Use these links to rapidly review the document

EXACT SCIENCES CORPORATION ANNUAL REPORT ON FORM 10-K YEAR ENDED DECEMBER 31, 2002 TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2002

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 000-32179

EXACT SCIENCES CORPORATION

(Exact Name of registrant as specified in its charter)

DELAWARE

(State or other jurisdiction of

incorporation or organization) | | 02-0478229

(IRS Employer Identification No.) |

63 Great Road, Maynard, Massachusetts

(Address of principal executive offices) |

|

01754

(zip code) |

Registrant's telephone number, including area code: (978) 897-2800

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.01 Par Value

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report(s), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by checkmark whether or the registrant is an accelerated filer (as defined in the Exchange Act Rule 12B-2). Yes ý No o

The aggregate market value of the voting stock held by non-affiliates of the Registrant, as of the last business day of the Registrant's most recently completed second fiscal quarter was approximately $221,720,000 (based on the closing price of the Registrant's Common Stock on June 28, 2002 of $15.97 per share).

The number of shares outstanding of the Registrant's $.01 par value Common Stock as of March 14, 2003 was 19,031,882.

DOCUMENT INCORPORATED BY REFERENCE

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days of the end of the fiscal year ended December 31, 2002. Portions of such proxy statement are incorporated by reference into Part III of this Form 10-K.

EXACT SCIENCES CORPORATION

ANNUAL REPORT ON FORM 10-K

YEAR ENDED DECEMBER 31, 2002

TABLE OF CONTENTS

i

PART I

Item 1. Business

This Business section and other parts of this Form 10-K contain forward-looking statements that involve risk and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those set forth in "Management's Discussion and Analysis of Financial Condition and Results of Operations—Factors That May Affect Future Results" and elsewhere in this Form 10-K.

Overview

EXACT Sciences Corporation (Nasdaq: EXAS) has developed and continues to develop proprietary technologies in applied genomics (our "PreGen™ technologies") that we believe will revolutionize the early detection of colorectal cancer and other types of common cancers. We believe that medical practitioners will order tests based on our PreGen technologies as part of a regular screening program for the early detection of these cancers. We also believe that the widespread and periodic application of tests utilizing our PreGen technologies will reduce mortality, morbidity and the costs associated with these cancers.

We have selected colorectal cancer as the first application of our PreGen technologies because it is the most deadly cancer among non-smokers, curable if detected early and is well understood from a genomics point of view. There are an estimated 80 million Americans age 50 and over for whom the American Cancer Society recommends regular colorectal cancer screening. Current detection methods for colorectal cancer have proven to be inadequate as screening tools due to invasiveness, inadequate performance characteristics, or poor patient compliance.

Our first major commercial application derived from our PreGen technologies is PreGen-Plus™, a proprietary, non-invasive DNA-based test for the early detection of colorectal cancer in the average-risk population. In June 2002, we entered into an agreement to exclusively license Laboratory Corporation of America® Holdings ("LabCorp®") our PreGen technologies necessary to perform fecal-based colorectal cancer screening. Additionally, we have also agreed to provide LabCorp with access to additional PreGen technologies that we develop that may improve the efficacy or efficiency of PreGen-Plus through the five-year exclusivity period.

As part of our strategic alliance with LabCorp, LabCorp will conduct colorectal cancer screening tests using our PreGen technologies at their facilities and will be responsible for all billing and collection activities relating to tests LabCorp performs, and we will receive a per-test royalty fee on each test.

PreGen-Plus utilizes our proprietary PreGen technologies to isolate minute amounts of human DNA that are shed from the colon into stool. From that DNA, we then identify mutations in the DNA that are shed from abnormal cells and that are indicative of colorectal cancer and pre-cancerous lesions. We have conducted blinded clinical studies at leading medical institutions that we believe indicate that cancer screening using our PreGen technologies are able to detect colorectal cancer at an early stage more accurately in patients who have the disease than existing non-invasive screening methods currently available. Early detection results in less expensive and more effective treatment of patients. We believe that the benefits of early detection and the ease of use and accuracy of tests using our PreGen technologies will convince medical practitioners and patients to use these screening tests. We have conducted, and are currently conducting, clinical studies of our PreGen technologies to detect colorectal cancer in a variety of patients, including several studies focusing on asymptomatic patients over the age of 50. We also plan to develop, and work with others to develop, other commercial products and services based on our PreGen technologies.

1

We were incorporated in the State of Delaware on February 10, 1995 as Lapidus Medical Systems, Inc. We changed our corporate name to EXACT Laboratories, Inc. on December 11, 1996, to EXACT Corporation on September 12, 2000 and to EXACT Sciences Corporation on December 1, 2000. Our executive offices are currently located at 63 Great Road, Maynard, Massachusetts 01754. Our telephone number is (978) 897-2800. Our web address is www.exactsciences.com. We make available on our Internet website free of charge our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports as soon as practicable after we electronically file such material with the SEC. The information contained in our website is not incorporated by reference in this Annual Report on Form 10-K.

Colorectal Cancer

Colorectal cancer is the most deadly cancer in the U.S. among non-smokers and the second most deadly cancer overall. The only cancer that kills more people each year is lung cancer. The American Cancer Society estimates that in the U.S. there will be approximately 148,000 new cases of colorectal cancer and approximately 57,000 people will die from colorectal cancer in 2003. Unfortunately, almost 50% of the patients with a new diagnosis of colorectal cancer will die from the disease within five years of diagnosis.

Despite these risks, current non-invasive colorectal cancer screening methods, such as fecal occult blood testing ("FOBT'), find only indirect evidence of cancer. These tests suffer from poor sensitivity or specificity, require patients to touch or manipulate their stool, and modify their diet or medications, which results in poor patient compliance. Current alternative procedures-based detection technologies, such as flexible sigmiodoscopy, colonoscopy and virtual colonoscopy, while more effective than FOBT in the early detection of colorectal cancer, require patients to modify their diet or medications and undergo bowel preparation for the procedure which also results in poor patient compliance. Additionally, procedures such as flexible sigmiodoscopy and colonoscopy are considered invasive and suffer problems of scalability because of the short supply of clinicians, endoscopy suites and fees associated with these tests. As a result, mortality and the cost of treatment of colorectal cancer remains high.

We have designed our PreGen technologies to detect colorectal cancer using a single whole stool sample obtained non-invasively and in the privacy of one's own home. Unlike other screening tests, patients are not required to touch or manipulate their stool, modify their diet or medications or undergo any bowel preparation, which we believe will result in higher patient compliance. Higher compliance could dramatically decrease mortality from this curable disease.

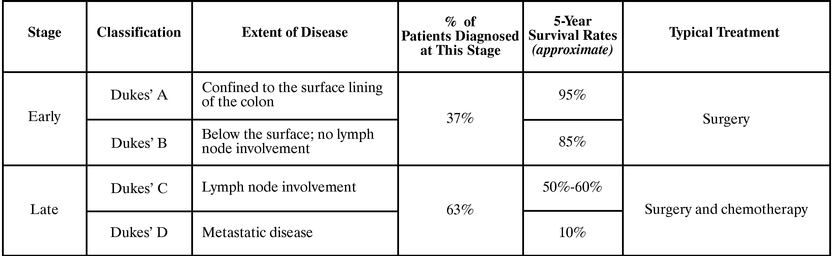

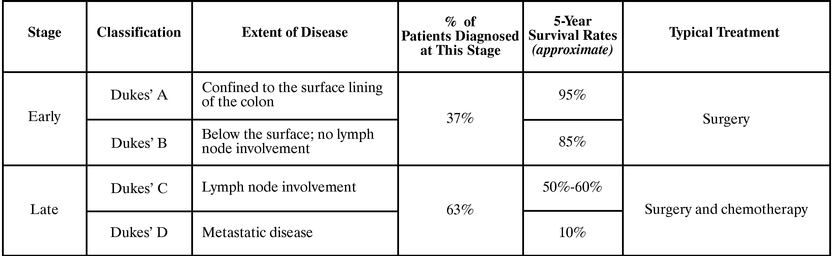

Medical practitioners commonly classify colorectal cancer into four stages at the time of diagnosis as shown in the following table:

2

Detection of pre-cancerous adenomas and cancer in its earliest stages increases the likelihood of survival and reduces the cost of treatment and care. As a result, the American Cancer Society recommends that the 80 million Americans age 50 and above undergo regular colorectal cancer screening.

Genomics, a relatively new discipline, broadly defined, is the study of the genome. Initial efforts in human genomics centered on identifying, mapping, sequencing and analyzing the definitive sequence of every gene in the human genome. Scientists are now focusing on applying that knowledge to the development of novel technologies used for the detection and management of disease, as well as the development of improved therapeutics.

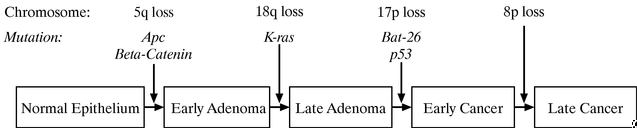

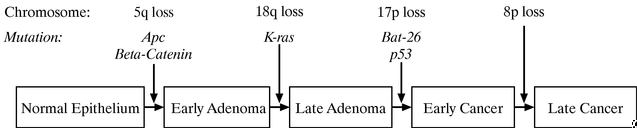

Cancer begins to develop when the DNA in a single normal cell mutates or changes in such a way that ultimately results in unregulated cell growth. In a ground-breaking paper published in theNew England Journal of Medicine in 1988, Dr. Bert Vogelstein, one of our scientific collaborators, and his colleagues described a multi-step model of colorectal cancer development. In 1990, Dr. Eric Fearon, a former member of our scientific advisory board, and Dr. Vogelstein published a diagram depicting the development of colorectal cancer. An updated version of this diagram showing many of the genomic events involved in the development of colorectal cancer is shown below:

The diagram illustrates that cancer develops in steps that results from alterations in multiple genes in an individual cell, and occurs frequently with chromosome loss. The diagram shows that these alterations lead to pathologic changes in the colon from normal epithelium—the tissue that lines the surface of the colon—through early and late adenomas, which are a form of pre-cancerous growth, to early cancer and late cancer. These alterations, shown in the above diagram, usually accumulate over many years, and are typically due to:

- •

- mutations in individual genes, such as theApc,K-ras andp53 genes;

- •

- larger scale effects in which large parts of a chromosome or even entire chromosome and chromosome arms, such as 5q, 18q, 17p and 8p, are deleted; or

- •

- inactivation of the mismatch repair genes (the genes responsible for correcting misincorporated bases of DNA after DNA replication) that manifest themselves as deletions in polynucleotide DNA regions such as BAT-26.

The multi-step process provides an abundance of genomic targets that may be used for the early detection of cancer. By detecting genetic alterations associated with cancer, the disease can be treated at its most curable stage. While most other colorectal cancer screening tests seek to detect the pathologic changes (polyps, adenomas, lesions, etc.) thatresult from genetic alterations at the cellular level, our PreGen technologies seek to detect the genetic alterations directly. We believe this increases the likelihood of early detection.

3

Our Solution

Today, millions of Americans avoid current colorectal screening methods for a variety of reasons, including embarrassment, fear and discomfort due to invasiveness, bowel preparation, the potential for the need to touch or manipulate their stool and modification of their diet or medications. This creates a dilemma for today's medical practitioner who knows colorectal screening is essential but is faced with patients who simply choose not to get tested or who choose the least invasive, least sensitive method available, FOBT. We believe medical practitioners will view PreGen-Plus as a more effective alternative for the millions of Americans for whom the American Cancer Society recommends regular screening.

Through regular screening, we believe PreGen-Plus will improve patient screening compliance and thereby enable the detection of colorectal cancer and adenomas earlier so that patients can be treated more effectively. Using our PreGen technologies, a laboratory will isolate the human DNA shed from the surface of the colon into a stool sample. The laboratory will then use our PreGen technologies to identify mutations in the human DNA shed from abnormal cells associated with adenomas and colorectal cancer. If an individual tests positive using the PreGen-Plus test, the ordering physician should refer the patient for an appropriate diagnostic test such as colonoscopy.

We believe colorectal cancer screening tests using our PreGen technologies will become widely-accepted and used routinely for screening as a result of the following features and benefits:

- •

- Earlier Detection. Early detection saves lives. Based upon data from completed clinical studies, we believe colorectal cancer screening tests using our PreGen technologies will detect Dukes' A and B cancers, as well as some pre-cancerous lesions. We believe that this will represent a marked improvement over other non-invasive colorectal cancer screening methods being used today.

- •

- Higher Sensitivity. Since the fall of 1998, we have conducted a series of blinded clinical studies in collaboration with leading medical institutions using our colorectal cancer screening tests. In all of these clinical studies, the sensitivity of colorectal cancer screening tests utilizing our PreGen technologies substantially exceeded the sensitivity reported for FOBT and flexible sigmiodoscopy.

- •

- Higher Compliance. We designed our PreGen technologies to detect colorectal cancer using a single whole stool sample obtained non-invasively and in the privacy of one's own home. Unlike other screening tests, patients are not required to touch or manipulate their stool, modify their diet or medications or undergo any bowel preparation. Moreover, we believe that, based on the results of our clinical studies and trials, we will be able to educate physicians about the potential for improving detection of colorectal cancer with tests based on our PreGen technologies. We also believe that this will lead many primary care physicians to include regular colorectal cancer screening as a part of their periodic physical examinations of patients aged 50 and above.

- •

- Cost-effective Prevention and Treatment. We believe that colorectal cancer screening tests using our PreGen technologies will detect early stage lesions more effectively than currently available non-invasive screening methods. As a result of this early detection, medical practitioners will have the ability to treat early stage colorectal cancer and pre-cancerous lesions which is less expensive and more effective than treating late stage cancer.

- •

- Scalability. Screening 80 million Americans age 50 and above requires the ability to efficiently test a large population. Procedures such as flexible sigmiodoscopy and colonoscopy suffer problems of scalability because of the short supply of clinicians, endoscopy suites and reimbursement. We believe tests using our PreGen technologies will enable efficient mass screening on a regular basis.

4

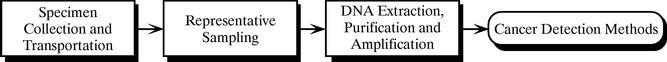

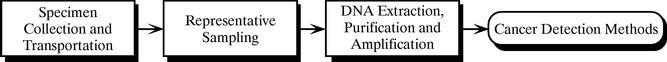

Our Testing Process

Diagnostic tests typically require sample collection and preparation procedures as well as detection methods. We have developed a three-step sample collection and preparation process and five detection methods that apply genomics discoveries to the early detection of colorectal cancer. As of December 31, 2002, we have 26 issued U.S. patents and 30 pending U.S. patent applications relating to our testing process.

Specimen Collection and Transportation. Our PreGen technologies for colorectal cancer are based on collecting a single whole stool sample in an easy, non-invasive manner. Utilizing our specially designed sample container, samples can be either brought by the patient directly to the laboratory performing the colorectal cancer-screening test or sent directly from the patient's home using one of the many national couriers.

Representative Sampling. Before we developed our PreGen technologies, no one had been able to reproducibly extract human DNA and consistently find mutations in stool. We believe that this was due to the non-uniform distribution of abnormal DNA in stool. We have invented proprietary homogenization methods designed to ensure that the portion of stool sample that is processed at the laboratory will contain uniformly distributed DNA throughout the portion of the sample being tested, and that the stool sample is, therefore, representative of the entire stool and colon. Based upon our data to date, we believe these methods lead to increased sensitivity and reproducible results.

DNA Extraction, Purification and Amplification. The isolation and amplification of human DNA found in stool is technically challenging because over 99% of DNA in stool is not human DNA, but is actually DNA from bacteria normally found in the colon. In addition, there are substances in stool that make the isolation and amplification of human DNA a difficult task. Our proprietary PreGen technologies allow for the reproducible isolation and amplification of human DNA found in stool.

Cancer Detection Methods. We have designed proprietary methods for detecting and identifying genomic markers associated with colorectal cancer that can be performed on existing instruments commonly available in clinical laboratories conducting molecular testing.

Our Proprietary PreGen Technologies

Our PreGen technologies are comprised of a variety of proprietary tools and techniques that continue to evolve as we seek to optimize sensitivity, specificity, and the operational efficiency of our PreGen technologies. Our first major commercial application, PreGen-Plus, is derived from our suite of PreGen technologies and represents an assay that will likely evolve over time based on our on-going research and development activities. Our scientists regularly explore the efficacy, impact, and relationship among each of the PreGen technologies to ensure the combination of our PreGen technologies are best suited to optimize sensitivity, specificity and operational efficiency for an assay. They also evaluate our PreGen technologies for other potential standalone applications or products that may be developed in the future.

The information below sets forth those PreGen technologies that we believe will be important to PreGen-Plus, either at the time of commercial launch, or over the long-term. Each of the technologies below enable the early detection of cancer by identifying the presence of minute amounts of altered human DNA relative to the large amounts of normal DNA naturally present in stool. Each of these proprietary methods for detecting and identifying genomic markers associated with colorectal cancer can be performed on existing instruments commonly available in clinical laboratories conducting

5

molecular testing. Our proprietary testing process includes the cancer detection technologies described below as well as other proprietary methods important to the overall efficacy of PreGen-Plus.

Name

| | Role in Detection

| | Our Scientific Advance

|

|---|

| Multiple Mutation Detection (MuMu®) | | • Each element of MuMu detects a specific mutation within a cancer-related gene | | • Sensitive and specific detection of rare DNA mutations in a heterogeneous environment |

| Deletion Technology | | • Detects short deletions and insertions in BAT-26 | | • Sensitive and specific detection of rare DNA insertions and deletions mutations in a heterogeneous environment |

| DNA Integrity Assay (DIA®) | | • Detects abnormally long human DNA fragments associated with colorectal abnormality | | • Proprietary marker associated with cancer that does not require knowledge of which specific genes cause cancer |

| Enumerated Loss of Heterozygosity (e-LOH) | | • Enumerates ratio of paternal DNA to maternal DNA at a given genomic site to identify chromosomal loss that is characteristic of many cancers | | • Statistical method that applies a commonly used analytical technique to indicate a large portion of a chromosome is missing and does not require knowledge of which specific genes cause cancer |

| DNA isolation based on acquired Hybrigel™ technology | | • Cost effective, automated DNA isolation platform that increases the amount of DNA that can be isolated from fecal specimens | | • Technology platform that will increase the DNA purity and yield within samples collected from all bodily fluids |

| Oligonucleotide Tiling | | • Mutation scanning technology that can be used to screen for abnormalities in DNA segments such as Apc | | • Proprietary platform that can be used to scan genes or segments of DNA for mutations, alterations, transitions or transversions without prior knowledge of the site of mutation |

Multiple Mutation. Multiple Mutation, or MuMu, identifies DNA mutations at specific sites. We have currently selected 21 sites that are commonly mutated in the colorectal cancer-related genesApc,p53 andK-ras. We have designed our proprietary MuMu method to allow simultaneous probing of different DNA sequences and to allow analysis even though only a small amount of DNA in the sample is derived from abnormal cells while the vast majority is derived from normal human cells or bacteria.

Deletion Technology. Deletion Technology detects short deletions and insertions in segments of DNA that are indications of defects in cellular mechanisms for DNA repair. Approximately 15% of sporadic colorectal cancers, referred to as mismatch-repair cancers, result from inactivation of the proteins that normally repair errors in DNA after DNA replication. We have developed a proprietary method for identifying this condition by detecting the presence of short deletions and insertions in a DNA segment known as BAT-26 in samples that have less than 1% of mutant BAT-26 in an excess of normal Bat-26. This altered DNA segment appears in virtually all colorectal cancers with defects in the mismatch repair mechanism.

6

DNA Integrity Assay. DNA recovered from the stool of many cancer patients contains a small but detectable population of DNA that is longer than DNA recovered from individuals who do not have cancer and have never had cancer or adenomas. Use of this proprietary detection method does not require knowledge of which genes cause cancer. In addition to its utility for our colorectal cancer tests, we believe that this discovery may lead us to the development of markers for other types of cancers.

Enumerated Loss of Heterozygosity. In normal cells, the quantity of DNA inherited from each parent is generally equal. This is not true for cells from many different types of cancers, including virtually all non-mismatch repair colorectal cancers. This condition, which is an imbalance of maternal and paternal chromosomal fragments, is called loss of heterozygosity, or LOH. Prior to our development efforts, we believe that scientists were unable to detect LOH in stool samples. We have developed proprietary methods for detecting LOH in a highly heterogeneous DNA sample such as stool by enumerating the ratio of fragments of DNA that are inherited from each parent at defined locations in the genome. We call this detection method e-LOH. Use of this detection method does not require knowledge of which genes cause cancer. We believe that our novel e-LOH detection method may also be broadly applicable to early cancer detection using a variety of bodily fluids.

DNA Isolation Based On Hybrigel Technology. This technology involves the isolation and/or detection of DNA fragments using DNA probes affixed into an elecrophoretic medium. It is our intention to use this as a sample preparation platform for isolation of human DNA from stool specimens. To date, we have an active program validating this platform, developing laboratory consumables and exploring manufacturing options. We believe this platform will be capable of isolating and purifying DNA from numerous bodily fluids in a cost-effective and efficient manner.

Oligonucleotide Tiling. This is a technology that we have developed to allow us to scan large regions of DNA for mutations. For example 80% of the mutations that occur in theApc gene occur in an approximate 800 base pair segment. Currently, technologies like sequencing and protein truncation testing are costly and laborious to perform. Oligonucleotide tiling is efficient, sensitive and can be performed using most laboratory equipment. Additionally, this technology may be used for scanning mutations in many different genes for both sporadic and hereditary cancers.

Clinical Studies

In collaboration with the Mayo Clinic, we have completed three blinded clinical studies since the fall of 1998. These clinical studies included stool samples from 219 patients seen at the Mayo Clinic, 58 of whom were diagnosed with colorectal cancer by means of colonoscopy at the Mayo Clinic. The first two clinical studies were conducted using frozen, partial stool samples. The sensitivity for each of these two clinical studies was 91% and 67%, respectively. In the spring of 2000, we conducted a third clinical study with the Mayo Clinic in which we collected fresh, whole stool samples. The sensitivity in this clinical study was 78%. Specificity in these studies ranged from 93% to 100% across all three clinical studies.

During 2002, we presented results from three additional studies. The first of these was conducted in collaboration with the University of Nebraska and was presented at the Digestive Disease Week Conference ("DDW") in May 2002. This study included 17 patients with colorectal cancer who had their cancer diagnosed by means of a colonoscopy. The sensitivity of this clinical study was 65% as our PreGen technologies were able to detect 11 of the 17 cancers. Three separate stool samples from each patient were analyzed and the results demonstrated that analysis of a single stool sample appeared to be equivalent to analyzing three stools from the same patient.

The second study was in collaboration with the Kaiser Clinic in Sacramento, California and was also presented at DDW in 2002. In this study, stool samples were obtained from patients who were

7

diagnosed with colorectal cancer by means of a flexible sigmiodoscopy. The sensitivity of this clinical study was 67% as our PreGen technologies were able to detect 26 of 39 invasive cancers. In addition, the results from this study indicated that our PreGen technologies were at least equally effective in detecting early stage (Dukes' A and B) disease (20/26, 77%) as they were in detecting late stage (Dukes' C and D) disease (5/11, 45%). Most early stage cancers can be readily cured by surgery, and hence the importance of early detection.

The third study was conducted in the greater Boston area in collaboration with four leading academic medical institutions and was presented at the American College of Gastroenterology meeting held in October 2002. In this study, patients who had been diagnosed with colorectal cancer by means of a colonoscopy provided a stool sample prior to undergoing surgical resection of their cancer. The sensitivity of this clinical study was 64% as our PreGen technologies were able to detect 30 of 47 invasive cancers. In addition, stool samples were obtained one month after surgery in some of these patients, and the analysis of those stool samples demonstrated that mutations from the cancer were generally not present after surgery.

The results of all of these studies are summarized in the following table:

Study

| | Completed

| | Number of

Cancer Patients

| | Sensitivity

| |

|---|

| Mayo Clinic I Pilot Study | | 1999 | | 22 | | 91 | % |

| Mayo Clinic II Study | | 2000 | | 27 | | 67 | % |

| Mayo Clinic III Study | | 2000 | | 9 | | 78 | % |

| University of Nebraska Study | | 2002 | | 17 | | 65 | % |

| Kaiser Clinic Study | | 2002 | | 39 | | 67 | % |

| Greater Boston Area Study | | 2002 | | 47 | | 64 | % |

| | | | |

| | | |

| Total | | | | 161 | | | |

These sensitivity rates are superior to the 25%-30% sensitivity of the fecal occult blood test and the approximately 48% sensitivity of flexible sigmiodoscopy for colorectal cancers located throughout the colon.

In the third quarter of 2001, we initiated a blinded multi-center clinical trial that is expected to include an estimated 5,500 patients from over 80 academic and community-based practices who are asymptomatic, age 50 and older. The goal of this clinical trial will be to provide additional data supporting the superiority of tests utilizing our Pre-Gen technology versus the most widely used brand of FOBT, Hemoccult II®, in detecting colorectal cancer in this average-risk population. We are conducting this clinical trial in accordance with the applicable guidelines of the United States Food and Drug Administration, or FDA, so that the results may be used in any application that we may make to the FDA in the future. We expect patient enrollment in this clinical trial to conclude by the end of the first quarter of 2003 and expect that study data will be available in the fourth quarter of 2003.

In October 2001, we signed a Clinical Trial Agreement with the Mayo Clinic in which our PreGen technologies will be the subject of an independent study by the Mayo Clinic for which the Mayo Clinic received a $4.9 million grant from the National Cancer Institute of the National Institutes of Health. Dr. David Ahlquist, a director of the Colorectal Neoplasia Clinic at Mayo, is the principal investigator of this clinical trial and has assisted us in certain of our previous clinical trials and in the use of PreGen technologies in the detection of colorectal cancer. This three-year study will involve approximately 4,000 patients at average risk for developing colorectal cancer, and will compare the results of our non-invasive, genomics-based screening technology with those of FOBT, a common first-line colorectal cancer screening option. The Mayo Clinic has indicated that it expects enrollment in this clinical trial to be completed sometime in 2004.

8

While most adenomas do not progress to cancer in a patient's lifetime, those that do are more likely to have villous features characterized by an irregular surface and associated with more rapid growth. Our results for detecting adenomas using our PreGen technologies have varied in different studies. In the Mayo Clinic I study, there were 11 patients with advanced adenomas greater than one centimeter in size, of which 9, or 82%, were detected. In the Kaiser Clinic study, there were 19 patients with advanced adenomas, of which 13, or 68%, were detected. In the Boston study, there were 14 patients with advanced adenomas, of which five, or 36% were detected. We believe that by detecting adenomas more likely to progress to cancer during a patient's lifetime, through a non-invasive screening procedure, will provide additional medical value for our PreGen technologies. We intend to test our ability to detect advanced adenomas in our 5,500-patient clinical trial.

Research and Development

Our research and development efforts focus on developing multiple DNA-based methods for the early detection of cancer and pre-cancerous lesions. We believe that the evaluation of these methods in a clinical setting will determine the best approaches for commercialization. We also focus on developing methods to automate and simplify the collection, preparation and analysis of samples to produce cost-effective commercial tests. Our research and development expense, including stock-based compensation, for fiscal 2000, 2001 and 2002 was $6.1 million, $14.2 million and $20.5 million, respectively.

Assay Development. We continue to focus our research and development efforts on improving the sensitivity, throughput and cost of PreGen-Plus while maintaining our specificity level. We continue to evaluate new potential cancer gene markers, chemistries and technologies that we believe may be useful in increasing the clinical sensitivity and throughput, and decreasing the cost of PreGen-Plus.

Process Development. We have undertaken a multi-year effort to automate the testing process and reduce the cost of processing stool samples. Our objectives include eliminating many of the manual steps, reducing the use of expensive reagents and increasing screening throughput. This effort is important so that our strategic partners can offer products based upon our PreGen technologies at commercially reasonable prices.

Extensions to Other Cancers. Our proprietary DIA detection method uses a marker that we believe may be broadly applicable to the detection of other cancers in addition to colorectal cancer. In the course of our blinded clinical studies with the Mayo Clinic, we tested 50 stool samples from patients diagnosed with aero-digestive cancers, such as cancer in the lung, pancreas, esophagus, stomach and duodenum, gall bladder and bile ducts. Combined, these cancers kill more people than colorectal cancer. The results from these studies indicated sensitivity that varies between 20% and over 90%, depending on the original site of the cancer. These studies were conducted in patients with advanced cancer, and we will have to demonstrate that we can detect these cancers at an early stage in order for our PreGen technologies to be clinically and commercially useful. Additional studies are underway to refine the methodology and evaluate patients with earlier stage disease. If the results are promising, we intend to develop methods and technologies to detect these cancers.

Adenomas. While our research focus has been the detection of invasive colorectal cancer, we intend to conduct research on improved methods for adenoma detection, particularly those advanced adenomas that are most likely to progress to invasive colorectal cancer (size greater than 1cm, villous features or high grade dysplasia). As part of this effort, we have invented a new method for scanning regions of DNA at sites often associated with adenoma development. In addition, our Hybrigel technology allows us to retrieve more DNA from a stool sample which we believe should increase the likelihood of adenoma detection.

9

Strategic Alliance

We established our first licensing agreement with LabCorp in July 2001, and expanded the relationship in June 2002, when we entered into an exclusive, long-term strategic alliance to commercialize PreGen-Plus™, a proprietary, non-invasive DNA-based technology for the early detection of colorectal cancer in the average-risk population based upon our PreGen technologies. Pursuant to the license agreement, we licensed to LabCorp all U.S. and Canadian patents and patent applications owned by us relating to our PreGen technologies for the detection of colorectal cancer in the average-risk population. The license is exclusive for a five-year period, followed by a non-exclusive license for the life of the patents. As a result of this agreement, LabCorp will be responsible for the processing of all colorectal cancer screening tests in the United States and Canada using our PreGen technologies at their facilities, including the billing and collection of tests performed.

In return for the exclusive license, LabCorp has agreed to pay us certain upfront, milestone and performance-based payments, and a per-test royalty fee. LabCorp made an initial payment of $15 million to us upon the signing of the agreement, and a second payment of $15 million is to be made upon the commercial launch of PreGen-Plus. In addition, we may be eligible for milestone payments from LabCorp of up to $30 million based upon deliverables related to scientific acceptance, reimbursement approval and technology improvements, and up to an additional $15 million based upon the achievement of significant LabCorp revenue thresholds. In addition to these payments, we will receive a royalty fee for each PreGen-Plus test performed by LabCorp. In conjunction with this strategic alliance, we have issued to LabCorp a warrant to purchase 1,000,000 shares of our common stock, exercisable over a three-year period at an exercise price of $16.09 per share. We assigned a value to the warrant of $6.6 million under the Black-Scholes option-pricing model which has been recorded as a reduction in the initial upfront deferred license fee of $15 million.

We are actively engaged with LabCorp in preparing for the commercial availability of PreGen-Plus. The companies are currently focusing their efforts on: assay validation, technology transfer and licensing; contracting with manufacturers and suppliers; physician education and demand creation; broad-based reimbursement initiatives; advocacy development; and sales force training. While some of these efforts will be on-going after the launch of PreGen-Plus, others, such as assay validation, technology transfer and licensing and contracting with manufacturers and suppliers, must be completed prior to LabCorp making PreGen-Plus commercially available. Additionally, there are a number of significant initiatives that are primarily LabCorp's responsibility that must be accomplished prior to commercialization, if we are to be successful. Some of the major initiatives include assay validation at LabCorp's facility, the creation of an adequate distribution infrastructure for sample movement, the build-out of adequate laboratory space, the hiring and training of personnel, the establishment of supply agreements with vendors, and the licensing of certain third-party technologies for use in the PreGen-Plus assay as it is currently configured.

10

Sales and Marketing

We continue to build our sales and marketing organization to support the commercialization of PreGen-Plus. While our PreGen technologies may extend themselves to several other types of cancer or lend themselves to other product opportunities over time, the current primary focus of our sales and marketing organization is the commercialization of PreGen-Plus for colorectal cancer.

Our PreGen-Plus commercialization strategy, being executed vigorously with LabCorp, is designed to address the needs of four major constituencies: (i) primary care physicians (including family practice, generalists, internists, and obstetricians and gynecologists, together "PCPs"); (ii) gastroenterology thought leaders; (iii) consumers; and (iv) third-party payors.

- •

- PCPs drive most colorectal cancer screening activities; as such they are principal targets of our promotional activities.

- •

- Gastroenterologists are highly vocal in advocating colorectal cancer screening, and perform the vast majority of the reference standard screening procedure, colonoscopy. Because they are key to establishing new tests as standard of care and are highly influential with local primary care physicians, we are working closely with gastroenterology thought leaders.

- •

- Consumers can be very influential in the screening process as well; as such they are important promotional targets.

- •

- All promotional targets, PCPs, gastroenterologists and consumers, will bring important pressure on the fourth major constituency, third party payors, such as Medicare, major national and regional managed care organizations and insurance carriers, and self-insured employer groups. Activities addressing these groups have as their goal payment for PreGen-Plus, and, later, formal inclusion in plan reimbursement policies.

To address these four important constituencies, we have engaged in five broad sales and marketing activities: (i) direct sales to physicians; (ii) medical education programs; (iii) advocacy development; (iv) consumer marketing initiatives; and (v) managed care activities.

- •

- Sales initiatives to date have included direct detailing of medical professionals at numerous conventions and in their individual offices, resulting in widespread awareness of the product. We have also initiated a robust, six-month training program designed to educate and prepare all of LabCorp's sales representatives to support the upcoming product launch of PreGen-Plus. After launch, LabCorp's sales force will execute the majority of physician calls.

- •

- We are executing numerous educational initiatives directed at luminaries in the field, as well as local PCPs, to promote the potential value of PreGen-Plus in their practices. These include continuing medical education ("CME") and non-CME symposia, publications, and speaker's bureau programming. The goal of these efforts is to enhance of our credibility and, long-term, gain inclusion in formal clinical practice guidelines.

- •

- We are working with most influential advocacy groups to promote their awareness of PreGen-Plus, its performance characteristics, and its potential value in clinical practice toward the goal of reducing mortality from colorectal cancer. We intend to build on growing public awareness of colorectal cancer through our activities with these advocacy groups. Our efforts to date have led to inclusion of PreGen-Plus in various well-circulated brochures, and radio and television broadcasts.

- •

- Because PreGen-Plus promises to be a more consumer-friendly screening option, patients are more likely to ask their doctor for PreGen-Plus which, in turn, should help drive sales. Accordingly, we are evaluating various consumer-marketing initiatives that may enhance awareness of PreGen-Plus and increase consumer advocacy for the test among physicians.

11

- •

- Finally, we have been educating Medicare, major national and regional managed care organizations and insurance carriers, and self-insured employer groups about the need and clinical rationale for PreGen-Plus. Along with LabCorp, we are having discussions with key decision makers at most of the major payors, with the goal of shortening the review time and gaining approval for the inclusion of PreGen-Plus in formal practice guidelines within each payor's plan following commercial launch. In addition, we also continue to address reimbursement for PreGen-Plus from government payors, primarily the Centers for Medicare and Medicaid Services ("CMS", formerly known as the Health Care Financing Administration) by educating their senior staff about the need and clinical rationale for PreGen-Plus (See "Reimbursement").

Reimbursement

We are currently working to obtain national coverage and reimbursement approval for tests using our PreGen technologies from Medicare as well as major national and regional managed care organizations and insurance carriers, and self-insured employer groups. We currently do not have formal reimbursement approval from any organization or public agency, and do not anticipate such approval until some time after the commercialization of PreGen-Plus. Medicare and other third-party payors will independently evaluate our PreGen technologies by, among other things, reviewing the published literature with respect to the results obtained from our clinical studies. We intend to assist these organizations in evaluating our PreGen technologies by providing scientific and clinical data in support of our assertions regarding the superiority and appropriateness of our PreGen technologies. In addition, we intend to present analysis showing the benefits of early disease detection and the resulting cost-effectiveness of our PreGen technologies. Current molecular diagnostic procedural terminology ("CPT") codes are available which will allow our PreGen technologies to be billed following completion of a test prescribed (ordered) by a physician for a patient. We believe that the existence of current CPT codes with applicability to our screening test will help facilitate Medicare's reimbursement process.

The Federal Balanced Budget Act of 1997 required Medicare to reimburse for colorectal cancer screening for average-risk patients beginning on January 1, 1998 and mandated Medicare coverage for FOBT preformed by the guaiac method and flexible sigmiodoscopy. Congress amended the Budget Act of 1997 to include coverage for double contrast barium enema, a radiographic imaging test used to detect colorectal cancer in areas beyond the reach of flexible sigmiodoscopy. This was further expanded to include a screening colonoscopy every 10 years as an available option effective July 2001. We believe these actions provide evidence of the public interest in colorectal cancer screening methods and the federal government's willingness to fund these methods.

Most importantly, the Federal Balanced Budget Act of 1997 allows new technologies to be included as colorectal cancer screening tests by action of the Secretary of Health and Human Services without the need for additional Congressional action. In the spring of 1999, we met with senior staff members of CMS to apprise them of our progress and to determine the steps we would need to take prior to a reimbursement determination. Following that meeting, we successfully petitioned the CMS staff to cover all medical expenses of a patient participating in our clinical studies who tests positive for colorectal cancer, which we believe was a favorable departure from prior CMS policy of not reimbursing for these costs.

In October of 2002, we met with CMS to discuss the reimbursement process. Subsequent to that meeting, CMS published its approach to expanding the colorectal cancer screening benefit to include new technologies by use of a national coverage decision process, thereby avoiding the time-consuming notice and comment procedures otherwise applicable.

12

In addition, we continue to work on building support in Congress and have met with several members of Congressional staffs and national organizations with an interest in colorectal cancer. In October 1999, we testified before the Subcommittee on Health of the House Ways and Means Committee in support of the Eliminate Colorectal Cancer Act of 1999. The Eliminate Colorectal Cancer Act of 1999 requires private insurers to cover colorectal cancer screening tests deemed appropriate by physicians and patients to the same extent as the Federal Balanced Budget Act of 1997 covers for Medicare.

We believe that colorectal cancer screening tests based on our PreGen technologies will add a lifesaving and cost-effective alternative to currently available colorectal cancer screening methods. We believe that reimbursement for FOBT tests ranges from $5 to $30, but, as stated earlier, FOBT sensitivity only falls in the 25% to 30% range, and is most effective in detecting later stage cancers when survival rates are low and treatment costs are high. We believe that reimbursement for flexible sigmiodoscopy ranges from $80 to $500, but at best, can directly detect no more than half of all colorectal cancers and adenomas since it only reaches the first third of the colon, where approximately 50% of lesions develop. Medicare and some private insurers currently reimburse for colonoscopy for cancer screening once every 10 years in average risk individuals. We believe that the cost of this procedure ranges from $700 to $2,000, and while colonoscopy is sensitive, the use of colonoscopy as a screening test to date has been limited due to low patient compliance and capacity constraints which result in generally long scheduling lead times for the procedure.

Government Regulation

Certain of our activities are, or have the potential to be, subject to regulatory oversight by the FDA under provisions of the Federal Food, Drug and Cosmetic Act and regulations thereunder, including regulations governing the development, marketing, labeling, promotion, manufacturing and export of our products. Failure to comply with applicable requirements can lead to sanctions, including withdrawal of products from the market, recalls, refusal to authorize government contracts, product seizures, civil money penalties, injunctions and criminal prosecution.

Generally, certain categories of medical devices, a category that may be deemed to include products based upon our PreGen technologies, require FDA pre-market approval or clearance before they may be marketed and placed into commercial distribution. The FDA has not, however, actively regulated in-house laboratory tests that have been developed and validated by the laboratory providing the tests. Additionally, the FDA has demonstrated prior enforcement discretion and is currently undergoing internal review on its legal authority for regulating these products. Pre-market clearance or approval is not currently required for this category of products. The FDA does regulate the sale of certain reagents, including some of our reagents, used in laboratory tests. The FDA refers to the reagents used in these tests as analyte specific reagents. Analyte specific reagents react with a biological substance including those intended to identify a specific DNA sequence or protein. These reagents generally do not require FDA pre-market approval or clearance if they are (i) sold to clinical laboratories certified by the government to perform high complexity testing and (ii) labeled in accordance with FDA requirements, including a statement that their analytical and performance characteristics have not been established. A similar statement would also be required on all advertising and promotional materials relating to analyte specific reagents such as those used in our test. Laboratories also are subject to restrictions on the labeling and marketing of tests that have been developed using analyte specific reagents. The analyte specific reagent regulatory category is relatively new and its regulatory boundaries are not well defined. We believe that in-house testing based upon our PreGen technologies, and any analyte specific reagents that we intend to sell to leading clinical reference laboratories currently do not require FDA approval or clearance. We cannot be sure, however, that the FDA will not change its policy in a manner that would result in tests based upon our

13

PreGen technologies, or a combination of reagents, to require pre-market approval or clearance. In addition, we cannot be sure that the FDA will not change its position in ways that could negatively affect our operations either through regulation or new enforcement initiatives.

Regardless of whether a medical device requires FDA approval or clearance, a number of other FDA requirements apply to its manufacturer and to those who distribute it. Device manufacturers must be registered and their products listed with the FDA, and certain adverse events, correction and removals must be reported to the FDA. The FDA also regulates the product labeling, promotion, and in some cases, advertising, of medical devices. Manufacturers must comply with the FDA's Quality System Regulation which establishes extensive requirements for design, quality control, validation and manufacturing. Thus, manufacturers and distributors must continue to spend time, money and effort to maintain compliance, and failure to comply can lead to enforcement action. The FDA periodically inspects facilities to ascertain compliance with these and other requirements.

We are also subject to U.S. and state laws and regulations regarding the operation of clinical laboratories. The federal Clinical Laboratory Improvement Amendments of 1988 ("CLIA") and laws of certain other states impose certification requirements for clinical laboratories, and establish standards for quality assurance and quality control, among other things. Clinical laboratories are subject to inspection by regulators, and the possible sanctions for failing to comply with applicable requirements. Sanctions available under CLIA include prohibiting a laboratory from running tests, requiring a laboratory to implement a corrective plan, and imposing civil monetary penalties. If we fail to meet the requirements of CLIA or state law, it could cause us to incur significant expense.

Any diagnostic test kits that we, or our partners, may sell would require FDA clearance or approval before they could be placed into commercial distribution. There are two regulatory review procedures by which a product may receive such approval or clearance. Some products may qualify for clearance under a pre-market notification, or 510(k) process. Under such a process, the manufacturer provides to the FDA a pre-market notification that it intends to begin marketing the product, and demonstrates to the FDA's satisfaction, through appropriate studies, that the product is substantially equivalent to a comparative product that has been legally marketed and is currently in commercial distribution. Clearance of a 510(k) means that the product has the equivalent intended use, is as safe and effective as, and does not raise significant questions of safety and effectiveness than a legally marketed device. A 510(k) submission for anin vitro diagnostic device generally must include labeling information, performance data, and in some cases, it must include data from human clinical studies. Marketing may commence under a 510(k) submission when the FDA issues a clearance letter determining the product to be substantially equivalent to a comparative device.

If a medical device does not qualify for the 510(k) submission process by not being substantially equivalent or raising new issues of safety and effectiveness, the FDA may require submission of a pre-market approval application, or PMA, before marketing can begin. PMA applications must demonstrate, among other matters, that the medical device is safe and effective. A PMA application is a more comprehensive submission than a 510(k) submission, resulting in longer review and approval timeframes and usually includes the results of extensive pre-clinical and clinical studies and detailed information on the product, design and manufacturing system. Before the FDA will approve an original PMA, the manufacturer must undergo and pass a pre-approval inspection that assesses its compliance with the requirements of the FDA's Quality System Regulations.

We believe that if our products are sold in FDA approved diagnostic test kit form; they would likely require PMA approval. As compared to the 510(k) process, the PMA process is traditionally more lengthy and costly, and we cannot be sure that the FDA will approve PMAs for our products in a timely fashion, or at all. Additionally, FDA requests for additional studies during the review period are

14

not uncommon, and can significantly delay approvals. Even if we were able to gain approval of a product for one indication, changes to the product, its indication, or its labeling would likely require additional approvals in the form of a PMA Supplement.

Once a physician orders a test, the patient will need to receive a specimen container to collect the patient's stool. Although specimen transport and storage containers are also medical devices regulated by the FDA, such containers generally have been exempted by regulation from the FDA's pre-market clearance or approval requirement. We believe that our specimen container falls within an applicable exemption, but we cannot be sure that the FDA will not assert that our container is not exempt and seek to impose a pre-market clearance or approval requirement.

Intellectual Property

In order to protect our proprietary PreGen technologies, we rely on combinations of patent, trademark, and copyright protection, as well as confidentiality agreements with employees, consultants, and third parties.

We have pursued an aggressive patent strategy designed to maximize our patent position with respect to third parties. Generally, we have filed patents and patent applications that cover the methods we have designed to detect colorectal cancer as well as other cancers. We have also filed patent applications covering the preparation of stool samples and the extraction of DNA from heterogeneous stool samples. As part of our strategy, we seek patent coverage in the United States and in foreign countries on aspects of our PreGen technologies that we believe will be significant to our market strategy or that we believe provide barriers to entry for our competition.

As of December 31, 2002, we had 26 patents issued and 30 pending patent applications in the United States and, in foreign jurisdictions, 8 patents issued and 107 pending applications. Our success depends to a significant degree upon our ability to develop proprietary products and technologies and to obtain patent coverage for such products and technologies. We intend to continue to file patent applications covering newly-developed products or technologies.

Each of our patents generally has a term of 20 years from its respective priority filing dates. Consequently, our first patents are set to expire in 2016. We have filed terminal disclaimers in certain later-filed patents, which means that such later-filed patents will expire earlier than the twentieth anniversary of their priority filing dates.

A third-party institution has asserted co-inventorship rights with respect to one of our issued patents relating to use of our e-LOH detection method on pooled samples from groups of patients. Our current cancer screening detection methods do not include pooled samples. To date, no legal proceedings have been initiated by this third party. If any third party, including the third party discussed above, asserting co-inventorship rights with respect to any of our patents is successful in challenging our inventorship determination, such patent may become unenforceable or we may be required to add that third party inventor to the applicable patent, resulting in co-ownership of such patent with the third party. Co-ownership of a patent allows the co-owner to exercise all rights of ownership, including the right to use, transfer and license the rights protected by the applicable patent.

We and a third-party institution have filed a joint patent application under the Patent Cooperation Treaty that will be co-owned by us and the third-party institution relating to the use of various DNA markers, including the DNA Integrity Assay, to detect cancers of the lung, pancreas, esophagus, stomach, small intestine, bile duct, naso-pharyngeal, liver and gall bladder in stool. This patent application does not relate to the detection of colorectal cancer and designates the United States, Japan, Europe and Canada as the territories in which rights are sought.

15

We license on a non-exclusive basis certain polymerase chain reaction ("PCR") technology from Roche Molecular Systems, Inc. This license relates to a gene amplification process used in almost all genetic testing, and the patent that we utilize expires in mid-2004. In exchange for the license, we have agreed to pay Roche a royalty based on net revenues we receive from commercial tests that we perform at our facility. Our strategic relationship with LabCorp, however, contemplates commercial tests being performed in LabCorp's facilities, rather than in our facility, and therefore, this obligation becomes the responsibility of LabCorp. Roche may terminate this license upon notice if we fail to pay royalties, fail to submit reports or breach a material term of the license agreement.

We license on a non-exclusive basis technology from Genzyme Corporation, a licensee of patents owned by Johns Hopkins University and of which Dr. Vogelstein is an inventor. This license relates to the use of theApc andp53 genes and methodologies related thereto in connection with our products and services and lasts through 2013, the life of the patent term of the last-licensed Genzyme patent. In exchange for the license, we have agreed to pay Genzyme a royalty based on net revenues we receive from commercial tests we perform at our facility and the sale of analyte specific diagnostic test kits, as well as certain milestone payments and maintenance fees. In addition, we must use reasonable efforts to make products and services based on these patents available to the public. Genzyme may terminate this license upon notice if we fail to pay milestone payments and royalties, achieve a stated level of sales or submit reports. In addition, if we fail to request FDA clearance for a diagnostic test as required by the agreement, Genzyme may terminate the license. As noted previously, our strategic relationship with LabCorp contemplates commercial tests being performed in LabCorp's facilities, rather than our facility, and therefore, this obligation becomes the responsibility of LabCorp.

We license on an exclusive basis, in the field of stool-based colorectal cancer screening, from Matrix Technologies Corporation, d/b/a Apogent Discoveries, certain patents owned by Apogent relating to its Acrydite™ technologies. The license provides us and our sublicensees, with the ability to manufacture and use the Acrydite technology in the PreGen-Plus assay. The Acrydite technology is useful in connection with our proprietary electrophoretic DNA gel capture technology used in the isolation of nucleic acids and the diagnosis of disease that we purchased from MT Technologies.

We license on an exclusive basis from Johns Hopkins University certain patents owned by JHU that relate to digital amplification of DNA. We believe that this license will allow us and our partners to develop and commercialize novel detection technologies to enhance the performance of our current technologies. In exchange for the license, we have agreed to pay JHU certain royalties on revenues received by us relating to our or our sublicensees' sales of products and services that incorporate the JHU technology.

We and LabCorp are currently negotiating additional third-party technology license and supply agreements that are necessary to the commercial launch of the PreGen-Plus assay.

Competition

To our knowledge, none of the large genomics or diagnostics companies is developing tests to conduct stool-based DNA testing. However, these companies may be working on similar tests that have not yet been announced. In addition, other companies may succeed in developing novel or improving existing technologies and marketing products and services that are more effective or commercially attractive than ours. Some of these companies may be larger than we are and can commit significantly greater financial and other resources to all aspects of their business, including research and development, marketing, sales and distribution.

We also face competition from alternative procedures-based detection technologies such as flexible sigmiodoscopy, colonoscopy and virtual colonoscopy as well as traditional screening tests such as the Hemoccult II. Virtual colonoscopy involves a new approach that requires patients to undergo bowel preparation similar to a colonoscopy after which they are scanned by a spiral CT scanner. Three-

16

dimensional images are constructed to allow a radiologist to virtually travel through the colon and visualize the colon for polyps and cancers.

In addition, certain of our competitors are developing serum-based tests, an alternative cancer-screening approach that is based on detection of proteins or nucleic acids that are produced by colon cancers and may be found circulating in blood. We believe serum-based testing is not able to detect disease at the earliest stages of cancer at levels of sensitivity and specificity comparable to that of stool-based testing.

We believe the principal competitive factors in the cancer screening market include:

- •

- high sensitivity;

- •

- high specificity;

- •

- non-invasiveness;

- •

- acceptance by the medical community, especially primary care medical practitioners;

- •

- adequate reimbursement from Medicare and other third-party payors;

- •

- cost-effectiveness; and

- •

- patent protection.

Employees

As of December 31, 2002, we had seventy-five employees, eight of whom have Ph.D.s and two of whom have M.D.s. Forty-seven employees are engaged in research and development, ten employees in sales and marketing and eighteen employees in general and administration. None of our employees is represented by a labor union. We consider our relationship with our employees to be good. As of December 31, 2002, we also had twenty contractual employees who were primarily involved in performing tests associated with our on-going clinical trials.

Item 2. Properties

We currently lease approximately 20,000 square feet of space in our headquarters located in Maynard, Massachusetts under various leases that expire on June 30, 2003 and November 1, 2003. In January 2003, we signed a lease for approximately 56,000 square feet of space in Marlborough, Massachusetts for a seven-year term and expect to relocate substantially all of our operations into this new facility by October 2003. We believe that this new facility will be adequate to meet our space requirements for the foreseeable future.

Item 3. Legal Proceedings

From time to time we are a party to various legal proceedings arising in the ordinary course of our business. The outcome of litigation cannot be predicted with certainty and some lawsuits, claims or proceedings may be disposed of unfavorably to us. Intellectual property disputes often have a risk of injunctive relief which, if imposed against us, could materially and adversely affect our financial condition, or results of operations. From time to time, third parties have asserted and may in the future assert intellectual property rights to technologies that are important to our business and have demanded and may in the future demand that we license their technology. We are not currently a party to any material legal proceedings.

Item 4. Submission of Matters to a Vote of Security Holders

No matters were submitted to a vote of security holders during the fourth quarter of fiscal 2002.

17

PART II

Item 5. Market for Registrant's Common Equity and Related Stockholder Matters

Our common stock has been listed for trading on the Nasdaq National Market under the symbol "EXAS" since the effective date of our initial public offering on January 30, 2001. Prior to that time, there was no public market for our common stock. On March 14, 2003, the last reported price of our common stock on the Nasdaq National Market was $9.51 per share. Based upon information supplied to us by the registrar and transfer agent for our common stock, the number of common stockholders of record on March 14, 2003 was approximately 150, not including beneficial owners in nominee or street name. We believe that a significant number of shares of our common stock are held in nominee name for beneficial owners. The high and low common stock prices per share subsequent to our initial public offering in January 2001 were as follows:

| | High

| | Low

|

|---|

| Fiscal 2002 Quarter Ended: | | | | | | |

| March 31 | | $ | 12.16 | | $ | 7.27 |

| June 30 | | $ | 17.40 | | $ | 9.32 |

| September 30 | | $ | 15.90 | | $ | 9.75 |

| December 31 | | $ | 15.99 | | $ | 9.65 |

| Fiscal 2001 Quarter Ended: | | | | | | |

| March 31 | | $ | 15.38 | | $ | 7.50 |

| June 30 | | $ | 14.15 | | $ | 5.30 |

| September 30 | | $ | 15.57 | | $ | 7.75 |

| December 31 | | $ | 11.75 | | $ | 6.75 |

We have not paid any cash dividends on our common stock and we currently intend to retain any future earnings for use in our business. Accordingly, we do not anticipate that any cash dividends will be declared or paid on the common stock in the foreseeable future.

EQUITY COMPENSATION PLAN INFORMATION

The Company maintains the following three equity compensation plans under which our equity securities are authorized for issuance to our employees and/or directors: the 1995 Stock Option Plan, the 2000 Stock Option and Incentive Plan and the 2000 Employee Stock Purchase Plan. Each of the foregoing equity compensation plans was approved by our stockholders. The following table presents information about these plans as of December 31, 2002.

Plan Category

| | Number Of Securities To Be

Issued Upon Exercise Of

Outstanding Options,

Warrants, And Rights

| | Weighted Average Exercise

Price Of Outstanding

Options, Warrants And Rights

| | Number Of Securities Remaining

Available For Future Issuance

Under Equity Compensation Plans

(Excluding Securities Outstanding)

|

|---|

| Equity compensation plans approved by security holders | | 2,892,291 | | $ | 7.07 | | 702,162 |

| Equity compensation plans not approved by security holders | | None | | | None | | None |

| | |

| |

| |

|

| Total | | 2,892,291 | | $ | 7.07 | | 702,162 |

No further grants will be made under the 1995 Stock Option Plan.

18

Item 6. Selected Financial Data

The selected historical financial data set forth below as of December 31, 2001 and 2002 and for the years ended December 31, 2000, 2001 and 2002, are derived from our financial statements, which have been audited by Ernst & Young LLP, independent auditors, as of December 31, 2002 and for the year then ended; and by Arthur Andersen LLP, our former independent public accountants, as of December 31, 2001 and for the years ended December 31, 2000 and 2001, and which are included elsewhere in this Form 10-K. The selected historical financial data as of December 31, 1998, 1999 and 2000 and for the years ended December 31, 1998 and 1999 are derived from our audited financial statements, which have been audited by Arthur Andersen LLP, our former independent public accountants and which are not included elsewhere in this Form 10-K.

The selected historical financial data should be read in conjunction with, and are qualified by reference to "Management's Discussion and Analysis of Financial Condition and Results of Operations," our financial statements and notes thereto and the report of independent public auditors included elsewhere in this Form 10-K.

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| |

|---|

| | (Dollars in thousands, except share and per share data)

| |

|---|

| Statement of Operations Data: | | | | | | | | | | | | | | | | |

| | Revenue | | $ | — | | $ | — | | $ | — | | $ | 51 | | $ | 897 | |

| | Cost of revenues | | | — | | | — | | | — | | | — | | | 9 | |

| | Research and development | | | 2,849 | | | 3,689 | | | 5,332 | | | 13,335 | | | 19,989 | |

| | Selling, general and administrative | | | 1,170 | | | 1,560 | | | 4,814 | | | 9,078 | | | 9,701 | |

| | Stock-based compensation (1) | | | 2 | | | 14 | | | 3,184 | | | 3,788 | | | 2,043 | |

| | |

| |

| |

| |

| |

| |

| | Loss from operations | | | (4,021 | ) | | (5,263 | ) | | (13,330 | ) | | (26,150 | ) | | (30,845 | ) |

| | Interest income | | | 443 | | | 299 | | | 1,447 | | | 2,665 | | | 962 | |

| | |

| |

| |

| |

| |

| |

| | | Net loss | | $ | (3,578 | ) | $ | (4,964 | ) | $ | (11,883 | ) | $ | (23,485 | ) | $ | (29,883 | ) |

| | |

| |

| |

| |

| |

| |

| Net loss per common share: | | | | | | | | | | | | | | | | |

| | Basic and diluted | | $ | (6.08 | ) | $ | (5.32 | ) | $ | (8.13 | ) | $ | (1.42 | ) | $ | (1.62 | ) |

| | |

| |

| |

| |

| |

| |

| Weighted average common shares outstanding: | | | | | | | | | | | | | | | | |

| | Basic and diluted | | | 588,143 | | | 932,593 | | | 1,461,726 | | | 16,487,499 | | | 18,433,400 | |

| | |

| |

| |

| |

| |

| |

| Balance Sheet Data: | | | | | | | | | | | | | | | | |

| | Cash and cash equivalents | | $ | 8,826 | | $ | 3,553 | | $ | 26,470 | | $ | 56,843 | | $ | 17,439 | |

| | Marketable securities | | | — | | | — | | | — | | | — | | | 26,407 | |

| | Total assets | | | 9,708 | | | 4,754 | | | 29,059 | | | 63,100 | | | 50,086 | |

| | Stockholders' equity | | | 9,298 | | | 4,410 | | | 27,700 | | | 58,967 | | | 38,349 | |

- (1)

- The following summarizes the departmental allocation of stock-based compensation:

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

|

|---|

| | Research and development | | $ | 2 | | $ | 9 | | $ | 810 | | $ | 898 | | $ | 478 |

| | Selling, general and administrative | | | — | | | 5 | | | 2,374 | | | 2,890 | | | 1,565 |

| | |

| |

| |

| |

| |

|

| | Total | | $ | 2 | | $ | 14 | | $ | 3,184 | | $ | 3,788 | | $ | 2,043 |

| | |

| |

| |

| |

| |

|

19

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

This report and other documents we have filed with the SEC contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended, and are subject to the "safe harbor" created by those sections. Some of the forward-looking statements can be identified by the use of forward-looking terms such as "believes," "expects," "may," "will," "should," "could," "seek," "intends," "plans," "estimates," "anticipates" or other comparable terms. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those in the forward-looking statements. We urge you to consider the risks and uncertainties discussed below and elsewhere in this report and in the other documents filed with the SEC in evaluating our forward-looking statements. We have no plans to update our forward-looking statements to reflect events or circumstances after the date of this report. We caution readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made.

Overview

We apply proprietary genomic technologies to the early detection of common cancers. We have selected colorectal cancer screening as the first application of our PreGen technologies platform. Since our inception on February 10, 1995, our principal activities have included:

- •

- researching and developing our PreGen technologies for colorectal cancer screening;

- •

- conducting clinical studies to validate our colorectal cancer screening tests;

- •

- negotiating licenses for intellectual property of others incorporated into our technologies;

- •

- developing relationships with opinion leaders in the scientific and medical communities;

- •

- conducting market studies and analyzing potential approaches for commercializing our PreGen technologies;

- •

- hiring research and clinical personnel;

- •

- hiring management and other support personnel;

- •

- raising capital;

- •

- licensing our proprietary PreGen technologies to LabCorp; and

- •

- working with LabCorp on activities necessary to prepare for commercial launch of PreGen-Plus.

On June 26, 2002, we entered into a license agreement with LabCorp for an exclusive, long-term strategic alliance between the parties to commercialize PreGen-Plus, our proprietary, non-invasive technology for the early detection of colorectal cancer in the average-risk population. Pursuant to the license agreement, we agreed to license to LabCorp all U.S. and Canadian patents and patent applications owned by us relating to our PreGen technologies for the detection of colorectal cancer in an average-risk population. The license is exclusive for a five-year period, followed by a non-exclusive license for the life of the patents. In return for the license, LabCorp has agreed to pay us certain upfront, milestone and performance-based payments, and a per-test royalty fee. LabCorp made an initial payment of $15 million upon the signing of the agreement, and a second payment of $15 million is to be made upon the commercial launch of PreGen-Plus. In addition, we may be eligible for milestone payments from LabCorp totaling up to $30 million based upon Company deliverables related to scientific acceptance, reimbursement approval and technology improvements and up to $15 million upon the achievement of significant LabCorp revenue thresholds. In addition to these payments, the Company will receive a royalty fee for each PreGen-Plus test performed by LabCorp. In conjunction with the strategic alliance, the Company has issued to LabCorp a warrant to purchase 1,000,000 shares

20

of its common stock, exercisable over a three-year period at an exercise price of $16.09 per share. The Company assigned a value to the warrant of $6,550,000 under the Black-Scholes option-pricing model, which has been recorded as a reduction in the initial upfront deferred license fee of $15 million.