SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 4, 2008

ARC INTERNATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

NORTHSTAR VENTURES, INC.

(Former Name)

Nevada

(State or other jurisdiction of incorporation)

0-31379 91-2016816

(Commission File Number) (IRS Employer Identification No.)

333 Turnbull Canyon Road, City of Industry, California 91745

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including areacode: (626) 606-1051

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[] Written communications pursuant to Rule 425 under the Securities Act

[] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

[] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act.

Item 1.01. Entry into a Material Definitive Agreement

Item 2.01.Completion of Acquisition or Disposition of Assets.

On January 4, 2008, the Registrant acquired 100% of the outstanding common stock of ARC International Corp.ARC International Corp., a California corporation (“ARC International Corp.”). The acquisition was effected pursuant to an Agreement and Plan of Reorganization dated December 31, 2007. In connection with the acquisition, the Registrant issued 10,803,834 newly authorized shares of common stock, the officers and directors of the Registrant resigned and the persons named in Item 5.02 were elected as officers and directors.The Registrant issued 10,000 shares to one individual for legal services.

There were 473,250 shares outstanding prior to the Closing. Effective at Closing, certain holders of convertible debt of the Registrant converted such debt into 1,000,000 shares of common stock.

As a result of this issuance and the debt conversion, there were 12,297,084 shares of common stock outstanding as of January 4, 2008. On March 14, 2008 the Registrant effected a 1-for-two reverse stock split, resulting in 6,148,542 shares outstanding. In the remainder of this report, all share numbers have been adjusted for this stock split.

When used in this Form 8-K, the words "expects," "anticipates," "estimates" and similar expressions are intended to identify forward-looking statements. Such statements are subject to risks and uncertainties, including those set forth below under "Risks and Uncertainties," that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date hereof. ARC International Corp. expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company's expectations with regard thereto or any change in events, conditions or circumstances on which any statement is based. This discussion should be read together with the financial statements and other financial information included in this Form 8-K.

Item 3.02 Unregistered Sales of Equity Securities

The Registrant issued 5,401,917 shares of its common stock as of January 4, 2008 to the 6 shareholders of ARC International Corp. The offer and sale was made without any public offering or solicitation, and was exempt under Section 4(2) of the Securities Act.

The Registrant issued 500,000 shares of its common stock on January 4, 2008 to holders of a $50,000 convertible promissory note, and issued 10,000 shares for services rendered to one individual. The offer and sale was made without any public offering or solicitation, and was exempt under Section 4(2) of the Securities Act.

Item 5.01 Changes in Control of Registrant

A change of control took place on January 4, 2008 as a result of the acquisition of ARC International Corp. described above. Control was assumed from Dempsey Mork. The names of the current directors and executive officers of the Registrant and holders of more than 5% of the outstanding shares of common stock, the number of shares held and the percentage of the total issued and outstanding Common Stock owned by each of them are included below in the discussion of the Company.

2. Applicable Form 10SB information pursuant to Item 5.01(8) is set forth ..

When used in this Form 8-K, the words "expects," "anticipates," "estimates" and similar expressions are intended to identify forward-looking statements. Such statements are subject to risks and uncertainties, including those set forth below under "Risks and Uncertainties," that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date hereof. ARC International Corp. expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company's expectations with regard thereto or any change in events, conditions or circumstances on which any statement is based. This discussion should be read together with the financial statements and other financial information included in this Form 8-K.

The shares are a speculative investment and risky. You should especially consider the following risk factors, in addition to the risk factor s that apply to enterprises in the e waste recycling industry.

We have significant capital requirements in connection with our business expansion.

The recycling business is capital intensive, requiring significant expenditures for transportation equipment and specialized recycling equipment. As ARC strives to recover more material from e-waste to meet its goal of 100% recovery, it will require significant purchases of this equipment, some of which will need to be custom designed or adapted from existing equipment. ARC is in need of approximately $2,500,000 in funding to carry out its business plan for the next 12 months for recycling equipment and facilities improvement. The ARC Offering will provide up to $3,480,000 of this funding, but since the ARC Offering is being conducted on a “straight best efforts” basis, we might need to seek capital from other offerings or from other sources such as debt financing. As a result of the significant operating expenses related to start up operations, operating results will be adversely affected if significant sales do not materialize, whether due to competition or otherwise. There can be no assurance that ARC will be able to obtain required funding, nor that it will be able to continue its growth in the future or maintain profitability. There can be no assurance that ARC will be able to implement its business plan in accordance with its internal forecasts or to a level that meets the expectations of investors. See: Management’s Discussion and Analysis.”

We plan to expand in part through acquisitions, which could be risky and cause delays in our offering.

We may acquire other companies in the e waste recycling business in those cities where we do not already have a physical presence. An acquisition could enable us to expand more rapidly, but the success of any acquisition will be heavily dependent upon due diligence investigation of the acquired company’s operations and history, including liabilities. ARC’s ability to acquire any business will be subject to the ability of ARC to obtain audited financial statements of the acquired company, unless such business is not deemed to be material (generally, a business whose sales are equal or exceed 10% of ARC’s revenues for the prior fiscal year would be considered “material.”) See “Business-Expansion Plan.”

.SUMMARY

Prior to the acquisition of ARC International Corp., the Registrant was a “shell” company. The following is intended to be a summary of the most important aspects of our business.

ARC International Corporation

ARC International Corporation (“ARC” or “ARC”) has been engaged in the business of e-waste recycling and

resource recovery since 1996, concentrated primarily in the Northeast, Midwest, Southwest and Western regions of the

United States, in addition to Northwest Mexico. ARC is currently expanding its Mexican operations. In addition, we are

seeking strategic acquisitions in, Canada, Vietnam, China, and Taiwan.

E-waste is a growing environmental problem. The US Environmental Protection Agency says that up to 1.9 million tons of e-waste is generated each year and only about 379,000 million tons are recycled; the unrecycled e-waste is sent to landfills. Of the amount that is recycled, a large portion of the waste is shipped to Asia for recycling or landfills. ARC is providing solutions to meet this problem. Our mission is “Zero Waste, Zero Landfill, and Zero Pollution.” In addition to expanding our processing capability, we are continuously striving to increase the materials that can be economically recovered from e-waste, such as gold, copper, silver, lead, glass, paper and plastics.

ARC recycles waste from manufacturers, businesses and consumers. California, along with 6 other states, pays a subsidy in connection with e-waste recycling. ARC also refurbishes and resells obsolete electronic inventory and serviceable electronics to the less developed world, including countries such as Cambodia, Thailand, Indonesia, Laos, Myanmar and Philippines.

ARC has grown primarily through internal expansion. We have 6 e-waste processing facilities nationwide, including

our California headquarters and are opening additional locations in 2008 including our Baja California, Mexico Norte

e waste processing facility. ARC has e-waste operations in California, Illinois, Georgia, Nevada, New Jersey, Texas and

Mexico. We operate primarily in larger metropolitan markets where ARC has access to major transportation infrastructure.

ARC currently owns and operates a total of 5 collection facilities, and 6 recycling facilities.

; ARC’s growth strategy is centered on e-waste collection and recycling expansion programs, in addition to

acquisitions, primarily within larger regional markets, as well as select Mexican and Chinese markets. We pursue a "hub

and spoke" expansion and acquisition strategy, involving acquiring or establishing collection facilities in our target markets

that can be serviced by our existing and planned recycling facilities. ARC targets both profitable and under-performing

collection and recycling businesses. We will also consider acquiring collection and recycling businesses in markets where

these businesses can complement our growth plans.

ARC believes it enhances the productivity of acquired businesses thro

ugh our expertise in regulatory and permitting

matters and through our internal recycling capabilities. We also seek to optimize the performance of acquired businesses

and the utilization of collection capacity by securing a captive e-waste stream and other recyclable products for each recycling

facility through an integrated network of collection locations; through long-term disposal contracts; through enhanced marketing

initiatives; through the public contract bidding process; and through other programs that reduce dependence on recyclable

product volumes from unaffiliated sources. At present, approximately 95% of the recyclable products received by our facilities

is derived from ARC's own collection facilities or is received under contracts of more than one year in duration. We seek to

improve operating efficienci

es and profitability through increased utilization of our collection and recycling facilities, rationalizing

operating and administrative costs.

ARC’s recycling operations currently recycles approximately 95% of the products which we collect. We have

established a mix of residential

, commercial, industrial and municipally-contracted service revenues.

Another element of ARC’s growth strategy is shown by our recent entry into the Mexican marketplace.

In November, 2007, an affiliate of ARC acq

uired a 100% interest in an approximately 50 acre site, strategically

fronting Highway 1. ARC has begun the initial construction of an approximately 50,000 sq. ft. state-of-the-art facility that

will include e-waste recycling, battery recycling, a smelting plant and a 60 ton scale facility that will be open to the public.

In addition, we have established a collection center in Tijuana. We will lease the facility from the affiliate upon its completion,

expected in April 2008.

ARC believes the Baja California Norte project provides the Company with a strategic entry into the Mexican

recycling market and provides a base for expanding our operations in Mexico. We intend to increase our operations in

Mexico pr

imarily through joint ventures with local entities or by acquiring existing waste collection and/or recycling businesses.

Our address is 333 Turnbull Canyon Road, City of Industry, California 91745, and our telephone number is

(626) 606-1051

Selected Operations Data

The following table shows our results of operations for the past 5 years. The selected operations data below has been derived from the audited financial statements for the years ended March 31, 2007 and 2006, and the unaudited nine months ended December 31, 2007.

Nine Months Ended

December 31, Years ended March 31,

2007 2007 2006

Revenue $ 24,025,333 $ 17,896,460 $ 15,310,569 $

Cost of Goods Sold 14,113,854 6,670,024 9,056,095

General and Administrative

Expenses 8,894,143 10,133,325 5,922,742

Operating Income 1,017,336 1,093,111 331,727

Interest Expense 386,169 244,046 83,691

Net Income after taxes 502,089 529,102 182,000

Net Income per share $ ..09 $ ..09 $ ..06

MANAGEMENT’S DISCUSSION AND ANALYSIS

Year Ended March 31, 2007 compared to Year Ended March 31, 2006

Revenues increased 17% from 2006 to 2007 and gross profit increased from 40.8% of revenues in 2006 to 62.7% of net revenues in 2007. The increase in sales was due to opening new locations and increased sales at existing locations. Increases in gross profit was attributable to increases in efficiency of our recycling processes. General and administrative expenses increased by 58% from 2006 to 2007. The increase in general and administrative expenses was primarily caused by increased amounts incurred for research and development expenses for increasing recycling efficiency, and increases in legal and accounting, employee expenses, rent, travel and utilities related to the expansion of ARC’s facilities. ARC believes that general and administrative expenses will increase in the future in line with its continuing business expansion, and with increases in revenues. In addition, in the fiscal year ended March 31, 2008 legal and accounting expenses will increase in connection with ARC’s status as a public company.

Interest expenses increased from $83,691 in fiscal 2006 to $244,046 due to increased borrowings to fund expansion. Net income of $529,192 in fiscal 2007 was 244% higher than 2006 net income of $182,000. Management believes that for fiscal 2008 net income will also continue to increase, although management cannot guarantee that the increase will be at the same rate.

Liquidity and Capital Resources

As of March 31, 2007, ARC had working capital of $941,336 and shareholders’ equity of $2,480,729. ARC has a revolving credit and line of credit agreement with a bank for $4,000,000, of which $2,744,504 was utilized as of March 31, 2007. Both lines were not renewal upon its termination on August 31, 2007. Two new accounts receivable lines were entered into with a different bank in October 2007. One line is for up to $4,800,000 for up to 85% of eligible accounts. The second line is for Exim-bank guaranteed receivables for 90% of eligible accounts receivable. ARC had one bank line of for equipment purchases for $1,000,000,all of which was utilized as of March 31, 2007, and another bank line for equipment of $744,000, of which $659,840 was utilized as of March 31, 2007. For the fiscal year ended March 31, 2008, ARC estimates it will require obtaining additional lines of credit, or increases in the existing lines, of approximately $9,000,000, in order to fund equipment purchases. In addition, ARC’s Baja California Mexico facility will require capital expenditures of approximately $2,500,000 commencing during fiscal 2008 and continuing until sometime in fiscal 2009. The loan agreements for these lines of credit contain financial covenants, including requirements for minimum working capital coverage which were in default as of March 31, 2007. ARC subsequently corrected the technical default. ARC believes it can obtain the required increases in credit facilities or in the alternative obtain capital through the sales of its equity securities. However, ARC has no agreement or arrangement for obtaining such equity infusions and there can be no assurance that the needed cash can be obtained. If such cash is not obtained ARC will not be able to continue to expand its operations.

Information included in this report includes forward looking statements, which can be identified by the use of forward-looking terminology such as may, expect, anticipate, believe, estimate, or continue, or the negative thereof or other variations thereon or comparable terminology. The statements in "Risk Factors" and other statements and disclaimers in this report constitute cautionary statements identifying important factors, including risks and uncertainties, relating to the forward-looking statements that could cause actual results to differ materially from those reflected in the forward-looking statements.

Any or all of our forward looking statements in this annual report and in any other public statements we make may turn out to be wrong. They can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties. Consequently, no forward looking statement can be guaranteed. In addition, we undertake no responsibility to update any forward-looking statement to reflect events or circumstances which occur after the date of this report.

Material factors which will affect ARC’s operating results in future periods include the following:

Continuation of California’s Electronic Recycling Waste Program and similar programs in other states

Constraints in California’s state budget which could be caused by an estimated budget deficit of $14 billion for 2008;

ARC’s ability to maintain and increase the efficiency of its recycling operations.

ARC’s success in implementing its expansion program, particularly its proposed processing center in Baja California, Mexico.

Competition in the e-waste industry from existing competitors or from recycling or waste management companies which may enter the industry.

ARC’s ability to continue to obtain debt financing for its expansion and to obtain equity financing as well

Other factors which are mentioned in this report or which may be mentioned in ARC’s future reports under the Securities Exchange Act of 1934.

BUSINESS

Background

ARC International Corporation (“ARC,” the “Company” or “us”) was incorporated in Nevada in December 1998 under the name “Northstar Ventures, Inc.” Northstar Ventures, Inc., a “blank check” or “shell” company, filed a Registration Statement on Form 10-SB in 2000 and thereby became required to file reports under the Securities Exchange Act of 1934. On January 4, 2008, Northstar, with 746,625 outstanding shares, acquired all the outstanding shares of ARC International Corp., a California corporation engaged in recycling e-waste (“ARC California”), by the issuance of 6,138,542 new shares of its common stock. ARC California was incorporated in California in 1996. Northstar subsequently changed its name to ARC International Corporation, and the sole officer and director of Northstar was replaced by designees of ARC California. As a result of the above transaction, ARC’s corporate structure consists of a Nevada holding company; a California subsidiary which is the operating company; and a new Mexican subsidiary, ARC de Mexico SA. For purposes of this report, references to ARC or the Company are to the consolidated entity unless the context requires otherwise.

General

ARC International Corporation (“ARC”) has been engaged in the business of e-waste recycling and resource recovery since 1996. We have 11 e-waste processing facilities nationwide including our California headquarters and are opening additional locations in 2008, including a state of the art waste processing facility in Baja California Norte, Mexico currently under construction.

E-waste is a growing environmental problem. The US Environmental Protection Agency says that up to 1.9 million tons of e-waste is generated each year and only about 379,000 million tons are recycled; the unrecycled e-waste is sent to landfills. Of the amount that is recycled, a large portion of the waste is shipped to Asia for recycling or landfills. ARC is providing solutions to meet this problem. Our mission is “Zero Waste, Zero Landfill, Zero Pollution.” In addition to expanding our processing capability, we are continuously striving to increase the materials that can be economically recovered from e-waste, such as gold, copper, silver, lead, glass, paper and plastics.

ARC recycles waste from manufacturers, businesses and consumers. California, along with 6 other states, pays a subsidy in connection with e-waste recycling. ARC also refurbishes and resells obsolete electronic inventory and serviceable electronics to the less developed world.

E-waste

About 304 million electronic devices, including cell phones, TVs, VCR, computers and monitors were removed from US households in 2005, according to the EPA. Businesses are also significant sources of e-waste. The components of e-waste include glass, wood, paper, plastics, ferrous and non ferrous metals such as gold, silver, copper, mercury, cadmium, lead, antimony, beryllium, and chromium. The heavy metals in e-waste are hazardous if leached from landfills. About $6 in material can be recovered from one computer. Improper recycling of e-waste as carried out in the developing world is highly polluting. For example, copper can be recovered from wiring by simply burning off the plastic insulation. Gold can be recovered by burning capacitors. These processed release dioxins and other toxins in the atmosphere. Most of the e-waste materials are not recycled or recovered by backyard methods. In response to the e-waste recycling problem in the developing world, the Basel Convention has been adopted to ban the export of e-waste to developing countries. The United States of America is not a party to the Basel Convention. China has banned the importation of e-waste, although enforcement of this law is not consistent.

In response to the e-waste problem, several manufacturers are reducing the use of lead and other heavy metals, and some offer free recycling programs. Local governments offer e-waste collection programs; however, the majority of e-waste is not recycled.

ARC’s E-waste processing markets

ARC’s e-waste recycling services three primary markets: original equipment manufacturers, large businesses and residential consumers. Original equipment manufacturers require assistance in the disposal of obsolete or returned inventory. An example of obsolete inventory would be dial up modems. Frequently this inventory is still serviceable and, with the permission of the manufacturer, ARC remarkets the new equipment to Asian markets through its Cambodian remarketing subsidiary. This subsidiary also refurbishes used equipment for resale.

Business customers are continually upgrading their information technology infrastructure and require the services of a reliable and service oriented e-waste recycler such as ARC. For our business customers, we provide procedures to document the receipt, disassembly, destruction and recycling of e-waste. We also document the erasure of data from storage media. Our documentation procedures provide assurances to business customers that e-waste has been disposed of properly, without the possibility of continuing legal liability on their part.

Consumer e-waste is provided principally by governmental collection programs. ARC promotes community e-waste recycling events in its areas of operation.

Recycling process

The recycling process is rationalized on the basis that sorted e-waste is more valuable than unsorted. The higher the level of sorting, the higher the value. After sorting and disassembly, we sort components mechanically and by hand, separate the various materials either by hand or my means of various material handling, crushing and sorting machines. We design or adapt commercial recycling equipment for our needs. After separation, material is sold to local and oversea manufactures or recyclers . E-waste recyclers in the United States can generally recycle and resell about 99% (by weight) with the remainder (consisting of cost) not being economically recyclable without substantial investment in plant and equipment. The recycler must pay a third party for the appropriate disposal of this residue.

Expansion Program

During calendar 2008 we intend to expand into 8 to 10 additional locations in the United States and open overseas facilities in the Pacific Rim as well. ARC has established an internal training program called “ARC University” to train facility personnel in our new locations in ARC’s methods and recycling philosophy.

Our Baja California Norte facility is being constructed on the outskirts of Ensenada, Mexico. This location was chosen due to its proximity to the United States and the port of Ensenada. The Baja California Norte processing facility will complete processing for the e waste collected throughout all our North American locations. ARC’s intent is to centralize the major portion of its recycling in this location, and to invest in the specialized equipment to recycle a higher percent of the e-waste. Our goal is 100% recycling. We plan to establish a smelter at this location to recycle glass from CRT monitors, to recover more metals from the e waste and process recyclable plastics, and market the recycled materials internationally. We hope to open this facility in April, 2008

We may acquire other companies in the e waste recycling business in those cities where we do not already have a physical presence. An acquisition could enable us to expand more rapidly, but the success of any acquisition will be heavily dependent upon due diligence investigation of the acquired company’s operations and history, including liabilities. ARC’s ability to acquire any business will be subject to the ability for ARC to obtain audited financial statements of the acquired company, unless such business is not deemed to be material (generally, a business whose sales are equal or exceed 10% of ARC’s revenues for the prior fiscal year would be considered “material.”.

ARC is seeking ways to use its recycling expertise in other facets of the recycling industry. In particular, we recently acquired a small auto recycler in Santa Ana California and one in Tijuana Baja California. Auto recycling is currently an insignificant percentage of our business. Following the operation of these pilot locations, we will evaluate whether entry into this market will be appropriate.

E-waste Subsidy; Governmental Regulation

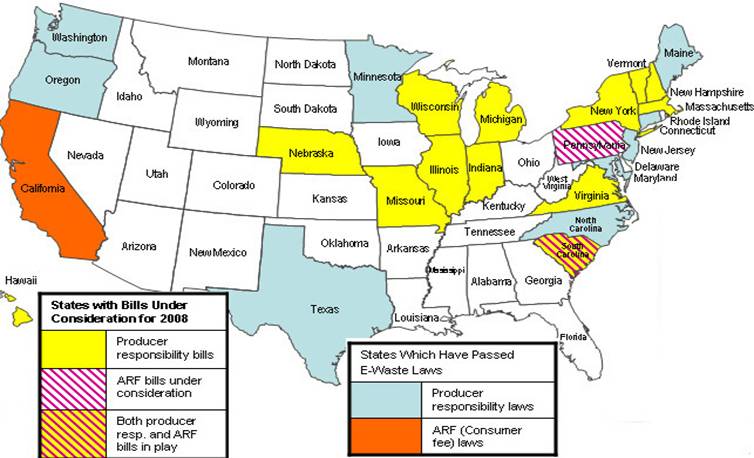

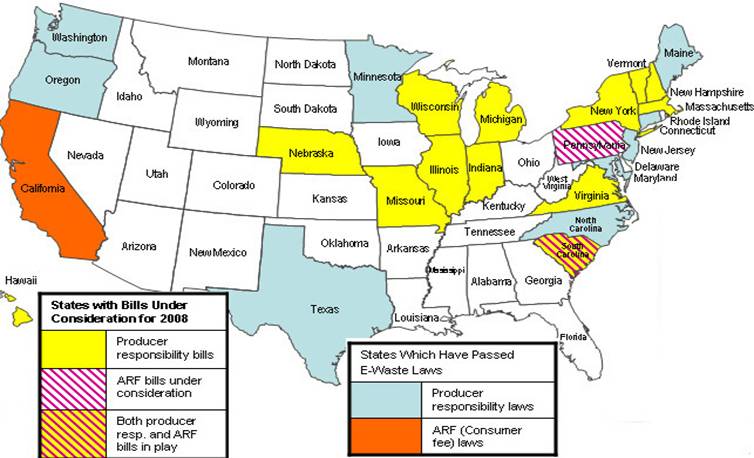

The California Waste Recycling Act of 2003 established a funding system for the collection and recycling of cathode ray tubes, liquid crystal display monitors, and other video display devices. Under this law, retailers collect a recycling fee at the time of initial sale of covered devices, and remit this fee to California. California pays eligible recyclers a fee for collecting and recycling these devices, and prohibits their export as e-waste unless the handling of the covered devices in the country of destination can be shown to comply with international standards ARC, as an authorized collector and recycler, receives a payment from the State of California for collection and recycling of these covered devices. We have collector and recycling licenses at both our City of Industry location in Los Angeles County and in our Hayward location in Northern California. Currently, the states of Maryland, Maine, Connecticut, North Carolina, Oregon, Washington and British Columbia Canada, have similar e-waste collection subsidy programs. The California subsidy program provides significant revenue to ARC.The State of California pays $0.48/lb for recycled monitors, Laptop computers and TVs.

ARC is required by each State or local government to maintain permits for the handling, recycling and disposal of e-waste and toxic materials. Regulations require the payment of licensing fees, compliance with handling and disposal regulations and inspections to verify compliance. ARC maintains a regulatory department to ensure compliance with these regulations. Zoning and other municipal requirements limit where recyclers can operate. Should ARC increase its ability to recover materials, it could be subject to additional environmental or other requirements.

Competition

We compete with a large number of e-waste recycling firms. For example, in California there are over 500 licensed e-waste collection and recycling facilities. According to information provided by the state of California, we are the second largest recycler by volume in the state. The largest participant in California’s e-waste program is Electronic Recyclers, and the third largest is SIMS Recycling Solutions. We do not yet enjoy these dominant positions in other states, and the e-waste business is not dominated nationally by any one competitor or group of competitors. We are aware of a large competitor, Amandi, Inc., which claims to have 300 employees at eight locations. Amandi opened California operations in 2007 and is not yet a significant competitor in California. Our goal is to become the largest e-waste recycler in the United States. In addition, there are numerous companies engaged in recycling and garbage collection in the United States, many of which have more financial resources than us and are better established. Should one of the larger waste disposal companies enter the e-waste market, they would compete with us.

Employees

We have 150 employees, almost all of which are full time. No employees are represented by labor unions.

Properties

ARC leases facilities for its operations in the following locations.We are seeking for additional facilities nationwide in selected cities at this time as well as internationally in the Pacific Rim.

Location Square footage

City of Industry-Turnbull Canyon 130,000

City of Industry-Lemon Avenue 40,000

Chicago IL 10,000

Atlanta GA 27,500

Las Vegas NV 13,500

Kearney NJ 12,000

El Paso Texas 32,000

Hayward CA 14,400

Arlington TX 87,120

Santa Ana CA 40,000

San Diego CA 10,500

An additional location near Ensenada, Baja California Norte is under construction on a 50 acre parcel of property. This property is owned by an affiliate of ARC and will be leased to ARC. The Turnbull Canyon property is also leased from an affiliate. See “Certain Transactions.”

Legal Proceedings

ARC International Corporation is not a party to any material pending legal proceeding.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 4, 2008, Dempsey Mork resigned as President, Chief Financial Officer and Director of the Registrant. Mr. Mork provided no written statement in connection with his resignation. However, his resignation and the election of the new officers and directors was a condition to closing of the Agreement and Plan of Reorganization described in Item 1.01.

The following are the officers and directors.

Jay Hooper, age 51, is Chief Executive Officer and Director of the Registrant. He founded ARC International Corp. in 1996 and has been its Chief Executive Officer and a director since inception. From 1985 to 1996 he was the founder and President of American Research Corp., an early stage supplier of Dell Computer. From 1980 to 1985 he was founder and President of Plus and Plus Corporation, in Taiwan. Plus and Plus was the first company to display Chinese fonts on a PC. From 1978 to 1980 Mr. Hooper was Sales Manager of Pulse Technology, Inc., in Tokyo, Japan. Mr. Hooper has a degree in Electrical Engineering from the Oriental Institute of Technology College in Taiwan, and studied business law at US

Rebecca Hooper, age 37, is a Director of the Registrant. She has worked part time in the accounting department of ARC International Corp. since its founding in 1996. She was employed as an engineer by Jiangxi801 from 1994 to 1996. Ms. Hooper received a Bachelor in Science from the Jiagxi University of Science and Technology in 1994. She is the spouse of Jay Hooper.

Frank Lin, age 63, is an independent director of the Registrant. For more than the past 5 years, he has been Director of Wan Hai Lines Ltd., Managing Director of AirSeaLand and eLogistic Company Limited, and Director of Rapido Logistic Service Ltd. Prior to that time he held various positions as follows: President, CEO and Director of Allied Ind. & Eng. Corporation (USA); President, CEO and Director of Allied Ind. & Eng. Enterprise Co. Ltd.; President of Apogee Development LLC; Secretary General and CEO of Central Cooperated Corporation; Executive Director of the Board of Directors of A & E Development; Managing Director of AirSeaLand Products Company Limited; Chairman of the Board of Speedy Grand Limited; member of the Advisor Board of Taiwan Shin Sheng Daily News Shipping News Center; CEO of Morinokaze International; CEO of Total Shipping . Mr. Lin was Chairman of the National Taipei University of Technology, Materials and Mineral Resources Engineering Education Foundation; Chairman of the Alumni Association of that university; a member of the Advisory Board of the Taiwan Nihon University Alumni Association; Professor and Vice Dean of the International Study Institute, Honorary Director Vice President and Advisor to the Board of the National Development Initiatives Institute; President of the National Taipei University of Technology Alumni Association of North America; President (1993) of the Joint Chinese University Alumni Association of Southern California; Visiting Professor & Graduate School Visiting Purser of Aomori Chou Gakuin University; and a member of the Board of Advisors of the Hot Springs Tourism Association of Taiwan and the Chinese Club of San Marino. Mr. Lin graduated from the Taiwan Provincial Taipei Institute of Technology in 1966 (Mining and Metallurgy); the National Cheng Chi University (Public and Management Center) in 1967; the Nihon University College of Industry Management, Department of Management in 1971; and the University of California Anderson School, Top Management EMBA in 1991.

Kara Yu, age 47, has been Chief Financial Officer of ARC International Corp. since July, 2004. From July 1999 to May 2003 she was Controller of KYE International Corp., and she was Controller/Accounting Manager of CAF Technology Corp. from August 1989 to May 1999. Ms. Yu received a BA from the University of Washington-Seattle.

Audit Committee

We do not at this time have an audit committee or a financial statements expert on the Board of Directors due to the limited size of the Company.

Executive Compensation

The following table sets forth the cash and all other compensation of ARC International Corporation's executive officers and directors during each of the last three fiscal years. The remuneration described in the table does not include the cost to ARC International Corporation of any benefits which may be furnished to the named executive officers, including premiums for health insurance and other benefits provided to such individual that are extended in connection with the conduct of ARC International Corporation's business, which total less than $10,000 for each individual per year.

Name and Principal Position Year Salary

Jay Hooper, President 2007 $ 120,000

2006 96,000

2005 96,000

Kara Yu, Chief Financial Officer 2007 $ 72,000

2006 72,000

2005 60,000

ARC has never granted any stock options or other equity awards. Directors receive no compensation for acting as directors.

ARC International Corporation, by resolution of its Board of Directors and stockholders, adopted a 2007 Stock Option Plan (the "Plan") in December, 2007. The Plan enables ARC to offer an incentive based compensation system to employees, officers and directors and to employees of companies who do business with ARC.

In the discretion of a committee comprised of non-employee directors (the "Committee"), directors, officers, and key employees or employees of companies with which we do business become participants in the Plan upon receiving grants in the form of stock options or restricted stock. A total of 2,000,000 shares are authorized for issuance under the Plan, of which no shares are issued. ARC may increase the number of shares authorized for issuance under the Plan or may make other material modifications to the Plan without shareholder approval. However, no amendment may change the existing rights of any option holder.

Any shares which are subject to an award but are not used because the terms and conditions of the award are not met, or any shares which are used by participants to pay all or part of the purchase price of any option may again be used for awards under the Plan. However, shares with respect to which a stock appreciation right has been exercised may not again be made subject to an award.

Stock options may be granted as non-qualified stock options or incentive stock options, but incentive stock options may not be granted at a price less than 100% of the fair market value of the stock as of the date of grant (110% as to any 10% shareholder at the time of grant); non-qualified stock options may not be granted at a price less than 85% of fair market value of the stock as of the date of grant. Restricted stock may not be granted under the Plan in connection with incentive stock options.

Stock options may be exercised during a period of time fixed by the Committee except that no stock option may be exercised more than ten years after the date of grant or three years after death or disability, whichever is later. In the discretion of the Committee, payment of the purchase price for the shares of stock acquired through the exercise of a stock option may be made in cash, shares of Common Stock or by delivery or recourse promissory notes or a combination of notes, cash and shares of ARC's common stock or a combination thereof. Incentive stock options may only be issued to directors, officers and employees.

PRINCIPAL SHAREHOLDERS

The following table sets forth information relating to the beneficial ownership of Company common stock as of the date of this report by (i) each person known by ARC International Corporation to be the beneficial owner of more than 5% of the outstanding shares of common stock (ii) each of ARC International Corporation's directors and executive officers, and (iii) the Percentage After Offering assumes the sale of all shares offered. Unless otherwise noted below, ARC International Corporation believes that all persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned by them. For purposes hereof, a person is deemed to be the beneficial owner of securities that can be acquired by such person within 60 days from the date hereof upon the exercise of warrants or options or the conversion of convertible securities. Each beneficial owner's percentage ownership is determined by assuming that any warrants, options or convertible securities that are held by such person (but not those held by any other person) and which are exercisable within 60 days from the date hereof, have been exercised. The address of each unless noted is 333 Turnbull Canyon Road, City of Industry, California 91745.

Number of

Common Shares Percentage

Name Office Owned(1) Owned

Jay Hooper President and Director 3,867,896(2) 62.9%

Rebecca Hooper Director 3,867.896(3) 62.9%

Frank Lin Director - -- - --

Kara Yu Chief Financial Officer 122,771 2.0%

ARC International Group Inc.(3) 1,263,480 20.50%

All officers and directors

as a group (4 persons) 4,113,438 64.9%

(1) Except as otherwise noted, shares are owned beneficially and of record, and such record shareholder has sole voting, investment, and dispositive power.

(2) Includes 540,192 shares held of record by the Jay Hooper Family Trust, and 184,157 shares owned by Rebecca Hooper, Mr. Hooper’s spouse. The current trustee of the Jay Hooper Family Trust is Jay Hooper. Mr. and Mrs. Hooper disclaim beneficial ownership of the shares held by the other.

(3) Includes 184,157 shares owned directly by Rebecca Hooper and 3,683,739 shares beneficially owned by her spouse, Jay Hooper.

(4) ARC International Group, Inc. is owned and controlled by Cheng Wei Zhang.

CERTAIN TRANSACTIONS

The President of ARC, who is also the majority shareholder, has personally guaranteed ARC’s revolving line of credit in the amount of $4,000,000 and equipment purchasing lines totaling $1,744,000.

ARC’s Turnbull Canyon facilities were leased from a non-affiliated party in December, 2006 for a lease expiring in December, 2009. The lease agreement provided ARC with an option to purchase the property until October 2007 for $12,309,888. ARC transferred this option to purchase to an entity controlled by the President at no cost. ARC now leases this facility from its President at a price of $0.54 per square foot, triple net, which is $0.67 in total. The lease from the affiliate of the President expires on Dec. 31, 2103. ARC believes that the purchase of the Turnbull facility by its President was in the best interests of ARC as it enables ARC to utilize its cash and borrowing resources on its core business. The lease rate was based on rates for comparable industrial properties in the area. The Board of Directors believes the lease rate is at fair market value.

The Baja California property is owned by an affiliate of Mr. Hooper. The lease rate has not yet been determined. The lease will commence on build completion, estimated for April, 2008.

On January 4, 2008, the six shareholders of ARC International Corp., a California corporation, received 5,401,917 shares of ARC common stock in exchange for their shares of the California corporation.

DESCRIPTION OF SECURITIES

Common Stock

ARC International Corporation's Articles of Incorporation authorizes the issuance of 100,000,000 shares of common stock, $.001 par value per share, of which 6,138,542 shares were outstanding as of December 31, 2007. Holders of shares of common stock are entitled to one vote for each share on all matters to be voted on by the stockholders. Holders of common stock have no cumulative voting rights. Holders of shares of common stock are entitled to share ratably in dividends, if any, as may be declared, from time to time by the Board of Directors in its discretion, from funds legally available therefore. In the event of a liquidation, dissolution or winding up of ARC, the holders of shares of common stock are entitled to share pro rata all assets remaining after payment in full of all liabilities. Holders of common stock have no preemptive rights to purchase ARC's common stock. There are no conversion rights or redemption or sinking fund provisions with respect to the common stock.

Meetings of stockholders may be called by the board of directors, the chairman of the board, the president, or by one or more holders entitled to cast in the aggregate not less than 20% of the votes at the meeting. Holders of a majority of the shares outstanding and entitled to vote at the meeting must be present, in person or by proxy, for a quorum to be present to enable the conduct of business at the meeting.

ARC intends to furnish holders of its common stock annual reports containing audited financial statements and to make public quarterly reports containing unaudited financial information.

Transfer Agent

The transfer agent for the common stock is Corporate Stock Transfer, 3200 Cherry Creek Road South, Denver, Colorado 80902, and its telephone number is (303) 282-4800. Their website is www.corporatestock.com.

Item 5.02 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On March 14, 2008, the Registrant amended its Articles of Incorporation to change its name to ARC International Corporation and also amended the Articles to update the language in the Articles of Incorporation to indemnify the officers and directors to the fullest extent permitted under Nevada law. The amendment also served to effect a 1-for-two reverse stock split,

The Registrant will change its fiscal year to March 31 to match the fiscal year of its recently acquired subsidiary, ARC International Corp. The Registrant has not yet determined the transition reports which will be filed.

Item 9.01. Financial Statements and Exhibits

(a) Financial Statements.

The audited financial statements of ARC International Corp. for the two years ended March 31, 2007 and the unaudited financial statements as of December 31, 2007 are filed by this amendment.

(b) Exhibits

2.2 Agreement and Plan of Reorganization between the Registrant and ARC International Corp.. Filed with original report.

3.1 Amended and Restated Articles of Incorporation, as filed on March 14, 2008. Filed herewith.

21. ARC International Corp., a California corporation, is a wholly owned subsidiary of the Registrant.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Dated: June 25, 2008 ARC INTERNATIONAL CORPORATION

By: /s/ Jay Hooper

Jay Hooper

President