corrected, if at the time the company registered (or applied for approval of) the previous offering and issuance of | |

| securities the FSC had notified it to make self-correction on certain items: None. | 217 |

| 7. The items notified to be further disclosed, if at the time the company registered the | |

| current offering and issuance of securities the FSC had notified it to make | |

| supplemental disclosure on certain items: Not applicable. | 217 |

8. The statement or promised items disclosed in the prospectus from the company's registration (application) for offering and issuance of securities for the first time, the

preceding time, and within the most recent three fiscal years, and the current state of | |

| fulfillment of such: None. | 217 |

9. The major content of any dissenting opinion of any director or supervisor regarding any material resolution passed by the board of directors, where there is a record

or written statement of such opinion, for the most recent fiscal year and up to the date | |

| of publication of the prospectus. None. | 217 |

| 10. Any legal sanctions against the company or its internal personnel, or any disciplinary action taken by the company against its own personnel for violation of internal controls, during the most recent fiscal year or during the current fiscal year up to the date of publication of the prospectus; and a description of the main shortcomings in the company's internal control system as well as an indication of measures for improvement: None | 217 |

| 11. The statement issued by the securities underwriter, the issuer, and the issuer's directors, supervisors, General Manager, financial or accounting officer, and the managerial officers involved in the current registration for public offering and | |

| issuance of securities, specifying that no underwriting related fees will be refunded | |

| or collected: Please refer to Appendix 7. | 217 |

| 12. For a case that involves the issuer conducting a cash capital increase or an offering of corporate bonds with equity characteristics and adopting book building and public underwriting, the statement issued by the securities underwriter and issuer, | |

| specifying that allocation to related parties and insiders is prohibited. Not applicable. . 217 | |

| 13. Where depending on the nature of its operations, the issuer has engaged experts with | |

| professional knowledge and vast experience in technology, operations and finance | |

| etc. to conduct analysis and give opinions on the issuer's existing operating status | |

| and future development after current issuance of securities, the assessment opinions | |

| of such experts shall be disclosed: Not applicable. | 218 |

| 14. Other necessary supplemental information: None. | 218 |

| 15. Matters relating to the state of its implementation of corporate governance that should | |

| be recorded by a company listed on the stock exchange or traded on an OTC market: . 218 | |

| VI. Important Resolutions, Articles of Incorporation and Relevant Laws and Regulations . 244 | |

| 1. Key resolution records and text of resolution on the current issue: | 244 |

Annexes:1. Capital increase price calculation

| 2. | The consolidated financial statements and CPA audit reports of 2014 |

| 3. | The consolidated financial statements and CPA audit reports of 2015 |

| 4. | The Q3 consolidated financial statements and CPA audit reports of 2016 |

| 5. | The individual financial statements and CPA audit reports of 2014 |

| 6. | The individual financial statements and CPA audit reports of 2015 |

| 7. | Statement for non-refund underwriting costs |

I. Company Overview

1. Company Profile

(1) Date of establishment: March 23, 1984

(2) Addresses and telephone numbers of the headquarter, branch companies, and factories

Headquarter

Address: No.26, Jing 3rd Rd., Nantz Processing Export Zone, Kaohsiung City

Telephone:(07)3617131

Fax:(07)3613094、3614546

Taipei Office

Address: Rm. 1901, 19F, No. 333, Section 1, Keelung Rd, Xinyi District, Taipei City

Telephone:(02)87805489、66365678

Fax:(02)27576121

Zhongli Branch

Address: No. 550, Section 1, Zhonghua Rd, Zhongli District, Taoyuan City

Telephone:(03)4527121

Fax:(03)4628658

Nantou Branch

Address: No. 135, Lane 351, Section 1, Taiping Rd, Caotun Township, Nantou County

Telephone:(049)2350876

Fax:(049)2315924

Kaohsiung Factory

Address: No.26, Jing 3rd Rd., Nantz Processing Export Zone, Kaohsiung City

Telephone:(07)3617131

Zhongli Factory

Address: No. 516, 550, Section 1, Zhonghua Rd, Fuhua Village, Zhongli District, Taoyuan City

Telephone:(03)4527121

Nantou Factory

Address: No. 135, Lane 351, Section 1, Taiping Rd, Caotun Township, Nantou County

Telephone:(049)2350876

(4) Company History

The Company was founded on the spirit of contributing to the country through industrial development, a belief embraced by Jason Chang and Richard Chang, who actively supported the government's high-tech development policy, used cash and specialized technologies to raise capitals. The Company primarily engages in the manufacturing, assembly, reprocessing, testing, and export of integrated circuit of various types. Time line of the Company:

March 1984 The Company was established.

July 1984 The Company's first factory was opened.

August 1984 Began exporting Plastic Dual In-Line Package (PDIP) to European countries, North America, and Japan.

February 1985 Began exporting Ceramic Dual In-Line Package (CDIP) to Japan, European countries, and North America.

October 1985 Began exporting high-quality Plastic Leaded Chip Carriers (PLCC) to the United States.

May 1987 Began exporting high-quality Pin Grid Array (PGA) and plastic Pin Grid

Array (PPGA) to European countries and North America.

May–July 1989 Approved by the Securities and Futures Commission (1989) Tai-Cai-Zheng-1 No. 24594 and Taiwan Securities Exchange (1989) Shang-Zi No. 4461 to meet the ownership diversity standard on May 25, 1989, and began trading on the Taiwan Stock Exchange on July 19, 1989.

March 1990 Entered the semiconductor test market by acquiring 99.9% of the shares of ASE Test Inc., equivalent to NT$105,006,183.

March 1991 Established ASE Malaysia to engage in manufacture, reprocessing, assembly, testing, and export of integrated circuits of various types. Established ASE Hong Kong to facilitate transfer and acceptance of overseas (Malaysia) production base orders and customer service.

August 1991 Began mass production of Plastic Enhanced Quad Flat Package (EQFP).

November 1991 The Company's product received the Award of Excellence for Quality from Motorola.

April 1992 Achieved ISO9002 quality certificate.

July 1995 Issued 8,600,000 units of DRs to Asian, American, and European countries. Each DR represents five common shares of the Company. In total, 43,000,000 shares were issued, par value of NT$10 per share and sold at US$15.25 per unit. The funds raised were equivalent to NT$3.39 billion.

June 1996 ASE Test Limited began trading on NASDAQ.

September 1997 Issued Euro Convertible Bonds to the value of US$200 million.

November 1997 Passed the Semiconductor Assembly Council (SAC) certification.

January 1998 ASE Test Limited (Singapore) issued 120,000,000 TDRs by using 1,500,000 ordinary shares, and began trading on Taiwan Stock Exchange.

March 1998 Awarded QS 9000 certification for quality management.

September 1998 Awarded ISO 14001 certification for environment quality management.

March 1999 ASE Test Limited (Singapore) issued TDRs for the second time through issuing of 2,500,000 ordinary shares and began trading on Taiwan Stock Exchange.

May 1989 ASE Test Limited (Singapore) acquired 70% of the shares of ISE LAB.

July 1999 Acquired Motorola's manufacturing facilities in Chungli, Taiwan and Paju, Korea. This acquisition promoted the long-term strategic alliance between ASE and Motorola, strengthened ASE's vertical integration, and increased product scope.

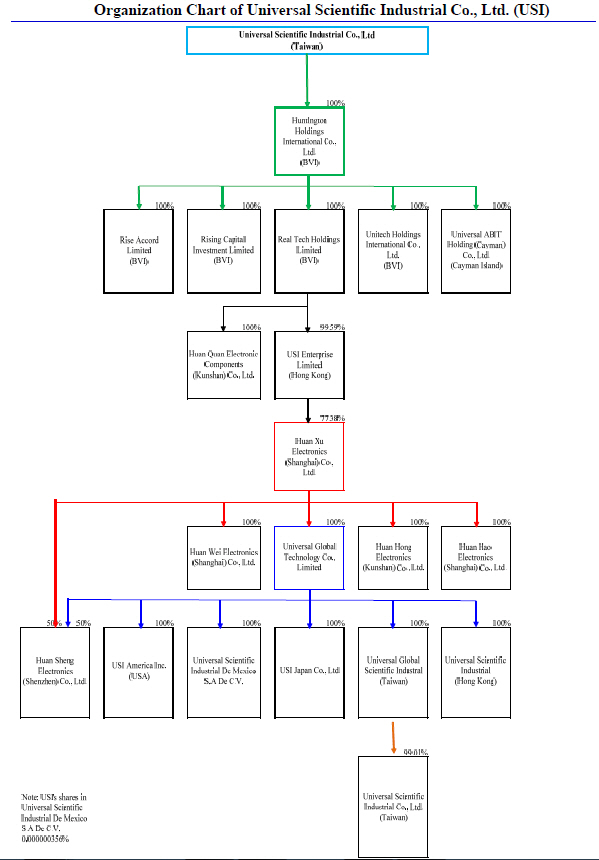

February–July 1999 Obtained operating rights and 20.67% of the shares of Universal Scientific Industrial Co., Ltd. (USI), to broaden ASE's scope of OEM, increase service items for customers, and expand customer group.

September 2000 To enhance the Company's competitiveness in the global semiconductor market and thereby strengthen its image and international visibility, the Company issued 20,000,000 ADRs on September 25 in U.S. time, each representing five ordinary shares of the Company. In total, 100,000,000 ordinary shares were issued, with par value of NT$10. The

issue price was US$7 per unit, and the funds raised were equivalent to NT$4.38 billion.

September 2002 Won the 10th Outstanding Award from the Industrial Technology Development Award of Ministry of Economic Affairs.

July 2003 Combined wholly owned subsidiaries ASE New Investment Co., Ltd. and ASE Investment Co., Ltd.

September 2003 Issued Euro Convertible Bonds to the value of US$200 million.

October 2003 The Company's Board of Directors resolved to combine subsidiaries ASE Co., Ltd. and ASE Technology Co., Ltd. The conversion ratio was set as one share of ASE Co., Ltd. for 0.85 share of ASE Technology Co., Ltd. and as one share of ASE Technology Co., Ltd. for 0.5 share of the Company. The Company anticipated to combine and convert 282,315,437 shares.

February 2004 Signed the agreement to purchase the shares of NEC and acquired NEC Electronics' IC packaging and test operations in Takahata, Japan.

July 2004 Established ASE (Kunshan) Inc., which was resolved in the meeting of the board in June 2004. The amount invested was US$12 million. This establishment was approved by the Investment Commission on July 23, 2004.

August 2004 The Company merged with subsidiaries ASE Semiconductor Co., Ltd. and ASE Technology Co., Ltd., with the Company being the surviving company, and a Zhongli Branch was established. The Company acquired the ASE Semiconductor Co., Ltd. (Shanghai), which was a company set up in China by Omniquest Industrial Limited, a company invested by ASE Semiconductor Co., Ltd. This acquisition was approved by the Investment Commission on August 10, 2004. Established ASE Electronics Inc. (Shanghai), which was resolved in the meeting of the board in July 2004. The amount invested was US$12 million. This establishment was approved by the Investment Commission on August 20, 2004.

November 2004 The Board of Directors resolved in September 2004 to increase the capital of ASE (Shanghai) Inc. by US$30 million, and this resolution was approved by the Investment Commission on November 25, 2004.

June 2005 The Board of Directors resolved in May 2005 to increase the capital of ASE (Shanghai) Inc. by US$30 million, and this resolution was approved by the Investment Commission on June 30, 2005.

October 2005 Won the 13th Outstanding Award from the Industrial Technology Development Award of Ministry of Economic Affairs.

November 2005 The Board of Directors resolved in August 2005 to increase the capital of ASE (Shanghai) Inc. by US$30 million, and this resolution was approved by the Investment Commission on November 2, 2005. Won the Philippine President Award on the night of the award ceremony for Excellent International Manufacturers by the Philippine President.

December 2005 Established ASE New High-Tech (Shanghai), which was resolved in the meeting of the board in November 2005. The amount invested was US$15 million. This establishment was approved by the Investment Commission on December 21, 2005.

March 2006 Invested NT$30 million in establishing a wholly owned subsidiary, ASE Electronics Inc.

May 2006 Approved by the Board of Directors to transfer material business department to subsidiary ASE Electronics Inc. The conversion ratio was NT$10 of the operating value of the transferred material business department for one ordinary share of ASE Electronics Inc.

August 2006 Officially transferred material business department to ASE Electronics Inc., and obtained 294,929,700 ordinary shares of the ASE Electronics Inc. The Company was approved by the Board of Directors in June 2006 to increase the capital of ASE (Kunshan) Inc. by US$30 million. This capital increase was approved by the Investment Commission on August 1, 2006.

September 2006 Transferred 147,500,000 ordinary shares and 147,429,700 shares of the Company's ASE Electronics Inc. to subsidiaries ASE Labuan Inc. and ASE Mauritius Inc., respectively, in support of the company's global operation strategy and financial planning.

December 2006 Passed the resolution of the Board of Directors in November 2006 to adopt the US$60 million capital of subsidiary J&R Holding Limited to accept and transfer 100% of the shares of Weiyu Technology Testing Fengzhuang Limited Company in China. This adoption was approved by the Investment Commission on December 29, 2006. The Company's subsidiary ASE Mauritius Inc. transferred 147,429,700 shares of the Company's ASE Electronics Inc. to subsidiary ASE Labuan Inc. in support of the company's global operation strategy and financial planning.

June 2007 Transferred 3,000,000 ordinary shares of the Company's ASE Electronics Inc. to subsidiary ASE Labuan Inc. in support of the company's global operation strategy and financial planning.

July 2007 Acquired 60% of the shares of NXP Semiconductors Suzhou Ltd. held by NXPB.V. with its own capital of US$21,600,000 through its subsidiary J&R Holding Limited in March 2007. This acquisition was approved by the Investment Commission on July 2, 2007. (Approved on March 7, 2008, the name was changed to Suzhou ASE Semiconductor Ltd.)

August 2007 To integrate the name of the company group, the Company renamed the Weiyu Technology Testing Fengzhuang Limited Company in China to ASE Assembly & Test (Shanghai) Ltd., and this renaming was approved by the Investment Commission on August 29, 2007.

February 2008 Approved by the Board of Directors in October 2007 to increase the capital of ASE Assembly & Test (Shanghai) Ltd. by US$30 million. This capital increase was approved by the Investment Commission on February 20, 2008. Passed the resolution of the Board of Directors in January 2008 to adopt US$7 million in capital to accept and transfer 100% of the shares of Weihai Shiyi Electronic Co.,Ltd. in China through subsidiary J&R Holding Limited. This adoption was approved by the Investment Commission on February 15, 2008. (Approved on May 22, 2008, the name was changed to ASE Semiconductor Ltd. (Weihai)).

May 2008 Approved by the Board of Directors in March 2008 to increase the capital of ASE Assembly & Test (Shanghai) Ltd. by US$90 million. This capital increase was approved by the Investment Commission on May 16, 2008. Approved by the Board of Directors in June 2006 to increase the capital of ASE Semiconductor Ltd. (Weihai) by US$13 million. This capital increase was approved by the Investment Commission on May 22, 2008.

August 2008 Approved by the Board of Directors in July 2008 to increase the capital of ASE Electronics (Kunshan) Ltd. by US$6 million. This capital increase was approved by the Investment Commission on August 7, 2008.

November 2008 To safeguard the Company's credit and shareholders' rights and interests, the Company was approved by the Board of Directors in November 2008 to repurchase 144,037,000 ordinary shares for the first time and eliminate these shares accordingly.

January 2009 To safeguard the Company's credit and shareholders' rights and interests, the Company was approved by the Board of Directors in January 2009 to repurchase 73,937,000 ordinary shares for the second time and eliminate these shares accordingly.

February 2009 Approved by the Board of Directors in December 2008 to increase the capital of ASE Semiconductor Ltd. (Weihai) by US$20 million. This capital increase was approved by the Investment Commission on February 4, 2009.

July 2009 Approved by the Board of Directors in June 2009 to increase the capital of ASE Semiconductor Ltd. (Kunshan) by US$20 million. This capital increase was approved by the Investment Commission on July 31, 2009.

November 2009 Passed the resolution of the Board of Directors in November 2009 to publicly acquire the shares of Universal Scientific Industrial Co., Ltd. (USI) taking into consideration of cash and the Company's ordinary shares (306,596,000 shares) held by J&R Holding Limited (107,308,600 shares) and ASE Test Singapore Inc. (199,287,400 shares).

February 2010 The aforementioned public acquisition was completed on February 9, 2010. Through this acquisition, the Company obtained 641,669,316 ordinary shares of USI in addition to 192,944,213 existing ordinary shares of the company before acquisition. After acquisition, the Company holds 78.1% of the voting shares of USI.

August 2010 The application to terminate the shares of USI was approved by the Board of Directors in April 2010. Concurrently, the Company committed to acquiring the shares of USI. Public acquisition was completed on August 5, 2010, acquiring 222,243,661 outstanding shares of USI in addition to the 834,613,529 existing shares of USI prior to acquisition. After acquisition, the Company holds 98.9% of the voting shares of USI.

November 2010 To safeguard the Company's credit and shareholders' rights and interests, the Company was approved by the Board of Directors in November 2010 to repurchase 37,000,000 ordinary shares for the third time and eliminate these shares accordingly. To comply with government policies, the Company issued shares by way of scripless issue as of November 26, 2010.

January 2011 Considering the group's operation strategy, the Company was approved by the Board of Directors in January 2011 to setup a Nantou Branch that undertakes the existing micro-electronic assembly business of USI.

March 2011 Approved by the Board of Directors in November 2011 to increase the capital of ASE Semiconductor Ltd. (Weihai) by using its own fund of US$60 million through ASE (Korea) Inc. This capital increase was approved by the Investment Commission on March 1, 2011.

June 2011 Passed the resolution of the Board of Directors in June 2011 to raise mid-to-long-term funds, repaying short-term debts to improve the

Company's financial structure. Within the limit of NT$8 billion, the Company issued ordinary corporate bonds guaranteed by five banks, including the Bank of Taiwan.

August 2011 Issued guaranteed ordinary corporate bonds of NT$8 billion. To safeguard the Company's credit and shareholders' rights and interests, the Company was approved by the Board of Directors in August 2011 to repurchase 34,000,000 ordinary shares for the fourth time and eliminate these shares accordingly.

September 2011 To safeguard the Company's credit and shareholders' rights and interests, the Company was approved by the Board of Directors in September 2011 to repurchase 50,000,000 ordinary shares and 30,000,000 shares for the 5th and 6th time respectively and eliminate these shares accordingly.

November 2011 To strengthen the resources, labor, and technological integration of the subsidiary Power ASE Technology ("Power ASE"), the Company was approved by the Board of Directors on November 8, 2011 to publicly acquire the ordinary shares of Power ASE held by shareholders other than those of the Company at NT$18.5 per share. The Company completed the public acquisition on November 18, 2011, acquiring 105,697,703 ordinary shares of Power ASE, approximately NT$1.96 billion in value. In addition to the 55.7% shares of Power ASE originally held by the Company, the Company now holds 99.2% of the shares of Power ASE.

December 2011 Won the Contribution Award from the National Invention and Creation Award of Ministry of Economic Affairs.

May 2012 To integrate resources and enhance business benefit and competitiveness, the Company received approval from the Board of Directors in March 2012 to merge with Power ASE by cash. The Company is the surviving company following the merge, and Power ASE is the dissolved company. The base date of the merge was May 1, 2012.

November 2012 The Company's 2011 CSR Report won the Taiwan Corporate Sustainability Report Award: Copper Award by the Taiwan Institute for Sustainable Energy.

December 2012 Won the Award of Excellence in Intellectual Property Management and the Award for Best Intellectual Property Report by the Ministry of Economic Affairs.

Since 2009 the Company has incorporated green building standards in the construction and planning of building K12, using Taiwan EEWH diamond certification and LEED platinum certification as the design criteria. Following a series of processes, including planning, designing, construction, validation, written review, and onsite inspections, the Company successfully passed the evaluation by the Ministry of Interior in December 2012 and won the Taiwan EEWH diamond certification.

July 2013 Taking into consideration ASE resource integration and economies of scale of the industry, the Company combined its two subsidiaries in China, ASE (Kunshan) Inc. and ASE Electronics (Kunshan). The ASE (Kunshan) Inc. merged with ASE Electronics (Kunshan), with the ASE Electronics (Kunshan) as the dissolved company. After merger, ASE Electronics (Kunshan) conducted liquidation. ASE (Kunshan) Inc. recovered/canceled

an investment of US$24 million.

August 2013 To integrate resources and enhance business benefit and competitiveness, the Company received approval from the Board of Directors in July 2013 to merge with Yang Ting Tech Co., Ltd., a subsidiary in which the Company holds 100% of voting shares,

in accordance with the Business Mergers and Acquisitions Act and other relevant laws and regulations. The Company was the surviving company after the merge, and Yang Ting Tech was the dissolved company. The base date of the merge was August 30, 2013.

September 2013 Issued the 3rd Overseas Zero Coupon Convertible Bonds to the value of US$400 million.

Issued 130,000,000 ordinary shares for capital increase.

October 2013 Approved by the Board of Directors in August 2013 to increase the capital of ASE Semiconductor Ltd. (Weihai) by by means of debt for equity using US$25 million through ASE (Korea) Inc. This capital increase was approved by the Investment Commission on October 29, 2013.

July 2014 Approved by the Board of Directors in July 2014 to increase the capital of ASE Semiconductor Ltd. (Weihai) through ASE (Korea) Inc by using its own fund of US$20 million. This capital increase was approved by the Investment Commission on August 18, 2014.

September 2014 Awarded Forbes Asia Fabulous 50 companies 2014, the only listed company in Taiwan to receive this award in 2014.

October 2014 Re-applied with Kaohsiung Customs, Customs Administration, for Authorized Economic Operator (AEO) safety certification. The Company passed on-site verification and again acquired AEO qualification.

January 2015 The Company's Chairman and CEO, Jason Chang, as well as the COO, Wu Tien-Yu, were honored with the 2014 SEMI Award at the Industry Strategy Symposium (ISS) in 2015, which was held in California, United States. This award recognizes ASE's dedication in developing and studying technologies for surpassing traditional gold wire bonding technologies and introducing copper wire bonding technologies.

May 2015 ASE and TDK Corporation engaged in a joint venture to establish ASE Embedded Electronics Incorporated. Monetary value in NTD equivalent to US$39,490,000 was invested in this joint venture, aiding the Company to acquire approximately 51% of share ownership, while TDK Corporation obtained roughly 49% of share ownership.

The Company's subsidiary, ASE Zhongli, passed the customs' AEO certification.

July 2015 Issued the 4th Currency Linked Zero Coupon Convertible Bonds due 2018 to the value of US$200 million.

Won the Best Trade Contribution Award by the Bureau of Foreign Trade, Ministry of Economic Affairs.

October 2015 Approved by the Board of Directors in August 2015 to acquire, for the first time, the ordinary shares of Siliconware Precision Industries Co., Ltd. (SPIL). Completed public acquisition in October 2015, acquiring 779,000,000 outstanding ordinary shares of SPIL, which account for

24.99% of issued voting shares.

Kaohsiung Plants K11 and K12 obtained the Certification of Green Factory Label by the Industrial Development Bureau, Ministry of Economic Affairs, officially becoming a green factory that has been honored with the Green Factory label.

November 2015 In the Taiwan Corporate Sustainability Award competition held by the Taiwan Institute for Sustainable Energy in 2015, the Company won the Taiwan Top 50 Corporate Sustainability Report Silver Medal Awards in the Electronic Information Manufacturing Industry category.

The Company's Kaohsiung Plants, K4, K7, K8, K10, K11, and K12 obtained the ISO 15408 safety certification, EAL6 Site Certification, from the Germany Federal Office for Information Security (BSI), the only semiconductor wafer packaging and testing OEM plant across the world to obtain this certification.

December 2015 Rated by Fitch Ratings with a long-term credit rating of A+ (twn) on December 16, 2015.

Taking into consideration ASE resource integration and economies of scale of the industry, the Company completed the merge of its two subsidiaries in China, ASE (Shanghai) Inc. and ASE Electronics (Shanghai). To fulfill corporate social responsibility and strive toward sustainable develop, the Company was affirmed by the British Standards Institute four years in a row as of 2012 and won the received the 'Inclusive Green Growth Award' and the 'GRC (governance, risk management and compliance) Award'. The Company also obtained the Green Enterprise Paradigm Award, highlighting the Company's commitment in building a green enterprise.

Kaohsiung Plants K3 and K5 passed the green factory certification by the Industrial Development Bureau, Ministry of Economic Affairs, in December 2015. Kaohsiung Plant K9 passed the clean production certification on February 1, 2013, and obtained an extension of this certification by the Industrial Development Bureau, Ministry of Economic Affairs in December 2015.

January 2016 Kaohsiung Plant K8 passed the clean production certification on February 1, 2013, and obtained an extension of this certification by the Industrial Development Bureau, Ministry of Economic Affairs in January 2016.

March 2016 Approved by the Board of Directors in December 2015 to acquire, for the second time, the ordinary shares of Siliconware Precision Industries Co., Ltd. (SPIL). The Company will be acquiring 770,000,000 outstanding ordinary shares of SPIL, which account for 24.71% of issued voting shares. However, the Fair Trade Commission did not complete the review of this case by the end of the acquisition period. Therefore, the Company announced that the condition of acquisition was not met.

In accordance with the resolution of the Board of Directors, in March 2016 the Company paid NT$13,296,307,000 to acquire 201,548,000 ordinary shares and 9,690,000 depositary receipts in SPIL (each recognized as 5 ordinary shares), increasing the shareholding ratio from 24.99% to 33.02%.

April 2016 In accordance with the resolution of the Board of Directors, in April 2016 the Company acquired 8,300,000 ordinary in SPIL on the open market using NT$439,191,000 in cash, increasing the shareholding ratio from 33.02% to

33.29%.

Ranked as a Top 6% to Top 20% listed company in the 2015 (2nd) Corporate Governance Assessment

June 2016 ASE and SPIL jointly entered into the execution of a joint share exchange agreement, in which ASE will apply for the establishment of ASE Investment Holding, which will acquire 100% equity of both ASE and SPIL by means of joint share exchange.

July 2016 Selected as the component of the TWSE Corporate Governance 100 Index by TWSE.

September 2016 In response to the capital increase of ASE Embedded Electronics Inc., share subscription was performed by all existing shareholders based on their shareholding percentage of ASE and TDK Corporation. After subscription, the Company invested NT$765,000,000, with shareholding percentage maintaining at 51%.

October 2016 The Zhongli Plant was the first packaging and testing OEM plant in the world to pass the ISO 26262 certification.

November 2016 Made the CDP’s Climate A List in 2016, the only company in Taiwan to receive A rating in the CDP climate change assessment.

The Company passed the resolution of the Fair Trade Commission that approves a joint holding company between ASE and SPIL.

II. Risk items

(I) Risk factors

1. Within the last year and as of the printing of this prospectus, the effects that annual interest, exchange fluctuation, and inflation rates have on the profits and losses of the company as well as the future response measures

(1) The effects that annual interest have on company profits as well as the future response measures:

The Company and its subsidiaries have made appropriate flexible adjustments with regards to the cash position required for the company's operating activities. The financial costs for the first three quarters in 2015 and 2016 were respectively NT$2,312,143,000 and NT$1,746,585,000, accounting for 0.82% and 0.88% of the net operating income for the year. These results suggest a minimal impact of interest rate on company profits. In future, we will continue to closely monitor the trends of interest rate and to employ low-interest financing instruments and beneficial interest rate conditions in order to maintain minimal financing cost and active credit limit. Subsequently, interest rate risks that are likely to occur in business operations can be averted.

(2) The effects that exchange fluctuation have on company profits as well as the future response measures:

The Company and its subsidiaries conduct hedging by adopting natural hedging in conjunction with low-risk and safe hedge targets. The net profits on foreign currency exchange for Q3 in 2015 and 2016 were respectively NT$(713,213,000) and NT$2,235,621,000, accounting for (0.25)% and 1.13% of the net operating income. This suggests that the profits were not affected by exchange fluctuation. In future, we will pay attention to the global economy and changes in exchange rate and focus on reducing the risks of exchange rate variations as our main management practice.

Concurrently, we will also deliberately examine how the company allocate its funds and mitigate the effects of exchange rate fluctuations as a means of effective management.

(3) The effects that currency inflation have on company profits as well as the future response measures:

Currently inflation did not exert a material impact on the profits of the Company and its subsidiaries. In addition to closely monitoring price fluctuations in the market, the Company and its subsidiaries will maintain a positive interactive relation with their suppliers and customers and appropriately adjust product selling price and stock inventory. These efforts should be able to effectively mitigate the impact of currency inflation on the Company and its subsidiaries.

2. Within the last year and as of the printing of this prospectus, main policies for engaging in high-risk engagements, highly leveraged investments, endorsement guarantees, and derivative transaction policies; main reasons for profits and losses; and future response measures. The Company engages in the transactions listed in the preceding paragraph in accordance with relevant handling procedures as formulated by the Company.

The Company and its subsidiaries adopt robust, conservative operating strategy and abstain from engaging in high-risk, high-leverage investments. The Company has complied with laws and regulations of the Securities and Futures Bureau (SFB) in developing internal management guidelines and operating procedures that are based on a sound financial and operational plan, including the Procedure for Lending Funds to Other Parties, Procedure for Making Endorsements and Guarantees, and Procedure for the Acquisition or Disposal of Assets. In future, the Company will continue to abide by procedural regulations and perform all transactions in accordance with relevant regulations.

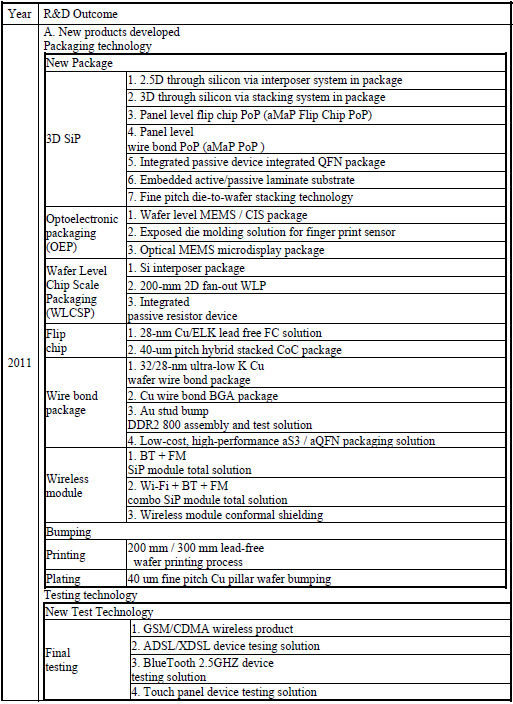

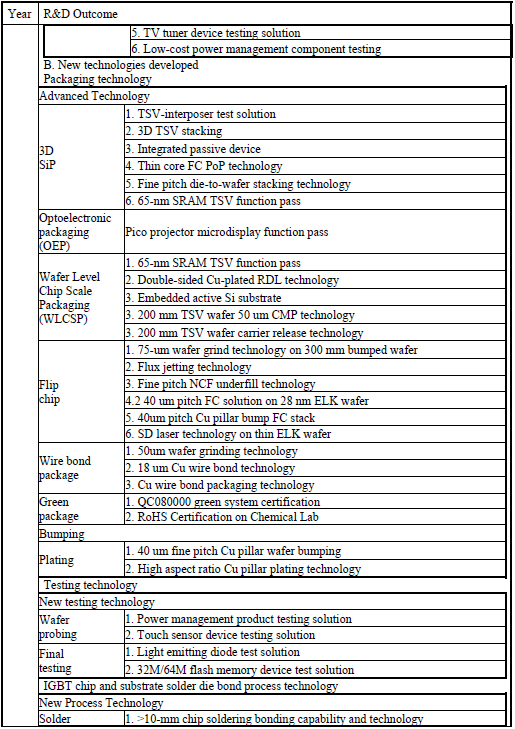

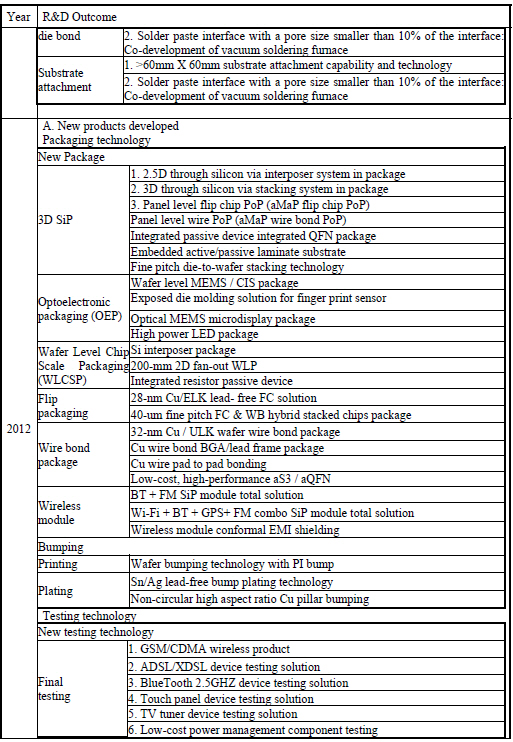

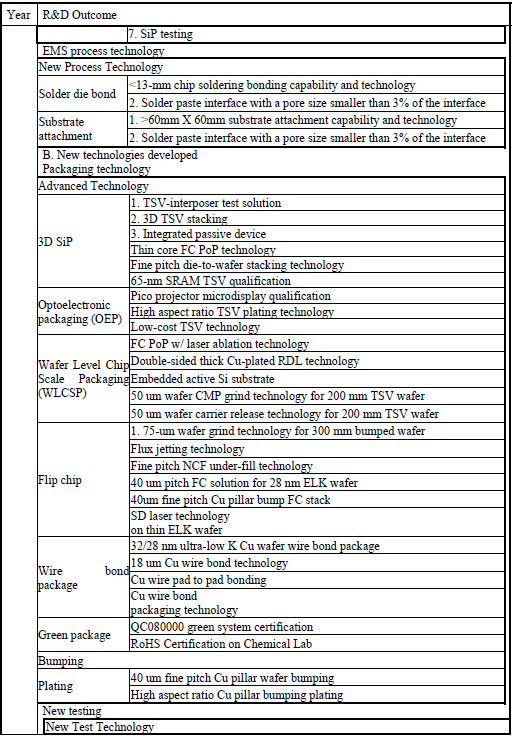

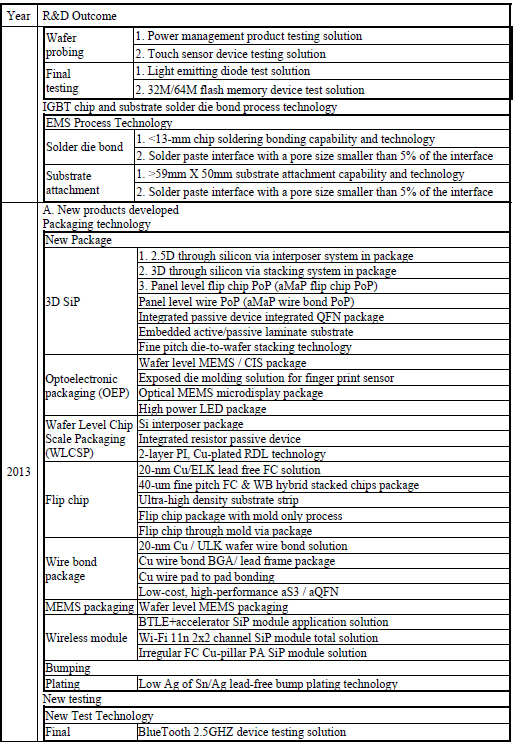

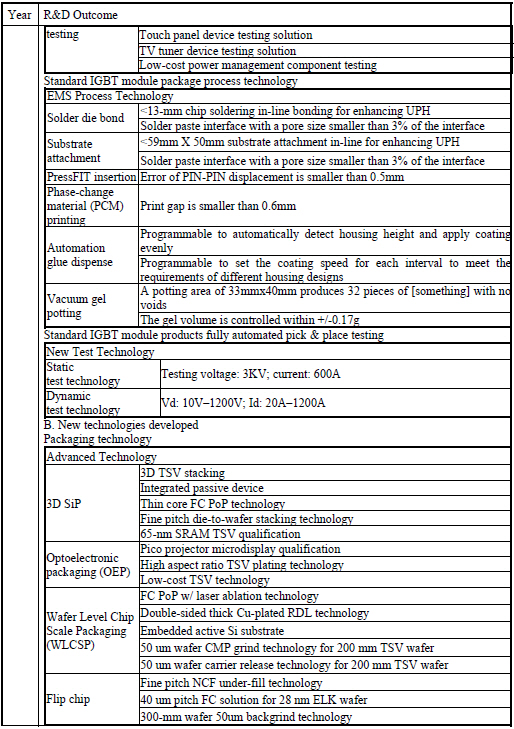

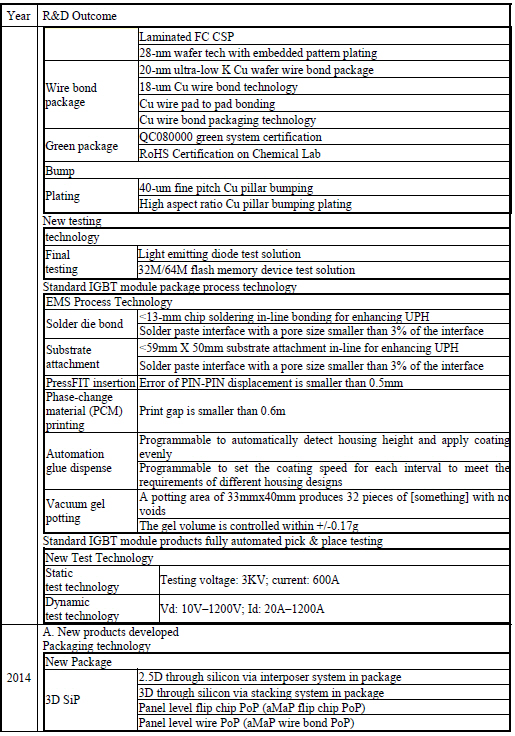

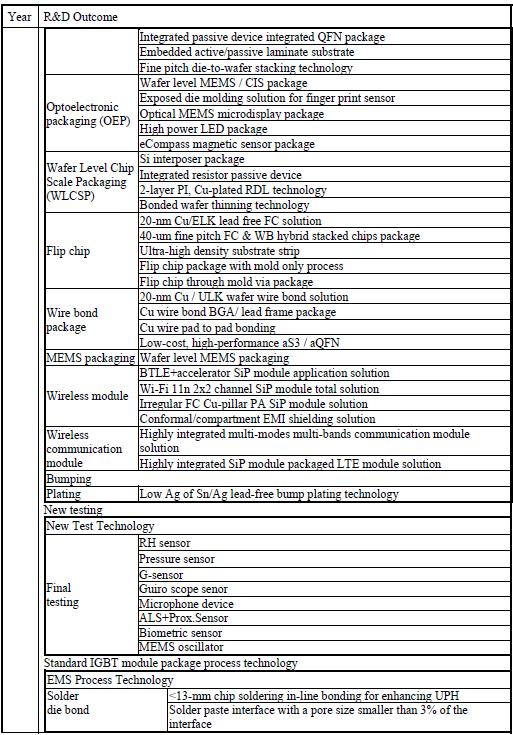

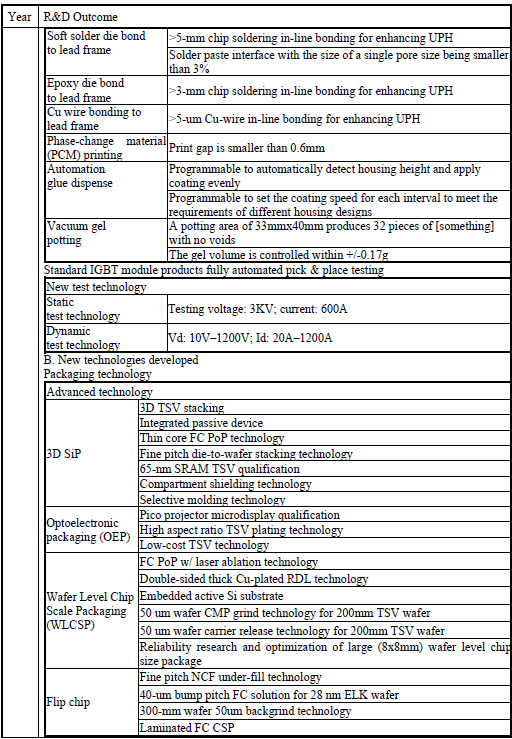

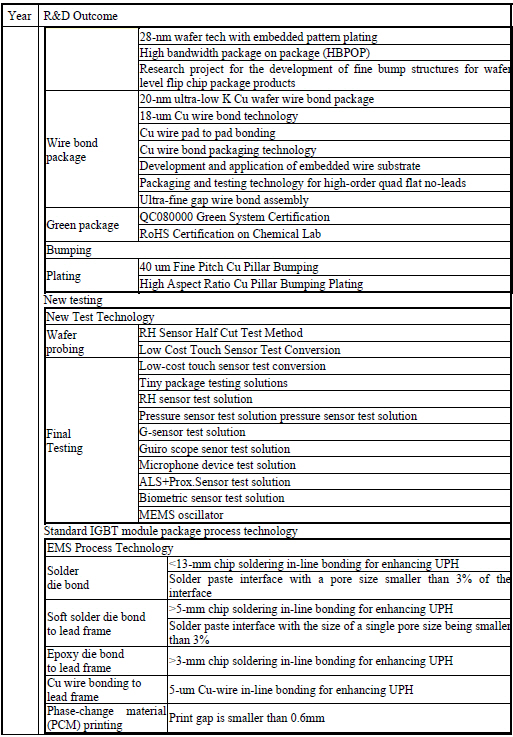

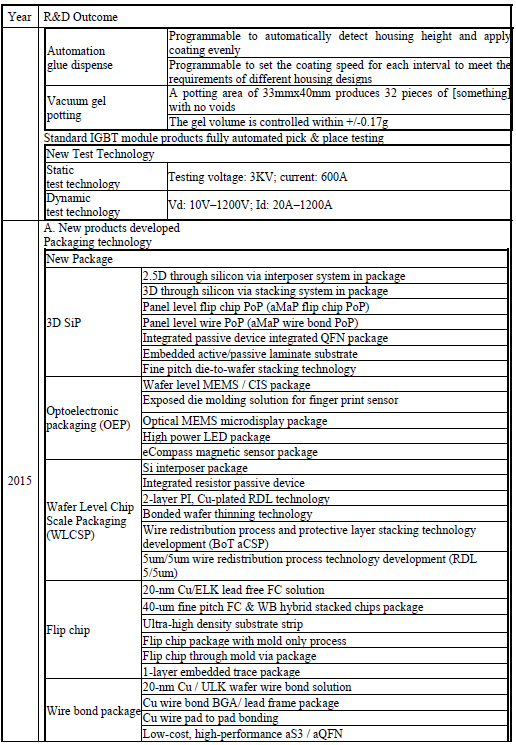

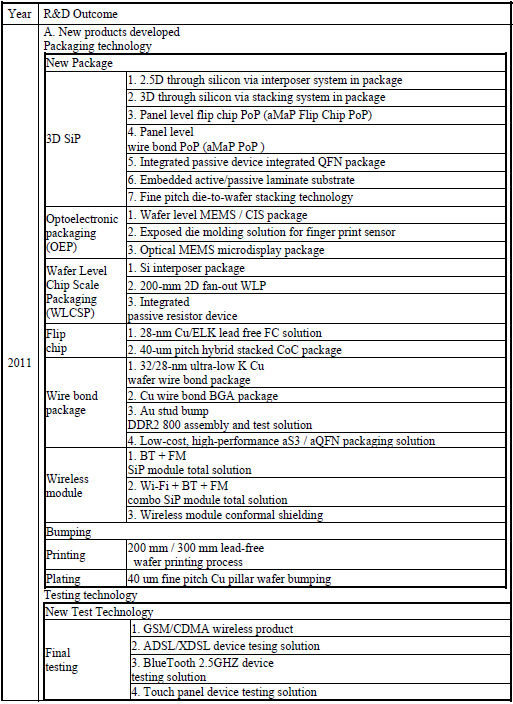

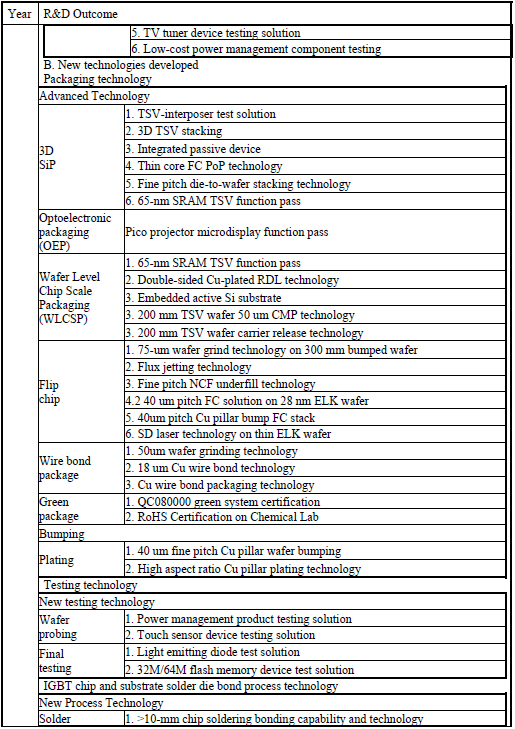

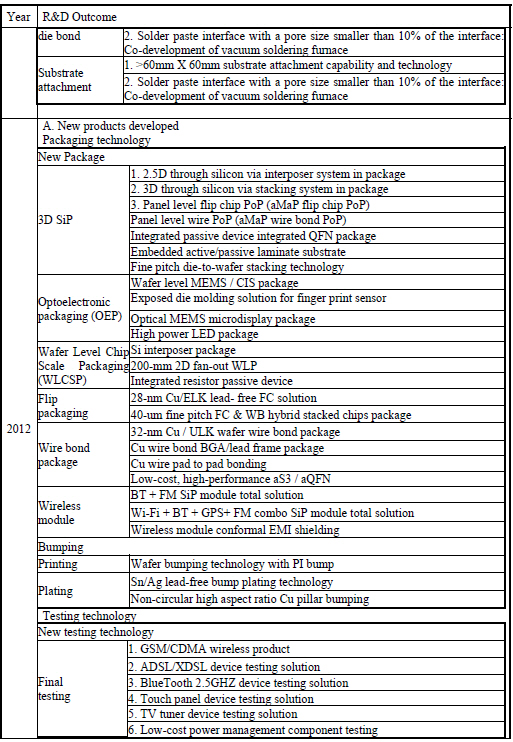

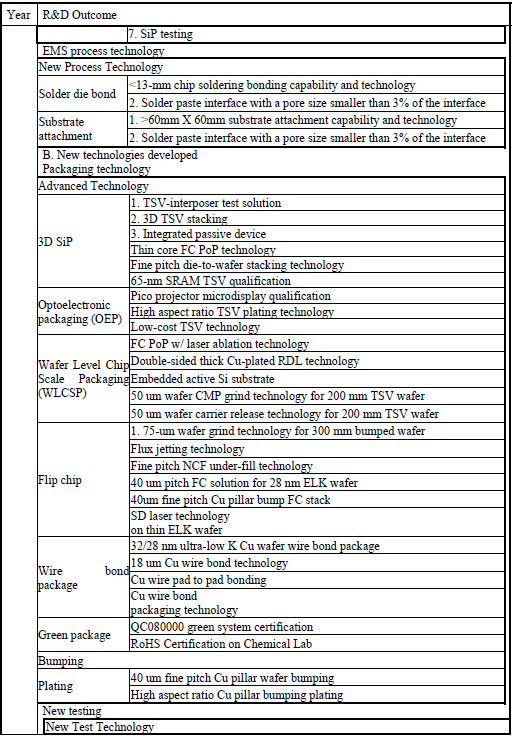

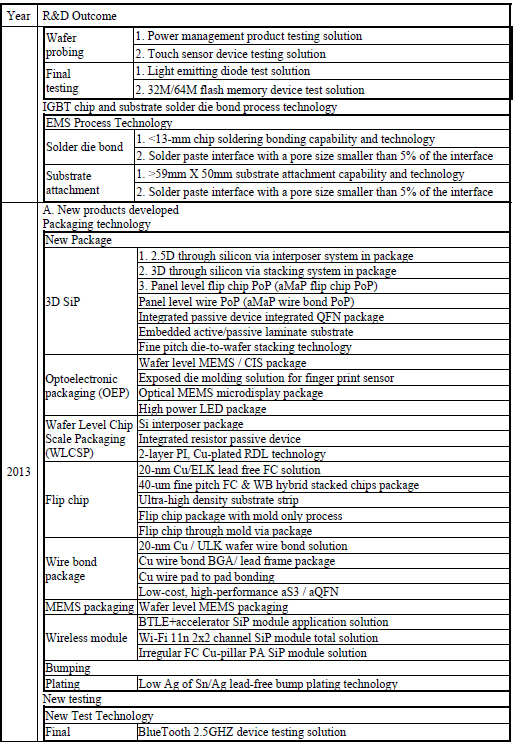

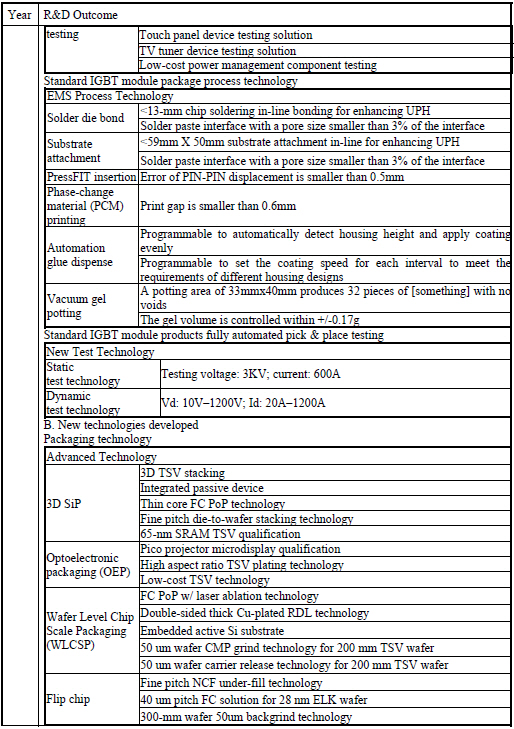

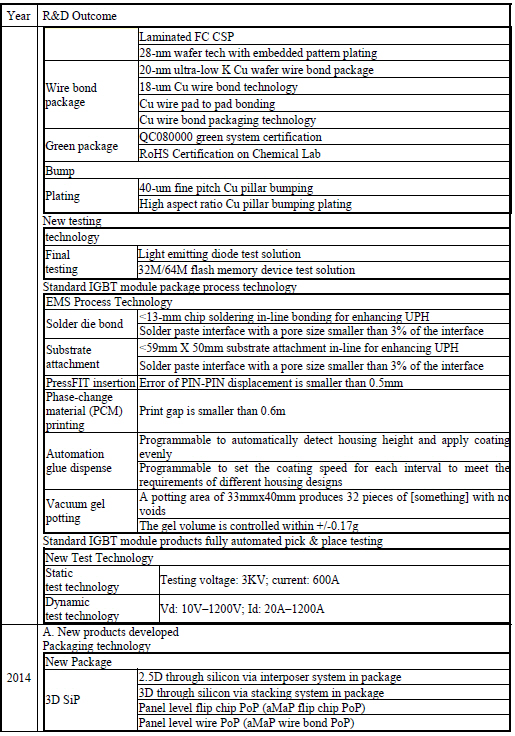

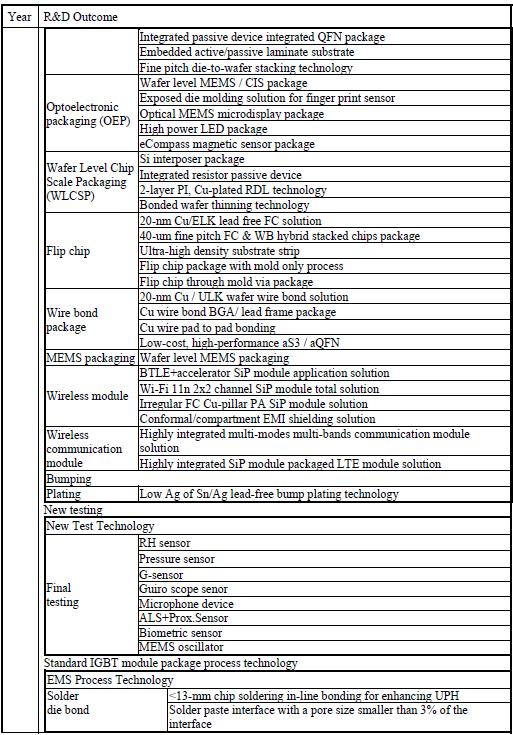

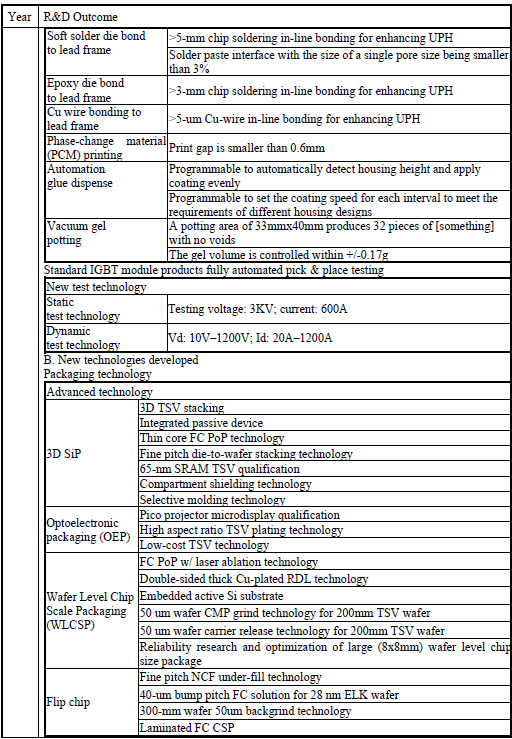

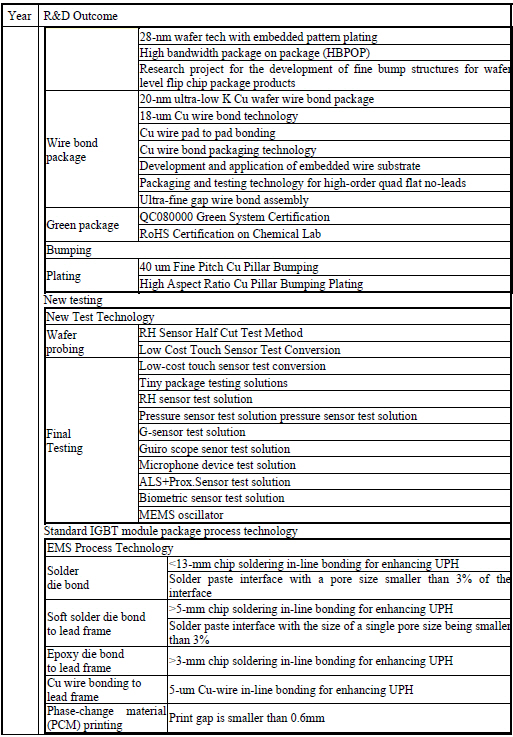

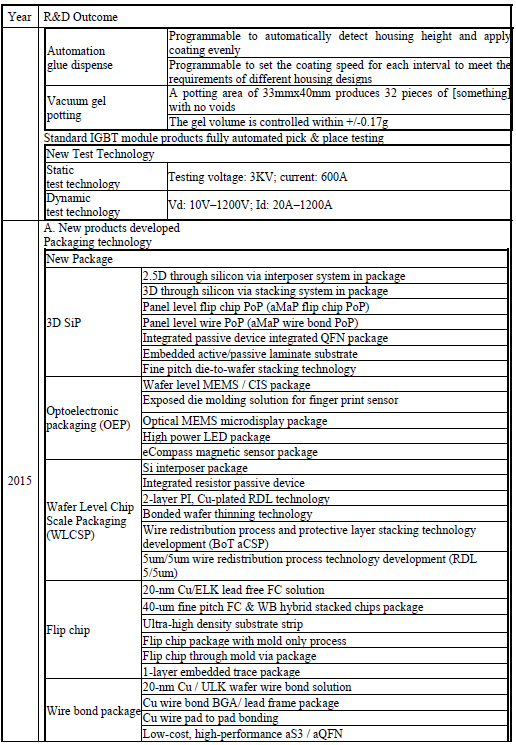

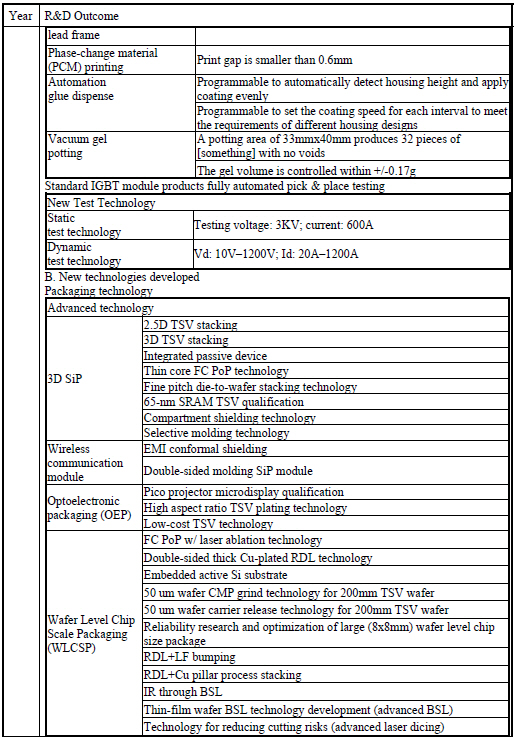

3. Future R&D plans and anticipated investments in R&D expenses

(1) Future R&D plans

Please read pages 46 to 49 of this prospectus.

(2) Anticipated investments in R&D expenses

The Company and its subsidiaries anticipate to invest NT$430,000,000 in R&D for the pilot production of their packaging products, and NT$3,864,000,000 in R&D of other packaging products. It is anticipated that NT$480,000,000 will be invested in R&D for the pilot production of packaging products, and NT$5,000,000 in the R&D of other packaging products. NT$37,000,000 in R&D expense will be invested in the testing and pilot production of module process technologies.

(3) Factors influencing the success of future R&D

| Ÿ | Development of advanced packaging technology capability and integration with existing packaging technologies |

| Ÿ | Optimal solution for minimizing the cost of producing existing packaging and testing technologies |

| Ÿ | Process and manufacturing standardization and industry chain integration |

| Ÿ | Verification and instant introduction of mass-produced new core facilities |

| Ÿ | Development and cultivation of packaging, testing, substrate, module, and system integration capabilities |

| Ÿ | Development and cultivation of substrate, element, and module design capabilities |

| Ÿ | Complete product R&D process and project management system |

| Ÿ | Integration of product development and existing production equipment to lower R&D costs |

| Ÿ | Customer-oriented organizational design and internal operation mechanism |

| Ÿ | Adequately monitor market supply and demand, and take the lead in developing advanced packaging, substrate, and testing technologies according to market dynamics and trends in order to ensure leading technological status and to provide customers with optimal solutions in a timely manner when new products are launched in the market |

| Ÿ | Strengthening of R&D talent cultivation |

| Ÿ | Implementation and reinforcement of knowledge management system |

| Ÿ | Strengthening of IP strategy and management |

| Ÿ | Designing, R&D, and manufacturing of Eco-design products that meet environmental protection regulations |

| Ÿ | Effective management of R&D benefits, risks, scheduling, and personnel |

| Ÿ | Formation of strategic alliance with benchmark customers, reduction of R&D costs and risks, and development of IC-package-system Co-design |

| Ÿ | Development and advancement of testing development capabilities |

| Ÿ | Development and advancement of R&D core technology capabilities |

4. Within the last year and as of the printing of this prospectus, the effects of the key domestic and international policy and law changes have on the financial operations of the company as well as the response measures:

(1) According to Jin-Guan-Zheng-Fa No. 1030029342 and Jin-Guan-Zheng-Fa No. 1030010325 announced by the FSC, the Company began adopting the 2013 IFRS, IAS, IFRIC, and SIC (collectively, the “IFRSs”), which are announced by the IASB and approved by the FSC, as of 2015 as well as the Regulations Governing the Preparation of Financial Reports by Securities Issuers, to compile its consolidated financial reports. In addition, the Company adopts the IFRSs announced by the IASB but not yet approved by the FSC. Concerning the impact on the consolidated financial reports, the Company will continue to evaluate these reports and complete such evaluation by the specified due date in accordance with the schedule provided by the FSC.

(2) In response to the amendments to the Company Act and Securities and Exchange Act, the Company examined and amended its management guidelines at all times to ensure that legal compliance.

5. Within the last year and as of the printing of this prospectus, the effects that technological changes and industry changes have on the financial operations of the company as well as the response measures

(1) The uncertainty and discontinuity of the global economy are a major challenge of the semiconductor industry. ASE overcomes this challenge by cooperating with customers and vendors to meet customer demands, reduce costs, mitigate risks, continuously observe market pulse, and maintain a closer interaction with customers to identify their needs and changes in their needs. Subsequently, we actively gathered and analyzed market information to alleviate the technological impact of changes in product requirements.

Customer competitiveness and the timing to launch a new product are the key to the success of introducing a new technology. ASE responds to this trend by monitoring market trends and supply/demand conditions, taking the lead to develop key technologies and patents according to market trends and product blueprint of benchmark customers in order to ensure a leading technological status. ASE also reduces R&D costs by ensuring that the process of product development is compatible with existing production equipment to provide customers with the best solution when new products are launched in the market.

(3) According to our experience in the R&D and innovation of new technologies, we found that R&D expenses and new core facilities are a critical component of these processes. Therefore, we respond by ensuring consistency between new technologies and ASE’s future blueprints, and by actively forming strategic alliance with customers to implement resource sharing and ultimately reduce R&D risks. ASE regularly visits its leading customers, participates in technological seminars, and works with benchmark customers to collectively plan product blueprints and product regulations that ensure that R&D technologies can facilitate meeting customers’ delivery deadline.

ASE Nantou Plant (ASENT) has long been devoted to developing electrical and electronic products, including military and industrial power modules for DC converters. The Plant offers multiple solutions to high-power electrical and electronic industrial applications. ASE actively interacts with its customers to determine their needs and changes in their needs. Moreover, the Company actively gathers and analyzes market information to mitigate the effects of technological changes. In future, ASE will place greater level of emphasis on intelligent energy conservation practices, using our extensive experiences and resources in the development of electrical and electronic products. We will also orient our development efforts toward incorporating insulated-gate bipolar transistor (IGBT) standard module packaging and IPM smart module.

6. Within the last year and as of the printing of this prospectus, the effects that corporate image have on corporate crisis management as well as the response measures

The Company and its subsidiaries have always operated under the concept of integrity, law-abiding, and fulfillment of social responsibility. In face of the accidental incident in 2013 involving leakage of wastewater from our Kaohsiung Plant, ASE faced the consequences of this incident with courage and proactively handled the situation, while continuing to make relevant improvements in order to endeavor to reshape the company's image.

7. Within the last year and as of the printing of this prospectus, expected benefits and possible risks of merger and acquisition as well as the response measures

(1) To engage in organizational adjustment and thereby enhance operational flexibility, subsidiary Universal Scientific Industrial Co., Ltd. (USI) passed the resolution of the meeting of the Board of Directors to take April 1, 2015 as the base date for the transfer of its investment business, and reducing the capital by NT$16,012,966,000, equivalent to eliminating 1,601,297,000 outstanding shares. The capital reduction ratio was 97.56%Regarding the operating value assumed by USI Inc. due to such transfer, 1,000,000,000 ordinary shares were issued to the existing shareholders of USI. The ratio was 609.27 ordinary shares per 1,000 shares held as of the base date. USI completed the registration for the capital reduction on April 17, 2015, and the new company was also registered on April 17, 2015. The transfer did not exert an influence on the Company’s net value per share and earnings per share or those of its subsidiaries, because the Company and its subsidiaries hold control over the USI Co.,

Ltd. and USI Inc.

Integrating the resources along the industry chain of the Company and its subsidiaries’ electronic manufacturing services (EMS), and establishing reasonable separations in the operational models of semiconductor packaging and testing and EMS, would enhance the efficiency of these two areas. To this end, in February 2016, the Company disposed of 39,603 shares of its subsidiary USI Co. Ltd. to subsidiary Universal Global Scientific Industrial Co., Ltd. at NT$20 per share, the total value of the transaction was NT$792,064,000. The shareholding ratio of the Company and its subsidiaries in USI Co. Ltd. was lowered from 99.0% to 76.5%. This transaction did not change the Company’s control over its subsidiary USI Co. Ltd., the transfer was conducted in the form of an equity transaction, and the recognized capital reserve was reduced by NT$20,552,000.

(2) To integrate group resources, subsidiary USI Electronics Inc. was approved by the Board of Directors on March 25, 2015 to merge with USI America Inc. (known as USI Manufacturing Services, Inc. before May 2015) and USI @Work, Inc. USI America Inc. served as the surviving company, and USI @Work, Inc. served as the dissolved company. USI @Work, Inc. was completely merged and eliminated in August 2015. Such merge is anticipated to help USI America Inc. lower management cost and increase business performance, which positively influence the net value per share and earnings per share of USI America Inc.

(3) Taking into consideration ASE resource integration and economies of scale of the industry, the two subsidiaries in China, ASE (Shanghai) Inc. and ASE Electronics (Shanghai) passed a resolution of the meeting of the Board on December 17, in which ASE (Shanghai) Inc. used RMB99,318,000 in new shareholdings and its original investment company trading in its equities in ASE Electronics (Shanghai) to acquire ASE Electronics (Shanghai), with ASE (Shanghai) Inc. being the surviving company and ASE Electronics (Shanghai) being the dissolved company. The base date of the acquisition was temporarily set on January 1, 2016. As of the printing date of this prospectus, the acquisition is still in progress because approval from the competent authority is still pending. The anticipated benefit of such acquisition is that ASE (Shanghai) Inc. can directly obtain the funds of ASE Electronics (Shanghai) to improve its financial structure and lower operational cost, which positively influence the net value per share and earnings per share of ASE (Shanghai) Inc..

(4) In September 2015, the Company acquired 779,000,000 ordinary shares of SPIL at NT$45 per share and 10,650,000 depositary receipts, each recognized as 5 ordinary shares. This accounts for a total shareholding of 24.99%, which has a major effect on SPIL. Between March and April 2016, the Company acquired ordinary shares in SPIL on the open market using NT$13,735,498 in cash and 258,300,000 depositary receipts (each recognized as 5 ordinary shares), increasing the shareholding ratio from 24.99% to 33.29%.

In response to the future development and sustainable management of the semiconductor industry, the Company received approval from the Board in June 2016 to enter a share exchange agreement with SPIL. The Company will submit application to setup an ASE Investment Holding (hereafter referred to as “ASE Investment”) and to engage in share transfer with SPIL so that the ASE Investment will obtain 100% share ownership to ASE and SPIL. The consideration of such share transfer is to exchange one ordinary share of ASE for 0.5 ordinary share of ASE Investment, and one ordinary share of SPIL for cash of NT$55 (adjusted to NT$51.2 following earnings distribution in 2016).

As of the date of printing of this prospectus, the share transfer will be performed in accordance with the collective share transfer agreement and still requires multiple prerequisite conditions before it can be achieved (including but are not limited to the approval of shareholders’ meeting of the Company and SPIL, and the approval or consent of relevant competent authorities for this transaction). Unless otherwise agreed by the Company and SPIL, if the aforementioned condition cannot be met or has been exempted before December 31, 2017, then this agreement will be terminated automatically.

Because of the aforementioned collective share transfer agreement, the Company will handle its existing treasury stocks and converted equity corporate bonds that have been issued by adopting the following principles:

A. For outstanding 3rd overseas non-guaranteed convertible bonds that are issued by the Company, unless these bonds had been redeemed or repurchased and canceled or the bond holder has exercised his/her conversion right before the base date of the share transfer, the holder may, after the Company has obtained the approval of competent authorities, convert these bonds into newly issued ordinary shares of ASE Investment on the base date of share transfer in accordance with relevant laws and regulations, the consignment agreement of these bonds, and the conversion ratio.

B. To support the issuance of the 4th overseas non-guaranteed convertible bonds, the Company has repurchased treasury stocks for conversion before the share transfer base date, converting them into shares of ASE Investment on the basis of the conversion rate. These shares will be held by the Company, and the conversion rate specified in the share transfer agreement will be adjusted as the conversion price for overseas non-guaranteed convertible corporate bonds.

C. Before signing the collective share transfer agreement, ASE Investment will fulfill the Company's obligations as of the share transfer base date with regards to the issued stock options that are approved by the competent authorities. The price and quantity of share transfer shall be changed to new ordinary shares of ASE Investment in accordance with the adjustment of conversion rate and object of contract execution. The remaining issuance condition and original issuance condition shall be identical. However, the specific method of execution shall be conducted by the ASE Investment following relevant laws and regulations and the instructions approved by the competent authorities.

8. Within the last year and as of the printing of this prospectus, expected benefits and possible risks of factory expansions as well as the response measures

Because the growth of the semiconductor market presented an optimistic prospect, the Company and its subsidiaries anticipate that the magnitude of growth in 2016 will exceed that of 2015. Regarding investment, to adequately and effectively utilize existing production capacities, the Company and its subsidiaries have increased their production capacity in the past few years to an extent that they can now fulfill most of their orders. To improve the return rate and reduce investment risks, the Company and its subsidiaries focused primarily on our existing production capacities and equipment as well as investments in new equipment in order to boost market growth. In addition to using new plants, we will incorporate new investments into consideration depending on the actual market demands.

9. Within the last year and as of the printing of this prospectus, the risks of concentrated procurement or sales as well as the response measures

(1) Overly concentrated procurements easily disrupt the supply process because of

production or quality abnormalities and also weaken suppliers' bargaining power. The Company and its subsidiaries have formulated policies for diversifying their suppliers of direct material and machinery equipment in order to identify the few alternative suppliers (2nd source) who can concentrate on supply resources and materials. Regarding the source of supply in a foreign oligopolistic market, we actively fostered domestic suppliers with potentials in technological R&D to disperse risks and reduce costs.

(2) The Company and its Subsidiaries were not involved in matters relating to concentrated sales.

10. Within the last year and as of the printing of this prospectus, the effects and risks that large-number transfers or replacements of directors, supervisors, or major shareholders holding over 10% of the company's shares have to the company as well as the response measures:

Within the last year and as of the printing of this prospectus, there were no large-number transfers or replacements of directors or major shareholders holding over 10% of the company's shares.

11. Within the last year and as of the printing of this prospectus, the effects and risks that operating rights changes have to the company as well as the response measures

In the most recent year and as of the printing date of this prospectus, the Company has never changed the operating rights.

12. Other important risks and response measures: None.

(II) Litigation or non-litigation events

1. Finalized judgments or pending litigations, non-litigations, or administrative disputes for the company in the last two years until the printing date of this prospectus whereby the results may have major impacts to the shareholders' rights or share prices

(1) The Company received a statement of charge from Taiwan Kaohsiung District Court in November 2015. The charge involved SPIL appealing to the Court for confirming the non-existence of the Company's right to request for being listed as a shareholder in the shareholders' roster of SPIL. Because SPIL did not pay the court fee by the specified deadline, the Taiwan Kaohsiung District Court dismissed the lawsuit, thus imposing no material influence on the consolidated financial status and financial performance of the Company and its subsidiaries.

(2) Kaohsiung City Government Environmental Protection Bureau (hereafter referred to as "EPB") fined the Company NT$102,014,000 (referred to as "Fine") for violating the Water Pollution Control Act. The Company filed an appeal against the said Fine and the appeal was dismissed by the Kaohsiung City Government. Subsequently, the Company filed an administrative lawsuit with the Kaohsiung High Administrative Court to request the Kaohsiung City Government to withdraw the decision and the Fine and to request the EPB to return the fine that the Company has already paid. The Kaohsiung High Administrative Court provided a ruling on March 22, 2016 to withdraw the decision and the Fine and to dismiss the remaining appeal (i.e., request for refund of the fine paid). On April 4, 2016, the Company lodged an appeal against the part of the ruling that negatively affects the Company. The case is currently being reviewed by the supreme administrative court.

Kaohsiung District Prosecutors Office filed a lawsuit against the Company in January 2014 for violating the Waste Disposal Act, and the Taiwan Kaohsiung District Court fined the Company NT$3,000,000 for violating Article 47 of the Waste Disposal Act. The Company appealed against the ruling in accordance with

legal procedures. The Taiwan High Court Kaohsiung Branch reached a verdict on September 29, 2015, ruling the Company not guilty.

2. Finalized judgments or pending litigations, non-litigations, or administrative disputes associated to the company's directors, supervisors, General Manager, responsible person, or major shareholders holding over 10% of the company's shares in the last two years until the printing date of this prospectus whereby the results may have major impacts to the shareholders' rights or share prices: None.

3. Company directors, supervisors, managers, or major shareholders holding over 10% of the company's shares have involved in matters described by Article 157 of the Securities and Exchange Act as well as the status of the case currently handled by the company within the last two years and as of the printing of this prospectus: None.

(III) Company directors, supervisors, managers, or major shareholders holding over 10% of the company's shares have involved in financial turnover difficulties or suffer credit losses within the last two years and as of the printing of this prospectus; and the effects on the company's financial conditions must be specified: None.

(IV) Other important issues: None.

3. Company Organization

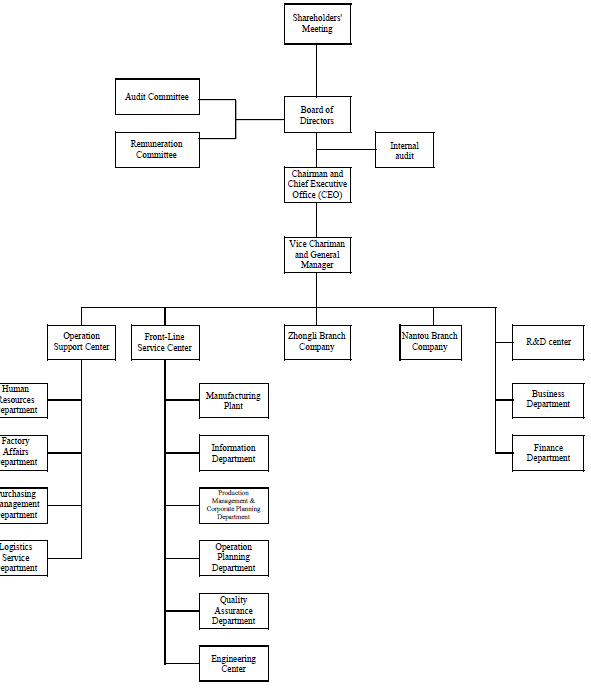

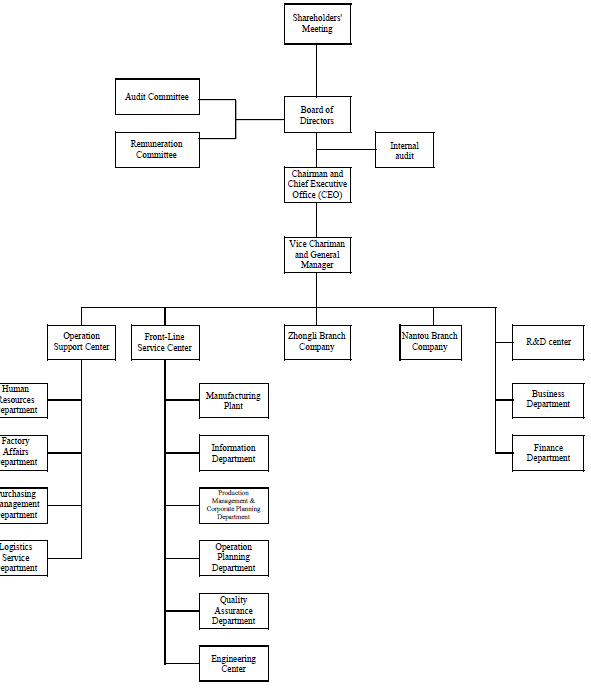

(I) Organization system

1. Organization structure

2. Business operations of the various key business departments

| Department | Duties |

| Operation | Human | Human resource management and organizational |

| Department | Duties |

| Support Center | Resource Division | development Ÿ Human Resource Operation Service Division: Provide employee service, develop labor requirement plan, plan and manage employee recruitment, remuneration, welfare, and performance systems, and manage central security protection system ŸHuman Resource Operation Development Division: Plan organizational development and strategies, strengthen employee care and concern, and participate in CSR and charity events |

| Plant Affair Division: | Handle environmental protection tasks of plant and administrative areas, manage general affairs, and control and manage labor safety ŸNew Construction Division: Devise plant expansion plans, monitor new construction works and manage construction acceptance tasks, and ensure operation development ŸOccupational Safety Division: Integrate organization of plant areas and plant affairs, strengthen laws and regulation identification and standardize practices, and assume responsibility in occupational safety and environmental management and sustainable development ŸPlant Affair Technological Integration Division: Integrate and strengthen the following aspects: supplier quality and reliability of plant affair system; integration and operation of plant safety and maintenance, introduction and planning of new technologies and equipment |

| Procurement Management Division | Procure, manage, and control machines and product materials ŸProcurement Management Division 1: Integrate the procurement of production materials with supplier resource management ŸProcurement Management Division 2: Allocate repair, general affairs, and procurement tasks and integrate and manage cross-department resources ŸProcurement Management Division 3: Integrate mechanical equipment, procure resources, and develop and promote cross-unit systems |

| Logistic Service Division | Handle matters pertaining to storage, import/export activities, and insurance and tax accounting |

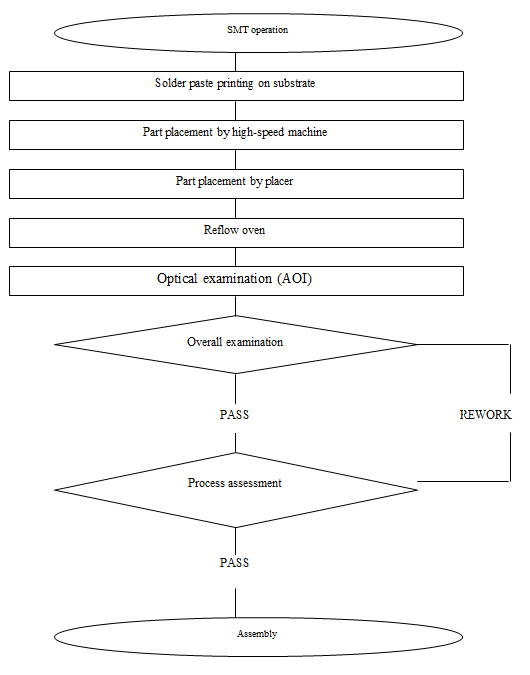

| Front Line Service Center | Manufacturing Plant | Handle matters related to semiconductor packaging OEM, product production planning, product manufacturing, progress management, onsite management, and equipment maintenance |

| Information Division | Construct company information system and implement e-management strategies and system services ŸAutomated and Engineering Information Division: Manage strategic development of automated and engineering information system, innovation, framework planning, system integration, and system design and maintenance ŸTechnical Information Division: Evaluate, integrate, setup, |

| Department | Duties |

| | | and maintain software and hardware applications of the company information system ŸOperation and Customer Information Division: Plan, develop, maintain, and manage corporate operation management and customer information service IT application system ŸManufacturing Information Division: Manage strategic development of manufacturing information system, innovation, framework planning, system integration, and system design and maintenance |

| Production and Management Planning Division | Manage production planning and operational efficiency |

| Operation Planning Division | Plan operation and project proposals, and integrate and implement administrative resource plans |

| Quality Assurance Division | Examine and ensure product qualities ŸQuality Assurance Division: Ensure quality management mechanism and monitor product quality ŸQuality System Division: Establish product reliability and assure the accuracy of measuring instruments ŸQuality Engineering Division: Ensure customer communication and coordination, develop product testing process, and conduct quality control |