UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | ¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Materials Pursuant to §240.14a-12 |

AMERICAN CENTURY CALIFORNIA TAX-FREE AND MUNICIPAL FUNDS AMERICAN CENTURY GOVERNMENT INCOME TRUST AMERICAN CENTURY INTERNATIONAL BOND FUNDS AMERICAN CENTURY INVESTMENT TRUST AMERICAN CENTURY MUNICIPAL TRUST AMERICAN CENTURY QUANTITATIVE EQUITY FUNDS, INC. AMERICAN CENTURY TARGET MATURITIES TRUST AMERICAN CENTURY VARIABLE PORTFOLIOS II, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant |

Payment of Filing Fee (Check the appropriate box):

| x | No Fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. | |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

American Century California Tax-Free and Municipal Funds

American Century Government Income Trust

American Century International Bond Funds

American Century Investment Trust

American Century Municipal Trust

American Century Quantitative Equity Funds, Inc.

American Century Target Maturities Trust

American Century Variable Portfolios II, Inc.

What am I being asked to vote on?

Shareholders of each of the Issuers listed above are being asked to approve the election of four nominated Directors/Trustees (each a “Nominee” and collectively the “Nominees”) to the Board of Directors/Trustees of each Issuer.

When will the special meeting be held? Who can vote?

The special meeting (the “Meeting”) will be held on June 13, 2016, at 9:00 a.m. Central time at American Century Investments’ office at 4500 Main Street, Kansas City, Missouri, 64111. Please note, the Meeting is being held solely for the purpose of voting for the election of directors/trustees. No presentations about the Issuers’ funds (each a “Fund” and collectively the “Funds”) are planned. If you owned shares of one of the Funds at the close of business on April 1, 2016, you are entitled to vote, even if you later sold the shares. Each shareholder is entitled to one vote per dollar of shares owned, with fractional dollars voting proportionally.

Why am I being asked to elect the Nominees to the Boards?

Under the Investment Company Act of 1940, the Boards of Directors/Trustees (the “Boards”) are allowed to appoint new Board members to fill vacancies so long as immediately after such appointment, at least two-thirds of the directors/trustees have been elected by shareholders. Five of the seven current Directors/Trustees of each Issuer have been elected by shareholders. The two Directors/Trustees that have not been elected by shareholders were previously appointed by the Boards. Although more than two-thirds of the current Directors/Trustees were elected by shareholders, the Boards are unable to fill additional vacancies without a shareholder vote.

Who are the Nominees for election to the Boards of Directors/Trustees?

The Boards of Directors/Trustees have nominated Anne Casscells, Jonathan D. Levin, Tanya S. Beder and Jeremy I. Bulow for election by shareholders at the Meeting. You are being asked to elect Ms. Casscells and Dr. Levin to fill two vacant positions on each Issuer’s Board of Directors/Trustees. Ms. Casscells and Dr. Levin currently serve as advisory members to the Boards. You are also being asked to elect Ms. Beder and Dr. Bulow, both of whom currently serve on the Boards but have not previously been elected by shareholders. If the four nominated Directors/Trustees are elected, the Boards will have increased flexibility to appoint additional Board members in the future.

How do the Boards recommend that I vote?

The Boards, including all of the Independent Directors/Trustees, unanimously recommend you vote FOR the proposal. For a discussion of the factors the Boards considered in approving the proposal, see the accompanying materials.

My holdings in the Funds are small, why should I vote?

Your vote makes a difference. If many shareholders do not vote their proxies, an Issuer may not receive enough votes to go forward with its special meeting. This means additional costs will be incurred to solicit votes to determine the outcome of the proposal.

Why are multiple proxy cards enclosed?

You will receive a proxy card for each of the Funds in which you are a shareholder. In addition, if you own shares of the same Fund in multiple accounts that are titled differently, you will receive a proxy card for each account.

How do I cast my vote?

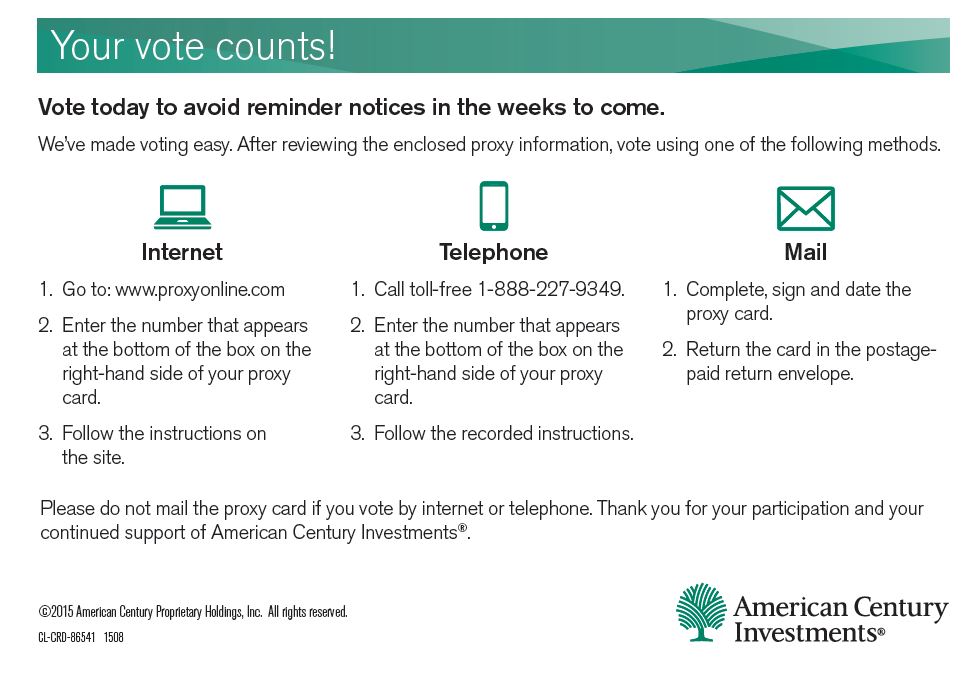

You may vote online, by phone, by mail or in person at the special meeting. To vote online, access the Web site listed on a proxy card. To vote by telephone, call the toll-free number listed on a proxy card. To vote online or by telephone, you will need the number that appears in the gray box on each of your proxy cards. To vote by mail, complete, sign and send us the enclosed proxy card(s) in the enclosed postage-paid envelope. You also may vote in person at the special meeting on June 13, 2016. If you need more information or have any questions on how to cast your vote, call our proxy solicitor, D. F. King & Co., Inc., at 1-877-361-7971.

What else do I need to know?

Shareholders of the issuer(s) as of April 1, 2016, are eligible to vote on the proposal and will receive a detailed proxy statement in mid-April, 2016.

If you are eligible, we encourage you to vote as soon as possible.

The shareholder meeting is scheduled for June 13, 2016.

A proxy statement with respect to the information described above will be mailed to shareholders of record on April 18, 2016 and filed with the Securities and Exchange Commission (SEC). Investors are urged to read the proxy statement because it contains important information. The proxy statement and other relevant documents will be available free of charge on the SEC’s website at www.sec.gov or by calling 1-800-345-2021.

You should consider the fund’s investment objectives, risks, charges and expenses carefully before you invest. The fund’s prospectus or summary prospectus, which can be obtained by calling 1-800-345-2021, contains this and other information about the fund, and should be read carefully before investing. Investments are subject to risk.

American Century Investment Services, Inc. Distributor

Copyright 2016 American Century Proprietary Holdings Inc. All rights reserved.