UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☒ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

SENOMYX, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | |

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

On May 2, 2017, Senomyx, Inc. issued a press release titled “ISS and Glass Lewis Recommend a Vote FOR ALL of Senomyx’s Nominees,” a copy of which is provided immediately below:

ISS and Glass Lewis Recommend a Vote FOR ALL of Senomyx’s Nominees

Both Leading Proxy Advisory Firms Recommend Senomyx Shareholders Support Entire Senomyx Slate by Voting on the WHITE Proxy Card Today

NEW YORK (May 2, 2017) – The Board of Directors of Senomyx, Inc. (“Senomyx” or the “Company”) (NASDAQ: SNMX), a leading company using proprietary taste science technologies to discover, develop, and commercialize novel flavor ingredients and natural high intensity sweeteners for the food, beverage, and flavor industries, today announced that leading proxy advisory firms, Institutional Shareholder Services (ISS) and Glass Lewis, have both recommended that Senomyx shareholders reject efforts by an activist investor group (“Concerned Shareholders and Nominees of Senomyx” or “CSNS”) to replace the Company's Board of Directors. Consistent with the ISS and Glass Lewis recommendations, Senomyx urges shareholders to vote "FOR" each of the Company's seven nominees on the WHITE proxy card today.

Kent Snyder, Chairman of the Board of Directors of Senomyx, said, “We are pleased that both leading proxy advisory firms have recommended that shareholders vote for our full slate of nominees. ISS and Glass Lewis have each laid out detailed cases to demonstrate that electing our nominees is the right choice for shareholders to protect their investment, and we look forward to continuing to make our case to shareholders in advance of the Annual Meeting on May 11th.”

Senomyx shareholders are reminded that their votes are extremely important, no matter how few shares they own. To follow the recommendations of ISS, Glass Lewis and the Senomyx Board, shareholders should vote the WHITE proxy card “FOR" each of the Company's seven nominees TODAY by telephone, by Internet, or by signing and dating the WHITE proxy card.

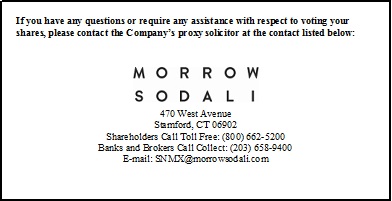

If you have any questions or require any assistance with voting your shares, please contact the Company's proxy solicitor listed below:

Morrow Sodali

SNMX@morrowsodali.com

(203) 658-9400 or Toll Free: (800) 662-5200

About Senomyx, Inc.

Senomyx discovers novel flavor ingredients and natural high intensity sweeteners that allow food and beverage companies to create better-for-you products. Under its direct sales program, Senomyx sells its Complimyx® brand flavor ingredients, Sweetmyx®, Savorymyx®, and Bittermyx®, to flavor companies for use in a wide variety of foods and beverages. In addition, Senomyx has partnerships with leading global food, beverage, and ingredient supply companies, which are currently marketing products that contain Senomyx's flavor ingredients. For more information, please visit www.senomyx.com.

Contacts

Sloane & Company

Dan Zacchei / Joe Germani, 212-486-9500

dzacchei@sloanepr.com / jgermani@sloanepr.com

If you have any questions or require any assistance with respect to voting your shares, please contact the Company’s proxy solicitor at the contact listed below:

Important Additional Information

Senomyx, its directors and certain of its executive officers will be deemed to be participants in the solicitation of proxies from Company shareholders in connection with the matters to be considered at the Company’s annual meeting of shareholders scheduled to be held on May 11, 2017. The Company has filed a definitive proxy statement and a WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its solicitation of proxies from Company shareholders. COMPANY SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT AND ACCOMPANYING WHITE PROXY CARD AS THEY CONTAIN IMPORTANT INFORMATION. Information regarding the identity of participants in this solicitation by the Company, and their direct or indirect interests, by security holdings or otherwise, is set forth in the proxy statement and other materials filed by the Company with the SEC. Shareholders will be able to obtain the proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC for no charge at the SEC’s website at www.sec.gov. Copies will also be available for no charge at http://proxy2017.senomyx.com, by writing to the Company at 4767 Nexus Centre Drive, San Diego, California 92121 or by calling the Company’s proxy solicitor, Morrow Sodali, at 1 (800) 662-5200.

Forward-Looking Statements

Information presented in this communication contains forward-looking statements within the meaning of the Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) and the Private Securities Litigation Reform Act of 1995. All statements relating to events or results that may occur in the future, including, but not limited to, the development, growth and expansion of the Company’s business, the Company’s intent, belief, or current expectations, primarily with respect to the Company’s future operating performance, and the product the Company expects to offer and other statements regarding matters that are not historical facts, are forward-looking statements. Forward-looking statements generally can be identified by words such as “may,” “will,” “could,” “anticipate,” “expect,” “intend,” “believe,” “continue,” or the negative of such terms, or other comparable terminology. These statements are based on numerous assumptions and involve known and unknown risks, uncertainties and other factors that could significantly affect the Company’s operations and may cause the Company’s actual actions, results, financial condition, performance or achievements to be substantially different from any future actions, results, financial condition, performance or achievements expressed or implied by any such forward-looking statements. Those factors include, but are not limited to, (i) general economic and business conditions; (ii) changes in market conditions; (iii) changes in regulations; (iv) actual or potential takeover or other change-of-control threats; (v) the effect of merger or acquisition activities; (vi) changes in the Company’s plans, strategies, targets, objectives, expectations or intentions; and (vii) other risks, uncertainties and factors indicated from time to time in the Company’s reports and filings with the SEC including, without limitation, most recently the Company’s Annual Report on Form 10-K for the period ended December 31, 2016, under the heading Item 1A - “Risk Factors” and the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The forward-looking statements speak only as of the date on which they are made and the Company does not intend, and undertakes no obligation to update or publicly release any revision to any such forward-looking statements, whether as a result of the receipt of new information, the occurrence of subsequent events, the change of circumstance or otherwise, except as required by law. Each forward-looking statement contained in the Company’s proxy statement is specifically qualified in its entirety by the aforementioned factors. You are advised to carefully read the Company’s proxy statement in conjunction with the important disclaimers set forth above prior to reaching any conclusions or making any investment decisions.

3