HIP Energy Corporation

Suite 404-999 Canada Place

World Trade Centre

Vancouver, BC, Canada V6E 3E2

January 14, 2011

Securities and Exchange Commission

100 F Street North East

Washington, DC 20549

U.S.A.

| Attention: | John Reynolds, Assistant Director |

| | Division of Corporation Finance |

Dear Sirs:

| Re: | HIP Energy Corporation |

| | Form 20-F for the Fiscal Year Ended November 30, 2009 |

| | Filed: April 23, 2010 (the “Form 20-F”) |

| | File No. 000-30972 |

Thank you for your letter of November 29, 2010 with respect to the Form 20-F. We provide below our responses to your comments. For your ease of reference, the responses are numbered in a manner that corresponds with your comments.

Form 20-F for Fiscal Year Ended November 30, 2009

Item 4 Information on HIP Energy Corporation, page 13

| 1. | We note the projected results of operations in this filing and other filings, such as the Form 6-K for the period ending May 31, 2010. Please tell us why you believe it is appropriate to include projections in your reports. In this regard, among other factors, we note the absence of historical operations and your unproven technology. |

The Company has attached as exhibit “A” to this letter a draft amendment to the Form 20-F (the “Form 20-F/A”) omitting the projections included in the Company’s Form 20-F. The projections were inadvertently included in the table of management prepared projected operating expenses for the ensuing year. See the revised table under the heading “Project 1 – Budget for First Financing” on page 23 of the Form 20-F/A.

Item 7 Major Shareholders and Related Party Transactions, page 35

| 2. | In future filings, please disclose the names of the related parties involved in any material related party transactions, in addition to stating their relationship to you. |

- 2 -

The Company will disclose the names of all related parties involved in any material related party transaction in future filings with the Securities and Exchange Commission.

Item 15T. Controls and Procedures, page 45

Disclosure Controls and Procedures, page 45

| 3. | We note your disclosure that your disclosure controls and procedures (“DC&P”) evaluation was performed as of December 31, 2009. Please amend your disclosure to provide your evaluation as of your fiscal year end November 30, 2009, as opposed to December 31, 2009. Refer to Item 15(a) of Form 20-F. |

The Company has corrected the year end reference in its disclosure controls and procedures evaluation. See the revised disclosure on page 45 of the Form 20-F/A.

Management’s Annual Report on Internal Control Over Financial Reporting, page 45

| 4. | We note your disclosure under this heading stating “our CEO and CFO have evaluated the effectiveness of our disclosure controls and procedures (as such term is defined in Rules 13a-15 and 15d-15 under the Exchange Act) as of the end of the period covered by this Annual Report are ineffective.” Please amend your Form 20-F to conclude your internal control over financial reporting (“ICFR”), as defined in Rule 13a-15(f) and 15d- 15(f) under the Exchange Act, was ineffective as of November 30, 2009. Refer to Item 15(b)(3) of Form 20-F. |

The Company has revised the disclosure on page 46 of the Form 20-F/A to disclose that the internal control over financial reporting was ineffective as of November 30, 2009 as requested.

| 5. | We note that you identified several material weaknesses in your ICFR. Please describe in an amendment to your Form 20-F the pervasiveness the material weaknesses’ impacts on your ICFR and financial reporting. In addition, describe your plans to remediate the material weaknesses. |

The Company has added the following disclosure respecting the weaknesses in its ICFR and its plans to remediate same on page 46 of the Form 20-F/A as follows:

These weaknesses in our internal controls over financial reporting greatly increase the likelihood that a material misstatement would not be prevented or detected. Management and our Board work to mitigate the risk of a material misstatement in financial reporting; however, there can be no assurance that this risk can be reduced to less than a remote likelihood of a material misstatement.

During the review period ending November 30, 2009 the Company was designated as a shell company having had no defined business during the same period management had nominal financial resources to retain independent management and thus much of the financial oversight was handled by one individual holding the office of both CEO and CFO. Although financial recording and preparation of internal and filed financial statements were undertaken by other third parties, all material financial transactions were not routinely reviewed by independent directors or officers.

- 3 -

| During fiscal 2010 the Company took steps to address weaknesses in its ICFR including greatly expanding its board of directors, segregating the duties of CEO and CFO and increasing its internal financial oversight review and approval process, including establishing an audit committee and the requirement of two signatories on all transactions in excess of $5000. In addition all internally prepared general ledgers are reviewed by the companies VP finance before submission to its independent accountants. |

| | |

| 6. | We note management and your Board work to mitigate the risk of a material misstatement in financial reporting stemming from the identified material weaknesses. Please describe in an amendment to your Form 20-F the controls that mitigate the risk of a material misstatement. |

Please see the Company’s response to question 5 above and the revised disclosure on page 46 of the Form 20-F/A.

Other

| 7. | Please provide us with your analysis supporting the conclusion that the company continues to be a foreign private issuer following its March 30, 2010 transactions. |

The term “foreign private issuer” is defined in Rule 3b-4 of the Securities Exchange Act of 1934 as follows:

“The termforeign private issuer means any foreign issuer other than a foreign government except for an issuer meeting the following conditions as of the last business day of its most recently completed second fiscal quarter:

| | 1. | More than 50 percent of the issuer's outstanding voting securities are directly or indirectly held of record by residents of the United States; and |

| | | | |

| | 2. | Any of the following: |

| | | | |

| | | i. | The majority of the executive officers or directors are United States citizens or residents; |

| | | | |

| | | ii. | More than 50 percent of the assets of the issuer are located in the United States; or |

| | | | |

| | | iii. | The business of the issuer is administered principally in the United States.” |

On page 36 of the Form 20-F the Company included the following geographic breakdown of the Company’s stockholders showing that U.S. residents held less than 50% of the issued and outstanding voting securities of the Company:

- 4 -

As of March 31, 2010, Computershare Trust Company, our registrar and transfer agent, reported that our company’s 56,211,660 common shares are held as follows:

| | | Percentage of | Number of Registered |

| Location | Number of Shares | Shares | Shareholders of Record |

| Canada | 6,197,651 | 11% | 23 |

| United States | 20,013,951 | 35.6% | 14 |

| British VirginIslands | 30,000,000 | 53.4% | 1 |

| Other | 58 | * | 1 |

| Total | 56,211,660 | 100% | 39 |

* Less than 1%.

Accordingly, based on the fact that the Company had less than 50% of its shareholders resident in the U.S. and was a “foreign issuer” as at March 31, 2010 the Company believes it continued to be a foreign private issuer following the March 30, 2010 transaction.

We look forward to any further comments you may have in regard to the Form 20-F or with respect to the above responses. Should you have any questions, please do not hesitate to contact the writer directly.

Yours truly,

HIP ENERGY CORPORATION

/s/ Richard Coglon

Richard Coglon

President

EXHIBIT A

Form 20-F/A

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F /A

(Amendment No. 1)

(Mark One)

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedNovember 30, 2009.

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _______________________

For the transition period from ____________________ to ____________________

Commission file number000-30972

HIP ENERGY CORPORATION

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 404 – 999 World Trade Centre

Vancouver, British Columbia, Canada V6E 3E2

(Address of principal executive offices)

Richard Coglon, President,

604.641.1367

richard@hipenergycorp.com

Suite 404 – 999 World Trade Centre

Vancouver, British Columbia, Canada V6E 3E2

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Name of each exchange on which registered |

| Not Applicable | Not Applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not Applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

There were 6,211,660, common shares, without par value, issued and outstanding as of November 30, 2009.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] YES [X] NO

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

[ ] YES [X] NO

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] YES [ ] NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)

[ ] YES [ ] NO

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [ ] | International Financial Reporting Standards as issued | Other [X] |

| | by the International Accounting Standards Board [ ] | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

[X] Item 17 [ ] Item 18

2

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

[ ] YES [X] NO

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

[ ] YES [ ] NO

3

EXPLANATORY NOTE

This Amendment No. 1 (the “Amended 20-F”) to Hip Energy Corporation’s (the “Company”) Annual Report on Form 20-F for the year ended November 30, 2009, amends our Annual Report on Form 20-F for the year ended December 31, 2009 which was initially filed with the Securities and Exchange Commission on April 23, 2010, (the “Original Filing”). The Amended 20-F is being filed for the following purposes:

| | (a) | remove certain management projections inadvertently included in the table of projected operating expenses under the heading “Plan of Operation”; |

| | | |

| | (b) | correct a typographical error with respect to the date the Company’s management performed an evaluation of the Company’s disclosure controls and procedures under the heading “Item 15T. Controls and Procedures”; and |

| | | |

| | (c) | provide additional disclosure regarding the material weaknesses in the Company’s internal controls over financial reporting and the Company’s plans to remediate the material weaknesses. |

Other than as expressly set forth above, this Amended 20-F does not, and does not purport to, update or restate the information in any Item of the Original Filing or reflect any events that have occurred after the Original Filing was filed. The filing of this Amended 20-F shall not be deemed an admission that the Form 10-K, when made, included any known, untrue statement of material fact or knowingly omitted to state a material fact necessary to make a statement not misleading.

PART I

GENERAL

In this Annual Report on Form 20-F, references to:

“Asset Purchase Agreement” means the asset purchase agreement among HIP, HIP Texas, EEL, and HIP Resources dated March 14, 2010;

“EEL” means Equi Energy LLC, a Texas corporation;

“HIP Resources” means HIP Energy Resource Limited, a British Virgin Islands corporation;

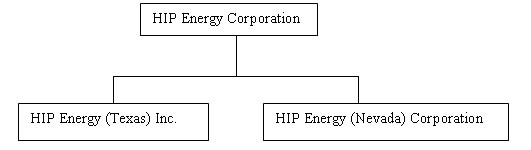

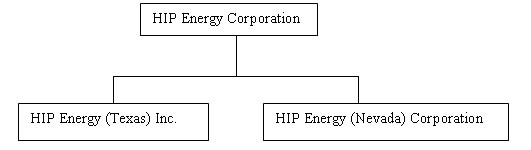

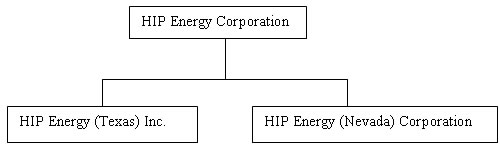

“HIP Nevada” means HIP Energy (Nevada) Corporation, a Nevada corporation and a wholly owned subsidiary of HIP;

“HIP Tech” means HIP Technology Limited, a British Virgin Islands corporation;

“HIP Texas” means HIP Energy (Texas), Inc., a Texas corporation and a wholly owned subsidiary of HIP;

“HIP Downhole Process Technology” means the technology relating to the hydrogen inducement down hole oil and gas recovery process acquired by HIP Texas pursuant to the License Agreement, which is described in more detail under the heading “Business Overview - HIP Downhole Process Technology”;

“Group Rich” means Group Rich Development Limited, a British Virgin Islands corporation;

“License Agreement” means the license agreement among HIP Tech, Group Rich, HIP Nevada and HIP dated March 14, 2010;

“We”, “us”, “our”, the “Company”, and “HIP” means HIP Energy Corporation, a British Columbia corporation; and

“Well Bores” means the rights acquired to various well bores by HIP Nevada pursuant to the Asset Purchase Agreement.

Certain statements in this annual report are not historical and are forward-looking statements. These statements relate to expectations, beliefs, intentions, plans, objectives, assumptions or future events or performance of HIP. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “intend”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “project”, “predict”, “potential”, or “continue” or the negative of these terms or other comparable terminology. In particular, this annual report contains forward-looking statements pertaining to the following:

the quantity of potential oil and gas reserves;

potential oil and gas production levels;

potential production and operating activities and timing of such activities;

capital expenditure programs;

our ability to raise capital;

projections of market prices and costs;

4

discussion regarding any future joint venture agreements;

the acquisition of future well bores;

the viability of the HIP Downhole Process Technology; and

treatment under governmental regulatory regimes and tax laws.

Readers should read these forward-looking statements carefully because they discuss future expectations, contain projections of future results of operations or of financial condition or state other forward-looking information. Readers should be aware that these forward-looking statements involve known and unknown risks, uncertainties and contingencies and are based on assumptions that may not materialize or occur in the manner assumed. Consequently, actual results may vary from the estimates or predictions stated in the materials and these variations may be material.

These risks, uncertainties and contingencies which may affect the assumptions underlying these forward-looking statements include, among others:

risks and uncertainties associated with estimating potential oil and gas reserves including interpreting engineering and geological data;

risks and uncertainties associated with our ability to establish the economic viability of the HIP Downhole Process Technology;

incorrect assessment that the Well Bores are suited for the HIP Downhole Process Technology;

geological, technical, drilling and processing problems;

liabilities inherent in oil and gas operations;

inability of HIP Resources to transfer the Louisiana Well Bores;

volatility in market prices for oil and gas and foreign currency exchange rates;

possible adverse effects of governmental regulations including changes in environmental and other regulations that may impose restrictions in areas where we operate;

competition for capital, acquisitions of reserves, undeveloped lands and skilled personnel;

investors becoming unwilling or unable to complete future private placements;

risks and uncertainties associated with our ability to raise additional capital; and

the risks described under the heading “Risk Factors”.

Further, any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by applicable law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for management to predict all of such factors and to assess in advance the impact of such factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

Unless otherwise indicated, all dollar amounts referred to herein are in Canadian dollars.

5

ITEM 1 Identity of Directors, Senior Management and Advisers

Not applicable.

ITEM 2 Offer Statistics and Expected Timetable

Not applicable.

ITEM 3 Key Information

A. Selected Financial Data

The following financial data summarizes selected financial data for our company prepared in accordance with Canadian generally accepted accounting principles for the five fiscal years ended November 30, 2009. Additional information is presented to show the differences which would result from the application of United States generally accepted accounting principles to our financial information. The information presented below for the five year period ended November 30, 2009 is derived from our audited financial statements which were examined by our independent auditor. The information set forth below should be read in conjunction with our audited financial statements and related notes included in this annual report and with the information appearing under the heading “Item 5 Operating and Financial Review and Prospects”.

Selected Financial Data

(Stated in Canadian Dollars –Calculated in accordance with Canadian GAAP)

Fiscal Year Ended November 30 (Audited)

| | CANADIAN GAAP | 2009 | 2008 | 2007 | 2006 | 2005 |

| | | | | | | |

| | Net Sales or Operating Revenue | $- | $- | $- | $- | $- |

| | Total Expenses | $66,143 | $47,508 | $61,980 | $58,145 | $71,186 |

| | Other Income | $- | $- | $- | $- | $- |

| | Loss from Continuing Operations | $(66,143) | $(47,508) | $(61,980) | $(58,145) | $(71,186) |

| | Net Loss and Comprehensive Loss for the Year | $(66,143) | $(47,508) | $(61,980) | $(58,145) | $(71,186) |

| | Net Loss and comprehensive loss per Common Share | $(0.02) | $(0.04) | $(0.05) | $(0.05) | $(0.05) |

| | Total Assets | $13,588 | $4,733 | $6,236 | $18,020 | $80,120 |

| | Total Stockholders’ Equity (Deficiency) | $(98,119) | $(95,267) | $(52,759) | $9,221 | $67,366 |

| | Capital Stock | $4,337,789 | $4,279,498 | $4,279,498 | $4,279,498 | $4,279,498 |

| | Weighted Average Number of Common Shares

(adjusted to reflect changes in capital) | 3,978,774 | 1,211,651 | 1,211,651 | 1,211,651 | 1,211,651 |

| | Basic and Diluted Net Loss per Common Share | $(0.02) | $(0.04) | $(0.05) | $(0.05) | $(0.05) |

| | Long-Term Debt | $- | $- | $- | $- | $- |

| | Cash Dividends per Common Share | $- | $- | $- | $- | $- |

6

Selected Financial Data

(Stated in Canadian Dollars - Calculated in accordance with US GAAP)

Fiscal Year Ended November 30 (Audited)

| | UNITED STATES GAAP | 2009 | 2008 | 2007 | 2006 | 2005 |

| | | | | | | |

| | Net Sales or Operating Revenue | $- | $- | $- | $- | $- |

| | Total Expenses | $66,143 | $47,508 | $61,980 | $58,145 | $71,186 |

| | Income (Loss) From Operations | $66,143 | $47,508 | $61,980 | $58,145 | $71,186 |

| | Other Income | $- | $- | $- | $- | $- |

| | Loss from Continuing Operations | $(66,143) | $(47,508) | $(61,980) | $(58,145) | $(71,186) |

| | Net loss and comprehensive loss for the year | $(66,143) | $(47,508) | $(61,980) | $(58,145) | $(71,186) |

| | Basic and Diluted Loss per Common Share | $(0.02) | $(0.05) | $(0.05) | $(0.05) | $(0.05) |

| | Total Assets | $13,588 | $4,733 | $6,236 | $18,020 | $80,120 |

| | Total Stockholders’ Equity (Deficiency) | $(98,119) | $(95,267) | $(52,759) | $9,221 | $67,366 |

| | Capital Stock | $4,337,789 | $4,279,498 | $4,279,498 | $4,279,498 | $4,279,498 |

| | Weighted Average Number of Common Shares

(adjusted to reflect changes in capital) |

3,978,774 |

1,211,651 |

1,211,651 |

1,211,651 |

1,211,651 |

| | Diluted Net Income per Common Share | $(0.02) | $(0.04) | $(0.05) | $(0.05) | $(0.05) |

| | Long-term Debt | $- | $- | $- | $- | $- |

| | Cash Dividends per Common Share | $- | $- | $- | $- | $- |

Reconciliation to United States Generally Accepted Accounting Principles

There are no material differences between Canadian generally accepted accounting principles and United States generally accepted accounting principles on the balance sheets and statements of operations and comprehensive loss and cash flows of our company.

Disclosure of Exchange Rate History

Since June 1, 1970, the government of Canada has permitted a floating exchange rate to determine the value of the Canadian dollar as compared to the United States dollar. On March 31, 2010, the exchange rate in effect for Canadian dollars exchanged for United States dollars, expressed in terms of Canadian dollars (based on the noon buying rates listed with the Bank of Canada) was $1.0156. For the past five fiscal years ended November 30, 2009 and for the six monthly periods between October 2009 and March 2010, the following exchange rates were in effect for Canadian dollars exchanged for United States dollars, expressed in terms of Canadian dollars (based on the noon buying rates in New York City, for cable transfers in Canadian dollars, as certified for customs purposes by the Federal Reserve Bank of New York). As the Federal Reserve Bank has discontinued the publication of foreign exchange rates on December 31, 2008 the rates listed after December 31, 2008 are based on the exchange rates in effect for Canadian dollars exchanged for United States dollars, expressed in terms of Canadian dollars (based on theintra-day high/low rates between 08:00 (ET) and 16:00 (ET) listed with the Bank of Canada):

| Year Ended | Average |

| | |

| November 30, 2005 | $1.2163 |

| November 30, 2006 | $1.1347 |

| November 30, 2007 | $0.9661 |

| November 30, 2008 | $1.2360 |

| November 30, 2009 | $1.1644 |

7

| Month Ended | Low/High |

| | |

| October 2009 | $1.0292/$1.0845 |

| November 2009 | $1.0460/$1.0774 |

| December 2009 | $1.0445/$1.0748 |

| January 2010 | $1.0278/$1.0695 |

| February 2010 | $1.0420/$1.0692 |

| March 2010 | $1.0113/$1.0421 |

B. Capitalization and Indebtedness

Not applicable

C. Reasons for the Offer and Use of Proceeds

Not applicable

D. Risk Factors

Much of the information included in this annual report includes or is based upon estimates, projections or other “forward-looking statements”. Such forward-looking statements include any projections or estimates made by our company and our management in connection with our business operations. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein.

Such estimates, projections or other forward-looking statements involve various risks and uncertainties as outlined below. We caution the reader that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other forward-looking statements.

The common shares of our company are considered speculative. You should carefully consider the following risks and uncertainties in addition to other information in this annul report in evaluating our company and our business before purchasing shares of our company’s common stock. Our business, operating and financial condition could be harmed due to any of the following risks.

Risks Relating to our Business

We are an early-stage oil and gas development company without revenues. Our ability to continue in business depends upon our continued ability to obtain significant financing from external sources and the success of the HIP Downhole Process Technology and any production resulting therefrom, none of which can be assured.

We are an early-stage oil and gas technology development company without any revenues, and there can be no assurance of our ability to develop and operate our projects profitably. We have historically depended entirely upon capital infusion from the issuance of equity securities and loans from insiders to provide the cash needed to fund our operations, but we cannot assure you that we will be able to continue to do so. Our ability to continue in business depends upon our continued ability to obtain significant financing from external sources and the success of our development efforts and any production efforts resulting therefrom. Any reduction in our ability to raise equity capital in the future would force us to reallocate funds from other planned uses and could have a significant negative effect on our business plans and operations, including our ability to continue our current development activities.

8

Our auditors’ opinion on our November 30, 2009 financial statements includes an explanatory paragraph in respect of there being substantial doubt about our ability to continue as a going concern.

We have incurred a net loss of $4,445,908 for the cumulative period from June 22, 1983 (inception) to November 30, 2009. We anticipate generating losses for at least the next 12 months. Therefore, there is substantial doubt about our ability to continue operations in the future as a going concern as described by our auditors with respect to the financial statements for the year ended November 30, 2009. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event that we cannot continue in existence. Our business operations may fail if our actual cash requirements exceed our estimates and we are not able to obtain further financing. If we cannot continue as a viable entity, our shareholders may lose some or all of their investment in our company.

We will require significant capital to complete the ongoing development of the HIP Downhole Process Technology and any resulting application of the HIP Downhole Process Technology on the Well Bores.

We anticipate that we will have to seek additional financing to fund the development of the HIP Downhole Process Technology and any resulting application of the HIP Downhole Process Technology on any of the Well Bores. We cannot assure you that our actual cash requirements will not exceed our estimates, and in any case we will require additional financing to bring our interests into commercial operation, finance working capital, and pay for operating expenses and capital requirements until we achieve a positive cash flow. Additional capital also may be required in the event we incur any significant unanticipated expenses.

In light of our operating history, and under the current capital and credit market conditions, we may not be able to obtain additional equity or debt financing on acceptable terms if and when we need it. Even if financing is available, it may not be available on terms that are favorable to us or in sufficient amounts to satisfy our requirements.

If we require, but are unable to obtain, additional financing in the future, we may be unable to implement our business plan and our growth strategies, respond to changing business or economic conditions, withstand adverse operating results, and compete effectively. More importantly, if we are unable to raise further financing when required, our planned development of the Well Bores may have to be scaled down or even ceased, and our ability to generate revenues in the future would be negatively affected.

The economic viability of the HIP Downhole Process Technology is unproven and may not achieve commercialization, widespread market acceptance or economic viability. If the HIP Downhole Process Technology does not prove to be economically viable, our business will suffer and may fail in its entirety.

Although we have performed initial testing on the viability of the HIP Downhole Process Technology, our assessment of the HIP Downhole Process Technology is primarily based upon historical data provided by the vendors relating to past test results. Further, the HIP Downhole Process Technology has not been proven in a commercial context over any significant period of time. Even if our HIP Downhole Process Technology is proven to be economically viable, it may not achieve widespread market acceptance. Our success will depend on our ability to prove that the HIP Downhole Process Technology is economically viable. We believe that the economic viability of the HIP Downhole Process Technology will depend on many factors, including:

the effectiveness of the HIP Downhole Process Technology to enhance oil or gas recovery on any one or a series of wells or well bores;

the safety and efficacy of the HIP Downhole Process Technology generally and on a well or series of well bores;

direct cost savings resulting from the use or application of the HIP Downhole Process Technology has not been proven on a sustained and ongoing well or well bore;

direct affect of any long term application of the HIP Downhole Process Technology on a well or series of well bores;

9

We are dependent on a single technology, and if it cannot compete or find market acceptance, our business will suffer.

Our strategy is dependent on the success of a single technology. Our strategy will be to focus our development on the HIP Downhole Process Technology and the commercialization of the technology on a well or series of well bores. Focus on this single technology leaves us vulnerable to competing products and alternative secondary oil and gas enhancement methods. If the HIP Downhole Process Technology is not proven to be commercially viable or we cannot find market acceptance or cannot compete against other technologies, our business will suffer and may fail in its entirety.

We rely on patents and proprietary rights to protect our technology.

We rely on a combination of trade secrets, confidentiality agreements and procedures and patents to protect our proprietary technologies. We have been granted a patent in the U.S. covering the HIP Downhole Process Technology. Additional patent applications will need to be made in the U.S. from time to time. The claims contained in any patent application may not be allowed, or any patent or our patents collectively may not provide adequate protection for our products and technology. In the absence of patent protection, we may be vulnerable to competitors who attempt to copy our products or gain access to our trade secrets and know-how. In addition, the laws of foreign countries may not protect our proprietary rights to this technology to the same extent as the laws of the U.S.

The HIP Downhole Process Technology may infringe or be challenged for infringement on other technology.

We have attempted to ensure that our products do not infringe the proprietary rights of others. If a dispute arises concerning our technology, we could become involved in litigation that might involve substantial cost. Such litigation might also divert substantial management attention away from our operations and into efforts to enforce our patents, protect our trade secrets or know-how or determine the scope of the proprietary rights of others. If a proceeding resulted in adverse findings, we could be subject to significant liabilities to third parties. We might also be required to seek licenses from third parties in order to manufacture or sell our products. Our ability to manufacture and sell our products might also be adversely affected by other unforeseen factors relating to the proceeding or its outcome.

Our lack of diversification increases the risk of an investment in us, and our financial condition and results of operations may deteriorate if we fail to diversify.

Our business focus is solely related to the ongoing development and application of the HIP Downhole Process Technology on oil and gas wells or well bores. As a result, we lack diversification, in terms of the nature of our business. We will likely be impacted more acutely by factors affecting our industry in which we operate than we would if our business were more diversified. If we cannot diversify our operations, our financial condition and results of operations could deteriorate.

The potential profitability of oil and gas operations and ventures depends upon factors beyond the control of our company.

The potential profitability of oil and gas projects on which the HIP Downhole Process Technology is applied and the oil and gas industry generally is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls, or any combination of these and other factors, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to world-wide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance and the continued economic viability of our company.

10

Adverse weather conditions can also hinder or affect the application or continued ability of the HIP Downhole Process Technology to operate or remain viable. A well on which the HIP Downhole Process Technology is applied may be productive but may become uneconomic as a result of severe or unseasonable weather conditions.The marketability of oil and gas which may be acquired or discovered will be affected by numerous factors beyond our control, including the proximity and capacity of oil and gas pipelines and processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production and environmental protection. The extent of these factors cannot be accurately predicted but the combination of these factors may result in our company not receiving an adequate return on invested capital.

Primary and secondary drilling or enhancement of oil and gas wells involves many risks and we may become liable for well abandonment, plugging, pollution or other liabilities which may have an adverse effect on our financial position.

Any enhanced recovery or drilling for oil and gas generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labour disruptions, blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labour, and other risks are involved. We may become subject to liability for pollution or hazards against which we cannot adequately insure or which we may elect not to insure. Incurring any such liability may have a material adverse effect on our financial position and operations.

Oil and gas operations are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our company. Further, development and production activities are subject to certain environmental regulations which may prevent or delay the commencement or continuance of our operations.

Oil and gas operations in the United States and Canada are subject to federal, state and provincial laws and regulations relating to the protection of the environment, including, but not limited to, laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Oil and gas operations in the United States and Canada are also subject to federal, state and provincial laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling and or enhanced recovery methods and equipment. Various permits from government bodies are required for drilling or secondary well enhancement operations to be conducted; no assurance can be given that such permits will be received. No assurance can be given that environmental standards imposed by federal, state and provincial authorities will not be changed or that any such changes would not have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may elect not to insure against due to prohibitive premium costs and other reasons. Our current and anticipated development and enhancement recovery activities are subject to the aforementioned environment regulations. When and if we enter into production we will become subject to additional regulations which do not currently pertain to us or affect our current operations.

Specifically, we are subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. In addition, legislation has been enacted which requires well and facility sites to be abandoned and reclaimed to the satisfaction of federal, state and provincial authorities. Such laws and regulations are frequently changed and we are unable to predict the ultimate cost of compliance.

We may not effectively manage the growth necessary to execute our business plan.

Any growth will place significant strain on our current personnel, systems and resources. We expect that we will be required to hire qualified consultants and employees to help us manage our growth effectively. We believe that we will also be required to improve our management, technical, information and accounting systems, controls and procedures. We may not be able to maintain the quality of our operations, control our costs, continue complying with all applicable regulations and expand our internal management, technical information and accounting systems to support our desired growth. If we fail to manage our anticipated growth effectively, our business could be adversely affected.

11

Risks Relating to our Management

As a majority of our directors and officers are residents of countries other than the United States, investors may find it difficult to enforce, within the United States, any judgments obtained against our company, directors and officers.

A majority of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our company, officers, and directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

Key management employees may fail to properly carry out their duties or may leave which could negatively impact corporate operations and/or share pricing.

Our company’s financial condition and the success of the HIP Downhole Process Technology on our oil and gas enhanced recovery operations is dependent on our ability to hire and retain highly skilled and qualified personnel. We face competition for qualified personnel from numerous industry sources, and there can be no assurance that we will be able to attract and retain qualified personnel on acceptable terms. The loss of service of any of our key personnel could have a material adverse effect on our operations or financial condition. We do not have key-man insurance on any of our employees.

Our Articles contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our Articles contain provisions with respect to the indemnification of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by them in a civil, criminal or administrative action or proceeding to which they are made a party by reason of their being or having been a director or officer of our company.

Risks Relating to Our Stock

Our common stock is illiquid and shareholders may be unable to sell their shares.

Our common stock is currently quoted on the Over-the-Counter Bulletin Board and is thinly traded. In the past, our trading price has fluctuated widely, depending on many factors that may have little to do with our operations or business prospects. There is currently a limited market for our common stock and we can provide no assurance to investors that a market will develop. If a market for our common stock does not develop, our shareholders may not be able to re-sell the shares of our common stock that they have purchased and they may lose all of their investment. Public announcements regarding our company, changes in government regulations, conditions in our market segment and changes in earnings estimates by analysts may cause the price of our common shares to fluctuate substantially. In addition, the Over-the-Counter Bulletin Board is not an exchange and, because trading of securities on the Over-the-Counter Bulletin Board is often more sporadic than the trading of securities listed on an exchange, you may have difficulty reselling any of the shares you purchase from our selling shareholders.

Securities class-action litigation has often been instituted following periods of volatility in the market price of a company’s securities. Such litigation, if instituted against our company, could result in substantial costs for our company and a diversion of management’s attention and resources.

Investors’ interests in our company will be diluted and investors may suffer dilution in their net book value per share if we issue additional shares or raise funds through the sale of equity securities.

Our constating documents authorize the issuance of an unlimited number of common shares and an unlimited number of preference shares. In the event that we are required to issue additional shares or enter into private placements to raise financing through the sale of equity securities, investors’ interests in our company will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. If we do issue additional shares, it will cause a reduction in the proportionate ownership and voting power of all existing shareholders.

12

We have never declared or paid cash dividends on our common shares and do not anticipate doing so in the foreseeable future.

There can be no assurance that our board of directors will ever declare cash dividends, which action is exclusively within our discretion. Shareholders cannot expect to receive a dividend on our common shares in the foreseeable future, if at all.

Trading of our stock may be restricted by the Securities and Exchange Commission’s “Penny Stock” regulations which may limit a stockholder’s ability to buy and sell our stock.

The United States Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of, our common stock.

The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a shareholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

ITEM 4 Information on HIP Energy Corporation

A. History and Development of HIP Energy Corporation

Name

Our legal and commercial name is “HIP Energy Corporation”.

13

Principal Office

In connection with our new business plan, we have recently moved our principal office from Suite 1680, 200 Burrard Street, Vancouver, British Columbia, Canada V6C 3L6 to Suite 404, 999 World Trade Centre, Vancouver, British Columbia, V6E 3E2. Our telephone number is 604.641.1367 and our facsimile number is 604.641.1214.

Corporate Information

Our company was incorporated pursuant to the laws of the Province of British Columbia under the British ColumbiaCompany Act in June 1983 under the name “Bradner Resources Ltd.”. On March 29, 2004, the British ColumbiaBusiness Corporations Act came into effect, replacing the British ColumbiaCompany Act. As required by theBusiness Corporations Act, our company was “transitioned” under theBusiness Corporations Act, effective March 31, 2004.

Our company is currently a reporting issuer under the securities laws of British Columbia and Alberta.

Important Events

On December 13, 1999, our name was changed from “Bradner Resources Ltd.” to “Bradner Ventures Ltd.”

On December 17, 2001, we entered into a share exchange agreement (the “Bestshot Agreement”) with Bestshot.com Inc., Bestshot.com Corp., John Davis, Richard Coglon and Mark Morrill, pursuant to which, we were to acquire 100% of the issued and outstanding shares (a total of 20,515,942 common shares) of Bestshot.com Inc. in exchange for 24,618,590 common shares in the capital of our company. We elected not to proceed with the completion of the share exchange due to the fact that Bestshot.com Inc. was unable to obtain shareholder approval with respect to its continuation from Wyoming, its current jurisdiction of incorporation, to the province of Alberta. Our obligation to consummate the transactions contemplated by the Bestshot Agreement was subject to the fulfilment of a number of conditions precedent, including the continuation of Bestshot.com Inc.

On March 31, 2004, our authorized and issued shares of common stock and preferred stock were consolidated on the basis of one (1) post-consolidated common share for each five (5) pre-consolidated common shares so that our authorized capital consisted of 15,000,000 common shares and 5,000,000 preferred shares with 1,058,256 common shares issued and no preferred shares issued. Our authorized capital was then increased to 75,000,000 common shares and 25,000,000 preferred shares with 1,058,256 common shares issued and no preferred shares issued. The share consolidation was effective with the OTC Bulletin Board on April 21, 2004 and our trading symbol was changed to “BNVLF”.

On November 17, 2009, we changed our name from “Bradner Ventures Ltd.” to “HIP Energy Corporation” and effected a five (5) for one (1) reverse stock split of our issued and outstanding common stock. The name change and reverse stock split were effected with the OTC Bulletin Board on November 19, 2009. Our trading symbol was changed from “BNVLF” to “HIPCF”. Also effective October 20, 2009 we effected an increase in our authorized capital to an unlimited number of common shares and an unlimited number of preferred shares. We received approval for the increase in authorized capital, reverse split and name change at our annual general meeting of shareholders held on July 31, 2009.

On March 30, 2010, pursuant to the Asset Purchase Agreement, HIP Texas, a wholly-owned subsidiary of HIP, acquired from HIP Resources ownership of the Well Bores. The Well Bores are described in detail under the heading “Business Overview - The Well Bores”. The consideration for the sale and transfer of the Well Bores was the issuance of 20 million common shares of HIP to EEL.

On March 30, 2010, pursuant to the License Agreement, HIP Nevada, a wholly-owned subsidiary of HIP, acquired from HIP Tech an exclusive worldwide license for use of the HIP Downhole Process Technology. The HIP Downhole Process Technology is described in detail under the heading “Business Overview - HIP Downhole Process Technology”. The consideration for the acquisition of the HIP Downhole Process Technology was the issuance of 30 million common shares of HIP to Group Rich and a royalty payment, which is described in detailed under the heading “Business Overview - License Agreement”.

14

The acquisition of the Well Bores by HIP Texas and the exclusive worldwide right to the HIP Downhole Process Technology by HIP Nevada caused us to cease to be a “shell company”, as defined in Rule 12b-2 of the Exchange Act.

Capital Expenditures

During the period from the last three fiscal years ended November 30, 2009, we did not undertake any capital expenditures.

Our planned capital expenditures for the next twelve months are summarized below under the heading “Buiness Overview - Plan of Operation – Use of Funding”. These anticipated expenditures relate to the development of the Well Bores and the implementation of the HIP Downhole Process Technology. Our planned capital expenditures are primarily located in Texas and Lousiana, the location of the Well Bores.

Takeover offers

We are not aware of any indication of any public takeover offers by third parties in respect of our common shares during our last and current financial years.

B. Business Overview

For the fiscal years ended November 30, 2009, 2008 and 2007, we incurred net losses of $66,143, $47,508, and $61,980 respectively. We did not generate any revenues during such periods.

Overview

Prior to the acquisition of the Well Bores and the exclusive worldwide license to the HIP Downhole Process Technology, our company did not have an operating business. Our sole business was to identify a suitable business opportunity or a suitable business with which to enter into a business combination. Our current business is to increase the recovery from oil wells using the HIP Downhole Process Technology.

Traditional oil exploration involves acquiring exploration or drilling rights, conducting seismic and other subsurface studies to estimate if oil and gas is present, and then drilling of the properties in order to attempt to discover and extract the oil and gas. The process can be extremely expensive and time consuming. Costs for drilling a single well have escalated dramatically and can run into the hundreds of thousands of dollars. Further, a significant percentage of all traditional exploration wells drilled each year end-up being dry holes. Our business is to increase the production of proven but unproductive wells, or to increase production from damaged, uneconomical, and stripper well bores using the HIP Downhole Process Technology.

Our initial focus will be to concentrate our operations on applying the HIP Downhole Process Technology to existing and proven well bores and reservoirs that have become non-commercial, uneconomic, depleted or damaged. We intend to demonstrate the value of the HIP Downhole Process Technology by improving the recovery of oil from well bores, after which we intend to acquire additional well bores that we believe could have an increase in production if the HIP Downhole Process Technology was applied to the well bores. We believe we can generate more revenues by participating in the development of the well bores, rather than by licensing the HIP Downhole Process Technology to third parties. We believe the Company will benefit from increased industry recognition of the HIP Downhole Process Technology, while generating an ongoing and sustained cash flow from the increased recovery of hydrocarbons.

15

HIP Downhole Process Technology

The HIP Downhole Process Technology was developed over a period of 28 years by Mr. Peter Noonan, who worked extensively with chemical engineers, scientists and oil and gas reservoirs and its associated field applications in the development of the areas in enhanced oil recovery systems. Over time, certain oil and gas wells will experience significant production decreases, as the remaining hydrocarbon molecules become heavier and attract unwanted elements. The HIP Downhole Process stops and reverses the formation of these heavier molecules and prevents the production decrease.

When material from an oil or gas well is removed too rapidly or when too much material has been removed by production, the remaining hydrocarbon material in the reservoir can change in such a way to become heavier and more resistant to flow. The result is the formation of paraffinic and asphaltic compounds that cause solidification or increase in pour-point temperatures. The viscosity of the hydrocarbon material increases tremendously, as electrochemical potential differences increase molecular attraction. Increased viscosity attracts other elements and compounds, such as entrained water, salts, metallic and foreign materials (silicates, carbonates and oxides), which further increases resistance to flow and leads to decreased production. As the reservoir pressure decreases over time, many wells become blocked and the remaining hydrocarbon compounds become very large molecules that are heavier in weight. As a result, there is a build-up of large molecular structure material which consists of paraffinic, asphaltenes, salt residuals, calcites, sulfites and metallic residuals, which further reduces production output. In many instances the resultant build up of viscous material will completely shut down production before the full availability of proven recoverable reserves is recovered.

The HIP Downhole Process utilizes a constant injection of formulized heated gaseous fluids through a proprietary method of deliver. This process causes a physical reaction of molecular exchange in such a way that promotes formation of simple hydrogen molecular relationships and eliminates large electrochemical potential differences. This inhibits formation of heavier hydrocarbon molecules. The process works best when the pressure, volume, and temperature of the well are maintained as constant as possible. Elemental and salt residues of the process remain in place in a reservoir since the technology is instrumental in producing molecular exchange to form lighter hydrocarbon molecules similar to those that have been removed from the reservoir formation by production.

The HIP Downhole Process is intended to increase both oil and gas production and decrease the lifting costs of the well. The decrease in lifting costs is intended to result in an increased revenue stream.

The Well Bores

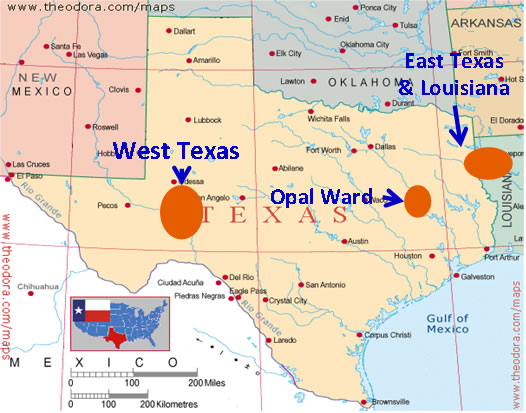

On March 30, 2010, following the closing of the Asset Purchase Agreement, HIP acquired all of HIP Resources rights, title and interest to 50 well bores located in West Texas and 1 well bore located in Opal Ward (collectively, the “Texas Well Bores”). Figure 1 – Location of Well Bores shows the general location of the Texas Well Bores.

16

Figure 1- Location of Well Bores

In addition, under the terms of the Asset Purchase Agreement, HIP Resources agreed to transfer to HIP, all of HIP Resources rights, title and interest in 101 well bores located in East Texas and Louisiana (the “Louisiana Well Bores” together with the Texas Well Bores, the “Well Bores”).

17

The following is a list of the Texas Well Bores including Oil Lease numbers, number of wells and total depth:

Lease Name | Oil

Lease

Gas ID

No. | Location | Numberof

Wells | Total

Depth |

| West Texas | | | | |

| Cluster 1 | | | | |

| Texaco 9-1 (Texaco “9”) | 33329 | Section 9 Block 56 Range 3 | 1 | 3,700 |

| Texaco 9-2 | 33329 | Section 9 Block 56 Range 3 | 1 | 3,700 |

| Texaco 9-3 | 33329 | Section 9 Block 56 Range 3 | 1 | 3,700 |

| Texaco 9-4 | 33329 | Section 9 Block 56 Range 3 | 1 | 3,700 |

| Texaco 9-5 | 33329 | Section 9 Block 56 Range 3 | 1 | 3,700 |

| Phillips 66 #2 (Phillips 66) | 32571 | Section 18 Block 56 Range 3 | 1 | 3,700 |

| Phillips 66 #3 (Phillips 66 3A) | 33149 | Section 18 Block 56 Range 3 | 1 | 3,700 |

| Cluster 2 | | | | |

| Arco State 14-1 | 33585 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 #5 | 33585 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 #2 (Arco State 14) | 33585 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 #4 | 33585 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 - A #1 (Arco State 14A) | 34155 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 - A #2 (Arco State 14A) | 34155 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 - A #3 (Arco State 14A) | 34155 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 - A #4 (Arco State 14A) | 34155 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State #2 Injection (dual Well) | 25126 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State #3 | 25126 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State #4 | 25126 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State #5 | 25126 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 24 #2 (Arco State 24) | 069586 | Section 24 Block 57 Range 3 | 1 | 3,400 |

| Arco State 24 #3 (Arco State 24) | 069779 | Section 24 Block 57 Range 3 | 1 | 3,400 |

| Arco State 24 #4 (Arco State 24) | 069912 | Section 24 Block 57 Range 3 | 1 | 3,400 |

| Cluster 3 | | | | |

| Reeves BK HD - 1 (Horizontal) | 36100 | Section 15 Block 56 Range 3 | 1 | 4,900 |

| Reeves BK FEE # 1 | 32288 | Section 15 Block 56 Range 3 | 1 | 3,700 |

| Reeves BK # 2 (Reeves-BK-FEE) | 32288 | Section 15 Block 56 Range 3 | 1 | 3,700 |

| Reeves BK # 3 | 32288 | Section 15 Block 56 Range 3 | 1 | 3,700 |

| Reeves BK FEE # 5 | 32288 | Section 15 Block 56 Range 3 | 1 | 3,700 |

| BK # 4 (Texaco Reeves BK) | 33947 | Section 15 Block 56 Range 3 | 1 | 3,700 |

| Texaco 23 #1 (Texaco “23”) | 33670 | Section 23 Block 56 Range 3 | 1 | 3,700 |

| Texaco 23 #2 | 33670 | Section 23 Block 56 Range 3 | 1 | 3,700 |

| Texaco 23 #3 | 33670 | Section 23 Block 56 Range 3 | 1 | 3,700 |

| Texaco 13-1 HD Horizontal (Penwell) | 12345 | Section 13 Block 56 Range 3 | 1 | 4,987 |

18

| Lease Name | Oil

Lease

Gas ID

No. | Location | Number

of Wells | Total

Depth |

| Cluster 4- Regular 57 | | | | |

| Anadarko State 14 #5 (Anadarko State A) | 34376 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Anadarko State 14 #6 (Anadarko State R) | 34463 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Anadarko State 14 #1 (Anadarko State 14) | 072948 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Anadarko State 14 #2 (Anadarko State 14) | 074167 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Anadarko State 14 #3 (Anadarko State 14) | 075491 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Anadarko State 14 #4 (Anadarko State 14) | 075724 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Anadarko State 23 #4 (Anadarko State) | 34313 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Stack State 1 | 34366 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Stack State 2 | 34366 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Cluster 5 | | | | |

| Reeves AM 25 #1 (AM Reeves) | 34146 | Section 25 Block 57 Range 3 | 1 | 6,200 |

| Reeves AM 25 #1 (Reeves -AM- Fee) | 036114 | Section 25 Block 57 Range 3 | 1 | 3,200 |

| Reeves AM 25 #2 (Reeves -AM- Fee) | 036115 | Section 25 Block 57 Range 3 | 1 | 3,200 |

| State of Texas 23 # 5 (State 26) | 34312 | Section 23 Block 56 Range 3 | 1 | 3,100 |

| State of Texas 26 # 5 (State 23) | 34464 | Section 26 Block 57 Range 3 | 1 | 3,100 |

| State of Texas 26 # 1 (State of Texas 26) | 066070 | Section 26 Block 57 Range 3 | 1 | 3,100 |

| State of Texas 26 # 3 (State of Texas 26) | 069567 | Section 26 Block 57 Range 3 | 1 | 3,100 |

| State of Texas 26 # 4 (State of Texas 26) | 069568 | Section 26 Block 57 Range 3 | 1 | 3,100 |

| State of Texas 26 # 7 (Robinson) | 36098 | Section 26 Block 57 Range 3 | 1 | 3,100 |

| Cluster 6 | | | | |

| Meeker 15 -1 | 30942 | Section 15 Block 21 Range 3 | 1 | 3,700 |

| Opal Ward # 1 | 1 Leon | | 1 | 9,475 |

| Total | | | 52 | |

The following is a list of the Louisiana Well Bores including Oil Lease numbers, number of wells and total depth:

| Lease Name | Oil Lease

Gas ID

No. | Location | Number

of Wells | Total

Depth |

| East Texas | | | | |

| Cluster 1 | | | | |

| Cowherd # 1 | 129107 | | 2 | 6,180 |

| Cowherd # 2 | 12629 | | 2 | 6,622 |

| Cowherd # 3 | | | 1 | 2,500 |

| Peggy Ashley 1 | 129114 | | 1 | 6,174 |

| Chevron # 1 | | | 1 | 6,088 |

| Chevron # 3 | | | 1 | 6,150 |

| Panola # 1 | | | 1 | 2,500 |

| Panola # 2 | | | 1 | 2,500 |

| Panola # 3 | | | 1 | 2,500 |

19

| Lease Name | Oil Lease

Gas ID

No. | Location | Number

of Wells | Total

Depth |

| Panola # 4 | | | 1 | 2,500 |

| Panola # 5 | | | 1 | 2,500 |

| Panola # 6 | | | 1 | 2,500 |

| Elysian # 1 | | | 1 | 2,700 |

| Elysian # 2 | | | 1 | 2,700 |

| Elysian # 3 | | | 1 | 2,700 |

| Elysian # 4 | | | 1 | 2,700 |

| Elysian # 5 | | | 1 | 2,700 |

| Elysian # 6 | | | 1 | 2,700 |

| Elysian # 7 | | | 1 | 2,700 |

| Elysian # 8 | | | 1 | 2,700 |

| Elysian # 9 | | | 1 | 2,700 |

| Elysian # 10 | | | 1 | 2,700 |

| Elysian # 11 | | | 1 | 2,700 |

| Elysian # 12 | | | 1 | 2,700 |

| Elysian # 13 | | | 1 | 2,700 |

| Elysian # 14 | | | 1 | 2,700 |

| Elysian # 15 | | | 1 | 2,700 |

| Elysian # 16 | | | 1 | 2,700 |

| Elysian # 17 | | | 1 | 2,700 |

| Elysian # 18 | | | 1 | 2,700 |

| Elysian # 19 | | | 1 | 2,700 |

| Elysian # 20 | | | 1 | 2,700 |

| Elysian # 21 | | | 1 | 2,700 |

| Elysian # 22 | | | 1 | 2,700 |

| Laeke A-1 | | | 1 | 2,700 |

| Laeke A-2 | | | 1 | 2,700 |

| Laeke B-1 | | | 1 | 2,700 |

| Laeke B-2 | | | 1 | 2,700 |

| Laeke B-3 | | | 1 | 2,700 |

| | | East Texas Total | 41 | |

| Louisiana | | | | |

| Abney J. D. Lease | 1 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 2 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 3 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 4 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 5 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 6 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 7 Harrison | | 1 | 2,475 |

20

| Lease Name | Oil Lease

Gas ID

No. | Location | Number

of Wells | Total

Depth |

| Abney J. D. Lease | 8 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 9 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 10 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 11 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 12 Harrison | | 1 | 2,475 |

| Abney #1 (460) | 103405 | | 1 | 2,500 |

| Abney #3 | 105607 | | 1 | 2,500 |

| Abney #4 | 105839 | | 1 | 2,500 |

| Abney #5 | 106853 | | 1 | 2,500 |

| Abney #6 | 107873 | | 1 | 2,500 |

| Abney #7 | 109040 | | 1 | 2,500 |

| Abney #8 | 110360 | | 1 | 2,500 |

| Abney #9 | 110361 | | 1 | 2,500 |

| Abney #10 | 113026 | | 1 | 2,500 |

| Abney #11 | 131636 | | 1 | 2,500 |

| Abney #12 | 129650 | | 1 | 2,500 |

| Abney #13 | 130786 | | 1 | 2,500 |

| Abney #14 | 133367 | | 1 | 2,500 |

| Abney #15 | 133412 | | 1 | 2,500 |

| Abney #16 | 131635 | | 1 | 2,500 |

| Abney #17 | 130887 | | 1 | 2,500 |

| Abney #18 | 127779 | | 1 | 2,500 |

| Abney #19 | 131605 | | 1 | 2,500 |

| Abney #20 | 128716 | | 1 | 2,500 |

| Abney #21 | 127217 | | 1 | 2,500 |

| Abney #22 | 127385 | | 1 | 2,500 |

| Abney D #2 (150) | 130119 | | 1 | 2,500 |

| Abney D #3 | 130138 | | 1 | 2,500 |

| Abney D #4 | 130640 | | 1 | 2,500 |

| Abney D #5 | 130752 | | 1 | 2,500 |

| Abney D #6 | 130923 | | 1 | 2,500 |

| Abney D #7 | 131025 | | 1 | 2,500 |

| Abney D #8 | 131104 | | 1 | 2,500 |

| Abney D #9 | 133427 | | 1 | 2,500 |

| Abney D #10 | 136179 | | 1 | 2,500 |

| Abney D #11 | 133466 | | 1 | 2,500 |

| Abney D #12 | 136343 | | 1 | 2,500 |

| Abney D #14 | 136702 | | 1 | 2,500 |

21

| Lease Name | Oil Lease

Gas ID

No. | Location | Number

of Wells | Total

Depth |

| Atkinson A #001 | | | 1 | 2,500 |

| Atkinson A #002 | | | 1 | 2,500 |

| Atkinson A #003 | | | 1 | 2,500 |

| Atkinson B #001 | | | 1 | 2,500 |

| Atkinson B #002 | | | 1 | 2,500 |

| Atkinson B #003 | | | 1 | 2,500 |

| Abney Kirk #001 | | | 1 | 2,500 |

| Abney Kirk #002 | | | 1 | 2,500 |

| Abney Kirk #003 | | | 1 | 2,500 |

| Abney Kirk #004 | | | 1 | 2,500 |

| Abney Kirk #005 | | | 1 | 2,500 |

| Abney Kirk #006 | | | 1 | 2,500 |

| Abney Kirk #007 | | | 1 | 2,500 |

| Abney Kirk #008 | | | 1 | 2,500 |

| Abney Kirk #009 | | | 1 | 2,500 |

| Total | | | 101 | |

In consideration for the Well Bores, HIP issued 20,000,000 of its common shares to EEL at a deemed price of $0.001 per share. As a condition of the Asset Purchase Agreement, on January 12, 2010, HIP, HIP Texas, and HIP Nevada entered into a joint operating agreement with TexLa Operating Company ("TexLa"), whereby TexLa agreed to develop the Well Bores using the HIP Downhole Process Technology. In consideration for their services, TexLa was granted a 10% working interest in any of the Well Bores that the HIP Downhole Process Technology is applied to. This structure is intended to ensure that TexLa’s interest is aligned with HIP, as TexLa will have an operating interest in the Well Bores. Also as a condition of the Asset Purchase Agreement, the parties agreed to enter into a Non-Competition Agreement dated March 14, 2010 pursuant to which EEL and HIP Resources agreed, among other things, not to compete against the business of HIP for a period of four years from the date of the agreement. In addition, as the License Agreement grants HIP a worldwide exclusive license to the HIP Downhole Process Technology, EEL and HIP Resources will not be able to use the HIP Downhole Process Technology on any well or well bores, except as provided under the License Agreement.

Current Operations

According to data provided to us by HIP Tech under the License Agreement, the HIP Downhole Process Technology has dissipated the barrier of 23 impediments that restricted or shut in the reservoirs located in the West Texas field, where the Texas Well Bores are located. According to data provided to us by HIP Tech, the HIP Process was applied on several of the Well Bores during the period from 1998 through 2004. These Well Bores experienced an increase in production after the HIP Downhole Process Technology was applied.

More recently, during 2008 to the present, the HIP Downhole Process has been applied on a single Well Bore, namely the Opal Ward 1 well, (the “Opal Well”) located in Opal Ward, Texas. The Opal Well was chosen specifically for its use as a “central process unit”, which, when fully operational, would serve as the central control and processing facility for an offset of up to 15 or more oil and gas wells located within the same reservoir. As at February 2010, the Opal Well was being operated for its increased production on a continuous flow basis using the HIP Downhole Process. The HIP Downhole Process has increased the down hole pressure to 3361 psi compared to down hole pressures of 431 psi in March 1993 when the Opal Well was shut in. If we are successful in replication these pressure and expected production increases as we expand out to offsetting wells, then we will be in a position to aggressively pursue the acquisition or leasing of additional well bores on which to apply the HIP Downhole Process Technology. Our ability to prove the commercial viability of the HIP Downhole Process Technology is the key to our business.

22

Plan of Operation

Financing

We plan to focus on those areas that will result in the production of oil and gas in the shortest time frame. In pursuing this objective, we plan to raise funds as required with the intent of minimizing dilution and maximizing return on funds deployed. Until such time as the HIP Downhole Process Technology is further developed and results in revenues from production of oil and gas from applied wells, we plan to primarily rely on traditional equity markets and if available, debt instruments to raise our required funding.

Use of Funding

Any funds received will, at the discretion of management, be allocated in part to establishing 5 to 8 test wells, which may include the expansion from the central unit at the Opal Well into 5 additional offset well locations within the same reservoir or development of any of the Well Bores. If oil and gas production is attained from these low production or problematic wells using the HIP Downhole Process, we will then continue to expand our commercialization of the HIP Downhole Process Technology.

We plan on deploying monies in those prospect areas where we have the greatest understanding of the existing well bores and reservoirs. To this end, we plan to focus our initial efforts on using the HIP Process in well bores and basins in such regions as the Woodbine and Austin Chalk region of the U.S. These regions are low-risk and long-term energy producers. We will participate in such regions with landowners or companies that have access to leases located in geological trends that have demonstrated substantial historical production and have potential remaining reserves that can be exploited in a low-risk, systematic fashion.

Based on our initial project plan and budget, we anticipate that we will require an investment of approximately $1.45 million to fund a capital project and operating costs and are expected to be deployed as set out in the following table:

| Project 1 - Budget for First Financing |

| Summarized Statement of Changes in Cash |

| | Year 1 |

| | | | | | |

| Operating Costs: | 1st QTR | 2nd QTR | 3rd QTR | 4th QTR | Total YR 1 |

| - License to HIP(T) | 19,515 | 104,448 | 193,974 | 223,817 | 541,754 |

| - Field operating costs | 50,700 | 28,350 | 26,850 | 35,250 | 141,150 |

| - Field Labor Costs | 3,600 | 3,600 | 3,600 | 36,000 | 46,800 |

| - Admin Operating Costs | 231,601 | 246,302 | 235,302 | 103,100 | 816,305 |

| - Admin CDN Costs | 129,900 | 192,800 | 192,800 | 192,800 | 708,300 |

| Total Costs | 435,316 | 575,500 | 652,526 | 590,967 | 2,254,309 |

| | | | | | |

| Capital Assets | | | | | |

| - Project Capital Costs | (575,500) | (250,000) | | | (825,500) |

23

Our sole tangible assets consist of the Well Bores and the exclusive worldwide license to the HIP Downhole Process Technology. It is however a requirement of the application of the HIP Downhole Process Technology that certain equipment and other fixed or other tangible assets be acquired or leased in order that any potential commercialization of the HIP Tech on any of the well bores can be realized. The equipment required as part of the HIP Downhole Process in part forms the basis of the application patent relating to the HIP Downhole Process Technology and in other cases is readily available oilfield equipment. The availability of any specific equipment may affect our ability to carry out its operations in a timely and cost effective manner. As stated earlier, our short-term plan is to apply and test the HIP Downhole Process Technology on a number of wells and wellbores acquired from HIP Resources. The results of these tests and the ongoing development and application of the HIP Downhole Process Technology will directly affect the company’s ability to generate revenue and raise additional capital to further expand its programs and acquire any ongoing plant and equipment. As with any new technology applications there is inherent risk that the technology itself may not prove commercially viable or result in any economic production.

China Joint Venture