UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F /A Amendment No. 1

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended November 30, 2011

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-30972

HIP ENERGY CORPORATION

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

5548 Parthenon Place, West Vancouver, British Columbia, Canada V7V2V7

(Address of principal executive offices)

Richard Coglon, President,

604.377.5515

richard@hipenergycorp.com

5548 Parthenon Place, West Vancouver, British Columbia, Canada V7V2V7

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class Name of each exchange on which registered

Not Applicable Not Applicable

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not Applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

There were 60,727,660 common shares, without par value, issued and outstanding as of November 30, 2011.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES NO

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

YES NO

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES NO

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer Accelerated filer Non-accelerated filer

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP | International Financial Reporting Standards as issued by the International Accounting Standards Board | Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES NO

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

YES NO

EXPLANATORY NOTE

We are filing this Form 20-F/A Amendment No.1 to include the audit report of BDO Canada LLP for the Financial Statements for the year ended November 30, 2010.

PART I

GENERAL

In this Annual Report on Form 20-F, references to:

“Asset Purchase Agreement” means the asset purchase agreement among HIP, HIP Texas, EEL, and HIP Resources dated March 14, 2010;

“EEL” means Equi Energy LLC, a Texas corporation;

“HIP Resources” means HIP Energy Resource Limited, a British Virgin Islands corporation;

“HIP Nevada” means HIP Energy (Nevada) Corporation, a Nevada corporation and a wholly owned subsidiary of HIP;

“HIP Tech” means HIP Technology Limited, a British Virgin Islands corporation;

“HIP Texas” means HIP Energy (Texas), Inc., a Texas corporation and a wholly owned subsidiary of HIP;

“HIP Downhole Process Technology” means the technology relating to the hydrogen inducement down hole oil and gas recovery process acquired by HIP Texas pursuant to the License Agreement, which is described in more detail under the heading “Business Overview - HIP Downhole Process Technology”;

“Group Rich” means Group Rich Development Limited, a British Virgin Islands corporation;

“License Agreement” means the license agreement among HIP Tech, Group Rich, HIP Nevada and HIP dated March 14, 2010;

“We”, “us”, “our”, the “Company”, and “HIP” means HIP Energy Corporation, a British Columbia corporation; and

“Well Bores” means the rights acquired to various well bores by HIP Nevada pursuant to the Asset Purchase Agreement.

Certain statements in this annual report are not historical and are forward-looking statements. These statements relate to expectations, beliefs, intentions, plans, objectives, assumptions or future events or performance of HIP. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “intend”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “project”, “predict”, “potential”, or “continue” or the negative of these terms or other comparable terminology. In particular, this annual report contains forward-looking statements pertaining to the following:

| · | the quantity of potential oil and gas reserves; |

| · | potential oil and gas production levels; |

| · | potential production and operating activities and timing of such activities; |

| · | capital expenditure programs; |

| · | our ability to raise capital; |

| · | projections of market prices and costs; |

| · | discussion regarding any future joint venture agreements; |

| · | the acquisition of future well bores; |

| · | the viability of the HIP Downhole Process Technology; and |

| · | treatment under governmental regulatory regimes and tax laws. |

Readers should read these forward-looking statements carefully because they discuss future expectations, contain projections of future results of operations or of financial condition or state other forward-looking information. Readers should be aware that these forward-looking statements involve known and unknown risks, uncertainties and contingencies and are based on assumptions that may not materialize or occur in the manner assumed. Consequently, actual results may vary from the estimates or predictions stated in the materials and these variations may be material.

These risks, uncertainties and contingencies which may affect the assumptions underlying these forward-looking statements include, among others:

| · | risks and uncertainties associated with estimating potential oil and gas reserves including interpreting engineering and geological data; |

| · | risks and uncertainties associated with our ability to establish the economic viability of the HIP Downhole Process Technology; |

| · | incorrect assessment that the Well Bores are suited for the HIP Downhole Process Technology; |

| · | geological, technical, drilling and processing problems; |

| · | liabilities inherent in oil and gas operations; |

| · | inability of HIP Resources to transfer the Louisiana Well Bores; |

| · | volatility in market prices for oil and gas and foreign currency exchange rates; |

| · | possible adverse effects of governmental regulations including changes in environmental and other regulations that may impose restrictions in areas where we operate; |

| · | competition for capital, acquisitions of reserves, undeveloped lands and skilled personnel; |

| · | investors becoming unwilling or unable to complete future private placements; |

| · | risks and uncertainties associated with our ability to raise additional capital; and |

| · | the risks described under the heading “Risk Factors”. |

Further, any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by applicable law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for management to predict all of such factors and to assess in advance the impact of such factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

Unless otherwise indicated, all dollar amounts referred to herein are in United States dollars. All references to CDN$ are to Canadian dollars and all references to US$ are to United States dollars.

ITEM 1. Identity of Directors, Senior Management and Advisers

Not applicable.

ITEM 2. Offer Statistics and Expected Timetable

Not applicable.

ITEM 3. Key Information

A. Selected Financial Data

The following financial data summarizes selected financial data for our company prepared in accordance with Canadian generally accepted accounting principles for the five fiscal years ended November 30, 2011. Additional information is presented to show the differences which would result from the application of United States generally accepted accounting principles to our financial information. Prior to March 30, 2010, our functional currency was the Canadian dollar and the reporting currency was the Canadian dollar. Effective March 30, 2010, our functional and reporting currency is the U.S. dollar. This results in all foreign currency impacts of holding non-U.S. dollar denominated financial assets and liabilities being recorded through the statement of earnings. We accounted for this change prospectively. The information presented below for the five year period ended November 30, 2011 is derived from our audited financial statements which were examined by our independent auditor. The information set forth below should be read in conjunction with our audited financial statements and related notes included in this annual report and with the information appearing under the heading “Item 5 Operating and Financial Review and Prospects”.

Selected Financial Data

(Calculated in accordance with Canadian GAAP)

Fiscal Year Ended November 30 (Audited)

| CANADIAN GAAP | | 2011 (US$) | | | 2010 (US$) | | | 2009 (US$) | | | 2008 (CDN$) | | | 2007 (CDN$) | |

| Net Sales or Operating Revenue | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | – | |

| Total Expenses | | $ | 668,208 | | | $ | 759,312 | | | $ | 57,419 | | | $ | 47,508 | | | $ | 61,980 | |

| Income (Loss) from Continuing Operations | | $ | (668,208 | ) | | $ | (759,312 | ) | | $ | (57,419 | ) | | $ | (47,508 | ) | | $ | (61,980 | ) |

Net Income (Loss) and Comprehensive Income (Loss) for the Year | | $ | (668,208 | ) | | $ | (759,312 | ) | | $ | (70,007 | ) | | $ | (47,508 | ) | | $ | (61,980 | ) |

| Total Assets | | $ | 111,705 | | | $ | 417,654 | | | $ | 12,795 | | | $ | 4,733 | | | $ | 6,236 | |

| Total Stockholders’ Equity (Deficiency) | | $ | (384,794 | ) | | $ | 283,414 | | | $ | (92,389 | ) | | $ | (95,267 | ) | | $ | (52,759 | ) |

| Capital Stock | | $ | 4,409,168 | | | $ | 4,409,168 | | | $ | 3,275,168 | | | $ | 4,279,498 | | | $ | 4,279,498 | |

| Weighted Average Number of Common Shares (adjusted to reflect changes in capital) | | | 60,727,660 | | | | 42,650,696 | | | | 3,978,774 | | | | 1,211,651 | | | | 1,211,651 | |

| Basic and Diluted Net Loss per Common Share | | $ | (0.01 | ) | | $ | (0.02 | ) | | $ | (0.01 | ) | | $ | (0.04 | ) | | $ | (0.05 | ) |

| Long-Term Debt | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | – | |

| Cash Dividends per Common Share | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | – | |

Selected Financial Data

(Calculated in accordance with U.S. GAAP)

Fiscal Year Ended November 30 (Audited)

| UNITED STATES GAAP | | 2011 (US$) | | | 2010 (US$) | | | 2009 (US$) | | | 2008 (CDN$) | | | 2007 (CDN$) | |

| Net Sales or Operating Revenue | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | – | |

| Total Expenses | | $ | 668,208 | | | $ | 759,312 | | | $ | 57,419 | | | $ | 47,508 | | | $ | 61,980 | |

| Income (Loss) from Continuing Operations | | $ | (668,208 | ) | | $ | (759,312 | ) | | $ | (57,419 | ) | | $ | (47,508 | ) | | $ | (61,980 | ) |

Net Income (Loss) and Comprehensive Income (Loss) for the Year | | $ | (668,208 | ) | | $ | (759,312 | ) | | $ | (70,007 | ) | | $ | (47,508 | ) | | $ | (61,980 | ) |

| Total Assets | | $ | 111,705 | | | $ | 417,654 | | | $ | 12,795 | | | $ | 4,733 | | | $ | 6,236 | |

| Total Stockholders’ Equity (Deficiency) | | $ | (384,794 | ) | | $ | 283,414 | | | $ | (92,389 | ) | | $ | (95,267 | ) | | $ | (52,759 | ) |

| Capital Stock | | $ | 4,409,168 | | | $ | 4,409,168 | | | $ | 3,275,168 | | | $ | 4,279,498 | | | $ | 4,279,498 | |

Weighted Average Number of Common Shares (adjusted to reflect changes in capital) | | | 60,727,660 | | | | 42,650,696 | | | | 3,978,774 | | | | 1,211,651 | | | | 1,211,651 | |

| Basic and Diluted Net Loss per Common Share | | $ | (0.01 | ) | | $ | (0.02 | ) | | $ | (0.01 | ) | | $ | (0.04 | ) | | $ | (0.05 | ) |

| Long-term Debt | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | – | |

| Cash Dividends per Common Share | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | – | |

Reconciliation to United States Generally Accepted Accounting Principles

There are no material differences between Canadian generally accepted accounting principles and United States generally accepted accounting principles on the balance sheets and statements of operations and comprehensive loss and cash flows of our company.

Disclosure of Exchange Rate History

Since June 1, 1970, the government of Canada has permitted a floating exchange rate to determine the value of the Canadian dollar as compared to the United States dollar. On April 16, 2012, the exchange rate in effect for Canadian dollars exchanged for United States dollars, expressed in terms of Canadian dollars (based on the noon buying rates listed with the Bank of Canada) was $0.9967. For the past five fiscal years ended November 30, 2011 and for the six monthly periods between October 2011 and March 2012, the following exchange rates were in effect for Canadian dollars exchanged for United States dollars, expressed in terms of Canadian dollars (based on the noon buying rates in New York City, for cable transfers in Canadian dollars, as certified for customs purposes by the Federal Reserve Bank of New York). As the Federal Reserve Bank has discontinued the publication of foreign exchange rates on December 31, 2008 the rates listed after December 31, 2008 are based on the exchange rates in effect for Canadian dollars exchanged for United States dollars, expressed in terms of Canadian dollars (based on the intra-day high/low rates between 08:00 (ET) and 16:00 (ET) listed with the Bank of Canada):

| Year Ended | Average |

| November 30, 2007 | $0.9661 |

| November 30, 2008 | $1.2360 |

| November 30, 2009 | $1.1644 |

| November 30, 2010 | $1.0336 |

| November 30, 2011 | $0.9891 |

| Month Ended | Low/High |

| October 2011 | $1.0149/$1.0253 |

| November 2011 | $1.0219/$1.0297 |

| December 2011 | $1.0197/$1.0240 |

| January 2012 | $1.0099/$1.0161 |

| February 2012 | $0.9950/$0.9997 |

| March 2012 | $0.9915/$0.9963 |

B. Capitalization and Indebtedness

Not applicable

C. Reasons for the Offer and Use of Proceeds

Not applicable

D. Risk Factors

Much of the information included in this annual report includes or is based upon estimates, projections or other “forward-looking statements”. Such forward-looking statements include any projections or estimates made by our company and our management in connection with our business operations. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein.

Such estimates, projections or other forward-looking statements involve various risks and uncertainties as outlined below. We caution the reader that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other forward-looking statements.

The common shares of our company are considered speculative. You should carefully consider the following risks and uncertainties in addition to other information in this annual report in evaluating our company and our business before purchasing shares of our company’s common stock. Our business, operating and financial condition could be harmed due to any of the following risks.

Risks Relating to our Business

We are an early-stage oil and gas development company without revenues. Our ability to continue in business depends upon our continued ability to obtain significant financing from external sources and the success of the HIP Downhole Process Technology and any production resulting therefrom, none of which can be assured.

We are an early-stage oil and gas technology development company without any revenues, and there can be no assurance of our ability to develop and operate our projects profitably. We have historically depended entirely upon capital infusion from the issuance of equity securities and loans from insiders to provide the cash needed to fund our operations, but we cannot assure you that we will be able to continue to do so. Our ability to continue in business depends upon our continued ability to obtain significant financing from external sources and the success of our development efforts and any production efforts resulting therefrom. Any reduction in our ability to raise equity capital in the future would force us to reallocate funds from other planned uses and could have a significant negative effect on our business plans and operations, including our ability to continue our current development activities.

Our auditors’ opinion on our November 30, 2011 financial statements includes an explanatory paragraph in respect of there being substantial doubt about our ability to continue as a going concern.

We have incurred a net loss of $4,692,373 for the cumulative period from June 22, 1983 (inception) to November 30, 2011. We anticipate generating losses for at least the next 12 months. Therefore, there is substantial doubt about our ability to continue operations in the future as a going concern as described by our auditors with respect to the financial statements for the year ended November 30, 2011. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event that we cannot continue in existence. Our business operations may fail if our actual cash requirements exceed our estimates and we are not able to obtain further financing. If we cannot continue as a viable entity, our shareholders may lose some or all of their investment in our company.

We will require significant capital to complete the ongoing development of the HIP Downhole Process Technology and any resulting application of the HIP Downhole Process Technology on the Well Bores.

We anticipate that we will have to seek additional financing to fund the development of the HIP Downhole Process Technology and any resulting application of the HIP Downhole Process Technology on any of the Well Bores. We cannot assure you that our actual cash requirements will not exceed our estimates, and in any case we will require additional financing to bring our interests into commercial operation, finance working capital, and pay for operating expenses and capital requirements until we achieve a positive cash flow. Additional capital also may be required in the event we incur any significant unanticipated expenses.

In light of our operating history, and under the current capital and credit market conditions, we may not be able to obtain additional equity or debt financing on acceptable terms if and when we need it. Even if financing is available, it may not be available on terms that are favourable to us or in sufficient amounts to satisfy our requirements.

If we require, but are unable to obtain, additional financing in the future, we may be unable to implement our business plan and our growth strategies, respond to changing business or economic conditions, withstand adverse operating results, and compete effectively. More importantly, if we are unable to raise further financing when required, our planned development of the Well Bores may have to be scaled down or even ceased, and our ability to generate revenues in the future would be negatively affected.

The economic viability of the HIP Downhole Process Technology is unproven and may not achieve commercialization, widespread market acceptance or economic viability. If the HIP Downhole Process Technology does not prove to be economically viable, our business will suffer and may fail in its entirety.

Although we have performed initial testing on the viability of the HIP Downhole Process Technology, our assessment of the HIP Downhole Process Technology is primarily based upon historical data provided by the vendors relating to past test results. Further, the HIP Downhole Process Technology has not been proven in a commercial context over any significant period of time. Even if our HIP Downhole Process Technology is proven to be economically viable, it may not achieve widespread market acceptance. Our success will depend on our ability to prove that the HIP Downhole Process Technology is economically viable. We believe that the economic viability of the HIP Downhole Process Technology will depend on many factors, including:

| · | the effectiveness of the HIP Downhole Process Technology to enhance oil or gas recovery on any one or a series of wells or well bores; |

| · | the safety and efficacy of the HIP Downhole Process Technology generally and on a well or series of well bores; |

| · | direct cost savings resulting from the use or application of the HIP Downhole Process Technology has not been proven on a sustained and ongoing well or well bore; |

| · | direct affect of any long term application of the HIP Downhole Process Technology on a well or series of well bores; |

| · | the pricing and cost effectiveness of the HIP Downhole Process Technology; and |

| · | our ability to respond to changes in regulations. |

We are dependent on a single technology, and if it cannot compete or find market acceptance, our business will suffer.

Our strategy is dependent on the success of a single technology. Our strategy will be to focus our development on the HIP Downhole Process Technology and the commercialization of the technology on a well or series of well bores. Focus on this single technology leaves us vulnerable to competing products and alternative secondary oil and gas enhancement methods. If the HIP Downhole Process Technology is not proven to be commercially viable or we cannot find market acceptance or cannot compete against other technologies, our business will suffer and may fail in its entirety.

We rely on patents and proprietary rights to protect our technology.

We rely on a combination of trade secrets, confidentiality agreements and procedures and patents to protect our proprietary technologies. We have been granted a patent in the U.S. covering the HIP Downhole Process Technology. Additional patent applications will need to be made in the U.S. from time to time. The claims contained in any patent application may not be allowed, or any patent or our patents collectively may not provide adequate protection for our products and technology. In the absence of patent protection, we may be vulnerable to competitors who attempt to copy our products or gain access to our trade secrets and know-how. In addition, the laws of foreign countries may not protect our proprietary rights to this technology to the same extent as the laws of the U.S.

The HIP Downhole Process Technology may infringe or be challenged for infringement on other technology.

We have attempted to ensure that our products do not infringe the proprietary rights of others. If a dispute arises concerning our technology, we could become involved in litigation that might involve substantial cost. Such litigation might also divert substantial management attention away from our operations and into efforts to enforce our patents, protect our trade secrets or know-how or determine the scope of the proprietary rights of others. If a proceeding resulted in adverse findings, we could be subject to significant liabilities to third parties. We might also be required to seek licenses from third parties in order to manufacture or sell our products. Our ability to manufacture and sell our products might also be adversely affected by other unforeseen factors relating to the proceeding or its outcome.

Our lack of diversification increases the risk of an investment in us, and our financial condition and results of operations may deteriorate if we fail to diversify.

Our business focus is solely related to the ongoing development and application of the HIP Downhole Process Technology on oil and gas wells or well bores. As a result, we lack diversification, in terms of the nature of our business. We will likely be impacted more acutely by factors affecting our industry in which we operate than we would if our business were more diversified. If we cannot diversify our operations, our financial condition and results of operations could deteriorate.

The potential profitability of oil and gas operations and ventures depends upon factors beyond the control of our company.

The potential profitability of oil and gas projects on which the HIP Downhole Process Technology is applied and the oil and gas industry generally is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls, or any combination of these and other factors, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to world-wide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance and the continued economic viability of our company.

Adverse weather conditions can also hinder or affect the application or continued ability of the HIP Downhole Process Technology to operate or remain viable. A well on which the HIP Downhole Process Technology is applied may be productive but may become uneconomic as a result of severe or unseasonable weather conditions. The marketability of oil and gas which may be acquired or discovered will be affected by numerous factors beyond our control, including the proximity and capacity of oil and gas pipelines and processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production and environmental protection. The extent of these factors cannot be accurately predicted but the combination of these factors may result in our company not receiving an adequate return on invested capital.

Primary and secondary drilling or enhancement of oil and gas wells involves many risks and we may become liable for well abandonment, plugging, pollution or other liabilities which may have an adverse effect on our financial position.

Any enhanced recovery or drilling for oil and gas generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labour disruptions, blow-outs, sour gas leakage, fire, inability to obtain

suitable or adequate machinery, equipment or labour, and other risks are involved. We may become subject to liability for pollution or hazards against which we cannot adequately insure or which we may elect not to insure. Incurring any such liability may have a material adverse effect on our financial position and operations.

Oil and gas operations are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our company. Further, development and production activities are subject to certain environmental regulations which may prevent or delay the commencement or continuance of our operations.

Oil and gas operations in the United States and Canada are subject to federal, state and provincial laws and regulations relating to the protection of the environment, including, but not limited to, laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Oil and gas operations in the United States and Canada are also subject to federal, state and provincial laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling and or enhanced recovery methods and equipment. Various permits from government bodies are required for drilling or secondary well enhancement operations to be conducted; no assurance can be given that such permits will be received. No assurance can be given that environmental standards imposed by federal, state and provincial authorities will not be changed or that any such changes would not have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may elect not to insure against due to prohibitive premium costs and other reasons. Our current and anticipated development and enhancement recovery activities are subject to the aforementioned environment regulations. When and if we enter into production we will become subject to additional regulations which do not currently pertain to us or affect our current operations.

Specifically, we are subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. In addition, legislation has been enacted which requires well and facility sites to be abandoned and reclaimed to the satisfaction of federal, state and provincial authorities. Such laws and regulations are frequently changed and we are unable to predict the ultimate cost of compliance.

We may not effectively manage the growth necessary to execute our business plan.

Any growth will place significant strain on our current personnel, systems and resources. We expect that we will be required to hire qualified consultants and employees to help us manage our growth effectively. We believe that we will also be required to improve our management, technical, information and accounting systems, controls and procedures. We may not be able to maintain the quality of our operations, control our costs, continue complying with all applicable regulations and expand our internal management, technical information and accounting systems to support our desired growth. If we fail to manage our anticipated growth effectively, our business could be adversely affected.

Risks Relating to our Management

As a majority of our directors and officers are residents of countries other than the United States, investors may find it difficult to enforce, within the United States, any judgments obtained against our company, directors and officers.

A majority of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our company, officers, and directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

Key management employees may fail to properly carry out their duties or may leave which could negatively impact corporate operations and/or share pricing.

Our company’s financial condition and the success of the HIP Downhole Process Technology on our oil and gas enhanced recovery operations is dependent on our ability to hire and retain highly skilled and qualified personnel. We face competition for qualified personnel from numerous industry sources, and there can be no assurance that we will be able to attract and retain qualified personnel on acceptable terms. The loss of service of any of our key personnel could have a material adverse effect on our operations or financial condition. We do not have key-man insurance on any of our employees.

Our Articles contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our Articles contain provisions with respect to the indemnification of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by them in a civil, criminal or administrative action or proceeding to which they are made a party by reason of their being or having been a director or officer of our company.

Risks Relating to Our Stock

Our common stock is illiquid and shareholders may be unable to sell their shares.

Our common stock is currently quoted on the Over-the-Counter Bulletin Board and is thinly traded. In the past, our trading price has fluctuated widely, depending on many factors that may have little to do with our operations or business prospects. There is currently a limited market for our common stock and we can provide no assurance to investors that a market will develop. If a market for our common stock does not develop, our shareholders may not be able to re-sell the shares of our common stock that they have purchased and they may lose all of their investment. Public announcements regarding our company, changes in government regulations, conditions in our market segment and changes in earnings estimates by analysts may cause the price of our common shares to fluctuate substantially. In addition, the Over-the-Counter Bulletin Board is not an exchange and, because trading of securities on the Over-the-Counter Bulletin Board is often more sporadic than the trading of securities listed on an exchange, you may have difficulty reselling any of the shares you purchase from our selling shareholders.

Securities class-action litigation has often been instituted following periods of volatility in the market price of a company’s securities. Such litigation, if instituted against our company, could result in substantial costs for our company and a diversion of management’s attention and resources.

Investors’ interests in our company will be diluted and investors may suffer dilution in their net book value per share if we issue additional shares or raise funds through the sale of equity securities.

Our constating documents authorize the issuance of an unlimited number of common shares and an unlimited number of preference shares. In the event that we are required to issue additional shares or enter into private placements to raise financing through the sale of equity securities, investors’ interests in our company will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. If we do issue additional shares, it will cause a reduction in the proportionate ownership and voting power of all existing shareholders.

We have never declared or paid cash dividends on our common shares and do not anticipate doing so in the foreseeable future.

There can be no assurance that our board of directors will ever declare cash dividends, which action is exclusively within our discretion. Shareholders cannot expect to receive a dividend on our common shares in the foreseeable future, if at all.

Trading of our stock may be restricted by the Securities and Exchange Commission’s “Penny Stock” regulations which may limit a stockholder’s ability to buy and sell our stock.

The United States Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized

risk disclosure document in a form prepared by the Securities and Exchange Commission which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of, our common stock.

The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a shareholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

ITEM 4. Information on HIP Energy Corporation.

A. History and Development of HIP Energy Corporation

Name

Our legal and commercial name is “HIP Energy Corporation”.

Principal Office

Our office is located at 5548 Parthenon Place, West Vancouver, British Columbia, Canada V7V 2V7, our telephone number is 604.377.5515 and our facsimile number is 604.921.4764.

Corporate Information

Our company was incorporated pursuant to the laws of the Province of British Columbia under the British Columbia Company Act in June 1983 under the name “Bradner Resources Ltd.”. On March 29, 2004, the British Columbia Business Corporations Act came into effect, replacing the British Columbia Company Act. As required by the Business Corporations Act, our company was “transitioned” under the Business Corporations Act, effective March 31, 2004.

Our company is currently a reporting issuer under the securities laws of British Columbia and Alberta.

Important Events

On December 13, 1999, our name was changed from “Bradner Resources Ltd.” to “Bradner Ventures Ltd.”

On March 31, 2004, our authorized and issued shares of common stock and preferred stock were consolidated on the basis of one (1) post-consolidated common share for each five (5) pre-consolidated common shares so that our authorized capital consisted of 15,000,000 common shares and 5,000,000 preferred shares with 1,058,256 common shares issued and no preferred shares issued. Our authorized capital was then increased to 75,000,000 common shares and 25,000,000 preferred shares with 1,058,256 common shares issued and no preferred shares issued. The share consolidation was effective with the OTC Bulletin Board on April 21, 2004 and our trading symbol was changed to “BNVLF”.

On November 17, 2009, we changed our name from “Bradner Ventures Ltd.” to “HIP Energy Corporation” and effected a five (5) for one (1) reverse stock split of our issued and outstanding common stock. The name change and reverse stock split were effected with the OTC Bulletin Board on November 19, 2009. Our trading symbol was changed from “BNVLF” to “HIPCF”. Also effective October 20, 2009 we effected an increase in our authorized capital to an unlimited number of common shares and an unlimited number of preferred shares. We received approval for the increase in authorized capital, reverse split and name change at our annual general meeting of shareholders held on July 31, 2009.

On March 30, 2010, pursuant to the Asset Purchase Agreement, HIP Texas, a wholly-owned subsidiary of HIP, acquired from HIP Resources ownership of the Well Bores. The Well Bores are described in detail under the heading “Business Overview – The Well Bores”. The consideration for the sale and transfer of the Well Bores was the issuance of 20 million common shares of HIP to EEL.

On March 30, 2010, pursuant to the License Agreement, HIP Nevada, a wholly-owned subsidiary of HIP, acquired from HIP Tech an exclusive worldwide license for use of the HIP Downhole Process Technology. The HIP Downhole Process Technology is described in detail under the heading “Business Overview – HIP Downhole Process Technology”. The consideration for the acquisition of the HIP Downhole Process Technology was the issuance of 30 million common shares of HIP to Group Rich and a royalty payment, which is described in detailed under the heading “Business Overview – License Agreement”.

The acquisition of the Well Bores by HIP Texas and the exclusive worldwide right to the HIP Downhole Process Technology by HIP Nevada caused us to cease to be a “shell company”, as defined in Rule 12b-2 of the Exchange Act.

Current Period Operations

The plan of the Company in 2011 was to have move its focus from its single test well at Opal Ward, and to assemble a larger control area in which to test the scalability of the HIP Downhole Process Technology. To do this the Company looked to acquire rights covering approximately 6,400 acres covering rights from the surface to the base of the Travis Peak formation. Within this larger control area, the Company had assembled 10 historically producing but dormant wellbores on which to test the HIP Downhole Process Technology. Of these wellbores, three were acquired previously from HIP Energy Resource Limited, and seven were purchased for $60,000 from Peak Energy Corp. of Dallas, Texas. The Company did complete construction of its 3 acre central facilities site on which the equipment necessary to test the HIP Downhole Process Technology (the “HIP Control Unit”) had been assembled. To date, 8 of the 10 test wells have been piped to the HIP Control Unit, but the Company is waiting for the agreement of the Texas Parks and Wildlife Commission (“TWC”) before the well bore modifications and final hook-up of the wells can be completed. All of the wellheads required for each wellbore are also onsite and awaiting final modifications required for the HIP Downhole Process Technology.

During 2011, the TWC issued a cease work order on the Peak leases due to a dispute between TWC and the Company’s operator, Texla, which arose from the requirement by the TWC that Texla enter into a “surface access agreement” with the TWC after it had acquired the leases from the previous operator.

To date Texla has had no success in coming to an agreement with TWC with respect to a surface access agreement on the Peak wells. As a result of the delays, the leases held by Texla on the Peak wells have expired subject to Texla being successful in making a claim to the Texas Railway Commission claiming “force majeure” under each of the leases arising from the inaction and delays from TWC. Texla has retained legal counsel to assist with its position and the lease expiry situation arising from delays in the parties coming to an agreement. In the event Texla is unable to come to an agreement with TWC, the entire Peak investment and expenditure may be lost and the Company will have to then focus it’s testing of the HIP Downhole Process Technology in another area. In such an event, the Company will require additional funding to pursue these objectives.

Assuming Texla is successful in proceeding with the surface access agreement and renewing the leases on the Peak prospect, then the Company estimates that it will require approximately $300,000 to complete construction and assembly of the HIP Control Unit and to connect and finish modifications to the five phase 1 wells. Once completed, the Company

expects that the cost of adding each of the remaining 5 wells will be approx. $40,000 per well. The Company will have to raise additional funds to pursue this objective. Phase 1 of the Company’s program continues to be to complete and to test at least five of the 10 wells within the next 12 months. If this plan is not feasible, then management will assess focusing its efforts to test the HIP Downhole Process Technology on other wellbores and leases in east Texas proximate to its central facility.

Capital Expenditures

Opal and other Well Bores

On March 30, 2010, we acquired all rights, title and interest in and to 51 well bores located in West Texas, and 1 well bore (the “Opal Well”) located in Central Texas and an additional 41 wells and well bores located in East Texas and 60 wells and well bores located in West Louisiana. We issued 20,000,000 shares of common stock as consideration for the sale and transfer of the initial 52 well bores in West and Central Texas and the 41 East Texas and 60 Louisiana well bores. $5,000 was assigned as the purchase price of the well bores using carryover basis of accounting. In consideration of the transfer of the Opal Well, we agreed to pay consideration totalling $250,000 plus an additional “audited and agreed” amount to be provided by HIPER consisting of accrued development, equipment and lease operating costs incurred by HIPER on the Opal Well. We paid $62,500 and the balance of these costs will be paid on a declining basis from any oil and gas production revenues received by us as generated on the Opal Well in excess of 20 bbl oil or gas equivalent per day, using the HIP Downhole Process Technology. We have not recorded an accrued liability for the balance of the costs owed given that they are contingent on oil and gas production produced from the Opal Well. During the year ended November 30, 2011, the Company recognized an impairment loss of $62,500 related to the Opal Well.

Peak Well Bores

On January 1, 2010, we entered into a joint operating agreement with a company to operate and develop the Well Bores using the HIP Downhole Process Technology. We forwarded $60,000 as a deposit and acquired the leases from Peak. During the past year however, the Company’s intention of focusing its operations on the development of its Peak wells and 3 acre central facility was frustrated due to a cease work order implemented by the Texas Parks and Wildlife Commission (TWC) on the Peak leases. The dispute between TWC and the Company’s operator, Texla, arose from the requirement by the TWC that Texla enter into a “surface access agreement” with the TWC after it had acquired the leases from the previous operator. Neither Texla or the Company believe that the TWC had the rights to cause Texla to cease operations, and that the TWC did so in bad faith and without the legal authority to do so.

Exploration Advances

As at November 30, 2010, we had advanced $210,000 to the well bores operator for specific property use but which had yet to be spent as of that date. These funds were spent during the year ended November 30, 2011. Our planned capital expenditures for the next twelve months are summarized below under the heading “Business Overview – Plan of Operation – Use of Funding”. These anticipated expenditures relate to the development of the Well Bores and the implementation of the HIP Downhole Process Technology. Our planned capital expenditures are primarily located in Texas and Louisiana, the location of the Well Bores.

Takeover offers

We are not aware of any indication of any public takeover offers by third parties in respect of our common shares during our last and current financial years.

B. Business Overview

For the fiscal years ended November 30, 2011, 2010 and 2009, we incurred net losses of $668,208, $759,312 and $57,419 respectively. We did not generate any revenues during such periods.

Overview

Prior to the acquisition of the Well Bores and the exclusive worldwide license to the HIP Downhole Process Technology, our company did not have an operating business. Our sole business was to identify a suitable business opportunity or a suitable business with which to enter into a business combination. Our current business is to increase the recovery from oil wells using the HIP Downhole Process Technology.

Traditional oil exploration involves acquiring exploration or drilling rights, conducting seismic and other subsurface studies to estimate if oil and gas is present, and then drilling of the properties in order to attempt to discover and extract the oil and gas. The process can be extremely expensive and time consuming. Costs for drilling a single well have escalated dramatically and can run into the hundreds of thousands of dollars. Further, a significant percentage of all traditional exploration wells drilled each year end-up being dry holes. Our business is to increase the production of proven but unproductive wells, or to increase production from damaged, uneconomical, and stripper well bores using the HIP Downhole Process Technology.

Our initial focus will be to concentrate our operations on applying the HIP Downhole Process Technology to existing and proven well bores and reservoirs that have become non-commercial, uneconomic, depleted or damaged. We intend to demonstrate the value of the HIP Downhole Process Technology by improving the recovery of oil from well bores, after which we intend to acquire additional well bores that we believe, could have an increase in production if the HIP Downhole Process Technology was applied to the well bores. We believe we can generate more revenues by participating in the development of the well bores, rather than by licensing the HIP Downhole Process Technology to third parties. We believe we will benefit from increased industry recognition of the HIP Downhole Process Technology, while generating an ongoing and sustained cash flow from the increased recovery of hydrocarbons.

HIP Downhole Process Technology

The HIP Downhole Process Technology was developed over a period of 28 years by Mr. Peter Noonan, who worked extensively with chemical engineers, scientists and oil and gas reservoirs and its associated field applications in the development of the areas in enhanced oil recovery systems. Over time, certain oil and gas wells will experience significant production decreases, as the remaining hydrocarbon molecules become heavier and attract unwanted elements. The HIP Downhole Process Technology stops and reverses the formation of these heavier molecules and prevents the production decrease.

When material from an oil or gas well is removed too rapidly or when too much material has been removed by production, the remaining hydrocarbon material in the reservoir can change in such a way to become heavier and more resistant to flow. The result is the formation of paraffinic and asphaltic compounds that cause solidification or increase in pour-point temperatures. The viscosity of the hydrocarbon material increases tremendously, as electrochemical potential differences increase molecular attraction. Increased viscosity attracts other elements and compounds, such as entrained water, salts, metallic and foreign materials (silicates, carbonates and oxides), which further increases resistance to flow and leads to decreased production. As the reservoir pressure decreases over time, many wells become blocked and the remaining hydrocarbon compounds become very large molecules that are heavier in weight. As a result, there is a build-up of large molecular structure material which consists of paraffinic, asphaltenes, salt residuals, calcites, sulfites and metallic residuals, which further reduces production output. In many instances the resultant build up of viscous material will completely shut down production before the full availability of proven recoverable reserves is recovered.

The HIP Downhole Process Technology utilizes a constant injection of formulized heated gaseous fluids through a proprietary method of delivery. This process causes a physical reaction of molecular exchange in such a way that promotes formation of simple hydrogen molecular relationships and eliminates large electrochemical potential differences. This inhibits formation of heavier hydrocarbon molecules. The process works best when the pressure, volume, and temperature of the well are maintained as constant as possible. Elemental and salt residues of the process remain in place in a reservoir since the technology is instrumental in producing molecular exchange to form lighter hydrocarbon molecules similar to those that have been removed from the reservoir formation by production.

The HIP Downhole Process Technology is intended to increase both oil and gas production and decrease the lifting costs of the well. The decrease in lifting costs is intended to result in an increased revenue stream.

The Well Bores

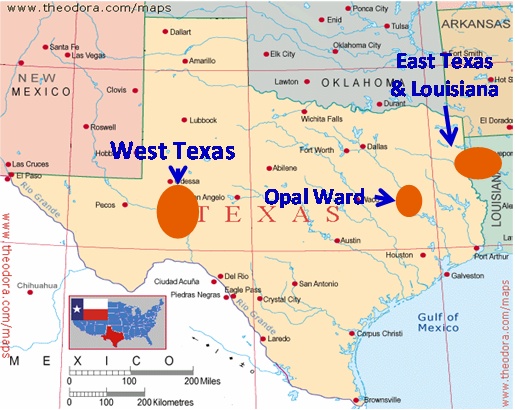

On March 30, 2010, following the closing of the Asset Purchase Agreement, HIP acquired all of HIP Resources rights, title and interest to 51 well bores located in West Texas and 1 well bore located in Opal Ward (collectively, the “Texas Well Bores”). Figure 1 – Location of Well Bores shows the general location of the Texas Well Bores.

Figure 1- Location of Well Bores

Figure 1 – Location of Well Bores

In addition, under the terms of the Asset Purchase Agreement, HIP Resources agreed to transfer to HIP, all of HIP Resources rights, title and interest in 101 well bores located in East Texas and Louisiana (the “Louisiana Well Bores” together with the Texas Well Bores, the “Well Bores”).

The following is a list of the Texas Well Bores including Oil Lease numbers, number of wells and total depth:

| Lease Name | Oil Lease Gas ID No. | Location | Number of Wells | Total Depth |

| West Texas | | | | |

| Cluster 1 | | | | |

| Texaco 9-1 (Texaco “9”) | 33329 | Section 9 Block 56 Range 3 | 1 | 3,700 |

| Texaco 9-2 | 33329 | Section 9 Block 56 Range 3 | 1 | 3,700 |

| Texaco 9-3 | 33329 | Section 9 Block 56 Range 3 | 1 | 3,700 |

| Texaco 9-4 | 33329 | Section 9 Block 56 Range 3 | 1 | 3,700 |

| Texaco 9-5 | 33329 | Section 9 Block 56 Range 3 | 1 | 3,700 |

| Phillips 66 #2 (Phillips 66) | 32571 | Section 18 Block 56 Range 3 | 1 | 3,700 |

| Phillips 66 #3 (Phillips 66 3A) | 33149 | Section 18 Block 56 Range 3 | 1 | 3,700 |

| Cluster 2 | | | | |

| Arco State 14-1 | 33585 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 #5 | 33585 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 #2 (Arco State 14) | 33585 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 #4 | 33585 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 - A #1 (Arco State 14A) | 34155 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 - A #2 (Arco State 14A) | 34155 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 - A #3 (Arco State 14A) | 34155 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 14 - A #4 (Arco State 14A) | 34155 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State #2 Injection (dual Well) | 25126 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State #3 | 25126 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State #4 | 25126 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State #5 | 25126 | Section 14 Block 56 Range 3 | 1 | 3,700 |

| Arco State 24 #2 (Arco State 24) | 069586 | Section 24 Block 57 Range 3 | 1 | 3,400 |

| Arco State 24 #3 (Arco State 24) | 069779 | Section 24 Block 57 Range 3 | 1 | 3,400 |

| Arco State 24 #4 (Arco State 24) | 069912 | Section 24 Block 57 Range 3 | 1 | 3,400 |

| Cluster 3 | | | | |

| Reeves BK HD - 1 (Horizontal) | 36100 | Section 15 Block 56 Range 3 | 1 | 4,900 |

| Reeves BK FEE # 1 | 32288 | Section 15 Block 56 Range 3 | 1 | 3,700 |

| Reeves BK # 2 (Reeves-BK-FEE) | 32288 | Section 15 Block 56 Range 3 | 1 | 3,700 |

| Reeves BK # 3 | 32288 | Section 15 Block 56 Range 3 | 1 | 3,700 |

| Reeves BK FEE # 5 | 32288 | Section 15 Block 56 Range 3 | 1 | 3,700 |

| BK # 4 (Texaco Reeves BK) | 33947 | Section 15 Block 56 Range 3 | 1 | 3,700 |

| Texaco 23 #1 (Texaco “23”) | 33670 | Section 23 Block 56 Range 3 | 1 | 3,700 |

| Texaco 23 #2 | 33670 | Section 23 Block 56 Range 3 | 1 | 3,700 |

| Texaco 23 #3 | 33670 | Section 23 Block 56 Range 3 | 1 | 3,700 |

| Texaco 13-1 HD Horizontal (Penwell) | 12345 | Section 13 Block 56 Range 3 | 1 | 4,987 |

| Cluster 4 - Regular 57 | | | | |

| Anadarko State 14 #5 (Anadarko State A) | 34376 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Anadarko State 14 #6 (Anadarko State R) | 34463 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Anadarko State 14 #1 (Anadarko State 14) | 072948 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Anadarko State 14 #2 (Anadarko State 14) | 074167 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Anadarko State 14 #3 (Anadarko State 14) | 075491 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Anadarko State 14 #4 (Anadarko State 14) | 075724 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Anadarko State 23 #4 (Anadarko State) | 34313 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Stack State 1 | 34366 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Stack State 2 | 34366 | Section 14 Block 57 Range 3 | 1 | 3,200 |

| Cluster 5 | | | | |

| Reeves AM 25 #1 (AM Reeves) | 34146 | Section 25 Block 57 Range 3 | 1 | 6,200 |

| Reeves AM 25 #1 (Reeves -AM- Fee) | 036114 | Section 25 Block 57 Range 3 | 1 | 3,200 |

| Reeves AM 25 #2 (Reeves -AM- Fee) | 036115 | Section 25 Block 57 Range 3 | 1 | 3,200 |

| State of Texas 23 # 5 (State 26) | 34312 | Section 23 Block 56 Range 3 | 1 | 3,100 |

| State of Texas 26 # 5 (State 23) | 34464 | Section 26 Block 57 Range 3 | 1 | 3,100 |

| State of Texas 26 # 1 (State of Texas 26) | 066070 | Section 26 Block 57 Range 3 | 1 | 3,100 |

| State of Texas 26 # 3 (State of Texas 26) | 069567 | Section 26 Block 57 Range 3 | 1 | 3,100 |

| State of Texas 26 # 4 (State of Texas 26) | 069568 | Section 26 Block 57 Range 3 | 1 | 3,100 |

| State of Texas 26 # 7 (Robinson) | 36098 | Section 26 Block 57 Range 3 | 1 | 3,100 |

| Cluster 6 | | | | |

| Meeker 15 -1 | 30942 | Section 15 Block 21 Range 3 | 1 | 3,700 |

| Opal Ward # 1 | 1 Leon | | 1 | 9,475 |

| Total | | | 52 | |

The following is a list of the Louisiana Well Bores including Oil Lease numbers, number of wells and total depth:

| Lease Name | Oil Lease Gas ID No. | Location | Number of Wells | Total Depth |

| East Texas | | | | |

| Cluster 1 | | | | |

| Cowherd # 1 | 129107 | | 2 | 6,180 |

| Cowherd # 2 | 12629 | | 2 | 6,622 |

| Cowherd # 3 | | | 1 | 2,500 |

| Peggy Ashley 1 | 129114 | | 1 | 6,174 |

| Chevron # 1 | | | 1 | 6,088 |

| Chevron # 3 | | | 1 | 6,150 |

| Panola # 1 | | | 1 | 2,500 |

| Panola # 2 | | | 1 | 2,500 |

| Panola # 3 | | | 1 | 2,500 |

| Panola # 4 | | | 1 | 2,500 |

| Panola # 5 | | | 1 | 2,500 |

| Panola # 6 | | | 1 | 2,500 |

| Elysian # 1 | | | 1 | 2,700 |

| Elysian # 2 | | | 1 | 2,700 |

| Elysian # 3 | | | 1 | 2,700 |

| Elysian # 4 | | | 1 | 2,700 |

| Elysian # 5 | | | 1 | 2,700 |

| Elysian # 6 | | | 1 | 2,700 |

| Elysian # 7 | | | 1 | 2,700 |

| Elysian # 8 | | | 1 | 2,700 |

| Elysian # 9 | | | 1 | 2,700 |

| Elysian # 10 | | | 1 | 2,700 |

| Elysian # 11 | | | 1 | 2,700 |

| Elysian # 12 | | | 1 | 2,700 |

| Elysian # 13 | | | 1 | 2,700 |

| Elysian # 14 | | | 1 | 2,700 |

| Elysian # 15 | | | 1 | 2,700 |

| Elysian # 16 | | | 1 | 2,700 |

| Elysian # 17 | | | 1 | 2,700 |

| Elysian # 18 | | | 1 | 2,700 |

| Elysian # 19 | | | 1 | 2,700 |

| Elysian # 20 | | | 1 | 2,700 |

| Elysian # 21 | | | 1 | 2,700 |

| Elysian # 22 | | | 1 | 2,700 |

| Laeke A-1 | | | 1 | 2,700 |

| Laeke A-2 | | | 1 | 2,700 |

| Laeke B-1 | | | 1 | 2,700 |

| Laeke B-2 | | | 1 | 2,700 |

| Laeke B-3 | | | 1 | 2,700 |

| | | East Texas Total | 41 | |

| Louisiana | | | | |

| Abney J. D. Lease | 1 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 2 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 3 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 4 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 5 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 6 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 7 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 8 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 9 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 10 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 11 Harrison | | 1 | 2,475 |

| Abney J. D. Lease | 12 Harrison | | 1 | 2,475 |

| Abney #1 (460) | 103405 | | 1 | 2,500 |

| Abney #3 | 105607 | | 1 | 2,500 |

| Abney #4 | 105839 | | 1 | 2,500 |

| Abney #5 | 106853 | | 1 | 2,500 |

| Abney #6 | 107873 | | 1 | 2,500 |

| Abney #7 | 109040 | | 1 | 2,500 |

| Abney #8 | 110360 | | 1 | 2,500 |

| Abney #9 | 110361 | | 1 | 2,500 |

| Abney #10 | 113026 | | 1 | 2,500 |

| Abney #11 | 131636 | | 1 | 2,500 |

| Abney #12 | 129650 | | 1 | 2,500 |

| Abney #13 | 130786 | | 1 | 2,500 |

| Abney #14 | 133367 | | 1 | 2,500 |

| Abney #15 | 133412 | | 1 | 2,500 |

| Abney #16 | 131635 | | 1 | 2,500 |

| Abney #17 | 130887 | | 1 | 2,500 |

| Abney #18 | 127779 | | 1 | 2,500 |

| Abney #19 | 131605 | | 1 | 2,500 |

| Abney #20 | 128716 | | 1 | 2,500 |

| Abney #21 | 127217 | | 1 | 2,500 |

| Abney #22 | 127385 | | 1 | 2,500 |

| Abney D #2 (150) | 130119 | | 1 | 2,500 |

| Abney D #3 | 130138 | | 1 | 2,500 |

| Abney D #4 | 130640 | | 1 | 2,500 |

| Abney D #5 | 130752 | | 1 | 2,500 |

| Abney D #6 | 130923 | | 1 | 2,500 |

| Abney D #7 | 131025 | | 1 | 2,500 |

| Abney D #8 | 131104 | | 1 | 2,500 |

| Abney D #9 | 133427 | | 1 | 2,500 |

| Abney D #10 | 136179 | | 1 | 2,500 |

| Abney D #11 | 133466 | | 1 | 2,500 |

| Abney D #12 | 136343 | | 1 | 2,500 |

| Abney D #14 | 136702 | | 1 | 2,500 |

| Atkinson A #001 | | | 1 | 2,500 |

| Atkinson A #002 | | | 1 | 2,500 |

| Atkinson A #003 | | | 1 | 2,500 |

| Atkinson B #001 | | | 1 | 2,500 |

| Atkinson B #002 | | | 1 | 2,500 |

| Atkinson B #003 | | | 1 | 2,500 |

| Abney Kirk #001 | | | 1 | 2,500 |

| Abney Kirk #002 | | | 1 | 2,500 |

| Abney Kirk #003 | | | 1 | 2,500 |

| Abney Kirk #004 | | | 1 | 2,500 |

| Abney Kirk #005 | | | 1 | 2,500 |

| Abney Kirk #006 | | | 1 | 2,500 |

| Abney Kirk #007 | | | 1 | 2,500 |

| Abney Kirk #008 | | | 1 | 2,500 |

| Abney Kirk #009 | | | 1 | 2,500 |

| Total | | | 101 | |

In consideration for the Well Bores, HIP issued 20,000,000 of its common shares to EEL for $5,000 based on the carryover cost. As a condition of the Asset Purchase Agreement, on January 12, 2010, HIP, HIP Texas, and HIP Nevada entered into a joint operating agreement with TexLa Operating Company (“TexLa”), whereby TexLa agreed to develop the Well Bores using the HIP Downhole Process Technology. In consideration for their services, TexLa was granted a 10% working interest in any of the Well Bores that the HIP Downhole Process Technology is applied to. This structure is intended to ensure that TexLa’s interest is aligned with HIP, as TexLa will have an operating interest in the Well Bores. Also as a condition of the Asset Purchase Agreement, the parties agreed to enter into a Non-Competition Agreement dated March 14, 2010 pursuant to which EEL and HIP Resources agreed, among other things, not to compete against the business of HIP for a period of four years from the date of the agreement. In addition, as the License Agreement grants HIP a worldwide exclusive license to the HIP Downhole Process Technology, EEL and HIP Resources will not be able to use the HIP Downhole Process Technology on any well or well bores, except as provided under the License Agreement.

Current Operations

During the past year, our focus has been to undertake ongoing testing of our HIP Downhole Process Technology on the Opal Ward #1 Well (the “Opal Well”), which is located in central Texas. We have been making the necessary design changes and modifications to the HIP Control Unit located on the Opal Well. These design modifications were successful in stimulating the well bore and during such testing periods resulted in the production of oil and gas from the Opal Well, which had been a dead or dormant wellbore. Having been encouraged by the testing results using the HIP Downhole Process Technology on the Opal Well, our management proceeded to assemble a larger scale “test” project around various wellbores which it holds and has acquired in East Texas.

The plan of the Company in 2011 was to have move its focus from its single test well at Opal Ward, and to assemble a larger control area in which to test the scalability of the HIP Downhole Process Technology. To do this the Company looked to acquire rights covering approximately 6,400 acres covering rights from the surface to the base of the Travis Peak formation. Within this larger control area, the Company had assembled 10 historically producing but dormant wellbores on which to test the HIP Downhole Process Technology. Of these wellbores, three were acquired previously from HIP Energy Resource Limited, and seven were purchased for $60,000 from Peak Energy Corp. of Dallas, Texas. The Company did complete construction of its 3 acre central facilities site on which the equipment necessary to test the HIP Downhole Process Technology (the “HIP Control Unit”) had been assembled. To date, 8 of the 10 test wells have been piped to the HIP Control Unit, but the Company is waiting for the agreement of the Texas Parks and Wildlife Commission (“TWC”) before the well bore modifications and final hook-up of the wells can be completed. All of the wellheads required for each wellbore are also onsite and awaiting final modifications required for the HIP Downhole Process Technology.

During 2011, the TWC issued a cease work order on the Peak leases due to a dispute between TWC and the Company’s operator, Texla, which arose from the requirement by the TWC that Texla enter into a “surface access agreement” with the TWC after it had acquired the leases from the previous operator.

To date Texla has had no success in coming to an agreement with TWC with respect to a surface access agreement on the Peak wells. As a result of the delays, the leases held by Texla on the Peak wells have expired subject to Texla being successful in making a claim to the Texas Railway Commission claiming “force majeure” under each of the leases arising from the inaction and delays from TWC. Texla has retained legal counsel to assist with its position and the lease expiry situation arising from delays in the parties coming to an agreement. In the event Texla is unable to come to an agreement with TWC, the entire Peak investment and expenditure may be lost and the Company will have to then focus it’s testing of the HIP Downhole Process Technology in another area. In such an event, the Company will require additional funding to pursue these objectives.

Assuming Texla is successful in proceeding with the surface access agreement and renewing the leases on the Peak prospect, then the Company estimates that it will require approximately $300,000 to complete construction and assembly of the HIP Control Unit and to connect and finish modifications to the five phase 1 wells. Once completed, the Company expects that the cost of adding each of the remaining 5 wells will be approx. $40,000 per well. The Company will have to raise additional funds to pursue this objective. Phase 1 of the Company’s program continues to be to complete and to test at least five of the 10 wells within the next 12 months. If this plan is not feasible, then management will assess focusing its efforts to test the HIP Downhole Process Technology on other wellbores and leases in east Texas proximate to its central facility.

Plan of Operation

Financing

We plan to focus on those areas that will result in the production of oil and gas in the shortest time frame. In pursuing this objective, we plan to raise funds as required with the intent of minimizing dilution and maximizing return on funds deployed. Until such time as the HIP Downhole Process Technology is further developed and results in revenues from production of oil and gas from applied wells, we plan to primarily rely on traditional equity markets and if available, debt instruments to raise our required funding.

Use of Funding

Any funds received will, at the discretion of management, be allocated in part to testing the HIP Tech at the Opal Well and then expand the test to additional well locations in other areas testing the scalability of the HIP Tech. If oil and gas production is attained from these low-production or problematic wells using the HIP Downhole Process Technology, we will then continue to expand our commercialization of the HIP Downhole Process Technology.

We plan on deploying monies in those prospect areas where we have the greatest understanding of the existing well bores and reservoirs. To this end, we plan to focus our initial efforts on using the HIP Process in well bores and basins in such regions as the Woodbine and Austin Chalk region of the U.S. These regions are low-risk and long-term energy producers. We will participate in such regions with landowners or companies that have access to leases located in geological trends that have demonstrated substantial historical production and have potential remaining reserves that can be exploited in a low-risk, systematic fashion.

Based on our initial project plan and budget, we anticipate that we will require an investment of approximately $500,000 to fund a capital project and operating costs over the next 12 months.

We estimate that we will require approximately $300,000 to complete construction and assembly of the HIP Control Unit at the Central Facility in East Texas and to connect and finish modifications to the 5 phase 1 wells. If we do not proceed with these Peak wells then such funding will be required to undertake operations on additional leases we will require in east texas to further test the HIP Downhole Process Technology.

Our sole tangible assets consist of the Well Bores and the exclusive worldwide license to the HIP Downhole Process Technology. It is however a requirement of the application of the HIP Downhole Process Technology that certain equipment and other fixed or other tangible assets be acquired or leased in order that any potential commercialization of the HIP Tech on any of the well bores can be realized. The equipment required as part of the HIP Downhole Process Technology in part forms the basis of the application patent relating to the HIP Downhole Process Technology and in other cases is readily available oilfield equipment. The availability of any specific equipment may affect our ability to carry out its operations in a timely and cost effective manner. As stated earlier, our short-term plan is to apply and test the HIP Downhole Process Technology on a number of wells and wellbores acquired from HIP Resources. The results of these tests and the on-going development and application of the HIP Downhole Process Technology will directly affect our ability to generate revenue and raise additional capital to further expand its programs and acquire any on-going plant and equipment. As with any new technology applications there is inherent risk that the technology itself may not prove commercially viable or result in any economic production.

China Joint Venture

We have had preliminary discussions with China Jianghan Oilfield Company (“JOC”) to form a joint venture (a “China Joint Venture”). Our discussion to-date have focussed on the development of an initial pilot program to prove the economic viability of the HIP Downhole Process Technology on an agreed number of “beta” test well bores within the Jianghan Oilfield in China. After the economic viability of the HIP Downhole Process Technology has been proven, the HIP Downhole Process Technology would be applied on a large scale. As of the date of this report, we have not signed any definitive agreements with JOC and they may cease discussions at any time. Further, although we are at an advanced stage of negotiations and agreement as to the financial terms, number of wells and contribution of the respective parties, we have not signed any letters of intent or memorandums of understanding regarding same at this time.

License Agreement

Under the License Agreement, HIP Nevada was granted a worldwide exclusive license to the HIP Downhole Process Technology for the purpose of developing, producing, using, selling or otherwise commercially exploiting all subject matter encompassed within the scope of the HIP Downhole Process Technology. The consideration for the acquisition of the HIP Downhole Process Technology was the issuance of 30 million common shares of HIP to Group Rich and the grant of an agreed royalty structure on certain non-China ventures by HIP.

The royalty payment varies depending on the project. HIP Tech and HIP, collectively, will split any proceeds from a non-China Joint Venture as follows:

| (i) | On all Non-China joint venture related projects or operations on which the HIP Downhole Process Technology are being applied, HIP agrees subject to (ii) below, pay to Group Rich and HIP Tech (together the “Licensor”) a royalty fee equal to 25% of the gross revenue received by HIP from oil and gas wells where cumulative gross production per well exceeds more than 20 barrels of oil equivalences per day (Bblsoepd) for each monthly period. In the event cumulative production per well is equal to or less than 20 Bblsoepd for each monthly period, then the royalty will be reduced to 20% of the gross revenue received by HIP for all such wells. |

| Gross Average Production Per Well Per Day, calculated commencing from the day immediately after Well bore Commercialization | Percentage Payable to Licensor |

| Up to 20 barrels per well per day | 20% Gross Revenue |

| Greater than 20 barrels per well per day | 25% Gross Revenue |