As filed with the Securities and Exchange Commission on January 18, 2012

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHC Helicopter S.A.

(Exact name of registrant issuer as specified in its charter)

SEE TABLE OF ADDITIONAL REGISTRANTS

| | | | |

Luxembourg

| | 4522

| | N/A

|

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

4740 Agar Drive

Richmond, BC V7B 1A3, Canada

(604) 276-7500

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 590-9070

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

| | | | |

Michael O’Neill, Esq.

Chief Legal Officer CHC Helicopter S.A.

4740 Agar Drive

Richmond, BC V7B 1A3, Canada

(604) 276-7500 | | Edward P. Tolley III, Esq.

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017-3954

(212) 455-2000 | | Russ Hill, Esq.

VP, Deputy General Counsel CHC Helicopter S.A.

4740 Agar Drive

Richmond, BC V7B 1A3, Canada

(604) 276-7500 |

Approximate date of commencement of proposed exchange offer:As soon as practicable after this Registration Statement is declared effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issue Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of Each Class of Securities

to be Registered | | Amount to be

Registered | | Proposed Maximum

Offering Price Per

Note | | Proposed Maximum

Aggregate Offering

Price (1) | | Amount of

Registration Fee |

9.250% Senior Secured Notes due 2020 | | $1,100,000,000 | | 100% | | $1,100,000,000 | | $126,060 |

Guarantees of 9.250% Senior Secured Notes due 2020 (2) | | N/A (3) | | (3) | | (3) | | (3) |

|

|

| (1) | Estimated solely for the purpose of calculating the registration fee under Rule 457(f) of the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | See inside facing page for additional registrant guarantors. |

| (3) | Pursuant to Rule 457(n) under the Securities Act, no separate filing fee is required for the guarantees. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Additional Registrant Guarantors

| | | | | | |

Exact Name of Registrant Guarantor as Specified in its Charter | | State or

Other Jurisdiction

of Incorporation or

Organization | | I.R.S. Employer

Identification Number | | Address, Including Zip Code

and Telephone Number,

Including Area Code,

of Registrant Guarantor’s

Principal Executive Offices |

6922767 Holding S.à r.l. | | Luxembourg | | 98-0598004 | | 13-15 Avenue de la Liberté

L-1931 Luxembourg +352-2689-01 |

| | | |

Capital Aviation Services B.V. | | Netherlands | | 98-0592415 | | 9 Parellaan

2132 WS Hoofddorp The Netherlands +31 (0)23 555 55 55 |

| | | |

CHC Capital (Barbados) Limited. | | Barbados | | N/A | | Deighton House

Dayrell’s Road at Deighton St. Michael, BB14030

Barbados (246) 228-4472 |

| | | |

CHC Den Helder B.V. | | Netherlands | | N/A | | 9 Parellaan

2132 WS Hoofddorp The Netherlands +31 (0)23 555 55 55 |

| | | |

CHC Global Operations (2008) Inc. | | Canada | | N/A | | 4740 Agar Drive

Richmond, BC V7B 1A3 Canada (604) 276-7500 |

| | | |

CHC Global Operations International Inc. | | Canada | | N/A | | 4740 Agar Drive

Richmond, BC V7B 1A3 Canada (604) 276-7500 |

| | | |

CHC Helicopter Holding S.à r.l. | | Luxembourg | | 94-13440907 | | 13-15 Avenue de la Liberté

L-1931 Luxembourg +352-2689-01 |

| | | |

CHC Helicopters (Barbados) Limited. | | Barbados | | N/A | | Deighton House

Dayrell’s Road at Deighton St. Michael, BB14030

Barbados (246) 228-4472 |

| | | |

CHC Holding NL B.V. | | Netherlands | | 98-0596801 | | 9 Parellaan

2132 WS Hoofddorp The Netherlands +31 (0)23 555 55 55 |

| | | |

CHC Holding (UK) Limited | | Scotland | | N/A | | CHC House

Howe Moss Drive Kirkhill Industrial Estate Dyce Aberdeen AB21 0GL Scotland +44-1224-846-000 |

| | | | | | |

| | | |

CHC Hoofddorp B.V. | | Netherlands | | 98-0952413 | | 9 Parellaan

2132 WS Hoofddorp The Netherlands +31 (0)23 555 55 55 |

| | | |

CHC Netherlands B.V. | | Netherlands | | 98-2592409 | | 9 Parellaan

2132 WS Hoofddorp The Netherlands +31 (0)23 555 55 55 |

| | | |

CHC Norway Acquisition Co AS | | Norway | | 98-0596777 | | Stavanger Lufthavn

4050 Sola Norway +47 51 94 10 00 |

| | | |

CHC Sweden AB | | Sweden | | 98-0597510 | | 9 Parellaan

2132 WS Hoofddorp The Netherlands +31 (0)23 555 55 55 |

| | | |

Helicopter Services Group AS | | Norway | | 98-0592436 | | Stavanger Lufthavn

4050 Sola Norway +47 51 94 10 00 |

| | | |

Helikopter Service AS | | Norway | | 98-0592440 | | Stavanger Lufthavn

4050 Sola Norway +47 51 94 10 00 |

| | | |

Heli-One Canada Inc. | | Canada | | N/A | | 4740 Agar Drive

Richmond, BC V7B 1A3 Canada (604) 276-7500 |

| | | |

Heli-One Defence B.V. | | Netherlands | | 98-2592461 | | 9 Parellaan

2132 WS Hoofddorp The Netherlands +31 (0)23 555 55 55 |

| | | |

Heli-One Holdings (UK) Limited. | | England | | 98-0596780 | | CHC House

Howe Moss Drive Kirkhill Industrial Estate Dyce Aberdeen AB21 0GL Scotland +44-1224-846-000 |

| | | |

Heli-One (Europe) AS | | Norway | | 98-0592435 | | Stavanger Lufthavn

4050 Sola Norway +47 51 94 10 00 |

| | | |

Heli-One Leasing Inc. | | Canada | | N/A | | 4740 Agar Drive

Richmond, BC V7B 1A3 Canada (604) 276-7500 |

| | | | | | |

| | | |

Heli-One Leasing (Norway) AS | | Norway | | 45-4005893 | | Stavanger Lufthavn

4050 Sola Norway +47 51 94 10 00 |

| | | |

Heli-One (Norway) AS | | Norway | | 98-0476722 | | Stavanger Lufthavn

4050 Sola Norway +47 51 94 10 00 |

| | | |

Heli-One (Netherlands) B.V. | | Netherlands | | 98-0592414 | | 9 Parellaan

2132 WS Hoofddorp The Netherlands +31 (0)23 555 55 55 |

| | | |

Heli-One (U.K.) Limited | | Scotland | | 98-0592451 | | CHC House

Howe Moss Drive Kirkhill Industrial Estate Dyce Aberdeen AB21 0GL Scotland +44-1224-846-000 |

| | | |

Heli-One (U.S.) Inc. | | Delaware | | 84-1719617 | | 2711 Centerville Road

Suite 400 Wilmington, Delaware 19808 (970) 492-1000 |

| | | |

Heli-One USA Inc. | | Texas | | 75-2303691 | | 350 N. Paul Street

Suite 2900 Dallas, Texas 75201 (970) 492-1000 |

| | | |

Heliworld Leasing Limited. | | England | | 98-0592464 | | CHC House

Howe Moss Drive Kirkhill Industrial Estate Dyce Aberdeen AB21 0GL Scotland +44-1224-846-000 |

| | | |

CHC Leasing (Ireland) Limited | | Ireland | | N/A | | The Boat House

Bishop Street Dublin 8 Ireland Tel: +353 1 407 0011 |

| | | |

Integra Leasing AS | | Norway | | 98-0592439 | | Stavanger Lufthavn

4050 Sola, Norway +47 51 94 10 00 |

| | | |

Lloyd Bass Strait Helicopters Pty. Ltd. | | Australia | | 98-0592398 | | Level 4, 1060 Hay Street

West Perth, WA

Australia 6005+61 8 6217 7401 |

| | | |

Lloyd Helicopters International Pty. Ltd in its own capacity and as trustee of the Australian Helicopters Trust | | Australia | | 98-0592400 | | Level 4, 1060 Hay Street

West Perth, WAAustralia 6005 +61 8 6217 7401 |

| | | | | | |

| | | |

Lloyd Helicopters Pty. Ltd | | Australia | | 98-0592393 | | Level 4, 1060 Hay Street

West Perth, WAAustralia 6005 +61 8 6217 7401 |

| | | |

Lloyd Helicopter Services Limited | | Scotland | | 98-0596781 | | CHC House

Howe Moss Drive Kirkhill Industrial Estate Dyce, Aberdeen AB21 0GL Scotland +44-1224-846-000 |

| | | |

Lloyd Helicopter Services Pty. Ltd | | Australia | | 98-0592394 | | Level 4, 1060 Hay Street

West Perth, WAAustralia 6005 +61 8 6217 7401 |

| | | |

Lloyd Off-Shore Helicopters Pty. Ltd | | Australia | | 98-0592402 | | Level 4, 1060 Hay Street

West Perth, WAAustralia 6005 +61 8 6217 7401 |

| | | |

Management Aviation Limited. | | England | | 98-0592135 | | CHC House

Howe Moss Drive Kirkhill Industrial Estate Dyce Aberdeen AB21 0GL Scotland +44-1224-846-000 |

| | | |

North Denes Aerodrome Limited | | England | | 98-0592203 | | CHC House

Howe Moss Drive Kirkhill Industrial Estate Dyce Aberdeen AB21 0GL Scotland +44-1224-846-000 |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 18, 2012

PRELIMINARY PROSPECTUS

CHC Helicopter S.A.

Offer to Exchange (the “exchange offer”)

$1,100,000,000 aggregate principal amount of its 9.250% Senior Secured Notes due 2020 (the “exchange notes”), which have been registered under the Securities Act of 1933, as amended (the “Securities Act”), for any and all of its outstanding unregistered 9.250% Senior Secured Notes due 2020 (the “outstanding notes”).

We are conducting the exchange offer in order to provide you with an opportunity to exchange your unregistered notes for freely tradable notes that have been registered under the Securities Act.

The exchange offer

| | • | | We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradable. |

| | • | | You may withdraw tenders of outstanding notes at any time prior to the expiration date of the exchange offer. |

| | • | | The exchange offer expires at 12:00 a.m. midnight, New York City time, on ,2012, unless extended. We do not currently intend to extend the expiration date. |

| | • | | The exchange of the outstanding notes for the exchange notes in the exchange offer will not be a taxable event for United States federal income tax purposes. |

| | • | | The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the exchange notes will be freely tradable. |

Results of the exchange offer

| | • | | The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the exchange notes on a national market. |

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the outstanding notes under the Securities Act.

See “Risk Factors” beginning on page 20 for a discussion of certain risks that you should consider before participating in the exchange offer.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the exchange notes to be distributed in the exchange offer or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Each broker-dealer that receives exchange notes for its own account pursuant to this exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer shall not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after consummation of this exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

The date of this prospectus is .

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. The prospectus may be used only for the purposes for which it has been published and no person has been authorized to give any information not contained herein. If you receive any other information, you should not rely on it. We are not making an offer of these securities in any state where the offer is not permitted.

TABLE OF CONTENTS

i

INDUSTRY AND MARKET DATA

The market data and other statistical information (such as the size of certain markets and our position and the position of our competitors within these markets, oil and gas production and market information) used throughout this prospectus are based on independent industry publications, government publications, reports by market research firms or other published independent sources. Some market data and statistical information are also based on our good faith estimates, which are derived from our review of internal surveys, as well as the independent sources listed above. This information may prove to be inaccurate because of the method by which we obtain some of the data for our estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. As a result, although we believe these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness.

ENFORCEABILITY OF CIVIL LIABILITIES

The Company and the Issuer are organized under the laws of Luxembourg. In addition, most of the guarantors of the notes are organized outside of the United States. Many of the Issuer’s and the guarantors’ directors, officers, and controlling persons, as well as certain experts named in this prospectus, reside outside the United States, and all or a substantial portion of their assets and our assets are located outside of the United States. As a result, it may be difficult for investors to effect service of process within the United States upon these persons or to enforce against them, either inside or outside the United States, judgments obtained against them in U.S. courts, or to enforce in U.S. courts judgments obtained against them in courts in jurisdictions outside the United States, in each case, in any action predicated upon civil liabilities under the U.S. federal securities laws. We have been advised by Loyens & Loeff, our Luxembourg counsel, that there is doubt as to the enforceability against these persons in Luxembourg, whether in original actions or in actions for enforcements of judgments of U.S. courts, of liabilities predicated solely upon the U.S. federal securities laws and there are similar limitations in other jurisdictions. In addition, there are similar or additional limitations on the enforceability of civil liabilities in the other jurisdictions where our guarantors or their assets are located or our guarantors’ directors, officers and controlling persons are located. See “Limitations on Validity and Enforceability of Guarantees and Security Interests and Enforceability of Civil Liabilities.”

Therefore, it may not be possible to enforce judgments against us, our non-U.S. guarantors and certain of our and our guarantors’ directors and officers or some of the experts named in this prospectus.

BASIS OF PRESENTATION

The audited consolidated financial statements of the top-most parent guarantor, 6922767 Holding S.à r.l. (the “Successor” or “Company”), consist of the Successor’s consolidated balance sheets as of April 30, 2011 and 2010 and the Successor’s consolidated statements of operations, changes in shareholder’s equity and cash flows for the years ended April 30, 2011, 2010 and 2009 and the consolidated statements of operations, changes in shareholder’s equity and cash flows of CHC Helicopter Corporation (the “Predecessor”) for the period from May 1, 2008 to September 15, 2008.

6922767 Holding S.à r.l. was incorporated on February 20, 2008 under the laws of Luxembourg and is a private limited liability company (Société à responsabilité limitée) (S.à r.l.) whose sole purpose was to acquire the Predecessor. The Company completed its acquisition of the Predecessor on September 16, 2008 and has included the results of operations and cash flows of the entity formerly known as CHC Helicopter Corporation from September 16, 2008 to April 30, 2009 in its audited consolidated financial statements for the fiscal 2009 year. The Company’s results of operations also include organizational expenses and losses related to the acquisition as it was not previously operating in the helicopter transportation services industry from May 1, 2008 up to the date of the acquisition.

ii

The acquisition of CHC Helicopter Corporation was accounted for using the purchase method of accounting. The application of the purchase method of accounting requires the allocation of the acquisition purchase price to the tangible and intangible assets acquired and liabilities assumed based on their respective fair values as of the date of the acquisition. As a result, the assets and liabilities acquired from the Predecessor on the date of acquisition are recorded at fair values and these became the Successor’s cost basis. Accordingly, the Predecessor period from May 1, 2008 to September 15, 2008 and the Successor period from May 1, 2008 to April 30, 2009 have a different basis of accounting.

The Predecessor adopted the U.S. dollar as its reporting currency on May 1, 2008. As such, historical figures previously reported in Canadian dollars have been translated into U.S. dollars using the current rate method. Under this method, the statement of operations and cash flow statement items have been translated into U.S. dollars using the rates in effect at the date of the transactions. Assets and liabilities have been translated using the exchange rate in effect at the balance sheet date. The Predecessor applied this method retrospectively to all activity that commenced May 1, 2004. Equity balances which arose prior to May 1, 2004 have been translated to the reporting currency at the exchange rate in effect on May 1, 2004.

FORWARD-LOOKING STATEMENTS

The information in this prospectus includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical fact included in this prospectus, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this prospectus, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Although these forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events, actual results may differ materially from those stated in or implied by these forward-looking statements. Such factors include, but are not limited to, the following:

| | • | | competition in the markets we serve; |

| | • | | loss of any of our large, long-term support contracts; |

| | • | | failure to maintain standards of acceptable safety performance; |

| | • | | political, economic and regulatory uncertainty; |

| | • | | problems with our non-wholly owned entities; |

| | • | | exposure to credit risks; |

| | • | | assimilation of acquisitions and the impact of any future material acquisitions; |

| | • | | inability to fund our working capital requirements; |

| | • | | unanticipated costs or cost increases; |

| | • | | risks inherent in the operation of helicopters; |

| | • | | reduced activity in the oil and gas industry; |

| | • | | inability to obtain necessary aircraft, aircraft parts, insurance or lease financing; |

| | • | | exchange rate fluctuations; |

iii

| | • | | global financial market instability; |

| | • | | insufficient assets in our defined benefit pension plan; |

| | • | | allocation of risk between our customers and us; |

| | • | | inability to dispose of our older aircraft and parts; |

| | • | | inability to service our debt obligations; |

| | • | | compliance risks associated with international activities; |

| | • | | application of tax laws in various jurisdictions; |

| | • | | inability to upgrade our technology; |

| | • | | reduction or cancellation of services for government agencies; |

| | • | | our sponsor may have interests that conflict with ours; |

| | • | | risk related to our operations under local law; and |

| | • | | inability to maintain government issued licenses. |

We caution you that the above list of cautionary statements is not exhaustive and should be considered with the risks described under “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated. We disclaim any intentions or obligations to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except in accordance with applicable securities laws.

iv

GLOSSARY

Embedded equity | Embedded equity represents the amount by which the estimated market value of a leased aircraft exceeds the leased aircraft purchase option price at September 16, 2008, the acquisition date (see “Basis of Presentation.”) Embedded equity is assessed annually for impairment or earlier if indicators of impairment are identified. Impairment, if any, is recognized in the consolidated statements of operations. |

EMS | Emergency medical services. |

Heavy helicopter | A category of twin-engine helicopters that requires two pilots, can accommodate 19 to 26 passengers and can operate under instrument flight rules, which allow daytime and nighttime flying in a variety of weather conditions. The greater passenger capacity, larger cabin, longer range, and ability to operate in adverse weather conditions make heavy aircraft more suitable than single engine aircraft for offshore support. Heavy helicopters are generally utilized to support the oil and gas sector, construction and forestry industries and SAR and EMS customer requirements. |

IFR | Instrument flight rules, which allow for daytime and nighttime flying in a variety of weather conditions. |

Long-term contracts | Contracts of three years or longer in duration. |

Medium helicopter | A category of twin-engine helicopters that generally requires two pilots, can accommodate nine to 15 passengers and can operate under instrument flight rules, which allow daytime and nighttime flying in a variety of weather conditions. The greater passenger capacity, longer range, and ability to operate in adverse weather conditions make medium aircraft more suitable than single engine aircraft for offshore support. Medium helicopters are generally utilized to support the oil and gas sector, construction and forestry industries and SAR and EMS customer bases in certain jurisdictions. Medium helicopters can also be used to support the utility and mining sectors, where transporting a smaller number of passengers or carrying light loads over shorter distances is required. |

Medium term contracts | Contracts of greater than one year and less than three years in duration. |

MRO | Maintenance, repair and overhaul. |

New technology | When used herein to classify our aircraft, a category of higher value, recently produced, more sophisticated and more comfortable aircraft, including Eurocopter’s EC225, EC135, EC145 and EC155; Agusta’s AW139; and Sikorsky’ S76C+, S76C++ and S92A. |

v

Old technology | When used herein to classify our aircraft, all aircraft other than new technology aircraft, including Eurocopter’s AS365 and Super Puma; Sikorsky’s 76A, 76B, 76C and S61N; and Bell’s 412, 212 and 214. |

OEM | Original equipment manufacturer. |

PBH | Power-by-the-hour. A program where an aircraft operator pays a fee per flight hour to an MRO provider as compensation for repair and overhaul components required in order for the aircraft to maintain an airworthy condition. |

VFR | Visual flight rules, which require daylight and good weather conditions. |

vi

PROSPECTUS SUMMARY

This summary highlights selected information in this prospectus and may not contain all of the information that is important to you. You should carefully read this entire prospectus, including the information set forth under the heading “Risk Factors” and the consolidated financial statements included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, references in this prospectus to “we,” “our,” “us,” “the Company,” “the Successor” and “our Company” refer to 6922767 Holding S.à r.l., a Luxembourg société à responsabilité limitée, and its consolidated subsidiaries (which include all operations of CHC Helicopter S.A.).

Our Company

We are a world-leading commercial operator of medium and heavy helicopters, providing mission-critical services to the offshore oil and gas industry, as well as search and rescue (“SAR”) and emergency medical services (“EMS”) to government agencies and commercial operators through our Helicopter Services segment. The helicopter services we provide to our customers in the oil and gas industry are essential for the continued production of hydrocarbons from existing offshore oil and gas platforms and the exploration and development of new oil fields, while our SAR and EMS services help save lives. In addition, our maintenance, repair and overhaul (“MRO”) segment, Heli-One is a world leading independent commercial provider of helicopter support services with offerings that include MRO, integrated logistics support, helicopter parts sales and distribution, and complete outsourcing of maintenance for helicopter operators. Heli-One services our own flight operations and third-party customers around the world.

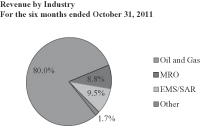

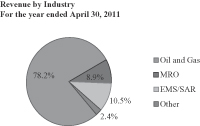

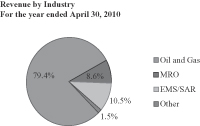

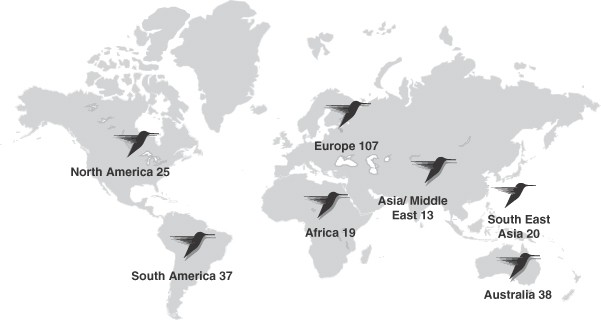

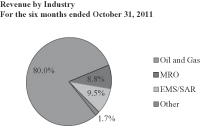

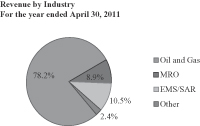

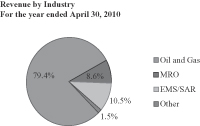

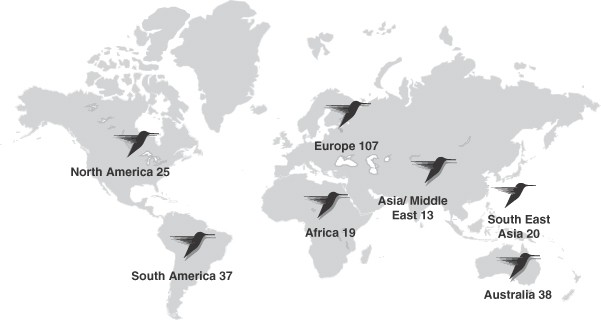

We have been providing helicopter services for more than 60 years through our subsidiaries and predecessor companies, and currently operate in 27 countries, covering every major offshore oil and gas producing region of the world except the Gulf of Mexico. Our major operations are in Norway, the United Kingdom, Ireland, the Netherlands, Australia, Brazil, Canada, and Africa. As of October 31, 2011, we operated 259 aircraft, comprising 112 heavy and 141 medium helicopters, along with six fixed-wing aircraft. For the six months ended October 31, 2011 and the fiscal year ended April 30, 2011, helicopter transportation services for the oil and gas industry accounted for approximately 80% and 78% of our total revenue, respectively, SAR and EMS activities accounted for approximately 10% and 11% of our total revenue, respectively, and MRO and other helicopter support services represented approximately 10% and 11% of our total revenue, respectively.

Helicopter Services

Our Helicopter Services segment consists of flying operations in the Eastern North Sea, Western North Sea, the Americas, the Australasia region and the Africa-Euro Asia region serving customers primarily in the offshore oil and gas industry and SAR and EMS. The Eastern North Sea is comprised mainly of Norway while the Western North Sea includes the United Kingdom, Ireland, the Netherlands and Denmark. The Americas is comprised of Brazil and North American countries. The Australasia region includes Australia and Southeast Asian countries and the Africa-Euro Asia region includes Nigeria, Kazakhstan, Turkey, Mozambique, Tanzania and other African countries.

We are one of two global helicopter service providers to the offshore oil and gas industry. We provide transportation services to and from production platforms, drilling rigs and other offshore installations and facilities.

| | • | | Our helicopter services in the oil and gas industry are largely characterized by medium to long-term contracts (i.e., two to eight years in duration, with an average of four years). |

| | • | | The majority of our customers are large national and multinational companies. |

1

| | • | | Our services are critical to customers as helicopter transportation is a cost-effective, viable means to transport crews from land to offshore platforms. Our fuel costs are passed through to our customers. |

| | • | | Maintaining a strong safety record is a primary concern for our customers, and as of October 31, 2011, our five-year rolling average was 0.35 accidents per 100,000 flight hours. |

We particularly target opportunities for long-term contracts that require medium and heavy helicopters, operated by highly trained personnel with state-of-the-art safety management systems and a world-class operating track record. We are a market leader in most of the regions we serve, with a well-established reputation for safety, customer service and aircraft reliability. We are a major operator in the North Sea, one of the world’s largest oil-producing regions. We operate the largest fleet of heavy helicopters in Brazil to service our customers in the oil and gas sector, a market that is shifting to heavy helicopter technology as pre-salt fields in ultra deepwater environments have been further developed, and we service the industry in Africa, Australia and Southeast Asia. For the six months ended October 31, 2011 and the fiscal year ended April 30, 2011, revenues generated by helicopter transportation services for the oil and gas industry accounted for approximately 80% and 78% of our total revenues, respectively.

Our oil and gas production customers generally provide our helicopter services business with a stable and predictable revenue stream. Offshore production platforms generally run at full capacity, irrespective of commodity prices, until the economic end-life of the respective field. These production platforms generally have lives of 20 years or more depending on the size and characteristics of the field.

We are one of the world’s leading commercial providers of SAR and EMS services through our Helicopter Services segment. We have long-term contracts with government agencies and commercial operators in the United Kingdom, Ireland, Norway and Australia. Our SAR and EMS contracts average eight years in duration and provide a stable and predictable revenue stream. Contracts are generally entered into directly with state and federal governments.

| | • | | We utilize state-of-the-art aircraft specifically configured and equipped with emergency medical and rescue equipment. Our crews are multidisciplined professionals with extensive training for the high level of expertise required for maritime search and rescue, thus ensuring maximum safety during rescue operations. |

| | • | | Our EMS business provides for the transport of medical personnel and equipment direct to the scene of an accident, and the rapid transport of victims to and between hospitals. |

| | • | | We expect further increased demand for SAR and EMS helicopter services as governments increasingly outsource these activities. |

| | • | | Revenue streams from SAR and EMS services are not driven by general economic conditions or short-term hydrocarbon prices. For the six months ended October 31, 2011 and the fiscal year ended April 30, 2011, revenues generated by SAR and EMS services accounted for approximately 10% and 11% of our total revenues, respectively. |

Maintenance, Repair and Overhaul

Our MRO segment, Heli-One is a world-leading independent commercial provider of helicopter support and MRO services. Our comprehensive range of capabilities and broad geographic footprint allow us to offer a full suite of aftermarket services including engine, airframe and component MRO, logistics support, parts sales and distribution, and high-value engineering and design. We provide these services individually or as part of multi-year, complete maintenance outsourcing. We operate independent licensed commercial engine and major-component MRO facilities for the Eurocopter SuperPuma and Eurocopter EC225 helicopters. Additionally, we service a wide variety of other helicopter types, including the Eurocopter Dauphin, Sikorsky S61N, Sikorsky S76

2

series, Sikorsky S92A, Agusta AW139, Bell 212 and Bell 412. We provide sophisticated avionics integration services to the armed forces of European nations, and we partner with helicopter manufacturers around the world to provide MRO services to their direct customers.

We believe our MRO segment enhances our business model in several respects:

| | • | | Third-party demand for MRO services by governments, militaries and the civil sector provides a diverse stream of revenue to CHC’s business. |

| | • | | Air worthiness regulations, which are established by civil aviation authorities and manufacturers, require that every dynamic component of a helicopter be replaced or overhauled on a scheduled basis, resulting in steady demand for our MRO services. |

| | • | | Our in-house repair and overhaul capabilities provide operational control and flexibility over the maintenance of our fleet, lowering operating cost and providing a competitive advantage. |

Competitive Strengths

| | • | | Global Footprint.We currently operate helicopter transportation services in 27 countries. In addition, we have our own internal MRO operations, Heli-One, which services aircraft in most of the countries in which we maintain flying operations. Our broad geographic coverage enables us to respond to customer needs and new business opportunities, while adhering to international safety standards, local market regulations and customs. Additionally, as multinational oil and gas companies seek helicopter operators that can provide one standard of service in many locations around the world, our geographic coverage allows us to effectively compete for many of these contracts. We have a proven record for obtaining the required licenses and permits to operate in new jurisdictions, including, where necessary, through local alliances. |

| | • | | Industry-Leading Safety Record. We have sophisticated safety and training programs and practices that have resulted in an industry-leading safety record. We have implemented a global safety management system, and we meet or exceed the stringent safety and performance audits conducted by our customers. We also host a highly regarded annual international safety summit, which is a manifestation of our single-minded commitment to safe operations. Attendees include our customers, manufacturers, competitors and regulators. |

| | • | | Strong Long-Term Relationships with Leading Companies and Organizations.We have multi-year relationships with major oil and gas companies and with SAR and EMS customers around the world, especially in Ireland, the United Kingdom and Australia, where many have been our customers continuously for more than two decades. These long-term customer relationships are enabled, in large part, because of our focus on and accomplishments in safety and flight training, our crews’ experience, and service quality that consistently meets or exceeds customer standards. In addition to helicopter transportation, certain customers rely on us for ancillary services, including our computerized logistics systems that enhance crew scheduling and passenger handling services, which further strengthen relationships and often generate additional revenue. |

| | • | | Large, Modern and Diversified Fleet of Helicopters.We are a world-leading commercial operator of medium and heavy helicopters. Our large fleet allows us to meet the diverse operational requirements of our customers and minimize disruptions in service. To meet customer-specific requirements and ensure that we and our customers are not overly reliant on any one aircraft type or manufacturer, we most commonly operate Sikorsky S92A and Eurocopter EC225 heavy aircraft and Sikorsky S76 series and Agusta AW139 medium aircraft. Our fleet includes some of the most advanced civilian aircraft in the world. We have modernized our fleet significantly over the last five years, bringing the average age of our fleet from approximately 19 years to approximately 12 years. The total committed capital requirements as of October 31, 2011 is approximately $722.3 million for aircraft with delivery dates between fiscal 2012 and 2017. |

3

| | • | | Retention of Asset Value in Our Owned Fleet. Based on third party appraisals as of April 30, 2011, the estimated fair market value of our owned aircraft fleet was $367.5 million. A significant portion of a helicopter’s value resides in its major components, including engines, gearboxes, transmissions and rotable parts. As these components are replaced or upgraded on a regular basis, older aircraft models are capable of meeting many of the same performance standards as newer aircraft. |

| | • | | In-House Repair and Overhaul Business.Our MRO business, Heli-One diversifies our revenue streams, reduces our costs and positions us as a full-service, high-quality helicopter operator. We are a market leader and operate independent licensed commercial-engine and major-component MRO facilities for the Eurocopter Super Puma and Eurocopter EC225 helicopters. We also have the capability to support several other helicopter types including the Eurocopter Dauphin, Sikorsky S61N, Sikorsky S76 series, Sikorsky S92A, Agusta AW139, Bell 212 and Bell 412. This allows us to control the quality and cost of our helicopter maintenance, repair and refurbishment. |

Our Business Strategy

Our goal is to enhance our leadership position and to create superior value by consistently and efficiently providing safe, reliable value-added services to our customers while maximizing return on assets, earnings and cash flow. We intend to focus on the following key initiatives:

| | • | | Strengthening Our Competitive Position in Existing Markets.We intend to improve our ability to win new contracts, renew existing contracts, strengthen our existing customer relationships and enhance our competitive position by increasing our focus on customer needs and reducing costs, while maintaining high standards for safety and reliability. Our global footprint, industry-leading safety record and diversified fleet of large and medium helicopters ideally position us to serve increased demand from existing customers and new customers. |

| | • | | Expanding Our Helicopter Transportation Operations.We intend to capitalize on our broad geographic coverage, long-term customer relationships and our fleet capabilities to fulfill new opportunities in developing oil and gas regions. Some of these geographic regions, including Brazil, Australia and Southeast Asia, where we currently have infrastructure and operations, are expected to be the fastest growing markets for offshore helicopter transportation services. We are exploring expansion into military transportation services. |

| | • | | Growing the MRO Business.We plan to expand our MRO revenues by further penetrating markets for overhaul of major components and engines and by pursuing new opportunities in heavy and medium aircraft maintenance, as well as military helicopter support. |

| | • | | Growth Through Acquisition.We may evaluate acquisition opportunities for both our flying and MRO businesses to further strengthen our position in existing markets and establish ourselves in new ones. |

| | • | | Focusing on Long-Term Contracts.We are prioritizing long-term contracts with our major customers to maximize the stability of our revenue. |

4

Corporate Structure

On September 16, 2008, a corporation controlled by funds affiliated with First Reserve Corporation (“First Reserve”) acquired the Predecessor of the Issuer’s direct parent for an aggregate purchase price of $2,376.5 million.

The following chart sets forth a simplified summary of our corporate and financing structure.

| (1) | As of October 31, 2011, we had $120.0 million aggregate principal amount of borrowings outstanding under our senior secured revolving credit facility. Our senior secured revolving credit facility matures in 2015. |

| (2) | For information about the financial positions and results of operations of our non-guarantor subsidiaries, see Note 21 of our unaudited interim consolidated financial statements for the six months ended October 31, 2011 and Note 29 of our audited annual consolidated financial statements for the year ended April 30, 2011. |

5

Corporate Information

The Issuer was formed in June 2008 in connection with the acquisition of the predecessor of CHC Helicopter LLC (which has converted to a Luxembourg société à responsabilité limitée as CHC Helicopter Holding S.à r.l.), the Issuer’s direct parent, by funds affiliated with First Reserve. In connection with the issuance of the outstanding notes, the Issuer converted from a Luxembourg société à responsabilité limitée (private limited liability company) to a société anonyme (public company limited by shares).

The Issuer’s registered office is located at 13-15 Avenue de la Liberté L-1931 Luxembourg and its registration number is B139673.

The corporate headquarters of Heli-One Canada Inc. are located at 4740 Agar Drive, Richmond, British Columbia, V7B 1A3 Canada and our telephone number at that location is (604) 276-7500. The Issuer has entered into an agreement with Heli-One Canada Inc. to provide certain management services, subject to authority limits as determined by our board and set out in such agreement.

6

The Exchange Offer

$1.1 billion aggregate principal amount of the outstanding notes were issued in a private offering on October 4, 2010. The term “notes” refers collectively to the outstanding notes and the exchange notes.

General | In connection with the private offering, the Issuer and the guarantors of the outstanding notes entered into a registration rights agreement with the initial purchasers in which they agreed, among other things, to deliver this prospectus to you and to use commercially reasonable efforts to complete the exchange offer no later than 720 days after October 4, 2010, the closing date of the issuance of the outstanding notes. You are entitled to exchange in the exchange offer your outstanding notes for the exchange notes which are identical in all material respects to the outstanding notes except: |

| | • | | the exchange notes have been registered under the Securities Act; |

| | • | | the exchange notes are not entitled to any registration rights which are applicable to the outstanding notes under the registration rights agreement; and |

| | • | | the additional interest provision of the registration rights agreement is no longer applicable. |

The Exchange Offer | The Issuer is offering to exchange $1.1 billion aggregate principal amount of the exchange notes, which have been registered under the Securities Act, for any and all of the outstanding notes. You may only exchange outstanding notes in denominations of $100,000 and integral multiples of $1,000 in excess thereof. |

Resale | Based on an interpretation by the staff of the SEC set forth in no-action letters issued to third parties, we believe that the exchange notes issued pursuant to the exchange offer in exchange for outstanding notes may be offered for resale, resold and otherwise transferred by you (unless you are our “affiliate” or an “affiliate” of any guarantor within the meaning of Rule 405 under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act; provided that: |

| | • | | you are acquiring the exchange notes in the ordinary course of your business; and |

| | • | | you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

| | If you are a broker-dealer and receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making activities or other trading activities, you must acknowledge that you will deliver this prospectus in connection with any resale of the exchange notes. See “Plan of Distribution.” |

7

| | Any holder of outstanding notes who: |

| | • | | is our affiliate or an affiliate of any guarantor; |

| | • | | does not acquire exchange notes in the ordinary course of its business; or |

| | • | | tenders its outstanding notes in the exchange offer with the intention to participate, or for the purpose of participating, in a distribution of exchange notes |

| | cannot rely on the position of the staff of the SEC set forth inMorgan Stanley & Co. Incorporated (available June 5, 1991) andExxon Capital Holdings Corporation (available May 13, 1988), as interpreted in the SEC’s letter toShearman & Sterling, dated available July 2, 1993, or similar no-action letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the exchange notes. |

Expiration Date | The exchange offer will expire at 12:00 a.m. midnight, New York City time, on , 2012, unless extended by us. We do not currently intend to extend the expiration date. |

Withdrawal | You may withdraw the tender of your outstanding notes at any time prior to 12:00 a.m. midnight, New York City time, on the expiration date. We will return to you any of your outstanding notes that are not accepted for any reason for exchange, without expense to you, promptly after the expiration or termination of the exchange offer. |

Conditions to the Exchange Offer | The exchange offer is subject to customary conditions, which we may waive in our sole discretion. See “The Exchange Offer—Conditions to the Exchange Offer.” |

Procedures for Tendering Outstanding Notes | If you wish to participate in the exchange offer, you must complete, sign and date the accompanying letter of transmittal, or a facsimile of such letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must then mail or otherwise deliver the letter of transmittal, or a facsimile of such letter of transmittal, together with the outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. |

| | If you hold outstanding notes through The Depository Trust Company (“DTC”) and wish to participate in the exchange offer, you must comply with the Automated Tender Offer Program procedures of DTC by which you will agree to be bound by the letter of transmittal. By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things: |

| | • | | you are not our “affiliate” or an “affiliate” of any guarantor within the meaning of Rule 405 under the Securities Act; |

8

| | • | | you do not have an arrangement or understanding with any person or entity to participate in the distribution of the exchange notes; |

| | • | | you are acquiring the exchange notes in the ordinary course of your business; and |

| | • | | if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making activities, that you will deliver a prospectus, as required by law, in connection with any resale of such exchange notes. |

Special Procedures for Beneficial Owners | If you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those outstanding notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender those outstanding notes on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your outstanding notes, either make appropriate arrangements to register ownership of the outstanding notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. |

Guaranteed Delivery Procedures | If you wish to tender your outstanding notes and your outstanding notes are not immediately available or you cannot deliver your outstanding notes, the letter of transmittal or any other required documents, or you cannot comply with the procedures under DTC’s Automated Tender Offer Program for transfer of book-entry interests, prior to the expiration date, you must tender your outstanding notes according to the guaranteed delivery procedures set forth in this prospectus under “The Exchange Offer—Guaranteed Delivery Procedures.” |

Effect on Holders of Outstanding Notes | As a result of the making of, and upon acceptance for exchange of, all validly tendered outstanding notes pursuant to the terms of the exchange offer, we and the guarantors of the notes will have fulfilled a covenant under the registration rights agreement. Accordingly, there will be no increase in the interest rate on the outstanding notes under the circumstances described in the registration rights agreement. If you do not tender your outstanding notes in the exchange offer, you will continue to be entitled to all the rights and limitations applicable to the outstanding notes as set forth in the indenture; however, we and the guarantors of the notes will not have any further obligation to you to provide for the exchange and registration of the outstanding notes under the registration rights agreement. To the extent that the outstanding notes are tendered and accepted in the exchange offer, the trading market for the outstanding notes that are not so tendered and |

9

| | accepted could be adversely affected. See “Risk Factors—Risks Related to the Exhange Offer—There may be adverse consequences if you do not exchange your outstanding notes.” |

Consequences of Failure to Exchange | All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we and the guarantors of the notes do not currently anticipate that we will register the outstanding notes under the Securities Act. |

United States Federal Income Tax Consequences | The exchange of outstanding notes for exchange notes in the exchange offer will not be a taxable event to holders for United States federal income tax purposes. See “United States Federal Income Tax and Luxembourg Income Tax Consequences of the Exchange Offer.” |

Use of Proceeds | We will not receive any cash proceeds from the issuance of the exchange notes in the exchange offer. See “Use of Proceeds.” |

Exchange Agent | The Bank of New York Mellon is the exchange agent for the exchange offer. The addresses and telephone numbers of the exchange agent are set forth under “The Exchange Offer—Exchange Agent.” |

10

The Exchange Notes

The summary below describes the principal terms of the exchange notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of Notes” section of this prospectus contains a more detailed description of the terms and conditions of the exchange notes. The exchange notes will have terms identical in all material respects to the corresponding outstanding notes, except that the exchange notes will not contain terms with respect to transfer restrictions, registration rights and additional interest for failure to observe certain obligations in the applicable registration rights agreement.

Issuer | CHC Helicopter S.A. |

Securities Offered | $1.1 billion aggregate principal amount of 9.250% Senior Secured Notes due 2020 (the “exchange notes”). |

Maturity | The exchange notes will mature on October 15, 2020, unless earlier redeemed or repurchased. |

Interest | Interest on the exchange notes will be payable semi-annually on April 15 and October 15, commencing April 15, 2012. |

Guarantees | 6922767 Holding S.à r.l., the Issuer’s indirect parent, CHC Helicopter Holding S.à r.l., the Issuer’s direct parent, and all of 6922767 Holding S.à r.l.’s existing and future restricted subsidiaries that guarantee our revolving credit facility will guarantee the exchange notes on a senior secured first-priority basis. |

| | For information about the financial positions and results of operations of our non-guarantor subsidiaries, see Note 21 of our unaudited interim consolidated financial statements for the six months ended October 31, 2011 and Note 29 of our audited annual consolidated financial statements for the year ended April 30, 2011. |

Ranking | The exchange notes and the related guarantees will be general senior secured obligations of the Issuer and the guarantors and will be: |

| | • | | senior in right of payment to the Issuer’s and the guarantors’ future subordinated indebtedness; |

| | • | | equal in right of payment with all of the Issuer’s and the guarantors’ existing and future senior indebtedness, including obligations under our revolving credit facility and the outstanding notes; |

| | • | | effectively senior to all of the Issuer’s and the guarantors’ existing and future unsecured indebtedness to the extent of the value of the collateral securing the exchange notes and the guarantees; |

| | • | | effectively equal in right to all of the Issuer’s and the guarantors’ debt that shares in the collateral securing the exchange notes and the guarantees; and |

| | • | | structurally subordinated to all of the existing and future liabilities (including trade payables) of each of the Issuer’s and the guarantors’ subsidiaries that do not guarantee the exchange notes; |

11

| | The now owned or hereafter acquired collateral will secure the exchange notes and the guarantees, as well as the obligations under our revolving credit facility, the outstanding notes and certain hedging and cash management obligations on a first-priority basis, subject to permitted liens. Under the terms of the security documents, however, the proceeds of any collection, sale, disposition or other realization of collateral received in connection with the exercise of remedies (including distributions of cash, securities or other property on account of the value of the collateral in a bankruptcy, insolvency, reorganization or similar proceedings) will be applied first to repay amounts due under the revolving credit facility, including any post-petition interest with respect thereto, certain hedging obligations relating to obligations under the revolving credit facility and certain cash management obligations of the Issuer and the guarantors owed to lenders under the revolving credit facility before the holders of the notes receive such proceeds. As a result, the claims of holders of notes to such proceeds will rank behind the claims, including interest, of the lenders and letter of credit issuers under the revolving credit facility, including claims for such hedging obligations and cash management obligations. See “Description of Notes—Collateral and Security Documents—Intercreditor Agreement” and “Risk Factors—Your right to take enforcement action with respect to the liens securing the exchange notes is limited in certain circumstances, and will receive the proceeds from such enforcement only after lenders under our revolving credit facility and holders of certain other priority claims have been reimbursed.” |

| | As of October 31, 2011, we had: |

| | • | | $1,339.2 million of total indebtedness outstanding (see — “Capitalization”), which includes the outstanding notes of $1.1 billion, $120.0 million of borrowings under the revolving credit facility and capital lease obligations of $104.7 million; and |

| | • | | an additional $113.5 million of committed capacity under our revolving credit facility, all of which would be secured on an equal basis with the exchange notes, net of $96.5 million in outstanding letters of credit, which would reduce the availability under our revolving credit facility. |

| | For further discussion, see “Description of Other Indebtedness—Senior Secured Revolving Credit Facility.” |

Collateral | The exchange notes and related guarantees will be secured, subject to permitted liens, on a first-priority basis along with our obligations under the revolving credit facility, the outstanding notes and certain hedging and cash management obligations by substantially all of our and our guarantors’ assets (other than certain excluded assets) now owned or acquired in the future. See “Description of Notes—Collateral and Security Documents.” |

12

| | No appraisal of the value of the collateral has been made in connection with this exchange offer, and the value of the collateral in the event of liquidation may be materially different from book value. As a result, we can make no assurance that our historic book values will approximate fair value or that such fair values will be sufficient to fully collateralize the exchange notes. In addition, the collateral will not include any capital stock of a subsidiary to the extent that the pledge of such capital stock results in our being required to file separate financial statements of such subsidiary with the SEC, and any such capital stock that triggers such a requirement to file financial statements of such subsidiary with the SEC would be automatically released from the collateral securing the exchange notes and related guarantees. |

| | Some of our property and assets are excluded from the collateral, as described in “Description of Notes—Collateral and Security Documents.” |

Sharing of First-Priority Lien | In certain circumstances, we may secure indebtedness permitted to be incurred by the covenant described in “Description of Notes—Certain Covenants—Incurrence of Indebtedness and Issuance of Preferred Equity” by granting liens upon any or all of the collateral securing the notes and obligations under the revolving credit facility on an equal basis with the liens securing the notes and the guarantees and, in certain circumstances, with payment priority equal to the revolving credit facility. |

Optional Redemption | The Issuer may redeem the exchange notes, in whole or in part, at any time on or after October 15, 2015, at a redemption price equal to 100% of the principal amount thereof, plus a premium declining ratably to par plus accrued and unpaid interest as set forth under “Description of Notes—Optional Redemption.” |

| | At any time before October 15, 2013, the Issuer may redeem up to 35% of the aggregate principal amount of the exchange notes issued under the indenture with the net cash proceeds of one or more equity offerings at a redemption price equal to 109.250% of the principal amount thereof, plus accrued and unpaid interest; provided that: |

| | • | | at least 50% of the aggregate principal amount of the exchange notes (including any additional notes issued after October 4, 2010) remains outstanding immediately after the occurrence of such redemption; and |

| | • | | such redemption occurs within 180 days of the date of the closing of any such equity offering. |

| | In addition, the Issuer may redeem some or all of the exchange notes prior to October 15, 2015 at a redemption price equal to 100% of the principal amount thereof, plus a “make-whole” premium as set forth under “Description of Notes—Optional Redemption,” plus accrued and unpaid interest to the date of such redemption. |

13

| | During any 12-month period commencing October 4, 2010 until October 15, 2015, the Issuer may also redeem up to 10% of the aggregate principal amount of the exchange notes during any twelve-month period at a redemption price of 103% of the principal amount thereof, plus accrued and unpaid interest, if any. |

Tax Redemption | If, as a result of certain tax law changes, the Issuer would be obligated to pay additional amounts in respect of withholding taxes or certain other tax indemnification payments, and such obligation cannot be avoided by taking reasonable measures available to the Issuer, the Issuer may redeem the exchange notes in whole, but not in part, at a price equal to 100% of the principal amount thereof plus accrued and unpaid interest, and all additional amounts, if any, then due or becoming due on the redemption date. See “Description of Notes—Optional Redemption.” |

Mandatory Offers to Purchase | Upon a change of control, if the Issuer does not otherwise redeem the exchange notes, each holder of exchange notes will be entitled to require the Issuer to repurchase all or a portion of its exchange notes at a purchase price equal to 101% of the principal amount thereof, plus accrued and unpaid interest. See “Description of Notes—Repurchase at the Option of Holders—Change of Control.” The Issuer’s ability to purchase the exchange notes upon a change of control will be limited by the terms of our debt agreements, including our revolving credit facility, which may result in a default under the exchange notes. We cannot assure you that the Issuer will have the financial resources to purchase the exchange notes in such circumstances. |

| | Certain asset dispositions may be triggering events which may require us to use the excess proceeds (as such term is defined in the indenture) from those asset dispositions to make an offer to purchase the exchange notes at 100% of their principal amount, together with accrued and unpaid interest, if any. |

Certain Covenants | The indenture governing the exchange notes contains covenants limiting our ability and the ability of our restricted subsidiaries to: |

| | • | | incur additional indebtedness or issue certain preferred shares; |

| | • | | pay dividends or repurchase or redeem equity interests; |

| | • | | limit dividends or other payments by restricted subsidiaries that are not guarantors to us or our other subsidiaries; |

| | • | | make certain investments; |

| | • | | engage in other business activities; |

| | • | | enter into certain types of transactions with our affiliates; and |

| | • | | sell assets or consolidate or merge with or into other companies. |

14

| | These and other covenants contained in the indenture governing the exchange notes are subject to important exceptions and qualifications, which are described under “Description of Notes.” In addition, if and for as long as the notes have an investment grade rating from both Standard & Poor’s Ratings Group, Inc. and Moody’s Investors Service, Inc., and no default or event of default exists under the indenture, we will not be subject to certain of the covenants listed above. See “Description of Notes—Certain Covenants—Covenant Suspension.” |

Public Market | The exchange notes will be freely transferable but will be new securities for which there will not initially be a market. Accordingly, we cannot assure you that a liquid market for the exchange notes will develop. See “Risk Factors—Risks Related to Our Indebtedness and the Exchange Notes—Your ability to transfer the exchange notes may be limited by the absence of an active trading market, and there is no assurance that any active trading market will be maintained for the exchange notes.” |

You should carefully consider all the information in the prospectus prior to exchanging your outstanding notes. In particular, we urge you to carefully consider the factors set forth under the “Risk Factors” section.

15

Summary Historical Consolidated Financial Data

The following table sets forth summary historical consolidated financial data of the Predecessor and the Successor for the periods indicated. 6922767 Holding S.à r.l., the Successor was incorporated on February 20, 2008 under the laws of Luxembourg and is a private limited liability company (Société à responsabilité limitée) (S.à r.l.) whose sole purpose was to acquire the CHC Helicopter Corporation, the Predecessor. The Company completed its acquisition of the Predecessor on September 16, 2008 and has included the results of operations of the entity formerly known as CHC Helicopter Corporation from September 16, 2008 to April 30, 2009 in its audited consolidated financial statements for the fiscal 2009 year. In addition to the operating results of the entity formerly known as CHC Helicopter Corporation, the Company’s results of operations also include organizational expenses and losses from May 1, 2008 up to the date of the acquisition. The acquisition of CHC Helicopter Corporation was accounted for using the purchase method of accounting and the application of the purchase method of accounting requires the allocation of the acquisition purchase price to the tangible and intangible assets acquired and liabilities assumed based on their respective fair values as of the date of the acquisition. Accordingly, the Predecessor period from May 1, 2008 to September 15, 2008 and the Successor period from May 1, 2008 to April 30, 2009 have a different basis of accounting. The comparability of the financial statements of the Predecessor and Successor periods has been impacted by the application of the acquisition accounting.

The summary consolidated statements of operations and cash flow data for the Successor periods presented below for the year ended April 30, 2011, 2010 and 2009 and the Predecessor period from May 1, 2008 to September 15, 2008 and the Successor’s balance sheet data as of April 30, 2011 and 2010 have been derived from the audited financial statements included elsewhere in this prospectus. The Successor’s balance sheet data as of April 30, 2009 have been derived from our audited financial statements not included in this prospectus. Our historical operating results are not necessarily indicative of future operating results. The summary consolidated statements of operation and cash flow data for the six months ended October 31, 2011 and 2010 and the balance sheet data as of October 31, 2011 have been derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus. The interim unaudited consolidated financial statements have been prepared on a basis consistent with our annual audited consolidated financial statements. In the opinion of management, such unaudited financial data reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair statement of the results for those periods. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full year or any future period.

16

The summary financial data presented below is qualified in its entirety by reference to, and should be read in conjunction with, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Successor | | | | | Predecessor | |

| | | For the

six months ended

October 31, | | | For the

year ended

April 30, | | | | | For the period

from May 1,

2008 to

September 15,

2008 | |

| (in thousands of U.S. dollars) | | (Unaudited)

2011 | | | (Unaudited)

2010 | | | 2011 | | | 2010 | | | 2009 | | | | |

| | | | | | | | | | | | | | | (vi) | | | | | (vi) | |

Operating data: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 832,649 | | | $ | 693,295 | | | $ | 1,445,460 | | | $ | 1,313,566 | | | $ | 761,895 | | | | | $ | 510,090 | |

Direct costs | | | (679,987 | ) | | | (572,344 | ) | | | (1,211,680 | ) | | | (1,029,882 | ) | | | (612,428 | ) | | | | | (446,823 | ) |

Earnings from equity accounted investees | | | 1,221 | | | | 584 | | | | 2,159 | | | | 1,436 | | | | 1,118 | | | | | | 311 | |

General and administration expenses | | | (29,452 | ) | | | (23,001 | ) | | | (65,391 | ) | | | (61,157 | ) | | | (26,910 | ) | | | | | (12,479 | ) |

Amortization | | | (52,532 | ) | | | (45,149 | ) | | | (99,625 | ) | | | (77,738 | ) | | | (51,978 | ) | | | | | (46,816 | ) |

Restructuring costs | | | (11,884 | ) | | | (1,987 | ) | | | (4,751 | ) | | | (4,855 | ) | | | (5,568 | ) | | | | | (15 | ) |

Recovery (impairment) of receivables and funded residual value guarantees | | | 47 | | | | — | | | | (1,919 | ) | | | (13,266 | ) | | | (19,900 | ) | | | | | (38,300 | ) |

Impairment of intangible assets | | | (1,825 | ) | | | — | | | | (20,608 | ) | | | (53,903 | ) | | | (25,000 | ) | | | | | — | |

Impairment of property and equipment | | | — | | | | — | | | | — | | | | (36,240 | ) | | | — | | | | | | — | |

Impairment of assets held for sale | | | (11,632 | ) | | | (3,619 | ) | | | (5,239 | ) | | | (26,585 | ) | | | (4,900 | ) | | | | | (13,300 | ) |

Gain (loss) on disposal of assets | | | 3,741 | | | | 1,883 | | | | 7,193 | | | | (2,686 | ) | | | 1,346 | | | | | | 545 | |

Goodwill impairment charge | | | — | | | | — | | | | — | | | | — | | | | (639,187 | ) | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating earnings (loss) | | | 50,346 | | | | 49,662 | | | | 45,599 | | | | 8,690 | | | | (621,512 | ) | | | | | (46,787 | ) |

Financing charges | | | (63,782 | ) | | | (94,104 | ) | | | (140,582 | ) | | | (74,459 | ) | | | (91,822 | ) | | | | | (14,027 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Loss from continuing operations, before income tax | | | (13,436 | ) | | | (44,442 | ) | | | (94,983 | ) | | | (65,769 | ) | | | (713,334 | ) | | | | | (60,814 | ) |

Income tax recovery (provision) | | | 12,485 | | | | (546 | ) | | | 32,916 | | | | (9,297 | ) | | | 9,204 | | | | | | 3,521 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net loss from continuing operations | | | (951 | ) | | | (44,988 | ) | | | (62,067 | ) | | | (75,066 | ) | | | (704,130 | ) | | | | | (57,293 | ) |

Net earnings (loss) from discontinued operations, net of tax | | | (8,312 | ) | | | (1,728 | ) | | | (3,202 | ) | | | (1,436 | ) | | | (380 | ) | | | | | 114 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net loss | | $ | (9,263 | ) | | $ | (46,716 | ) | | $ | (65,269 | ) | | $ | (76,502 | ) | | $ | (704,510 | ) | | | | $ | (57,179 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net loss attributable to the Company | | $ | (19,793 | ) | | $ | (50,694 | ) | | $ | (70,338 | ) | | $ | (70,607 | ) | | $ | (691,222 | ) | | | | $ | (57,179 | ) |

Net earnings (loss) attributable to Non-controlling interest | | | 10,530 | | | | 3,978 | | | | 5,069 | | | | (5,895 | ) | | | (13,288 | ) | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net loss | | $ | (9,263 | ) | | $ | (46,716 | ) | | $ | (65,269 | ) | | $ | (76,502 | ) | | $ | (704,510 | ) | | | | $ | (57,179 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

17

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Successor | | | | | Predecessor | |

| | | As at and for the

six months ended

October 31, | | | As at and for the

year ended

April 30, | | | | | As at and

for the period

from May 1,

2008 to

September 15,

2008 | |

| (in thousands of U.S. dollars) | | (Unaudited)

2011 | | | (Unaudited)

2010 | | | 2011 | | | 2010 | | | 2009 | | | | |

| | | | | | | | | | | | | | | (vi) | | | | | (vi) | |

Segmented information | | | | | | | | | | | | | | | | | | | | | | | | | | |

Segment revenues | | | | | | | | | | | | | | | | | | | | | | | | | | |

Helicopter Services | | $ | 758,822 | | | $ | 630,134 | | | $ | 1,319,491 | | | $ | 1,195,360 | | | $ | 684,920 | | | | | $ | 473,976 | |

MRO | | | 207,992 | | | | 175,102 | | | | 358,857 | | | | 366,882 | | | | 184,440 | | | | | | 143,333 | |

Corporate and other | | | 2,809 | | | | 1,991 | | | | 4,872 | | | | 14,199 | | | | 9,624 | | | | | | 7,114 | |

Eliminations | | | (136,974 | ) | | | (113,932 | ) | | | (237,760 | ) | | | (262,875 | ) | | | (117,089 | ) | | | | | (114,333 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total segment revenue | | | 832,649 | | | | 693,295 | | | | 1,445,460 | | | | 1,313,566 | | | | 761,895 | | | | | | 510,090 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Segment EBITDAR (i) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Helicopter Services | | | 207,814 | | | | 186,031 | | | | 379,798 | | | | 371,118 | | | | 196,925 | | | | | | 101,372 | |

MRO | | | 34,823 | | | | 18,745 | | | | 34,146 | | | | 54,451 | | | | 33,926 | | | | | | 12,360 | |

Corporate and other | | | (35,106 | ) | | | (26,661 | ) | | | (78,568 | ) | | | (56,534 | ) | | | (25,645 | ) | | | | | (9,732 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total segment EBITDAR | | | 207,531 | | | | 178,115 | | | | 335,376 | | | | 369,035 | | | | 205,206 | | | | | | 104,000 | |

Segment EBITDA (ii) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Helicopter Services | | | 207,814 | | | | 186,031 | | | | 379,798 | | | | 371,118 | | | | 196,925 | | | | | | 101,372 | |

MRO | | | 34,823 | | | | 18,745 | | | | 34,146 | | | | 54,451 | | | | 33,926 | | | | | | 12,360 | |

Corporate and other | | | (118,206 | ) | | | (106,242 | ) | | | (243,396 | ) | | | (201,606 | ) | | | (107,176 | ) | | | | | (62,633 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total segment EBITDA | | | 124,431 | | | | 98,534 | | | | 170,548 | | | | 223,963 | | | | 123,675 | | | | | | 51,099 | |

Amortization | | | (52,532 | ) | | | (45,149 | ) | | | (99,625 | ) | | | (77,738 | ) | | | (51,978 | ) | | | | | (46,816 | ) |

Restructuring costs | | | (11,884 | ) | | | (1,987 | ) | | | (4,751 | ) | | | (4,855 | ) | | | (5,568 | ) | | | | | (15 | ) |

Recovery (impairment) of receivables and funded residual value guarantees | | | 47 | | | | — | | | | (1,919 | ) | | | (13,266 | ) | | | (19,900 | ) | | | | | (38,300 | ) |

Impairment of intangible assets | | | (1,825 | ) | | | — | | | | (20,608 | ) | | | (53,903 | ) | | | (25,000 | ) | | | | | — | |

Impairment of property and equipment | | | — | | | | — | | | | — | | | | (36,240 | ) | | | — | | | | | | — | |

Impairment of assets held for sale | | | (11,632 | ) | | | (3,619 | ) | | | (5,239 | ) | | | (26,585 | ) | | | (4,900 | ) | | | | | (13,300 | ) |