SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the registrantx

Filed by a party other than the registrant¨

Check the appropriate box:

¨ Preliminary proxy statement.

¨ Confidential, for use of the

Commission only (as permitted by

Rule 14a-6(e)(2)).

x Definitive proxy statement.

¨ Definitive additional materials.

¨ Soliciting material under Rule14a-12.

ATP OIL & GAS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Notice of Annual Meeting

Of Stockholders and

Proxy Statement

May 28, 2003

At the offices of

ATP Oil & Gas Corporation

4600 Post Oak Place, Suite 200

Houston, Texas 77027

ATP Oil & Gas Corporation

4600 Post Oak Place, Suite 200

Houston, Texas 77027

Notice of Annual Meeting of Shareholders

To Be Held May 28, 2003

Dear Shareholder:

You are cordially invited to attend the 2003 Annual Meeting of Shareholders (the “Annual Meeting”) of ATP Oil & Gas Corporation, a Texas corporation (the “Company”), which will be held on May 28, 2003 at 10:30 a.m., local time, at the offices of ATP Oil & Gas Corporation, 4600 Post Oak Place, Suite 200, Houston, Texas 77027. The Annual Meeting will be held for the following purposes:

| 1. | To elect two Directors to serve until the 2006 Annual Meeting of Shareholders. |

| 2. | To ratify the appointment of KPMG LLP as independent auditors of the Company for the fiscal year ending December 31, 2003. |

| 3. | To transact such other business as may properly come before such meeting or any adjournment(s) or postponement(s) thereof. |

The close of business on April 11, 2003 has been fixed as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting or any adjournment(s) or postponement(s) thereof.

Whether or not you plan to attend the Annual Meeting, we ask that you sign and return the enclosed proxy as promptly as possible to ensure that your shares will be represented. A self-addressed envelope has been enclosed for your convenience. If you attend the meeting, you may withdraw any previously given proxy and vote your shares in person.

By Order of the Board of Directors,

CAROL E. OVERBEY

Corporate Secretary

April 28, 2003

ATP Oil & Gas Corporation

4600 Post Oak Place, Suite 200

Houston, Texas 77027

(713) 622-3311

Proxy Statement

Solicitation and Revocability of Proxies

The enclosed proxy is solicited by and on behalf of the Board of Directors (the “Board”) of ATP Oil & Gas Corporation, a Texas corporation (the “Company”), for use at the 2003 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on May 28, 2003 at 10:30 a.m., local time, at the offices of ATP Oil & Gas Corporation, Suite 200, Houston, Texas 77027, or at any adjournment(s) or postponement(s) thereof. The solicitation of proxies by the Board of Directors will be conducted primarily by mail. American Stock Transfer & Trust Company has been retained to assist the Company in the solicitation of proxies in connection with the Annual Meeting as part of its services as the Company’s transfer agent for which we pay $600 per month, plus out-of-pocket expenses for the proxy mailing which we expect to be approximately $2,500.00. In addition, officers, Directors and employees of the Company may solicit proxies personally or by telephone, telegram or other forms of wire or facsimile communication. The Company will reimburse brokers, custodians, nominees and fiduciaries for reasonable expenses incurred by them in forwarding proxy material to beneficial owners of common stock (the “Common Stock”) of the Company. The costs of the solicitation will be borne by the Company. This proxy statement and the form of proxy were first mailed to shareholders of the Company on or about April 28, 2003.

The enclosed proxy, even though executed and returned, may be revoked at any time prior to the voting of the proxy (a) by the execution and submission of a revised proxy, (b) by written notice to the Secretary of the Company or (c) by voting in person at the Annual Meeting. In the absence of such revocation, shares represented by the proxies will be voted at the Annual Meeting.

At the close of business on April 11, 2003, the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting, there were outstanding 20,322,167 shares of Common Stock, each share of which is entitled to one vote. Common Stock is the only class of outstanding securities of the Company entitled to notice of and to vote at the Annual Meeting.

The Company’s annual report to shareholders for the year ended December 31, 2002, including financial statements, is being mailed with this proxy statement to all shareholders entitled to vote at the Annual Meeting. The annual report does not constitute a part of this proxy soliciting material.

Item 1 on Proxy Card: Election of Two Directors

Two Directors are to be elected at the Annual Meeting. The Company’s Bylaws provide for a classified Board of Directors, divided into Classes I, II and III. The terms of office are staggered three year terms which are currently scheduled to expire on the dates of the Company’s Annual Meetings of Shareholders in 2003 (Class III), in 2004 (Class I) and in 2005 (Class II). The two nominees are to be elected to Class III for a three-year term expiring at the Company’s Annual Meeting of Shareholders in 2006. The Board’s nominees for the two Class III Directors to be elected at the 2003 Annual Meeting are the incumbent Directors Mr. Arthur H. Dilly and Mr. Robert C. Thomas.

The Board of Directors recommends voting “For” the election of each of the Director nominees.

1

A plurality of the votes cast in person or by proxy by the holders of Common Stock is required to elect a Director. Accordingly, under the Texas Business Corporation Act (“TBCA”) and the Company’s Bylaws, abstentions and broker non-votes would have no effect on the election of Directors assuming a quorum is present or represented by proxy at the Annual Meeting. A broker non-vote occurs if a broker or other nominee does not have discretionary authority and has not received instructions with respect to a particular item. Shareholders may not cumulate their votes in the election of Directors.

Unless otherwise instructed or unless authority to vote is withheld, the enclosed proxy will be voted FOR the election of the nominees listed below. Although the Board of Directors does not contemplate that any of the nominees will be unable to serve, if such a situation arises prior to the Annual Meeting, the persons named in the enclosed proxy will vote for the election of such other person(s) as may be nominated by the Board of Directors.

The following table sets forth information regarding the names, ages and principal occupations of the nominees and Directors, directorships in other companies held by them and the length of continuous service as a Director of the Company:

Nominees for Election at the Annual Meeting

Class III Directors | Principal Occupation and Directorships | Director Since | Age | |||

Arthur H. Dilly | Director of the Company since 2001; Executive Secretary Emeritus, Board of regents of the University of Texas System; Chairman and Chief Executive Officer, Austin Geriatrics Center. | 2001 | 73 | |||

Robert C. Thomas | Director of the Company since 2001; Former Chairman and CEO of Tenneco Gas; Chairman of the Board, The Sarkeys Energy Center of the University of Oklahoma; Director, PetroCorp Incorporated; Advisory Director, Pride International, Inc. | 2001 | 74 | |||

Continuing Directors | ||||||

Class I Directors | Principal Occupation and Directorships | Director Since | Age | |||

T. Paul Bulmahn | President and Chairman of the Company. | 1991 | 59 | |||

Gerard J. Swonke | Director of the Company; Of Counsel to the law firm of McConn & Williams, L.L.P. | 1995 | 58 | |||

Class II Directors | Principal Occupation and Directorships | Director Since | Age | |||

Chris A. Brisack | Director of ATP Energy, Inc. since 1995; Partner in Norquest & Brisack, LLP; Of Counsel to the law firm of Rodriguez, Colvin & Chaney, LLP; Board Member of Texas State Library & Archives Commission, appointed by Governor George W. Bush. | 2001 | 44 | |||

Walter Wendlandt | Director of the company since 2001; Former Director, Railroad Commission of Texas (18 years); Sole practitioner, Attorney at Law. | 2001 | 73 |

Each of the nominees and Directors named above has been engaged in the principal occupation set forth opposite his name for the past five years except as set forth in the following biographies:

Arthur H. Dilly (BA with honors, MA) has served as a Director since January 2001. From 1981 to 1998, Mr. Dilly served as Executive Secretary of the Board of Regents of the University of Texas System. He currently serves as Chairman and Chief Executive Officer of Austin Geriatrics Center, Inc., a nonprofit corporation providing housing and support services for the low income elderly, a post he has held since 1990. He has served

2

as Vice Chairman of the Board of Directors of the Shivers Cancer Foundation, a nonprofit organization providing patient support services and education, since 1998. From 1978 to 1981, he was Executive Director for Development, The University of Texas System.

Robert C. Thomas (BS—Geological Engineering) has served as a Director since January 2001. Since 1994, Mr. Thomas has served as Chairman of the Board of The Sarkeys Energy Center of the University of Oklahoma and as a Senior Associate with Cambridge Energy Research Associates, an international energy consulting firm. Additionally, between 1998 and 2001 he served as Vice Chairman of the Gas Research Institute Advisory Council (now Gas Technology Institute). In 1994, Mr. Thomas stepped down as Chairman and Chief Executive Officer of Tenneco Gas when he reached mandatory retirement age after thirty-eight years with Tenneco beginning in 1956. He was elected president of Tenneco Gas in 1983 and chairman and chief executive officer in 1990. He was with Tenneco’s domestic exploration and production operations until 1970 when he was elected Vice President of Tenneco Oil Company’s Canadian subsidiary with responsibility for all engineering, drilling, processing plant and production operations. Mr. Thomas is a member of the Board of Directors of PetroCorp Incorporated and an Advisory Director of Pride International, Inc. He was in 2001 immediate past Chairman of the Board of Directors of the YMCA of the Greater Houston Area and President of the Board of Directors of Houston Hospice. He additionally has served on the Board of Governors of The Houston Forum. Mr. Thomas has also served over 10 years on each of the following Board of Directors: The Interstate Natural Gas Association of America, the American Gas Association, Gas Research Institute, and the Institute of Gas Technology. From 1989 to 1994 he was a member of the National Petroleum Council and served as a Vice President of the International Association of LNG Importers headquartered in Paris.

T. Paul Bulmahn (BA, JD, MBA) has served as the Company’s Chairman and President since he founded the company in 1991. In 1991, he was elected Chairman, Houston Bar Association Oil, Gas and Mineral Law Section, and in 1992 he was elected to serve for a three year term on the Oil & Gas Council of the State Bar of Texas. From 1988 to 1991, Mr. Bulmahn served as President and Director of Harbert Oil & Gas Corporation. From 1984 to 1988, Mr. Bulmahn served as Vice President, General Counsel of Plumb Oil Company. From 1978 to 1984, Mr. Bulmahn served as counsel for Tenneco’s interstate gas pipelines and as regulatory counsel in Washington, D.C. From 1973 to 1978, Mr. Bulmahn served the Railroad Commission of Texas, the Public Utility Commission and the Interstate Commerce Commission as an administrative law judge. He has chaired various oil and gas industry seminars, including “Marginal Offshore Field Development” in 1996 and the “Upstream Oil and Gas E-Business Conference” in 2000, and has been a faculty lecturer in natural gas regulations. In June 2000, Mr. Bulmahn was selected Entrepreneur Of The Year 2000 in Energy & Energy Services by Ernst & Young LLP.

Gerard J. Swonke (BA—Economics, JD) has served as a Director since 1995. In November of 2001 he joined the law firm of McConn & Williams, L.L.P. Of Counsel. Between 1985 and 2001, he was Of Counsel to the law firm of Greenberg, Peden, Siegmeyer & Oshman, P.C. With both firms he was engaged in representing domestic and international oil and gas clients in contract drafting and negotiations, including but not limited to Indonesia, Africa and the North Sea. From 1975 to 1985 he was Regional Counsel for Aminoil, Inc. with legal responsibility for the company’s international and domestic obligations. From 1967 to 1974 when he received his law degree he was Controller for Automated Systems Corporation with responsibility for corporate accounting and preparation of financial statements and corporate tax returns.

Chris A. Brisack (BS cum laude, JD) has served as a Director of ATP Energy, Inc. since its creation in May, 1995. He also served as a Director of ATP Oil & Gas Corporation from 1991 until 1995. Mr. Brisack is a partner in the law firm of Norquest & Brisack, LLP. He is also Of Counsel to the law firm of Rodriguez, Colvin & Chaney, LLP. He was appointed by Governor George W. Bush and currently serves on the Texas State Library and Archives Commission. He was Chairman of Special Olympics (Rio Grande Valley) and Leadership Edinburg, and was elected three times as Chairman of the Hidalgo County Republican Party. After finishing law school, he served as law clerk to United States District Court Judge Ricardo Hinojosa, in the Southern District of Texas. Governor Bush twice named Mr. Brisack to the Honorary Inaugural Committee.

3

Walter Wendlandt (BS—Mechanical Engineering, JD) has served as a Director since January 2001. He was Director, Railroad Commission of Texas for a total of eighteen years during the period from 1961 to 1985. Mr. Wendlandt has been a sole practitioner of law since 1984. He served as a Trustee of the Augustana Annuity Trust from 1964 to 1992, a Director of the Georgetown Railroad from 1979 to 1982, and Director of Lamar Savings Association in 1989. He additionally has served as President, National Conference of State Transportation Specialists; Chairman, State Bar Committee on Public Utilities Law; and was a member for six years of the Technical Pipeline Safety Standards Committee of the U.S. Department of Transportation.

Security Ownership of Certain Beneficial Owners

The following table presents information regarding beneficial ownership of our Common Stock as of February 17, 2003, by:

| • | each known beneficial owner of more than 5% of our Common Stock; |

| • | each of our Directors and nominees for Director; |

| • | the persons named in our 2002 Summary Compensation Table; and |

| • | all of our current executive officers and Directors as a group. |

Unless otherwise noted, the persons named in the table have sole voting and investment power with respect to all shares shown as beneficially owned by them. As of February 17, 2003 approximately 20,410,212 shares of common stock were issued and 20,334,372 shares were outstanding. The address of each person in the table is the address of the Company. The number of shares beneficially owned by a person includes shares that are subject to stock options that are exercisable within 60 days of February 17, 2003. The shares are also deemed outstanding for the purpose of computing their percentage ownership. These shares are not outstanding for the purpose of computing the percentage of ownership of any other person.

Beneficial Owner | Shares Beneficially Owned | Percentage of Beneficial Ownership | |||

T. Paul Bulmahn | 9,015,267 | 44.38 | % | ||

Gerald W. Schlief | 3,495,433 | 17.20 | % | ||

Carol E. Overbey | 1,117,738 | 5.50 | % | ||

Albert L. Reese, Jr. | 614,676 | 3.03 | % | ||

Leland Tate (1) | 114,286 | * |

| ||

John E. Tschirhart (1) | 125,500 | * |

| ||

Arthur H. Dilly (2) | 7,500 | * |

| ||

Gerard J. Swonke (2) | 5,000 | * |

| ||

Robert C. Thomas (2) | 15,000 | * |

| ||

Walter Wendlandt (2) | 30,000 | * |

| ||

Chris A. Brisack (2) | 5,000 | * |

| ||

All executive officers and Directors as a group, 11 persons (3) | 14,545,400 | 70.11 | % |

| * | Indicates less than 1 percent |

| (1) | Includes beneficial ownership of the following numbers of shares that may be acquired within 60 days of February 17, 2003 pursuant to stock options awarded under our stock plans: Leland Tate: 114,286 shares; John E. Tschirhart: 117,500 shares. |

| (2) | Includes options to purchase 5,000 shares pursuant to vested stock options granted to non-employee Directors at the time each became a Director. |

| (3) | Includes 256,786 shares that may be acquired through the exercise of stock options. |

4

Directors’ Meetings and Committees of the Board of Directors

The Company’s Board of Directors held nine meetings during 2002. Each Director attended at least 75% of the aggregate total meetings of the Board of Directors and the committees on which such Director served during his tenure of service.

Audit Committee. The Audit Committee currently consists of Messrs. Swonke, Thomas and Wendlandt. The primary purpose of the Committee is to assist the Board in monitoring:

| • | the integrity of the Company’s financial reporting process and systems of internal controls regarding finance, accounting and legal and regulatory compliance; and |

| • | the independence and performance of the Company’s independent auditors and any internal audit function that may be utilized in the future. |

During 2002, the Audit Committee held six meetings. The report of the Audit Committee is set forth below.

Compensation Committee. The compensation committee consists of Messrs. Brisack, Dilly and Swonke. This committee’s responsibilities include:

| • | administering and granting awards under our 2000 Stock Plan; |

| • | reviewing the compensation of our President and recommendations of the President as to appropriate compensation for our other executive officers and key personnel; |

| • | examining periodically our general compensation structure; and |

| • | supervising our pension and compensation plans. |

During 2002 the Compensation Committee held one meeting. The report of the Compensation Committee follows.

Report of the Audit Committee

The Audit Committee is governed by a restated charter adopted by the Board of Directors on May 10, 2001. A copy of the charter was included as Annex A to the Proxy statement relating to our 2002 Annual Meeting of Shareholders. The Audit Committee’s primary duties and responsibilities include:

| • | recommending annually to our Board of Directors the selection of our independent public accountants; |

| • | reviewing and approving the scope of our independent public accountants’ audit activity and the extent of non-audit services; |

| • | reviewing with management and the independent public accountants the adequacy of our basic accounting systems and the effectiveness of our internal audit plan and activities; |

| • | reviewing our financial statements with management and the independent public accountants and exercising general oversight of our financial reporting process; and |

| • | reviewing our litigation and other legal matters that may affect our financial condition and monitoring compliance with our business ethics and other policies. |

Management is responsible for the Company’s internal controls and the financial reporting process. The independent accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and for issuing a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes.

The Audit Committee held six meetings during fiscal 2002. During these meetings, the Audit Committee reviewed and discussed the Company’s financial statements with management and KPMG LLP (“KPMG”), its independent certified public accountants.

5

The Audit Committee reviewed and discussed the audited financial statements of the Company for the fiscal year ended December 31, 2002 with the Company’s management and management represented to the Audit Committee that the Company’s financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee discussed with KPMG matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The Audit Committee received the written disclosures and the letter from KPMG required by Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees), and the Audit Committee discussed with KPMG their independence from the Company.

Based on the Audit Committee’s discussions with management and the independent accountants and the Audit Committee’s review of the representation of management and the report of the independent accountants to the Audit Committee, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2002 for filing with the Securities and Exchange Commission.

Each of the members of the Audit Committee listed below is independent as defined under the listing standards of the National Association of Securities Dealers.

Audit Committee

Gerard J. Swonke, Chairman

Robert C. Thomas

Walter Wendlandt

6

Compensation of Directors

We grant to each of our non-employee Directors options to purchase 5,000 shares of common stock at an exercise price equal to the market value of the stock at the time of the grant for serving as a member of our board of Directors. In addition, each outside Director receives $2,000 per board meeting and $500 per committee meeting attended and is reimbursed for expenses incurred. Directors who are our employees do not receive cash compensation for their services as Directors or members of committees of the Board.

Section 16 Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers, Directors and persons who beneficially own more than 10% of the Common Stock to file reports of ownership and changes in ownership of the Common Stock with the SEC and to furnish the Company with copies of all Section 16(a) forms they file.

Based on the Company’s review of the Section 16(a) filings that have been received by the Company, the Company has identified the following reports that were filed late. Robert C. Thomas filed a late report on Form 4 with respect to one transaction. Mr. Thomas filed the report, which was due by February 11, 2002, on March 6, 2002. Gerald W. Schlief filed one late report on Form 4 with respect to one transaction. Mr. Schlief filed the report, which was due by February 11, 2002, on July 31, 2002. On September 17, 2002, Walter Wendlandt filed one late report on Form 4 with respect to three transactions. The reports for these transactions were due by September 12, 2002, September 13, 2002 and September 16, 2002.

Following the implementation of an accelerated filing deadline, which requires transactions to be reported on Form 4 within two business days of the date of the transaction, the Company has implemented a compliance process with respect to the timely filing of Section 16(a) reports. Under the process, each reporting person who is an officer or director of the Company must contact the Company’s legal department prior to engaging in any transaction in equity securities of the Company. Once contacted, the legal department will assist with the timely filing of all necessary reports. The Company’s management believes that its new compliance process as well as heightened awareness of the requirements of Section 16(a) of the Exchange Act will eliminate or significantly reduce untimely filings in the future.

7

Executive Compensation

The following table sets forth information regarding the compensation of our President and each of our four other most highly compensated executive officers for the years ended December 31, 2002, 2001 and 2000.

Summary Compensation Table

Annual Compensation | All Other Compensation (1) | |||||||

Name and Principal Position | Year | Salary | Bonus | |||||

T. Paul Bulmahn (2) Chairman and President | 2002 2001 2000 | 315,000 190,000 155,600 | 350,000 24,373 85,800 | 5,500 5,100 5,300 | ||||

Gerald W. Schlief (2) Senior Vice President | 2002 2001 2000 | 188,333 175,000 156,900 | 50,000 20,789 31400 | 5,500 5,100 5,300 | ||||

Albert L. Reese, Jr. Senior Vice President | 2002 2001 2000 | 156,833 150,000 125,000 | 15,000 14,185 123,800 | 5,155 4,926 4,400 | ||||

Leland E. Tate Sr. Vice President, Operations | 2002 2001 2000 | 188,333 162,500 55,192 | 29,300 4,300 3,000 | 5,500 4,125 0 | ||||

John E. Tschirhart Sr. Vice President, International and General Counsel | 2002 2001 2000 | 158,333 125,000 93,000 | 40,000 11,003 37,200 | 3,967 2,888 3,900 | ||||

| (1) | Consists of matching contributions to our 401k savings plan. |

| (2) | In 2000, Mr. Bulmahn and Mr. Schlief each received overriding royalty interests in one of our properties at the time we acquired our interest in the property. In connection with their receiving these interests, we recorded a non-cash charge of $0.3 million in 2000. These overriding royalty interests entitle the holder to receive a designated percentage of the net revenue during the life of the property. Our officers received these interests for their contributions to our growth during our early years. We do not expect our officers to receive such interests in the future. |

Stock Options

The Company has not granted any stock options to the named executive officers during the year ended December 31, 2002.

Stock Option Exercises and Fiscal Year-End Values

The named executive officers did not exercise any options during the year ended December 31, 2002. The following table contains information with respect to the value of unexercised options held by each of the named executive officers:

Shares Acquired on Exercise | Value Realized | Number of Securities Underlying Unexercised Options at December 31, 2002 | Value of Unexercised In-the-Money Options at December 31, 2002 (1) | ||||||||||||

Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

Leland E. Tate | 0 | $ | 0 | 84,524 | 104,762 | $ | 13,095 | $ | 6,548 | ||||||

John E. Tschirhart | 0 | $ | 0 | 75,833 | 79,167 | $ | 110,767 | $ | 82,084 | ||||||

| (1) | Based on the closing price on the NASDAQ National Market for Common Stock on December 31, 2002 ($4.07 per share). |

8

2000 Stock Option Plan

Our Board of Directors and our shareholders adopted the 2000 Stock Plan. The purpose of the plan is to provide Directors, employees and consultants of ATP and its subsidiaries additional incentive and reward opportunities designed to enhance the profitable growth of our company. The plan provides for the granting of incentive stock options intended to qualify under Section 422 of the Internal Revenue Code, options that do not constitute incentive stock options and restricted stock awards. The plan is administered by the compensation committee of our Board of Directors. In general, the compensation committee is authorized to select the recipients of awards and the terms and conditions of those awards.

The number of shares of common stock that may be issued under the plan will not exceed 4,000,000 shares, subject to adjustment to reflect stock dividends, stock splits, recapitalizations and similar changes in our capital structure. Shares of common stock which are attributable to awards which have expired, terminated or been canceled or forfeited are available for issuance or use in connection with future awards. The maximum number of shares of common stock that may be subject to awards granted under the plan to any one individual during the term of the plan will not exceed 50% of the aggregate number of shares that may be issued under the plan. The price at which a share of common stock may be purchased upon exercise of an option granted under the plan will be determined by the compensation committee but (a) in the case of an incentive stock option, such purchase price will not be less than the fair market value of a share of common stock on the date such option is granted, and (b) in the case of an option that does not constitute an incentive stock option, such purchase price will not be less than 50% of the fair market value of a share of common stock on the date such option is granted.

Shares of common stock that are the subject of a restricted stock award under the plan will be subject to restrictions on disposition by the holder of such award and an obligation of such holder to forfeit and surrender the shares under certain circumstances. The restrictions will be determined by the compensation committee in its sole discretion, and the compensation committee may provide that the restrictions will lapse upon (a) the attainment of one or more performance targets established by the compensation committee, (b) the award holder’s continued employment with ATP or continued service as a consultant or Director for a specified period of time, (c) the occurrence of any event or the satisfaction of any other condition specified by the compensation committee in its sole discretion or (d) a combination of any of the foregoing.

No awards under the plan may be granted after ten years from the date the plan is adopted by our Board of Directors. The plan will remain in effect until all awards granted under the plan have been satisfied or expired. Our Board of Directors in its discretion may terminate the plan at any time with respect to any shares of common stock for which awards have not been granted. The plan may be amended, other than to increase the maximum aggregate number of shares that may be issued under the plan or to change the class of individuals eligible to receive awards under the plan, by our Board of Directors without the consent of our shareholders. No change in any award previously granted under the plan may be made which would impair the rights of the holder of such award without the approval of the holder.

1998 Stock Option Plan

In December 1998, our Board of Directors and our shareholders adopted the ATP Oil & Gas Corporation 1998 Stock Option Plan. In conjunction with our initial public offering, the 1998 Stock Option Plan was amended to provide that the options granted under the plan will remain outstanding until their termination dates; however, no additional options will be granted.

Options granted under the plan expire on February 9, 2006; however, options granted to an individual who, at the time of the grant, owned more than 10% of our common stock expire five years from the date of the grant. There were no grants to individuals who owned more than 10% of our common stock. Each option under the 1998 Stock Option Plan may not be exercised for more than a percentage of the aggregate number of shares offered by such option in accordance with the following vesting schedule: 1/3 on April 9, 2001, 1/3 on February 9, 2002 and 1/3 February 9, 2003.

9

If there is a merger or consolidation of ATP that results in at least 40% of the outstanding voting stock of ATP (or the successor of ATP) being owned by persons or entities other than the shareholders of ATP prior to the merger or consolidation, all outstanding options will become vested and fully exercisable for the remainder of their terms. If there is a change in control other than as described in the preceding sentence, then the compensation committee may effect certain alternatives with respect to the options, including permitting exercise of the options for a limited period of time, requiring surrender of the option in exchange for cash payments, or providing for subsequent exercise for the number and class of shares of stock or other securities or property in accordance with the terms of the transaction.

401k Savings Plan

Effective March 1, 1997, we adopted a 401k savings plan. This savings and profit sharing plan covers all of our employees. The plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended, and Section 401(a) of the Internal Revenue Code.

The assets of the plan are held and the related investments are executed by the plan’s trustee. Participants in the plan have investment alternatives in which to direct their funds and may direct their funds in one or more of these investment alternatives. We pay all administrative fees on behalf of the plan. The plan provides for discretionary matching by ATP which is currently 50% of each participant’s contributions up to 6% of the participant’s compensation. We contributed $96,581.00 for the year ended December 31, 2002; $70,000 for the year ended December 31, 2001, $56,200 and for the year ended December 31, 2000.

ATP All-Employee Bonus Program

The ATP All-Employee Bonus Program is a bonus program designed to benefit all employees based upon our overall performance. We have historically made payments to employees through the All-Employee Bonus Program on a semi-annual basis when conditions permit. The amount available for each employee under this program is based upon a formula that considers length of service and base compensation. Each employee is eligible to participate in the program allocations effective the first day of the month following the employee’s date of employment with ATP. There are certain restrictions related to payment of an employee’s allocation from the program within their first year of employment. Those payments have represented approximately 20% of average eligible compensation during the allocation period.

Employee Bonus Policy

The purpose of the Employee Bonus Policy is to compensate employees who demonstrate exemplary performance. It is discretionary in amount, in addition to employee compensation and participation in any other benefits offered to employees, and is open to all employees regardless of tenure, title, or responsibility.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the Board of Directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors or Compensation Committee. No person who was an officer or employee of the Company or any of its subsidiaries in 2002, or in prior years, served as a member of the Company’s Compensation committee in 2002.

Report of the Compensation Committee

The primary goal of the Compensation Committee (the “Committee”) is to establish a compensation program that serves the long-term interests of the Company and its stockholders. Such a program is intended to attract and retain the highest caliber employee talent available, and the value of such talent is expected to manifest itself in superior Company performance within the industry. The levels of compensation of our

10

executive officers are determined in a similar manner to the determination of all of our employees. In determining the level of compensation for executive officers who are significant shareholders of the Company, including the CEO, the Committee recognizes that their ownership position provides significant incentives to perform at a high level.

The Company’s compensation program at present consists of three main components: (1) base salary; (2) discretionary bonuses based on overall company performance as well as individual performance as medium term incentives; and (3) discretionary grants of stock options as long term incentives and to align the long term interests of the Company’s employees and the stockholders.

Base Salary. The Company’s objective in determining base salaries is to offer annual compensation that is competitive in the industry. Adjustments to base salaries are made on an as-needed basis depending on the employee’s performance over time, changes in job scope, competition in the market and the Company’s size.

Bonuses. The Company’s bonus programs are intended to provide additional compensation opportunities depending on individual and Company performance. Bonuses under the Company’s discretionary All Employee Bonus Program are determined periodically based on the Company’s performance. The Company’s Incentive Bonus Program provides individual employees with discretionary bonuses based on individual performance.

Stock Option Grants. The Company’s long term incentives are available to all employees in the form of stock option grants under one or both of the Company’s incentive stock option programs. The options are granted at the market price on the date of the grant, and have value only if the stock price increases above the exercise price, and vesting and exercise of the options occur. Vesting occurs only if the recipients remain employed until the end of the vesting period, during which time they have an incentive to contribute to the Company’s improvement in performance. Individual option grants are based on individual performance and responsibility levels within the Company.

Under the 1998 program employees received options with a term of five years. These options vest in the following manner: 1/3 vested sixty days after the Company’s initial public offering, with the remainder vesting 1/3 on the first anniversary and 1/3 on the second anniversary of the initial public offering.

Under the 2000 program employees received options with terms of years and vesting schedules determined by the Committee at the time of each grant.

The Committee periodically reviews the Company’s compensation plan to make sure that the overall plan meets the above goals and is of the opinion that at this time such goals are presently being met. The Committee also believes that the growth of the Company requires continued development of the comprehensive employment philosophy that will assure retention and facilitate attraction of capable executives in the future. To that end, the Committee has identified the need for such a philosophy to address compensation domestically and internationally, as well as the unique features of the Company that have made it successful in the past, and will assure its continued success in the future, at retaining the most qualified personnel.

11

Chief Executive Officer Compensation

The compensation for our Chief Executive Officer is determined with the same criteria as that used to determine compensation for our other executive officers. The Committee recognized that Mr. Bulmahn’s significant ownership position in the Company provides a high level of stock based incentive. The Committee also recognized the substantial contributions made by Mr. Bulmahn during 2002 and prior years in service to the Company, and adjusted his compensation during 2002 to reflect the positive results achieved under his direction and the accomplishment of continued growth for the company.

The Compensation Committee

Chris A. Brisack, Chairman

Gerard J. Swonke

Arthur H. Dilly

12

Shareholder Return Performance Presentation

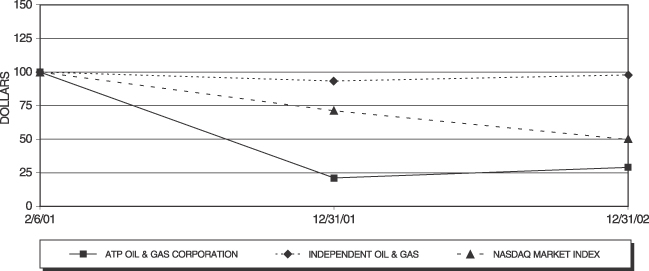

The information set forth in the graph and table on the following page compares the value of the Common Stock to the Nasdaq Market Index and to the MG Independent Oil & Gas Index prepared by Media General Financial Services. Each of the total cumulative returns presented assumes a $100 investment beginning February 6, 2001, the date the Company commenced trading and ending December 31, 2002.

The performance of the indices is shown on a total return (dividend reinvestment) basis; however, we paid no dividends on our common stock during the period shown. The graph lines merely connect the beginning and end of the measuring periods and do not reflect fluctuations between those dates.

Total Return Analysis | 2/6/01 | 12/31/01 | 12/31/02 | ||||

ATP Oil & Gas Corporation | $ | 100.00 | 21.29 | 29.07 | |||

MG Independent Oil & Gas Index | $ | 100.00 | 93.36 | 97.76 | |||

NASDAQ | $ | 100.00 | 71.33 | 49.76 | |||

13

Item 2 on Proxy Card: Ratification of Appointment of Independent Auditors

The Board of Directors has appointed the firm of KPMG LLP as independent auditors of the Company upon the recommendation of the Audit Committee for the fiscal year ending December 31, 2003, and recommends ratification by the shareholders of such appointment.

The Board of Directors recommends a vote “For” this proposal.

Ratification of the appointment of independent auditors requires the affirmative vote of a majority of the votes entitled to be cast by holders of shares of Common Stock who are represented in person or by proxy at the Annual Meeting. Under the TBCA and the Company’s By-laws, an abstention or a broker non-vote would have the same legal effect as a vote against this proposal. A broker non-vote occurs if a broker or other nominee does not have discretionary authority and has not received instructions with respect to a particular item.

Unless otherwise instructed or unless authority to vote is withheld, the enclosed proxy will be voted FOR the appointment of KPMG LLP as independent auditors.

In the event the appointment is not ratified, the Board of Directors will consider the appointment of other independent auditors. The Board of Directors may terminate the appointment of KPMG LLP as the Company’s independent auditors without the approval of the shareholders of the Company whenever the Board of Directors deems such termination necessary or appropriate. A representative of KPMG LLP is expected to attend the Annual Meeting and will have the opportunity to make a statement, if such representative desires to do so, and will be available to respond to appropriate questions.

Audit Fees

The audit fees paid to KPMG total $337,434.00 for audit of the Company’s financial statements for the 2002 fiscal year.

All Other Fees

In addition during 2002, the Company paid to KPMG fees for audit related services totaling $26,500.00 and fees for tax services totaling $39,355. No other fees were paid to KPMG during 2002. The Audit Committee considered the non-audit services provided by KPMG and determined that the services provided are compatible with maintaining KPMG’s independence.

14

Shareholder Proposals and Director Nominations

Shareholders may propose matters to be presented at future shareholders’ meetings and may also nominate persons for election as Directors. Formal procedures exist for such proposals and nominations.

Any shareholder desiring to present a proposal for inclusion in the Company’s proxy materials for the annual meeting of shareholders to be held in 2004 (“the 2004 Annual Meeting”) must present the proposal to the Secretary of the Company not later than December 30, 2003. Only those proposals that comply with the requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended, will be included in the Company’s proxy materials for the 2004 Annual Meeting. Written notice of shareholder proposals submitted outside the process of Rule 14a-8 for consideration at the 2004 Annual Meeting (but not included in the Company’s proxy materials) must be delivered in writing to the Secretary of the Company between December 30, 2003 and January 29, 2004 in order to be considered timely, subject to compliance with any other applicable provisions of the Company’s bylaws. The chairman of the meeting may determine that any proposal for which the Company did not receive timely notice shall not be considered at the meeting. If in the discretion of such chairman any such proposal is to be considered at the meeting, the persons designated in the Company’s proxy materials shall be granted discretionary authority with respect to the untimely stockholder proposal.

The Board of Directors will consider any nominee recommended by shareholders for election at the 2004 Annual Meeting if that nomination is delivered in writing to the Secretary of the Company between December 30, 2003 and January 29, 2004, subject to compliance with any other provisions of the Company’s By-laws.

Other Matters

The Board of Directors does not know of any other matters that are to be presented for action at the Annual Meeting. However, if any other matters properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof, it is intended that the enclosed proxy will be voted in accordance with the judgment of the persons named in the proxy.

By Order of the Board of Directors,

CAROL E. OVERBEY

Corporate Secretary

April 28, 2003

15

ANNUAL MEETING OF SHAREHOLDERS OF

ATP Oil & Gas Corporation

May 28, 2003

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

ê Please detach and mail in the envelope provided. ê

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE.

PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HEREx

1. To elect two Directors to serve until the 2006 Annual Meeting of | FOR | AGAINST | ABSTAIN | |||||||

¨ FOR ALL NOMINEES

¨ WITHHOLD AUTHORITY FOR ALL NOMINEES | NOMINEES: o Arthur H. Dilly o Robert C. Thomas | 2. To ratify the appointment of KPMG LLP as independent | ¨ | ¨ | ¨ | |||||

¨ FOR ALL EXCEPT (See instructions below) | 3. To transact such other business as may properly come before such | |||||||||

INSTRUCTION: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT”and fill in the circle next to each nominee you wish to withhold, as shown here:l

| ||||||||||

To change the address on your account, please check the box at the right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. ¨ | ||||||||||

Signature of Shareholder | Date: | Signature of Shareholder | Date: |

Note: Please sign exactly as your name appears on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

ATP Oil & Gas Corporation

Notice of Annual Meeting of Shareholders

To Be Held May 28, 2003

You are cordially invited to attend the 2003 Annual Meeting of Shareholders (the “Annual Meeting”) of ATP Oil & Gas Corporation, a Texas corporation (the “Company”), which will be held on May 28, 2003 at 10:00 a.m., local time, at the offices of ATP Oil & Gas Corporation, 4600 Post Oak Place, Suite 200, Houston, Texas 77027.

Whether or not you plan to attend the Annual Meeting, we ask that you sign and return the enclosed proxy as promptly as possible to ensure that your shares will be represented. A self-addressed envelope has been enclosed for your convenience. If you attend the meeting, you may withdraw any previously given proxy and vote your shares in person.

(Continued and to be signed on the reverse side)