(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Index |

|

Identification |

|

|

|

|

|

|

|

|

Capital Stock Breakdown |

|

|

|

|

|

| 1 | |

Individual Financial Statements |

|

|

|

|

|

| ||

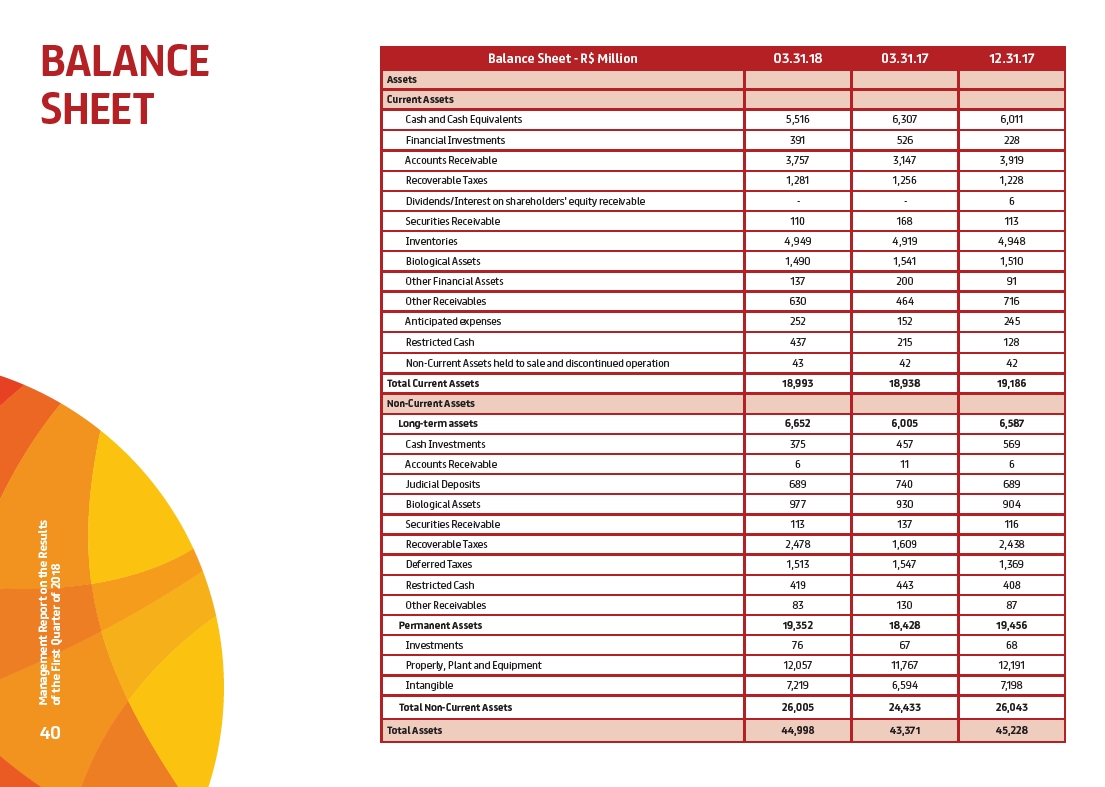

Balance Sheet Assets |

|

|

|

|

|

| 2 | |

Balance Sheet Liabilities |

|

|

|

|

|

| 3 | |

Statement of Income |

|

|

|

|

|

| 5 | |

Statement of Comprehensive Income |

|

|

|

| 6 | |||

Statement of Cash Flows |

|

|

|

|

|

| 7 | |

Statement of Changes in Shareholders' Equity |

|

|

|

| ||||

Statement of Changes in Shareholders' Equity - from 01/01/2018 to 03/31/2018 | 8 | |||||||

Statement of Changes in Shareholders' Equity - from 01/01/2017 to 03/31/2017 | 9 | |||||||

Statement of Added Value |

|

|

|

|

|

| 10 | |

Consolidated Financial Statements |

|

|

|

|

| |||

Balance Sheet Assets |

|

|

|

|

|

| 11 | |

Balance Sheet Liabilities |

|

|

|

|

|

| 12 | |

Statement of Income |

|

|

|

|

|

| 13 | |

Statement of Comprehensive Income |

|

|

|

| 14 | |||

Statement of Cash Flows |

|

|

|

|

|

| 15 | |

Statement of Changes in Shareholders' Equity |

|

|

|

| ||||

Statement of Changes in Shareholders' Equity - from 01/01/2018 to 03/31/2018 | 16 | |||||||

Statement of Changes in Shareholders' Equity - from 01/01/2017 to 03/31/2017 | 17 | |||||||

Statement of Added Value |

|

|

|

|

|

| 18 | |

Management Report |

|

|

|

|

|

| 19 | |

Explanatory Notes |

|

|

|

|

|

|

| 60 |

Breakdown of the Capital by Owner |

|

|

|

|

| 132 | ||

Declarations and Opinion |

|

|

|

|

|

| ||

Independent Auditors' Report on Review of Quartely Financial Information |

| 133 | ||||||

Opinion of the Audit Commitee |

|

|

|

|

| 135 | ||

Statement of Executive Board on the Quartely Financial Information and Independent Auditor's Report on Review of Interim Financial Information | 136 | |||||||

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A. Identification / Capital Stock Breakdown |

|

Number of shares | Current Quarter |

(Units) | 03.31.18 |

Paid-in Capital | |

Common | 812,473,246 |

Preferred | - |

Total | 812,473,246 |

| |

Treasury Shares |

|

Common | 1,333,701 |

Preferred | - |

Total | 1,333,701 |

1

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Individual FS / Balance Sheet Assets (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Current Quarter |

| Previous Year |

1 | Total Assets | 37,325,846 | 39,983,749 | |

1.01 | Current Assets | 14,493,048 | 17,371,001 | |

1.01.01 | Cash and Cash Equivalents | 1,825,671 | 3,584,701 | |

1.01.02 | Marketable Securities | 155,475 | 166,322 | |

1.01.02.01 | Financial Investments Evaluated at Fair Value | 155,475 | 166,322 | |

1.01.02.01.01 | Held for Trading | 155,475 | 166,322 | |

1.01.03 | Trade Accounts Receivable | 5,948,177 | 7,433,022 | |

1.01.03.01 | Trade Accounts Receivable | 5,840,917 | 7,325,588 | |

1.01.03.02 | Other Receivables | 107,260 | 107,434 | |

1.01.04 | Inventories | 2,828,567 | 2,817,784 | |

1.01.05 | Biological Assets | 1,270,330 | 1,261,556 | |

1.01.06 | Recoverable Taxes | 829,916 | 842,034 | |

1.01.06.01 | Current Recoverable Taxes | 829,916 | 842,034 | |

1.01.06.01.01 | Income and social contribution tax (IR/CS) | 392,330 | 373,319 | |

1.01.06.01.03 | Recoverable Taxes | 464,328 | 488,454 | |

1.01.06.01.04 | Provision for losses | (26,742) | (19,739) | |

1.01.08 | Other Current Assets | 1,634,912 | 1,265,582 | |

1.01.08.03 | Other | 1,634,912 | 1,265,582 | |

1.01.08.03.01 | Interest on Shareholders' Equity Receivable | 1,163 | 7,352 | |

1.01.08.03.02 | Derivatives | 121,552 | 49,132 | |

1.01.08.03.04 | Accounts Receivable from Disposal of Equity Interest | - | 28,897 | |

1.01.08.03.06 | Restricted Cash | 416,988 | 108,795 | |

1.01.08.03.10 | Other | 1,095,209 | 1,071,406 | |

1.02 | Non-current Assets | 22,832,798 | 22,612,748 | |

1.02.01 | Non-current Assets | 5,547,926 | 5,523,188 | |

1.02.01.01 | Financial Investments Evaluated at Fair Value | 196,820 | 276,900 | |

1.02.01.01.02 | Available for Sale | 196,820 | 276,900 | |

1.02.01.02 | Marketable Securities Valued at Amortized Cost | 83,731 | 82,418 | |

1.02.01.02.01 | Held to Maturity | 83,731 | 82,418 | |

1.02.01.03 | Trade Accounts Receivable | 118,095 | 121,749 | |

1.02.01.03.01 | Trade Accounts Receivable | 5,667 | 5,944 | |

1.02.01.03.02 | Other Receivables | 112,428 | 115,805 | |

1.02.01.05 | Biological Assets | 781,160 | 773,560 | |

1.02.01.06 | Deferred Taxes | 957,371 | 883,953 | |

1.02.01.06.01 | Deferred Income Tax and Social Contribution | 957,371 | 883,953 | |

1.02.01.09 | Other Non-current Assets | 3,410,749 | 3,384,608 | |

1.02.01.09.03 | Judicial Deposits | 674,627 | 676,732 | |

1.02.01.09.05 | Income and social contribution tax (IR/CS) | 15,794 | 15,794 | |

1.02.01.09.06 | Provision for losses from Income and social contribution tax (IR/CS) | (8,985) | (8,985) | |

1.02.01.09.07 | Recoverable Taxes | 2,358,551 | 2,344,830 | |

1.02.01.09.08 | Provision for losses | (112,445) | (118,684) | |

1.02.01.09.10 | Restricted Cash | 418,564 | 407,803 | |

1.02.01.09.11 | Other | 64,643 | 67,118 | |

1.02.02 | Investments | 5,178,494 | 4,960,752 | |

1.02.02.01 | Investments | 5,178,494 | 4,960,752 | |

1.02.02.01.01 | Equity in Associates | 12,569 | 7,551 | |

1.02.02.01.02 | Interest on Wholly-owned Subsidiaries | 5,164,818 | 4,952,093 | |

1.02.02.01.04 | Other | 1,107 | 1,108 | |

1.02.03 | Property, Plant and Equipment, Net | 9,101,053 | 9,189,492 | |

1.02.03.01 | Property, Plant and Equipment in Operation | 8,542,925 | 8,611,605 | |

1.02.03.02 | Property, Plant and Equipment Leased | 233,843 | 220,690 | |

1.02.03.03 | Property, Plant and Equipment in Progress | 324,285 | 357,197 | |

1.02.04 | Intangible | 3,005,325 | 2,939,316 | |

1.02.04.01 | Intangible | 3,005,325 | 2,939,316 | |

1.02.04.01.02 | Software | 211,277 | 188,615 | |

1.02.04.01.03 | Trademarks | 1,173,000 | 1,173,000 | |

1.02.04.01.04 | Goodwill | 1,542,929 | 1,542,929 | |

1.02.04.01.05 | Software Leased | 43,984 | 12,505 | |

1.02.04.01.08 | Other | 34,135 | 22,267 |

See accompanying notes to the consolidated financial statements.

2

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Individual FS / Balance Sheet Liabilities (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Current Quarter |

| Previous Year |

2 | Total Liabilities | 37,325,846 |

| 39,983,749 |

2.01 | Current Liabilities | 14,691,567 | 14,391,025 | |

2.01.01 | Social and Labor Obligations | 195,859 | 205,513 | |

2.01.01.01 | Social Obligations | 120,302 | 118,905 | |

2.01.01.02 | Labor Obligations | 75,557 | 86,608 | |

2.01.02 | Trade Accounts Payable | 4,912,881 | 5,284,296 | |

2.01.02.01 | Domestic Suppliers | 4,073,591 | 4,503,627 | |

2.01.02.01.01 | Domestic Suppliers | 3,653,796 |

| 4,026,929 |

2.01.02.01.02 | Supply Chain Finance | 419,795 |

| 476,698 |

2.01.02.02 | Foreign Suppliers | 839,290 | 780,669 | |

2.01.02.02.01 | Foreign Suppliers | 658,390 |

| 608,453 |

2.01.02.02.02 | Supply Chain Finance | 180,900 |

| 172,216 |

2.01.03 | Tax Obligations | 204,060 | 228,962 | |

2.01.03.01 | Federal Tax Obligations | 37,909 | 50,215 | |

2.01.03.01.02 | Other Federal | 37,909 | 50,215 | |

2.01.03.02 | State Tax Obligations | 164,166 | 176,461 | |

2.01.03.03 | Municipal Tax Obligations | 1,985 | 2,286 | |

2.01.04 | Short Term Debts | 6,788,142 | 4,038,367 | |

2.01.04.01 | Short Term Debts | 6,788,142 | 4,038,367 | |

2.01.04.01.01 | Local Currency | 6,075,916 | 3,401,603 | |

2.01.04.01.02 | Foreign Currency | 712,226 | 636,764 | |

2.01.05 | Other Obligations | 1,666,952 | 3,776,280 | |

2.01.05.01 | Advances from related parties | 874,064 | 3,051,892 | |

2.01.05.01.04 | Advances from related parties | 874,064 | 3,051,892 | |

2.01.05.02 | Other | 792,888 | 724,388 | |

2.01.05.02.01 | Dividends and Interest on Shareholders' Equity Payable | 2,088 | 1,723 | |

2.01.05.02.04 | Derivatives | 496,359 | 282,619 | |

2.01.05.02.05 | Management and Employees Profit Sharing | 4,183 | 95,900 | |

2.01.05.02.08 | Other Obligations | 290,258 | 344,146 | |

2.01.06 | Provisions | 923,673 | 857,607 | |

2.01.06.01 | Tax, Social Security, Labor and Civil Risk Provisions | 548,617 | 516,597 | |

2.01.06.01.01 | Tax Risk Provisions | 50,506 | 51,416 | |

2.01.06.01.02 | Social Security and Labor Risk Provisions | 303,293 | 251,342 | |

2.01.06.01.04 | Civil Risk Provisions | 194,818 | 213,839 | |

2.01.06.02 | Other Provisons | 375,056 | 341,010 | |

2.01.06.02.04 | Vacations & Christmas Bonuses Provisions | 298,446 | 264,400 | |

2.01.06.02.05 | Employee Benefits Provisions | 76,610 | 76,610 | |

2.02 | Non-current Liabilities | 11,557,883 | 14,392,513 | |

2.02.01 | Long-term Debt | 6,940,980 | 9,508,371 | |

2.02.01.01 | Long-term Debt | 6,940,980 | 9,508,371 | |

2.02.01.01.01 | Local Currency | 2,439,651 | 4,970,269 | |

2.02.01.01.02 | Foreign Currency | 4,501,329 | 4,538,102 | |

2.02.02 | Other Obligations | 3,519,531 | 3,614,130 | |

2.02.02.01 | Liabilities with Related Parties | 2,454,558 | 2,634,565 | |

2.02.02.01.04 | Advances from Related Parties and Other Liabilities | 2,454,558 | 2,634,565 | |

2.02.02.02 | Other | 1,064,973 | 979,565 | |

2.02.02.02.06 | Other Obligations | 1,064,973 | 979,565 |

See accompanying notes to the consolidated financial statements.

3

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Individual FS / Balance Sheet Liabilities (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Current Quarter |

| Previous Year |

2.02.04 | Provisions | 1,097,372 | 1,270,012 | |

2.02.04.01 | Tax, Social Security, Labor and Civil Risk Provisions | 816,639 | 998,743 | |

2.02.04.01.01 | Provisions for Tax Contingencies | 225,107 | 221,463 | |

2.02.04.01.02 | Social Security and Labor Risk Provisions | 166,672 | 257,581 | |

2.02.04.01.04 | Provisions for Civil Contingencies | 54,802 | 149,299 | |

2.02.04.01.05 | Contingent Liability | 370,058 | 370,400 | |

2.02.04.02 | Other Provisons | 280,733 | 271,269 | |

2.02.04.02.04 | Employee Benefits Plans | 280,733 | 271,269 | |

2.03 | Shareholders' Equity | 11,076,396 | 11,200,211 | |

2.03.01 | Paid-in Capital | 12,460,471 | 12,460,471 | |

2.03.01.01 | Paid-in Capital | 12,553,418 | 12,553,418 | |

2.03.01.02 | Cost of Shares Issuance | (92,947) | (92,947) | |

2.03.02 | Capital Reserves | 43,144 | 43,614 | |

2.03.02.01 | Goodwill on the Shares Issuance | 166,192 | 166,192 | |

2.03.02.04 | Granted Options | 261,359 | 261,829 | |

2.03.02.05 | Treasury Shares | (71,483) | (71,483) | |

2.03.02.07 | Gain on Disposal of Shares | (73,094) | (73,094) | |

2.03.02.08 | Goodwill on Acquisition of Non-Controlling Entities | (40,534) | (40,534) | |

2.03.02.09 | Acquisition of Non-Controlling Entities | (199,296) |

| (199,296) |

2.03.04 | Profit Reserves | 101,367 | 101,367 | |

2.03.04.01 | Legal Reserves | 101,367 | 101,367 | |

2.03.05 | Accumulated Earnings (Losses) | (140,018) |

| - |

2.03.08 | Other Comprehensive Income | (1,388,568) | (1,405,241) | |

2.03.08.01 | Derivative Financial Intruments | (491,676) | (572,152) | |

2.03.08.02 | Financial Instruments (Available for Sale) | (118,909) | (56,258) | |

2.03.08.03 | Cumulative Translation Adjustments of Foreign Currency | (771,345) | (766,959) | |

2.03.08.04 | Actuarial Losses | (6,638) | (9,872) |

See accompanying notes to the consolidated financial statements.

4

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Individual FS / Statement of Income (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Accumulated Current Year |

| Accumulated Previous Year |

3.01 | Net Sales | 5,910,489 | 6,652,541 | |

3.02 | Cost of Goods Sold | (4,976,025) | (5,484,356) | |

3.03 | Gross Profit | 934,464 | 1,168,185 | |

3.04 | Operating (Expenses) Income | (627,719) | (1,191,307) | |

3.04.01 | Selling | (756,366) | (753,189) | |

3.04.02 | General and Administrative | (54,993) | (56,571) | |

3.04.04 | Other Operating Income | 94,751 | 58,631 | |

3.04.05 | Other Operating Expenses | (66,602) | (152,942) | |

3.04.06 | Income from Associates and Joint Ventures | 155,491 | (287,236) | |

3.05 | Income Before Financial and Tax Results | 306,745 | (23,122) | |

3.06 | Financial Results | (515,657) | (319,161) | |

3.06.01 | Financial Income | 190,845 | 377,629 | |

3.06.02 | Financial Expenses | (706,502) | (696,790) | |

3.07 | Income Before Taxes | (208,912) | (342,283) | |

3.08 | Income and Social Contribution | 84,590 | 60,849 | |

3.08.01 | Current | - | (34,243) | |

3.08.02 | Deferred | 84,590 | 95,092 | |

3.09 | Net Income from Continued Operations | (124,322) | (281,434) | |

3.11 | Net Income | (124,322) | (281,434) | |

3.99 | Earnings per Share - (Brazilian Reais/Share) | |||

3.99.01 | Earnings per Share - Basic | |||

3.99.01.01 | ON | (0.15327) | (0.35223) | |

3.99.02 | Earning per Share - Diluted | |||

3.99.02.01 | ON | (0.15327) | (0.35223) |

See accompanying notes to the consolidated financial statements.

5

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Individual FS / Statement ofComprehensive Income (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Accumulated Current Year | Accumulated Previous Year | |

4.01 | Net Income | (124,322) | (281,434) | |

4.02 | Other Comprehensive Income | 16,673 | (26,869) | |

4.02.01 | Gains (Losses) in Foreign Currency Translation Adjustments | (4,386) | (33,178) | |

4.02.02 | Unrealized Gains (Losses) in Available for Sale Marketable Securities | (92,771) | (63,588) | |

4.02.03 | Taxes on Unrealized Gains (Losses) on Investments on Available for Sale Marketable Securities | 30,120 | 19,271 | |

4.02.04 | Unrealized Gains (Losses) on Cash Flow Hedge | 119,985 | 77,619 | |

4.02.05 | Taxes on Unrealized Gains (Losses) on Cash Flow Hedge | (39,509) | (31,354) | |

4.02.06 | Actuarial Gains (Losses) on Pension and Post-employment Plans | 5,520 | 6,609 | |

4.02.07 | Taxes on Realized Gains (Losses) on Pension Post-employment Plans | (2,286) | (2,248) | |

4.03 | Comprehensive Income | (107,649) | (308,303) |

See accompanying notes to the consolidated financial statements.

6

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Individual FS / Statement of Cash Flow (Indirect method) (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Accumulated Current Year |

| Accumulated Previous Year |

6.01 | Net Cash Provided by Operating Activities | (1,154,135) | 251,976 | |

6.01.01 | Cash from Operations | 83,598 | 355,922 | |

6.01.01.01 | Net Income (Loss) for the Period | (124,322) | (281,434) | |

6.01.01.03 | Depreciation and Amortization | 189,142 | 174,081 | |

6.01.01.04 | Depreciation and Depletion of Biological Assets | 148,276 | 151,510 | |

6.01.01.05 | Results on Disposals of Property, Plant and Equipments | 6,930 | (6,999) | |

6.01.01.08 | Deferred Income Tax | (84,590) | (95,092) | |

6.01.01.09 | Provision for Tax, Civil and Labor Risks | 24,558 | 97,203 | |

6.01.01.10 | Interest and Exchange Rate Variations | 57,126 | 16,409 | |

6.01.01.11 | Equity Pick-Up | (155,491) | 287,236 | |

6.01.01.17 | Others | 21,969 | 13,008 | |

6.01.02 | Changes in Operating Assets and Liabilities | (1,237,733) | (103,946) | |

6.01.02.01 | Trade Accounts Receivable | 1,517,286 | 1,126,400 | |

6.01.02.02 | Inventories | 7,848 | 97,101 | |

6.01.02.03 | Trade Accounts Payable | (417,071) | (536,846) | |

6.01.02.04 | Supply Chain Finance | (48,219) | (397,753) | |

6.01.02.05 | Payment of Tax, Civil and Labor Risks Provisions | (83,078) | (59,999) | |

6.01.02.06 | Others Operating Assets and Liabilities | (2,519,764) | (63,571) | |

6.01.02.08 | Redemption of Held for Trading Securities | 13,428 | 25,115 | |

6.01.02.11 | Fair value for for Assets and Liabilities | 355,066 | (39,301) | |

6.01.02.12 | Payment of Interest | (98,932) | (374,875) | |

6.01.02.14 | Interest on Shareholders' Equity Received | 6,189 | 7,447 | |

6.01.02.15 | Biological assets - Current | (8,774) |

| 50,034 |

6.01.02.16 | Interest received | 38,288 | 62,302 | |

6.02 | Net Cash Provided by Investing Activities | (593,502) | (687,689) | |

6.02.04 | Redemptions of Available for Sale | - | 15,011 | |

6.02.05 | Redemptions of Restricted Cash (Investments) | (303,787) | - | |

6.02.06 | Additions to Property, Plant and Equipment | (161,420) | (233,736) | |

6.02.07 | Receivable from Disposals of Property, Plant and Equipment | 19,775 | 33,127 | |

6.02.09 | Additions to Intangible | (5,597) | (39,554) | |

6.02.10 | Additions to Biological Assets - Non-current | (142,178) | (151,412) | |

6.02.11 | Investments in Associates and Joint Venturies | (295) | (305) | |

6.02.13 | Net Cash Transferred to Subsidiaries | - | (309,615) | |

6.02.17 | Advance for Future Capital Increase | - | (1,205) | |

6.03 | Net Cash Provided by Financing Activities | (8,627) | 119,923 | |

6.03.01 | Proceeds from Debt Issuance | 239,676 | 715,584 | |

6.03.02 | Payment of Debt | (248,303) | (595,661) | |

6.04 | Exchange Rate Variation on Cash and Cash Equivalents | (2,766) | (112) | |

6.05 | Increase (Decrease) in Cash and Cash Equivalents | (1,759,030) | (315,902) | |

6.05.01 | At the Beginning of the Period | 3,584,701 | 3,856,505 | |

6.05.02 | At the End of the Period | 1,825,671 | 3,540,603 |

See accompanying notes to the consolidated financial statements.

7

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Individual FS / Statement of Changes in Shareholders' Equity for the Period from 01/01/2018 to 03/31/2018 (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Paid-in Capital |

| Capital Reserves, Granted Options and Treasury Shares |

| Profit Reserves |

| Retained Earnings |

| Other Comprehensive Income |

| Shareholders' Equity |

5.01 | Balance at January 1, 2018 | 12,460,471 | 43,614 | 101,367 | - | (1,405,241) | 11,200,211 | |||||

5.02 | Previous Year Adjustment | - | - | - | (15,696) | - | (15,696) | |||||

5.03 | Opening Balance Adjusted | 12,460,471 | 43,614 | 101,367 | (15,696) | (1,405,241) | 11,184,515 | |||||

5.04 | Share-based Payments | - | (470) | - | - | - | (470) | |||||

5.04.03 | Options Granted | - | (470) | - | - | - | (470) | |||||

5.04.13 | Non-Controlling Interests | - | - | - | - | - | - | |||||

5.05 | Total Comprehensive Loss | - | - | - | (124,322) | 16,673 | (107,649) | |||||

5.05.01 | Net Loss for the Period | - | - | - | (124,322) | - | (124,322) | |||||

5.05.02 | Other Comprehensive Income | - | - | - | - | 16,673 | 16,673 | |||||

5.05.02.01 | Financial Instruments Adjustments | - | - | - | - | 119,985 | 119,985 | |||||

5.05.02.02 | Tax on Financial Instruments Adjustments | - | - | - | - | (39,509) | (39,509) | |||||

5.05.02.06 | Unrealized Loss in Available for Sale Marketable Securities | - | - | - | - | (92,771) | (92,771) | |||||

5.05.02.07 | Tax on Unrealized Loss in Available for Sale Marketable Securities | - | - | - | - | 30,120 | 30,120 | |||||

5.05.02.08 | Actuarial Gains on Pension and Post-employment Plans | - | - | - | - | 3,234 | 3,234 | |||||

5.05.02.09 | Cumulative Translation Adjustments of Foreign Currency | - | - | - | - | (4,386) | (4,386) | |||||

5.07 | Balance at March 31, 2018 | 12,460,471 | 43,144 | 101,367 | (140,018) | (1,388,568) | 11,076,396 |

See accompanying notes to the consolidated financial statements.

8

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Individual FS / Statement of Changes in Shareholders' Equity for the Period from 01/01/2017 to 03/31/2017 (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Paid-in Capital |

| Capital Reserves, Granted Options and Treasury Shares |

| Profit Reserves |

| Retained Earnings |

| Other Comprehensive Income |

| Shareholders' Equity |

5.01 | Balance at January 1, 2017 | 12,460,471 | (680,850) | 1,350,675 | - | (1,290,318) | 11,839,978 | |||||

5.03 | Opening Balance Adjusted | 12,460,471 | (680,850) | 1,350,675 | - | (1,290,318) | 11,839,978 | |||||

5.04 | Share-based Payments | - | 10,591 | - | - | - | 10,591 | |||||

5.04.03 | Options Granted | - | 10,591 | - | - | - | 10,591 | |||||

5.04.13 | Non-Controlling Interests | - | - | - | - | - | - | |||||

5.05 | Total Comprehensive Income | - | - | - | (281,434) | (26,869) | (308,303) | |||||

5.05.01 | Net Income for the Period | - | - | - | (281,434) | - | (281,434) | |||||

5.05.02 | Other Comprehensive Income | - | - | - | - | (26,869) | (26,869) | |||||

5.05.02.01 | Financial Instruments Adjustments | - | - | - | - | 77,619 | 77,619 | |||||

5.05.02.02 | Tax on Financial Instruments Adjustments | - | - | - | - | (31,354) | (31,354) | |||||

5.05.02.06 | Unrealized Gain in Available for Sale Marketable Securities | - | - | - | - | (63,588) | (63,588) | |||||

5.05.02.07 | Tax on Unrealized Gain in Available for Sale Marketable Securities | - | - | - | - | 19,271 | 19,271 | |||||

5.05.02.08 | Actuarial gains on pension and post-employment plans | - | - | - | - | 4,361 | 4,361 | |||||

5.05.02.09 | Cumulative Translation Adjustments of Foreign Currency | - | - | - | - | (33,178) | (33,178) | |||||

5.07 | Balance at March 31, 2017 | 12,460,471 | (670,259) | 1,350,675 | (281,434) | (1,317,187) | 11,542,266 |

See accompanying notes to the consolidated financial statements.

9

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Individual FS / Statement of Value Added (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Accumulated Current Year |

| Accumulated Previous Year |

7.01 | Revenues | 6,730,770 | 7,421,939 | |

7.01.01 | Sales of Goods, Products and Services | 6,631,580 | 7,414,947 | |

7.01.02 | Other Income | (21,084) | (183,374) | |

7.01.03 | Revenue Related to Construction of Own Assets | 126,369 | 184,425 | |

7.01.04 | (Provision) Reversal for Doubtful Accounts Reversal | (6,095) | 5,941 | |

7.02 | Raw Material Acquired from Third Parties | (4,543,748) | (4,999,143) | |

7.02.01 | Costs of Products and Goods Sold | (3,987,342) | (4,332,080) | |

7.02.02 | Materials, Energy, Third Parties Services and Other | (588,716) | (659,714) | |

7.02.03 | Recovery (Loss) of Assets Values | 32,310 | (7,349) | |

7.03 | Gross Added Value | 2,187,022 | 2,422,796 | |

7.04 | Retentions | (337,418) | (325,591) | |

7.04.01 | Depreciation, Amortization and Exhaustion | (337,418) | (325,591) | |

7.05 | Net Added Value | 1,849,604 | 2,097,205 | |

7.06 | Received from Third Parties | 346,874 | 90,555 | |

7.06.01 | Equity Pick-Up | 155,491 | (287,236) | |

7.06.02 | Financial Income | 190,845 | 377,629 | |

7.06.03 | Other | 538 | 162 | |

7.07 | Added Value to be Distributed | 2,196,478 | 2,187,760 | |

7.08 | Distribution of Added Value | 2,196,478 | 2,187,760 | |

7.08.01 | Payroll | 841,658 | 924,754 | |

7.08.01.01 | Salaries | 602,321 | 729,631 | |

7.08.01.02 | Benefits | 189,850 | 146,971 | |

7.08.01.03 | Government Severance Indemnity Fund for Employees | 49,487 | 48,152 | |

7.08.02 | Taxes, Fees and Contributions | 719,881 | 790,905 | |

7.08.02.01 | Federal | 262,672 | 324,427 | |

7.08.02.02 | State | 448,819 | 458,472 | |

7.08.02.03 | Municipal | 8,390 | 8,006 | |

7.08.03 | Capital Remuneration from Third Parties | 759,261 | 753,535 | |

7.08.03.01 | Interests | 711,051 | 707,795 | |

7.08.03.02 | Rents | 48,210 | 45,740 | |

7.08.04 | Interest on Own Capital | (124,322) | (281,434) | |

7.08.04.03 | Retained Earnings | (124,322) | (281,434) |

See accompanying notes to the consolidated financial statements.

10

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

ConsolidatedFS / Balance Sheet Assets (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Current Quarter |

| Previous Year |

1 | Total Assets | 44,997,619 | 45,228,481 | |

1.01 | Current Assets | 18,992,897 | 19,185,523 | |

1.01.01 | Cash and Cash Equivalents | 5,515,699 | 6,010,829 | |

1.01.02 | Marketable Securities | 390,598 | 228,430 | |

1.01.02.01 | Financial Investments Evaluated at Fair Value | 222,976 | 211,441 | |

1.01.02.01.01 | Held for Trading | 208,426 | 195,994 | |

1.01.02.01.02 | Available for Sale | 14,550 | 15,447 | |

1.01.02.02 | Marketable Securities Evaluated at Amortized Cost | 167,622 | 16,989 | |

1.01.02.02.01 | Held to Maturity | 167,622 | 16,989 | |

1.01.03 | Trade Accounts Receivable | 3,866,332 | 4,032,149 | |

1.01.03.01 | Trade Accounts Receivable | 3,756,716 | 3,919,022 | |

1.01.03.02 | Other Receivables | 109,616 | 113,127 | |

1.01.04 | Inventories | 4,949,268 | 4,948,168 | |

1.01.05 | Biological Assets | 1,490,183 | 1,510,480 | |

1.01.06 | Recoverable Taxes | 1,281,270 | 1,228,259 | |

1.01.06.01 | Current Recoverable Taxes | 1,281,270 | 1,228,259 | |

1.01.06.01.01 | Income and social contribution tax (IR/CS) | 572,463 | 499,341 | |

1.01.06.01.03 | Recoverable Taxes | 738,730 | 752,021 | |

1.01.06.01.04 | Provision for losses | (29,923) | (23,103) | |

1.01.08 | Other Current Assets | 1,499,547 | 1,227,208 | |

1.01.08.03 | Other | 1,499,547 | 1,227,208 | |

1.01.08.03.01 | Interest on Shareholders' Equity Receivable | - | 6,187 | |

1.01.08.03.02 | Derivatives | 137,095 | 90,536 | |

1.01.08.03.04 | Accounts Receivable from Disposal of Equity Interest | - | 28,897 | |

1.01.08.03.06 | Restricted Cash | 436,797 | 127,821 | |

1.01.08.03.10 | Other | 925,655 | 973,767 | |

1.02 | Non-current Assets | 26,004,722 | 26,042,958 | |

1.02.01 | Non-current Assets | 6,652,326 | 6,586,544 | |

1.02.01.01 | Financial Investments Evaluated at Fair Value | 238,445 | 328,816 | |

1.02.01.01.02 | Available for Sale | 238,445 | 328,816 | |

1.02.01.02 | Marketable Securities Evaluated at Amortized Cost | 136,538 | 239,989 | |

1.02.01.02.01 | Held to Maturity | 136,538 | 239,989 | |

1.02.01.03 | Trade Accounts Receivable | 118,950 | 122,654 | |

1.02.01.03.01 | Trade Accounts Receivable | 6,430 | 6,260 | |

1.02.01.03.02 | Other Receivables | 112,520 | 116,394 | |

1.02.01.05 | Biological Assets | 976,735 | 903,654 | |

1.02.01.06 | Deferred Taxes | 1,512,786 | 1,369,366 | |

1.02.01.06.01 | Deferred Income Tax and Social Contribution | 1,512,786 | 1,369,366 | |

1.02.01.09 | Other Non-current Assets | 3,668,872 | 3,622,065 | |

1.02.01.09.03 | Judicial Deposits | 689,220 | 688,940 | |

1.02.01.09.05 | Income and social contribution tax (IR/CS) | 28,520 | 29,039 | |

1.02.01.09.06 | Provision for losses from Income and social contribution tax (IR/CS) | (9,029) | (9,029) | |

1.02.01.09.07 | Recoverable Taxes | 2,593,242 | 2,555,555 | |

1.02.01.09.08 | Provision for losses | (134,917) | (137,400) | |

1.02.01.09.10 | Restricted Cash | 418,564 | 407,803 | |

1.02.01.09.11 | Other | 83,272 | 87,157 | |

1.02.02 | Investments | 75,520 | 68,195 | |

1.02.02.01 | Investments | 75,520 | 68,195 | |

1.02.02.01.01 | Equity in Associates | 67,369 | 60,227 | |

1.02.02.01.04 | Other | 8,151 | 7,968 | |

1.02.03 | Property, Plant and Equipment, Net | 12,057,494 | 12,190,583 | |

1.02.03.01 | Property, Plant and Equipment in Operation | 11,381,154 | 11,508,581 | |

1.02.03.02 | Property, Plant and Equipment Leased | 245,196 | 228,056 | |

1.02.03.03 | Property, Plant and Equipment in Progress | 431,144 | 453,946 | |

1.02.04 | Intangible | 7,219,382 | 7,197,636 | |

1.02.04.01 | Intangible | 7,219,382 | 7,197,636 | |

1.02.04.01.02 | Software | 230,748 | 210,228 | |

1.02.04.01.03 | Trademarks | 1,626,447 | 1,649,910 | |

1.02.04.01.04 | Goodwill | 4,217,264 | 4,192,228 | |

1.02.04.01.05 | Software Leased | 43,984 | 12,505 | |

1.02.04.01.08 | Other | 1,100,939 | 1,132,765 |

See accompanying notes to the consolidated financial statements.

11

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

ConsolidatedFS / Balance SheetLiabilities (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Current Quarter |

| Previous Year |

2 | Total Liabilities | 44,997,619 | 45,228,481 | |

2.01 | Current Liabilities | 17,553,261 | 14,907,874 | |

2.01.01 | Social and Labor Obligations | 323,199 | 330,448 | |

2.01.01.01 | Social Obligations | 168,601 | 159,106 | |

2.01.01.02 | Labor Obligations | 154,598 | 171,342 | |

2.01.02 | Trade Accounts Payable | 6,719,078 | 7,160,675 | |

2.01.02.01 | Domestic Suppliers | 4,585,234 | 4,937,047 | |

2.01.02.01.01 | Domestic Suppliers | 4,107,230 |

| 4,418,630 |

2.01.02.01.02 | Supply Chain Finance | 478,004 |

| 518,417 |

2.01.02.02 | Foreign Suppliers | 2,133,844 | 2,223,628 | |

2.01.02.02.01 | Foreign Suppliers | 1,948,260 |

| 2,026,856 |

2.01.02.02.02 | Supply Chain Finance | 185,584 |

| 196,772 |

2.01.03 | Tax Obligations | 432,087 | 426,028 | |

2.01.03.01 | Federal Tax Obligations | 172,430 | 160,844 | |

2.01.03.01.01 | Income Tax and Social Contribution Payable | 123,475 | 93,278 | |

2.01.03.01.02 | Other Federal | 48,955 | 67,566 | |

2.01.03.02 | State Tax Obligations | 257,020 | 262,343 | |

2.01.03.03 | Municipal Tax Obligations | 2,637 | 2,841 | |

2.01.04 | Short Term Debts | 7,891,438 | 5,031,351 | |

2.01.04.01 | Short Term Debts | 7,891,438 | 5,031,351 | |

2.01.04.01.01 | Local Currency | 6,245,479 | 3,592,760 | |

2.01.04.01.02 | Foreign Currency | 1,645,959 | 1,438,591 | |

2.01.05 | Other Obligations | 1,148,205 | 999,952 | |

2.01.05.01 | Liabilities with Related Parties | - | 5 | |

2.01.05.02 | Other | 1,148,205 | 999,947 | |

2.01.05.02.01 | Dividends and Interest on Shareholders' Equity Payable | 2,088 | 1,916 | |

2.01.05.02.04 | Derivatives | 529,072 | 299,491 | |

2.01.05.02.05 | Management and Employees Profit Sharing | 8,950 | 95,900 | |

2.01.05.02.08 | Other Obligations | 608,095 | 602,640 | |

2.01.06 | Provisions | 1,039,254 | 959,420 | |

2.01.06.01 | Tax, Social Security, Labor and Civil Risk Provisions | 569,791 | 536,089 | |

2.01.06.01.01 | Tax Risk Provisions | 50,506 | 51,416 | |

2.01.06.01.02 | Social Security and Labor Risk Provisions | 319,096 | 264,552 | |

2.01.06.01.04 | Civil Risk Provisions | 200,189 | 220,121 | |

2.01.06.02 | Other Provisons | 469,463 | 423,331 | |

2.01.06.02.04 | Vacations and Christmas Bonuses Provisions | 384,278 | 338,146 | |

2.01.06.02.05 | Employee Benefits Provisions | 85,185 | 85,185 | |

2.02 | Non-current Liabilities | 15,832,295 | 18,607,825 | |

2.02.01 | Long-term Debt | 12,872,296 | 15,413,027 | |

2.02.01.01 | Long-term Debt | 12,872,296 | 15,413,027 | |

2.02.01.01.01 | Local Currency | 3,219,651 | 5,750,269 | |

2.02.01.01.02 | Foreign Currency | 9,652,645 | 9,662,758 | |

2.02.02 | Other Obligations | 1,451,225 | 1,492,776 | |

2.02.02.02 | Other | 1,451,225 | 1,492,776 | |

2.02.02.02.06 | Other Obligations | 1,451,225 | 1,492,776 | |

2.02.03 | Deferred Taxes | 164,135 | 155,303 | |

2.02.03.01 | Deferred Income Tax and Social Contribution | 164,135 | 155,303 | |

2.02.04 | Provisions | 1,344,639 | 1,546,719 | |

2.02.04.01 | Tax, Social Security, Labor and Civil Risk Provisions | 1,023,303 | 1,237,116 | |

2.02.04.01.01 | Provisions for Tax Contingencies | 243,166 | 251,972 | |

2.02.04.01.02 | Social Security and Labor Risk Provisions | 322,500 | 427,172 | |

2.02.04.01.04 | Provisions for Civil Contingencies | 87,350 | 187,330 | |

2.02.04.01.05 | Contingent Liabilities | 370,287 | 370,642 | |

2.02.04.02 | Other Provisons | 321,336 | 309,603 | |

2.02.04.02.04 | Employee Benefits Plans | 321,336 | 309,603 | |

2.03 | Shareholders' Equity | 11,612,063 | 11,712,782 | |

2.03.01 | Paid-in Capital | 12,460,471 | 12,460,471 | |

2.03.01.01 | Paid-in Capital | 12,553,418 | 12,553,418 | |

2.03.01.02 | Cost of Shares Issuance | (92,947) | (92,947) | |

2.03.02 | Capital Reserves | 43,144 | 43,614 | |

2.03.02.01 | Goodwill on the Shares Issuance | 166,192 | 166,192 | |

2.03.02.04 | Granted Options | 261,359 | 261,829 | |

2.03.02.05 | Treasury Shares | (71,483) | (71,483) | |

2.03.02.07 | Gain on Disposal of Shares | (73,094) | (73,094) | |

2.03.02.08 | Goodwill on Acquisition of Non-Controlling Interests | (40,534) | (40,534) | |

2.03.02.09 | Acquisition of Non-Controlling Interests | (199,296) |

| (199,296) |

2.03.04 | Profit Reserves | 101,367 | 101,367 | |

2.03.04.01 | Legal Reserves | 101,367 | 101,367 | |

2.03.05 | Accumulated Earnings / Loss | (140,018) | - | |

2.03.08 | Other Comprehensive Income | (1,388,568) | (1,405,241) | |

2.03.08.01 | Derivative Financial Instruments | (491,676) | (572,152) | |

2.03.08.02 | Financial Instrument (Available for Sale) | (118,909) | (56,258) | |

2.03.08.03 | Cumulative Translation Adjustments of Foreign Currency | (771,345) | (766,959) | |

2.03.08.04 | Actuarial Losses | (6,638) | (9,872) | |

2.03.09 | Non-controlling Interest | 535,667 | 512,571 |

See accompanying notes to the consolidated financial statements.

12

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

ConsolidatedFS / Statement of Income (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Accumulated Current Year |

| Accumulated Previous Year |

3.01 | Net Sales | 8,203,033 | 7,809,449 | |

3.02 | Cost of Goods Sold | (6,666,457) | (6,433,502) | |

3.03 | Gross Profit | 1,536,576 | 1,375,947 | |

3.04 | Operating (Expenses) Income | (1,240,993) | (1,307,746) | |

3.04.01 | Selling | (1,134,146) | (1,086,898) | |

3.04.02 | General and Administrative | (133,185) | (130,316) | |

3.04.04 | Other Operating Income | 99,506 | 64,469 | |

3.04.05 | Other Operating Expenses | (78,684) | (162,534) | |

3.04.06 | Income from Associates and Joint Ventures | 5,516 | 7,533 | |

3.05 | Income Before Financial and Tax Results | 295,583 | 68,201 | |

3.06 | Financial Results | (516,824) | (412,545) | |

3.06.01 | Financial Income | 385,299 | 525,569 | |

3.06.02 | Financial Expenses | (902,123) | (938,114) | |

3.07 | Income Before Taxes | (221,241) | (344,344) | |

3.08 | Income and Social Contribution | 107,435 | 58,610 | |

3.08.01 | Current | (30,120) | (88,290) | |

3.08.02 | Deferred | 137,555 | 146,900 | |

3.09 | Net Income from Continued Operations | (113,806) | (285,734) | |

3.11 | Net Income | (113,806) | (285,734) | |

3.11.01 | Attributable to: Controlling Shareholders | (124,322) | (281,434) | |

3.11.02 | Attributable to: Non-controlling Interest | 10,516 | (4,300) | |

3.99 | Earnings per share - (Brazilian Reais/Share) | |||

3.99.01 | Earnings per Share - Basic | |||

3.99.01.01 | ON | (0.14030) | (0.35761) | |

3.99.02 | Earning per Share - Diluted | |||

3.99.02.01 | ON | (0.14030) | (0.35761) |

See accompanying notes to the consolidated financial statements.

13

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

ConsolidatedFS / Statement ofComprehensive Income (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Accumulated Current Year |

| Accumulated Previous Year |

4.01 | Net Income | (113,806) |

| (285,734) |

4.02 | Other Comprehensive Income | 16,673 |

| (26,869) |

4.02.01 | Gains (Losses) in Foreign Currency Translation Adjustments | (4,386) |

| (33,178) |

4.02.02 | Unrealized Gains (Losses) in Available for Sale Marketable Securities | (92,771) | (63,588) | |

4.02.03 | Taxes on Unrealized Gains (Losses) on Investments on Available for Sale Marketable Securities | 30,120 | 19,271 | |

4.02.04 | Unrealized Gains (Losses) on Cash Flow Hedge | 119,985 | 77,619 | |

4.02.05 | Taxes on Unrealized Gains (Losses) on Cash Flow Hedge | (39,509) | (31,354) | |

4.02.06 | Actuarial Gains (Losses) on Pension and Post-employment Plans | 5,520 | 6,609 | |

4.02.07 | Taxes on Realized Gains (Losses) on Pension Post-employment Plans | (2,286) | (2,248) | |

4.03 | Comprehensive Income | (97,133) |

| (312,603) |

4.03.01 | Attributable to: BRF Shareholders | (107,649) |

| (308,303) |

4.03.02 | Attributable to: Non-Controlling Interests | 10,516 |

| (4,300) |

See accompanying notes to the consolidated financial statements.

14

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

ConsolidatedFS / Statement ofCash Flow (Indirect method) (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Accumulated Current Year |

| Accumulated Previous Year |

6.01 | Net Cash Provided by Operating Activities | 196,155 | (1,043,467) | |

6.01.01 | Cash from Operations | 454,079 | 96,516 | |

6.01.01.01 | Net Income for the Period | (113,806) | (281,434) | |

6.01.01.02 | Non-controlling Interest | - | (4,300) | |

6.01.01.03 | Depreciation and Amortization | 289,259 | 250,356 | |

6.01.01.04 | Depreciation and Depletion of Biological Assets | 197,814 | 187,148 | |

6.01.01.05 | Results on Disposals of Property, Plant and Equipments | 10,434 | (4,327) | |

6.01.01.08 | Deferred Income Tax | (137,555) | (146,900) | |

6.01.01.09 | Provision for Tax, Civil and Labor Risks | 12,182 | 101,171 | |

6.01.01.10 | Interest and Exchange Rate Variations | 155,365 | (19,164) | |

6.01.01.11 | Equity Pick-Up | (5,516) | (7,533) | |

6.01.01.17 | Others | 45,902 | 21,499 | |

6.01.02 | Changes in Operating Assets and Liabilities | (257,924) | (1,139,983) | |

6.01.02.01 | Trade Accounts Receivable | 183,856 | (52,057) | |

6.01.02.02 | Inventories | 32,570 | (124,856) | |

6.01.02.03 | Trade Accounts Payable | (507,527) | (338,138) | |

6.01.02.04 | Supply Chain Finance | (51,629) | (325,842) | |

6.01.02.05 | Payment of Tax, Civil and Labor Risks Provisions | (89,597) | (60,793) | |

6.01.02.06 | Others Operating Assets and Liabilities | (126,324) | 83,261 | |

6.01.02.07 | Investment in Held for Trading Securities | (42,289) | (73,034) | |

6.01.02.08 | Redemption of Held for Trading Securities | 33,057 | 76,508 | |

6.01.02.11 | Fair value for for Assets and Liabilities | 408,717 | (41,665) | |

6.01.02.12 | Payment of Interest | (161,727) | (434,644) | |

6.01.02.13 | Payment of Income Tax and Social Contribution | (198) | (32,868) | |

6.01.02.14 | Interest on Shareholders' Equity Received | 6,187 | 7,447 | |

6.01.02.15 | Biological Assets - Current | 14,272 |

| 104,172 |

6.01.02.16 | Interest Received | 42,708 | 72,526 | |

6.02 | Net Cash Provided by Investing Activities | (787,766) | (393,485) | |

6.02.01 | Marketable Securities | (35,476) | - | |

6.02.04 | Redemptions of Available for Sale Securities | - | 104,612 | |

6.02.05 | Redemptions of Restricted Cash (Investments) | (304,696) | - | |

6.02.06 | Additions to Property, Plant and Equipment | (207,394) | (281,603) | |

6.02.07 | Receivable from Disposals of Property, Plant and Equipment | 19,775 | 33,127 | |

6.02.09 | Additions to Intangible | (5,636) | (39,625) | |

6.02.10 | Additions to Biological Assets - Non-current | (254,044) | (183,321) | |

6.02.11 | Investments in Associates and Joint Venturies | (295) | (305) | |

6.02.12 | Business Combination, net of cash | - |

| (26,370) |

6.03 | Net Cash Provided by Financing Activities | 77,175 | 1,396,112 | |

6.03.01 | Proceeds from Debt Issuance | 733,639 | 2,425,000 | |

6.03.02 | Payment of Debt | (656,464) | (1,028,888) | |

6.04 | Exchange Rate Variation on Cash and Cash Equivalents | 19,306 | (9,062) | |

6.05 | Decrease (Increase) in Cash and Cash Equivalents | (495,130) | (49,902) | |

6.05.01 | At the Beginning of the Period | 6,010,829 | 6,356,919 | |

6.05.02 | At the End of the Period | 5,515,699 | 6,307,017 |

See accompanying notes to the consolidated financial statements.

15

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Consolidated FS / Statement of Changes in Shareholders' Equity for the period from 01/01/2018 to 03/31/2018 (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Paid-in Capital |

| Capital Reserves, Granted Options and Treasury Shares |

| Profit Reserves |

| Retained Earnings |

| Other Comprehensive Income |

| Shareholders' Equity |

| Participation of Non-Controlling Shareholders |

| Total Shareholders' Equity |

5.01 | Balance at January 1, 2018 | 12,460,471 | 43,614 | 101,367 | - | (1,405,241) | 11,200,211 | 512,571 | 11,712,782 | |||||||

5.02 | Previous Year Adjustment | - | - | - | (15,696) | - | (15,696) | - | (15,696) | |||||||

5.03 | Opening Balance Adjusted | 12,460,471 | 43,614 | 101,367 | (15,696) | (1,405,241) | 11,184,515 | 512,571 | 11,697,086 | |||||||

5.04 | Share-based Payments | - | (470) | - | - | - | (470) | 12,580 | 12,110 | |||||||

5.04.03 | Options Granted | - | (470) | - | - | - | (470) | - | (470) | |||||||

5.04.13 | Non-Controlling Interests | - | - | - | - | - | - | 12,580 | 12,580 | |||||||

5.05 | Total Comprehensive Loss | - | - | - | (124,322) | 16,673 | (107,649) | 10,516 | (97,133) | |||||||

5.05.01 | Net Loss for the Period | - | - | - | (124,322) | - | (124,322) | 10,516 | (113,806) | |||||||

5.05.02 | Other Comprehensive Income | - | - | - | - | 16,673 | 16,673 | - | 16,673 | |||||||

5.05.02.01 | Financial Instruments Adjustments | - | - | - | - | 119,985 | 119,985 | - | 119,985 | |||||||

5.05.02.02 | Tax on Financial Instruments Adjustments | - | - | - | - | (39,509) | (39,509) | - | (39,509) | |||||||

5.05.02.06 | Unrealized Loss in Available for Sale Marketable Securities | - | - | - | - | (92,771) | (92,771) | - | (92,771) | |||||||

5.05.02.07 | Tax on Unrealized Loss in Available for Sale Marketable Securities | - | - | - | - | 30,120 | 30,120 | - | 30,120 | |||||||

5.05.02.08 | Actuarial Gains on Pension and Post-employment Plans | - | - | - | - | 3,234 | 3,234 | - | 3,234 | |||||||

5.05.02.09 | Cumulative Translation Adjustments of Foreign Currency | - | - | - | - | (4,386) | (4,386) | - | (4,386) | |||||||

5.07 | Balance at March 31, 2018 | 12,460,471 | 43,144 | 101,367 | (140,018) | (1,388,568) | 11,076,396 | 535,667 | 11,612,063 |

See accompanying notes to the consolidated financial statements.

16

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Consolidated FS / Statement of Changes in Shareholders' Equity for the period from 01/01/2017 to 03/31/2017 (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Paid-in Capital |

| Capital Reserves, Granted Options and Treasury Shares |

| Profit Reserves |

| Retained Earnings |

| Other Comprehensive Income |

| Shareholders' Equity |

| Participation of Non-Controlling Shareholders |

| Total Shareholders' Equity |

5.01 | Balance at January 1, 2017 | 12,460,471 | (680,850) | 1,350,675 | - | (1,290,318) | 11,839,978 | 379,375 | 12,219,353 | |||||||

5.03 | Opening Balance Adjusted | 12,460,471 | (680,850) | 1,350,675 | - | (1,290,318) | 11,839,978 | 379,375 | 12,219,353 | |||||||

5.04 | Share-based Payments | - | 10,591 | - | - | - | 10,591 | 5,796 | 16,387 | |||||||

5.04.03 | Options Granted | - | 10,591 | - | - | - | 10,591 | - | 10,591 | |||||||

5.04.13 | Non-Controlling Interests | - | - | - | - | - | - | 5,796 | 5,796 | |||||||

5.05 | Total Comprehensive Income | - | - | - | (281,434) | (26,869) | (308,303) | (4,300) | (312,603) | |||||||

5.05.01 | Net Income for the Period | - | - | - | (281,434) | - | (281,434) | (4,300) | (285,734) | |||||||

5.05.02 | Other Comprehensive Income | - | - | - | - | (26,869) | (26,869) | - | (26,869) | |||||||

5.05.02.01 | Financial Instruments Adjustments | - | - | - | - | 77,619 | 77,619 | - | 77,619 | |||||||

5.05.02.02 | Tax on Financial Instruments Adjustments | - | - | - | - | (31,354) | (31,354) | - | (31,354) | |||||||

5.05.02.06 | Unrealized Gain in Available for Sale Marketable Securities | - | - | - | - | (63,588) | (63,588) | - | (63,588) | |||||||

5.05.02.07 | Tax on Unrealized Gain in Available for Sale Marketable Securities | - | - | - | - | 19,271 | 19,271 | - | 19,271 | |||||||

5.05.02.08 | Actuarial gains on pension and post-employment plans | - | - | - | - | 4,361 | 4,361 | - | 4,361 | |||||||

5.05.02.09 | Cumulative Translation Adjustments of Foreign Currency | - | - | - | - | (33,178) | (33,178) | - | (33,178) | |||||||

5.07 | Balance at March 31, 2017 | 12,460,471 | (670,259) | 1,350,675 | (281,434) | (1,317,187) | 11,542,266 | 380,871 | 11,923,137 |

See accompanying notes to the consolidated financial statements.

17

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Individual FS / Statement of Value Added (in thousands of Brazilian Reais)

|

|

Account Code | Account Description | Accumulated Current Year |

| Accumulated Previous Year |

7.01 | Revenues | 9,136,405 | 8,715,844 | |

7.01.01 | Sales of Goods, Products and Services | 9,014,128 | 8,677,958 | |

7.01.02 | Other Income | (12,613) | (193,829) | |

7.01.03 | Revenue Related to Construction of Own Assets | 158,611 | 225,886 | |

7.01.04 | (Provision) Reversal for Doubtful Accounts Reversal | (23,721) | 5,829 | |

7.02 | Raw Material Acquired from Third Parties | (6,094,863) | (5,875,442) | |

7.02.01 | Costs of Products and Goods Sold | (5,284,637) | (4,941,216) | |

7.02.02 | Materials, Energy, Third Parties Services and Other | (857,575) | (921,589) | |

7.02.03 | Recovery of Assets Values | 47,349 | (12,637) | |

7.03 | Gross Added Value | 3,041,542 | 2,840,402 | |

7.04 | Retentions | (487,073) | (437,504) | |

7.04.01 | Depreciation, Amortization and Exhaustion | (487,073) | (437,504) | |

7.05 | Net Added Value | 2,554,469 | 2,402,898 | |

7.06 | Received from Third Parties | 391,140 | 533,795 | |

7.06.01 | Equity Pick-Up | 5,516 | 7,533 | |

7.06.02 | Financial Income | 385,299 | 525,569 | |

7.06.03 | Other | 325 | 693 | |

7.07 | Added Value to be Distributed | 2,945,609 | 2,936,693 | |

7.08 | Distribution of Added Value | 2,945,609 | 2,936,693 | |

7.08.01 | Payroll | 1,247,910 | 1,254,649 | |

7.08.01.01 | Salaries | 941,265 | 982,749 | |

7.08.01.02 | Benefits | 247,543 | 214,921 | |

7.08.01.03 | Government Severance Indemnity Fund for Employees | 59,102 | 56,979 | |

7.08.02 | Taxes, Fees and Contributions | 822,306 | 936,504 | |

7.08.02.01 | Federal | 374,872 | 479,636 | |

7.08.02.02 | State | 435,301 | 445,151 | |

7.08.02.03 | Municipal | 12,133 | 11,717 | |

7.08.03 | Capital Remuneration from Third Parties | 989,199 | 1,031,274 | |

7.08.03.01 | Interests | 909,442 | 949,934 | |

7.08.03.02 | Rents | 79,757 | 81,340 | |

7.08.04 | Interest on Own Capital | (113,806) | (285,734) | |

7.08.04.03 | Retained Earnings | (124,322) | (281,434) | |

7.08.04.04 | Non-Controlling Interest | 10,516 | (4,300) |

See accompanying notes to the consolidated financial statements.

18

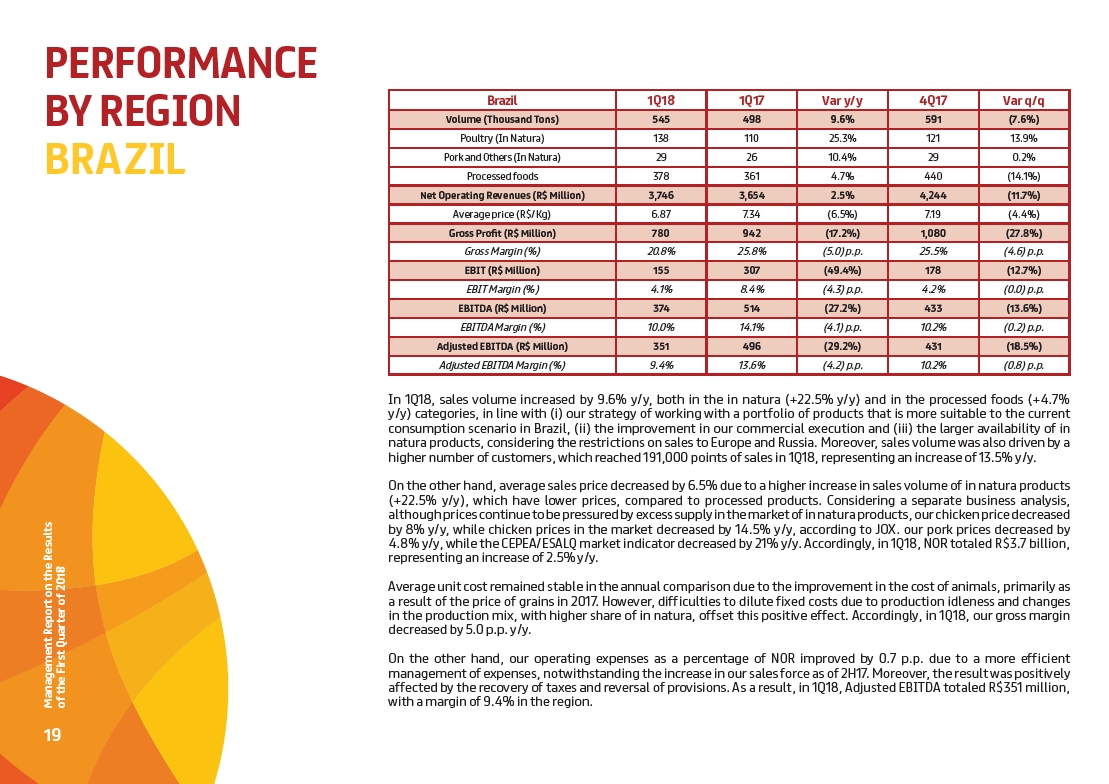

19

20

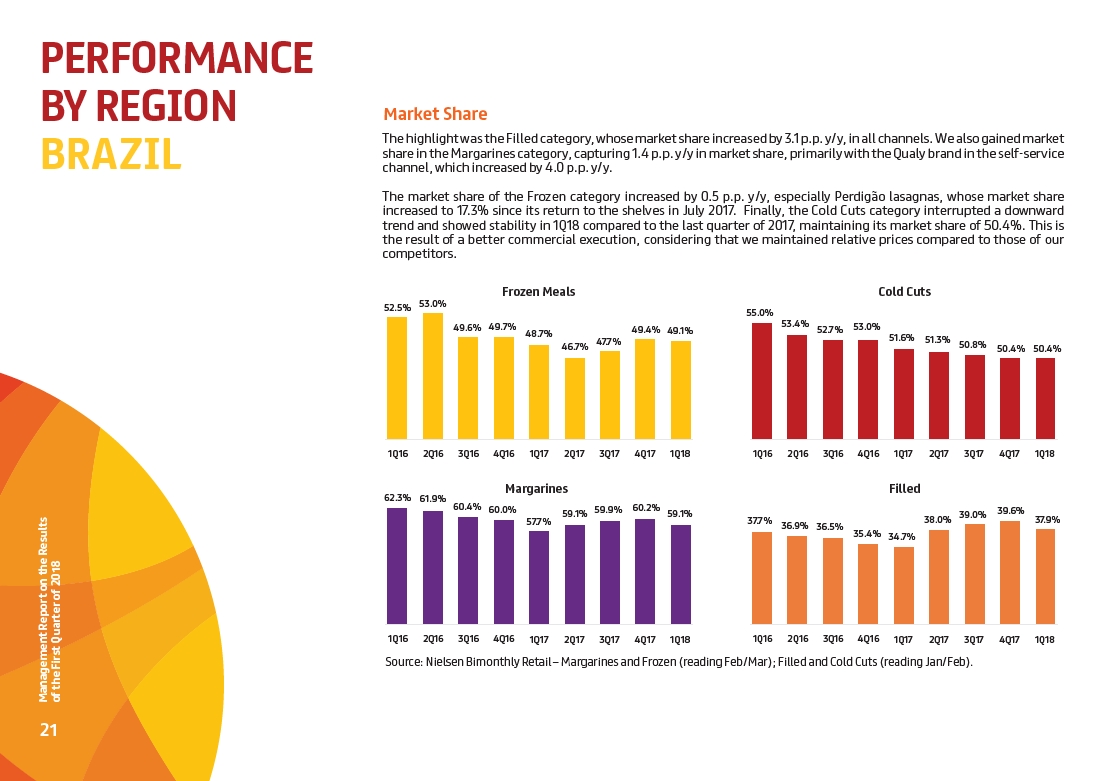

21

22

23

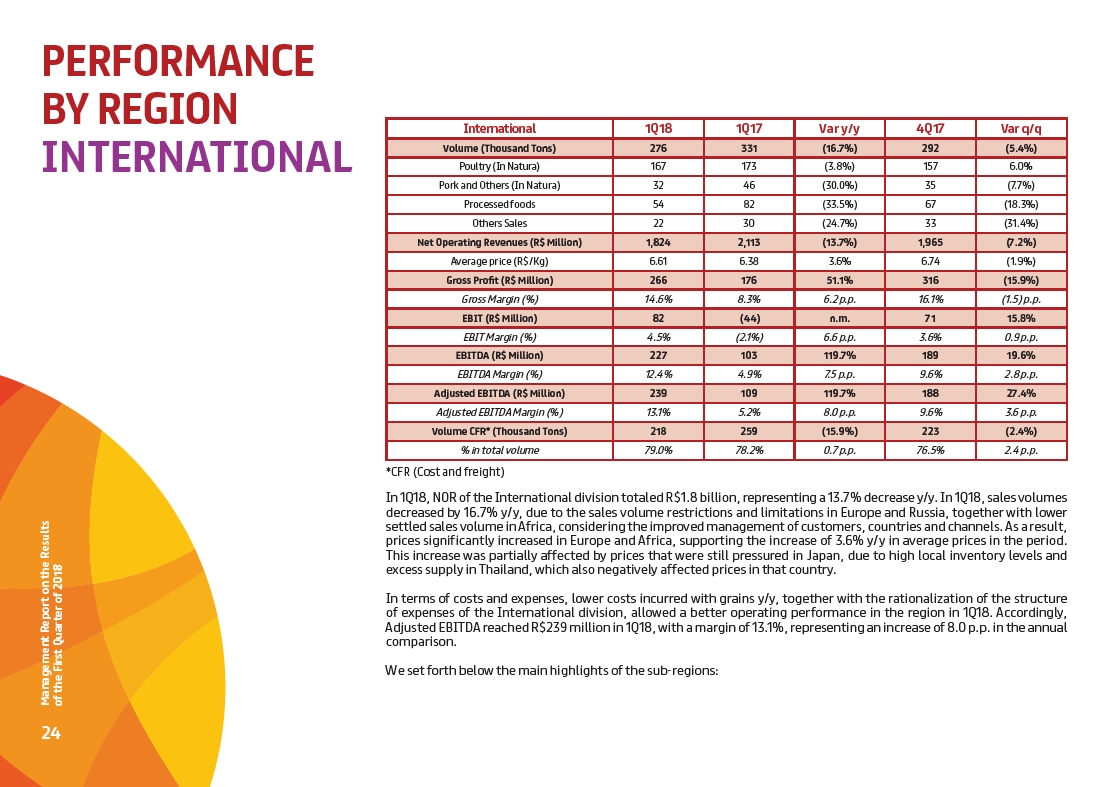

24

25

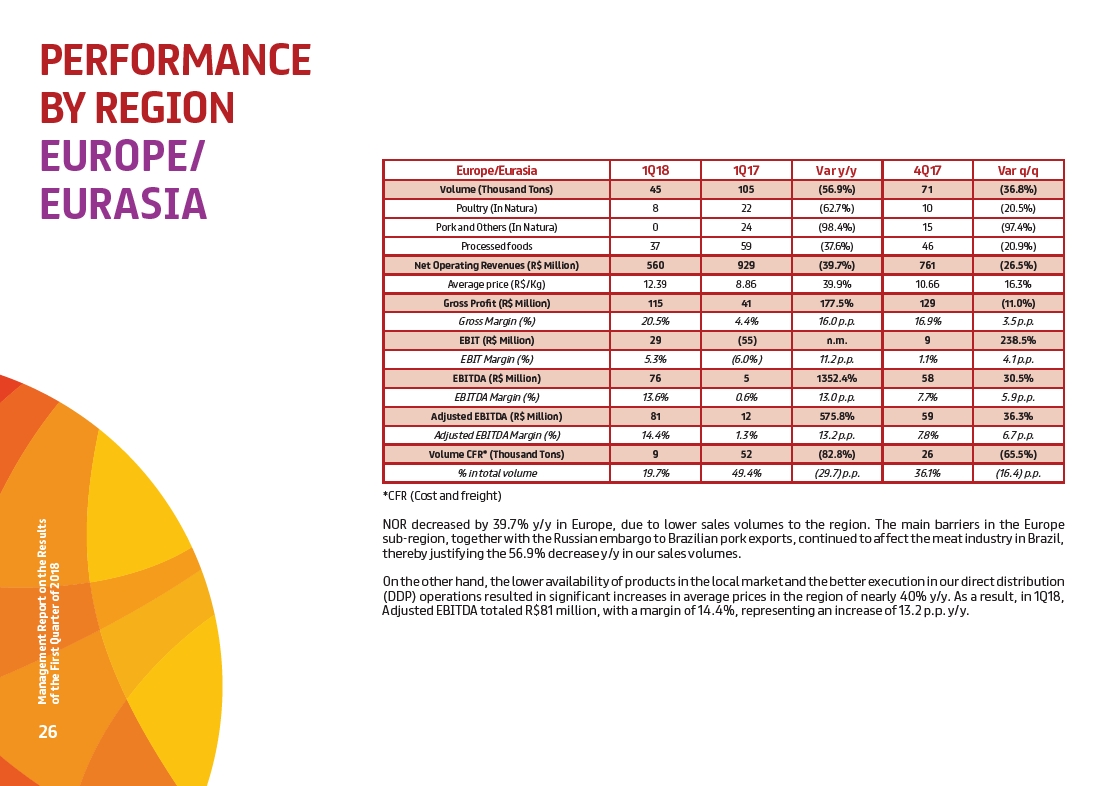

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Explanatory Notes (in thousands of Brazilian Reais)

|

|

1. COMPANY’S OPERATIONS

BRF S.A. (“BRF”) and its consolidated subsidiaries (collectively the “Company”) is a multinational Brazilian Company, which owns a comprehensive and diverse portfolio of products and it is one of the world’s largest producers of foods. With a focus on raising, producing and slaughtering of poultry and pork for processing, production and sale of fresh meat, processed products, pasta, sauce, mayonnaise, frozen vegetables and soybean by-products, among which the following are highlighted:

· Whole chickens and frozen cuts of chicken, turkey and pork;

· Ham products, bologna, sausages, frankfurters and other smoked products;

· Hamburgers, breaded meat products and meatballs;

· Lasagnas, pizzas, cheese breads, pies and frozen vegetables;

· Margarine, sauces and mayonnaise; and

· Soy meal and refined soy flour, as well as animal feed.

BRF is a public company, listed on the New Market of B3 (“Brasil, Bolsa, Balcão”), under the ticker BRFS3, and listed on the New York Stock Exchange (“NYSE”), under the ticker BRFS. Its headquarters are located at 475 Jorge Tzachel street, in the City of Itajaí, State of Santa Catarina.

Our portfolio strategy is focused on creating new, convenient, practical and healthy products for our consumers based on their needs. We seek to achieve that goal through strong innovation to provide us with increasing value-added items that will differentiate us from our competitors and strengthen our brands.

The Company's business model is by means of a vertical and integrated production system, which are distributed through an extensive distribution network, reaching the 5 continents, to meet the supermarkets, retail stores, wholesalers, restaurants and other institutional customers. In addition, our facilities are strategically located near to their raw material suppliers or its main consumption centers.

The Company has as main brands Sadia, Perdigão, Qualy, Chester®, Perdix, Paty and Banvit that are highly recognized, especially in Brazil, Argentina, Turkey and the Middle East. On February, 2018 the Company launched in Brazil the Kidelli brand that presents a portfolio of products different from other brands and very diversified, based on poultry and pork, offer our quality products with competitive price.

60

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Explanatory Notes (in thousands of Brazilian Reais)

|

|

1.1. Equity interest

% equity interest | |||||||||||||

Entity |

| Main activity | Country | Participation | Accounting method | 03.31.18 | 12.31.17 | ||||||

BRF Energia S.A. |

|

| Commercialization of eletric energy |

| Brazil |

| Direct |

| Consolidated |

| 100.00% |

| 100.00% |

BRF GmbH | Holding | Austria | Direct | Consolidated | 100.00% | 100.00% | |||||||

BRF Foods LLC | Import and commercialization of products | Russia | Indirect | Consolidated | 99.90% | 99.90% | |||||||

BRF France SARL | Marketing and logistics services | France | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF Global Company Nigeria Ltd. | Marketing and logistics services | Nigeria | Indirect | Consolidated | 99.00% | 99.00% | |||||||

BRF Global Company South Africa Proprietary Ltd. | Import and commercialization of products | South Africa | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF Global Company Nigeria Ltd. | Marketing and logistics services | Nigeria | Indirect | Consolidated | 1.00% | 1.00% | |||||||

BRF Global GmbH | (b) | Holding and trading | Austria | Indirect | Consolidated | 100.00% | 100.00% | ||||||

BRF Foods LLC | Import and commercialization of products | Russia | Indirect | Consolidated | 0.10% | 0.10% | |||||||

Qualy 5201 B.V. | (b) | Import, commercialization of products and holding | The Netherlands | Indirect | Consolidated | 100.00% | 100.00% | ||||||

Xamol Consultores Serviços Ltda. | Import and commercialization of products | Portugal | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF Japan KK | Marketing and logistics services | Japan | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF Korea LLC | Marketing and logistics services | Korea | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF Shanghai Management Consulting Co. Ltd. | Advisory and related services | China | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF Shanghai Trading Co. Ltd. | Commercialization and distribution of products | China | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF Singapore PTE Ltd. | Marketing and logistics services | Singapore | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF Germany GmbH | Import and commercialization of products | Germany | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF GmbH Turkiye Irtibat | Import and commercialization of products | Turkey | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF Holland B.V. | Import and commercialization of products | The Netherlands | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Campo Austral S.A. | Industrialization and commercialization of products | Argentina | Indirect | Consolidated | 2.66% | 2.66% | |||||||

Eclipse Holding Cöoperatief U.A. | Holding | The Netherlands | Indirect | Consolidated | 0.01% | 0.01% | |||||||

BRF B.V. | Industrialization, import and commercialization of products | The Netherlands | Indirect | Consolidated | 100.00% | 100.00% | |||||||

ProudFood Lda | Import and commercialization of products | Angola | Indirect | Consolidated | 10.00% | 10.00% | |||||||

BRF Hungary LLC | Import and commercialization of products | Hungary | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF Iberia Alimentos SL | Import and commercialization of products | Spain | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF Invicta Ltd. | Import, commercialization and distribution of products | England | Indirect | Consolidated | 69.16% | 69.16% | |||||||

Invicta Food Products Ltd. | Import and commercialization of products | England | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF Wrexham Ltd. | Industrialization, import and commercialization of products | England | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Invicta Food Group Ltd. | (b) | Import, commercialization and distribution of products | England | Indirect | Consolidated | 100.00% | 100.00% | ||||||

Invicta Foods Ltd. | Import, commercialization and distribution of products | England | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Invicta Foodservice Ltd. | Import, commercialization and distribution of products | England | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Universal Meats (UK) Ltd. | (b) | Import, Industrialization, commercialization and distribution of products | England | Indirect | Consolidated | 100.00% | 100.00% | ||||||

BRF Italia SPA | Import and commercialization of products | Italy | Indirect | Consolidated | 67.00% | 67.00% | |||||||

Compañía Paraguaya Comercial S.A. | Import and commercialization of products | Paraguay | Indirect | Consolidated | 99.00% | 99.00% | |||||||

Campo Austral S.A. | Industrialization and commercialization of products | Argentina | Indirect | Consolidated | 50.48% | 50.48% | |||||||

Itega S.A. | Holding | Argentina | Indirect | Consolidated | 96.00% | 96.00% | |||||||

Eclipse Holding Cöoperatief U.A. | Holding | The Netherlands | Indirect | Consolidated | 99.99% | 99.99% | |||||||

Buenos Aires Fortune S.A. | Holding | Argentina | Indirect | Consolidated | 5.00% | 5.00% | |||||||

Campo Austral S.A. | Industrialization and commercialization of products | Argentina | Indirect | Consolidated | 8.44% | 8.44% | |||||||

Eclipse Latam Holdings | Holding | Spain | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Buenos Aires Fortune S.A. | Holding | Argentina | Indirect | Consolidated | 95.00% | 95.00% | |||||||

Campo Austral S.A. | Industrialization and commercialization of products | Argentina | Indirect | Consolidated | 6.53% | 6.53% | |||||||

Campo Austral S.A. | Industrialization and commercialization of products | Argentina | Indirect | Consolidated | 31.89% | 31.89% | |||||||

Itega S.A. | Holding | Argentina | Indirect | Consolidated | 4.00% | 4.00% | |||||||

Golden Foods Poultry Limited | Holding | Thailand | Indirect | Consolidated | 48.52% | 48.52% | |||||||

Golden Poultry Siam Limited | Holding | Thailand | Indirect | Consolidated | 51.84% | 51.84% | |||||||

Golden Poultry Siam Limited | Holding | Thailand | Indirect | Consolidated | 48.16% | 48.16% | |||||||

BRF Thailand Limited | Import, Industrialization, commercialization and distribution of products | Thailand | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BRF Feed Thailand Limited | Import, Industrialization, commercialization and distribution of products | Thailand | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Golden Foods Sales (Europe) Limited | Holding and trading | England | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Golden Quality Foods Europe BV | Import, commercialization and distribution of products | The Netherlands | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Golden Quality Foods Netherlands BV | Import, commercialization and distribution of products | The Netherlands | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Golden Foods Siam Europe Limited | (b) | Import, commercialization and distribution of products | England | Indirect | Consolidated | 100.00% | 100.00% | ||||||

Golden Quality Poultry (UK) Ltd | Import, commercialization and distribution of products | England | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Perdigão Europe Lda. | Import and export of products | Portugal | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Perdigão International Ltd. | Import and export of products | Cayman Island | Indirect | Consolidated | 100.00% | 100.00% | |||||||

BFF International Ltd. | Financial fundraising | Cayman Island | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Highline International | (a) | Financial fundraising | Cayman Island | Indirect | Consolidated | 100.00% | 100.00% | ||||||

Sadia Overseas Ltd. | Financial fundraising | Cayman Island | Indirect | Consolidated | 98.00% | 98.00% | |||||||

ProudFood Lda | Import and commercialization of products | Angola | Indirect | Consolidated | 90.00% | 90.00% | |||||||

Sadia Chile S.A. | Import and commercialization of products | Chile | Indirect | Consolidated | 40.00% | 40.00% | |||||||

Sadia Foods GmbH | Import and commercialization of products | Germany | Indirect | Consolidated | 100.00% | 100.00% | |||||||

SATS BRF Food PTE Ltd. | Import, industrialization, commercialization and distribution of products | Singapore | Joint venture | Equity pick-up | 49.00% | 49.00% | |||||||

BRF Global Namíbia | Import and commercialization of products | Namibia | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Wellax Food Logistics C.P.A.S.U. Lda. |

| Import and commercialization of products | Portugal | Indirect | Consolidated | 100.00% | 100.00% | ||||||

BRF Luxembourg Sarl |

| Holding |

| Luxemburgo |

| Direct |

| Consolidated |

| 100.00% |

| 100.00% | |

BRF Austria GmbH | Holding | Austria | Indirect | Consolidated | 100.00% | 100.00% | |||||||

One Foods Holdings Ltd | Holding | United Arab Emirates | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Al-Wafi Food Products Factory LLC | Industrialization and commercialization of products | United Arab Emirates | Indirect | Consolidated | 49.00% | 49.00% | |||||||

Badi Ltd. | Holding | United Arab Emirates | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Al-Wafi Al-Takamol International for Foods Products | Import and commercialization of products | Saudi Arabia | Indirect | Consolidated | 75.00% | 75.00% | |||||||

BRF Al Yasra Food K.S.C.C. ("BRF AFC") | Import, commercialization and distribution of products | Kuwait | Indirect | Consolidated | 49.00% | 49.00% | |||||||

BRF Foods GmbH | Industrialization, import and commercialization of products | Austria | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Al Khan Foodstuff LLC ("AKF") | Import, commercialization and distribution of products | Oman | Indirect | Consolidated | 70.00% | 70.00% | |||||||

FFM Further Processing Sdn. Bhd. | Industrialization, import and commercialization of products | Malaysia | Indirect | Consolidated | 70.00% | 70.00% | |||||||

SHB Comércio e Indústria de Alimentos S.A. | Industrialization and commercialization of products | Brazil | Indirect | Consolidated | 99.99% | 99.99% | |||||||

TBQ Foods GmbH | Commercialization of products | Austria | Indirect | Consolidated | 60.00% | 60.00% | |||||||

Banvit Bandirma Vitaminli | Holding | Turkey | Indirect | Consolidated | 91.71% | 91.71% | |||||||

Banvit Enerji ve Elektrik Üretim Ltd. Sti. | Commercialization of eletric energy | Turkey | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Banvit Foods SRL | Industrialization of grains and animal feed | Romania | Indirect | Consolidated | 0.01% | 0.01% | |||||||

Nutrinvestments BV | Holding | The Netherlands | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Banvit ME FZE | Marketing and logistics services | United Arab Emirates | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Banvit Foods SRL | Industrialization of grains and animal feed | Romania | Indirect | Consolidated | 99.99% | 99.99% | |||||||

BRF Malaysia Sdn Bhd | Marketing and logistics services | Malaysia | Indireta | Consolidated | 100.00% | 100.00% | |||||||

Federal Foods LLC | Import, commercialization and distribution of products | United Arab Emirates | Indirect | Consolidated | 49.00% | 49.00% | |||||||

Federal Foods Qatar | Import, commercialization and distribution of products | Qatar | Indirect | Consolidated | 49.00% | 49.00% | |||||||

SHB Comércio e Indústria de Alimentos S.A. | Industrialization and commercialization of products | Brazil | Indirect | Consolidated | 0.01% | 0.01% | |||||||

BRF Hong Kong LLC | Import, commercialization and distribution of products | Hong Kong | Indirect | Consolidated | 100.00% | 100.00% | |||||||

Establecimiento Levino Zaccardi y Cia. S.A. | (a) |

| Industrialization and commercialization of dairy products |

| Argentina |

| Direct |

| Consolidated |

| 99.94% |

| 99.94% |

BRF Pet S.A. |

|

| Industrialization and commercialization and distribution of feed and nutrients for animals |

| Brazil |

| Direct |

| Consolidated |

| 100.00% |

| 100.00% |

PP-BIO Administração de bem próprio S.A. |

|

| Management of assets |

| Brazil |

| Affiliate |

| Equity pick-up |

| 33.33% |

| 33.33% |

PSA Laboratório Veterinário Ltda. |

| Veterinary activities |

| Brazil |

| Direct |

| Consolidated |

| 99.99% |

| 99.99% | |

Sino dos Alpes Alimentos Ltda. | (a) | Industrialization and commercialization of products | Brazil | Indirect | Consolidated | 99.99% | 99.99% | ||||||

PR-SAD Administração de bem próprio S.A. |

|

| Management of assets |

| Brazil |

| Affiliate |

| Equity pick-up |

| 33.33% |

| 33.33% |

Quickfood S.A. |

|

| Industrialization and commercialization of products |

| Argentina |

| Direct |

| Consolidated |

| 91.21% |

| 91.21% |

Sadia Alimentos S.A. | Holding | Argentina | Direct | Consolidated | 43.10% | 43.10% | |||||||

Avex S.A. |

|

| Industrialization and commercialization of products |

| Argentina |

| Indirect |

| Consolidated |

| 33.98% |

| 33.98% |

Sadia International Ltd. | Import and commercialization of products | Cayman Island | Direct | Consolidated | 100.00% | 100.00% | |||||||

Sadia Chile S.A. | Import and commercialization of products | Chile | Indirect | Consolidated | 60.00% | 60.00% | |||||||

Sadia Uruguay S.A. | Import and commercialization of products | Uruguay | Indirect | Consolidated | 5.10% | 5.10% | |||||||

Avex S.A. | Industrialization and commercialization of products | Argentina | Indirect | Consolidated | 66.02% | 66.02% | |||||||

Compañía Paraguaya Comercial S.A. | Import and commercialization of products | Paraguay | Indirect | Consolidated | 1.00% | 1.00% | |||||||

Sadia Alimentos S.A. |

|

| Holding |

| Argentina |

| Indirect |

| Consolidated |

| 56.90% |

| 56.90% |

Sadia Overseas Ltd. |

|

| Financial fundraising |

| Cayman Island |

| Direct |

| Consolidated |

| 2.00% |

| 2.00% |

Sadia Uruguay S.A. | Import and commercialization of products | Uruguay | Direct | Consolidated |

| 94.90% |

| 94.90% | |||||

UP Alimentos Ltda. |

|

| Industrialization and commercialization of products |

| Brazil |

| Affiliate |

| Equity pick-up |

| 50.00% |

| 50.00% |

Vip S.A. Empreendimentos e Participações Imobiliárias | Commercialization of owned real state | Brazil | Direct | Consolidated | 100.00% | 100.00% | |||||||

Establecimiento Levino Zaccardi y Cia. S.A. | (a) | Industrialization and commercialization of dairy products | Argentina | Indirect | Consolidated | 0.06% | 0.06% | ||||||

PSA Laboratório Veterinário Ltda. | Veterinary activities | Brazil | Indirect | Consolidated | 0.01% | 0.01% | |||||||

Sino dos Alpes Alimentos Ltda. | (a) |

| Industrialization and commercialization of products |

| Brazil |

| Indirect |

| Consolidated |

| 0.01% |

| 0.01% |

61

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Explanatory Notes (in thousands of Brazilian Reais)

|

|

(a) Dormant subsidiaries.

(b) The wholly-owned subsidiary BRF Global GmbH, operates as a trading in the European market and owns 101 direct subsidiaries in Madeira Island, Portugal, with an investment as of March 31, 2018 of R$3,415 (R$3,617 as of December 31, 2017) and a direct subsidiary in Den Bosch, The Netherlands, denominated Qualy 20 with an investment as of March 31, 2018 of R$6,735 (R$6,471 as of December 31, 2017). The wholly-owned subsidiary Qualy 5201 B.V. owns 212 subsidiaries in The Netherlands being the amount of this investment as of March 31, 2018 of R$24,090 (R$20,210 as of December 31, 2017). The indirect subsidiary Invicta Food Group Ltd. owns 120 direct subsidiaries in Ashford, England, with an investment of R$131,162 as of March 31, 2018 (R$126,570 as of December 31, 2017). The indirect subsidiary Universal Meats (UK) Ltd owns 99 direct subsidiaries in Ashford, England with an investment of R$41,950 as of March 31, 2018 (R$41,636 as of December 31, 2017). The indirect subsidiary Golden Foods Siam Europe Ltd (GFE) owns 32 subsidiaries in Ashford. England with an investment of R$375 as of March 31, 2018 (R$16 as of December 31, 2017). The purpose of these subsidiaries is to operate in the European market to increase the Company’s market share, which is regulated by a system of poultry and turkey meat import quotas.

1.2. Carne Fraca Operation

BRF's Statutory Audit Committee has initiated an investigation with respect to the allegations involving BRF employees in the Carne Fraca Operation and it involved outside counsel. The investigation is substantially concluded.

The Company revisited food quality and safety processes and reinforced our internal control and compliance.

1.3. Trapaça Operation

On March 5, 2018, the Company learned of a decision issued by a federal judge of the 1st Federal Court of Ponta Grossa/PR, authorizing the search and seizure of information and documents from us and certain current and former employees, and the temporary detention of eleven individuals, who have already been released. Current or former employees of BRF were identified for questioning. Based on the judge’s decision authorizing the temporary detention and the search and seizure, the main allegations at this stage involve alleged misconduct relating to quality violations, improper use of feed components, and falsification of tests at certain BRF manufacturing plants and accredited labs.

62

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Explanatory Notes (in thousands of Brazilian Reais)

|

|

The Company is cooperating with authorities and initiated an internal investigation with respect to the allegations. BRF’s Statutory Audit Committee has initiated an investigation with respect to the alleged misconduct involving BRF employees in the Trapaça Operation and it involved outside counsel. The investigation is still at its early stages and at this point the results obtained have not indicated necessary adjustments in BRF’s financial statements.

As a result of the Trapaça Operation, on March 5, 2018, BRF received notice from Ministry of Agriculture, Livestock and Food Supply (“MAPA”) that it immediately suspended exports from its Rio Verde/GO, Carambeí/PR and Mineiros/GO plants to 12 (twelve) countries that require specific sanitary requirements for the control of the bacteria group Salmonella spp and Salmonella pullorum. On March 15, 2018, MAPA suspended exports from 9 (nine) other BRF plants to the European Union, but revoked the temporary suspension on April 18, 2018. Although to date, the Company have not received any formal notice from Brazilian or European authorities, media reports indicate that the European Union is considering suspending imports of poultry from certain production facilities in Brazil, including supposedly due to sanitary concerns. If the European Union, were to implement any such ban of imports from BRF’s production facilities, the Company may not be able to sell its products from such embargoed production plants in the European Union, and depending on the extension of such suspension, it’s results of operations may be adversely affected if BRF are not capable of directing any exceeding production capacity resulting from suspension to other markets at similar prices.

The outcome of this operation may result in penalties, fines and sanctions from governmental authorities or other forms of liabilities. Also, as a result of this operation, the Company may present losses related to contingencies, adjustments to net realizable value of inventories and recoverability of certain assets, all of which are not possible to be estimated at this moment and therefore, no provision has been recorded, except for expenses incurred and disclosed in note 31.

1.4. U.S. Class Action

On March 12, 2018, a purported shareholder class action lawsuit was filed in U.S. Federal District Court in the Southern District of New York alleging, among other things, that BRF and certain of its officers and/or directors engaged in securities fraud or other unlawful business practices related to the regulatory issues or other illegal commercial acts related to Trapaça and Carne Fraca Operation. Because this lawsuit is in its early stage, the possible loss or range of losses, if any, arising from this litigation cannot be estimated. While BRF believes that the claims are without merit and will continue to defend against the litigation vigorously, in the event that this litigation is decided against the Company, or BRF enter into an agreement to settle, there can be no assurance that an unfavorable outcome would not have a material impact.

63

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE)

ITR – Quarterly Information – March 31, 2018 – BRF S.A.

Explanatory Notes (in thousands of Brazilian Reais)

|

|

1.5. Extraordinary General Shareholders’ Meeting for change of Board of Directors

On March 5, 2018, the Company was called for an Extraordinary General Shareholders’ Meeting to be held jointly with the Ordinary General Shareholders’ Meeting on April 26, 2018 to deliberate on the requests: (i) removal of all current members of the Board of Directors; (ii) approval of the number of 10 members to compose the Board of Directors; (iii) election of new members to fill the positions on the Board of Directors; and (iv) election of the Chairman and Vice-Chairman of the Board of Directors.

1.6. Seasonality

In Brazil and Southern Cone operating segments, in months of November and December of each year, the Company is impacted by seasonality due to Christmas and New Year’s Celebrations, being the best-selling products in this period: turkey, Chester®, ham and pork loins.

In One Foods operating segment, seasonality is due to Ramadan, which is the holy month of the Muslim Calendar. The start of Ramadan depends on the beginning of the moon cycle and therefore can vary each year.

2. MANAGEMENT’S STATEMENT AND BASIS OF PREPARATION AND PRESENTATION OF FINANCIAL STATEMENTS