FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report Of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of July, 2010

Commission File No. 000-30972

HIP ENERGY CORPORATION

(Translation of registrant’s name into English)

Suite 404 – 999 Canada Place, World Trade Centre, Vancouver, BC, Canada V6E 3E2

(Address of principal executive office)

[Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F]

Form 20-F [ X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) [ ]

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) [ ]

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [X]

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82 -_________

HIP ENERGY CORPORATION

NOTICE OF NO AUDITOR REVIEW OF CONSOLIDATED INTERIM FINANCIAL STATEMENTS

Under National Instrument 51-102, Part 4, subsection 4.3(3)(a), if an auditor has not performed a review of the consolidated interim financial statements, they must be accompanied by a notice indicating that the consolidated interim financial statements have not been reviewed by an auditor.

The Company’s independent auditor has not performed a review of these consolidated interim financial statements in accordance with standards established by the Canadian Institute of Chartered Accountants for a review of consolidated interim financial statements by an entity’s auditor.

HIP ENERGY CORPORATION

(A Development Stage Company)

Consolidated Interim Financial Statements

(Expressed in US dollars)

(Unaudited)

May 31, 2010

HIP Energy Corporation

(A Development Stage Company)

Consolidated Balance Sheets

(Unaudited - Expressed in US dollars)

| | May 31, 2010 $ | November 30, 2009 $ |

| | | |

| ASSETS | | |

| | | |

| Current Assets | | |

| | | |

| Cash | 874,716 | 11,526 |

| GST recoverable | 5,740 | 1,281 |

| Prepaid expenses | 529 | – |

| | | |

| Total Current Assets | 880,985 | 12,807 |

| | | |

| Intangible Assets (Note 4) | 262,820 | – |

| Oil and Gas Properties (Note 3) | 300,480 | – |

| | | |

| Total Assets | 1,444,285 | 12,807 |

| | | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIENCY) | | |

| | | |

| Current Liabilities | | |

| | | |

| Accounts payable and accrued liabilities | 25,087 | 44,021 |

| Advance payable (Note 2) | 61,672 | 61,263 |

| Due to related parties | 32,698 | – |

| | | |

| Total Liabilities | 119,457 | 105,284 |

| | | |

| Stockholders’ Equity (Deficiency) | | |

| | | |

Capital Stock (Note 7) Authorized: unlimited common shares, without par value unlimited preferred shares, without par value Issued: 60,727,660 common shares (November 30, 2009 – 6,211,660) | 4,904,168 | 3,275,168 |

| | | |

| Contributed Surplus | 10,349 | 9,144 |

| | | |

| Deficit Accumulated During the Development Stage | (3,589,689) | (3,376,789) |

| | | |

| Total Stockholders’ Equity (Deficiency) | 1,324,828 | (92,477) |

| | | |

| Total Liabilities and Stockholders’ Equity (Deficiency) | 1,444,285 | 12,807 |

| | | |

| Nature of operations and ability to continue as a going concern (Note 1) | | |

| | | |

Approved on behalf of the Board:

| “Richard Coglon” | | “James Chui” |

| Director | | Director |

The accompanying notes are an integral part of these consolidated interim financial statements

HIP Energy Corporation

(A Development Stage Company)

Consolidated Interim Statements of Operations and Comprehensive Loss

(Unaudited - Expressed in US dollars)

| | Accumulated from June 22, 1983 (Date of Inception) to May 31, 2010 $ | | | | |

| Three Months Ended | Six Months Ended |

| May 31, | May 31, |

2010 $ | 2009 $ | 2010 $ | 2009 $ |

| | | | | | |

| EXPENSES | | | | | |

| Amortization | 1,620 | – | – | – | – |

| Bad debts | 192 | – | – | – | – |

| Bank charges and interest | 49,940 | 609 | 215 | 743 | 322 |

| Consulting and secretarial | 192,342 | 33,751 | – | 33,751 | – |

| Finders’ fees | 139,802 | – | – | – | – |

| Foreign exchange (gain) loss | 52,605 | 3,580 | 10,306 | 4,074 | 8,894 |

| Management fees (Note 2(a)) | 298,213 | 32,221 | 412 | 32,703 | 818 |

| Mineral property expenses | 42,782 | – | – | – | – |

| Office and miscellaneous | 127,948 | 1,670 | 4,107 | 1,927 | 4,632 |

| Professional fees (Note 2(b)) | 804,449 | 91,565 | 5,701 | 98,314 | 10,924 |

| Shareholder information | 79,733 | 9,183 | – | 9,183 | – |

| Transfer agent and regulatory fees | 142,166 | 1,171 | 489 | 2,380 | 1,396 |

| Travel and promotion | 90,111 | 29,825 | – | 29,825 | – |

| Write-down of mineral property | 1,126,922 | – | – | – | – |

| | | | | | |

| | 3,148,825 | 203,575 | 21,231 | 212,900 | 26,986 |

| | | | | | |

| OTHER ITEMS | | | | | |

| Interest income | (18,009) | – | – | – | – |

| Gain on settlement of debt | (880) | – | – | – | – |

| Gain on option | (918,602) | – | – | – | – |

| Loss on sale of computer equipment | 266 | – | – | – | – |

| Loss on sale of long-term investment | 479,627 | – | – | – | – |

| Write-down of advances to affiliate | 417,809 | – | – | – | – |

| Write-down of long-tem investment | 480,653 | – | – | – | – |

| | | | | | |

| | 440,864 | – | – | – | – |

| | | | | | |

| Net Loss and Comprehensive Loss for the Period | (3,589,689) | (203,575) | (21,231) | (212,900) | (26,986) |

| | | | | | |

| | | | | | |

| Net Loss Per Share – Basic and Diluted | (0.00) | (0.01) | (0.01) | (0.01) |

| | | | | | |

| | | | | | |

| Weighted Average Number of Shares Outstanding | 42,340,000 | 2,244,000 | 24,474,000 | 1,734,000 |

| | | | | | |

The accompanying notes are an integral part of these consolidated interim financial statements

HIP Energy Corporation

(A Development Stage Company)

Consolidated Interim Statements of Cash Flows

(Unaudited - Expressed in US dollars)

| | | |

| |

| Six Months Ended |

May 31, 2010 $ | | May 31, 2009 $ |

| NET INFLOW (OUTFLOW) OF CASH RELATED TO THE FOLLOWING ACTIVITIES: | | | | |

| | | | | |

| OPERATING | | | | |

| Net loss for the period | | (212,900) | | (26,986) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

| Foreign currency translation | | 409 | | 7,085 |

| Donated services | | 1,206 | | 2,046 |

| Changes in non-cash working capital items related to operations | | | | |

| Increase in GST recoverable | | (4,459) | | (1,035) |

| Due to related parties | | 32,698 | | |

| Prepaid expenses | | (529) | | – |

| Increase (decrease) in accounts payable and accrued liabilities | | (19,735) | | 9,951 |

| | | | | |

| Net cash used in operating activities | | (203,310) | | (8,939) |

| | | | | |

| INVESTING | | | | |

| Acquisition of oil and gas properties | | (62,500) | | – |

| | | | | |

| Net cash flows used in investing activities | | (62,500) | | – |

| | | | | |

| FINANCING | | | | |

| Advance payable | | – | | (20,182) |

| Capital stock issued for cash | | 1,129,000 | | 50,000 |

| | | | | |

| Net cash flows provided by financing activities | | 1,129,000 | | 29,818 |

| | | | | |

| NET CASH INFLOWS | | 863,190 | | 20,879 |

| | | | | |

| CASH, BEGINNING OF PERIOD | | 11,526 | | 3,732 |

| | | | | |

| CASH, ENDING OF PERIOD | | 874,716 | | 24,611 |

| | | | | |

| Cash paid for income taxes during the year | | $ Nil | | $ Nil |

| Cash paid for interest during the year | | $ Nil | | $ Nil |

Non-cash transactions – Note 6

The accompanying notes are an integral part of these consolidated interim financial statements

HIP Energy Corporation

(A Development Stage Company)

Notes to the Consolidated Interim Financial Statements

May 31, 2010

(Unaudited - Expressed in US dollars)

| 1. | NATURE OF OPERATIONS AND ABILITY TO CONTINUE AS A GOING CONCERN |

The Company was incorporated on June 22, 1983, and on November 17, 2009, the Company changed its name from Bradner Ventures Ltd. to HIP Energy Corporation. The Company is currently a reporting issuer under the security laws of British Columbia and Alberta, Canada and its common shares are listed on the OTC Bulletin Board under the trading symbol "HIPCF". The Company is a development stage company and accordingly, the statements of operations and comprehensive loss, and cash flows include a total of all expenditures and other income and expenses since inception, June 22, 1983 to May 31, 2010. Prior to the acquisition of the Well Bores and the exclusive worldwide license to the HIP Downhole Process Technology, the Company did not have an operating business. The sole business was to identify a suitable business opportunity or a suitable business with which to enter into a business combination. The Company’s current business is to increase the recovery from oil wells using the HIP Downhole Process Technology.

Basis of Presentation

These interim consolidated financial statements and related notes are presented in accordance with accounting principles generally accepted in Canada, and are expressed in US dollars. The Company incorporated a wholly-owned subsidiary HIP Energy (Texas), Inc., (“HIP Texas”) on February 12, 2010 in Texas to facilitate the acquisition of the Well Bores as described in Note 3. The Company also incorporated a wholly-owned subsidiary HIP Energy (Nevada), Corporation, (“HIP Nevada”) on March 11, 2010 in Nevada to facilitate the acquisition of the exclusive worldwide license for use of the HIP Downhole Process Technology as described in Note 4. The financial statements include accounts of the Company and its wholly-owned subsidiaries, HIP Texas and HIP Nevada. All intercompany transactions and balances have been elimi nated. The Company’s fiscal year-end is November 30.

These consolidated financial statements have been prepared in accordance with generally accepted accounting principles in Canada applicable to a going concern, which assumes that the Company will be able to meet its obligations and continue its operations for its next fiscal year. Realization values may be substantially different from carrying values as shown and these consolidated financial statements do not give effect to adjustments that would be necessary to the carrying values and classification of assets and liabilities should the Company be unable to continue as a going concern. At May 31, 2010, the Company has accumulated losses of $3,589,689 since its inception and expects to incur further losses in the development of its business, all of which casts substantial doubt about the Company's ability to continue as a going concern . The Company’s ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they become due.

The operations of the Company have primarily been funded by the issuance of capital stock. Continued operations of the Company are dependent on the Company's ability to raise funds through debt financing, complete equity financings or generate profitable operations in the future. Management's plan in this regard is to secure additional funds through future equity financings. Such financings may not be available or may not be available on reasonable terms. The interim consolidated financial statements contain no adjustments which reflect the outcome of this uncertainty.

The unaudited interim consolidated financial statements have been prepared in accordance with Canadian generally accepted accounting principles for interim financial information. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. The unaudited interim consolidated financial statements have been prepared in accordance with the accounting principles and policies described in the Company’s annual financial statements for the year ended November 30, 2009, and should be read in conjunction with those statements. In the opinion of management, all adjustments (consisting of normal and recurring accruals) considered necessary for fair presentation of the Company’s financial position, results of operations and cash flows have been included. Operating results for the three month and six month periods ended May 31, 2010 are not necessarily indicative of the results that may be expected for future quarters or the year ended November 30, 2010.

Change in Functional Currency

On March 30, 2010, the Company completed the acquisition of certain Well Bores and a Technology License, both of which are located in the United States. Subsequent to the acquisitions, the Company’s operations, fundraising activities, and any future revenues will be denominated in United States (“US”) dollars. As a result of this change in circumstances, the Company undertook a review of the functional currency exposures of all of its business units according to CICA Section 1651 Foreign Currency Translation and concluded that the currency exposures of its Canadian and foreign operations are now predominately in US dollars. Prior to March 30, 2010, the Company’s functional currency was the Canadian dollar and the reporting currency was the Canadian dollar . Effective March 30, 2010, the Company’s functional and reporting currency is the US dollar. This results in all foreign currency impacts of holding non-US dollar denominated financial assets and liabilities being recorded through the statement of earnings. The Company accounted for this change prospectively. The translated amounts on March 29, 2010 become the historical basis for all balance sheet items as at March 30, 2009, except for shareholders’ equity at historical cost.

HIP Energy Corporation

(A Development Stage Company)

Notes to the Consolidated Interim Financial Statements

May 31, 2010

(Unaudited - Expressed in US dollars)

| 2. | RELATED PARTY TRANSACTIONS |

The Company entered into the following transactions with related parties, which are measured at the exchange amount.

| | a) | During the six month period ended May 31, 2010, the Company incurred $33,166 (2009 - $868 (Cdn$1,000)) for management fees to directors, officers and private companies controlled by them. |

| | b) | As at May 31, 2010, the Company owes $47,440 (Cdn$50,000) (November 30, 2009 - $47,125 (Cdn$50,000)) to a former director for advances, which are unsecured, non-interest bearing and payable on demand. |

| | c) | As at May 31, 2010, the Company owes $14,232 (Cdn$15,000) (November 30, 2009 - $14,138 (Cdn$15,000)) to a private company owned by a shareholder for advances, which are unsecured, non-interest bearing and payable on demand. |

On March 30, 2010, the Company’s subsidiary, HIP Texas, completed an Asset Purchase Agreement with HIP Energy Resource Limited (“HIPER”), a British Virgin Island corporation and its wholly-owned subsidiary, Equi Energy LLC, a Texas limited liability company, pursuant to which the Company acquired all rights, title and interest in and to 50 well bores located in West Texas, and 1 well bore (the “Opal Well”) located in Central Texas. In addition, the Company will, within 12 months, be transferred title to an additional 41 wells and well bores located in East Texas and 60 wells and well bores located in West Louisiana. The Company issued 20,000,000 shares of common stock at a fair value of $0.01 per share as consideration for the sale and transfer of the initial 50 well bores in West Texas and the 41 East Te xas and 60 Louisiana well bores. In consideration of the transfer of the Opal Well, the Company agreed to pay HIPER its accrued development, equipment and lease operating costs incurred on the Opal Well. The Company paid $62,500 and the balance of these costs will be paid on a declining basis from any oil and gas production revenues received by the Company as generated on the Opal Well in excess of 20 bbl oil or gas equivalent per day, using the HIP Downhole Process Technology.

In April 2010, the Company entered into a joint operating agreement with TexLa Operating Company (“TexLa”) to develop the Well Bores using the HIP Downhole Process Technology. In consideration for their services, TexLa will be granted a 10% working interest in any of the Well Bores that the HIP Downhole Process Technology is applied to.

On March 30, 2010, the Company’s subsidiary, Hip Nevada completed the acquisition of the worldwide exclusive rights to the proprietary HIP Downhole Process Technology pursuant to the terms of a License Agreement with Hip Technology Limited, and its subsidiary Group Rich Development Limited. The Hip Downhole Process Technology is a proprietary down hole oil and gas technology designed and developed to increase oil and gas production from non-commercial, uneconomic, depleted or damaged well bores and oil and gas reservoirs. In consideration for the grant of the License Agreement, the Company issued 30,000,000 shares of common stock at a fair value of $0.01 per share and agreed to pay Hip Technology Limited an annual royalty fee equal to 25% of net revenue from income associated with the use and application of the HIP Do wnhole Process Technology.

| | a) | Pursuant to the acquisitions of the Well Bores and the HIP Downhole Process Technology, the Company entered into an agreement with an individual to issue 80,000 shares of common stock as Finders’ Fee with a fair value of $0.01 per share. As at May 31, 2010, the shares had not been issued |

| | b) | The Company entered into several management and consulting agreements with directors and officers in which the Company agreed to pay aggregate monthly fees of $31,666. The monthly fees will increase to an aggregate of $63,332 within 30 days of the Company completing a private placement of $4,000,000 or the Company having achieved 30 days of continuous production of an average of 20 bbls of oil per day per well, or a combined oil and gas equivalent, from a minimum of 10 wells forming part of a 10 well unit on which the Company has successfully applied the HIP Downhole Process Technology. |

HIP Energy Corporation

(A Development Stage Company)

Notes to the Consolidated Interim Financial Statements

May 31, 2010

(Unaudited - Expressed in US dollars)

| | Accumulated from June 22, 1983 (Date of Inception) to May 31, 2010 $ | | | | |

| Three Months Ended | Six Months Ended |

| May 31, | May 31, | May 31, | May 31, |

2010 $ | 2009 $ | 2010 $ | 2009 $ |

| | | | – | | |

| Shares issued for settlement of debt | 304,323 | – | – | – | – |

| Shares issued for finder’s fee | 153,342 | – | – | – | – |

| Shares issued for acquisition of mineral property | 345,695 | – | – | – | – |

| Shares issued for acquisition of intangible assets (Note 4) | 300,000 | 300,000 | – | 300,000 | – |

| Shares issued for acquisition of oil and gas properties (Note 3) | 200,000 | 200,000 | – | 200,000 | – |

| Donated services | 10,349 | – | 1,086 | 1,205 | 2,172 |

On October 20, 2009 the Company effected an increase in authorized capital to an unlimited number of common shares and an unlimited number of preferred shares.

Common Shares

The common shares of the Company are all of the same class, are voting and entitle stockholders to receive dividends. Upon liquidation or wind-up, stockholders are entitled to participate equally with respect to any distribution of net assets or any dividends which may be declared.

| | a) | On March 29, 2010, the Company issued 30,000,000 shares of common stock with a fair value of $300,000 for the worldwide exclusive rights to the proprietary “HIP Down Hole Oil and Gas Enhancement Technology”. |

| | b) | On March 29, 2010, the Company issued 20,000,000 shares of common stock with a fair value of $200,000 to acquire all rights, title and interest in and to various oil and gas assets in Texas and Louisiana. |

| | c) | On April 16, 2010, the Company issued 2,416,000 shares of common stock pursuant to a private placement. The Company received $0.25 per share of common stock for total proceeds of $604,000. |

| | d) | On April 30, 2010, the Company issued 2,100,000 shares of common stock pursuant to a private placement. The Company received $0.25 per share of common stock for total proceeds of $525,000. |

Preferred Shares

The preferred shares of the Company may be issued in one or more series and may be designated as voting or non-voting and cumulative or non-cumulative. Upon liquidation or wind-up, stockholders are entitled to participate equally with respect to any distribution of net assets before any distribution is made to the holders of the common shares. The Company had no preferred shares outstanding at May 31, 2010 and November 30, 2009.

Stock Options

The Company, from time to time, allows officers, key employees and non-employee directors to be granted options to purchase shares of the Company’s authorized but un-issued common stock. Options currently expire no later than 10 years from the grant date and generally vest on the date of grant. These options are granted with an exercise price equal to the market price of the Company’s common stock on the date of the grant. The Company had no options outstanding as at May 31, 2010 and November 30, 2009.

| 8. | UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES |

These consolidated financial statements have been prepared in accordance with generally accepted accounting principles (“GAAP”) in Canada. There are no material differences between Canadian GAAP and United States GAAP on the balance sheets and statements of operations and comprehensive loss, and cash flows. Management does not believe that any recently issued, but not yet effective, accounting standard if currently adopted could have a material effect on the accompanying consolidated financial statements.

HIP ENERGY CORPORATION

FORM 51-102F1

MANAGEMENT’S DISCUSSION AND ANALYSIS

For the Six Month Period Ended May 31, 2010

July 30, 2010

The following discussion and analysis of our financial condition and results of operations for the quarterly period ended May 31, 2010 should be read in conjunction with our financial statements and related notes included in this interim report. Our financial statements included in this interim report were prepared in accordance with Canadian generally accepted accounting principles.

Information contained herein includes estimates and assumptions which management is required to make concerning future events, and may constitute forward-looking statements under applicable securities laws. Forward-looking statements include plans, expectations, estimates, forecasts and other comments that are not statements of fact. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential”, or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our com pany’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, we do not intend to update any of these forward-looking statements to conform these statements to actual results.

The amounts included in the following discussion are expressed in U.S. dollars.

Historical Review of Business Operations:

As earlier announced on November 17, 2009, we changed our name from Bradner Ventures Ltd. (“Bradner”) to HIP Energy Corporation (“HIP”) and effected a five (5) for one (1) reverse stock- split of our issued and outstanding common stock. The name change and reverse stock-split were effected with the OTC Bulletin Board on November 19, 2009. Our trading symbol was changed from “BNVLF” to “HIPCF”. Also effective October 20, 2009, we effected an increase in our authorized capital to an unlimited number of common shares and an unlimited number of preferred shares. We received approval for the increase in authorized capital, reverse split and name-change at our annual general meeting of shareholders held on July 31, 2009.

On March 30, 2010, pursuant to the Asset Purchase Agreement, HIP Texas, a wholly-owned subsidiary of HIP, acquired from HIP Resources ownership of the Well Bores. The Well Bores are described in detail under the heading “Business Overview – The Well Bores”. The consideration for the sale and transfer of the Well Bores was the issuance of 20 million common shares of HIP to EEL.

On March 30, 2010, pursuant to the License Agreement, HIP Nevada, a wholly-owned subsidiary of HIP, acquired from HIP Tech, an exclusive worldwide license for use of the HIP Downhole Process Technology. The HIP Downhole Process Technology is described in detail under the heading “Business Overview - HIP Downhole Process Technology”. The consideration for the acquisition of the HIP Downhole Process Technology was the issuance of 30 million common shares of HIP to Group Rich and a royalty payment, which is described in detailed under the heading “Business Overview - License Agreement”.

The acquisition of the Well Bores by HIP Texas and the exclusive worldwide right to the HIP Downhole Process Technology by HIP Nevada caused us to cease to be a “shell company”, as defined in Rule 12b-2 of the Exchange Act.

Prior to the acquisition of the Well Bores and the exclusive worldwide license to the HIP Downhole Process Technology, our company did not have an operating business. Our sole business was to identify a suitable business opportunity or a suitable business with which to enter into a business combination. Our current business is to increase the recovery from oil wells using the HIP Downhole Process Technology.

In consideration for the Well Bores, HIP issued 20,000,000 of its common shares to EEL at a fair value price of $0.01 per share. As a condition of the Asset Purchase Agreement, on January 12, 2010, HIP, HIP Texas, and HIP Nevada entered into a joint operating agreement with TexLa Operating Company (“TexLa”), whereby TexLa agreed to develop the Well Bores using the HIP Downhole Process Technology. In consideration for their services, TexLa was granted a 10% working interest in any of the Well Bores that the HIP Downhole Process Technology is applied to. This structure is intended to ensure that TexLa’s interests are aligned with HIP, as TexLa will have an operating interest in the Well Bores. Also as a condition of the Asset Purchase Agreement, the parties agreed to enter into a Non-Competition Agreement dated March 14 , 2010 pursuant to which EEL and HIP Resources agreed, among other things, not to compete against the business of the Company for a period of four years from the date of the agreement. In addition, as the License Agreement grants HIP a worldwide exclusive license to the HIP Downhole Process Technology, EEL and HIP Resources will not be able to use the HIP Downhole Process Technology on any well or well bores, except as provided under the License Agreement.

HIP Energy –Discussion on its Technology and Current Operations

Traditional oil exploration involves acquiring exploration or drilling rights, conducting seismic and other subsurface studies to estimate if oil and gas is present, and then drilling of the properties in order to attempt to discover and extract the oil and gas. The process can be extremely expensive and time consuming. Costs for drilling a single well have escalated dramatically and can run into the hundreds of thousands of dollars. Further, a significant percentage of all traditional exploration wells drilled each year end-up being dry holes. Our business is to increase the production of proven but unproductive wells, or to increase production from damaged, uneconomical, and stripper well bores using the HIP Downhole Process Technology.

Our initial focus will be to concentrate our operations on applying the HIP Downhole Process Technology to existing and proven well bores and reservoirs that have become non-commercial, uneconomic, depleted or damaged. We intend to demonstrate the value of the HIP Downhole Process Technology by improving the recovery of oil from well bores, after which we intend to acquire additional well bores that we believe, could have an increase in production if the HIP Downhole Process Technology was applied to the well bores. We believe we can generate more revenues by participating in the development of the well bores, rather than by licensing the HIP Downhole Process Technology to third parties. We believe the Company will benefit from increased industry recognition of the HIP Downhole Process Technology, while generating an ongoing and sustai ned cash flow from the increased recovery of hydrocarbons.

According to data provided to us by HIP Tech under the License Agreement, the HIP Downhole Process Technology has dissipated the barrier of 23 impediments that restricted or shut in the reservoirs located in the West Texas field, where the Texas Well Bores are located. According to data provided to us by HIP Tech, the HIP Process was applied on several of the Well Bores during the period from 1998 through 2004. These Well Bores experienced an increase in production after the HIP Downhole Process Technology was applied.

Since the closing of its acquisition, the Company’s focus has been in applying the HIP Tech on a single Well Bore, namely the Opal Ward 1 well, (the “Opal Well”) located in Opal Ward, Texas. The Opal Well, which was shut-in in 1993 having little or no production, was chosen specifically for its use as a “central process unit”, which, when fully operational, would potentially serve as the central control and processing facility for an offset of up to 15 or more oil and gas wells located within the same reservoir, assuming that the Company could acquire any of the additional offsetting oil and gas leases.

During the period March 1, 2010 to present, the Company’s focus has primarily been on closing the HIP Tech Acquisition and working with Texla, its Operator, and various other in-house and contract service providers, to undertake ongoing testing of its HIP Downhole Process on the Opal Ward #1 Well, making the necessary design changes and modifications to the Control Unit and its layout having regard to the nuances of the Opal well itself, and how it was reacting to well stimulation from time to time. The design modifications made by the Company in conjunction with HIPTL (the Licensor) were successful in stimulating the well bore and producing both oil and gas

during the testing periods. As a result of these positive advances in both the Control Unit layout and positive resulting well stimulation on the Opal Ward #1, management has elected to proceed over the next 30 – 60 days with the revision of various design aspects of the Control Unit and thereafter to commence a 30 day continuous production run on the Opal Ward #1 well. The purpose of the continuous production run will be to establish whether the HIP Tech will be effective in providing enough downhole well stimulation on the Opal Ward #1 well to result in sustained increased production of oil and gas over a protracted period. In addition, if successful, the continuous production run test will provide further confirmation of the viability of the HIP Tech to not only stimulate dead or low production wells, but also provide evidence that the HIP Tech may serve as a potentially viable replacement of the traditional plunger or pump jack systems for lifting oil and gas from low pressure and low production wells.

In addition to its efforts at Opal Ward, the Company has retained an oil and gas “landman” who is based in both Louisiana and Texas to assist in reviewing and providing advice on its wellbores and the status of any leases thereon, and on additional well bores and leases in Louisiana and Texas on which the Company may actively pursue the advancement of a larger 5+ well pilot program using the HIP Tech. During this time the Company will continue to proceed with the developments at Opal in the hope of being able to make the necessary modifications as may be required to increase the number of wells on which the HIP Tech can be successfully applied over a distance, thereby increasing the economic returns and viability of the HIP Tech Process.

License Agreement

Under the License Agreement, HIP Nevada was granted a worldwide exclusive license to the HIP Downhole Process Technology for the purpose of developing, producing, using, selling or otherwise commercially exploiting all subject matter encompassed within the scope of the HIP Downhole Process Technology. The consideration for the acquisition of the HIP Downhole Process Technology was the issuance of 30 million common shares of HIP to Group Rich and the grant of an agreed royalty structure on certain non-China ventures by HIP.

The royalty payment varies depending on the project. HIP Tech and HIP, collectively, will split any proceeds from a non-China Joint Venture as follows:

(i) On all Non-China joint venture related projects or operations on which the HIP Downhole Process Technology are being applied, HIP agrees subject to (ii) below, pay to Group Rich and HIP Tech (together the “Licensor”) a royalty fee equal to 25% of the gross revenue received by HIP from oil and gas wells where cumulative gross production per well exceeds more than 20 barrels of oil equivalences per day (Bblsoepd) for each monthly period. In the event cumulative production per well is equal to or less than 20 Bblsoepd for each monthly period, then the royalty will be reduced to 20% of the gross revenue received by HIP for all such wells.

| Gross Average Production Per Well Per Day, calculated commencing from the day immediately after Well bore Commercialization | Percentage Payable to Licensor |

| Up to 20 barrels per well per day | 20% Gross Revenue |

| Greater than 20 barrels per well per day | 25% Gross Revenue |

(ii) Immediately upon HIP completing an equity or debt financing of US$1,000,000 or more, the gross royalty set out in (i) will be reduced to a flat 25% of all net revenue derived by HIP from projects on which the HIP Downhole Process Technology is being applied.

Organizational Structure

Our organizational structure is as follows:

HIP Energy (Texas) Corp. (“HIP Texas”) is a wholly owned subsidiary that is governed by the laws of the state of Texas. HIP Texas was incorporated for the purposes of holding title to the Well Bores.

HIP Energy (Nevada) Corp. (“HIP Nevada”) is a wholly owned subsidiary that is governed by the laws of the state of Nevada. HIP Nevada was incorporated for the purposes of holding our license to the HIP Downhole Process Technology.

Results of Operations

Three Month Period Ended May 31, 2010 Compared to the Three Month Period May 31, 2009:

Our company did not generate any revenues during the three months ended May 31, 2010. Net loss and expenses were $203,575 for the three months ended May 31, 2010, compared to $21,231 for the three months ended May 31, 2009. The increase in net loss and expenses in the three month period ended May 31, 2010 were primarily from those required to close the HIP Acquisition, maintain our continuous disclosure requirements as a public company, to initiate the task of implementing and testing the HIP Tech at the Opal Ward #1 well; and continue with the review of additional oil and gas well bore and leasing opportunities.

Net loss per share was $(0.00) for the three months ended May 31, 2010, compared to a net loss per share of $(0.01) for the three months ended May 31, 2009.

Six Month Period Ended May 31, 2010 Compared to the Six Month Period May 31, 2009:

Our company did not generate any revenues during the six months ended May 31, 2010. Net loss and expenses were $212,900 for the six months ended May 31, 2010, compared to $26,986 for the six months ended May 31, 2009. The increase in net loss and expenses in the six month period ended May 31, 2010 were primarily from those required to close the HIP Acquisition, maintain our continuous disclosure requirements as a public company, to initiate the task of implementing and testing the HIP Tech at the Opal Ward #1 well; and continue with the review of additional oil and gas well bore and leasing opportunities.

Net loss per share was $(0.00) for the six months ended May 31, 2010, compared to a net loss per share of $(0.01) for the six months ended May 31, 2009.

Selected Quarterly and Year-to-Date Financial Information

The following table provides selected quarterly financial information for the three months and six months ended May 31, 2010 and May 31, 2009:

| | Three Months Ended May 31, 2010 | Three Months Ended May 31, 2009 | Six Months Ended May 31, 2010 | Six Months Ended May 31, 2009 |

| | | | | |

| Revenue | $Nil | $Nil | $Nil | $Nil |

| | | | | |

| Net loss | (203,575) | (21,231) | (212,900) | (26,986) |

| | | | | |

| Net loss per share (basic and fully diluted) | (0.00) | (0.00) | (0.00) | (0.00) |

| | | | | |

| | | As at May 31, 2010 | | As at November 30, 2009 |

| | | | | |

| Total assets | | $ | 1,444,285 | | $ | 12,807 |

| | | | | |

| Shareholders’ equity (deficit) | | 1,324,828 | | | (92,477) |

| | | | | |

Summary of Quarterly Results

Quarterly Results of the Eight Quarters ended May 31, 2010

| | | 2010 | 2009 |

| | | | | | | | | |

| | | May 31 | | February 28 | | November 30 | | August 31 |

| | | (unaudited) | | (unaudited) | | (audited) | | (unaudited) |

| | | | | | | | | |

| Revenues | | $ | Nil | | $ | Nil | | $ | Nil | | $ | Nil |

| | | | | | | | | | | | | |

| Net loss | | | (203,575) | | | (9,325) | | | (33,605) | | | (9,321) |

| | | | | | | | | | | | | |

| Basic and Diluted earnings (loss) per share | | | (0.00) | | | (0.00) | | | (0.00) | | | (0.00) |

| | | | | | | | | |

| | | | | | | | | |

| | | 2009 | 2008 |

| | | | | | | | | |

| | | May 31 | | February 28 | | November 30 | | August 31 |

| | | (unaudited) | | (unaudited) | | (audited) | | (unaudited) |

| | | | | | | | | | |

| Revenues | | $ | Nil | | $ | Nil | | $ | Nil | | $ | Nil |

| | | | | | | | | | | | | |

| Net loss | | | (21,231) | | | (5,755) | | | (16,646) | | | (9,943) |

| | | | | | | | | | | | | |

| Basic and Diluted earnings (loss) per share | | | (0.00) | | | (0.00) | | | (0.00) | | | (0.01) |

Liquidity

We had cash and other current assets of $880,985 as at May 31, 2010, compared to $12,807 as at November 30, 2009. Our company’s normal operating expenses for the six months ended May 31, 2010 of $212,900 included consulting and secretarial fees of $33,751, professional fees (accounting, administration and legal) of $98,314, management fees of $32,703, travel and promotion of $29,825 and other expenses of $18,307.

Operating Activities

Operating activities used cash of $203,310 for the six months ended May 31, 2010, compared to $8,939 for the six months ended May 31, 2009.

Investing Activities

The Company paid $62,500 as partial consideration for oil and gas interests during the six months ended May 31, 2010.

Financing Activities

In April 2010, we completed two private placements consisting of 4,516,000 common shares for proceeds of $1,129,000. On May 12, 2009, the Company completed a private placement with a director of the Company for the purchase of 5,000,000 common shares for proceeds of $50,000.

Capital Resources

Financing

We plan to focus on those areas that will result in the production of oil and gas in the shortest time frame. In pursuing this objective, we plan to raise funds as required with the intent of minimizing dilution and maximizing return on funds deployed. Until such time as the HIP Downhole Process Technology is further developed and results in revenues from production of oil and gas from applied wells, we plan to primarily rely on traditional equity markets and if available, debt instruments to raise our required funding. During the period ended May 31, 2010, we raised $1,129,000 through the sale of common stock.

Use of Funding

Any funds received will, at the discretion of management, be allocated in part to establishing 5 to 8 test wells, which may include the expansion from the central unit at the Opal Well into 5 additional offset well locations within the same reservoir or development of any of the Well Bores. If oil and gas production is attained from these low production or problematic wells using the HIP Process, we will then continue to expand our commercialization of the HIP Downhole Process Technology.

We plan on deploying monies in those prospect areas where we have the greatest understanding of the existing well bores and reservoirs. To this end, we plan to focus our initial efforts on using the HIP Process in well bores and basins in such regions as the Woodbine and Austin Chalk region of the U.S. These regions are low-risk and long-term energy producers. We will participate in such regions with landowners or companies that have access to leases located in geological trends that have demonstrated substantial historical production and have potential remaining reserves that can be exploited in a low-risk, systematic fashion.

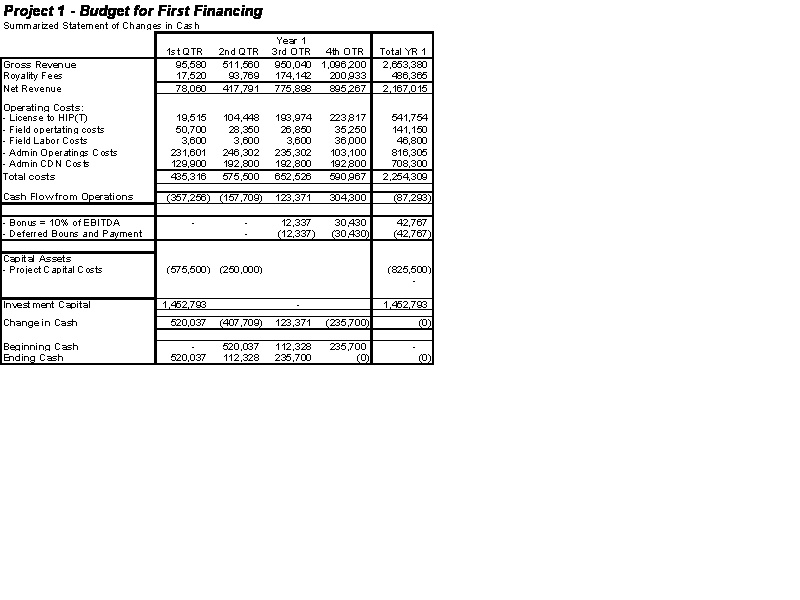

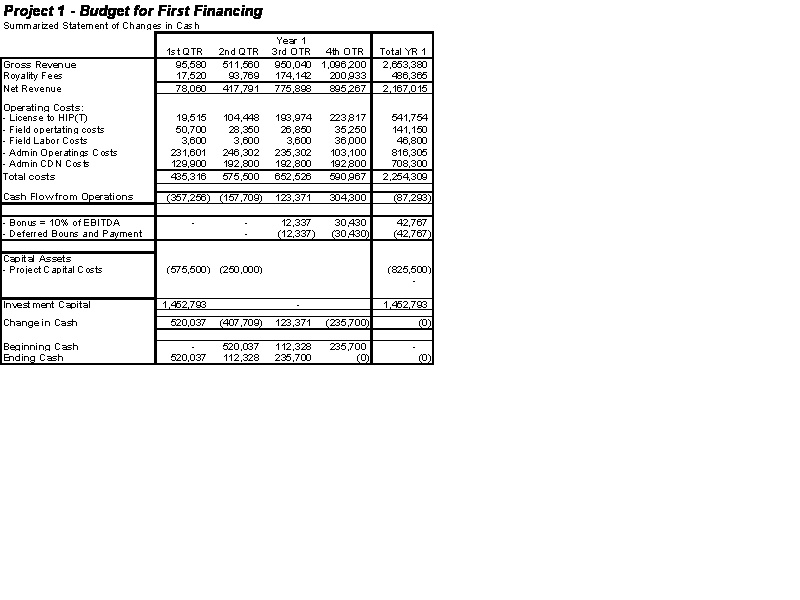

We have an initial project plan and budget that envisages an investment approximately $1 million to fund a capital project and operating costs and are expected to be deployed as set out in the following table:

Our sole tangible assets consists of the Well Bores and the exclusive worldwide license to the HIP Downhole Process Technology. It is however a requirement of the application of the HIP Downhole Process Technology that certain equipment and other fixed or other tangible assets be acquired or leased in order that any potential commercialization of the HIP Tech on any of the well bores can be realized. The equipment required as part of the HIP Downhole Process in part forms the basis of the application patent relating to the HIP Downhole Process Technology and in other cases is readily available oilfield equipment. The availability of any specific equipment may affect our ability to carry out its operations in a timely and cost effective manner. As stated earlier, our short-term plan is to apply and test the HIP Downhole Process Technolo gy on a number of wells and wellbores acquired from HIP Resources. The results of these tests and the ongoing development and application of the HIP Downhole Process Technology will directly affect the Companies ability to generate revenue and raise additional capital to further expand its programs and acquire any ongoing plant and equipment. As with any new technology applications there is inherent risk that the technology itself may not prove commercially viable or result in any economic production.

China Joint Venture

We have been in preliminary discussion with the applicable parties to form a joint venture (a “China Joint Venture”). Our discussion to-date have focussed on the development of an initial pilot program to prove the economic viability of the HIP Downhole Process Technology on an agreed number of “beta” test well bores within a designated oilfield in China. After the economic viability of the HIP Downhole Process Technology has been proven, the HIP Downhole Process Technology applied on a large scale. As of the date of this report, we have not signed any definitive agreements with JOC and they may cease discussions at any time. Further, although we are at an advanced stage of negotiations and agreement as to the financial terms, number of wells and contribution of the respective parties, we have not sig ned any letters of intent or memorandums of understanding regarding same at this time.

Off-balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Transactions with Related Parties

The Company entered into the following transactions with related parties, which are measured at the exchange amount.

| | a) | During the six month period ended May 31, 2010, the Company incurred $33,166 (2009 - $868 (Cdn$1,000)) for management fees to directors, officers and private companies controlled by them. |

| | b) | As at May 31, 2010, the Company owes $47,440 (Cdn$50,000) (November 30, 2009 - $47,125 (Cdn$50,000)) to a former director for advances, which are unsecured, non-interest bearing and payable on demand. |

| | c) | As at May 31, 2010, the Company owes $14,232 (Cdn$15,000) (November 30, 2009 - $14,138 (Cdn$15,000)) to a private company owned by a shareholder for advances, which are unsecured, non-interest bearing and payable on demand. |

Application of Critical Accounting Policies

The preparation of financial statements in conformity with Canadian generally accepted accounting principles requires our management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Significant areas requiring the use of management estimates relate to the impairment of mineral property interests and the determination of reclamation obligations. Actual results could differ from those estimates. By their nature, such estimates are subject to measurement uncertainty and the effect on the financial statements of changes in such estimates in future periods could be significant. The financial statements have, in management’ s opinion, been properly prepared within the framework of the significant accounting policies summarized below.

Change in Functional Currency

On March 30, 2010, the Company completed the acquisition of certain Well Bores and a Technology License, both of which are located in the United States. Subsequent to the acquisitions, the Company’s operations, fundraising activities, and any future revenues will be denominated in United States (“US”) dollars. As a result of this change in circumstances, the Company undertook a review of the functional currency exposures of all of its business units according to CICA Section 1651 Foreign Currency Translation and concluded that the currency exposures of its Canadian and foreign operations are now predominately in US dollars. Prior to March 30, 2010, the Company’s functional currency was the Canadian dollar and the reporting currency was the Canadian dollar. Effective March 30, 2010, the Company’s functional and reporting currency is the US dollar. This results in all foreign currency impacts of holding non-US dollar denominated financial assets and liabilities being recorded through the statement of earnings. The Company accounted for this change prospectively. The translated amounts on March 29, 2010 become the historical basis for all balance sheet items as at March 30, 2009, except for shareholders’ equity at historical cost.

Stock-Based Compensation

Stock-based compensation is accounted for at fair value as determined by the Black-Scholes option pricing model using amounts that are believed to approximate the volatility of the trading price of our company’s stock, the expected lives of awards of stock-based compensation, the fair value of our company’s stock and the risk-free interest rate. The estimated fair value of awards of stock-based compensation is charged to expense as awards vest, with offsetting amounts recognized as contributed surplus.

Accounting Changes

The Company adopted CICA Handbook Section 1506 “Accounting Changes” which revises the standards on changes in accounting policy, estimates or errors to require a change in accounting policy to be applied retrospectively (unless doing so is impracticable or is specified otherwise by a new accounting standard), changes in estimates to be recorded prospectively, and prior period errors to be corrected retrospectively. Voluntary changes in accounting policy are allowed only when they result in financial statements that provide reliable and more relevant information. In addition, these revised standards call for enhanced disclosures about the effects of changes in accounting policies, estimates and errors on the financial statements. The impact of this new standard cannot be determined until such time as the Company makes a chan ge in accounting policy, other than the changes resulting from the implementation of the new CICA Handbook standards discussed in this note.

Cash Distributions

The Company follows the CICA Handbook Section 1540, Cash Flow Statements, which has been amended to require additional disclosures where cash distributions are made in accordance with a contractual obligation for cash distributions. The adoption of this section has not resulted in any changes on the disclosure within the financial statements.

Capital Disclosures

Effective December 1, 2007, the Company adopted the new CICA guidelines of Section 1535, Capital Disclosures, which requires companies to disclose their objectives, policies and processes for managing capital, quantitative data about what the entity regards as capital, and whether companies have complied with externally imposed capital requirements and, if not in compliance, the consequences of such non-compliance.

In the management of capital, the Company includes cash in the definition of capital. The Company manages its capital structure and makes adjustments to it, based on the funds available to the Company, in order to seek and identify suitable business opportunities or business combinations in Canada. The board of directors does not establish quantitative return on capital criteria for management, but rather relies on the expertise of the Company’s management to sustain future development of the business.

The Company places its cash with institutions of high credit worthiness. At May 31, 2010, the Company had cash of $874,716 compared to $11,526 as at November 30, 2009.

The Company has historically relied on the equity markets and advances from related parties to fund its activities. In order to carry out identifying business opportunities and pay for administrative costs, the Company will spend its existing working capital and raise additional funds as needed.

Management reviews its capital management approach on an ongoing basis and believes that this approach, given the relative size of the Company, is reasonable. There have been no changes made to the capital management policy during the year.

Recently Adopted Accounting Pronouncements

The Canadian Accounting Standards Board (“AcSB”) issued CICA Handbook Section 3064 which replaces Section 3062, Goodwill and Other Intangible Assets, and Section 3450, Research and Development Costs. This new section establishes standards for the recognition, measurement, presentation and disclosure of goodwill subsequent to its initial recognition and of intangible assets. Standards concerning goodwill remain unchanged from the standards included in the previous Section 3062. The section applies to interim and annual financial statements relating to fiscal years beginning on or after October 1, 2008. Effective December 1, 2008, the Company has applied this standard and the adoption of this did not have material impact on the financial statements.

The amended Section 1400 provides guidance related to management’s assessment of the Company’s ability to continue as a going concern. The additional requirement requires management to make an assessment of the Company’s ability to continue as a going concern and to disclose any material uncertainties related to events or conditions that may cast significant doubt upon the entity’s ability to continue as a going concern. Note 1 addresses the additional disclosure as required.

The CICA handbook Section 1000 has been amended to focus on the capitalization of costs that meet the definition of an asset and de-emphasizes the matching principle. The revised requirements are effective for annual and interim financial statements relating to fiscal years beginning on or after October 1, 2008. The amendment has not resulted in any changes on the financial position or results of the Company.

Recent Accounting Pronouncements

In 2006, the AcSB published a new strategic plan that will significantly affect financial reporting requirements for Canadian companies. The AcSB strategic plan outlines the convergence of Canadian GAAP with IFRS over an expected five year transitional period. In February 2008, the AcSB announced that 2011 is the changeover date for publicly-listed companies to use IFRS, replacing Canada’s own GAAP. The date is for interim and annual financial statements relating to fiscal years beginning on or after January 1, 2011. The transition date of January 1, 2011 will require the restatement for comparative purposes of amounts reported by the Company for the year ended November 30, 2011. While the Company has begun assessing the adoption of IFRS for 2011, the financial reporting impact of the transition to IFRS cannot be reasonably estim ated at this time. The Company is currently assessing the impact of the above new accounting standards on the Company’s financial positions and results of operations.

The CICA handbook Section 1601, “Consolidated Financial Statements”, and Section 1602, “Non-controlling Interests”, replaces Section 1600. Section 1601 establishes standards for the preparation of consolidated financial statements. Section 1602 establishes standards for accounting, for a non-controlling interest in a subsidiary in consolidated financial statements, subsequent to a business combination. Section 1602 is equivalent to the corresponding provisions of International Financial Reporting Standard IAS 27, “Consolidated and Separate Financial Statements”. These standards are effective for the Company for interim and annual financial statements beginning on January 1, 2011. Early adoption is permitted. The Company has not yet determined the impact of the adoption of these changes on its financi al statements.

The CICA handbook Section 1582, “Business Combinations”, which replaces Section 1581, “Business

Combinations”, establishes standards for the accounting for a business combination. It is the Canadian GAAP equivalent to International Financial Reporting Standard IFRS 3, “Business Combinations”. This standard is effective for interim and annual financial statements beginning on January 1, 2011. Early adoption is permitted. The Company has not yet determined the impact of the adoption of these changes on its financial statements.

International financial reporting standards (‘IFRS”)

In 2006, the AcSB published a new strategic plan that will significantly affect financial reporting requirements for Canadian companies. The AcSB strategic plan outlines the convergence of Canadian GAAP with IFRS over an expected five year transitional period. In February 2008, the AcSB announced that 2011 is the changeover date for publicly-listed companies to use IFRS, replacing Canada’s own GAAP. The date is for interim and annual financial statements relating to fiscal years beginning on or after January 1, 2011. The transition date of January 1, 2011 will require the restatement for comparative purposes of amounts reported by the Company for the year ended November 30, 2012. While the Company has begun assessing the adoption of IFRS for 2011, the financial reporting impact of the transition to IFRS cannot be reasonably estim ated at this time. The Company does not expect the adoption of IFRS to have a material impact on the Company’s financial position and results of operations.

Disclosure Controls and Procedures and Internal Controls and Procedures

In contrast to the certificate required for non-venture issuers under National Instrument 52-109 Certification of Disclosure in Issuer’s Annual and Interim Filings (“NI 52-109”), the Company utilizes the Venture Issuer Basic Certificate which does not include representations relating to the establishment and maintenance of disclosure controls and procedures (“DC&P”) and internal control over financial reporting (“ICFR”), as defined in National Instrument NI 52-109. In particular, the Company’s certifying officers are not making any representations relating to the establishment and maintenance of:

(a) controls and other procedures designed to provide reasonable assurance that information required to be disclosed by the issuer in its annual filings, interim filings or other reports filed or submitted under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation; and

(b) a process to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer’s GAAP.

The Company’s certifying officers are responsible for ensuring that processes are in place to provide them with sufficient knowledge to support the representations they are making in their certifications. Investors should be aware that inherent limitations on the ability of certifying officers of a venture issuer to design and implement on a cost effective basis DC&P and ICFR as defined in NI 52-109 may result in additional risks to the quality, reliability, transparency and timeliness of interim and annual filings and other reports provided under securities legislation.

Outstanding Securities

The authorized capital of our company consists of 100,000,000 common shares, divided into 75,000,000 common shares without par value and 25,000,000 preference shares without par value. As of July 30, 2010, there were 60,727,660 common shares issued and outstanding and no preference shares issued and outstanding in the capital of our company. The company has no options or warrants outstanding.

Additional Disclosure for Venture Issuers Without Significant Revenue

| | Six Months Ended May 31, 2010 | | Six Months Ended May 31, 2009 | |

| | | | | | |

| General and Administrative Expenses | $ | 212,900 | | $ | 26,986 |

Additional Information

Additional information relating to our company is available for viewing on the SEDAR website at www.sedar.com.

FORM 52-109FV2

CERTIFICATION OF INTERIM FILINGS - VENTURE ISSUER BASIC CERTIFICATE

I, Richard Coglon, Chief Executive Officer of HIP Energy Corporation, certify the following:

Review: I have reviewed the interim financial statements and interim MD&A (together, the “interim filings”) of HIP Energy Corporation (the “issuer”) for the interim period ended May 31, 2010.

No misrepresentations: Based on my knowledge, having exercised reasonable diligence, the interim filings do not contain any untrue statement of a material fact or omit to state a material fact required to be stated or that is necessary to make a statement not misleading in light of the circumstances under which it was made, with respect to the period covered by the interim filings.

Fair presentation: Based on my knowledge, having exercised reasonable diligence, the interim financial statements together with the other financial information included in the interim filings fairly present in all material respects the financial condition, results of operations and cash flows of the issuer, as of the date of and for the periods presented in the interim filings.

Date: July 30, 2010

“Richard Coglon”

Richard Coglon

Chief Executive Officer

In contrast to the certificate required for non-venture issuers under National Instrument 52-109 Certification of Disclosure in Issuers’ Annual and Interim Filings (NI 52-109), this Venture Issuer Basic Certificate does not include representations relating to the establishment and maintenance of disclosure controls and procedures (DC&P) and internal control over financial reporting (ICFR), as defined in NI 52-109. In particular, the certifying officers filing this certificate are not making any representations relating to the establishment and maintenance of

| i) | controls and other procedures designed to provide reasonable assurance that information required to be disclosed by the issuer in its annual filings, interim filings or other reports filed or submitted under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation; and |

| ii) | a process to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer’s GAAP. |

The issuer’s certifying officers are responsible for ensuring that processes are in place to provide them with sufficient knowledge to support the representations they are making in this certificate. Investors should be aware that inherent limitations on the ability of certifying officers of a venture issuer to design and implement on a cost effective basis DC&P and ICFR as defined in NI 52-109 may result in additional risks to the quality, reliability, transparency and timeliness of interim and annual filings and other reports provided under securities legislation.

FORM 52-109FV2

CERTIFICATION OF INTERIM FILINGS - VENTURE ISSUER BASIC CERTIFICATE

I, Richard Coglon, Chief Financial Officer of HIP Energy Corporation, certify the following:

Review: I have reviewed the interim financial statements and interim MD&A (together, the “interim filings”) of HIP Energy Corporation (the “issuer”) for the interim period ended May 31, 2010.

No misrepresentations: Based on my knowledge, having exercised reasonable diligence, the interim filings do not contain any untrue statement of a material fact or omit to state a material fact required to be stated or that is necessary to make a statement not misleading in light of the circumstances under which it was made, with respect to the period covered by the interim filings.

Fair presentation: Based on my knowledge, having exercised reasonable diligence, the interim financial statements together with the other financial information included in the interim filings fairly present in all material respects the financial condition, results of operations and cash flows of the issuer, as of the date of and for the periods presented in the interim filings.

Date: July 30, 2010

“Richard Coglon”

Richard Coglon

Chief Financial Officer

In contrast to the certificate required for non-venture issuers under National Instrument 52-109 Certification of Disclosure in Issuers’ Annual and Interim Filings (NI 52-109), this Venture Issuer Basic Certificate does not include representations relating to the establishment and maintenance of disclosure controls and procedures (DC&P) and internal control over financial reporting (ICFR), as defined in NI 52-109. In particular, the certifying officers filing this certificate are not making any representations relating to the establishment and maintenance of

| i) | controls and other procedures designed to provide reasonable assurance that information required to be disclosed by the issuer in its annual filings, interim filings or other reports filed or submitted under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation; and |

| ii) | a process to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer’s GAAP. |

The issuer’s certifying officers are responsible for ensuring that processes are in place to provide them with sufficient knowledge to support the representations they are making in this certificate. Investors should be aware that inherent limitations on the ability of certifying officers of a venture issuer to design and implement on a cost effective basis DC&P and ICFR as defined in NI 52-109 may result in additional risks to the quality, reliability, transparency and timeliness of interim and annual filings and other reports provided under securities legislation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

HIP ENERGY CORPORATION

/s/ Richard Coglon

Richard Coglon

President

Date: August 3, 2010