Exhibit 99.1

| | RISC |

| | |

| | Level 3, 1138 Hay Street |

| 1 March 2012 | WEST PERTH WA 6005 |

| | |

| | PO Box 275 |

| | WEST PERTH WA 6872 |

| Mr. Michael R. McElwrath | |

| Far East Energy Corporation | |

| 363 N Sam Houston Pkwy E | Tel: + 61 (0) 8 9420 6660 |

| Suite 380 | Fax: +61 (0) 8 9420 6690 |

| Houston 77060 Texas | Email: riscsupport@riscpl.com |

| | Web: www.riscpl.com |

| | |

| | ACN 150 789 030 |

Dear Mr. McElwrath,

Shouyang US SEC Reserves as at 31 December 2011

At the request of Far East Energy Corporation (FEEC), RISC has estimated the reserves and future revenue of Far East Energy Corporation’s (FEEC) interests in the coal bed methane property (CBM) located in the Shouyang Contract Area, China.

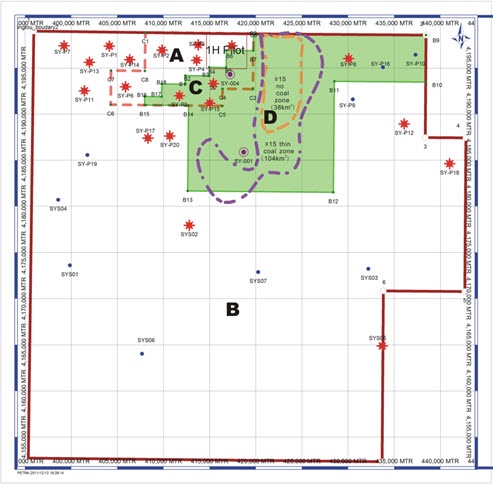

The Shouyang Production Sharing Contract Area (PSC) is in the Shanxi Province approximately 400 km south west of Beijing. The location map is shown in Figure 1. Development within the Shouyang Block is focused on the #3, #9 and #15 coal seams in the northern part of the PSC.

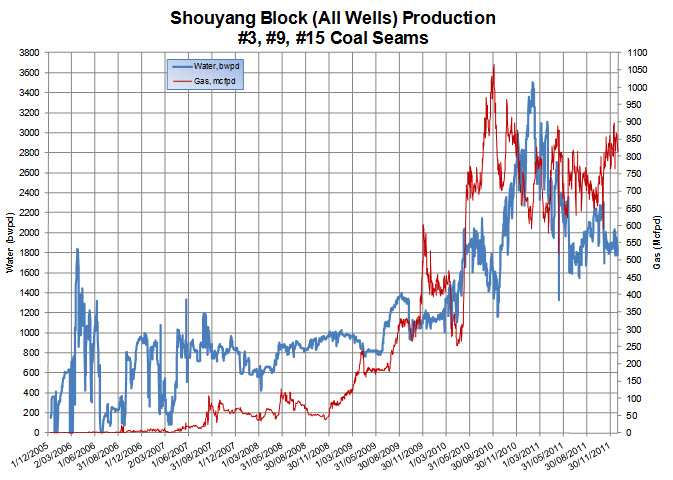

In November 2011, FEEC relinquished two portions labelled C and D in Figure 2 totalling 306.5 km2 and retained two remaining portions labelled A and B with a combined area of 1656.3 km2 (409,282 acres). FEEC has a 100% interest in portion A and a 70% interest in portion B in partnership with CUCBM. ConocoPhillips has a 3.5 % overriding royalty (ORR).

Figure 1 Shouyang Location Map

Figure 2 Shouyang Contract Area

The reserve estimates have been prepared in accordance with definitions and regulations of the U.S Securities and Exchange Commission (SEC) and the FASB Accounting Standards Codification Topic 932, Extractive Industries-Oil and Gas with the exclusion of future income tax and Chinese VAT. The SEC oil and gas reserve definitions are included at the end of this report. The purpose of the report is for FEEC’s use in filing with the SEC. RISC’s estimates of the gross and net reserves and net future revenue attributable to FEEC as at 31 December 2011 are shown in Table 1. Net reserves have been calculated from FEEC’s share of cost gas and profit gas in accordance with the PSC terms and account for 100% of FEEC’s proved petroleum reserves. The proved reserves set forth herein are attributable to approximately 7,760 acres (31.4 square kilometers) in area A and 5,600 acres (22.7 square kilometers) in area B. The probable and possible reserves set forth herein are attributable to all of area A (approximately 16,062 acres or 65 square kilometers) plus approximately 69,440 acres (281 square kilometres) in area B, inclusive of the proved locations.

| | Gross Reserves | Net Reserves | Future Net Revenue $million |

| | MMscf | MMscf | Undiscounted | 10% Discount |

| Category | | | | |

| Proved Developed | 14,160 | 13,505 | 59.7 | 34.5 |

| Proved Undeveloped | 45,469 | 41,094 | 100.4 | 30.9 |

| Total Proved | 59,629 | 54,599 | 160.1 | 65.4 |

| Probable Developed | 3,653 | 3,608 | 19.9 | 14.9 |

| Probable Undeveloped | 511,300 | 375,994 | 1,278.1 | 649.0 |

| Total Probable | 514,953 | 379,603 | 1,298.0 | 663.9 |

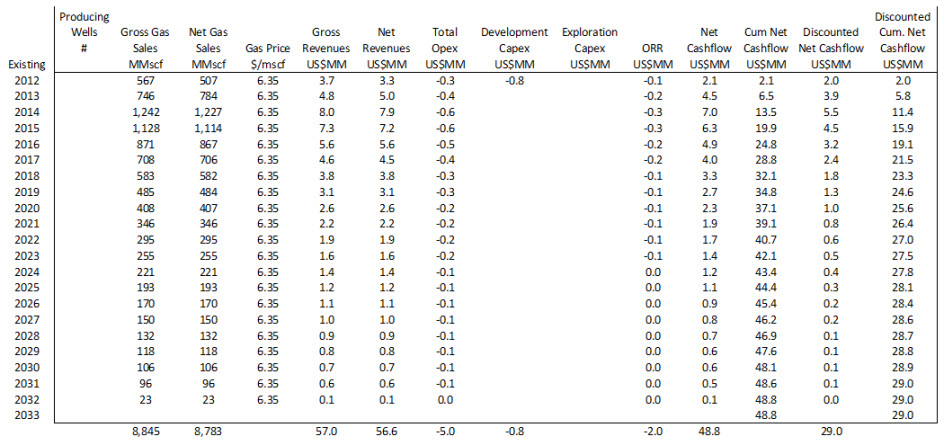

| Possible Developed | 8,845 | 8,783 | 48.8 | 29.0 |

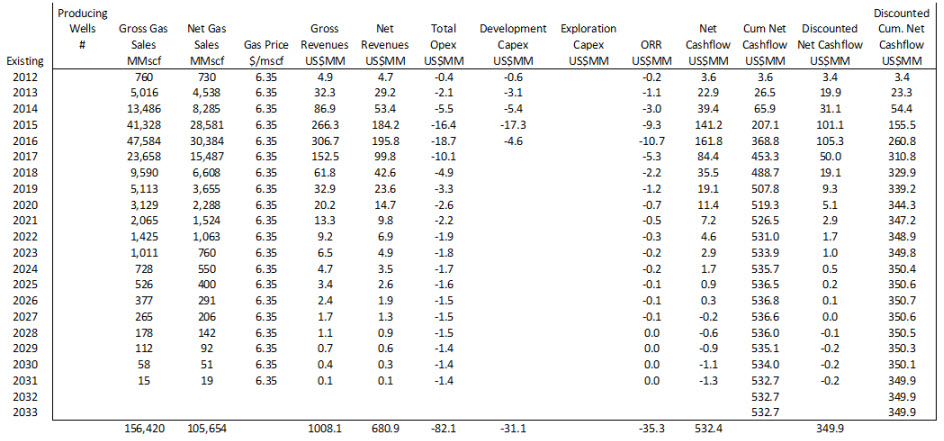

| Possible Undeveloped | 156,420 | 105,654 | 532.4 | 349.9 |

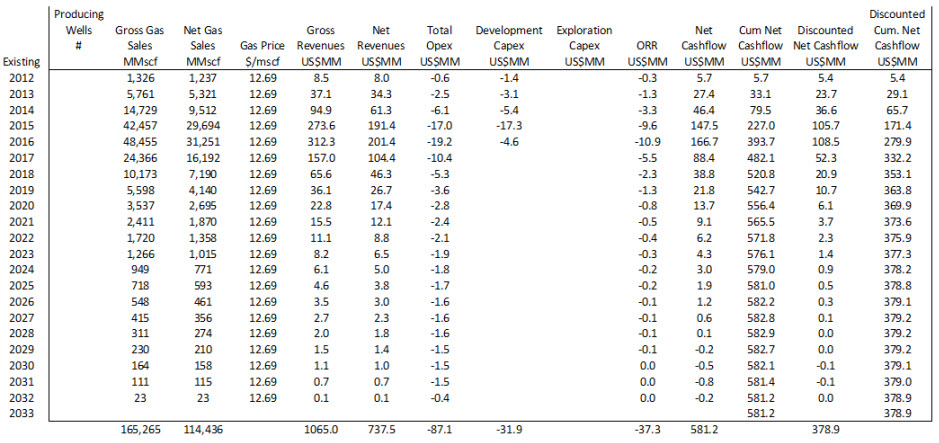

| Total Possible | 165,265 | 114,436 | 581.2 | 378.9 |

Totals may differ due to rounding. Gas volumes are expressed in units of million standard cubic feet at reference conditions of 60 deg F and 14.696 psia |

Table 1 Gross and Net Reserves and Future Net Revenue attributable to FEEC as at 31 December 2011

Resource Evaluation

The resource evaluation is based on data from 95 CBM wells. The data included production performance, coal thickness, gas content measurements, gas storage capacity and proximate analysis data along with stratigraphic information from numerous coal exploration drill holes. Seismic data was limited to some regional lines that demonstrated the structural style and geological trends. The data indicate that the coal packages are quite continuous in the three target seams: #3, #9 and #15, with seam 15 (the deepest) being the most volumetrically significant. A number of smaller seams lie within these intervals that are currently not targeted for development. This represents a volumetric upside that has not been assessed or included in our estimates.

The target coal seams outcrop to the north of the block and can be examined in coal mines that are working the outcrop. The coal seams dip from north to south. Seam depths average from near surface to 900m below ground level in the north and have been demonstrated to contain commercial gas contents as deep as 1390m in well SYS-05 in the south eastern portion of the block with prospectivity below this depth. The majority of the well and coal bore data is concentrated in the north of the Block and confidence in the accuracy of structure and coal seam isopach mapping diminishes away from this area. The majority of CBM data has been acquired for the #15 seam and as a result there is less confidence in the regional distribution of CBM properties in the # 9 and # 3 seams. Reserves have been assigned to seam 15 in portions of area A and B and seam 9 in portions of area A where analysis of geoscience and engineering data provides a reasonable certainty that they are economically producible.

RISC has reviewed and accepts FEEC’s net coal thickness values for volumetric estimates. RISC has modified FEEC’s maps by extrapolating the gridded well values to the boundary of the Shouyang Block.

Original Gas-In-Place volumes (OGIP) were estimated using probabilistic methods based on coal tonnage, (area x thickness x density), coal quality (ash, moisture and density) and gas content.

The seam thickness averages 3.7m for seam 15, 2.5m for seam 9 and 1.5m for seam 3. The production data also supports coal continuity over significant distances.

The desorbed gas content of the coals from the samples taken averages 11.7 m3/tonne as received (ar) from 245 samples, but values as high as 25 m3/tonne have been observed in well SYS-05 in the south east of the permit. The average ar gas content does not vary significantly between seams, but there is a trend of increasing gas content and saturation with depth. The average ash content is 16% for seam 15, 37% for seam 9 and 19% for seam 3. The coal density is typically 1.5 tonne/m3.

Data from well tests and performance analysis indicates coal permeability is in the range 10 to 300 millidarcies (mD) with an average permeability of approximately 50 mD. The critical desorption pressures based on production performance are in the range 90 to 490 pounds per square inch absolute (psia) with an average of approximately 250 psia.

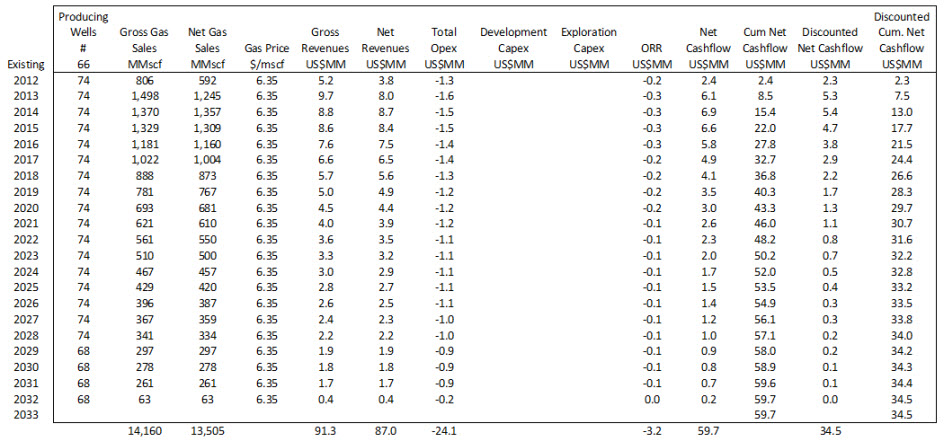

As at December 2011, there are 66 producing wells and 8 non producing wells that are expected to be placed on production in 2012. Dewatering commenced in 2005 and 0.6 billion standard cubic feet (Bcf) of gas has been produced to 31 December 2011. The historical production performance shown in Figure 3.

FEEC has evaluated a number of completion technologies; horizontal wells, under-reaming and fracture stimulation. They have selected fracture stimulation as the preferred technique. The well performance to date reflects the use of a number of completion techniques that have been determined as a result of the pilot studies to be sub optimal and consequently the average production performance can be expected to improve for future development wells.

Well spacing employed by FEEC varies from approximately 35 to 140 acres, with most wells in the most intensely developed 1H production area drilled on an approximate 40 acre spacing. Analysis of the reservoir pressure and geological data between producing wells has shown that an average well drainage area of 80 acres is reasonably certain. In order to accelerate the dewatering of the coals, a 40 acre infill development well spacing is planned by FEEC.

Figure 3 Shouyang Production Performance

Development Plan

FEEC has advised a firm development drilling program of up to 2130 wells planned with at least 20 rigs in areas A and B for the years 2012 to 2016 from which the current estimates of reserves in this report are based. 230 wells are planned for 2012, 400 in 2013 and 500 wells per year in 2014, 2015, and 2016. For the proved undeveloped reserves case, a total of 260 development well locations have been identified in areas A and B (Table 2). For the probable and possible undeveloped reserve cases, an additional 1870 development well locations have been identified. Future drilling is based on a well spacing of 40 acres to accelerate the dewatering process. FEEC has advised that there are virtually no areas within the PSC that are inaccessible for CBM development, as deviated wells will be used to access coal seams located below areas with restricted surface access.

Development Area | Producing and Non Producing Wells included in development | Future Development Wells |

| | | Proved | Probable and Possible | Total Proved + Probable + Possible |

| A | 68 | 126 | 274 | 400 |

| B | 6 | 134 | 1596 | 1730 |

| Total | 74 | 260 | 1870 | 2130 |

Table 2 Shouyang Block Development Proved and Probable Undeveloped Areas and Development Well Count

RISC has assumed future development wells are fracture stimulated. The initial development is focussed on seam 15. In 2013 38 wells located in the portion of seam 9 within area A where reserves have been established are assumed to be fracture stimulated and produced comingled with seam 15.

Gas production forecasts used were generated using industry-standard industry numerical modelling software for coal bed methane. Each development area and coal seam were modelled separately, based on parameters from the geological analysis, laboratory data and determined from analysis of production.

Production forecasts were truncated at the end of the PSC term at 30 June 2032.

The gas composition typically has 96 % methane with low CO2 and N2 content, consequently the gas does not require conditioning to meet pipeline specifications.

After drilling and completion, wells will be hooked up to a simple gas gathering system. Water is separated at the well site and disposed of by evaporation. Gas is transported to localised gas plants consisting of a simple dehydration and compression up to 500 psi for delivery to a third party gas network. The field is operated using electricity purchased from a local grid. On this basis it was assumed that all future production will be sold as sales gas.

Capital and operating costs were supplied by FEEC. These are summarised in Appendix 1 and have been used for the proved reserves case. For the probable and possible cases, the same cost base was used however we have estimated a drilling learning curve commencing in 2013 resulting in a 10% improvement in drilling costs

by 2015.

Economics

RISC has estimated undiscounted and discounted future net revenue using the fiscal and working interest terms defined in the Shouyang Block PSC supplied by FEEC and the Fifth Modification Agreement dated 11 November 2011 (English versions). The economic assumptions are:

| | · | FEEC has a 100% interest in PSC area A and a 70% interest in area B |

| | · | The PSC term expires on 30 June 2032 |

| | · | Government royalty of 0-3% based on production levels |

| | · | The evaluation date is at 31 December 2011. |

| | · | The gas price used is US$6.35/Mscf,1 (thousand standard cubic foot) in accordance with the gas sales agreement dated June 12 2010 and Chinese Government policy. The prices are based on the average price received and US dollar-Yuan exchange rate on the first day of each month in 2011. |

| | · | The gas sales agreement has a 20 year term expiring on 10 June 2030. RISC has assessed that gas sales beyond the current contract term are reasonably certain and consequently has assigned reserves until the end of the PSC term. |

| | · | No cost or price inflation. |

| | · | A 10% nominal mid-year discount has been used as the rate for the discounted future net cash flow. |

| | · | RISC has used a past cost balance of US$106.7 million exploration (100% FEEC) and a $2.84 million balance due to CUCBM for past exploration at 31/12/2011, as supplied by FEEC. We have not audited these costs |

| | · | An over-riding royalty of 3.5% is payable to ConocoPhillips. |

| | · | The future cash flows are defined as FEEC’s share of cost gas and profit gas in accordance with the PSC terms less royalties. Future cash flows are before income tax and Chinese VAT. |

The economic values contained in this report are for the purposes of demonstrating economic viability to meet standard cash flow measures under Regulation S-X. They do not purport to be the fair market value of FEEC’s interests in the Shouyang Block. Cash flow summaries are included in Appendices 2 to 10.

Qualifications

RISC is independent with respect to FEEC as provided in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information promulgated by the Society of Petroleum Engineers. RISC has no pecuniary interest, other than to the extent of the professional fees receivable for the preparation of this report, or other interest in the assets evaluated, that could reasonably be regarded as affecting our ability to

1 Under the gas sales agreement, the sales volume is defined at conditions of 20 deg C and 1.01325 bars absolute. The reserves and production in this report are stated at conditions of 60 deg F and 14.696 psia. Therefore a correction factor of 1.0154 has been applied to the gas volumes in the economic model to adjust for the different reference conditions.

give an unbiased view of these assets.

The assessment of petroleum assets is subject to uncertainty because it involves judgments on many variables that cannot be precisely assessed, including reserves, future oil and gas production rates, the costs associated with producing these volumes, access to product markets, product prices and the potential impact of fiscal or regulatory changes.

The statements and opinions attributable to RISC are given in good faith and in the belief that such statements are neither false nor misleading. In carrying out its tasks, RISC has considered and relied upon information obtained from FEEC as well as information in the public domain. The information included well reports, seismic data, maps, interpretation reports, production and well completion data, AFE’s, previous analyses, financial records and legal documents. The material was reviewed for its quality, accuracy and validity and was considered to be acceptable. RISC believes that that full disclosure has been made of all relevant material in FEEC’s possession and that information provided, is to the best of its knowledge, accurate and true.

The information provided to RISC has included both hard copy and electronic information supplemented with discussions between RISC and representatives of FEEC.

Whilst every effort has been made to verify data and resolve apparent inconsistencies, we believe our review and conclusions are sound, but neither RISC nor its servants accept any liability, except any liability which cannot be excluded by law, for its accuracy, nor do we warrant that our enquiries have revealed all of the matters which a more extensive examination may disclose. In particular, we have not independently verified property title, encumbrances, regulations and future costs that apply to these assets. RISC relied on FEEC’s advice in relation to opening balances at the evaluation date of past recovered and unrecovered development and exploration costs.

RISC has not made a physical inspection of the property as this was not considered necessary for our assessment.

Our assessment was carried out only for the purpose referred to above and may not have relevance in other contexts. The estimates contained in our assessment may increase or decrease and RISC’s opinions may change as further information becomes available.

The evaluation has been carried out by RISC staff under the supervision of Mr Geoffrey J Barker. Mr Barker has a B.Sc. from Melbourne University and a M.Eng. (Pet. Eng) from Sydney University. He has over 30 years experience in the oil and gas industry, has been a partner of RISC since 1996, is the Partner in charge of RISC’s unconventional gas practice and served on the SPE’s Oil and Gas Reserves Committee from 2006-2009. He has been responsible for company and property valuations, independent expert reports, reservoir studies, reserve assessments, business and project development plans for oil and gas properties in more than 50 countries.

| Yours sincerely, |

| |

| /s/ Geoffrey J Barker |

| Geoffrey J Barker |

| |

| Partner |

Definitions of Oil and Gas Reserves

Adapted from U.S. Securities and Exchange Commission Regulation S-X Section 210.4-10(a)

The following definitions are set forth in U.S. Securities and Exchange Commission (SEC) Regulation S-X Section 210.4-10(a).

(1) Acquisition of properties. Costs incurred to purchase, lease or otherwise acquire a property, including costs of lease bonuses and options to purchase or lease properties, the portion of costs applicable to minerals when land including mineral rights is purchased in fee, brokers’ fees, recording fees, legal costs, and other costs incurred in acquiring properties

(2) Analogous reservoir. Analogous reservoirs, as used in resources assessments, have similar rock and fluid properties, reservoir conditions (depth, temperature, and pressure) and drive mechanisms, but are typically at a more advanced stage of development than the reservoir of interest and thus may provide concepts to assist in the interpretation of more limited data and estimation of recovery. When used to support proved reserves, an “analogous reservoir” refers to a reservoir that shares the following characteristics with the reservoir of interest:

| | (i) Same geological formation (but not necessarily in pressure communication with the reservoir of interest); |

| | (ii) Same environment of deposition; |

| | (iii) Similar geological structure; and |

| | (iv) Same drive mechanism. |

Instruction to paragraph (a)(2): Reservoir properties must, in the aggregate, be no more favorable in the analog than in the reservoir of interest.

(3) Bitumen. Bitumen, sometimes referred to as natural bitumen, is petroleum in a solid or semi-solid state in natural deposits with a viscosity greater than 10,000 centipoise measured at original temperature in the deposit and atmospheric pressure, on a gas free basis. In its natural state it usually contains sulfur, metals, and other non-hydrocarbons.

(4) Condensate. Condensate is a mixture of hydrocarbons that exists in the gaseous phase at original reservoir temperature and pressure, but that, when produced, is in the liquid phase at surface pressure and temperature.

(5) Deterministic estimate. The method of estimating reserves or resources is called deterministic when a single value for each parameter (from the geoscience, engineering, or economic data) in the reserves calculation is used in the reserves estimation procedure.

(6) Developed oil and gas reserves. Developed oil and gas reserves are reserves of any category that can be expected to be recovered:

| | (i) Through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well; and |

| | (ii) Through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well. |

(7) Development costs. Costs incurred to obtain access to proved reserves and to provide facilities for extracting, treating, gathering and storing the oil and gas. More specifically, development costs, including depreciation and applicable operating costs of support equipment and facilities and other costs of development activities, are costs incurred to:

| | (i) | Gain access to and prepare well locations for drilling, including surveying well locations for the purpose of determining specific development drilling sites, clearing ground, draining, road building, and relocating public roads, gas lines, and power lines, to the extent necessary in developing the proved reserves. |

| | (ii) | Drill and equip development wells, development-type stratigraphic test wells, and service wells, including the |

| | | costs of platforms and of well equipment such as casing, tubing, pumping equipment, and the wellhead assembly. |

| | (iii) | Acquire, construct, and install production facilities such as lease flow lines, separators, treaters, heaters, manifolds, measuring devices, and production storage tanks, natural gas cycling and processing plants, and central utility and waste disposal systems. |

| | (iv) | Provide improved recovery systems. |

(8) Development project. A development project is the means by which petroleum resources are brought to the status of economically producible. As examples, the development of a single reservoir or field, an incremental development in a producing field, or the integrated development of a group of several fields and associated facilities with a common ownership may constitute a development project.

(9) Development well. A well drilled within the proved area of an oil or gas reservoir to the depth of a stratigraphic horizon known to be productive.

(10) Economically producible. The term economically producible, as it relates to a resource, means a resource which generates revenue that exceeds, or is reasonably expected to exceed, the costs of the operation. The value of the products that generate revenue shall be determined at the terminal point of oil and gas producing activities as defined in paragraph (a)(16) of this section.

(11) Estimated ultimate recovery (EUR). Estimated ultimate recovery is the sum of reserves remaining as of a given date and cumulative production as of that date.

(12) Exploration costs. Costs incurred in identifying areas that may warrant examination and in examining specific areas that are considered to have prospects of containing oil and gas reserves, including costs of drilling exploratory wells and exploratory-type stratigraphic test wells. Exploration costs may be incurred both before acquiring the related property (sometimes referred to in part as prospecting costs) and after acquiring the property. Principal types of exploration costs, which include depreciation and applicable operating costs of support equipment and facilities and other costs of exploration activities, are:

| | (i) | Costs of topographical, geographical and geophysical studies, rights of access to properties to conduct those studies, and salaries and other expenses of geologists, geophysical crews, and others conducting those studies. Collectively, these are sometimes referred to as geological and geophysical or “G&G” costs. |

| | (ii) | Costs of carrying and retaining undeveloped properties, such as delay rentals, ad valorem taxes on properties, legal costs for title defense, and the maintenance of land and lease records. |

| | (iii) | Dry hole contributions and bottom hole contributions. |

| | (iv) | Costs of drilling and equipping exploratory wells. |

| | (v) | Costs of drilling exploratory-type stratigraphic test wells |

(13) Exploratory well. An exploratory well is a well drilled to find a new field or to find a new reservoir in a field previously found to be productive of oil or gas in another reservoir. Generally, an exploratory well is any well that is not a development well, an extension well, a service well, or a stratigraphic test well as those items are defined in this section.

(14) Extension well. An extension well is a well drilled to extend the limits of a known reservoir.

(15) Field. An area consisting of a single reservoir or multiple reservoirs all grouped on or related to the same individual geological structural feature and/or stratigraphic condition. There may be two or more reservoirs in a field which are separated vertically by intervening impervious strata, or laterally by local geologic barriers, or by both. Reservoirs that are associated by being in overlapping or adjacent fields may be treated as a single or common operational field. The geological terms “structural feature” and “stratigraphic condition” are intended to identify localized geological features as opposed to the broader terms of basins, trends, provinces, plays, areas-of-interest, etc.

(16) Oil and gas producing activities.

(i) Oil and gas producing activities include:

(A) The search for crude oil, including condensate and natural gas liquids, or natural gas (“oil and gas”) in their natural states and original locations;

(B) The acquisition of property rights or properties for the purpose of further exploration or for the purpose of removing the oil or gas from such properties;

(C) The construction, drilling, and production activities necessary to retrieve oil and gas from their natural reservoirs, including the acquisition, construction, installation, and maintenance of field gathering and storage systems, such as:

(1) Lifting the oil and gas to the surface; and

(2) Gathering, treating, and field processing (as in the case of processing gas to extract liquid hydrocarbons); and

(D) Extraction of saleable hydrocarbons, in the solid, liquid, or gaseous state, from oil sands, shale, coalbeds, or other nonrenewable natural resources which are intended to be upgraded into synthetic oil or gas, and activities undertaken with a view to such extraction.

Instruction 1 to paragraph (a)(16)(i): The oil and gas production function shall be regarded as ending at a “terminal point”, which is the outlet valve on the lease or field storage tank. If unusual physical or operational circumstances exist, it may be appropriate to regard the terminal point for the production function as:

a. The first point at which oil, gas, or gas liquids, natural or synthetic, are delivered to a main pipeline, a common carrier, a refinery, or a marine terminal; and

b. In the case of natural resources that are intended to be upgraded into synthetic oil or gas, if those natural resources are delivered to a purchaser prior to upgrading, the first point at which the natural resources are delivered to a main pipeline, a common carrier, a refinery, a marine terminal, or a facility which upgrades such natural resources into synthetic oil or gas.

Instruction 2 to paragraph (a)(16)(i): For purposes of this paragraph (a)(16), the term saleable hydrocarbons means hydrocarbons that are saleable in the state in which the hydrocarbons are delivered.

(ii) Oil and gas producing activities do not include:

(A) Transporting, refining, or marketing oil and gas;

(B) Processing of produced oil, gas or natural resources that can be upgraded into synthetic oil or gas by a registrant that does not have the legal right to produce or a revenue interest in such production;

(C) Activities relating to the production of natural resources other than oil, gas, or natural resources from which synthetic oil and gas can be extracted; or

(D) Production of geothermal steam.

(17) Possible reserves. Possible reserves are those additional reserves that are less certain to be recovered than probable reserves.

(i) When deterministic methods are used, the total quantities ultimately recovered from a project have a low probability of exceeding proved plus probable plus possible reserves. When probabilistic methods are used, there should be at least a 10% probability that the total quantities ultimately recovered will equal or exceed the proved plus probable plus possible reserves estimates.

(ii) Possible reserves may be assigned to areas of a reservoir adjacent to probable reserves where data control and interpretations of available data are progressively less certain. Frequently, this will be in areas where geoscience and engineering data are unable to define clearly the area and vertical limits of commercial production from the reservoir by a defined project.

(iii) Possible reserves also include incremental quantities associated with a greater percentage recovery of the hydrocarbons in place than the recovery quantities assumed for probable reserves.

(iv) The proved plus probable and proved plus probable plus possible reserves estimates must be based on reasonable alternative technical and commercial interpretations within the reservoir or subject project that are clearly documented, including comparisons to results in successful similar projects.

(v) Possible reserves may be assigned where geoscience and engineering data identify directly adjacent portions of a reservoir within the same accumulation that may be separated from proved areas by faults with

displacement less than formation thickness or other geological discontinuities and that have not been penetrated by a wellbore, and the registrant believes that such adjacent portions are in communication with the known (proved) reservoir. Possible reserves may be assigned to areas that are structurally higher or lower than the proved area if these areas are in communication with the proved reservoir.

(vi) Pursuant to paragraph (a)(22)(iii) of this section, where direct observation has defined a highest known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves should be assigned in the structurally higher portions of the reservoir above the HKO only if the higher contact can be established with reasonable certainty through reliable technology. Portions of the reservoir that do not meet this reasonable certainty criterion may be assigned as probable and possible oil or gas based on reservoir fluid properties and pressure gradient interpretations.

(18) Probable reserves. Probable reserves are those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered.

(i) When deterministic methods are used, it is as likely as not that actual remaining quantities recovered will exceed the sum of estimated proved plus probable reserves. When probabilistic methods are used, there should be at least a 50% probability that the actual quantities recovered will equal or exceed the proved plus probable reserves estimates.

(ii) Probable reserves may be assigned to areas of a reservoir adjacent to proved reserves where data control or interpretations of available data are less certain, even if the interpreted reservoir continuity of structure or productivity does not meet the reasonable certainty criterion. Probable reserves may be assigned to areas that are structurally higher than the proved area if these areas are in communication with the proved reservoir.

(iii) Probable reserves estimates also include potential incremental quantities associated with a greater percentage recovery of the hydrocarbons in place than assumed for proved reserves.

(iv) See also guidelines in paragraphs (a)(17)(iv) and (a)(17)(vi) of this section.

(19) Probabilistic estimate. The method of estimation of reserves or resources is called probabilistic when the full range of values that could reasonably occur for each unknown parameter (from the geoscience and engineering data) is used to generate a full range of possible outcomes and their associated probabilities of occurrence.

(20) Production costs.

| | (i) | Costs incurred to operate and maintain wells and related equipment and facilities, including depreciation and applicable operating costs of support equipment and facilities and other costs of operating and maintaining those wells and related equipment and facilities. They become part of the cost of oil and gas produced. Examples of production costs (sometimes called lifting costs) are: |

| | (A) | Costs of labor to operate the wells and related equipment and facilities. |

| | (B) | Repairs and maintenance |

| | (C) | Materials, supplies, and fuel consumed and supplies utilized in operating the wells and related equipment and facilities. |

| | (D) | Property taxes and insurance applicable to proved properties and wells and related equipment and facilities. |

| | (ii) | Some support equipment or facilities may serve two or more oil and gas producing activities and may also serve transportation, refining, and marketing activities. To the extent that the support equipment and facilities are used in oil and gas producing activities, their depreciation and applicable operating costs become exploration, development or production costs, as appropriate. Depreciation, depletion, and amortization of capitalized acquisition, exploration, and development costs are not production costs but also become part of the cost of oil and gas produced along with production (lifting) costs identified above. |

(21) Proved area. The part of a property to which proved reserves have been specifically attributed.

(22) Proved oil and gas reserves. Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time.

(i) The area of the reservoir considered as proved includes:

(A) The area identified by drilling and limited by fluid contacts, if any, and

(B) Adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be continuous with it and to contain economically producible oil or gas on the basis of available geoscience and engineering data.

(ii) In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest known hydrocarbons (LKH) as seen in a well penetration unless geoscience, engineering, or performance data and reliable technology establishes a lower contact with reasonable certainty.

(iii) Where direct observation from well penetrations has defined a highest known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally higher portions of the reservoir only if geoscience, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty.

(iv) Reserves which can be produced economically through application of improved recovery techniques (including, but not limited to, fluid injection) are included in the proved classification when:

(A) Successful testing by a pilot project in an area of the reservoir with properties no more favorable than in the reservoir as a whole, the operation of an installed program in the reservoir or an analogous reservoir, or other evidence using reliable technology establishes the reasonable certainty of the engineering analysis on which the project or program was based; and

(B) The project has been approved for development by all necessary parties and entities, including governmental entities.

(v) Existing economic conditions include prices and costs at which economic producibility from a reservoir is to be determined. The price shall be the average price during the 12-month period prior to the ending date of the period covered by the report, determined as an unweighted arithmetic average of the first-day-of-the-month price for each month within such period, unless prices are defined by contractual arrangements, excluding escalations based upon future conditions.

(23) Proved properties. Properties with proved reserves.

(24) Reasonable certainty. If deterministic methods are used, reasonable certainty means a high degree of confidence that the quantities will be recovered. If probabilistic methods are used, there should be at least a 90% probability that the quantities actually recovered will equal or exceed the estimate. A high degree of confidence exists if the quantity is much more likely to be achieved than not, and, as changes due to increased availability of geoscience (geological, geophysical, and geochemical), engineering, and economic data are made to estimated ultimate recovery (EUR) with time, reasonably certain EUR is much more likely to increase or remain constant than to decrease.

(25) Reliable technology. Reliable technology is a grouping of one or more technologies (including computational methods) that has been field tested and has been demonstrated to provide reasonably certain results with consistency and repeatability in the formation being evaluated or in an analogous formation.

(26) Reserves. Reserves are estimated remaining quantities of oil and gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering oil and gas or related substances to market, and all permits and financing required to implement the project.

Note to paragraph (a)(26): Reserves should not be assigned to adjacent reservoirs isolated by major, potentially sealing, faults until those reservoirs are penetrated and evaluated as economically producible. Reserves should not be assigned

to areas that are clearly separated from a known accumulation by a non-productive reservoir (i.e., absence of reservoir, structurally low reservoir, or negative test results). Such areas may contain prospective resources (i.e., potentially recoverable resources from undiscovered accumulations).

(27) Reservoir. A porous and permeable underground formation containing a natural accumulation of producible oil and/or gas that is confined by impermeable rock or water barriers and is individual and separate from other reservoirs

(28) Resources. Resources are quantities of oil and gas estimated to exist in naturally occurring accumulations. A portion of the resources may be estimated to be recoverable, and another portion may be considered to be unrecoverable. Resources include both discovered and undiscovered accumulations.

(29) Service well. A well drilled or completed for the purpose of supporting production in an existing field. Specific purposes of service wells include gas injection, water injection, steam injection, air injection, salt-water disposal, water supply for injection, observation, or injection for in-situ combustion.

(30) Stratigraphic test well. A stratigraphic test well is a drilling effort, geologically directed, to obtain information pertaining to a specific geologic condition. Such wells customarily are drilled without the intent of being completed for hydrocarbon production. The classification also includes tests identified as core tests and all types of expendable holes related to hydrocarbon exploration. Stratigraphic tests are classified as “exploratory type” if not drilled in a known area or “development type” if drilled in a known area.

(31) Undeveloped oil and gas reserves. Undeveloped oil and gas reserves are reserves of any category that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion.

(i) Reserves on undrilled acreage shall be limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances.

(ii) Undrilled locations can be classified as having undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances, justify a longer time.

(iii) Under no circumstances shall estimates for undeveloped reserves be attributable to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual projects in the same reservoir or an analogous reservoir, as defined in paragraph (a)(2) of this section, or by other evidence using reliable technology establishing reasonable certainty.

(32) Unproved properties. Properties with no proved reserves.

APPENDIX 1 – SUMMARY OF CAPEX AND OPEX

| CAPEX Items |

| Wells | | Amount | | Unit |

| - Well Drill & Complete (700 m vertical) | | | 226 | | $’000/well |

| - Well Drill & Complete (1300 m vertical) | | | 347 | | $’000/well |

| - Well Frac | | | 60 | | $’000/well |

| - Well Recompletion (to upper zones) | | | 50 | | $’000/well |

| Gathering & Hook-up | | | | | |

| - Gathering & Hook-up | | | 25 | | $’000/well |

| Gas Plant | | | | | |

| - Gas (TEG) Plant | | | 85 | | $’000/MMscfd |

| - Compression | | | 250 | | $’000/MMscfd |

| OPEX Items |

| Wells | | | | | |

| - Well Opex | | | 1,000 | | $/well/month |

| Facilities | | | | | |

| - Electricity | | | 0.35 | | $/Mcf of gas sold |

| - Variable | | | 0.15 | | $/Mcf of gas sold |

| - Maintenance | | | 10 | | $'000/MMscfd/year |

| - Staff | | | 25 | | $'000/man/year |

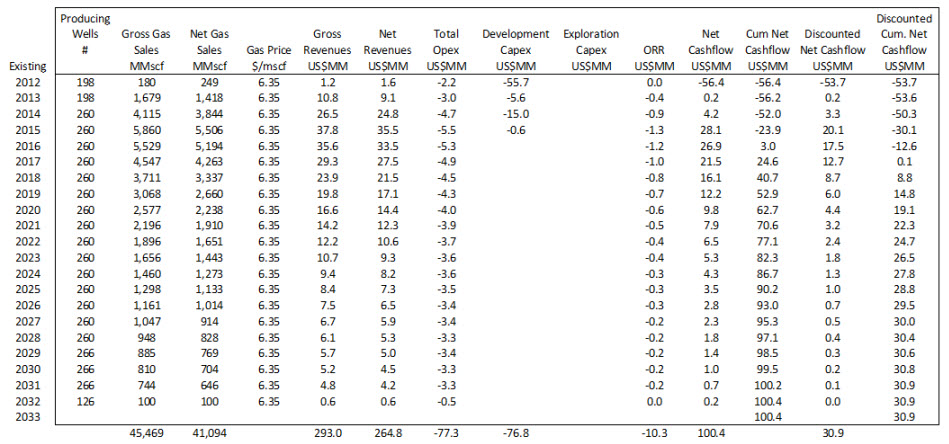

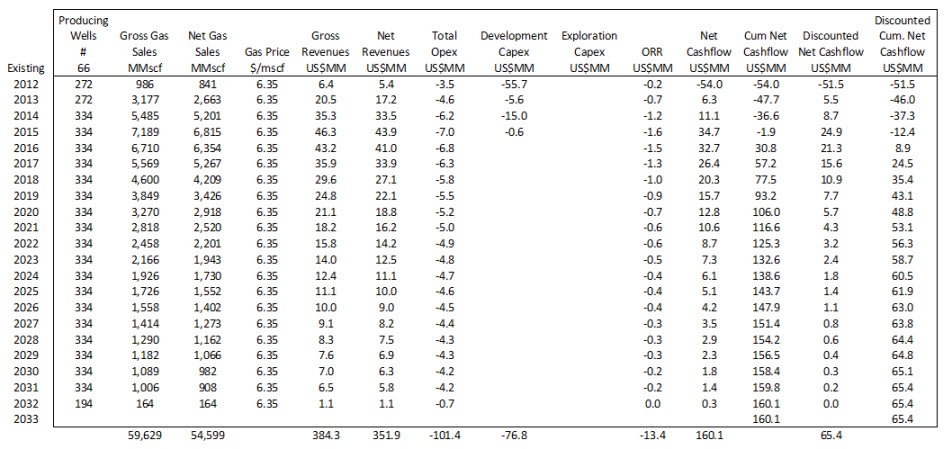

APPENDIX 2 – PROVED DEVELOPED RESERVES, WELL COUNT, PRODUCTION AND CASH FLOWS

| Notes: | Costs shown as negative numbers |

| | Decline in well numbers from 2029 on is due to end of economic life in area B |

APPENDIX 3 – PROVED UNDEVELOPED RESERVES, WELL NUMBERS, PRODUCTION AND CASH FLOWS

| Notes: | Costs shown as negative numbersCosts |

| | Increase in producing wells in 2029 due to extension of economic life relative to developed case |

| | Decline in well numbers in 2032 is due to end of economic life in area B |

| | Excess of Net over Gross Gas Sales in 2012 is due to timing of cost recovery |

APPENDIX 4 – PROVED DEVELOPED AND UNDEVELOPED RESERVES, WELL NUMBERS, PRODUCTION AND CASH FLOWS

| Notes: | Costs shown as negative numbers |

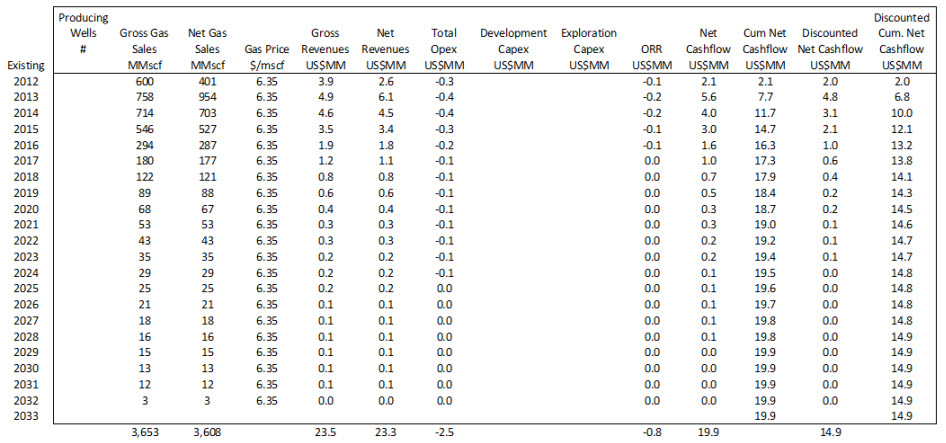

APPENDIX 5 – PROBABLE DEVELOPED RESERVES, WELL NUMBERS, PRODUCTION AND CASH FLOWS

| Notes: | Costs shown as negative numbers |

| | Producing wells included in Proved Developed cash flows |

| | Excess of Net over Gross Gas Sales in 2013 is due to timing of cost recovery |

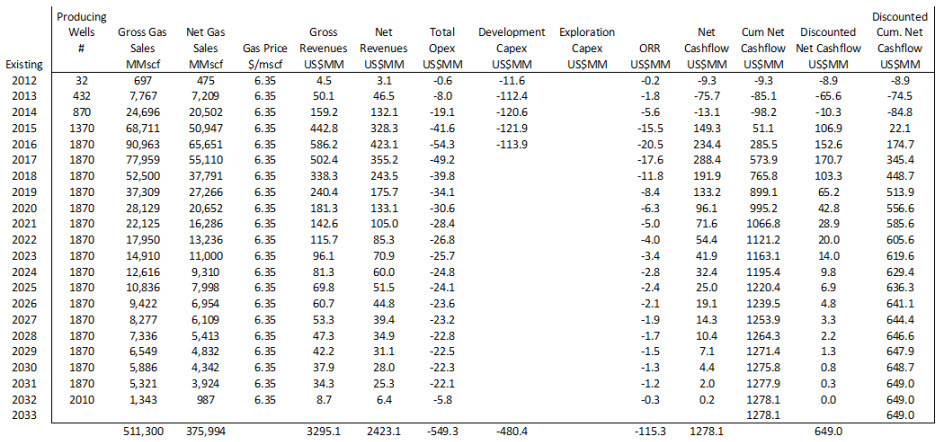

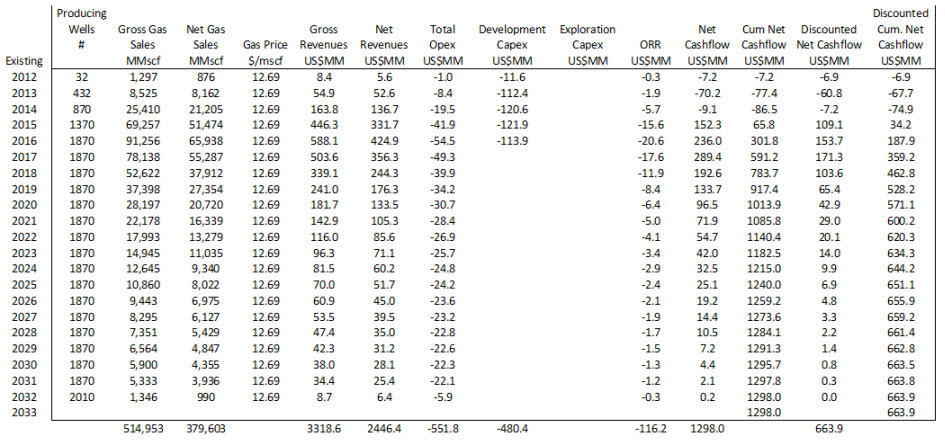

APPENDIX 6 – PROBABLE UNDEVELOPED RESERVES, WELL NUMBERS, PRODUCTION AND CASH FLOWS

| Notes: | Costs shown as negative numbers |

| | Increase in producing wells in 2032 due to extension of economic life relative to the Proved Undeveloped case |

APPENDIX 7 – PROBABLE DEVELOPED AND UNDEVELOPED RESERVES, WELL NUMBERS, PRODUCTION AND CASH FLOW

| Notes: | Costs shown as negative numbers |

| | Increase in producing wells in 2032 due to extension of economic life relative to the Proved developed and undeveloped case |

APPENDIX 8 – POSSIBLE DEVELOPED RESERVES, WELL NUMBERS, PRODUCTION AND CASH FLOWS

| Notes: | Costs shown as negative numbers |

| | Producing wells included in Proved Developed cash flows |

| | Excess of Net over Gross Gas Sales in 2013 is due to timing of cost recovery |

APPENDIX 9 – POSSIBLE UNDEVELOPED RESERVES, WELL NUMBERS, PRODUCTION AND CASH FLOWS

| Notes: | Costs shown as negative numbers |

| | Producing wells included in Proved Undeveloped and Probable Undeveloped cash flows |

| | Excess of Net over Gross Gas Sales in 2032 is due to timing of cost recovery |

APPENDIX 10 – POSSIBLE DEVELOPED AND UNDEVELOPED RESERVES, WELL NUMBERS, PRODUCTION AND CASH FLOWS

| Notes: | Costs shown as negative numbers |

| | Producing wells included in Probable Developed and Undeveloped cash flows |

| | Excess of Net over Gross Gas Sales in 2031 is due to timing of cost recovery |