Exhibit 4.2

INCORPORATED UNDER THE LAWS OF THE STATE OF MARYLAND SERIES C CONVERTIBLE NONCUMULATIVE PERPETUAL PREFERRED STOCK, PAR VALUE $1.00 SEE REVERSE FOR CERTAIN DEFINITIONS CUSIP 20366P 20 9 THIS CERTIFIES THAT is the owner of FULLY PAID AND NONASSESSABLE SHARES OF SERIES C CONVERTIBLE NONCUMULATIVE PERPETUAL PREFERRED STOCK, $1.00 PAR VALUE PER SHARE, OF The shares represented by this certificate are transferable only on the stock transfer books of Community Financial Shares, Inc. (the “Company”) by the holder of record hereof, or by his duly authorized PREFERRED attorney or legal representative, upon the surrender of this certificate properly endorsed. This certificate and the shares represented hereby are issued and shall be held subject to all the provisions of the Articles of Incorporation and Bylaws of the Company and any amendments thereto (copies of which are on file with the Corporate Secretary of the Company), to all of which provisions the holder by acceptance hereof, assents. The shares evidenced by this certificate are not of an insurable type and are not insured by the Federal Deposit Insurance Corporation. IN WITNESS THEREOF, COMMUNITY FINANCIAL SHARES, INC. has caused this certificate to be executed by the facsimile signatures of its duly authorized officers and has caused a facsimile of its corporate seal to be hereunto affixed. Dated: CORPORATE SECRETARY PRESIDENT & CHIEF EXECUTIVE OFFICER

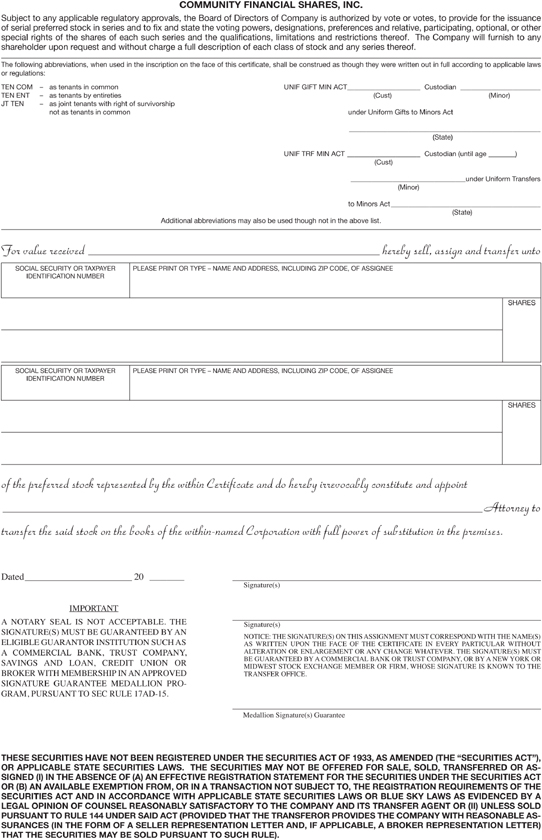

COMMUNITY FINANCIAL SHARES, INC. Subject to any applicable regulatory approvals, the Board of Directors of Company is authorized by vote or votes, to provide for the issuance of serial preferred stock in series and to fix and state the voting powers, designations, preferences and relative, participating, optional, or other special rights of the shares of each such series and the qualifications, limitations and restrictions thereof. The Company will furnish to any shareholder upon request and without charge a full description of each class of stock and any series thereof. The following abbreviations, when used in the inscription on the face of this certificate, shall be construed as though they were written out in full according to applicable laws or regulations: TEN COM as tenants in common TEN ENT as tenants by entireties JT TEN – as joint tenants with right of survivorship not as tenants in common UNIF GIFT MIN ACT Custodian (Cust) (Minor) under Uniform Gifts to Minors Act (State) UNIF TRF MIN ACT Custodian (until age) (Cust) under Uniform Transfers (Minor) to Minors Act Additional abbreviations may also be used though not in the above list. For value received hereby sell, assign and transfer unto SOCIAL SECURITY OR TAXPAYER IDENTIFICATION NUMBER PLEASE PRINT OR TYPE – NAME AND ADDRESS, INCLUDING ZIP CODE, OF ASSIGNEE SHARES SOCIAL SECURITY OR TAXPAYER IDENTIFICATION NUMBER PLEASE PRINT OR TYPE – NAME AND ADDRESS, INCLUDING ZIP CODE, OF ASSIGNEE SHARES of the preferred stock represented by the within Certificate and do hereby irrevocably constitute and appoint Attorney to transfer the said stock on the books of the within-named Corporation with full power of substitution in the premises. Dated 20 SIGNATURE(S) A NOTARY SEAL MUST IS NOT BE GUARANTEED ACCEPTABLE. BY THE AN A ELIGIBLE COMMERCIAL GUARANTOR BANK, INSTITUTION TRUST COMPANY, SUCH AS BROKER SAVINGSWITH ANDMEMBERSHIP LOAN, CREDIT IN ANUNION APPROVED OR SIGNATURE GRAM, PURSUANT GUARANTEE TO SEC RULE MEDALLION 17AD-15.PRO-Signature(s) Signature(s) AS NOTICE: WRITTEN THE SIGNATURE(S) UPON THE FACE ON THIS OF THE ASSIGNMENT CERTIFICATE MUST IN CORRESPOND EVERY PARTICULAR WITH THE WITHOUT NAME(S) ALTERATION BE GUARANTEED OR ENLARGEMENT BY A COMMERCIAL OR ANY BANK CHANGE OR TRUST WHATEVER. COMPANY, THE ORSIGNATURE(S) BY A NEW YORK MUST OR TRANSFER MIDWEST STOCK OFFICE. EXCHANGE MEMBER OR FIRM, WHOSE SIGNATURE IS KNOWN TO THE Medallion Signature(s) Guarantee THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OR (B) AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS OR BLUE SKY LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY AND ITS TRANSFER AGENT OR (II) UNLESS SOLD PURSUANT TO RULE 144 UNDER SAID ACT (PROVIDED THAT THE TRANSFEROR PROVIDES THE COMPANY WITH REASONABLE ASSURANCES (IN THE FORM OF A SELLER REPRESENTATION LETTER AND, IF APPLICABLE, A BROKER REPRESENTATION LETTER) THAT THE SECURITIES MAY BE SOLD PURSUANT TO SUCH RULE).