- BRFS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

BRF (BRFS) 6-KCurrent report (foreign)

Filed: 13 Aug 21, 12:00am

INDEX

| STATEMENT OF FINANCIAL POSITION | 4 |

| STATEMENT OF INCOME (LOSS) | 5 |

| STATEMENT OF COMPREHENSIVE INCOME (LOSS) | 6 |

| STATEMENT OF CHANGES IN EQUITY | 7 |

| STATEMENT OF CASH FLOWS | 8 |

| STATEMENT OF VALUE ADDED | 9 |

| MANAGEMENT REPORT | 10 |

| 1. | COMPANY’S OPERATIONS | 29 |

| 2 | BASIS OF PREPARATION AND PRESENTATION OF INTERIM FINANCIAL INFORMATION | 34 |

| 3 | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES | 34 |

| 4 | CASH AND CASH EQUIVALENTS | 35 |

| 5 | MARKETABLE SECURITIES | 35 |

| 6 | TRADE ACCOUNTS RECEIVABLE AND OTHER RECEIVABLES | 36 |

| 7 | INVENTORIES | 37 |

| 8 | BIOLOGICAL ASSETS | 38 |

| 9 | RECOVERABLE TAXES | 40 |

| 10 | DEFERRED INCOME TAXES | 42 |

| 11 | JUDICIAL DEPOSITS | 44 |

| 12 | INVESTMENTS | 45 |

| 13 | PROPERTY, PLANT AND EQUIPMENT, NET | 46 |

| 14 | INTANGIBLE ASSETS | 48 |

| 15 | LOANS AND BORROWINGS | 50 |

| 16 | TRADE ACCOUNTS PAYABLE | 34 |

| 17 | SUPPLY CHAIN FINANCE | 53 |

| 18 | LEASES | 53 |

| 19 | SHARE-BASED PAYMENT | 57 |

| 20 | EMPLOYEES BENEFITS PLANS | 57 |

| 21 | PROVISION FOR TAX, CIVIL AND LABOR RISKS | 58 |

| 22 | EQUITY | 59 |

| 23 | EARNINGS (LOSS) PER SHARE | 61 |

| 24 | FINANCIAL INSTRUMENTS AND RISK MANAGEMENT | 61 |

| 25 | SEGMENT INFORMATION | 75 |

| 26 | NET SALES | 77 |

| 27 | OTHER OPERATING INCOME (EXPENSES), NET | 77 |

| 28 | FINANCIAL INCOME (EXPENSES), NET | 78 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 2 |

| 29 | STATEMENT OF INCOME BY NATURE | 79 |

| 30 | RELATED PARTIES | 79 |

| 31 | COMMITMENTS | 82 |

| 32 | TRANSACTIONS THAT DO NOT INVOLVE CASH | 82 |

| 33 | EVENTS AFTER THE REPORTING PERIOD | 83 |

| 34 | APPROVAL OF THE INTERIM FINANCIAL INFORMATION | 84 |

| COMENTARY ABOUT THE BEHAVIOR OF THE COMPANY’S PROJECTIONS | 85 |

| BREAKDOWN OF THE CAPITAL BY OWNER (NOT REVIEWED) | 85 |

| INDEPENDENT AUDITORS’ REPORT ON REVIEW OF INTERIM FINANCIAL INFORMATION | 86 |

| OPINION OF THE AUDIT AND INTEGRITY COMMITTEE | 87 |

| STATEMENT OF EXECUTIVE BOARD ON THE INTERIM FINANCIAL INFORMATION AND INDEPENDENT AUDITOR’S REPORT | 88 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 3 |

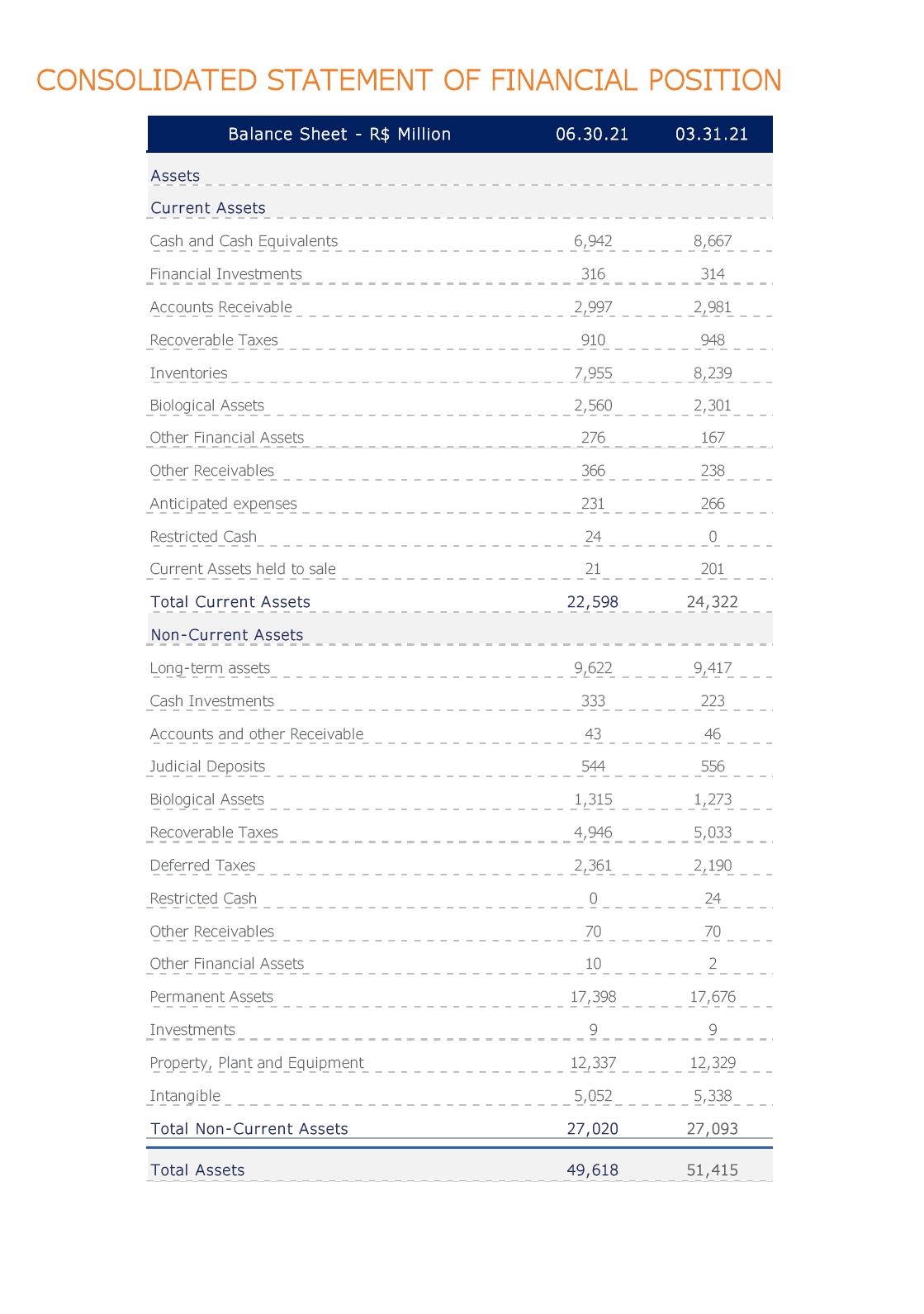

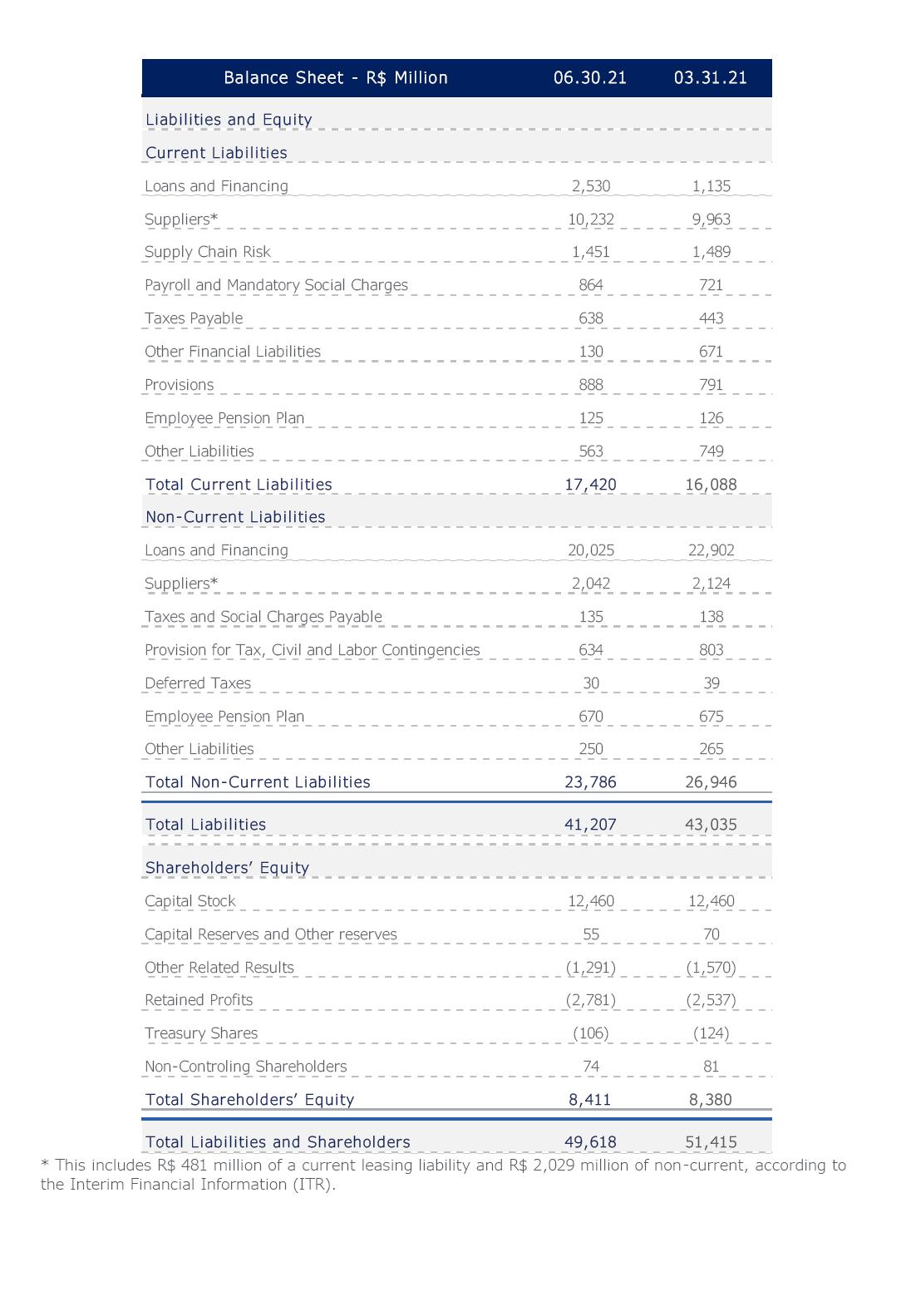

STATEMENT OF FINANCIAL POSITION

| Parent company | Consolidated | Parent company | Consolidated | |||||||||||||||||

| ASSETS | Note | 06.30.21 | 12.31.20 | 06.30.21 | 12.31.20 | LIABILITIES | Note | 06.30.21 | 12.31.20 | 06.30.21 | 12.31.20 | |||||||||

| CURRENT ASSETS | CURRENT LIABILITIES | |||||||||||||||||||

| Cash and cash equivalents | 4 | 2,651,573 | 3,876,139 | 6,941,842 | 7,576,625 | Loans and borrowings | 15 | 2,182,461 | 811,919 | 2,530,352 | 1,059,984 | |||||||||

| Marketable securities | 5 | 315,036 | 312,515 | 316,410 | 314,158 | Trade accounts payable | 16 | 8,826,451 | 8,156,231 | 9,751,391 | 8,996,206 | |||||||||

| Trade and other receivables | 6 | 6,470,799 | 5,254,064 | 2,996,513 | 4,136,421 | Supply chain finance | 17 | 1,450,608 | 1,452,637 | 1,450,608 | 1,452,637 | |||||||||

| Inventories | 7 | 6,316,497 | 5,161,261 | 7,954,637 | 6,802,759 | Lease liability | 18 | 374,773 | 302,946 | 480,526 | 383,162 | |||||||||

| Biological assets | 8 | 2,478,574 | 2,044,288 | 2,559,876 | 2,129,010 | Payroll, related charges and employee profit sharing | 826,692 | 860,836 | 863,738 | 940,816 | ||||||||||

| Recoverable taxes | 9 | 774,361 | 812,338 | 832,782 | 899,120 | Taxes payable | 515,950 | 268,347 | 638,241 | 395,630 | ||||||||||

| Recoverable income taxes | 9 | 39,926 | 28,888 | 77,240 | 43,840 | Derivative financial instruments | 24 | 129,613 | 378,543 | 130,197 | 384,969 | |||||||||

| Derivative financial instruments | 24 | 272,881 | 361,315 | 276,137 | 377,756 | Provision for tax, civil and labor risks | 21 | 884,305 | 860,889 | 887,520 | 865,338 | |||||||||

| Restricted cash | 24,245 | 1 | 24,245 | 1 | Employee benefits | 20 | 114,938 | 114,938 | 124,508 | 125,230 | ||||||||||

| Assets held for sale | 4,956 | 15,637 | 20,694 | 186,025 | Advances from related parties | 30 | 9,981,649 | 8,960,394 | - | - | ||||||||||

| Other current assets | 389,109 | 348,722 | 597,398 | 446,269 | Liabilities directly associated with assets held for sale | - | - | - | 21,718 | |||||||||||

| Other current liabilities | 237,046 | 335,137 | 563,383 | 814,638 | ||||||||||||||||

| Total current assets | 19,737,957 | 18,215,168 | 22,597,774 | 22,911,984 | Total current liabilities | 25,524,486 | 22,502,817 | 17,420,464 | 15,440,328 | |||||||||||

| NON-CURRENT ASSETS | NON-CURRENT LIABILITIES | |||||||||||||||||||

| LONG-TERM RECEIVALBLES | Loans and borrowings | 15 | 17,253,656 | 18,498,335 | 20,024,831 | 21,344,442 | ||||||||||||||

| Marketable securities | 5 | 14,911 | 15,044 | 333,034 | 344,577 | Trade accounts payable | 16 | 13,198 | 13,781 | 13,198 | 13,781 | |||||||||

| Trade and other receivables | 6 | 42,765 | 49,569 | 43,069 | 49,864 | Lease liability | 18 | 1,822,879 | 1,965,748 | 2,028,605 | 2,153,519 | |||||||||

| Recoverable taxes | 9 | 4,877,222 | 4,868,219 | 4,877,232 | 4,868,198 | Taxes payable | 135,350 | 141,252 | 135,350 | 141,252 | ||||||||||

| Recoverable income taxes | 9 | 54,293 | 54,123 | 69,164 | 54,859 | Provision for tax, civil and labor risks | 21 | 634,225 | 837,106 | 634,449 | 837,382 | |||||||||

| Deferred income taxes | 10 | 2,326,180 | 2,068,769 | 2,361,035 | 2,109,064 | Deferred income taxes | 10 | - | - | 30,219 | 26,527 | |||||||||

| Judicial deposits | 11 | 543,839 | 553,276 | 543,893 | 553,341 | Liabilities with related parties | 30 | 43,194 | 41,892 | - | - | |||||||||

| Biological assets | 8 | 1,249,007 | 1,154,726 | 1,314,660 | 1,221,749 | Employee benefits | 20 | 541,824 | 521,855 | 669,657 | 651,325 | |||||||||

| Receivables from related parties | 30 | 309 | 315 | - | - | Derivative financial instruments | 24 | 7,655 | 727 | 7,655 | 727 | |||||||||

| Derivative financial instruments | 24 | 9,894 | 234 | 9,894 | 234 | Other non-current liabilities | 251,846 | 249,691 | 242,421 | 242,089 | ||||||||||

| Restricted cash | 1 | 24,357 | 1 | 24,357 | ||||||||||||||||

| Other non-current assets | 64,067 | 77,829 | 69,781 | 82,123 | ||||||||||||||||

| Total long-term receivables | 9,182,488 | 8,866,461 | 9,621,763 | 9,308,366 | Total non-current liabilities | 20,703,827 | 22,270,387 | 23,786,385 | 25,411,044 | |||||||||||

| EQUITY | 22 | |||||||||||||||||||

| Capital | 12,460,471 | 12,460,471 | 12,460,471 | 12,460,471 | ||||||||||||||||

| Capital reserves | 141,834 | 141,834 | 141,834 | 141,834 | ||||||||||||||||

| Other equity transactions | (87,028) | 246 | (87,028) | 246 | ||||||||||||||||

| Investments | 12 | 11,159,568 | 11,922,325 | 9,401 | 8,874 | Accumulated losses | (2,780,682) | (2,594,028) | (2,780,682) | (2,594,028) | ||||||||||

| Property, plant and equipment, net | 13 | 11,276,956 | 11,168,558 | 12,336,681 | 12,215,580 | Treasury shares | (106,196) | (123,938) | (106,196) | (123,938) | ||||||||||

| Intangible assets | 14 | 3,208,378 | 3,186,476 | 5,052,273 | 5,220,102 | Other comprehensive loss | (1,291,365) | (1,298,801) | (1,291,365) | (1,298,801) | ||||||||||

| Attributable to controlling shareholders | 8,337,034 | 8,585,784 | 8,337,034 | 8,585,784 | ||||||||||||||||

| Non-controlling interests | - | - | 74,009 | 227,750 | ||||||||||||||||

| Total non-current assets | 34,827,390 | 35,143,820 | 27,020,118 | 26,752,922 | Total equity | 8,337,034 | 8,585,784 | 8,411,043 | 8,813,534 | |||||||||||

| TOTAL ASSETS | 54,565,347 | 53,358,988 | 49,617,892 | 49,664,906 | TOTAL LIABILITIES AND EQUITY | 54,565,347 | 53,358,988 | 49,617,892 | 49,664,906 | |||||||||||

The accompanying notes are an integral part of the financial statements.

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 4 |

STATEMENT OF INCOME (LOSS)

| Parent company | Consolidated | ||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||

| Note | Apr - Jun | Jan - Jun | Apr - Jun | Jan - Jun | Apr - Jun | Jan - Jun | Apr - Jun | Jan - Jun | |||||||||

| CONTINUING OPERATIONS | |||||||||||||||||

| NET SALES | 26 | 10,231,317 | 19,522,706 | 7,063,409 | 14,512,454 | 11,636,901 | 22,228,878 | 9,103,926 | 18,052,991 | ||||||||

| Cost of sales | 29 | (8,465,859) | (15,670,856) | (6,182,886) | (12,011,795) | (9,410,919) | (17,807,936) | (7,125,034) | (13,821,122) | ||||||||

| GROSS PROFIT | 1,765,458 | 3,851,850 | 880,523 | 2,500,659 | 2,225,982 | 4,420,942 | 1,978,892 | 4,231,869 | |||||||||

| OPERATING INCOME (EXPENSES) | |||||||||||||||||

| Selling expenses | 29 | (1,244,998) | (2,348,974) | (1,057,781) | (2,090,348) | (1,544,112) | (2,977,138) | (1,360,889) | (2,645,223) | ||||||||

| General and administrative expenses | 29 | (127,173) | (225,853) | (122,609) | (209,890) | (192,275) | (352,259) | (190,465) | (333,025) | ||||||||

| Impairment loss on trade receivables | 6 | (3,160) | (5,716) | 22,024 | (9,078) | (5,072) | (8,492) | 21,096 | (11,755) | ||||||||

| Other operating income (expenses), net | 27 | 66,379 | 101,389 | 147,221 | (84,110) | 95,799 | 125,180 | 138,553 | (100,000) | ||||||||

| Income (loss) from associates and joint ventures | 12 | (1,671,573) | (694,847) | 2,086,260 | 6,073,512 | - | - | - | - | ||||||||

| INCOME (LOSS) BEFORE FINANCIAL RESULTS AND INCOME TAXES | (1,215,067) | 677,849 | 1,955,638 | 6,180,745 | 580,322 | 1,208,233 | 587,187 | 1,141,866 | |||||||||

| Financial income | 66,570 | 175,441 | 66,332 | 173,109 | 83,824 | 206,477 | 81,833 | 194,711 | |||||||||

| Financial expenses | (766,120) | (1,477,049) | (577,883) | (1,192,623) | (797,274) | (1,423,689) | (166,563) | (735,913) | |||||||||

| Foreign exchange and monetary variations | 1,722,830 | 418,139 | (1,037,987) | (4,851,516) | (45,928) | (144,806) | (105,573) | (255,570) | |||||||||

| FINANCIAL INCOME (EXPENSES), NET | 28 | 1,023,280 | (883,469) | (1,549,538) | (5,871,030) | (759,378) | (1,362,018) | (190,303) | (796,772) | ||||||||

| INCOME (LOSS) BEFORE TAXES | (191,787) | (205,620) | 406,100 | 309,715 | (179,056) | (153,785) | 396,884 | 345,094 | |||||||||

| Income taxes | 10 | (11,069) | 27,206 | (102,230) | (51,766) | (19,503) | (22,313) | (89,755) | (76,197) | ||||||||

| INCOME (LOSS) FROM CONTINUING OPERATIONS | (202,856) | (178,414) | 303,870 | 257,949 | (198,559) | (176,098) | 307,129 | 268,897 | |||||||||

| LOSS FROM DISCONTINUED OPERATIONS | (41,286) | (41,286) | - | - | (41,286) | (41,286) | - | - | |||||||||

| INCOME (LOSS) FOR THE PERIOD | (244,142) | (219,700) | 303,870 | 257,949 | (239,845) | (217,384) | 307,129 | 268,897 | |||||||||

| Net Income (loss) from Continuing Operation Attributable to | |||||||||||||||||

| Controlling shareholders | (202,856) | (178,414) | 303,870 | 257,949 | (202,856) | (178,414) | 303,870 | 257,949 | |||||||||

| Non-controlling interest | - | - | - | - | 4,297 | 2,316 | 3,259 | 10,948 | |||||||||

| (202,856) | (178,414) | 303,870 | 257,949 | (198,559) | (176,098) | 307,129 | 268,897 | ||||||||||

| Net Loss From Discontinued Operations Attributable to | |||||||||||||||||

| Controlling shareholders | (41,286) | (41,286) | - | - | (41,286) | (41,286) | - | - | |||||||||

| Non-controlling interest | - | - | - | - | - | - | - | - | |||||||||

| (41,286) | (41,286) | - | - | (41,286) | (41,286) | - | - | ||||||||||

| INCOME (LOSS) PER SHARE FROM CONTINUED OPERATIONS | |||||||||||||||||

| Weighted average shares outstanding - basic | 807,934,252 | 807,820,708 | 809,612,517 | 810,672,698 | |||||||||||||

| Income (loss) per share - basic | 23 | (0.25) | (0.22) | 0.38 | 0.32 | ||||||||||||

| Weighted average shares outstanding - diluted | 807,934,252 | 807,820,708 | 809,875,209 | 810,935,390 | |||||||||||||

| Income (loss) per share - diluted | 23 | (0.25) | (0.22) | 0.38 | 0.32 | ||||||||||||

| LOSSES PER SHARE FROM DISCONTINUED OPERATIONS | |||||||||||||||||

| Weighted average shares outstanding - basic | 807,934,252 | 807,820,708 | - | - | |||||||||||||

| Losses per share - basic | 23 | (0.05) | (0.05) | - | - | ||||||||||||

| Weighted average shares outstanding - diluted | 807,934,252 | 807,820,708 | - | - | |||||||||||||

| Losses per share - diluted | 23 | (0.05) | (0.05) | - | - | ||||||||||||

The accompanying notes are an integral part of the financial statements.

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 5 |

STATEMENT OF COMPREHENSIVE INCOME (LOSS)

| Parent company | Consolidated | ||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||

| Note | Apr - Jun | Jan - Jun | Apr - Jun | Jan - Jun | Apr - Jun | Jan - Jun | Apr - Jun | Jan - Jun | |||||||||

| Income (loss) for the period | (244,142) | (219,700) | 303,870 | 257,949 | (239,845) | (217,384) | 307,129 | 268,897 | |||||||||

| Other comprehensive income (loss) | |||||||||||||||||

| Loss on foreign currency translation of foreign operations | (48,326) | (96,637) | (46,972) | (148,522) | (59,221) | (139,581) | (63,994) | (105,697) | |||||||||

| Gain (loss) on net investment hedge | 170,638 | 45,877 | (69,236) | (342,111) | 170,638 | 45,877 | (69,236) | (342,111) | |||||||||

| Gain (loss) on cash flow hedge | 24 | 152,584 | 57,113 | 268,028 | (741,483) | 152,584 | 57,113 | 268,028 | (741,483) | ||||||||

| Gain (loss) on debt investments measured at FVTOCI (1) | 5 | - | - | 2,703 | (170) | - | - | 2,703 | (170) | ||||||||

| Net other comprehensive income (loss), to be reclassified to the statement of income in subsequent periods | 274,896 | 6,353 | 154,523 | (1,232,286) | 264,001 | (36,591) | 137,501 | (1,189,461) | |||||||||

| Gain on equity investments measured at FVTOCI (1) | 5 | - | 26,030 | 4,636 | 5,003 | - | 26,030 | 4,636 | 5,003 | ||||||||

| Actuarial gains on pension and post-employment plans | 20 | 4,199 | 8,099 | 6,647 | 13,035 | 4,181 | 8,035 | 6,623 | 12,964 | ||||||||

| Net other comprehensive income, with no impact into subsequent statement of income | 4,199 | 34,129 | 11,283 | 18,038 | 4,181 | 34,065 | 11,259 | 17,967 | |||||||||

| Comprehensive income (loss), net of taxes | 34,953 | (179,218) | 469,676 | (956,299) | 28,337 | (219,910) | 455,889 | (902,597) | |||||||||

| Attributable to | |||||||||||||||||

| Controlling shareholders | 34,953 | (179,218) | 469,676 | (956,299) | 34,953 | (179,218) | 469,676 | (956,299) | |||||||||

| Non-controlling interest | - | - | - | - | (6,616) | (40,692) | (13,787) | 53,702 | |||||||||

| 34,953 | (179,218) | 469,676 | (956,299) | 28,337 | (219,910) | 455,889 | (902,597) | ||||||||||

| (1) | FVTOCI: Fair Value Through Other Comprehensive Income. |

Items above are stated net of income taxes and the related taxes are disclosed in note 10.

The accompanying notes are an integral part of the financial statements.

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 6 |

STATEMENT OF CHANGES IN EQUITY

| Attributed to controlling shareholders | |||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | |||||||||||||||||||||||||||||||

| Capital | Capital reserves | Other equity transactions (4) | Treasury shares | Accumulated foreign currency translation adjustments | Gains (losses) on marketable securities at FVTOCI (2) | Gains (losses) on cash flow hedge | Actuarial gains (losses) | Retained losses | Total equity | Non-controlling interest | Total shareholders' equity (consolidated) | ||||||||||||||||||||

| BALANCES AT DECEMBER 31, 2019 | 12,460,471 | 141,834 | 51,011 | (38,239) | (193,379) | 4,454 | (356,721) | (176,823) | (3,996,985) | 7,895,623 | 252,726 | 8,148,349 | |||||||||||||||||||

| Comprehensive income (loss) (1) | |||||||||||||||||||||||||||||||

| Gains (losses) on foreign currency translation of foreign operations | - | - | - | - | (207,734) | - | - | - | - | (207,734) | 28,308 | (179,426) | |||||||||||||||||||

| Loss on net investment hedge | - | - | - | - | (277,856) | - | - | - | - | (277,856) | - | (277,856) | |||||||||||||||||||

| Unrealized gains on marketable securities at FVTOCI (2) | - | - | - | - | - | 2,562 | - | - | - | 2,562 | - | 2,562 | |||||||||||||||||||

| Unrealized losses in cash flow hedge | - | - | - | - | - | - | (81,500) | - | - | (81,500) | - | (81,500) | |||||||||||||||||||

| Actuarial losses on pension and post-employment plans | - | - | - | - | - | - | - | 7,589 | - | 7,589 | (468) | 7,121 | |||||||||||||||||||

| Income for the year | - | - | - | - | - | - | - | - | 1,383,564 | 1,383,564 | 6,505 | 1,390,069 | |||||||||||||||||||

| SUB-TOTAL COMPREHENSIVE INCOME (LOSS) | - | - | - | - | (485,590) | 2,562 | (81,500) | 7,589 | 1,383,564 | 826,625 | 34,345 | 860,970 | |||||||||||||||||||

| Employee benefits remeasurement - defined benefit | - | - | - | - | - | - | (19,393) | 19,393 | - | - | - | ||||||||||||||||||||

| Appropriation of income (loss) | |||||||||||||||||||||||||||||||

| Dividends | - | - | - | - | - | - | - | - | - | - | (4,458) | (4,458) | |||||||||||||||||||

| Share-based payments | - | - | 180 | 20,371 | - | - | - | - | - | 20,551 | - | 20,551 | |||||||||||||||||||

| Acquisition of non-controlling interests | - | - | (50,945) | - | - | - | - | - | - | (50,945) | (54,863) | (105,808) | |||||||||||||||||||

| Acquisition of treasury shares | - | - | - | (106,070) | - | - | - | - | - | (106,070) | - | (106,070) | |||||||||||||||||||

| BALANCES AT DECEMBER 31, 2020 | 12,460,471 | 141,834 | 246 | (123,938) | (678,969) | 7,016 | (438,221) | (188,627) | (2,594,028) | 8,585,784 | 227,750 | 8,813,534 | |||||||||||||||||||

| Comprehensive income (loss) (1) | |||||||||||||||||||||||||||||||

| Losses on foreign currency translation of foreign operations | - | - | - | - | (96,637) | - | - | - | - | (96,637) | (42,944) | (139,581) | |||||||||||||||||||

| Gain on net investment hedge | - | - | - | - | 45,877 | - | - | - | - | 45,877 | - | 45,877 | |||||||||||||||||||

| Unrealized gains on marketable securities at FVTOCI (2) | - | - | - | - | - | 26,030 | - | - | - | 26,030 | - | 26,030 | |||||||||||||||||||

| Unrealized gains in cash flow hedge | - | - | - | - | - | - | 57,113 | - | - | 57,113 | - | 57,113 | |||||||||||||||||||

| Actuarial gains (losses) on pension and post-employment plans | - | - | - | - | - | - | - | 8,099 | - | 8,099 | (64) | 8,035 | |||||||||||||||||||

| Income (loss) for the period | - | - | - | - | - | - | - | - | (219,700) | (219,700) | 2,316 | (217,384) | |||||||||||||||||||

| SUB-TOTAL COMPREHENSIVE INCOME (LOSS) | - | - | - | - | (50,760) | 26,030 | 57,113 | 8,099 | (219,700) | (179,218) | (40,692) | (219,910) | |||||||||||||||||||

| Realized gain in marketable securities at FVTOCI (2) | - | - | - | - | (33,046) | - | - | 33,046 | - | - | - | ||||||||||||||||||||

| Share-based payments | - | - | (7,601) | 17,742 | - | - | - | - | - | 10,141 | - | 10,141 | |||||||||||||||||||

| Acquisition of non-controlling interests (3) | - | - | (79,673) | - | - | - | - | - | - | (79,673) | (113,049) | (192,722) | |||||||||||||||||||

| BALANCES AT JUNE 30, 2021 | 12,460,471 | 141,834 | (87,028) | (106,196) | (729,729) | - | (381,108) | (180,528) | (2,780,682) | 8,337,034 | 74,009 | 8,411,043 | |||||||||||||||||||

| (1) | All changes in other comprehensive income are presented net of taxes. |

| (2) | FVTOCI: Fair Value Through Other Comprehensive Income. |

| (3) | Acquisition of remaining participation in the subsidiary AFC (note 1.1). |

| (4) | Comparative period was restated as described in note 22.2. |

The accompanying notes are an integral part of the financial statements.

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 7 |

STATEMENT OF CASH FLOWS

| Parent company | Consolidated | |||||||

| 2021 | 2020 | 2021 | 2020 | |||||

| Restated (4) | Restated (4) | |||||||

| Jan - Jun | Jan - Jun | Jan - Jun | Jan - Jun | |||||

| OPERATING ACTIVITIES | ||||||||

| Income (loss) from continuing operations | (178,414) | 257,949 | (176,098) | 268,897 | ||||

| Adjustments for: | ||||||||

| Depreciation and amortization | 692,540 | 610,390 | 889,894 | 741,053 | ||||

| Depreciation and depletion of biological assets | 441,867 | 377,490 | 485,564 | 420,747 | ||||

| Result on disposal of property, plant and equipments and investment | (7,304) | 2,380 | (36,015) | 7,409 | ||||

| Write-down of inventories to net realizable value | 26,920 | 40,021 | 32,974 | 63,180 | ||||

| Provision for tax, civil and labor risks | (11,388) | 181,851 | (11,876) | 182,108 | ||||

| Income from investments under the equity method | 694,847 | (6,073,512) | - | - | ||||

| Financial results, net | 883,469 | 5,871,030 | 1,362,018 | 796,772 | ||||

| Tax recoveries and gains in tax lawsuits | (54,392) | (224,820) | (54,392) | (224,820) | ||||

| Deferred income tax | (283,296) | 51,766 | (293,328) | 37,865 | ||||

| Employee profit sharing | 14,526 | 121,399 | 29,055 | 117,992 | ||||

| Other provisions | 4,007 | 251,911 | 6,780 | 259,024 | ||||

| 2,223,382 | 1,467,855 | 2,234,576 | 2,670,227 | |||||

| Trade accounts receivable | (1,187,604) | (395,989) | 1,068,291 | 643,436 | ||||

| Inventories | (1,182,156) | (701,669) | (1,301,476) | (1,223,384) | ||||

| Biological assets - current | (434,286) | (258,755) | (448,702) | (268,631) | ||||

| Trade accounts payable | 230,502 | 286,358 | 300,223 | 522,587 | ||||

| Supply chain finance | (3,074) | 140,750 | (3,074) | 140,750 | ||||

| Cash generated (applied) by operating activities | (353,236) | 538,550 | 1,849,838 | 2,484,985 | ||||

| Investments in securities at FVTPL (1) | (23,894) | 2,800 | (23,894) | - | ||||

| Redemptions of securities at FVTPL (1) | 28,098 | 99,264 | 28,339 | 102,172 | ||||

| Interest received | 37,068 | 50,925 | 38,254 | 57,176 | ||||

| Dividends and interest on shareholders' equity received | - | 196 | - | - | ||||

| Payment of tax, civil and labor provisions | (198,301) | (129,746) | (198,301) | (129,748) | ||||

| Derivative financial instruments | (525,012) | 1,137,007 | (511,333) | 1,141,152 | ||||

| Payment of income taxes | - | - | - | (146) | ||||

| Other operating assets and liabilities (2) | 1,374,315 | 947,290 | 27,958 | 450,922 | ||||

| Net cash provided by operating activities | 339,038 | 2,646,286 | 1,210,861 | 4,106,513 | ||||

| INVESTING ACTIVITIES | ||||||||

| Redemptions of securities at amortized cost | - | - | 166,112 | - | ||||

| Redemptions of securities at FVTOCI (3) | - | - | 86,059 | - | ||||

| Redemption of restricted cash | 400 | 285,622 | 400 | 285,622 | ||||

| Additions to property, plant and equipment | (544,406) | (274,851) | (602,926) | (285,323) | ||||

| Additions to biological assets - non-current | (533,242) | (423,203) | (588,040) | (470,300) | ||||

| Proceeds from disposals of property, plant, equipments and investment | 8,500 | 65,717 | 8,500 | 65,717 | ||||

| Additions to intangible assets | (105,909) | (64,428) | (101,106) | (59,067) | ||||

| Business combination, net of cash | - | - | (131,212) | - | ||||

| Sale of participation in subsidiaries with loss of control | - | - | 132,951 | 38,546 | ||||

| Acquisition of participation in joint ventures and subsidiaries | (528) | (547) | (528) | (547) | ||||

| Capital increase in associates | (58,998) | (5,000) | - | - | ||||

| Net cash used in investing activities | (1,234,183) | (416,690) | (1,029,790) | (425,352) | ||||

| Net cash provided by investing activities from discontinued operations | - | - | (17,550) | - | ||||

| Net cash used in investing activities | (1,234,183) | (416,690) | (1,047,340) | (425,352) | ||||

| FINANCING ACTIVITIES | ||||||||

| Proceeds from debt issuance | 1,011,355 | 2,855,552 | 1,264,223 | 3,357,785 | ||||

| Repayment of debt | (511,602) | (1,381,422) | (539,359) | (1,639,768) | ||||

| Payment of interest | (553,110) | (474,804) | (646,355) | (553,441) | ||||

| Treasury shares acquisition | - | (106,070) | - | (106,070) | ||||

| Acquisition of non-controlling interests | - | - | (238,421) | (100,390) | ||||

| Payment of lease liabilities | (281,251) | (221,046) | (373,512) | (268,264) | ||||

| Net cash provided by (used in) financing activities | (334,608) | 672,210 | (533,424) | 689,852 | ||||

| EFFECT OF EXCHANGE RATE VARIATION ON CASH AND CASH EQUIVALENTS | 5,187 | 198,521 | (264,880) | 1,062,477 | ||||

| Net increase (decrease) in cash and cash equivalents | (1,224,566) | 3,100,327 | (634,783) | 5,433,490 | ||||

| Balance at the beginning of the period | 3,876,139 | 1,368,980 | 7,576,625 | 4,237,785 | ||||

| Balance at the end of the period | 2,651,573 | 4,469,307 | 6,941,842 | 9,671,275 | ||||

| (1) | FVTPL: Fair Value Through Profit and Loss. |

| (2) | In the Parent company, contemplates mainly the effects of prepayments of exports with subsidiaries in the amount of R$(738,485) in the six-month period ended on June 30, 2021 (R$3,767,176 in the same period of the previous year). |

| (3) | FVTOCI: Fair Value Through Other Comprehensive Income. |

| (4) | Restated according to reclassifications described in note 3. |

The accompanying notes are an integral part of the financial statements.

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 8 |

STATEMENT OF VALUE ADDED

| Parent company | Consolidated | |||||||

| 2021 | 2020 | 2021 | 2020 | |||||

| Jan - Jun | Jan - Jun | Jan - Jun | Jan - Jun | |||||

| 1 - REVENUES | 22,291,765 | 16,618,793 | 25,074,739 | 20,130,286 | ||||

| Sales of goods and products | 21,645,303 | 16,317,046 | 24,355,190 | 19,859,521 | ||||

| Other income | 118,276 | 38,180 | 156,595 | 18,082 | ||||

| Revenue related to construction of own assets | 533,902 | 272,645 | 571,446 | 264,438 | ||||

| Expected credit losses | (5,716) | (9,078) | (8,492) | (11,755) | ||||

| 2 - SUPPLIES ACQUIRED FROM THIRD PARTIES | (14,819,852) | (10,954,133) | (17,247,444) | (12,966,408) | ||||

| Costs of goods sold | (12,610,883) | (9,226,376) | (14,607,519) | (10,887,673) | ||||

| Materials, energy, third parties services and other | (2,223,811) | (1,737,674) | (2,659,600) | (2,077,276) | ||||

| Reversal for inventories losses | 14,842 | 9,917 | 19,675 | (1,459) | ||||

| 3 - GROSS ADDED VALUE (1-2) | 7,471,913 | 5,664,660 | 7,827,295 | 7,163,878 | ||||

| 4 - DEPRECIATION AND AMORTIZATION | (1,134,407) | (987,880) | (1,375,458) | (1,161,800) | ||||

| 5 - NET ADDED VALUE (3-4) | 6,337,506 | 4,676,780 | 6,451,837 | 6,002,078 | ||||

| 6 - RECEIVED FROM THIRD PARTIES | (521,766) | 6,245,730 | 204,117 | 194,653 | ||||

| Income from associates and joint ventures | (694,847) | 6,073,512 | - | - | ||||

| Financial income | 175,441 | 173,109 | 206,477 | 194,711 | ||||

| Others | (2,360) | (891) | (2,360) | (58) | ||||

| 7 - ADDED VALUE TO BE DISTRIBUTED (5+6) | 5,815,740 | 10,922,510 | 6,655,954 | 6,196,731 | ||||

| 8 - DISTRIBUTION OF ADDED VALUE | 5,815,740 | 10,922,510 | 6,655,954 | 6,196,731 | ||||

| Payroll | 2,524,199 | 2,504,040 | 2,822,070 | 2,743,528 | ||||

| Salaries | 1,799,065 | 1,829,075 | 2,032,779 | 2,021,894 | ||||

| Benefits | 595,083 | 544,184 | 649,805 | 582,713 | ||||

| Government severance indemnity fund for employees | 130,051 | 130,781 | 139,486 | 138,921 | ||||

| Taxes, Fees and Contributions | 2,322,184 | 2,045,361 | 2,389,656 | 2,085,446 | ||||

| Federal | 920,221 | 850,068 | 984,795 | 886,296 | ||||

| State | 1,380,576 | 1,174,975 | 1,380,472 | 1,174,972 | ||||

| Municipal | 21,387 | 20,318 | 24,389 | 24,178 | ||||

| Capital Remuneration from Third Parties | 1,147,771 | 6,115,160 | 1,620,326 | 1,098,860 | ||||

| Interests, including exchange variation | 1,082,252 | 6,052,527 | 1,591,837 | 999,871 | ||||

| Rents | 65,519 | 62,633 | 28,489 | 98,989 | ||||

| Interest on Own-Capital | (178,414) | 257,949 | (176,098) | 268,897 | ||||

| Income (loss) for the period from continuing operations | (178,414) | 257,949 | (178,414) | 257,949 | ||||

| Non-controlling interest | - | - | 2,316 | 10,948 | ||||

The accompanying notes are an integral part of the financial statements.

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 9 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 10 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 11 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 12 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 13 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 14 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 15 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 16 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 17 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 18 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 19 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 20 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 21 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 22 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 23 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 24 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 25 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 26 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 27 |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 28 |

| 1. | COMPANY’S OPERATIONS |

BRF S.A. (“BRF”) and its subsidiaries (collectively the “Company”) is a publicly traded company, listed on the segment Novo Mercado of Brasil, Bolsa, Balcão (“B3”), under the ticker BRFS3, and listed on the New York Stock Exchange (“NYSE”), under the ticker BRFS. The Company’s registered office is at Rua Jorge Tzachel, nº 475, Bairro Fazenda, Itajaí - Santa Catarina and the main business office is in the city of São Paulo.

BRF is a Brazilian multinational company, with global presence, which owns a comprehensive portfolio of products, and it is one of the world’s largest companies of food products. The Company operates by raising, producing and slaughtering poultry and pork for processing, production and sale of fresh meat, processed products, pasta, margarine and others.

The Company holds as main brands Sadia, Perdigão, Qualy, Chester®, Kidelli, Perdix and Banvit, present mainly in Brazil, Turkey and Middle Eastern countries.

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 29 |

| 1.1. | Equity interest |

| % equity interest | |||||||||

| Entity | Main activity | Country (1) | 06.30.21 | 12.31.20 | |||||

| BRF GmbH | Holding | Austria | 100.00 | 100.00 | |||||

| BRF Foods LLC | (g) | Import, industrialization and commercialization of products | Russia | 99.99 | 99.90 | ||||

| BRF Global Company Nigeria Ltd. | Marketing and logistics services | Nigeria | 99.00 | 99.00 | |||||

| BRF Global Company South Africa Proprietary Ltd. | Administrative, marketing and logistics services | South Africa | 100.00 | 100.00 | |||||

| BRF Global Company Nigeria Ltd. | Marketing and logistics services | Nigeria | 1.00 | 1.00 | |||||

| BRF Global GmbH | Holding and trading | Austria | 100.00 | 100.00 | |||||

| BRF Foods LLC | (h) | Import, industrialization and commercialization of products | Russia | 0.01 | 0.10 | ||||

| BRF Japan KK | Marketing and logistics services, import, export, industrialization and commercialization of products | Japan | 100.00 | 100.00 | |||||

| BRF Korea LLC | Marketing and logistics services | Korea | 100.00 | 100.00 | |||||

| BRF Shanghai Management Consulting Co. Ltd. | Provision of consultancy and marketing services | China | 100.00 | 100.00 | |||||

| BRF Shanghai Trading Co. Ltd. | Import, export and commercialization of products | China | 100.00 | 100.00 | |||||

| BRF Singapore Foods PTE Ltd. | Administrative, marketing and logistics services | Singapore | 100.00 | 100.00 | |||||

| Eclipse Holding Cöoperatief U.A. | Holding | The Netherlands | 99.99 | 99.99 | |||||

| Buenos Aires Fortune S.A. | Holding | Argentina | 4.36 | 4.36 | |||||

| Eclipse Latam Holdings | Holding | Spain | 100.00 | 100.00 | |||||

| Buenos Aires Fortune S.A. | Holding | Argentina | 95.64 | 95.64 | |||||

| Perdigão Europe Lda. | Import, export of products and administrative services | Portugal | 100.00 | 100.00 | |||||

| Perdigão International Ltd. | (d) | Import and export of products | Cayman Island | - | 100.00 | ||||

| ProudFood Lda. | Import and commercialization of products | Angola | 90.00 | 90.00 | |||||

| Sadia Chile S.A. | Import, export and commercialization of products | Chile | 40.00 | 40.00 | |||||

| Wellax Food Logistics C.P.A.S.U. Lda. | Import, commercialization of products and administrative services | Portugal | 100.00 | 100.00 | |||||

| BRF Austria GmbH | Holding | Austria | 100.00 | 100.00 | |||||

| One Foods Holdings Ltd. | Holding | UAE | 100.00 | 100.00 | |||||

| Al-Wafi Food Products Factory LLC | Import, export, industrialization and commercialization of products | UAE | 49.00 | 49.00 | |||||

| Badi Ltd. | Holding | UAE | 100.00 | 100.00 | |||||

| Al-Wafi Al-Takamol International for Foods Products | Import and commercialization of products | Saudi Arabia | 100.00 | 100.00 | |||||

| Joody Al Sharqiya Food Production Factory LLC | (b) | Import and commercialization of products | Saudi Arabia | 100.00 | - | ||||

| BRF Al Yasra Food K.S.C.C. ("BRF AFC") | (c) | Import, commercialization and distribution of products | Kuwait | 100.00 | 75.00 | ||||

| BRF Foods GmbH | Industrialization, import and commercialization of products | Austria | 100.00 | 100.00 | |||||

| Al Khan Foodstuff LLC ("AKF") | Import, commercialization and distribution of products | Oman | 70.00 | 70.00 | |||||

| FFQ GmbH | (e) | Industrialization, import and commercialization of products | Austria | - | 100.00 | ||||

| TBQ Foods GmbH | Holding | Austria | 60.00 | 60.00 | |||||

| Banvit Bandirma Vitaminli | Import, industrialization and commercialization of products | Turkey | 91.71 | 91.71 | |||||

| Banvit Enerji ve Elektrik Üretim Ltd. Sti. | (a) | Generation and commercialization of electric energy | Turkey | 100.00 | 100.00 | ||||

| Banvit Foods SRL | (f) | Industrialization of grains and animal feed | Romania | - | 0.01 | ||||

| Nutrinvestments BV | Holding | The Netherlands | 100.00 | 100.00 | |||||

| Banvit ME FZE | Marketing and logistics services | UAE | 100.00 | 100.00 | |||||

| Banvit Foods SRL | (f) | Industrialization of grains and animal feed | Romania | - | 99.99 | ||||

| One Foods Malaysia SDN. BHD. | Marketing and logistics services | Malaysia | 100.00 | 100.00 | |||||

| Federal Foods LLC | Import, commercialization and distribution of products | UAE | 49.00 | 49.00 | |||||

| Federal Foods Qatar | Import, commercialization and distribution of products | Qatar | 49.00 | 49.00 | |||||

| BRF Hong Kong LLC | (a) | Import, commercialization and distribution of products | Hong Kong | 100.00 | 100.00 | ||||

| Eclipse Holding Cöoperatief U.A. | Holding | The Netherlands | 0.01 | 0.01 | |||||

| Establecimiento Levino Zaccardi y Cia. S.A. | (a) | Industrialization and commercialization of dairy products | Argentina | 99.99 | 99.99 | ||||

| BRF Energia S.A. | Commercialization of eletric energy | Brazil | 100.00 | 100.00 | |||||

| BRF Pet S.A. | Industrialization, commercialization and distribution of feed and nutrients for animals | Brazil | 100.00 | 100.00 | |||||

| PP-BIO Administração de bem próprio S.A. | (i) | Management of assets | Brazil | 33.33 | 33.33 | ||||

| PR-SAD Administração de bem próprio S.A. | Management of assets | Brazil | 33.33 | 33.33 | |||||

| ProudFood Lda. | Import and commercialization of products | Angola | 10.00 | 10.00 | |||||

| PSA Laboratório Veterinário Ltda. | Veterinary activities | Brazil | 99.99 | 99.99 | |||||

| Sino dos Alpes Alimentos Ltda. | (a) | Industrialization and commercialization of products | Brazil | 99.99 | 99.99 | ||||

| Sadia Alimentos S.A. | Holding | Argentina | 43.10 | 43.10 | |||||

| Sadia Chile S.A. | Import, export and commercialization of products | Chile | 60.00 | 60.00 | |||||

| Sadia International Ltd. | (a) | Import and commercialization of products | Cayman Island | 100.00 | 100.00 | ||||

| Sadia Uruguay S.A. | Import and commercialization of products | Uruguay | 100.00 | 100.00 | |||||

| Sadia Alimentos S.A. | Holding | Argentina | 56.90 | 56.90 | |||||

| Vip S.A. Empreendimentos e Participações Imobiliárias | Commercialization of owned real state | Brazil | 100.00 | 100.00 | |||||

| Establecimiento Levino Zaccardi y Cia. S.A. | (a) | Industrialization and commercialization of dairy products | Argentina | 0.01 | 0.01 | ||||

| PSA Laboratório Veterinário Ltda. | Veterinary activities | Brazil | 0.01 | 0.01 | |||||

| Sino dos Alpes Alimentos Ltda. | (a) | Industrialization and commercialization of products | Brazil | 0.01 | 0.01 | ||||

| (1) | UAE – United Arab Emirates. |

| (a) | Dormant subsidiaries. The Company is evaluating the liquidation of these subsidiaries. |

| (b) | On January 18, 2021, 100% of the capital stock of Joody Al Sharqiya Food Production Factory LLC was acquired (note 1.2). |

| (c) | On March 9, 2021, the minority stake on BRF AFC was acquired, as described below. |

| (d) | On March 24, 2021, the subsidiary Perdigão International Ltd. was dissolved. |

| (e) | On March 30, 2021, the subsidiary FFQ GMBH was dissolved. |

| (f) | On May 4, 2021 the sale of shares held in Banvit Foods SRL was concluded, as described below. |

| (g) | On May 31, 2021, BRF GMBH became owner of 99.99% of BRF Food LLC. |

| (h) | On May 31, 2021, BRF Global GMBH became owner of 0.01% of BRF Food LLC. |

| (i) | On July 30, 2021, BRF S.A. sold all the shares held in PP-BIO Administração de bem próprio S.A. |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 30 |

On March 9, 2021 the Company, through its wholly-owned subsidiary One Foods Holdings Ltd.(“One Foods”) acquired from Al Yasra Food Company W.L.L the minority stake of 25% of BRF Al Yasra Food K.S.C.C. (“BRF AFC”), entity located in Kuwait, responsible for the distribution of BRF products in the country. The transaction was concluded for the amount equivalent to R$238,421 (USD40,828) and from this date, BRF AFC became a wholly-owned subsidiary of One Foods. The amount paid is presented in the financing activities on the statement of cash flows and the difference between the amount paid and the book value of the participation acquired was recorded in Equity as Other Reserves, in the amount of R$79,673.

On May 4, 2021, Nutrinvestment BV and Banvit Bandirma Vitaminli, indirectly controlled subsidiaries of the Company, concluded the sale to Aaylex System Group S.A. of 100% of the shares held in Banvit Foods SRL, engaged in the activities of manufacture of animal feed and egg hatchery in Romania. The sale amount, received on that date, was equivalent to R$132,425 (EUR 20,300). In June, the parties established a price adjustment due to net debt and working capital, in the amount equivalent to R$13,059 (EUR2,157). In the six-month period ended on June 30, 2021, the Company recognized a gain with the sale of R$23,590, mainly due to the write-off of the currency translation adjustment and to the price adjustment, recorded under Other Operating Income.

Except for the associates PP-BIO and PR-SAD in which the Company records the investments by the equity method, all other entities shown in the table above were consolidated.

| 1.2. | Business combinations |

On January 18, 2021, through its wholly-owned subsidiary Badi Limited ("Badi"), the Company concluded the acquisition of 100% of the capital stock of Joody Al Sharqiya Food Production Factory ("Joody Al"), a food processing company in Saudi Arabia. The initial transaction amount was equivalent to R$41,620 (SAR29,793) paid in cash, and from this date, Joody Al has become a wholly-owned subsidiary of Badi. The consideration paid may be adjusted according to certain conditions established in the purchase agreement.

The goodwill of R$12,376 arising from the business combination consists mainly of the synergies expected with the combination of the operations of BRF and Joody Al, strengthening the Company’s presence in the Saudi Arabian market. The goodwill has been allocated to the International segment.

The fair value of the acquired assets and assumed liabilities in the business combination is presented below:

| Fair value on the acquisition date | ||

| Assets | ||

| Cash and cash equivalents | 408 | |

| Inventories | 832 | |

| Advances | 232 | |

| Property, plant and equipment, net | 30,128 | |

| 31,600 | ||

| Liabilities | ||

| Trade accounts payable | 1,420 | |

| Taxes payable | 550 | |

| Employee benefits | 286 | |

| Other current liabilities | 100 | |

| 2,356 | ||

| Net assets acquired | 29,244 | |

| Fair value of consideration paid | 41,620 | |

| Goodwill | 12,376 |

On June 18, 2021, through its wholly-owned subsidiary BRF Pet S.A., the Company executed a sale and purchase agreement for the acquisition of 100% of the capital stock of the companies that compose the Hercosul Group and paid an advance in the amount of R$90,000, which will be part of the consideration paid. On August 2, 2021, the transaction was concluded.

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 31 |

On June 25, 2021, also through its wholly-owned subsidiary BRF Pet S.A., the Company executed a sale and purchase agreement for the acquisition of 100% of the capital stock of Mogiana Alimentos S.A. The transaction is subject to the satisfaction of conditions precedent.

The price to be paid for these acquisitions is of R$1,350,000 and is still subject to adjustments usual to transactions of this nature.

The acquisitions above will be reflected in the financial statements in the period when the transactions are concluded, according to applicable accounting requirements.

| 1.3. | Discontinued Operations |

During the second quarter of 2021, the Company completed the price adjustment process related to sale of Campo Austral S.A. and determined a preliminary price adjustment related to the sale of Avex S.A., which is subject to modifications until the final agreement is signed between the parties.

The referred price adjustment totaled R$49,358 (R$41,286 net of taxes) and are presented in Net Loss of Discontinued Operations, consistently with the practice adopted in the sale of the operations in 2019.

| 1.4. | Investigations involving BRF |

| 1.4.1. | Carne Fraca and Trapaça operations |

The Company has been subject to two investigations conducted by Brazilian governmental entities, denominated “Carne Fraca Operation” in 2017 and “Trapaça Operation” in 2018, as detailed in the financial statements for the year ended on December 31, 2020 (note 1.2). The Company’s Audit and Integrity Committee conducted independent investigations, along with the Independent Investigation Committee, composed of external members and with external legal advisors in Brazil and abroad with respect to the allegations involving BRF employees and former employees.

The main impacts observed as result of the referred investigations were recorded in Other Operating Expenses in the amount of R$8,142 for the six-month period ended on June 30, 2021 (R$24,072 in the same period of the previous year) and for three-month period ended on June 30, 2021 R$2,905 (R$11,771 in the same period of the previous year) mostly related to expenditures with lawyers, legal advisors and consultants.

In addition to the impacts already recorded, there are uncertainties about the outcome of these investigations which may result in penalties, fines and normative sanctions, right restrictions and other forms of liabilities, for which the Company is not able to make a reliable estimate of the potential losses. The outcomes may result in payments of substantial amounts, which may cause a material adverse effect on the Company’s financial position, results and cash flows in the future.

Regarding the investigations conducted by regulators offices and governmental entities in the United States of America about these operations, on February 25, 2021, the Division of Enforcement of the U.S. Securities and Exchange Commission (“SEC”) issued a letter to the Company stating that it has concluded its investigation and, based on information to date, does not intend to recommend an enforcement action by the SEC against the Company. On May 5, 2021, the U.S. Department of Justice (“DOJ”) issued a letter stating that it has closed its investigation against BRF, based on information to date. No sanctions or penalties were imposed against the Company.

| 1.4.2. | Governance enhancement |

The Company has been taking actions to strengthen the compliance with its policies, procedures and internal controls.

The Company believes that its efforts strengthens and consolidates its governance to ensure the highest levels of safety standards, integrity and quality.

Among the actions implemented, are: (i) strengthening in the risk management, specially compliance, (ii) continuous improvement of the Compliance, Internal Audit and Internal Controls departments, (iii) review and issuance of new policies and procedures specifically related to applicable anticorruption laws, (iv) review and enhancement of the procedures for reputational verification of business partners, (v) review and enhancement of the processes of internal investigation, (vi) expansion of the independent reporting channel, (vii) review of transactional controls, and (viii) review and issuance of new consequence policy for misconduct.

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 32 |

| 1.5. | Coronavirus (COVID-19) |

On January 31, 2020 the World Health Organization announced that the COVID-19 is a global health emergency and on March 11, 2020 declared it a global pandemic. The outbreak has triggered significant decisions from governments and private sector entities, which in addition to the potential impact, increased the uncertainty level for the economic agents and may cause effects in the amounts recognized in the interim financial information.

BRF continues to operate its industrial complexes, distribution centers, logistics, supply chain and administrative offices, even if temporarily and partially under remote work regime in some of the corporate offices. Therefore, until the date of approval of this interim financial information, there has been no relevant change in its production plan, operation and/or commercialization. Additionally, management has developed and implemented contingency plans to maintain the operations and monitors the effects of the pandemic through a permanent multidisciplinary monitoring committee, formed by executives, specialists in the public health area and consultants.

Due to the pandemic, the Company has incurred in direct expenditures, such as transportation, personnel, prevention, control and donations, which are presented in the statement of income (loss) within the following line items:

| Consolidated | ||||||||

| 2021 | 2020 | |||||||

| Apr - Jun | Jan - Jun | Apr - Jun | Jan - Jun | |||||

| Cost of sales | (57,431) | (121,656) | (173,674) | (174,288) | ||||

| Selling expenses | (19,166) | (24,090) | (18,575) | (46,317) | ||||

| General and administrative expenses | (5,876) | (16,947) | (25,893) | (26,066) | ||||

| (82,473) | (162,693) | (218,142) | (246,671) |

The management considered in its projections of results and cash flows, to the best of its knowledge, the effects and uncertainties regarding the pandemic. Due to the high volatility and uncertainty around the length and the impact of the pandemic, the Company will continue to monitor the situation and evaluate the impacts on assumptions and estimates used in preparing our financial reporting.

| 1.6. | Seasonality |

During the months of November and December of each year, the Company is impacted by seasonality in the Brazil operating segment due to Christmas and New Year’s Celebrations. The products that are relevant contributors are: turkey, Chester®, ham and pork cuts (hind leg/pork loin).

In the International operating segment, seasonality is due to Ramadan, which is the holy month of the Muslim calendar. The beginning of Ramadan depends on the beginning of the moon cycle and in 2021 occurred between April 13, 2021 and May 12, 2021.

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 33 |

| 2. | BASIS OF PREPARATION AND PRESENTATION OF INTERIM FINANCIAL INFORMATION |

The parent company’s and consolidated interim financial information was prepared in accordance with the CPC 21 (R1) – Interim Financial Statements and the IAS 34 – Interim Financial Reporting issued by the International Accounting Standards Board - IASB as well as with the standards issued by the Brazilian Securities and Exchange Commission. All the relevant information applicable to the interim financial information, and only them, are being evidenced and correspond to those used by administration in its management.

The parent company’s and consolidated interim financial information is expressed in thousands of Brazilian Reais (“R$”), unless otherwise stated. For disclosures of amounts in other currencies, the values were also expressed in thousands, unless otherwise stated.

The preparation of the parent company’s and consolidated interim financial information require Management to make judgments, use estimates and adopt assumptions that affect the reported amounts of revenues, expenses, assets and liabilities, as well as the disclosures of contingent liabilities. The uncertainty inherent to these judgments, assumptions and estimates could result in material adjustments to the carrying amount of certain assets and liabilities in future periods.

Any judgments, estimates and assumptions are reviewed at each reporting period.

The parent company’s and consolidated interim financial information was prepared based on the recoverable historical cost, except for the following material items recognized in the statements of financial position:

(i) derivative financial instruments and non-derivative financial instruments measured at fair value;

(ii) share-based payments and employee benefits measured at fair value;

(iii) biological assets measured at fair value; and

(iv) assets held for sale in instances where the fair value is lower than historical cost.

The Company prepared parent company’s and consolidated interim financial information under the going concern assumption and disclosed all relevant information in its explanatory notes, in order to clarify and complement the accounting basis adopted.

| 3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The interim financial information, in this case quarterly financial information, aim to provide updated information based on the last annual financial statements disclosed. Therefore, the quarterly financial information focus on new activities, events and circumstances and do not repeat the information previously disclosed, except when Management judges that the maintenance of the information is relevant.

The interim financial information was prepared based on the accounting policies and estimates calculation methodologies adopted in the preparation of the annual financial statements for the year ended December 31, 2020 (note 3), except for: (i) the income taxes, which were measured according to CPC 21 / IAS 34 by applying the estimated annual effective tax rate to the pre-tax profit or loss for the interim period; and (ii) classification of payment of interest in the statements of cash flows, as described below.

In the six-month period ended June 30, 2021, the Company changed the classification of payment of interest in the statement of cash flows, reclassifying this item from Operating Activities to Financing Activities. This change was made for better presentation of the Company’s cash flows and convergence with the reports used by the administration in its management.

To ensure comparability between the periods presented, the Company performed the following reclassifications for the six-month period ended on June 30, 2020:

| Jan - Jun 2020 | ||||||||||||

| Parent company | Consolidated | |||||||||||

| Previously presented | Reclassification | Restated | Previously presented | Reclassification | Restated | |||||||

| Net cash provided by operating activities | 2,171,482 | 474,804 | 2,646,286 | 3,553,072 | 553,441 | 4,106,513 | ||||||

| Net cash used in investing activities | (416,690) | - | (416,690) | (425,352) | - | (425,352) | ||||||

| Net cash provided by (used in) financing activities | 1,147,014 | (474,804) | 672,210 | 1,243,293 | (553,441) | 689,852 | ||||||

| Effect of exchange rate variation on cash and cash equivalents | 198,521 | - | 198,521 | 1,062,477 | - | 1,062,477 | ||||||

| Net increase in cash and cash equivalents | 3,100,327 | - | 3,100,327 | 5,433,490 | - | 5,433,490 | ||||||

There were no changes on such policies and estimates calculation methodologies. As allowed by CPC 21 / IAS 34, Management decided not to disclose again the details of the accounting policies adopted by the Company. Hence, the interim financial information should be read along with the annual financial statements for the year ended December 31, 2020, in order to allow the users to further understand the Company’s financial conditions and liquidity, as well as its capacity to generate profits and cash flows.

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 34 |

| 4. | CASH AND CASH EQUIVALENTS |

| Average rate (1) | Parent company | Consolidated | |||||||

| 06.30.21 | 12.31.20 | 06.30.21 | 12.31.20 | ||||||

| Cash and bank accounts | |||||||||

| U.S. Dollar | - | 500 | 520 | 1,727,636 | 1,185,208 | ||||

| Brazilian Reais | - | 82,180 | 111,615 | 86,105 | 112,181 | ||||

| Euro | - | 2,944 | 6,144 | 72,737 | 54,687 | ||||

| Other currencies | - | 110 | 28 | 1,129,025 | 1,086,996 | ||||

| 85,734 | 118,307 | 3,015,503 | 2,439,072 | ||||||

| Cash equivalents | |||||||||

| In Brazilian Reais | |||||||||

| Investment funds | 0.67% | 3,759 | 4,684 | 3,759 | 4,684 | ||||

| Bank deposit certificates | 3.95% | 2,442,530 | 3,650,812 | 2,452,201 | 3,662,448 | ||||

| 2,446,289 | 3,655,496 | 2,455,960 | 3,667,132 | ||||||

| In U.S. Dollar | |||||||||

| Term deposit | - | - | - | - | 198,878 | ||||

| Overnight | 0.13% | 119,550 | 102,336 | 1,420,426 | 1,220,232 | ||||

| Other currencies | |||||||||

| Term deposit | 1.00% | - | - | 49,953 | 51,311 | ||||

| 119,550 | 102,336 | 1,470,379 | 1,470,421 | ||||||

| 2,651,573 | 3,876,139 | 6,941,842 | 7,576,625 | ||||||

| (1) | Weighted average annual rate. |

| 5. | MARKETABLE SECURITIES |

| Average rate (2) | Parent company | Consolidated | |||||||||||

| WAM (1) | Currency | 06.30.21 | 12.31.20 | 06.30.21 | 12.31.20 | ||||||||

| Fair value through other comprehensive income | |||||||||||||

| Stocks | - | HKD | - | - | - | - | 42,029 | ||||||

| Fair value through profit and loss | |||||||||||||

| Financial treasury bills | 3.29 | R$ | 1.90% | 315,036 | 312,515 | 315,036 | 312,515 | ||||||

| Investment funds - FIDC BRF | 2.46 | R$ | - | 14,911 | 15,044 | 14,911 | 15,044 | ||||||

| Investment funds | 0.50 | ARS | - | - | - | 1,374 | 1,643 | ||||||

| 329,947 | 327,559 | 331,321 | 329,202 | ||||||||||

| Amortized cost | |||||||||||||

| Sovereign bonds and others (3) | 1.83 | AOA | 3.82% | - | - | 318,123 | 287,504 | ||||||

| 329,947 | 327,559 | 649,444 | 658,735 | ||||||||||

| Current | 315,036 | 312,515 | 316,410 | 314,158 | |||||||||

| Non-current (4) | 14,911 | 15,044 | 333,034 | 344,577 | |||||||||

| (1) | Weighted average maturity in years. |

| (2) | Weighted average annual rate. |

| (3) | It’s comprised of private securities and sovereign securities of the Angola Government and are presented net of expected credit losses in the amount of R$14,666 (R$9,894 on December 31, 2020). |

| (4) | Maturity until December of 2023. |

On June 30, 2021, the amount of R$204,659 (R$366,671 on December 31, 2020) classified as cash and cash equivalents and marketable securities were pledged as guarantee, with no use restrictions, for USD denominated future contracts traded on B3.

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 35 |

| 6. | TRADE ACCOUNTS RECEIVABLE AND OTHER RECEIVABLES |

| Parent company | Consolidated | ||||||

| 06.30.21 | 12.31.20 | 06.30.21 | 12.31.20 | ||||

| Trade accounts receivable | |||||||

| Domestic customers | 782,439 | 1,999,807 | 785,826 | 2,002,586 | |||

| Domestic related parties | 13,695 | 6,228 | - | - | |||

| Foreign customers | 480,019 | 537,584 | 2,782,923 | 2,716,551 | |||

| Foreign related parties | 5,714,836 | 3,239,348 | - | - | |||

| 6,990,989 | 5,782,967 | 3,568,749 | 4,719,137 | ||||

| ( - ) Adjustment to present value | (5,936) | (10,026) | (9,710) | (13,316) | |||

| ( - ) Expected credit losses | (542,708) | (555,712) | (590,676) | (605,940) | |||

| 6,442,345 | 5,217,229 | 2,968,363 | 4,099,881 | ||||

| Current | 6,435,531 | 5,210,498 | 2,961,245 | 4,092,855 | |||

| Non-current | 6,814 | 6,731 | 7,118 | 7,026 | |||

| Other receivables | |||||||

| Other receivables | 88,216 | 113,949 | 88,216 | 113,949 | |||

| ( - ) Adjustment to present value | (602) | (156) | (602) | (156) | |||

| ( - ) Expected credit losses | (16,395) | (27,389) | (16,395) | (27,389) | |||

| 71,219 | 86,404 | 71,219 | 86,404 | ||||

| Current | 35,268 | 43,566 | 35,268 | 43,566 | |||

| Non-current (1) | 35,951 | 42,838 | 35,951 | 42,838 | |||

| (1) | Weighted average maturity of 2.07 years. |

The Company performs credit assignments with no right of return to the BRF Clients’ Credit Rights Investment Fund (“FIDC BRF“), which has the sole purpose to acquire credit rights arising from commercial transactions carried out between the Company and its clients in Brazil. On June 30, 2021, FIDC BRF had an outstanding balance of R$761,098 (R$549,083 on December 31, 2020) related to such credit rights, which are no longer recorded in the Company’s statement of financial position.

On June 30, 2021, other receivables are mainly represented by receivables from the sale of farms and various properties, with a balance of R$64,846 (R$78,258 on December 31, 2020).

The movements of the expected credit losses are presented below:

| Parent company | Consolidated | ||

| 06.30.21 | 06.30.21 | ||

| Beginning balance | (555,712) | (605,940) | |

| (Additions) Reversals | (5,716) | (8,492) | |

| Write-offs | 1,765 | 3,406 | |

| Exchange rate variation | 16,955 | 20,350 | |

| Ending balance | (542,708) | (590,676) | |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 36 |

The aging of trade accounts receivable is as follows:

| Parent company | Consolidated | ||||||

| 06.30.21 | 12.31.20 | 06.30.21 | 12.31.20 | ||||

| Not overdue | 6,433,441 | 5,206,584 | 2,774,988 | 4,010,140 | |||

| Overdue | |||||||

| 01 to 60 days | 12,954 | 29,631 | 195,166 | 104,195 | |||

| 61 to 90 days | 1,778 | 1,357 | 5,329 | 6,045 | |||

| 91 to 120 days | 1,619 | 469 | 1,689 | 398 | |||

| 121 to 180 days | 2,592 | 458 | 6,728 | 7,024 | |||

| 181 to 360 days | 3,138 | 3,448 | 10,499 | 15,688 | |||

| More than 360 days | 535,467 | 541,020 | 574,350 | 575,647 | |||

| ( - ) Adjustment to present value | (5,936) | (10,026) | (9,710) | (13,316) | |||

| ( - ) Expected credit losses | (542,708) | (555,712) | (590,676) | (605,940) | |||

| 6,442,345 | 5,217,229 | 2,968,363 | 4,099,881 | ||||

| 7. | INVENTORIES |

| Parent company | Consolidated | ||||||

| 06.30.21 | 12.31.20 | 06.30.21 | 12.31.20 | ||||

| Finished goods | 3,254,827 | 2,162,977 | 4,707,457 | 3,610,585 | |||

| Work in progress | 228,392 | 191,110 | 229,769 | 192,335 | |||

| Raw materials | 1,751,812 | 1,920,891 | 1,852,725 | 2,046,681 | |||

| Packaging materials | 142,408 | 88,359 | 146,467 | 92,256 | |||

| Secondary materials | 641,529 | 522,125 | 651,111 | 531,801 | |||

| Supplies | 182,827 | 173,030 | 220,008 | 207,033 | |||

| Imports in transit | 67,951 | 107,829 | 67,951 | 107,829 | |||

| Other | 148,937 | 75,508 | 181,342 | 94,816 | |||

| (-) Adjustment to present value | (102,186) | (80,568) | (102,193) | (80,577) | |||

| 6,316,497 | 5,161,261 | 7,954,637 | 6,802,759 | ||||

The movements in the write-down of inventories to the net realizable value, for which the additions, reversals and write-offs were recorded against Cost of Sales, are presented in the table below:

| Parent company | |||||||

| 06.30.21 | |||||||

| Realizable value through sale | Impaired inventories | Obsolete inventories | Total | ||||

| Beginning balance | (23,957) | (23,579) | (7,715) | (55,251) | |||

| Additions | (61,538) | (35,136) | (3,142) | (99,816) | |||

| Reversals | 72,896 | - | - | 72,896 | |||

| Write-offs | - | 39,137 | 2,625 | 41,762 | |||

| Ending balance | (12,599) | (19,578) | (8,232) | (40,409) | |||

| Consolidated | |||||||

| 06.30.21 | |||||||

| Realizable value through sale | Impaired inventories | Obsolete inventories | Total | ||||

| Beginning balance | (31,155) | (29,831) | (14,719) | (75,705) | |||

| Additions | (74,026) | (42,361) | (4,349) | (120,736) | |||

| Reversals | 87,762 | - | - | 87,762 | |||

| Write-offs | - | 47,213 | 4,235 | 51,448 | |||

| Business combination | - | (42) | - | (42) | |||

| Exchange rate variation | 392 | 364 | 487 | 1,243 | |||

| Ending balance | (17,027) | (24,657) | (14,346) | (56,030) | |||

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 37 |

| 8. | BIOLOGICAL ASSETS |

The live animals are represented by poultry and pork and segregated into consumables and animals for production. The rollforward of the biological assets are presented below:

| Parent company | ||||||||||||||

| 06.30.21 | ||||||||||||||

| Current | Non-current | |||||||||||||

| Live animals | Live animals | |||||||||||||

| Poultry | Pork | Total | Poultry | Pork | Forests | Total | ||||||||

| Beginning balance | 783,706 | 1,260,582 | 2,044,288 | 405,030 | 425,252 | 324,444 | 1,154,726 | |||||||

| Additions/Transfer | 6,514,763 | 4,523,483 | 11,038,246 | 42,234 | 217,798 | 20,318 | 280,350 | |||||||

| Changes in fair value (1) | 1,197,546 | 275,166 | 1,472,712 | 57,914 | (115,640) | - | (57,726) | |||||||

| Harvest | - | - | - | - | - | (26,569) | (26,569) | |||||||

| Write-off | - | - | - | - | - | (140) | (140) | |||||||

| Transfer between current and non-current | 42,015 | 59,619 | 101,634 | (42,015) | (59,619) | - | (101,634) | |||||||

| Transfer to inventories | (7,603,504) | (4,574,802) | (12,178,306) | - | - | - | - | |||||||

| Ending balance | 934,526 | 1,544,048 | 2,478,574 | 463,163 | 467,791 | 318,053 | 1,249,007 | |||||||

| Consolidated | ||||||||||||||

| 06.30.21 | ||||||||||||||

| Current | Non-current | |||||||||||||

| Live animals | Live animals | |||||||||||||

| Poultry | Pork | Total | Poultry | Pork | Forests | Total | ||||||||

| Beginning balance | 868,428 | 1,260,582 | 2,129,010 | 472,053 | 425,252 | 324,444 | 1,221,749 | |||||||

| Additions/Transfer | 6,522,342 | 4,523,483 | 11,045,825 | 42,990 | 217,798 | 20,318 | 281,106 | |||||||

| Changes in fair value (1) | 1,204,383 | 275,166 | 1,479,549 | 68,259 | (115,640) | - | (47,381) | |||||||

| Harvest | - | - | - | - | - | (26,569) | (26,569) | |||||||

| Write-off | - | - | - | - | - | (140) | (140) | |||||||

| Transfer between current and non-current | 42,015 | 59,619 | 101,634 | (42,015) | (59,619) | - | (101,634) | |||||||

| Transfer to inventories | (7,603,504) | (4,574,802) | (12,178,306) | - | - | - | - | |||||||

| Exchange variation | (17,836) | - | (17,836) | (12,471) | - | - | (12,471) | |||||||

| Ending balance | 1,015,828 | 1,544,048 | 2,559,876 | 528,816 | 467,791 | 318,053 | 1,314,660 | |||||||

| (1) | The change in the fair value of biological assets includes depreciation of breeders and depletion of forests in the amount of R$441,867 in the parent company and R$485,564 in the consolidated. |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 38 |

The estimated balances and quantities of live animals are set forth below:

| Parent company | |||||||

| 06.30.21 | 12.31.20 | ||||||

| Quantity (thousand of heads) | Book value | Quantity (thousand of heads) | Book value | ||||

| Consumable biological assets | |||||||

| Immature poultry | 173,065 | 934,526 | 178,143 | 783,706 | |||

| Immature pork | 4,216 | 1,544,048 | 4,204 | 1,260,582 | |||

| Total current | 177,281 | 2,478,574 | 182,347 | 2,044,288 | |||

| Production biological assets | |||||||

| Immature poultry | 5,845 | 167,452 | 6,243 | 152,632 | |||

| Mature poultry | 10,624 | 295,711 | 10,207 | 252,398 | |||

| Immature pork | 199 | 100,935 | 203 | 93,466 | |||

| Mature pork | 453 | 366,856 | 457 | 331,786 | |||

| Total non-current | 17,121 | 930,954 | 17,110 | 830,282 | |||

| 194,402 | 3,409,528 | 199,457 | 2,874,570 | ||||

| Consolidated | |||||||

| 06.30.21 | 12.31.20 | ||||||

| Quantity (thousand of heads) | Book value | Quantity (thousand of heads) | Book value | ||||

| Consumable biological assets | |||||||

| Immature poultry | 192,597 | 1,015,828 | 199,877 | 868,428 | |||

| Immature pork | 4,216 | 1,544,048 | 4,204 | 1,260,582 | |||

| Total current | 196,813 | 2,559,876 | 204,081 | 2,129,010 | |||

| Production biological assets | |||||||

| Immature poultry | 6,669 | 195,009 | 7,320 | 188,967 | |||

| Mature poultry | 12,061 | 333,807 | 11,395 | 283,086 | |||

| Immature pork | 199 | 100,935 | 203 | 93,466 | |||

| Mature pork | 453 | 366,856 | 457 | 331,786 | |||

| Total non-current | 19,382 | 996,607 | 19,375 | 897,305 | |||

| 216,195 | 3,556,483 | 223,456 | 3,026,315 | ||||

The Company has forests pledged as collateral for financing and tax/civil contingencies on June 30, 2021 in the amount of R$74,845 in the parent company and in the consolidated (R$68,381 in the parent company and in the consolidated at December 31, 2020).

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 39 |

| 9. | RECOVERABLE TAXES |

The rollforward of recoverable taxes are set forth below:

| Parent company | ||||||||||||||

| Note | 12.31.20 | Additions | Compensations / Reversals | Transfers (1) | Interest | 06.30.21 | ||||||||

| ICMS and VAT | 9.1 | |||||||||||||

| Recoverable ICMS and VAT | 1,483,612 | 212,292 | (36,667) | (89,314) | 120 | 1,570,043 | ||||||||

| (-) Impairment | (154,721) | (16,397) | 14,225 | 14,116 | - | (142,777) | ||||||||

| PIS and COFINS | 9.2 | |||||||||||||

| Recoverable PIS and COFINS | 3,167,001 | 263,179 | (433,178) | - | 16,129 | 3,013,131 | ||||||||

| (-) Impairment | (14,228) | - | - | - | - | (14,228) | ||||||||

| IPI | 9.3 | |||||||||||||

| Recoverable IPI | 808,524 | 2,978 | (460) | - | 48,624 | 859,666 | ||||||||

| (-) Impairment | (1,984) | - | - | - | - | (1,984) | ||||||||

| INSS | ||||||||||||||

| Recoverable INSS | 341,824 | 5,869 | (56,356) | - | 1,921 | 293,258 | ||||||||

| (-) Impairment | (102) | - | - | - | - | (102) | ||||||||

| Other taxes | ||||||||||||||

| Other recoverable taxes | 52,115 | 23,930 | - | - | - | 76,045 | ||||||||

| (-) Impairment | (1,484) | - | 15 | - | - | (1,469) | ||||||||

| 5,680,557 | 491,851 | (512,421) | (75,198) | 66,794 | 5,651,583 | |||||||||

| Current | 812,338 | 774,361 | ||||||||||||

| Non-current | 4,868,219 | 4,877,222 | ||||||||||||

| Note | 12.31.20 | Additions | Compensations / Reversals | Transfers (1) | Restatement | 06.30.21 | ||||||||

| Income taxes | 9.4 | |||||||||||||

| Recoverable income taxes | 91,996 | 11,128 | (8) | - | 88 | 103,204 | ||||||||

| (-) Impairment | (8,985) | - | - | - | - | (8,985) | ||||||||

| 83,011 | 11,128 | (8) | - | 88 | 94,219 | |||||||||

| Current | 28,888 | 39,926 | ||||||||||||

| Non-current | 54,123 | 54,293 | ||||||||||||

| (1) | The transfers occur from Recoverable Taxes to Other Current Assets and Other Non-Current Assets when sales of credits are made to third parties. |

| Consolidated | ||||||||||||||||

| Note | 12.31.20 | Additions | Compensations / Reversals | Transfers (1) | Interest | Exchange variation | 06.30.21 | |||||||||

| ICMS and VAT | 9.1 | |||||||||||||||

| Recoverable ICMS and VAT | 1,568,975 | 246,914 | (94,724) | (89,314) | 120 | (5,049) | 1,626,922 | |||||||||

| (-) Impairment | (154,721) | (16,397) | 14,225 | 14,116 | - | 1 | (142,776) | |||||||||

| PIS and COFINS | 9.2 | |||||||||||||||

| Recoverable PIS and COFINS | 3,168,099 | 263,439 | (433,235) | - | 16,128 | 1 | 3,014,432 | |||||||||

| (-) Impairment | (14,228) | - | - | - | - | - | (14,228) | |||||||||

| IPI | 9.3 | |||||||||||||||

| Recoverable IPI | 808,528 | 2,978 | (460) | - | 48,623 | - | 859,669 | |||||||||

| (-) Impairment | (1,984) | - | - | - | - | - | (1,984) | |||||||||

| INSS | ||||||||||||||||

| Recoverable INSS | 341,825 | 5,869 | (56,356) | - | 1,920 | - | 293,258 | |||||||||

| (-) Impairment | (102) | - | - | - | - | - | (102) | |||||||||

| Other taxes | ||||||||||||||||

| Other recoverable taxes | 52,889 | 23,930 | (1) | - | - | (49) | 76,769 | |||||||||

| (-) Impairment | (1,963) | - | 15 | - | - | 2 | (1,946) | |||||||||

| 5,767,318 | 526,733 | (570,536) | (75,198) | 66,791 | (5,094) | 5,710,014 | ||||||||||

| Current | 899,120 | 832,782 | ||||||||||||||

| Non-current | 4,868,198 | 4,877,232 | ||||||||||||||

| Note | 12.31.20 | Additions | Compensations / Reversals | Transfers (1) | Restatement | Exchange variation | 06.30.21 | |||||||||

| Income taxes | 9.4 | |||||||||||||||

| Recoverable income taxes | 107,728 | 56,726 | (5,439) | - | 86 | (3,668) | 155,433 | |||||||||

| (-) Impairment | (9,029) | - | - | - | - | - | (9,029) | |||||||||

| 98,699 | 56,726 | (5,439) | - | 86 | (3,668) | 146,404 | ||||||||||

| Current | 43,840 | 77,240 | ||||||||||||||

| Non-current | 54,859 | 69,164 | ||||||||||||||

| (1) | The transfers occur from Recoverable Taxes to Other Current Assets and Other Non-Current Assets when sales of credits are made to third parties. |

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 40 |

| 9.1. | PIS and COFINS –Social Integration Plan and Contribution for Social Security Financing |

On December 7, 2020 the Company received an unappealable judicial decision to a process filled by Batávia S.A. (subsidiary incorporated by BRF S.A.) granting the Company the right to exclude ICMS from the PIS and COFINS calculation basis. Throughout the first semester of 2021, the Company, supported by its consultants, obtained the fiscal files for the period and reconciled them with the accessory obligations, measuring the credits reliably through the ICMS presented in the invoices. Thus, the amount of R$75,043 was recognized under Recoverable PIS and COFINS, being R$29,887 of principal recorded in Other Operating Income and R$45,156 of interests recorded in Financial Income.

As of June 30, 2021, the updated balance of the processes related to the exclusion of the ICMS from the PIS and COFINS calculation basis recognized by the Company is R$2,717,801 (R$2,818,391 as of December 31, 2020). The amount of R$191,761 related do these credits was offset against other federal taxes in the six-month period ended on June 30, 2021 (null in the same period of the previous year).

In the study prepared by the Management, its realization is estimated through offsetting with federal taxes or through reimbursement of the amounts as expected below:

| PIS and COFINS | |

| Current | 524,823 |

| Non-current | 2,192,978 |

| July to december 2022 | 328,000 |

| 2023 | 537,000 |

| 2024 | 672,000 |

| 2025 | 655,978 |

| 2,717,801 |

| 9.2. | IPI - Industrialized Product Tax |

The Company recognized relevant tax assets as result of gains from lawsuits related to IPI, specially “crédito prêmio”. The balance referring to these assets in the parent company and consolidated on June 30, 2021 is R$909,443 (R$860,820 on December 31, 2020), of which R$853,624 (R$805,001 on December 31, 2020) is recorded as Recoverable Taxes and the remainder, referring to cases in which the government will reimburse in cash, is recorded as Other Current Assets, in the amount of R$43,428 (R$40,370 on December 31, 2020) and as Other Non-Current Assets, in the amount of R$12,391 (R$15,449 on December 31, 2020).

In the study prepared by the Management, its realization is estimated through the refund of the amounts as expected below:

| IPI | |

| Current | 43,428 |

| Non-current | 866,015 |

| July to december 2022 | 12,391 |

| 2025 | 626,659 |

| 2026 | 226,965 |

| 909,443 |

| 9.3. | Realization of Brazilian federal tax credits |

The Company used PIS, COFINS, IPI, IRPJ, CSLL, INSS and other tax credits to offset federal taxes payable such as INSS and withholding Income Tax in the amount of R$490,002 in the six-month period ended June 30, 2021 (R$411,683 in the parent company and consolidated in the same period of the previous year), preserving its liquidity and optimizing its capital structure.

BRF S.A. | INTERIM FINANCIAL INFORMATION – June 30, 2021 | 41 |

| 10. | DEFERRED INCOME TAXES |

| 10.1. | Composition |

| Parent company | Consolidated | ||||||

| 06.30.21 | 12.31.20 | 06.30.21 | 12.31.20 | ||||

| Assets | |||||||

| Tax losses carryforward | 2,052,840 | 2,052,843 | 2,070,138 | 2,060,846 | |||

| Negative calculation basis (social contribution) | 769,405 | 769,402 | 772,951 | 772,283 | |||

| Temporary differences - Assets | |||||||

| Provisions for tax, civil and labor risks | 463,517 | 458,019 | 463,517 | 458,019 | |||

| Suspended collection taxes | 1,881 | 1,871 | 1,881 | 1,871 | |||

| Expected credit losses | 169,078 | 194,969 | 169,090 | 194,977 | |||

| Impairment on tax credits | 62,353 | 67,900 | 62,353 | 67,900 | |||

| Provision for other obligations | 99,519 | 115,959 | 100,364 | 115,959 | |||

| Employees' profit sharing | 13,365 | 86,752 | 13,365 | 86,752 | |||

| Write-down to net realizable value of inventories | 13,819 | 19,184 | 14,117 | 19,189 | |||

| Employees' benefits plan | 223,299 | 216,510 | 237,987 | 216,510 | |||

| Lease basis difference | 104,766 | 86,308 | 104,766 | 86,308 | |||

| Adjustment to estimated annual effective tax rate - CPC 21 | 518,647 | - | 518,647 | - | |||

| Other temporary differences | 12,209 | 10,632 | 9,449 | 40,028 | |||

| 4,504,698 | 4,080,349 | 4,538,625 | 4,120,642 | ||||

| Temporary differences - Liabilities | |||||||

| Difference on tax x accounting basis for goodwill amortization | (321,298) | (320,729) | (321,298) | (320,729) | |||

| Difference on tax x accounting basis for depreciation (useful life) | (871,650) | (851,436) | (868,245) | (851,436) | |||

| Business combination (1) | (855,821) | (740,385) | (874,963) | (761,429) | |||

| Unrealized gains on derivatives, net | (58,246) | (42,493) | (58,246) | (42,493) | |||

| Unrealized fair value gains, net | (50,477) | (39,269) | (49,560) | (39,269) | |||

| Other temporary differences | (21,026) | (17,268) | (35,497) | (22,749) | |||

| (2,178,518) | (2,011,580) | (2,207,809) | (2,038,105) | ||||

| Total deferred taxes | 2,326,180 | 2,068,769 | 2,330,816 | 2,082,537 | |||

| Total Assets | 2,326,180 | 2,068,769 | 2,361,035 | 2,109,064 | |||

| Total Liabilities | - | - | (30,219) | (26,527) | |||

| 2,326,180 | 2,068,769 | 2,330,816 | 2,082,537 | ||||

| (1) | The deferred tax asset on the Sadia business combination was recorded on the amortization difference between the accounting and tax goodwill calculated as of the purchase price allocation date. The deferred tax liability on the Sadia business combination is substantially represented by the allocation of goodwill to property, plant and equipment, brands and contingent liabilities. |

The roll-forward of deferred income taxes, net, is set forth below:

| Parent company | Consolidated | ||

| 06.30.21 | 06.30.21 | ||

| Beginning balance | 2,068,769 | 2,082,537 | |