UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

¨ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

¨ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 001-15148

BRF S.A.

(Exact Name of Registrant as Specified in its charter)

N/A

(Translation of Registrant’s name into English)

Federative Republic of Brazil

(Jurisdiction of Incorporation or Organization)

R. Hungria, 1400 - 5th Floor

Jd. Europa – 01455-000

São Paulo – SP, Brazil

(Address of principal executive offices)

Lorival Nogueira Luz Júnior, Global Chief Executive and Financial and Investor Relations Officer

Tel. (5511) 2322-5005, Fax (5511) 2322-5740

R. Hungria, 1400 - 5th Floor

Jd. Europa – 01455-000

São Paulo – SP, Brazil

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class Common Shares, no par value* American Depositary Shares (as evidenced by American Depositary Receipts), each representing one share of common stock | Name of each exchange on which registered The New York Stock Exchange The New York Stock Exchange |

____________________

* Not for trading purposes, but only in connection with the registration of American Depositary Shares representing those common shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

At December 31, 2017 | 812,473,246 shares of common stock |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yesx No¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes¨ Nox

Note- Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes¨ No¨

Note: Not required for registrant.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer ¨ |

Non-accelerated filer ¨ | Emerging growth company ¨ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

¨ U.S. GAAP | x International Financial Reporting Standards as issued by the International Accounting Standards Board | ¨ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17¨ Item 18¨.

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes¨ Nox

TABLE OF CONTENTS

Page

Table of Contents

PART I

INTRODUCTION

Unless otherwise indicated, all references herein to (1) “BRF” are references to BRF S.A., a corporation organized under the laws of the Federative Republic of Brazil (“Brazil”), and its consolidated subsidiaries, (2) the “Company,” “we,” “us,” “our” or “our company” are references to BRF, and (3) “common shares” are references to the Company’s authorized and outstanding common stock, designated ordinary shares (ações ordinárias), each without par value. All references herein to the “real,” “reais” or “R$” are to the Brazilian real, the official currency of Brazil. All references to “U.S. dollars,” “dollars” or “U.S.$” are to the United States dollar. All references to “euro” or “EUR” are to euros, the official currency of the Eurozone in the European Union. All references to “Argentine peso,” or “ARS” are to the Argentine peso, the official currency of Argentina.

Market data and certain industry forecasts used herein were obtained from internal surveys, market research, publicly available information and industry publications. While we believe that market research, publicly available information and industry publications we use are reliable, we have not independently verified market and industry data from third-party sources. Moreover, while we believe our internal surveys are reliable, they have not been verified by any independent source.

We have made rounding adjustments to reach some of the figures included herein. As a result, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

Forward-Looking Statements

This Annual Report on Form 20-F contains information that constitute forward-looking statements. They appear in a number of places and include statements regarding the intent, belief or current expectations of the Company, its directors or its executive officers with respect to (i) the implementation of the principal operating strategies of the Company, including integration of current acquisitions as well as the conclusion of acquisitions or joint venture transactions or other investment opportunities that may occur in the future, (ii) general economic, political and business conditions in our company’s markets, both in Brazil and abroad, (iii) the cyclicality and volatility of raw materials and selling prices, (iv) health risks related to the food industry, (v) the risk of outbreak of animal diseases (vi) more stringent trade barriers in key export markets and increased regulation of food safety and security, (vii) strong international and domestic competition, (viii) interest rate fluctuations, inflation and exchange rate movements of the real in relation to the U.S. dollar and other currencies, (ix) the declaration or payment of dividends, (x) the direction and future operation of the Company, (xi) the implementation of the Company’s financing strategy and capital expenditure plans, (xii) the Company’s financial condition or results of operations and (xiii) other factors identified or discussed under “Item 3. Key Information—D. Risk Factors.”

Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those in the forward-looking statements. The accompanying information contained in this Annual Report on Form 20-F, including without limitation the information set forth under the heading “Item 5. Operating and Financial Review and Prospects,” identifies important factors that could cause such differences. In light of the risks, uncertainties and assumptions associated with forward-looking statements, you should not place undue reliance on any forward-looking statements. Additional risks that we may currently deem immaterial or that are not presently known to us could also cause the forward-looking events discussed in this Annual Report on Form 20-F not to occur.

Our forward-looking statements speak only as of the date of this Annual Report on Form 20-F or as of the date they are made, and except as otherwise required by applicable securities laws, the Company undertakes no obligation to publicly update any forward-looking statement, whether because of new information, future events or otherwise.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

1

Table of Contents

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

We present below certain selected financial data derived from our consolidated financial statements as of and for the years ended December 31, 2017, 2016, 2015, 2014, and 2013, included herein, prepared in accordance with the International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). IFRS differs in certain significant respects from the accounting principles generally accepted in the United States, or “U.S. GAAP.”

In July 2015, we sold the assets of our then dairy segment, including plants and trademarks, toLactalis do Brasil – Comércio, Importação e Exportação de Laticínios Ltda. (“Lactalis”). As a result, this segment is reported as discontinued operations. Unless stated otherwise, the results and cash flows that we present in this Annual Report on Form 20-F do not consider the results and cash flows from our dairy segment discontinued operation.

The summary financial data should be read in conjunction with our consolidated financial statements and the notes thereto contained in this Annual Report on Form 20-F, as well as the information set forth under the heading “Item 5. Operating and Financial Review and Prospects.”

| |

| | | | | |

| (in millions ofreais, except share, per share and per ADS amounts and as otherwise indicated) |

Income Statement Data | | | | | |

Continuing Operations | | | | | |

Net sales | 33,469.4 | 33,732.9 | 32,196.6 | 29,006.8 | 27,787.5 |

Gross profit | 6,904.1 | 7,526.5 | 10,088.9 | 8,509.4 | 6,909.9 |

Operating income | | | | | |

Income (Loss) from Continuing Operations | | | | | |

| | | | | |

Income (Loss) from Discontinued Operations | | | | | |

Net profit (Loss) | | | | | |

Attributable to: | | | | | |

Controlling shareholders | (1,125.6) | (372.4) | 3,111.2 | 2,225.0 | 1,062.4 |

Non-controlling shareholders | | | | | |

| | | | | |

Earnings (loss) per share - basic from continuing operations | (1.3675) | (0.4581) | 3.5009 | 2.4529 | 1.1713 |

Earnings (loss) per ADS - basic from continuing operations | (1.3675) | (0.4581) | 3.5009 | 2.4529 | 1.1713 |

Earnings (loss) per share – basic | (1.3675) | (0.4581) | 3.7184 | 2.5563 | 1.2204 |

Earnings (loss) per ADS – basic | (1.3675) | (0.4581) | 3.7184 | 2.5563 | 1.2204 |

Weighted average shares outstanding at the end of the year – basic (millions) | 803,560 | 801,903 | 842,000 | 870,412 | 870,535 |

Earnings (loss) per share – diluted | (1.3675) | (0.4581) | 3.6932 | 2.5551 | 1.2192 |

Earnings (loss) per ADS – diluted | (1.3675) | (0.4581) | 3.6932 | 2.5551 | 1.2192 |

Weighted average shares outstanding at the end of the year – diluted (millions) | 803,560 | 801,903 | 842,402 | 870,824 | 871,442 |

Dividends per share | — | 0.7641 | 1.1998 | 0.8486 | 0.8315 |

Dividends per ADS | — | 0.7641 | 1.1998 | 0.8486 | 0.8315 |

Dividends per ADS (in U.S.$) | — | 0.2345 | 0.3073 | 0.3195 | 0.3550 |

Exchange Rate (R$/U.S.$) on December 31 | 3.3080 | 3.2591 | 3.9048 | 2.6562 | 2.3426 |

| |

| | | | | |

| (in millions ofreais, except as otherwise indicated) |

Balance Sheet Data | | | | | |

Cash and cash equivalents | 6,010.8 | 6,356.9 | 5,362.9 | 6,006.9 | 3,127.7 |

Trade accounts receivable, net | 3,919.0 | 3,085.1 | 3,876.3 | 3,046.9 | 3,338.4 |

Inventories | 4,948.2 | 4,791.6 | 4,032.9 | 2,941.4 | 3,111.6 |

Total current assets | 19,185.4 | 18,893.7 | 19,180.1 | 17,488.3 | 13,242.5 |

Property, plant and equipment, net | 12,190.6 | 11,746.2 | 10,915.8 | 10,059.3 | 10,821.6 |

Intangible assets | | | | | |

Total non-current assets | | | | | |

Total assets | | | | | |

Short-term debt | 5,031.4 | 3,245.0 | 2,628.2 | 2,738.9 | 2,696.6 |

Trade accounts payable | | | | | |

Total current liabilities | | | | | |

Long-term debt | 15,413.0 | 15,717.4 | 12,551.1 | 8,850.4 | 7,484.6 |

Total non-current liabilities | 18,607.8 | 18,085.1 | 14,931.0 | 10,844.7 | 9,242.4 |

Equity | | | | | |

Capital | 12,460.5 | 12,460.5 | 12,460.5 | 12,460.5 | 12,460.5 |

Total equity | | | | | |

Total liabilities and equity | | | | | |

2

Table of Contents

| | | | | |

Operating Data | | | | | |

Poultry slaughtered (million heads per year) | 1,628.1 | 1,715.3 | 1,724.4 | 1,663.6 | 1,795.9 |

Pork/beef slaughtered (thousand heads per year) | 9,938.4 | 9,614.1 | 9,510.5 | 9,620.6 | 9,744.1 |

Total production of meat and other processed products (thousand tons per year) | 4,332.2 | 4,251.6 | 4,358.2 | 4,307.1 | 4,595.4 |

Employees (at year end)(1) | 108,234 | 102,463 | 96,279 | 108,829 | 110,138 |

(1) Includes permanent and temporary employees.

Exchange Rates

The Brazilian foreign exchange system allows the purchase and sale of foreign currency and the international transfer of reaisby any person or legal entity, regardless of the amount, subject to certain regulatory procedures.

In the past, the Central Bank has intervened occasionally to control unstable movements in foreign exchange rates. We cannot predict whether the Central Bank or the Brazilian government will continue to permit the realto float freely or will intervene in the exchange rate market through the return of a currency band system or otherwise. The realmay depreciate or appreciate against the U.S. dollar and/or the euro substantially. Furthermore, Brazilian law provides that, whenever there is a serious imbalance in Brazil’s balance of payments or there are serious reasons to foresee a serious imbalance, temporary restrictions may be imposed on remittances of foreign capital abroad. We cannot assure you that such measures will not be taken by the Brazilian government in the future. See “Item 3. Key Information—D. Risk Factors—Risks Relating to Brazil—Exchange rate movements may adversely affect our financial condition and results of operations.”

The following table shows the selling rate for U.S. dollars for the periods and dates indicated. The information in the “Average” column represents the average of the daily exchange rates during the periods presented. The numbers in the “Period End” column are the quotes for the exchange rate as of the last business day of the period in question.

| |

| | | | |

2013 | 2.4457 | 1.9528 | 2.1605 | 2.3426 |

2014 | 2.7403 | 2.1974 | 2.3547 | 2.6562 |

2015 | 4.1949 | 2.5754 | 3.3387 | 3.9048 |

2016 | 4.1558 | 3.1193 | 3.4833 | 3.2591 |

2017 | 3.3807 | 3.0510 | 3.1925 | 3.3080 |

3

Table of Contents

| |

| | |

October 2017 | 3.28 | 3.20 |

November 2017 | 3.29 | 3.21 |

December 2017 | 3.33 | 3.23 |

January 2018 | 3.27 | 3.14 |

February 2018 | 3.28 | 3.17 |

March 2018 | 3.33 | 3.21 |

April 2018 (through April 26, 2018) | 3.50 | 3.31 |

Source: Central Bank.

The exchange rate on April 26, 2018 was R$3.49 per U.S.$1.00.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Risks Relating to Our Business and Industry

Health risks related to our business and the food industry could adversely affect our ability to sell our products. We have been recently subject to significant investigations relating to, among other things, food safety and quality control.

We are subject to risks affecting the food industry generally, including risks posed by contamination or food spoilage, evolving nutritional and health-related concerns, consumer product liability claims, product tampering, the possible unavailability and expense of liability insurance, public perception of product safety for both the industry as a whole and also our products specifically, but not exclusively, as a result of disease outbreaks or the fear of such outbreaks, the potential cost and disruption of a product recall and possible impacts on our image and brands. Among such risks are those related to raising animals, including disease and adverse weather conditions.

Meat can be subject to contamination during processing and distribution. In particular, processed meat may become exposed to various disease-producing pathogens, including listeria monocytogenes, salmonella and generic E. coli. These pathogens can also be introduced to our products during production or as a result of improper handling by third-party food processors, franchisees, distributors, foodservice providers or consumers. Spoilage, especially spoilage due to failure of temperature-control storage and transportation systems, is also a risk. We maintain systems designed to monitor food safety risks throughout all stages of production and distribution, but these systems could fail to function properly and product contamination could still occur. Failures in our systems to ensure food safety could result in harmful publicity that could cause damage to our brands, reputation and image and negatively impact sales, which could have a material adverse impact on our business, results of operations, financial condition and prospects.

Brazilian authorities are investigating the Brazil’s meat processing industry in the so-called “Carne Fraca Operation.” The investigation involves a number of companies in the Brazilian industry and, among other things, include allegations relating to food safety and quality control. On January 22, 2018, the 3rd Public Prosecutor’sOffice of the State of Goiás, offered a complaint against Mr. Laércio José Brunetto, industrial manager of our Mineiros plant, located in the State of Goiás, by the time of the events of theCarne Fraca Operation and current member of our corporate engineering team, and a former employee who was dismissed on August 16, 2016 and was the head of the quality control of the Mineiros plant. Both of them were charged for allegedly committing crimes against consumers, as provided in article 7, item II of Law 8,137/90. In connection with this investigation, there is currently no indictment in Brazil against us for production of products unfit for human consumption or possible harm for the health of consumers. According to the Public Prosecutor’s Office, laboratory tests (dripping tests) have verified excessive levels of water absorbed by the chicken products apprehended at Mineiros plant. The Public Prosecutor’s Office alleges we produced chicken products with higher quantities of water than the limits permitted by the Brazilian Ministry of Agriculture, Livestock and Food Supply (Ministério da Agricultura, Pecuária e Abastecimento, or “MAPA”), with potential damages to customers, considering they would be acquiring chicken meat products with inferior weight than those indicated on the product package, since part of the weight of the frozen chicken would consist merely of water contained therein.

4

Table of Contents

On March 5, 2018, BRF learned of a decision issued by a federal judge of the 1st Federal Court of Ponta Grossa - Paraná, authorizing the search and seizure of information and documents from us and certain current and former employees, and the temporary detention of certain individuals. In what media reports have identified as “Trapaça Operation,” in total eleven current and former employees of BRF were temporarily detained for questioning, including former Chief Executive Officer Pedro Faria and former Vice President for Global Operations Helio Rubens. All such current and former employees have been released. A number of other BRF employees and former employees were identified for questioning. Based on the judge’s decision authorizing the temporary detention and the search and seizure, the main allegations at this stage involve alleged misconduct relating to quality violations, improper use of feed components, and falsification of tests at certain BRF manufacturing plants and accredited labs.

We are cooperating with authorities and initiated an internal investigation with respect to the allegations.

As a result of theTrapaçaOperation, on March 5, 2018, we received notice from MAPA that it immediately suspended exports from our Rio Verde/GO, Carambeí/PR and Mineiros/GO plants to twelve countries that require specific sanitary requirements for the control of the bacteria group Salmonella spp and Salmonella pullorum. MAPA temporarily suspended exports from nine other BRF plants to the European Union on March 15, 2018, but revoked the temporary suspension on April 18, 2018. Although to date we have not received any formal notice from Brazilian or European authorities, media reports indicate that the European Union is considering suspending imports of poultry from certain production facilities in Brazil (including ours) supposedly due to sanitary concerns. If the European Union were to implement any such ban of imports from our production facilities, we may not be able to sell our products from such embargoed production plants in the European Union, and depending on the extension of such suspension, our results of operations may be adversely affected if we are not capable of directing any exceeding production capacity resulting from suspension to other markets at similar prices.

Even if our own products are not affected by contamination, our industry may face adverse publicity in certain of its markets if the products of other producers become contaminated, which could result in negative public perception about the safety of our products and reduced consumer demand for our products in the affected category. Significant lawsuits, widespread product recalls, and other negative events faced by us or our competitors could result in a widespread loss of consumer confidence in the safety and quality of our products. Our sales are ultimately dependent on consumer preferences, and any actual or perceived health risks associated with our products could cause customers to lose confidence in the safety and quality of our products and have a material adverse impact on our business, results of operations, financial condition and prospects.

More stringent trade barriers in key export markets may negatively affect our results of operations.

Because of the growing market share of Brazilian poultry, pork and beef products in the international markets, Brazilian exporters are increasingly being affected by measures taken by importing countries to protect local producers. The competitiveness of Brazilian companies has led certain countries to establish trade barriers to limit the access of Brazilian companies to their markets. Trade barriers can consist of both tariffs and non-tariff barriers. In our industry, non-tariff barriers are a particular concern, especially sanitary and technical restrictions.

5

Table of Contents

As a result of the regulators’ inquiries and the public announcement of allegations of wrongdoings involving BRF and other companies in the Brazilian meat industry in the context of theCarne Fraca Operation andTrapaça Operation, some export markets have been temporarily closed and our average selling prices for some products and in some markets have fallen. As a result of theTrapaça Operation, on March 5, 2018, we received notice from MAPA that it immediately suspended exports from our Rio Verde/GO, Carambeí/PR and Mineiros/GO plants to twelve countries that require specific sanitary requirements for the control of the bacteria group Salmonella spp and Salmonella pullorum. MAPA temporarily suspended exports from nine other BRF plants to the European Union on March 15, 2018, but revoked the temporary suspension on April 18, 2018. For more information about the “Trapaça Operation” see “Item 8. Financial Information—B. Significant Changes—Carne Fraca Operation” and “Item 8. Financial Information—B. Significant Changes— Trapaça Operation.”

Some countries, such as Russia and South Africa, have a history of erecting trade barriers to imports of food products. In Europe, another of our key markets, the European Union has adopted a quota system for certain chicken products and prohibitive tariffs for certain products that do not have quotas in order to mitigate the effects of Brazil’s lower production costs on local producers over European producers.

Many developed countries use direct and indirect subsidies to enhance the competitiveness of their producers in other markets. In addition, local producers in some markets may exert political pressure on their governments to prevent foreign producers from exporting to their market, particularly during unfavorable economic conditions. Any of the above restrictions could substantially affect our export volumes and, consequently, our export sales and financial performance. If new trade barriers arise in our key export markets, we may face difficulties in reallocating our products to other markets on favorable terms, and our business, financial condition and results of operations might be adversely affected.

For instance, Saudi Arabia recently considered whether poultry slaughtering practices in Brazil conforms with halal practices in Muslim markets. Brazil uses electric currents to leave poultry unconscious prior to slaughtering and Saudi Arabia raised concerns that such practice may violate the Muslim norm. In March 2018, officials with the Brazilian Agriculture Ministry and representatives of Brazil’s animal protein producer association traveled to Saudi Arabia to meet with Saudi Arabian authorities and explain that the electric currents do not kill the poultry. If the Brazilian authorities do not convince the Saudi Arabian authorities that its practices meet halal practices, unless we adapt our poultry slaughtering practices to conform with new practices eventually required by Saudi Arabia, we may not be able to sell the poultry produced by the system using electric currents to Saudi Arabia beginning in May 2018. There can be no assurance that we will able to promote such adaptation in a timely or cost-effective manner or at all, and any such adaptation may negatively affect our margins in sales to Saudi Arabia if we are not able to pass on these increased costs to our customers.

Raising animals and meat processing involve animal health and disease control risks, which could have an adverse impact on our results of operations and financial condition.

Our operations involve raising poultry and hogs and processing their meat, which require us to maintain certain standards of animal health and control disease. We could be required to destroy animals or suspend the sale or export of some of our products to customers in Brazil and abroad, in the event of an outbreak of disease affecting animals, such as the following: (1) in the case of hogs and certain other animals, foot-and-mouth disease and (H5N1) influenza (discussed below); and (2) in the case of poultry, avian influenza and Newcastle disease. In addition, if the Porcine Reproductive and Respiratory Syndrome and Porcine Epidemic Diarrhea, which have broken out in Europe and the United States, were to outbreak in Brazil, we could be required to destroy hogs, however currently there is no legislation supporting this action. Destruction of poultry, hogs or other animals would preclude recovery of costs incurred in raising or purchasing these animals and result in additional expense for the disposal of such animals and loss of inventory. An outbreak of foot-and-mouth disease could have an effect on livestock we own and the availability of livestock for purchase. Also, the global effects of avian influenza would impact consumer perception of certain protein products and our ability to access certain markets, which would adversely affect our results of operations and financial condition.

Outbreaks, or fears of outbreaks, of any animal diseases may lead to cancellation of orders by our customers and, particularly if the disease has the potential to affect humans, create adverse publicity that may have a material adverse effect on consumer demand for our products. Moreover, outbreaks of animal diseases in Brazil mayresult in foreign governmental action to close export markets to some or all of our products, which may result in the destruction of some or all of these animals. Our poultry business in Brazilian and export markets could also be negatively affected by avian influenza.

6

Table of Contents

Chicken and other birds in some countries, particularly in Asia but also in Europe, the Americas and Africa, have on occasion become infected by highly pathogenic avian influenza in recent years. In a small number of highly-publicized cases, the avian influenza has been transmitted from birds to humans, resulting in illness and, at times, death. Accordingly, health authorities in many countries have taken steps to prevent outbreaks of this viral disease, including destruction of afflicted poultry flocks.

During the last years, some human cases of avian influenza and related deaths were reported, according to the World Health Organization (“WHO”). The cases reported were caused by the H5N1 virus. In 2013, direct human-to-human transmission of the H7N9 virus was proven. Various countries in Asia, the Middle East and Africa reported human cases in the last five years and various European countries reported avian flu cases in poultry. In 2014, there were reports of human cases of avian influenza in Egypt, Indonesia, Cambodia, China and Vietnam. In the Americas, there were reports of human cases of avian influenza in both Canada and the United States. In early 2015, new cases of H5N1 and H5N2 reported in the United States resulted in restrictions on US exports. In 2016, new outbreaks occurred in bird populations across Northern Europe, including France, the Netherlands, Switzerland, Finland, and Germany. Middle Eastern and African countries also had outbreaks during 2016.

To date, Brazil has not had a documented case of avian influenza, although there are concerns that an outbreak of avian influenza may occur in the country in the future. Any outbreak of avian influenza in Brazil could lead to required destruction of our poultry flocks, which would result in decreased sales in the poultry industry, prevent recovery of costs incurred in raising or purchasing poultry, and result in additional expense for the disposal of destroyed poultry. In addition, any outbreak of avian influenza in Brazil would likely lead to immediate restrictions on the export of some of our products to key export markets. Preventive actions adopted by Brazilian authorities, if any, may not be effective in precluding the spread of avian influenza within Brazil. In early 2017, Chile, a neighboring country, confirmed the occurrence of avian influenza.

Whether or not an outbreak of avian influenza occurs in Brazil, further outbreaks of avian influenza anywhere in the world could have a negative impact on the consumption of poultry in our key export markets or in Brazil, and a significant outbreak would negatively affect our results of operation and financial condition. Any outbreak could lead to the imposition of costly preventive controls on poultry imports in our export markets. Accordingly, any spread of avian influenza, or increasing concerns about this disease, may have a material and adverse effect on our company.

Climate change may negatively affect our business and results of operations.

We consider the potential effects of climate change when evaluating and managing our operations and supply chain, recognizing the vulnerability of natural resources and agricultural inputs that are essential for our activities. The main risks we have identified relate to the alterations in temperature (average and extreme), changes in rainfall (average and extreme, such as drought, flooding and storms) and lack of water, which could affect agricultural productivity – grains in particular, animal wellbeing and the availability of energy and water. These changes could have a direct impact on our costs, raising the price of agricultural commodities as a result of long periods of drought or excessive rainfall, increasing operating costs to ensure animal wellbeing, increasing the risk of rationing and raising the price of electrical energy through water shortages and the need for other energy sources to supply the demand for electricity. We also consider potential regulatory changes and monitor trends in changes to licensing legislation for greenhouse gas emissions at the domestic and international levels.

Our operations are largely dependent on electricity, and energy-related expenses are one of our highest fixed costs. Energy costs have historically fluctuated significantly over time, and increases in energy costs could result in reduced profits. A significant interruption in energy supply or outright loss of energy at any of our facilities could result in a temporary disruption in production and delivery of products to customers and additional costs.

A significant portion of Brazil’s installed electric generation capacity is currently dependent upon hydroelectric generation facilities. Hydroelectric production is vulnerable to a variety of factors, includingprecipitation. If the amount of water available to energy producers becomes increasingly scarce due to drought or diversion for other uses, as has occurred in recent years, our energy expenses may increase. For example, following the 2015 drought conditions in the Southeast of Brazil, the availability of power generation from hydroelectric sources was reduced and as a result, our electricity expenses increased during the period.

7

Table of Contents

Among the initiatives we have taken to reduce our exposure to climate change and to maintain our competitiveness in terms of costs is the monitoring of stocks in grains purchases and the constant monitoring of the weather in agricultural regions to guide buying decisions, as well as anticipating price movements in the commodity markets. We also undertake projects to develop more efficient processes that consume less energy. Other initiatives include technological innovations in the animal-raising installations to improve the environment and acclimatization and safeguard the animal’s welfare. We may fail to continue to implement programs to mitigate effects of climate change, which may affect our business and results of operations in the future.

Any shortage or lack of water could materially adversely affect our business and results of operations.

A study conducted by the Food and Agriculture Organization indicates that, in the next two decades, the demand for water will increase 50% on a global scale. In connection with that, it is estimated that by 2025, 1.8 billion people will live in places with absolute shortage of water and two thirds of the global population will live in water-stressed places. By 2050, the demand for water will jump 55%, according to the Food and Agriculture Organization, on a global scale, including some of our key markets, such as North Africa and the Middle East. Water is an essential input for our businesses, being present from the production of grains and inputs, the agricultural chain through our production processes. As a result, the shortage or lack of water represents a critical risk for our business. On the other hand, we are aware that the industrial use of water may adversely affect its availability. Although Brazil holds nearly a fifth of the world’s water reserves, the World Economic Forum warns, year-by-year, that water crises is one of the most relevant Global Risk.

In order to mitigate these risks, we developed a methodology to evaluate water-related risks in the locations where we have operations in order to understand the specific impacts of our company and others in those regions and, consequently, reduce our water consumption and exposure to water supply risks in each location. It is an initiative regarding water-related risks through which we can assess internal and external aspects impacting water supply and quality and generate a score for each unit. The objective is to carry out internal and external actions to reduce consumption and comply with applicable rules in order to minimize our impact on the environment and the community. We analyzed the micro and macro watersheds composing the region, as well as the industrial activities and characteristics of the use of water resources, in order to understand the local demand growth, anticipating risks. Although we use a methodology developed by us to evaluate water-related risks in our areas of operation, this methodology may fail to accurately assess the water supply or anticipate water-related risks. This could result in us or our key suppliers encountering water shortages. In addition, the increased industrial use of water by water intensive business may also adversely affect the continuing availability and quality of water in Brazil. Whether unexpected or expected, the shortage or lack of water could materially adversely affect our business and results of operations.

We have a governance structure and compliance processes designed to promote our compliance with law, positive image and reputation in the marketplace, but they may fail to ensure compliance with relevant anti-fraud, anti-corruption, anti-bribery, anti-money laundering and other international trade laws and regulations.

We have a framework of antifraud initiatives - including anti-bribery and anti-corruption - that supports all business segments and their commercial standards worldwide. However, we may not be able to mitigate all fraud risk entirely. Any negative reflection on our image or our brand from these or other activities could have a negative impact on our results of operations, as well as our ability to achieve our growth strategy.

We are subject to anti-fraud, anticorruption, anti-bribery, anti-money laundering and other international trade laws and regulations. We are required to comply with the laws and regulations of Brazil and various jurisdictions where we conduct operations. In particular, we are subject to the Brazilian Anti-Corruption Law nº 12,846, the U.S. Foreign Corrupt Practices Act of 1977 (“FCPA”), the United Kingdom Bribery Act of 2010, as well as economic sanction programs, including those administered by the United Nations, the European Union and the United States, including the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”). The FCPAprohibits providing anything of value to foreign officials for the purposes of obtaining or retaining business or securing any improper business advantage. As part of our business, we may deal with entities and employees that are considered foreign officials for purposes of the FCPA. In addition, economic sanctions programs restrict our dealings with certain sanctioned countries, individuals and entities.

8

Table of Contents

Although we have internal policies and procedures designed to ensure compliance with applicable anti-fraud, anti-bribery and anti-corruption laws and sanctions regulations, potential violations of anti-fraud and anticorruption laws have been identified on occasion as part of our compliance and internal control processes. In addition, we were recently notified of allegations involving potential misconduct by some of our employees in the context of theCarne Fraca Operation. For more details, see “Item 8. Financial Information – B. Significant Changes –Carne Fraca Operation.” As a result of theCarne Fraca Operation and related consequences, we incurred in expenses and recorded provisions for losses in inventories in the total amount of R$363.4 million in 2017, which significantly impacted our results of operations.

When allegations of non-compliance with applicable anti-fraud, anti-bribery and anti-corruption laws and sanctions regulations arise, we attempt to act promptly to learn relevant facts, conduct appropriate due diligence, and take any appropriate remedial action to address the risk. Given the size of our operations and the complexity of the production chain, there can be no assurance our internal policies and procedures will be sufficient to prevent or detect all inappropriate or unlawful practices, fraud or violations of law or our internal policies and procedures by our employees, directors, officers, partners, or any third-party agents and service providers or that such persons will not take actions in violation of our policies and procedures (or otherwise in violation of the relevant anti-fraud, anti-corruption laws and sanctions regulations) for which we or they may be ultimately held responsible. Violations of anti-fraud, anti-bribery and anti-corruption laws and sanctions regulations could have a material adverse effect on our business, reputation, brand, selling prices, results of operations and financial condition, including as a result of the closure of international markets. We may be subject to one or more enforcement actions, investigations and proceedings by authorities for alleged infringements of these laws. These proceedings may result in penalties, fines, sanctions or other forms of liability. Potential bad developments in theCarne Fraca Operation may also negatively affect the market price of our common shares and ADRs.

Failure to maintain adequate internal controls could adversely affect our reputation and business.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting that provide reasonable assurance of the reliability of the preparation and reporting of our financial statements for external use. Inadequate internal controls may result in our failure to meet public reporting requirements accurately and on a timely basis and harm our reputation. The inherent limitations of internal controls over financial reporting may not prevent or detect all misstatements or fraud, regardless of the adequacy of those controls, and, therefore, we cannot assure that material weaknesses will not be identified in the future.

Our failure to continually innovate and successfully launch new products that address our clients’ needs and requirements, as well as maintain our brand image, could adversely impact our operating results.

Our financial success depends on our ability to anticipate changes in consumer preferences and dietary habits and our ability to successfully develop and launch new products and product variations that are desirable to consumers. We devote significant resources to new product development and product extensions; however, we may not be successful in developing innovative new products or our new products may not be commercially successful. For example, trends towards prioritizing health and wellness present a challenge for developing and marketing successful new lines of products to address these consumer preferences. To the extent that we are not able to effectively gauge the direction of our key markets and successfully identify, develop, manufacture and market new or improved products in these changing markets, in a timely or cost-effective manner, our products, brands, our financial results and our competitive position may suffer, which could have a material adverse effect on our business, results of operations, financial condition and prospects.

We also seek to maintain and extend the image of our brands through marketing, including advertising, consumer promotions and trade spending. Due to inherent risks in the marketplace associated with advertising, promotions and new product introductions, including uncertainties about trade and consumer acceptance, our marketing investments may not prove successful in maintaining or increasing our market share. Continuing globalfocus on health and wellness, including weight management, increasing media attention to the role of food marketing and bad press about our quality controls and products, including in connection with theCarne FracaOperation andTrapaça Operation, could adversely affect our brand image or lead to stricter regulations and greater scrutiny of food marketing practices.

9

Table of Contents

Our success in maintaining, extending and expanding our brand image also depends on our ability to adapt to a rapidly changing media environment, including increasing reliance on social media and online dissemination of advertising campaigns. The growing use of social and digital media increases the speed and extent that information or misinformation and opinions can be shared.

Negative posts or comments about us, our brands or our products on social or digital media could seriously damage our reputation and brand image. If we do not maintain or improve our brand image, then our product sales, financial condition and results of operations could be materially and adversely affected.

Recent and future acquisitions or joint ventures may divert management resources or prove to be disruptive to our company.

We regularly review and pursue opportunities for strategic growth through acquisitions, joint ventures and other initiatives. We have completed several acquisitions in recent years, such as Golden Foods Siam (“GFS”) in Thailand, Campo Austral and Calchaqui in Argentina, Universal Meats (UK) Ltd. (“Universal Meats”) in the United Kingdom, Al Khan Foodstuff LLC (“AFK”) in Oman, and the Qatar National Import and Export Co. (“QNIE”) frozen distribution business in Qatar. We entered into in September 2016 a subscription and purchase agreement for the acquisition of 70% of FFM Further Processing SDN BHD, a food processing company incorporated under the laws of Malaysia. This transaction was completed on October 4, 2016. Additionally, we concluded the acquisition of Banvit Bandirma Vitamili Yem Sanayii A.S. (“Banvit”),the largest poultry producer in Turkey, in May 2017. For more details on certain of these transactions, see “Item 4. Information on the Company—A. History and Development of the Company.” Acquisitions, new businesses and joint ventures, especially involving sizeable enterprises, may present financial, managerial, operational and compliance risks and uncertainties, including:

· challenges in realizing the anticipated benefits of the transaction;

· diversion of management attention from existing businesses;

· difficulty with integrating personnel, especially to different managerial practices;

· disruptions when integrating financial, technological and other systems;

· difficulty identifying suitable candidate businesses or consummating a transaction on terms that are favorable to us;

· challenges in retaining an acquired company’s customers and key employees;

· increased compensation expenses for newly-hired employees;

· exposure to unforeseen liabilities or problems of the acquired companies or joint ventures;

· warranty claims and claims for damages which may be limited in content, timeframe and amount;

· challenges arising from a lack of familiarity with new markets with differing commercial and social norms and customs, which may adversely impact our strategic goals or require us to adapt our marketing and sales model for specific countries;

· compliance with foreign legal and regulatory systems; and

10

Table of Contents

· difficulties in transferring capital to new jurisdictions.

Acquisitions outside of Brazil may present additional difficulties and new political and countries risks, such as compliance with foreign legal and regulatory systems, difficulties to transfer capital, integration of personnel to different managerial practices and would increase our exposure to risks associated with international operations.

We may be unable to realize synergies and efficiency gains from our recent acquisitions in the timeframe we anticipate or at all, because of integration or other challenges. In addition, we may be unable to identify, negotiate or finance future acquisitions or other strategic initiatives particularly as part of our international growth strategy, successfully or at favorable terms, or to effectively integrate these acquisitions or joint venture businesses with our current businesses. Any future joint ventures or acquisitions of businesses, technologies, services or products might require us to obtain additional equity or debt financing, which may not be available on favorable terms, or at all. Future acquisitions and joint ventures may also result in unforeseen operating difficulties and expenditures, as well as strain on our organizational culture.

Political and economic risks in regions and countries where we have exposure could limit the profitability of our operations and our ability to execute our strategy in these regions.

Since we have expanded our operations around the world, we are subject to a variety of situations that may adversely affect our financial results. In the regions where we have production and distribution activities, we are subject, among others, to the following risks:

· governmental inertia;

· geopolitical risk and conflicts (including war, terrorism and civil unrest);

· imposition of exchange or price controls;

· imposition of restrictions on exports of our products or imports of raw materials necessary for our production (including embargos from countries where we have production and/or distribution activities);

· fluctuation of local currencies against the real;

· nationalization of our property;

· increase in export tax and income tax rates for our products; and

· unilateral (governmental) institutional and contractual changes, including controls on investments and limitations on new projects.

As a result of these factors, our results of operations and financial condition in the regions where we have production and distribution activities may be adversely affected, and we may experience in the future significant variability in our revenue on both an annual and a quarterly basis from those operations. For instance, it is unclear to us if the recent diplomatic crisis between Qatar and other Arab countries may lead to measures (such as trade embargo) that could ultimately impact our current operations in Qatar and in the region. The impact of these changes on our ability to deliver on our planned projects and execute our strategy cannot be ascertained with any degree of certainty, and these changes may, therefore, have an adverse effect on our operations and financial results.

Deterioration of general economic and political conditions could negatively impact our business.

Our business may be adversely affected by changes in Brazilian and global economic and political conditions, which may result in increased volatility in our markets and contribute to net losses.

11

Table of Contents

Brazilian economy is expected to recover more consistently in 2018, resuming gross domestic product (“GDP”) growth and creating more jobs. However, there are a few political risks: (1) presidential elections and (2) structural reforms. Both factors will bring high volatility to the domestic financial markets in the short term, and might hinder economic recovery in a longer term. In this scenario, improvement of the labor market and income growth may be limited, which could disfavor a substantial improvement of consumption. Other factors that may harm our business is the unfolding of theCarne Fraca Operation, which impacted the credibility of the whole sector and led some importers to ban specific slaughterhouses, of which a few remain banned until the present time, and also of the unfolding of theTrapaça Operation. As a result, exported volume declined and will be reallocated in other destinations.

Furthermore, on June 23, 2016, the United Kingdom held an in-or-out referendum on the United Kingdom’s membership within the European Union, the result of which favored the exit of the United Kingdom from the European Union, or “Brexit.” A process of negotiation will determine the future terms of the United Kingdom’s relationship with the European Union. The potential impact of Brexit on our market share, sales, profitability and results of operations is unclear. Depending on the terms of Brexit, economic conditions in the United Kingdom, the European Union and global markets may be adversely affected by reduced growth and volatility. The uncertainty before, during and after the period of negotiation could also have a negative economic impact and increase volatility in the markets, particularly in the Eurozone.

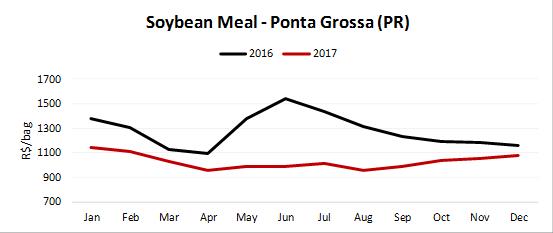

Our results of operations are subject to cyclicality and volatility affecting both our raw material prices and our selling prices.

Our business is largely dependent on the cost and supply of corn, soy meal, soybeans, hogs and other raw materials, as well as the selling prices of our poultry and pork. These prices are determined by supply and demand, which may fluctuate significantly, and other factors over which we have little or no control. These other factors include, among others, fluctuations in local and global poultry and hog production levels, environmental and conservation regulations, economic conditions, weather, animal and crop diseases, cost of international freight and exchange rate and interest rate fluctuations.

Our industry, both in Brazil and abroad, is generally characterized by cyclical periods of higher prices and profitability, followed by overproduction, leading to periods of lower prices and profitability. We are not able to mitigate these risks entirely.

Natural disasters, pandemics or extreme weather, including floods, excessive cold or heat, hurricanes or other storms, as well as any interruption we can observe in our plants that may require the temporary re-allocation of plant functions to other facilities could impair the health or growth of livestock or interfere with our operations due to power outages, damage to our production and processing facilities or disruption in transportation channels or information systems, among other issues.

Our international sales are subject to a broad range of risks associated with international operations.

International sales account for a significant portion of our net sales in line with our global strategy, representing 50.2% in 2015, 52.3% in 2016 and 51.0% in 2017. Our major international markets include the Middle East (particularly Saudi Arabia), Asia (particularly Japan, Hong Kong, Singapore and China), Europe, Eurasia (particularly Russia) Africa and Americas (particularly Argentina), where we are subject to many of the same risks described below in relation to Brazil. Our future financial performance will depend, to a significant extent, on the economic, political and social conditions in our main export markets.

Our future ability to conduct business in our export markets could be adversely affected by factors beyond our control, such as the following:

· exchange rate and interest rate fluctuations;

· commodities price volatility;

12

Table of Contents

· deterioration in international economic conditions;

· political risks, such as turmoil, government policies, difficulties to transfer capital and political instability;

· decreases in demand, particularly from large markets such as China;

· imposition of increased tariffs, anti-dumping duties or other trade barriers;

· strikes or other events affecting ports and other transport facilities;

· compliance with differing foreign legal and regulatory regimes;

· strikes, not only of our employees, but also of port employees, truck drivers, customs agents, sanitary inspection agents and other government agents at the Brazilian ports from which we export our products;

· sabotage affecting our products; and

· bad press related to the Brazilian meat processing industry, including in connection with theCarne Fraca Operation andTrapaça Operation.

The market dynamics of our important export markets can change quickly and unpredictably due to these factors, the imposition of trade barriers of the type described above and other factors, which together can significantly affect our export volumes, selling prices and results of operations.

Any of these risks could adversely affect our business and results of operations. In addition, flooding and similar events affecting the infrastructure necessary for the export of our products could adversely affect our revenues and results of operations.

We face significant competition from Brazilian and foreign producers, which could adversely affect our financial performance.

We face strong competition from other Brazilian producers in our domestic market and from Brazilian and foreign producers in our international markets. The Brazilian market for whole poultry, poultry and pork cuts is highly fragmented. Small producers can also be important competitors, some of which operate in the informal economy and are able to offer lower prices by meeting lower quality standards. Competition from small producers is a primary reason why we sell most of our frozen (in natura) meat products in the export markets and is a barrier to expanding our sales of those products in the domestic market. With respect to exports, we compete with other large, vertically integrated Brazilian producers that have the ability to produce quality products at low cost, as well as with foreign producers.

In addition, the potential growth of the Brazilian market for processed food, poultry, pork and beef and Brazil’s low production costs are attractive to international competitors. Although the main barrier to these companies has been the need to build a comprehensive distribution network and a network of outgrowers, international competitors with significant resources could undertake to build these networks or acquire and expand existing networks.

The Brazilian poultry and pork cuts markets, in particular, are highly price-competitive and sensitive to product substitution. Even if we remain a low-cost producer, customers may seek to diversify their sources of supply by purchasing a portion of the products they need from producers in other countries, as some of our customers in key export markets have begun to do. We expect that we will continue to face strong competition in all of our markets and anticipate that existing or new competitors may broaden their product lines and extend their geographic scope. Any failure by us to respond to product, pricing and other moves by competitors may negatively affect our financial performance.

13

Table of Contents

Increased regulation of food safety and animal welfare could increase our costs and adversely affect our results of operations.

Our manufacturing facilities and products are subject to governmental inspections and extensive regulation in the food safety area, including governmental food processing controls in all countries in which we operate, including internationally and in Brazil. We already incur significant costs in connection with the compliance with applicable rules. Changes in government regulations relating to food safety or animal welfare could require us to make additional investments or incur additional costs to meet the necessary specifications for our products. Our products are often inspected outside of Brazil by foreign food safety officials, and any failure to pass those inspections can result in us being required to return all or part of a shipment to Brazil, recall certain products, destroy all or part of a shipment or incur costs because of delays in delivering products to our customers. Any tightening of food safety or animal welfare regulations could result in increased costs and could have a material adverse effect on our business and results of operations, financial condition and prospects. In addition, we adopt worldwide animal welfare practices to serve our clients even though Brazil has limited regulations regarding animal welfare.

Our performance depends on favorable labor relations with our employees and our compliance with labor laws. Any deterioration of those relations or increase in labor costs could adversely affect our business.

As of December 31, 2017, we had approximately 108,234 employees worldwide. All of our production employees, in Brazil and in countries where there is a labor union force, are represented by labor unions. Upon the expiration of existing collective bargaining agreements or other collective labor agreements, we may not reach new agreements without union action and any such agreements may not be on terms satisfactory to us, which could result in us paying higher wages or benefits to union workers. If we are unable to negotiate acceptable union agreements, we may become subject to work stoppages or strikes.

Labor costs are among our most significant expenditures. Such costs represented approximately 14.8% of our cost of sales in 2017, increasing 0.8 percentage points compared to 2016, especially due to the consolidation of Banvit in our results of operations. In the event of an employee contractual structure review, additional operational expenses could be incurred. Additionally, during our normal business operation, we outsource some of our labor force, therefore being subject to the contingencies that may arise from this relationship. These contingencies may involve claims directly against us as if we were the direct employer of those outsourced workers or claims seeking our subsidiary liability. In the event that a significant amount of these contingencies materializes in an unfavorable outcome against us, we may be held liable for amounts higher than our provisions, which may have a material adverse effect on our business, financial and operational condition and results of operations. In addition, if the outsourced activities are deemed by the authorities to be core activities, outsourcing may be considered illegal and the outsourced workers may be considered our employees, which would result in a significant increase in our costs and could subject us to administrative and judicial procedures by the relevant authorities and fines. We are also subject to increases in our labor costs due to Brazilian inflation and increases in health insurance. Material increases in our labor costs could have a material adverse effect on our business, results of operations and financial condition and prospects.

Environmental laws and regulations require increasing expenditures for compliance.

We, like other Brazilian food producers, are subject to extensive Brazilian federal, state and local environmental laws, regulations, authorizations and licenses concerning, among other things, the interference with protected areas (conservation units, archeological areas and permanent preservation areas), handling and disposal of waste, discharges of pollutants into the air, water and soil, atmospheric emissions, noise and clean-up of contamination, all of which affect our business. Water management is especially crucial, posing many challenges to our operations. In Brazil, water use regulations impact farming operations, industrial production and hydroelectric power. Any failure to comply with any of these laws and regulations or any lack of authorizations or licenses could result in administrative and criminal penalties, such as fines, cancellation of authorizations or revocation of licenses, in addition to negative publicity and civil liability for remediation or compensation for environmental damage without any caps. We cannot operate a plant if the required environmental permit is not valid or updated. Civil penalties may include summons, fines, temporary or permanent bans, the suspension of subsidies by public bodies and the temporary or permanent shutdown of commercial activities. Criminal penalties include fines, temporaryinterdiction of rights and prison (for individual offenders) and liquidation, temporary interdiction of rights, fines and community services (for legal entities).

14

Table of Contents

Furthermore, pursuant to Brazilian environmental legislation, the corporate entity of a company will be disregarded (such that the owners of the company will be liable for its debts) if necessary to guarantee the payment of costs related to the recovery of environmental damages, whenever the legal entity is deemed by a court to be an obstacle to reimbursement of damages caused to the quality of the environment.

We have incurred, and will continue to incur, capital and operating expenditures to comply with these laws and regulations. Because of the possibility of unanticipated regulatory measures or other developments, particularly as environmental laws become more stringent in Brazil, the amount and timing of future expenditures required to maintain compliance could increase from current levels and could adversely affect the availability of funds for capital expenditures and other purposes. Compliance with existing or new environmental laws and regulations, as well as obligations in agreements with public entities, could result in increased costs and expenses.

Our plants are subject to environmental and operational licensing, based on their pollution potential and usage of natural resources. If, for example, one of our plants is built or expanded without an environmental license or if our environmental licenses expire, are not timely renewed or have their request of renewal dismissed by the competent environmental authority, we may incur fines and other administrative penalties, such as suspension of operations or closing of the facilities in question. Those same penalties may also be applicable in the case of failure to fulfill the conditions of validity foreseen in the environmental licenses already held by us. Currently, some of our environmental licenses are in the renewal process, and we cannot guarantee that environmental agencies will approve our renewal requests within the required legal period. Brazilian Complementary Law No. 140/2011 establishes that renewal of environmental licenses must be requested at least 120 days in advance of its expiration, so that the license may be automatically extended until a final decision from the environmental authority is reached. In the interim, we are permitted to continue operations under the respective license, during the renewal process. In addition, if since the issuance of a license under renewal there have been regulatory changes in the environmental standards that the plant is required to meet, the environmental agency may condition the renewal upon expensive facility upgrades, which might result in delays or disruptions, or, in the worst-case scenario, result in a denial of the license.

We are also subject to similar environmental laws and restrictions in all jurisdictions where we have plants and operations.

Unfavorable outcomes in legal proceedings may reduce our liquidity and negatively affect us.

We are defendants in civil, labor and tax proceedings and are also subject to consent agreements (Termo de Ajustamento de Conduta, or “TAC”). Under IFRS, we classify the risk of adverse results in legal proceedings as “remote,” “possible” or “probable.” We disclose the aggregate amounts of these proceedings that we have judged possible or probable, to the extent the amounts are known or reasonably estimable, and we record provisions only for losses that we consider probable. See “Item 8. Financial Information—Legal Proceedings” and Note 26 of our consolidated financial statements.

We are not required to record provisions for proceedings in which our management judges the risk of loss to be possible or remote. However, the amounts involved in some of these proceedings are substantial, and eventual losses on them could be significantly high. Even for the amounts recorded as provisions for probable losses, a judgment against us would have an impact on our cash flow if we were required to pay those amounts and the eventual losses could be higher than the provisions we have recorded. Unfavorable decisions in our legal proceedings may, therefore, reduce our liquidity and have a material adverse impact on our business, results of operations, financial condition and prospects.

With regard to tax contingencies, we are currently defendants in a number of cases, which include, for example, disputes about the offset of tax credits and the use of tax incentives in several states that have not yet reached a final ruling at Brazilian courts. In addition, we may face risks arising from potential impairment of input state VAT that we accumulate on exportations. We have a case involving Tax on the Circulation of Merchandise and Services (Imposto Sobre a Circulação de Mercadorias e Serviços, or “ICMS”) on sales of staple foods (cestabásica) on which the Supreme Court of Brazil has ruled against us. The case is currently pending judgment of a last appeal and, if the final decision is upheld against some or all of BRF’s operations, it could have a significant impact on our liquidity and financial results. See “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Legal Proceedings—Tax Proceedings.”

15

Table of Contents

As of December 31, 2017, we had R$1,773.2 million in provisions for contingencies, of which R$407.5 million was for civil contingencies, R$303.4 million was for tax contingencies, R$691.7 million was for labor contingencies and R$370.6 million was for contingent liabilities.

We are also currently being investigated in theCarne Fraca Operation andTrapaça Operation, which may result in penalties, fines and sanctions from governmental authorities or other forms of liability. For more information about the “Carne Fraca Operation” and “Trapaça Operation” see “Item 8. Financial Information—B. Significant Changes—Carne Fraca Operation” and “Item 8. Financial Information—B. Significant Changes— Trapaça Operation.” Any investigation from governmental authorities currently unknown to us with respect to any arguably unlawful business practice may also result in penalties, fines and sanctions or other forms of liability.

On March 12, 2018, a purported shareholder class action lawsuit was filed in the U.S. Federal District Court in the Southern District of New York alleging, among other things, that BRF and certain of its officers and/or directors engaged in securities fraud or other unlawful business practices related to the regulatory issues described above. Because this lawsuit is in its early stage, the possible loss or range of losses, if any, arising from this litigation cannot be estimated. While we believe that the claims against us are without merit and will continue to defend against the litigation vigorously, in the event that this litigation is decided against us, or we enter into an agreement to settle, there can be no assurance that an unfavorable outcome would not have a material impact on us.

Our inability or failure to protect our intellectual property and any intellectual property infringement against us could have a negative impact on our operating results.

Our ability to compete effectively depends in part on our rights to trademarks, logos and other intellectual property rights we own or license. We have not sought to register or protect every one of our trademarks in every country in which they are or may be used, which means that third parties may be able to limit or challenge our trademark rights there. Furthermore, because of the differences in foreign intellectual property or proprietary rights laws, we may not receive the same level of legal protection in every country in which we operate. Litigation may be necessary to enforce our intellectual property rights, and if we do not prevail, we could suffer a material adverse impact on our business, goodwill, financial position, results of operations and cash flows. Further, third parties may allege that our intellectual property and/or business activities infringe their own intellectual property or proprietary rights, and any litigation in this regard would be costly, regardless of the merits. If we are unsuccessful in defending any such third-party claims, or to settle such claims, we could be required to pay damages and/or enter into license agreements, which might not be available under favorable terms. We may also be forced to rebrand or redesign our products to avoid the infringement, which could result in significant costs in certain markets. If we are found to infringe any third party’s intellectual property, we could suffer a material adverse impact on our reputation, business, financial position, results of operations and cash flows.

Damages not covered by our insurance policies might result in losses for us, which could have an adverse effect on our business.

Certain kinds of losses cannot be insured against via third-party insurance, and our insurance policies are subject to liability limits and exclusions. For example, ammonia leakage, natural disasters or other catastrophic events may cause damage or disruption to our operations, international commerce and the global economy, and thus could have a material adverse effect on us. Additionally, we are exposed to certain product quality risks, such as criminal contamination, bird flu and salmonella that can impact our operations and which are not covered under insurance. If an event that cannot be insured occurs, or the damages are higher than our policy limits, we may incur significant costs. In addition, we could be required to pay indemnification to parties affected by such an event. In addition, even where we incur losses that are ultimately covered by insurance, we may incur additional expenses to mitigate the loss, such as shifting production to different facilities. These costs may not be fully covered by our insurance.

16

Table of Contents

From time to time, our installations may be affected by fires as was the case with our Toledo/PR unit in 2014 and other units in 2016, such as Chapecó/SC and Paranaguá/PR, and more recently in Lajeado/RS in 2017, besides electrical damages or explosion in substations, or widespread truck driver strikes. Although our business interruption insurance covers certain losses in connection with disruptions to our operations, all of our direct and indirect costs and intangible costs may not be covered by our insurance. Any similar event at these or other facilities in the future could have a material adverse impact on our business, results of operations, financial condition and prospects

Significant changes to the board composition may result in significant changes to our business strategy.