CATALYST BIOSCIENCES Corporate Overview 8 January 2020 Exhibit 99.1

Forward looking statements This presentation includes forward-looking statements that involve substantial risks and uncertainties. All statements included in this presentation, other than statement of historical facts, are forward-looking statements. Examples of such statements include, but are not limited to, potential markets for MarzAA, DalcA and CB 2782-PEG, potential use of MarzAA as a subcutaneous therapy for patients with hemophilia A or B with inhibitors and other bleeding disorders, clinical trial results, anticipated results of a PK study to support treatment of a bleed in 2020, plans for an end-of-Phase 2 meeting regarding MarzAA in early 2020, plans for final Phase 2b clinical trial data for DalcA in the first half of 2020, and potential milestone and royalty payments from Biogen. Actual results or events could differ materially from the plans, expectations and projections disclosed in these forward-looking statements. Various important factors could cause actual results or events to differ materially, including, but not limited to, the risk that additional human trials will not replicate the results from earlier trials or animal studies, that potential adverse effects may arise from the testing or use of MarzAA or DalcA, including the generation of antibodies, which has been observed in patients treated with DalcA, that clinical trials will take longer than anticipated to be completed, that costs required to develop or manufacture the Company’s products will be higher than anticipated, that Biogen will discontinue development of CB 2782-PEG, competition and other factors that affect our ability to establish collaborations on commercially reasonable terms and other risks described in the “Risk Factors” section of the Company’s quarterly report on Form 10-Q filed with the Securities and Exchange Commission on November 7, 2019, and in other filings with the Securities and Exchange Commission. The Company does not assume any obligation to update any forward-looking statements, except as required by law.

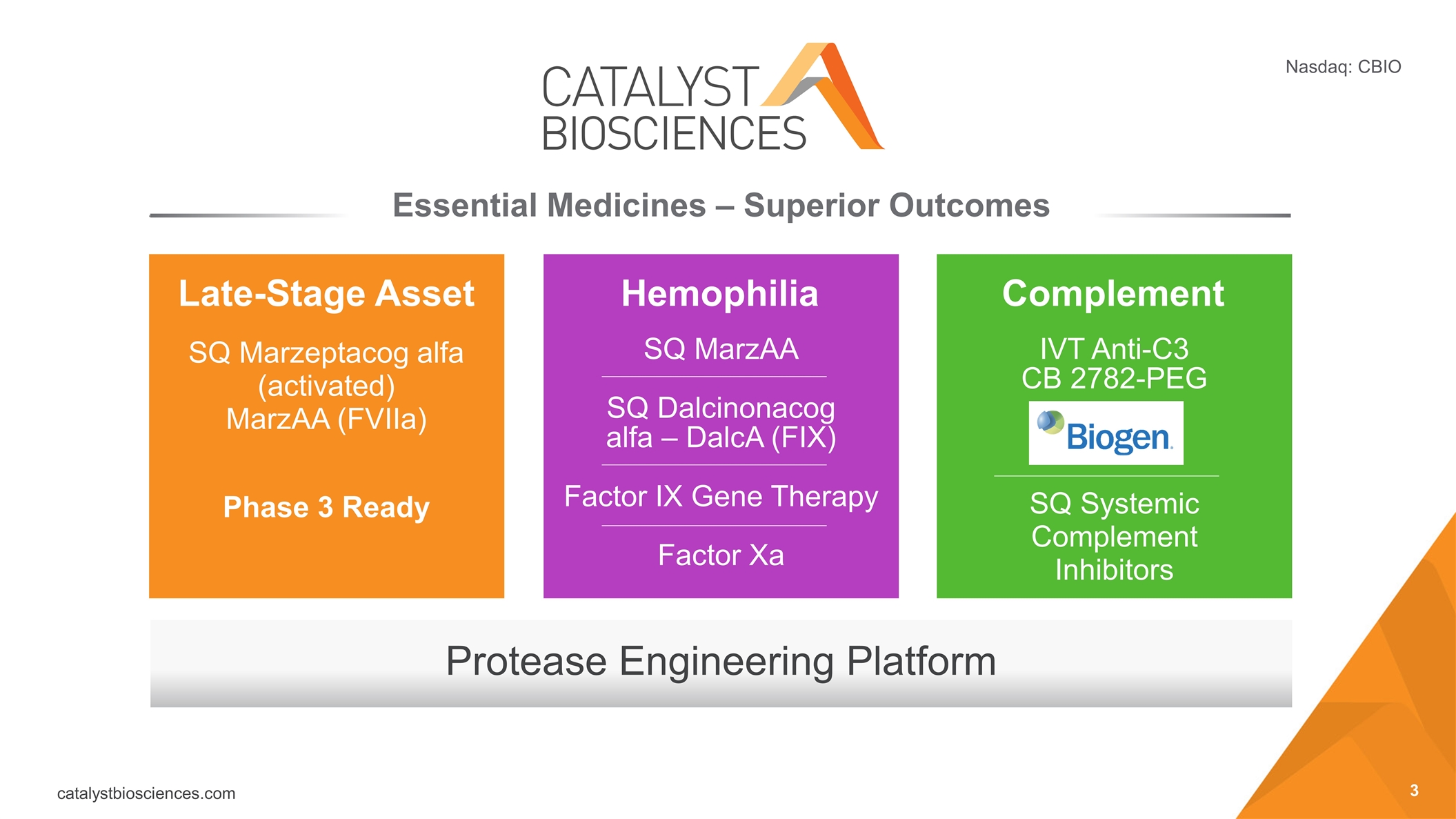

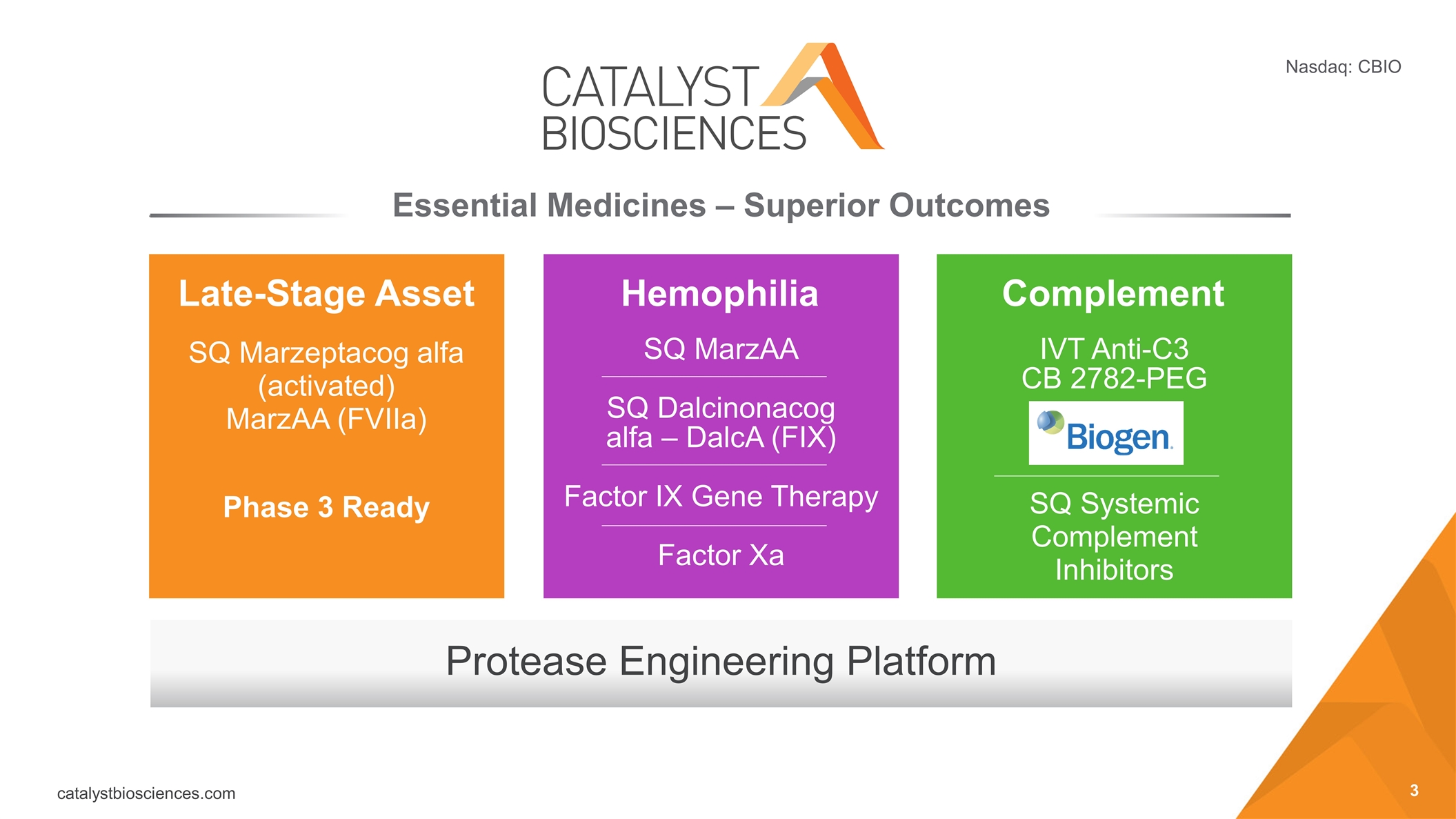

Protease Engineering Platform Essential Medicines – Superior Outcomes Late-Stage Asset Hemophilia Complement SQ Marzeptacog alfa (activated) MarzAA (FVIIa) Phase 3 Ready SQ MarzAA SQ Dalcinonacog alfa – DalcA (FIX) Factor IX Gene Therapy Factor Xa IVT Anti-C3 CB 2782-PEG SQ Systemic Complement Inhibitors

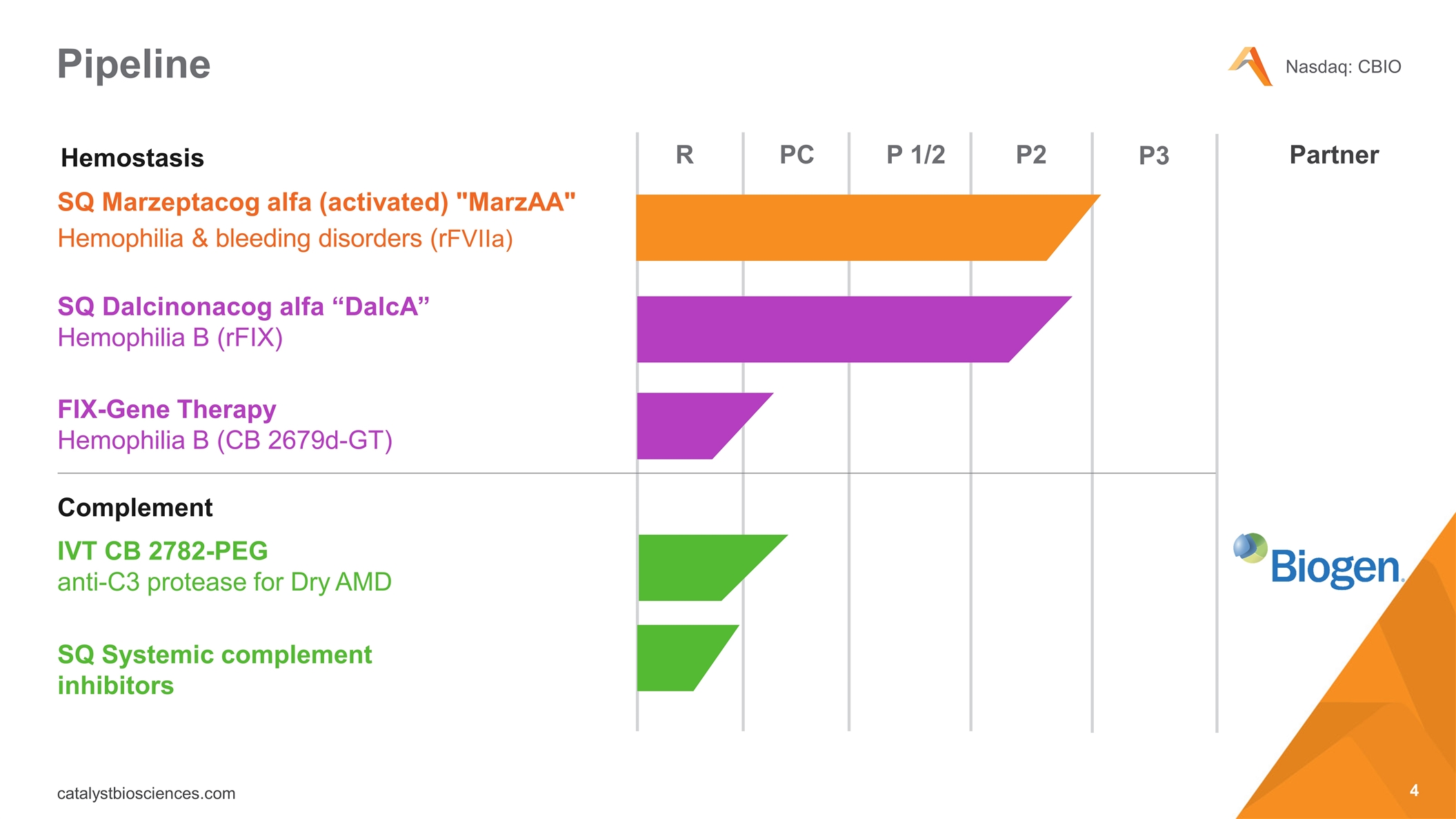

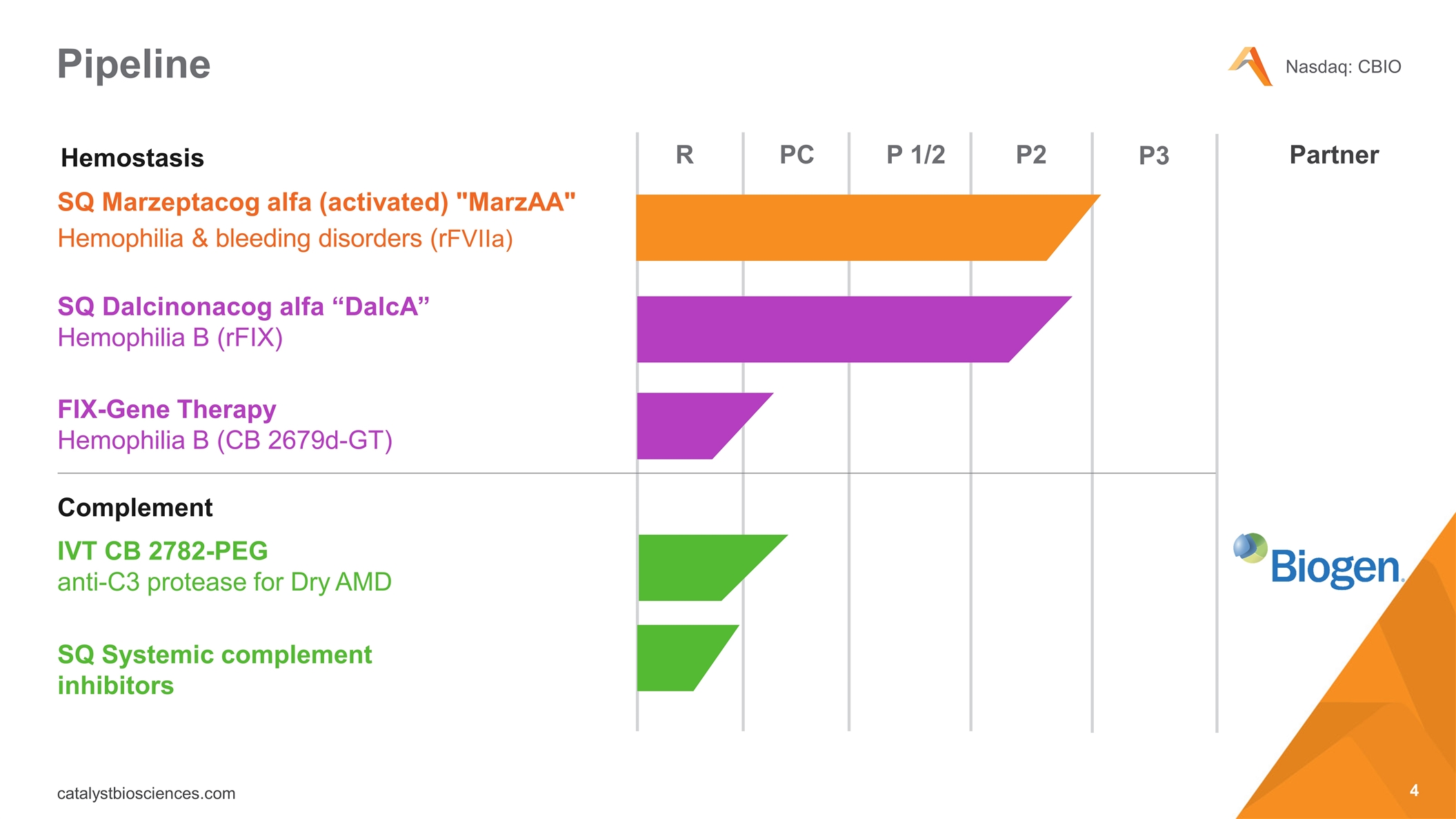

Pipeline SQ Marzeptacog alfa (activated) "MarzAA" Hemophilia & bleeding disorders (rFVIIa) SQ Dalcinonacog alfa “DalcA” Hemophilia B (rFIX) IVT CB 2782-PEG anti-C3 protease for Dry AMD Complement R PC P 1/2 P2 FIX-Gene Therapy Hemophilia B (CB 2679d-GT) P3 SQ Systemic complement inhibitors Hemostasis Partner

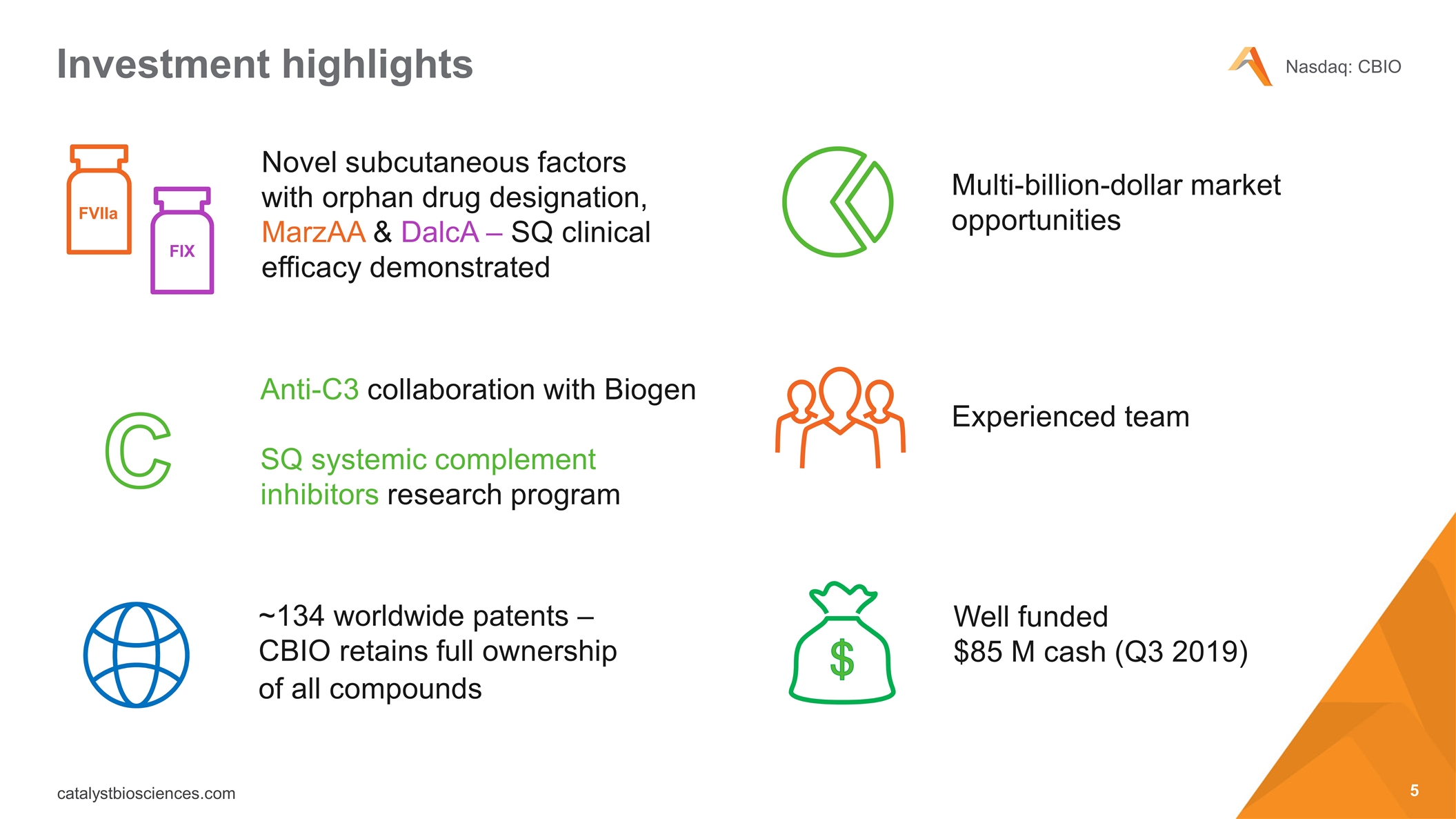

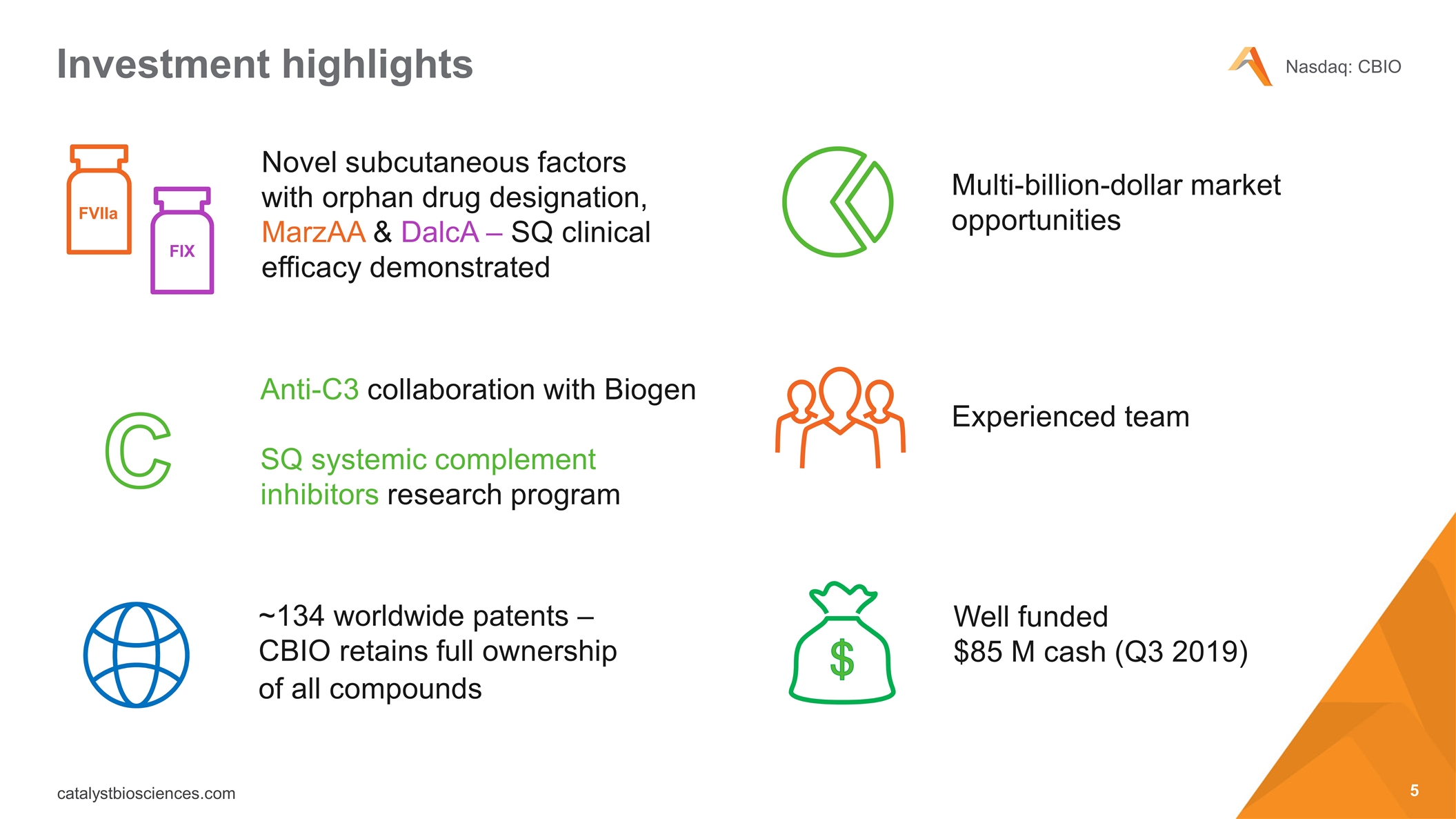

Investment highlights ~134 worldwide patents – CBIO retains full ownership of all compounds Experienced team Well funded $85 M cash (Q3 2019) Novel subcutaneous factors with orphan drug designation, MarzAA & DalcA – SQ clinical efficacy demonstrated Multi-billion-dollar market opportunities FVIIa FIX Anti-C3 collaboration with Biogen SQ systemic complement inhibitors research program C

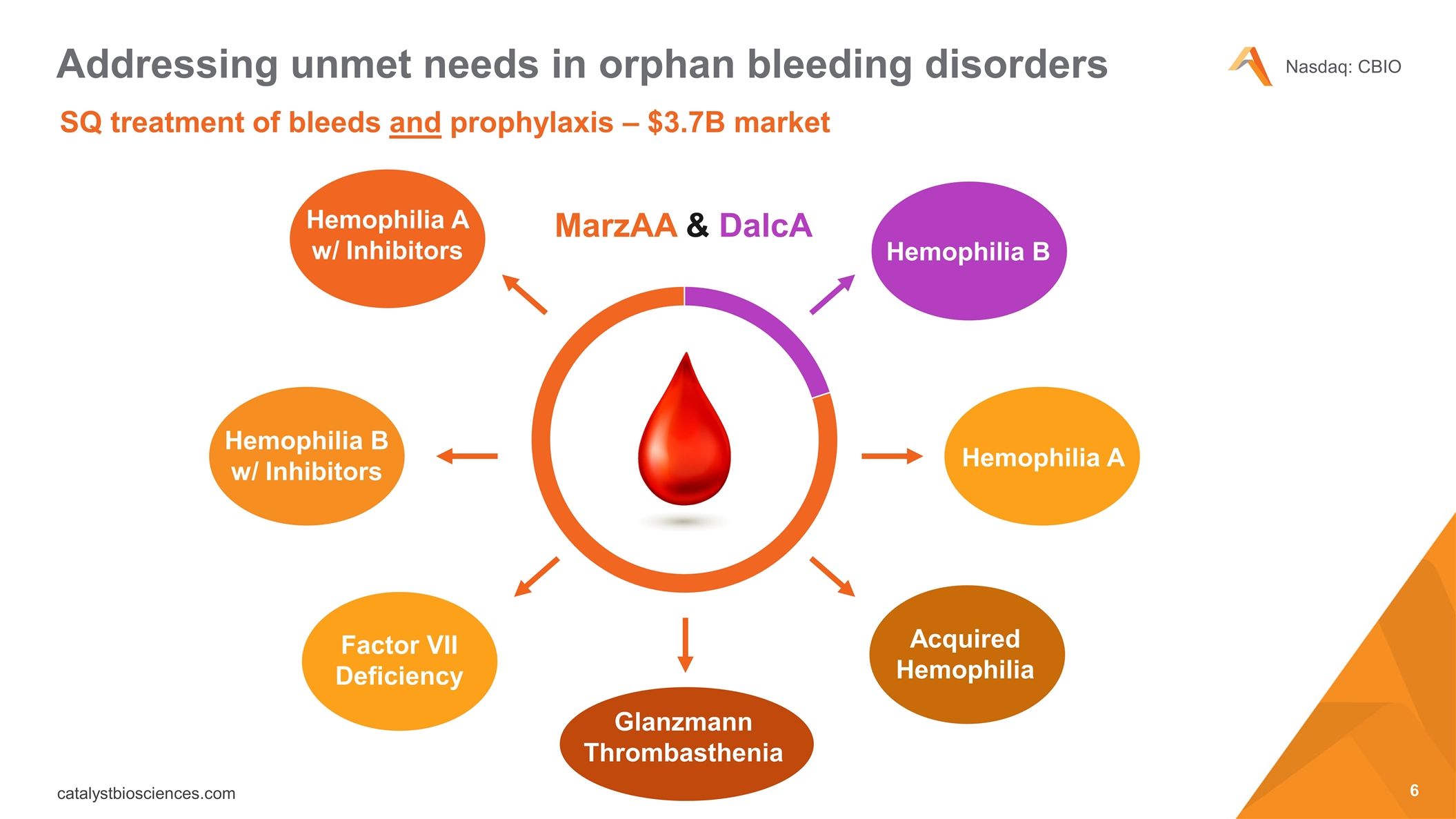

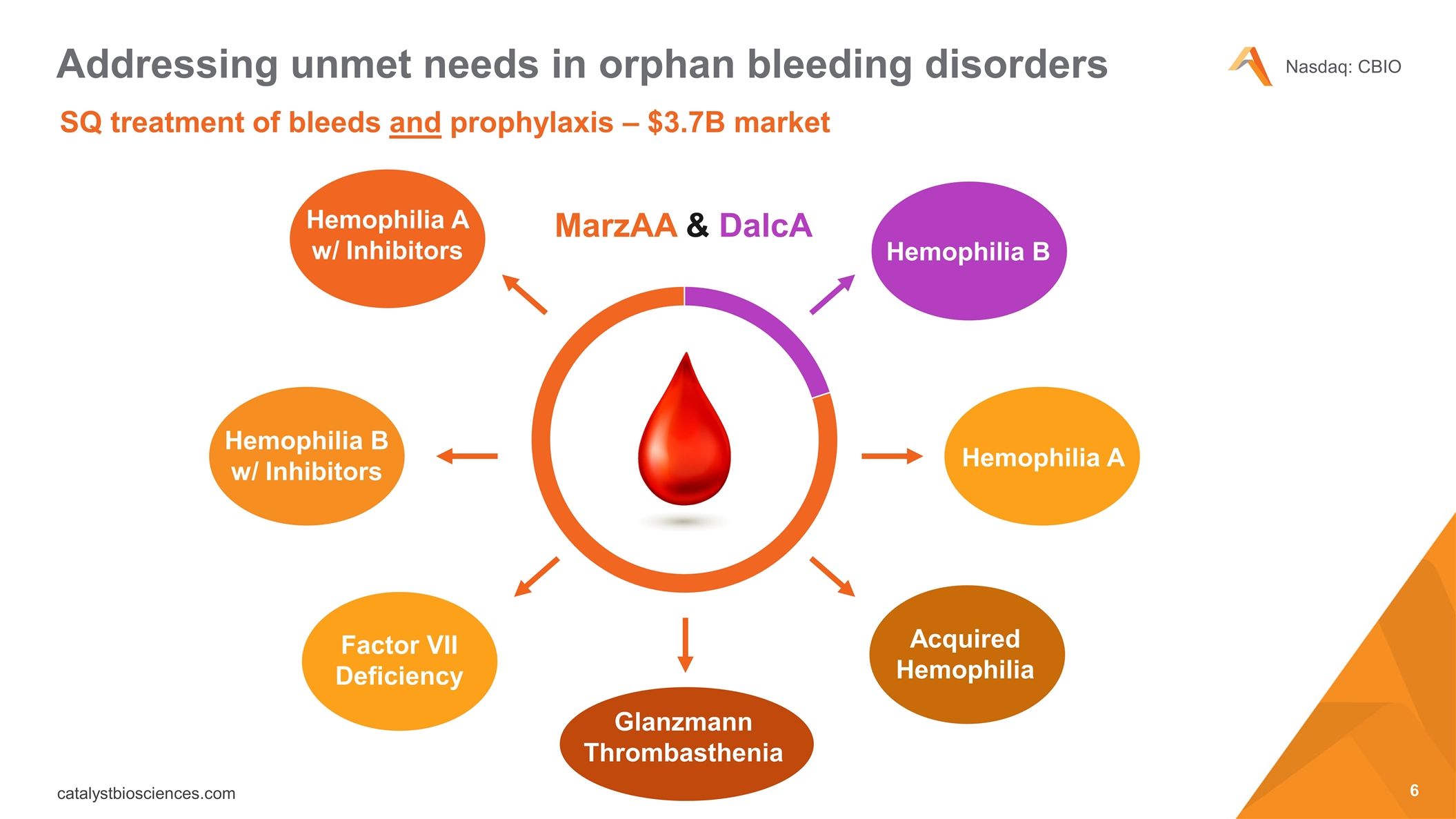

SQ treatment of bleeds and prophylaxis – $3.7B market Addressing unmet needs in orphan bleeding disorders MarzAA & DalcA Hemophilia A w/ Inhibitors Hemophilia B w/ Inhibitors Factor VII Deficiency Hemophilia B Hemophilia A Acquired Hemophilia Glanzmann Thrombasthenia

The Catalyst Biosciences subcutaneous solution Our highly potent candidates Quick & simple self-administered SQ injection SQ dosing is the future in hemophilia and other rare hematology indications Ideal for pediatric patients Much higher & more stable factor levels for prophylaxis Enable SQ treatment of bleeding

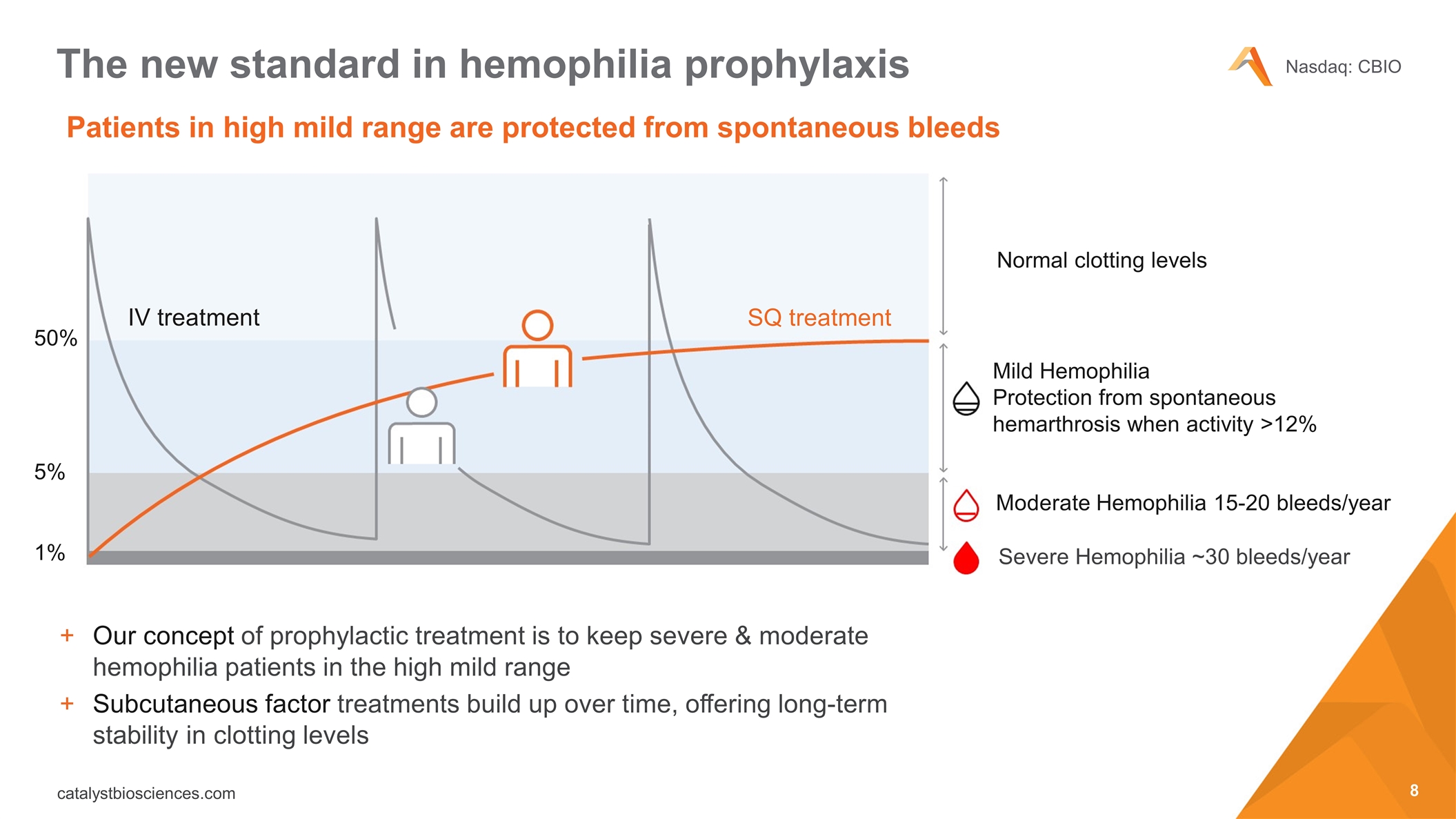

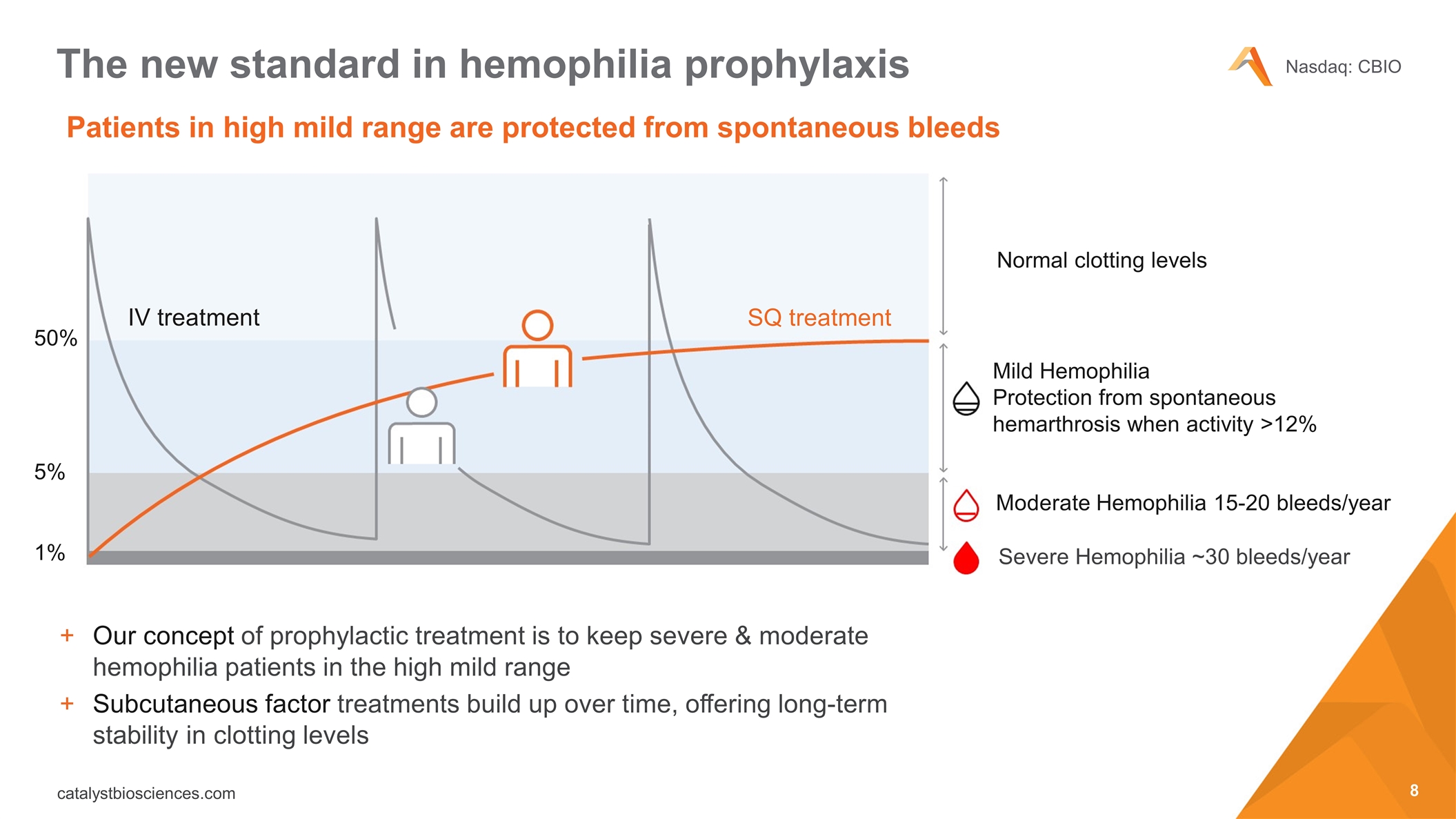

Patients in high mild range are protected from spontaneous bleeds The new standard in hemophilia prophylaxis Our concept of prophylactic treatment is to keep severe & moderate hemophilia patients in the high mild range Subcutaneous factor treatments build up over time, offering long-term stability in clotting levels Mild Hemophilia Protection from spontaneous hemarthrosis when activity >12% Normal clotting levels Moderate Hemophilia 15-20 bleeds/year IV treatment Severe Hemophilia ~30 bleeds/year SQ treatment 50% 5% 1%

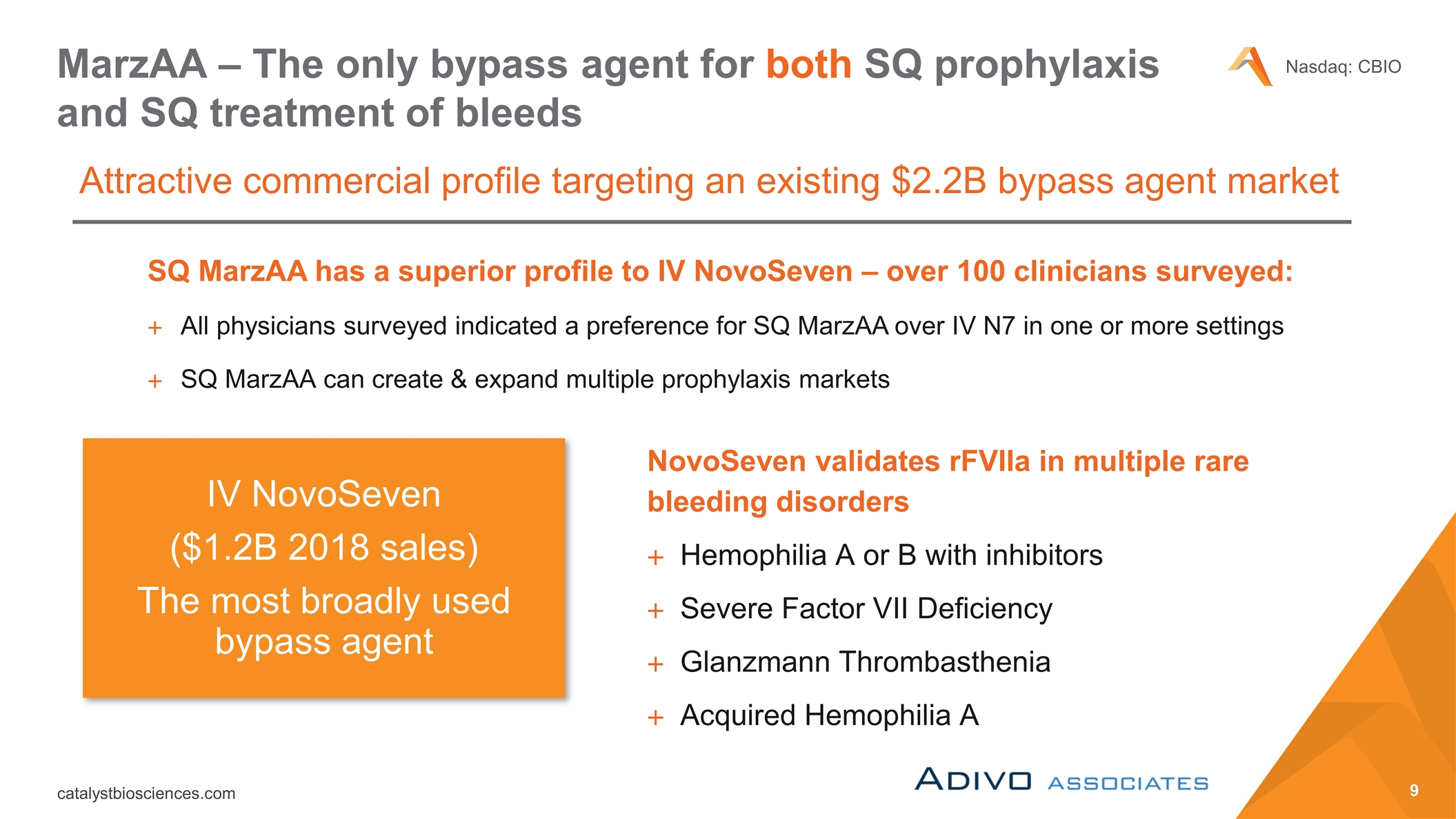

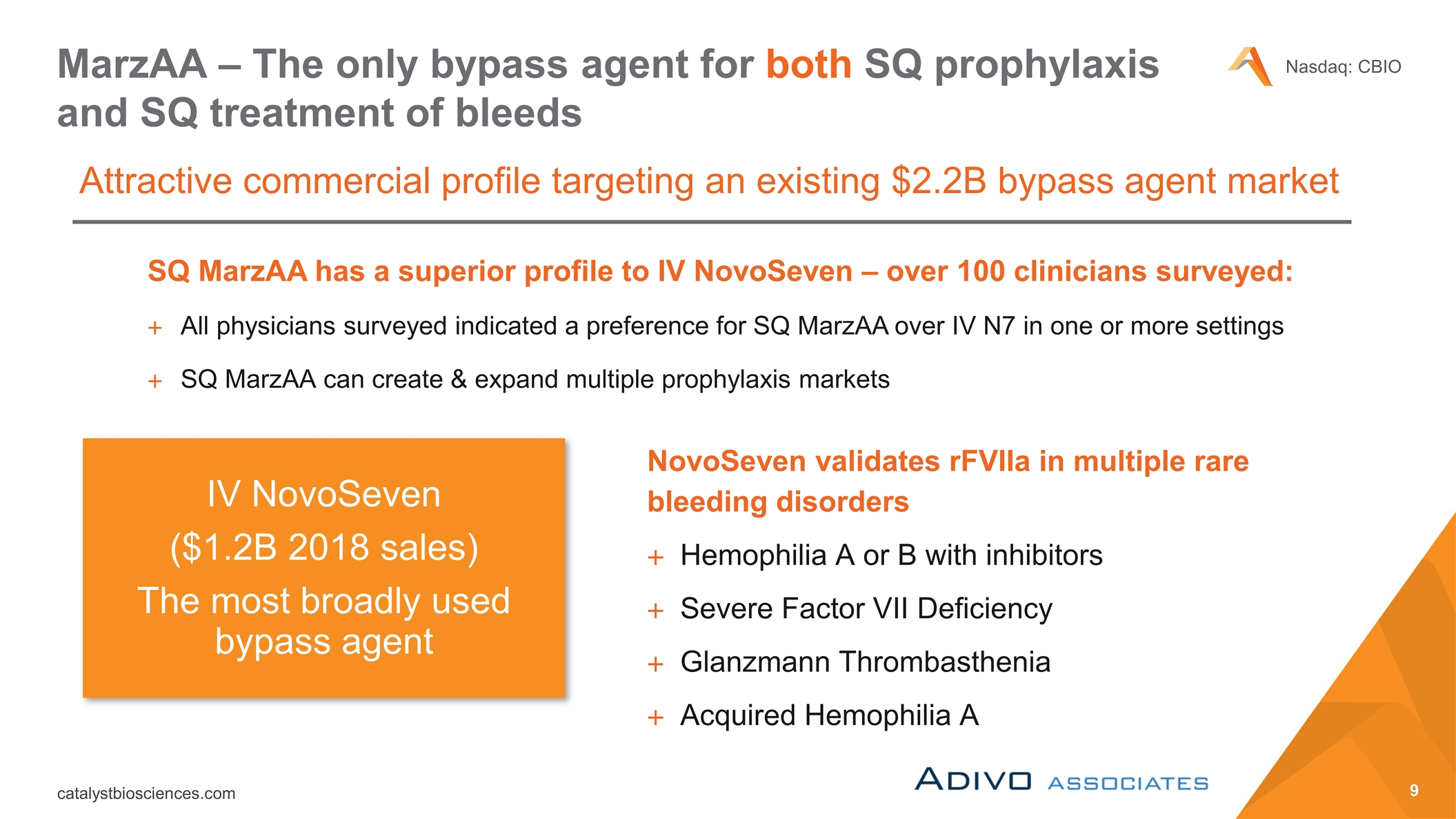

MarzAA – The only bypass agent for both SQ prophylaxis and SQ treatment of bleeds Attractive commercial profile targeting an existing $2.2B bypass agent market NovoSeven validates rFVIIa in multiple rare bleeding disorders Hemophilia A or B with inhibitors Severe Factor VII Deficiency Glanzmann Thrombasthenia Acquired Hemophilia A SQ MarzAA has a superior profile to IV NovoSeven – over 100 clinicians surveyed: All physicians surveyed indicated a preference for SQ MarzAA over IV N7 in one or more settings SQ MarzAA can create & expand multiple prophylaxis markets IV NovoSeven ($1.2B 2018 sales) The most broadly used bypass agent

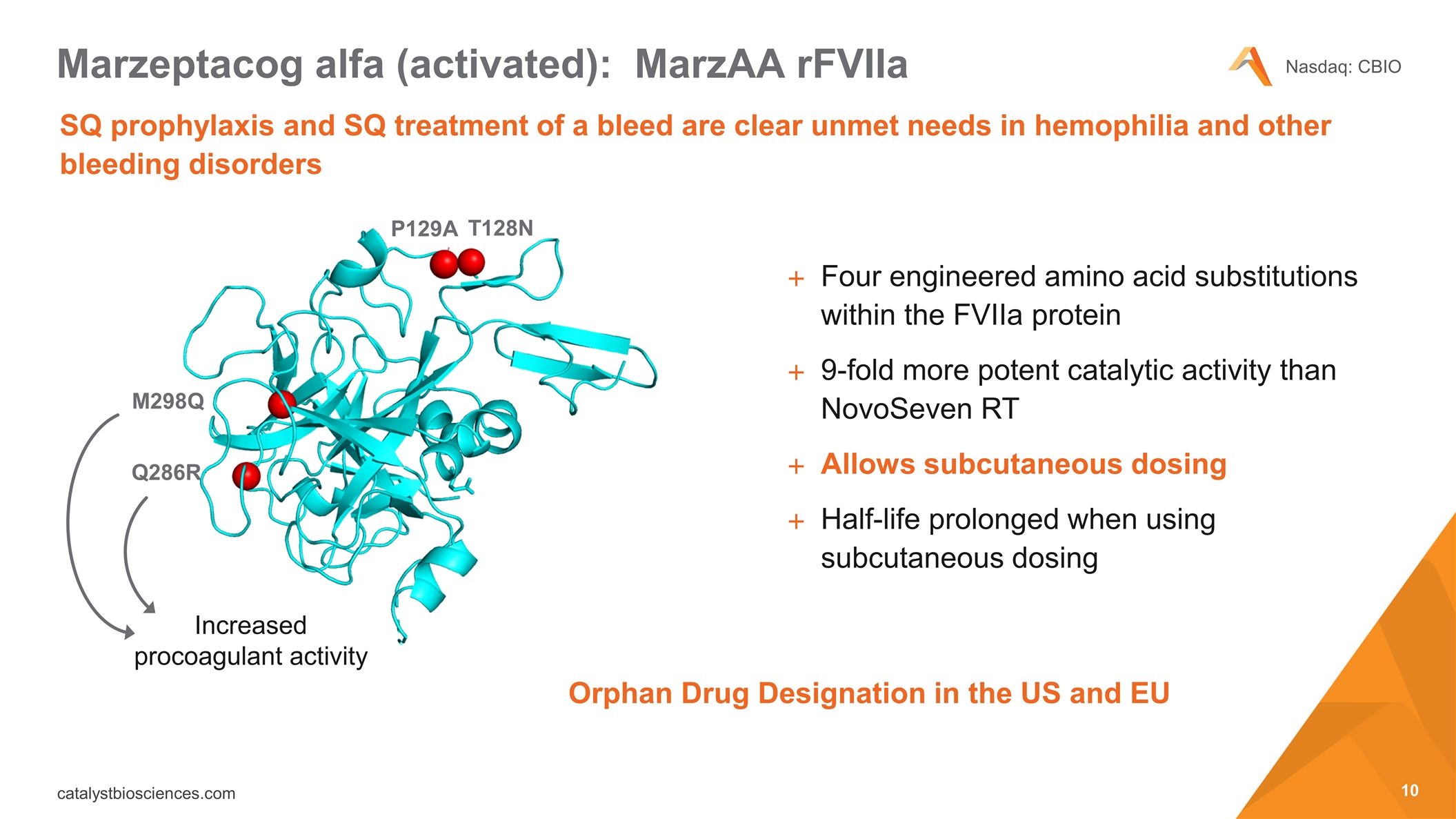

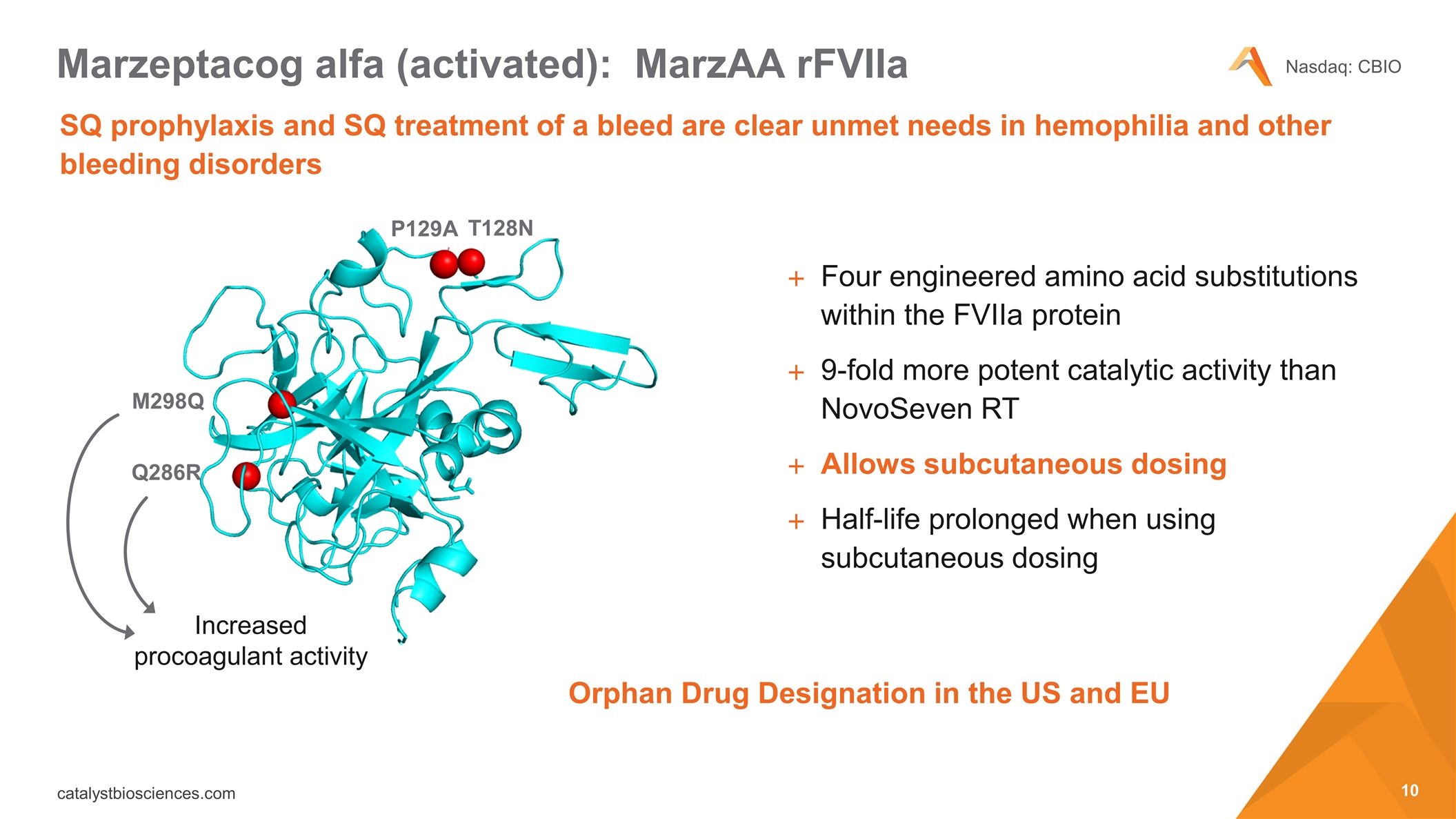

SQ prophylaxis and SQ treatment of a bleed are clear unmet needs in hemophilia and other bleeding disorders Marzeptacog alfa (activated): MarzAA rFVIIa P129A M298Q T128N Increased procoagulant activity Q286R Four engineered amino acid substitutions within the FVIIa protein 9-fold more potent catalytic activity than NovoSeven RT Allows subcutaneous dosing Half-life prolonged when using subcutaneous dosing Orphan Drug Designation in the US and EU

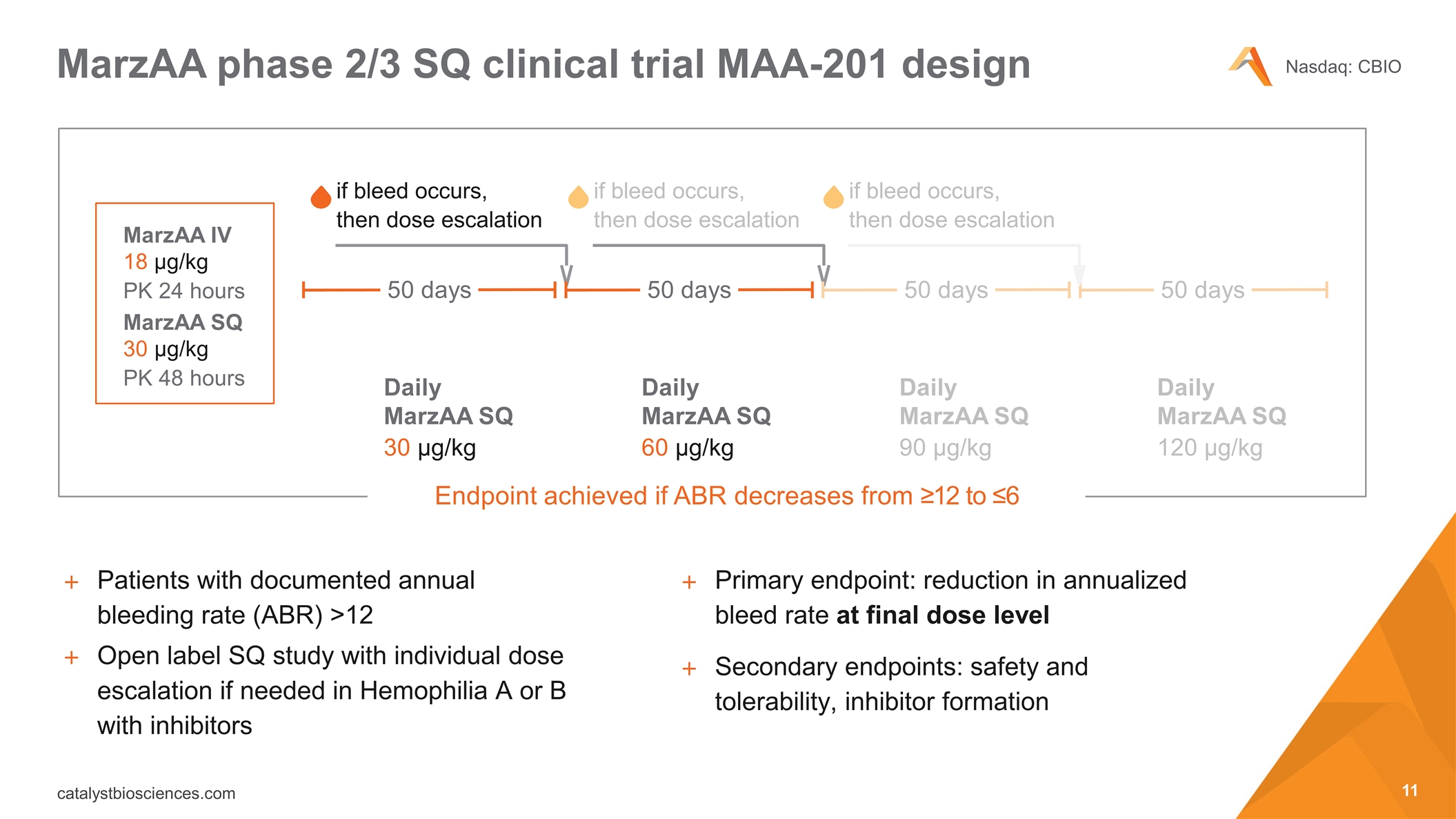

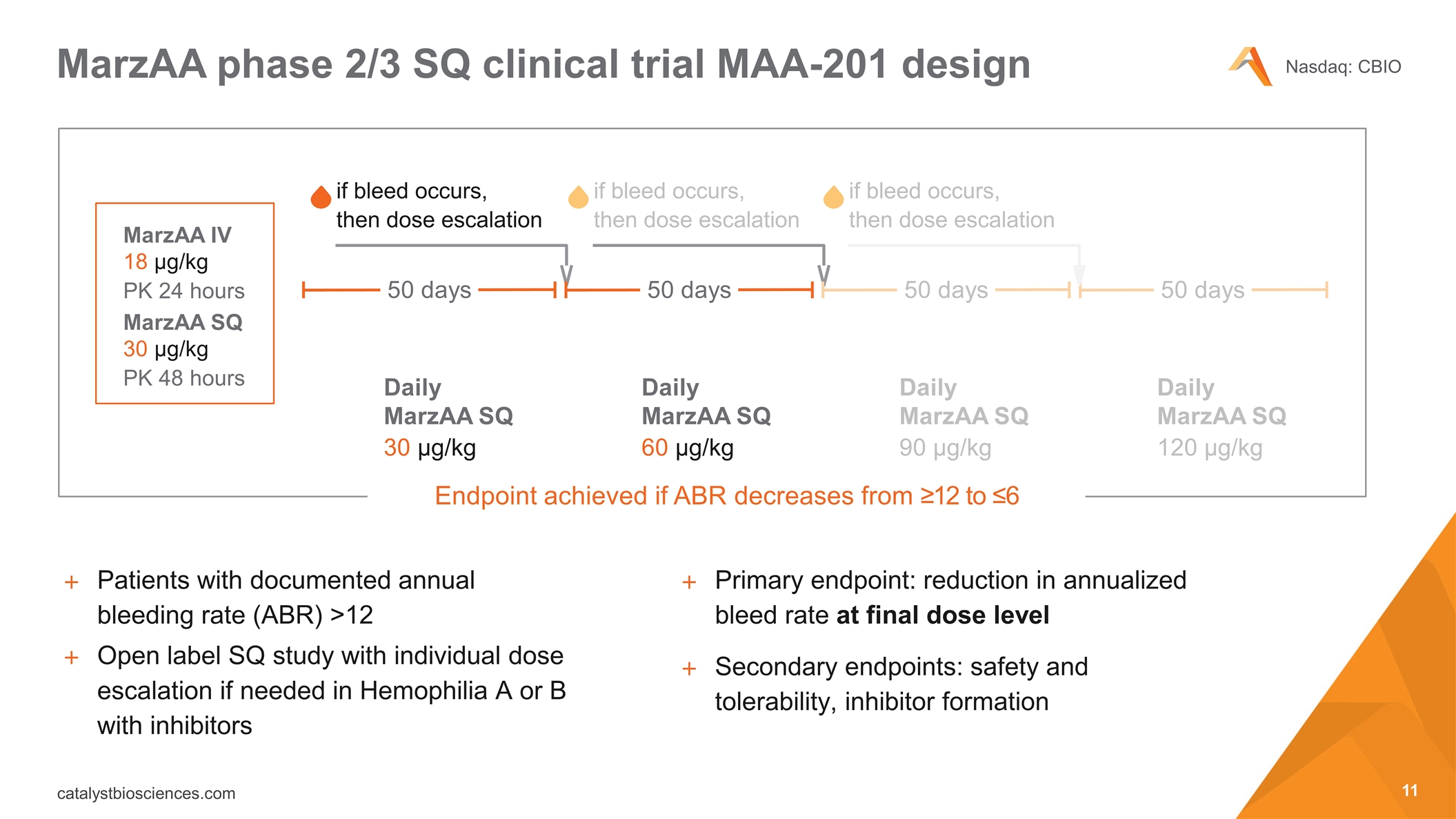

MarzAA phase 2/3 SQ clinical trial MAA-201 design Patients with documented annual bleeding rate (ABR) >12 Open label SQ study with individual dose escalation if needed in Hemophilia A or B with inhibitors Primary endpoint: reduction in annualized bleed rate at final dose level Secondary endpoints: safety and tolerability, inhibitor formation if bleed occurs, then dose escalation Endpoint achieved if ABR decreases from ≥12 to ≤6 Daily MarzAA SQ 60 µg/kg Daily MarzAA SQ 90 µg/kg Daily MarzAA SQ 120 µg/kg Daily MarzAA SQ 30 µg/kg MarzAA SQ 30 µg/kg PK 48 hours MarzAA IV 18 µg/kg PK 24 hours 50 days 50 days if bleed occurs, then dose escalation if bleed occurs, then dose escalation 50 days 50 days

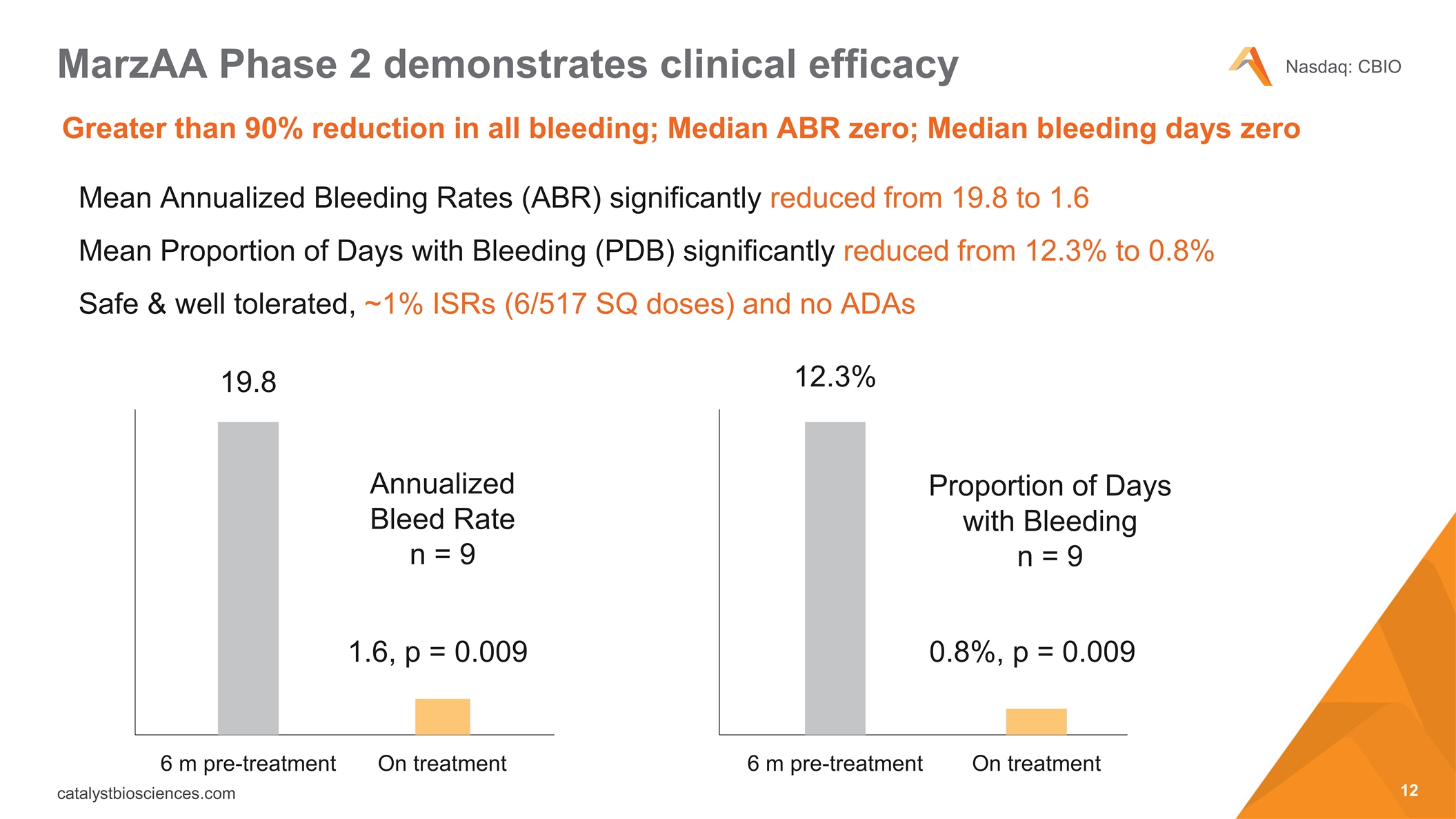

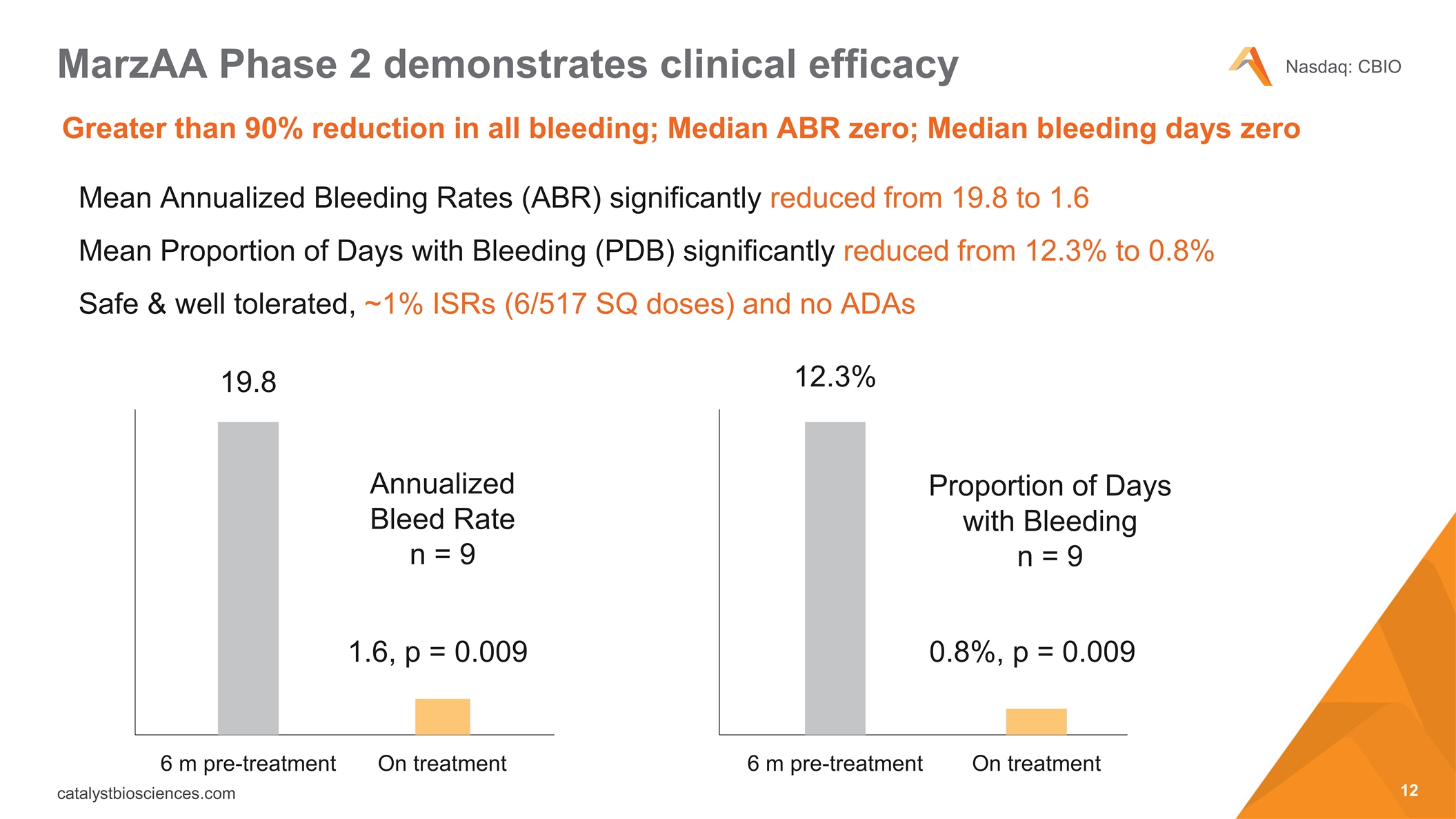

Mean Annualized Bleeding Rates (ABR) significantly reduced from 19.8 to 1.6 Mean Proportion of Days with Bleeding (PDB) significantly reduced from 12.3% to 0.8% Safe & well tolerated, ~1% ISRs (6/517 SQ doses) and no ADAs MarzAA Phase 2 demonstrates clinical efficacy Annualized Bleed Rate n = 9 Proportion of Days with Bleeding n = 9 6 m pre-treatment On treatment On treatment 19.8 12.3% 0.8%, p = 0.009 6 m pre-treatment 1.6, p = 0.009 Greater than 90% reduction in all bleeding; Median ABR zero; Median bleeding days zero

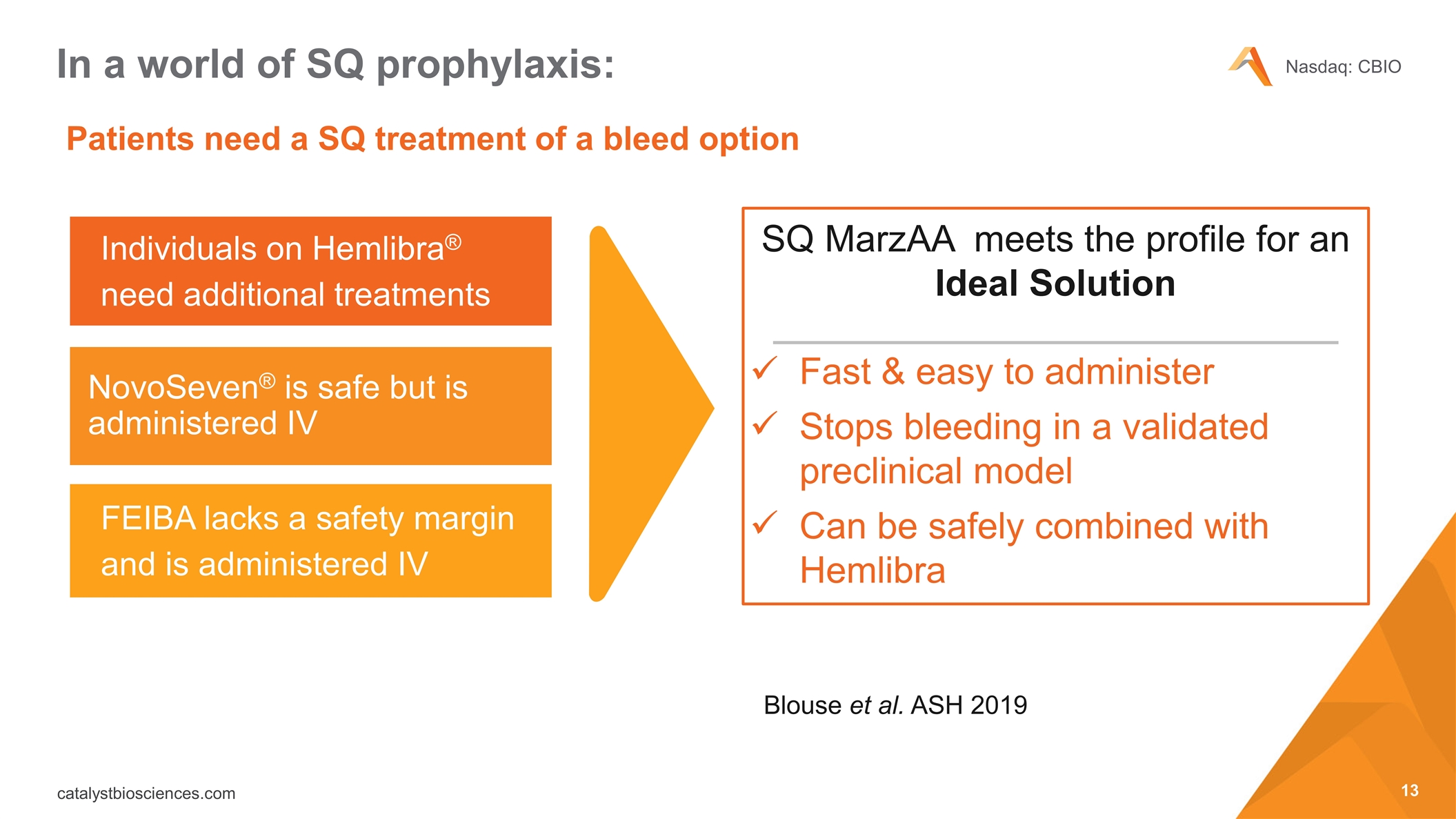

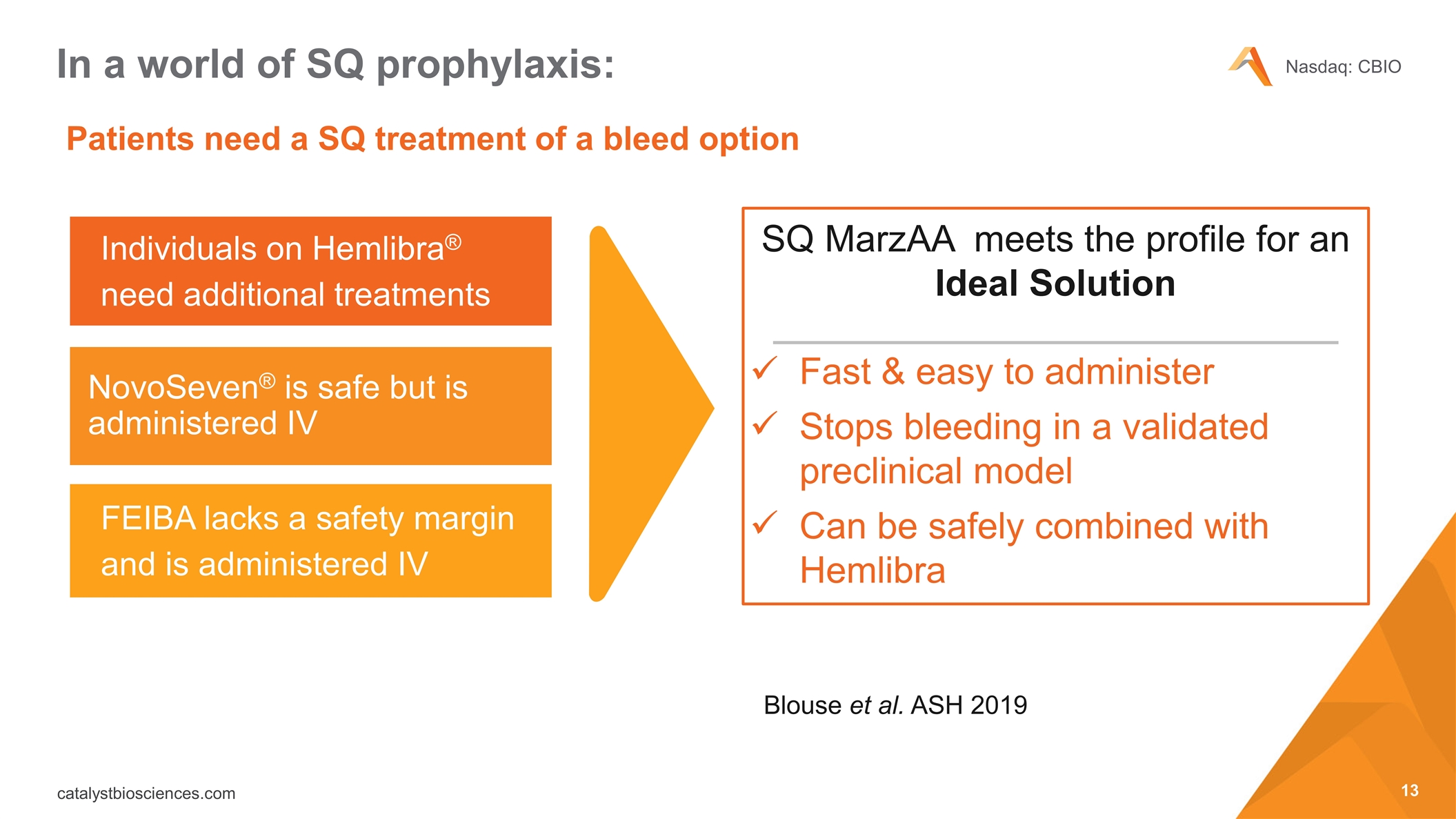

Patients need a SQ treatment of a bleed option In a world of SQ prophylaxis: Individuals on Hemlibra® need additional treatments NovoSeven® is safe but is administered IV FEIBA lacks a safety margin and is administered IV SQ MarzAA meets the profile for an Ideal Solution Fast & easy to administer Stops bleeding in a validated preclinical model Can be safely combined with Hemlibra Blouse et al. ASH 2019

Phase 3 studies to initiate in 2020 Marzeptacog alfa (activated) Initiated SQ dose escalation PK study to support treatment of a bleed – final data in 2020 P3 guidance from EMA & MHRA received – FDA EoP2 meeting in early 2020 Demonstrated P2 Clinical efficacy & tolerability for prophylaxis indications Large commercial opportunity across multiple rare bleeding disorders MarzAA combined with Hemlibra has comparable thrombin generation to NovoSeven Demonstrated preclinical PoC for SQ treatment of a bleed

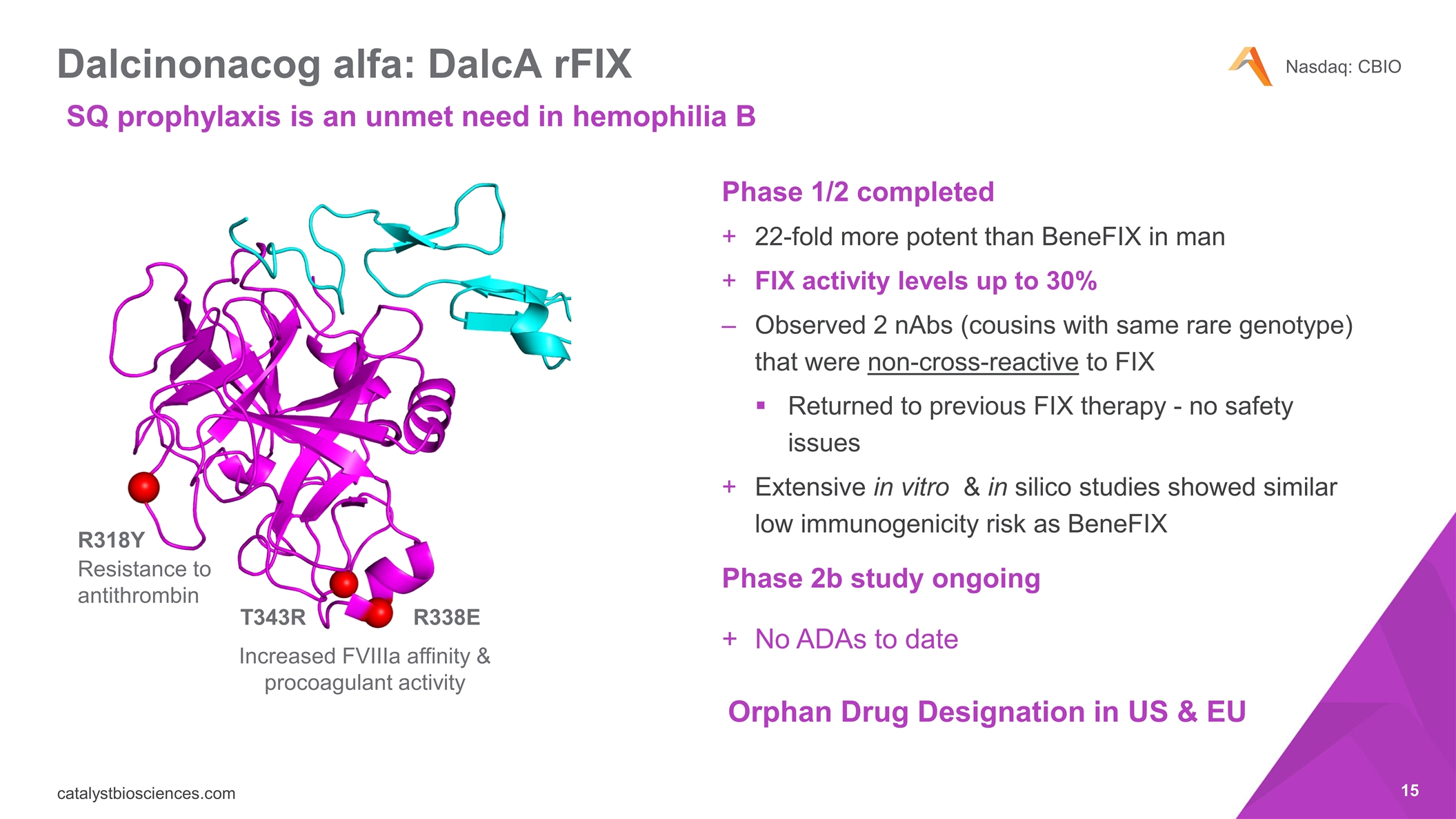

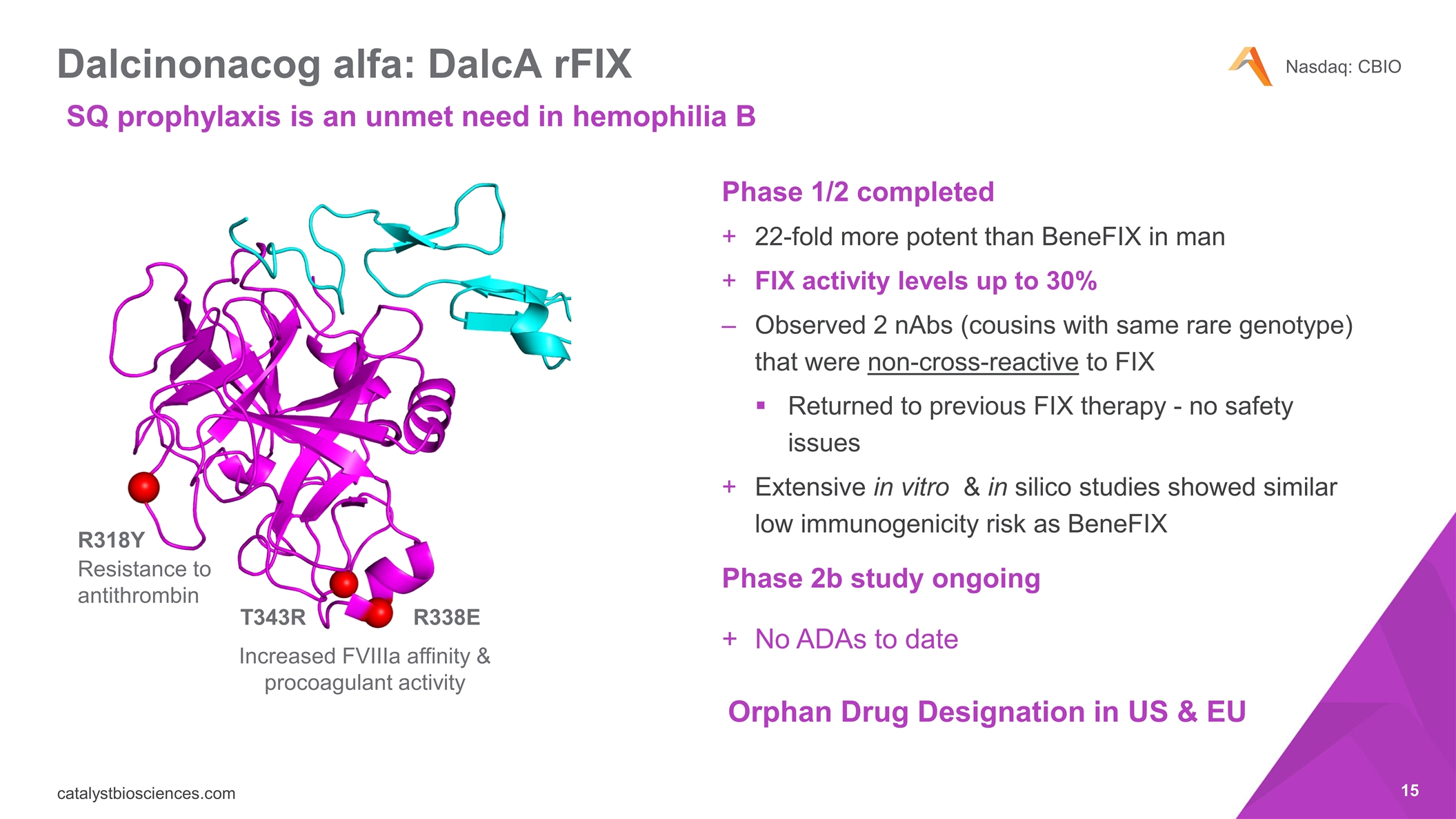

Dalcinonacog alfa: DalcA rFIX Phase 1/2 completed 22-fold more potent than BeneFIX in man FIX activity levels up to 30% Observed 2 nAbs (cousins with same rare genotype) that were non-cross-reactive to FIX Returned to previous FIX therapy - no safety issues Extensive in vitro & in silico studies showed similar low immunogenicity risk as BeneFIX Phase 2b study ongoing No ADAs to date R318Y R338E T343R Resistance to antithrombin Increased FVIIIa affinity & procoagulant activity Orphan Drug Designation in US & EU SQ prophylaxis is an unmet need in hemophilia B

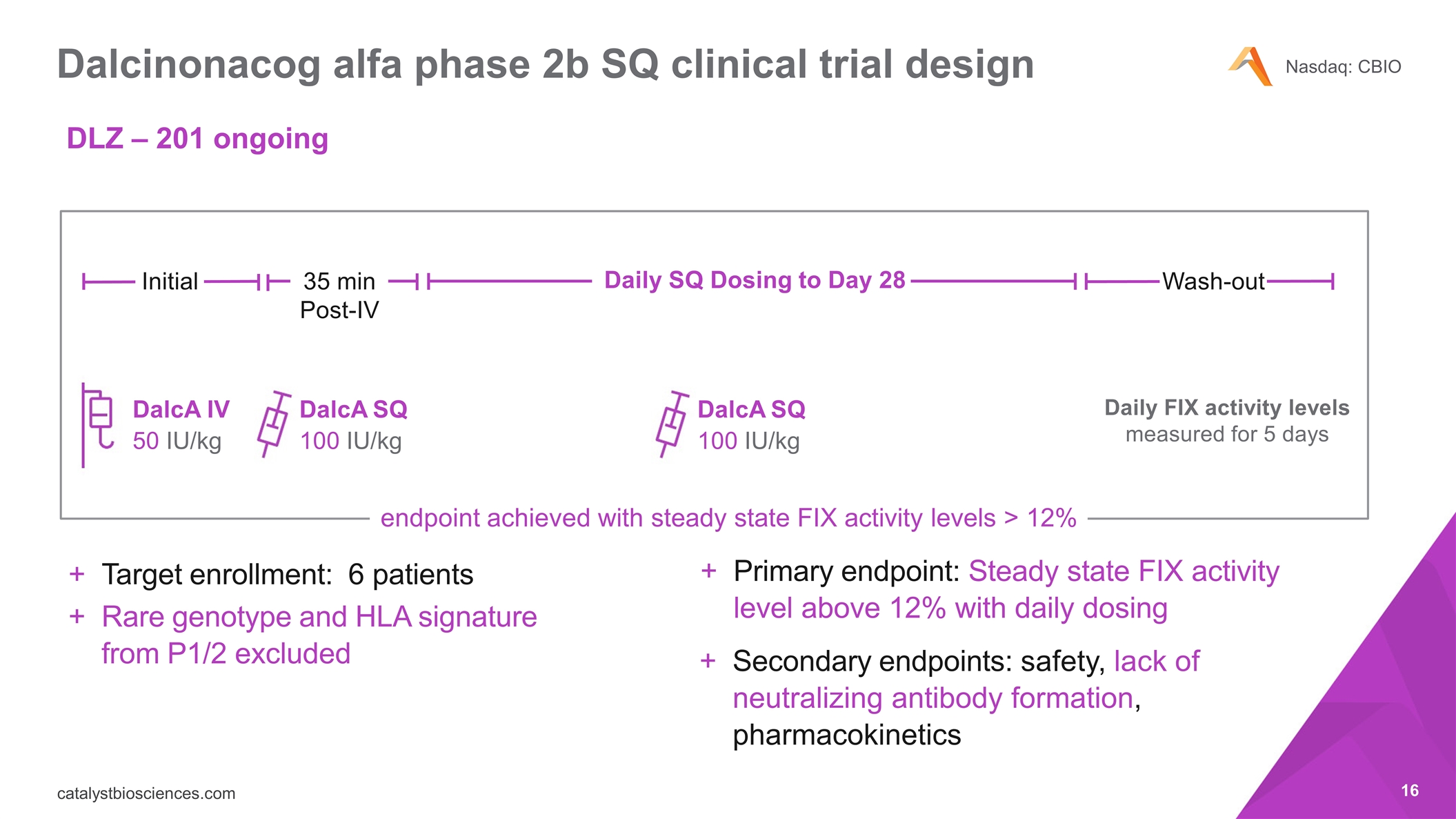

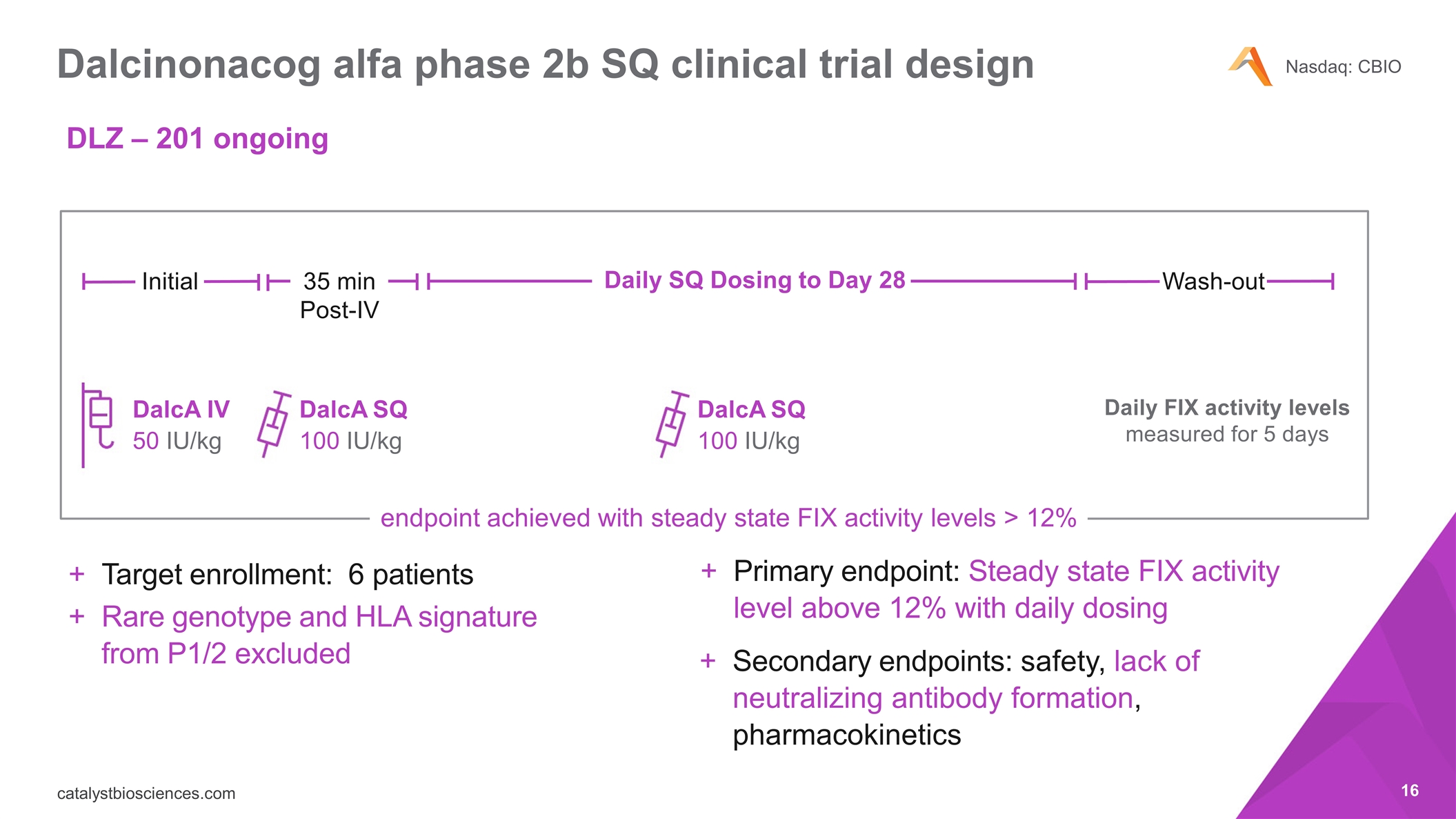

Dalcinonacog alfa phase 2b SQ clinical trial design endpoint achieved with steady state FIX activity levels > 12% Primary endpoint: Steady state FIX activity level above 12% with daily dosing Secondary endpoints: safety, lack of neutralizing antibody formation, pharmacokinetics DalcA SQ 100 IU/kg DalcA SQ 100 IU/kg Daily FIX activity levels measured for 5 days Initial 35 min Post-IV Daily SQ Dosing to Day 28 Wash-out DalcA IV 50 IU/kg Target enrollment: 6 patients Rare genotype and HLA signature from P1/2 excluded DLZ – 201 ongoing

Dalcinonacog alfa – DalcA Phase 2b update All study participants identified – study is ongoing 2 subjects have successfully completed 28 days of dosing & washout FIX activity levels exceeded the trial efficacy endpoint & n o ADAs observed Final data in 1H 2020

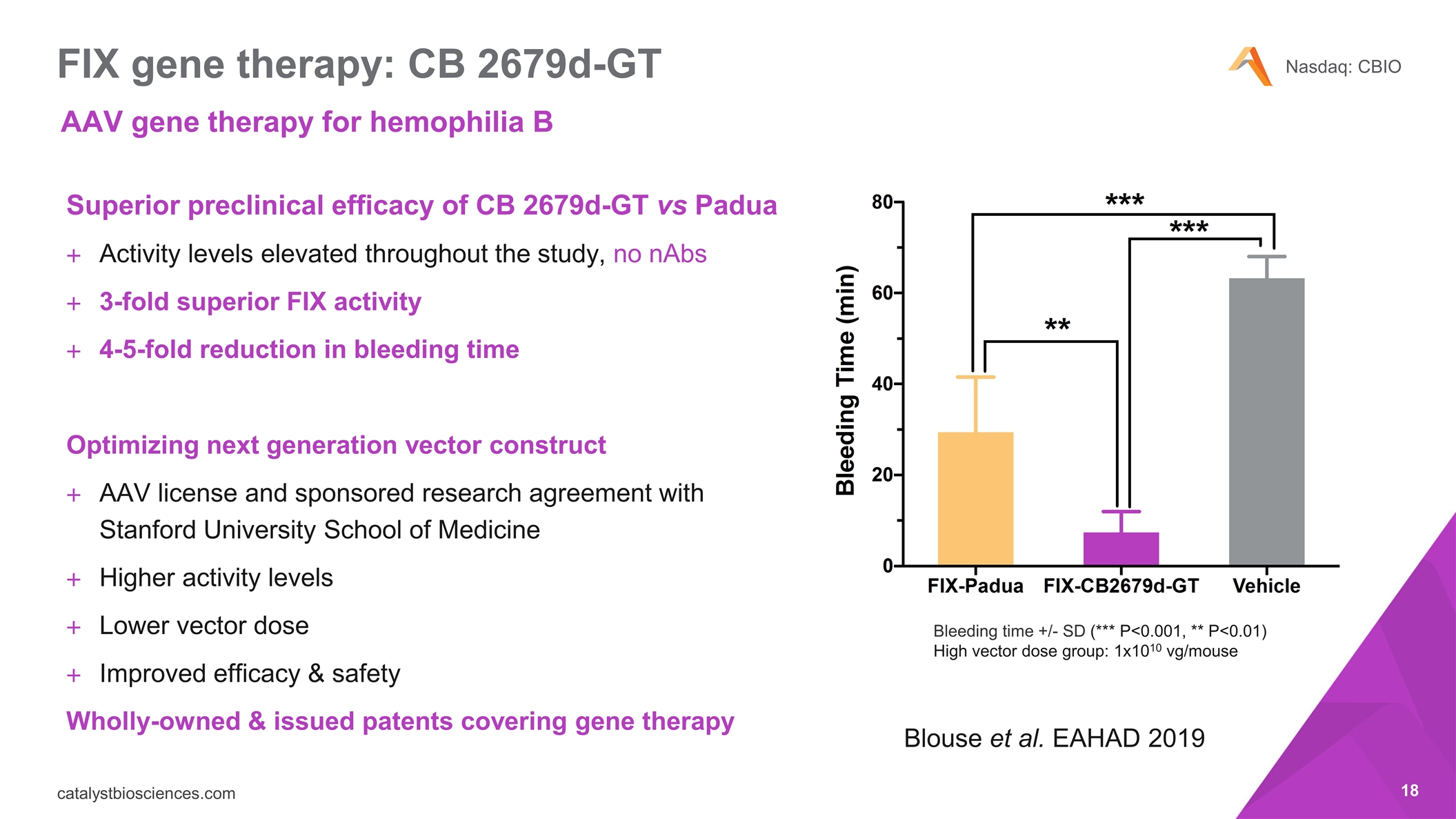

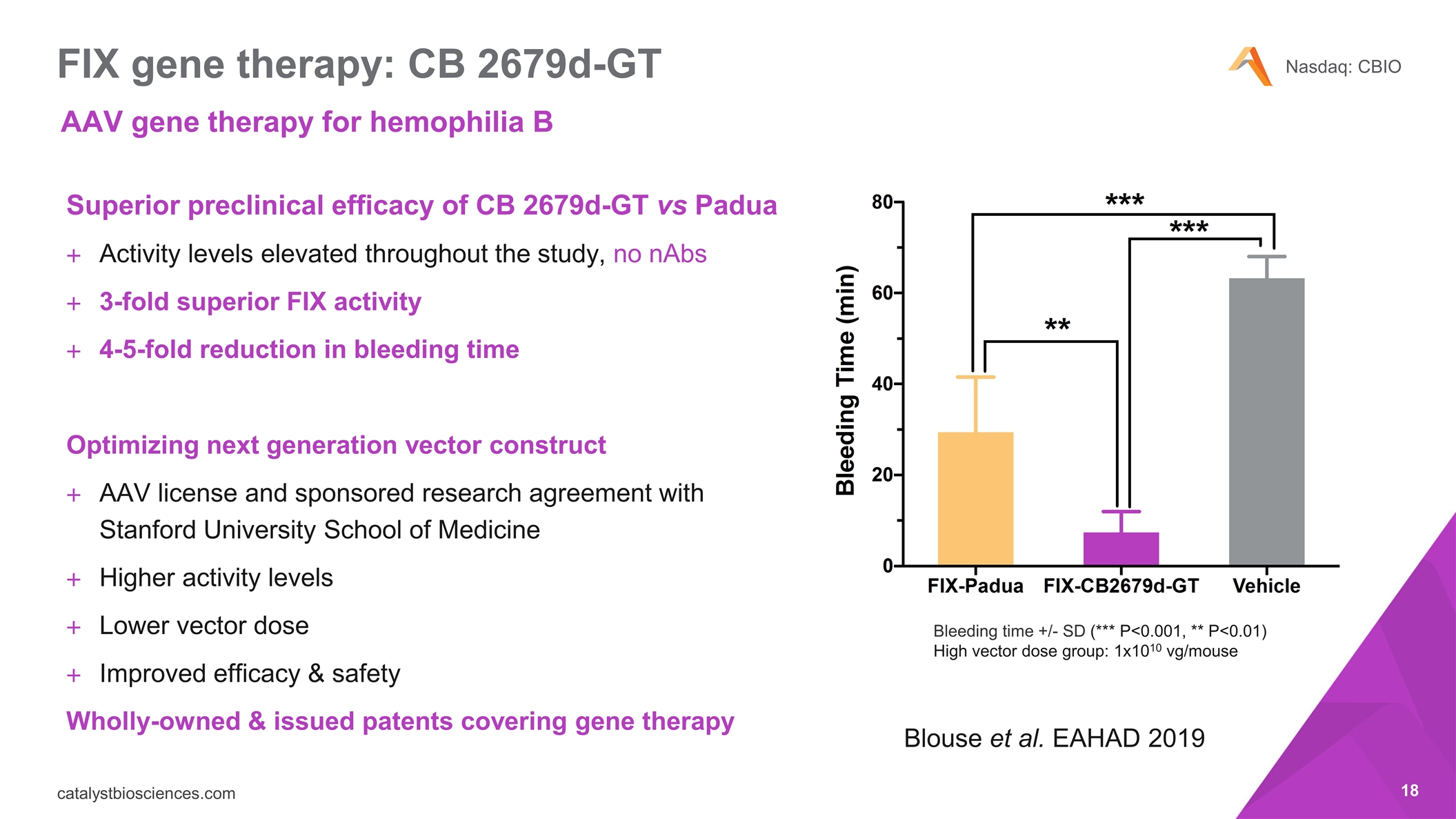

FIX gene therapy: CB 2679d-GT Superior preclinical efficacy of CB 2679d-GT vs Padua Activity levels elevated throughout the study, no nAbs 3-fold superior FIX activity 4-5-fold reduction in bleeding time Optimizing next generation vector construct AAV license and sponsored research agreement with Stanford University School of Medicine Higher activity levels Lower vector dose Improved efficacy & safety Wholly-owned & issued patents covering gene therapy Bleeding time +/- SD (*** P<0.001, ** P<0.01) High vector dose group: 1x1010 vg/mouse Blouse et al. EAHAD 2019 AAV gene therapy for hemophilia B

CB 2782-PEG anti-complement factor 3 (C3) protease Geographic Atrophy in Dry AMD Geographic atrophy is an advanced stage of dry age-related macular degeneration that results in the irreversible loss of retina and leads to blindness Dry AMD affects a million people in the United States and over five million people worldwide Global market is estimated at >$5B with no approved drugs C3 is the only clinically validated target for the treatment of Dry AMD Sources: National Eye Institute. Facts About Age-Related Macular Degeneration, Tufail 2015, The Eye Diseases Prevalence Research Group 2004, GlobalData

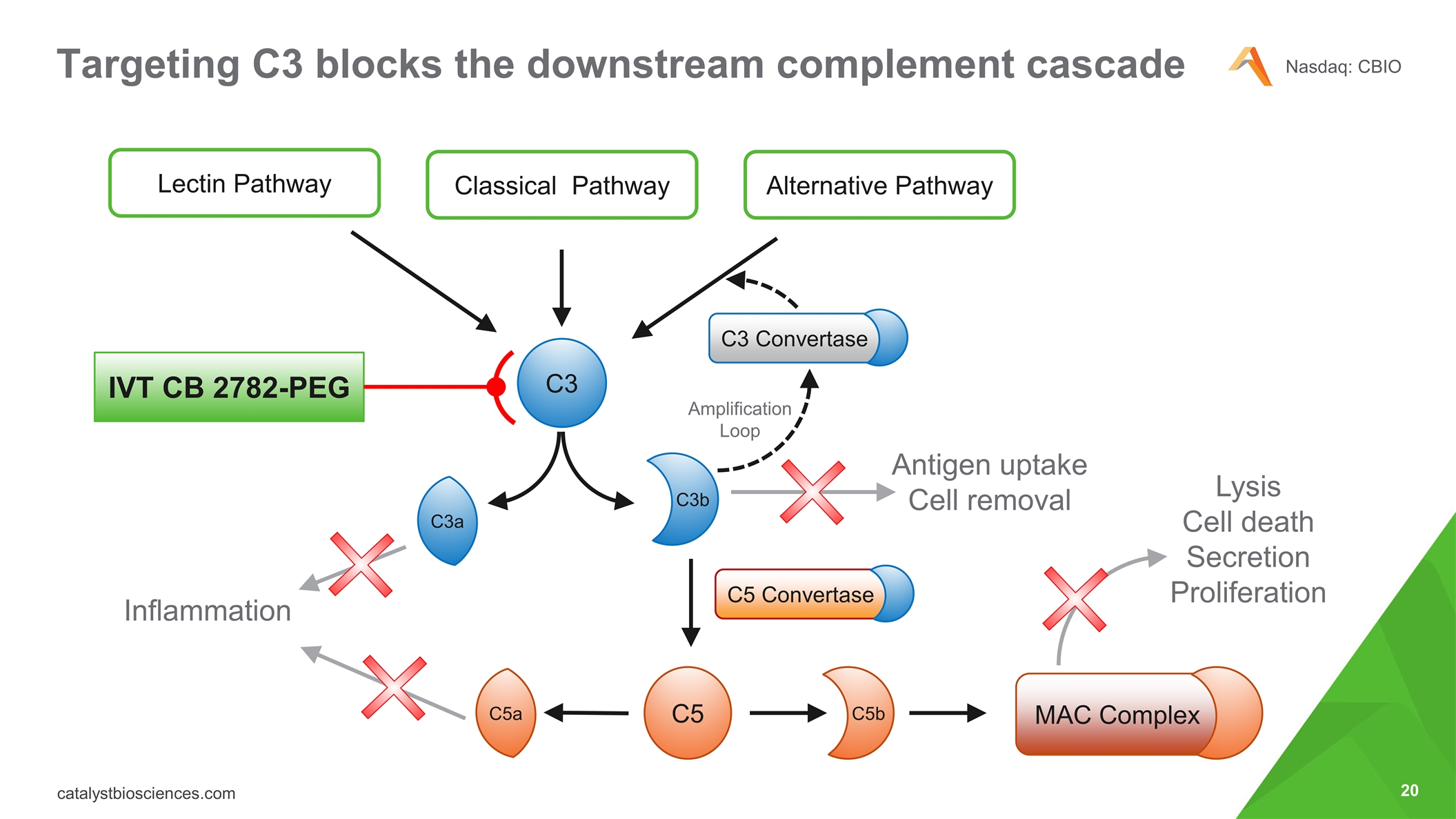

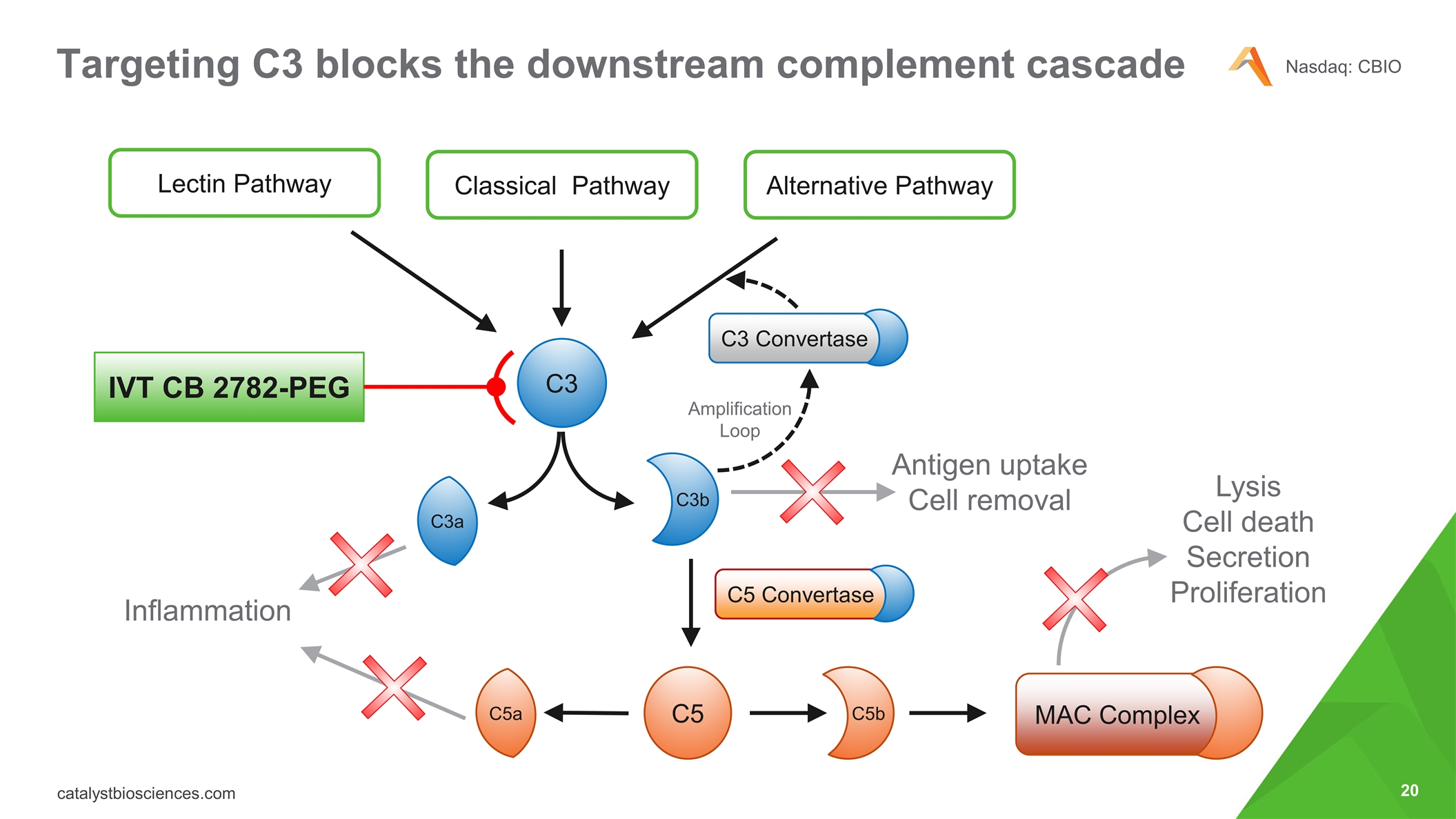

Targeting C3 blocks the downstream complement cascade Lectin Pathway Classical Pathway Alternative Pathway C3 C3a C3b C5 C5a C5b C3 Convertase MAC Complex C5 Convertase IVT CB 2782-PEG Amplification Loop Lysis Cell death Secretion Proliferation Inflammation Antigen uptake Cell removal

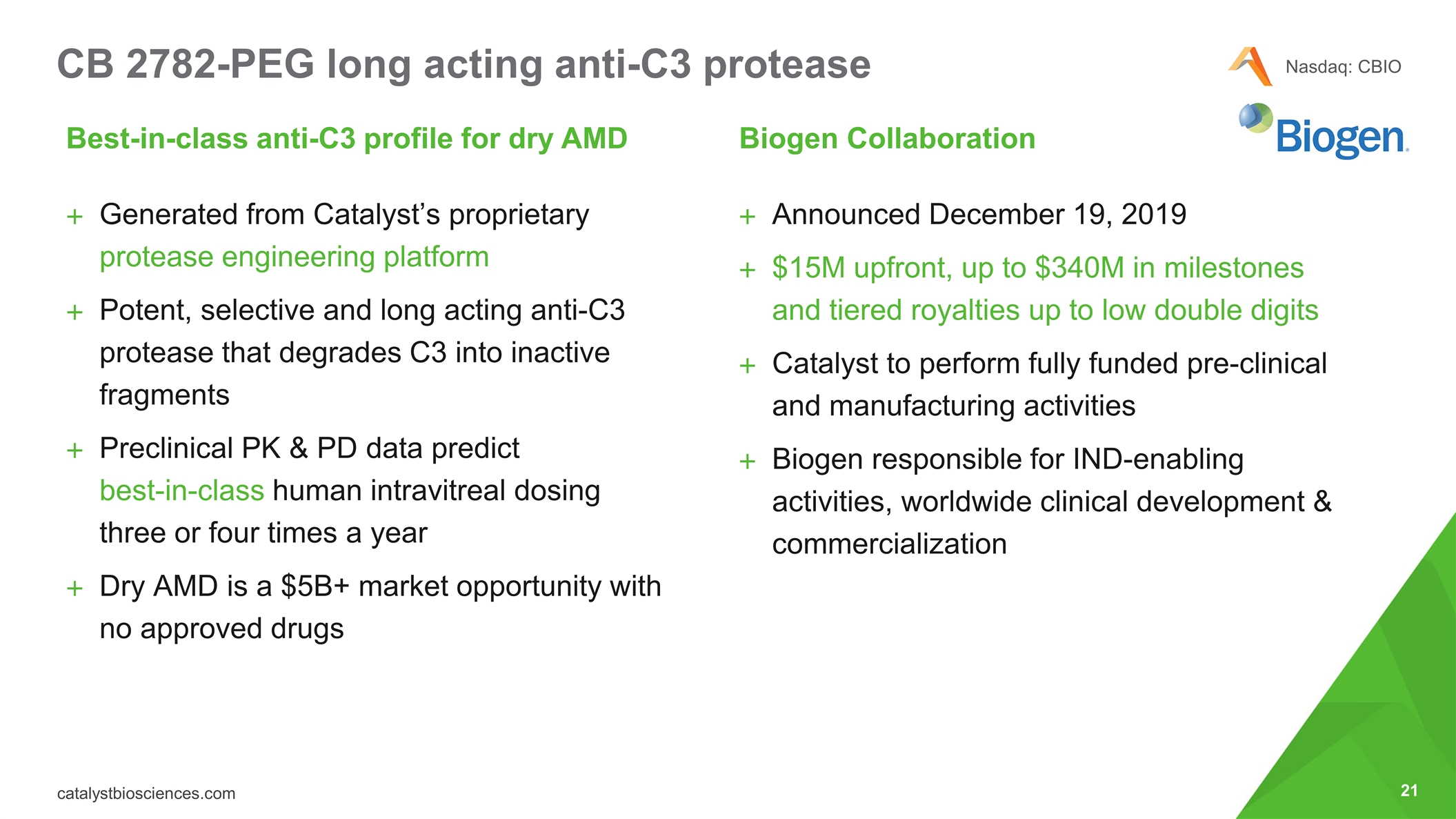

Generated from Catalyst’s proprietary protease engineering platform Potent, selective and long acting anti-C3 protease that degrades C3 into inactive fragments Preclinical PK & PD data predict best-in-class human intravitreal dosing three or four times a year Dry AMD is a $5B+ market opportunity with no approved drugs CB 2782-PEG long acting anti-C3 protease Best-in-class anti-C3 profile for dry AMD Biogen Collaboration Announced December 19, 2019 $15M upfront, up to $340M in milestones and tiered royalties up to low double digits Catalyst to perform fully funded pre-clinical and manufacturing activities Biogen responsible for IND-enabling activities, worldwide clinical development & commercialization

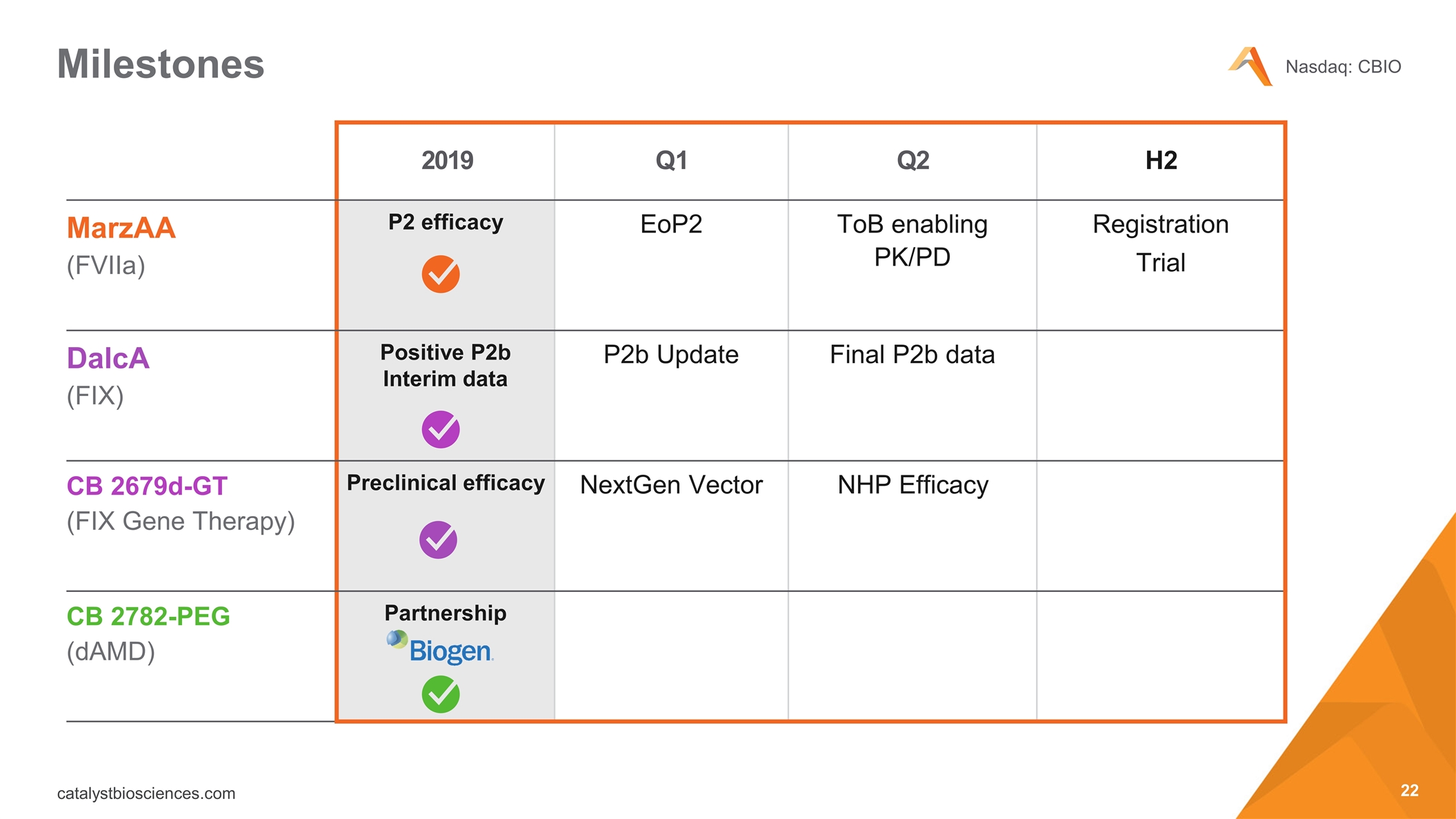

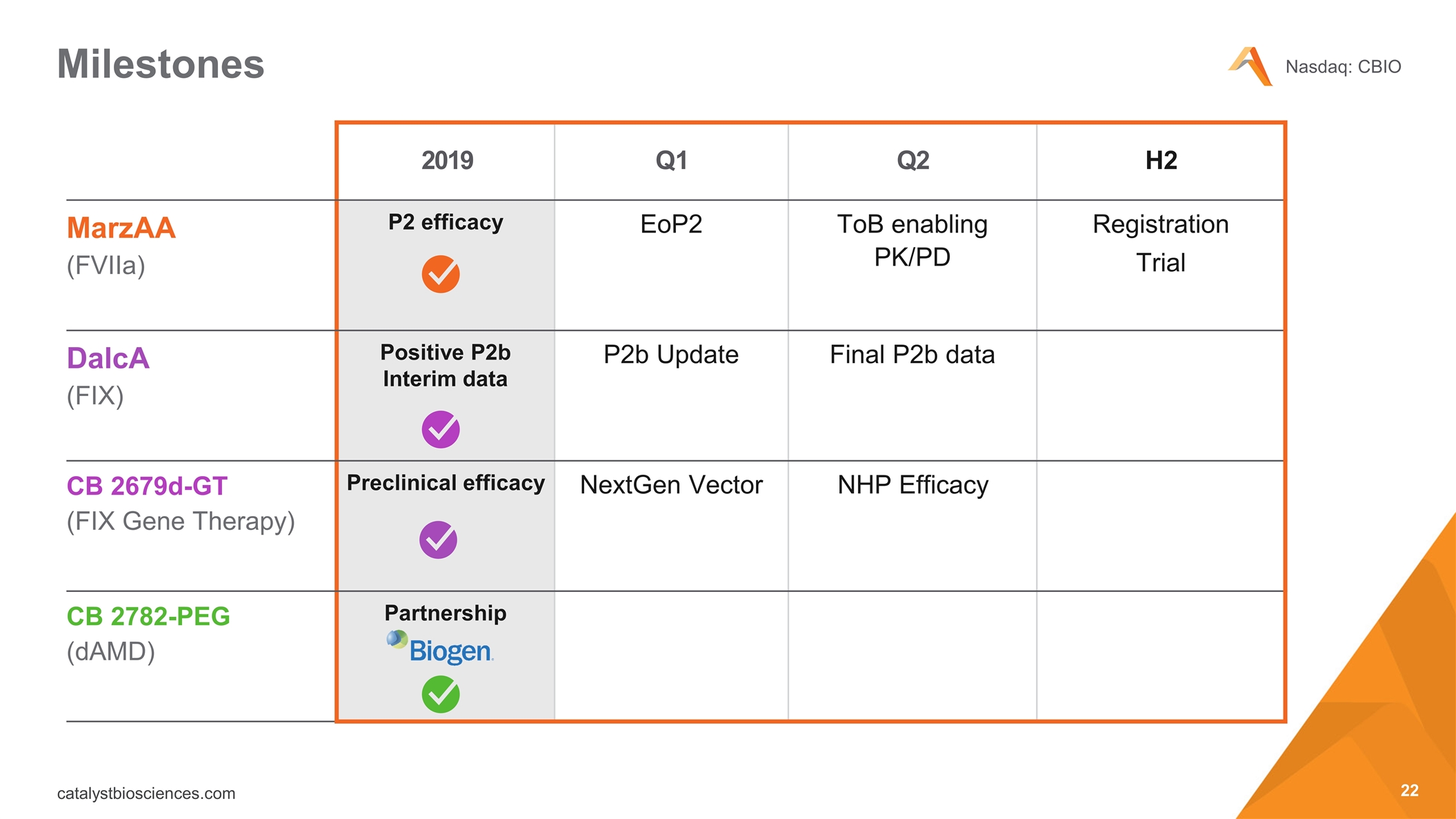

Milestones 2019 Q1 Q2 H2 MarzAA (FVIIa) P2 efficacy EoP2 ToB enabling PK/PD Registration Trial DalcA (FIX) Positive P2b Interim data P2b Update Final P2b data CB 2679d-GT (FIX Gene Therapy) Preclinical efficacy NextGen Vector NHP Efficacy CB 2782-PEG (dAMD) Partnership

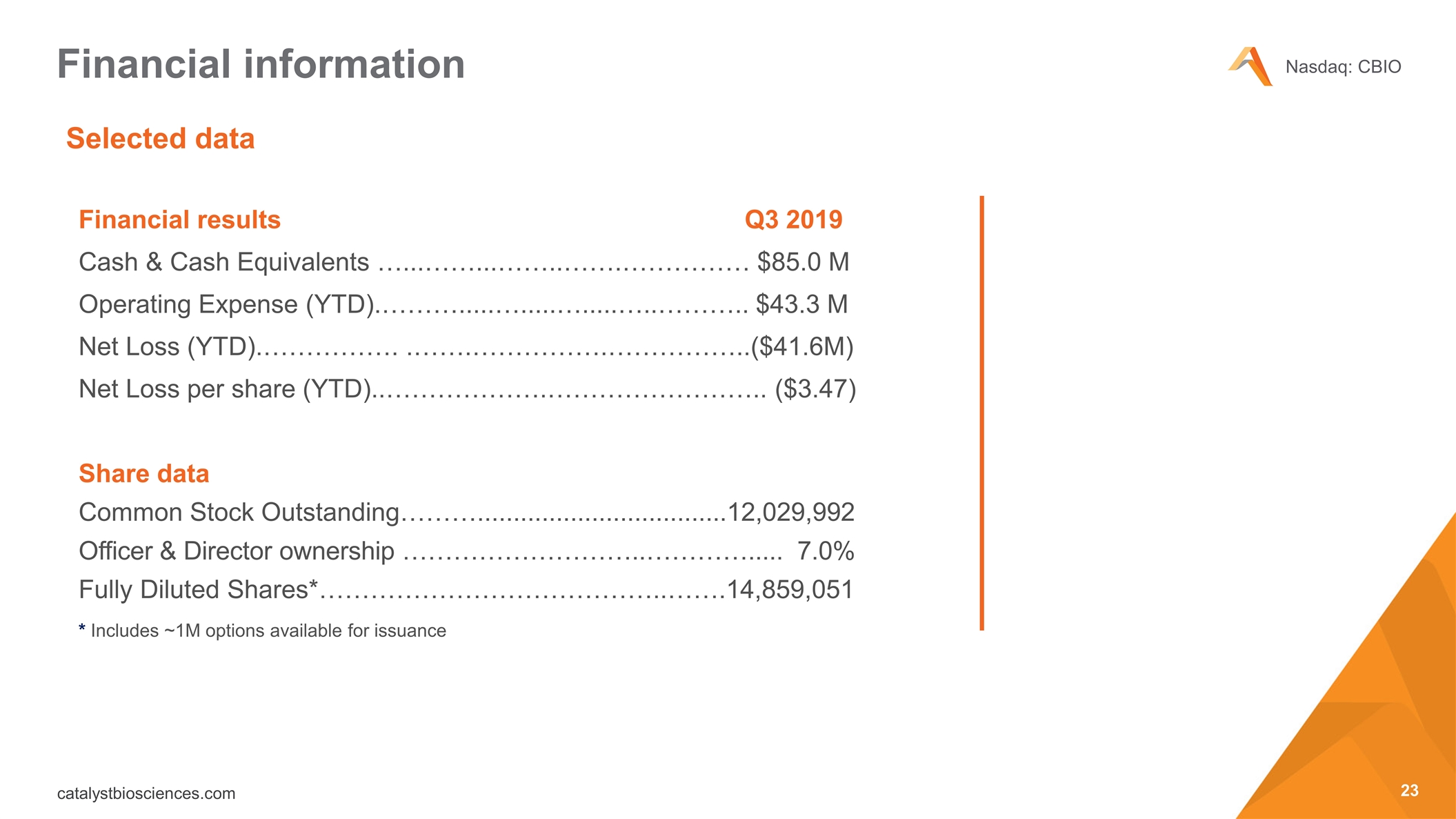

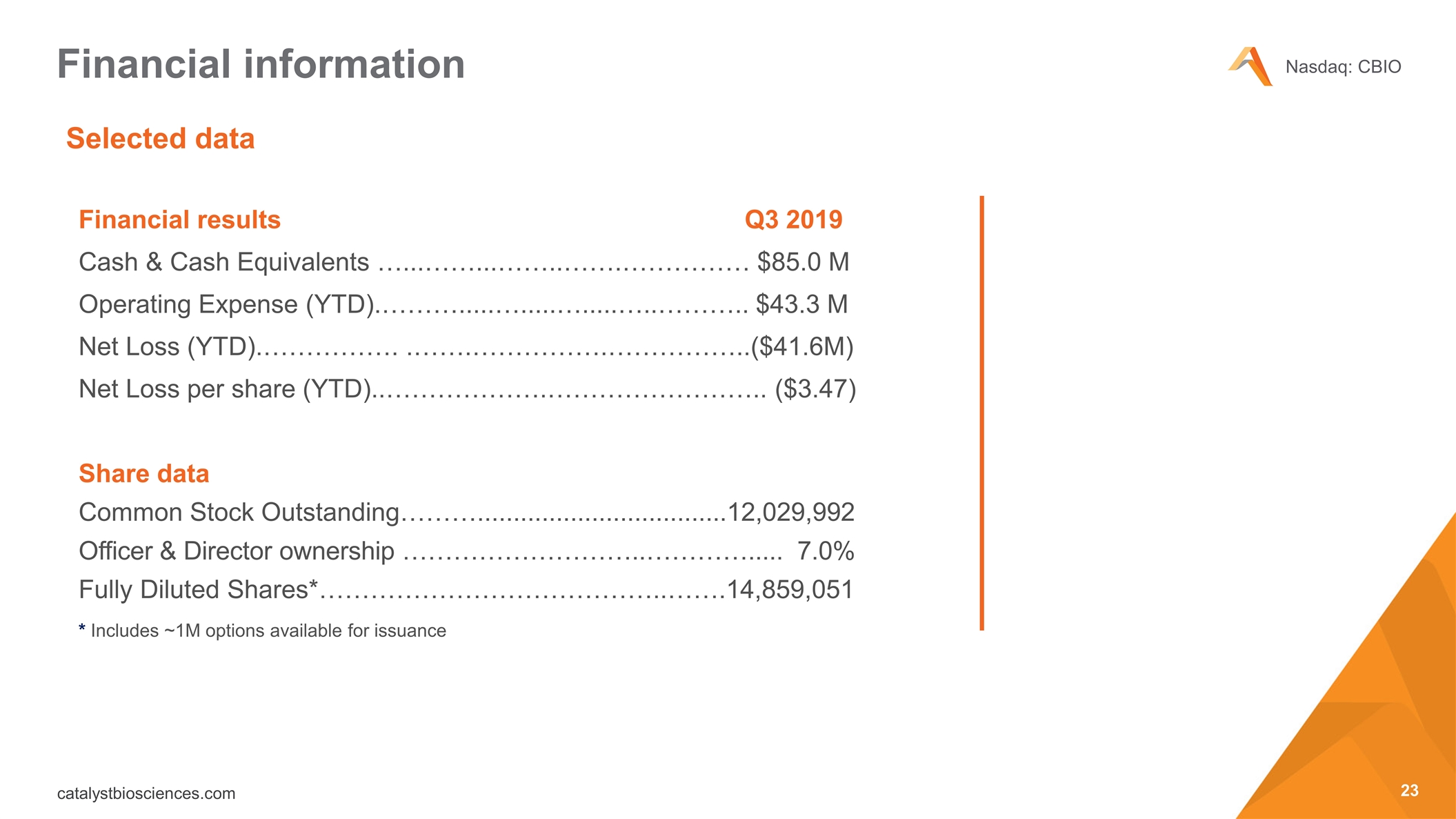

Selected data Financial information Financial results Q3 2019 Cash & Cash Equivalents …...……...……..…….…………… $85.0 M Operating Expense (YTD).……….....….....….....…..……….. $43.3 M Net Loss (YTD).……………. .…….…………….……………..($41.6M) Net Loss per share (YTD)..……………….…………………….. ($3.47) Share data Common Stock Outstanding………...................................12,029,992 Officer & Director ownership ………………………..…………..... 7.0% Fully Diluted Shares*…………………………………..…….14,859,051 * Includes ~1M options available for issuance

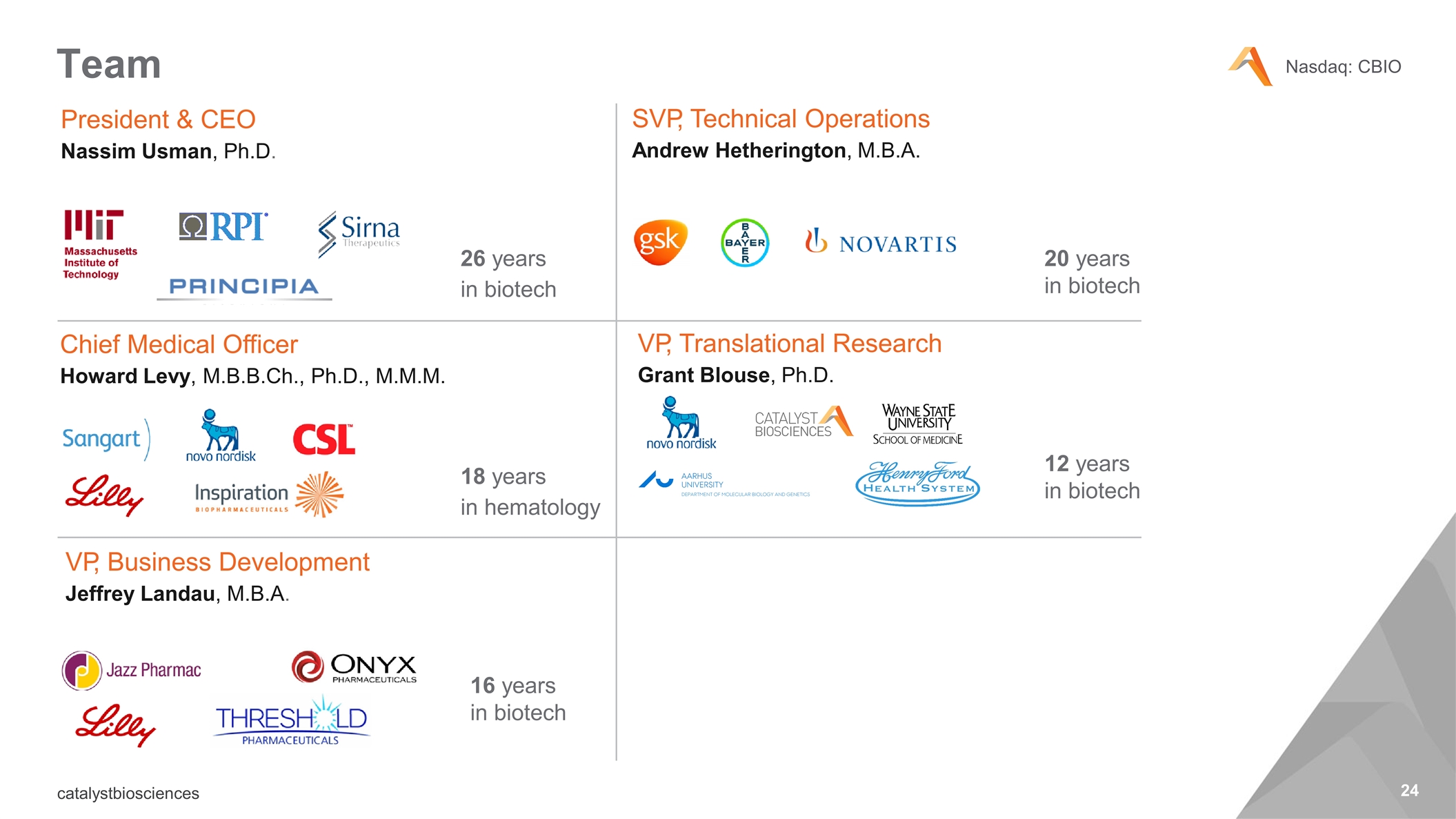

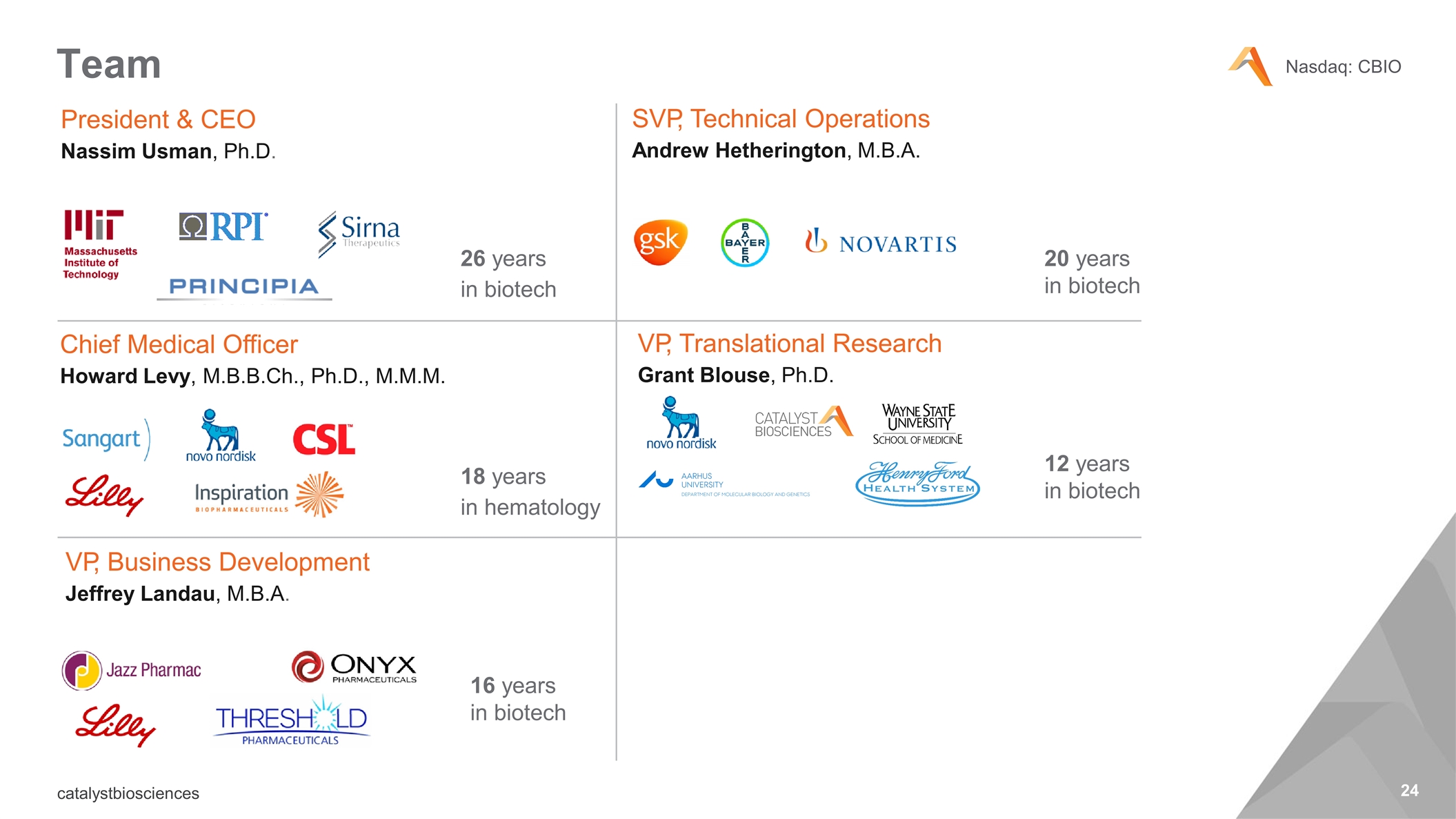

Team President & CEO Nassim Usman, Ph.D. Chief Medical Officer Howard Levy, M.B.B.Ch., Ph.D., M.M.M. SVP, Technical Operations Andrew Hetherington, M.B.A. 26 years in biotech 20 years in biotech 18 years in hematology VP, Translational Research Grant Blouse, Ph.D. 12 years in biotech VP, Business Development Jeffrey Landau, M.B.A. 16 years in biotech

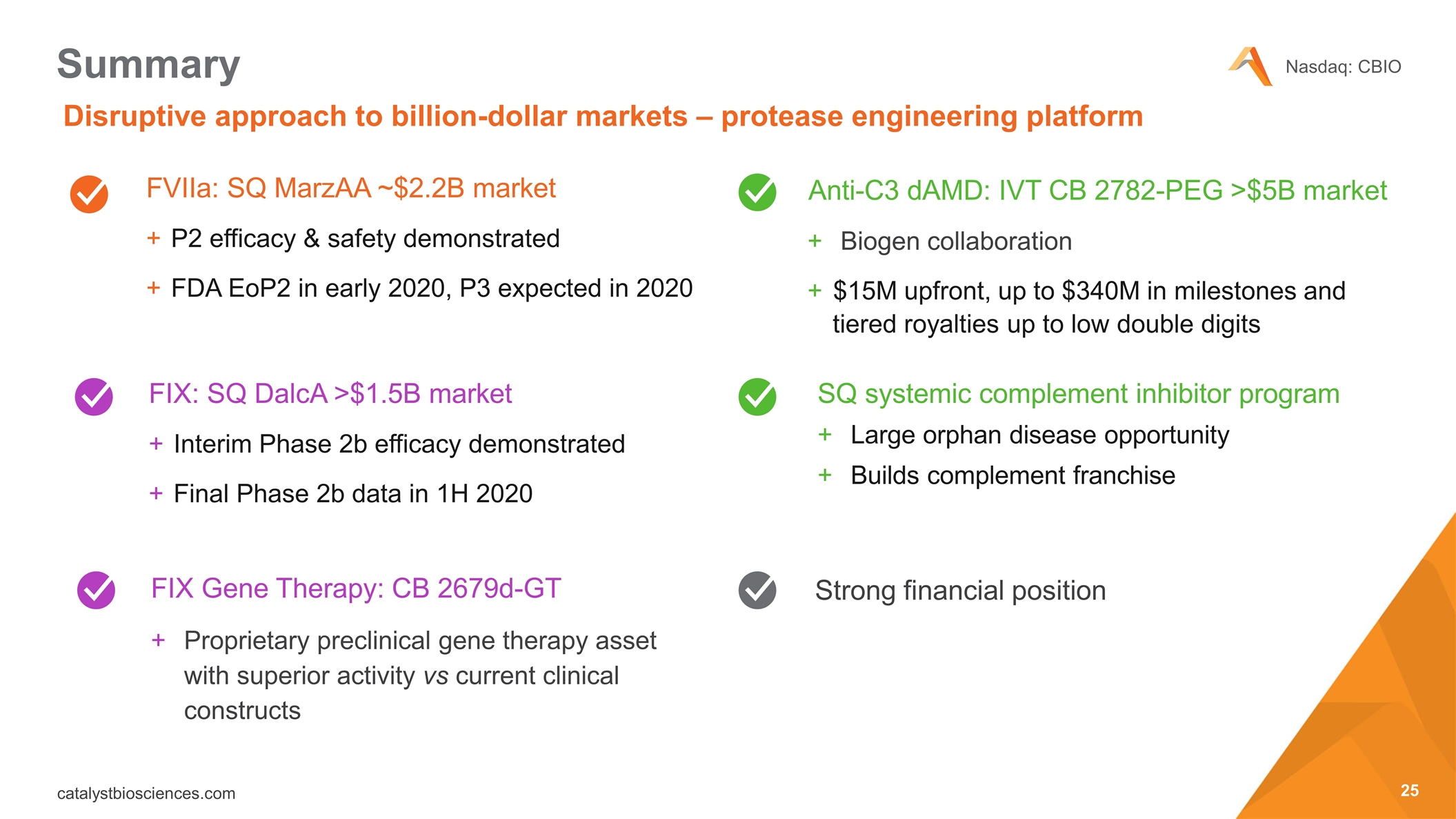

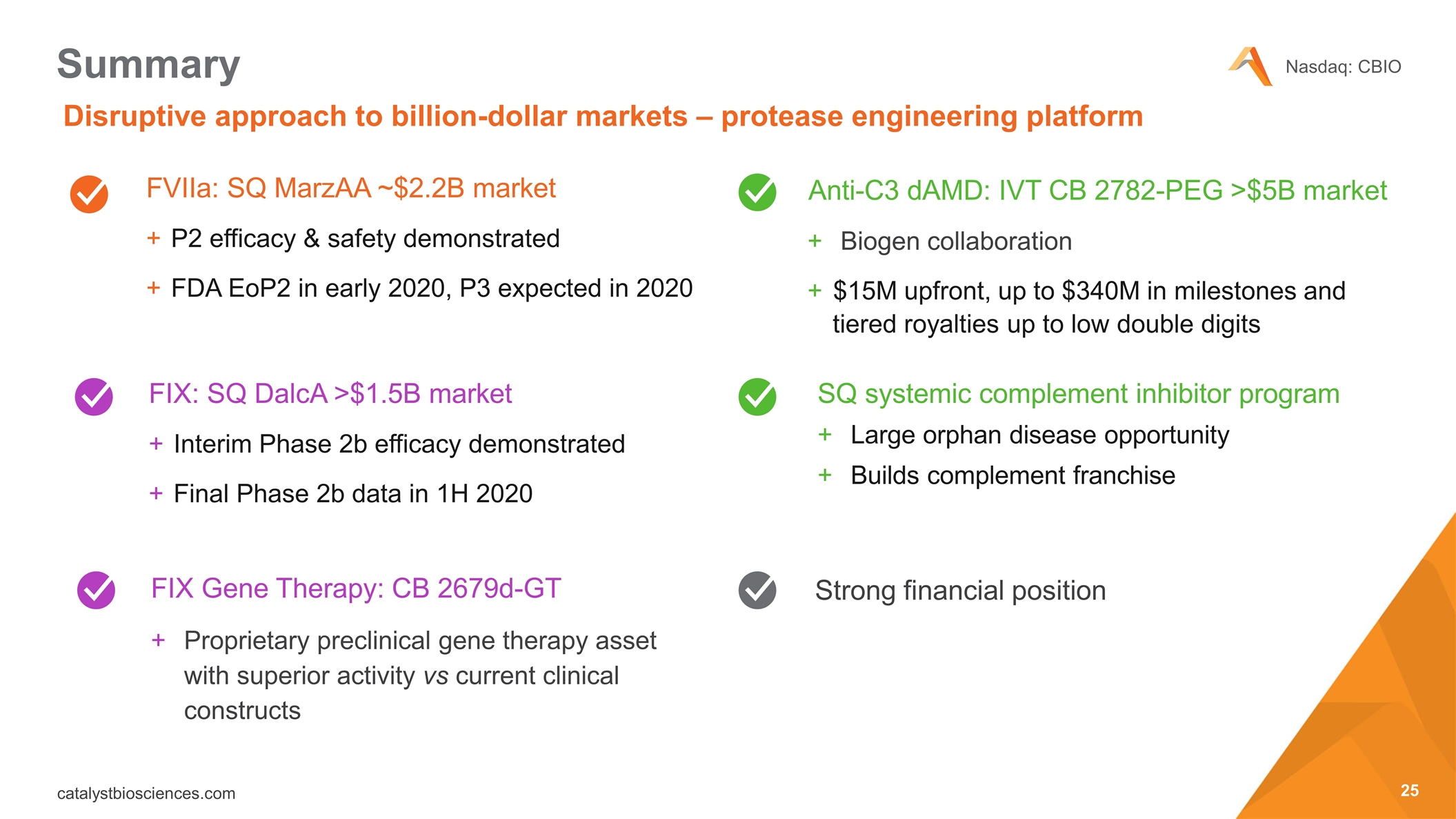

Summary Disruptive approach to billion-dollar markets – protease engineering platform FIX: SQ DalcA >$1.5B market Interim Phase 2b efficacy demonstrated Final Phase 2b data in 1H 2020 FVIIa: SQ MarzAA ~$2.2B market P2 efficacy & safety demonstrated FDA EoP2 in early 2020, P3 expected in 2020 Strong financial position FIX Gene Therapy: CB 2679d-GT Proprietary preclinical gene therapy asset with superior activity vs current clinical constructs Anti-C3 dAMD: IVT CB 2782-PEG >$5B market Biogen collaboration $15M upfront, up to $340M in milestones and tiered royalties up to low double digits SQ systemic complement inhibitor program Large orphan disease opportunity Builds complement franchise

THANK YOU Nasdaq: CBIO catalystbiosciences.com