- BRFS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

BRF (BRFS) 6-KCurrent report (foreign)

Filed: 11 May 20, 6:09am

FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated May11, 2020

Commission File Number 1-15148

BRF S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

8501, Av. das Nações Unidas, 1st Floor

Pinheiros - 05425-070-São Paulo – SP, Brazil

(Address of principal executive offices) (Zip code)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

* * *

This material includes certain forward-looking statements that are based principally on current expectations and on projections of future events and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance. These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors” in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May11, 2020 |

| ||

|

| ||

| BRF S.A. | ||

|

| ||

|

| ||

| By: | /s/ Carlos Alberto Bezerra de Moura | |

|

| Name: | Carlos Alberto Bezerra de Moura |

|

| Title: | Chief Financial and Investor Relations Officer

|

INDEX

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

2

INDEPENDENT AUDITOR’S REPORT ON REVIEW OF INTERIM FINANCIAL INFORMATION | ||

STATEMENT OF EXECUTIVE BOARD ON THE INTERIM FINANCIAL INFORMATION AND INDEPENDENT AUDITOR’S REPORT | ||

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

3

(in thousands of Brazilian Reais)

|

|

| Parent company |

| Consolidated |

|

|

| Parent company |

| Consolidated | |||||||||

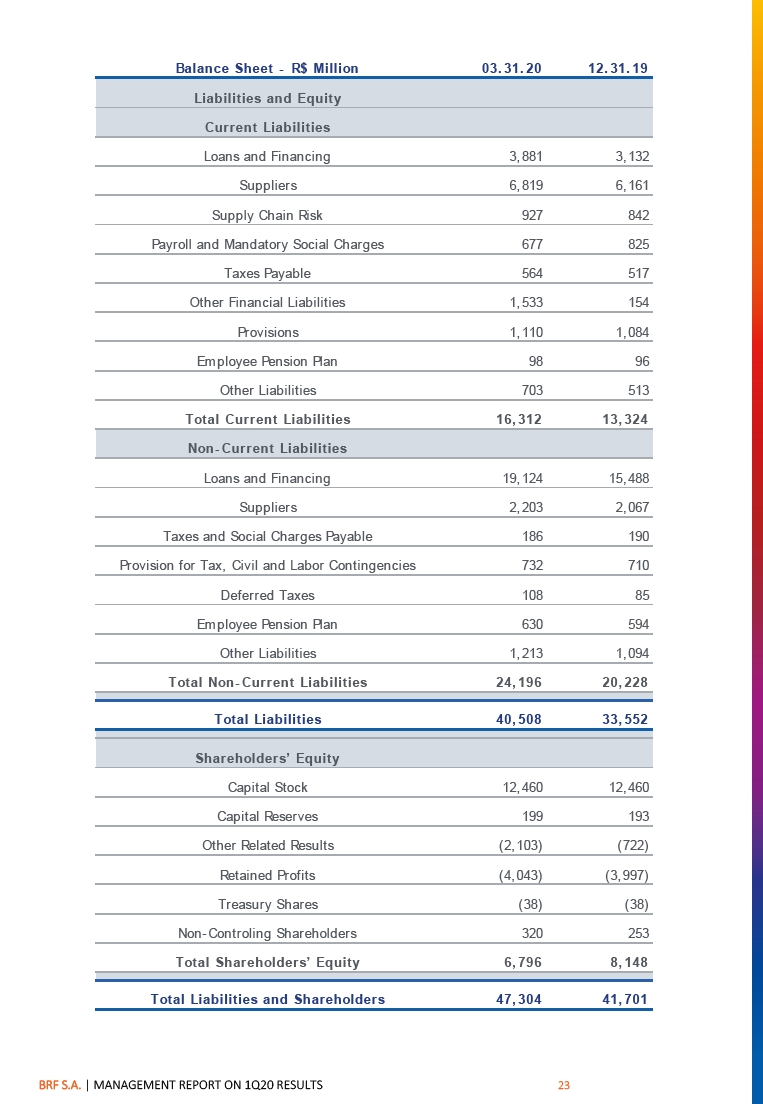

ASSETS | Note |

| 03.31.20 |

| 12.31.19 |

| 03.31.20 |

| 12.31.19 | LIABILITIES | Note |

| 03.31.20 |

| 12.31.19 |

| 03.31.20 |

| 12.31.19 | |

CURRENT ASSETS |

|

|

| CURRENT LIABILITIES |

|

|

| |||||||||||||

Cash and cash equivalents | 4 |

| 3,944,305 |

| 1,368,980 |

| 7,960,987 |

| 4,237,785 | Loans and borrowings | 15 |

| 3,771,137 |

| 3,033,034 |

| 3,880,548 |

| 3,132,029 | |

Marketable securities | 5 |

| 307,184 |

| 396,994 |

| 331,313 |

| 418,182 | Trade accounts payable | 16 |

| 5,800,464 |

| 5,270,762 |

| 6,455,268 |

| 5,784,419 | |

Trade and other receivables | 6 |

| 8,337,294 |

| 6,153,937 |

| 3,022,747 |

| 3,090,691 | Supply chain finance | 17 |

| 927,409 |

| 842,037 |

| 927,409 |

| 842,037 | |

Inventories | 7 |

| 3,302,873 |

| 2,786,147 |

| 4,765,144 |

| 3,887,916 | Lease liability | 18 |

| 285,032 |

| 313,058 |

| 364,208 |

| 376,628 | |

Biological assets | 8 |

| 1,624,830 |

| 1,545,127 |

| 1,702,523 |

| 1,603,039 | Payroll, related charges and employee profit sharing |

|

| 634,071 |

| 754,032 |

| 676,697 |

| 825,254 | |

Recoverable taxes | 9 |

| 275,517 |

| 274,480 |

| 486,067 |

| 473,732 | Tax payable |

|

| 228,332 |

| 268,193 |

| 563,826 |

| 517,208 | |

Recoverable income tax and social contribution | 9 |

| 47,976 |

| 40,291 |

| 192,467 |

| 152,486 | Derivative financial instruments | 24 |

| 1,523,671 |

| 151,722 |

| 1,533,176 |

| 153,612 | |

Derivative financial instruments | 24 |

| 281,299 |

| 193,740 |

| 282,115 |

| 195,324 | Provision for tax, civil and labor risks | 21 |

| 1,106,358 |

| 1,081,103 |

| 1,110,288 |

| 1,084,308 | |

Restricted cash |

|

| 24,361 |

| 296,294 |

| 24,361 |

| 296,294 | Employee benefits | 20 |

| 87,996 |

| 87,996 |

| 97,569 |

| 95,919 | |

Assets held for sale |

|

| 11,561 |

| 16,671 |

| 102,092 |

| 99,245 | Advances from related parties | 30 |

| 9,921,495 |

| 5,364,164 |

| - |

| - | |

Other current assets |

|

| 482,228 |

| 495,743 |

| 589,852 |

| 590,733 | Other current liabilities |

|

| 456,401 |

| 329,166 |

| 702,880 |

| 512,591 | |

Total current assets | 18,639,428 |

| 13,568,404 |

| 19,459,668 |

| 15,045,427 | Total current liabilities | 24,742,366 |

| 17,495,267 |

| 16,311,869 |

| 13,324,005 | |||||

|

|

|

|

|

| |||||||||||||||

NON-CURRENT ASSETS |

|

|

| NON-CURRENT LIABILITIES |

|

|

| |||||||||||||

LONG-TERM RECEIVALBLES |

|

|

|

|

|

|

|

|

| Loans and borrowings | 15 |

| 16,318,102 |

| 13,395,970 |

| 19,124,159 |

| 15,488,250 | |

Marketable securities | 5 |

| 15,490 |

| 14,891 |

| 381,942 |

| 307,352 | Trade accounts payable | 16 |

| 8,505 |

| 12,347 |

| 8,505 |

| 12,347 | |

Trade and other receivables | 6 |

| 68,202 |

| 71,029 |

| 68,201 |

| 71,029 | Lease liability | 18 |

| 2,023,682 |

| 1,939,494 |

| 2,194,078 |

| 2,054,552 | |

Recoverable taxes | 9 |

| 5,222,133 |

| 5,167,016 |

| 5,222,107 |

| 5,169,547 | Tax payable |

|

| 185,693 |

| 190,257 |

| 185,693 |

| 190,257 | |

Recoverable income tax and social contribution | 9 |

| 196,403 |

| 264,428 |

| 202,557 |

| 269,263 | Provision for tax, civil and labor risks | 21 |

| 731,732 |

| 709,760 |

| 732,093 |

| 710,061 | |

Deferred income taxes | 10 |

| 2,375,746 |

| 1,808,494 |

| 2,395,469 |

| 1,845,862 | Deferred income tax | 10 |

| - |

| - |

| 107,967 |

| 85,310 | |

Judicial deposits | 11 |

| 575,795 |

| 575,681 |

| 575,879 |

| 575,750 | Liabilities with related parties | 30 |

| 1,218,304 |

| 960,056 |

| - |

| - | |

Biological assets | 8 |

| 1,033,290 |

| 1,016,642 |

| 1,112,864 |

| 1,081,025 | Employee benefits | 20 |

| 521,262 |

| 506,791 |

| 630,205 |

| 593,555 | |

Receivables from related parties | 30 |

| 305 |

| 234 |

| - |

| - | Derivative financial instruments | 24 |

| 38,629 |

| 3 |

| 38,629 |

| 3 | |

Derivative financial instruments | 24 |

| 7,164 |

| 49,991 |

| 7,164 |

| 49,991 | Other non-current liabilities |

|

| 435,963 |

| 482,109 |

| 1,174,685 |

| 1,093,942 | |

Other non-current assets |

|

| 72,555 |

| 78,516 |

| 80,874 |

| 85,537 |

|

|

|

|

|

| |||||

Total long-term receivables | 9,567,083 |

| 9,046,922 |

| 10,047,057 |

| 9,455,356 | Total non-current liabilities | 21,481,872 |

| 18,196,787 |

| 24,196,014 |

| 20,228,277 | |||||

|

|

|

|

|

| |||||||||||||||

|

|

|

|

|

| |||||||||||||||

|

|

| EQUITY | 22 |

|

|

| |||||||||||||

|

|

| Capital |

|

| 12,460,471 |

| 12,460,471 |

| 12,460,471 |

| 12,460,471 | ||||||||

|

|

| Capital reserves |

|

| 199,434 |

| 192,845 |

| 199,434 |

| 192,845 | ||||||||

Investments | 12 |

| 10,059,770 |

| 6,499,517 |

| 16,909 |

| 14,880 | Accumulated losses |

|

| (4,042,906) |

| (3,996,985) |

| (4,042,906) |

| (3,996,985) | |

Property, plant and equipment, net | 13 |

| 11,194,839 |

| 11,333,302 |

| 12,375,656 |

| 12,276,889 | Treasury shares |

|

| (38,239) |

| (38,239) |

| (38,239) |

| (38,239) | |

Intangible assets | 14 |

| 3,239,355 |

| 3,139,532 |

| 5,405,045 |

| 4,908,079 | Other comprehensive loss |

|

| (2,102,523) |

| (722,469) |

| (2,102,523) |

| (722,469) | |

|

|

| Attributable to controlling shareholders |

|

| 6,476,237 |

| 7,895,623 |

| 6,476,237 |

| 7,895,623 | ||||||||

|

|

| Non-controlling interests |

|

| - |

| - |

| 320,215 |

| 252,726 | ||||||||

Total non-current assets | 34,061,047 |

| 30,019,273 |

| 27,844,667 |

| 26,655,204 | Total equity | 6,476,237 |

| 7,895,623 |

| 6,796,452 |

| 8,148,349 | |||||

|

|

|

|

|

| |||||||||||||||

TOTAL ASSETS | 52,700,475 |

| 43,587,677 |

| 47,304,335 |

| 41,700,631 | TOTAL LIABILITIES AND EQUITY | 52,700,475 |

| 43,587,677 |

| 47,304,335 |

| 41,700,631 | |||||

The accompanying notes are an integral part of the interim financial information.

BRF S.A.|INTERIM FINANCIAL INFORMATION - March 31, 2020

4

(in thousands of Brazilian Reais)

|

|

| Parent company |

| Consolidated | ||||

| Note |

| January to March 2020 |

| January to March 2019 |

| January to March 2020 |

| January to March 2019 |

CONTINUING OPERATIONS |

|

|

| ||||||

NET SALES | 26 |

| 7,449,045 |

| 6,417,946 |

| 8,949,065 |

| 7,359,250 |

Cost of sales | 29 |

| (5,828,909) |

| (5,269,824) |

| (6,696,088) |

| (5,842,180) |

GROSS PROFIT |

|

| 1,620,136 |

| 1,148,122 |

| 2,252,977 |

| 1,517,070 |

OPERATING INCOME (EXPENSES) |

|

|

|

|

|

|

|

|

|

Selling expenses | 29 |

| (1,032,567) |

| (900,491) |

| (1,284,334) |

| (1,135,295) |

General and administrative expenses | 29 |

| (87,281) |

| (91,680) |

| (142,560) |

| (141,229) |

Impairment loss on trade and other receivables | 29 |

| (31,102) |

| (6,538) |

| (32,851) |

| (5,507) |

Other operating income (expenses), net | 27 |

| (231,331) |

| (87,492) |

| (238,553) |

| (76,676) |

Income (loss) from associates and joint ventures | 12 |

| 3,987,252 |

| 212,368 |

| - |

| (165) |

INCOME BEFORE FINANCIAL RESULTS AND INCOME TAXES |

|

| 4,225,107 |

| 274,289 |

| 554,679 |

| 158,198 |

Financial expenses | 28 |

| (614,740) |

| (512,101) |

| (569,350) |

| (503,260) |

Financial income | 28 |

| 106,777 |

| 79,893 |

| 112,878 |

| 86,061 |

Foreign exchange and monetary variations | 28 | (3,813,529) | (144,281) | (149,997) |

| (31,066) | |||

LOSS BEFORE TAXES FROM CONTINUING OPERATIONS |

|

| (96,385) |

| (302,200) |

| (51,790) |

| (290,067) |

Income taxes | 10 |

| 50,464 |

| 190,137 |

| 13,558 |

| 176,789 |

LOSS FROM CONTINUING OPERATIONS |

|

| (45,921) |

| (112,063) |

| (38,232) |

| (113,278) |

DISCONTINUED OPERATIONS |

|

|

|

|

|

|

|

|

|

|

|

| |||||||

LOSS FROM DISCONTINUED OPERATIONS |

|

| - |

| (888,872) |

| - |

| (899,053) |

LOSS FOR THE PERIOD | (45,921) |

| (1,000,935) |

| (38,232) |

| (1,012,331) | ||

|

|

|

| ||||||

Net Income (Loss) from Continuing Operation Attributable to |

|

|

|

|

|

|

|

|

|

Controlling shareholders |

|

| (45,921) |

| (112,063) |

| (45,921) |

| (112,063) |

Non-controlling interest |

|

| - |

| - |

| 7,689 |

| (1,215) |

(45,921) |

| (112,063) |

| (38,232) |

| (113,278) | |||

|

|

| |||||||

Net Loss From Discontinued Operation Attributable to |

|

|

|

|

|

|

|

|

|

Controlling shareholders |

|

| - |

| (888,872) |

| - |

| (888,872) |

Non-controlling interest |

|

| - |

| - |

| - |

| (10,181) |

- |

| (888,872) |

| - |

| (899,053) | |||

|

|

| |||||||

LOSSES PER SHARE FROM CONTINUING OPERATIONS |

|

|

| ||||||

Weighted average shares outstanding - basic | 811,759,800 |

| 811,416,158 | ||||||

Losses per share - basic | 23 | (0.06) |

| (0.14) | |||||

Weighted average shares outstanding - diluted | 811,759,800 |

| 811,416,158 | ||||||

Losses per share - diluted | 23 | (0.06) |

| (0.14) | |||||

|

|

| |||||||

LOSSES PER SHARE FROM DISCONTINUED OPERATIONS |

|

|

| ||||||

Weighted average shares outstanding - basic | 811,759,800 |

| 811,416,158 | ||||||

Losses per share - basic | 23 | - |

| (1.10) | |||||

Weighted average shares outstanding - diluted | 811,759,800 |

| 811,416,158 | ||||||

Losses per share - diluted | 23 | - |

| (1.10) | |||||

The accompanying notes are an integral part of the interim financial information.

BRF S.A.|INTERIM FINANCIAL INFORMATION - March 31, 2020

5

(in thousands of Brazilian Reais)

|

|

| Parent company |

| Consolidated | ||||

| Note |

| January to March 2020 |

| January to March 2019 |

| January to March 2020 |

| January to March 2019 |

Loss for the period |

|

| (45,921) |

| (1,000,935) |

| (38,232) |

| (1,012,331) |

Other comprehensive income (loss) |

|

|

| ||||||

Gains (losses) on foreign currency translation adjustments |

|

| (101,550) |

| 708,460 |

| (41,703) |

| 698,465 |

Losses on hedge investments, net |

|

| (272,875) |

| - |

| (272,875) |

| - |

Unrealized gains (losses) on cash flow hedge | 24 |

| (1,009,511) |

| 14,239 |

| (1,009,511) |

| 14,239 |

Gains (losses) on marketable securities from debt securities at FVTOCI (1) | 5 | (2,873) |

| 393 |

| (2,873) |

| 393 | |

Net other comprehensive income (loss), to be reclassified to the statement of income in subsequent periods |

|

| (1,386,809) |

| 723,092 |

| (1,326,962) |

| 713,097 |

Gains on marketable equity securities at FVTOCI (1) | 5 |

| 367 |

| 61,016 |

| 367 |

| 61,016 |

Actuarial gains on pension and post-employment plans | 20 |

| 6,388 |

| 918 |

| 6,341 |

| 583 |

Net other comprehensive income, with no impact into subsequent statement of income |

|

| 6,755 |

| 61,934 |

| 6,708 |

| 61,599 |

Total comprehensive loss, net of taxes | (1,425,975) |

| (215,909) |

| (1,358,486) |

| (237,635) | ||

Attributable to |

|

|

|

|

|

|

|

|

|

Controlling shareholders | (1,425,975) |

| (215,909) |

| (1,425,975) |

| (215,909) | ||

Non-controlling interest | - |

| - |

| 67,489 |

| (21,726) | ||

(1,425,975) |

| (215,909) |

| (1,358,486) |

| (237,635) | |||

(1) FVTOCI: Fair Value Through Other Comprehensive Income.

Items above are stated net of tax and the related taxes are disclosed in note 10.

The accompanying notes are an integral part of the interim financial information.

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

6

(in thousands of Brazilian Reais)

|

| Attributed to of controlling shareholders | ||||||||||||||||||||

|

|

|

|

|

| Other comprehensive income (loss) |

|

|

|

| ||||||||||||

|

| Paid-in capital |

| Capital reserve |

| Treasury shares |

| Accumulated foreign currency translation adjustments |

| Marketable securities at FVTOCI |

| Gain (losses) on cash flow hedge |

| Actuarial losses |

| Retained earnings (losses) |

| Total equity |

| Non-controlling interest |

| Total shareholders' equity |

BALANCES AT DECEMBER 31, 2018 |

| 12,460,471 |

| 115,354 |

| (56,676) |

| (752,815) |

| (98,451) |

| (396,165) |

| (28,088) |

| (4,279,003) |

| 6,964,627 |

| 567,150 |

| 7,531,777 |

Adoption of IFRS 16 |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 6,287 |

| 6,287 |

| - |

| 6,287 |

Comprehensive income (loss) (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gains (losses) on foreign currency translation adjustments |

| - |

| - |

| - |

| 559,436 |

| - |

| - |

| - |

| - |

| 559,436 |

| (30,666) |

| 528,770 |

Gains in marketable securities at FVTOCI (2) |

| - |

| - |

| - |

| - |

| 102,905 |

| - |

| - |

| - |

| 102,905 |

| - |

| 102,905 |

Unrealized gains in cash flow hedge |

| - |

| - |

| - |

| - |

| - |

| 39,444 |

| - |

| - |

| 39,444 |

| - |

| 39,444 |

Actuarial losses on pension and post-employment plans |

| - |

| - |

| - |

| - |

| - |

| - |

| (148,735) |

| - |

| (148,735) |

| (1,786) |

| (150,521) |

Income (loss) for the year |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 297,612 |

| 297,612 |

| (160) |

| 297,452 |

SUB-TOTAL COMPREHENSIVE INCOME (LOSS) |

| - |

| - |

| - |

| 559,436 |

| 102,905 |

| 39,444 |

| (148,735) |

| 297,612 |

| 850,662 |

| (32,612) |

| 818,050 |

Realized loss in marketable securities at FVTOCI (2) |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (52,493) |

| (52,493) |

| - |

| (52,493) |

Employee benefits remeasurement - defined benefit |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 30,612 |

| 30,612 |

| - |

| 30,612 |

Appropriation of income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (4,988) |

| (4,988) |

Share-based payments |

| - |

| (6,861) |

| 18,437 |

| - |

| - |

| - |

| - |

| - |

| 11,576 |

| - |

| 11,576 |

Acquisition (sale) of non-controlling interests |

| - |

| 84,352 |

| - |

| - |

| - |

| - |

| - |

| - |

| 84,352 |

| (276,824) |

| (192,472) |

BALANCES AT DECEMBER 31, 2019 | 12,460,471 |

| 192,845 |

| (38,239) |

| (193,379) |

| 4,454 |

| (356,721) |

| (176,823) |

| (3,996,985) |

| 7,895,623 |

| 252,726 |

| 8,148,349 | |

Comprehensive income (loss) (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gains (losses) on foreign currency translation adjustments |

| - |

| - |

| - |

| (101,550) |

| - |

| - |

| - |

| - |

| (101,550) |

| 59,847 |

| (41,703) |

Losses on hedge investments, net |

| - |

| - |

| - |

| (272,875) |

| - |

| - |

| - |

| - |

| (272,875) |

| - |

| (272,875) |

Unrealized losses on marketable securities at FVTOCI (2) |

| - |

| - |

| - |

| - |

| (2,506) |

| - |

| - |

| - |

| (2,506) |

| - |

| (2,506) |

Unrealized losses in cash flow hedge |

| - |

| - |

| - |

| - |

| - |

| (1,009,511) |

| - |

| - |

| (1,009,511) |

| - |

| (1,009,511) |

Actuarial gains (losses) on pension and post-employment plans |

| - |

| - |

| - |

| - |

| - |

| - |

| 6,388 |

| - |

| 6,388 |

| (47) |

| 6,341 |

Income (loss) for the period |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (45,921) |

| (45,921) |

| 7,689 |

| (38,232) |

SUB-TOTAL COMPREHENSIVE INCOME (LOSS) |

| - |

| - |

| - |

| (374,425) |

| (2,506) |

| (1,009,511) |

| 6,388 |

| (45,921) |

| (1,425,975) |

| 67,489 |

| (1,358,486) |

Share-based payments |

| - |

| 6,589 |

|

|

| - |

| - |

| - |

| - |

| - |

| 6,589 |

| - |

| 6,589 |

BALANCES AT MARCH 31, 2020 |

| 12,460,471 |

| 199,434 |

| (38,239) |

| (567,804) |

| 1,948 |

| (1,366,232) |

| (170,435) |

| (4,042,906) |

| 6,476,237 |

| 320,215 |

| 6,796,452 |

(2) All changes in other comprehensive income are presented net of taxes.

(3) FVTOCI: Fair Value Through Other Comprehensive Income.

The accompanying notes are an integral part of the interim financial information.

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

7

(in thousands of Brazilian Reais)

|

| Parent company |

| Consolidated | ||||

|

| January to March 2020 |

| January to March 2019 |

| January to March 2020 |

| January to March 2019 |

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

Loss from continuing operations |

| (45,921) |

| (112,063) |

| (38,232) |

| (113,278) |

Adjustments for: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

| 301,538 |

| 317,659 |

| 364,768 |

| 371,628 |

Depreciation and depletion of biological assets |

| 186,261 |

| 177,166 |

| 207,052 |

| 192,990 |

Result on disposals of property, plant and equipments |

| 9,770 |

| (10,245) |

| 10,876 |

| (9,120) |

Provision for losses in inventories |

| 18,313 |

| 38,640 |

| 26,654 |

| 36,183 |

Provision for tax, civil and labor risks |

| 115,028 |

| 62,798 |

| 115,197 |

| 63,408 |

Impairment |

| - |

| - |

| 17,449 |

| - |

Income from associates and joint ventures |

| (3,987,252) |

| (212,368) |

| - |

| 165 |

Financial results, net |

| 4,321,492 |

| 576,489 |

| 606,469 |

| 448,265 |

Gains in tax lawsuit |

| (74,185) |

| - |

| (74,185) |

| - |

Deferred income tax |

| (50,464) |

| (190,137) |

| (29,907) |

| (200,889) |

Employee profit sharing |

| 49,525 |

| 49,811 |

| 46,644 |

| 61,837 |

Others (1) |

| 293,907 |

| 39,143 |

| 298,540 |

| 44,113 |

|

| 1,138,012 |

| 736,893 |

| 1,551,325 |

| 895,302 |

Trade accounts receivable |

| (2,190,361) |

| (1,786,735) |

| 352,280 |

| 340,048 |

Inventories |

| (535,039) |

| (118,813) |

| (856,085) |

| (169,695) |

Biological assets - current |

| (79,703) |

| (16,005) |

| (89,082) |

| (28,645) |

Trade accounts payable |

| 214,150 |

| (70,695) |

| 369,158 |

| (121,231) |

Supply chain finance |

| 83,201 |

| (197,691) |

| 83,201 |

| (197,663) |

Cash (applied) generated by operating activities |

| (1,369,740) |

| (1,453,046) |

| 1,410,797 |

| 718,116 |

Investments in securities at FVTPL (2) |

| - |

| (89,046) |

| - |

| (90,161) |

Redemptions of securities at FVTPL (2) |

| 98,864 |

| 10,766 |

| 98,972 |

| 11,144 |

Interest received |

| 8,962 |

| 31,273 |

| 13,914 |

| 36,403 |

Dividends and interest on shareholders' equity received |

| - |

| 8,247 |

| - |

| 12,399 |

Payment of tax, civil and labor provisions |

| (110,788) |

| (79,219) |

| (110,788) |

| (79,218) |

Payment of interest |

| (116,762) |

| (105,364) |

| (184,809) |

| (168,351) |

Payment of income tax and social contribution |

| - |

| - |

| (8) |

| (39) |

Other operating assets and liabilities |

| 3,558,647 |

| (459,986) |

| 1,600,948 |

| (342,962) |

Net cash (applied) provided by operating activities | 2,069,183 |

| (2,136,375) |

| 2,829,026 |

| 97,331 | |

Net cash (applied) provided by operating activities from discontinued operations |

| - |

| 87,498 |

| - |

| (85,029) |

Net cash (applied) provided by operating activities |

| 2,069,183 |

| (2,048,877) |

| 2,829,026 |

| 12,302 |

|

|

| ||||||

INVESTING ACTIVITIES |

|

|

| |||||

Investments in securities at amortized cost |

| - |

| - |

| - |

| (8,769) |

Redemptions of securities at amortized cost |

| - |

| 89,046 |

| - |

| 89,046 |

Redemptions of securities at FVTOCI (3) |

| - |

| 11,034 |

| - |

| 11,034 |

Redemption (Investments) in restricted cash |

| 287,621 |

| 110,846 |

| 287,621 |

| 111,291 |

Additions to property, plant and equipment |

| (110,702) |

| (71,240) |

| (115,030) |

| (75,371) |

Additions to biological assets - non-current |

| (201,654) |

| (164,260) |

| (226,549) |

| (188,351) |

Proceeds from disposals of property, plant, equipment and investments |

| 10,219 |

| 372,145 |

| 10,219 |

| 390,267 |

Additions to intangible assets |

| (27,870) |

| (23,043) |

| (24,766) |

| (23,072) |

Sale (acquisition) of participation in joint ventures and associated entities |

| (275) |

| (129) |

| (275) |

| (129) |

Capital increase (decrease) in associates and joint ventures |

| 5,000 |

| - |

| - |

| - |

Net cash provided (used in) investing activities |

| (37,661) |

| 324,399 |

| (68,780) |

| 305,946 |

Net cash provided (used in) investing activities from discontinued operations |

| - |

| - |

| - |

| 45,235 |

Net cash provided (used in) investing activities |

| (37,661) |

| 324,399 |

| (68,780) |

| 351,181 |

|

|

| ||||||

FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

Proceeds from debt issuance |

| 1,057,526 |

| 904,600 |

| 1,374,940 |

| 1,020,014 |

Repayment of debt |

| (483,387) |

| (987,136) |

| (665,833) |

| (1,706,533) |

Payment of lease liabilities |

| (111,198) |

| (119,426) |

| (134,792) |

| (135,276) |

Net cash provided (used in) by financing activities |

| 462,941 |

| (201,962) |

| 574,315 |

| (821,795) |

Net cash provided (used in) by financing activities from discontinued operations |

| - |

| - |

| - |

| 1,567 |

Net cash provided (used in) by financing activities |

| 462,941 |

| (201,962) |

| 574,315 |

| (820,228) |

EFFECT OF EXCHANGE RATE VARIATION ON CASH AND CASH EQUIVALENTS |

| 80,862 |

| 7,221 |

| 388,641 |

| 43,869 |

Net increase (decrease) in cash and cash equivalents |

| 2,575,325 |

| (1,919,219) |

| 3,723,202 |

| (412,876) |

At the beginning of the period |

| 1,368,980 |

| 3,826,698 |

| 4,237,785 |

| 5,036,011 |

At the end of the period |

| 3,944,305 |

| 1,907,479 |

| 7,960,987 |

| 4,623,135 |

(1) Includes provision for class action agreement (note 1.3).

(2) FVTPL: Fair Value Through Profit and Loss.

(3) FVTOCI: Fair Value Through Other Comprehensive Income.

The accompanying notes are an integral part of the interim financial information.

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

8

(in thousands of Brazilian Reais)

|

| Parent company |

| Consolidated | ||||

|

| January to March 2020 |

| Restated (1) January to March 2019 |

| January to March 2020 |

| Restated (1) January to March 2019 |

1 - REVENUES |

| 8,162,670 |

| 7,185,354 |

| 9,632,859 |

| 8,226,844 |

Sales of goods and products |

| 8,360,295 |

| 7,155,673 |

| 9,861,663 |

| 8,177,232 |

Other income |

| (181,413) |

| (37,436) |

| (191,895) |

| (19,032) |

Revenue related to construction of own assets |

| 109,134 |

| 71,134 |

| 102,272 |

| 71,715 |

Expected credit losses |

| (125,346) |

| (4,017) |

| (139,181) |

| (3,071) |

2 - RAW MATERIAL ACQUIRED FROM THIRD PARTIES |

| (5,198,443) |

| (4,632,990) |

| (6,141,065) |

| (5,295,432) |

Costs of goods sold |

| (4,465,712) |

| (3,992,809) |

| (5,267,555) |

| (4,517,989) |

Materials, energy, third parties services and other |

| (739,531) |

| (675,531) |

| (877,765) |

| (820,114) |

Reversal for inventories losses |

| 6,800 |

| 35,350 |

| 4,255 |

| 42,671 |

3 - GROSS ADDED VALUE (1-2) |

| 2,964,227 |

| 2,552,364 |

| 3,491,794 |

| 2,931,412 |

4 - DEPRECIATION AND AMORTIZATION |

| (487,799) |

| (494,825) |

| (571,820) |

| (564,618) |

5 - NET ADDED VALUE (3-4) |

| 2,476,428 |

| 2,057,539 |

| 2,919,974 |

| 2,366,794 |

|

|

|

|

|

|

|

|

|

6 - RECEIVED FROM THIRD PARTIES |

| 4,093,636 |

| 292,015 |

| 112,865 |

| 85,863 |

Income from associates and joint ventures |

| 3,987,252 |

| 212,368 |

| - |

| (165) |

Financial income |

| 106,777 |

| 79,893 |

| 112,878 |

| 86,061 |

Others |

| (393) |

| (246) |

| (13) |

| (33) |

|

|

| ||||||

7 - ADDED VALUE TO BE DISTRIBUTED (5+6) | 6,570,064 |

| 2,349,554 |

| 3,032,839 |

| 2,452,657 | |

|

|

| ||||||

8 - DISTRIBUTION OF ADDED VALUE | 6,570,064 |

| 2,349,554 |

| 3,032,839 |

| 2,452,657 | |

Payroll | 1,195,257 | 1,124,339 | 1,300,340 |

| 1,230,384 | |||

Salaries |

| 899,285 |

| 834,417 |

| 983,371 |

| 921,953 |

Benefits |

| 236,346 |

| 233,443 |

| 253,485 |

| 248,635 |

Government severance indemnity fund for employees |

| 59,626 |

| 56,479 |

| 63,484 |

| 59,796 |

Taxes, Fees and Contributions |

| 958,187 |

| 645,227 |

| 1,002,619 |

| 744,752 |

Federal |

| 360,103 |

| 173,364 |

| 403,299 |

| 271,798 |

State |

| 587,515 |

| 461,379 |

| 587,498 |

| 461,444 |

Municipal |

| 10,569 |

| 10,484 |

| 11,822 |

| 11,510 |

Capital Remuneration from Third Parties |

| 4,462,541 |

| 692,051 |

| 768,112 |

| 590,799 |

Interests, including exchange variation |

| 4,432,327 |

| 661,684 |

| 723,405 |

| 542,942 |

Rents |

| 30,214 |

| 30,367 |

| 44,707 |

| 47,857 |

Interest on Own-Capital |

| (45,921) |

| (112,063) |

| (38,232) |

| (113,278) |

Income (loss) of the period |

| (45,921) |

| (112,063) |

| (45,921) |

| (112,063) |

Non-controlling interest |

| - |

| - |

| 7,689 |

| (1,215) |

(1) The comparative period was restated for better disclosure of exchange variations.

The accompanying notes are an integral part of the interim financial information.

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

1. COMPANY’S OPERATIONS

BRF S.A. (“BRF”) and its subsidiaries (collectively the “Company”) is a publicly traded company, listed on the segment Novo Mercado of Brasil, Bolsa, Balcão (“B3”), under the ticker BRFS3, and listed on the New York Stock Exchange (“NYSE”), under the ticker BRFS. The Company’s registered office is at Rua Jorge Tzachel, nº 475, Bairro Fazenda, Itajaí - Santa Catarina and the main business office is in the city of São Paulo.

BRF is a Brazilian multinational company, with global presence, which owns a comprehensive portfolio of products, and it is one of the world’s largest companies of food products. The Company operates by raising, producing and slaughtering poultry and pork for processing, production and sale of fresh meat, processed products, pasta, margarine and others.

The Company holds as main brands Sadia, Perdigão, Qualy, Chester®, Kidelli, Perdix and Banvit, present mainly in Brazil, Turkey and Middle Eastern countries.

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

34

1.1. Equity interest

|

|

|

|

|

|

| % equity interest | ||

Entity |

|

| Main activity |

| Country |

| 03.31.20 |

| 12.31.19 |

BRF Energia S.A. |

|

| Commercialization of eletric energy |

| Brazil |

| 100.00 |

| 100.00 |

BRF GmbH |

|

| Holding |

| Austria |

| 100.00 |

| 100.00 |

BRF Foods LLC |

|

| Import, industrialization and commercialization of products |

| Russia |

| 99.90 |

| 99.90 |

BRF Global Company Nigeria Ltd. | (a) |

| Marketing and logistics services |

| Nigeria |

| 99.00 |

| 99.00 |

BRF Global Company South Africa Proprietary Ltd. |

|

| Administrative, marketing and logistics services |

| South Africa |

| 100.00 |

| 100.00 |

BRF Global Company Nigeria Ltd. | (a) |

| Marketing and logistics services |

| Nigeria |

| 1.00 |

| 1.00 |

BRF Global GmbH |

|

| Holding and trading |

| Austria |

| 100.00 |

| 100.00 |

BRF Foods LLC |

|

| Import, industrialization and commercialization of products |

| Russia |

| 0.10 |

| 0.10 |

BRF Japan KK |

|

| Marketing and logistics services, import, export, industrialization and commercialization of products |

| Japan |

| 100.00 |

| 100.00 |

BRF Korea LLC |

|

| Marketing and logistics services |

| Korea |

| 100.00 |

| 100.00 |

BRF Shanghai Management Consulting Co. Ltd. |

|

| Provision of consultancy and marketing services |

| China |

| 100.00 |

| 100.00 |

BRF Shanghai Trading Co. Ltd. |

|

| Import, export and commercialization of products |

| China |

| 100.00 |

| 100.00 |

BRF Singapore Foods PTE Ltd. |

|

| Administrative, marketing and logistics services |

| Singapore |

| 100.00 |

| 100.00 |

BRF Hungary LLC |

|

| Import and commercialization of products |

| Hungary |

| 100.00 |

| 100.00 |

Compañía Paraguaya Comercial S.A. | (a) |

| Import and commercialization of products |

| Paraguay |

| 99.00 |

| 99.00 |

Eclipse Holding Cöoperatief U.A. |

|

| Holding |

| The Netherlands |

| 99.99 |

| 99.99 |

Buenos Aires Fortune S.A. |

|

| Holding |

| Argentina |

| 5.00 |

| 5.00 |

Eclipse Latam Holdings |

|

| Holding |

| Spain |

| 100.00 |

| 100.00 |

Buenos Aires Fortune S.A. |

|

| Holding |

| Argentina |

| 95.00 |

| 95.00 |

Perdigão Europe Lda. |

|

| Import, export of products and administrative services |

| Portugal |

| 100.00 |

| 100.00 |

Perdigão International Ltd. |

|

| Import and export of products |

| Cayman Island |

| 100.00 |

| 100.00 |

BFF International Ltd. |

|

| Financial fundraising |

| Cayman Island |

| 100.00 |

| 100.00 |

Highline International | (a) |

| Financial fundraising |

| Cayman Island |

| 100.00 |

| 100.00 |

Sadia Overseas Ltd. | (a) |

| Financial fundraising |

| Cayman Island |

| 100.00 |

| 100.00 |

ProudFood Lda |

|

| Import and commercialization of products |

| Angola |

| 90.00 |

| 90.00 |

Sadia Chile S.A. |

|

| Import, export and commercialization of products |

| Chile |

| 40.00 |

| 40.00 |

BRF Global Namíbia | (a) |

| Import and commercialization of products |

| Namibia |

| 100.00 |

| 100.00 |

Wellax Food Logistics C.P.A.S.U. Lda. |

|

| Import, commercialization of products and administrative services |

| Portugal |

| 100.00 |

| 100.00 |

BRF Austria GmbH |

|

| Holding |

| Austria |

| 100.00 |

| 100.00 |

One Foods Holdings Ltd |

|

| Holding |

| United Arab Emirates |

| 100.00 |

| 100.00 |

Al-Wafi Food Products Factory LLC |

|

| Import, export, industrialization and commercialization of products |

| United Arab Emirates |

| 49.00 |

| 49.00 |

Badi Ltd. |

|

| Holding |

| United Arab Emirates |

| 100.00 |

| 100.00 |

Al-Wafi Al-Takamol International for Foods Products |

|

| Import and commercialization of products |

| Saudi Arabia |

| 75.00 |

| 75.00 |

BRF Al Yasra Food K.S.C.C. ("BRF AFC") |

|

| Import, commercialization and distribution of products |

| Kuwait |

| 49.00 |

| 49.00 |

BRF Foods GmbH |

|

| Industrialization, import and commercialization of products |

| Austria |

| 100.00 |

| 100.00 |

Al Khan Foodstuff LLC ("AKF") |

|

| Import, commercialization and distribution of products |

| Oman |

| 70.00 |

| 70.00 |

FFM Further Processing Sdn. Bhd. |

|

| Industrialization, import and commercialization of products |

| Malaysia |

| 70.00 |

| 70.00 |

FFQ GmbH |

|

| Industrialization, import and commercialization of products |

| Austria |

| 100.00 |

| 100.00 |

TBQ Foods GmbH |

|

| Holding |

| Austria |

| 60.00 |

| 60.00 |

Banvit Bandirma Vitaminli |

|

| Import, industrialization and commercialization of products |

| Turkey |

| 91.71 |

| 91.71 |

Banvit Enerji ve Elektrik Üretim Ltd. Sti. | (a) |

| Generation and commercialization of electric energy |

| Turkey |

| 100.00 |

| 100.00 |

Banvit Foods SRL |

|

| Industrialization of grains and animal feed |

| Romania |

| 0.01 |

| 0.01 |

Nutrinvestments BV |

|

| Holding |

| The Netherlands |

| 100.00 |

| 100.00 |

Banvit ME FZE |

|

| Marketing and logistics services |

| United Arab Emirates |

| 100.00 |

| 100.00 |

Banvit Foods SRL |

|

| Industrialization of grains and animal feed |

| Romania |

| 99.99 |

| 99.99 |

One Foods Malaysia SDN. BHD. |

|

| Marketing and logistics services |

| Malaysia |

| 100.00 |

| 100.00 |

Federal Foods LLC |

|

| Import, commercialization and distribution of products |

| United Arab Emirates |

| 49.00 |

| 49.00 |

Federal Foods Qatar |

|

| Import, commercialization and distribution of products |

| Qatar |

| 49.00 |

| 49.00 |

BRF Hong Kong LLC | (a) |

| Import, commercialization and distribution of products |

| Hong Kong |

| 100.00 |

| 100.00 |

Eclipse Holding Cöoperatief U.A. |

|

| Holding |

| The Netherlands |

| 0.01 |

| 0.01 |

Establecimiento Levino Zaccardi y Cia. S.A. | (a) |

| Industrialization and commercialization of dairy products |

| Argentina |

| 99.94 |

| 99.94 |

BRF Pet S.A. |

|

| Industrialization, commercialization and distribution of feed and nutrients for animals |

| Brazil |

| 100.00 |

| 100.00 |

PP-BIO Administração de bem próprio S.A. |

|

| Management of assets |

| Brazil |

| 33.33 |

| 33.33 |

PR-SAD Administração de bem próprio S.A. |

|

| Management of assets |

| Brazil |

| 33.33 |

| 33.33 |

ProudFood Lda |

|

| Import and commercialization of products |

| Angola |

| 10.00 |

| 10.00 |

PSA Laboratório Veterinário Ltda. |

|

| Veterinary activities |

| Brazil |

| 99.99 |

| 99.99 |

Sino dos Alpes Alimentos Ltda. | (a) |

| Industrialization and commercialization of products |

| Brazil |

| 99.99 |

| 99.99 |

Sadia Alimentos S.A. |

|

| Holding |

| Argentina |

| 43.10 |

| 43.10 |

Sadia International Ltd. |

|

| Import and commercialization of products |

| Cayman Island |

| 100.00 |

| 100.00 |

Sadia Chile S.A. |

|

| Import, export and marketing of products |

| Chile |

| 60.00 |

| 60.00 |

Sadia Uruguay S.A. |

|

| Import and commercialization of products |

| Uruguay |

| 5.10 |

| 5.10 |

Compañía Paraguaya Comercial S.A. | (a) |

| Import and commercialization of products |

| Paraguay |

| 1.00 |

| 1.00 |

Sadia Alimentos S.A. |

|

| Holding |

| Argentina |

| 56.90 |

| 56.90 |

Sadia Uruguay S.A. |

|

| Import and commercialization of products |

| Uruguay |

| 94.90 |

| 94.90 |

Vip S.A. Empreendimentos e Participações Imobiliárias |

|

| Commercialization of owned real state |

| Brazil |

| 100.00 |

| 100.00 |

Establecimiento Levino Zaccardi y Cia. S.A. | (a) |

| Industrialization and commercialization of dairy products |

| Argentina |

| 0.06 |

| 0.06 |

PSA Laboratório Veterinário Ltda. |

|

| Veterinary activities |

| Brazil |

| 0.01 |

| 0.01 |

Sino dos Alpes Alimentos Ltda. | (a) |

| Industrialization and commercialization of products |

| Brazil |

| 0.01 |

| 0.01 |

(a) Dormant subsidiaries. The Company is evaluating the liquidation of these subsidiaries.

Except for the associates PP-BIO and PR-SAD in which the Company records the investments by the equity method, all other subsidiaries shown in the table were consolidated.

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

35

1.2. Investigations involving BRF

The Company has been subject to two external investigations, denominated “Carne Fraca Operation” in 2017 and “Trapaça Operation” in 2018, as detailed below. The Company’s Audit and Integrity Committee conducted independent investigations, along with the Independent Investigation Committee, composed of external members and with external legal advisors in Brazil and abroad with respect to the allegations involving BRF employees and former employees in the scope of the aforementioned operations and other ongoing investigations.

For the three-month period ended on March 31, 2020, the main impacts observed as result of the referred investigations were recorded in other operating expenses in the amount of R$12,301 (R$11,113 on March 31, 2019), mostly related to expenditures with lawyers, legal advisors and consultants.

In addition to the impacts already registered, there are uncertainties about the outcome of these operations which may result in penalties, fines and normative sanctions, right restrictions and other forms of liabilities, for which the Company is not able to make a reliable estimate of the potential losses.

The outcomes may result in payments of substantial amounts, which may cause a material adverse effect on the Company’s financial position, results and cash flows in the future.

1.2.1. Carne Fraca Operation

On March 17, 2017, BRF became aware of a decision issued by a judge of the 14th Federal Court of Curitiba - Paraná, authorizing the search and seizure of information and documents, and the detention of certain individuals in the context of theCarne Fraca Operation. Two BRF employees were detained and subsequently released, as well as three others were identified for questioning.

In April 2017, the Brazilian Federal Police and the Brazilian federal prosecutors filed charges against BRF employees, which were accepted by the judge responsible for the process, and its main allegations in this phase involved misconduct related to improper offers and/or promises to government inspectors.

On June 04, 2018, the Company was informed about the establishment of a responsibility administrative process (“PAR”) by the Office of the Comptroller General (“CGU”), under the Law Nº 12,846/2013 (“Anti-corruption Law”), which aims to verify eventual administrative responsibilities related to the facts object of the criminal lawsuit Nº 5016879-04.2017.4.04.7000, (“Criminal Lawsuit”) in progress under the 14th Federal Court of the subsection of Curitiba/PR, as a consequence of theCarne Fraca Operation.

BRF has informed certain regulators and governmental entities, including the U.S. Securities and Exchange Commission (“SEC”) and the U.S. Department of Justice (“DOJ”) about theCarne Fraca Operation and is cooperating with such authorities, which are conducting their own investigations.

On September 28, 2018, the sentence of the Criminal Lawsuit in first instance was published, discharging one of the BRF employees and convicting a former employee for six months of detention with the possibility of substitution for a right-restricting penalty. The Brazilian federal prosecutors presented appeal to the first instance decision. The appeal is being analyzed by the Federal Regional Court of the 4th region.

1.2.2. Trapaça Operation

On March 5, 2018, the Company learned of a decision issued by a judge of the 1st Federal Court of Ponta Grossa/PR, authorizing the search and seizure of information and documents due to allegations involving misconduct relating to quality violations, improper use of feed components and falsification of tests at certain BRF manufacturing plants and accredited labs. Such operation was denominated asTrapaça Operation. On March 5, 2018, BRF received notice from the Ministry of Agriculture, Livestock and Food Supply (“MAPA”) immediately suspending exports from its Rio Verde/GO, Carambeí/PR and Mineiros/GO plants to 12 countriesthat require specific sanitary requirements for the control of the bacteria groupSalmonella spp andSalmonella pullorum.

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

36

On May 14, 2018, the Company received the formal notice that twelve plants located in Brazil were removed from the list that permits imports of animal origin products by the European Union’s countries. The measure came into force as of May 16, 2018 and affects only the plants located in Brazil and which have export licenses to the European Union, not affecting the supply to other markets or other BRF plants located outside Brazil and that export to the European market.

On October 15, 2018, the Federal Police Department submitted to the 1st Federal Criminal Court of the Judicial Branch of Ponta Grossa– PR the final report of its investigation in connection to theTrapaça Operation. The police inquiry indicted 43 people, including former key executives of the Company.

On December 04, 2019, the Public Prosecution filed charges against eleven people related to allegations about Premix (compound of vitamins, minerals, and amino acids for the inclusion of micro ingredients in the feed for the ideal nutrition of the animals) as outcome of theTrapaça Operation. No administration member, director or executive in current management position has been identified. Of the employees who were identified, only one person still remained active in his function and has preventively been removed after the filing of the charges, according to the current policy of the Company, which provides removal until the resolution of the case.

BRF informed certain regulators and government entities, including SEC and DOJ about theTrapaça Operation and has been cooperating with such authorities, which are conducting their own investigations.

1.2.3. Governance enhancement

The Company is cooperating with the investigations and collaborates to the clarification of the facts. The Company has been taking actions to strengthen the compliance with its policies, procedures and internal controls. In this sense, the Company has decided to move away, independently of the results of the investigations, all employees mentioned in the Federal Police’s final report of theTrapaça Operation until all facts are clarified.

The Company believes that its efforts strengthens and consolidates its governance to ensure the highest levels of safety standards, integrity and quality.

Among the actions implemented, are: (i) strengthening in the risk management, specially compliance, (ii) continuous strengthening of the Compliance, Internal Audit and Internal Controls departments, (iii) review and issuance of new policies and procedures specifically related to applicable anticorruption laws, (iv) review and enhancement of the procedures for reputational verification of business partners, (v) review and enhancement of the processes of internal investigation, (vi) expansion of the independent reporting channel, (vii) review of transactional controls, and (viii) review and issuance of new consequence policy for misconduct.

On March 12, 2018, a shareholder class action lawsuit was filed against the Company, some of its former managers and one current officer before the United States Federal District Court in the city of New York, on behalf of holders of American Depositary Receipts (“ADR”) between April 4, 2013 and March 5, 2018. The suit alleged violations of the federal securities laws of the United States related to allegations concerning, among other matters,Carne Fraca Operation andTrapaça Operation. On July 2, 2018, that Court appointed the City of Birmingham Retirement and Relief System lead plaintiff in the action. On October 25, 2019, the Court granted lead plaintiff leave to file a Fourth Amended Complaint, which was filed on November 8, 2019. On December 13, 2019, the served defendants filed a motion to dismiss. On January 21, 2020, the Lead Plaintiff filed its opposition motion and, on February 11, 2020, the defendants filed a response.

On March 27, 2020 the parties reached an agreement to settle this class action by payment of an amount equivalent to R$204,436 (USD40,000), to resolve all pending and prospective claims by individuals or entitieswho purchased or otherwise acquired BRF’s ADRs between April 4, 2013 and March 5, 2018. The settlement is subject to court ratification and execution of final settlement documentation.

The agreement does not constitute any admission of liability or wrongdoing by BRF or its executives and expressly provides that BRF denies any misconduct or that any plaintiff has suffered any damages or was harmed by any conduct alleged in this action.

The provision for the aforementioned amount was recognized in other operating expenses (note 27).

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

37

On January 31, 2020 the World Health Organization (WHO) announced that the COVID-19 is a global health emergency and on March 11, 2020 declared it a global pandemic. The outbreak has triggered significant decisions from governments and private sector entities, which in addition to the potential impact, increased the uncertainty level for the economic agents and may cause effects in the amounts recognized in the financial statements.

BRF continues to operate its industrial complexes, distribution centers, logistics, supply chain and administrative offices, even if temporarily and partially under remote work regime in some of the corporate offices. Therefore, until the date of approval of the interim financial information, there has been no relevant change in its production plan, operation and/or commercialization. Additionally, management has developed and implemented contingency plans to maintain the operations and monitors the effects of the pandemic through a permanent multidisciplinary monitoring committee, formed by executives, specialists in the public health area and consultants.

Customers from certain regions and channels in which the Company runs businesses are being affected, mainly by the measures of social distancing imposed by authorities. The Company foresees an increase in the default rates during the second quarter of 2020 and a consequent increase in the expected credit losses. The impacts of these increase in the expected credit losses are registered in the interim financial information (note 6).

Aiming to preventively strengthen its liquidity level during this period of high volatility, additionally to the strategies described in note 24 and to the active revolving credit facility not disbursed (note 15.1), during March and April of 2020 the Company contracted and disbursed credit facilities with financial institutions in Brazil in the aggregate amount of, approximately, R$1,830,000 and average term of one year, without any financial covenant clause. Considering the current liquidity level, the additional initiatives mentioned above, other credit lines under negotiation and the perspectives for the short and medium term, the management does not foresee relevant impacts that could compromise the operating and financial capacity affecting the Company’s continuity.

The management also understands that the projections of results and cashflows used for the impairment test of the cash generating units are still substantially adequate and there is no need for recognizing losses until this moment. Due to the high volatility and uncertainty around the length and the impact of the pandemic, the Company will keep monitoring the situation and evaluating the impacts on assumptions and estimates used in preparing our financial reporting.

During the months of November and December of each year, the Company is impacted by seasonality in the Brazil operating segment due to Christmas and New Year’s Celebrations. The products that are relevant contributors are: turkey, Chester®, ham and pork cuts (hind leg/pork loin).

In the International operating segment, seasonality is due to Ramadan, which is the holy month of the Muslim calendar. The beginning of Ramadan depends on the beginning of the moon cycle and in 2020 will be held between April 24, 2020 and May 23, 2020.

2. BASIS OF PREPARATION AND PRESENTATION OF INTERIM FINANCIAL STATEMENTS

The parent company’s and consolidated interim financial information were prepared in accordance with the CPC 21 (R1) – Interim Financial Statements and the IAS 34 – Interim Financial Reporting issued by the International Accounting Standards Board - IASB as well as with the standards issued by the Brazilian Securities and Exchange Commission (“CVM”). All the relevant information applicable to the interim financial information, and only them, are being evidenced and correspond to those used by administration in its management.

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

38

The parent company’s and consolidated interim financial information are expressed in thousands of Brazilian Reais (“R$”) and the disclosures of amounts in other currencies, when applicable, were also expressed in thousands, unless otherwise stated.

The preparation of the parent company’s and consolidated interim financial information require Management to make judgments, use estimates and adopt assumptions that affect the reported amounts of revenues, expenses, assets and liabilities, as well as the disclosures of contingent liabilities. The uncertainty inherent to these judgments, assumptions and estimates could result in material adjustments to the carrying amount of certain assets and liabilities in future periods.

Any judgments, estimates and assumptions are reviewed at each reporting period.

The parent company’s and consolidated interim financial information were prepared based on the recoverable historical cost, except for the following material items recognized in the statements of financial position:

(i) derivative financial instruments and non-derivative financial instruments measured at fair value;

(ii) share-based payments and employee benefits measured at fair value;

(iii) biological assets measured at fair value; and

(iv) assets held for sale in the cases the fair value is lower than historical cost.

The Company prepared parent company’s and consolidated financial statements under the going concern assumption and disclosed all relevant information in its explanatory notes, in order to clarify and complement the accounting basis adopted.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The interim financial information, in this case quarterly financial information, aim to provide updated information based on the last annual financial statements disclosed. Therefore, the quarterly financial information focus on new activities, events and circumstances and do not duplicate the information previously disclosed, except when Management judges that the maintenance of the information is relevant.

The interim financial information was prepared based on the accounting policies and estimates calculation methodologies adopted in the preparation of the annual financial statements for the year ended December 31, 2019 (note 3).

There were no changes on such policies and estimates calculation methodologies. As allowed by CPC 21 (R1), Management decided not to disclose again the details of the accounting policies adopted by the Company. Hence, the interim financial information should be read along with the annual financial statements for the year ended December 31, 2019, in order to allow the users to further understand the Company’s financial conditions and liquidity, as well as its capacity to generate profits and cash flows.

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

39

4. CASH AND CASH EQUIVALENTS

| Average rate (p.a.) |

| Parent company |

| Consolidated | ||||

|

| 03.31.20 |

| 12.31.19 |

| 03.31.20 |

| 12.31.19 | |

Cash and bank accounts |

|

|

|

|

|

|

|

|

|

U.S. Dollar | - |

| - |

| 403 |

| 1,673,451 |

| 1,356,128 |

Brazilian Reais | - |

| 59,892 |

| 166,506 |

| 60,739 |

| 167,051 |

Euro | - |

| 11,091 |

| 3,813 |

| 66,976 |

| 71,626 |

Other currencies | - |

| 12 |

| 180 |

| 1,217,686 |

| 694,982 |

|

|

| 70,995 |

| 170,902 |

| 3,018,852 |

| 2,289,787 |

Cash equivalents |

|

|

|

|

|

|

|

|

|

In Brazilian Reais |

|

|

|

|

|

|

|

|

|

Investment funds | 1.03% |

| 3,654 |

| 3,507 |

| 3,654 |

| 3,507 |

Bank deposit certificates | 3.46% |

| 3,468,565 |

| 869,473 |

| 3,484,021 |

| 879,758 |

|

|

| 3,472,219 |

| 872,980 |

| 3,487,675 |

| 883,265 |

In U.S. Dollar |

|

|

|

|

|

|

|

|

|

Term deposit | 3.22% |

| 331,125 |

| 254,583 |

| 364,986 |

| 270,714 |

Overnight | 0.07% |

| 69,966 |

| 70,515 |

| 1,089,474 |

| 689,874 |

Other currencies |

|

|

|

|

|

|

|

|

|

Term deposit | - |

| - |

| - |

| - |

| 104,145 |

|

|

| 401,091 |

| 325,098 |

| 1,454,460 |

| 1,064,733 |

3,944,305 |

| 1,368,980 |

| 7,960,987 |

| 4,237,785 | |||

|

|

|

|

| Average interest rate (p.a.) |

| Parent company |

| Consolidated | ||||

| WAM (1) |

| Currency |

|

| 03.31.20 |

| 12.31.19 |

| 03.31.20 |

| 12.31.19 | |

Fair value through other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit linked note | 3.15 |

| USD |

| 3.85% |

| - |

| - |

| 22,236 |

| 19,285 |

Stocks | - |

| R$ and HKD |

| - |

| - |

| - |

| 33,466 |

| 26,678 |

|

|

|

|

|

|

| - |

| - |

| 55,702 |

| 45,963 |

Fair value through profit and loss |

|

|

| ||||||||||

Financial treasury bills | 4.14 |

| R$ |

| 3.65% |

| 307,184 |

| 396,994 |

| 307,184 |

| 396,994 |

Investment funds - FIDC BRF | 3.71 |

| R$ |

| - |

| 15,490 |

| 14,891 |

| 15,490 |

| 14,891 |

Investment funds | 0.09 |

| ARS |

| - |

| - |

| - |

| 1,893 |

| 1,903 |

|

|

|

|

|

|

| 322,674 |

| 411,885 |

| 324,567 |

| 413,788 |

Amortized cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sovereign bonds and others (2) | 3.08 |

| AOA |

| 3.82% |

| - |

| - |

| 332,986 |

| 265,783 |

|

|

|

|

|

|

| 322,674 |

| 411,885 |

| 713,255 |

| 725,534 |

|

|

| |||||||||||

Current | 307,184 | 396,994 | 331,313 |

| 418,182 | ||||||||

Non-current (3) | 15,490 | 14,891 | 381,942 |

| 307,352 | ||||||||

(1) Weighted average maturity in years.

(2) It’s comprised of securities of the Angola Government and are shown net of expected losses on marketable securities in the amount of R$20,414 (R$1,983 on December 31, 2019).

(3) Maturity is September 01, 2025.

Additionally, as of March 31, 2020, the amount of R$172,580 (R$100,435 on December 31, 2019) was pledged as guarantee, with no use restrictions, for USD denominated future contracts, traded on B3.

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

40

6. TRADE ACCOUNTS RECEIVABLE AND OTHER RECEIVABLES

| Parent company |

| Consolidated | ||||

| 03.31.20 |

| 12.31.19 |

| 03.31.20 |

| 12.31.19 |

Trade accounts receivable |

|

|

| ||||

Domestic customers | 1,019,976 |

| 1,333,344 |

| 1,035,709 |

| 1,336,762 |

Domestic related parties | 521 |

| 800 |

| - |

| - |

Foreign customers | 526,667 |

| 457,413 |

| 2,585,021 |

| 2,215,050 |

Foreign related parties | 7,328,571 |

| 4,779,202 |

| - |

| - |

| 8,875,735 |

| 6,570,759 |

| 3,620,730 |

| 3,551,812 |

( - ) Adjustment to present value | (5,729) |

| (8,522) |

| (7,446) |

| (10,121) |

( - ) Expected credit losses | (582,851) |

| (457,505) |

| (643,029) |

| (503,848) |

|

|

| |||||

8,287,155 |

| 6,104,732 |

| 2,970,255 |

| 3,037,843 | |

|

|

| |||||

Current | 8,280,561 | 6,097,935 | 2,963,661 |

| 3,031,046 | ||

Non-current | 6,594 | 6,797 | 6,594 |

| 6,797 | ||

|

|

| |||||

Other receivables | 147,488 |

| 150,156 |

| 150,235 |

| 153,799 |

( - ) Adjustment to present value | (1,513) |

| (1,936) |

| (1,513) |

| (1,936) |

( - ) Expected credit losses | (27,634) |

| (27,986) |

| (28,029) |

| (27,986) |

|

|

|

|

|

|

|

|

118,341 |

| 120,234 |

| 120,693 |

| 123,877 | |

|

|

| |||||

Current | 56,733 | 56,002 | 59,086 |

| 59,645 | ||

Non-current (1) | 61,608 | 64,232 | 61,607 |

| 64,232 | ||

(1) Weighted average maturity of 2.59 years.

The Company performs credit assignments with no right of return to the BRF Clients’ Credit Rights Investment Fund (“FIDC BRF“), whose sole purpose is to acquire credit rights arising from commercial transactions carried out between the Company and its clients in Brazil. On March 31, 2020, FIDC BRF had an outstanding balance of R$720,585 (R$730,251 on December 31, 2019) related to such credit rights, which are no longer recorded in the Company’s statement of financial position.

On March 31, 2020, other receivables are mainly represented by receivables from the sale of farms and various properties, with a balance of R$103,418 (R$109,419 on December 31, 2019).

The movements of the expected credit losses are shown below:

| Parent company | Consolidated | |

| 03.31.20 |

| 03.31.20 |

Beginning balance | (457,505) |

| (503,848) |

Provision | (31,101) |

| (32,937) |

Write-offs | 2,751 |

| 2,778 |

Exchange rate variation | (96,996) |

| (109,022) |

Ending balance | (582,851) |

| (643,029) |

The aging of trade accounts receivable is as follows:

| Parent company |

| Consolidated | ||||

| 03.31.20 |

| 12.31.19 |

| 03.31.20 |

| 12.31.19 |

Not overdue | 8,288,974 |

| 6,028,415 |

| 2,713,588 |

| 2,820,308 |

Overdue |

|

|

|

|

|

|

|

01 to 60 days | 26,897 |

| 29,232 |

| 262,187 |

| 143,303 |

61 to 90 days | 2,443 |

| 5,549 |

| 13,601 |

| 19,409 |

91 to 120 days | 4,893 |

| 1,568 |

| 10,602 |

| 3,723 |

121 to 180 days | 6,938 |

| 876 |

| 14,290 |

| 3,934 |

181 to 360 days | 2,307 |

| 5,166 |

| 9,566 |

| 20,748 |

More than 360 days | 543,283 |

| 499,953 |

| 596,896 |

| 540,387 |

( - ) Adjustment to present value | (5,729) |

| (8,522) |

| (7,446) |

| (10,121) |

( - ) Expected credit losses | (582,851) |

| (457,505) |

| (643,029) |

| (503,848) |

| 8,287,155 |

| 6,104,732 |

| 2,970,255 |

| 3,037,843 |

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

41

| Parent company |

| Consolidated | ||||

| 03.31.20 |

| 12.31.19 |

| 03.31.20 |

| 12.31.19 |

Finished goods | 1,600,401 |

| 1,302,419 |

| 2,901,553 |

| 2,257,119 |

Work in progress | 165,214 |

| 147,022 |

| 168,221 |

| 149,470 |

Raw materials | 912,776 |

| 721,278 |

| 1,012,195 |

| 803,520 |

Packaging materials | 61,370 |

| 57,915 |

| 67,920 |

| 60,715 |

Secondary materials | 383,295 |

| 367,311 |

| 390,240 |

| 375,744 |

Supplies | 169,894 |

| 168,248 |

| 198,674 |

| 205,399 |

Imports in transit | 43,714 |

| 61,021 |

| 43,714 |

| 61,021 |

Other | 17,873 |

| 5,252 |

| 34,296 |

| 19,266 |

(-) Adjustment to present value | (51,664) |

| (44,319) |

| (51,669) |

| (44,338) |

| 3,302,873 |

| 2,786,147 |

| 4,765,144 |

| 3,887,916 |

The additions and reversals of provisions for losses on inventories, which were recorded under the item Cost of Goods Sold, are shown in the table below:

| Parent company | ||||||

|

|

|

|

|

|

| 03.31.20 |

Provision for adjustment to realizable value | Provision for deterioration | Provision for obsolescence | Total | ||||

Beginning balance | (9,075) |

| (37,729) |

| (8,416) |

| (55,220) |

Additions | (8,915) |

| (18,397) |

| (1,197) |

| (28,509) |

Reversals | 10,196 |

| - |

| - |

| 10,196 |

Write-offs | - |

| 24,411 |

| 702 |

| 25,113 |

Ending balance | (7,794) |

| (31,715) |

| (8,911) |

| (48,420) |

| Consolidated | ||||||

|

|

|

|

|

|

| 03.31.20 |

Provision for adjustment to realizable value | Provision for deterioration | Provision for obsolescence | Total | ||||

Beginning balance | (10,712) |

| (42,526) |

| (14,919) |

| (68,157) |

Additions | (13,200) |

| (22,030) |

| (3,505) |

| (38,735) |

Reversals | 12,081 |

| - |

| - |

| 12,081 |

Write-offs | - |

| 29,007 |

| 2,329 |

| 31,336 |

Exchange rate variation | 499 |

| (741) |

| (185) |

| (427) |

Ending balance | (11,332) |

| (36,290) |

| (16,280) |

| (63,902) |

BRF S.A.| INTERIM FINANCIAL INFORMATION - March 31, 2020

42

8. BIOLOGICAL ASSETS

The live animals are represented by poultry and pork and segregated into consumables and animals for production. The rollforward of the biological assets are shown below:

| Parent company | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| 03.31.20 | |

Current | Non-current | ||||||||||||

Live animals | Live animals |

|

|

| |||||||||

Poultry | Pork | Total | Poultry | Pork | Forests | Total | |||||||

Beginning balance | 557,773 |

| 987,354 |

| 1,545,127 | 350,285 |

| 337,804 |

| 328,553 |

| 1,016,642 | |

Additions/Transfer | 2,204,547 |

| 1,583,035 |

| 3,787,582 | 14,477 |

| 76,211 |

| 10,897 |

| 101,585 | |

Changes in fair value (1) | 452,669 |

| 107,617 |

| 560,286 | 7,021 |

| (40,032) |

| - |

| (33,011) | |

Harvest | - |

| - |

| - | - |

| - |

| (15,069) |

| (15,069) | |

Write-off | - |

| - |

| - | - |

| - |

| (85) |

| (85) | |

Transfer between current and non-current | 15,889 |

| 21,107 |

| 36,996 | (15,889) |

| (21,107) |

| - |

| (36,996) | |

Transfer to assets held for sale | - |

| - |

| - | - |

| - |

| 224 |

| 224 | |

Transfer to inventories | (2,657,081) |

| (1,648,080) |

| (4,305,161) | - |

| - |

| - |

| - | |

Ending balance | 573,797 |

| 1,051,033 |

| 1,624,830 |

| 355,894 |

| 352,876 |

| 324,520 |

| 1,033,290 |

| Consolidated | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| 03.31.20 | |

Current | Non-current | ||||||||||||

Live animals | Live animals |

|

|

| |||||||||

Poultry | Pork | Total | Poultry | Pork | Forests | Total | |||||||

Beginning balance | 615,685 |

| 987,354 |

| 1,603,039 | 414,668 |

| 337,804 |

| 328,553 |

| 1,081,025 | |

Additions/Transfer | 2,207,218 |

| 1,583,035 |

| 3,790,253 | 23,199 |

| 76,211 |

| 10,897 |

| 110,307 | |

Changes in fair value (1) | 459,377 |

| 107,617 |

| 566,994 | 2,402 |

| (40,032) |

| - |

| (37,630) | |

Harvest | - |

| - |

| - | - |

| - |

| (15,069) |

| (15,069) | |

Write-off | - |

| - |

| - | - |

| - |

| (85) |

| (85) | |

Transfer between current and non-current | 15,889 |

| 21,107 |

| 36,996 | (15,889) |

| (21,107) |

| - |

| (36,996) | |

Transfer between held for sale | - |

| - |

| - | - |

| - |

| 224 |

| 224 | |

Transfer to inventories | (2,657,081) |

| (1,648,080) |

| (4,305,161) | - |

| - |

| - |

| - | |

Exchange variation | 10,402 |

| - |

| 10,402 | 11,088 |

| - |

| - |

| 11,088 | |

Ending balance | 651,490 |

| 1,051,033 |

| 1,702,523 |

| 435,468 |

| 352,876 |

| 324,520 |