|

Exhibit 99.1

|

Investor Presentation

November 2014

|

|

These slides and the accompanying oral presentation contain forward-looking statements. All statements other than statements of historical fact contained in this presentation, including statements regarding third quarter 2014 financial results and future results of the operations and financial position of Cvent, Inc. (“Cvent” or the “Company”), including financial targets, business strategy, and plans and objectives for future operations, are forward-looking statements. Cvent has based these forward-looking statements on its estimates and assumptions of its financial results and its current expectations and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs as of the date of this presentation. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described under the heading “Risk Factors” in the Annual report on Form 10-K that Cvent filed with the Securities and Exchange Commission on March 21, 2014. Moreover, Cvent operates in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for Cvent management to predict all risks, nor can Cvent assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements Cvent may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this presentation are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although Cvent believes that the expectations reflected in the forward-looking statements are reasonable, Cvent cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither Cvent nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. Cvent undertakes no obligation to update publicly or revise any forward-looking statements for any reason after the date of this presentation, to conform these statements to actual results or to changes in Cvent’s expectations.

In addition to U.S. GAAP financials, this presentation includes certain non-GAAP financial measures, including Adjusted EBITDA and Free Cash Flow among others. These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. The non-GAAP financial measures used by Cvent may differ from the non-GAAP financial measures used by other companies. A reconciliation of these measures to the most directly comparable GAAP measure is included in the Appendix to these slides.

2

Update

Quick Highlights

Continued rapid profitable growth and strong customer adoption

Leading the $565B global meetings and events industry shift to technology

Expanding market leadership position

Investing to win disproportionate share of opportunity

4

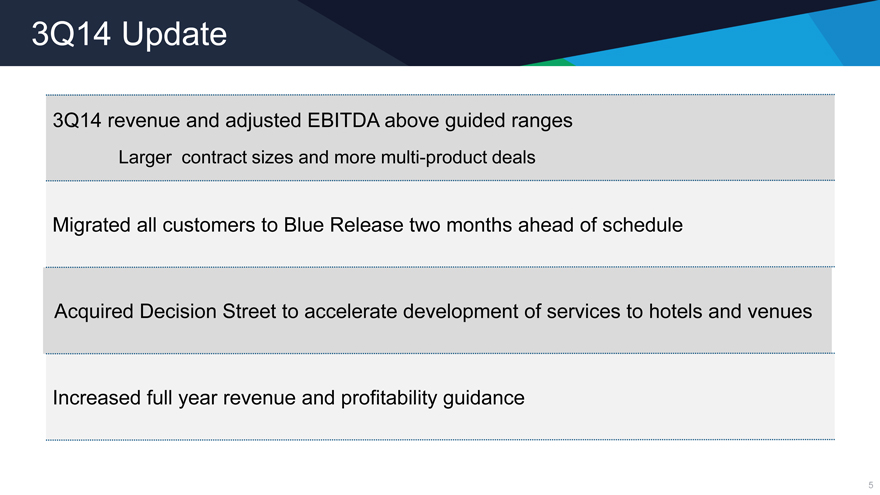

3Q14 Update

3Q14 revenue and adjusted EBITDA above guided ranges

Larger contract sizes and more multi-product deals

Migrated all customers to Blue Release two months ahead of schedule

Acquired Decision Street to accelerate development of services to hotels and venues

Increased full year revenue and profitability guidance

5

Meeting & Events Ecosystem

6

Agenda

Company Overview Event Management Platform

Supplier Network & Enterprise Hospitality Technology Sales & Marketing Financials Partnership Opportunities

7

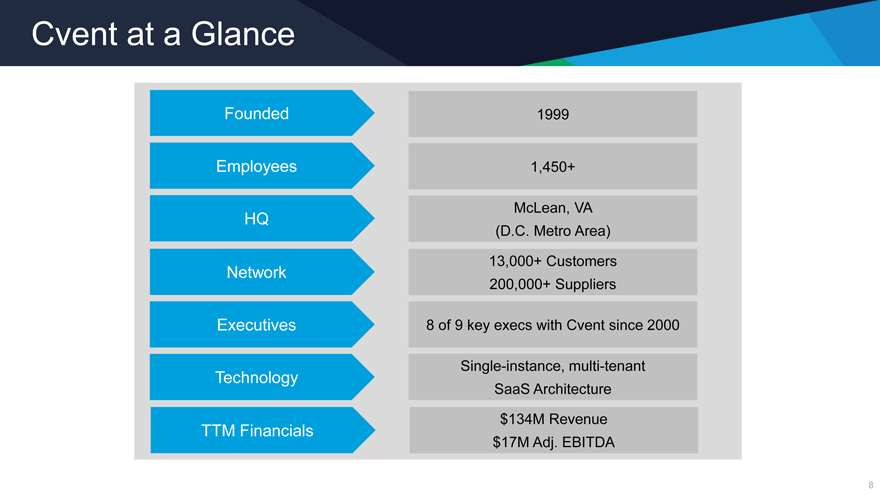

Cvent at a Glance

Founded 1999

Employees 1,450+

HQ McLean, VA

(D.C. Metro Area)

Network 13,000+ Customers

200,000+ Suppliers

Executives 8 of 9 key execs with Cvent since 2000

Technology Single-instance, multi-tenant

SaaS Architecture

TTM Financials $134M Revenue

$17M Adj. EBITDA

8

The Biggest Industry You’ve Never Heard Of

$565 Billion

Global Spend on Meetings & Events

Source: Frost & Sullivan estimates for Event Management Software in 2012 and Cvent Estimates for Online Marketing

Note: $565B spent on events and meetings in 2012 includes accommodations, transportation, and other support 9

Cvent Ecosystem

Corporate Buyers

Platform t organize, market and enhance meetings

Hotels & Venues

Networ connecting corporate buyer with hotel venues

10

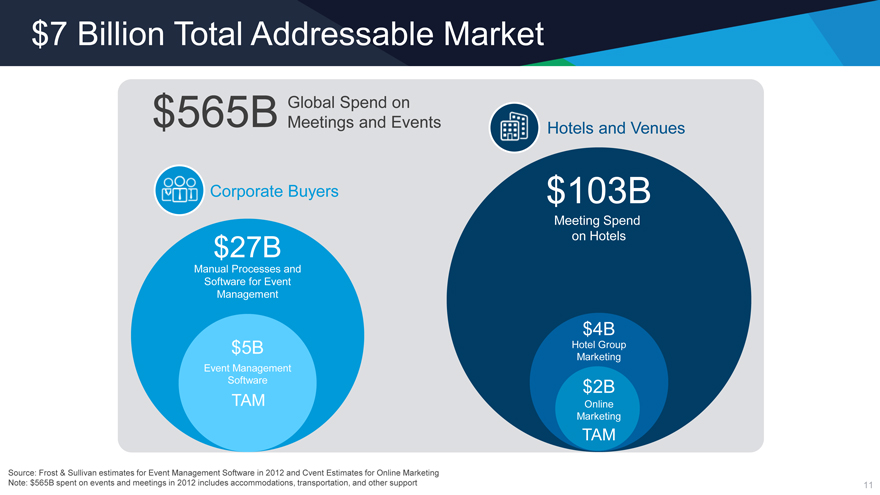

$7 Billion Total Addressable Market

$565B Global Spend on

Meetings and Events Hotels and Venues

Corporate Buyers

$27B

Manual Processes and Software for Event Management

$5B

Event Management Software

TAM

$103B

Meeting Spend on Hotels

$4B

Hotel Group Marketing

$2B

Online Marketing

TAM

Source: Frost & Sullivan estimates for Event Management Software in 2012 and Cvent Estimates for Online Marketing Note: $565B spent on events and meetings in 2012 includes accommodations, transportation, and other support

11

Agenda

Company Overview Event Management Platform

Supplier Network & Enterprise Hospitality Technology Sales & Marketing Financials Partnership Opportunities

12

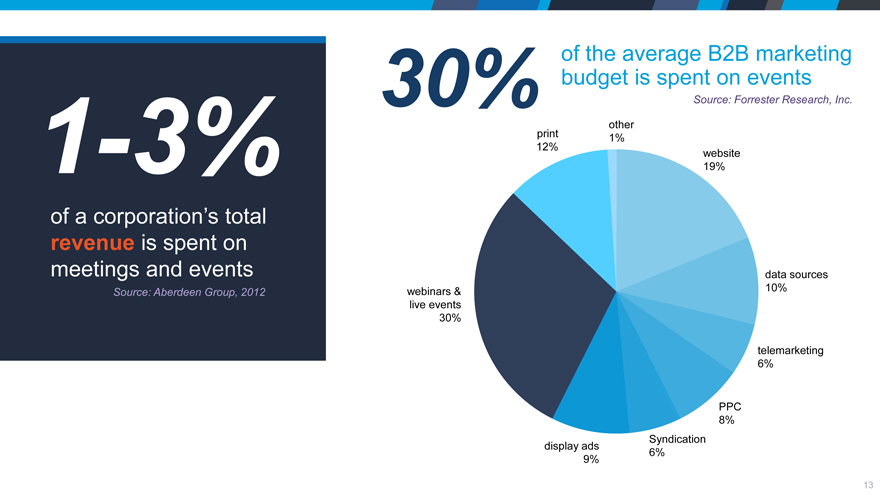

1-3%

of a corporation’s total revenue is spent on meetings and events

Source: Aberdeen Group, 2012

of the average B2B marketing budget is spent on events

30% Source: Forrester Research, Inc.

other

print 1%

12% website

19%

data sources

webinars & 10%

live events

30%

telemarketing

6%

PPC

8%

Syndication

display ads 6%

9%

13

After a company’s website, tradeshows & events are the most effective B2B marketing initiative

websites

tradeshows & events

printed publications

webinars & webcasts

email

support forums

virtual events

professional networking sites

blogs

online videos

LinkedIn

Facebook

Twitter

0% 10% 20% 30% 40% 50% 60% 70% 80% 90%

Source: Forrester Research, Inc.

14

The Challenges for Corporate Buyers

Expense

Mgmt/

Budgeting Venue

Sourcing

Service

Providers

Event

Management Event

Marketing

Event

Logistics

Attendee

Travel Reg

Services

Attendees expect mobile and social experience at events

15

Data Analytics

Meetings Management

Supplier Network

Event Marketing

Social Media

Event Registration

Housing and Travel

Onsite Tools

Mobile Apps

16

Cloud-based Platform Solution for Event Lifecycle

Event SMM Mobile

Marketing Apps

Meeting

Request Network

Registration

Social Web

Media Surveys

Ticketing

17

Event Mobile Apps: Large Greenfield Opportunity

2,000,000

annual events

25,000

event apps

The Blue Release

Simplifies user interface Users can turn off/on features Redesigned technical architecture

Simple Events Leads to Product Adoption

19

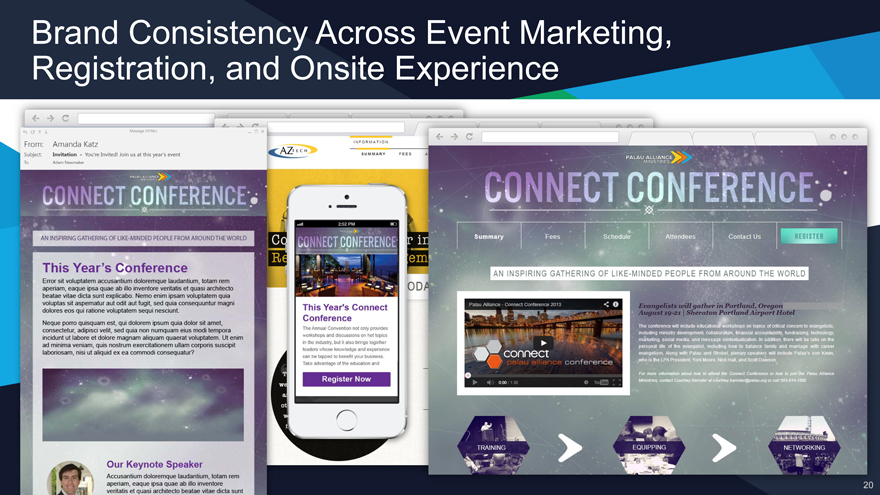

Brand Consistency Across Event Marketing, Registration, and Onsite Experience

20

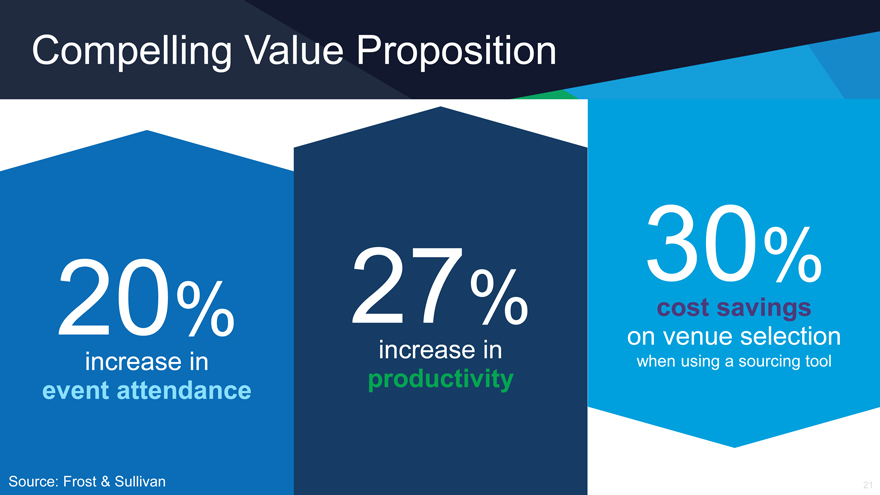

Compelling Value Proposition

20%

increase in event attendance

27%

increase in productivity

30%

cost savings on venue selection

when using a sourcing tool

Source: Frost & Sullivan

21

Enterprise Platform for the Global 5000

22

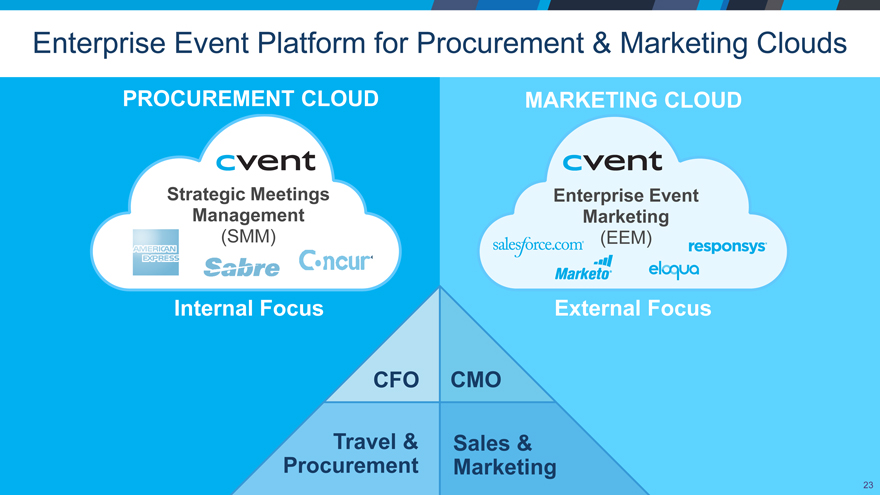

Enterprise Event Platform for Procurement & Marketing Clouds

PROCUREMENT CLOUD

Strategic Meetings Management

(SMM)

Internal Focus

MARKETING CLOUD

Enterprise Event Marketing

(EEM)

External Focus

CFO CMO

Travel & Sales &

Procurement Marketing

23

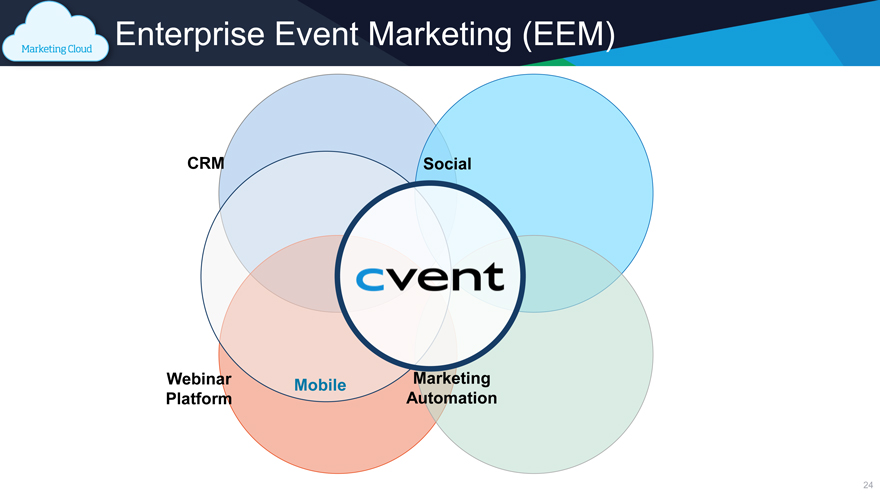

Enterprise Event Marketing (EEM)

CRM Social

Webinar Mobile Marketing

Platform Automation

24

Return on Events – Critical Success Factor for Marketers

Events are important, so how do you get the most out of them

+ +

Increase Increase Increase

attendance engagement leads for sales

= Higher Event ROI

25

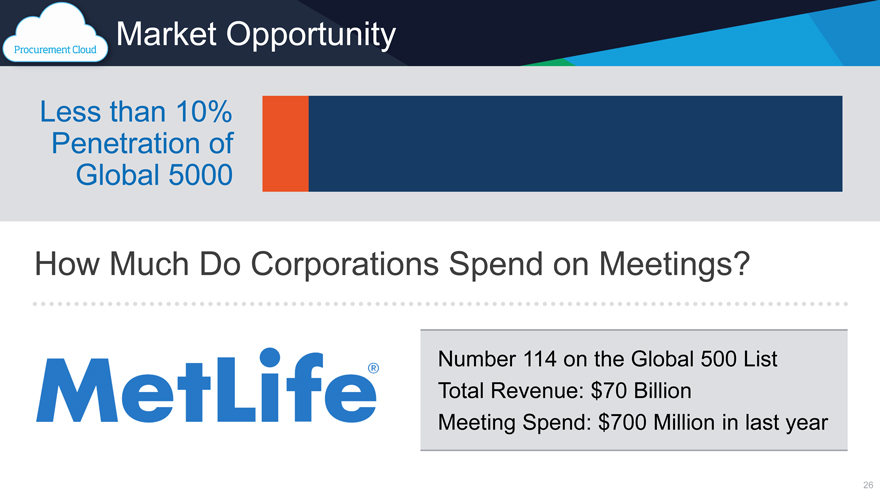

Market Opportunity

Less than 10% Penetration of Global 5000

How Much Do Corporations Spend on Meetings

Number 114 on the Global 500 List Total Revenue: $70 Billion Meeting Spend: $700 Million in last year

26

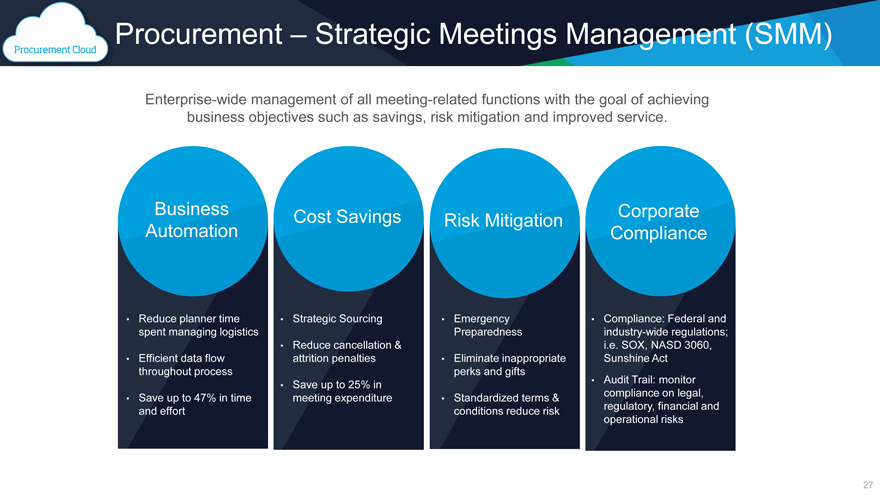

Procurement – Strategic Meetings Management (SMM)

Enterprise-wide management of all meeting-related functions with the goal of achieving business objectives such as savings, risk mitigation and improved service.

Business Automation

Reduce planner time spent managing logistics

Efficient data flow throughout process

Save up to 47% in time and effort

Cost Savings

Strategic Sourcing

Reduce cancellation & attrition penalties

Save up to 25% in meeting expenditure

Risk Mitigation

Emergency Preparedness

Eliminate inappropriate perks and gifts

Standardized terms & conditions reduce risk

Corporate Compliance

Compliance: Federal and industry-wide regulations; i.e. SOX, NASD 3060, Sunshine Act Audit Trail: monitor compliance on legal, regulatory, financial and operational risks

27

Agenda

Company Overview Event Management Platform

Supplier Network & Enterprise Hospitality Technology Sales & Marketing Financials Partnership Opportunities

28

Group Spend Segment: Huge Greenfield Opportunity

Hundreds of online travel agencies

Leisure Business

Transient

Meetings

& Events

$103B in spend

Thousands of travel management companies

The CSN Opportunity

29

The Challenge for Hotels and Venues

Inefficient and Non-Standardized Sales Process — Mostly Manual, Not Traceable, No Data

Corporate Buyers

Hotels and Venues

30

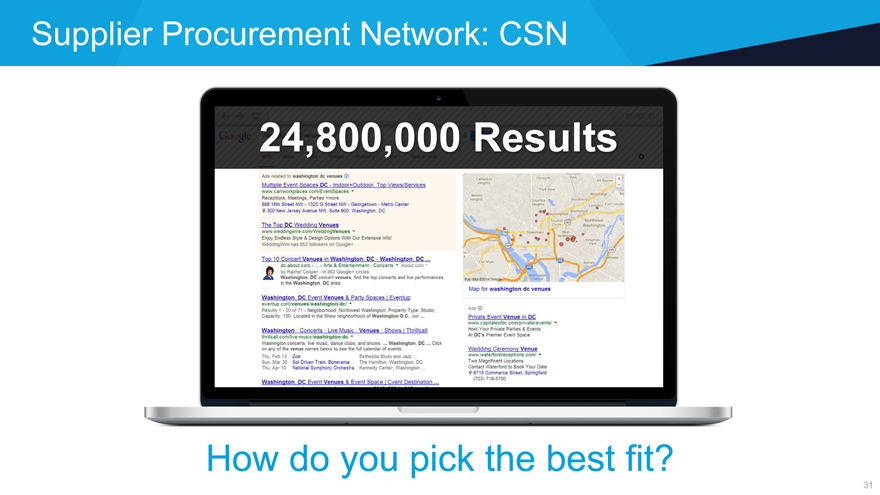

Supplier Procurement Network: CSN

31

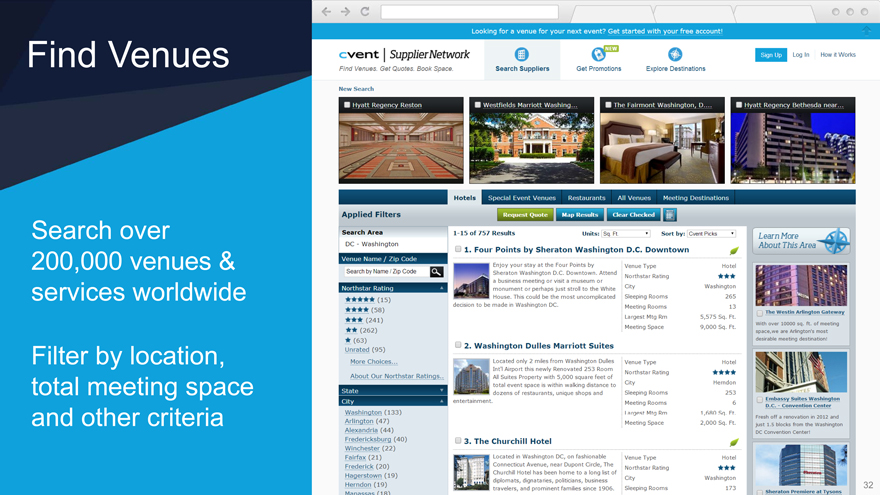

Find Venues

Search over 200,000 venues & services worldwide

Filter by location, total meeting space and other criteria

32

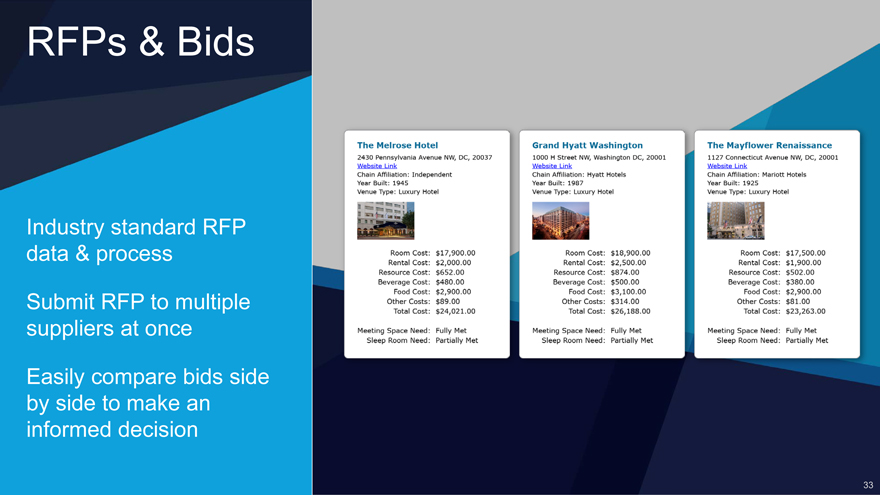

RFPs & Bids

Industry standard RFP data & process Submit RFP to multiple suppliers at once Easily compare bids side by side to make an informed decision

33

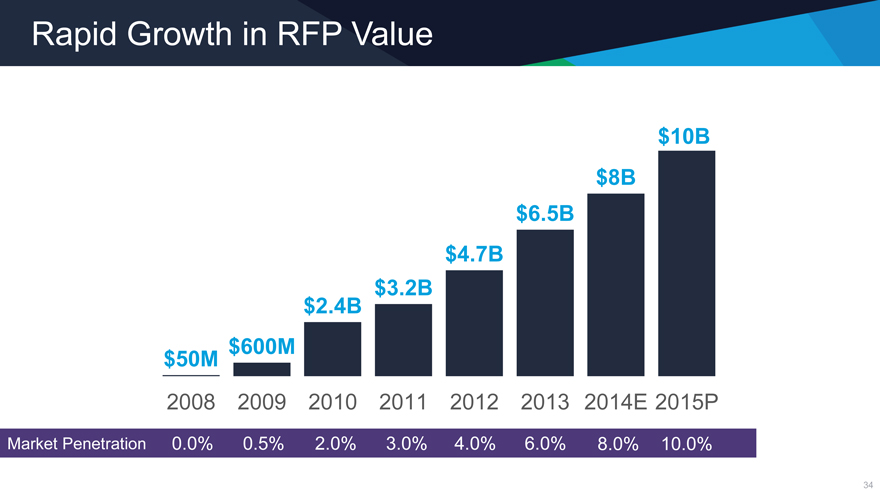

Rapid Growth in RFP Value

$10B

$8B

$6.5B

$4.7B

$3.2B

$2.4B

$50M $600M

2008 2009 2010 2011 2012 2013 2014E 2015P

Market Penetration 0.0% 0.5% 2.0% 3.0% 4.0% 6.0% 8.0% 10.0%

34

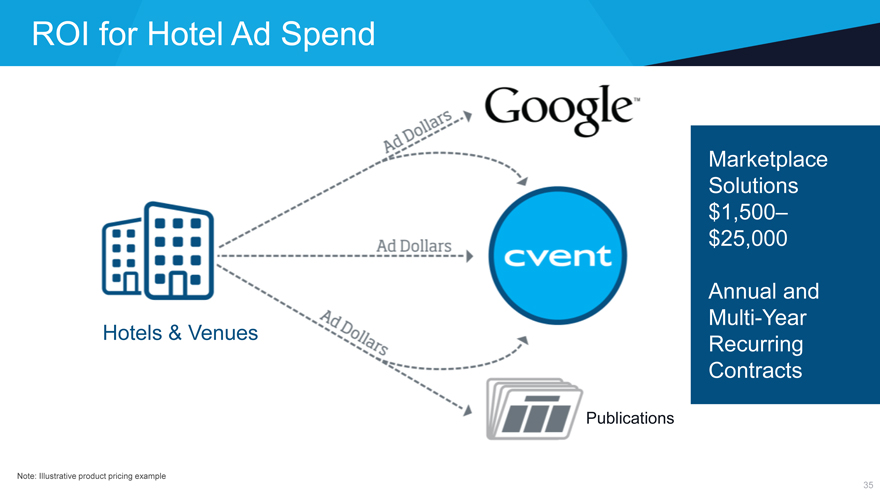

ROI for Hotel Ad Spend

Hotels & Venues

Marketplace Solutions $1,500–$25,000

Annual and Multi-Year Recurring Contracts

Publications

Note: Illustrative product pricing example

35

Global Hotel Customer Base

36

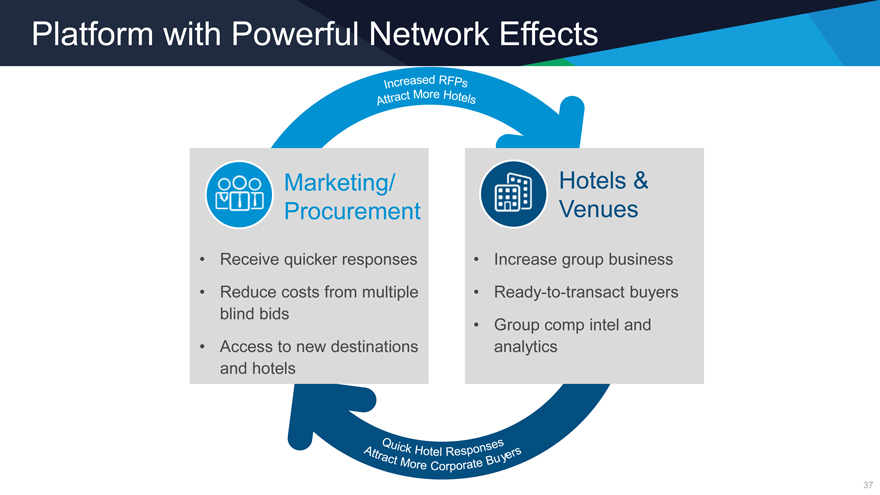

Platform with Powerful Network Effects

Marketing/ Procurement

Receive quicker responses Reduce costs from multiple blind bids Access to new destinations and hotels

Hotels & Venues

Increase group business Ready-to-transact buyers Group comp intel and analytics

37

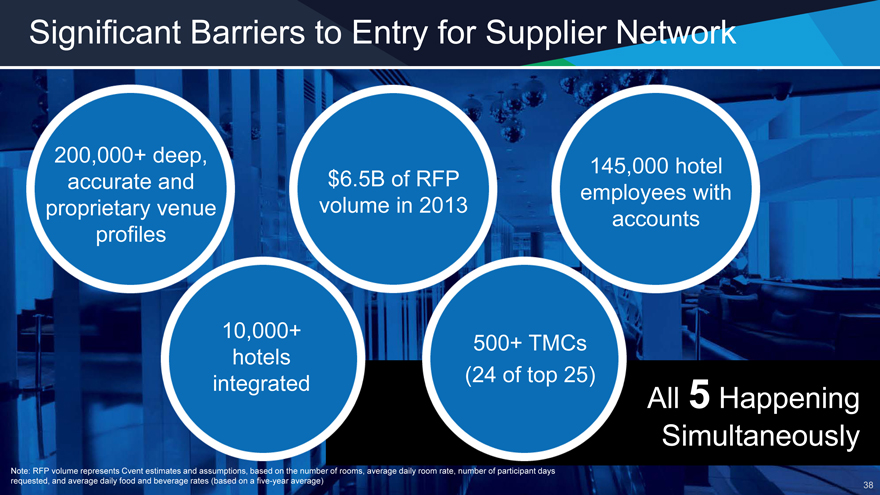

Significant Barriers to Entry for Supplier Network

200,000+ deep, accurate and proprietary venue profiles

$6.5B of RFP volume in 2013

145,000 hotel employees with accounts

10,000+ hotels integrated

500+ TMCs (24 of top 25)

All 5 Happening Simultaneously

Note: RFP volume represents Cvent estimates and assumptions, based on the number of rooms, average daily room rate, number of participant days requested, and average daily food and beverage rates (based on a five-year average)

38

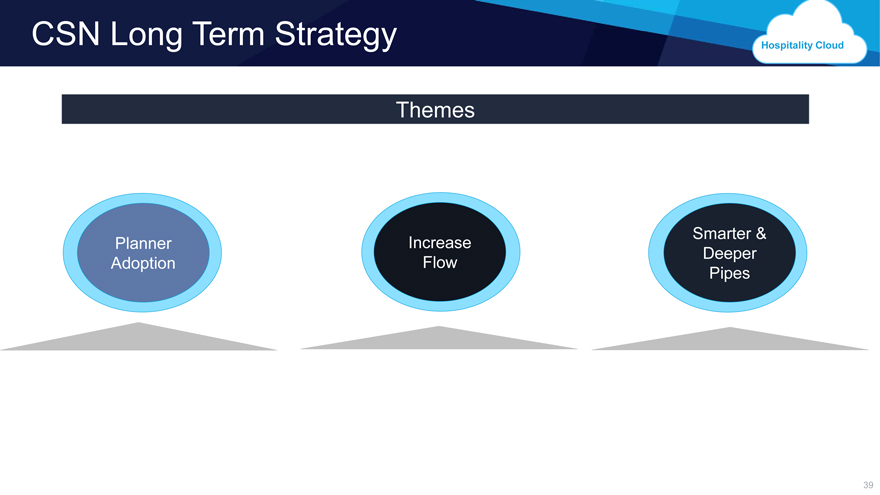

CSN Long Term Strategy

Themes

Planner Adoption

Increase Flow

Smarter & Deeper Pipes

39

Hospitality Cloud

Intelligent Decision-Making

Sales Enablement & Workflow Management

Comp Set Reporting & Industry Benchmarking

CSN 2.0 Hospitality Cloud

40

Agenda

Company Overview

Event Management Platform

Supplier Network & Enterprise Hospitality

Technology

Sales & Marketing

Financials

Partnership Opportunities

41

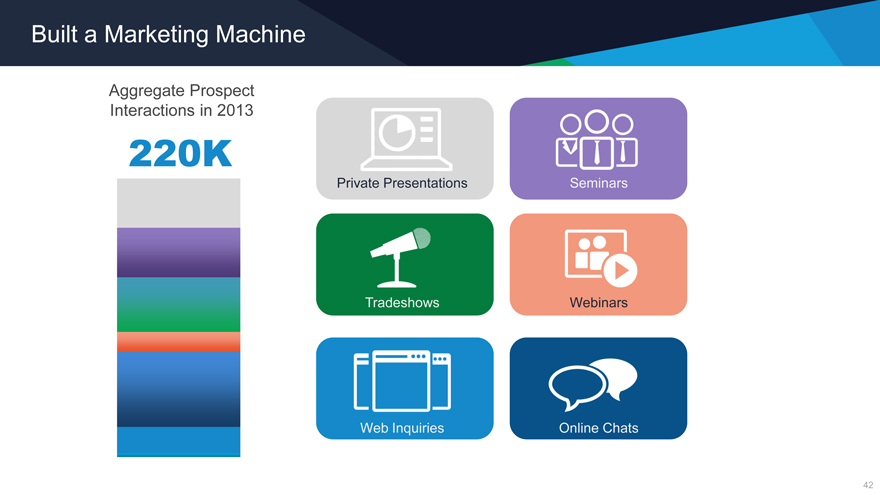

Built a Marketing Machine

Aggregate Prospect Interactions in 2013

220K

Private Presentations

Tradeshows

Online Chats

Seminars

Web Inquires

42

Converting Competitors to Customers

Then Now

Competitive

Product Partner/Customer

Competitive

Product Partner/Customer

Competitors above no longer offer competing products and now use Cvent

43

Scalable Global Culture

Experienced management team Don’t forget where we came from Cvent University Strategic capabilities in India “Best Places to Work”

44

Agenda

Company Overview

Event Management Platform

Supplier Network & Enterprise Hospitality

Technology

Sales & Marketing

Financials

Partnership Opportunities

45

Key Financial Highlights

Growing Network

Strong revenue growth

Significant future growth opportunities

Recurring Revenue

70% event platform; 30% hospitality solutions

97% retention for event platform; 107% for hospitality solutions

Generating Cash

Long history of positive adjusted EBITDA margins

Significant operating leverage as business scales

46

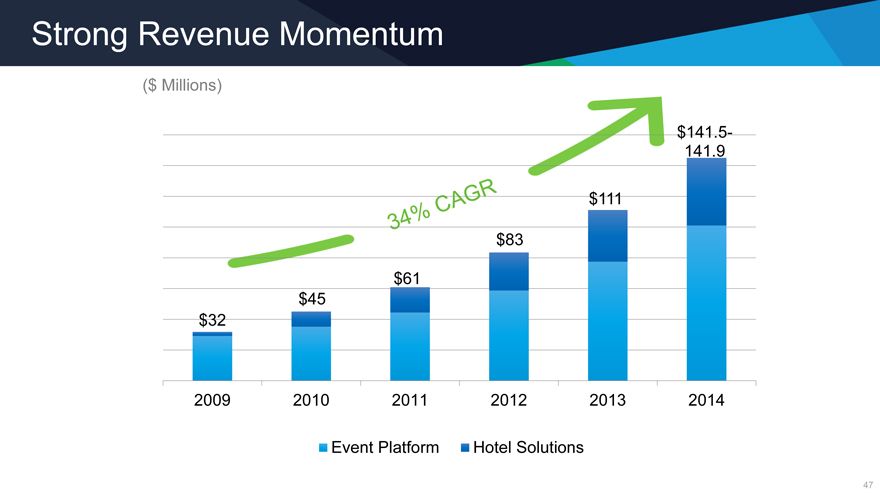

Strong Revenue Momentum

($ Millions)

$141.5-

141.9

$111

$83

$61

$45

$32

2009 2010 2011 2012 2013 2014

Event Platform Hotel Solutions

47

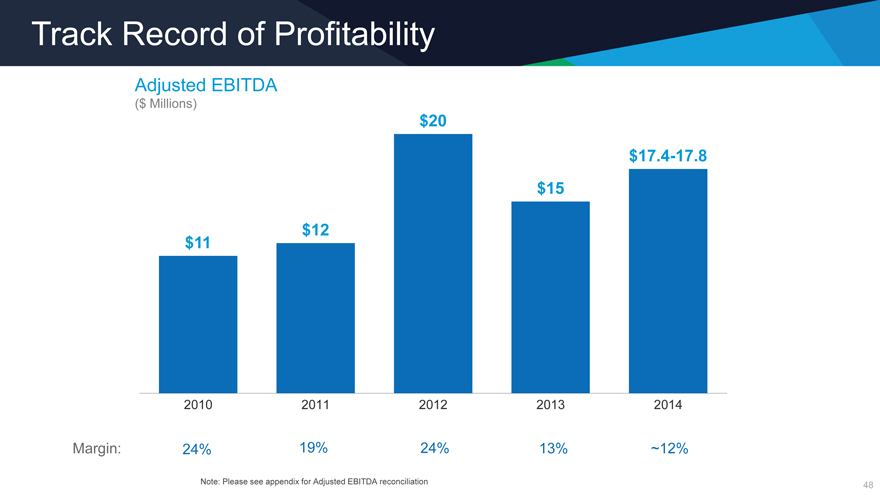

Track Record of Profitability

Adjusted EBITDA

($ Millions)

$20

$17.4-17.8

$15

$12

$11

2010 2011 2012 2013 2014

Margin: 24% 19% 24% 13% ~12%

Note: Please see appendix for Adjusted EBITDA reconciliation

48

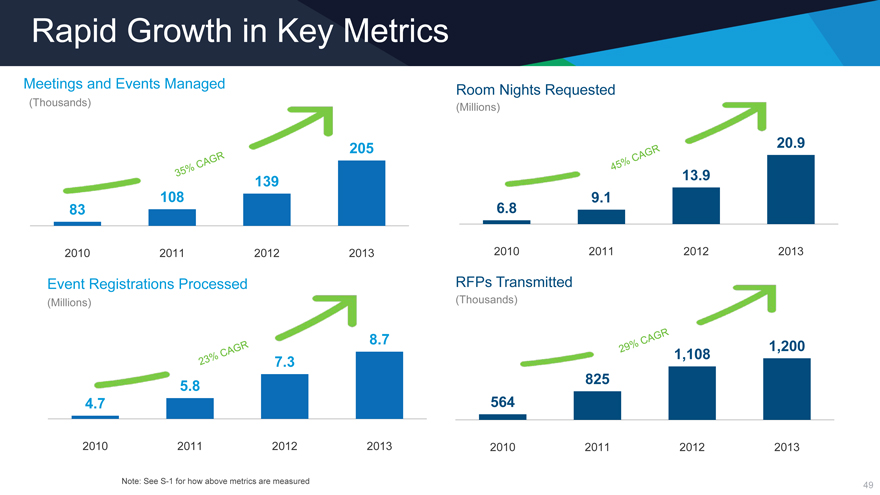

Rapid Growth in Key Metrics

Meetings and Events Managed

(Thousands)

Room Nights Requested

(Millions)

205

83

2010 2011 2012 2013

20.9

6.8 9.1

2010 2011 2012 2013

Event Registrations Processed

(Millions)

8.7

4.7

2010 2011 2012 2013

RFPs T

(Thousands)

825

564

2010 2011 2012 2013

Note: See S-1 for how above metrics are measured

49

Long Term Target Financial Model

Long Term

CY11 CY12 CY13 CY14 Target

Gross Margin 74% 76% 72% ~70% 80%

S&M as % 44% 40% 41% 35–40%

of Revenue

R&D as % 6% 8% 10% 10–12%

of Revenue

G&A as % 10% 10% 15% 8–10%

of Revenue

Adjusted 19% 24% 14% ~12% 25–30%

EBITDA Margin

*Represents guidance provided on November 6, 2014

Note: Presented on Non-GAAP basis excluding stock-based compensation. See Appendix for reconciliation of non-GAAP financial measures

50

Why We Win

Industry Platform

#1 cloud-based technology for meeting and event management

Monetize both sides of meetings and events ecosystem

Barriers to Entry

Event Management Platform

Powerful network effects

Execution

Fiscal discipline

Experienced management team

51

THANK YOU

Appendix

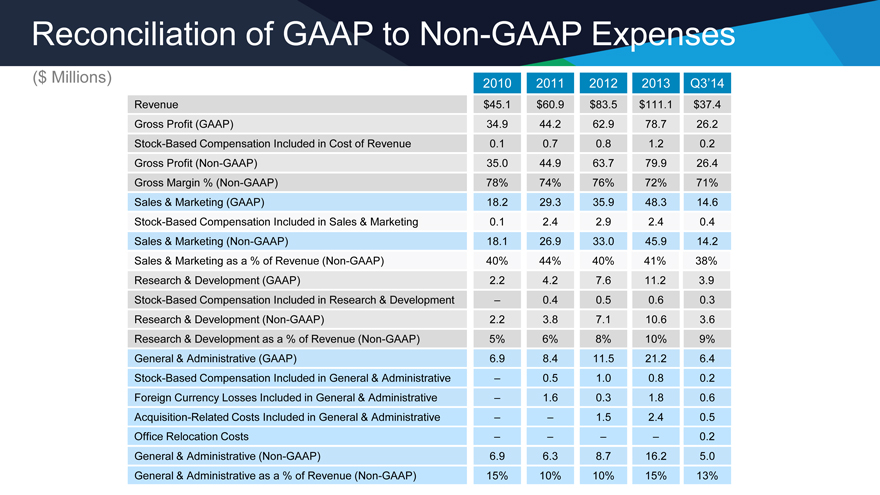

Reconciliation of GAAP to Non-GAAP Expenses

($ Millions) 2010 2011 2012 2013 Q3’14

Revenue $45.1 $60.9 $83.5 $111.1 $37.4

Gross Profit (GAAP) 34.9 44.2 62.9 78.7 26.2

Stock-Based Compensation Included in Cost of Revenue 0.1 0.7 0.8 1.2 0.2

Gross Profit (Non-GAAP) 35.0 44.9 63.7 79.9 26.4

Gross Margin % (Non-GAAP) 78% 74% 76% 72% 71%

Sales & Marketing (GAAP) 18.2 29.3 35.9 48.3 14.6

Stock-Based Compensation Included in Sales & Marketing 0.1 2.4 2.9 2.4 0.4

Sales & Marketing (Non-GAAP) 18.1 26.9 33.0 45.9 14.2

Sales & Marketing as a % of Revenue (Non-GAAP) 40% 44% 40% 41% 38%

Research & Development (GAAP) 2.2 4.2 7.6 11.2 3.9

Stock-Based Compensation Included in Research & Development – 0.4 0.5 0.6 0.3

Research & Development (Non-GAAP) 2.2 3.8 7.1 10.6 3.6

Research & Development as a % of Revenue (Non-GAAP) 5% 6% 8% 10% 9%

General & Administrative (GAAP) 6.9 8.4 11.5 21.2 6.4

Stock-Based Compensation Included in General & Administrative – 0.5 1.0 0.8 0.2

Foreign Currency Losses Included in General & Administrative – 1.6 0.3 1.8 0.6

Acquisition-Related Costs Included in General & Administrative – – 1.5 2.4 0.5

Office Relocation Costs – – – – 0.2

General & Administrative (Non-GAAP) 6.9 6.3 8.7 16.2 5.0

General & Administrative as a % of Revenue (Non-GAAP) 15% 10% 10% 15% 13%

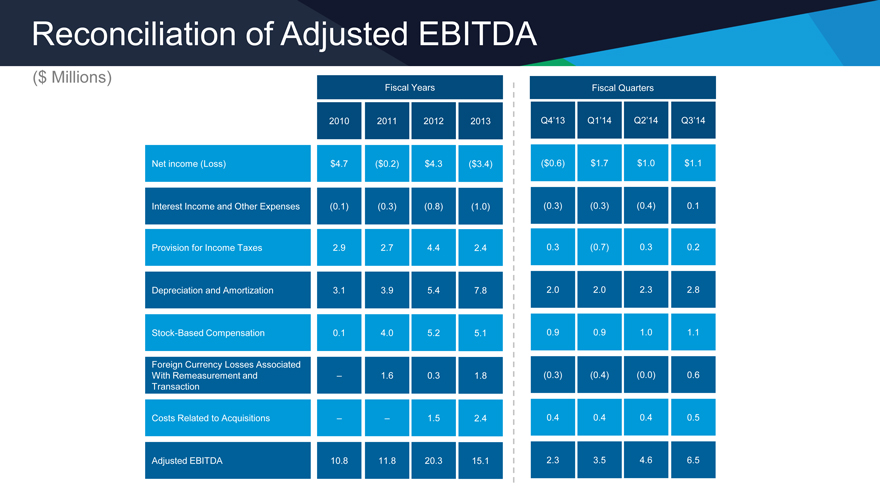

Reconciliation of Adjusted EBITDA

($ Millions)

Fiscal Years Fiscal Quarters

2010 2011 2012 2013 Q4’13 Q1’14 Q2’14 Q3’14

Net income (Loss) $4.7 ($0.2) $4.3 ($3.4) ($0.6) $1.7 $1.0 $1.1

Interest Income and Other Expenses (0.1) (0.3) (0.8) (1.0) (0.3) (0.3) (0.4) 0.1

Provision for Income Taxes 2.9 2.7 4.4 2.4 0.3 (0.7) 0.3 0.2

Depreciation and Amortization 3.1 3.9 5.4 7.8 2.0 2.0 2.3 2.8

Stock-Based Compensation 0.1 4.0 5.2 5.1 0.9 0.9 1.0 1.1

Foreign Currency Losses Associated

With Remeasurement and – 1.6 0.3 1.8 (0.3) (0.4) (0.0) 0.6

Transaction

Costs Related to Acquisitions – – 1.5 2.4 0.4 0.4 0.4 0.5

Adjusted EBITDA 10.8 11.8 20.3 15.1 2.3 3.5 4.6 6.5