Exhibit 99.1

Exhibit 99.1

Catalyst Biosciences

Exceptional Science. Essential Medicines.

Company Overview December 2015

Forward Looking Statements

This presentation includes forward-looking statements relating to the Catalyst Biosciences, Inc. (the “Company”). Forward-looking statements include statements about the potential markets for the Company’s product candidates, the potential advantages of the Company’s product candidates, product development plans and timelines, potential safety and efficacy of the Company’s product candidates, potential sales of product candidates, if approved, the Company’s intellectual property and any statement of belief or assumptions underlying any of the foregoing. These statements reflect the current views of the Company’s senior management with respect to future events. Forward-looking statements address matters that involve risks and uncertainties, such as the timing of, costs associated with and outcomes of development, clinical and regulatory activities, risks associated with third-party arrangements, including the risk that Catalyst must negotiate with Pfizer about obtaining manufacturing technology and know-how related to CB 813d, potential adverse effects arising from the testing or use of the Company’s drug candidates, risks related to the Company’s ability to develop, manufacture and commercialize product candidates, to obtain regulatory approval of product candidates and to obtain marketplace acceptance of product candidates, to avoid infringing patents held by other parties and to secure and defend patents of the Company, and to manage and obtain capital, including through any future financing or the conversion of outstanding convertible promissory notes. Further information regarding these and other risks is included in the Company’s Form 10-Q for the quarter ending September 30, 2015 filed with the Securities and Exchange Commission on November 5, 2015, under the heading “Risk Factors.

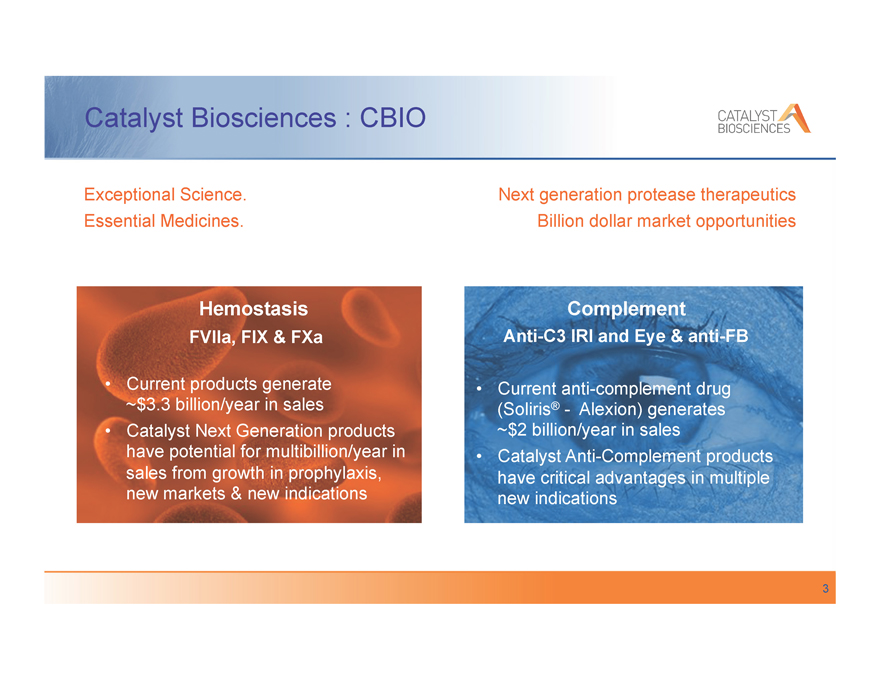

Catalyst Biosciences : CBIO

Exceptional Science. Essential Medicines.

Hemostasis

FVIIa, FIX & FXa

, Current products generate

~$3.3 billion/year in sales

, Catalyst Next Generation products have potential for multibillion/year in sales from growth in prophylaxis, new markets & new indications

Next generation protease therapeutics Billion dollar market opportunities

Complement

Anti-C3 IRI and Eye & anti-FB

, Current anti-complement drug (Soliris®— Alexion) generates

~$2 billion/year in sales

, Catalyst Anti-Complement products have critical advantages in multiple new indications

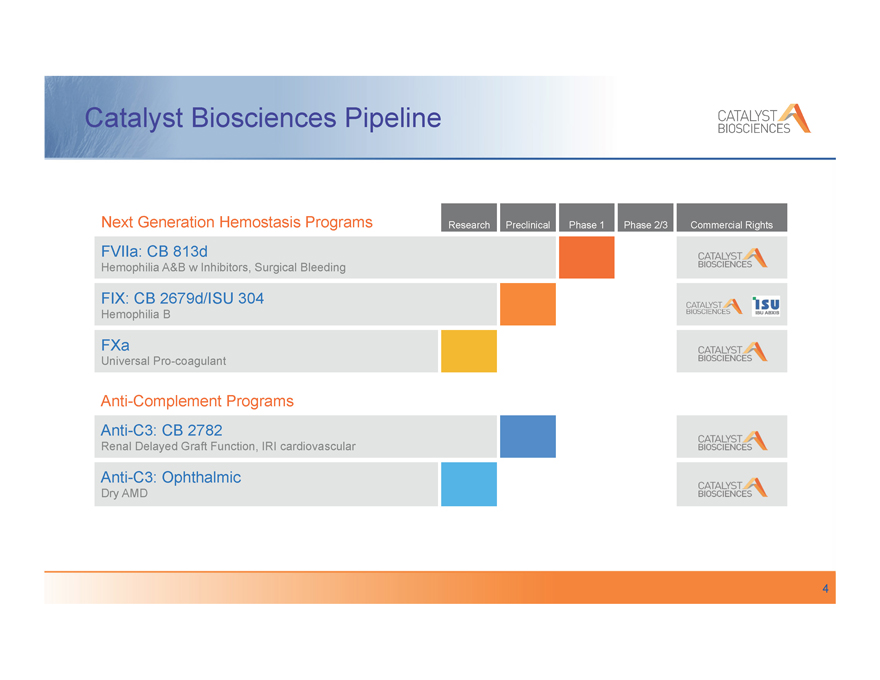

Catalyst Biosciences Pipeline

Next Generation Hemostasis Programs Research Preclinical Phase 1 Phase 2/3 Commercial Rights

FVIIa: CB 813d

Hemophilia A&B w Inhibitors, Surgical Bleeding

FIX: CB 2679d/ISU 304

Hemophilia B

FXa

Universal Pro-coagulant

Anti-Complement Programs

Anti-C3: CB 2782

Renal Delayed Graft Function, IRI cardiovascular

Anti-C3: Ophthalmic

Dry AMD

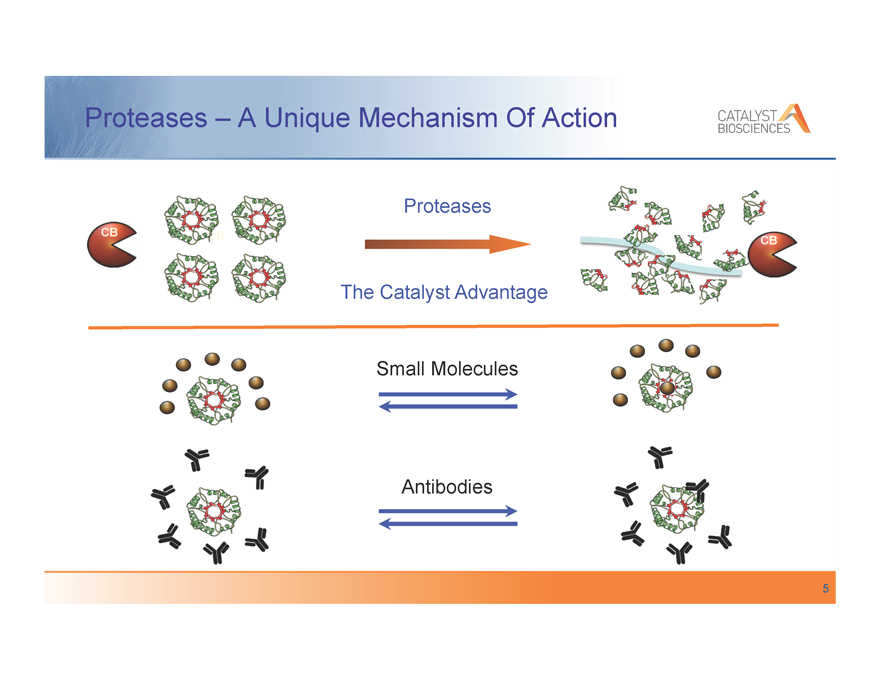

Proteases – A Unique Mechanism Of Action

Proteases

The Catalyst Advantage

Small Molecules

Antibodies

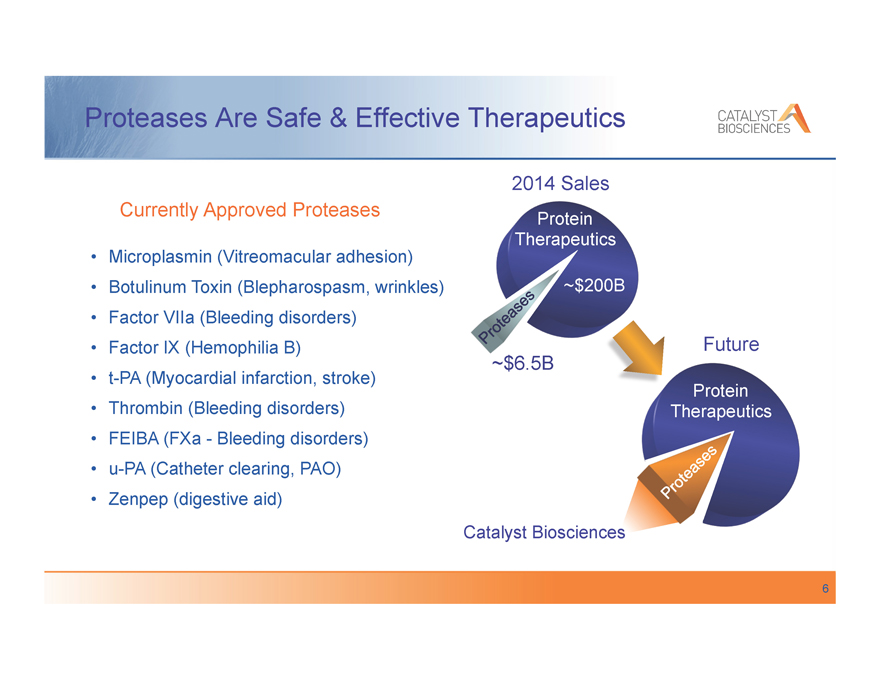

Proteases Are Safe & Effective Therapeutics

Currently Approved Proteases

Microplasmin (Vitreomacular adhesion) Botulinum Toxin (Blepharospasm, wrinkles) Factor VIIa (Bleeding disorders) Factor IX (Hemophilia B) t-PA (Myocardial infarction, stroke) Thrombin (Bleeding disorders) FEIBA (FXa—Bleeding disorders) u-PA (Catheter clearing, PAO) Zenpep (digestive aid)

2014 Sales

Protein

Therapeutics

~$200B

Future

~$6.5B

Protein

cs

Catalyst Biosciences

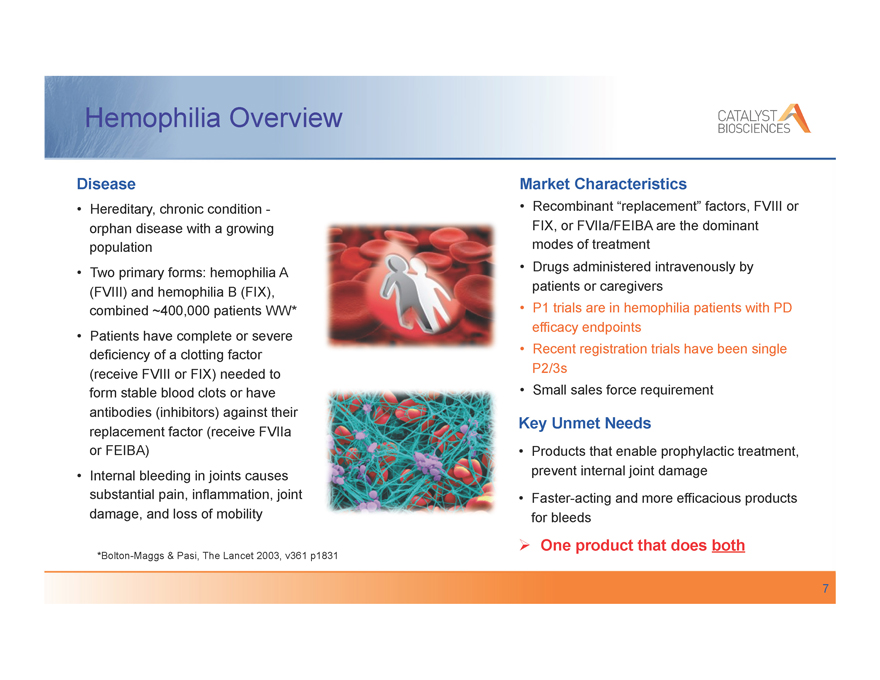

Hemophilia Overview

Disease

, Hereditary, chronic condition—orphan disease with a growing population

, Two primary forms: hemophilia A (FVIII) and hemophilia B (FIX), combined ~400,000 patients WW*

, Patients have complete or severe deficiency of a clotting factor (receive FVIII or FIX) needed to form stable blood clots or have antibodies (inhibitors) against their replacement factor (receive FVIIa or FEIBA)

, Internal bleeding in joints causes substantial pain, inflammation, joint damage, and loss of mobility

*Bolton-Maggs & Pasi, The Lancet 2003, v361 p1831

Market Characteristics

, Recombinant “replacement” factors, FVIII or FIX, or FVIIa/FEIBA are the dominant modes of treatment

, Drugs administered intravenously by patients or caregivers

, P1 trials are in hemophilia patients with PD efficacy endpoints

, Recent registration trials have been single P2/3s

, Small sales force requirement

Key Unmet Needs

, Products that enable prophylactic treatment, prevent internal joint damage

, Faster-acting and more efficacious products for bleeds

, One product that does both

7

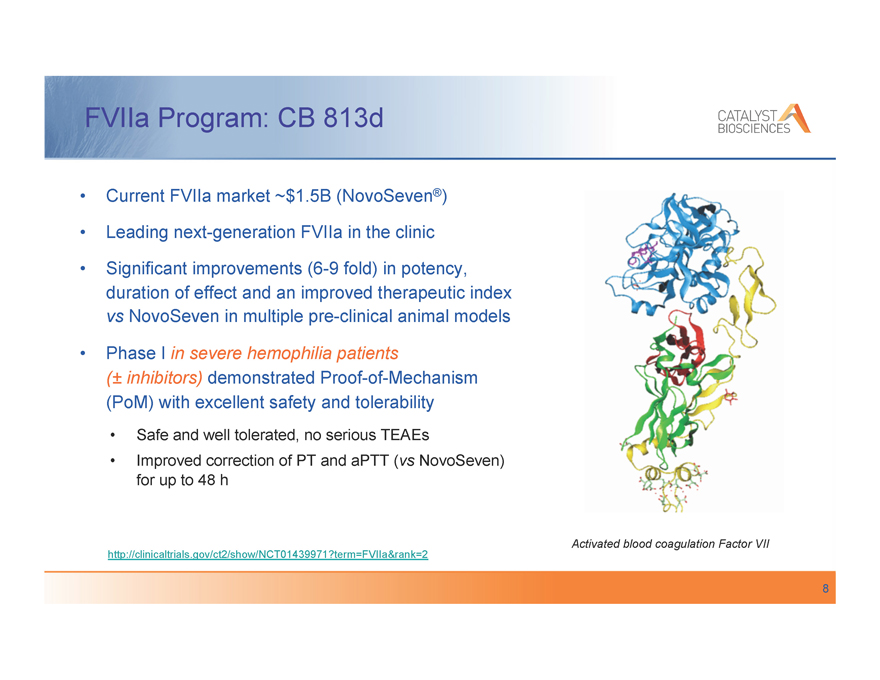

FVIIa Program: CB 813d

, Current FVIIa market ~$1.5B (NovoSeven®)

, Leading next-generation FVIIa in the clinic

, Significant improvements (6-9 fold) in potency, duration of effect and an improved therapeutic index vs NovoSeven in multiple pre-clinical animal models

, Phase I in severe hemophilia patients

(± inhibitors) demonstrated Proof-of-Mechanism (PoM) with excellent safety and tolerability

, Safe and well tolerated, no serious TEAEs

, Improved correction of PT and aPTT (vs NovoSeven) for up to 48 h

http://clinicaltrials.gov/ct2/show/NCT01439971,term=FVIIa&rank=2

Activated blood coagulation Factor VII

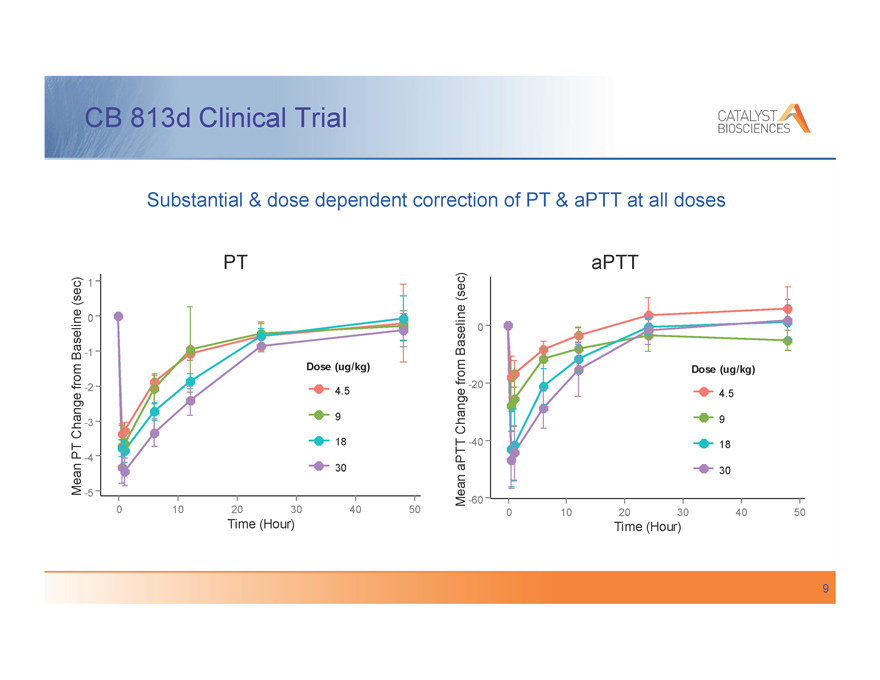

CB 813d Clinical Trial

Substantial & dose dependent correction of PT & aPTT at all doses

PT

(sec) 1

0

Baseline -1

Dose (ug/kg)

from -2 4.5

Change -3 9

18

PT -4

Mean 30

-5

0 10 20 30 40 50

Time (Hour)

aPTT

(sec)

Baseline 0

from Dose (ug/kg)

-20

4.5

Change 9

aPTT -40 18

30

Mean -60

0 10 20 30 40 50

Time (Hour)

9

CB 813d Clinical Trial

, Single doses up to 30 µg/kg were very well tolerated when administered to 25 hemophilia A and B patients in the non-bleeding state

, There were no instances of thrombosis or bleeding

, Evidence of pharmacologic activity was observed with dose-dependent changes of PT, aPTT, PF1+2, and TGA for up to 48 hours

, The terminal half-life of CB 813d was approximately 3.5 hours and was similar across all dose groups

, The results for safety and pharmacologic activity support further clinical development of CB 813d for treatment of individuals with hemophilia and inhibitors to FVIII or FIX

, Phase 2/3 trial anticipated to begin in Q1 2017

10

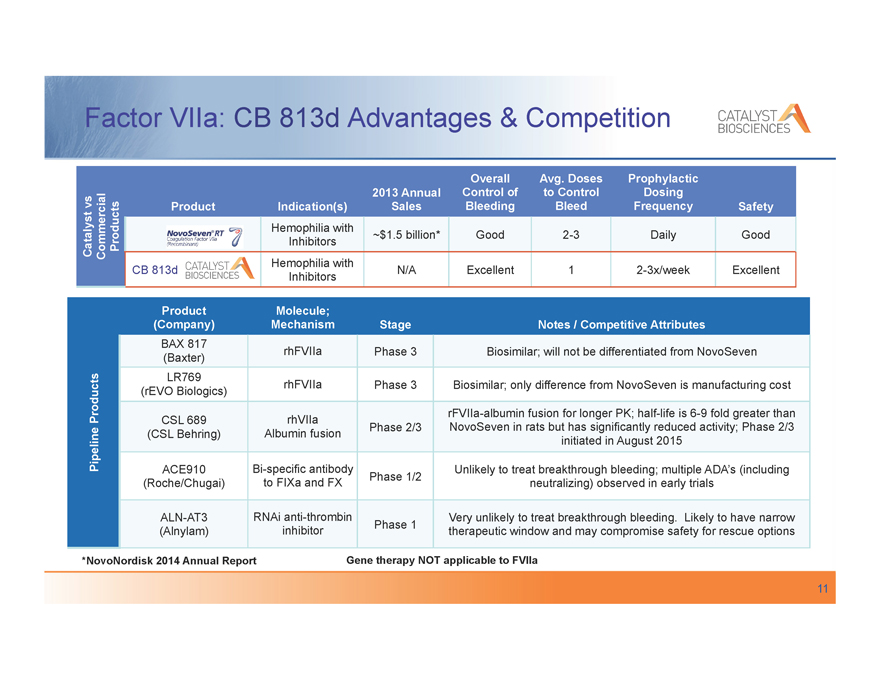

Factor VIIa: CB 813d Advantages & Competition

Overall Avg. Doses Prophylactic

2013 Annual Control of to Control Dosing

vs Product Indication(s) Sales Bleeding Bleed Frequency Safety

Hemophilia with

Catalyst Commercial Products Inhibitors ~$1.5 billion* Good 2-3 Daily Good

Hemophilia with

CB 813d N/A Excellent 1 2-3x/week Excellent

Inhibitors

Product Molecule;

(Company) Mechanism Stage Notes / Competitive Attributes

BAX 817

(Baxter) rhFVIIa Phase 3 Biosimilar; will not be differentiated from NovoSeven

LR769

(rEVO Biologics) rhFVIIa Phase 3 Biosimilar; only difference from NovoSeven is manufacturing cost

Products rFVIIa-albumin fusion for longer PK; half-life is 6-9 fold greater than

CSL 689 rhVIIa

(CSL Behring) Albumin fusion Phase 2/3 NovoSeven in rats but has significantly reduced activity; Phase 2/3

Pipeline initiated in August 2015

ACE910 Bi-specific antibody Unlikely to treat breakthrough bleeding; multiple ADA’s (including

Phase 1/2

(Roche/Chugai) to FIXa and FX neutralizing) observed in early trials

ALN-AT3 RNAi anti-thrombin Very unlikely to treat breakthrough bleeding. Likely to have narrow

Phase 1

(Alnylam) inhibitor therapeutic window and may compromise safety for rescue options

*NovoNordisk 2014 Annual Report Gene therapy NOT applicable to FVIIa

11

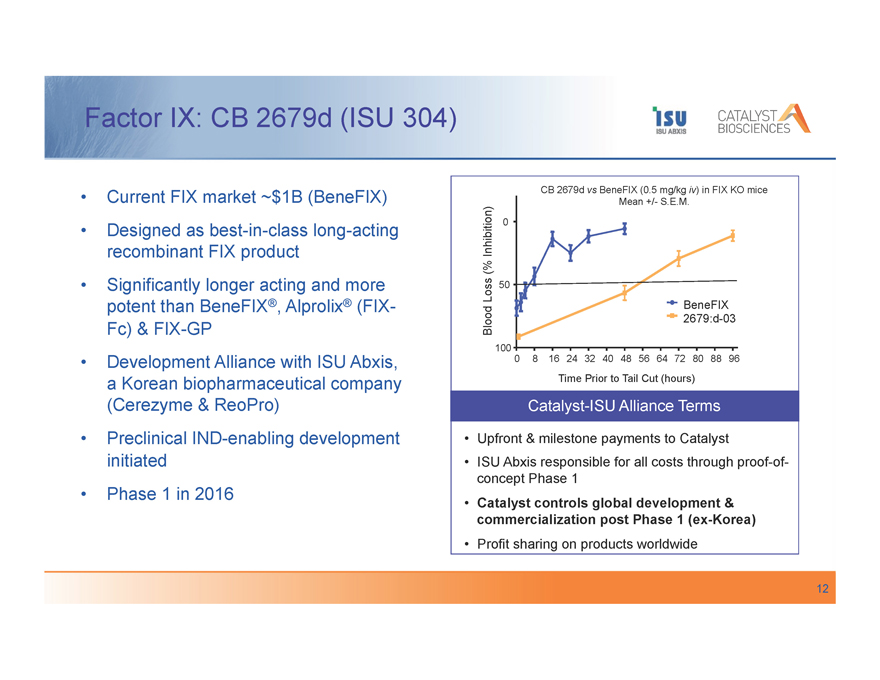

Factor IX: CB 2679d (ISU 304)

Current FIX market ~$1B (BeneFIX) Designed as best-in-class long-acting recombinant FIX product Significantly longer acting and more potent than BeneFIX®, Alprolix® (FIX-Fc) & FIX-GP

Development Alliance with ISU Abxis, a Korean biopharmaceutical company (Cerezyme & ReoPro) Preclinical IND-enabling development initiated Phase 1 in 2016

CB 2679d vs BeneFIX (0.5 mg/kg iv) in FIX KO mice

Mean +/- S.E.M.

Inhibition) 0

(%

Loss 50

BeneFIX

Blood 2679:d-03

100

0 8 16 24 32 40 48 56 64 72 80 88 96

Time Prior to Tail Cut (hours)

Catalyst-ISU Alliance Terms

, Upfront & milestone payments to Catalyst

, ISU Abxis responsible for all costs through proof-of-concept Phase 1

, Catalyst controls global development & commercialization post Phase 1 (ex-Korea)

, Profit sharing on products worldwide

12

Anti-Complement Opportunity

, Complement targets are biologically & clinically validated

–, KO mice studies

–, Human genetics

–, Approved drug (Soliris®) for PNH & aHUS;

–, Positive P2 data for Dry Age-Related Macular Degeneration (AMD) – Geographic Atrophy (GA)

, Multiple acute indications mediated by complement driven ischemia reperfusion injury

–, Transplant rejection: Initial indication – anti-C3 to prevent Renal Delayed Graft Function (DGF)

–, Cardiovascular: CABG, MI & Stroke (label expansion potential for a DGF drug)

, Chronic indications

–, Ocular: Initial indication – anti-C3 (ocular) to slow the progression of GA in Dry AMD

–, Asthma

–, Autoimmune

13

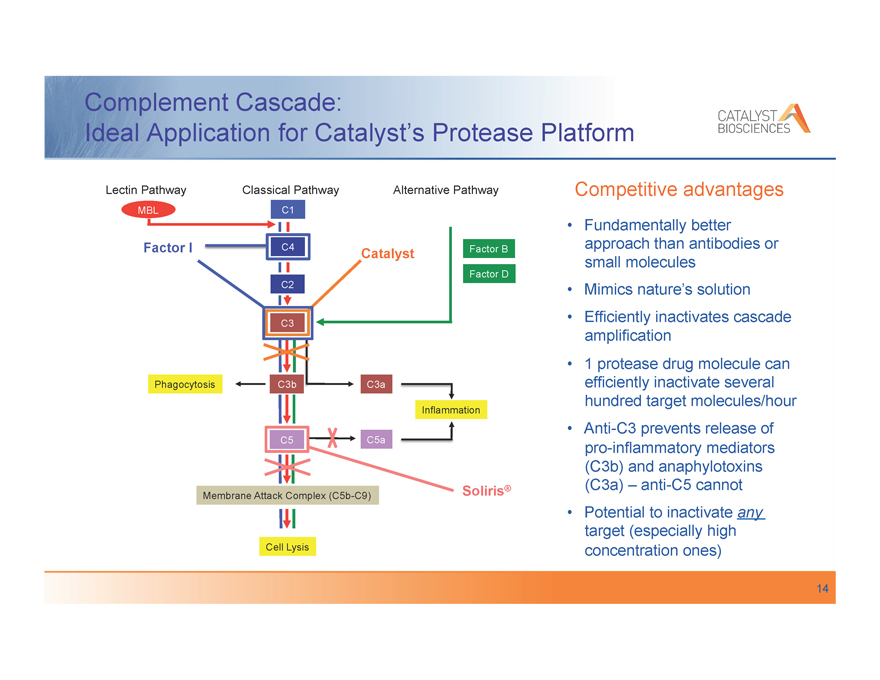

Complement Cascade:

Ideal Application for Catalyst’s Protease Platform

Lectin Pathway Classical Pathway Alternative Pathway

MBL C1

Factor I C4 Catalyst Factor B

Factor D

C2 C2

C3

Phagocytosis C3b C3a

Inflammation

C5 C5a

Membrane Attack Complex (C5b-C9) Soliris®

Cell Lysis

Competitive advantages

Fundamentally better approach than antibodies or small molecules Mimics nature’s solution Efficiently inactivates cascade amplification 1 protease drug molecule can efficiently inactivate several hundred target molecules/hour Anti-C3 prevents release of pro-inflammatory mediators (C3b) and anaphylotoxins (C3a) – anti-C5 cannot Potential to inactivate any target (especially high concentration ones)

14

Anti-C3 for Dry AMD

, Advanced dry AMD, or geographic atrophy

(GA), leads to loss of RPE photoreceptors,

blindness

, No approved drugs

, Global wet AMD market is >$4 billion

annually

, GA prevalence is equivalent to wet AMD

, Strong genetic evidence for complement in

pathogenesis of dry AMD*

, Complement is the only validated anti-GA

target

, Roche anti-Factor D antibody @ 10 mg/eye

intravitreal injection showed 20-44% inhibition

of GA progression with monthly dosing;

dosing every 2 months failed

C3 is the “best target” in the complement cascade

-, Targeting either individual pathways, e.g., alternative (Factor D) or C5 appears to be “leaky”, consequently limiting efficacy

Efficient inactivation of C3 expected to provide greater efficacy compared with competing anti-Factor D or anti-C5 strategies Catalytic turn-over of target expected to support efficacious dosing every 2 months or less frequently Less than 40% inhibition of GA progression over 18 months would be acceptable if dosing was less frequent than monthly

*Science, April 2005; JAMA, July 2006; NEJM, July, 2007; and others

15

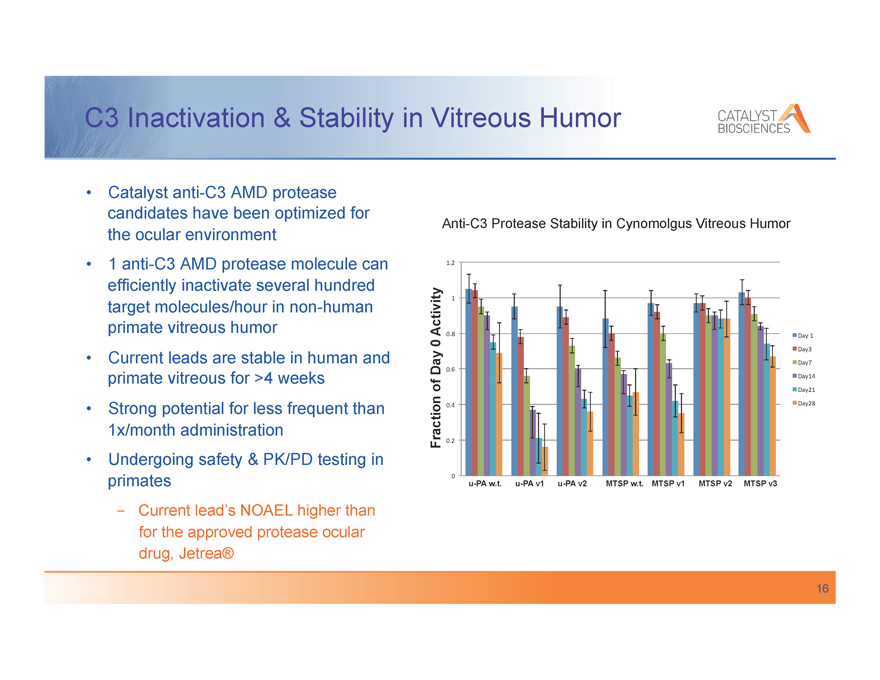

C3 Inactivation & Stability in Vitreous Humor

Catalyst anti-C3 AMD protease candidates have been optimized for the ocular environment 1 anti-C3 AMD protease molecule can efficiently inactivate several hundred target molecules/hour in non-human primate vitreous humor Current leads are stable in human and primate vitreous for >4 weeks Strong potential for less frequent than 1x/month administration Undergoing safety & PK/PD testing in primates

-, Current lead’s NOAEL higher than for the approved protease ocular drug, Jetrea®

Anti-C3 Protease Stability in Cynomolgus Vitreous Humor

1.2”

Activity 1”

0.8” Day“1”

0 Day3”

Day7”

Day 0.6”

Day14”

of Day21”

0.4” Day28”

Fraction 0.2”

0”

u-PA w.t. u-PA v1 u-PA v2 MTSP w.t. MTSP v1 MTSP v2 MTSP v3

16

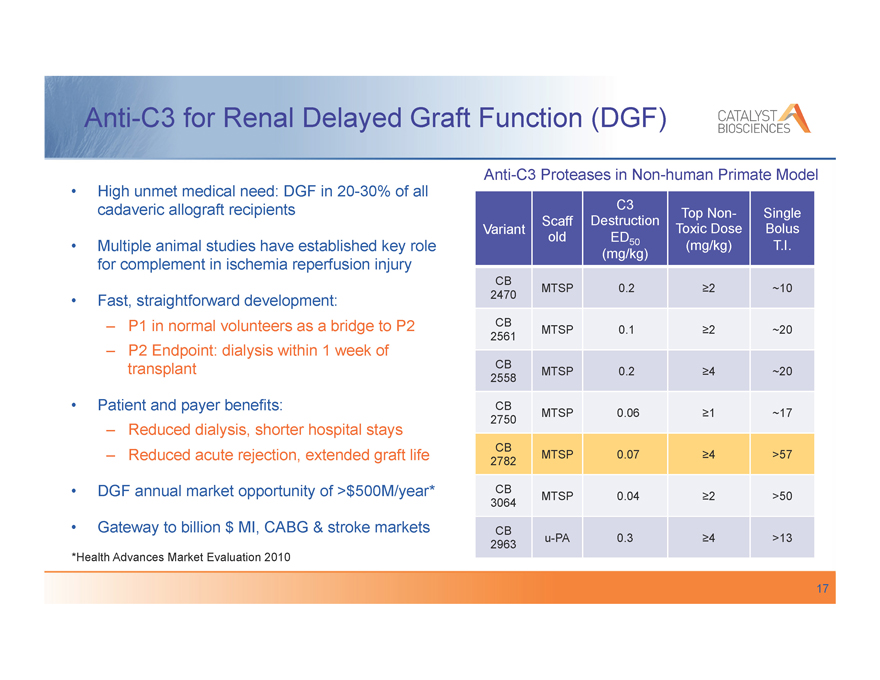

Anti-C3 for Renal Delayed Graft Function (DGF)

High unmet medical need: DGF in 20-30% of all cadaveric allograft recipients

Multiple animal studies have established key role for complement in ischemia reperfusion injury

Fast, straightforward development:

–, P1 in normal volunteers as a bridge to P2

–, P2 Endpoint: dialysis within 1 week of transplant

Patient and payer benefits:

–, Reduced dialysis, shorter hospital stays

–, Reduced acute rejection, extended graft life DGF annual market opportunity of >$500M/year* Gateway to billion $ MI, CABG & stroke markets

*Health Advances Market Evaluation 2010

Anti-C3 Proteases in Non-human Primate Model

C3

Scaff Destruction Top Non- Single

Variant Toxic Dose Bolus

old ED50 (mg/kg) T.I.

(mg/kg)

CB

2470 MTSP 0.2 ,2 ~10

CB

2561 MTSP 0.1 ,2 ~20

CB

2558 MTSP 0.2 ,4 ~20

CB

2750 MTSP 0.06 ,1 ~17

CB

2782 MTSP 0.07 ,4 >57

CB

3064 MTSP 0.04 ,2 >50

CB

2963 u-PA 0.3 ,4 >13

17

Intellectual Property

Comprehensive protection of all programs & protease engineering technologies

, Factor VIIa: Worldwide patents encompassing clinical candidate(s) and uses thereof, granted and pending, providing coverage through 2029-2031

, Factor IX: Worldwide patents (including composition of matter) granted and pending providing coverage through 2031

, Factor Xa: Worldwide patents (including composition of matter) filed and pending providing coverage through 2033

, Anti-complement programs: Current granted and pending worldwide, patents (including composition of matter) providing coverage through 2025, with new material >2035

, Technology platform: Worldwide issued and pending patents covering multiple novel protease screening and discovery technologies with through 2026

18

Catalyst Milestones

, 2016

–, Receive ISU FIX milestones

–, Publish data from the FVIIa, FIX, and anti-complement programs

–, Initiate CB 2679d FIX Phase 1 in hemophilia B patients

–, Demonstrate bi-monthly dosing feasibility in the Dry AMD program

–, Manufacture CB 813d FVIIa for P2/3 trial

–, Report initial Phase 1 proof-of-mechanism efficacy and safety data for CB 2679d FIX in hemophilia B patients

, 2017

–, Initiate CB 813d FVIIa P2/3 trial in hemophilia A + B inhibitor patients

–, Complete CB 2679d FIX Phase 1 in hemophilia B patients

–, Report on-demand efficacy and multi-dose safety in CB 813d FVIIa trial

19

Catalyst Biosciences Investor Highlights—CBIO

, Clinical Stage Public Protease-Based Hemostasis and Anti-Complement Company

–, Design of improved, second generation proteases: FVIIa & FIX

–, Proprietary platform that creates novel proteases: Anti-complement

, Leading next generation, long-acting Factor VIIa for hemophilia A/B inhibitor patients in ~$1.5B market with significant growth potential

–, Proof of mechanism, safety & tolerability demonstrated in hemophilia patients

–, Phase 1 Clinical Data presented at ISTH in June 2015

–, Phase 2/3 trial to initiate in Q1 2017

, Best-in-class Factor IX in hemophilia B; fully-funded to clinical Proof of Mechanism in late 2016

, Three additional programs

–, Highly differentiated, clinically-validated anti-complement approach to multibillion dollar Dry AMD market

–, Novel, anti-complement orphan program (renal delayed graft function) ready for IND-enabling studies

–, Best-in-class Factor Xa for hemophilia and surgical bleeding with strong pre-clinical efficacy

20

Catalyst Biosciences

Exceptional Science. Essential Medicines.

www.catalystbiosciences.com

21