Exhibit 99.3

Wipro Limited

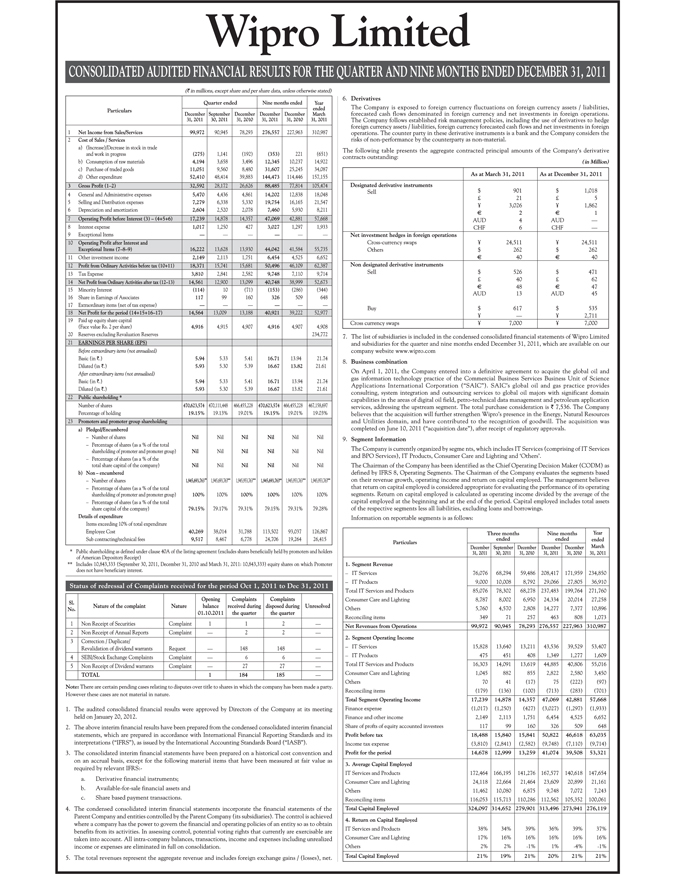

CONSOLIDATED AUDITED FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED DECEMBER 31,2011

Particulars Quarter ended Nine months ended Year ended March 31,2011

December 31,2011 September 30,2011 December 31,2010 December 31,2011 December 31,2010

1 |

| Net Income from Sales/Services 99,972 90,945 78,293 276357 227,963 310,987 |

2 |

| Cost of Sales/Services |

a) (Increase)/Decrease in stock in trade and work in progress

b) Consumption of raw materials

c) Purchase of traded goods

d) Other expenditure (275) 4,194 11,051 52,410 1,141 3,658 9,560 48,414(192) 3,496 8,480 39,883(353) 12345 31,607 144,473 221 10,237 25,245 114,446(651) 14,922 34,087 157,155

3 |

| Gross Profit (1-2) 32,592 28,172 26,626 88,485 77,814 105,474 |

4 |

| General and Administrative expenses |

5 |

| Selling and Distribution expenses |

6 Depreciation and amortization 5,470 7,279 2,604 4,436 6,338 2,520 4,861 5330 2,078 14,202 19,754 7,460 12,838 16,165 5,930 18,048 21347 8,211

7 |

| Operating Profit before Interest (3) -{4+5+6) 17,239 14,878 14357 47,069 42,881 57,668 |

8 |

| Interest expense |

9 Exceptional Items 1,017 1,250 427 3,027 1,297 1,933

10 |

| Operating Profit after Interest and Exceptional Items (7-8-9) 16,222 13,628 13,930 44,042 41,584 55,735 |

11 |

| Other investment income 2,149 2,113 1,751 6,454 4,525 6,652 |

12 |

| Profit from Ordinary Activities before tax(10+ll) 18,371 15,741 15,681 50,496 46,109 62387 |

13 |

| Tax Expense 3,810 2,841 2382 9,748 7,110 9,714 |

14 |

| Net Profit from Ordinary Activities after tax (12-13) 14361 12,900 13,099 40,748 38,999 52,673 |

15 |

| Minority Interest |

16 |

| Share in Earnings of Associates |

17 |

| Extraordinary items (net of tax expense)(114) 117 10 99(71) 16C(153) 326(286) 509(344) 648 |

18 |

| Net Profit of the pericxl(14+15+16-17) 14364 13,009 13,188 40,921 39,222 52,977 |

19 |

| Paid up equity share capital (Face value Rs. 2 per share) |

20 |

| Reserves excluding Revaluation Reserves 4,916 4,915 4,907 4,916 4,907 4,908 234,772 |

21 |

| EARNINGS PER SHARE (EPS) |

Before extraordinary items (not annualized)

Basic (in )

Diluted (in)

After extraordinary items (not annualized)

Basic (in)

Diluted (in ) 5.94 5.93

5.94 |

| 5.93 5.33 5.30 |

5.33 |

| 5.30 5.41 539 |

5.41 |

| 539 16.71 16.67 |

16.71 |

| 16.67 13.94 13.82 |

13.94 |

| 13.82 21.74 21.61 |

21.74 21.61

22 |

| Public shareholding * |

Number of shares Percentage of holding 470*23,574 19.15% 470,111,448

19.13% |

| 465,45522! 19.01% 470,623374 19.15% 465,455,128 19.01% 467,151,697 19.03% |

23 |

| Promoters and promoter group shareholding |

a) Pledge/Encumbered

- Number of shares

- Percentage of shares (as a % of the total shareholding of promote! and promotet group)

- Percentage of shares (as a % of the total share capital of the company)

b) Non-encumbered

- Number of shares

- Percentage of shares (as a % of the total shareholding of promotet and promoter group)

- Percentage of shares (as a % of the total share capital of the company)

Details of expenditure

Items exceeding 10% of total expenditure

Employee Cost

Sub contracting/technical fees Nil Nil Nil 1,945*93,363” 100% 79.15%

40,269 9,517 Nil Nil Nil

llWrtT

100%

79.17%

38,014 8,467 Nil Nil Nil

W5J5IJ8”

100% 7931%

31,788 6,778 Nil NO NO

100% 79.15%

113,502 24,706 Nil

Nil

Nil

1.945MO”

100% 7931%

93,037 19,264 Nil Nil Nil

100% 79.28%

126,867 26,415

* Public shareholding as defined under clause 40A of the listing agreement (excludes shares beneficially held by promoters and holders

of American Depository Receipt] ** Includes 10,843,333 (September 30,2011, December 31, 2010 and March 31, 2011:10,843,333) equity shares on which Promoter

does not have beneficiary interest,

Status of redressal of Complaints received for the period Oct 1, 2011 to Dec 31, 2011

SI. No. Nature of the complaint Nature Opening

balance

01.10.2011 Complaints

received during

the quarter Complaints

disposed during

the quarter Unresolved

1 |

| Non Receipt of Securities Complaint 1 1 2 — |

2 |

| Non Receipt of Annual Reports Complaint—2 2 — |

3 |

| Correction / Duplicate/ Revalidation of dividend warrants Request 148 148 |

4 |

| SEBI/Stock Exchange Cotnpkunts Complaint — 6 6 — |

5 |

| Non Receipt of Dividend warrants Complaint—27 27 — |

TOTAL 1 184 185 -

Note: There are certain pending cases relating to disputes over title to shares in which the company has been made a party. However these cases are not material in nature.

1. |

| The audited consolidated financial results were approved by Directors of the Company at its meeting held on January 20, 2012. |

2. |

| The above interim financial results have been prepared from die condensed consolidated interim financial statements, which are prepared in accordance with International Financial Reporting Standards and its interpretations (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). |

3. |

| The consolidated interim financial statements have been prepared on a historical cost convention and on an accrual basis, except for the following material items that have been measured at fair value as required by relevant IFRS:- |

a. |

| Derivative financial instruments; |

b. |

| Available-for-sale financial assets and |

c. |

| Share based payment transactions. |

4. |

| The condensed consolidated interim financial statements incorporate the financial statements of the Parent Company and entities controlled by the Parent Company (its subsidiaries). The control is achieved where a company has the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities. In assessing control, potential voting rights that currently are exercisable are taken into account. All intra-company balances, transactions, income and expenses including unrealized income or expenses are eliminated in full on consolidation. |

5. The total revenues represent the aggregate revenue and includes foreign exchange gains / (losses), net.

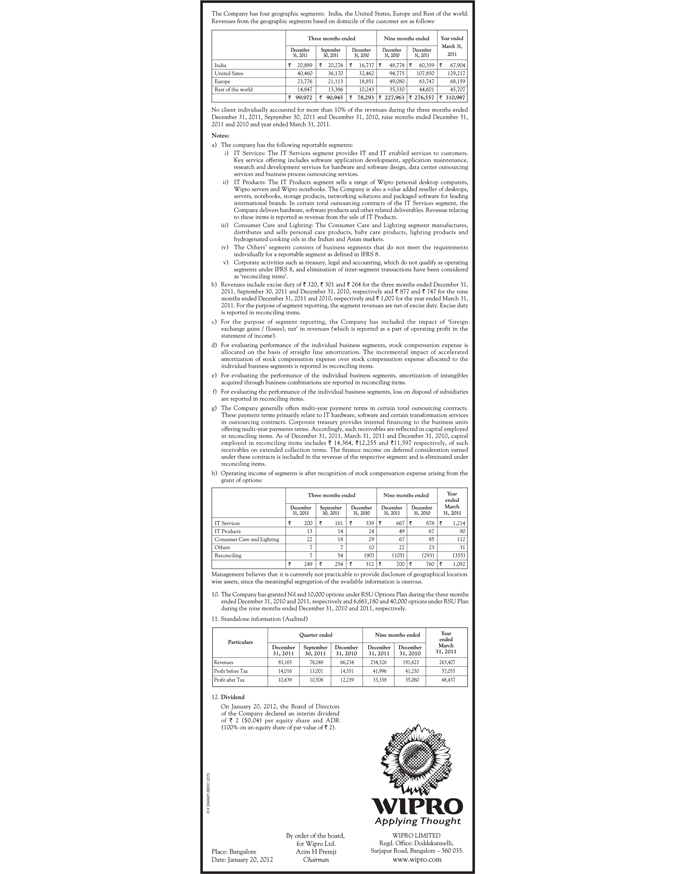

6. Derivatives

The Company is exposed to foreign currency fluctuations on foreign currency assets / liabilities, forecasted cash flows denominated in foreign currency and net investments in foreign operations. The Company follows established risk management policies, including the use of derivatives to hedge foreign currency assets / liabilities, foreign currency forecasted cash flows and net investments in foreign operations. The counter party in these derivative instruments is a bank and the Company considers the risks of non-performance by the counterparty as non-material.

The following table presents the aggregate contracted principal amounts of the Company’s derivative contracts outstanding:

(in Minim)

As at March 31,2011 As at December 31, 2011

Designated derivative instruments

Sell $ 901 £ 21 V 3,026 € 2 AUD 4 CHF 6 $ 1,018 £ 5 ¥ 1,862 € 1 AUD — CHF —

Net investment hedges in foreign operations Cross-currency swaps Others ¥ 24,511 $ 262 e 40 ¥ 24,511 $ 262 e 40

Non designated derivative Instruments

Sell

Buy $ 526

£ 40

€ 48

AUD 13

$ 617 ¥ — $ 471

£ 62

€ 47

AUD 45

$ 535 ¥ 2,711

Cross currency swaps ¥ 7,000 ¥ 7,000

7. |

| The list of subsidiaries is included in the condensed consolidated financial statements of Wipro Limited and subsidiaries for the quarter and nine months ended December 31, 2011, which are available on our company website www.wipro.com |

8. Business combination

On April 1, 2011, the Company entered into a definitive agreement to acquire the global oil and gas information technology practice of the Commercial Business Services Business Unit of Science Applications International Corporation (“SAIC”). SAIC’s global oil and gas practice provides consulting, system integration and outsourcing services to global oil majors with significant domain capabilities in the areas of digital oil field, petro-technical data management and petroleum application services, addressing the upstream segment. The total purchase consideration is 7 7,536. The Company believes that the acquisition will further strengthen Wipro’s presence in the Energy, Natural Resources and Utilities domain, and have contributed to the recognition of goodwill. The acquisition was completed on June 10, 2011 (“acquisition date”), after receipt of regulatory approvals.

9. |

| Segment Information |

The Company is currently organized by segments, which includes IT Services (comprising of IT Services and BPO Services), IT Products, Consumer Care and Lighting and ‘Others’.

The Chairman of the Company has been identified as the Chief Operating Decision Maker (CODM) as defined by IFRS 8, Operating Segments. The Chairman of the Company evaluates the segments based on their revenue growth, operating income and return on capital employed. The management believes that return on capital employed is considered appropriate for evaluating the performance of its operating segments. Return on capital employed is calculated as operating income divided by the average of the capital employed at the beginning and at the end of the period. Capital employed includes total assets of the respective segments less all liabilities, excluding loans and borrowings. Information on reportable segments is as follows:

Particulars Three months ended Nine months ended Year ended March 31,2011

December 31,2011 September 30,2011 December 31,2010 December 31,2011 December 31,2010

1. Segment Revenue

— IT Services

- IT Products

Total IT Services and Products Consumer Care and Lighting Others Reconciling items 76,076 9,000 68,294 10,008 59,486 8,792 208,417 29,066 171,959 27,805 234,850 36,910

85,076

8,787

5,760

349 78302

8,002

4,570

71 |

| 68,278 |

6,950

2,808

257 237,483

24334

14,277

463 199,764

20,014

7377

608 271,760 27,258 10,896 1,073

Net Revenues from Operations 99,972 90,945 78,293 276,557 227,963 310,987

2. Segment Operating Income

— IT Services

— IT Products

Total IT Services and Products

Consumer Care and Lighting

Others

Reconciling items

Total Segment Operating Income

Finance expense

Finance and other income

Share of profit of equity accounted investees

Profit before tax

Income tax expense

Profit for the period 15,828 475 13,640 451 13,211 408 43,536 1349 39,529 1,277 53,407 1,609

16,303

1,045

70

(179) 14,091

882

41

(136) 13,619

855 (17) (100) 44,885

2,822

75

(713) 40,806 2,580 (222) (283) 55,016 3,450 (97) (701)

17,239

(1,017)

2,149

117 14,878

(1,250)

2,113

99 |

| 14,357 |

(427)

1,751

160 47,069

(3,027)

6,454

326 42,881

(1,297)

4,525

509 57,668

(1,933)

6,652

648

18,488 (3,810) 15,840 (2,841) 15,841 (2,582) 50,822 (9,748) 46,618 (7,110) 63,035 (9,714)

14,678 12,999 13,259 41,074 39,508 53,321

3. Average Capital Employed IT Services and Products Consumer Care and Lighting Others Reconciling items 172,464 24,118 11,462

116,053 166,195 22,664

10,080 115,713 141,276

21,464

6,875

110,286 167,577

23,609

9,748

112,562 140,618

20,899

7,072

105352 147,654

21,161

7,243

100,061

Total Capital Employed 324,097 314,652 279,901 313,496 273,941 276,119

4. Return on Capital Employed IT Services and Products Consumer Care and Lighting Others 38% 17% 2% 34% 16% 2% 39% 16% -1% 36% 16% 1% 39% 16% 4% 37% 16%

-1%

Total Capital Employed 21% 19% 21% 20% 21% 21%

The Company has four geographic segments: India, the United States, Europe and Rest of the world. Revenues from the geographic segments based on domicile of the customer are as follows:

Three months ended Nine months ended Year ended

March 31,

2011

December 31,2011 September 30,2011 December 31,2010 December 31,2010 December 31,2011

India Rs. 20,889 Rs. 20,276 Rs. 16,737 Rs. 48,778 Rs. 60,359 Rs. 67,904

United Sates 40,460 36,170 32,462 94,775 107,850 129,217

Europe 23,776 21,113 18,851 49,080 63,747 68,159

Rest of the world 14,847 13,386 10,243 35,330 44,601 45,707

Rs. 99,972 Rs. 90,945 Rs. 78,293 Rs. 227,963 276,557 310,987

No client individually accounted for more than 10% of die revenues during the three months ended December 31, 2011, September 30, 2011 and December 31, 2010, nine months ended December 31, 2011 and 2010 and year ended March 31, 2011.

Notes:

a) The company has the following reportable segments:

i) IT Services: The IT Services segment provides IT and IT enabled services to customers.

Key service offering includes software application development, application maintenance,

research and development services for hardware and software design, data center outsourcing

services and business process outsourcing services. ii) IT Products: The IT Products segment sells a range of Wipro personal desktop computers,

Wipro servers and Wipro notebooks. The Company is also a value added reseller of desktops,

servers, notebooks, storage products, networking solutions and packaged software for leading

international brands. In certain total outsourcing contracts of the IT Services segment, the

Company delivers hardware, software products and other related deliverables. Revenue relating

to these items is reported as revenue from the sale of IT Products. iii) Consumer Care and Lighting: The Consumer Care and Lighting segment manufactures,

distributes and sells personal care products, baby care products, lighting products and hydrogenated cooking oils in the Indian and Asian markets. iv) The Others’ segment consists of business segments that do not meet the requirements individually for a reportable segment as defined in IFRS 8. v) Corporate activities such as treasury, legal and accounting, which do not qualify as operating

segments under IFRS 8, and elimination of inter-segment transactions have been considered

as ‘reconciling items’.

b) |

| Revenues include excise duty of 320, 301 and 264 for the three months ended December 31, 2011, September 30, 2011 and December 31, 2010, respectively and 877 and 747 for the nine months ended December 31, 2011 and 2010, respectively and 7 1,007 for the year ended March 31, 2011. For the purpose of segment reporting, the segment revenues are net of excise duty. Excise duty is reported in reconciling items. |

c) |

| For the purpose of segment reporting, the Company has included the impact of ‘foreign exchange gains / (losses), net’ in revenues (which is reported as a part of operating profit in the statement of income). |

d) |

| For evaluating performance of the individual business segments, stock compensation expense is allocated on the basis of straight line amortization. The incremental impact of accelerated amortization of stock compensation expense over stock compensation expense allocated to the individual business segments is reported in reconciling items. |

e) |

| For evaluating the performance of the individual business segments, amortization of intangibles acquired through business combinations are reported in reconciling items. |

f) |

| For evaluating the performance of the individual business segments, loss on disposal of subsidiaries are reported in reconciling items. |

g) |

| The Company generally offers multi-year payment terms in certain total outsourcing contracts. These payment terms primarily relate to IT hardware, software and certain transformation services in outsourcing contracts. Corporate treasury provides internal financing to the business units offering multi-year payments terms. Accordingly, such receivables are reflected in capital employed in reconciling items. As of December 31, 2011, March 31, 2011 and December 31, 2010, capital employed in reconciling items includes f 14,364, 12,255 and 11,597 respectively, of such receivables on extended collection terms. The finance income on deferred consideration earned under these contracts is included in the revenue of the respective segment and is eliminated under reconciling items. |

h) Operating income of segments is after recognition of stock compensation expense arising from the grant of options:

Three months ended Nine months ended Year ended March 31, 2011

December 31,2011 September 30,2011 December 31,2010 December 31,2011 December 31,2010

IT Services 200 161 339 f 667 f 878 1,214

IT Products 13 14 24 49 67 90

Consumer Care and Lighting 22 18 29 67 85 112

Others 7 7 10 22 23 31

Reconciling 7 54(90)(105)(293)(355)

T 249 T 254 T 312 7 700 J 760 1,092

Management believes that it is currently not practicable to provide disclosure of geographical location wise assets, since the meaningful segregation of the available information is onerous.

10. |

| The Company has granted Nil and 10,000 options under RSU Options Plan during the three months ended December 31,2010 and 2011, respectively and 6,661,180 and 40,000 options under RSU Plan during the nine months ended December 31, 2010 and 2011, respectively. |

11. Standalone information (Audited)

Particulars Quarter ended Nine months ended Year

ended March 31,2011

December 31,2011 September 30,2011 December 31, 2010 December 31,2011 December 31, 2010

Revenues 83,165 78,048 66,234 234,326 191,623 263,407

Profit before Tax 14,016 13,001 14,551 41,996 41,250 57,055

Profit after Tax 10,639 10,506 12,239 33,338 35,060 48,437

12. |

| Dividend |

On January 20, 2012, the Board of Directors of the Company declared an interim dividend of 7 2 ($0.04) per equity share and ADR (100% on an equity share of par value of 2). /WO

*SSSfeviii

By order of the board, WIPRO LIMITED

for Wipro Ltd. Regd. Office: Doddakannelli,

Place: Bangalore Azim H Premji Sarjapur Road, Bangalore—560 035.

Date: January 20,2012 Chairman www.wipro.com