Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

GPN similar filings

- 8 Nov 17 Results of Operations and Financial Condition

- 6 Sep 17 Entry into a Material Definitive Agreement

- 8 Aug 17 Entry into a Material Definitive Agreement

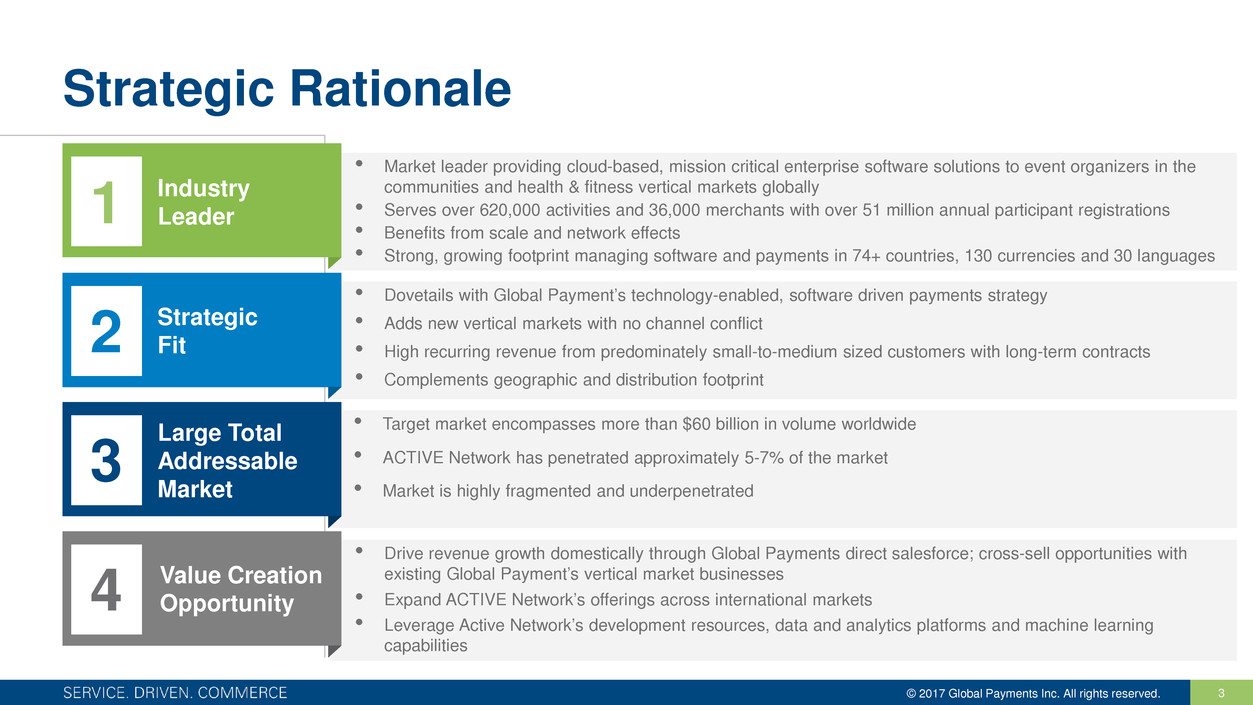

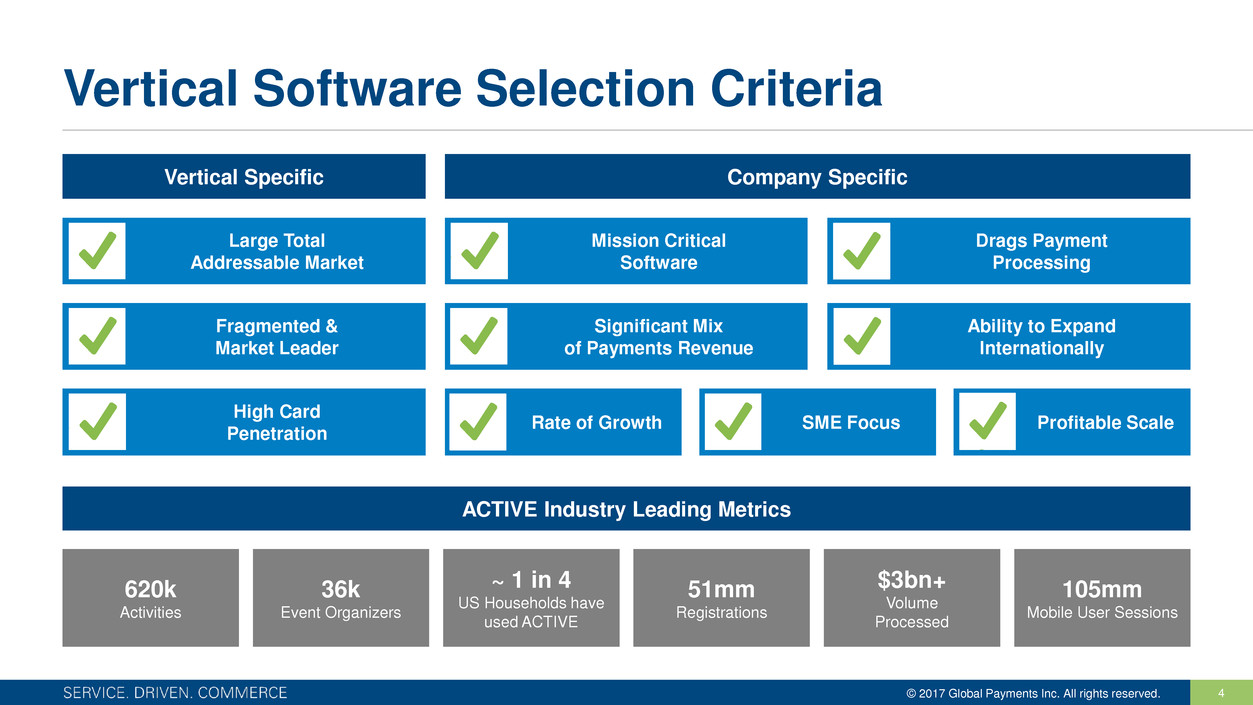

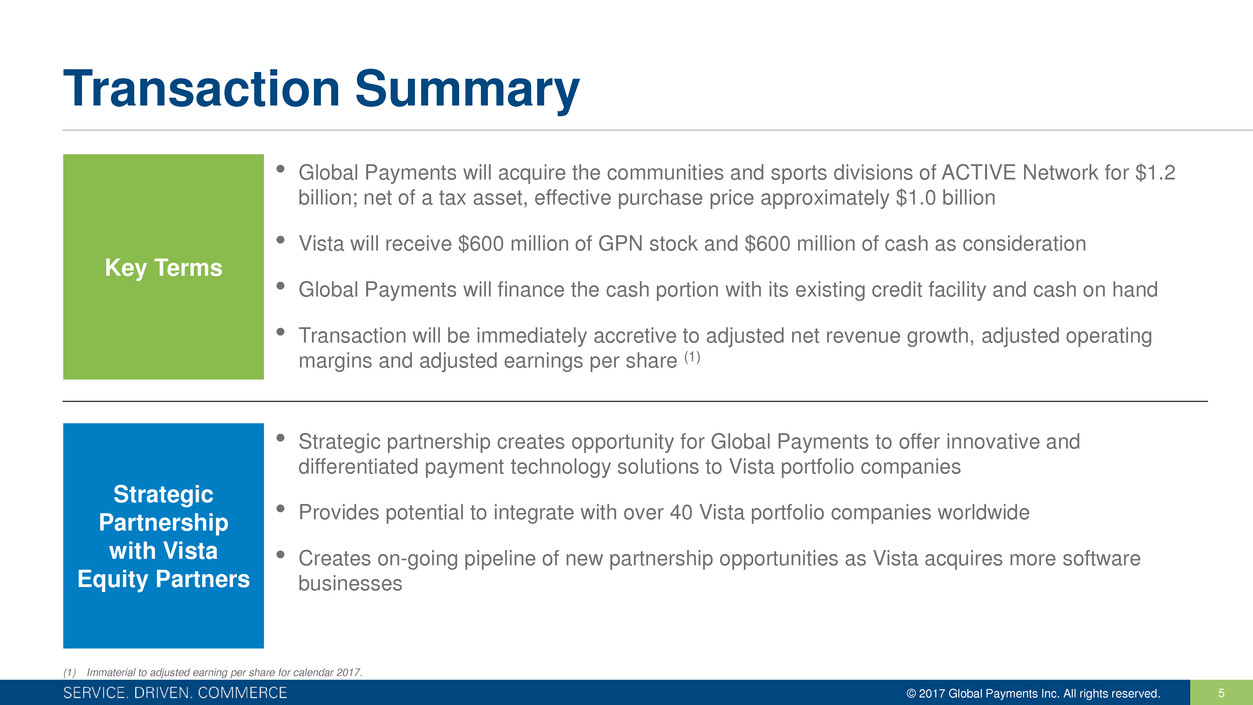

- 3 Aug 17 Announces Agreement to Acquire ACTIVE Network

- 4 May 17 Entry into a Material Definitive Agreement

- 4 May 17 Increases 2017 Outlook and Refinances Debt Facilities

- 2 Mar 17 Departure of Directors or Certain Officers

Filing view

External links