Exhibit (a)(10)

ABCD

Independent Expert Opinion

On the Determination of the Adequate Cash

Compensation pursuant to § 327b para. 1 AktG

(German Stock Corporations Act - Aktiengesetz)

as of 17 January 2007

Schering Aktiengesellschaft, Berlin

KPMG Deutsche Treuhand-Gesellschaft

Aktiengesellschaft Wirtschaftsprüfungsgesellschaft

KPMG Deutsche Treuhand-Gesellschaft

Aktiengesellschaft Wirtschaftsprüfungsgesellschaft

Independent Expert Opinion

On the Determination of the Adequate Cash Compensation

pursuant to § 327b para. 1 AktG

(German Stock Corporations Act - Aktiengesetz)

; as of 17 January 2007

Schering Aktiengesellschaft, Berlin

KPMG Deutsche Treuhand-Gesellschaft

Aktiengesellschaft Wirtschaftsprüfungsgesellschaft

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page I |

Table of Contents | |

Table of Contents | I |

| | | |

1 | Assignment and Execution | 1 |

| | 1.1 | Assignment | 1 |

| | 1.2 | Execution | 2 |

| | | | |

2 | Legal status | 3 |

| | | |

3 | Bases for Deriving the Cash Compensation | 5 |

| | 3.1 | Legal and Commercial Conditions | 5 |

| | 3.2 | Methodical Approach for deriving the Cash Compensation | 6 |

| | 3.3 | Share Price as Lower Value Limit | 7 |

| | | | |

4 | Present Value of the Guaranteed Dividend | 8 |

| | 4.1 | Amount of the Guaranteed Dividend | 8 |

| | 4.2 | Discount Rate | 8 |

| | | 4.2.1 | Risk-free rate | 8 |

| | | 4.2.2 | Risk Premium | 9 |

| | | 4.2.3 | Growth factor | 10 |

| | 4.3 | Determination of the Present Value | 10 |

| | | | |

5 | Analysis of the Share Price of Schering AG | 12 |

| | 5.1 | Relevance of the Share Price for Deriving the Cash Compensation | 12 |

| | 5.2 | Development of the Share Price for Schering AG | 14 |

| | 5.3 | Relevant average Share Price | 16 |

| | | | |

| 6 | Concluding Remarks | 18 |

| | | | |

Annex 1 General Engagement Terms for Wirtschaftsprü fer and Wirtschaftsprüfungsgesellschaften (“GET”)

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 1 |

| 1 | Assignment and Execution |

The management board of Bayer Schering GmbH, Leverkusen (previously named Dritte BV GmbH, Leverkusen, hereinafter "BSG") has mandated us in a letter dated 12 October 2006 to determine the cash compensation for the minority shareholders of

Schering AG, Berlin,

pursuant to § 327b para. 1 German Stock Corporations Act [Aktiengesetz, “AktG”].

Background is the intended exclusion of minority shareholders (squeeze-out) pursuant to § 327a et seq. AktG. We have used 17 January 2007 as the valuation date in accordance with § 327b para. 1 AktG as it is the date of the intended extraordinary shareholders meeting of Schering AG in which the decision is supposed to be made about the exclusion of the minority shareholders.

When carrying out the assignment, we relied on the German “Standards for performing company valuations” (IDW S 1: Grunds’tze zur Durchführung von Unternehmensbewertungen) which have been established by the main specialized committee of the German Institute of Certified Public Accountants (Institut der Wirtschaftsprüfer in Deutschland e.V.) dated 18 October 2005 (IDW S 1). For the purposes of this report, we are providing our report in the function as an independent expert (neutraler Gutachter).

The engagement is subject to the attached General Engagement Terms (“GET”) for accountants and accounting firms in the version dated 1 January 2002 (Allgemeine Auftragsbedingungen für Wirtschaftsprüfer und Wirtschaftsprüfungsgesellschaften) attached in the Annex. The maximum amount of our liability is determined pursuant to no. 9 of the GET and supplemental written agreements. With regard to third parties no. 1 para. 2 and no. 9 of the GET are determinative.

The independent expert opinion is prepared in connection with the intended exclusion of the minority shareholders pursuant to § 327a et seq. AktG by BSG as the main shareholder in accordance with § 327a para. 1 AktG and is exclusively for the internal use by the client. The internal use also includes the use of the independent expert opinion for implementing the exclusion of the minority shareholders, especially in the context of the written and oral reporting to the shareholders of Schering AG. This includes the possibility for the shareholders to review the independent expert opinion in connection with the shareholders meeting in the context of viewing the documents of Schering AG.

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 2 |

Subject to KPMG’s prior written approval, this independent expert opinion may be released to third parties in its full version only. This release must include a written statement setting out the pur-pose of the engagement, restrictions on releasing the report to other parties and liability arrangements. The release is conditional upon the third party agreeing in writing to accept the current GET and the limitations in our liability as well as confirming that it will treat the report as confidential and will not release the report to any other party.

The attorneys, auditors and advisors mandated by the clients in connection with the intended exclusion pursuant to § 327a et seq. AktG are not third parties within the meaning of this paragraph to the extent that they are subject to professional confidentiality and have not been released by the clients from the obligation to maintain confidentiality.

We executed the assignment in the months October through December 2006 in the offices of Schering AG as well as in our offices in Berlin and Frankfurt.

We have compiled the following list of the documents upon which our work was primarily based:

| - | Domination and Profit and Loss Transfer Agreement between BSG and Schering AG dated 31 July 2006; |

| - | Articles of Association excerpt from the Commercial Register. |

In addition, the information contact persons designated by the clients willingly provided additional information.

Our work is based on the documents provided for the purposes of the valuation. We critically examined these documents, but we did not subject them to an audit like in the case of auditing annual financial statements.

We wish to point out that the following presented calculations for the determination of the cash compensation have generally been prepared without decimals. Since the calculation was actually made with the exact values, the addition or subtraction of values in the tables can lead to discrepancies with the indicated subtotals or the total sums.

The Management Board of Schering AG has issued a letter of representation to us stating that all information relevant to the preparation of this appraisal has been granted correctly and completely.

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 3 |

Schering AG is a stock corporation under German law with its registered office in Berlin. It is registered in the commercial register of the Local Court [Amtsgericht] Charlottenburg, Berlin, under HRB 283 B.

The share capital of Schering AG is € 194,000,000 and is divided into 194,000,000 shares. As of 1 December 2006, the Company holds 3,124,300 treasury shares.

The purpose of the Company is according to the Articles of Association:

| - | the research and development of, the purchase and sale of chemical and biotechnological products; these products include especially pharmaceuticals, pharmaceutical ingredients, diagnostics and vaccines for human and veterinary medicine as well as fine chemicals, radioactive substances, and intermediate products; |

| - | the research of, the development of, the manufacture and sales of medicines and equipment for medical and laboratory purposes and |

| - | the preparation, acquisition, and utilization of chemical, biological, and technical procedures and facilities. |

The Articles of Association of Schering AG are valid in the version dated 27 October 2006. The fiscal year is the calendar year.

BSG acquired a shareholding in Schering AG of more than 95 % of the share capital (without treasury shares) by way of a voluntary public takeover offer dated 13 April 2006, including the amendment dated 30 May 2006, as well as supplemental purchases of shares at the stock exchange and over the counter.

Schering AG signed a Domination and Profit and Loss Transfer Agreement with BSG as the dominating company on 31 July 2006.

The extraordinary shareholders meeting of Schering AG approved this Domination and Profit and Loss Transfer Agreement with BSG on 13 September 2006 which provides for each share a cash compensation for the minority shareholders pursuant to § 305 AktG in an amount of € 89.00 and a fixed guaranteed dividend under § 304 AktG in the amount of € 4.60 (gross profit share). A deduction is made to the gross profit share for the corporate income tax including solidarity surcharge on the portion of the profit of € 3.70 per share which is subject to corporate income tax and is contained in the gross profit share. The Domination and Profit and Loss Transfer Agreement took effect upon registration in the commercial register at the registered office of Schering AG on 27 October 2006.

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 4 |

BSG did, as announced at the extraordinary shareholder meeting of the Schering AG on the 13 September 2006, raise the cash compensation to the Federal Financial Supervisory Authority (“Bundesanstalt für Finanzdienstleistungsaufsicht” (BaFin)) calculated three month weighted average share price of the Schering AG in the amount of € 89.36 per share, with the three month ending on the 13 September 2006.

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 5 |

| 3 | Bases for Deriving the Cash Compensation |

| 3.1 | Legal and Commercial Conditions |

Pursuant to § 327a para. 1 AktG, upon request of the shareholder holding 95 percent of the share capital (main shareholder), the shareholders meeting of a public listed company can resolve the transfer of the shares from the other shareholders (minority shareholders) to the main shareholder in exchange for granting adequate cash compensation. The main shareholder determines the amount of the cash compensation under § 327b para. 1 AktG; the main shareholder must consider the circumstances of the company at the time of the resolution of the shareholders meeting.

In a corporate group resulting from a affiliation contract, the circumstances of the dependent company are characterized by the domination and profit and loss transfer agreement. In this context, the legal positions of the dominating enterprise and the outside shareholders are fundamentally different. The dominating enterprise has comprehensive rights to issue instructions to the dependent company. This includes the right to issue instructions which are disadvantageous for the dependent company (§ 308 AktG). Therefore, the management of the dependent company can be focused on the interests of the corporate group upon the instruction of the dominating enterprise and is not required to base its conduct on the companies interests and thus, at the same time, on the interests of all shareholders of the dependent company. The economic situation of the shareholder groups is also fundamentally different. The dominating enterprise is entitled to the entire profit of the company, and the outside shareholders are no longer participating. The dominating enterprise can dissolve hidden reserves which arose prior to the conclusion of the contract and have them transferred to itself so that in the extreme situation for the dependent company, only the share capital as well as the statutory and precontractual reserves remain. As compensation, the outside shareholders receive a contractually determined recurring cash payment of a constant amount (guaranteed dividend, § 304 AktG) which is independent of the economic success of the company. The outside shareholder is, thus, excluded from the chances and risks of the economic development of the dependent company during the course of a domination and profit and loss transfer agreement (OLG Düsseldorf, AG 2004, 324/326); viewed economically, the shareholder is the owner of a risk bearing fixed income security.

The circumstance that the payments of surpluses to the shareholder groups resulting from the participation in the company are different in the case of a profit and loss transfer agreement must be taken into account when valuing the shares for the purpose of determining the cash compensation. Since the outside shareholders only have the contractual guaranteed dividend, a forecast for the future earnings of the company is no longer determinative (District Court [Landgericht, “LG”] Frankfurt, DK 2006, 223/225 “MAN Roland” as well as DK 2006, 553 et seq. "MG Vermögensverwaltung"). A valuation of the company with a subsequent distribution of the resulting corporate value to the shareholders corresponding to the participation in the

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 6 |

capital would be inappropriate because the outside shareholders specifically no longer participate in these earnings. The determination of a compensation derived from the proportionate corporate value would negate the effects of an existing domination and profit and loss transfer agreement and, thus, presume a fictitious legal status.

Considering that the outside shareholders no longer participate in the earnings of the company when a domination and profit and loss transfer agreement exists, and taking into account the circumstance that the dominating enterprise is authorized to also issue instructions which are disadvantageous, the adequate cash compensation must be determined exclusively as the present value of the guaranteed dividends subject to any higher, relevant share price.

Assuming a perpetual duration of the domination and profit and loss transfer agreement, the guaranteed dividend for the outside shareholder represents the long term result which must be capitalized. In the present case the following consideration support the view that this agreement will exist perpetually (the LG Frankfurt, cited above, as well as the Court of Appeals Berlin, NZG 2003, 6 44/645 assume without any further argumentation that there is a perpetual duration in the case of a contract which has not been terminated).

The Domination and Profit and Loss Transfer Agreement between BSG and Schering AG was concluded with a fixed initial term of five years (beginning with the year 2007) for an indefinite period of time. A termination of the contract has not yet occurred, and in view of the high degree of economic and organizational integration of Schering AG into the Bayer Group, this is not to be expected after expiration of the initial fixed term because the separation of the businesses in the case of a termination of the contract would be considerably impeded with the increasing degree of interconnection between the two contractually bound enterprises.

The planned and partially already initiated measures indicate the scope of the organizational integration: BSG intends to combine Schering AG in a comprehensive manner with the pharmaceutical activities of the Bayer Group. This means a combination of the organizational units, companies and locations combined with the closing of locations. A separation of the companies in the case of a termination of the Domination and Profit and Loss Transfer Agreement would, therefore, involve major efforts and it would have considerable disadvantages for both companies. Therefore, in the present case a very long term ultimately perpetual duration for the Domination a Profit and Loss Transfer Agreement can be assumed.

| 3.2 | Methodical Approach for deriving the Cash Compensation |

The value of the shares for the minority shareholders which is to be compensated by the majority shareholder is determined using the present value of the net cash flow resulting from the ownership in the enterprise (net receipts for the owners of the enterprise) (IDW S 1 No. 4). The relevant net cash flows are in the present case the guaranteed dividends set forth in the Domination and Profit and Loss Transfer Agreement. Since, as has been stated above, a perpetual duration

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 7 |

of the affiliation agreement can be assumed, the cash compensation is determined by discounting the constant guaranteed future dividends for a perpetual period of time.

In order to derive the present value of these payments a discount rate risk equivalent to the risk of the guaranteed dividend is used.

| 3.3 | Share Price as Lower Value Limit |

In an order dated 27 April 1999, the German Federal Constitutional Court [Bundesverfassungsgericht, “BVerfG”] held that in the case of certain special occasions for determining the value of an enterprise (for example, compensation under § 305 AktG or § 320b AktG), the share price must be considered as the minimum value when determining a cash compensation for minority shareholders (1 BvR 1613/94). The requirement of considering the share price, when determining the adequate compensation, does not mean, however, according to the view of the German Federal Constitutional Court, that this value is always the sole factor. Exceeding the amount is unobjectionable under constitutional law. There can, however, also be grounds under constitutional law which justify a lower value. This prevailing case law must also be applied to a adequate cash compensation in the context of excluding minority shareholders under §§ 327a et seq. AktG.

With regard to the development and relevance of the share price for the share in Schering AG, we refer to Chapter 5.

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 8 |

| 4 | Present Value of the Guaranteed Dividend |

| 4.1 | Amount of the Guaranteed Dividend |

The Domination and Profit and Loss Transfer Agreement provides under § 4 a compensation for the minority shareholders of gross € 4.60 per share, reduced by the corporate income tax and solidarity surcharge to be paid by Schering AG on that amount according to the applicable rate for these taxes for the relevant fiscal year. The deduction of the corporate income tax including the solidarity surcharge only applies to the proportionate amount of € 3.70 per share contained in the gross amount which is derived from profits subject to German corporate income tax and the solidarity surcharge., Taking into account the German corporate income tax and the solidarity surcharge this results in a guaranteed dividend in an amount of € 3.62 per share. Since the corporate income tax rate of 25 % as well as the solidarity surcharge of 5.5 % used for this purpose of determining the corporate income tax to be paid correspond to the currently applicable tax provisions, this amount is also used as the basis for the following valuation. The compensation, the guaranteed dividend, will be paid for the first time for the fiscal year 2006. It will be disbursed on the first bank working day after the ordinary shareholder meeting in 2007. However dividend will be reduced by a paid dividend from the Schering AG. From then on the compensation will be granted in full as annual recurring cash payment (guaranteed dividend).

In order to derive the present value of the guaranteed dividend payments, the future anticipated guaranteed dividend payments must be discounted to the valuation date with a suitable interest rate. This interest rate is established using the (anticipated) earnings and the price for the best alternative use of capital compared to the object to be valued. Economically viewed, the discount rate reflects the alternative decision of an investor who compares the anticipated earnings from the investor's investment with the return from a corresponding alternative investment. The discount rate then represents the return of an appropriate alternative investment to the existing investment if this alternative investment is equivalent to the capitalized flow of payments with regard to timing, risk and taxation (IDW S 1, Section 7.2.4.1.).

The discount rate can generally be broken down into a risk-free rate and a risk premium required by shareholders for the assumption of entrepreneurial risk. The approach corresponds in this context to the approach when determining the contractual guaranteed dividend payment.

The risk-free rate represents a risk free and maturity equivalent alternative investment compared to an investment in the guaranteed dividend being valued. In order to determine the risk-free interest rate for the purpose of determining the cash compensation, the yield curve for government bonds can be used as the basis because the zero bond factors which are derived from the

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 9 |

yield curveand are equivalent in terms of time to maturity ensures compliance with the equivalent term. The yield curve shows the relationship between the interest rates and the terms of zero bonds without a default risk.

Reference can be made to the published yield curve data of the German Federal Bank [Deutsche Bundesbank] as the data basis for the objective estimate of the yield curve. When using a yield curve, as a general rule the payment for each year must be discounted with the relevant appropriate interest rate according to the time of maturity. For reasons of practicality, a uniform risk-free rate can be calculated and used over the entire period of time, i.e. commencing with the first year.

Based on the yield curve of the German Federal Bank in the period from 1 September 2006 to 30 November 2006, we have determined a uniform risk-free rate of rounded 4.0 % which we use as a basis in the following calculations.

The interest rate used to capitalize the guaranteed dividend payment results from the sum of the risk-free rate and a reasonable risk premium. This approach corresponds to the derivation of the annuity factor when determining the guaranteed dividend payment under § 304 para 2 sentence 1 AktG.

The Domination and Profit and Loss Transfer Agreement between Schering AG and BSG provides in § 5 para. 6 that upon termination of the affiliation agreement as a result of a notice of termination by BSG, each minority shareholders is entitled to sell its shares to BSG in exchange for payment of € 89.00 per share or a higher amount determined by a court in special proceedings. Thus, the entrepreneurial risk for the minority shareholder no longer exists in this specific case upon conclusion of the affiliation agreement. At the time of termination of the affiliation agreement, the shareholder has the option to demand the cash compensation in the amount of € 89.00 per share agreed in the Domination and Profit and Loss Transfer Agreement or alternatively to remain a shareholder and again participate in the entrepreneurial risk of Schering AG. The economic risk position of the minority shareholder, after conclusion of the Domination and Profit and Loss Transfer Agreement is equivalent to the position of the holder of a corporate bond more precisely to a convertible bond or a bond with an option. Since the recipient of the guaranteed dividend only bears the risk that the debtor of the guaranteed dividend will default, indirectly Bayer AG, which issued a comfort letter for the obligations of BSG under and in connection with the affiliation agreement, it is appropriate to derive the discount rate taking into account the risk that Bayer will default (credit risk from the point of view of a third party financer).

In order to determine the credit risk of Bayer AG, all available data were analyzed. This included especially the risk assessment by rating agencies (Standard & Poor's und Moody’s) and

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 10 |

by banks as well as the current conditions of the syndicated loans to finance the acquisition of Schering as well as estimates by the Bayer treasury of conditions which could be obtained. All of these approaches are generally suitable to estimate the credit risk of Bayer, but all of these approaches have the common characteristic that they contain subjective elements, only represent a very specific situation or require other considerations and/or calculations in order to reach quantification.

In order to objectively determine the risk premium, we have examined the bonds issued in Euro by Bayer AG which are traded in the capital market and compared their credit risk premiums to secure (risk-free) Federal Bonds (“Bundesanleihen”) having the same time to maturity. The examination of the credit risk premiums showed a high degree of volatility in the premiums. For the valuation we have, therefore, applied a smoothed credit risk premium at a rate of 0.60 %.

Since the interest payments from a corporate bond are subject to the full income tax rate of the recipient, the risk premium is reduced by a typified income tax burden in the amount of 35 % in order to determine a discount rate after income tax which is equivalent to a bond.

When determining the present value of the guaranteed dividend payment, a deduction for growth is not taken into account because the guaranteed dividend payment is a stable flow of payments without growth.

| 4.3 | Determination of the Present Value |

It can be assumed that the first compensation payment for the year 2006, which is due after the next planned regular shareholders meeting of Schering AG scheduled for 23 May 2007, will still be paid to shareholders. Therefore the present value of the relevant guaranteed dividends results from the guaranteed dividends of € 3.62 per share commencing with the year 2008 for the precedent fiscal year. Assuming an unchanged date of the shareholders meeting in the future the present value of the guaranteed dividends is determined by a perpetual annuity as of the 24 May 2007, the day following the regular shareholders meeting in the year 2007. The resulting amount of the perpetual annuity must be discounted to present value as of 17 January 2007, the date of the extraordinary shareholders meeting of Schering AG.

From the guaranteed dividend in the amount of € 3.62 per share the typified income tax of 35 % taking into account the half-credit method must be deducted (€ 0.63 per share). Thus, it results a compensation payment after typified income tax of € 2.99 per share.

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 11 |

The relevant discount rate (after typified income tax) in the amount of 2.99 % results as follows:

| | |

Risk-free Rate Risk premium | 4.00% 0.60% |

Discount rate before income tax Income tax effect with typified income tax of 35% | 4.60% -1.16% |

| Discount rate after typified income tax | 2.99% |

The present value of the guaranteed dividend payments as of 24 May 2007 results as follows for an assumed perpetual term applying the formula for a perpetual annuity:

| | | |

Guaranteed dividend after corporate income tax and solidarity surcharge Personal income tax 35% (half-credit method procedure) | € € | 3.62 0.63 |

Guaranteed dividend after personal income tax Discount rate | € % | 2.99 2.99 |

Value per share as of 24 Mai 2007 | € | 100.00 |

| Value per share as of 17 Januar 2007 | € | 99.98 |

The resulting value per share in the amount of € 100.00 per share as of 24 May 2007 must be discounted back to the 17 January 2007. Discounted with the discount rate of 2.99 %, the value per share as of this effective date is € 98.98.

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 12 |

| 5 | Analysis of the Share Price of Schering |

| 5.1 | Relevance of the Share Price for Deriving the Cash Compensation |

With regard to the decision of the German Federal Constitutional Court [Bundesverfassungsgericht, “BVerfG”] dated 27 April 19991, the share price of the share of the company to be appraised must be compared to the calculated value per share. According to the decision of the BVerfG, an existing share price cannot remain without consideration when determining the compensation. Accordingly, the share price generally establishes the lower limit for adequate compensation. However, a lower amount can be considered if the share price in exceptional circumstances does not reflect the fair market value of the share. The case law of the BVerfG was specified in the judgment of the Federal Supreme Civil Court [Bundesgerichtshof, “BGH”] dated 12 March 2001.2 The court clarified that the share price cannot be considered to be the lowest limit for adequate compensation if it does not reflect the fair market value. According to the judgment of the BGH, this situation can exist if there has been no trading in the shares of the company over a long period of time, the individual outside shareholder is not in a position to sell its shares at the exchange price due to a narrow market or the share price has been manipulated. In the present case, there are no indications that such exceptional circumstances exist.

According to the decision of the BGH dated 12 March 2001, a reference price must generally be used as a basis for determining the share price, assuming that no certain influences stand in the way of this, whereby the reference price results from the average price over a period of three months. The use of the average is intended to eliminate potential manipulative influences and short term distortions. The three month reference period is supposed to extend until immediately before the relevant date, the date of the shareholders meeting (here, 17 January 2007).

With regard to the issue of whether the prices are to be weighted according to the daily sales or whether a simple average should be established, different views exist. According to the view of the Court of Appeals [Oberlandesgericht, “OLG”] Düsseldorf (8 November 2004 - I 19 W 9/03, AG 2005, pp. 538, 541), a simple average of the daily prices must be determined. Contrary to this, the OLG Frankfurt (9 January 2003 - 20 W 434/93, AG 2003, pp. 581, 582) refers to the Regulation on Offers under the German Securities Acquisition and Transfer Act [Angebotsverordnung zur Wertpapiererwerbs- und Übernahmegesetz, "WpÜG Offer Regulation"] and takes the view that for the purpose of determining the compensation the average share price based on weighted sales within the meaning of § 5 para. 1 and 3 WpÜG Offer Regulation must be used as the basis.

1 AktZ. 1 BvR 1805/94

2 AktZ. II ZB 15/00

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 13 |

Since the work on the valuation must be concluded several weeks before the shareholders meeting passing the resolution and the report by the main shareholder must be provided for review in accordance with § 327c para. 2 AktG prior to calling the shareholders meeting, the three month average price as of the date of the shareholders meeting cannot be determined at the time of determining and fixing the cash compensation.

According to the predominant view in the writings on this topic (cp., Wilm, NZG 2000, p. 239; Bungert, BB 2001, p. 1165; Meilicke/Heidel, DB 2001, p. 974; Beckmann, WPg 2004, p. 624; Krieger, BB 2002, p. 56; Großfeld, Unternehmens- und Anteilsbewertung im Gesellschaftsrecht [Valuation of Companies and Shares in Corporate Law], 4th ed., 2002, p. 196; Hüffer, AktG, 6th ed., 2004, § 305, note 24e; Krieger, Münchener Handbuch des Gesellschaftsrechts [Munich Handbook of Corporate Law], vol. 4 Aktiengesellschaft [Stock Corporation], 2nd ed., 1999, § 70, note 106; Koppensteiner, Kölner Kommentar zum Aktiengesetz [Cologne Commentary to the Stock Corporations Act], vol. 6, 3rd ed., 2004, § 305, note 104; Gude, Struktur’nderungen und Unternehmensbewertung zum Börsenkurs [Structural Changes and Corporate Valuation at the Share price], 2004, p. 387; Emmerich/Habersack, Aktien- und GmbH-Konzernrecht [Corporate Group Law for Stock Corporations and GmbHs], 4th ed., 2005, § 305, note 47c; Hüffer/Schmidt-Aßmann/Weber, Anteilseigentum, Unternehmenswert und Börsenkurs [Ownership of Shares, Corporate Valuation and Share price], 2005, p. 38), the reference period ends on the date of publication of the takeover offers or corporate group measures (cp, District Court [Landgericht, “LG”] Frankfurt, 6 February 2002 - 3/3 O 150/94; AG 2002, p. 358, 360). This view has also been reflected in § 5 para. 1 of the Offering Regulation for the WpÜG which states that the compensation offered in the case of a takeover offer must correspond to at least the average share price of the shares of the target company during the last three months prior to publication of the decision to issue an offer. The OLG Stuttgart (8 March 2006 - 20 W 5/05, ZIP 2006, p. 764) considers it appropriate using a reference period of three months prior to announcement of the measure instead of the three-month period prior to the shareholders meeting used by the BGH by referring to the situation under the law on capital markets and takeovers.

Despite this criticism expressed in the legal writings, at the present time many courts (see OLG Düsseldorf, 31 January 2003 - 19 W 9/00, AG 2003, p. 329, 331; OLG Hamburg, 7 August 2002 - 12 W 12/01, AG 2003, p. 583, 584) follow the decision of the BGH from the year 2001. Concerns that the share price can be influenced after the publication of the intended structural measure by speculation on the compensation and no longer reflects regular supply and demand mechanisms are not supposed to be so important compared to the principle of having a determinative date and the "free decision to divest".

However, doubts remain about whether the strict fixing of the reference period on the effective date of the corporate group measure in the above case law adequately reflects the pattern of behaviour of the market participants since the decision of the BVerfG in 1999. This is even more the case in the present instance. Since march 2006 the share prices of Schering AG have

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 14 |

been noticeably characterized by the takeover offers announced by Merck KGaA, Darmstadt (hereinafter “Merck KGaA”) and Bayer of € 77.00 and € 86.00/89.00 per share. Takeover offers are normally viewed in the market as a signal for subsequent corporate group measures.

| 5.2 | Development of the Share Price for Schering AG |

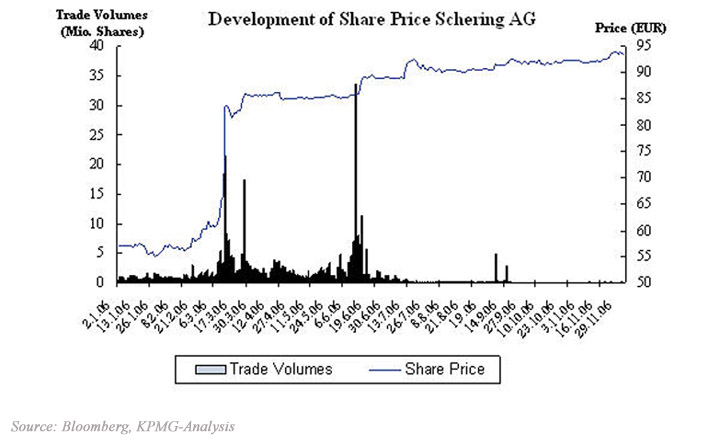

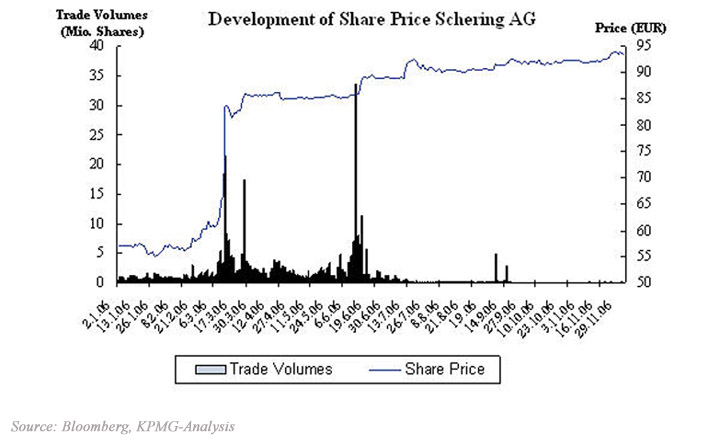

The following graph shows the development of the share price for Schering AG since the beginning of the year through 1 December 2006:

On 13 March 2006, Merck KGaA, announced its intent to submit a voluntary public takeover offer directed towards the shareholders of Schering AG in exchange for payment in the amount of € 77.00 per Schering share in cash. The background of this involved considerations on a merger of Merck KGaA and Schering AG to a global pharmaceutical and chemical company. The price of the Schering share increased on 13 March 2006 as a result of high volume trading of approximately 21.4 million shares by € 16.81 compared to the previous date to € 83.55 and, thus, significantly above the takeover offer of € 77.00, which corresponds to a gain in the share price of approximately 25 %. On 23 March 2006, Bayer AG announced that it wished to make a voluntary public takeover offer through its 100 % subsidiary BSG (at that time still named Dritte BV GmbH) to the shareholders of Schering AG for a payment of € 86.00 per Schering share. The purpose of the takeover offer was the incorporation of Schering AG and the pharmaceuticals division of Bayer to an independent division in the sub-group Bayer HealthCare. The

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 15 |

On 30 May 2006, the deadline for the offer was extended by Bayer until 14 June 2006. The conditions with regard to the minimum quota for acceptance and the takeover offer in the amount of € 86.00 remained unchanged. During this new period, it became known in the market that Merck KGaA had increased its holdings in Schering AG by additional purchases through the stock exchange to 21.4 %, which explained the high volumes in this period. DBV also acquired additional Schering shares through the stock exchange in this period. After Bayer announced the preparation of a mandatory offer in the course of an ad hoc notice under § 15 German Securities Trading Act [Wertpapierhandelsgesetz, “WpHG”], the commitment of Merck KGaA was made shortly before expiration of the acceptance period to sell its Schering shares to DBV at a price of € 89.00 per share. In a further ad hoc notice dated 14 June 2006, Bayer announced that all Schering shareholders who had already offered to sell their shares in the course of the offer process and those who would still do so prior to expiration of the offer deadline would also receive the price of € 89.00. As a result of this, the share price of the Schering shares increased on 15 June 2006 to € 89.07 and remained almost unchanged at this level until 10 July 2006. In the ad hoc notice under § 15 WpHG on 20 June 2006, Bayer announced that it had obtained control over 88 % of the outstanding Schering shares and, thus, the conditions for the takeover offer had been satisfied. The goal of complete takeover of Schering AG was again emphasized. After the end of the statutory acceptance deadline, Bayer announced on 12 July 2006 that it controlled more than 92.4 % of the outstanding Schering shares. The share price of Schering shares increased up to 26 July 2006 to € 90.56 per share, whereby the highest share price in this period was observed to be on 18 July 2006 at a price of € 92.48 per share.

Bayer announced on 26 July 2006 details on the intended Domination and Profit and Loss Transfer Agreement in the context of a press statement, as did Schering in the context of an ad hoc notice. In particular, the offered compensation amount pursuant to § 305 AktG, the guaranteed dividend under § 304 AktG as well as the corporate value of Schering AG as of 13 September 2006, the date of the intended extraordinary shareholders meeting, was announced. Up to that day, the price for the Schering shares had again decreased to € 90.56 per share. The price for the Schering shares remained virtually unchanged at low trading volumes until 8 September 2006. On 8 September 2006 BSG acquired a share package of approximately 4.7 mio. shares through the exchange, which led to an increase in the price up to € 92.60 per share. On the following day, 9 September 2006, Bayer reported in a press notice that it had achieved a shareholding in Schering AG of more than 95 % and pointed out that it, therefore,

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 16 |

had the necessary majority for a so-called squeeze-out, the transfer of the shares of the minority shareholders to the majority shareholder. The price of the Schering shares was virtually uninfluenced by this notification. The share price on the exchange for Schering shares did not significantly react even after the announcement by Bayer on 23 November 2006 with regard to the intended squeeze-out in the spring of 2007. Aside from a high trading volume on 15 September 2006 of around 2.8 mio. shares, the price for the Schering shares remained in a range from € 91.36 to € 93.85 (closing prices) at average trading volumes of less than 100,000 shares per day until 1 December 2006.

| 5.3 | Relevant average Share Price |

Under a strict economic view and a narrow interpretation of the requirements on the reference share price set by the BVerfG as a comparable, undistorted amount, a period for determining the reference price would be the three month period prior to 13 March 2006 because after 13 March 2006 the share price of Schering AG was influenced to a considerable degree by the announcement of the takeover offer, the intent to merge with Merck KGaA as well as the statement about the likely amount of the takeover offer of € 77. Rationally acting market participants increasingly acquired Schering shares after this time because the takeover offer was significantly above the share price prior to announcement of the takeover offer. Furthermore, the increase in the share price to € 83.55 on 13 March 2006 and the resulting market reaction showed a potential improvement of the offer as had been anticipated by a number of analysts. The course of the share price for the Schering shares in light of this background does not reflect the undistorted result of offer and demand free of special effects on the basis of anticipated fundamental corporate data of Schering AG and resulting expectations of price by the market participants on that basis; rather, the course of the share price reflects the expectations on the demand side resulting after 13 March 2006 with regard to the actual takeover offer and a potential improvement. Thus, the share price of Schering shares after 13 March 2006 can already be considered to have been distorted by speculation about the takeover offer of Merck KGaA. The three month period from 13 December 2005 to 12 March 2006 would be the relevant three month rate for determining the reference share price.

In its judgment dated 12 March 2001, the BGH does not consider the above described "speculation on compensation" as a basis for distortion of the share price; rather, the BGH considers this also to be behaviour of the market participants which establishes the share price on the basis of corresponding supply and demand in expectation of a more beneficial compensation resulting from the corporate group agreement. In addition, it must also be taken into account, differing from the above described primarily economically motivated procedure, that it was not the takeover offer of Merck KGaA but the takeover offer of Bayer AG which is the reason for the Domination and Profit and Loss Transfer Agreement, about which a resolution was adopted at the shareholders meeting on 13 September 2006, and the anticipated and announced exclusion of the minority shareholders which is intended to be resolved by the shareholders meeting on 17 January 2007.

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 17 |

It can be assumed in this regard that the share price for Schering AG was substantially influenced by the ad hoc notices of Bayer AG on 14 June 2006 with the notification of Bayer AG that it was willing to pay all Schering shareholders who had already offered their shares in the context of the offer process or would do so prior to expiration of the offer deadline also the price of € 89.00 per share in Schering AG, which resulted in an increase in the share price for the share to approximately € 89 after this date.

The share price for the Schering shares hovered around € 89 until 12 July 2006, the date on which Bayer AG announced that it had control over 92.4 % of the Schering shares. The share price increased steadily to € 92 in the following days. Since at that time no further information on the future integration of Schering AG and the pharmaceutical division of Bayer to an independent division of the sub-group Bayer HealthCare was known in the market, it can be assumed that as a result of the previous announcement of Bayer AG on a complete takeover, considerations by market participants about a possible procedure to exclude minority shareholders in the near future also contributed to the price situation. This assumption is supported by the fact that the price of the Schering shares remained virtually unchanged upon the notification of Bayer AG on 9 September 2006 with regard to achieving a shareholding in Schering AG of more than 95 %.

Although under a strictly economic point of view and a narrow interpretation of the requirements mentioned by the BVerfG for the reference price as a comparable, undistorted value, much earlier periods can be considered, we are determining the average share price on the basis of the period of time from 2 September 2006 through (and including) 1 December 2006 because at the time of conclusion of our report, there has been no announcement about the planned exclusion of the minority shareholders in the context of a relevant ad hoc notification. This point in time is consistent with the predominant opinion in the legal writings and is supported by the decision of the legislature which refers in § 5 WpÜG Offer Regulation to the three-month period of time prior to publishing the issuance of an offer to acquire for determining the minimum price derived from the share price in the case of takeover offers and mandatory offers. The derivation of the volume weighted average of the domestic share prices as a basis also corresponds to the regulations in § 5 para. 1 and para. 3 WpÜG Offer Regulation for the comparable case of the minimum consideration in the case of takeover and mandatory offers. The average weighted share price (source: Bloomberg) for the period from 2 September 2006 until (and including) 1 December 2006 in accordance with the above rules is € 92.06 per share.

Since this price is below the value of the discounted guaranteed dividend, it is according to high court decisions not relevant when determining the cash compensation offered under § 327a para.1 AktG.

| ABCD | | Schering AG |

Unauthorized translation | | Independent Expert Opinion |

of the legally binding | | Adequate Cash Compensation pursuant to § 327b AktG |

German original | | Page 18 |

We summarize the result of our independent expert opinion on the determination of the adequate cash compensation pursuant to § 327b para. 1 AktG as of 17 January 2007 in the context of the planned exclusion of the minority shareholders of Schering AG by BSG as the main shareholder under § 327a et seq. AktG as follows:

| · | The present value of the capitalized guaranteed dividends on the basis of the Domination and Profit and Loss Transfer Agreement existing between BSG and Schering AG is € 98.98 per share in Schering AG. |

| · | The average volume weighted share price of the shares in Schering AG in the three-month period from September 2006 up to (and including) 1 December 2006 is € 92.06. |

| · | The adequate cash compensation pursuant to § 327b para. 1 AktG is the amount € 98.98 per share in Schering AG. |

Frankfurt am Main, 3 December 2006

KPMG Deutsche Treuhand-Gesellschaft

Aktiengesellschaft

Wirtschaftsprüfungsgesellschaft

| Zeidler | Paulus |

| Certified Accountant | Certified Accountant |

Annex

[Translators notes are in square brackets]

General Engagement Terms

for

Wirtschaftsprüfer and Wirtschaftsprüfungsgesellschaften

[German Public Auditors and Public Audit Firms]

as of January 1, 2002

This is an English translation of the German text, which is the sole authoritative version

1. Scope (1) These engagement terms are applicable to contracts between Wirtschaftsprüfer [German Public Auditors] or Wirtschaftsprüfungsgesellschaften [German Public Audit Firms] (hereinafter collectively referred to as the “Wirtschaftsprüfer”) and their clients for audits, consulting and other engagements to the extent that something else has not been expressly agreed to in writing or is not compulsory due to legal requirements. (2) If, in an individual case, as an exception contractual relations have also been established between the Wirtschaftsprüfer and persons other than the client, the provisions of No. 9 below also apply to such third parties. 2. Scope and performance of the engagement (1) Subject of the Wirtschaftsprüfer’s engagement is the performance of agreed services - not a particular economic result. The engagement is performed in accordance with the Grunds’tze ordnungsm’ßiger Berufsausübung [Standards of Proper Professional Conduct]. The Wirtschaftsprüfer is entitled to use qualified persons to conduct the engagement. (2) The application of foreign law requires - except for financial attestation engagements - an express written agreement. (3) The engagement does not extend - to the extent it is not directed thereto - to an examination of the issue of whether the requirements of tax law or special regulations, such as, for example, laws on price controls, laws limiting competition and Bewirtschaftungsrecht [laws controlling certain aspects of specific business operations] were observed; the same applies to the determination as to whether subsidies, allowances or other benefits may be claimed. The performance of an engagement encompasses auditing procedures aimed at the detection of the defalcation of books and records and other irregularities only if during the conduct of audits grounds therefor arise or if this has been expressly agreed to in writing. (4) If the legal position changes subsequent to the issuance of the final professional statement, the Wirtschaftsprüfer is not obliged to inform the client of changes or any consequences resulting therefrom. 3. The client's duty to inform (1) The client must ensure that the Wirtschaftsprüfer - even without his special request - is provided, on a timely basis, with all supporting documents and records required for and is informed of all events and circumstances which may be significant to the performance of the engagement. This also applies to those supporting documents and records, events and circumstances which first became known during the Wirtschaftsprüfer’s work. (2) Upon the Wirtschaftsprüfer’s request, the client must confirm in a written statement drafted by the Wirtschaftsprüfer that the supporting documents and records and the information and explanation provided are complete. 4. Ensuring independence The client guarantees to refrain from everything which may endanger the independence of the Wirtschaftsprüfer’s staff. This particularly applies to offers of employment and offers to undertake engagements on one’s own account. 5. Reporting and verbal information If the Wirtschaftsprüfer is required to present the results of his work in writing, only that written presentation is authoritative. For audit engagements the long-form report should be submitted in writing to the extent that nothing else has been agreed to. Verbal statements and information provided by the Wirtschaftsprüfer’s staff beyond the engagement agreed to are never binding. 6. Protection of the Wirtschaftsprüfer’s intellectual property The client guarantees that expert opinions, organizational charts, drafts, sketches, schedules and calculations - especially quantity and cost computations - prepared by the Wirtschaftsprüfer within the scope of the engagement will be used only for his own purposes. | | 7. Transmission of the Wirtschaftsprüfer’s professional statement (1) The transmission of a Wirtschaftsprüfer’s professional statements (long-term reports, expert opinions and the like) to a third party requires the Wirtschaftsprüfer’s written consent to the extent that the permission to transmit to a certain third party does not result from the engagement terms. The Wirtschaftsprüfer is liable (within the limits of No. 9) towards third parties only if the prerequisites of the first sentence are given. (2) The use of the Wirtschaftsprüfer’s professional statements for promotional purposes is not permitted; an infringement entitles the Wirtschaftsprüfer to immediately cancel all engagements not yet conducted for the client. 8. Correction of deficiencies (1) Where there are deficiencies, the client is entitled to subsequent fulfillment [of the contract]. The client may demand a reduction in fees or the cancellation of the contract only for the failure to subsequently fulfill [the contract]; if the engagement was awarded by a person carrying on a commercial business as part of that commercial business, a government-owned legal person under public law or a special government-owned fund under public law, the client may demand the cancellation of the contract only if the services rendered are of no interest to him due to the failure to subsequently fulfill [the contact]. No. 9 applies to the extent that claims to damages exist beyond this. (2) The client must assert his claim for the correction of deficiencies in writing without delay. Claims pursuant to the first paragraph not arising from an intentional tort cease to be enforceable one year after the commencement of the statutory time limit for enforcement. (3) Obvious deficiencies, such as typing and arithmetical errors and formelle Mangel [deficiencies associated with technicalities] contained in Wirtschaftsprüfer’s professional statements (long-form reports, expert opinions and the like) may be corrected - and also be applicable versus third parties - by the Wirtschaftsprüfer at any time. Errors which may call into question the conclusions contained in the Wirtschaftsprüfer’s professional statements entitle the Wirtschaftsprüfer to withdraw - also versus third parties - such statements. In the cases noted the Wirtschaftsprüfer should first hear the client, if possible. 9. Liability (1) The liability limitation of § [“Article”] 323 (2) [“paragraph 2”] HGB [Handelsgesetzbuch”: German Commercial Code] applies to statutory audits required by law. (2) Liability for negligence; An individual case of damages If neither No. 1 is applicable nor a regulation exists in an individual case, pursuant to § 54a (1) no. 2 WPO [“Wirtschaftsprüferordnung”: Law regulating the Profession of Wirtschaftsprüfer] the liability of the Wirtschaftsprüfer for claims of compensatory damages of any kind - except for damages resulting from injury to life, body or health - for an individual case of damages resulting from negligence is limited to € 4 million; this also applies if liability to a person other than the client should be established. An individual case of damages also exists in relation to a uniform damage arising from a number of breaches of duty. The individual case of damages encompasses all consequences from a breach of duty without taking into account whether the damages occurred in one year or in a number of successive years. In this case multiple acts or omissions of acts based on a similar source of error or on a source of error of an equivalent nature are deemed to be a uniform breach of duty if the matters in question are legally or economically connected to one another. In this event the claim against the Wirtschaftsprüfer is limited to € 5 million. The limitation to the fivefold of the minimum amount insured does not apply to compulsory audits required by law. (3) Preclusive deadlines A compensatory damages claim may only be lodged within a preclusive decade of one year of the rightful claimant having become aware of the damage and of the event giving rise to the claim - at the very latest, however, within 5 years subsequent to the event giving rise to the claim. The claim expires if legal action is not taken within a six month deadline subsequent to the written refusal of acceptance of the indemnity and the client was informed of this consequence. The right to assert the bar of the preclusive deadline remains unaffected. Sentences 1 to 3 also apply to legally required audits with statutory liability limits. |

10. Supplementary (1) A subsequent amendment or abridgement of the financial statements or management report audited by a Wirtschaftsprüfer and accompanied by an auditor’s report requires the written consent of the Wirtschaftsprüfer even it these documents are not published. If the Wirtschaftsprüfer has not issued an auditor’s report, a reference to the audit conducted by the Wirtschaftsprüfer in the management report or elsewhere special for the general pubic is permitted only with the Wirtschaftsprüfer’s written consent and using the wording authorized by him. (2) If the Wirtschaftsprüfer revokes the auditor’s report, it may no longer be used. If the client has already made use of the auditor’s report, he must announce its revocation upon the Wirtschaftsprüfer’s request. (3) The client has a right to 5 copies of the long-form report. Additional copies will be charged for separately. 11. Supplementary provisions for assistance with tax matters (1) When advising on an individual tax issue as well as when furnishing continuous tax advice, the Wirtschaftsprüfer is entitled to assume that the facts provided by the client - especially numerical disclosures - are correct and complete; this also applies to bookkeeping engagements. Nevertheless, he is obliged to inform the client of any errors he has discovered. (2) The tax consulting engagement does not encompass procedures required to meet deadlines, unless the Wirtschaftsprüfer has explicitly accepted the engagement for this. In this event the client must provide the Wirtschaftsprüfer, on a timely basis, all supporting documents and records - especially tax assessments - material to meeting the deadlines, so that the Wirtschaftsprüfer has an appropriate time period available to work therewith. (3) In the absence of other written agreements, continuous tax advice encompasses the following work during the contract period: a) preparation of annual tax returns for income tax, corporation tax and business tax, as well as net worth tax returns on the basis of the annual financial statements and other schedules and evidence required for tax purposes to be submitted by the client b) examination of tax assessments in relation to the taxes mentioned in (a) c) negotiations with tax authorities in connection with the returns and assessments mentioned in (a) and (b) d) participation in tax audits and evaluation of the results of tax audits with respect to the taxes mentioned in (a) e) participation in Einspruchs- und Beschwerdeverfahren [appeals and complaint procedures] with respect to the taxes mentioned in (a). In the afore-mentioned work the Wirtschaftsprüfer takes material published legal decisions and administrative interpretations into account. (4) If the Wirtschaftsprüfer receives a fixed fee for continuous tax advice, in the absence of other written agreements the work mentioned under paragraph 3 (d) and (e) will be charged separately. (5) Services with respect to special individual issues for income tax, corporate tax, business tax, valuation procedures for property and net worth taxation, and net worth tax as well as all issues in relation to sales tax, wages tax, other taxes and dues require a special engagement. This also applies to: a) the treatment of nonrecurring tax matters, e.g. in the field of estate tax, capital transactions tax, real estate acquisition tax b) participation and representation in proceedings before tax and administrative courts and in criminal proceedings with respect to taxes, and c) the granting of advice and work with respect to expert opinions in connection with conversions of legal form, mergers, capital increases and reductions, financial reorganizations, admission and retirement of partners or shareholders, sale of a business, liquidation and the like. | | (6) To the extent that the annual sales tax return is accepted as additional work, this does not include the review of any special accounting prerequisites nor of the issue as to whether all potential legal sales tax reductions have been claimed. No guarantee is assumed for the completeness of the supporting documents and records to validate the deduction of the input tax credit. 12. Confidentiality towards third parties and data security (1) Pursuant to the law the Wirtschaftsprüfer is obliged to treat all facts that he comes to know in connection with his work as confidential, irrespective of whether these concern the client himself or his business associations, unless the client releases him from this obligation. (2) The Wirtschaftsprüfer may only release long-form reports, expert opinions and other written statements on the results of his work to third parties with the consent of his client. (3) The Wirtschaftsprüfer is entitled - within the purposes stipulated by the client - to process personal data entrusted to him or allow them to be processed by third parties. 13. Default of acceptance and lack of cooperation on the part of the client If the client defaults in accepting the services offered by the Wirtschaftsprüfer or if the client does not provide the assistance incumbent on him pursuant to No. 3 or otherwise, the Wirtschaftsprüfer is entitled to cancel the contract immediately. The Wirtschaftsprüfer’s right to compensation for additional expenses as well as for damages caused by the default or the lack of assistance is not affected, even if the Wirtschaftsprüfer does not exercise his right to cancel. 14. Remuneration (1) In addition to his claims for fees or remuneration, the Wirtschaftsprüfer is entitled to reimbursement of his outlays; sales tax will be billed separately. He may claim appropriate advances for remuneration and reimbursement of outlays and make the rendering of his services dependent upon the complete satisfaction of his claims. Multiple clients awarding engagements are jointly and severally liable. (2) Any set off against the Wirtschaftsprüfer’s claims for remuneration and reimbursement of outlays is permitted only for undisputed claims or claims determined to be legally valid. 15. Retention and return of supporting documentation and records (1) The Wirtschaftsprüfer retains, for seven yeas, the supporting documents and records in connection with the completion of the engagement - that had been provided to him and that he has prepared himself - as well as the correspondence with respect to the engagement. (2) After the settlement of his claims easing from the engagement, the Wirtschaftsprüfer, upon the request of the client, must return all supporting documents and records obtained from him or for him by reason of his work on the engagement. This does not, however, apply to correspondence exchanged between the Wirtschaftsprüfer and his client and to any documents of which the client already has the original or a copy. The Wirtschaftsprüfer may prepare and retain copies or photocopies of supporting documents and records which he returns to the client. 16. Applicable law Only German law applies to the engagement, its conduct and any clams arising therefrom. |