UNITED STATES

SECURITIES & EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantþ Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| þ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

FAR EAST ENERGY CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

The following corporate presentation was prepared by Far East Energy Corporation.

November 2006 Corporate Presentation |

2 Cautionary Statements • Far East Energy is scheduled to hold its 2006 annual meeting of stockholders on December 15, 2006, and filed a definitive proxy statement with the Securities and Exchange Commission on October 27, 2006 in connection with the meeting. Our stockholders are strongly advised to read the proxy statement and the accompanying WHITE proxy card and any other relevant documents filed with the Securities and Exchange Commission when they become available because they will contain important information. Stockholders will be able to obtain the proxy statement as well as any amendments or supplements to the proxy statement and any other documents that we file with the Securities and Exchange Commission for free on the Securities and Exchange Commission’s website. Their website is located at www.sec.gov. Copies of the proxy statement and any amendments and supplements to the proxy statement will also be available for free at our website at www.fareastenergy.com or by writing to the Secretary of Far East Energy, 400 N. Sam Houston Parkway East, Suite 205, Houston, Texas 77060. You can also request copies of the proxy materials, as they become available, from our proxy solicitor, Innisfree M&A Incorporated. Their toll-free number is 1-888-750-5834. • Statements contained in this presentation that state the intentions, hopes, beliefs, anticipations, expectations or predictions of the future of Far East Energy Corporation and its management are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. It is important to note that any such forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties. Actual results could differ materially from those projected in such forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include: the preliminary nature of well data, including permeability and gas content, and commercial viability of the wells; risk and uncertainties associated with exploration, development and production of oil and gas; drilling and production risks; our lack of operating history; limited and potentially inadequate cash resources; expropriation and other risks associated with foreign operations; anticipated pipeline construction and transportation of gas; matters affecting the oil and gas industry generally; lack of availability of oil and gas field goods and services; environmental risks; changes in laws or regulations affecting our operations, as well as other risks described in our Annual Report on Form 10-K, Quarterly Reports filed on Form 10-Q, and subsequent filings with the Securities and Exchange Commission. • Note to Investors: This presentation contains information about adjacent properties on which we have no right to explore. U.S. investors are cautioned that petroleum/mineral deposits on adjacent properties are not necessarily indicative of such deposits on our properties. |

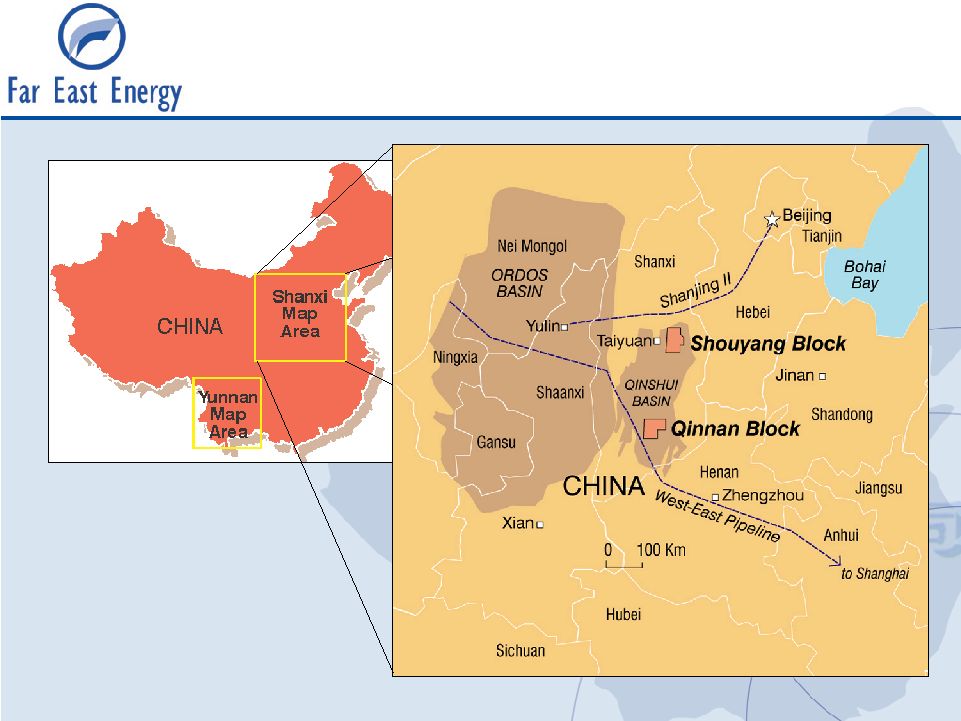

3 FEEC Profile Far East Energy Corporation (FEEC) headquartered in Houston, Texas, with offices in Beijing, Kunming and Taiyuan, China, is the 3rd largest coalbed methane acreage holder in China, with over 1.3 million acres in the Shanxi and Yunnan Provinces through agreements with ConocoPhillips and China United Coalbed Methane Corp., Ltd. FEEC is strategically positioned with two of its blocks (each covering approximately one-half million acres) ideally situated adjacent to two of China's major pipelines serving key industrial and business centers in Beijing and Shanghai. Far East Energy Corporation 400 N. Sam Houston Parkway E. Suite 205 Houston, TX 77060 Telephone: 832-598-0470 Facsimile: 832-598-0479 |

4 Approximately 1.3 million acres (5,250 km 2 ) in China’s coal rich Shanxi Province and Yunnan Province Situated near the two major national pipelines running to Beijing and Shanghai Shanxi Provincial government’s commitment to 1,080-mile pipeline network, a portion of which has been constructed Seasoned management team with extensive gas industry, international, and China-specific experience Sustained growth in the Chinese gas market provides compelling economics for locally sourced CBM Key Investment Highlights |

5 Management Michael R. McElwrath, Chief Executive Officer, President and Director formerly Acting Assistant Secretary of Energy Bruce N. Huff, Chief Financial Officer, Secretary and Treasurer formerly President and Chief Operating Officer of Harken Energy Garry Ward, Senior Vice President - Engineering Dr. Zhendong “Alex” Yang, Senior Vice President – Exploration Jeffrey R. Brown, President – Far East Energy (Bermuda) Ltd., formerly China Asset Manager, Kerr-McGee Board of Directors John C. Mihm, Chairman, retired Senior Vice President ConocoPhillips Michael R. McElwrath, CEO and President Donald A. Juckett, retired US Department of Energy Randall D. Keys, Financial Consultant and former CFO of BPZ Energy, Inc. Tim Whyte, Sofaer Capital, Inc. Thomas E. Williams, President - Maurer Technology, and Vice President - Research & Business Development of Noble Technology Services Division, both Noble Corporation subsidiaries Technical Advisors Don Gunther, Former Vice Chairman Bechtel Group Ken Ancell, Former Executive VP Tipperary, Principal Fairchild Ancell & Wells Management and Directors |

6 Third largest CBM acreage holder in China with over 1.3 million acres CBM Partners with ConocoPhillips and China United Coalbed Methane Corp. Ltd. (“CUCBM”) Based in Houston, Texas with offices in Beijing, Taiyuan and Kunming Currently dewatering three horizontal multi-lateral wells and drilling a fourth well – all located in the Shouyang Block in Shanxi Province Initial data has indicated much higher permeability coupled with high gas content; could enhance initial production rates and total potential gas production over the economic life of the well Corporate Overview |

7 Source: Oil and Gas Investor Shanxi Province |

8 Shanxi Project FEEC Drilling and Dewatering Activities Source: Oil and Gas Investor 1,057,638 Acres (4,280 km 2 ) National and intra- province pipelines in close proximity 66.5% participating interest potential Wells HZ01, HZ02, HZ03 and HZ04 in Shouyang Block |

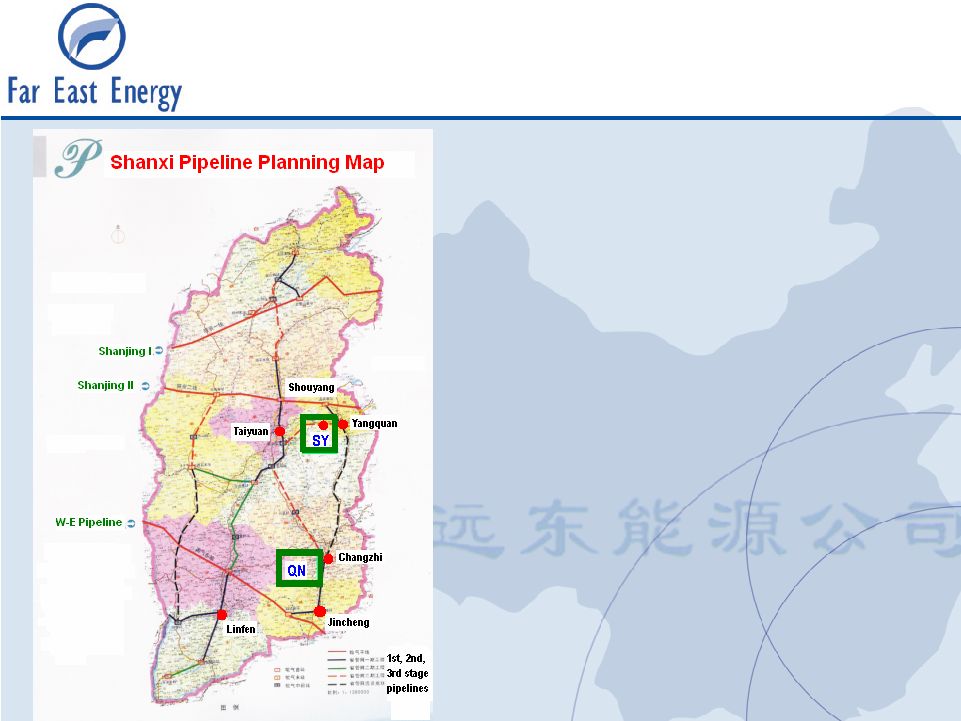

9 Shanxi Intra-Provincial Pipeline Planning Map • Shanxi Intra-Provincial Pipeline connecting FEEC acreage to major pipelines and metropolitan areas in Shanxi Province. • SY represents FEEC’s Shouyang Block • QN represents FEEC’s Qinnan Block Source: Natural Gas Corporation of Shanxi Province |

10 Production Sharing Contract (PSC) with China United Coalbed Methane Co. (CUCBM) government partner Far East Energy is Operator ConocoPhillips holds a 3.5% ORRI 30-year term in three phases: Exploration, development, production Far East Energy commits to exploration work program and expenditures over a five year period in order to earn its interest in the acreage Exploration costs borne solely by Far East Energy Development costs borne in proportion to ownership, with FEEC preferentially receiving cash flow until 9% rate return on exploration investment is realized Shanxi Production Sharing Contract |

11 Uncommonly High Perm and Gas • With our first horizontal wells, we believe we have discovered an uncommon combination of high permeability/high gas content. • High permeability in conjunction with high gas content and sufficient pressure generally results in higher gas production rates sustainable over a longer period of time. • High permeability allows gas to move with greater ease through coal, from greater distances to the well, and can result in prolific wells similar to those in America’s San Juan Basin or Australia’s Fairview Field. • High permeability, however, also means that water can move to the well from greater distances and it will take longer to dewater. |

12 High Perm/Gas = Higher Production Sustainable Over Longer Period • The key to making high permeability work to our advantage and to achieving maximum production at the earliest possible date is to drill a pattern of additional wells in the area of our first wells as rapidly as possible. • Australia’s Fairview Field, which is known in the industry to be a very productive field for CBM production, may be a good analog to what we have discovered in our Shouyang Area. The Fairview Field’s wells were steadily drilled in a pattern around the first wells, which resulted in enhanced dewatering and wells that initially came in at a slower rate and in lower amounts because of a lengthier dewatering period, steadily ramped up to high rates sustained over many years. Of course, until we achieve sustained production from our wells, we cannot be sure if the performance of our wells will mirror that of the Fairview Field. |

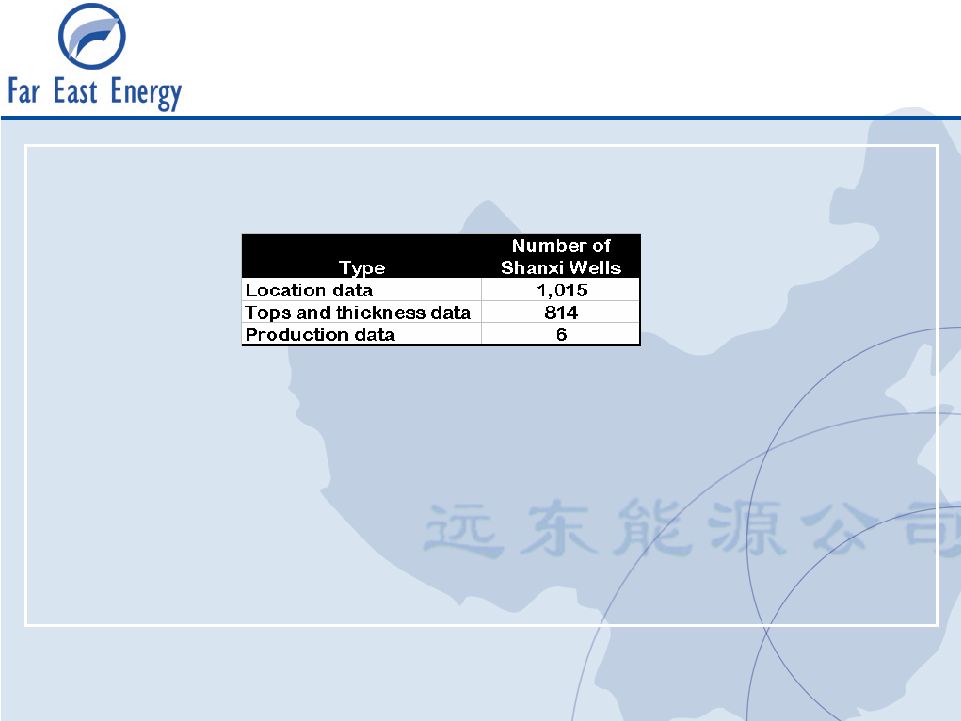

13 ConocoPhillips Shanxi Data Shanxi Analysis • Significant amount of well data available • Ash content, isotherm data, and gas content measurements for several wells in the region • Three seismic profiles analyzed for each block covering areas of no well control • Three main coal seams identified and evaluated: – Coals 3, 9, and 15 have substantial thickness in both blocks – Coals are laterally continuous and are of high grade – Coals capable of holding large volumes of gas Source: ConocoPhillips |

14 Drilling Evaluation of First Three Horizontal Wells: Finding: drilling costs were higher than expected but are trending down as the Company gains enhancements in the operations Recent Developments HZ01 HZ02 HZ03 Month & year spudded Jun 2005 Dec 2005 Apr 2006 Total days (including standby, drilling, completion, fishing and mobilization) 120 75 43 Horizontal extent 8,200 ft. 8,850 ft. 1,075 ft. |

15 Resource Comparison How does the Company’s Shanxi acreage compare with select U.S. CBM Basins? San Juan Black Warrior Raton Shanxi Acreage Coal Gas Content (Scf/ton) * 400-500 400-500 300-500 400-800 Coal Thickness: Typical net coal (feet) * 40 5 20 25-30 Pressure (psi) * 1500 400 400 450 Permeability (md) * 25 25 25 20-100 Source: Data on U.S. Basins from * John P. Seidle, Sproule Associates, Inc. Coalbed Methane of North America and ** Gas Research Institute Finding: preliminary technical data suggests that the Company’s Shanxi acreage compares well to these U.S. CBM plays. |

16 Average GDP growth of over 9% during the last decade World’s 2nd largest energy consumer Approximately 70% of China’s 34 Provinces suffered large scale electricity shortages in 2004 China ranks second in the world in carbon emissions China must increase energy supply while combating pollution 60-70% of China’s energy comes from coal Natural gas currently accounts for less than 3.5% of China’s energy use; by mandate it is expected to reach 8% by 2010 China |

17 CBM Addresses Energy Shortage and Environment Conventional gas – onshore gas results somewhat disappointing CBM Supply – China’s CBM resources estimated to be 1100 TCF (Source: China United Coalbed Methane Corporation, Ltd.) Clean – burns substantially cleaner than coal Environmental benefit – net reduction in emission of methane into atmosphere Safety – drilling in advance of mining can save more than 5,000 lives annually Proximity to market – primarily in Central & Eastern China and relatively close to major cities and institutions |

18 CBM receives favorable royalty treatment Market price vs. government established price Reported average of $6.65 per Mcf, with a higher range of prices for residential, commercial and industrial terminals Pipeline tariff approximately $1.60 Mcf per 600 miles Potentially higher prices for LNG, if necessary or available Strong profit potential after deducting lifting cost, tariff and taxes Shanxi project is located near national and intra-province pipelines • Shouyang Block – Shanjing II Pipeline to Beijing • Qinnan Block - West-East Pipeline to Shanghai • Shanxi Provincial government has recently constructed a portion of a planned 1,080-mile long intra-province pipeline network China Macro Gas Markets |

400 N. Sam Houston Parkway Suite 205 Houston, Texas 77060 Main Number: 832-598-0470 www.fareastenergy.com OTCBB: FEEC Investor Relations Contacts: Bruce N. Huff, Chief Financial Officer David Nahmias, Investor Relations |

20 Drilling Commences in Shouyang Block Spudding Ceremony for FEEC’s First Horizontal Well Project in the Shanxi Province - June 2005 |

21 Location data for over 850 wells in Qinnan area; 165 wells in Shouyang area Tops and thickness data for 678 wells in Qinnan area; 136 wells in Shouyang area • Shouyang wells clustered in north part of block; Qinnan wells clustered in east part of block Ash content, isotherm data, and gas content measurements for several wells in the region Production data for 3 wells in Qinnan area and 3 wells in Shouyang block Three seismic profiles were available for each block covering areas of no well control Topographic control grid Qinshui Basin boundary and outcrop pattern of coal seams Appendix (Shanxi Project) |

22 Geologic evaluation has identified three prospective areas within the Shouyang and Qinnan Blocks from 900-3000 ft (300 to 1000 meters) in depth • Shouyang North Area 204,335 acres total (827 Km²); 82,710 acres (334 Km²) within well control area • Qinnan East Area 113,904 acres total (461 Km²); 53,431 acres (216 Km²) within well control area • Qinnan West Area 171,103 acres (692 Km²) total Three main coal seams have been identified and evaluated • Coals 3, 9, and 15 have substantial thickness in both blocks • Coals are laterally continuous and are of high grade • Semi-anthracite rank makes the coals capable of holding large volumes of gas • Coals are well-cleated and have good permeability • Coals demonstrate high desorption rates Other less continuous coals within the section offer additional potential not captured in this evaluation Appendix (Shanxi Project) |

23 Contract Area: 1,057,000 acres (4,280 Km²) Participating Interests: Exploration: Far East Energy 100% Development: COP has a 3.5% ORRI* Far East 70%-100% costs and 66.5%-96.5% of production COP 3.5% ORRI CUCBM 0%-30% WI** * ConocoPhillips (COP) has elected a 3.5% ORRI (out of FEEC interest) at end of Phase II ** China United Coalbed Methane Corp Ltd. (CUCBM) has the right to participate in any development with up to 30% participating interest Shanxi Project |

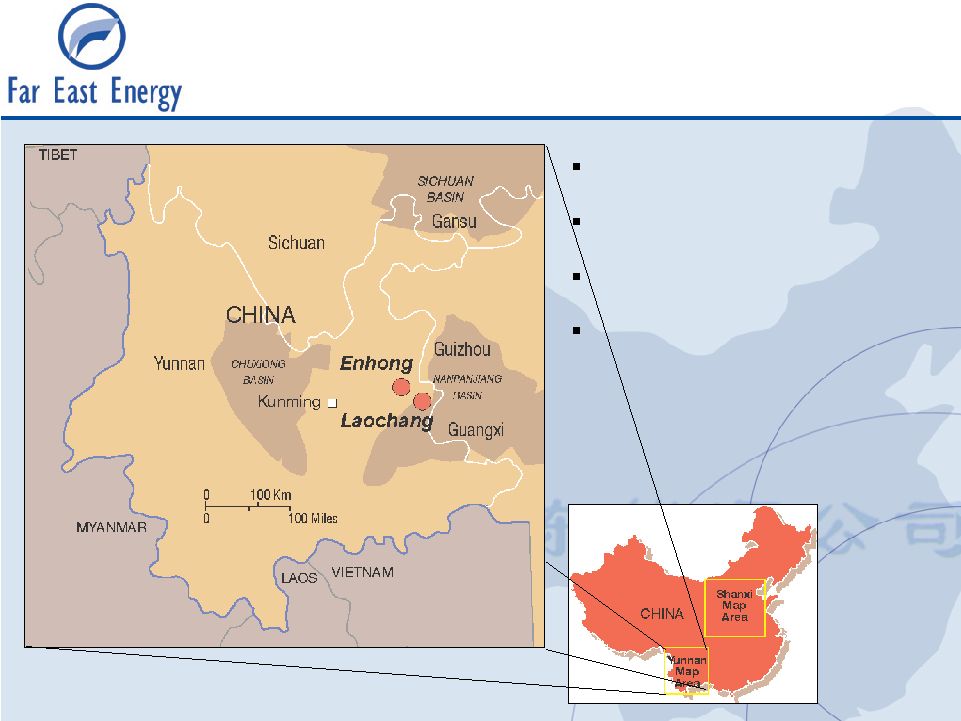

24 Yunnan Projects at a Glance Two large CBM projects 159,000 - 265,000 net acres Partners with CUCBM E&P costs reimbursed to FEEC from initial production revenues Source: Oil and Gas Investor |