PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION

PROSPECTUS

ARC INTERNATIONAL CORPORATION

2,000,000 Shares of Common Stock Offered by ARC

759,125 Shares of Common Stock Offered by Selling Shareholders

ARC International Corporation, a Nevada corporation (“ARC”) is offering 2,000,000 shares of common stock and the selling stockholders are offering 759,125 shares. ARC will not receive any proceeds from the sale of shares by the selling stockholders. Certain of the selling stockholders which were affiliates of ARC may be deemed to be underwriters.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed on the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.Purchase of these securities involves risks. See "Risk Factors" on page 5.

OFFERING BY ARC INTERNATIONAL CORPORATION

Initial Offering Price Sales Commissions Total Proceeds

&nb sp; to Company

Per share $4.00 $.40(1) $ 3.60

Total $8,000,000(2) $ 800,000(1) $ 7,200,000

&nb sp;

(1) Does not reflect costs of the offering, estimated at $290,000, including additional compensation to be received by the Underwriter in the form of (i) a non accountable expense allowance of $240,000 ($.12 per Share; and (ii) a five year option to purchase up to 200,000 Shares at a price per Share equal to 120% of the per Share public offering price, exercisable over a period of four years commencing one year from the date of this Prospectus (the "Underwriter’s Warrant”). In the event Shares are sold by the officers and directors of ARC, no sales commissions will be paid nor Underwriter’s Warrant will be issuable with respect to such Shares. In addition, ARC has agreed to indemnify the Underwriter against certain civil liabilities, including liabilities under the Securities Act of 1933. See "Underwriting

(2) The Underwriter is offering the Shares on behalf of ARC on a straight “best efforts,” no minimum offering.

OFFERING BY SELLING STOCKHOLDERS

Initial Offering Price(1) Sales Commissions Total to Selling Stockholders

&nb sp;

Per share $4.00 (2) $4.00

Total $3,036,500 (2) $3,036,500

&nb sp;

(1) The shares will be offered at the Initial Offering Price until such time, if any, that the common stock is trading or listed on a public market, at which time the common stock will be offered at market prices. The Initial Offering Price of $4.00 was determined by negotiations between ARC and the selling stockholders.

(2) ARC will not receive any proceeds from the Selling Stockholder Offering, and the Selling Stockholders are not required to reimburse ARC for any proportionate share of the offering expenses. No person has agreed to underwrite or take down any of the securities. For sales on any trading market, sales commissions will be limited to those paid in similar market transactions. Since the Underwriter does not make a market in any securities, the Underwriter will not receive any sales commissions from the sale of Shares by the Selling Stockholders. For private sale transactions, no sales commission can be paid. There is no minimum amount of securities which may be sold in the Selling Stockholder Offering.

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor there be any sale of these securities in any State in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such State. [JK LOGO HERE]

The date of this prospectus is September __, 2008.

PROSPECTUS SUMMARY

The following is intended to be a summary of the most important aspects of our business.

ARC International Corporation

ARC International Corporation (“ARC” or “ARC”) has been engaged in the business of e-waste recycling and resource recovery since 1996, concentrated primarily in the Northeast, Midwest, Southwest and Western regions of the United States, in addition to Northwest Mexico. ARC is currently expanding its Mexican operations. In addition, we are seeking strategic acquisitions in, Canada, Vietnam, China, and Taiwan.

E-waste is a growing environmental problem. The US Environmental Protection Agency says that up to 1.9 million tons of e-waste is generated each year and only about 379,000 tons are recycled; the unrecycled e-waste is sent to landfills. Of the amount that is recycled, a large portion of the waste is shipped to Asia for recycling or landfills. ARC is providing solutions to meet this problem. Our mission is “Zero Waste, Zero Landfill, and Zero Pollution.” In addition to expanding our processing capability, we are continuously striving to increase the materials that can be economically recovered from e-waste, such as gold, copper, silver, lead, glass, paper and plastics.

ARC recycles waste from manufacturers, businesses and consumers. California, along with 6 other states, pays a subsidy in connection with e-waste recycling. ARC also refurbishes and resells obsolete electronic inventory and serviceable electronics to the less developed world, including countries such as Cambodia, Thailand, Indonesia, Laos, Myanmar and Philippines.

ARC has grown primarily through internal expansion. We have 6 e-waste processing facilities nationwide,

including our California headquarters and are opening additional locations in 2008 including our Baja California, Mexico

Norte e waste process

ing facility. ARC has e-waste operations in California, Illinois, Georgia, Nevada, New Jersey, Texas

and Mexico. We operate primarily in larger metropolitan markets where ARC has access to major transportation infrastructure.

ARC currently owns and operates a total of 4 collection facilities, and 6 recycling facilities.

&

nbsp; ARC’s growth strategy is centered on e-waste collection and recycling expansion programs, in addition to

acquisitions, primarily within larger regional markets, as well as select Mexican and Chinese markets. We pursue a "hub and spoke"

expansion and acquisition strategy, involving acquiring or establishing collection facilities in our target markets that can be

serviced by our existing and planned recycling facilities. ARC targets both profitable and under-performing collection and recycling businesses. We will also consider acquiring collection and recycling businesses in markets where these

businesses can complement our growth plans.

ARC believes it enhances the productivity of acquired businesses through our expertise in regulatory and

permitting matters and through our internal recycling capabilities. We also seek to optimize the performance of acquired

businesses and the utilization of collection capacity by securing a captive e-waste stream and other recyclable products

for each recycling facility through an integrated network of collection locations; through long-term disposal contracts;

through enhanced marketing initiatives; through the

public contract bidding process; and through other programs that

reduce dependence on recyclable product volumes from unaffiliated sources. At present, approximately 95% of the

recyclable products received by our facilities is derived from ARC's own collection facilities or is received under

contracts of more than one year in duration. We seek to improve operating efficiencies and profitability through

increased utilization of our collection and recycling facilities, rationalizing operating and administrative costs.

ARC’s recycling operations currently recycles approximately 95% of the products which we collect. We

have established a mix of residential, commercial, industrial and municipally-contracted service revenues.

&nbs

p;

Another element of ARC’s growth strategy is shown by our recent entry into the Mexican marketplace.

In November, 2007, an affiliate of ARC acquired a 100% interest in an approximately 50 acre site, strategically fronting

Highway 1. ARC has begun the initial construction of an approximately 50,000 sq. ft. state-of-the-art facility that will

2

include e-waste recycling, battery recycling, a smelting plant and a 60 ton scale facility that will be open to the public.

In addition, we have established a collection center in Tijuana. We will lease the facility from the affiliate upon its

completion, expected later in 2008.

ARC believes the Baja California Norte project provides the Company with a strategic entry into the Mexican

recycling market and provides a base for expanding our operations in Mexico. We intend to increase our operations in

Mexico primarily through joint ventures with local entities or by acquiring existing waste collection and/or recycling businesses.

Our address is 333 Turnbull Canyon Road, City of Industry, California 91745, and

our telephone number is (626) 606-1051

Selected Operations Data

The selected operations data below has been derived from the audited financial

statements for the years ended March 31, 2008, 2007 and 2006 and the unaudited

three months ended June 30, 2008.

Three Months Ended

June

30,

Years ended March

31,

2008

2008

2007

2006

Revenue

$

7,239,794

$34,087,042 $ 17,896,460

$ 15,310,569

Cost of Goods

Sold

4,098,463

20,332,218

6,670,024

9,056,095

General and Administrative

Expenses

2,989,461

11,980,963

10,133,325

5,922,742

Operating

Income

242,870

1,783,861

1,093,111

331,727

Interest

Expense

128,763

507,345

244,046

83,691

Net Income after

taxes

145,722

461,636

529,102

182,000

Net Income per

share

$

..02

$

...08

$

..09

$

..06

The Offering

The offering includes shares offered by ARC and shares offered by the selling

stockholders, who are offering all of the shares owned by them. ARC’s

offering is being underwritten on a “straight best efforts, no minimum”

non-exclusive basis by Jackson, Kohle & Co. (the “Underwriter”). In the

event officers of ARC obtain purchasers for the ARC Offering, no sales

commissions or Underwriter’s Warrants will be earned by the Underwriter. The

Underwriter has not been engaged with respect to the Selling Stockholder

Offering.

Securities Offered:................................................... 2,000,000

shares by ARC

.....................................................................................

759,125 shares by selling stockholders.

Initial Offering Price................................................ $4.00 per

share.

Use of Proceeds....................................................... ARC will

use the proceeds of the ARC Offering ($6,910,540 if the maximum offering is

sold) for acquisitions in the e-waste industry, purchase of equipment, leasehold

improvements and working capital. ARC has not identified any

acquisition. Any acquisition which is material will be required to be

disclosed by post effective amendment to the registration statement of which

this prospectus is a part.

Offering Period:........................................................ Until

[12 months from effective date]

Risk

Factors.............................................................. The

securities offered hereby involve a high degree of risk and immediate

substantial dilution and should not be purchased by investors who cannot afford

the loss of their entire investment.

3

Common Stock Outstanding (1) Before

Offering:................ 6,151,042(1) shares

Common Stock Outstanding After

Offering:...................... 8,151,042(1) shares

Proposed _______________

Symbol................................ ___

(1)

Based on shares outstanding as of July 31, 2008 and gives effect to a 1-for 2

reverse stock split. Does not include up to 2,000,000 shares issuable

under the 2007 Stock Option Plan, nor the issuance of up to 200,000 shares

underlying the Underwriter’s Warrants. No options have been granted under

the 2007 Stock Option Plan.

4

Risk Factors

Before you buy the securities offered hereby consider the following risk factors

and the rest of this prospectus.

RISK FACTORS

The shares are a speculative investment and risky. You should especially

consider the following risk factors, in addition to the risk factor s that apply

to enterprises in the e waste recycling industry.

We have significant capital requirements in connection

with our business expansion.

The recycling business is capital intensive, requiring significant

expenditures for transportation equipment and specialized recycling equipment.

As ARC strives to recover more material from e-waste to meet its goal of 100%

recovery, it will require significant purchases of this equipment, some of which

will need to be custom designed or adapted from existing equipment. ARC is

in need of approximately $2,500,000 in funding to carry out its business plan

for the next 12 months for recycling equipment and facilities improvement. The

ARC Offering will provide up to $6,910,000, but since the ARC Offering is being

conducted on a “straight best efforts” basis, we might need to seek capital from

other offerings or from other sources such as debt financing. As a result of the

significant operating expenses related to start up operations, operating results

will be adversely affected if significant sales do not materialize, whether due

to competition or otherwise. There can be no assurance that ARC will be

able to obtain required funding, nor that it will be able to continue its

growth in the future or maintain profitability. There can be no assurance

that ARC will be able to implement its business plan in accordance with its

internal forecasts or to a level that meets the expectations of investors. See:

Management’s Discussion and Analysis.”

We plan to expand in part through acquisitions, which

could be risky and cause delays in our offering.

We may acquire other companies in the e waste recycling business in those cities

where we do not already have a physical presence. An acquisition could enable us

to expand more rapidly, but the success of any acquisition will be heavily

dependent upon due diligence investigation of the acquired company’s operations

and history, including liabilities. ARC’s ability to acquire any business will

be subject to the ability of ARC to obtain audited financial statements of

the acquired company, unless such business is not deemed to be material

(generally, a business whose sales are equal or exceed 10% of ARC’s revenues for

the prior fiscal year would be considered “material.”) In the event ARC

acquires any material business during the offering period it would be required

to suspend the offering until such time as this prospectus is amended to update

the information in this prospectus, including the required audited financial

information of the acquired business. See “Business-Expansion Plan.”

ADDITIONAL

INFORMATION

ARC International Corporation has filed a registration statement under the

Securities Act with respect to the securities offered hereby with the

Commission, 100 F Street, N.E., Washington, D.C. 20549. This prospectus,

which is a part of the registration statement, does not contain all of the

information contained in the registration statement and the exhibits and

schedules thereto, certain items of which are omitted in accordance with the

rules and regulations of the Commission. For further information with

respect to New Millennium Products and the securities offered, reference is made

to the registration statement, including all exhibits and schedules thereto,

which may be inspected and copied at the public reference facilities maintained

by the Commission at 100 F Street, N.E., Washington, D.C. 20549, at prescribed

rates during regular business hours. You can call the Commission at (202)

551-8090 for further assistance or information.

ARC is required to file reports and other information with the Commission.

All of such reports and other information may be inspected and copied at the

Commission's public reference facilities described above. The public may obtain

information on the operation of the public reference room in Washington, D.C. by

calling the Commission at 1-800-SEC-0330. The Commission maintains a web site

that contains reports, proxy and information statements and other information

regarding issuers that file electronically with the Commission. The

address of such site is http://www.sec.gov. In addition, ARC International

Corporation intends to make available to its shareholders annual reports,

including audited financial statements and such other reports as ARC

International Corporation may determine.

5

DILUTION

The difference between the initial public offering price per share of common

stock and the pro forma net tangible book value per share of Common Stock after

this offering constitutes the dilution to investors in this offering. Net

tangible book value per share is determined by dividing the net tangible book

value of ARC (tangible assets less total liabilities) by the number of

outstanding shares of Common Stock.

At June 30, 2008, the common stock had a net tangible book value of

$3,158,901 or $ 0.51 per share. After giving effect to the receipt

of the net proceeds from the sale of Shares offered hereby at an initial public

offering price of $4.00 per share, the pro forma net tangible book value of ARC

at June 30, 2008 would have been $10,068,901 or $1.23 per share, representing an

immediate increase in net tangible book value of $.72 per share to the present

stockholders, and immediate dilution of $2.77 per share to public

investors. The following table illustrates dilution to public investors on

a per share basis:

Public offering price per

share..........................................................................................................

$4.00

Net tangible book value per share before

offering................................................................

$0.51

Increase per share attributable to public

investors.....................................................................................................

$0.72 Pro forma net tangible book value per share after

offering.........................................................................................................

$1.23 Dilution per share to public

investors..........................................................................................................................................

$2.77

The following table sets forth with respect to the present stockholders and

public investors, a comparison of the number of shares of Common Stock owned by

the present stockholders, the number of shares of Common Stock to be purchased

from ARC by the purchasers of the Shares offered hereby and the respective

aggregate consideration paid to ARC and the average price per share.

Percent

Percent

Average

Shares

of

Total

Total

of

Total

Price

Stockholders

Purchased

Shares

Consideration

Consideration

Per Share

Present

Stockholders

6,151,042(1)

75.5%

$1,600,000

(2)

16.7%

$.26

Public

Investors

2,000,000

24.5%

8,000,000

__83.3%

$4.00

Total

8,151,042

100.0%

$9,600,000

100.0%

$1.18

DIVIDEND POLICY

ARC has not paid any dividends on its common stock. ARC currently intends

to retain any earnings for use in its business, and therefore does not

anticipate paying cash dividends in the foreseeable future.

6

MARKET PRICE OF COMMON

STOCK

Our common stock has never traded. As of July 31, 2008, there were 41

record holders of common stock.

There are no warrants or options outstanding and no registration rights have

been granted. At the present time 6,151,042 shares are outstanding,

including 759,125 shares which have been registered for resale via this

prospectus. These 759,125 shares are not currently eligible for resale

under Rule 144 until June 27, 2009. In addition, ARC has reserved for

issuance 2,000,000 shares of common stock to members of the Board of Directors,

employees, consultant and others under the 2007 Stock Option Plan, and ARC may

issue up to 200,000 shares upon exercise of Underwriter’s Warrants.

USE OF PROCEEDS

The net proceeds to the Company from the Offering are estimated to be

$6,910,000, after deducting the underwriting discount and estimated Offering

expenses. The Company will use the net proceeds in the following order of

priority. First ARC intends to complete the financing the development and

capital expenditures associated with the Baja California Norte e-waste

processing facility, estimated to be $2.5 million; then ARC may also use a

portion of the net proceeds, estimated at $500,000, for acquisition of other

companies in the e-waste business. No acquisition has been identified as

of the date of this prospectus. Additional amounts obtained from the offering

will be used to add plant and equipment for metal refining from the e-waste

stream (up to $2.5 million) and the remainder will be used for working capital

purposes.

7

MANAGEMENT’S DISCUSSION AND

ANALYSIS

Results of Operations

Three months ended June 30, 2008 compared to three

months ended June 30, 2007

Revenues in the 2008 period were only slightly higher than in the three months

ended June 30, 2007. We reduced operating expenses in the three months ended

June 30, 2008 as compared to the 2007 quarter by about 4%. While we had

significant increases in rent, supplies, depreciation and equipment rental, and

in marketing costs, we reduced our payroll, legal and travel costs as compared

to 2007.

Year Ended March 31, 2008 compared to Year Ended March

31, 2007

Revenues increased 90% from 2007 to 2008 and gross

profit decreased from 62.7% of revenues in 2007 to 40.3% of net revenues in

2007. The increase in sales was due to opening new locations and increased sales

at existing locations. The decrease in gross profit was attributable to the

higher percentage of sales under the California Electronic Waste Recycling

Program in 2007. General and administrative expenses increased by 18% from

2007 to 2008. The increase in general and administrative expenses was primarily

caused by increased amounts incurred for depreciation , insurance, leasing

expenses, legal and professional fees, rental expenses, offset in part by a

decrease in labor costs. ARC believes that general and administrative

expenses will increase in the future in line with its continuing business

expansion, and with increases in revenues.

Interest expenses increased from $244,046 in fiscal 2007 to $507,345 due

to increased borrowings to fund expansion. Net income of $461,636 in 2008 was

less than the $529,192. Management believes that for fiscal 2009 revenues will

continue to increase and we will be able to maintain profitability.

Liquidity and Capital Resources

As of June 30, 2008 and March 31, 2008, respectively, ARC had working capital of

$713,483 and $499,599 and shareholders’ equity of $3,158,901 and

$2,942,363. ARC had a revolving credit and line of credit agreement with a bank

s for up to $4,800,000 for up to 85% of eligible accounts. The second line

was for Exim-bank guaranteed receivables for 90% of eligible accounts

receivable. ARC had one bank line of for equipment purchases for

$1,000,000, all of which was utilized as of March 31, 2007, and another bank

line for equipment of $744,000, all of which was utilized as of March 31,

2007. All of these lines terminated on August 1, 2008. A new agreement a

revolving credit line of $5,000,000 is in the negotiation process. The proposed

terms of the agreement are for the loaning of up to 85% of domestic accounts

receivable assuming dilution is not more than 5%. An additional revolving

credit line of $5,000,000 is also in the negotiation process. The proposed

terms of the agreement are for the loaning of up to 90% of foreign accounts

receivable assuming dilution is not more than 5%. For the fiscal year

ended March 31, 2009, ARC estimates it will require obtaining additional lines

of credit, or increases in the existing lines, of approximately $9,000,000, in

order to fund equipment purchases. In addition, ARC’s Baja California Mexico

facility will require capital expenditures of approximately $2,500,000

commencing during fiscal 2008 and continuing until some time in fiscal 2009.

ARC believes it can obtain the required increases in credit facilities or

in the alternative obtain capital through the sales of its equity securities.

However, ARC has no agreement or arrangement for obtaining such equity infusions

and there can be no assurance that the needed cash can be obtained. If such cash

is not obtained ARC will not be able to continue to expand its operations.

Information included in this prospectus includes forward looking statements,

which can be identified by the use of forward-looking terminology such as may,

expect, anticipate, believe, estimate, or continue, or the negative thereof or

other variations thereon or comparable terminology. The statements in "Risk

Factors" and other statements and disclaimers in this prospectus constitute

cautionary statements identifying important factors, including risks and

uncertainties, relating to the forward-looking statements that could cause

actual results to differ materially from those reflected in the forward-looking

statements.

8

Any or all of our forward looking statements in this annual report and in any

other public statements we make may turn out to be wrong. They can be affected

by inaccurate assumptions we might make or by known or unknown risks and

uncertainties. Consequently, no forward looking statement can be guaranteed. In

addition, we undertake no responsibility to update any forward-looking statement

to reflect events or circumstances which occur after the date of this

prospectus.

Material factors which will affect ARC’s operating results in future periods

include the following:

Continuation of California’s Electronic Recycling Waste Program and similar

programs in other states

Constraints in California’s state budget which could be caused by an estimated

budget deficit of $14 billion for 2008;

ARC’s ability to maintain and increase the efficiency of its recycling

operations.

ARC’s success in implementing its expansion program, particularly its proposed

processing center in Baja California, Mexico.

Competition in the e-waste industry from existing competitors or from recycling

or waste management companies which may enter the industry.

ARC’s ability to continue to obtain debt financing for its expansion and to

obtain equity financing as well

Other factors which are mentioned in this Prospectus or which may be mentioned

in ARC’s future reports under the Securities Exchange Act of 1934.

BUSINESS

Background

ARC

International Corporation (“ARC,” the “Company” or “us”) was incorporated in

Nevada in December 1998 under the name “Northstar Ventures, Inc.”

Northstar Ventures, Inc., a “blank check” or “shell” company, filed

a Registration Statement on Form 10-SB in 2000 and thereby became required to

file reports under the Securities Exchange Act of 1934. On January 4,

2008, Northstar, with 746,625 outstanding shares, acquired all the outstanding

shares of ARC International Corp., a California corporation engaged in recycling

e-waste (“ARC California”), by the issuance of 6,138,542 new shares of its

common stock. ARC California was incorporated in California in 1996.

Northstar subsequently changed its name to ARC International Corporation, and

the sole officer and director of Northstar was replaced by designees of ARC

California. As a result of the above transaction, ARC’s corporate structure

consists of a Nevada holding company; a California subsidiary which is the

operating company; and a new Mexican subsidiary, ARC de Mexico SA. For

purposes of this Prospectus, references to ARC or the Company are to the

consolidated entity unless the context requires otherwise.

General

ARC International Corporation (“ARC”) has been engaged in the business of

e-waste recycling and resource recovery since 1996. We have 11 e-waste

processing facilities nationwide including our California headquarters and are

opening additional locations in 2008, including a state of the art waste

processing facility in Baja California Norte, Mexico currently under

construction.

E-waste is a growing environmental problem. The US Environmental Protection

Agency says that up to 1.9 million tons of e-waste is generated each year and

only about 379,000 tons are recycled; the unrecycled e-waste is sent to

landfills. Of the amount that is recycled, a large portion of the waste is

shipped to Asia for recycling or landfills. ARC is providing solutions to

meet this problem. Our mission is “Zero Waste, Zero Landfill, Zero Pollution.”

In addition to expanding our processing capability, we are continuously striving

to increase the materials that can be economically recovered from e-waste, such

as gold, copper, silver, lead, glass, paper and plastics.

9

ARC recycles waste from manufacturers, businesses and consumers. California,

along with 6 other states, pays a subsidy in connection with e-waste recycling.

ARC also refurbishes and resells obsolete electronic inventory and serviceable

electronics to the less developed world.

E-waste

About 304

million electronic devices, including cell phones, TVs, VCR, computers and

monitors were removed from US households in 2005, according to the EPA.

Businesses are also significant sources of e-waste. The components of

e-waste include glass, wood, paper, plastics, ferrous and non ferrous metals

such as gold, silver, copper, mercury, cadmium, lead, antimony, beryllium, and

chromium. The heavy metals in e-waste are hazardous if leached from

landfills. About $6 in material can be recovered from one computer. Improper

recycling of e-waste as carried out in the developing world is highly polluting.

For example, copper can be recovered from wiring by simply burning off the

plastic insulation. Gold can be recovered by burning capacitors. These processed

release dioxins and other toxins in the atmosphere. Most of the e-waste

materials are not recycled or recovered by backyard methods. In response

to the e-waste recycling problem in the developing world, the Basel Convention

has been adopted to ban the export of e-waste to developing countries. The

United States of America is not a party to the Basel Convention. China has

banned the importation of e-waste, although enforcement of this law is not

consistent.

In response to the e-waste problem, several manufacturers are reducing the use

of lead and other heavy metals, and some offer free recycling programs.

Local governments offer e-waste collection programs; however, the majority of

e-waste is not recycled.

ARC’s E-waste processing

markets

ARC’s e-waste recycling services three primary markets: original equipment

manufacturers, large businesses and residential consumers. Original equipment

manufacturers require assistance in the disposal of obsolete or returned

inventory. An example of obsolete inventory would be dial up modems. Frequently

this inventory is still serviceable and, with the permission of the

manufacturer, ARC remarkets the new equipment to Asian markets through its

Cambodian remarketing subsidiary. This subsidiary also refurbishes used

equipment for resale.

Business customers are continually upgrading their information technology

infrastructure and require the services of a reliable and service oriented

e-waste recycler such as ARC. For our business customers, we provide procedures

to document the receipt, disassembly, destruction and recycling of e-waste. We

also document the erasure of data from storage media. Our documentation

procedures provide assurances to business customers that e-waste has been

disposed of properly, without the possibility of continuing legal liability on

their part.

Consumer e-waste is provided principally by governmental collection

programs. ARC promotes community e-waste recycling events in its areas of

operation.

Recycling process

The recycling

process is rationalized on the basis that sorted e-waste is more valuable than

unsorted. The higher the level of sorting, the higher the value. After

sorting and disassembly, we sort components mechanically and by hand, separate

the various materials either by hand or by means of various material handling,

crushing and sorting machines. We design or adapt commercial recycling equipment

for our needs. After separation, material is sold to local and oversea

manufactures or recyclers . E-waste recyclers in the United States can generally

recycle and resell about 99% (by weight) with the remainder not

being economically recyclable without substantial investment in plant and

equipment. The recycler must pay a third party for the appropriate disposal of

this residue.

Expansion Program

During fiscal 2008 we intend to expand into 8 to 10 additional locations in the

United States and open overseas facilities in the Pacific Rim as well. ARC

has established an internal training program called “ARC University” to train

facility personnel in our new locations in ARC’s methods and recycling

philosophy.

10

Our Baja California Norte facility is being constructed on the outskirts of

Ensenada, Mexico. This location was chosen due to its proximity to the United

States and the port of Ensenada. The Baja California Norte processing facility

will complete processing for the e waste collected throughout all our North

American locations. ARC’s intent is to centralize the major portion of its

recycling in this location, and to invest in the specialized equipment to

recycle a higher percent of the e-waste. Our goal is 100% recycling. We plan to

establish a smelter at this location to recycle glass from CRT monitors, to

recover more metals from the e waste and process recyclable plastics, and market

the recycled materials internationally. We hope to open this facility in April,

2008

We may acquire other companies in the e waste recycling business in those cities

where we do not already have a physical presence. An acquisition could enable us

to expand more rapidly, but the success of any acquisition will be heavily

dependent upon due diligence investigation of the acquired company’s operations

and history, including liabilities. ARC’s ability to acquire any business will

be subject to the ability for ARC to obtain audited financial statements of the

acquired company, unless such business is not deemed to be material (generally,

a business whose sales are equal or exceed 10% of ARC’s revenues for the prior

fiscal year would be considered “material.” In the event ARC acquires any

material business during the offering period it would be required to suspend the

offering until such time as this prospectus is amended to update the information

in this prospectus, including the required audited financial information of the

acquired business.

ARC is seeking ways to use its recycling expertise in other facets of the

recycling industry. In particular, we recently acquired a small auto recycler in

Santa Ana California and one in Tijuana Baja California. Auto recycling is

currently an insignificant percentage of our business. Following the operation

of these pilot locations, we will evaluate whether entry into this market will

be appropriate.

ARC also intends to acquire metal recovery equipment in order to increase its

profit margins. Currently, ARC sells a portion of the recycled material to other

parties which refine metal from the material. ARC intends to invest up to $2.5

million in plant and equipment so that it can bring the metal extraction in

house.

E-waste Subsidy; Governmental

Regulation

The California

Waste Recycling Act of 2003 established a funding system for the collection and

recycling of cathode ray tubes, liquid crystal display monitors, and other video

display devices. Under this law, retailers collect a recycling fee at the time

of initial sale of covered devices, and remit this fee to California. California

pays eligible recyclers a fee for collecting and recycling these devices, and

prohibits their export as e-waste unless the handling of the covered devices in

the country of destination can be shown to comply with international standards

ARC, as an authorized collector and recycler, receives a payment from the State

of California for collection and recycling of these covered devices. We have

collector and recycling licenses at both our City of Industry location in Los

Angeles County and in our Hayward location in Northern California.

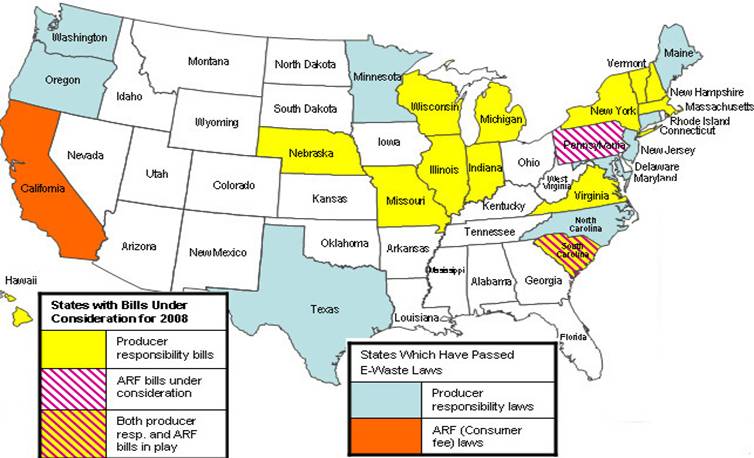

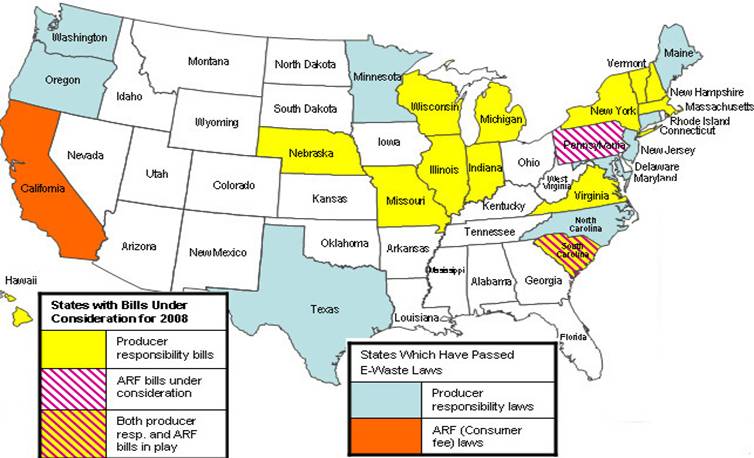

Currently, the states of Maryland, Maine, Connecticut, North Carolina, Oregon,

Washington and British Columbia Canada, have similar e-waste collection subsidy

programs. The California subsidy program provides significant revenue to ARC.

The State of California pays $0.39 to

$0.48/lb for recycled monitors, Laptop computers and TVs.

11

.

ARC is required by each State or local government to maintain permits for the

handling, recycling and disposal of e-waste and toxic materials.

Regulations require the payment of licensing fees, compliance with handling and

disposal regulations and inspections to verify compliance. ARC maintains a

regulatory department to ensure compliance with these regulations. Zoning and

other municipal requirements limit where recyclers can operate. Should ARC

increase its ability to recover materials, it could be subject to additional

environmental or other requirements.

Competition

We compete with a large number of e-waste recycling firms. For example, in

California there are over 500 licensed e-waste collection and recycling

facilities. According to information provided by the state of California, we are

the second largest recycler by volume in the state. The largest participant in

California’s e-waste program is Electronic Recyclers, and the third largest is

SIMS Recycling Solutions. We do not yet enjoy these dominant positions in

other states, and the e-waste business is not dominated nationally by any one

competitor or group of competitors. We are aware of a large competitor, Amandi,

Inc., which claims to have 300 employees at eight locations. Amandi opened

California operations in 2007 and is not yet a significant competitor in

California. Our goal is to become the largest e-waste recycler in the

United States. In addition, there are numerous companies engaged in recycling

and garbage collection in the United States, many of which have more financial

resources than us and are better established. Should one of the larger waste

disposal companies enter the e-waste market, they would compete with

us.

Employees

We have 120 employees, almost all of which are full time. No employees are

represented by labor unions.

12

Properties

ARC leases facilities for its operations in the

following locations. We are seeking for

additional facilities nationwide in selected cities at this time as well as

internationally in the Pacific Rim.

Location

Square footage

City of Industry-Turnbull Canyon

130,000

City of Industry-Lemon

Avenue

40,000

Chicago

IL

10,000

Atlanta

GA

27,500

Las Vegas

NV

13,500

KearneyNJ

12,000

El PasoTexas

32,000

HaywardCA

14,400

ArlingtonTX

87,120

San DiegoCA

10,500

An additional location near Ensenada, Baja California Norte is under

construction on a 50 acre parcel of property. This property is owned by an

affiliate of ARC and will be leased to ARC. The Turnbull Canyon property is also

leased from an affiliate. See “Certain Transactions.”

Legal Proceedings

ARC International Corporation is not a party to any material pending legal

proceeding.

13

MANAGEMENT

Directors and Executive

Officers

The members of the Board of Directors of ARC serve until the next annual meeting

of stockholders, or until their successors have been elected. The officers

serve at the pleasure of the Board of Directors. The following are the

directors and officers of ARC.

Jay Hooper, age 51, is Chief Executive Officer and Director of the Registrant.

He founded ARC International Corp. in 1996 and has been its Chief Executive

Officer and a director since inception. From 1985 to 1996 he was the founder and

President of American Research Corp., an early stage supplier of Dell Computer.

From 1980 to 1985 he was founder and President of Plus and Plus Corporation, in

Taiwan. Plus and Plus was the first company to display Chinese fonts on a PC.

From 1978 to 1980 Mr. Hooper was Sales Manager of Pulse Technology, Inc., in

Tokyo, Japan. Mr. Hooper has a degree in Electrical Engineering from the

Oriental Institute of Technology College in Taiwan, and studied business law at

US

Rebecca Hooper, age 37, is a Director of the Registrant. She has worked part

time in the accounting department of ARC International Corp. since its founding

in 1996. She was employed as an engineer by Jiangxi801 from 1994 to 1996. Ms.

Hooper received a Bachelor in Science from the Jiagxi University of Science and

Technology in 1994. She is the spouse of Jay Hooper.

Frank Lin, age 63, is an independent director of the Registrant. For more

than the past 5 years, he has been Director of Wan Hai Lines Ltd., Managing

Director of AirSeaLand and eLogistic Company Limited, and Director of Rapido

Logistic Service Ltd. Prior to that time he held various positions as

follows: President, CEO and Director of Allied Ind. & Eng. Corporation

(USA); President, CEO and Director of Allied Ind. & Eng. Enterprise Co.

Ltd.; President of Apogee Development LLC; Secretary General and CEO of Central

Cooperated Corporation; Executive Director of the Board of Directors of A &

E Development; Managing Director of AirSeaLand Products Company Limited;

Chairman of the Board of Speedy Grand Limited; member of the Advisor Board of

Taiwan Shin Sheng Daily News Shipping News Center; CEO of Morinokaze

International; CEO of Total Shipping . Mr. Lin was Chairman of the National

Taipei University of Technology, Materials and Mineral Resources Engineering

Education Foundation; Chairman of the Alumni Association of that university; a

member of the Advisory Board of the Taiwan Nihon University Alumni Association;

Professor and Vice Dean of the International Study Institute, Honorary Director

Vice President and Advisor to the Board of the National Development Initiatives

Institute; President of the National Taipei University of Technology Alumni

Association of North America; President (1993) of the Joint Chinese

University Alumni Association of Southern California; Visiting Professor &

Graduate School Visiting Purser of Aomori Chou Gakuin University; and a member

of the Board of Advisors of the Hot Springs Tourism Association of Taiwan and

the Chinese Club of San Marino. Mr. Lin graduated from the Taiwan Provincial

Taipei Institute of Technology in 1966 (Mining and Metallurgy); the National

Cheng Chi University (Public and Management Center) in 1967; the Nihon

University College of Industry Management, Department of Management in 1971; and

the University of California Anderson School, Top Management EMBA in 1991.

Kara Yu, age 47, has been Chief Financial Officer of ARC

International Corp. since July, 2004. From July 1999 to May 2003 she was

Controller of KYE International Corp., and she was Controller/Accounting Manager

of CAF Technology Corp. from August 1989 to May 1999. Ms. Yu received a BA from

the University of Washington-Seattle.

14

Audit Committee

We intend to establish an audit committee upon

close of this offering. We are seeking for another independent director to

chair the audit committee.

Executive Compensation

The following table sets forth the cash and all other compensation of ARC

International Corporation's executive officers and directors during each of the

last three fiscal years. The remuneration described in the table does not

include the cost to ARC International Corporation of any benefits which may be

furnished to the named executive officers, including premiums for health

insurance and other benefits provided to such individual that are extended in

connection with the conduct of ARC International Corporation's business, which

total less than $10,000 for each individual per year.

Name and

Principal

Position

Year

Salary

Jay Hooper,

President

2008

$ 120,000

2007

120,000

2006

96,000

Kara Yu,

Chief Financial

Officer

2008

$ 72,000

2007

72,000

2006

72,000

ARC has never granted any stock options or other equity awards. Directors

receive no compensation for acting as directors.

ARC International Corporation, by resolution of its Board of Directors and

stockholders, adopted a 2007 Stock Option Plan (the "Plan") in December,

2007. The Plan enables ARC to offer an incentive based compensation system

to employees, officers and directors and to employees of companies who do

business with ARC.

In the discretion of a committee comprised of non-employee directors (the

"Committee"), directors, officers, and key employees or employees of companies

with which we do business become participants in the Plan upon receiving grants

in the form of stock options or restricted stock. A total of 2,000,000

shares are authorized for issuance under the Plan, of which no shares are

issued. ARC may increase the number of shares authorized for issuance

under the Plan or may make other material modifications to the Plan without

shareholder approval. However, no amendment may change the existing rights

of any option holder.

Any shares which are subject to an award but are not used because the terms and

conditions of the award are not met, or any shares which are used by

participants to pay all or part of the purchase price of any option may again be

used for awards under the Plan. However, shares with respect to which a

stock appreciation right has been exercised may not again be made subject to an

award.

Stock options may be granted as non-qualified stock options or incentive stock

options, but incentive stock options may not be granted at a price less than

100% of the fair market value of the stock as of the date of grant (110% as to

any 10% shareholder at the time of grant); non-qualified stock options may not

be granted at a price less than 85% of fair market value of the stock as of the

date of grant. Restricted stock may not be granted under the Plan in

connection with incentive stock options.

Stock options may be exercised during a period of time fixed by the Committee

except that no stock option may be exercised more than ten years after the date

of grant or three years after death or disability, whichever is later. In

the discretion of the Committee, payment of the purchase price for the shares of

stock acquired through the exercise of a stock option may be made in cash,

shares of Common Stock or by delivery or recourse promissory notes or a

combination of notes, cash and shares of ARC's common stock or a combination

thereof. Incentive stock options may only be issued to directors, officers

and employees.

15

PRINCIPAL SHAREHOLDERS

The following table sets forth information relating to the beneficial ownership

of Company common stock as of the date of this prospectus by (I) each person

known by ARC International Corporation to be the beneficial owner of more than

5% of the outstanding shares of common stock (ii) each of ARC International

Corporation's directors and executive officers, and (iii) the Percentage After

Offering assumes the sale of all shares offered. Unless otherwise noted

below, ARC International Corporation believes that all persons named in the

table have sole voting and investment power with respect to all shares of common

stock beneficially owned by them. For purposes hereof, a person is deemed

to be the beneficial owner of securities that can be acquired by such person

within 60 days from the date hereof upon the exercise of warrants or options or

the conversion of convertible securities. Each beneficial owner's

percentage ownership is determined by assuming that any warrants, options or

convertible securities that are held by such person (but not those held by any

other person) and which are exercisable within 60 days from the date hereof,

have been exercised. The address of each unless noted is 333 Turnbull Canyon

Road, City of Industry, California 91745.

&nb

sp;

Number

of

Common

Percent

Shares

Percentage

After

Name

Office

Owned(1)

Owned

Offering

Jay

Hooper

President and

Director

3,882,628(2)

63.0%

47.6%

Rebecca Hooper

Director

3,882,628(3)

63.0%

47.6%

Kara

Yu

Chief Financial

Officer

122,771

2.00%

1.5%

ARC International Group

Inc.(4)

1,273,747

20.6%

15.6%

All officers and directors

as a group (4

persons)

4,005,399

65.0%

49.1%

(1)

Except as otherwise noted, shares

are owned beneficially and of record, and such record shareholder has sole

voting, investment, and dispositive power.

(2)

Includes 540,192 shares held of

record by the Jay Hooper Family Trust, and 184,157 shares owned by Rebecca

Hooper, Mr. Hooper’s spouse. The current trustee of the Jay Hooper Family Trust

is Jay Hooper. Mr. and Mrs. Hooper disclaim beneficial ownership of the shares

held by the other.

(3)

Includes

184,157 shares owned directly by Rebecca Hooper and 3,683,739 shares

beneficially owned by her spouse, Jay Hooper.

(4)

ARC International Group, Inc.

is owned and controlled by Cheng Wei Zhang.

16

SELLING STOCKHOLDERS

The shares of common

stock of ARC International Corporation offered by the Selling Stockholders will

be offered at market prices, as reflected on the National Association of

Securities Dealers Electronic Bulletin Board, or on the FINRAAQ Small Cap Market

if the Common Stock is then traded on FINRAAQ. It is anticipated that

registered broker-dealers will be allowed the commissions which are usual and

customary in open market transactions. There are no other arrangements or

understandings with respect to the distribution of the Common Stock.

Except as noted, the Selling Stockholders do not own any Common Stock except as

registered hereby for sale and will own no shares after the completion of the

offering. The relationship, if any, between ARC International Corporation

and any Selling Stockholder is set forth below.

Shares

Beneficially

Percentage

Owned

Total Shares

Name and

Address

and Being

Offered

After Offering

Magellan Capital Corp.

(1)

112,500

83-888 Ave. 51

Coachella, CA 92236

Dempsey K. Mork

(1)

37,500

83-888 Ave. 51

Coachella, CA 92236

Randall A. Baker

(2)

8,550

P.O. Box 1025

Morongo Va1ley, CA

92256

Norber L. LeBoeuf

(2)

6,375

829 E. Francis Drive

Palm Springs, CA 82252

Kathryn M.

LeBoeuf

4,000

829 E. Francis Drive

Palm Springs, CA 82252

Rose

Peskin

500

462 W. Mansfield

Los Angeles, CA 90036

Zachary

Peskin

500

462 W. Mansfield

Los Angeles, CA 90036

Sarah

Pesking

500

462 W. Mansfield

Los Angeles, CA 90036

Jacob

Peskin

500

462 W. Mansfield

Los Angeles, CA 90036

17

Annette

Baine

500

P.O.Box347

Lake Arrowhead, CA 92352

Michael

Baine

500

P.O. Box347

Lake Arrowhead, CA 92352

Michelle

Baine

500

P.O. Box347

Lake Arrowhead, CA 92352

James

Baine

500

P.O.Box347

Lake Arrowhead, CA 92352

Sally

Kerns

500

2910 Durand Ave.

Los Angeles, CA

90068

Michael

Kerns

500

2910 Durand Ave.

Los Angeles, CA 90068

Doug

Allen

100

5 Freemont St. Apt. 5

Provincetown, MA 02657

Melissa

Lakner

100

290 Monmouth St.Apt. C

Jersey City, NJ 07302

Marcia

Francois

100

8650 Grand Ave.

Yucca Valley, CA 92284

Tom

Thyne

200

14 Butler Hill Rd.

Somers, NY 10589

Peter

Timpano

200

408 W. 34th St. Apt. 6J

New York, NY

Ronald S.

Thompson

200

3825 Lakeview Drive

Pfafftown, NC 27040

James

Collins

200

6687 Morongo Road

29 Palms, CA 92277

18

James L.

Bryan

100

Van Benthuysenlaan 2273 DX

Voorburg, Netherlands

Irwin J.

Kirz

8,550

P.O. Box1025

Morongo Valley, CA

92256

Micah L.

Kirz

450

290 Monmouth St.Apt. C

Jersey City, NJ 07302

Barbara

Filiatreaux

500

P.O. Box 993

La Quinta, CA 92247

Lynn

Filiatreaux

500

24988 Blue Ravine Rd.108-140

Folsom, CA 95630

Robar China

Inc.

500

P.O. Box 993

La Quinta, CA 92247

Robert L.

Filiatreaux

500

256 S. Robertson

Los Angeles, CA 90210

Robert J.

Filiatreaux

12,250

77545 Calle Chillon

La Quinta, CA 92253

Patricia Mork

(1)

38,250

55051 Riviera

La Quinta, CA 92253

Magellan Capital Corp.

Profit Sharing

(1)

131,688

400 SW 15th St. Ste. 103C

Willmar, MN 56201

Millenium Group, Inc.

(3)

368,312

4519 Admiralty Way #130

MarinaDel Rey, CA 90292

William

Wilkinson

10,000

PO Box43

JollyHarbour, Antigua, WI

19

JK Advisers Hedge Fund

LLC(4)

10,000

3027 E. Sunset Rd., #106

Las Vegas, NV 89120

GFM

Electronics, S. A. de C.

V.

2,500

Pedro

Ramirez Vazquez 200th -10,

Col.

Valle Oriente,

San

Pedro Garza Garcia, Nuevo León

México,

C. P. 66269

TOTAL

759,125

* None

(1)

Mr. Mork controls Magellan Capital Corp., and the Magellan Capital Corp Profit

Sharing Plan. He was president, chief financial officer and director of

the public company before the acquisition of ARC International Corp (California)

in January 2008. Patricia Mork is his spouse.

(2)

Former officer or director

(3)

Millennium Group, Inc. is controlled by Jonathon Mork, the son of Dempsey

Mork.

(4)

JK Advisers Hedge Fund

LLC is controlled by Jehu Hand, the Chief Executive Officer of the

Underwriter.

20

PLAN OF DISTRIBUTION

ARC Offering

ARC has applied for

listing of the common stock on ______________. ARC is offering 2,000,000 shares

through Jackson, Kohle & Co., a FINRA registered broker dealer (the

“Underwriter”) on a “straight best efforts, no minimum” offering. No escrow of

offering proceeds will be established. Officers and directors may also offer

Shares in the ARC Offering, in which no sales commission will be payable with

respect to such Shares.The Underwriter has

advised ARC that it proposes to offer the Shares to the public at the offering

price set forth on the cover page of this Prospectus and that the Underwriter

may allot to certain Dealers who are members in good standing of FINRA of

$_________ per Share, of which not in excess of $____________ per Share may be

re-allowed to other Dealers who are members of FINRA. After the initial

public offering, the public offering price, commissions and re-allowances may be

changed by the Underwriter. The Underwriter may assign all or part of the ARC

Offering to its European Union affiliate, Jackson, Kohle SE.

ARC has agreed to pay to the Underwriter a non-accountable expense allowance of

3% of the gross proceeds of this offering, of which $___ has been paid to

date.

ARC has agreed to sell to the Underwriter, or its designees, for nominal

consideration, a five year Underwriter’s Warrant to purchase up to 200,000

Shares at 120% of the initial public offering price per Share. The

Underwriter’s Warrant will be exercisable during the four-year period commencing

one year from the date of this Prospectus. ARC has the right to call the

Underwriter’s Warrant on 60 day’s notice if the trading price of the common

stock exceeds $9.60 per share for 30 consecutive days, subject to the current

effectiveness of a registration statement covering the underlying shares and

other conditions. The Underwriter’s Warrant may not be transferred, sold,

assigned or hypothecated for one year from the date hereof except to officers of

the Underwriter. For the life of the Underwriter’s Warrant, the holder

thereof is given the opportunity to profit from a rise in the market price of

the common stock of ARC with a resulting dilution in the interest of other

stockholders. ARC may find it more difficult to raise additional equity

capital if it should be needed for the business of ARC while the Underwriter’s

Warrant is outstanding; and at any time when the holder of the Underwriter’s

Warrant might be expected to exercise it, ARC would probably be able to obtain

additional equity capital on terms more favorable than those provided in the

Underwriter’s Warrant. ARC has agreed, at its expense, to register under

the Securities Act, on one occasion, and at the expense of the Underwriter on

another occasion, the Underwriter’s Warrant, and/or the underlying securities at

the request of the holder thereof, during the four year period commencing one

year from the date of this Prospectus. ARC has also agreed to certain

"piggy-back" registration rights for the holders of the Underwriter’s Warrant,

and securities issuable upon exercise thereof, for a period of six years

commencing one year from the date of this Prospectus. The Underwriter has

informed ARC that it does not expect sales of Shares to be made to discretionary

accounts.

Prior to this offering, there has been no public trading market for ARC common

stock. Consequently, the initial public offering price of the Shares has

been determined by negotiations between ARC and the Underwriter. Among the

factors considered in determining the offering price and exercise prices were

ARC's historical results of operations, market prices and similar

securities of comparable publicly traded companies, certain financial and

operating information of companies engaged in activities similar to those of ARC

and the general condition of the securities markets.

Selling Stockholder Offering

ARC anticipates once the shares are trading on the ___________ or any

other market the selling stockholders will sell their shares directly into any

market created. The prices the selling stockholders will receive will be

determined by the market conditions. Selling stockholders may also sell in

private transactions, and may sell directly or through the Underwriter.

ARC International Corporation cannot predict the price at which shares may be

sold or whether the common stock will ever trade on any market. The shares

may be sold by the selling stockholders, as the case may be, from time to time,

in one or more transactions. ARC International Corporation does not intend

to enter into any arrangements with any securities dealers concerning

solicitation of offers to purchase the shares. Selling Stockholders may also

sell in private transactions, at privately negotiated prices, but no sales

commissions may be paid for effectuating private transactions.

21

Commissions and discounts paid in connection with the sale of the shares by the

selling stockholders will be determined through negotiations between them and

the broker-dealers through or to which the securities are to be sold and may

vary, depending on the broker-dealers fee schedule, the size of the transaction

and other factors. The separate costs of the selling stockholders will be borne

by them. The selling stockholders will, and any broker,-broker dealer or agent

that participates with the selling stockholders in the sale of the shares by

them may be deemed an "underwriter" within the meaning of the Securities Act,

and any commissions or discounts received by them and any profits on the resale

of shares purchased by them may be deemed to be underwriting commissions under

the Securities Act. ARC understands that it is the position of FINRA that such

sales commissions or discounts should not exceed 5% of the gross offering price

at which the selling stockholders sell their shares.

ARC will bear all costs of the offering except for sales commissions related to

the sale of shares by the Selling Stockholders Offering.

Regulation M

Regulation M prohibits certain market activities by persons selling securities

in a distribution. To demonstrate their understanding of those

restrictions and others, selling stockholders will be required, prior to the

release of unlegended shares to themselves or any transferee, to represent as

follows: that they have delivered a copy of this prospectus, and if they are

effecting sales on the Electronic Bulletin Board or interdealer quotation system

or any electronic network, that neither they nor any affiliates or person acting

on their behalf, directly or indirectly, has engaged in any short sale of ARC

common stock; and for a period commencing at least 5 business days before his

first sale and ending with the date of his last sale, bid for, purchase, or

attempt to induce any person to bid for or purchase ARC common

stock.

The Underwriter does not make markets in any securities.

CERTAIN TRANSACTIONS

The President of ARC, who is also the majority shareholder, has personally

guaranteed ARC’s revolving line of credit in the amount of $4,000,000 and

equipment purchasing lines totaling $1,744,000.

ARC’s Turnbull Canyon facilities were leased from a non-affiliated party in

December, 2006 for a lease expiring in December, 2009. The lease agreement

provided ARC with an option to purchase the property until October 2007 for

$12,309,888. ARC transferred this option to purchase to an entity controlled by

the President at no cost. ARC now leases this facility from its President at a

price of $0.54 per square foot, triple net, which is $0.67 in total. The lease

from the affiliate of the President expires on Dec. 31, 2103. ARC believes that

the purchase of the Turnbull facility by its President was in the best interests

of ARC as it enables ARC to utilize its cash and borrowing resources on its core

business. The lease rate was based on rates for comparable industrial

properties in the area. The Board of Directors believes the lease rate is

at fair market value.

The Baja California property is owned by an affiliate of

Mr. Hooper. The lease rate has not yet been determined. The lease

will commence on build completion, estimated for April, 2008.

On January 4, 2008, the five shareholders of ARC International Corp., a

California corporation, received 5,401,917 shares of ARC common stock in

exchange for their shares of the California corporation. This transaction

was reported in a Current Report on Form 8-K dated January 4, 2008.

��

DESCRIPTION OF SECURITIES

Common Stock

ARC International Corporation's Articles of Incorporation authorizes the

issuance of 80,000,000 shares of common stock, $.001 par value per share, of

which 6,151,042 shares were outstanding as of July 31, 2008. Holders of

shares of common stock are entitled to one vote for each share on all matters to

be voted on by the stockholders. Holders of common stock have no

cumulative voting rights. Holders of shares

22

of common stock are entitled to share ratably in

dividends, if any, as may be declared, from time to time by the Board of

Directors in its discretion, from funds legally available therefore. In

the event of a liquidation, dissolution or winding up of ARC, the holders of

shares of common stock are entitled to share pro rata all assets remaining after

payment in full of all liabilities. Holders of common stock have no

preemptive rights to purchase ARC's common stock. There are no conversion

rights or redemption or sinking fund provisions with respect to the common

stock.

Meetings of stockholders may be called by the board of directors, the chairman

of the board, the president, or by one or more holders entitled to cast in the

aggregate not less than 20% of the votes at the meeting. Holders of a

majority of the shares outstanding and entitled to vote at the meeting must be

present, in person or by proxy, for a quorum to be present to enable the conduct

of business at the meeting.

Preferred Stock

ARC's Certificate of Incorporation authorizes the issuance of 20,000,000 shares

of shares of preferred stock, no par value, of which no shares of Preferred

Stock are outstanding.

ARC's Board of Directors has authority, without action by the shareholders, to

issue all or any portion of the authorized but unissued preferred stock in one

or more series and to determine the voting rights, preferences as to dividends

and liquidation, conversion rights, and other rights of such series. ARC

considers it desirable to have preferred stock available to provide increased

flexibility in structuring possible future acquisitions and financings and in

meeting corporate needs which may arise. If opportunities arise that would

make desirable the issuance of preferred stock through either public offering or

private placements, the provisions for preferred stock in ARC's Articles of

Incorporation would avoid the possible delay and expense of a shareholder's

meeting, except as may be required by law or regulatory authorities.

Issuance of the preferred stock could result, however, in a series of securities

outstanding that will have certain preferences with respect to dividends and

liquidation over the common stock which would result in dilution of the income

per share and net book value of the common stock. Issuance of additional

common stock pursuant to any conversion right which may be attached to the terms

of any series of preferred stock may also result in dilution of the net income

per share and the net book value of the common stock. The specific terms

of any series of preferred stock will depend primarily on market conditions,

terms of a proposed acquisition or financing, and other factors existing at the

time of issuance. Therefore, it is not possible at this time to determine

in what respect a particular series of preferred stock will be superior to ARC's

common stock or any other series of preferred stock which ARC may issue.

The Board of Directors may issue additional preferred stock in future

financings, but has no current plans to do so at this time.

The issuance of Preferred Stock could have the effect of making it more

difficult for a third party to acquire a majority of the outstanding voting

stock of ARC.

ARC intends to furnish holders of its common stock annual reports containing

audited financial statements and to make public quarterly reports containing

unaudited financial information.

Transfer Agent

The transfer agent for the common stock is Corporate Stock Transfer, 3200 Cherry

Creek Road South D

Denver, Colorado 80902, and its telephone number

is (303) 282-4800. Their website is www.corporatestock.com.

INTEREST OF NAMED EXPERTS AND COUNSEL

The legality of the Shares offered hereby will be passed upon for ARC by Joel E.

Hand, Esq., San Diego, California.

23

EXPERTS

The audited financial statements of ARC International Corporation included in

this Prospectus as of March 31, 2008 and 2007 have been audited by the Black

Wing Group LLC, independent certified public accountant, to the extent and for

the periods set forth in their report thereon and are included in reliance upon

such report given upon the authority of such firm as experts in accounting and

auditing.

INDEMNIFICATION

ARC International Corporation has adopted provisions in its articles of

incorporation and bylaws that limit the liability of its directors and provide

for indemnification of its directors and officers to the full extent permitted

under the Nevada General Business Law. Under ARC International

Corporation's articles of incorporation, and as permitted under the Nevada

General Business Law, directors are not liable to ARC International Corporation

or its stockholders for monetary damages arising from a breach of their

fiduciary duty of care as directors. Such provisions do not, however,

relieve liability for breach of a director's duty of loyalty to ARC

International Corporation or its stockholders, liability for acts or omissions

not in good faith or involving intentional misconduct or knowing violations of

law, liability for transactions in which the director derived as improper

personal benefit or liability for the payment of a dividend in violation of

Nevada law. Further, the provisions do not relieve a director's liability

for violation of, or otherwise relieve ARC International Corporation or its

directors from the necessity of complying with, federal or state securities laws

or affect the availability of equitable remedies such as injunctive relief or

recision.

At present, there is no pending litigation or proceeding involving a director,

officer, employee or agent of ARC International Corporation where

indemnification will be required or permitted. ARC International

Corporation is not aware of any threatened litigation or proceeding that may

result in a claim for indemnification by any director or officer.

Insofar as indemnification for liabilities arising under the Securities Act of

1933 (the "Act") may be permitted to directors, officers and controlling persons

of ARC International Corporation pursuant to the foregoing provisions, or

otherwise, ARC International Corporation has been advised that in the opinion of

the Securities and Exchange Commission such indemnification is against public

policy as expressed in the Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other

than the payment by ARC International Corporation of expenses incurred or paid

by a director, officer or controlling person of ARC International Corporation in

the successful defense of any action, suit or proceeding) is asserted by such

director, officer or controlling person in connection with the securities being

registered, ARC International Corporation will, unless in the opinion of its

counsel the matter has been settled by controlling precedent, submit to a court

of appropriate jurisdiction the question whether such indemnification by it is

against public policy as expressed in the Securities Act and will be governed by

the final adjudication of such issue.

24

THE BLACKWING GROUP, LLC

18921G E VALLEY VIEW PARKWAY

#325

INDEPENDENCE, MO 64055

816-813-0098

Independent PCAOB Auditor’s Report

ARC

International Corp

333

Turnball Canyon Road

City

of Industry, CA 91745

We

have audited the accompanying balance sheets of ARC International Corp as of

March 31, 2007 and 2008, and the related statements of income, and changes in

members’ equity, and cash flows for the fiscal years then ended. These

financial statements are the responsibility of the Company’s management.

Our responsibility is to express an opinion on these financial statements based

on our audits.

We

conducted our audit in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require that

we plan and perform the audit to obtain reasonable assurance about whether the

financial statements are free of material misstatement. The Company is not

required to have, nor were we engaged to perform, an audit of its internal

control over financial reporting. Our audit included consideration of internal

control over financial reporting as a basis for designing audit procedures that

are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the Company’s internal control over financial

reporting. Accordingly, we express no such opinion. An audit also includes

examining, on a test basis, evidence supporting the amounts and disclosures in

the financial statements, assessing the accounting principles used and

significant estimates made by management, as well as evaluating the overall

financial statement presentation. We believe that our audit provides a

reasonable basis for our opinion.

In

our opinion, such financial statements present fairly, in all material respects,

the financial position of ARC International Corp as of March 31, 2007 and 2008,

and the results of its operations and its cash flows for the fiscal years then

ended in conformity with accounting principles generally accepted in the United

States of America.

The

Blackwing Group, LLC

Issuing

Office: Independence, MO

September

9, 2008

25

ARC INTERNATIONAL CORP.

BALANCE SHEETS

MARCH 31, 2008 AND 2007

ASSETS

2008

2007

Current Assets:

Cash and cash

equivalents

$

466,932

$

241,387

Accounts

receivable – Trade (Net of $40,000 and

$20,000)