CATALYST BIOSCIENCES December 18th 2018 Research & Development Day Exhibit 99.1

Forward looking statements 1 & 2 October 2018 Nassim Usman, Ph.D. President & CEO This presentation includes forward-looking statements that involve substantial risks and uncertainties. All statements, other than statement of historical facts, included in this presentation are forward-looking statements. Examples of such statements include, but are not limited to, the potential benefits of subcutaneous administration of dalcinonacog alfa (formerly CB 2679d/ISU304) and marzeptacog alfa (activated), the potential for long-term dosing of dalcinonacog alfa to maintain FIX activity in the high-mild hemophilia range, statements relating to Catalyst’s clinical trial timelines, including plans for a Phase 2b clinical trial of dalcinonacog alfa, including initiation in the first quarter of 2019 and presentation of data at ISTH, plans for a Phase 3 trial of dalcinonacog alfa, plans for the completion of the ongoing clinical trial of marzeptacog alpha (activated) and presentation of data at EAHAD and ISTH and for a Phase 3 trial of marzeptacog alfa (activated), and the potential market opportunities for these products. Actual results or events could differ materially from the plans and expectations and projections disclosed in these forward-looking statements. Various important factors could cause actual results or events to differ materially from the forward-looking statements that Catalyst makes, including, but not limited to, the risk that trial initiation or enrollment may be delayed and that ongoing or future trials may not achieve their endpoints, that subsequent clinical trials will not replicate the results from earlier clinical studies on small numbers of patients, that potential adverse effects may arise from the testing or use of Catalyst’s products, including the generation of antibodies or inhibitors, the risk that costs required to develop or manufacture Catalyst’s products will be higher than anticipated, the risk of competition from other hemophilia treatments, including those in development, Catalyst’s ability not to infringe third party intellectual property rights, and other factors described in the “Risk Factors” section of Catalyst’s Quarterly Report on Form 10-Q for the quarter ended September 31, 2018, which was filed with the Securities and Exchange Commission on November 1, 2018. Forward looking statements in this presentation speak only as of the date hereof. Catalyst does not assume any obligation to update any forward-looking statements, except as required by law.

Catalyst Biosciences: CBIO We are working to establish a new standard of care in hemophilia prophylaxis by developing highly potent subcutaneous treatments that improve the quality of life for patients with hemophilia with inhibitors, acquired hemophilia & hemophilia B

Investment highlights ~134 worldwide patents – CBIO retains full ownership of all compounds Experienced team Well funded $129 M cash (Q3 2018) Novel subcutaneous compounds with orphan drug designation FVIIa & FIX SQ efficacy clinically demonstrated Market: $3.4B in annual sales FIX FVIIa 2018

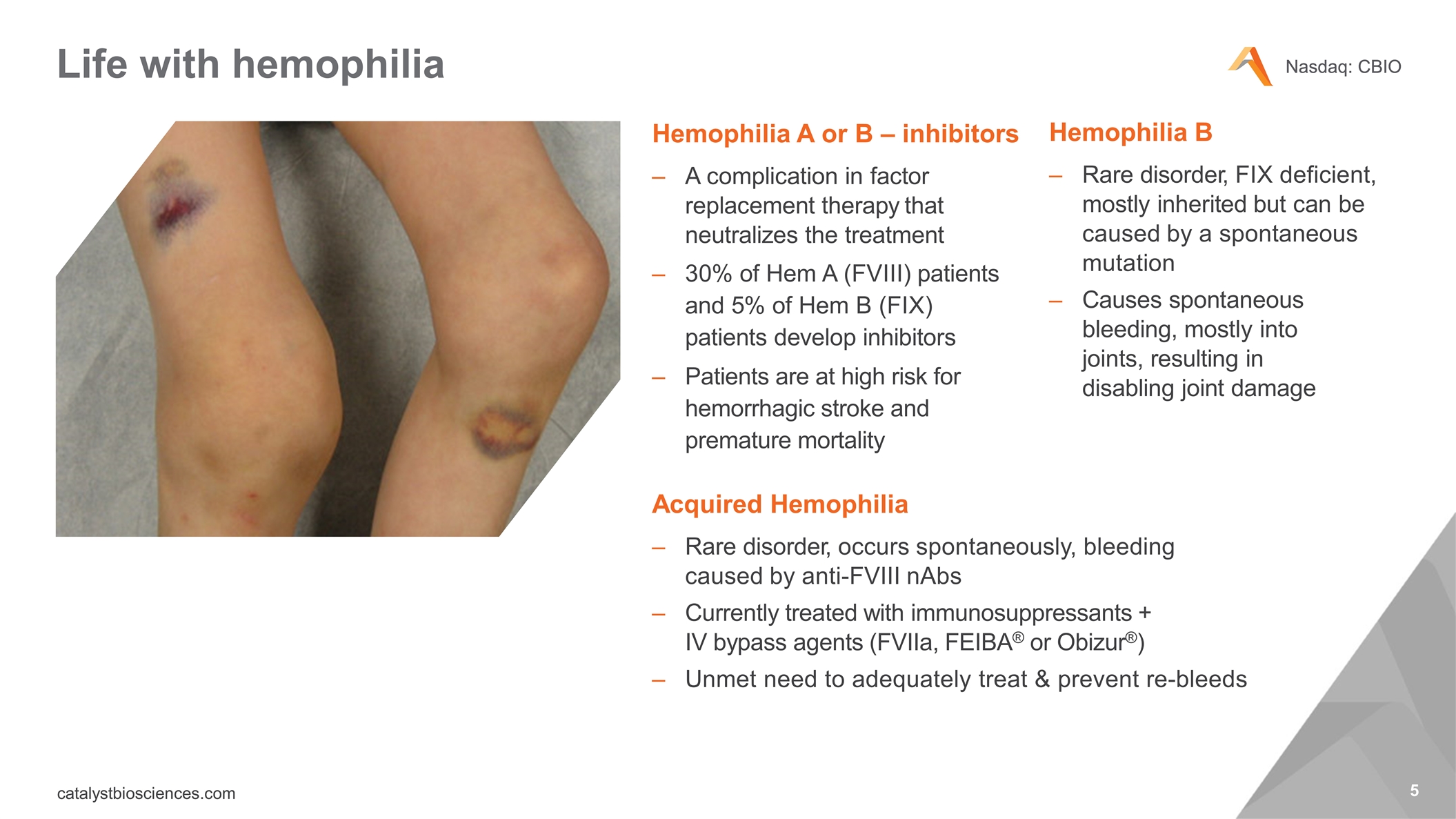

Life with hemophilia Hemophilia B Rare disorder, FIX deficient, mostly inherited but can be caused by a spontaneous mutation Causes spontaneous bleeding, mostly into joints, resulting in disabling joint damage Hemophilia A or B – inhibitors A complication in factor replacement therapy that neutralizes the treatment 30% of Hem A (FVIII) patients and 5% of Hem B (FIX) patients develop inhibitors Patients are at high risk for hemorrhagic stroke and premature mortality Acquired Hemophilia Rare disorder, occurs spontaneously, bleeding caused by anti-FVIII nAbs Currently treated with immunosuppressants + IV bypass agents (FVIIa, FEIBA® or Obizur®) Unmet need to adequately treat & prevent re-bleeds

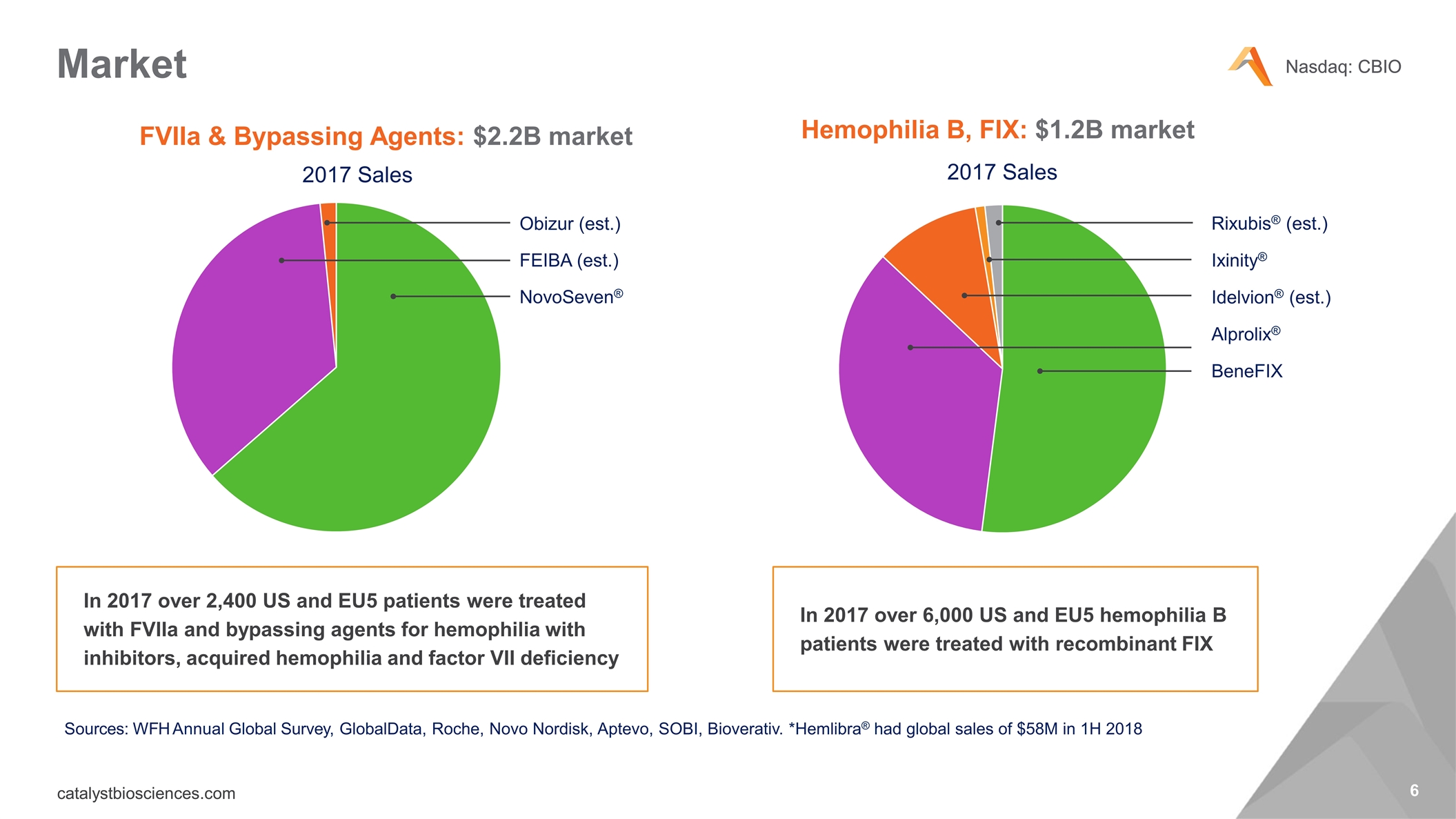

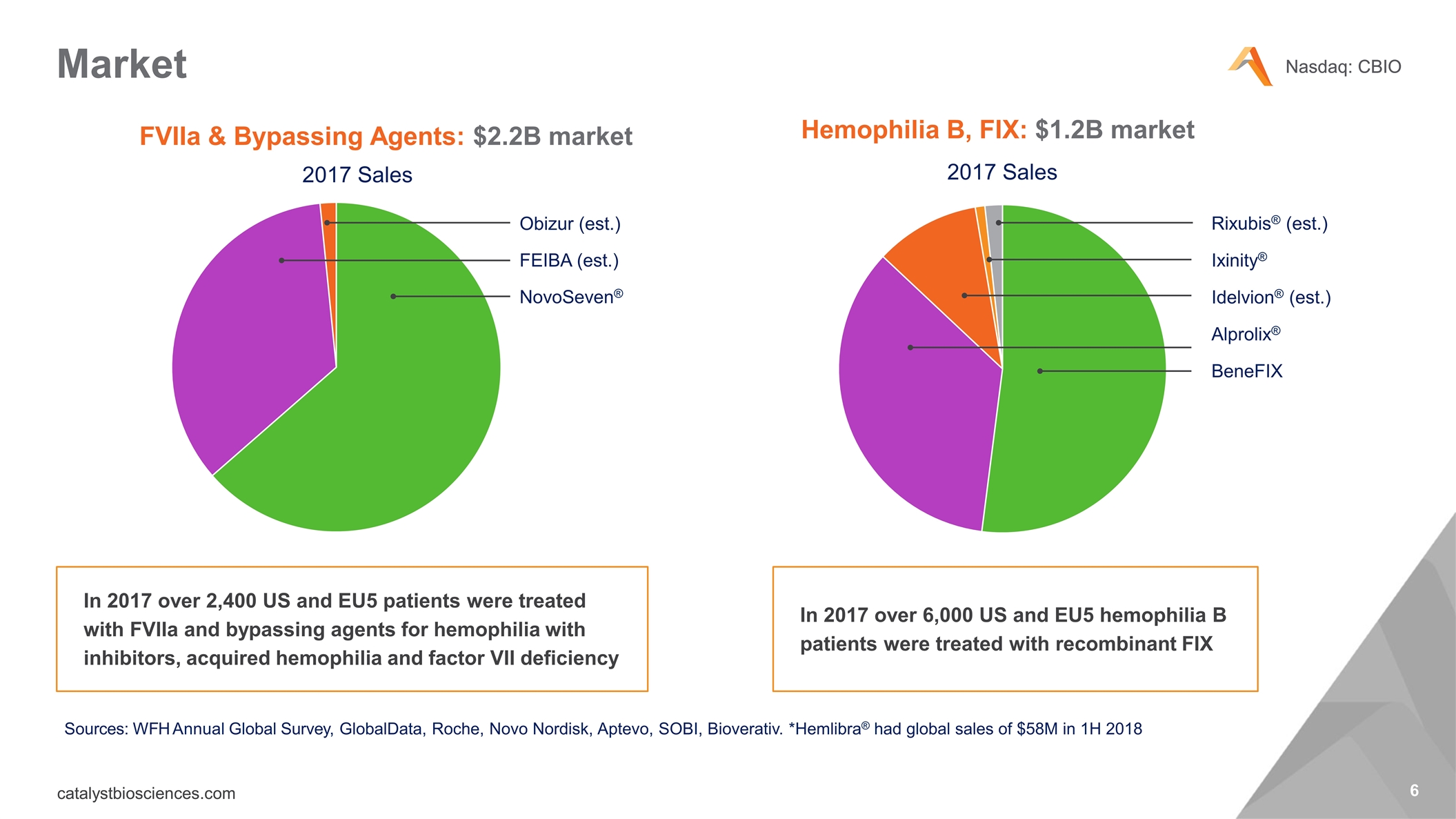

Market Hemophilia B, FIX: $1.2B market Sources: WFH Annual Global Survey, GlobalData, Roche, Novo Nordisk, Aptevo, SOBI, Bioverativ. *Hemlibra® had global sales of $58M in 1H 2018 FVIIa & Bypassing Agents: $2.2B market In 2017 over 2,400 US and EU5 patients were treated with FVIIa and bypassing agents for hemophilia with inhibitors, acquired hemophilia and factor VII deficiency In 2017 over 6,000 US and EU5 hemophilia B patients were treated with recombinant FIX BeneFIX 2017 Sales Alprolix® Idelvion® (est.) Ixinity® Rixubis® (est.) 2017 Sales NovoSeven® FEIBA (est.) Obizur (est.)

Available treatments Regular intravenous (IV) infusions are necessary to maintain higher clotting levels IV treatments are very unpleasant and time-consuming Inconvenience affects compliance, outcomes and quality of life Especially difficult for pediatric patients & their families

The Catalyst Biosciences solution Our highly potent solution: +Quick & simple subcutaneous injection – allows for self-administration including in pediatric patients +Much higher & stable factor levels – keeps patients at safe levels for much longer

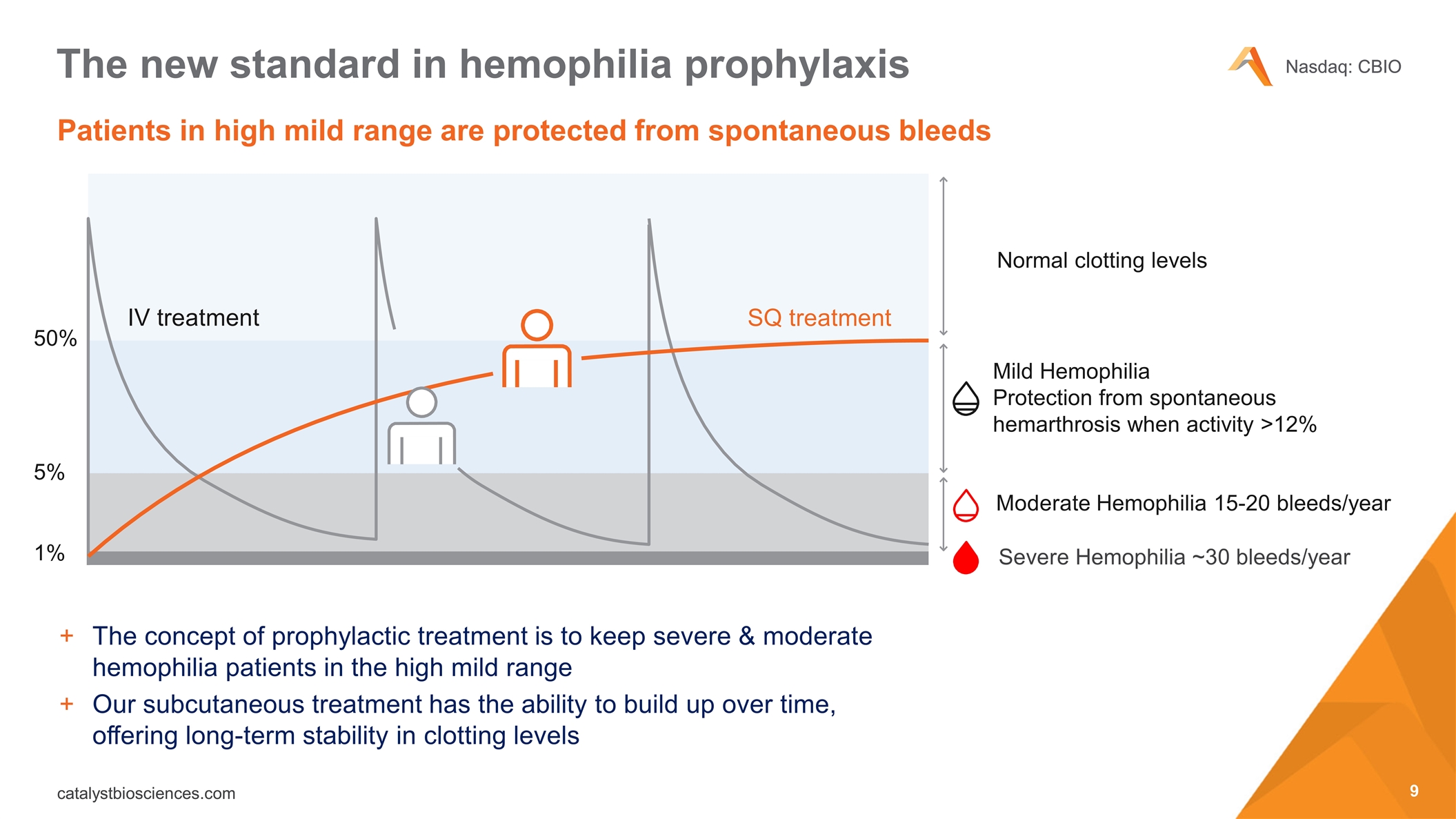

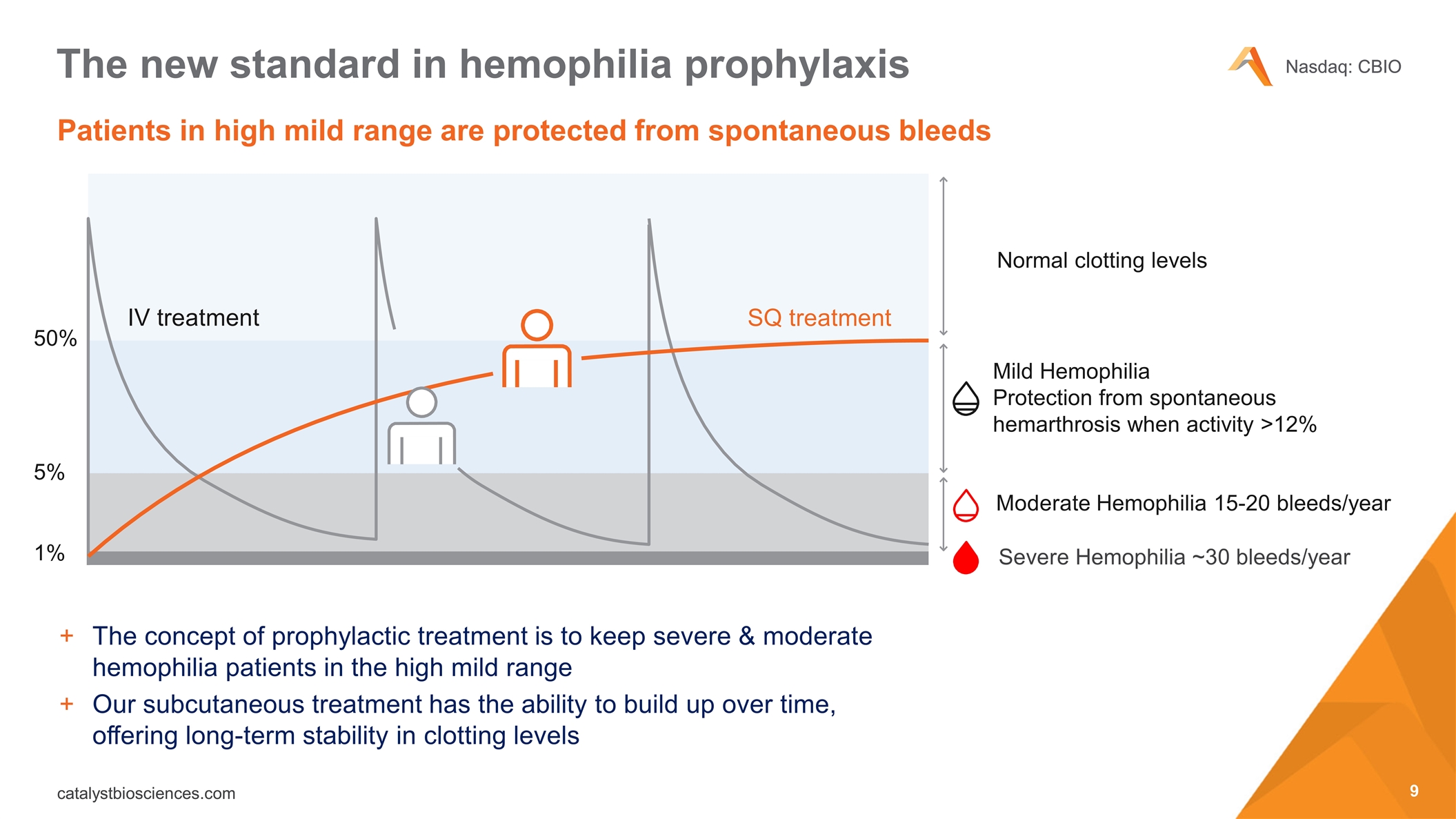

The new standard in hemophilia prophylaxis Patients in high mild range are protected from spontaneous bleeds The concept of prophylactic treatment is to keep severe & moderate hemophilia patients in the high mild range Our subcutaneous treatment has the ability to build up over time, offering long-term stability in clotting levels Mild Hemophilia Protection from spontaneous hemarthrosis when activity >12% Normal clotting levels Moderate Hemophilia 15-20 bleeds/year IV treatment Severe Hemophilia ~30 bleeds/year SQ treatment 50% 5% 1%

Pipeline Hemostasis programs: Hemophilia with inhibitors FVIIa: Marzeptacog alfa (activated) "MarzAA" (formerly CB 813d/PF-05280602 ) Hemophilia B FIX: Dalcinonacog alfa “DalcA” (formerly CB 2679d/ISU304) Universal pro-coagulant FXa: CB 1965a Dry AMD: anti-C3 protease CB 2782 Anti-complement programs: Research Preclinical Phase 1/2 Phase 2/3 Commercial rights CBIO CBIO CBIO CBIO

Team VP, Business Development Jeffrey Landau, M.B.A. President & CEO Nassim Usman, Ph.D. Chief Medical Officer Howard Levy, M.B.B.Ch., Ph.D., M.M.M. Chief Financial Officer Fletcher Payne SVP, Technical Operations Andrew Hetherington, M.B.A. 26 years in biotech 20 years in biotech 18 years in hematology 26 years in biotech 16 years in biotech VP, Translational Research Grant Blouse, Ph.D. 12 years in biotech

CATALYST BIOSCIENCES December 18th 2018 Dalcinonacog alfa

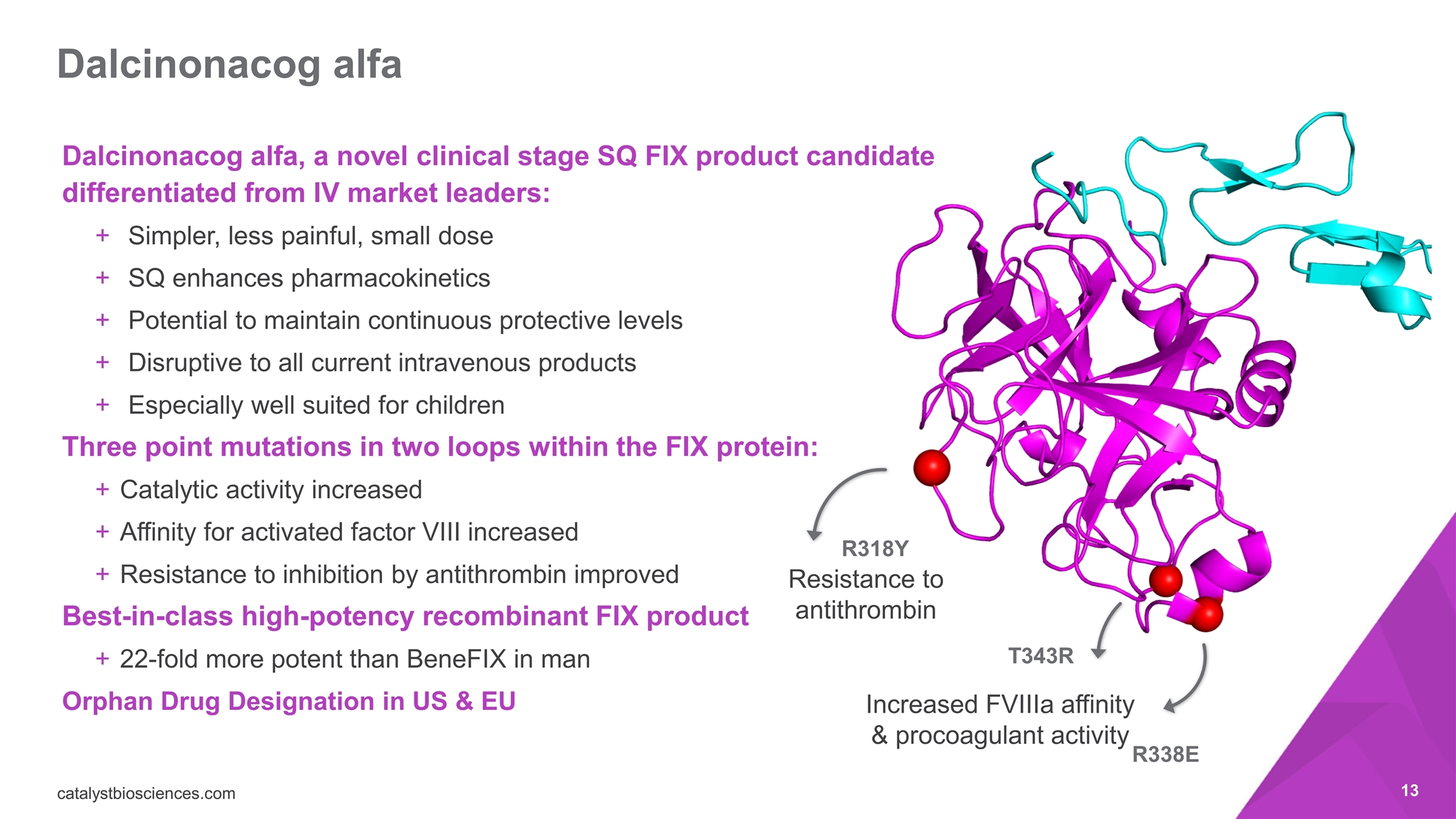

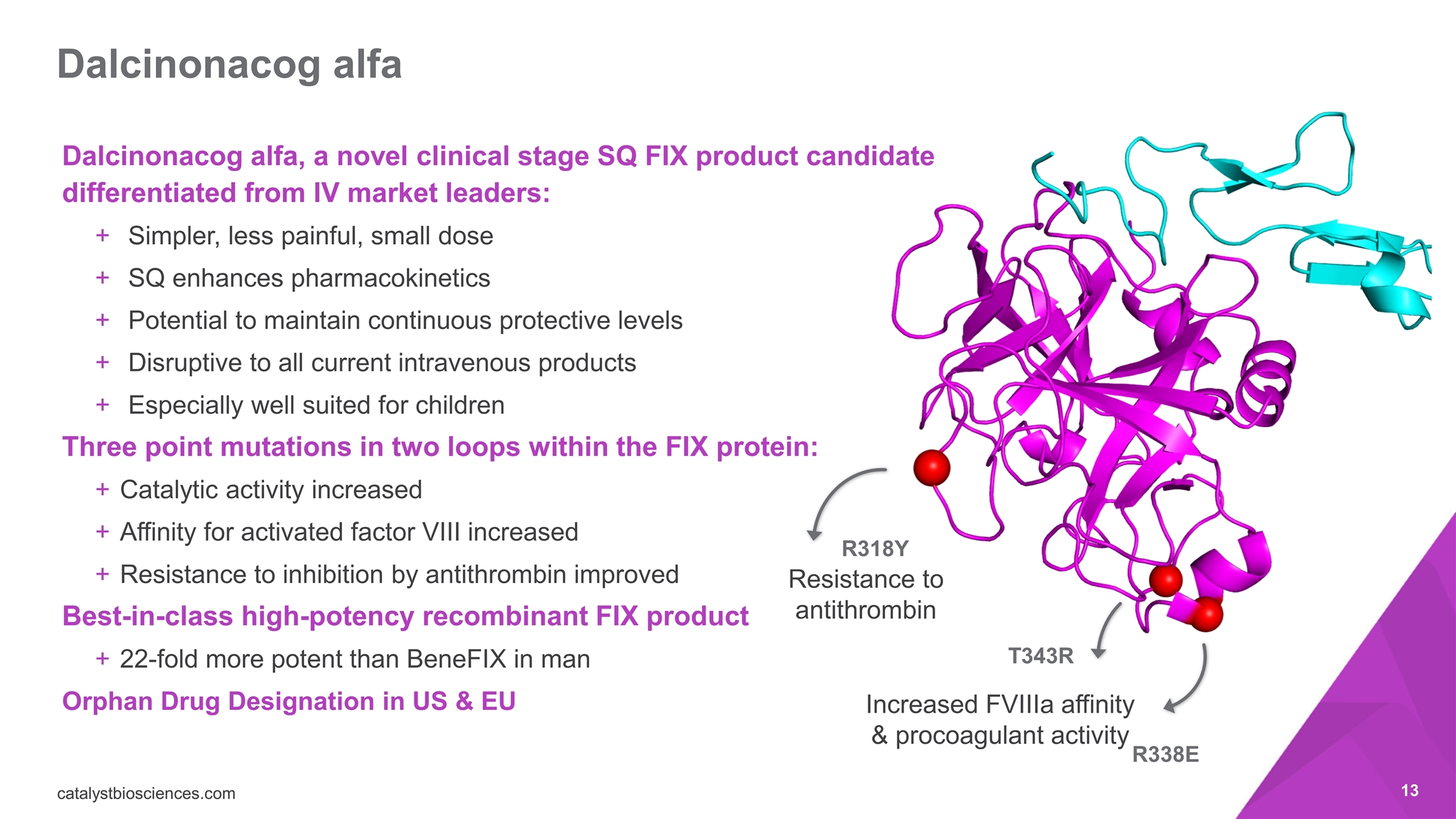

Dalcinonacog alfa, a novel clinical stage SQ FIX product candidate differentiated from IV market leaders: Simpler, less painful, small dose SQ enhances pharmacokinetics Potential to maintain continuous protective levels Disruptive to all current intravenous products Especially well suited for children Three point mutations in two loops within the FIX protein: Catalytic activity increased Affinity for activated factor VIII increased Resistance to inhibition by antithrombin improved Best-in-class high-potency recombinant FIX product 22-fold more potent than BeneFIX in man Orphan Drug Designation in US & EU Dalcinonacog alfa R318Y R338E T343R Resistance to antithrombin Increased FVIIIa affinity & procoagulant activity

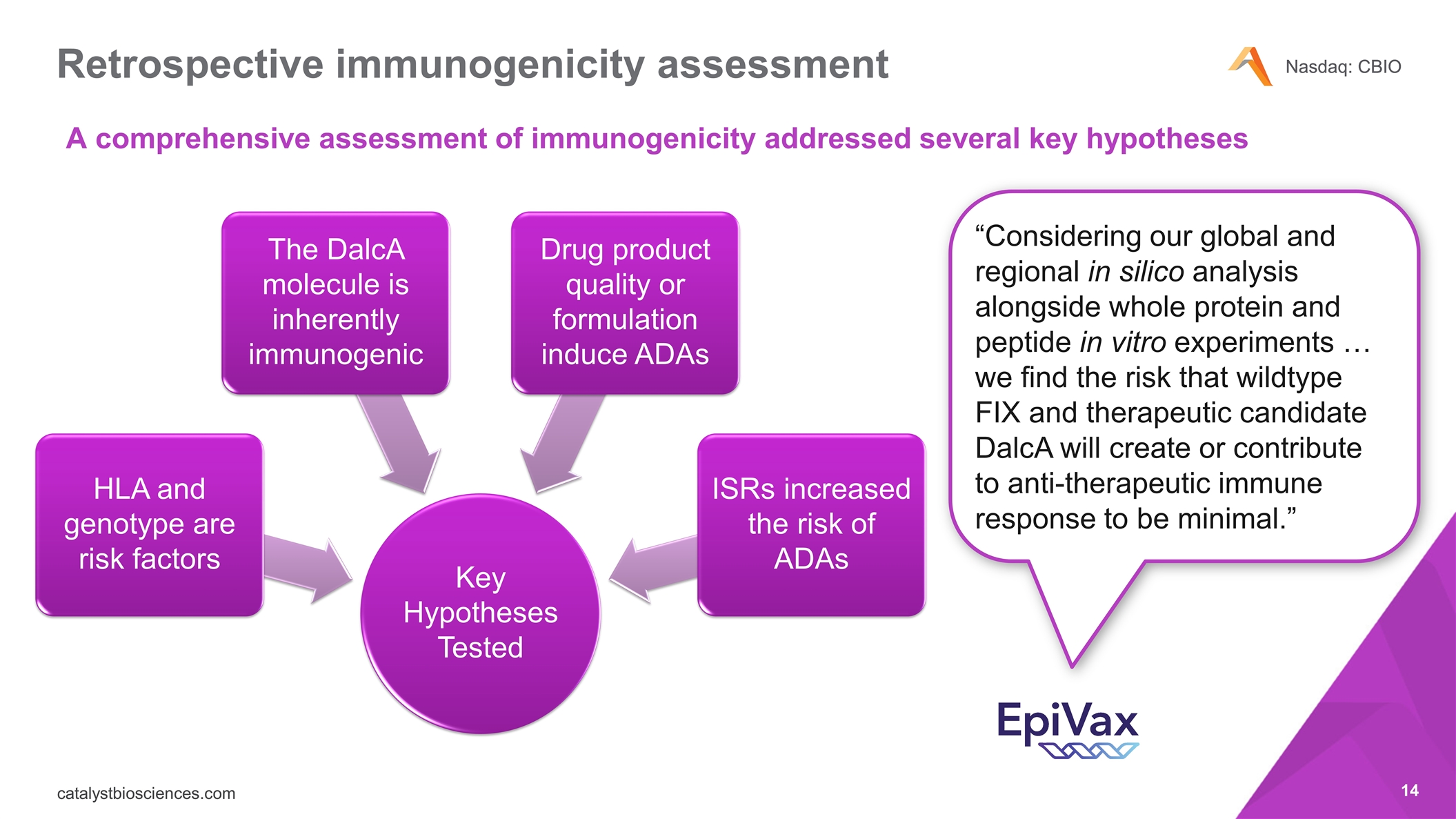

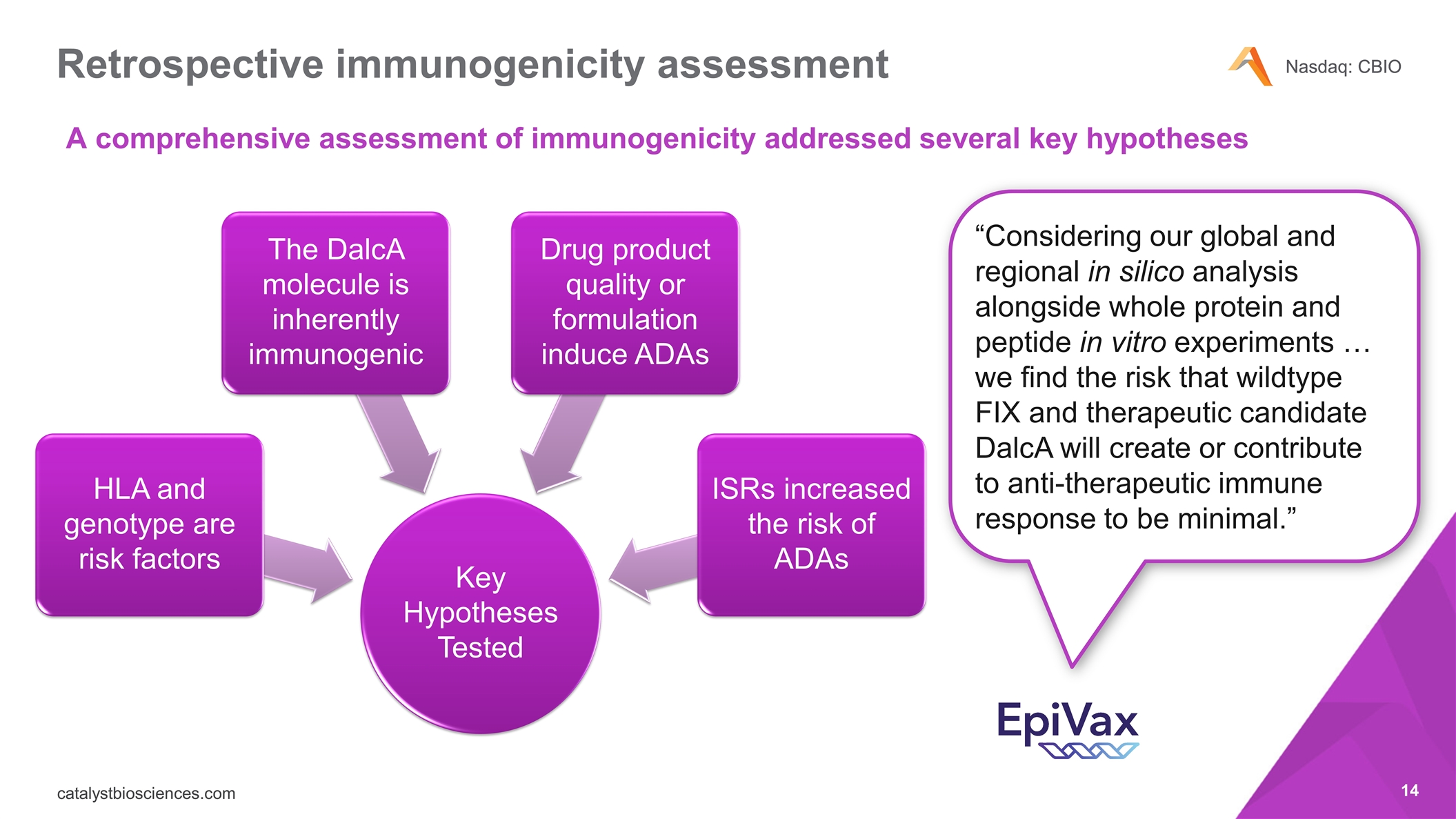

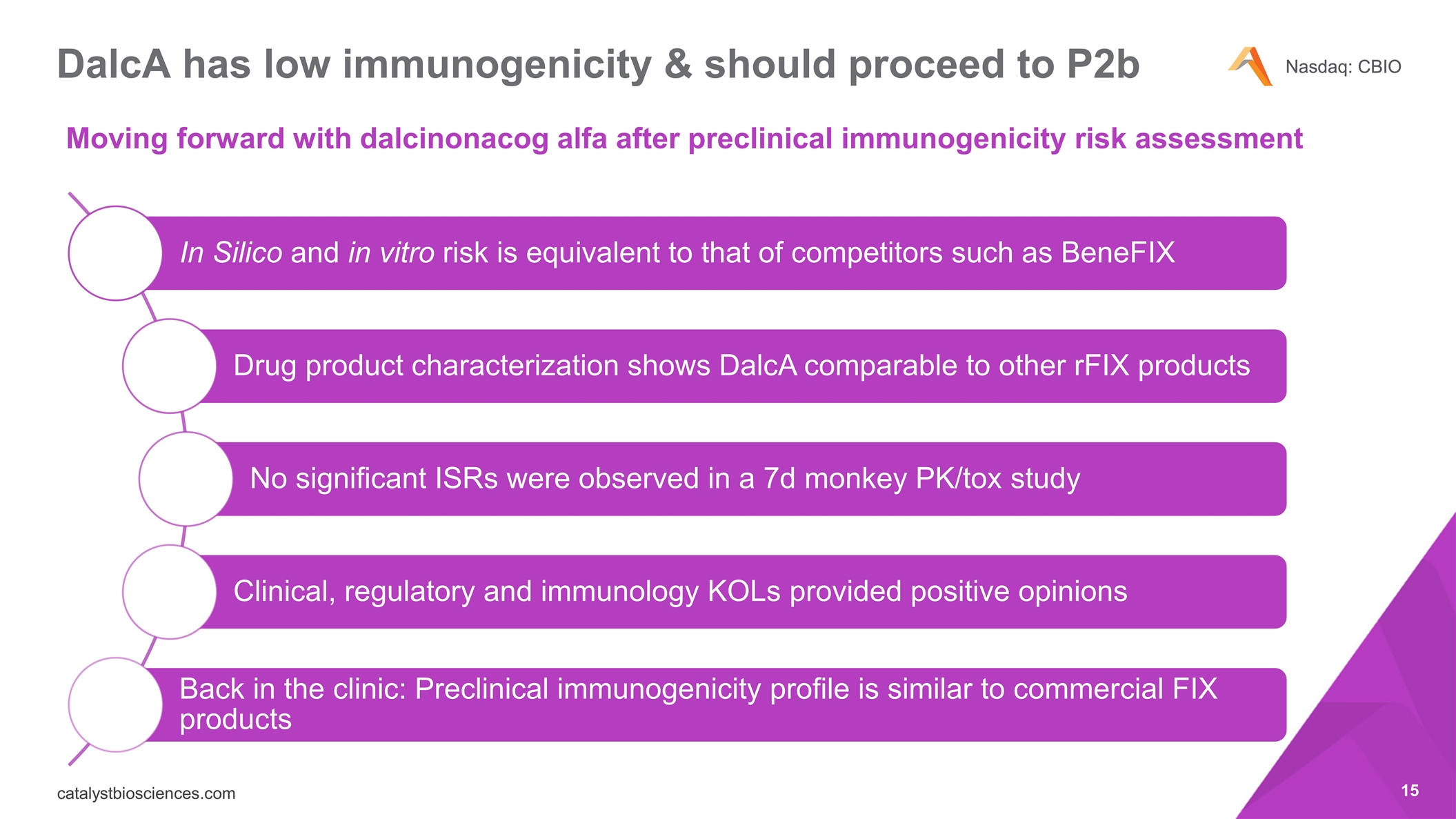

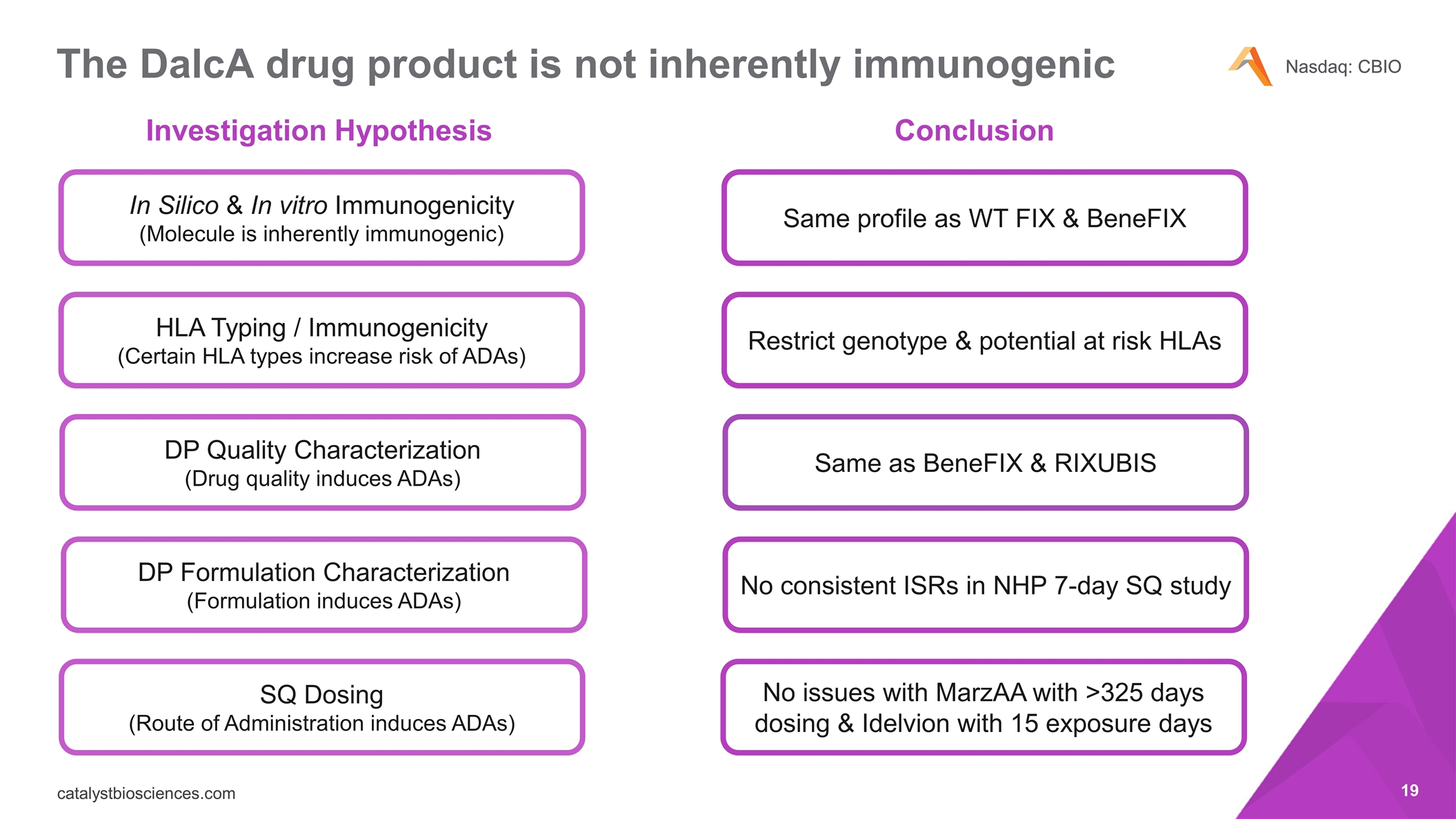

Retrospective immunogenicity assessment A comprehensive assessment of immunogenicity addressed several key hypotheses “Considering our global and regional in silico analysis alongside whole protein and peptide in vitro experiments … we find the risk that wildtype FIX and therapeutic candidate DalcA will create or contribute to anti-therapeutic immune response to be minimal.” Key Hypotheses Tested HLA and genotype are risk factors The DalcA molecule is inherently immunogenic Drug product quality or formulation induce ADAs ISRs increased the risk of ADAs

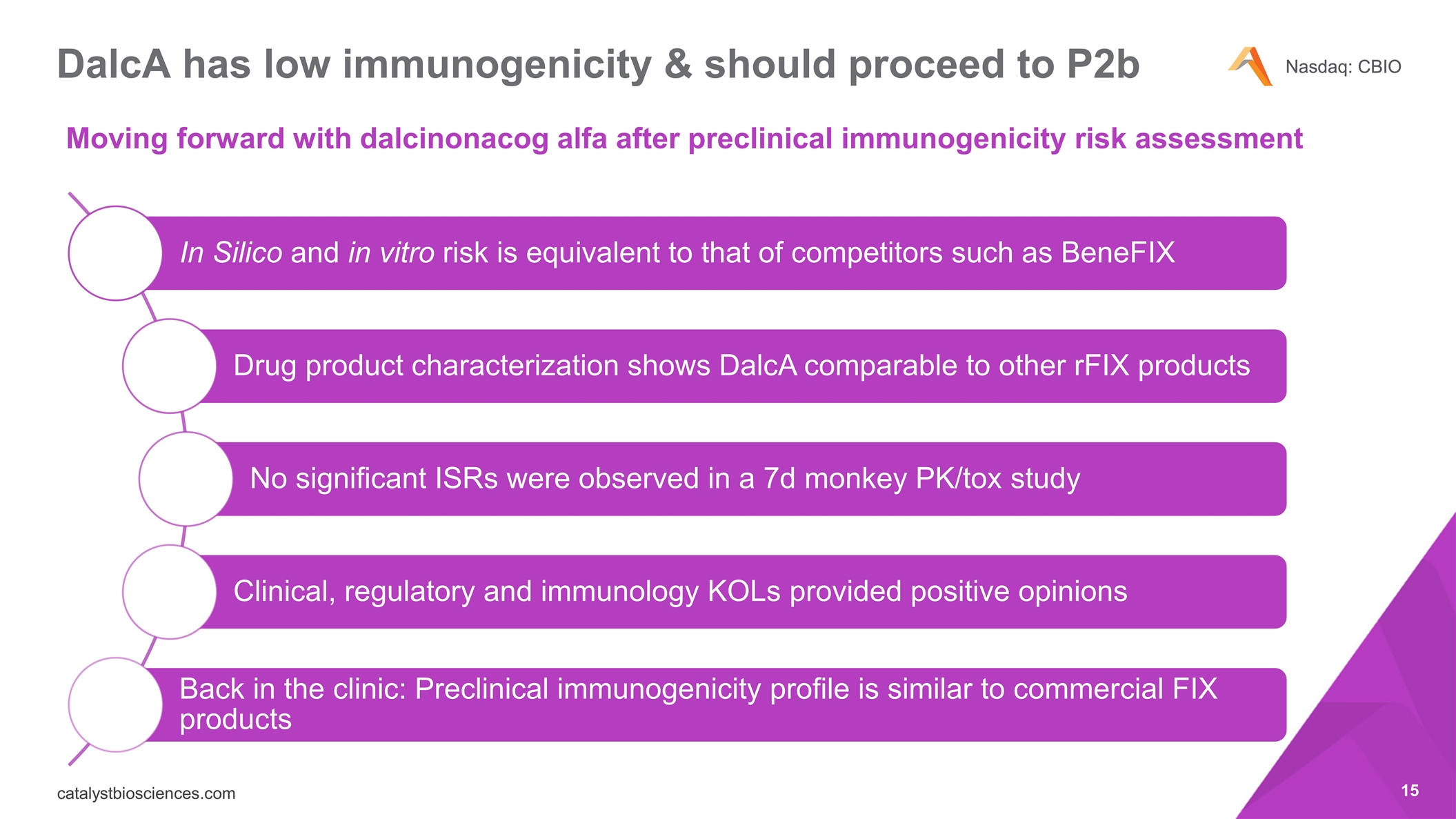

DalcA has low immunogenicity & should proceed to P2b Moving forward with dalcinonacog alfa after preclinical immunogenicity risk assessment In Silico and in vitro risk is equivalent to that of competitors such as BeneFIX No significant ISRs were observed in a 7d monkey PK/ tox study Drug product characterization shows DalcA comparable to other rFIX products Clinical, regulatory and immunology KOLs provided positive opinions Back in the clinic: Preclinical immunogenicity profile is similar to commercial FIX products

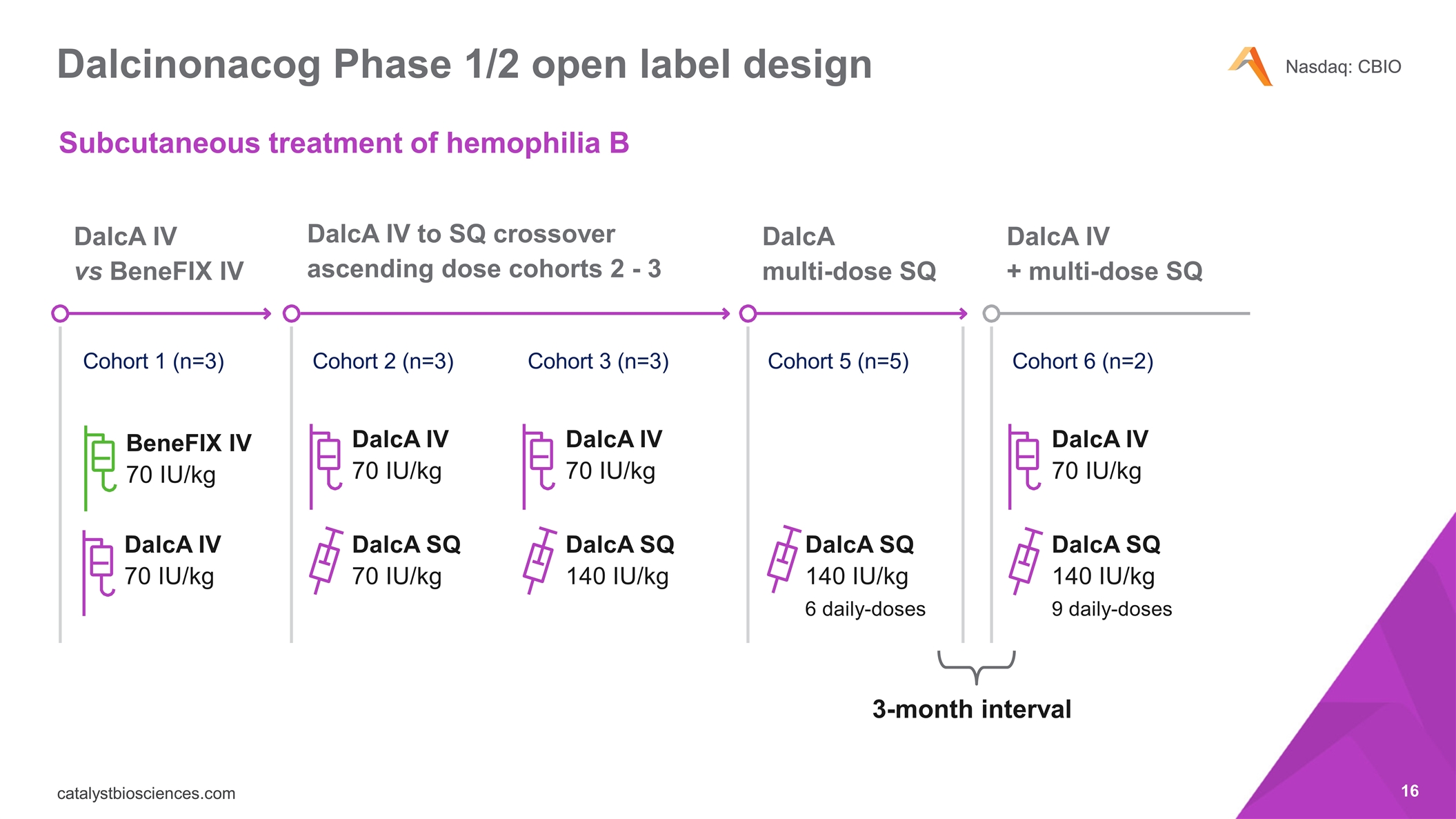

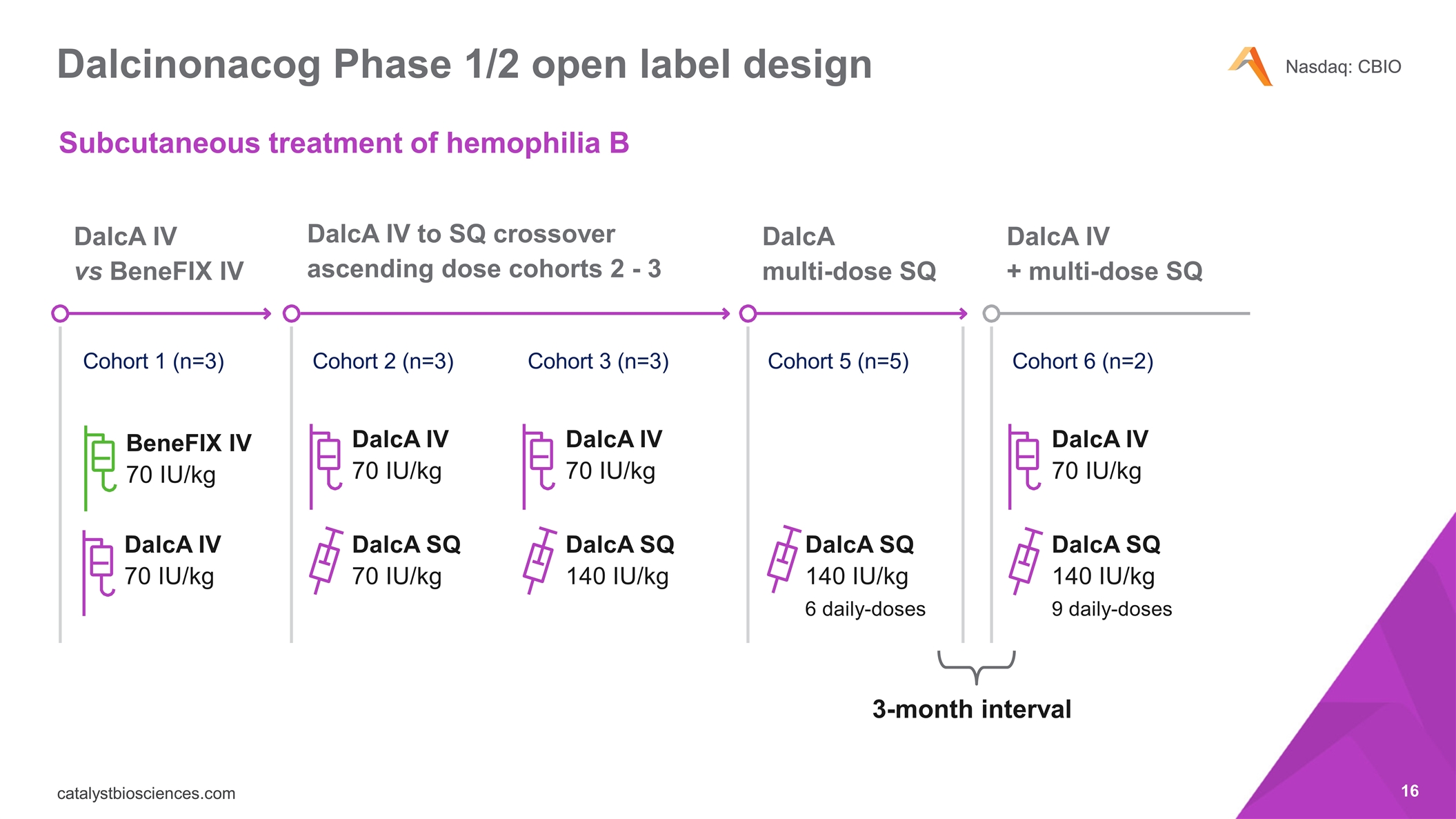

Dalcinonacog Phase 1/2 open label design DalcA IV vs BeneFIX IV BeneFIX IV 70 IU/kg DalcA IV 70 IU/kg DalcA IV 70 IU/kg DalcA IV 70 IU/kg DalcA IV 70 IU/kg DalcA SQ 70 IU/kg DalcA SQ 140 IU/kg 9 daily-doses DalcA SQ 140 IU/kg DalcA SQ 140 IU/kg 6 daily-doses DalcA IV to SQ crossover ascending dose cohorts 2 - 3 DalcA multi-dose SQ DalcA IV + multi-dose SQ Cohort 1 (n=3) Cohort 2 (n=3) Cohort 3 (n=3) Cohort 5 (n=5) Cohort 6 (n=2) Subcutaneous treatment of hemophilia B 3-month interval

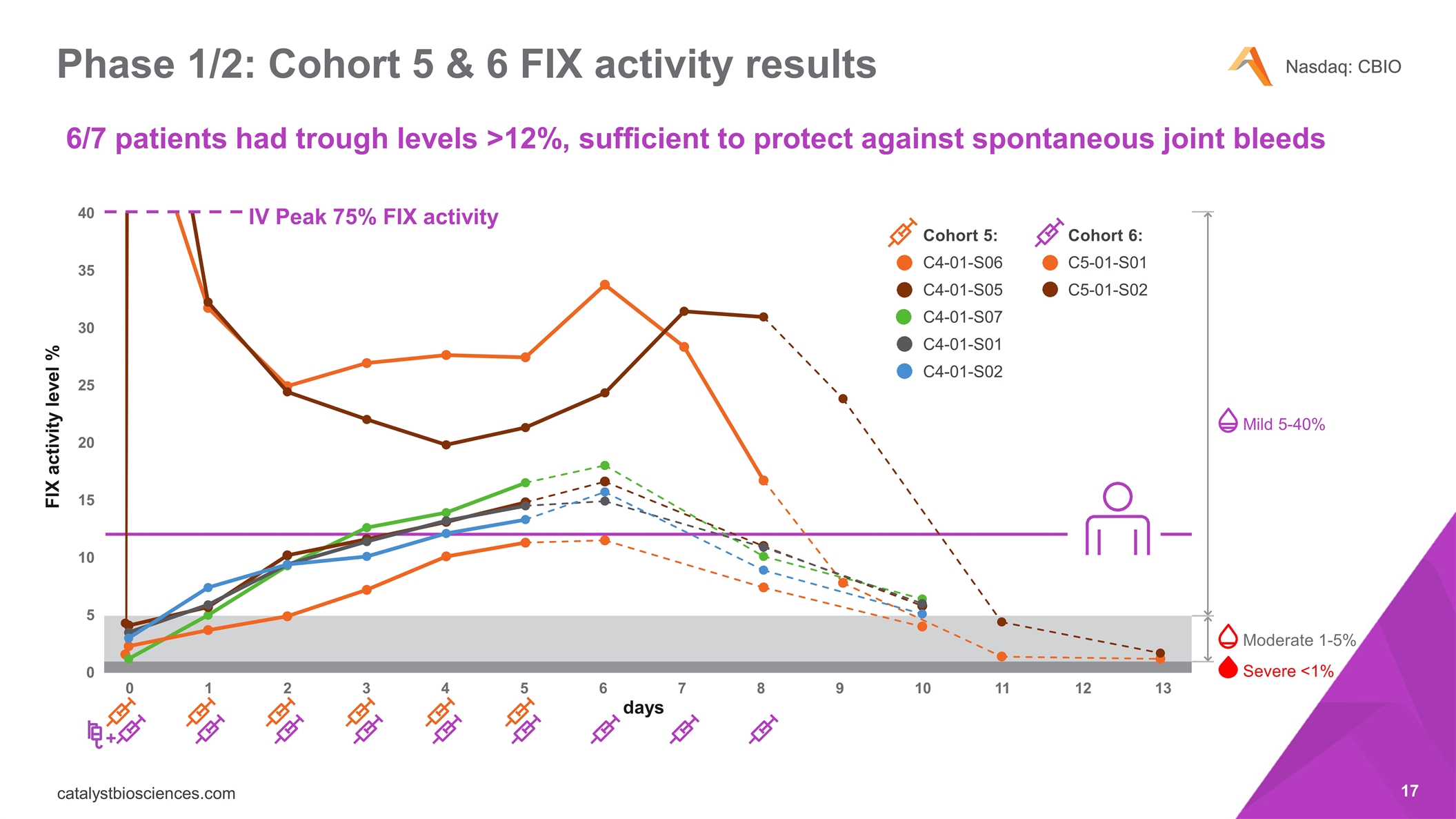

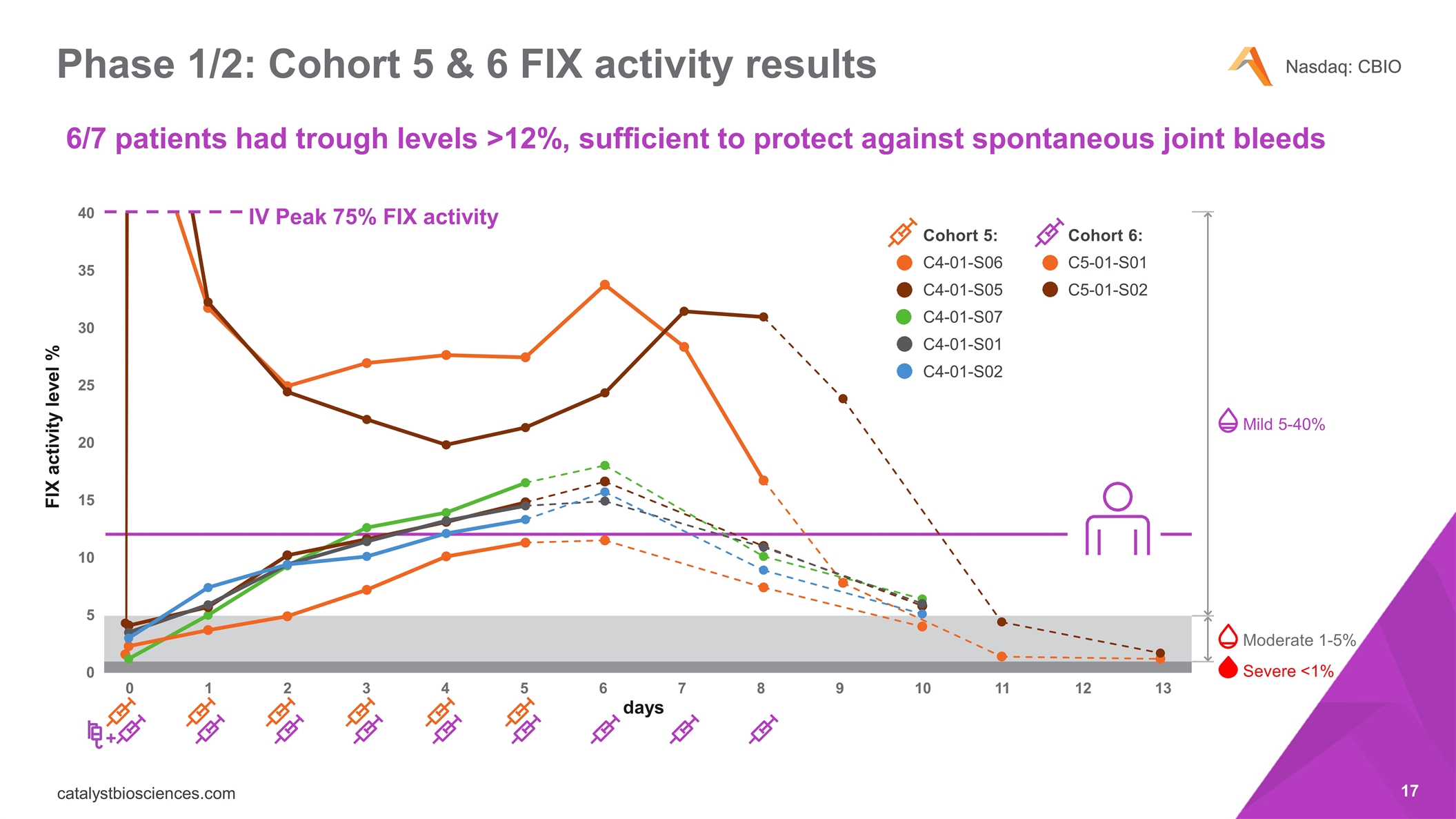

40 35 30 25 20 15 10 5 0 0 1 2 3 4 5 days FIX activity level % 6 7 8 9 13 11 10 12 Moderate 1-5% Mild 5-40% Severe <1% + Cohort 6: C5-01-S01 C5-01-S02 Cohort 5: C4-01-S06 C4-01-S05 C4-01-S07 C4-01-S01 C4-01-S02 IV Peak 75% FIX activity Phase 1/2: Cohort 5 & 6 FIX activity results 6/7 patients had trough levels >12%, sufficient to protect against spontaneous joint bleeds

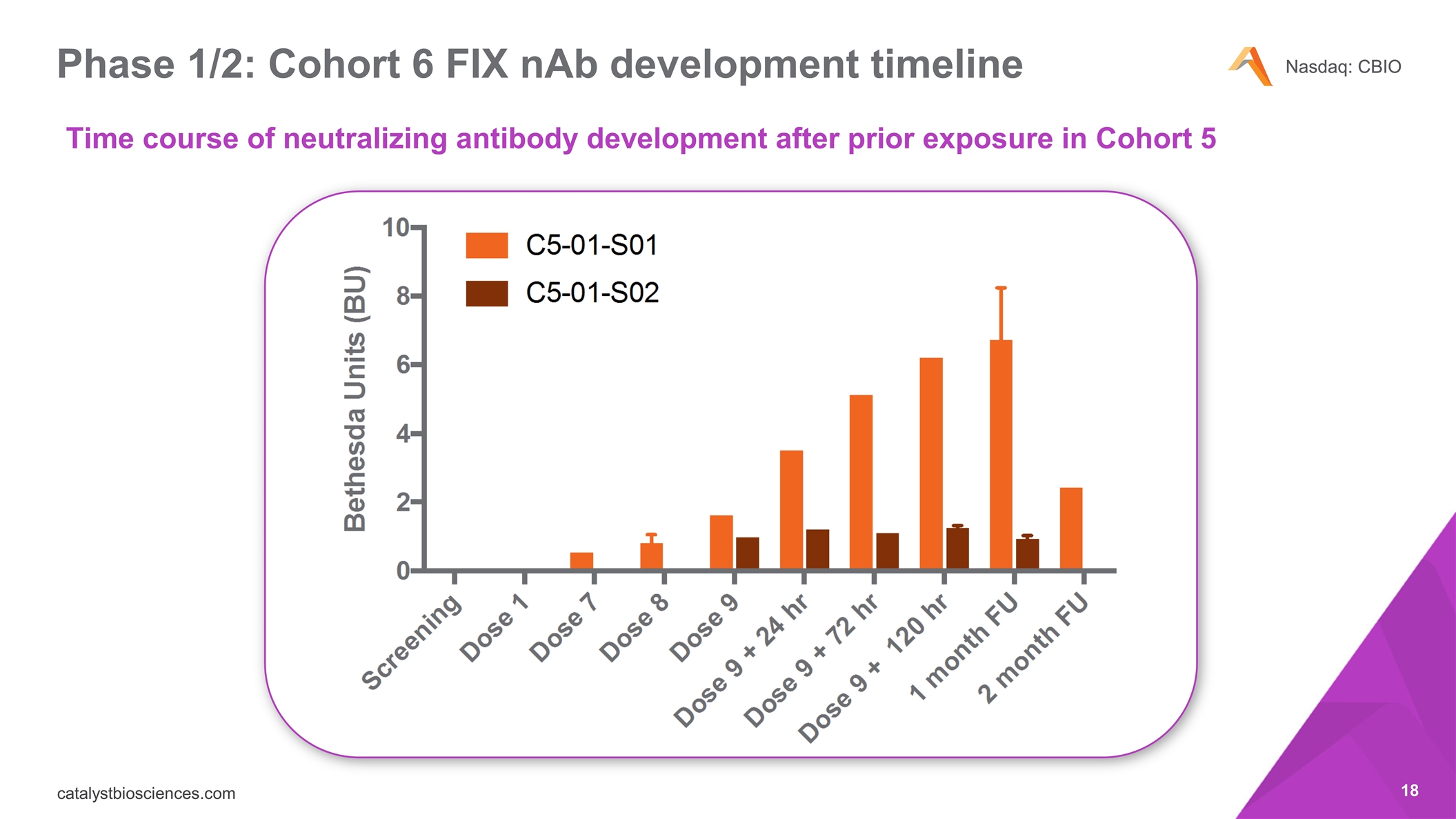

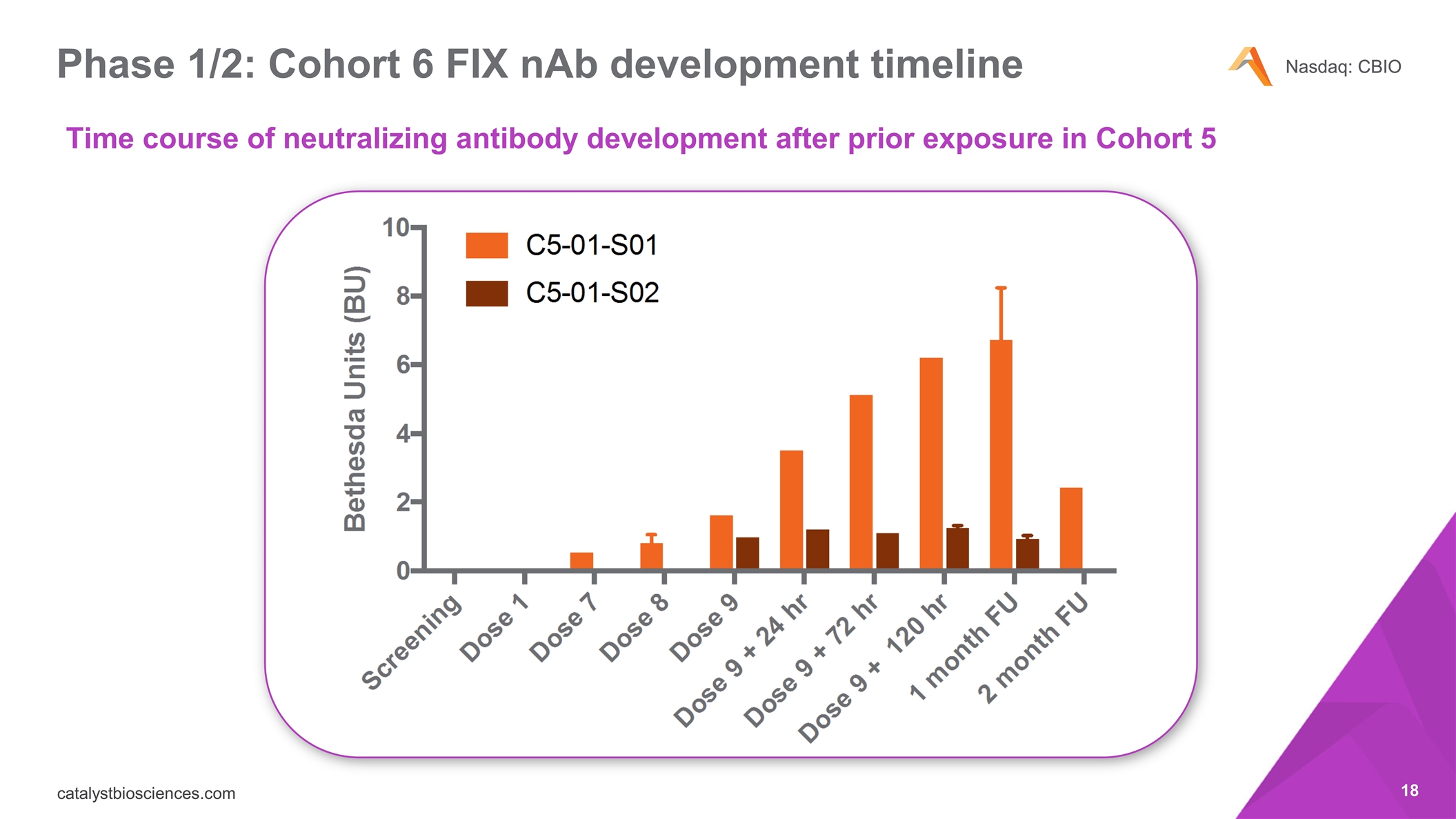

Phase 1/2: Cohort 6 FIX nAb development timeline Time course of neutralizing antibody development after prior exposure in Cohort 5

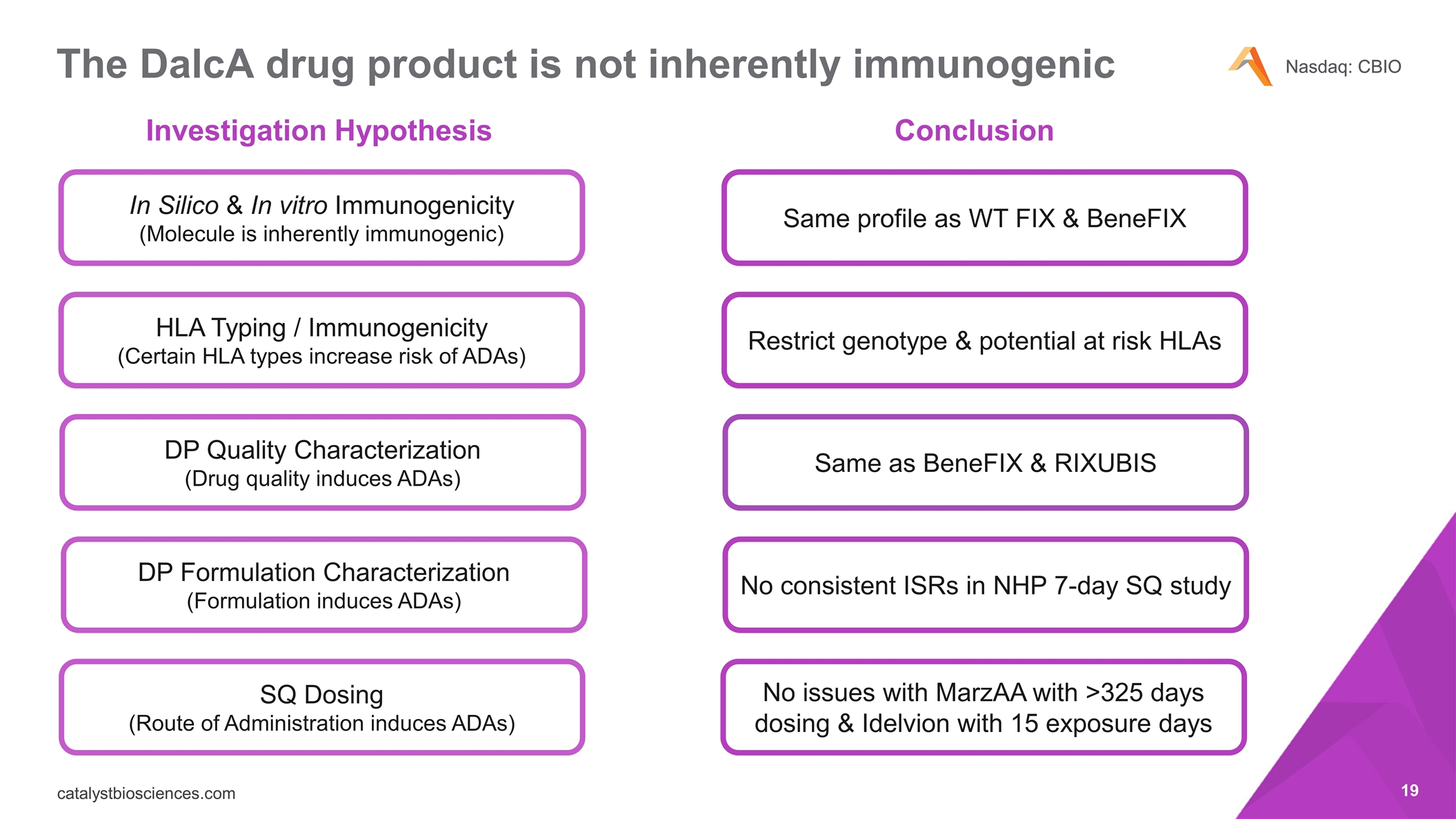

The DalcA drug product is not inherently immunogenic In Silico & In vitro Immunogenicity (Molecule is inherently immunogenic) HLA Typing / Immunogenicity (Certain HLA types increase risk of ADAs) DP Quality Characterization (Drug quality induces ADAs) DP Formulation Characterization (Formulation induces ADAs) Same as BeneFIX & RIXUBIS Same profile as WT FIX & BeneFIX Restrict genotype & potential at risk HLAs No consistent ISRs in NHP 7-day SQ study Investigation Hypothesis Conclusion SQ Dosing (Route of Administration induces ADAs) No issues with MarzAA with >325 days dosing & Idelvion with 15 exposure days

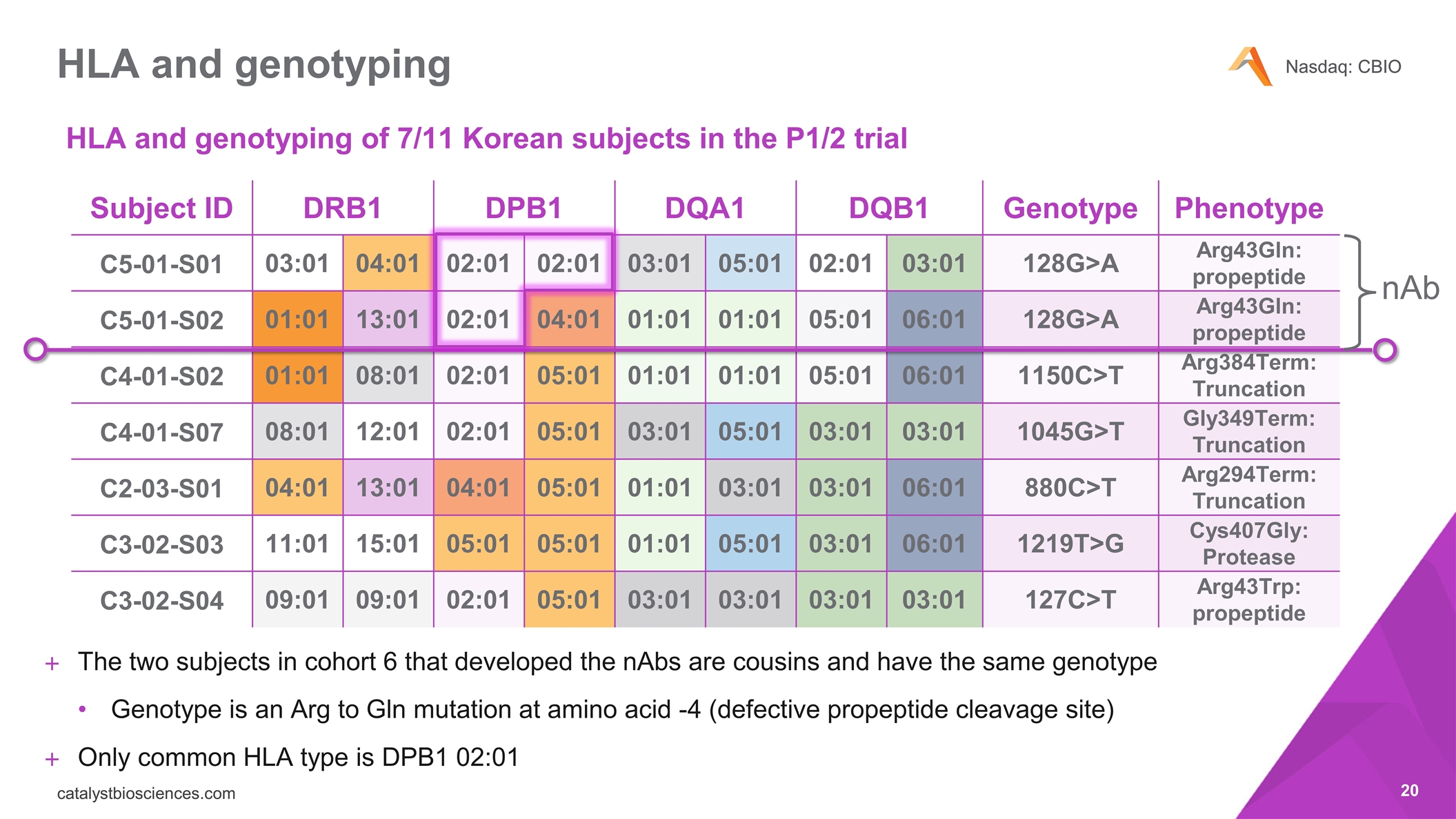

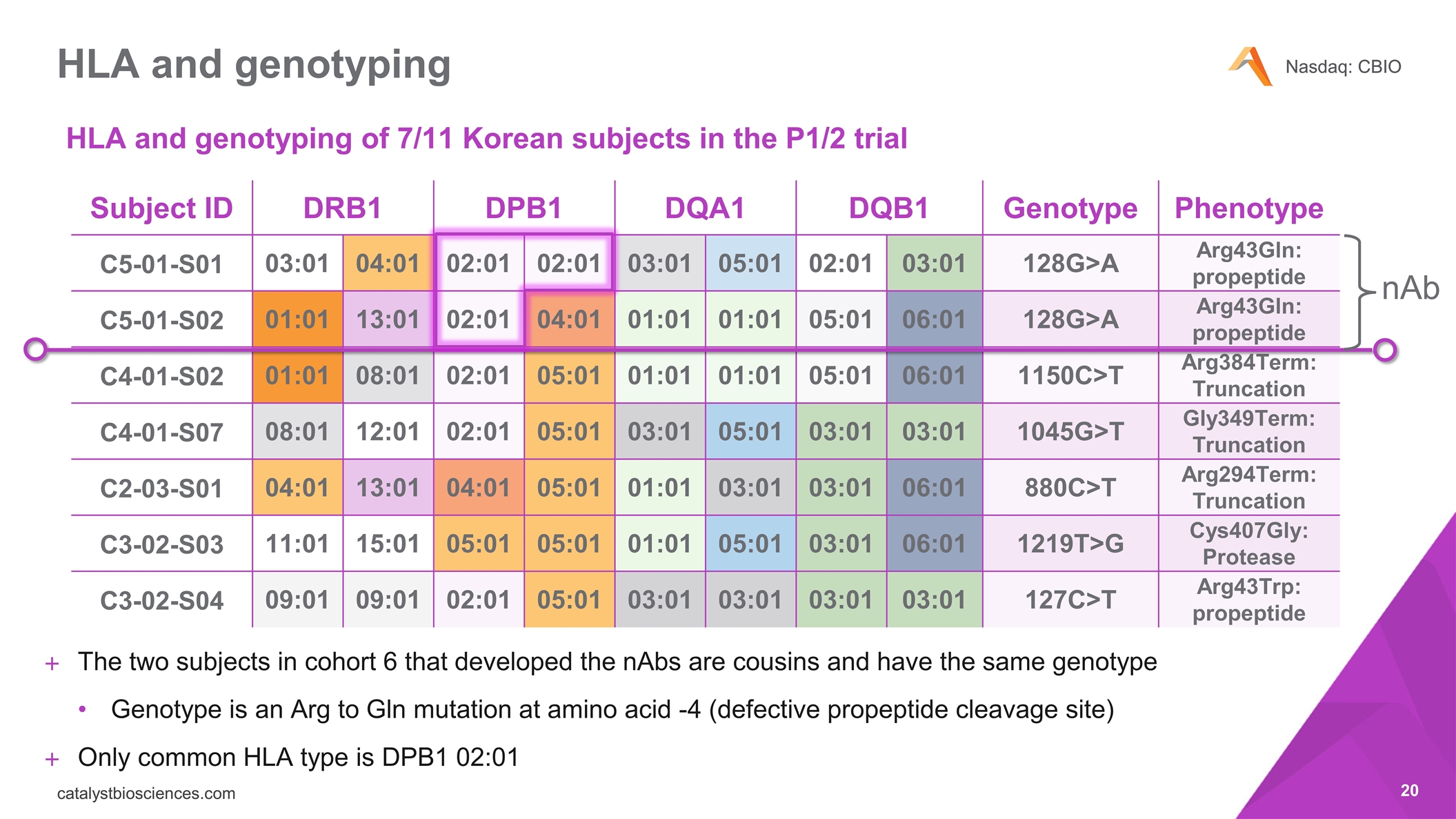

Subject ID DRB1 DPB1 DQA1 DQB1 Genotype Phenotype C5-01-S01 03:01 04:01 02:01 02:01 03:01 05:01 02:01 03:01 128G>A Arg43Gln: propeptide C5-01-S02 01:01 13:01 02:01 04:01 01:01 01:01 05:01 06:01 128G>A Arg43Gln: propeptide C4-01-S02 01:01 08:01 02:01 05:01 01:01 01:01 05:01 06:01 1150C>T Arg384Term: Truncation C4-01-S07 08:01 12:01 02:01 05:01 03:01 05:01 03:01 03:01 1045G>T Gly349Term: Truncation C2-03-S01 04:01 13:01 04:01 05:01 01:01 03:01 03:01 06:01 880C>T Arg294Term: Truncation C3-02-S03 11:01 15:01 05:01 05:01 01:01 05:01 03:01 06:01 1219T>G Cys407Gly: Protease C3-02-S04 09:01 09:01 02:01 05:01 03:01 03:01 03:01 03:01 127C>T Arg43Trp: propeptide The two subjects in cohort 6 that developed the nAbs are cousins and have the same genotype Genotype is an Arg to Gln mutation at amino acid -4 (defective propeptide cleavage site) Only common HLA type is DPB1 02:01 HLA and genotyping HLA and genotyping of 7/11 Korean subjects in the P1/2 trial nAb

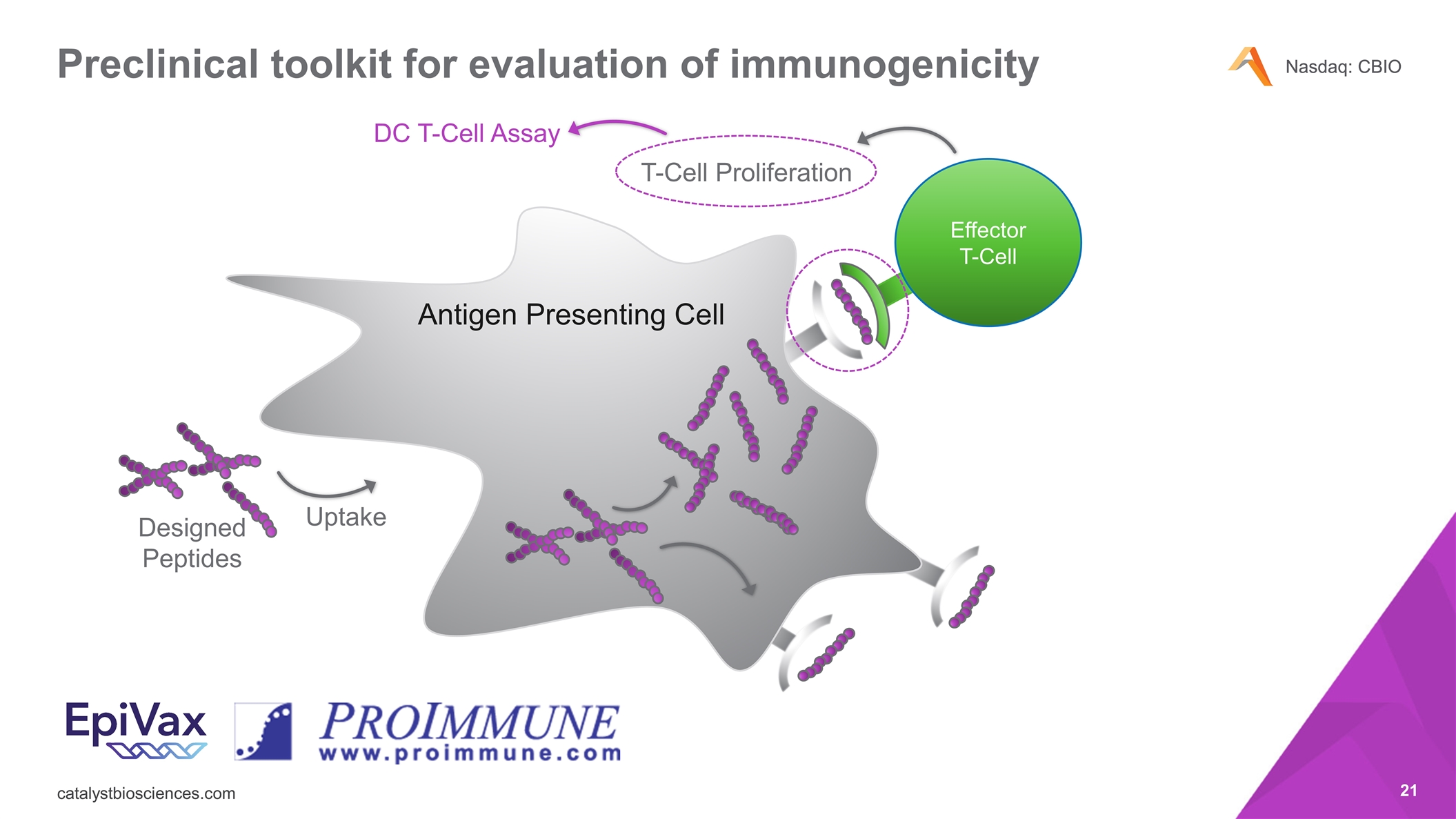

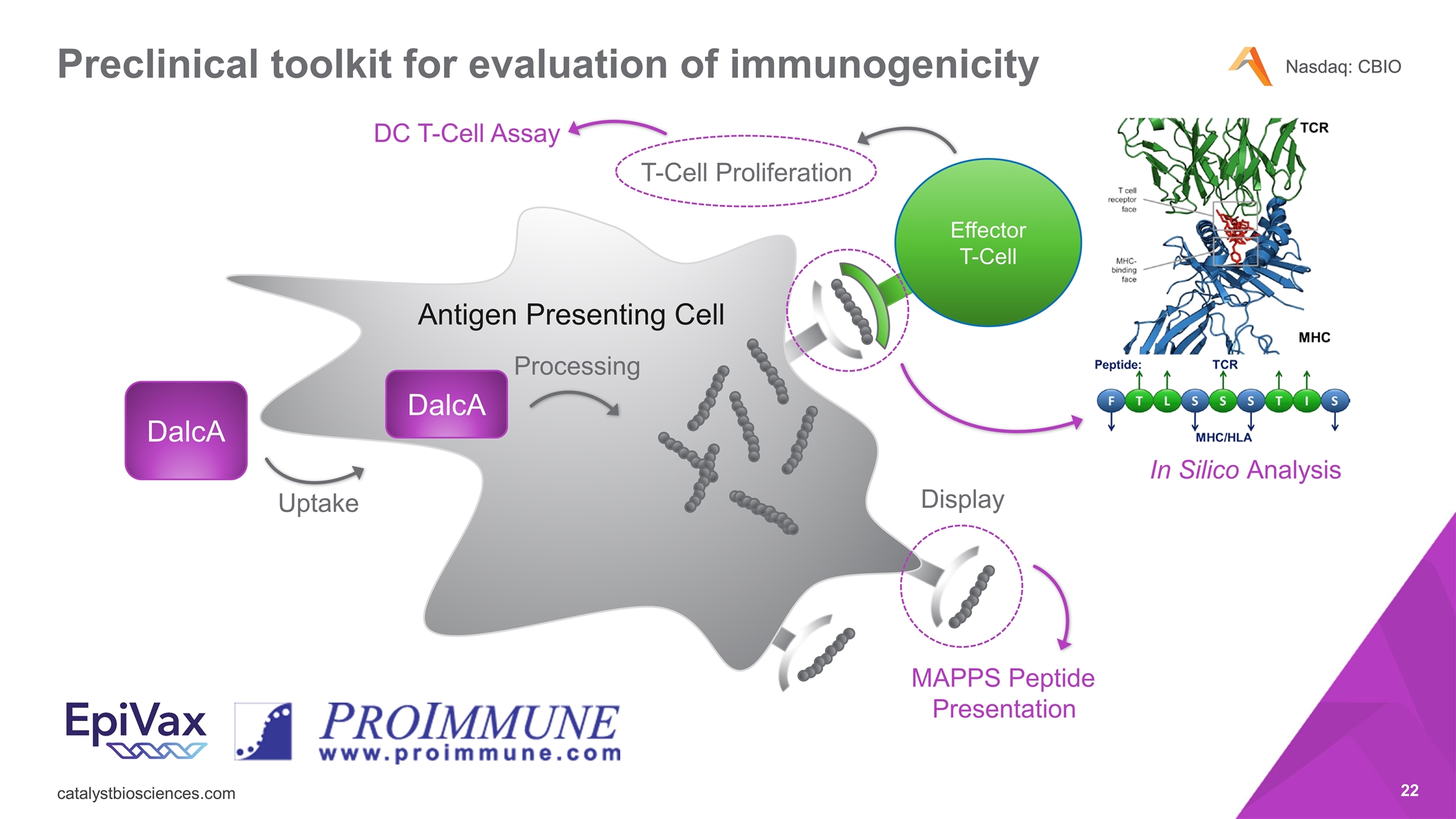

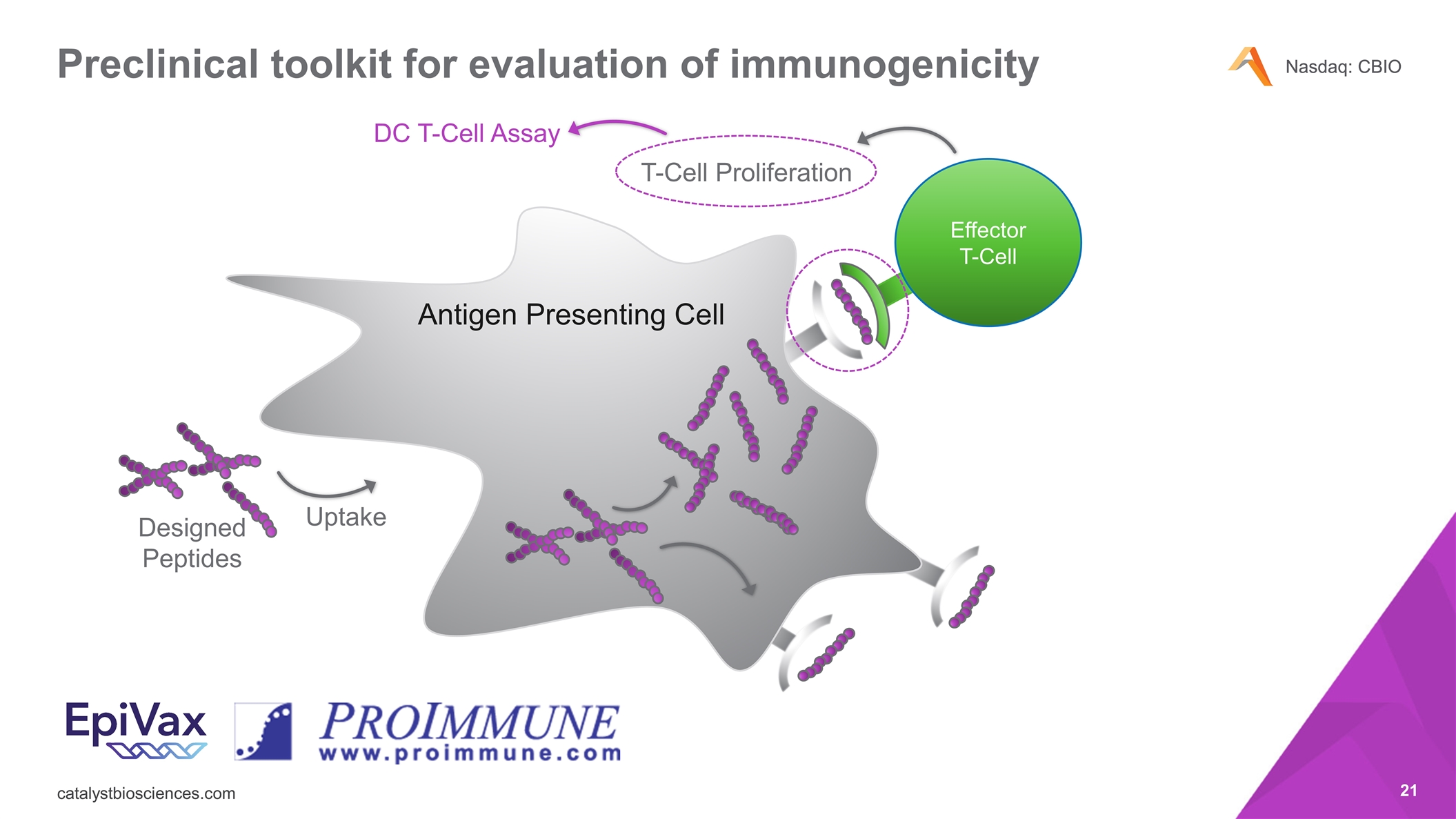

Preclinical toolkit for evaluation of immunogenicity Effector T-Cell Antigen Presenting Cell Designed Peptides T-Cell Proliferation DC T-Cell Assay Uptake

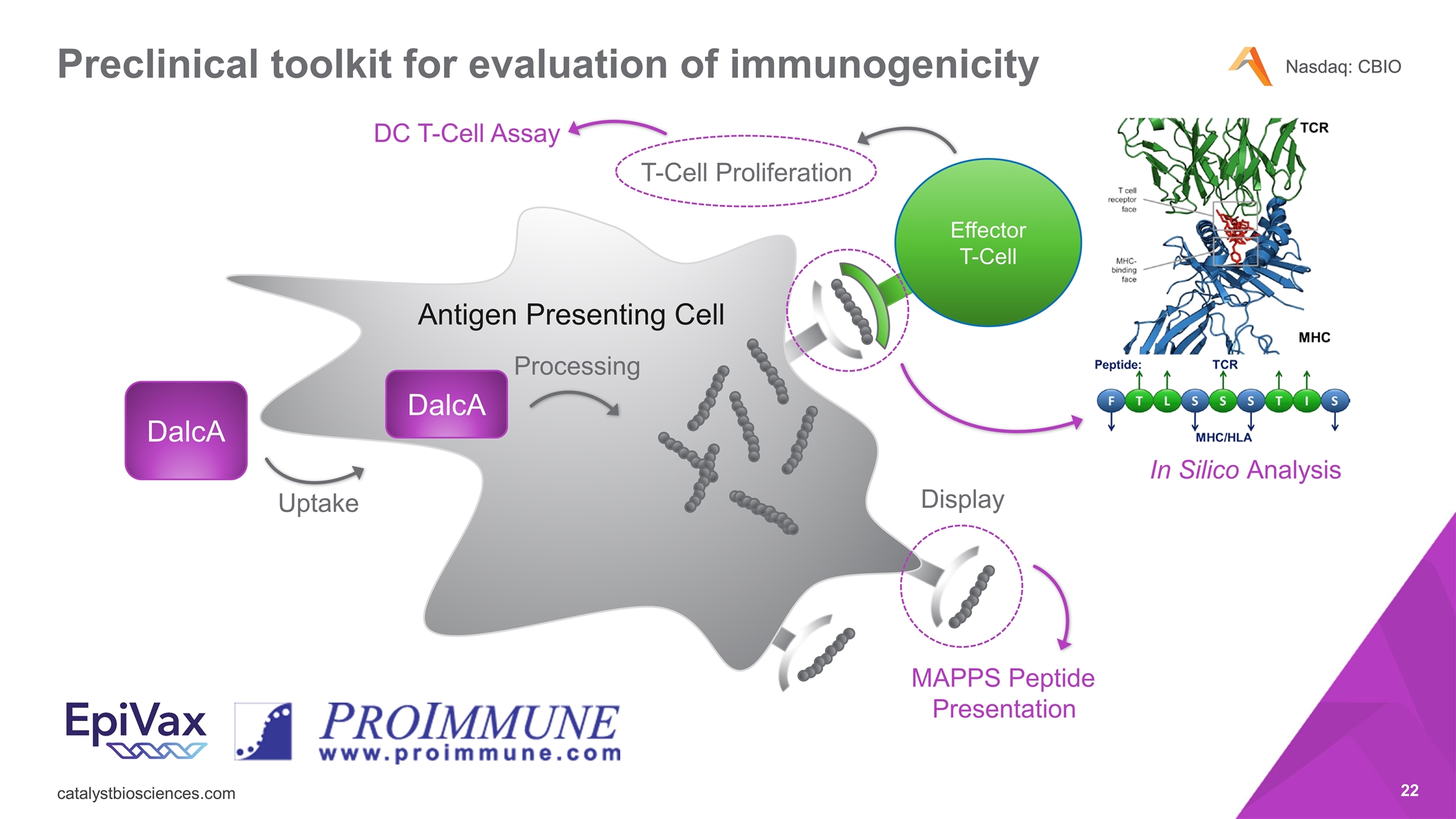

Preclinical toolkit for evaluation of immunogenicity Effector T-Cell Antigen Presenting Cell MAPPS Peptide Presentation In Silico Analysis DalcA DalcA Processing Display T-Cell Proliferation DC T-Cell Assay Uptake

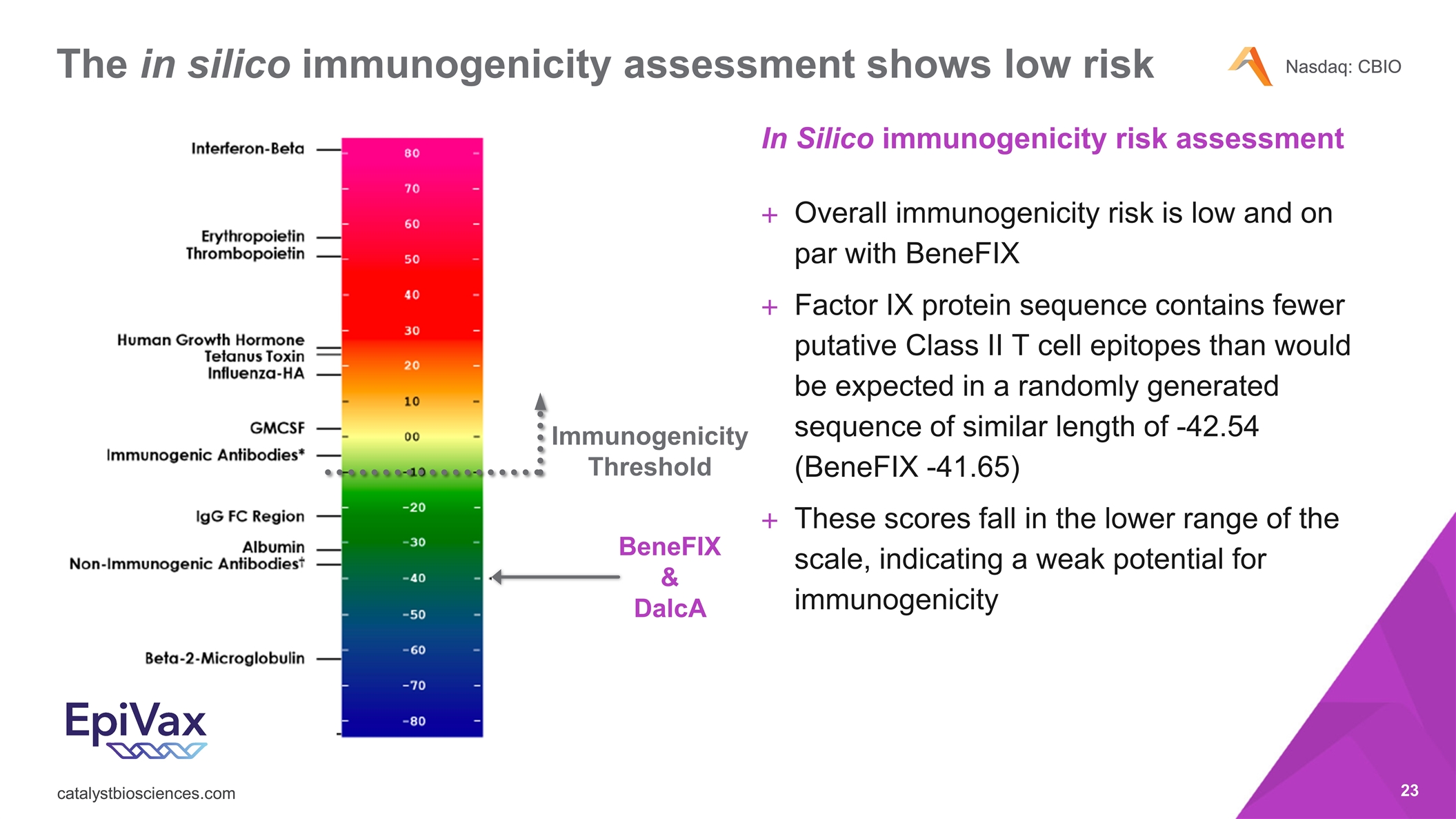

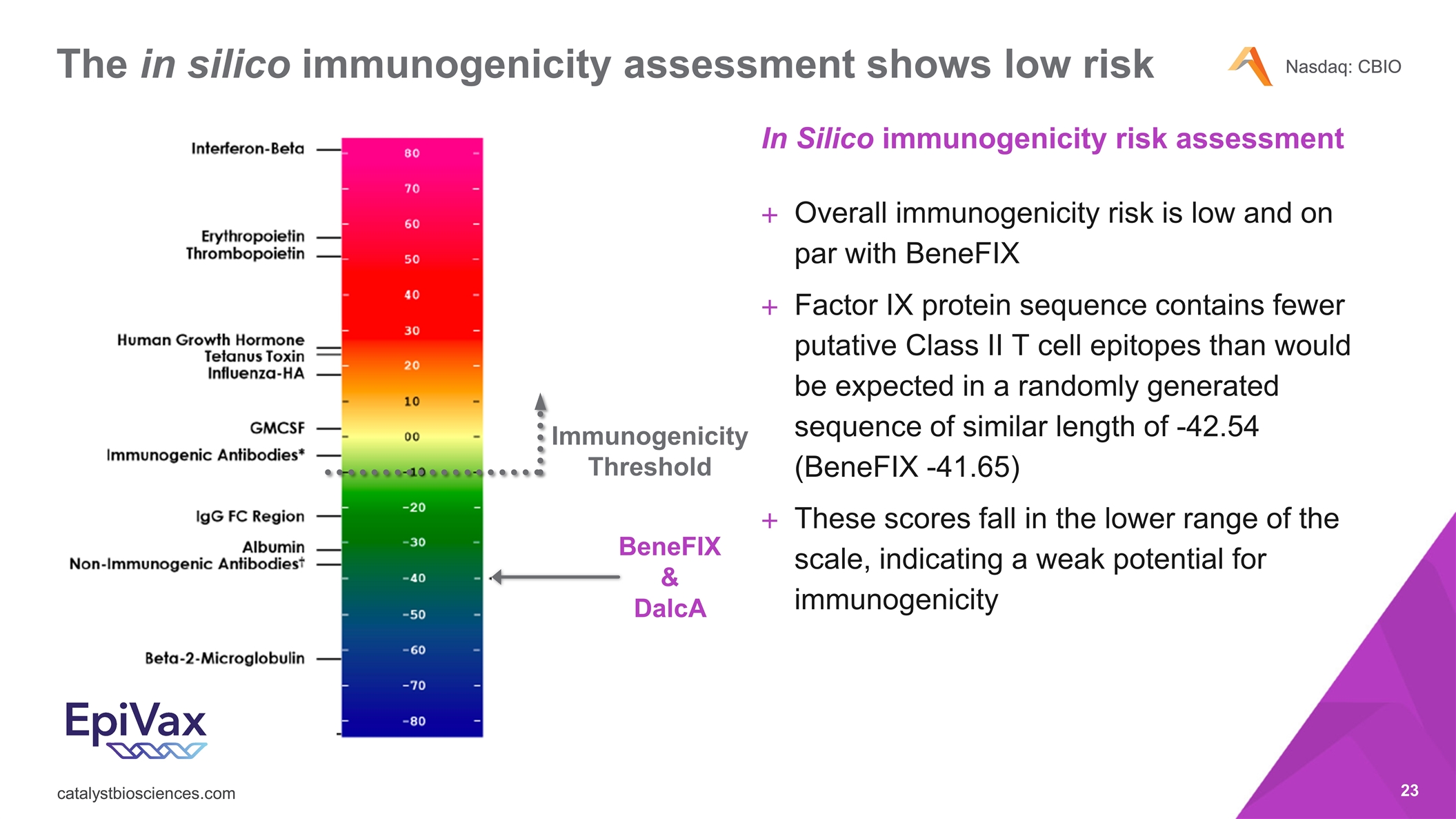

The in silico immunogenicity assessment shows low risk In Silico immunogenicity risk assessment Overall immunogenicity risk is low and on par with BeneFIX Factor IX protein sequence contains fewer putative Class II T cell epitopes than would be expected in a randomly generated sequence of similar length of -42.54 (BeneFIX -41.65) These scores fall in the lower range of the scale, indicating a weak potential for immunogenicity BeneFIX & DalcA Immunogenicity Threshold

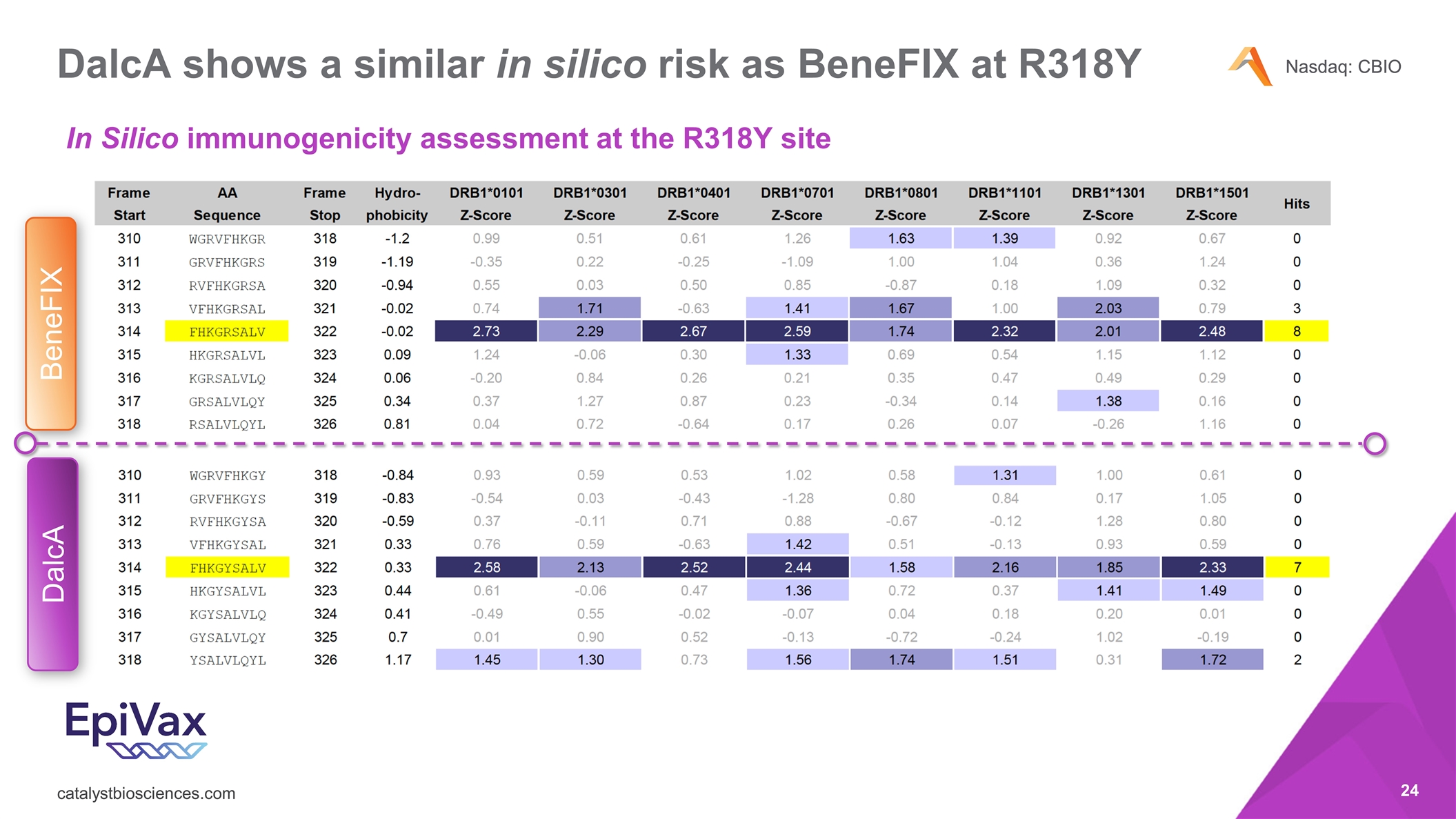

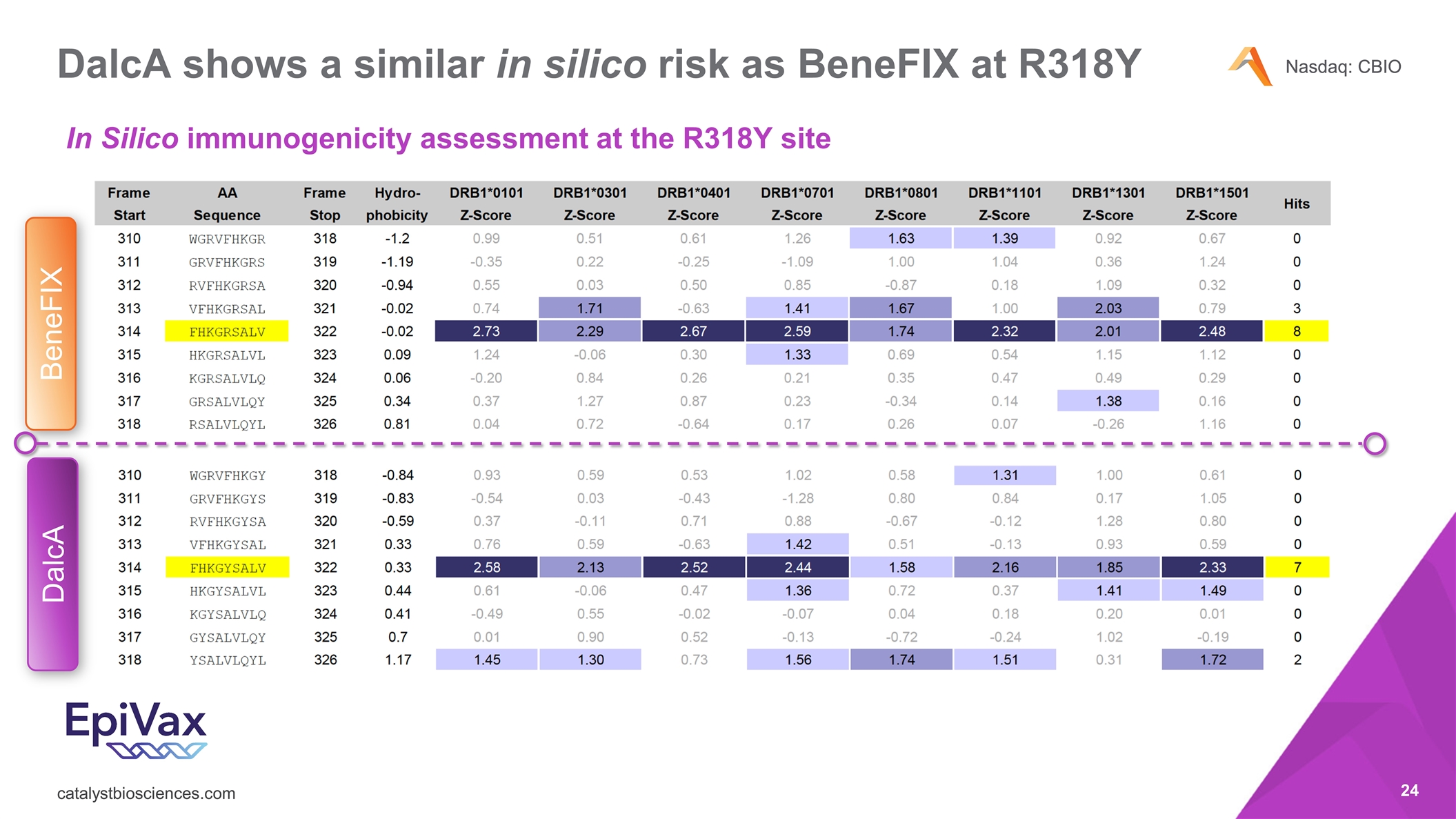

DalcA shows a similar in silico risk as BeneFIX at R318Y DalcA BeneFIX In Silico immunogenicity assessment at the R318Y site

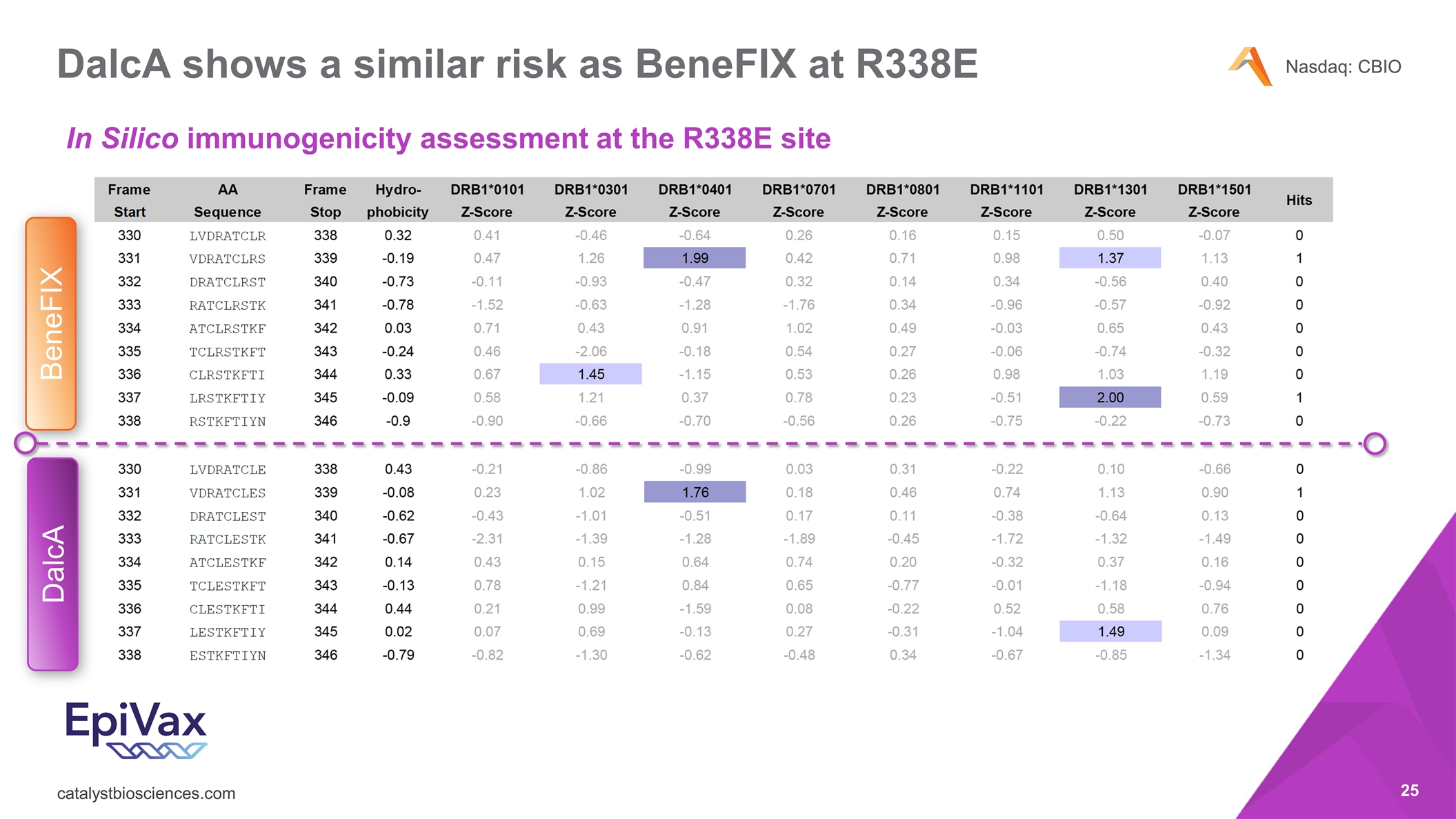

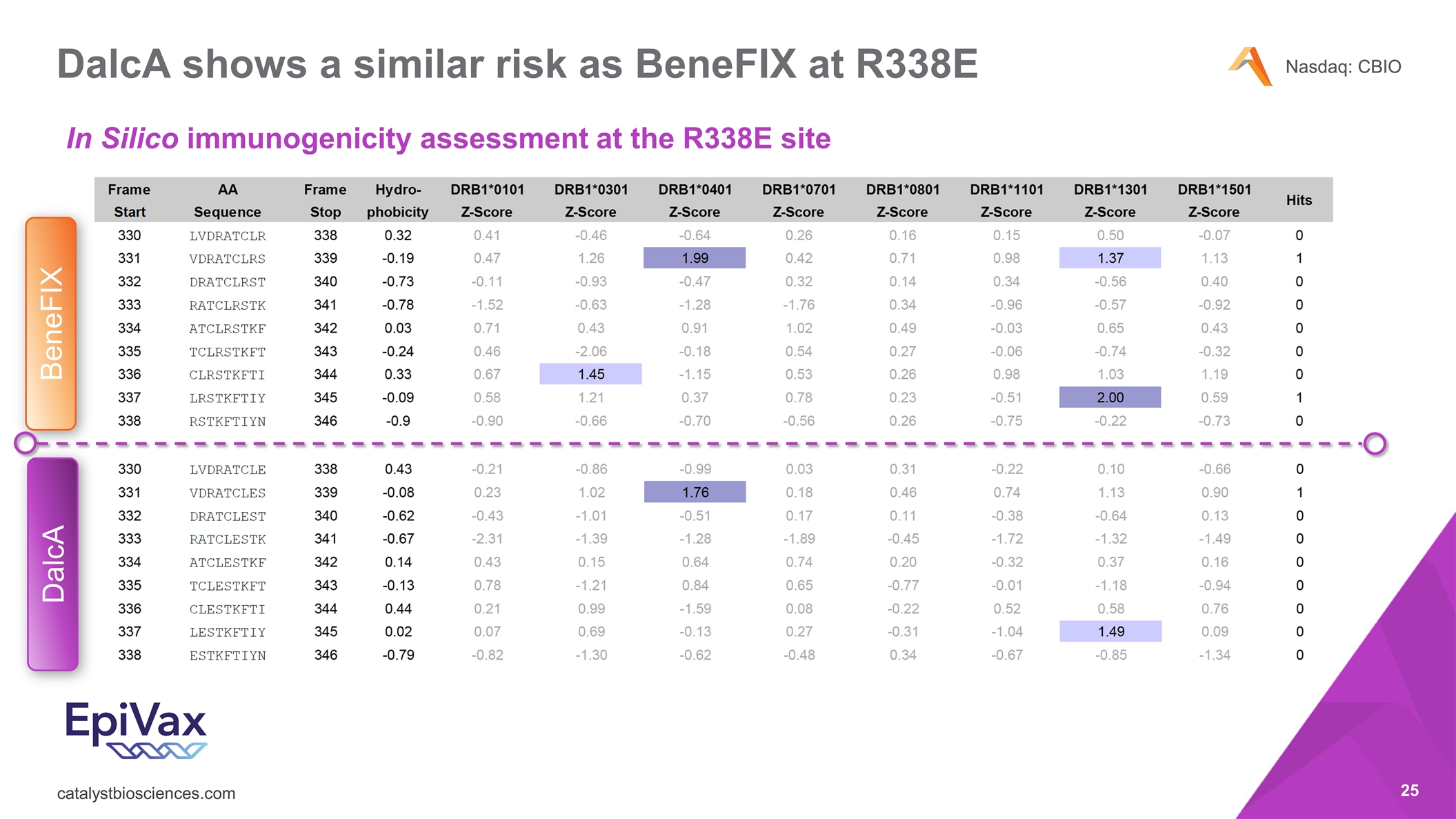

DalcA shows a similar risk as BeneFIX at R338E In Silico immunogenicity assessment at the R338E site DalcA BeneFIX

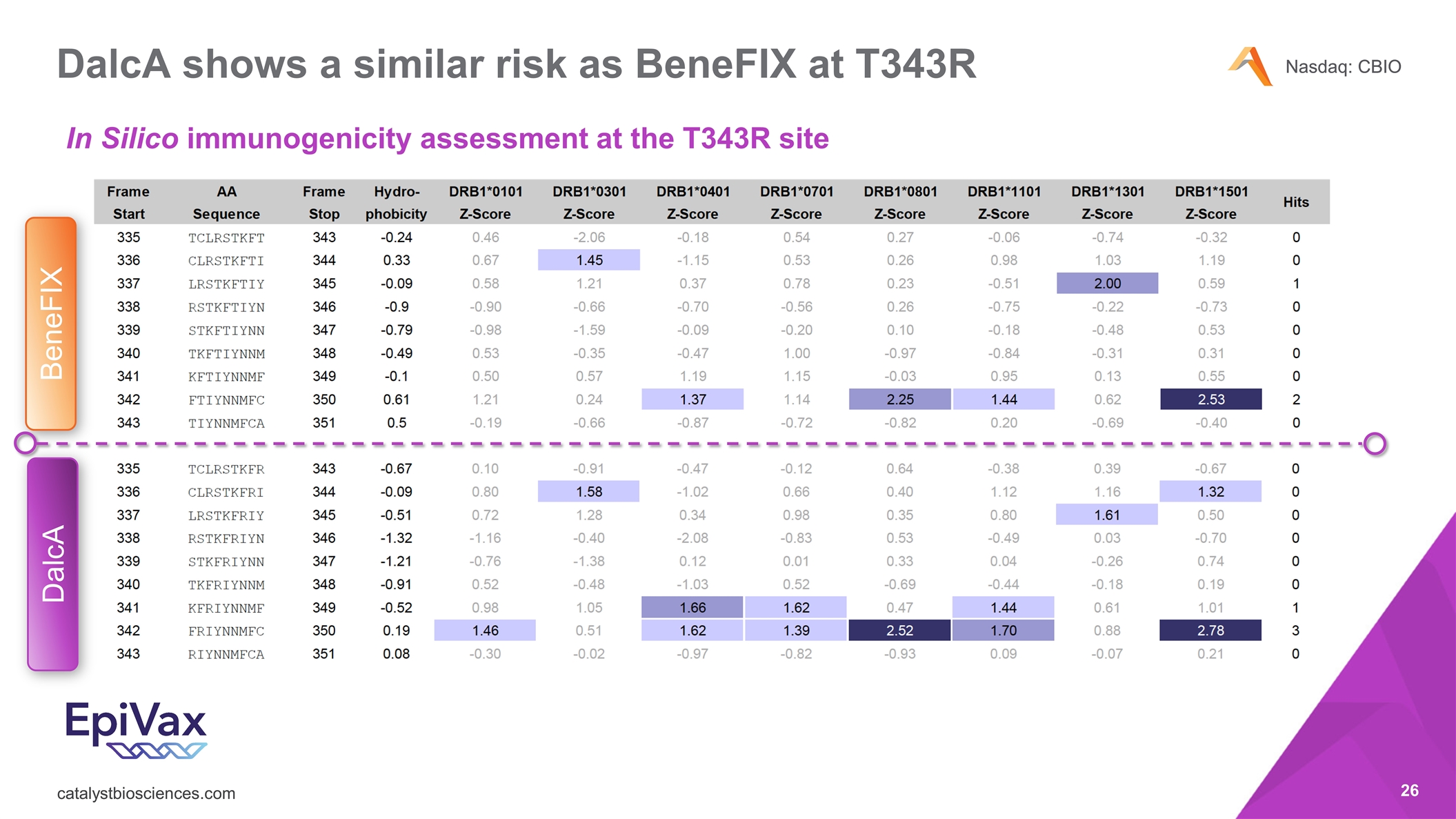

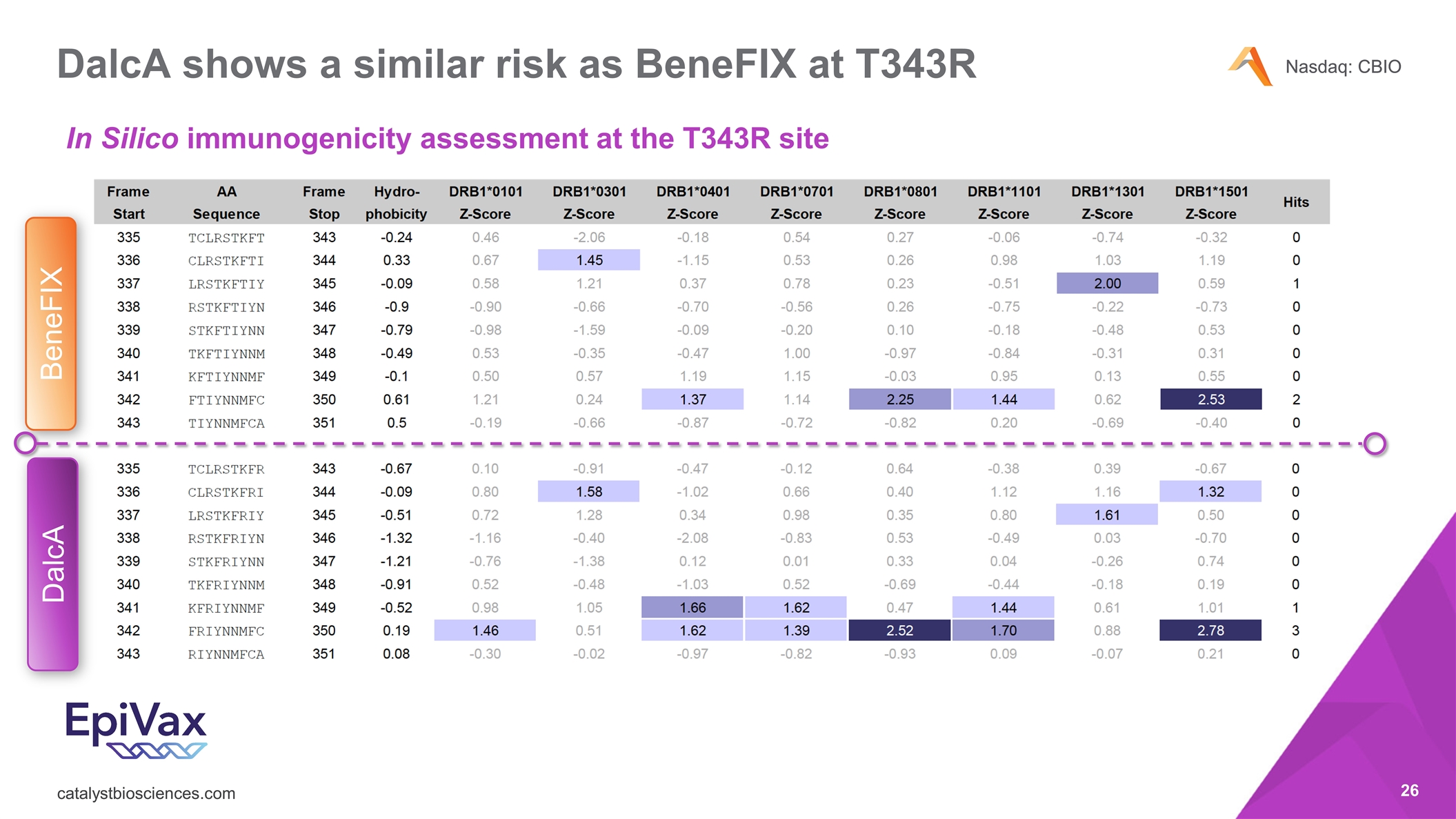

DalcA shows a similar risk as BeneFIX at T343R In Silico immunogenicity assessment at the T343R site DalcA BeneFIX

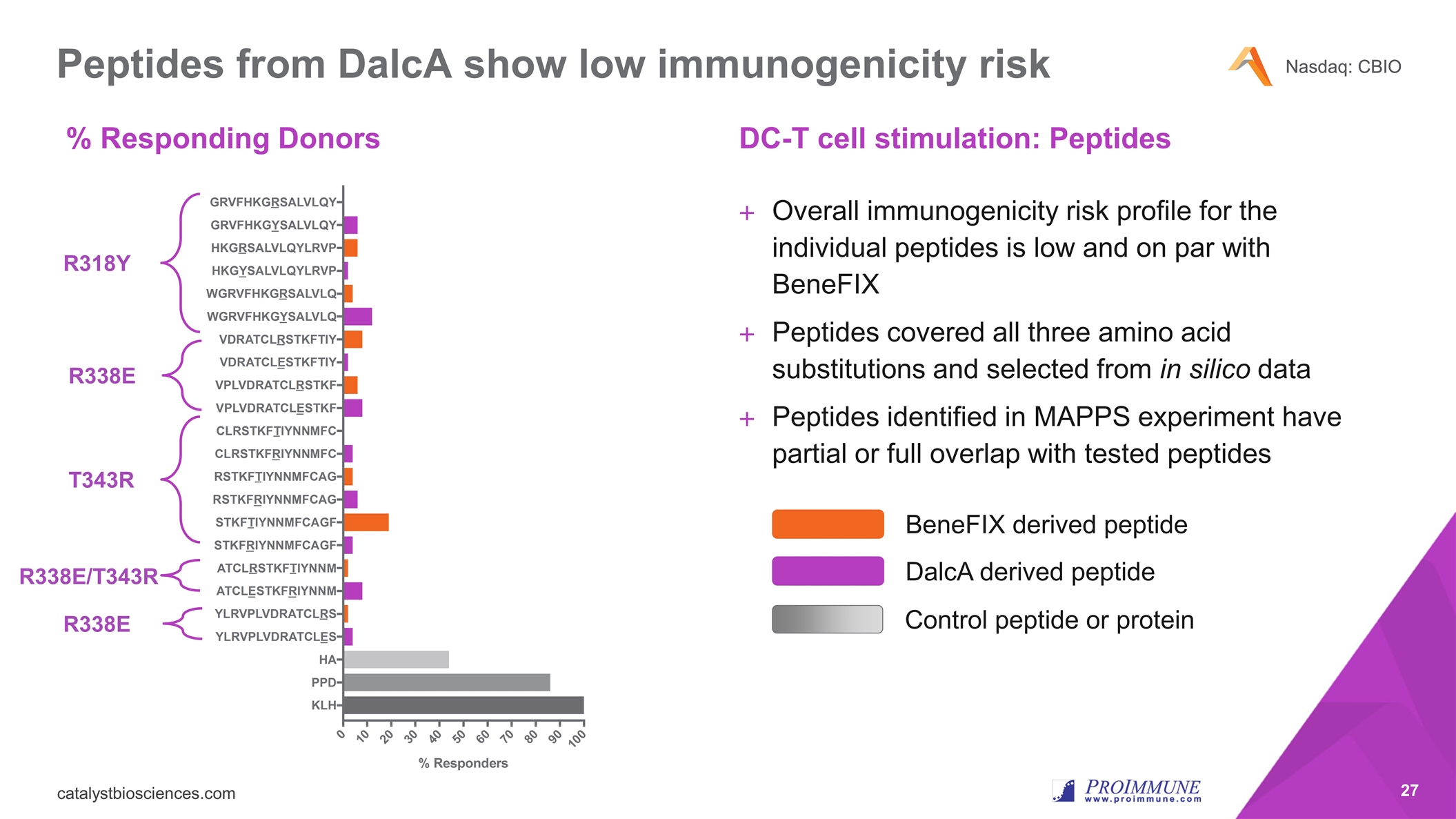

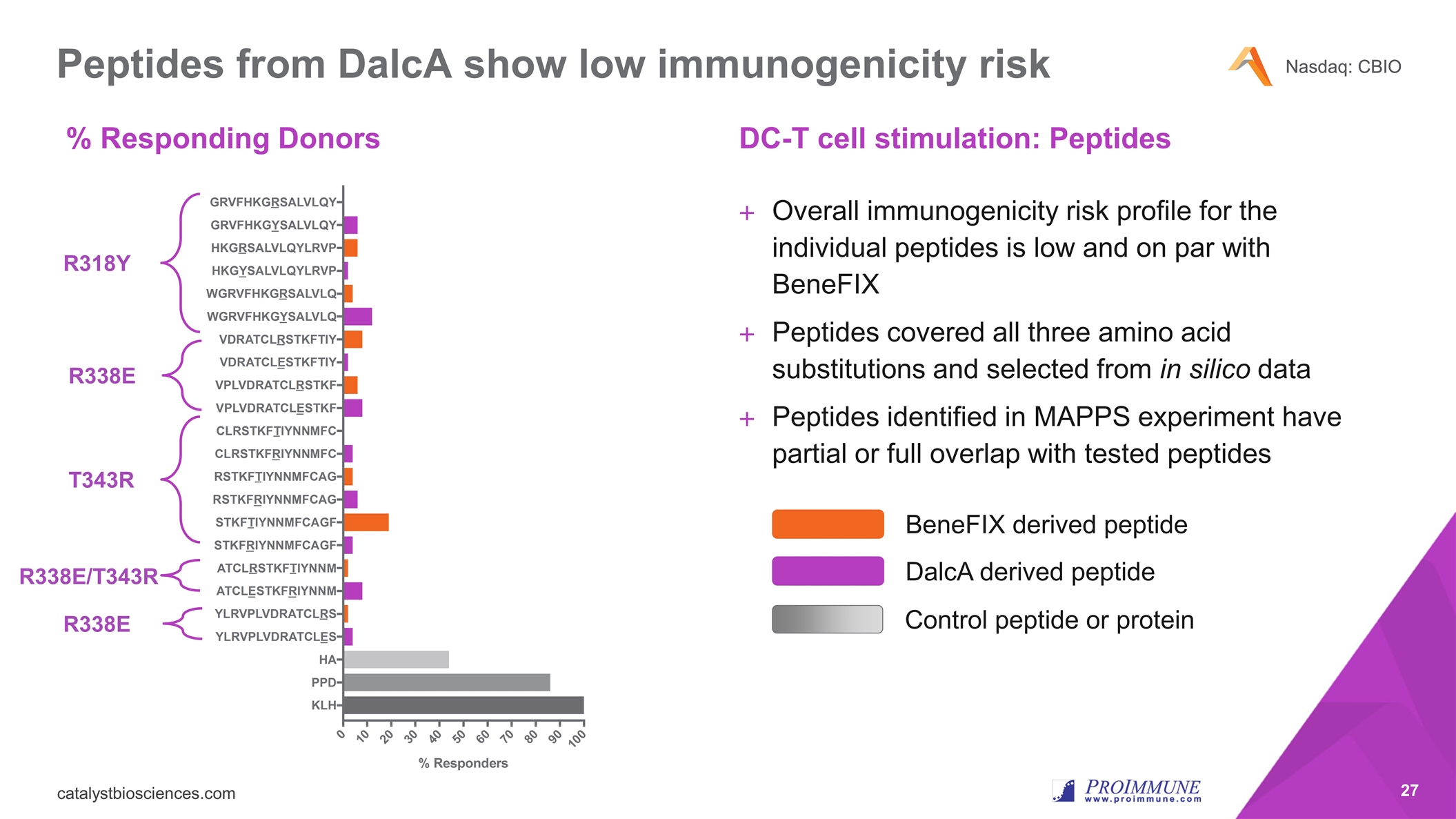

Peptides from DalcA show low immunogenicity risk % Responding Donors DC-T cell stimulation: Peptides Overall immunogenicity risk profile for the individual peptides is low and on par with BeneFIX Peptides covered all three amino acid substitutions and selected from in silico data Peptides identified in MAPPS experiment have partial or full overlap with tested peptides R318Y R338E T343R R338E R338E/T343R BeneFIX derived peptide DalcA derived peptide Control peptide or protein

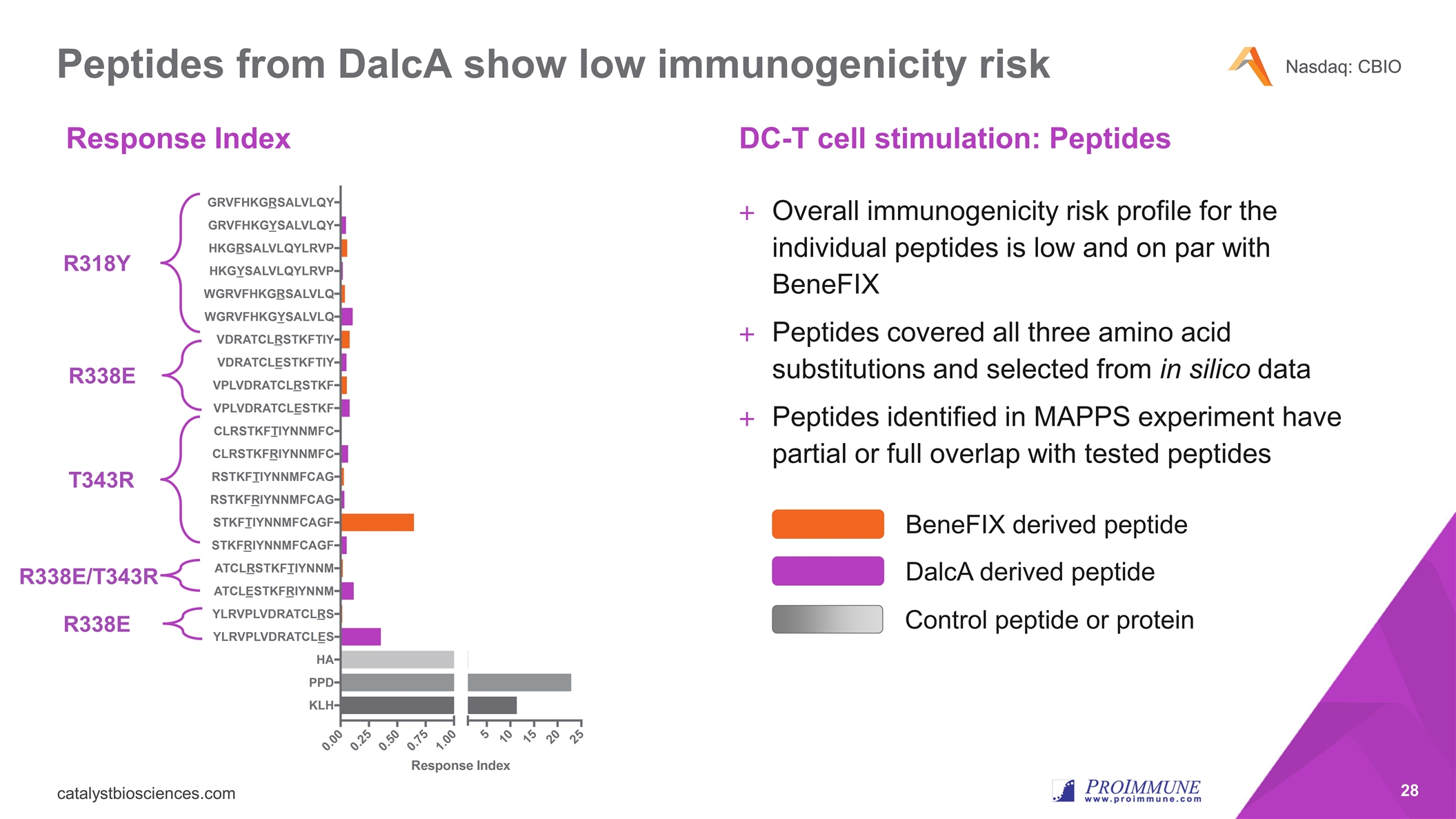

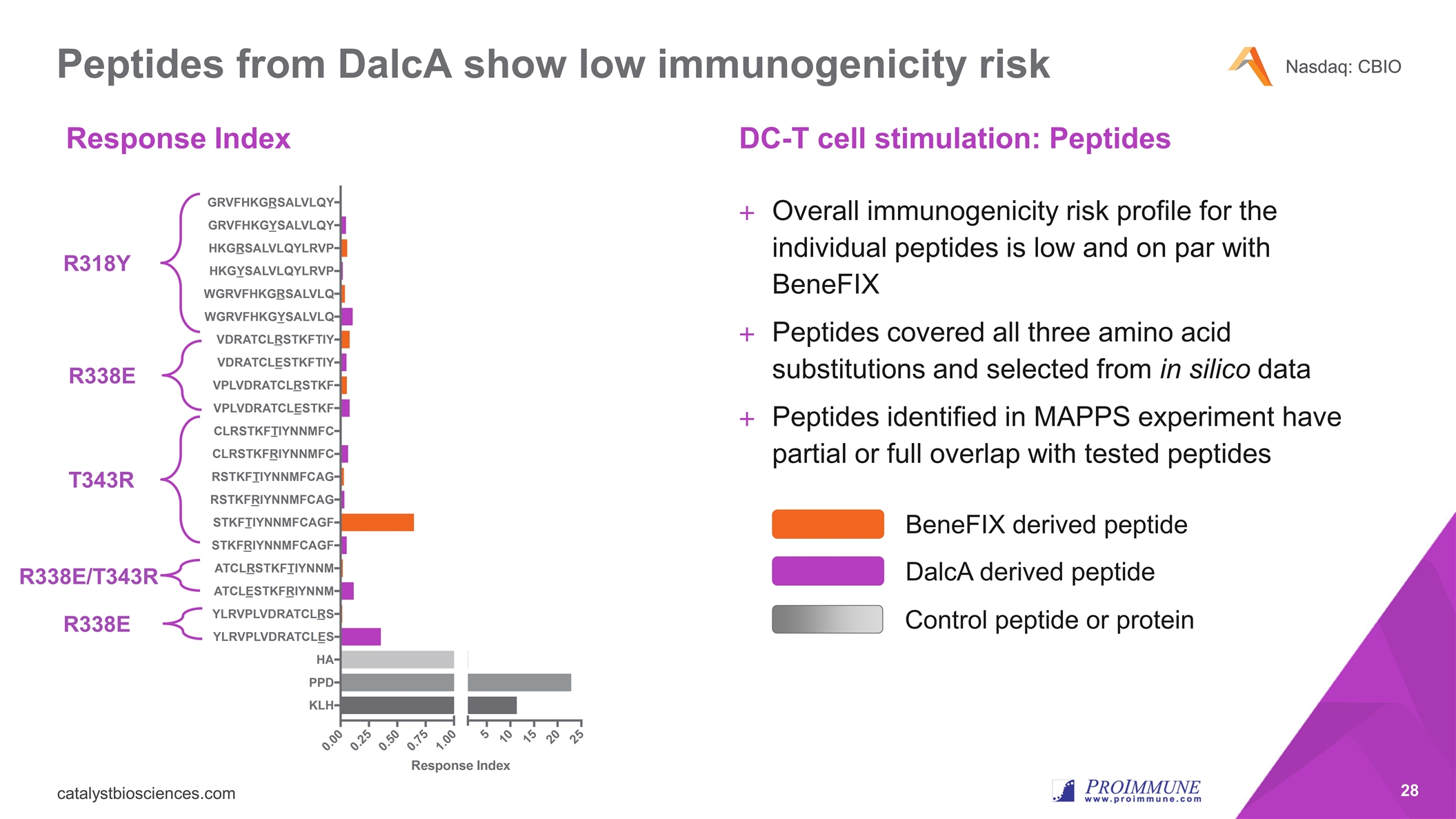

Peptides from DalcA show low immunogenicity risk Response Index DC-T cell stimulation: Peptides Overall immunogenicity risk profile for the individual peptides is low and on par with BeneFIX Peptides covered all three amino acid substitutions and selected from in silico data Peptides identified in MAPPS experiment have partial or full overlap with tested peptides R318Y R338E T343R R338E R338E/T343R BeneFIX derived peptide DalcA derived peptide Control peptide or protein

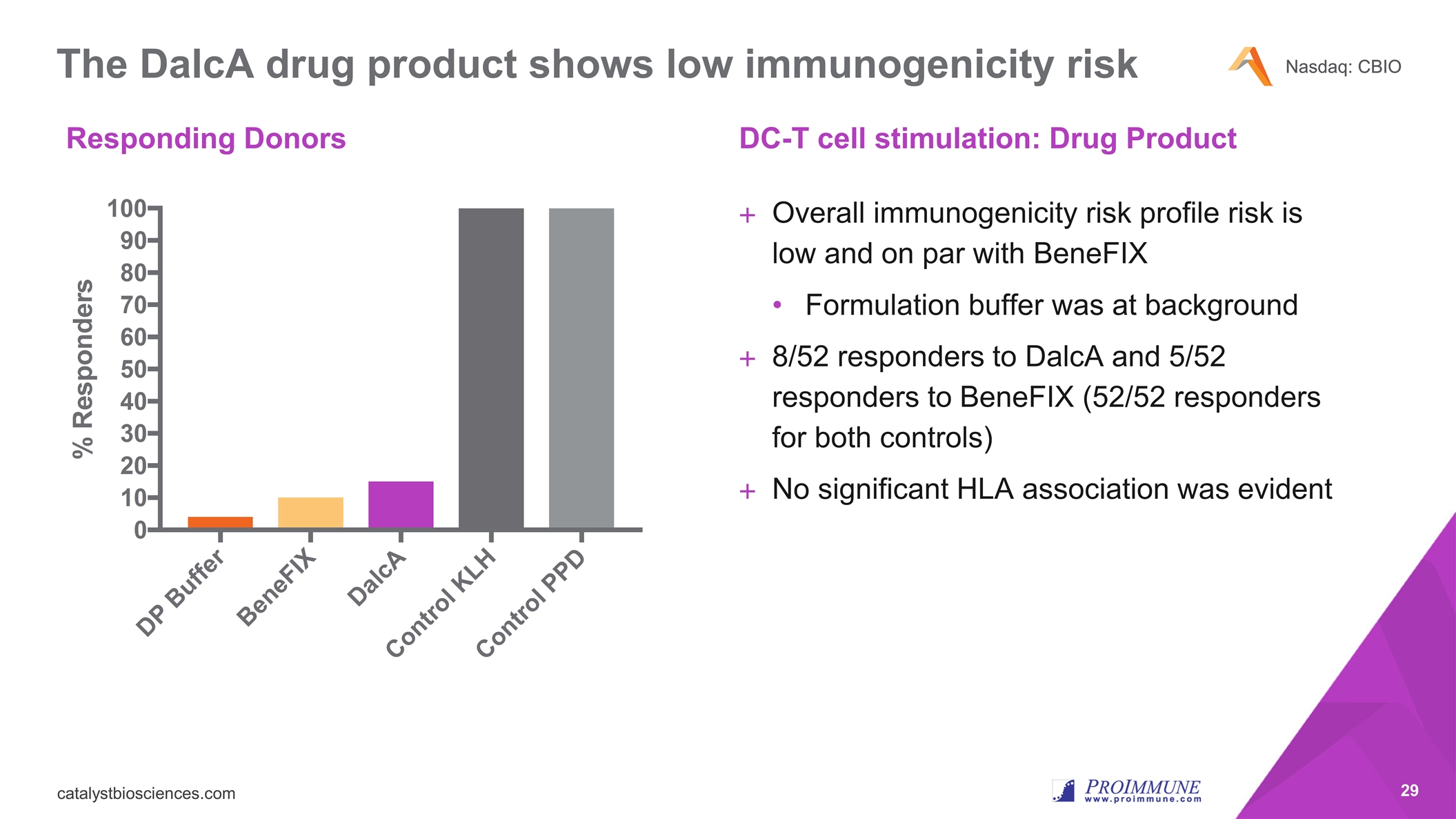

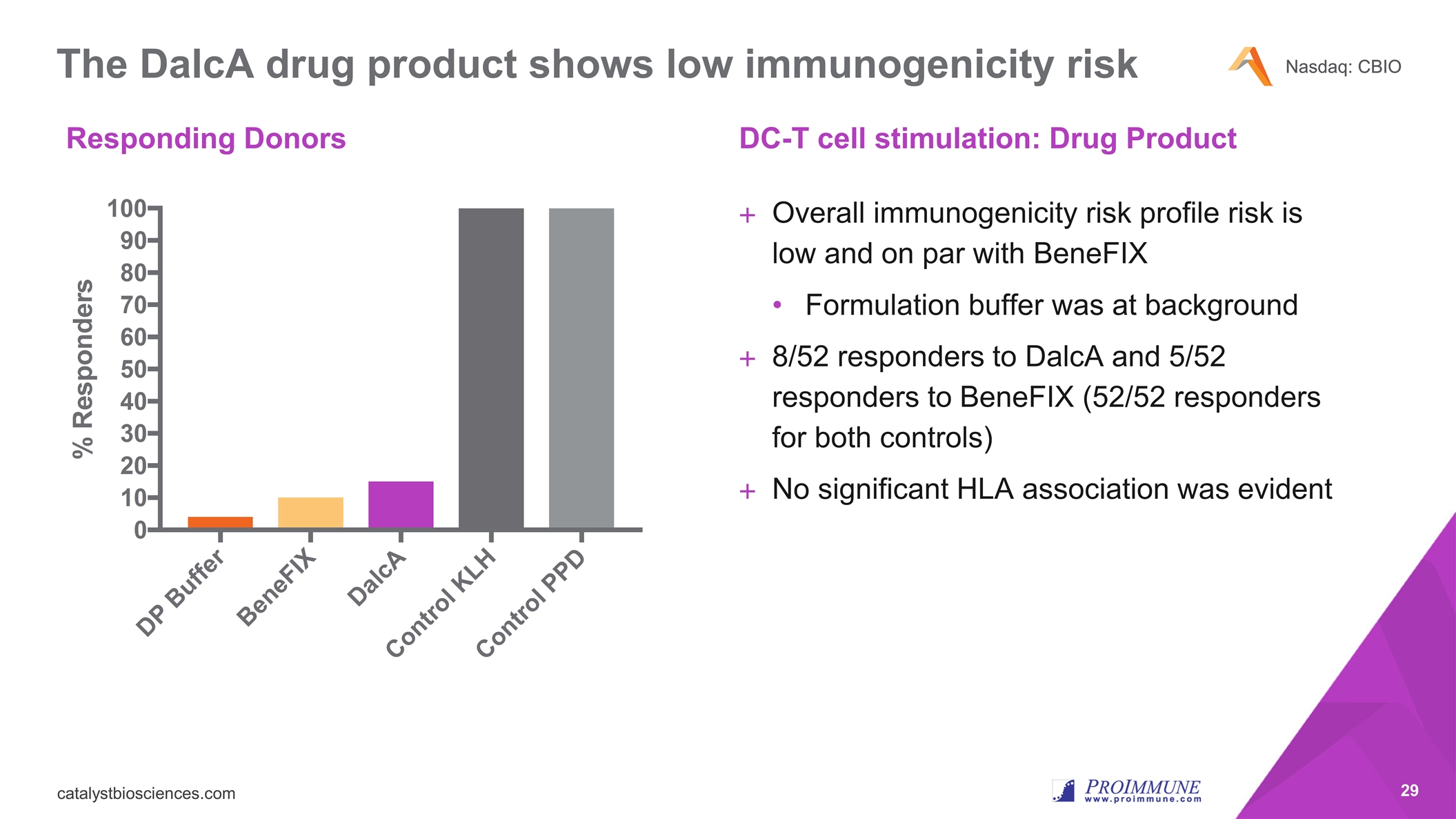

The DalcA drug product shows low immunogenicity risk Responding Donors DC-T cell stimulation: Drug Product Overall immunogenicity risk profile risk is low and on par with BeneFIX Formulation buffer was at background 8/52 responders to DalcA and 5/52 responders to BeneFIX (52/52 responders for both controls) No significant HLA association was evident

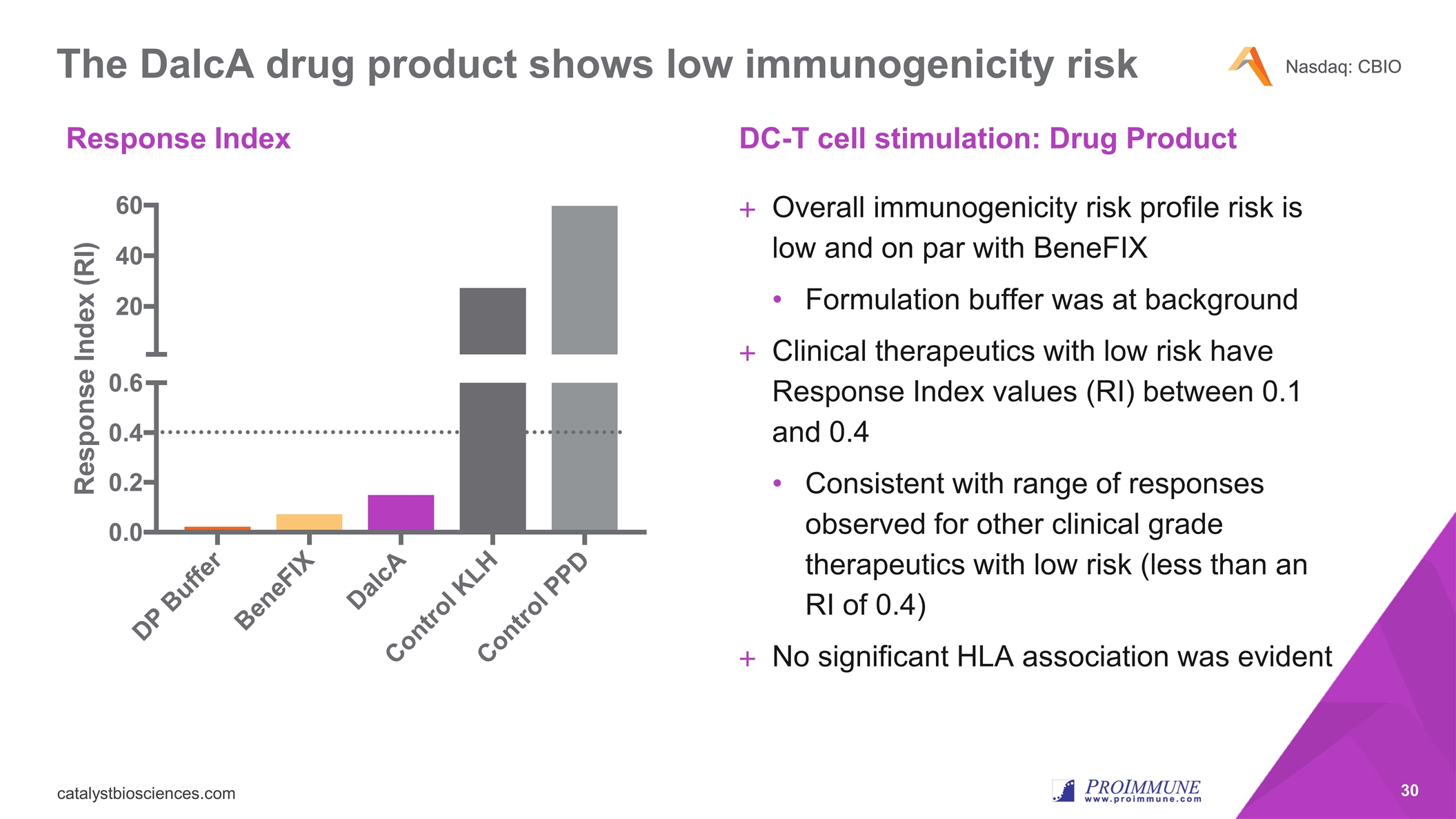

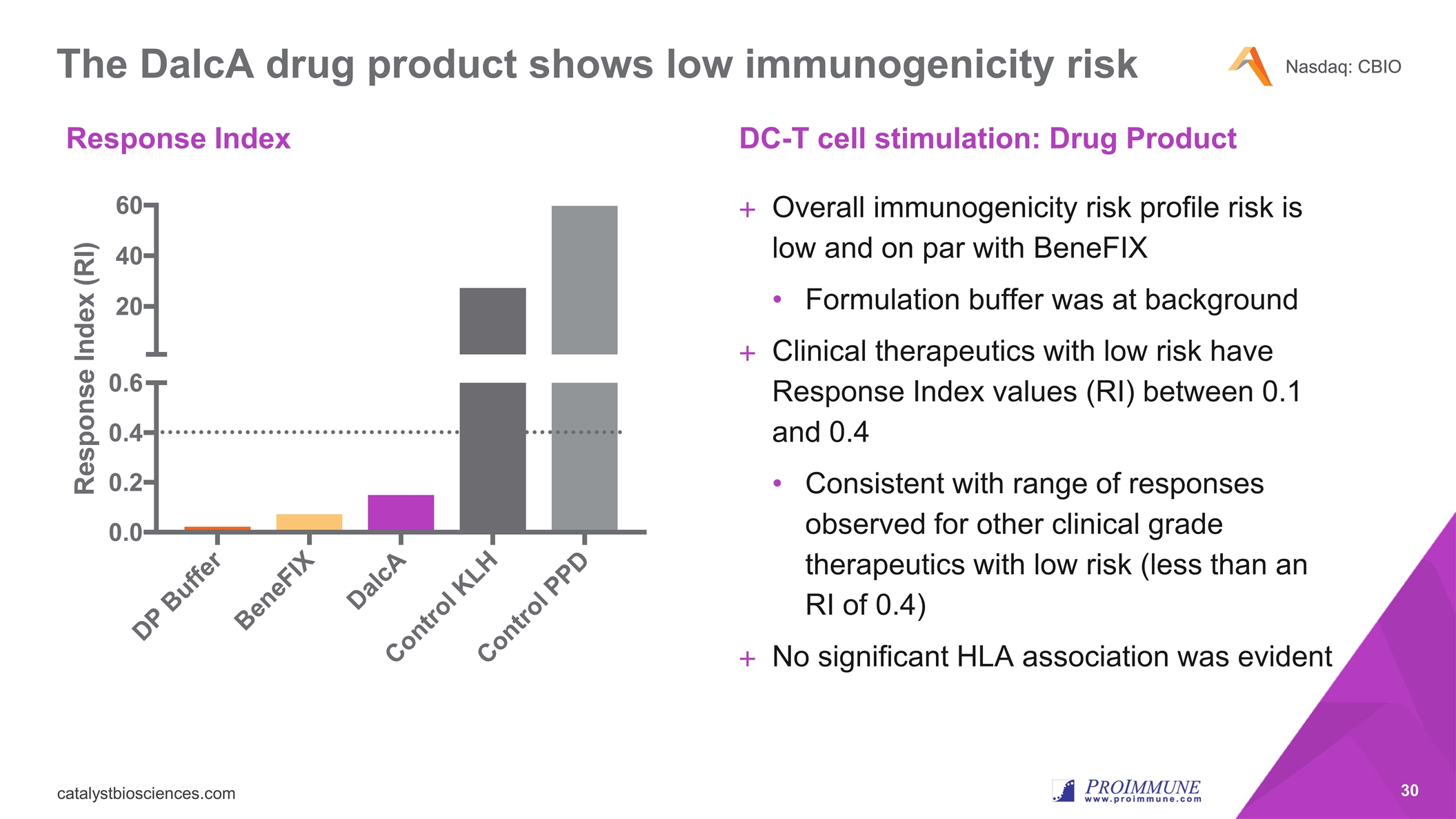

Response Index DC-T cell stimulation: Drug Product Overall immunogenicity risk profile risk is low and on par with BeneFIX Formulation buffer was at background Clinical therapeutics with low risk have Response Index values (RI) between 0.1 and 0.4 Consistent with range of responses observed for other clinical grade therapeutics with low risk (less than an RI of 0.4) No significant HLA association was evident The DalcA drug product shows low immunogenicity risk

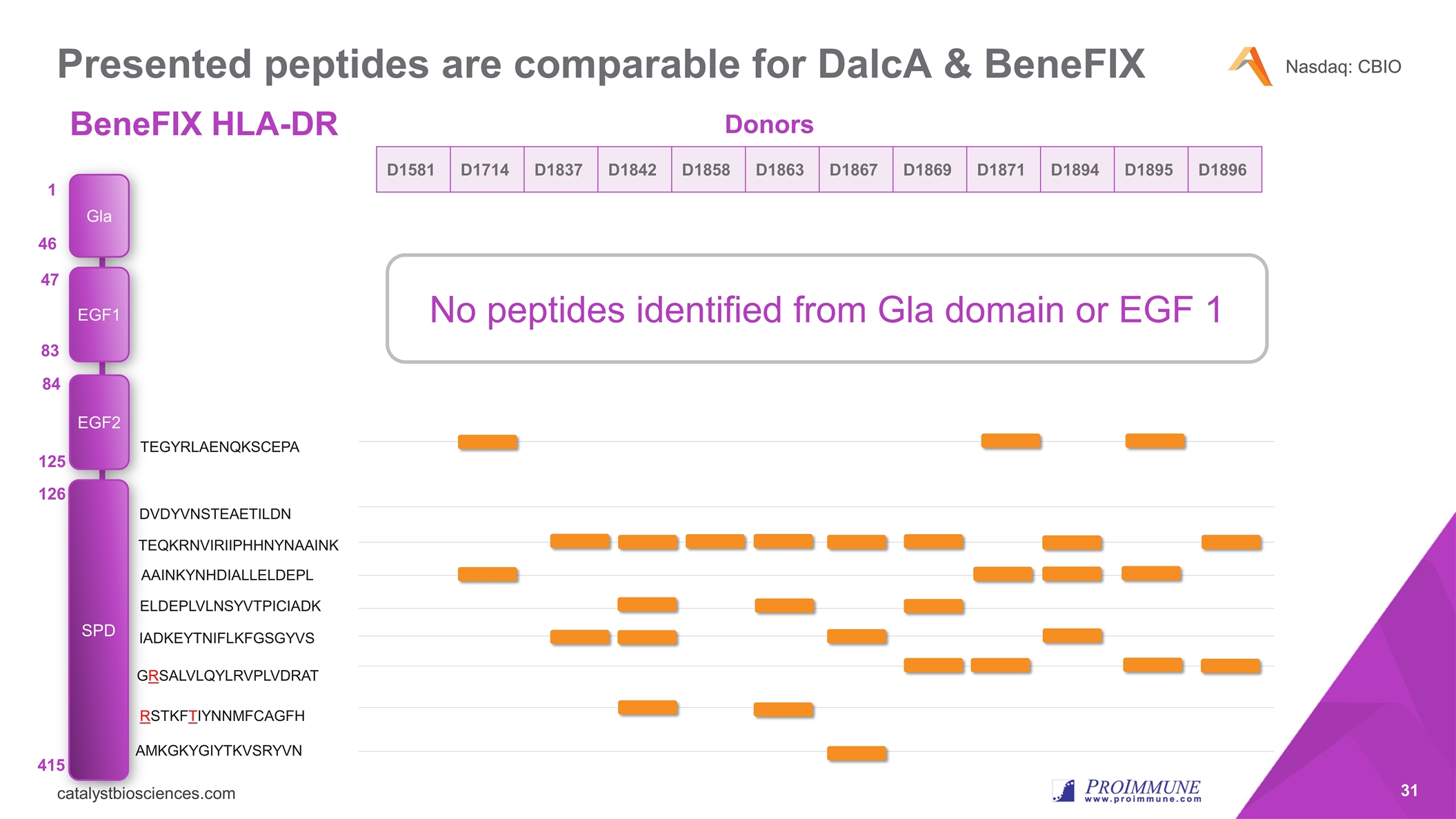

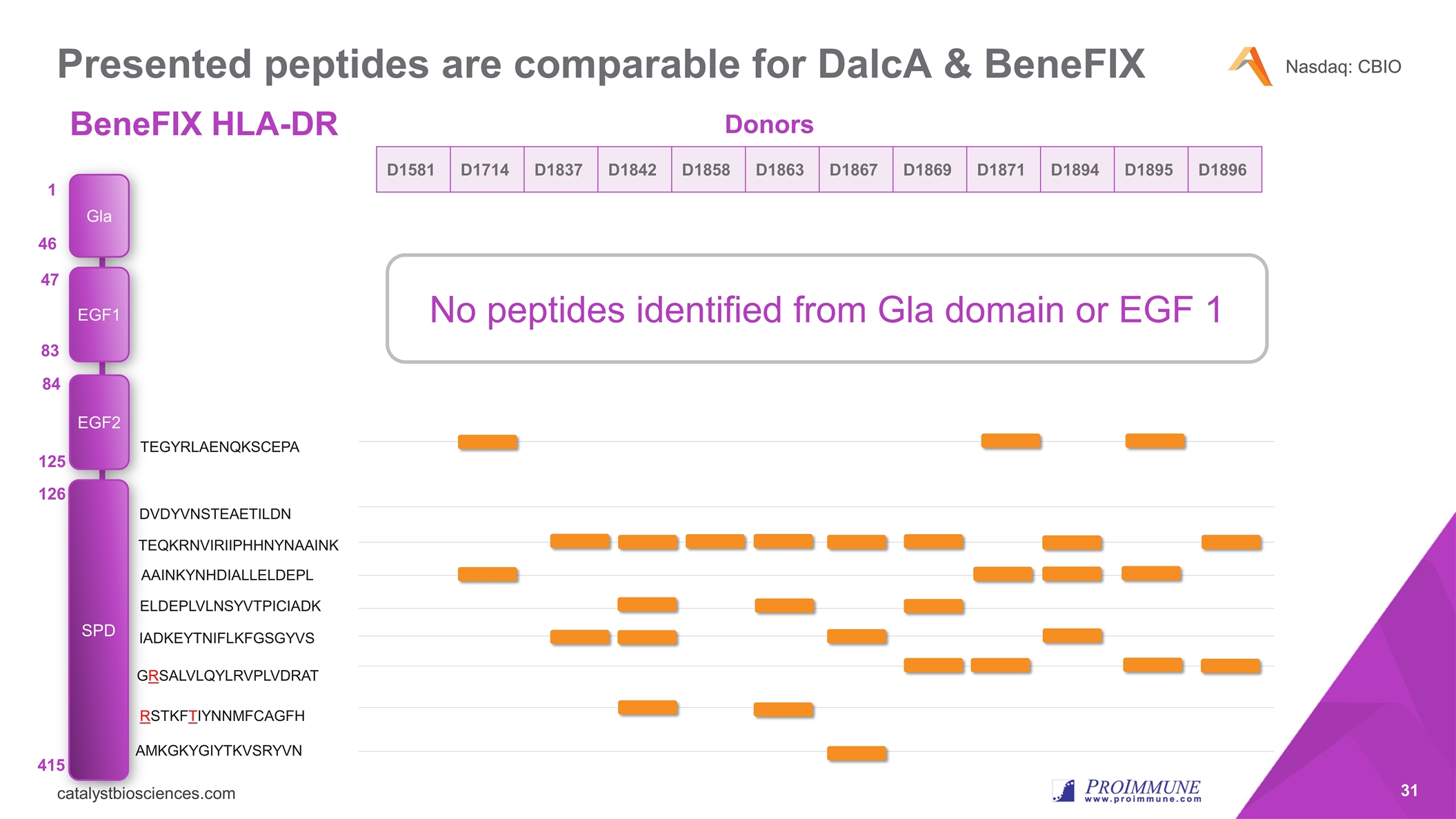

Presented peptides are comparable for DalcA & BeneFIX TEGYRLAENQKSCEPA Gla EGF1 EGF2 SPD 46 1 47 83 84 125 415 126 DVDYVNSTEAETILDN TEQKRNVIRIIPHHNYNAAINK AAINKYNHDIALLELDEPL ELDEPLVLNSYVTPICIADK IADKEYTNIFLKFGSGYVS GRSALVLQYLRVPLVDRAT RSTKFTIYNNMFCAGFH AMKGKYGIYTKVSRYVN No peptides identified from Gla domain or EGF 1 D1581 D1714 D1837 D1842 D1858 D1863 D1867 D1869 D1871 D1894 D1895 D1896 Donors BeneFIX HLA-DR

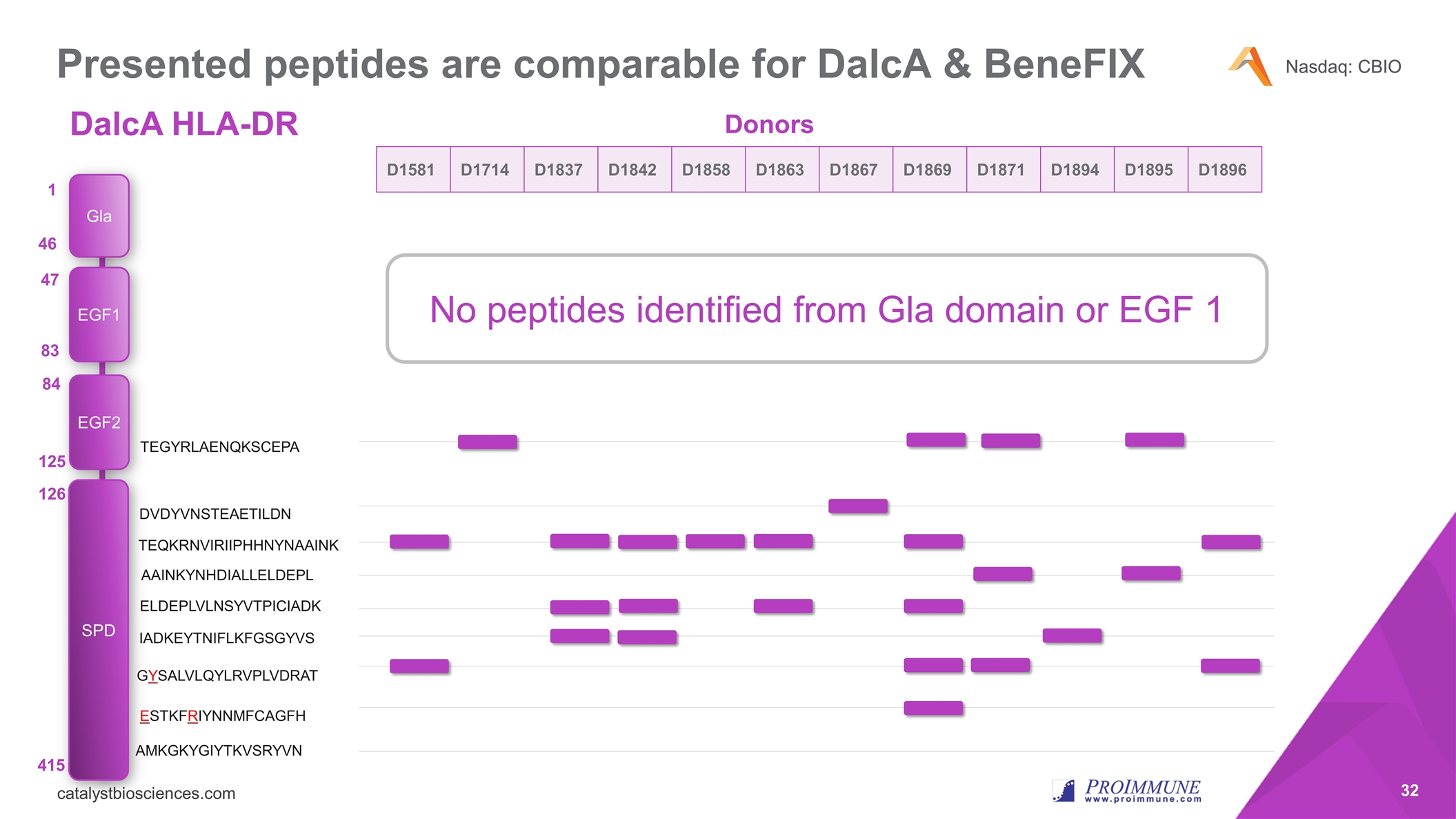

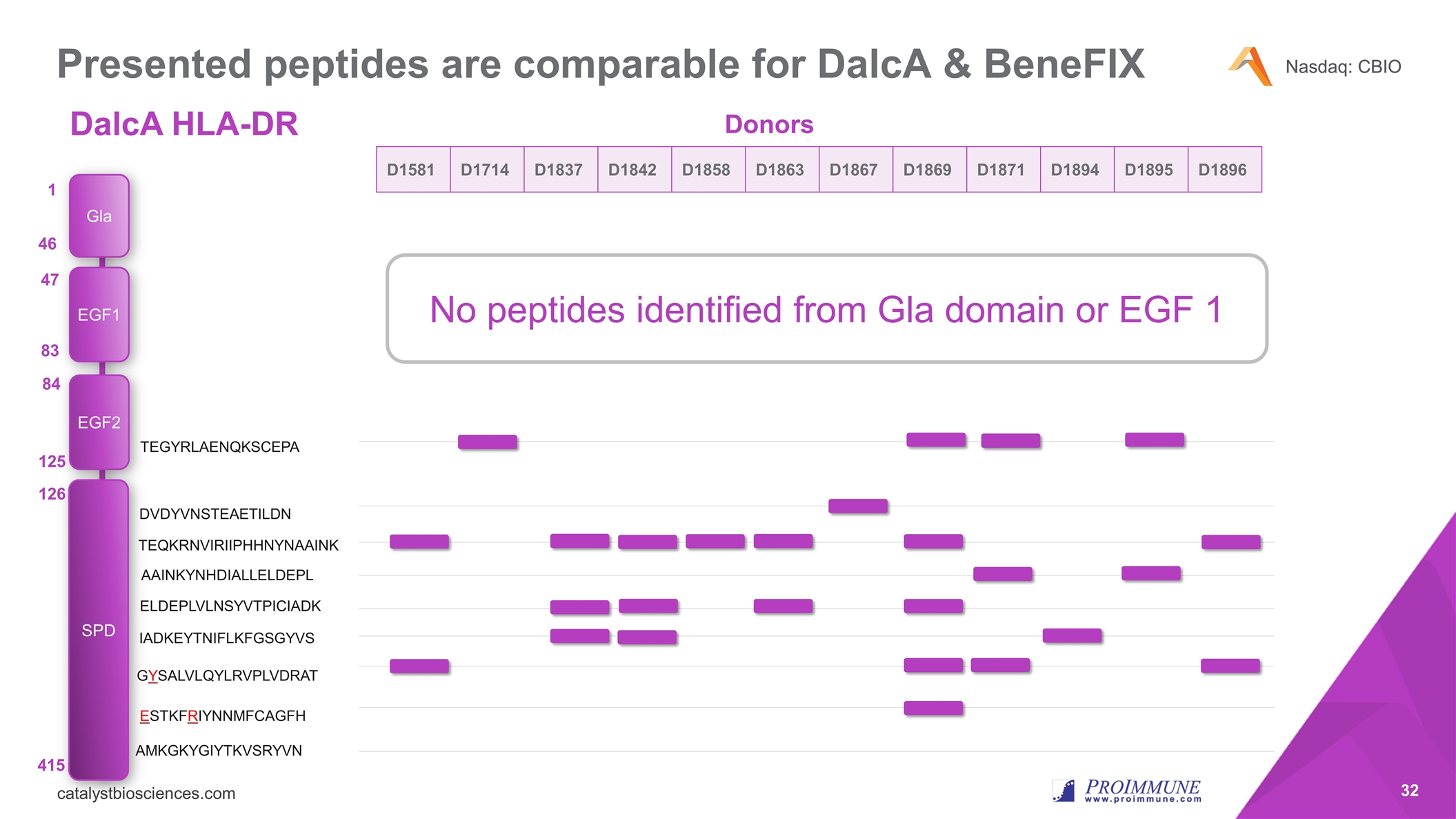

Presented peptides are comparable for DalcA & BeneFIX TEGYRLAENQKSCEPA Gla EGF1 EGF2 SPD 46 1 47 83 84 125 415 126 DVDYVNSTEAETILDN TEQKRNVIRIIPHHNYNAAINK AAINKYNHDIALLELDEPL ELDEPLVLNSYVTPICIADK IADKEYTNIFLKFGSGYVS GYSALVLQYLRVPLVDRAT ESTKFRIYNNMFCAGFH AMKGKYGIYTKVSRYVN D1581 D1714 D1837 D1842 D1858 D1863 D1867 D1869 D1871 D1894 D1895 D1896 Donors No peptides identified from Gla domain or EGF 1 DalcA HLA-DR

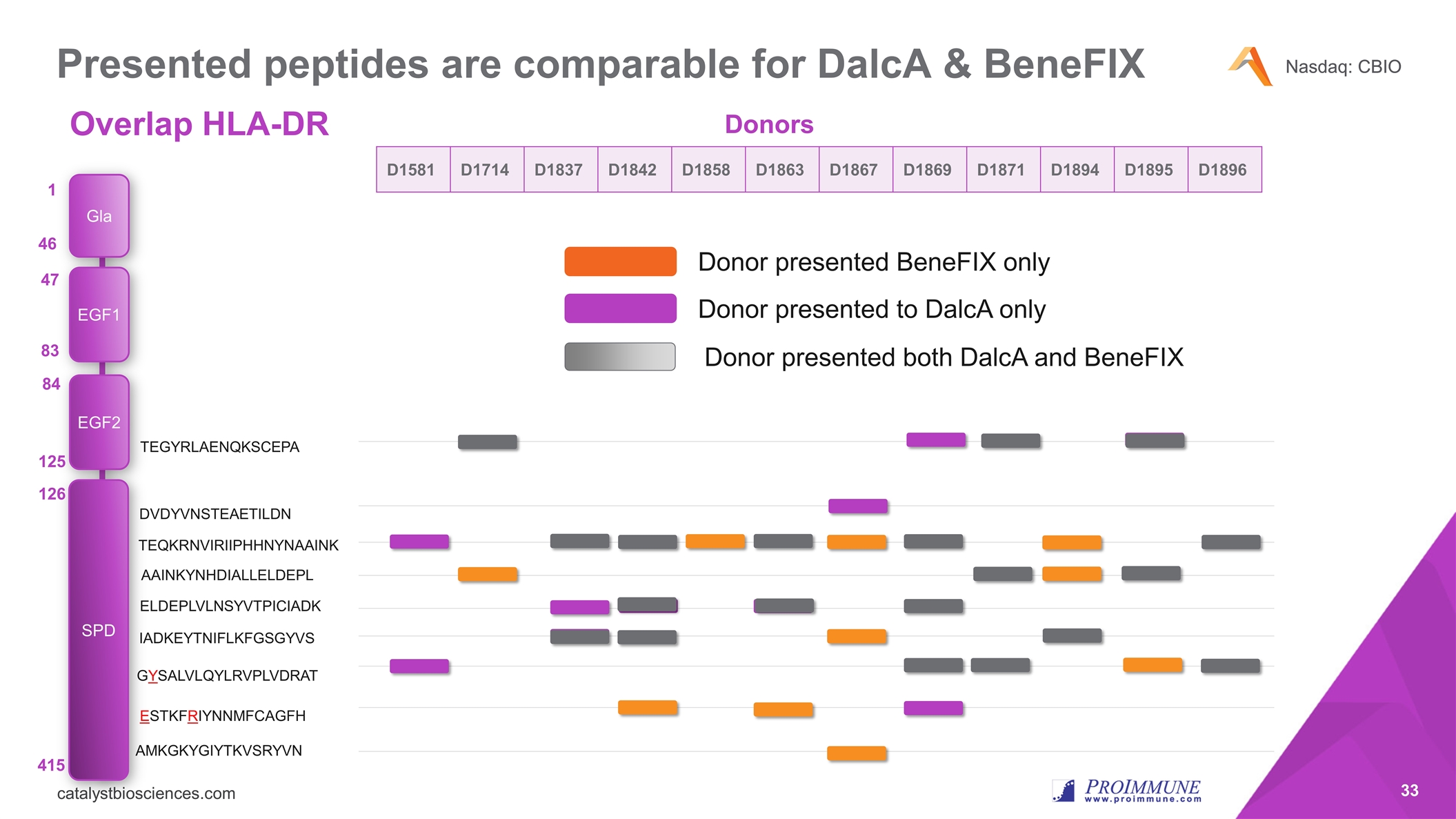

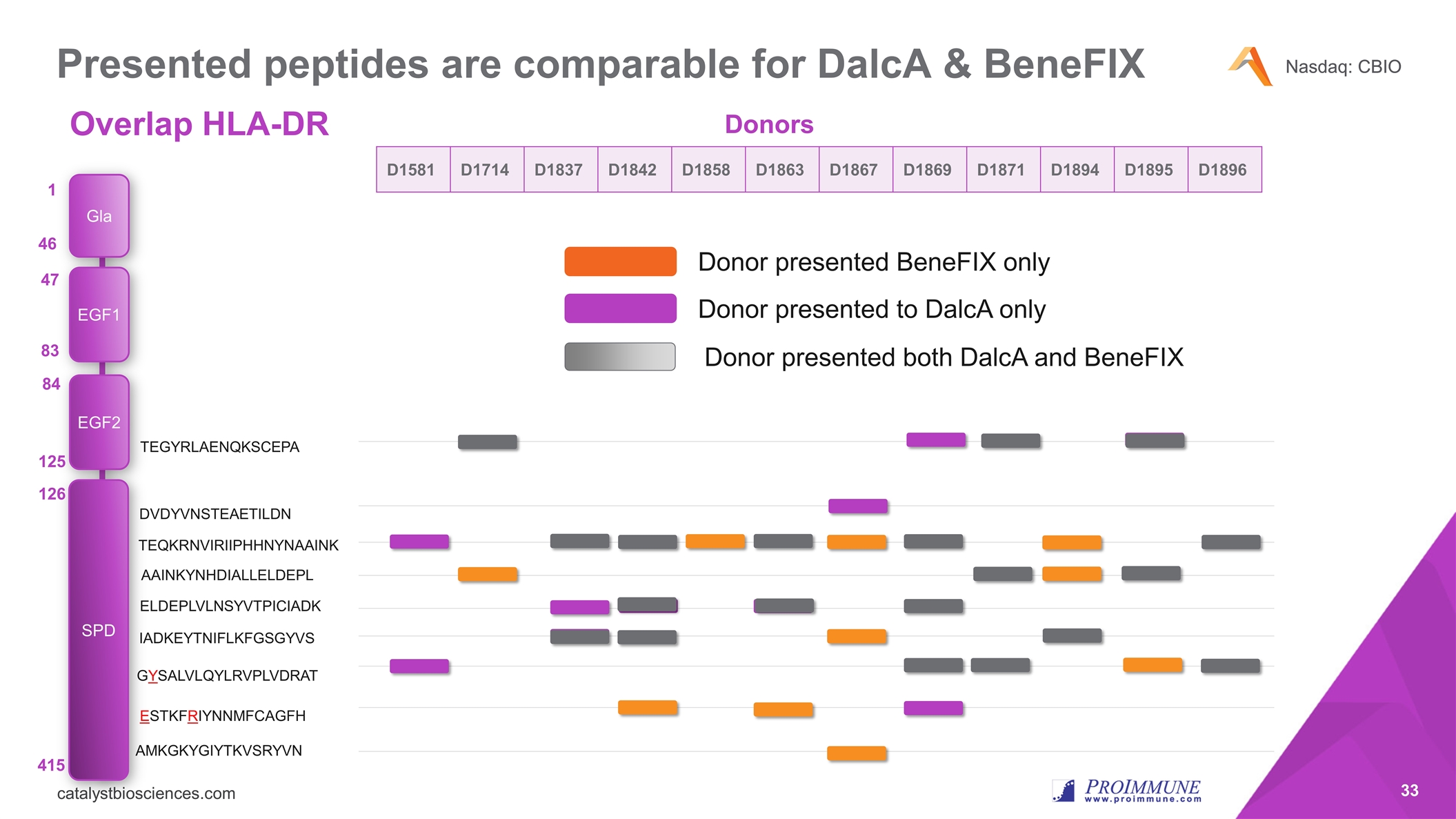

Presented peptides are comparable for DalcA & BeneFIX TEGYRLAENQKSCEPA Gla EGF1 EGF2 SPD 46 1 47 83 84 125 415 126 DVDYVNSTEAETILDN TEQKRNVIRIIPHHNYNAAINK AAINKYNHDIALLELDEPL ELDEPLVLNSYVTPICIADK IADKEYTNIFLKFGSGYVS GYSALVLQYLRVPLVDRAT ESTKFRIYNNMFCAGFH AMKGKYGIYTKVSRYVN D1581 D1714 D1837 D1842 D1858 D1863 D1867 D1869 D1871 D1894 D1895 D1896 Donors Donor presented BeneFIX only Donor presented to DalcA only Donor presented both DalcA and BeneFIX Overlap HLA-DR

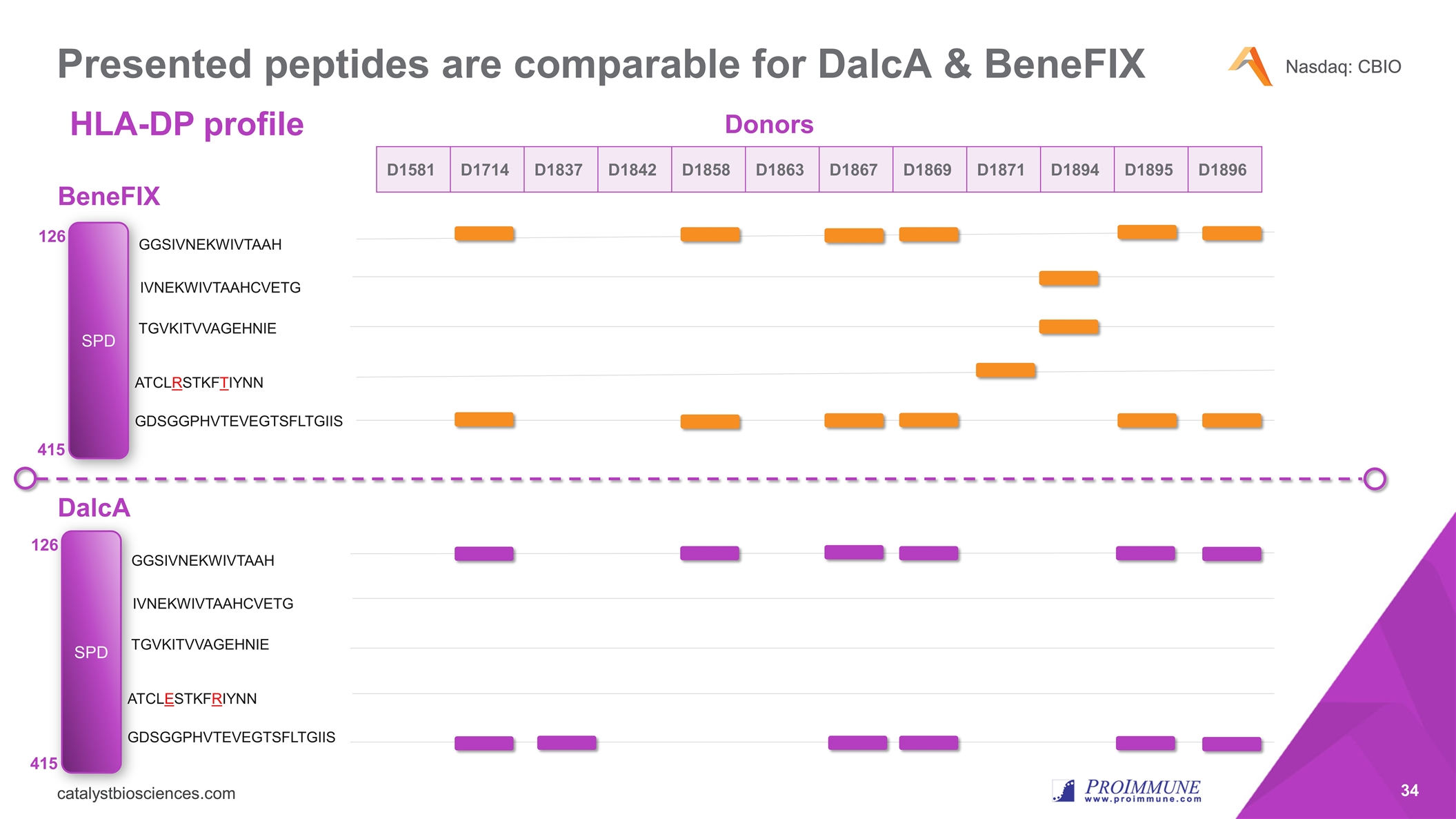

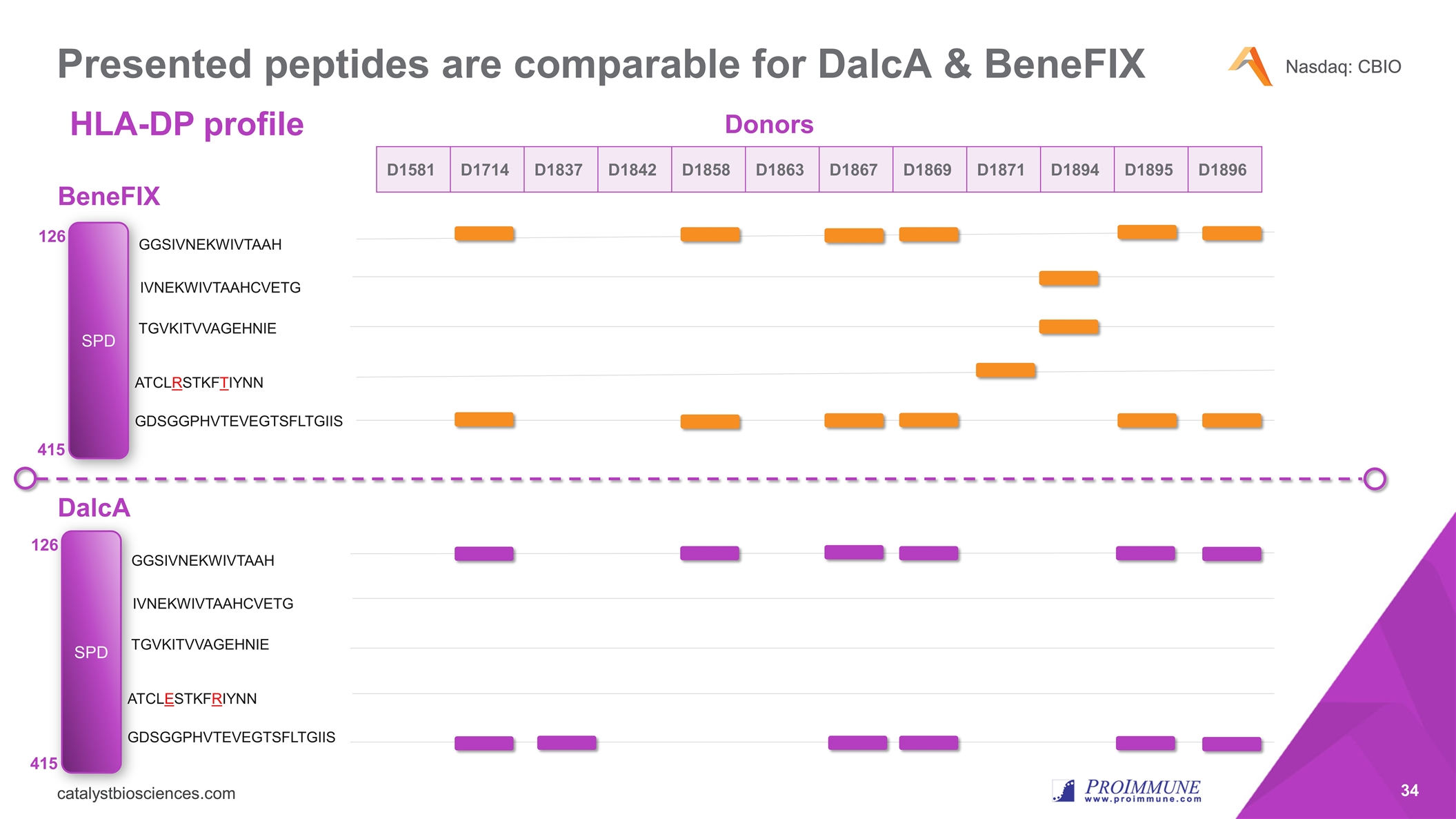

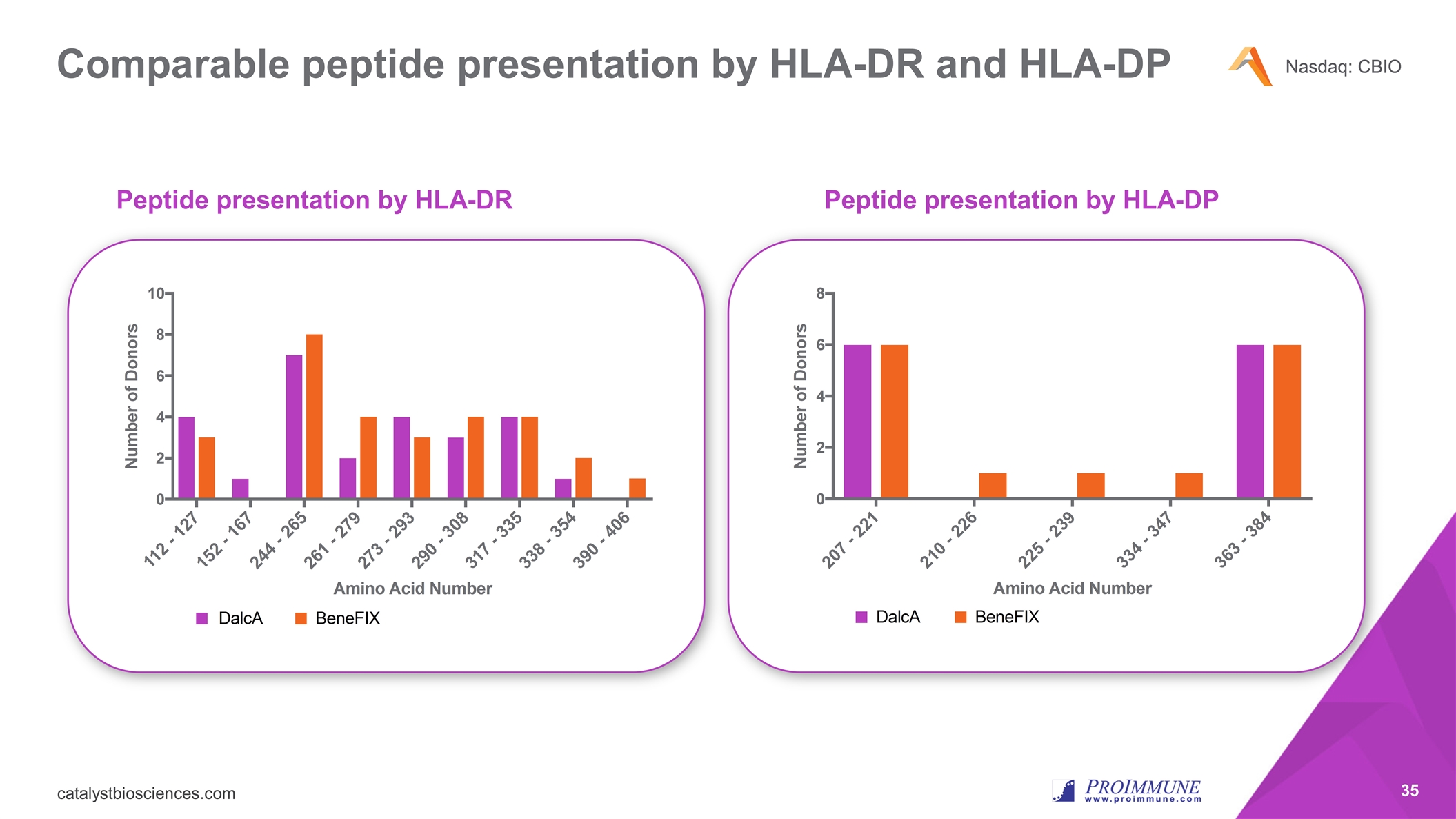

Presented peptides are comparable for DalcA & BeneFIX D1581 D1714 D1837 D1842 D1858 D1863 D1867 D1869 D1871 D1894 D1895 D1896 SPD 415 126 GGSIVNEKWIVTAAH IVNEKWIVTAAHCVETG TGVKITVVAGEHNIE ATCLESTKFRIYNN GDSGGPHVTEVEGTSFLTGIIS SPD 415 126 GGSIVNEKWIVTAAH IVNEKWIVTAAHCVETG TGVKITVVAGEHNIE ATCLRSTKFTIYNN GDSGGPHVTEVEGTSFLTGIIS BeneFIX DalcA Donors HLA-DP profile

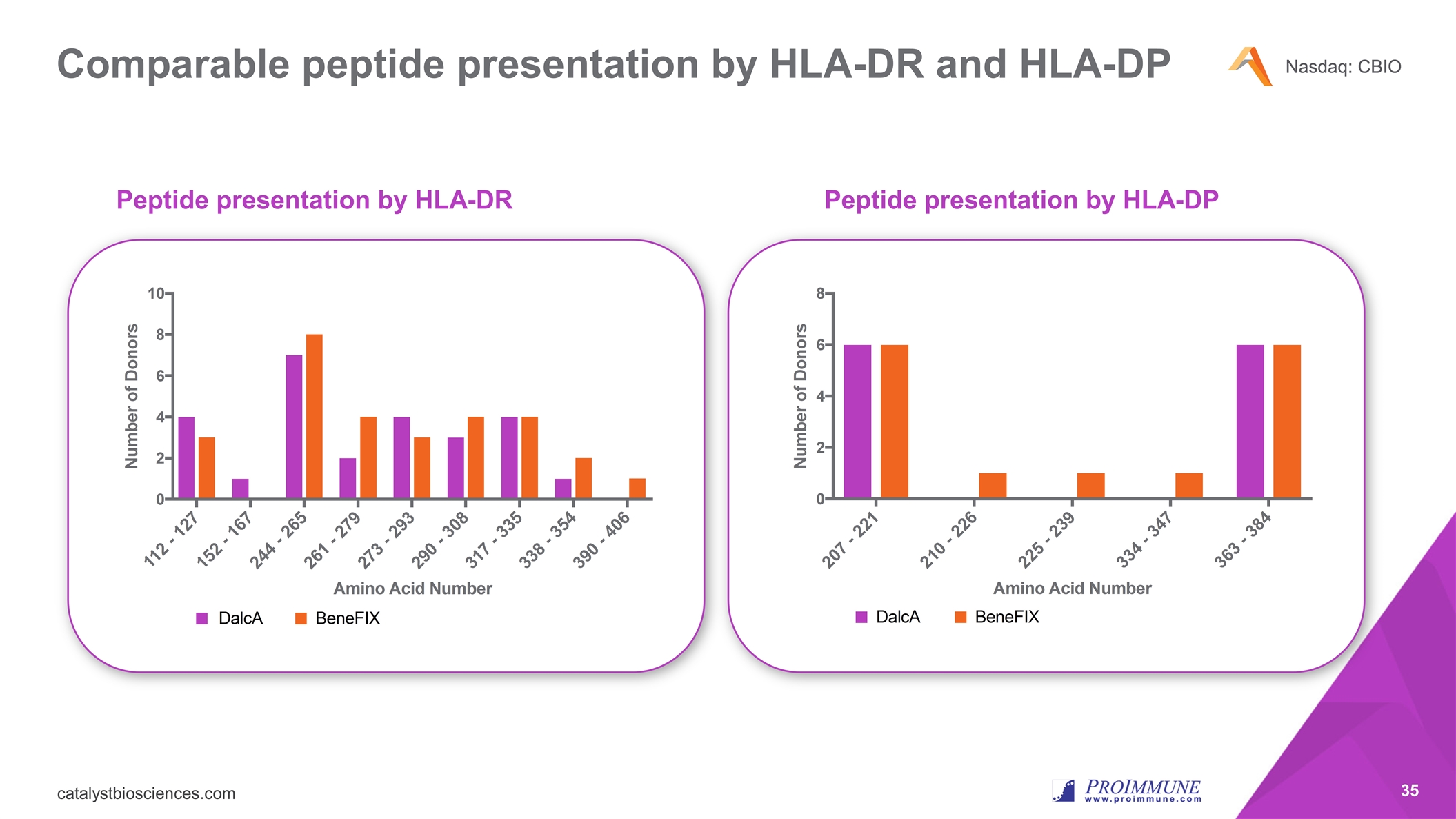

Comparable peptide presentation by HLA-DR and HLA-DP Peptide presentation by HLA-DR Peptide presentation by HLA-DP

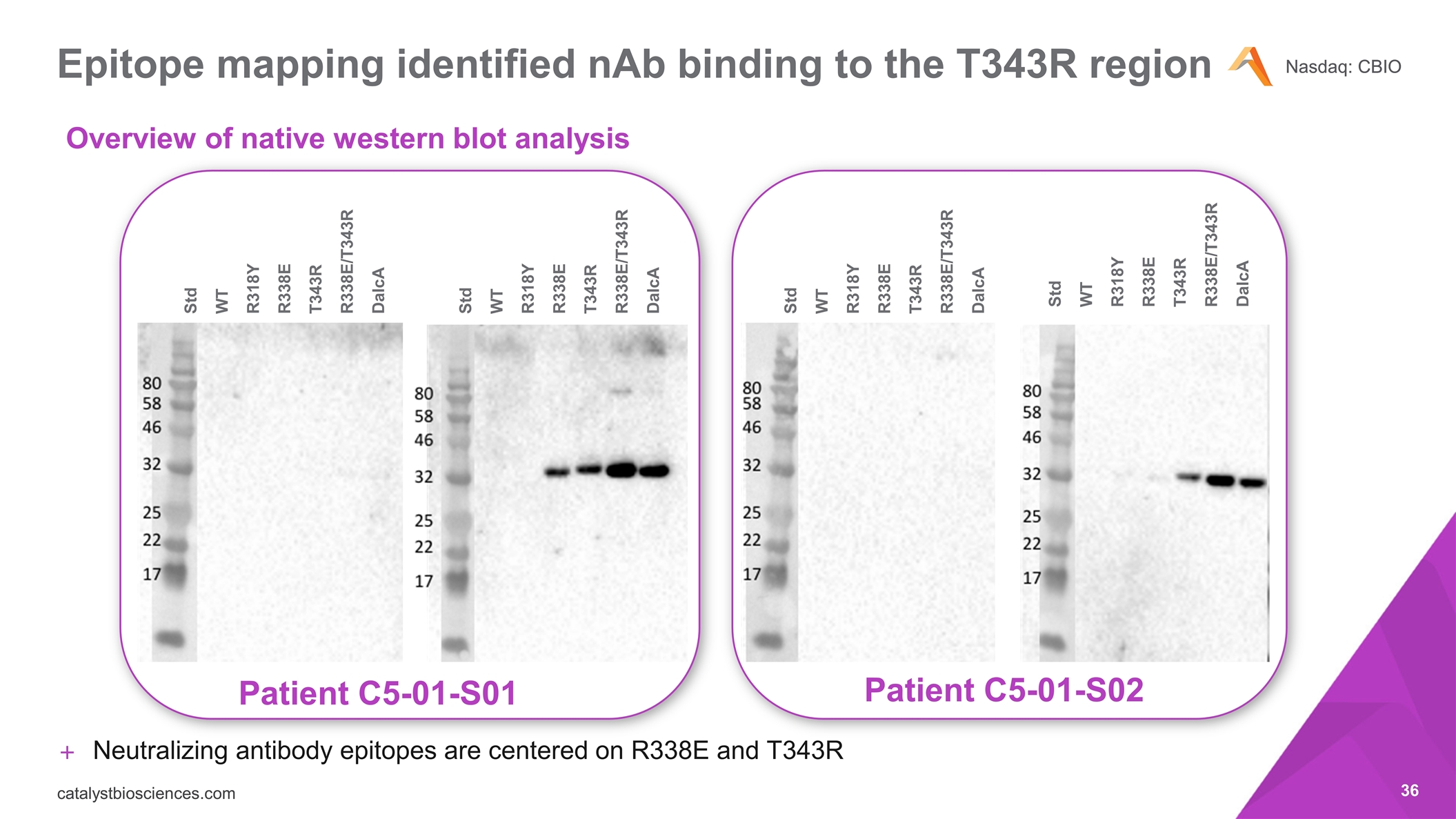

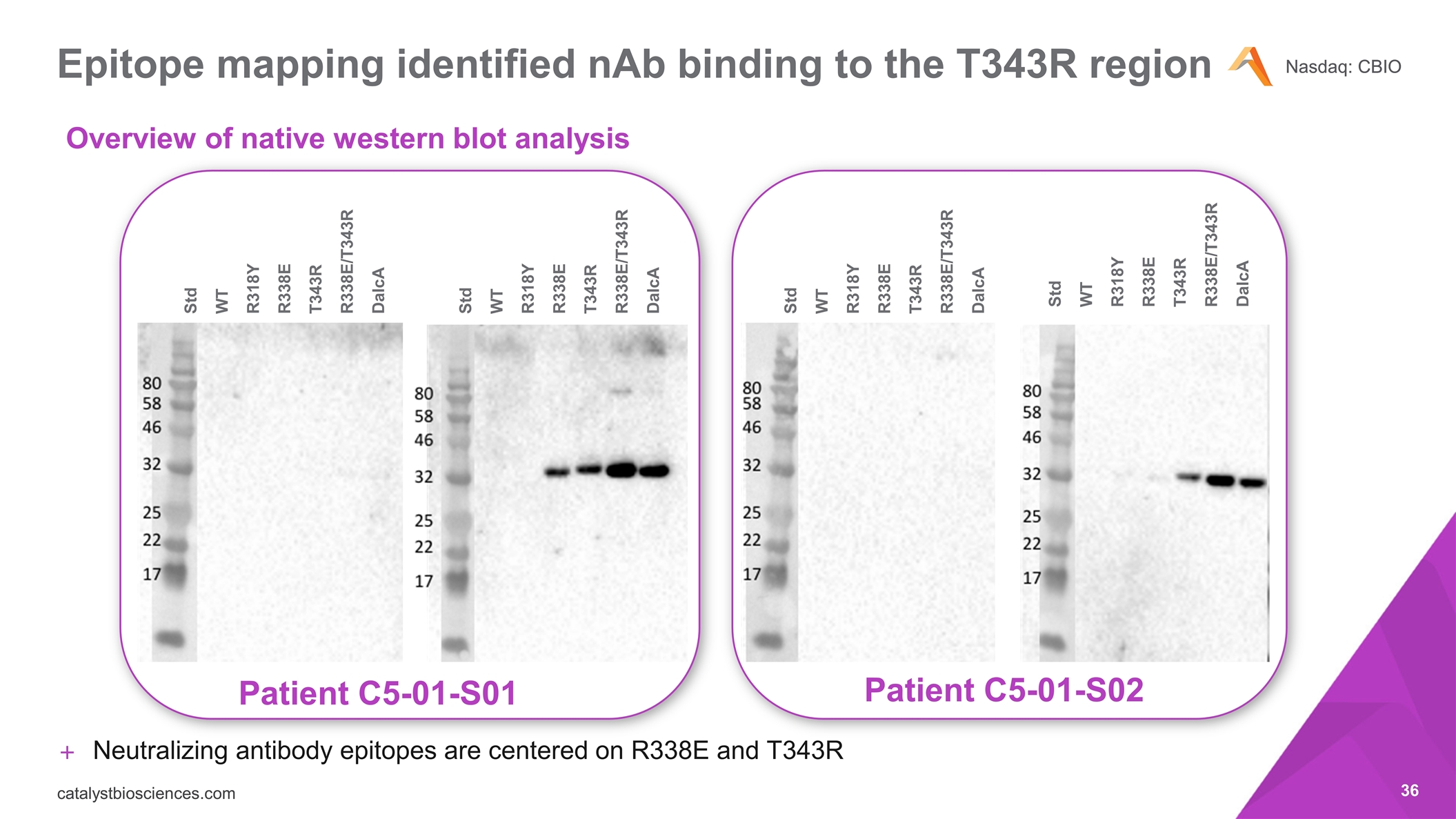

Neutralizing antibody epitopes are centered on R338E and T343R Epitope mapping identified nAb binding to the T343R region Overview of native western blot analysis Std WT R318Y R338E T343R R338E/T343R DalcA Std WT R318Y R338E T343R R338E/T343R DalcA Patient C5-01-S01 Std WT R318Y R338E T343R R338E/T343R DalcA Std WT R318Y R338E T343R R338E/T343R DalcA Patient C5-01-S02

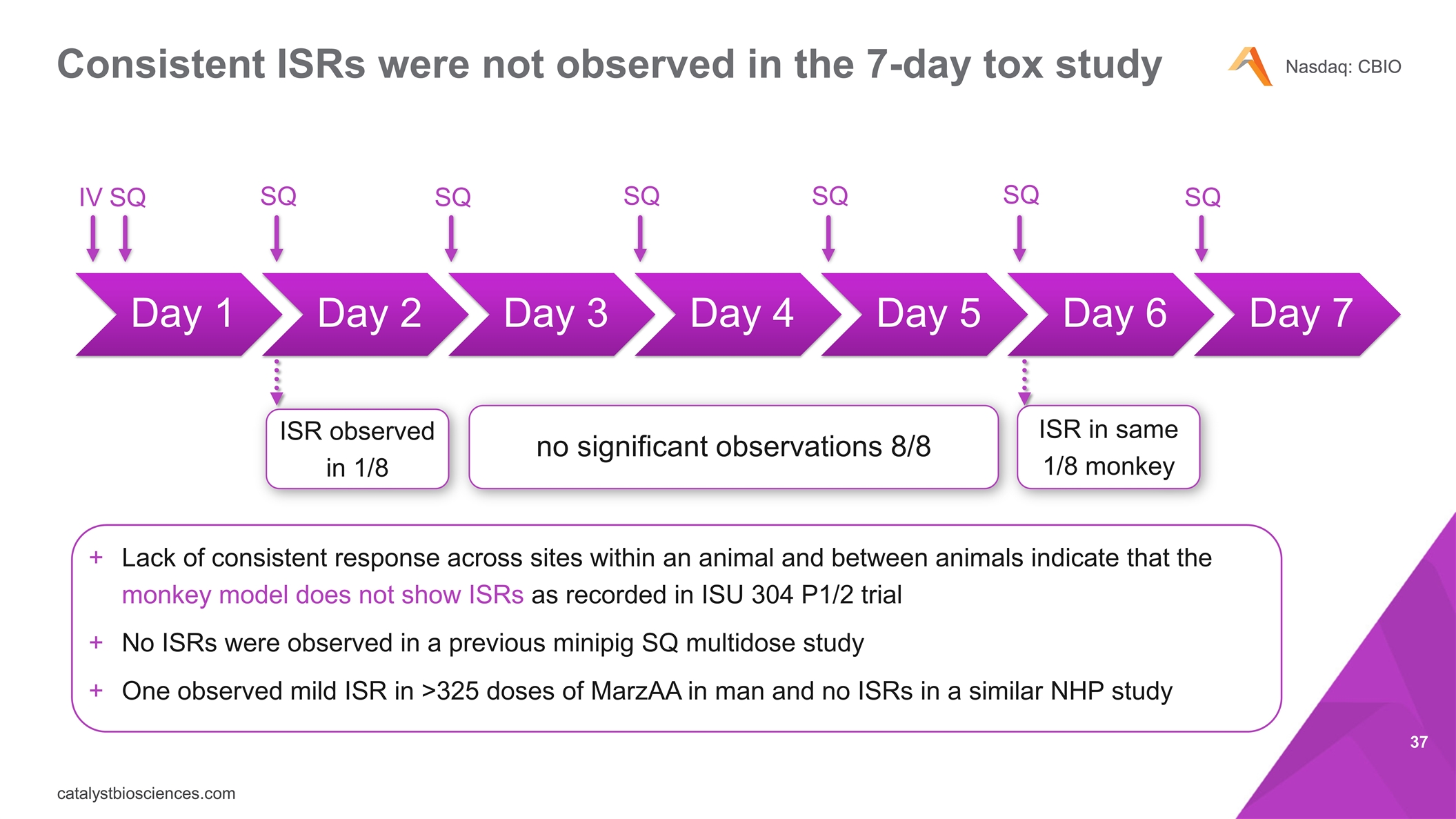

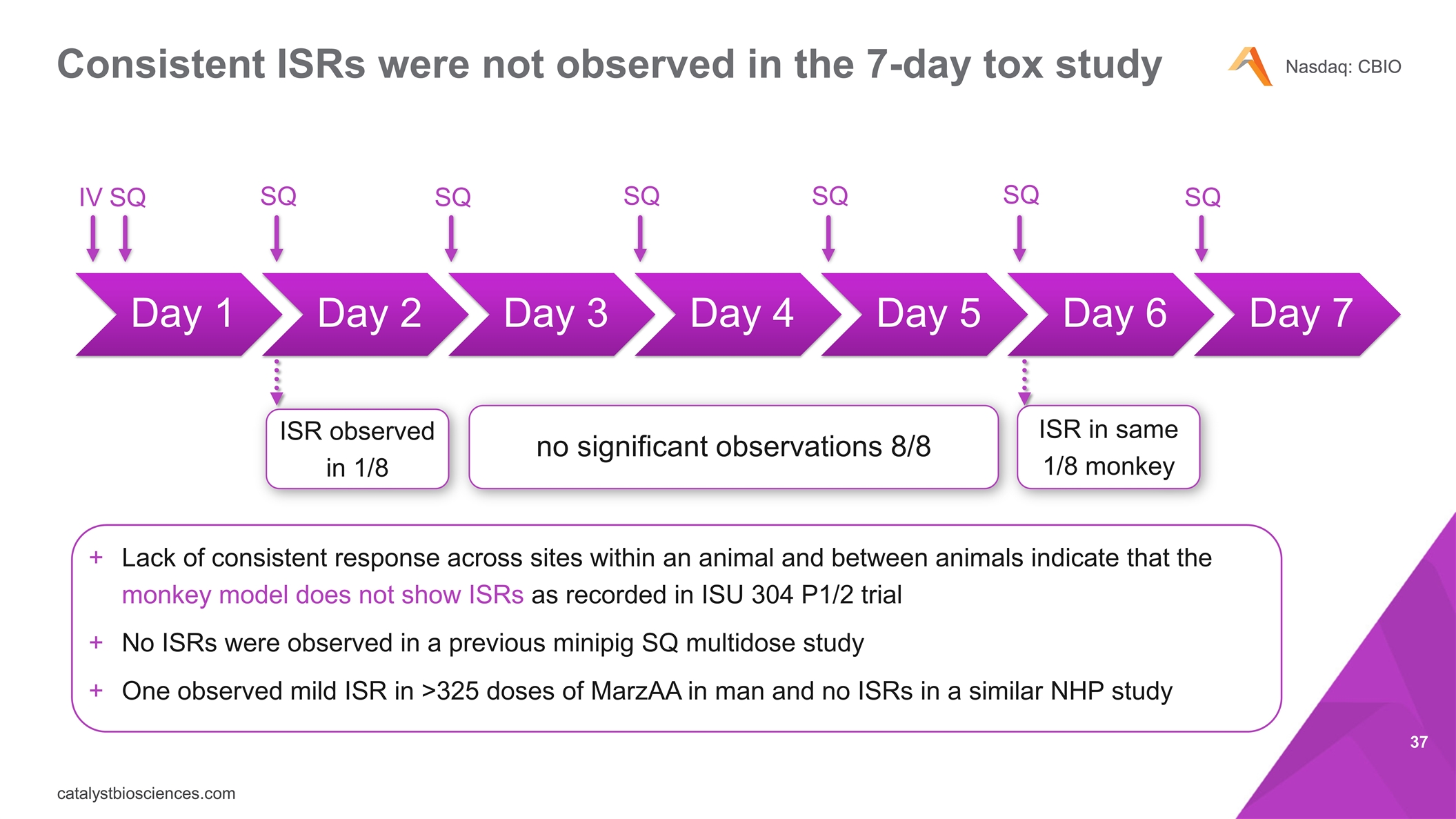

Consistent ISRs were not observed in the 7-day tox study IV SQ SQ SQ SQ SQ SQ SQ ISR observed in 1/8 ISR in same 1/8 monkey Lack of consistent response across sites within an animal and between animals indicate that the monkey model does not show ISRs as recorded in ISU 304 P1/2 trial No ISRs were observed in a previous minipig SQ multidose study One observed mild ISR in >325 doses of MarzAA in man and no ISRs in a similar NHP study no significant observations 8/8 Day 1 Day 5 Day 7 Day 2 Day 3 Day 4 Day 6

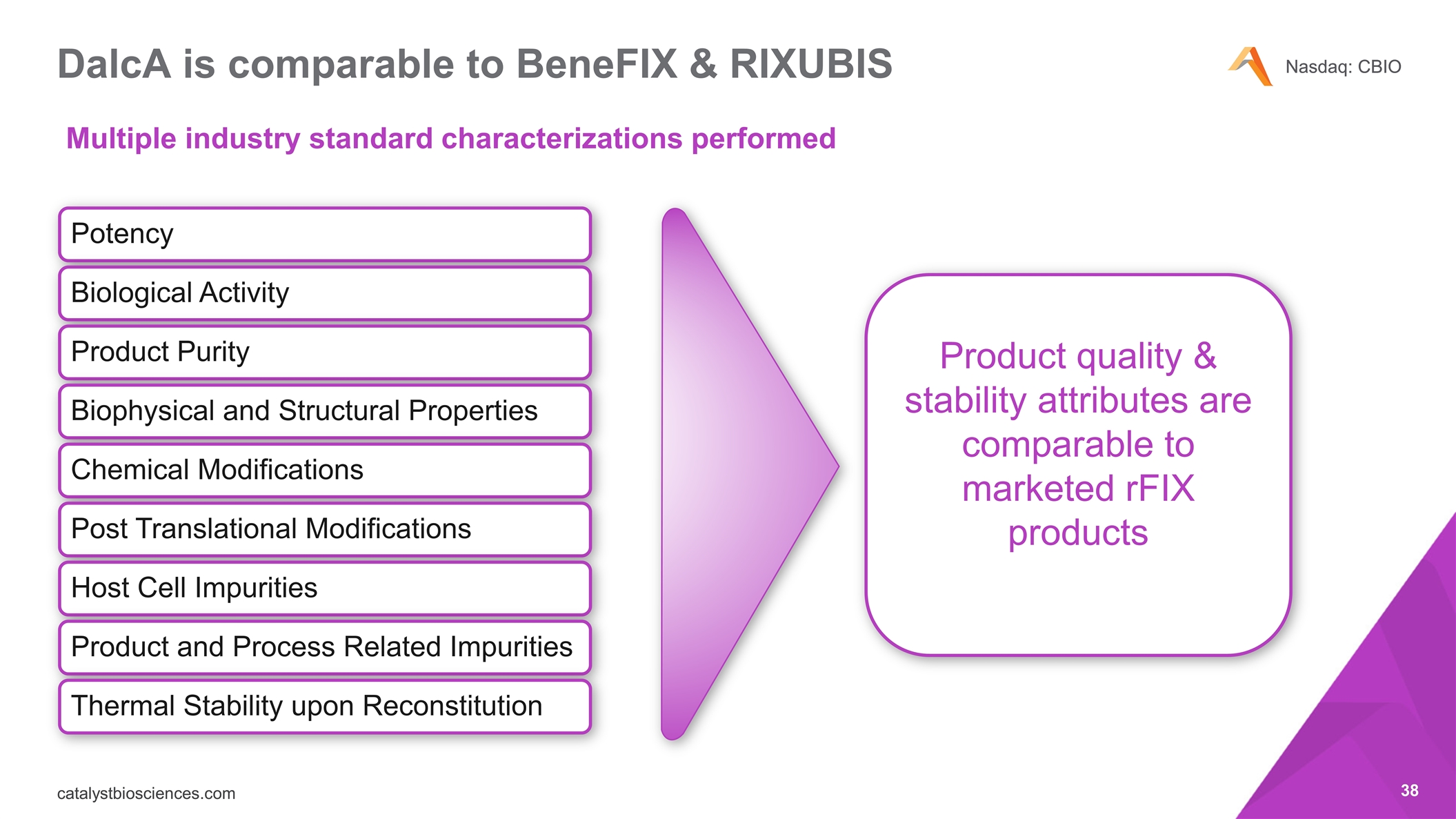

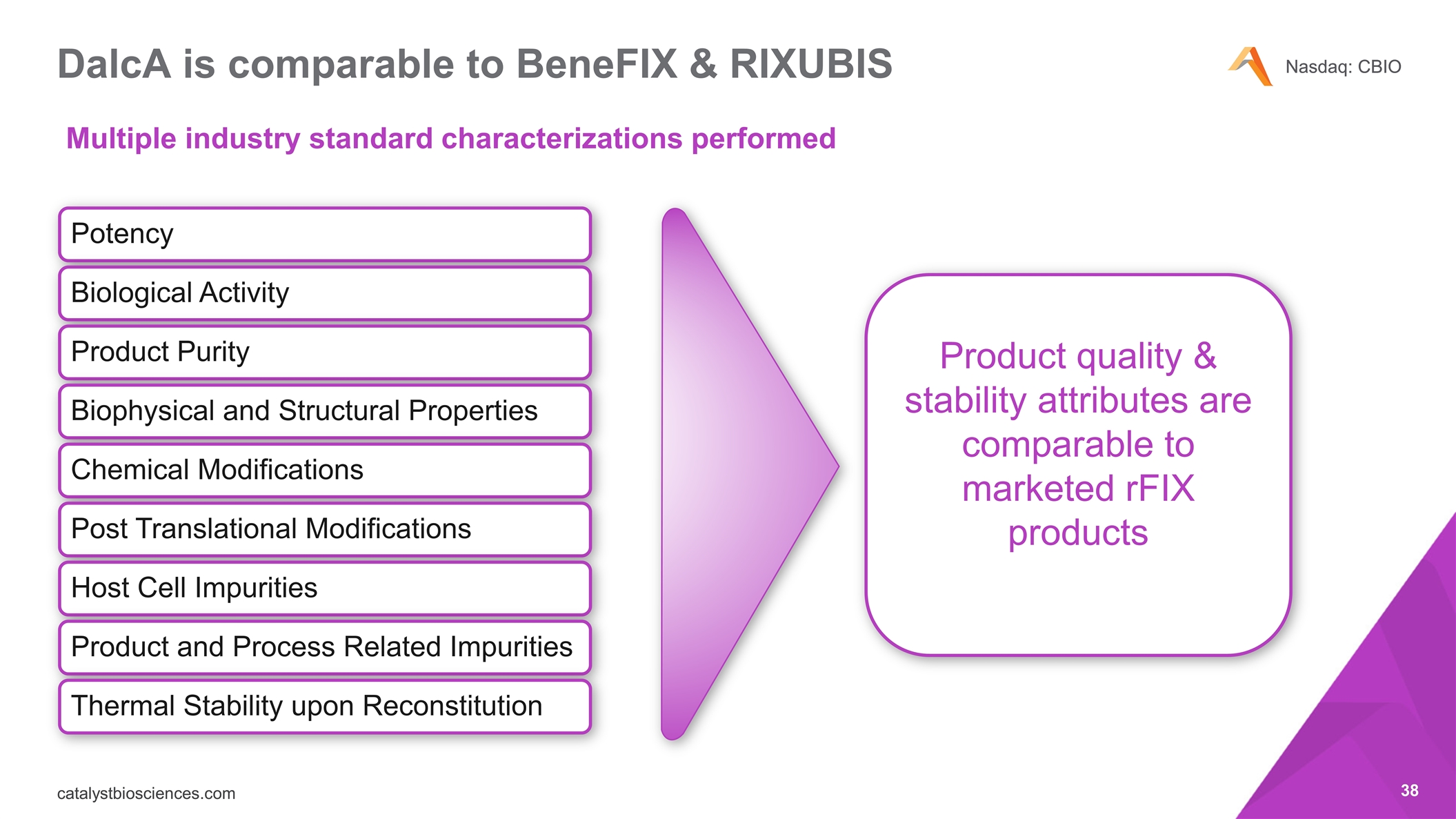

DalcA is comparable to BeneFIX & RIXUBIS Multiple industry standard characterizations performed Product quality & stability attributes are comparable to marketed rFIX products Potency Biological Activity Product Purity Biophysical and Structural Properties Chemical Modifications Post Translational Modifications Host Cell Impurities Product and Process Related Impurities Thermal Stability upon Reconstitution

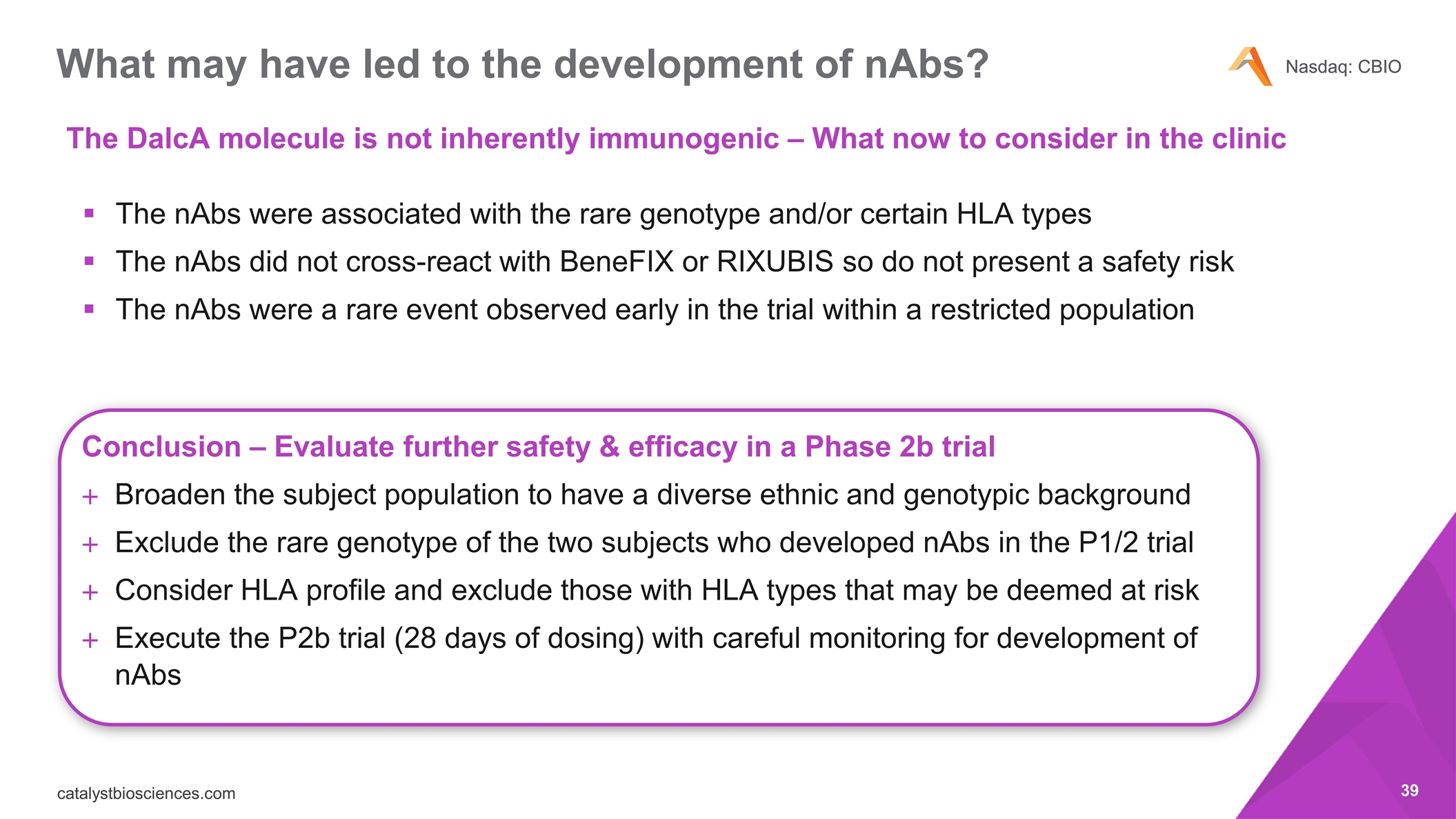

Conclusion – Evaluate further safety & efficacy in a Phase 2b trial Broaden the subject population to have a diverse ethnic and genotypic background Exclude the rare genotype of the two subjects who developed nAbs in the P1/2 trial Consider HLA profile and exclude those with HLA types that may be deemed at risk Execute the P2b trial (28 days of dosing) with careful monitoring for development of nAbs What may have led to the development of nAbs? The DalcA molecule is not inherently immunogenic – What now to consider in the clinic The nAbs were associated with the rare genotype and/or certain HLA types The nAbs did not cross-react with BeneFIX or RIXUBIS so do not present a safety risk The nAbs were a rare event observed early in the trial within a restricted population

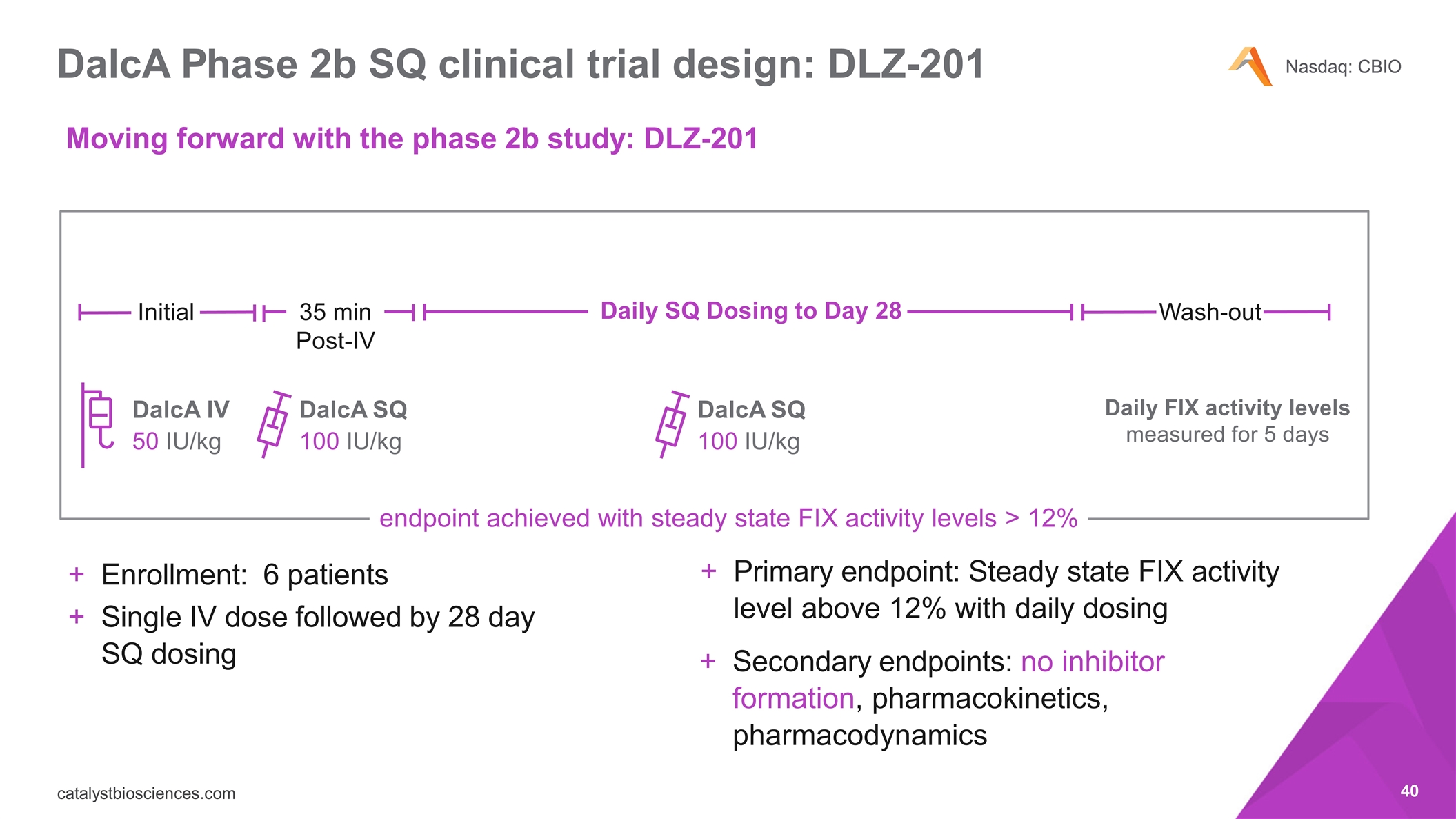

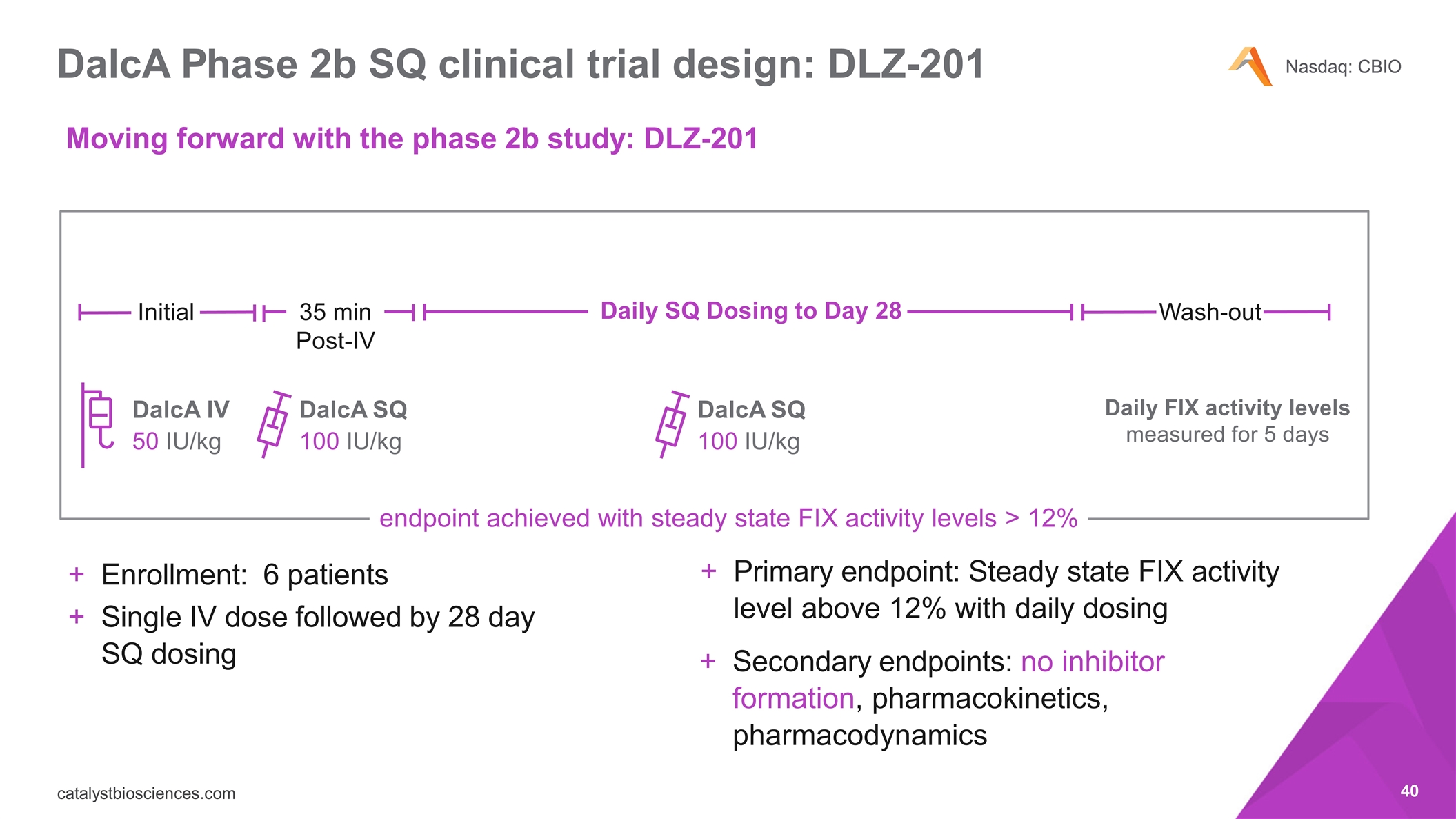

DalcA Phase 2b SQ clinical trial design: DLZ-201 endpoint achieved with steady state FIX activity levels > 12% Primary endpoint: Steady state FIX activity level above 12% with daily dosing Secondary endpoints: no inhibitor formation, pharmacokinetics, pharmacodynamics DalcA SQ 100 IU/kg DalcA SQ 100 IU/kg Daily FIX activity levels measured for 5 days Initial 35 min Post-IV Daily SQ Dosing to Day 28 Wash-out DalcA IV 50 IU/kg Enrollment: 6 patients Single IV dose followed by 28 day SQ dosing Moving forward with the phase 2b study: DLZ-201

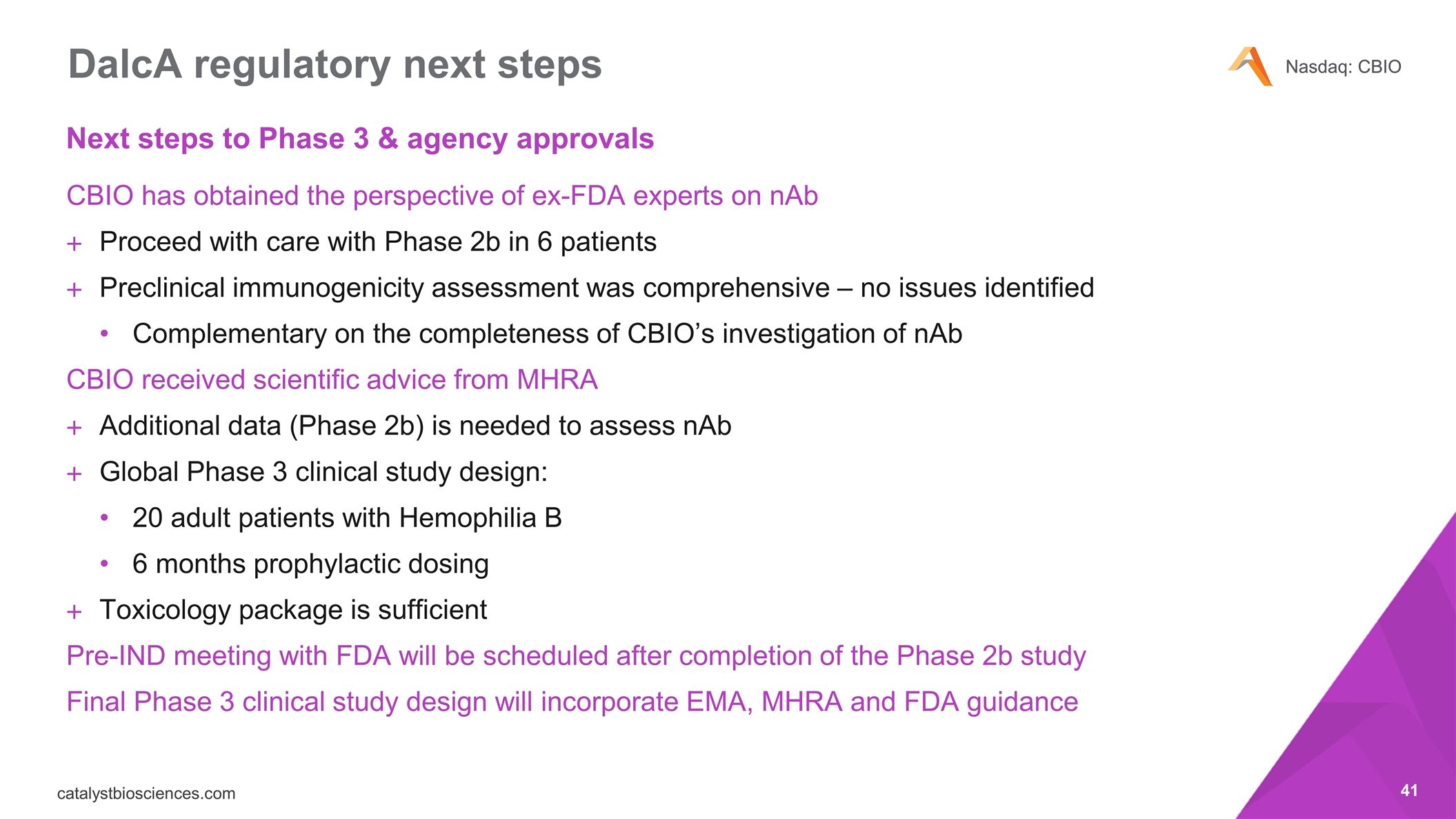

CBIO has obtained the perspective of ex-FDA experts on nAb Proceed with care with Phase 2b in 6 patients Preclinical immunogenicity assessment was comprehensive – no issues identified Complementary on the completeness of CBIO’s investigation of nAb CBIO received scientific advice from MHRA Additional data (Phase 2b) is needed to assess nAb Global Phase 3 clinical study design: 20 adult patients with Hemophilia B 6 months prophylactic dosing Toxicology package is sufficient Pre-IND meeting with FDA will be scheduled after completion of the Phase 2b study Final Phase 3 clinical study design will incorporate EMA, MHRA and FDA guidance DalcA regulatory next steps Next steps to Phase 3 & agency approvals

Conclusions on the dalcinonacog alfa program Moving forward in clinical development after an extensive immunogenicity risk assessment Preclinical immunogenicity assessment shows that dalcinonacog alfa is equivalent to that of competitors such as BeneFIX A comprehensive evaluation of the drug product shows comparable quality to marketed rFIX products KOLs and subject experts agree with the immunogenicity risk assessment and proceeding with the P2b to evaluate the safety and efficacy of dalcinonacog alfa

CATALYST BIOSCIENCES December 18th 2018 Marzeptacog alfa (activated)

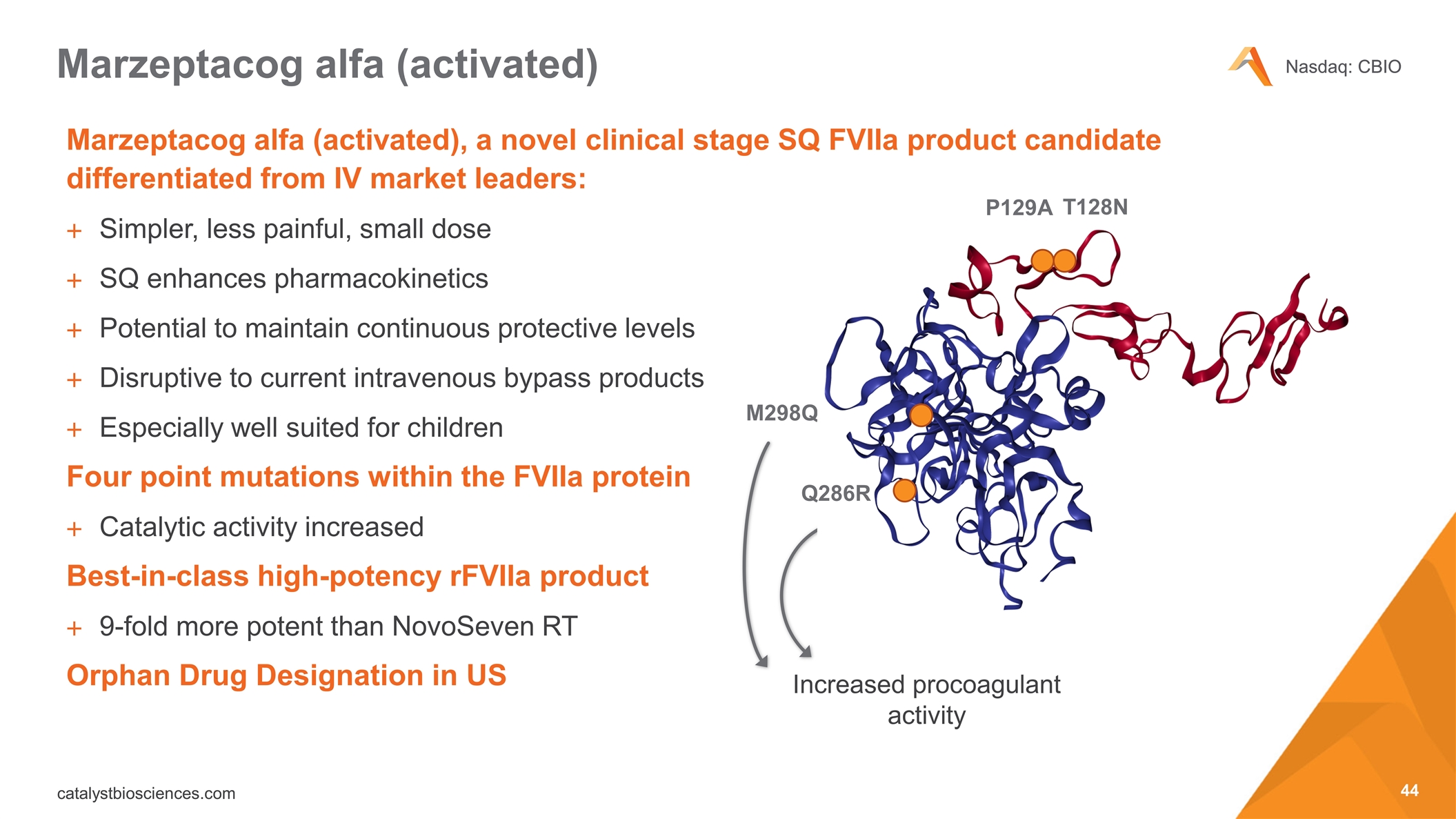

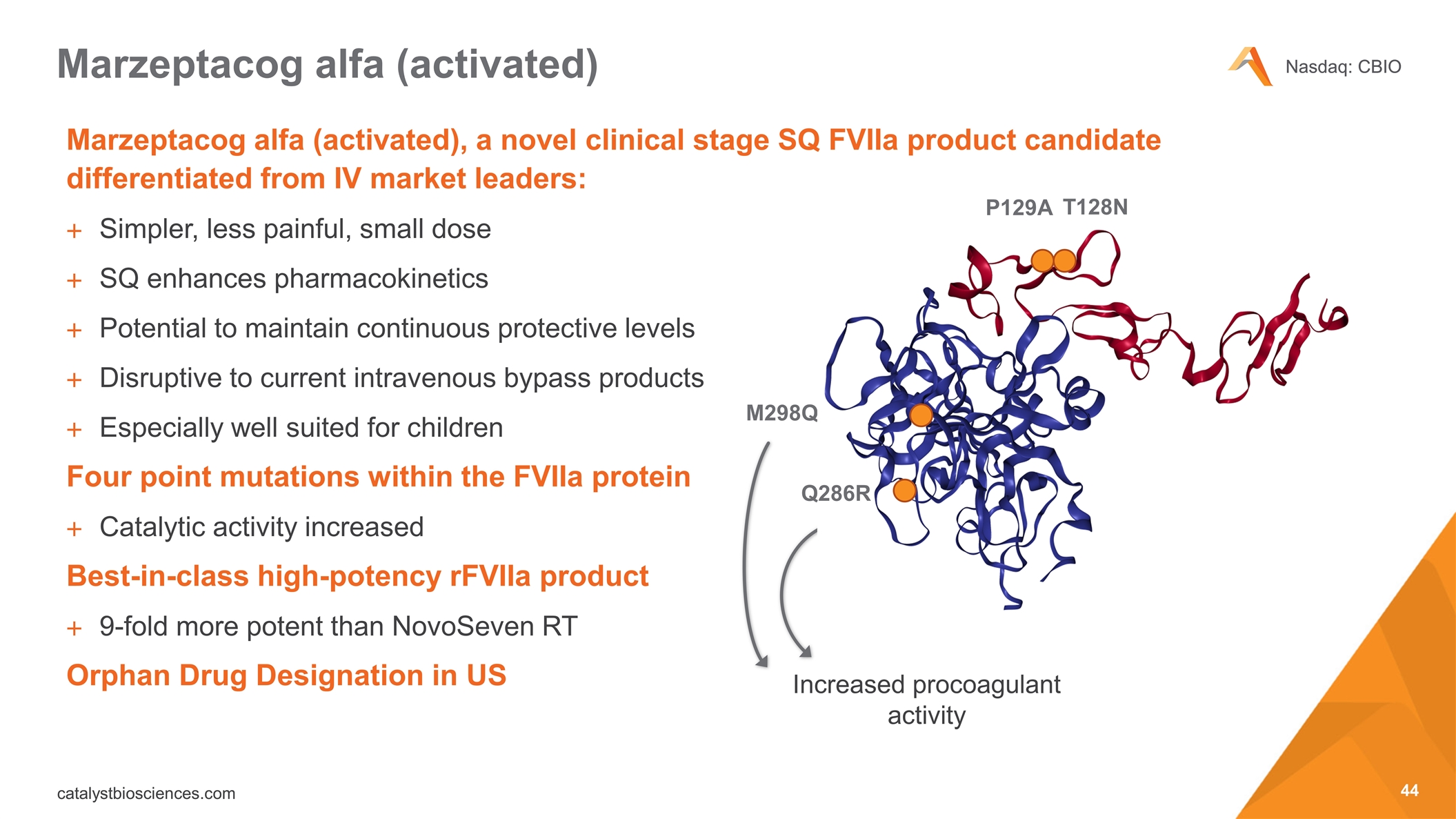

Marzeptacog alfa (activated), a novel clinical stage SQ FVIIa product candidate differentiated from IV market leaders: Simpler, less painful, small dose SQ enhances pharmacokinetics Potential to maintain continuous protective levels Disruptive to current intravenous bypass products Especially well suited for children Four point mutations within the FVIIa protein Catalytic activity increased Best-in-class high-potency rFVIIa product 9-fold more potent than NovoSeven RT Orphan Drug Designation in US Marzeptacog alfa (activated) P129A M298Q T128N Increased procoagulant activity Q286R

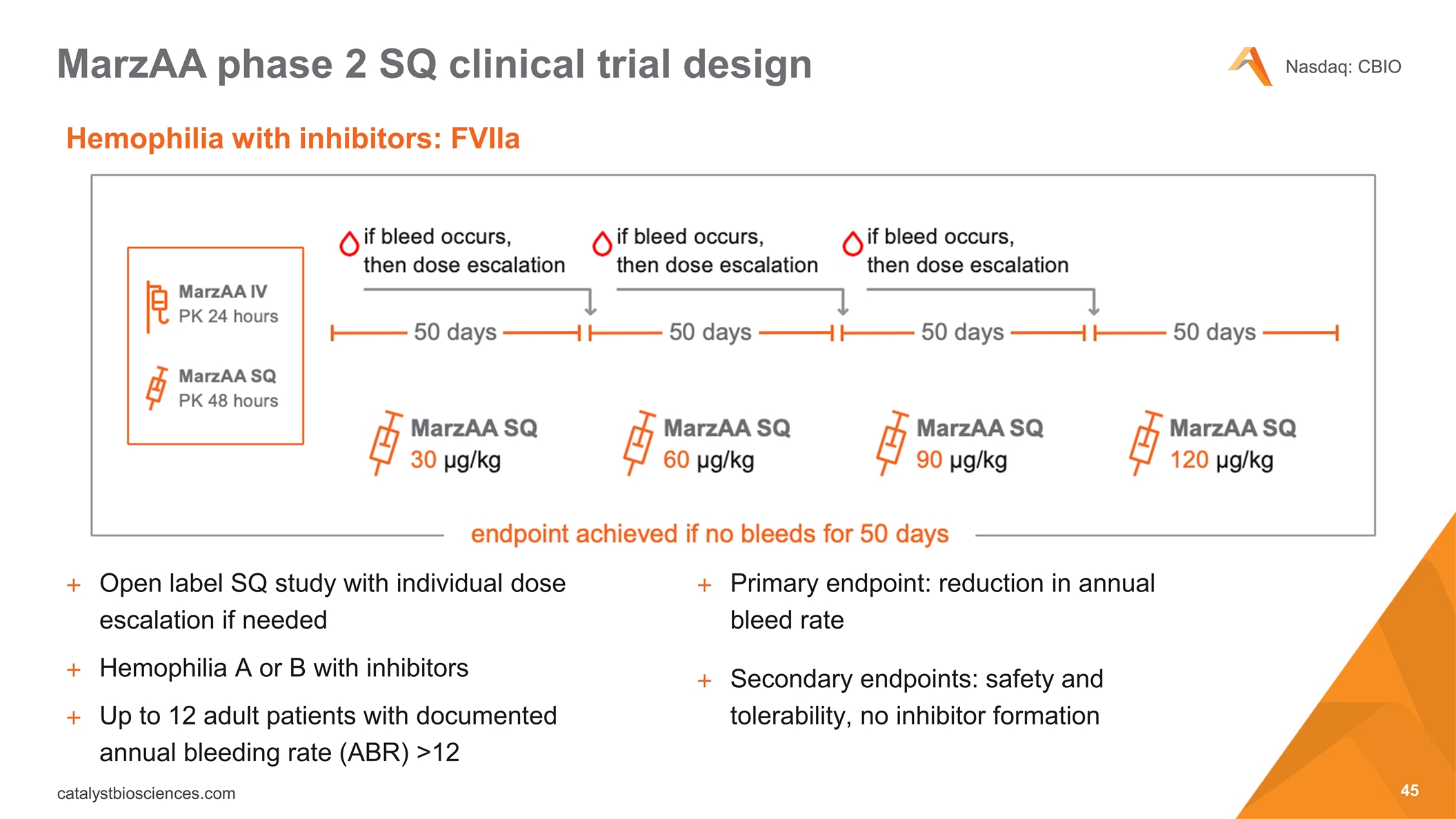

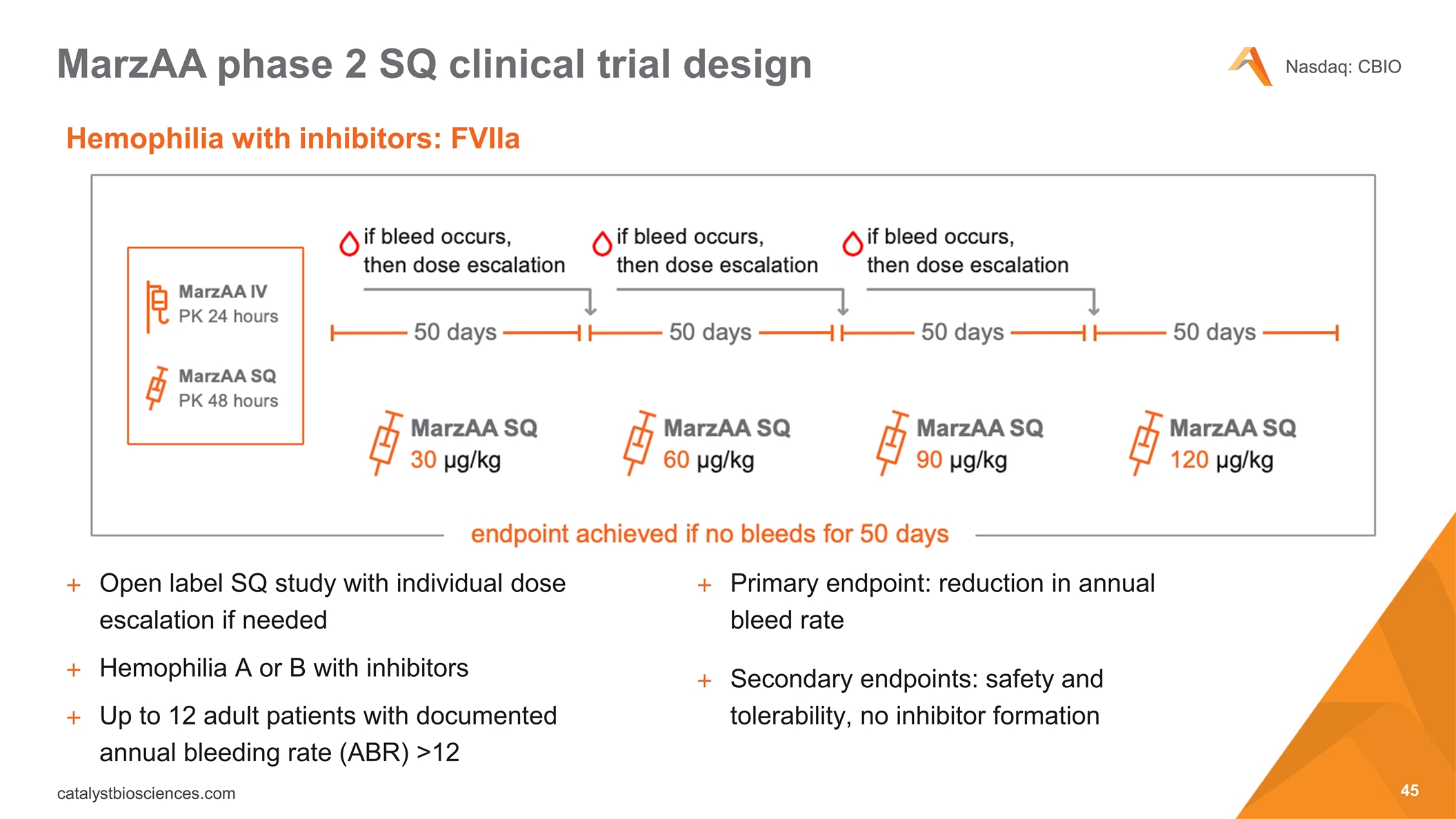

Open label SQ study with individual dose escalation if needed Hemophilia A or B with inhibitors Up to 12 adult patients with documented annual bleeding rate (ABR) >12 Hemophilia with inhibitors: FVIIa MarzAA phase 2 SQ clinical trial design Primary endpoint: reduction in annual bleed rate Secondary endpoints: safety and tolerability, no inhibitor formation

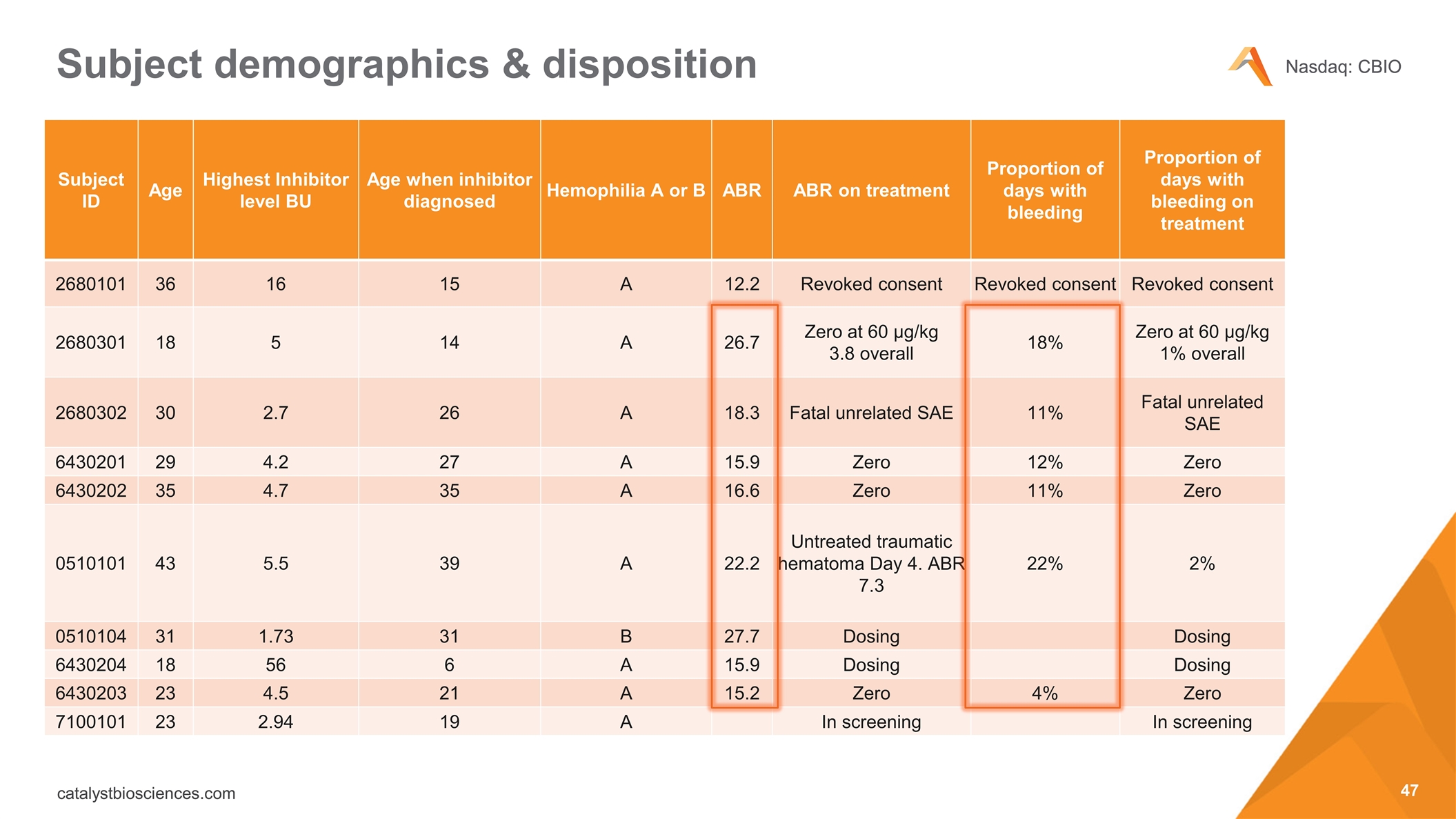

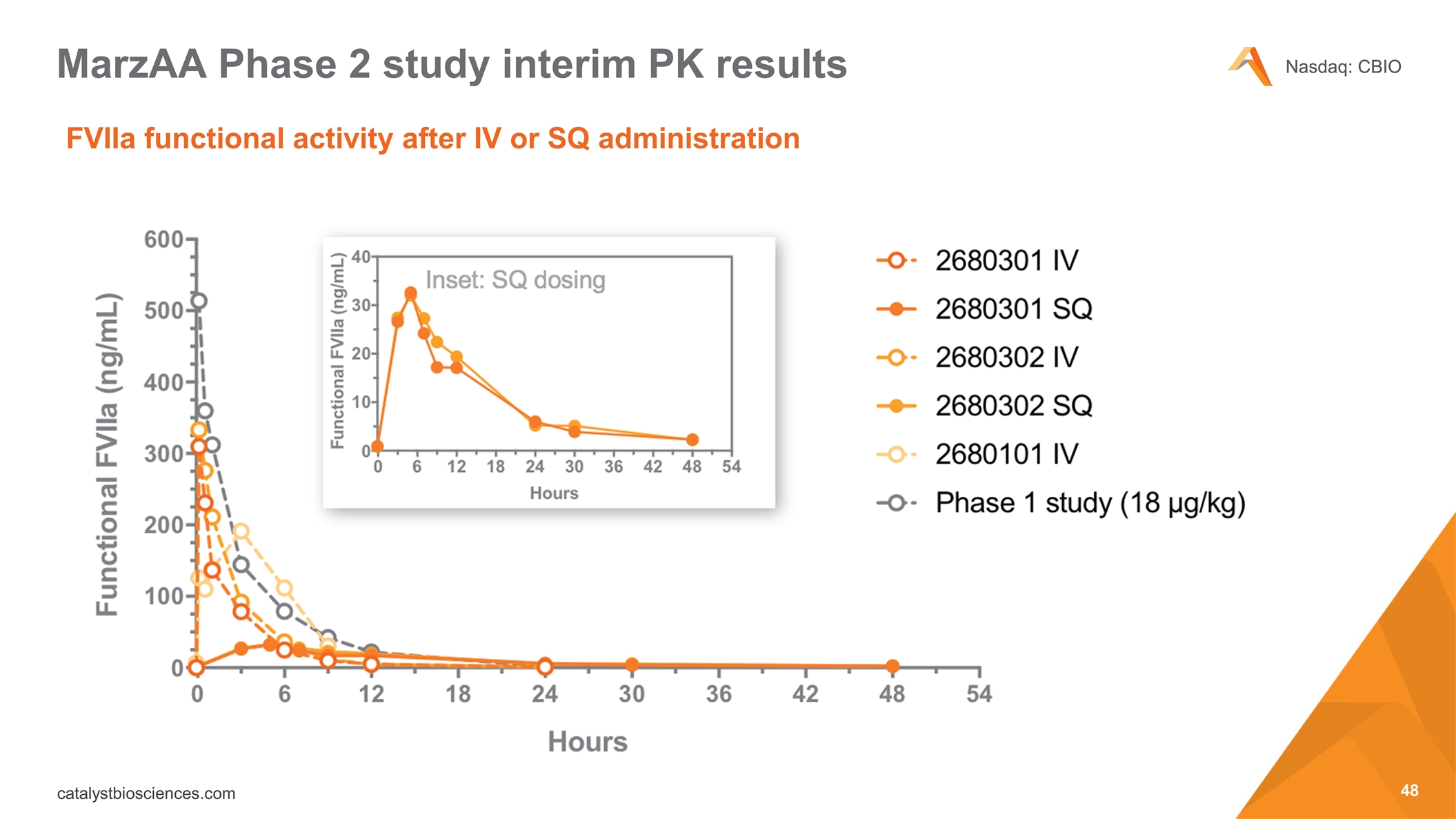

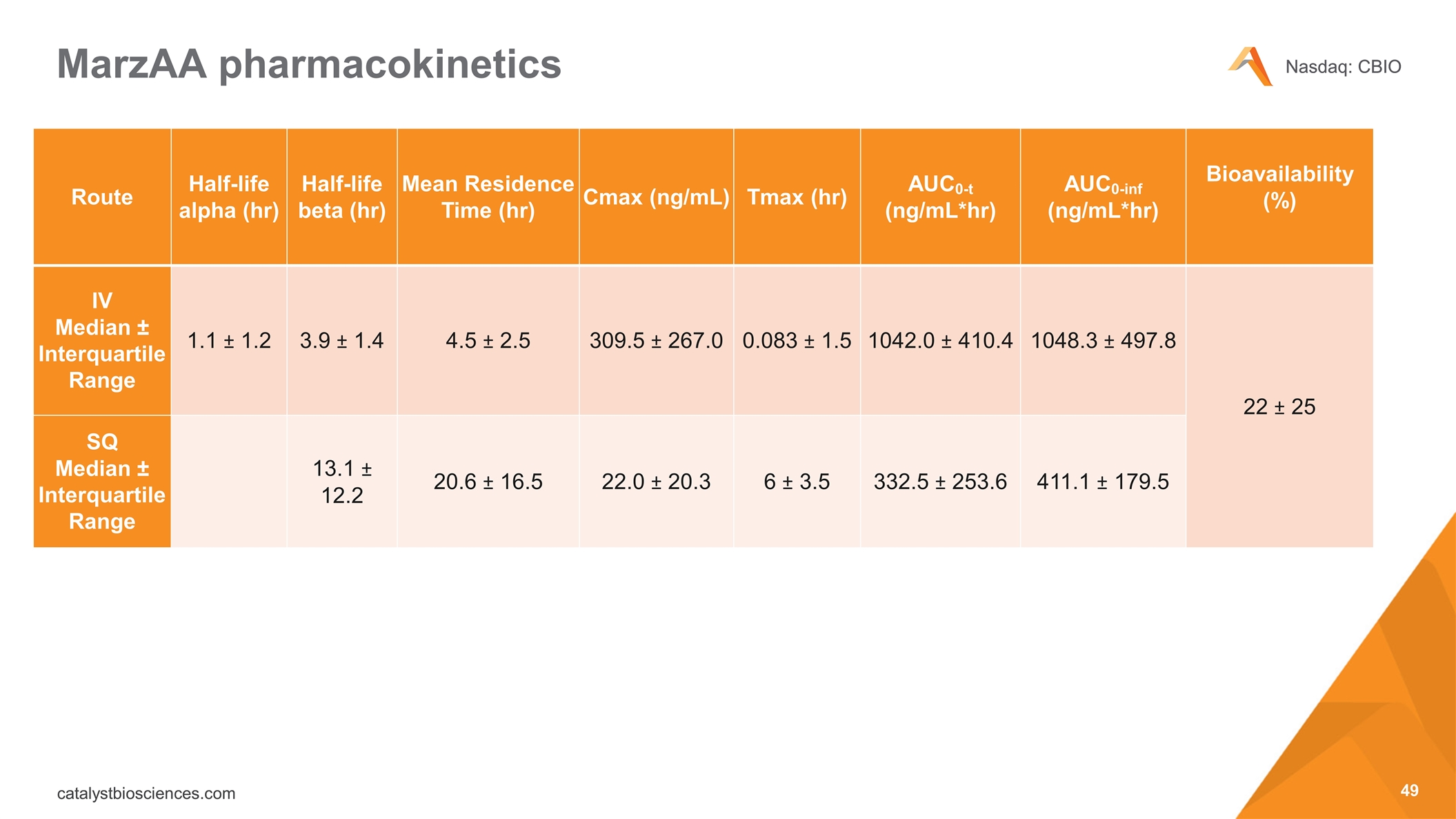

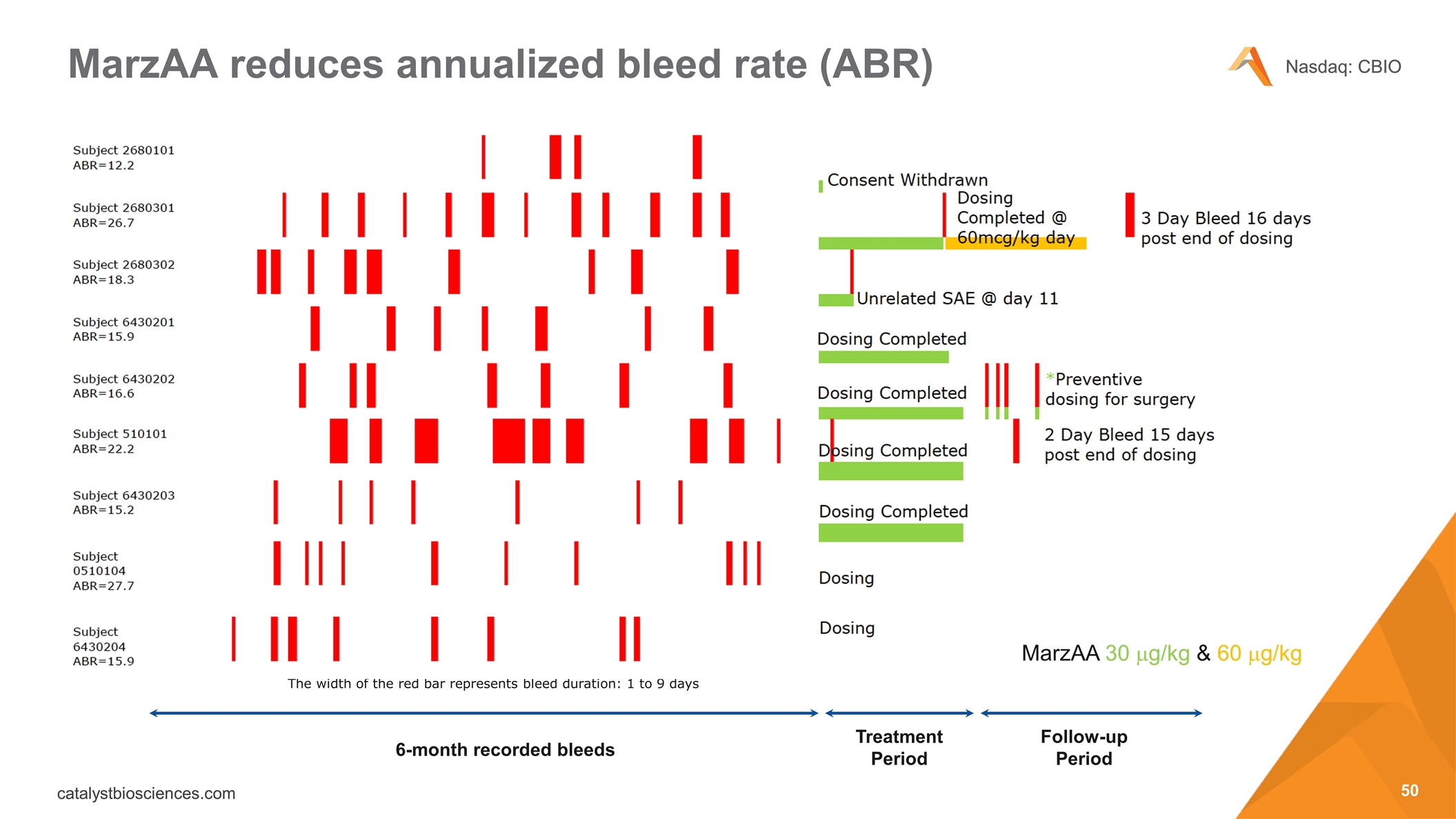

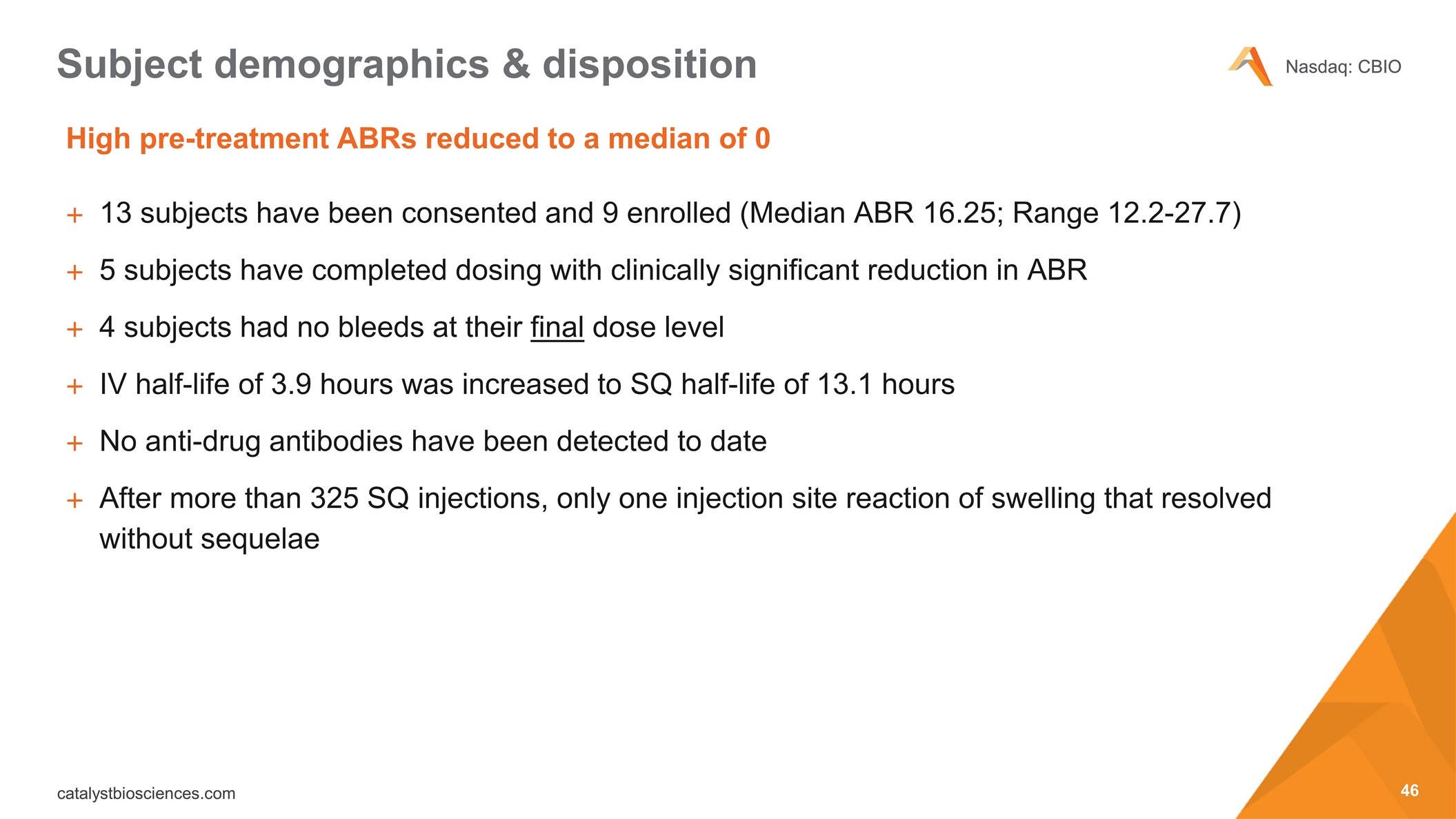

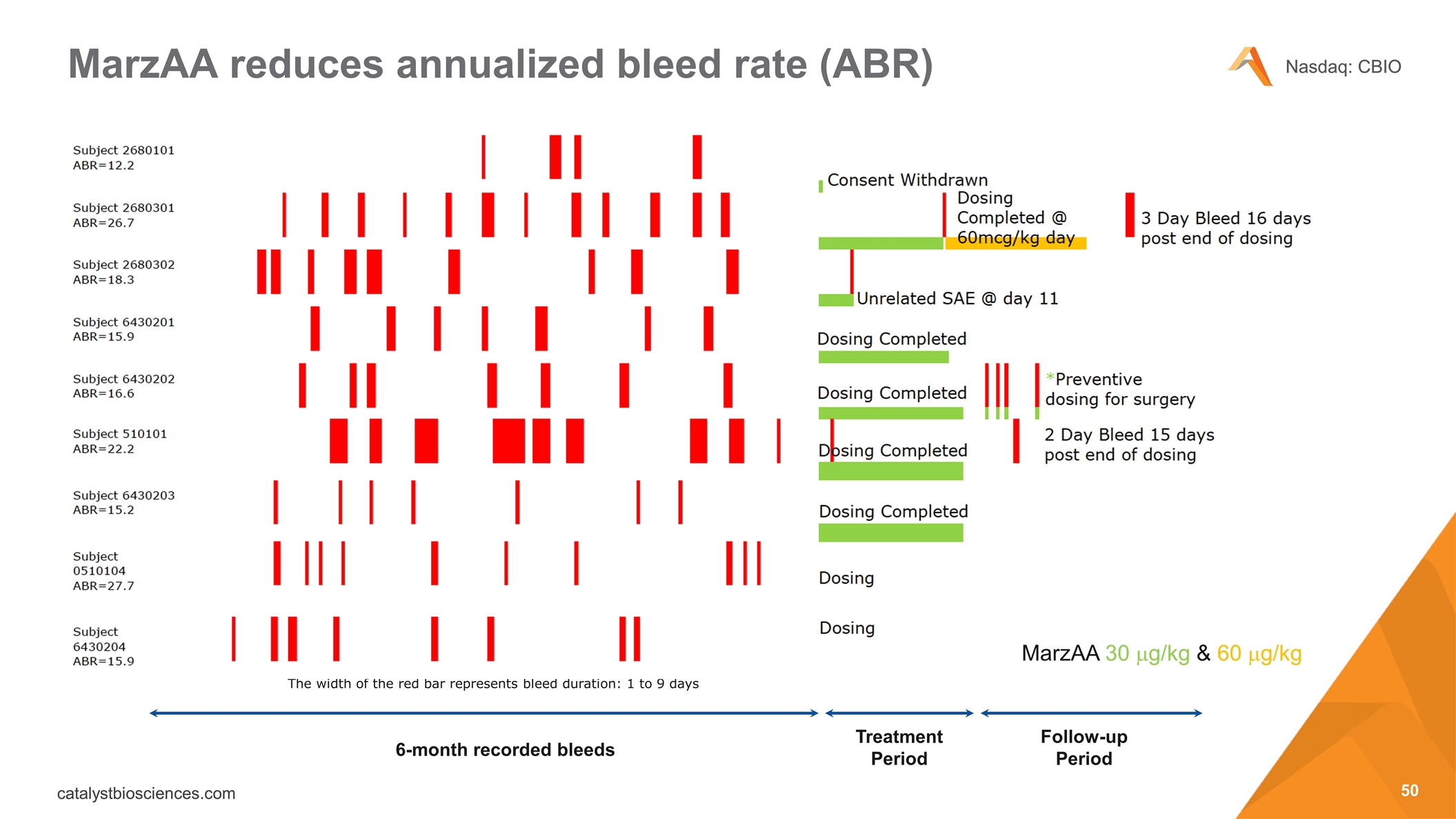

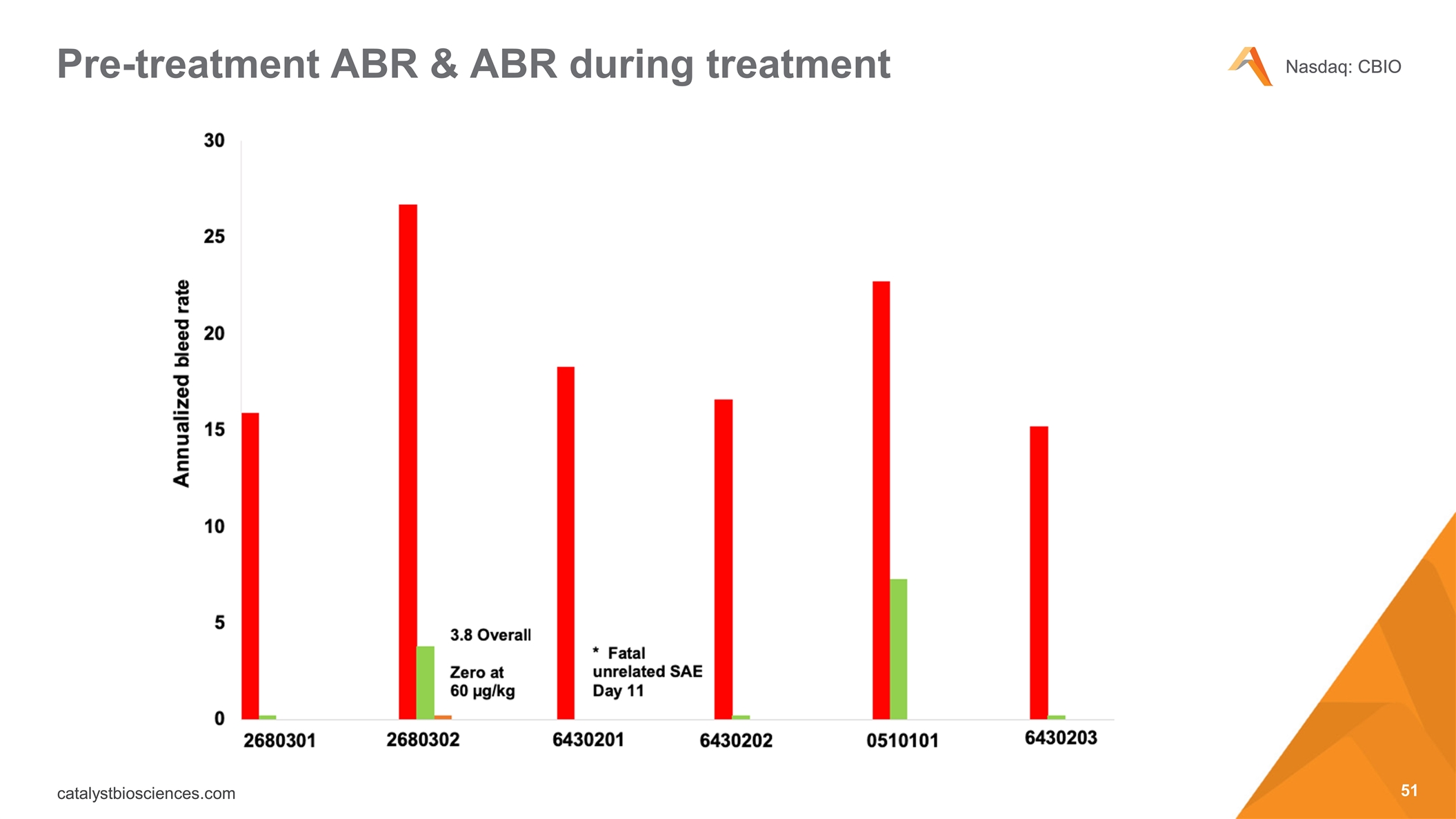

13 subjects have been consented and 9 enrolled (Median ABR 16.25; Range 12.2-27.7) 5 subjects have completed dosing with clinically significant reduction in ABR 4 subjects had no bleeds at their final dose level IV half-life of 3.9 hours was increased to SQ half-life of 13.1 hours No anti-drug antibodies have been detected to date After more than 325 SQ injections, only one injection site reaction of swelling that resolved without sequelae High pre-treatment ABRs reduced to a median of 0 Subject demographics & disposition

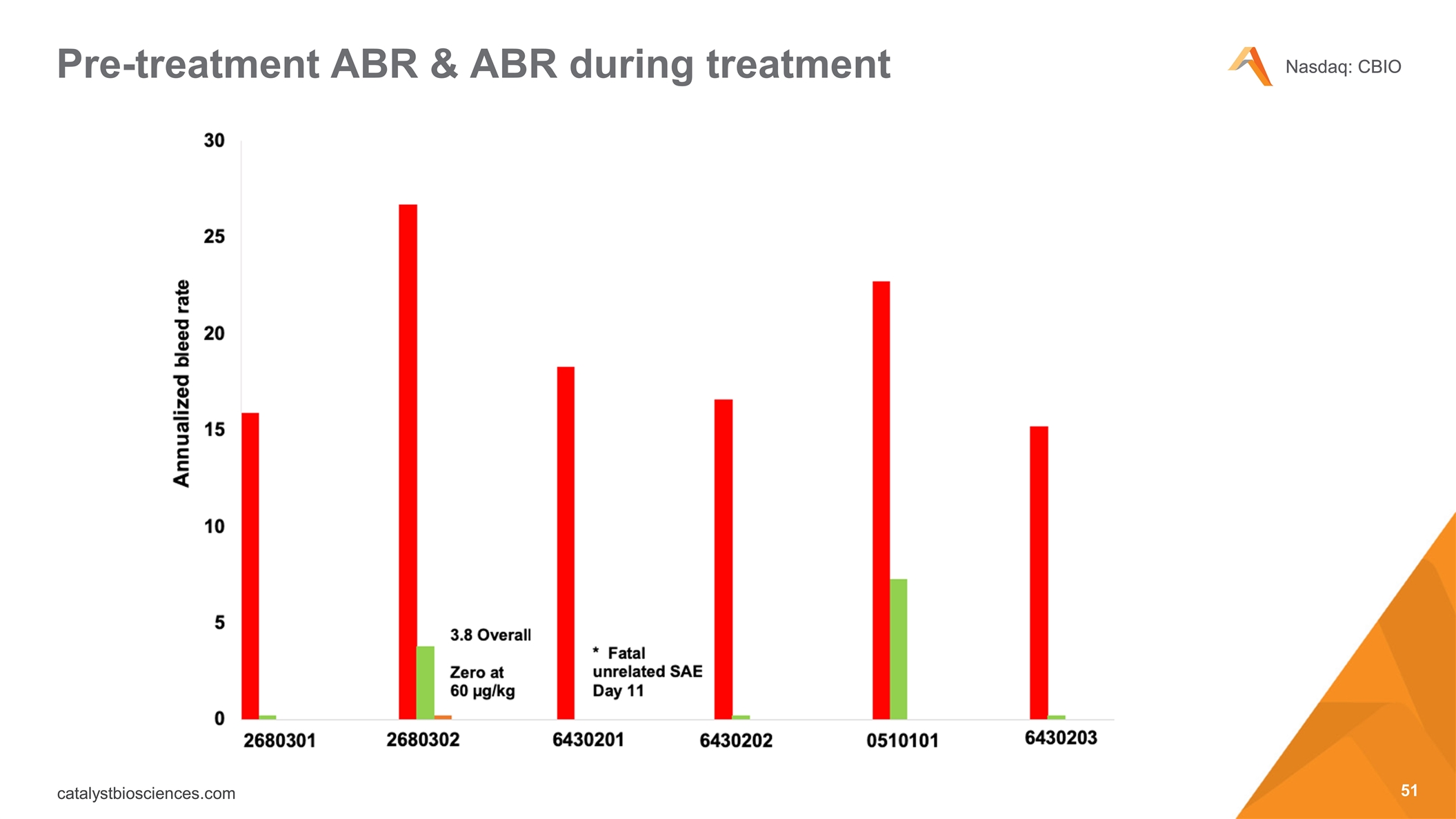

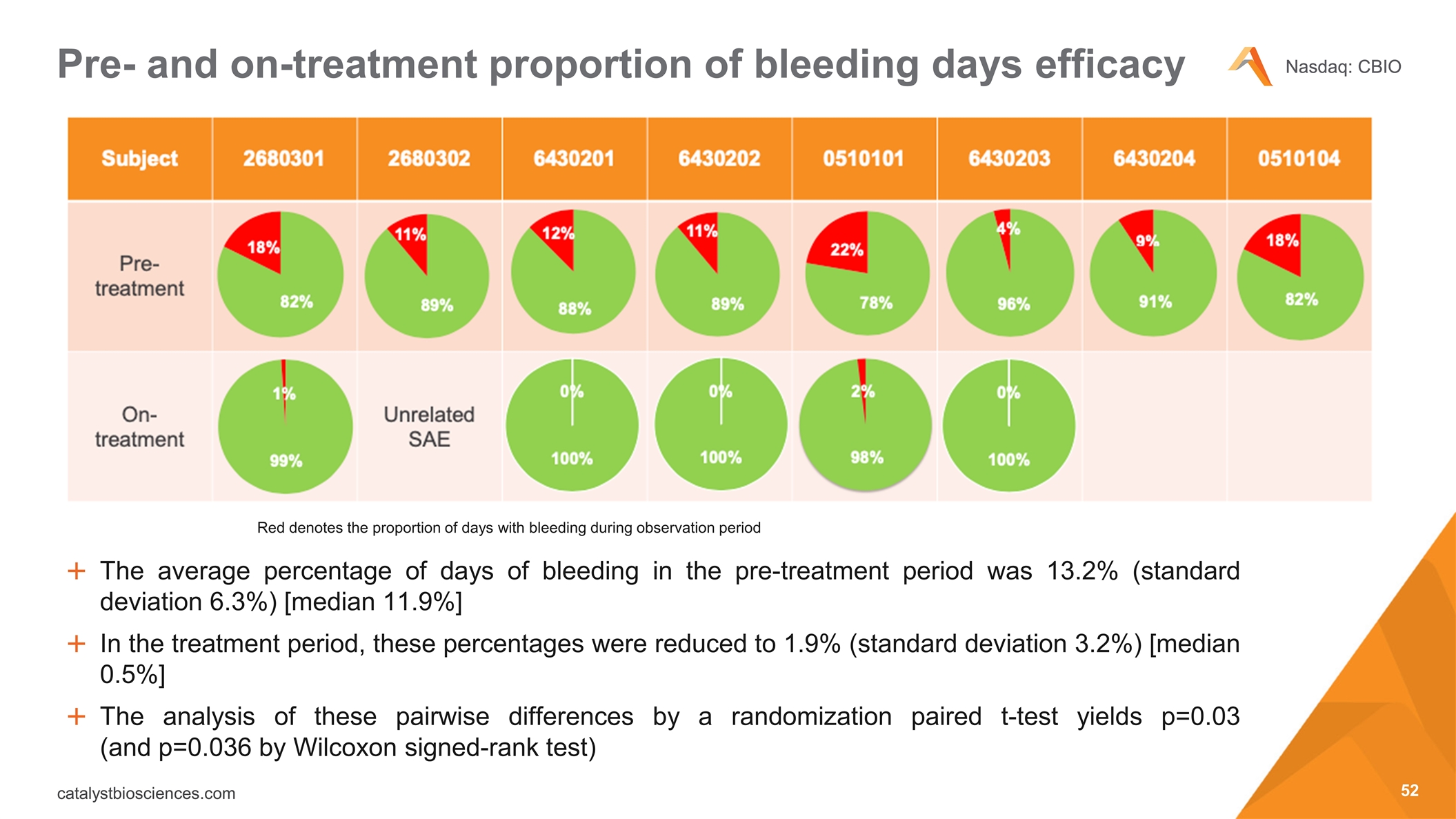

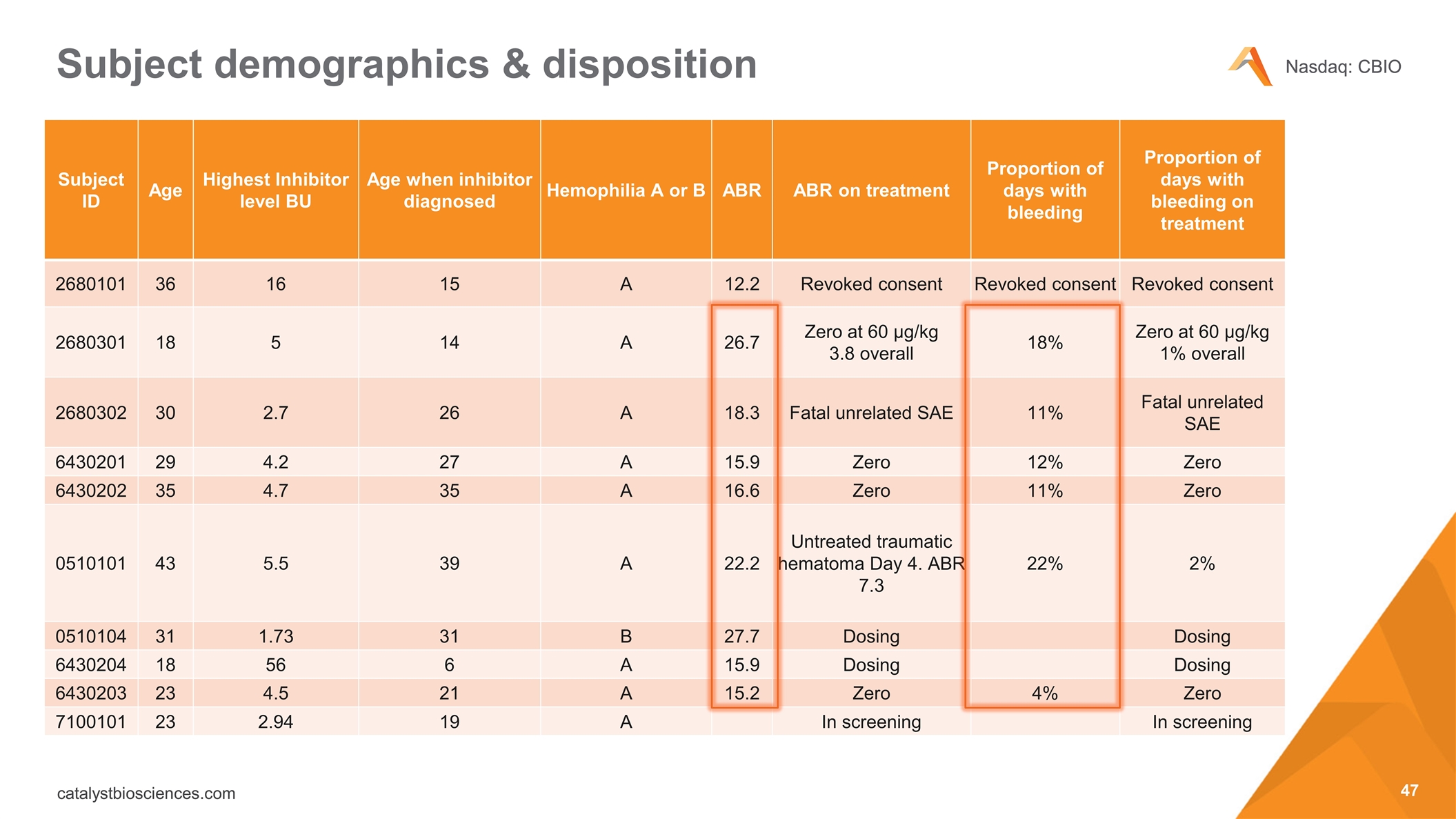

Subject demographics & disposition Subject ID Age Highest Inhibitor level BU Age when inhibitor diagnosed Hemophilia A or B ABR ABR on treatment Proportion of days with bleeding Proportion of days with bleeding on treatment 2680101 36 16 15 A 12.2 Revoked consent Revoked consent Revoked consent 2680301 18 5 14 A 26.7 Zero at 60 µg/kg 3.8 overall 18% Zero at 60 µg/kg 1% overall 2680302 30 2.7 26 A 18.3 Fatal unrelated SAE 11% Fatal unrelated SAE 6430201 29 4.2 27 A 15.9 Zero 12% Zero 6430202 35 4.7 35 A 16.6 Zero 11% Zero 0510101 43 5.5 39 A 22.2 Untreated traumatic hematoma Day 4. ABR 7.3 22% 2% 0510104 31 1.73 31 B 27.7 Dosing Dosing 6430204 18 56 6 A 15.9 Dosing Dosing 6430203 23 4.5 21 A 15.2 Zero 4% Zero 7100101 23 2.94 19 A In screening In screening

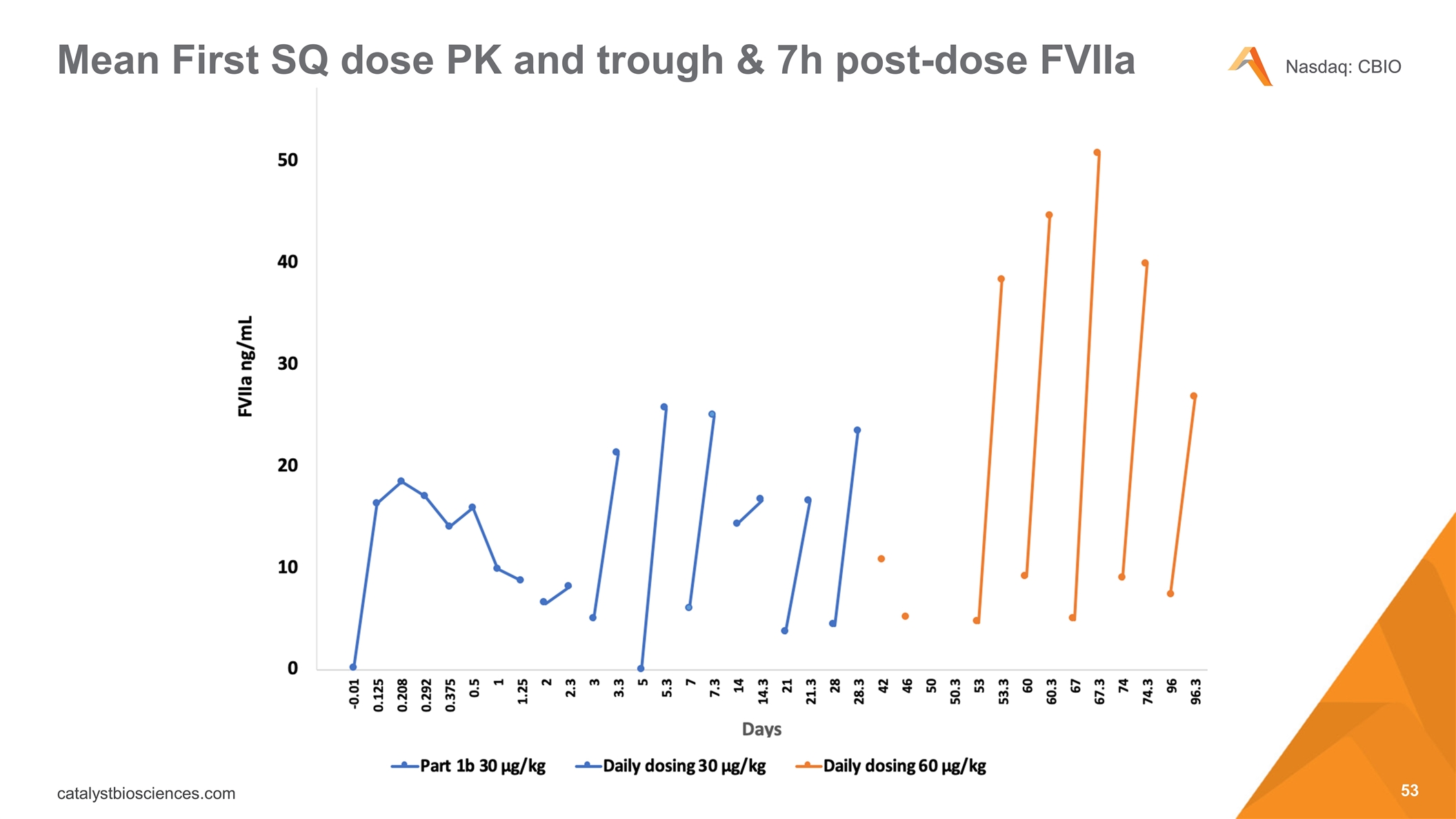

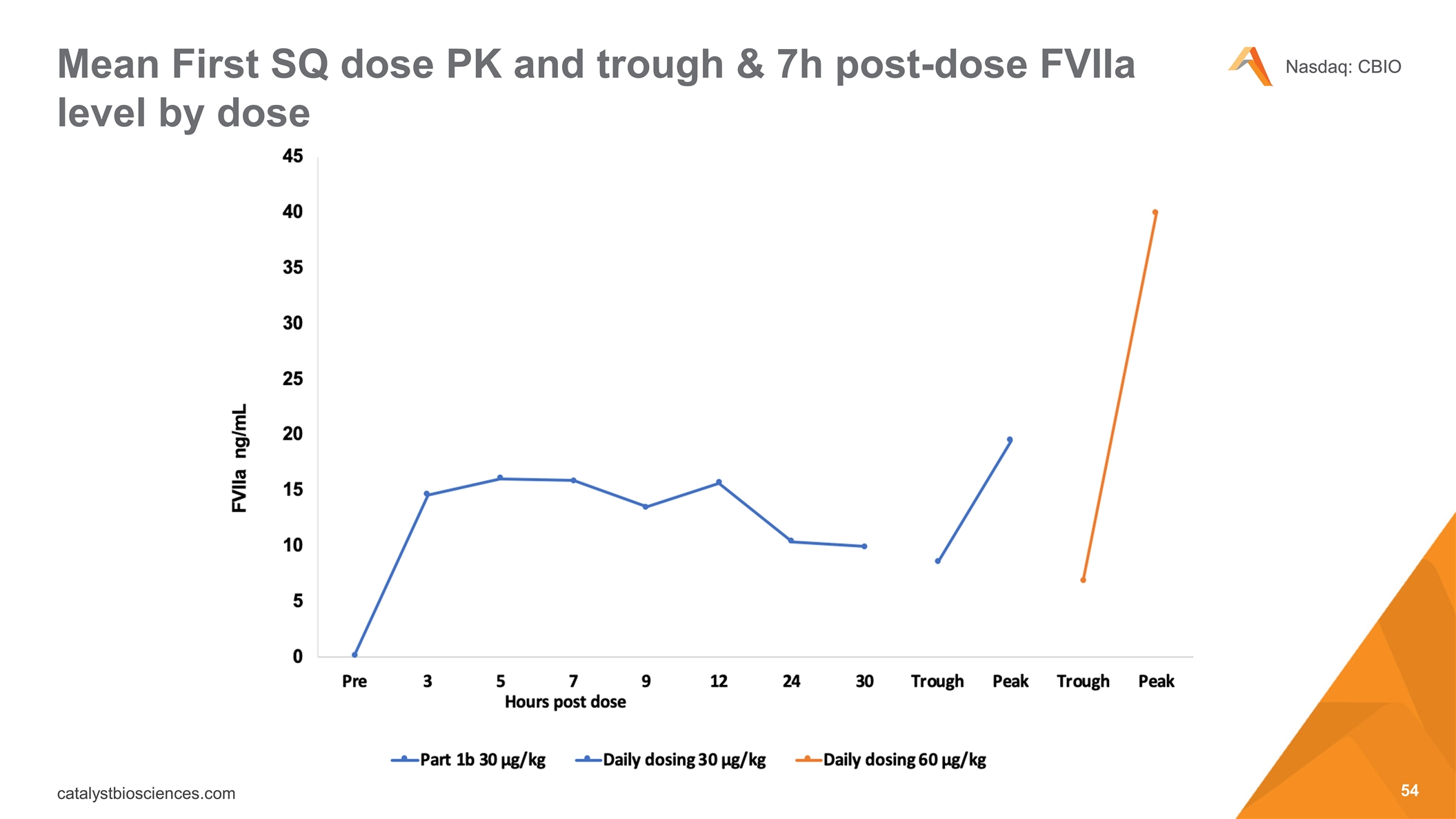

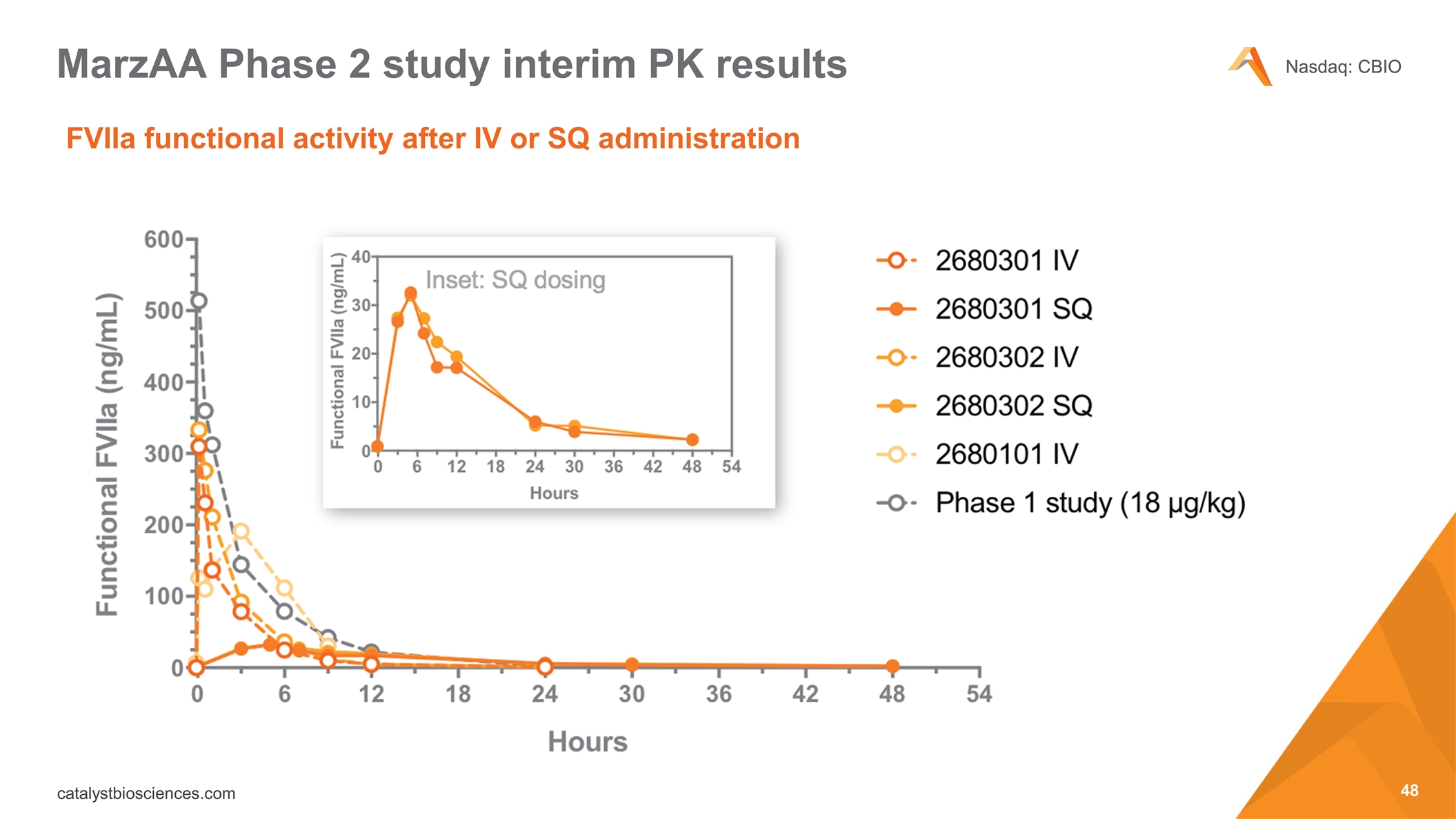

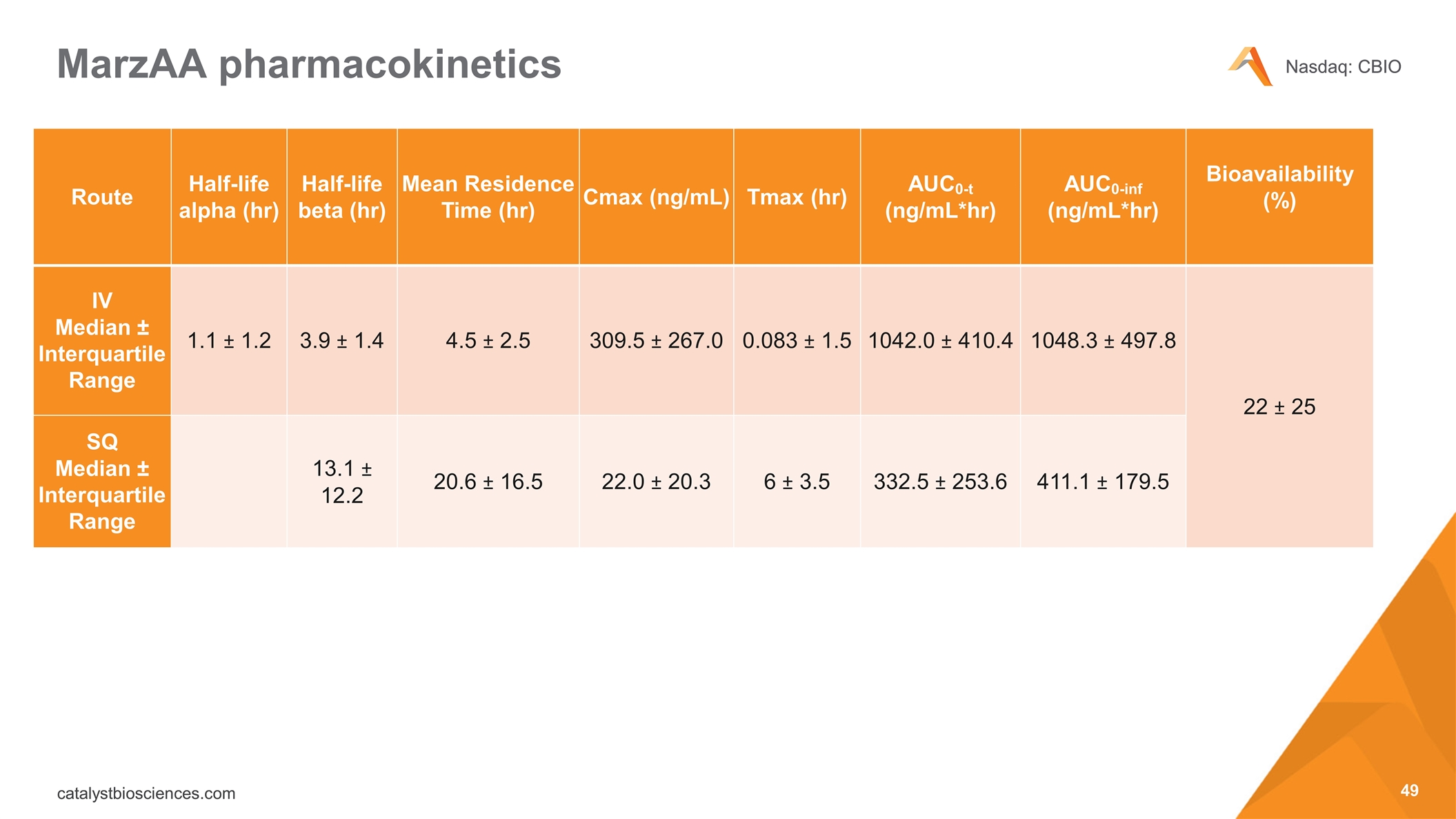

FVIIa functional activity after IV or SQ administration MarzAA Phase 2 study interim PK results

MarzAA pharmacokinetics Route Half-life alpha (hr) Half-life beta (hr) Mean Residence Time (hr) Cmax (ng/mL) Tmax (hr) AUC0-t (ng/mL*hr) AUC0-inf (ng/mL*hr) Bioavailability (%) IV Median ± Interquartile Range 1.1 ± 1.2 3.9 ± 1.4 4.5 ± 2.5 309.5 ± 267.0 0.083 ± 1.5 1042.0 ± 410.4 1048.3 ± 497.8 22 ± 25 SQ Median ± Interquartile Range 13.1 ± 12.2 20.6 ± 16.5 22.0 ± 20.3 6 ± 3.5 332.5 ± 253.6 411.1 ± 179.5

MarzAA reduces annualized bleed rate (ABR) The width of the red bar represents bleed duration: 1 to 9 days 6-month recorded bleeds Treatment Period Follow-up Period MarzAA 30 mg/kg & 60 mg/kg

Pre-treatment ABR & ABR during treatment

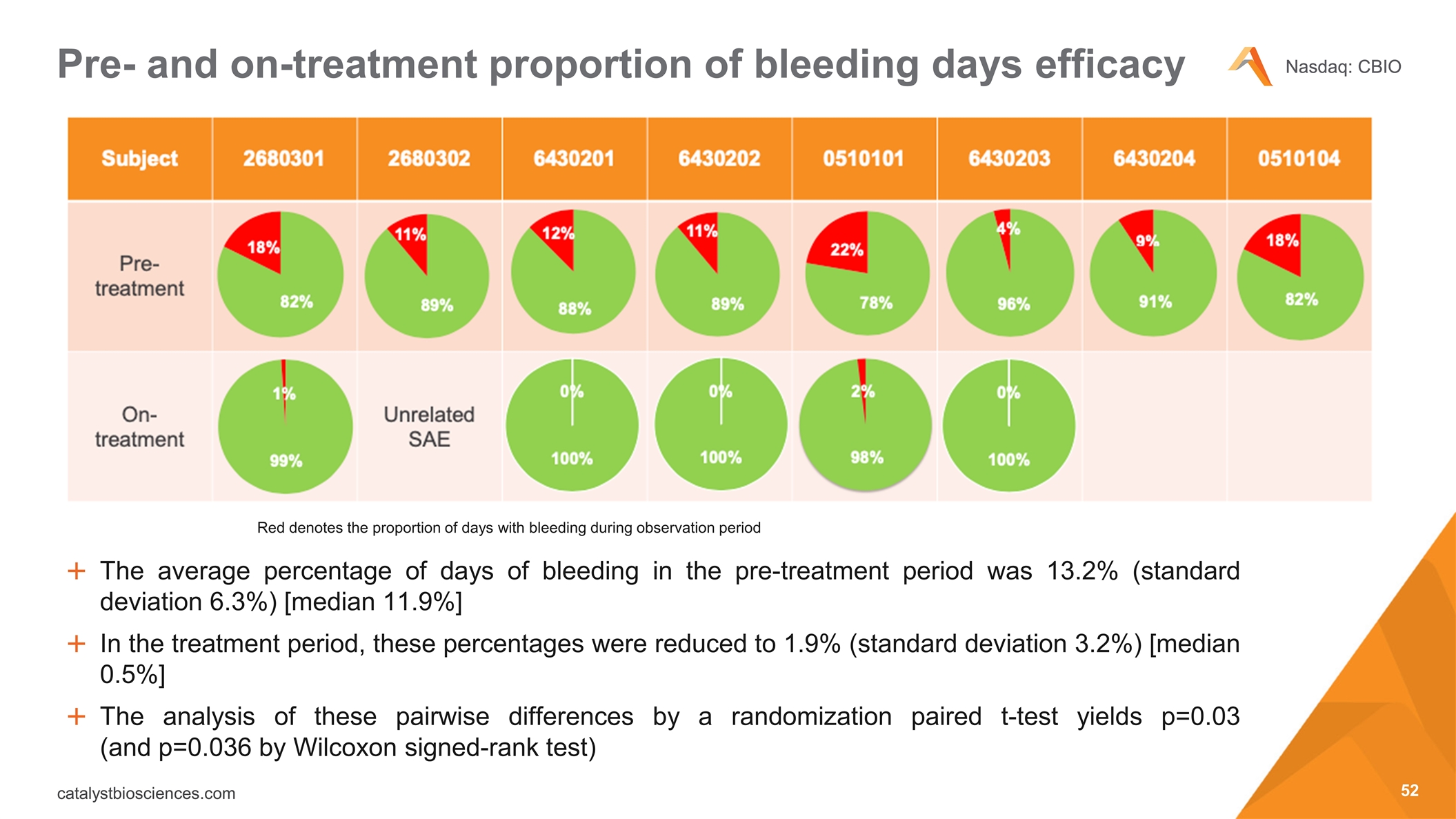

The average percentage of days of bleeding in the pre-treatment period was 13.2% (standard deviation 6.3%) [median 11.9%] In the treatment period, these percentages were reduced to 1.9% (standard deviation 3.2%) [median 0.5%] The analysis of these pairwise differences by a randomization paired t-test yields p=0.03 (and p=0.036 by Wilcoxon signed-rank test) Pre- and on-treatment proportion of bleeding days efficacy Red denotes the proportion of days with bleeding during observation period

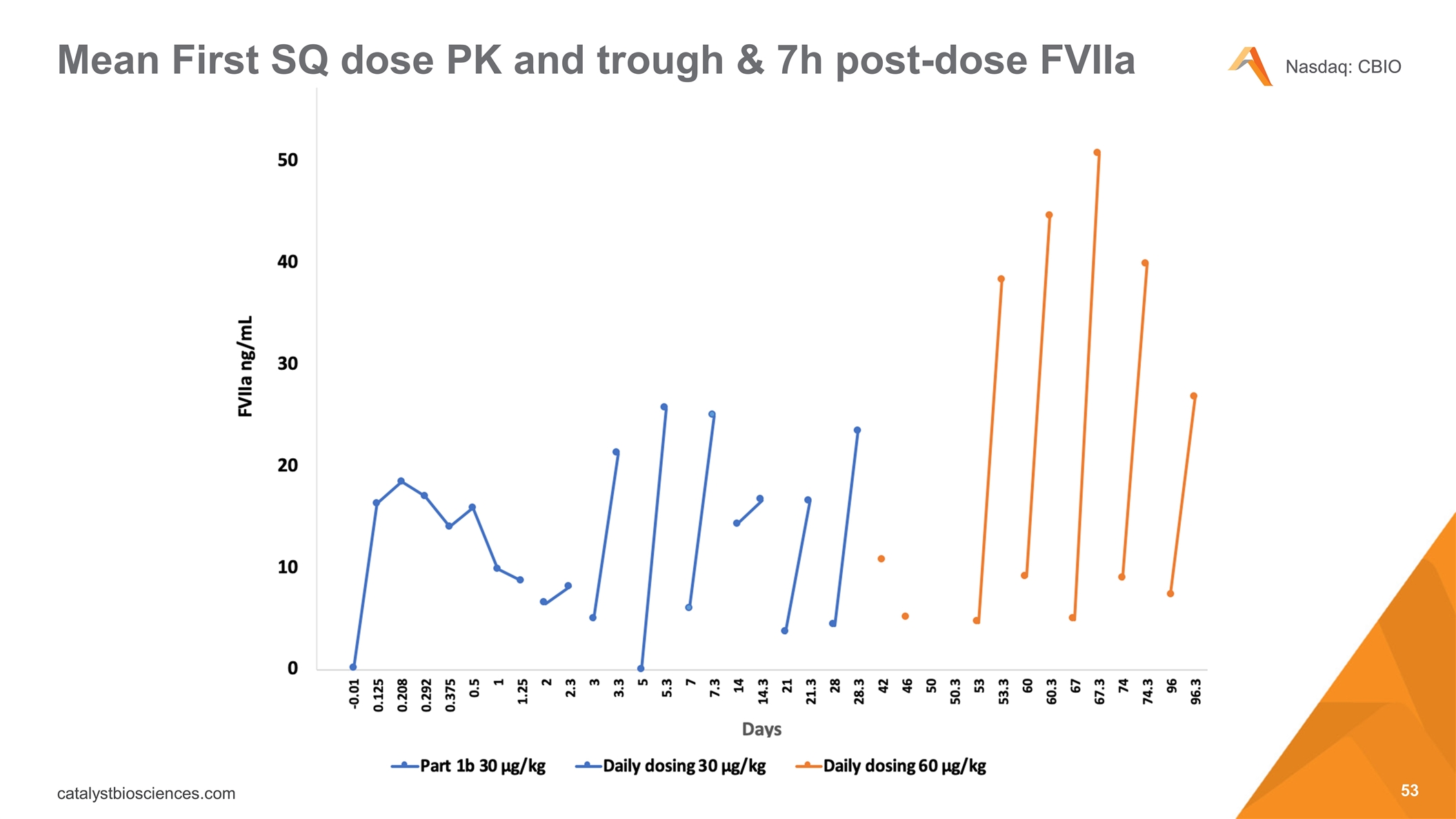

Mean First SQ dose PK and trough & 7h post-dose FVIIa

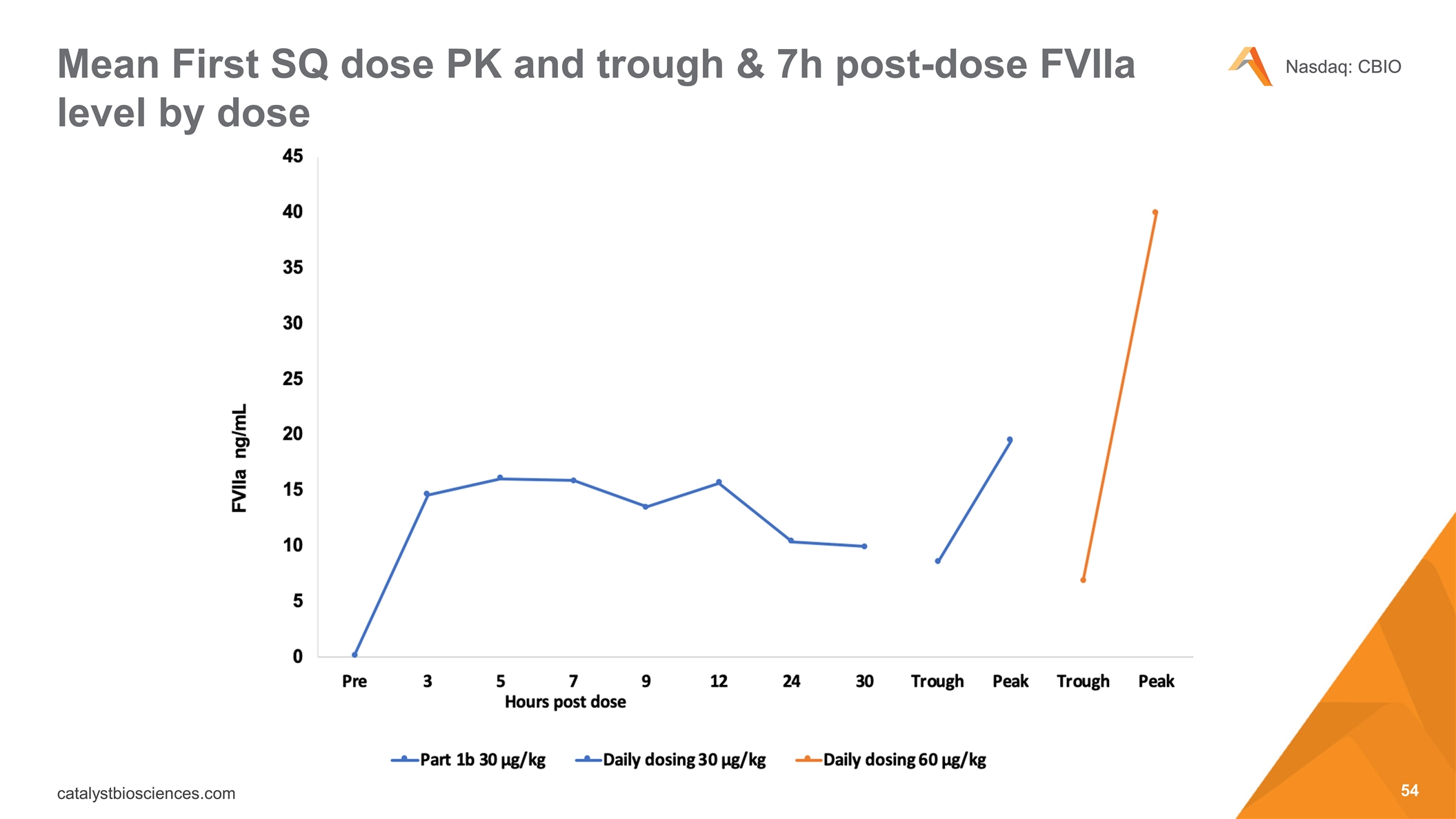

Mean First SQ dose PK and trough & 7h post-dose FVIIa level by dose

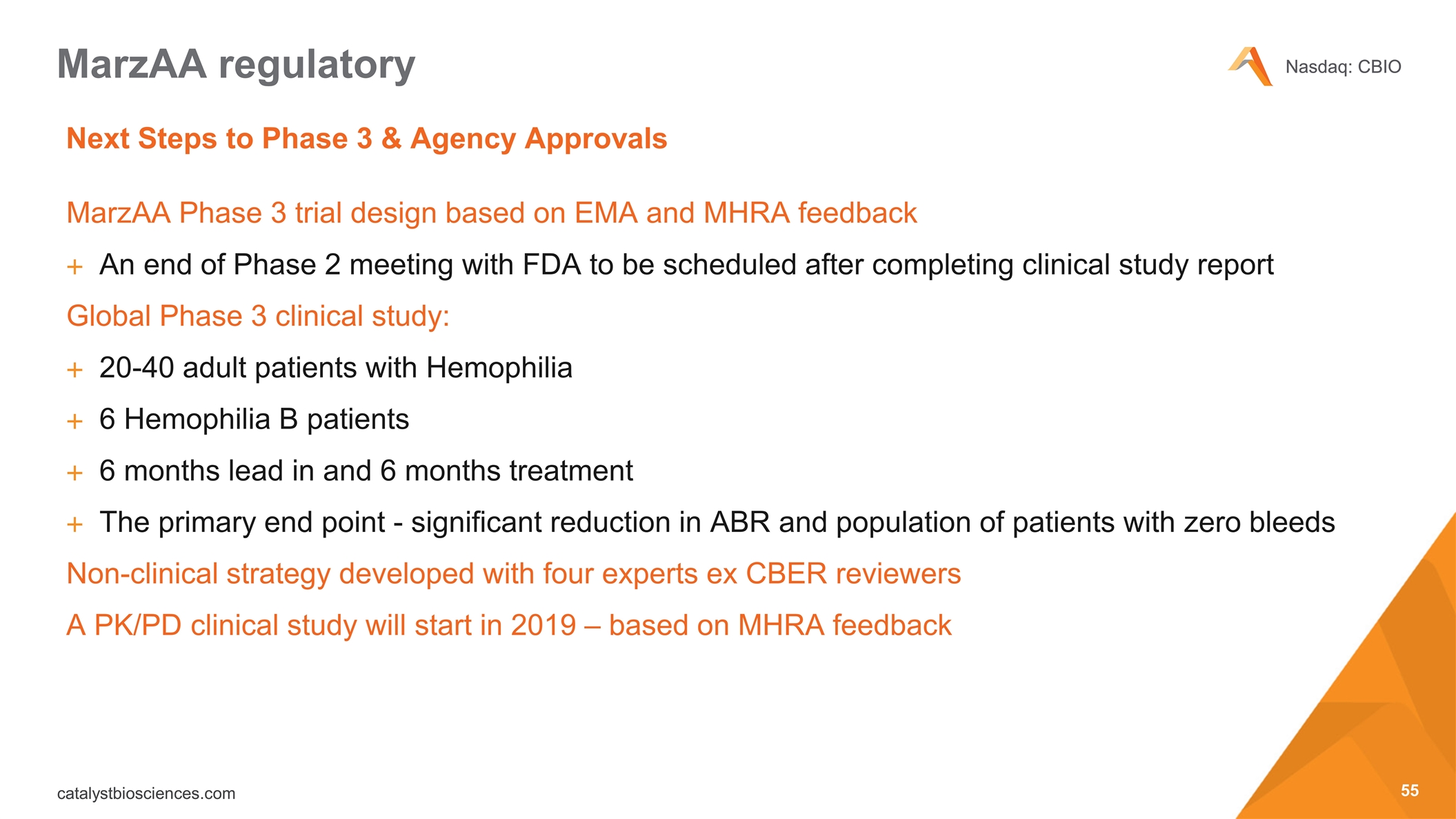

MarzAA Phase 3 trial design based on EMA and MHRA feedback An end of Phase 2 meeting with FDA to be scheduled after completing clinical study report Global Phase 3 clinical study: 20-40 adult patients with Hemophilia 6 Hemophilia B patients 6 months lead in and 6 months treatment The primary end point - significant reduction in ABR and population of patients with zero bleeds Non-clinical strategy developed with four experts ex CBER reviewers A PK/PD clinical study will start in 2019 – based on MHRA feedback Next Steps to Phase 3 & Agency Approvals MarzAA regulatory

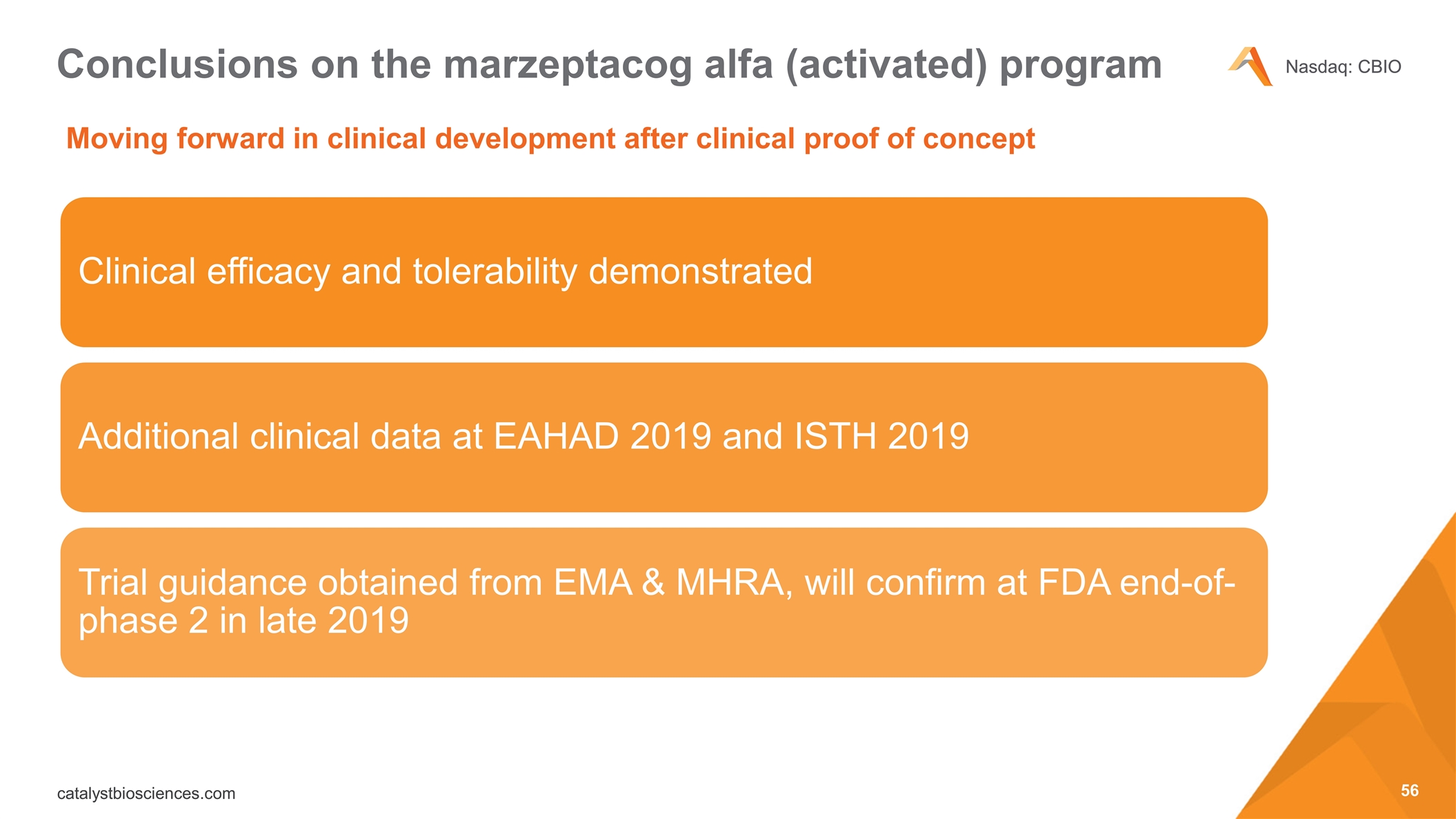

Moving forward in clinical development after clinical proof of concept Conclusions on the marzeptacog alfa (activated) program Clinical efficacy and tolerability demonstrated Additional clinical data at EAHAD 2019 and ISTH 2019 Trial guidance obtained from EMA & MHRA, will confirm at FDA end-of-phase 2 in late 2019

CATALYST BIOSCIENCES December 18th 2018 Financial Information

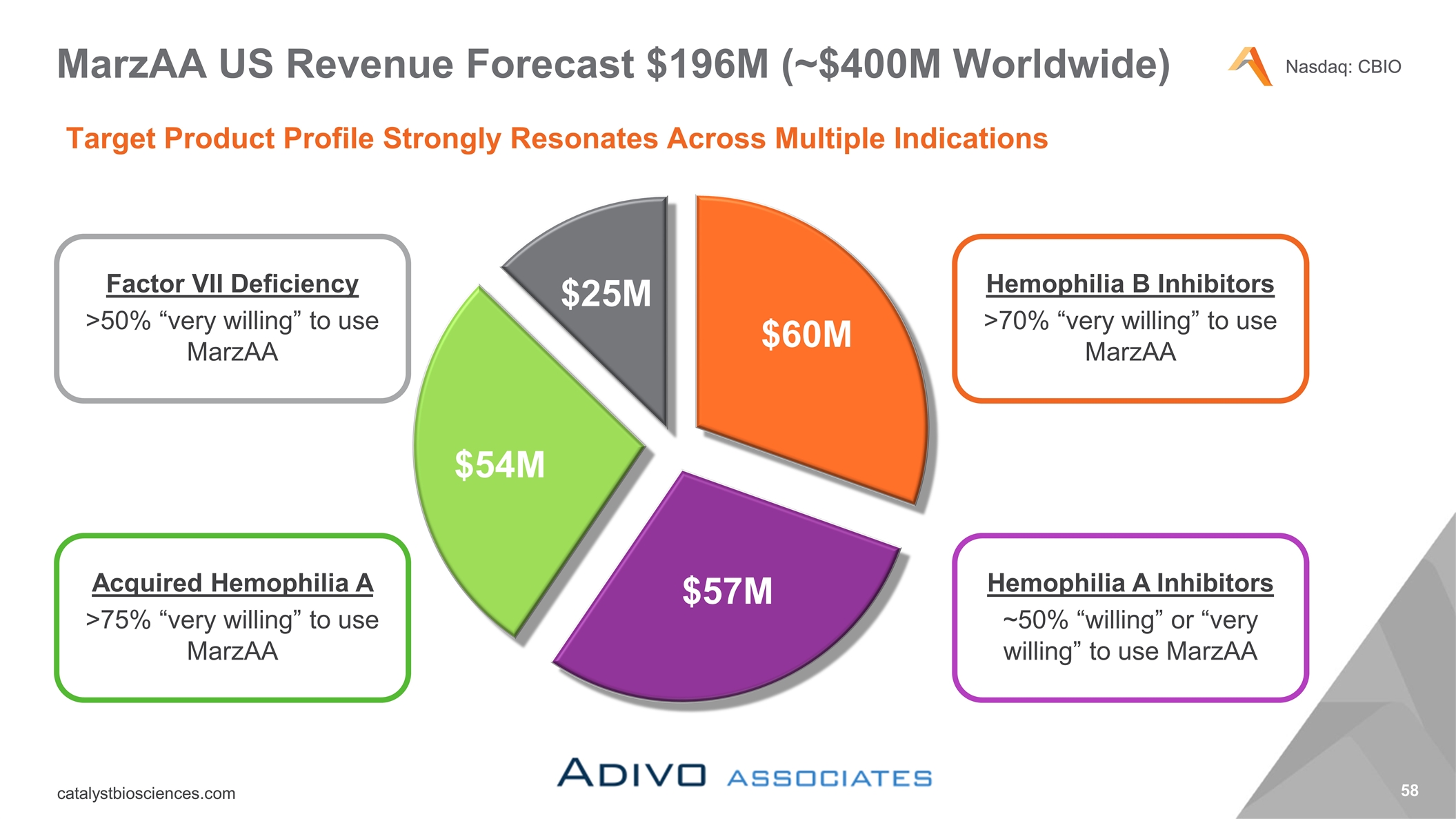

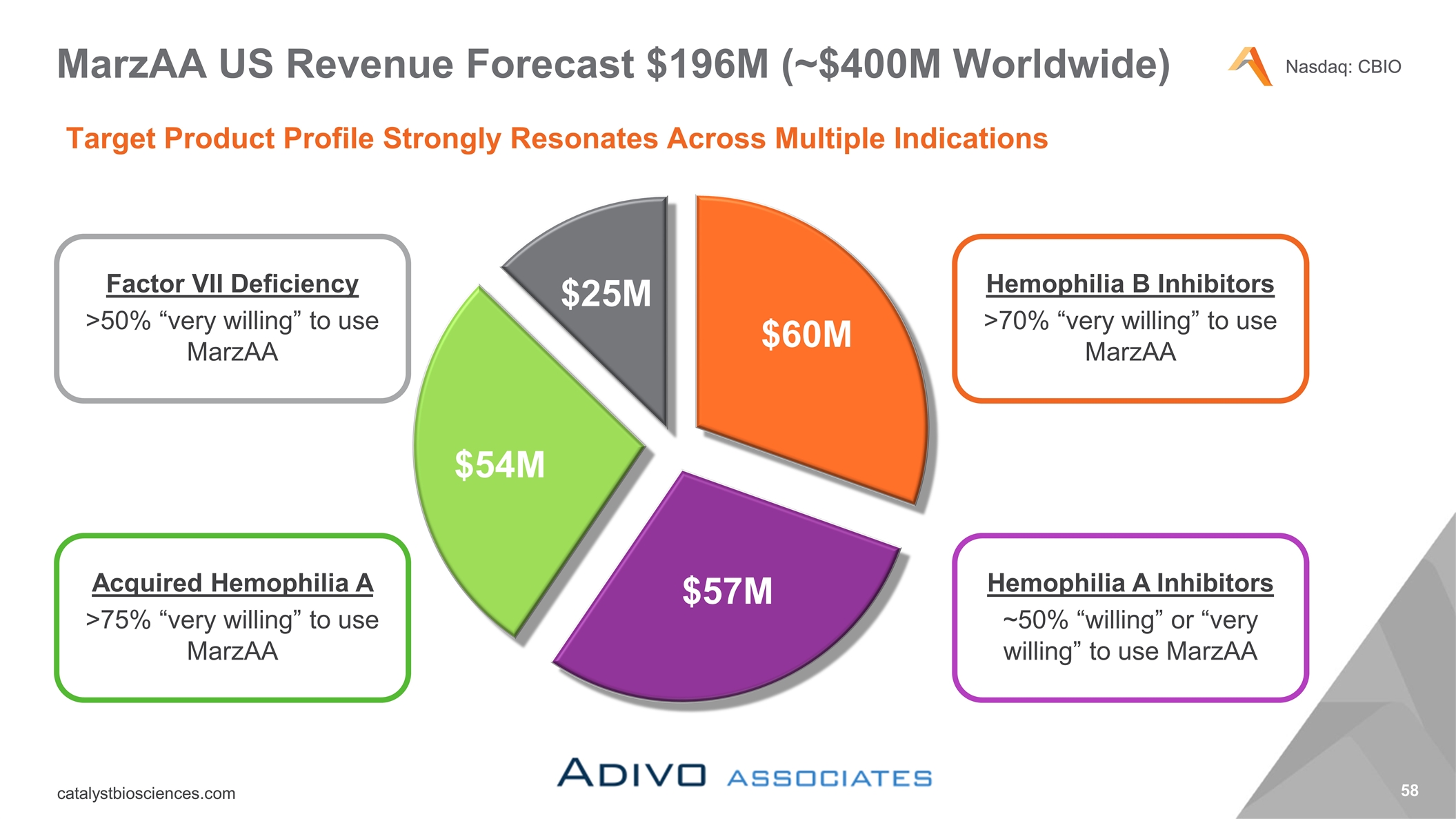

MarzAA US Revenue Forecast $196M (~$400M Worldwide) Target Product Profile Strongly Resonates Across Multiple Indications Hemophilia A Inhibitors ~50% “willing” or “very willing” to use MarzAA Hemophilia B Inhibitors >70% “very willing” to use MarzAA Factor VII Deficiency >50% “very willing” to use MarzAA Acquired Hemophilia A >75% “very willing” to use MarzAA $25M $54M $60M $57M

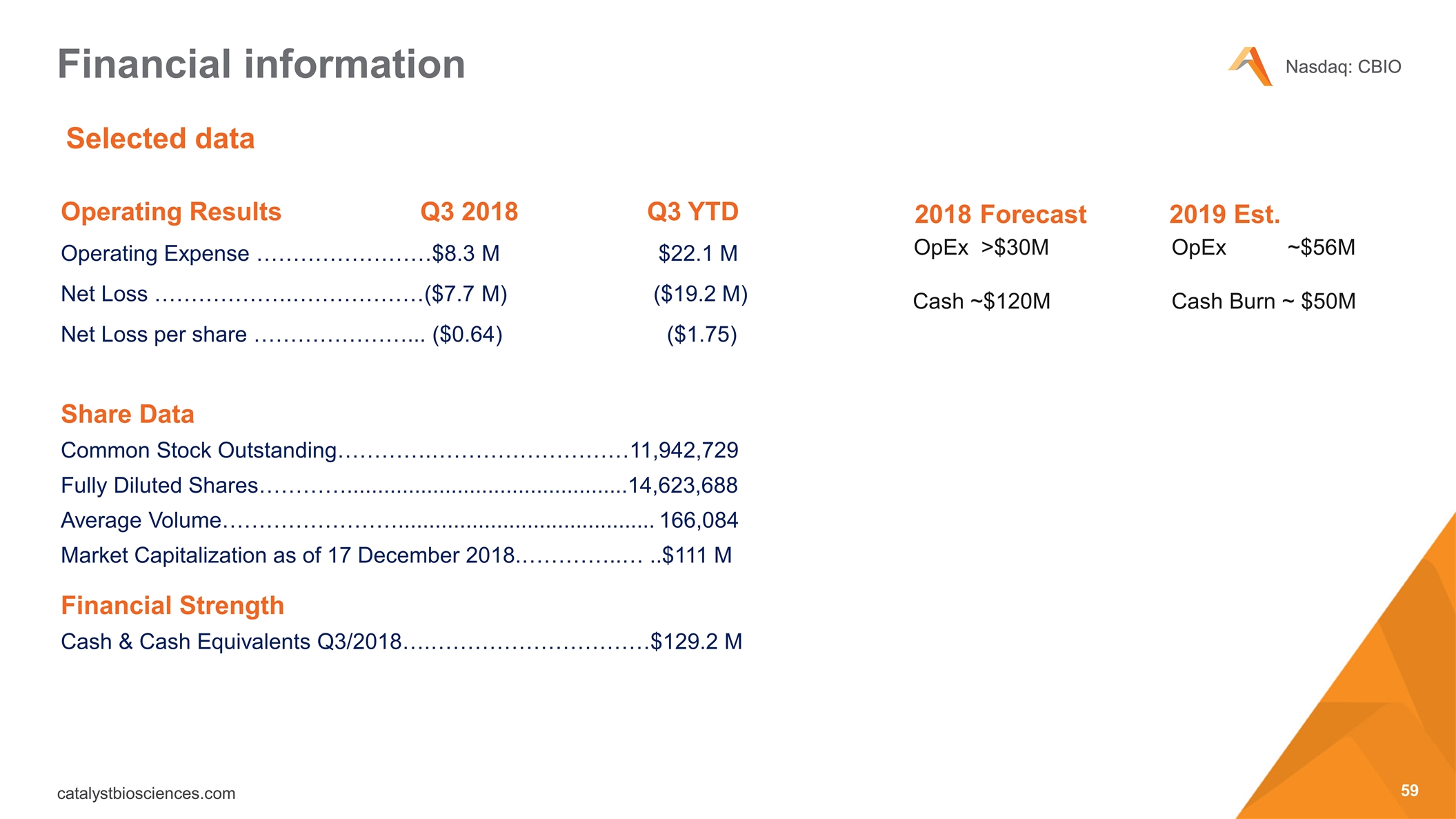

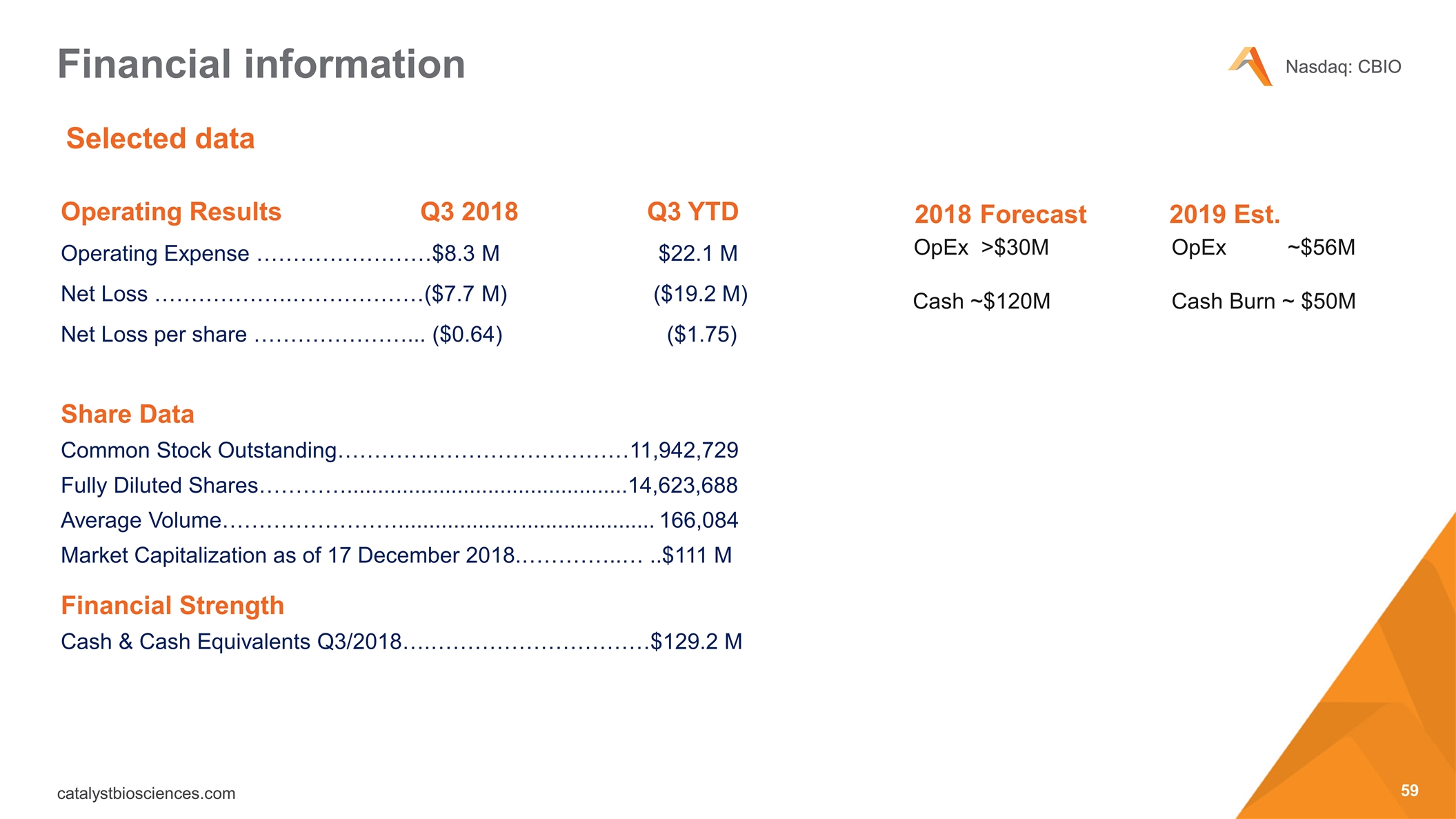

Financial information Selected data Operating Results Q3 2018 Q3 YTD Operating Expense ……………………$8.3 M $22.1 M Net Loss ……………….………………($7.7 M) ($19.2 M) Net Loss per share …………………... ($0.64) ($1.75) Share Data Common Stock Outstanding………….………………………11,942,729 Fully Diluted Shares…………..............................................14,623,688 Average Volume…………………….......................................... 166,084 Market Capitalization as of 17 December 2018.…………..… ..$111 M Financial Strength Cash & Cash Equivalents Q3/2018….…………………………$129.2 M 2018 Forecast 2019 Est. OpEx >$30M OpEx ~$56M Cash ~$120M Cash Burn ~ $50M

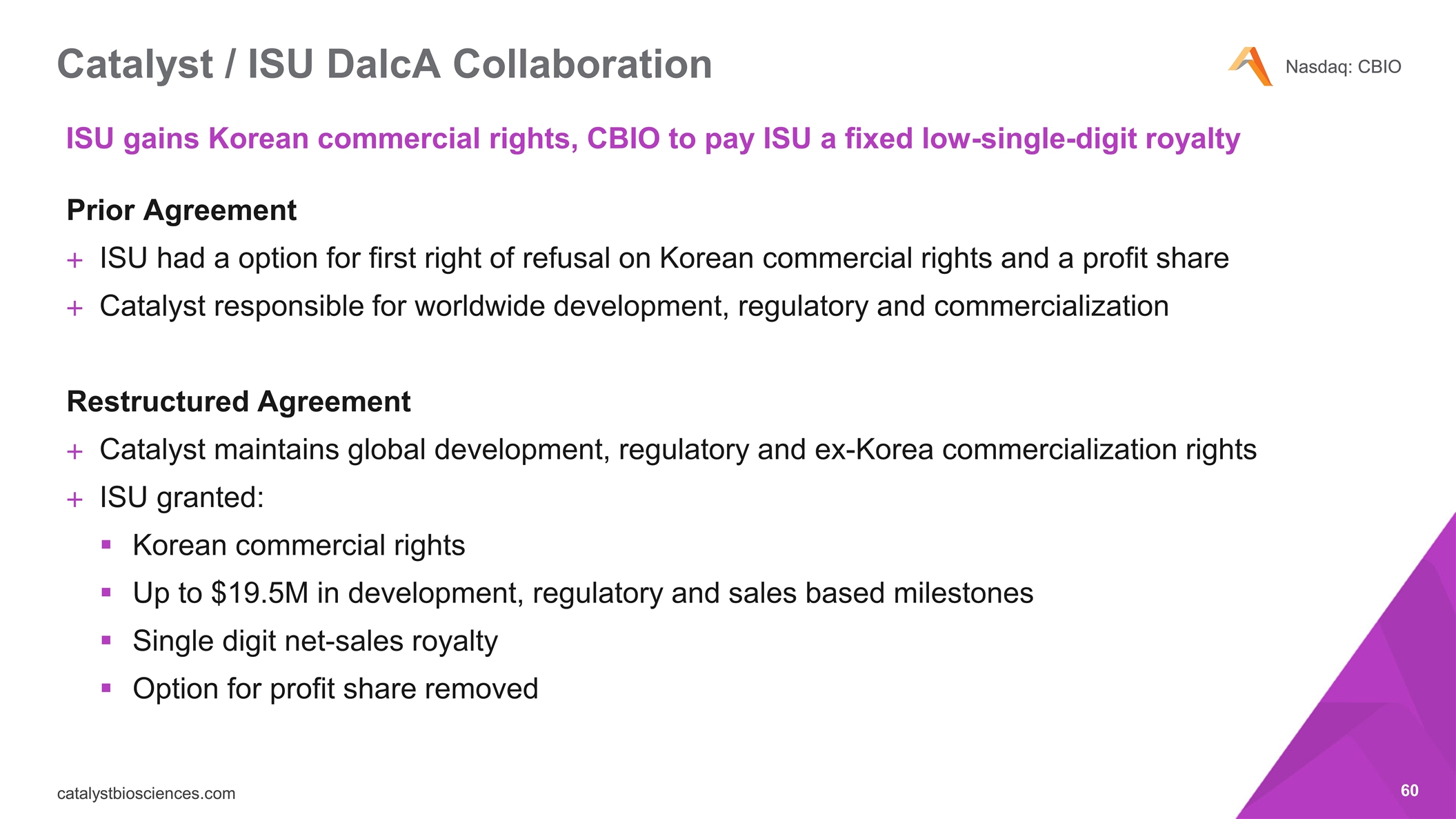

Prior Agreement ISU had a option for first right of refusal on Korean commercial rights and a profit share Catalyst responsible for worldwide development, regulatory and commercialization Restructured Agreement Catalyst maintains global development, regulatory and ex-Korea commercialization rights ISU granted: Korean commercial rights Up to $19.5M in development, regulatory and sales based milestones Single digit net-sales royalty Option for profit share removed Catalyst / ISU DalcA Collaboration ISU gains Korean commercial rights, CBIO to pay ISU a fixed low-single-digit royalty

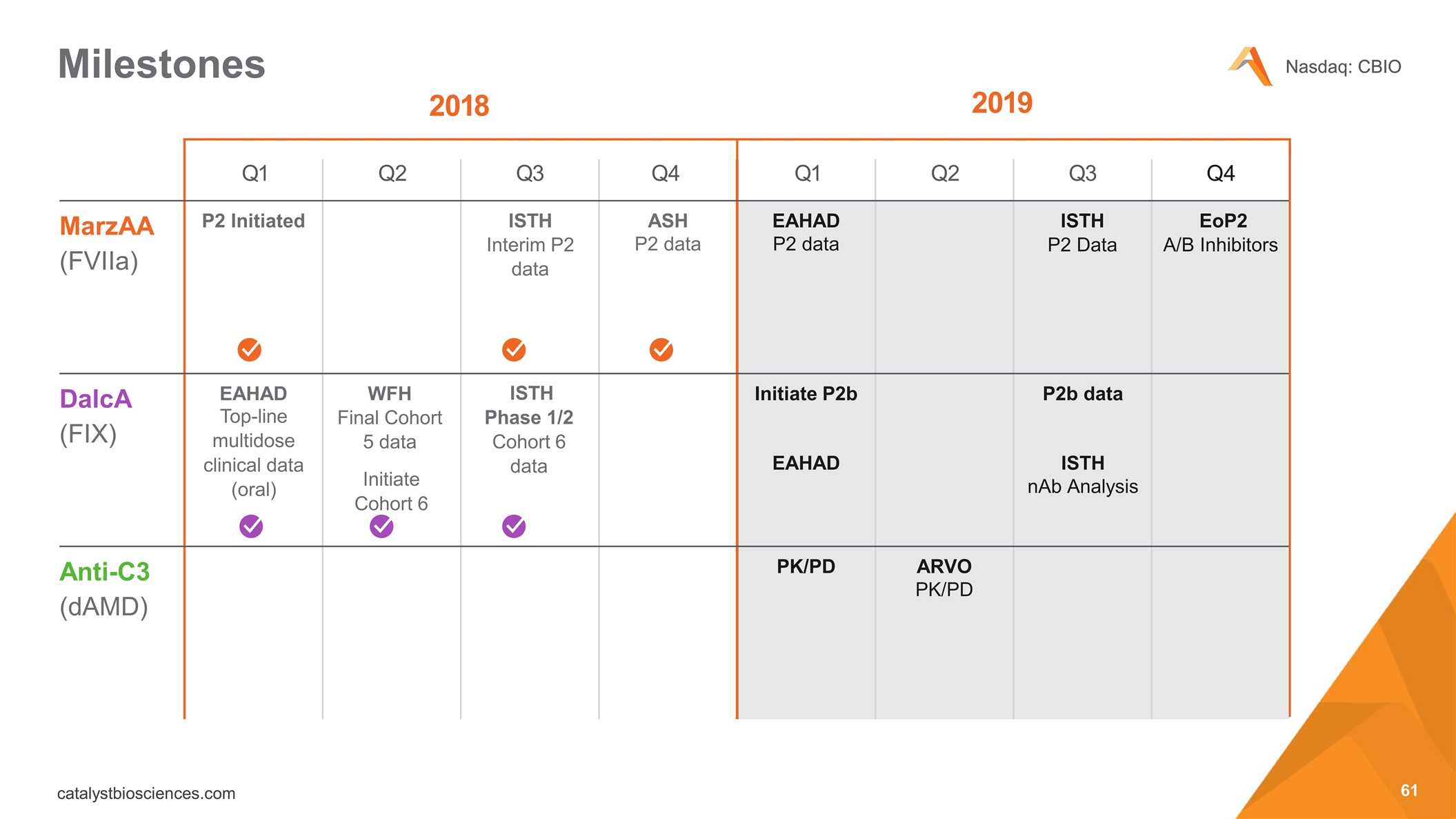

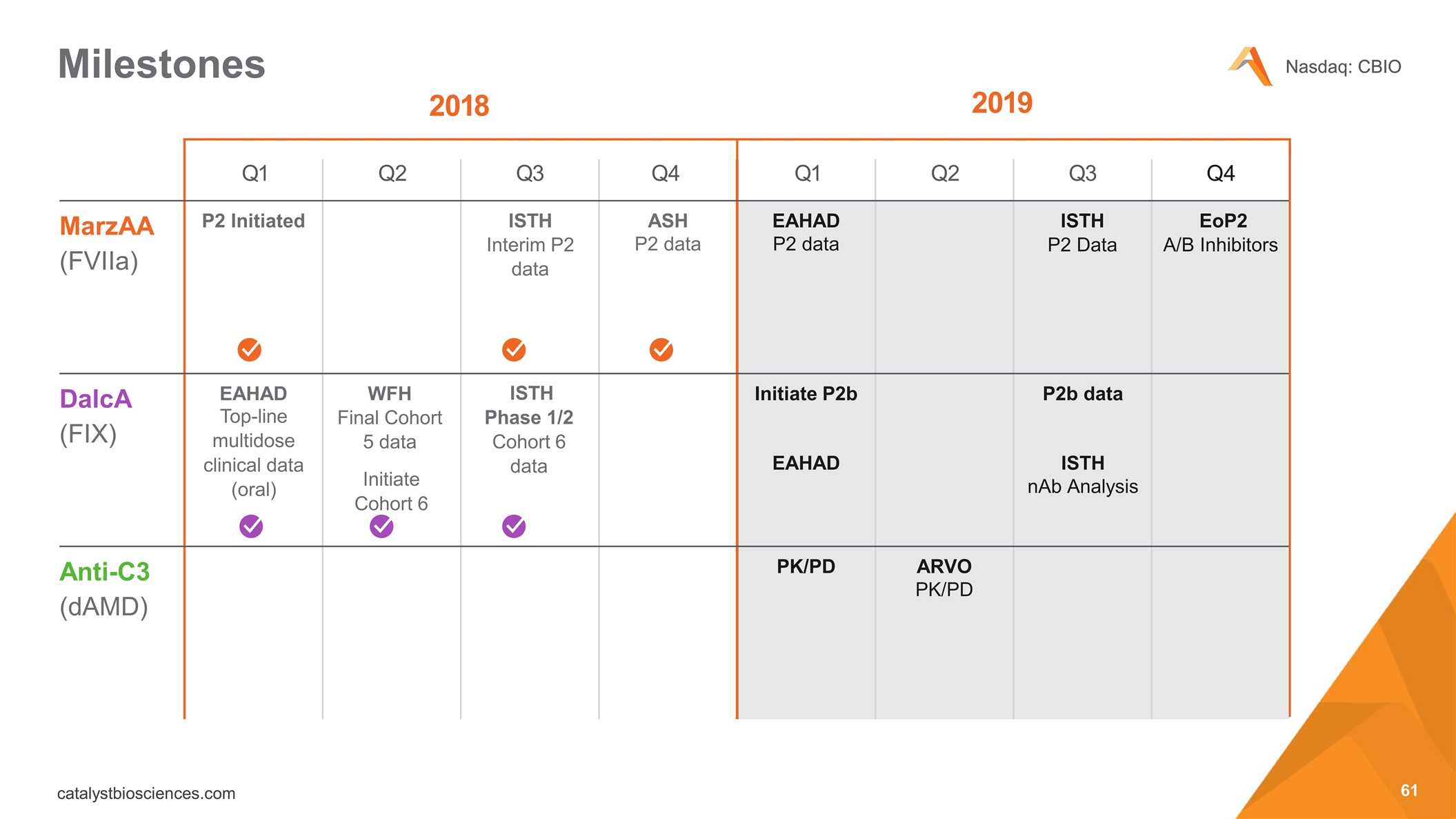

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 MarzAA (FVIIa) P2 Initiated ISTH Interim P2 data ASH P2 data EAHAD P2 data ISTH P2 Data EoP2 A/B Inhibitors DalcA (FIX) EAHAD Top-line multidose clinical data (oral) WFH Final Cohort 5 data Initiate Cohort 6 ISTH Phase 1/2 Cohort 6 data Initiate P2b EAHAD P2b data ISTH nAb Analysis Anti-C3 (dAMD) PK/PD ARVO PK/PD Milestones 2018 2019

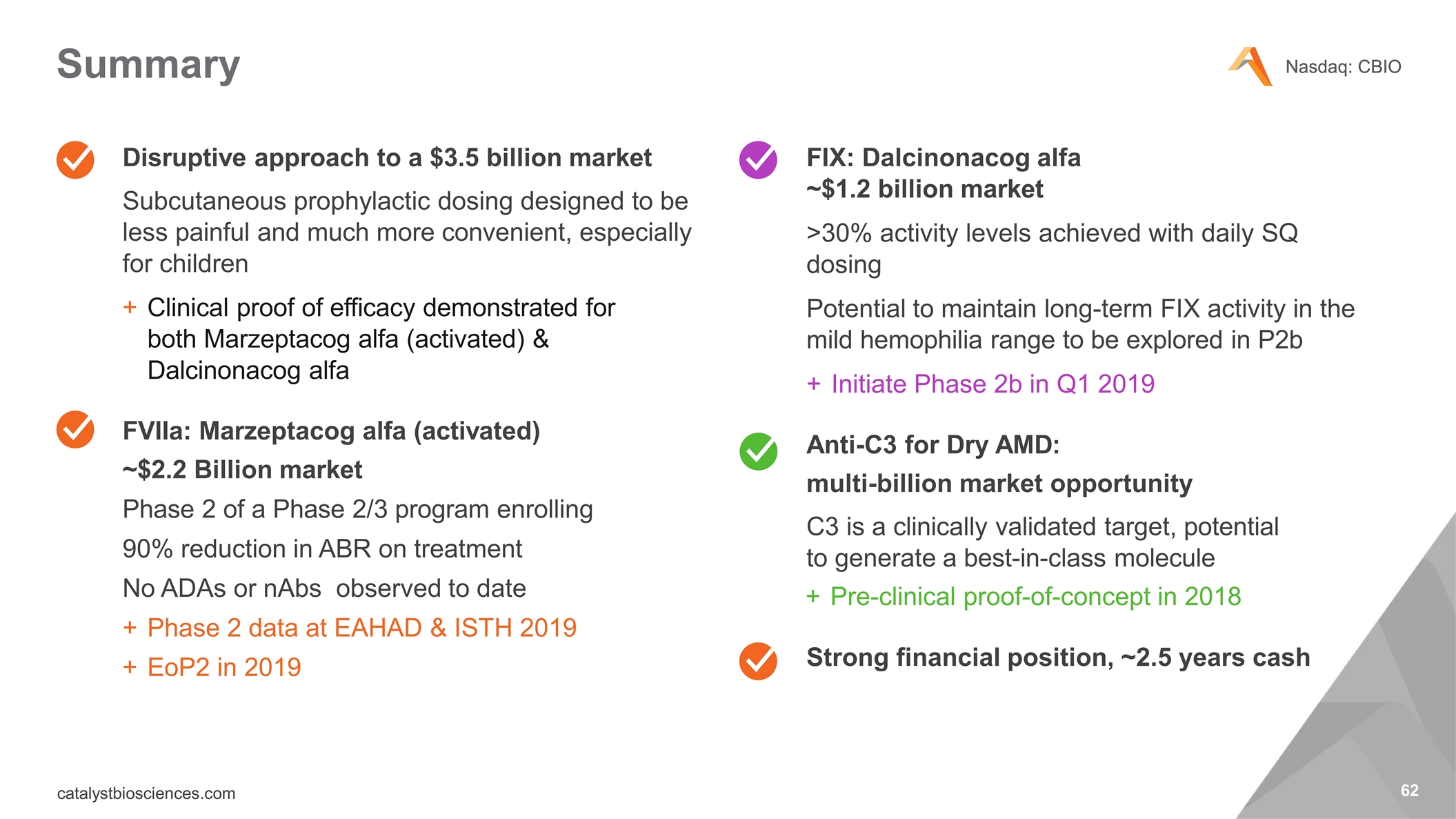

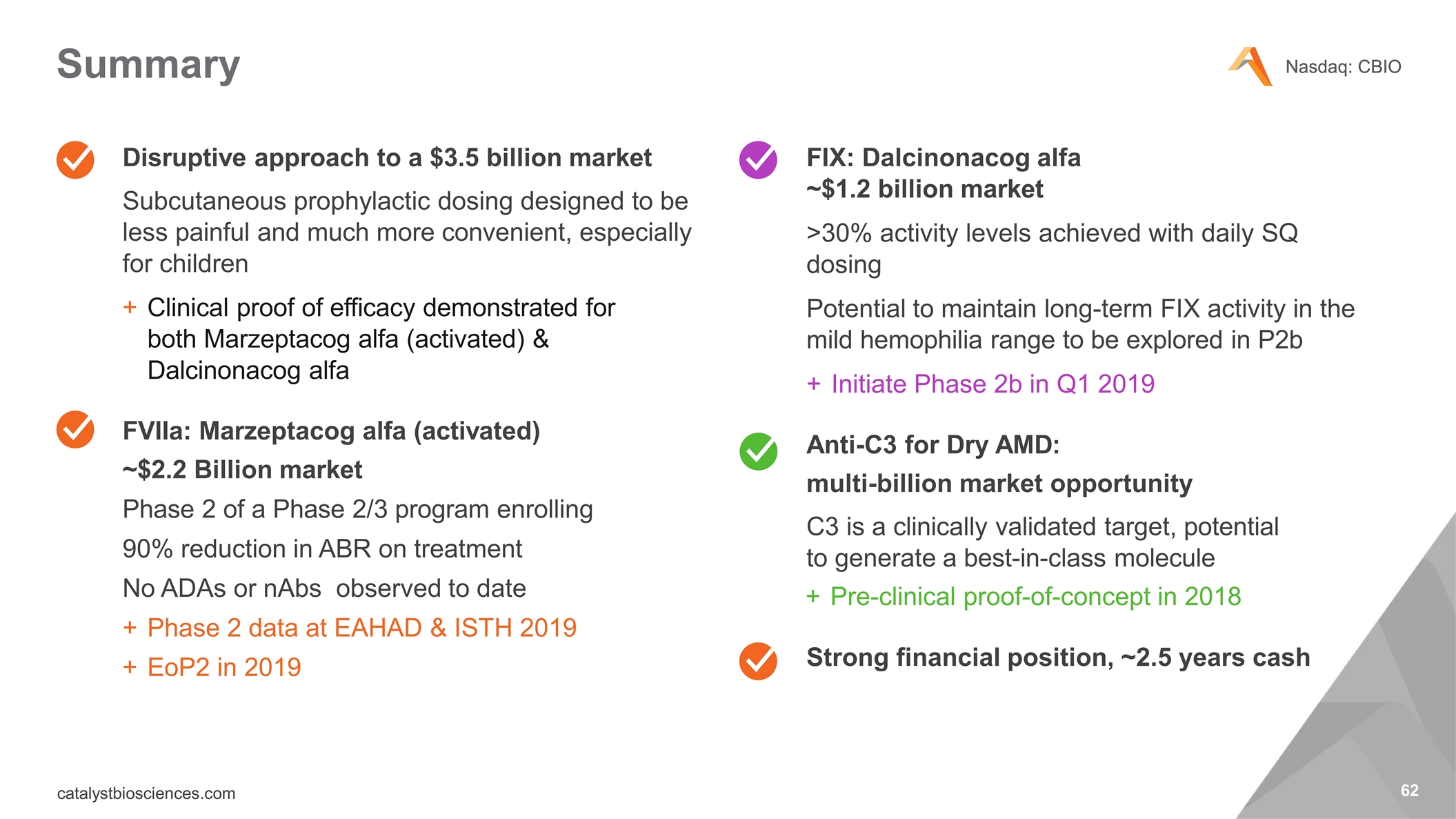

Summary Disruptive approach to a $3.5 billion market Subcutaneous prophylactic dosing designed to be less painful and much more convenient, especially for children Clinical proof of efficacy demonstrated for both Marzeptacog alfa (activated) & Dalcinonacog alfa FVIIa: Marzeptacog alfa (activated) ~$2.2 Billion market Phase 2 of a Phase 2/3 program enrolling 90% reduction in ABR on treatment No ADAs or nAbs observed to date Phase 2 data at EAHAD & ISTH 2019 EoP2 in 2019 FIX: Dalcinonacog alfa ~$1.2 billion market >30% activity levels achieved with daily SQ dosing Potential to maintain long-term FIX activity in the mild hemophilia range to be explored in P2b Initiate Phase 2b in Q1 2019 Anti-C3 for Dry AMD: multi-billion market opportunity C3 is a clinically validated target, potential to generate a best-in-class molecule Pre-clinical proof-of-concept in 2018 Strong financial position, ~2.5 years cash

THANK YOU Nasdaq: CBIO catalystbiosciences.com