UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | | | | | | | | | | | | | | | | | | |

| Investment Company Act file number | 811-10155 |

| |

| AMERICAN CENTURY VARIABLE PORTFOLIOS II, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| |

JOHN PAK

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| |

| Date of fiscal year end: | 12-31 |

| |

| Date of reporting period: | 12-31-2022 |

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) Provided under separate cover.

| | | | | |

| |

| Annual Report |

| |

| December 31, 2022 |

| |

| VP Inflation Protection Fund |

| Class I (APTIX) |

| Class II (AIPTX) |

| | | | | |

| Performance | |

| Portfolio Commentary | |

| Fund Characteristics | |

| Shareholder Fee Example | |

| Schedule of Investments | |

| Statement of Assets and Liabilities | |

| Statement of Operations | |

| Statement of Changes in Net Assets | |

| Notes to Financial Statements | |

| Financial Highlights | |

| Report of Independent Registered Public Accounting Firm | |

| Management | |

| |

| |

| |

| Additional Information | |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

| | | | | | | | | | | | | | | | | | | |

| Total Returns as of December 31, 2022 |

| | | | | Average Annual Returns | |

| | Ticker

Symbol | | 1 year | 5 years | 10 years | | Inception

Date |

| Class I | APTIX | | -12.88% | 1.64% | 0.93% | | 5/7/04 |

| Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) Index | — | | -11.85% | 2.11% | 1.11% | | — |

| Class II | AIPTX | | -13.08% | 1.38% | 0.67% | | 12/31/02 |

The performance information presented does not include the fees and charges assessed with investments in variable insurance products, those charges are disclosed in the separate account prospectus. The inclusion of such fees and charges would lower performance.

| | |

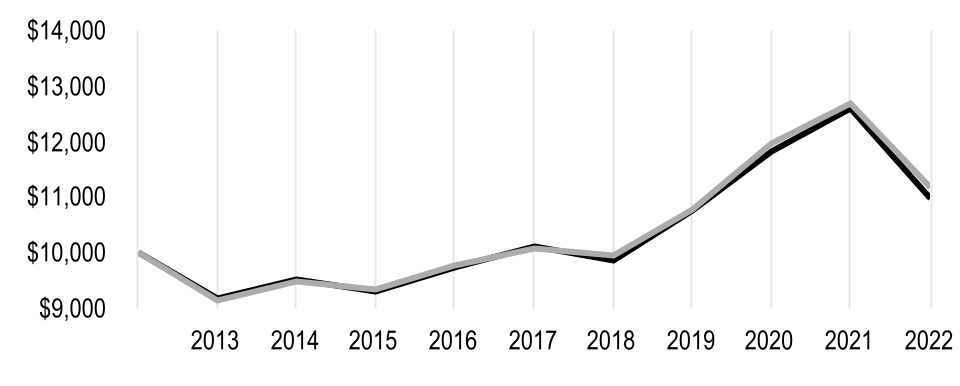

| Growth of $10,000 Over 10 Years |

| $10,000 investment made December 31, 2012 |

| Performance for other share classes will vary due to differences in fee structure. |

| | | | | |

| Value on December 31, 2022 |

| Class I — $10,965 |

|

| Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) Index — $11,173 |

|

| |

|

| |

|

| | | | | |

| Total Annual Fund Operating Expenses |

| Class I | Class II |

| 0.46% | 0.71% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-6488 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Bob Gahagan, Jim Platz and Miguel Castillo

Performance Summary

VP Inflation Protection returned -13.08%* for the 12 months ended December 31, 2022. The Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) Index returned -11.85% for the same period. Fund returns reflect operating expenses, while index returns do not.

Inflation Soared to Multiyear Highs

Fixed-income investors faced a tumultuous year in which broad indices logged record losses. Decades-high inflation, hawkish Federal Reserve (Fed) policy, soaring interest rates, economic uncertainty and geopolitical unrest created an unusual backdrop in which stock and bonds suffered steep losses.

Annual headline inflation (Consumer Price Index [CPI]) began the year on a rapid upswing and steadily rose to 9.1% in June, a 41-year high, before moderating to 6.5% by December. Annual core CPI (minus food and energy prices) peaked at 6.6% in September and ended the year at 5.7%. The effects of massive government spending combined with supply chain disruptions, labor shortages, surging energy prices and rapid home price appreciation contributed to elevated inflation.

Meanwhile, longer-term inflation expectations (10-year inflation breakeven rate) rose from 256 basis points (bps) at the end of 2021 to more than 300 bps in late April. But by year-end, it had dropped to 230 bps amid growing recession worries. The breakeven rate represents the difference between the 10-year nominal Treasury yield and the 10-year TIPS yield. Theoretically, the breakeven rate indicates market expectations for inflation for the next 10 years. It also reflects the inflation rate required (2.3% at year-end) for TIPS to outperform nominal Treasuries during the period.

Fed Policy Rattled Markets

With inflation soaring, the Fed finally launched a rate-hike campaign, but not until March 2022, when inflation had already reached 8.5%. Following a 25 bps hike in March, policymakers lifted rates 50 bps in May, 75 bps in June, July, September and November, and 50 bps in December. With the Fed on an aggressive tightening path and economic growth outlooks fading, recession fears set in, which contributed to the drop in the 10-year inflation breakeven rate.

Adding to the prevailing market challenges, Russia invaded Ukraine in late February, triggering ongoing global market unrest and energy sector instability. Furthermore, following back-to-back quarterly declines in gross domestic product (GDP), the U.S. economy entered a technical recession in the first half of 2022. Nevertheless, a still-strong labor market prevented the National Bureau of Economic Research from calling an official recession. GDP improved in the third quarter, advancing 3.2% (annualized).

*All fund returns referenced in this commentary are for Class II shares. Performance for other share classes will vary due to differences in fee structure; when Class II performance exceeds that of the index, other share classes may not. See page 2 for returns for all share classes.

Against this backdrop, yields soared, and most fixed-income sectors delivered losses for the 12-month period. The 10-year TIPS yield climbed from -1.04% on December 31, 2021, to 1.58% a year later. The 10-year Treasury yield climbed 237 bps to 3.88%, while the two-year Treasury yield jumped 369 bps to 4.42%, leaving the nominal yield curve inverted.

Like nominal Treasury yields, TIPS yields soared, causing their prices to decline. Prices fell at a greater rate than the principal adjustment for inflation, resulting in negative total returns for TIPS, even as inflation remained high. In the short term, particularly if rates and inflation are rising rapidly, TIPS returns and the inflation rate can diverge. TIPS are designed to offer inflation protection potential over the long term. Furthermore, while bond losses were widespread in 2022, TIPS fared better than nominal Treasuries, corporate and securitized bonds and the Bloomberg U.S. Aggregate Bond Index.

Out-of-Index Positions Weighed on Results

At the end of 2022, the portfolio was fully invested in TIPS as allowed by Internal Revenue Service (IRS) portfolio diversification regulations for insurance products (55% of assets). The remainder was primarily invested in out-of-index securitized and investment-grade corporate securities, which detracted from relative results. These credit-sensitive securities generally underperformed the all-TIPS index for the period.

Inflation Strategy Contributed

Exposure to inflation-indexed debt helped temper some of the negative effects from the corporate and securitized securities. Shorter maturity TIPS, which we favored, declined but fared better than nominal Treasuries and longer maturity TIPS. Additionally, to maximize inflation exposure while adhering to the IRS’ TIPS limit, we used inflation swaps to create an inflation overlay for the corporate and securitized securities. Inflation swaps are fixed-maturity instruments, negotiated through a counterparty (investment bank), that return the rate of inflation (CPI). All swaps bear counterparty credit risk, but American Century Investments applies stringent controls and oversight regarding this risk. This strategy positioned the portfolio with an overweight to inflation, which aided results.

Additionally, our yield curve positioning, which reflected a flattening bias, aided relative performance and offset the negative effects of extending duration. We gradually extended duration during the period, moving from a shorter-than-index posture to a slightly longer-than-index position as Treasury yields reached multiyear highs and recession risk mounted.

Outlook

We believe annual inflation has likely peaked for the current economic cycle. We expect good prices to ease, but inflationary pressures on services, mainly shelter and rent, should persist. We believe core CPI ultimately will reset at a higher level than current market expectations. Therefore, we believe inflation-linked bonds still offer value. Amid continuing economic uncertainty, we remain cautious in our out-of-index positioning, with a preference for higher-quality corporate and securitized securities.

| | | | | |

| DECEMBER 31, 2022 |

| Types of Investments in Portfolio | % of net assets |

| U.S. Treasury Securities | 52.2% |

| Corporate Bonds | 17.3% |

| U.S. Government Agency Securities | 8.3% |

| Collateralized Mortgage Obligations | 6.5% |

| Collateralized Loan Obligations | 5.0% |

| Asset-Backed Securities | 4.7% |

| Commercial Mortgage-Backed Securities | 2.5% |

| Municipal Securities | 0.1% |

| Short-Term Investments | 2.3% |

| Other Assets and Liabilities | 1.1% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from July 1, 2022 to December 31, 2022.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| Beginning Account Value 7/1/22 | Ending Account Value 12/31/22 | Expenses Paid During Period(1) 7/1/22 - 12/31/22 | Annualized Expense Ratio(1) |

| Actual | | | | |

| Class I | $1,000 | $965.20 | $2.82 | 0.57% |

| Class II | $1,000 | $963.50 | $4.06 | 0.82% |

| Hypothetical | | | | |

| Class I | $1,000 | $1,022.33 | $2.91 | 0.57% |

| Class II | $1,000 | $1,021.07 | $4.18 | 0.82% |

(1)Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 184, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses.

DECEMBER 31, 2022

| | | | | | | | |

| Principal

Amount/Shares | Value |

| U.S. TREASURY SECURITIES — 52.2% | | |

| U.S. Treasury Inflation Indexed Bonds, 2.00%, 1/15/26 | $ | 17,456,662 | | $ | 17,439,762 | |

| U.S. Treasury Inflation Indexed Bonds, 2.375%, 1/15/27 | 6,625,827 | | 6,760,831 | |

| U.S. Treasury Inflation Indexed Bonds, 1.75%, 1/15/28 | 11,174,532 | | 11,172,156 | |

| U.S. Treasury Inflation Indexed Bonds, 3.625%, 4/15/28 | 4,045,954 | | 4,411,462 | |

| U.S. Treasury Inflation Indexed Bonds, 2.50%, 1/15/29 | 4,129,151 | | 4,307,423 | |

| U.S. Treasury Inflation Indexed Bonds, 0.75%, 2/15/42 | 13,828,727 | | 11,586,760 | |

| U.S. Treasury Inflation Indexed Bonds, 0.625%, 2/15/43 | 18,898,726 | | 15,264,248 | |

| U.S. Treasury Inflation Indexed Bonds, 1.375%, 2/15/44 | 13,681,127 | | 12,718,477 | |

| U.S. Treasury Inflation Indexed Bonds, 0.75%, 2/15/45 | 15,185,520 | | 12,294,952 | |

| U.S. Treasury Inflation Indexed Bonds, 1.00%, 2/15/46 | 10,690,025 | | 9,089,361 | |

| U.S. Treasury Inflation Indexed Bonds, 0.875%, 2/15/47 | 2,407,217 | | 1,975,782 | |

| U.S. Treasury Inflation Indexed Bonds, 1.00%, 2/15/48 | 1,208,420 | | 1,018,313 | |

| U.S. Treasury Inflation Indexed Bonds, 1.00%, 2/15/49 | 236,844 | | 198,209 | |

| U.S. Treasury Inflation Indexed Bonds, 0.25%, 2/15/50 | 10,176,722 | | 6,872,490 | |

| U.S. Treasury Inflation Indexed Bonds, 0.125%, 2/15/51 | 8,756,037 | | 5,647,719 | |

| U.S. Treasury Inflation Indexed Bonds, 0.125%, 2/15/52 | 13,423,694 | | 8,707,078 | |

| U.S. Treasury Inflation Indexed Notes, 0.625%, 1/15/26 | 22,762,278 | | 21,855,592 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 4/15/26 | 17,328,423 | | 16,295,964 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 7/15/26 | 9,323,850 | | 8,788,689 | |

U.S. Treasury Inflation Indexed Notes, 0.125%, 10/15/26(1) | 9,814,680 | | 9,202,852 | |

| U.S. Treasury Inflation Indexed Notes, 0.375%, 1/15/27 | 1,233,620 | | 1,163,728 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 4/15/27 | 16,358,855 | | 15,251,286 | |

| U.S. Treasury Inflation Indexed Notes, 0.375%, 7/15/27 | 11,146,439 | | 10,509,382 | |

| U.S. Treasury Inflation Indexed Notes, 0.50%, 1/15/28 | 18,785,644 | | 17,673,464 | |

| U.S. Treasury Inflation Indexed Notes, 0.75%, 7/15/28 | 771,641 | | 735,415 | |

| U.S. Treasury Inflation Indexed Notes, 0.25%, 7/15/29 | 1,654,257 | | 1,515,361 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 1/15/30 | 14,477,875 | | 13,013,381 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 7/15/30 | 11,738,826 | | 10,518,040 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 1/15/31 | 21,635,397 | | 19,228,781 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 7/15/31 | 12,230,130 | | 10,815,194 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 1/15/32 | 26,251,500 | | 23,013,470 | |

| U.S. Treasury Inflation Indexed Notes, 0.625%, 7/15/32 | 16,974,011 | | 15,561,068 | |

TOTAL U.S. TREASURY SECURITIES (Cost $371,824,044) | | 324,606,690 | |

| CORPORATE BONDS — 17.3% | | |

| Aerospace and Defense — 0.3% | | |

| Raytheon Technologies Corp., 4.125%, 11/16/28 | 1,790,000 | | 1,716,895 | |

Airlines† | | |

British Airways Pass Through Trust, Series 2021-1, Class A, 2.90%, 9/15/36(2) | 149,571 | | 122,171 | |

| Automobiles — 0.9% | | |

| Honda Motor Co. Ltd., 2.27%, 3/10/25 | 2,340,000 | | 2,216,208 | |

| Toyota Motor Credit Corp., 2.50%, 3/22/24 | 3,299,000 | | 3,201,199 | |

| | 5,417,407 | |

| Banks — 6.4% | | |

| Banco Santander SA, 3.50%, 3/24/25 | 2,200,000 | | 2,120,326 | |

| Bank of America Corp., VRN, 3.46%, 3/15/25 | 3,355,000 | | 3,267,518 | |

| | | | | | | | |

| Principal

Amount/Shares | Value |

| Bank of America Corp., VRN, 3.38%, 4/2/26 | $ | 760,000 | | $ | 726,473 | |

| Bank of America Corp., VRN, 3.42%, 12/20/28 | 1,449,000 | | 1,314,558 | |

| Bank of America Corp., VRN, 2.88%, 10/22/30 | 777,000 | | 651,645 | |

Bank of Ireland Group PLC, VRN, 2.03%, 9/30/27(2) | 292,000 | | 246,935 | |

| Bank of Nova Scotia, 5.25%, 12/6/24 | 2,540,000 | | 2,546,611 | |

BNP Paribas SA, VRN, 2.82%, 11/19/25(2) | 2,260,000 | | 2,142,447 | |

| Citigroup, Inc., VRN, 4.04%, 6/1/24 | 2,650,000 | | 2,632,784 | |

| Citigroup, Inc., VRN, 3.07%, 2/24/28 | 190,000 | | 171,562 | |

| Citigroup, Inc., VRN, 3.52%, 10/27/28 | 446,000 | | 407,665 | |

| Discover Bank, VRN, 4.68%, 8/9/28 | 2,545,000 | | 2,443,218 | |

DNB Bank ASA, VRN, 2.97%, 3/28/25(2) | 1,535,000 | | 1,481,321 | |

| FNB Corp., 2.20%, 2/24/23 | 3,810,000 | | 3,791,095 | |

| HSBC Holdings PLC, 3.60%, 5/25/23 | 1,885,000 | | 1,873,406 | |

| HSBC Holdings PLC, VRN, 0.73%, 8/17/24 | 990,000 | | 954,219 | |

| HSBC Holdings PLC, VRN, 1.16%, 11/22/24 | 1,917,000 | | 1,826,517 | |

| HSBC Holdings PLC, VRN, 2.80%, 5/24/32 | 225,000 | | 174,598 | |

| JPMorgan Chase & Co., VRN, 5.55%, 12/15/25 | 2,235,000 | | 2,236,743 | |

| JPMorgan Chase & Co., VRN, 1.58%, 4/22/27 | 485,000 | | 426,710 | |

| JPMorgan Chase & Co., VRN, 2.95%, 2/24/28 | 650,000 | | 588,924 | |

| JPMorgan Chase & Co., VRN, 2.07%, 6/1/29 | 1,762,000 | | 1,474,663 | |

| JPMorgan Chase & Co., VRN, 2.52%, 4/22/31 | 1,097,000 | | 900,084 | |

| Lloyds Banking Group PLC, VRN, 4.72%, 8/11/26 | 1,140,000 | | 1,116,538 | |

National Australia Bank Ltd., 2.33%, 8/21/30(2) | 515,000 | | 393,159 | |

| Royal Bank of Canada, 4.24%, 8/3/27 | 1,365,000 | | 1,331,889 | |

Swedbank AB, 3.36%, 4/4/25(2) | 1,740,000 | | 1,673,833 | |

| Wells Fargo & Co., VRN, 4.54%, 8/15/26 | 455,000 | | 446,334 | |

| Wells Fargo & Co., VRN, 3.35%, 3/2/33 | 463,000 | | 391,273 | |

| | 39,753,048 | |

| Capital Markets — 1.1% | | |

FS KKR Capital Corp., 4.25%, 2/14/25(2) | 198,000 | | 185,750 | |

| Goldman Sachs Group, Inc., VRN, 1.76%, 1/24/25 | 1,727,000 | | 1,653,709 | |

| Goldman Sachs Group, Inc., VRN, 1.95%, 10/21/27 | 545,000 | | 477,251 | |

| Goldman Sachs Group, Inc., VRN, 2.64%, 2/24/28 | 535,000 | | 477,118 | |

| Goldman Sachs Group, Inc., VRN, 3.81%, 4/23/29 | 182,000 | | 166,570 | |

| Golub Capital BDC, Inc., 2.50%, 8/24/26 | 277,000 | | 235,503 | |

| Morgan Stanley, VRN, 0.53%, 1/25/24 | 1,938,000 | | 1,925,050 | |

| Morgan Stanley, VRN, 0.79%, 5/30/25 | 755,000 | | 702,318 | |

| Morgan Stanley, VRN, 2.48%, 9/16/36 | 270,000 | | 196,395 | |

UBS Group AG, VRN, 1.49%, 8/10/27(2) | 1,343,000 | | 1,157,111 | |

| | 7,176,775 | |

| Consumer Finance — 0.5% | | |

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust, 1.15%, 10/29/23 | 1,008,000 | | 970,204 | |

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust, 1.65%, 10/29/24 | 176,000 | | 162,461 | |

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust, 6.50%, 7/15/25 | 1,086,000 | | 1,101,448 | |

BOC Aviation USA Corp., 1.625%, 4/29/24(2) | 1,072,000 | | 1,018,057 | |

| | 3,252,170 | |

| Diversified Financial Services — 0.1% | | |

| Block Financial LLC, 3.875%, 8/15/30 | 800,000 | | 701,793 | |

| Diversified Telecommunication Services — 1.0% | | |

| AT&T, Inc., 0.90%, 3/25/24 | 2,150,000 | | 2,042,697 | |

| | | | | | | | |

| Principal

Amount/Shares | Value |

| AT&T, Inc., 4.35%, 3/1/29 | $ | 2,363,000 | | $ | 2,252,122 | |

| AT&T, Inc., 4.90%, 8/15/37 | 719,000 | | 663,630 | |

| Verizon Communications, Inc., 4.33%, 9/21/28 | 1,676,000 | | 1,614,805 | |

| | 6,573,254 | |

| Electric Utilities — 0.5% | | |

| Duke Energy Florida LLC, 1.75%, 6/15/30 | 610,000 | | 486,292 | |

| Duke Energy Progress LLC, 2.00%, 8/15/31 | 1,220,000 | | 967,109 | |

| NextEra Energy Capital Holdings, Inc., 5.00%, 7/15/32 | 1,580,000 | | 1,554,419 | |

| | 3,007,820 | |

| Entertainment — 0.1% | | |

Warnermedia Holdings, Inc., 3.76%, 3/15/27(2) | 472,000 | | 425,722 | |

| Equity Real Estate Investment Trusts (REITs) — 0.1% | | |

| American Tower Corp., 3.65%, 3/15/27 | 413,000 | | 386,349 | |

| Broadstone Net Lease LLC, 2.60%, 9/15/31 | 280,000 | | 210,523 | |

| | 596,872 | |

| Health Care Providers and Services — 0.3% | | |

Roche Holdings, Inc., 2.31%, 3/10/27(2) | 1,930,000 | | 1,761,079 | |

| Household Durables — 0.2% | | |

| Lennar Corp., 4.75%, 5/30/25 | 1,310,000 | | 1,302,853 | |

| Household Products — 0.3% | | |

| Colgate-Palmolive Co., 3.10%, 8/15/27 | 1,914,000 | | 1,812,988 | |

| Insurance — 0.1% | | |

Athene Global Funding, 1.99%, 8/19/28(2) | 308,000 | | 248,342 | |

Sammons Financial Group, Inc., 4.75%, 4/8/32(2) | 317,000 | | 265,591 | |

SBL Holdings, Inc., 5.125%, 11/13/26(2) | 144,000 | | 126,358 | |

| | 640,291 | |

| Internet and Direct Marketing Retail — 0.5% | | |

| Amazon.com, Inc., 4.60%, 12/1/25 | 3,205,000 | | 3,200,710 | |

| Life Sciences Tools and Services — 0.6% | | |

| Thermo Fisher Scientific, Inc., 1.22%, 10/18/24 | 3,930,000 | | 3,691,015 | |

| Machinery — 0.5% | | |

| Caterpillar Financial Services Corp., 3.65%, 8/12/25 | 3,160,000 | | 3,085,936 | |

| Media — 0.5% | | |

| Paramount Global, 4.95%, 1/15/31 | 380,000 | | 338,619 | |

Sky Ltd., 3.75%, 9/16/24(2) | 3,015,000 | | 2,945,004 | |

| | 3,283,623 | |

| Multi-Utilities — 0.8% | | |

| Ameren Corp., 1.95%, 3/15/27 | 2,220,000 | | 1,956,297 | |

| Ameren Illinois Co., 3.85%, 9/1/32 | 355,000 | | 330,874 | |

| Dominion Energy, Inc., 1.45%, 4/15/26 | 2,050,000 | | 1,827,427 | |

| Sempra Energy, 3.30%, 4/1/25 | 767,000 | | 736,170 | |

| | 4,850,768 | |

| Oil, Gas and Consumable Fuels — 0.7% | | |

| Exxon Mobil Corp., 2.71%, 3/6/25 | 3,770,000 | | 3,608,044 | |

| Petroleos Mexicanos, 3.50%, 1/30/23 | 331,000 | | 330,083 | |

| Petroleos Mexicanos, 6.70%, 2/16/32 | 425,000 | | 334,561 | |

| | 4,272,688 | |

| Pharmaceuticals — 0.4% | | |

| AbbVie, Inc., 2.95%, 11/21/26 | 1,200,000 | | 1,117,659 | |

| Zoetis, Inc., 2.00%, 5/15/30 | 1,580,000 | | 1,285,788 | |

| | 2,403,447 | |

| | | | | | | | |

| Principal

Amount/Shares | Value |

| Road and Rail — 0.4% | | |

| Canadian National Railway Co., 3.85%, 8/5/32 | $ | 2,170,000 | | $ | 2,022,821 | |

DAE Funding LLC, 1.55%, 8/1/24(2) | 229,000 | | 212,949 | |

| | 2,235,770 | |

| Software — 0.1% | | |

| Fidelity National Information Services, Inc., 1.15%, 3/1/26 | 745,000 | | 654,111 | |

| Specialty Retail — 0.5% | | |

| Home Depot, Inc., 2.70%, 4/15/25 | 836,000 | | 801,905 | |

| Lowe's Cos., Inc., 3.35%, 4/1/27 | 1,357,000 | | 1,275,971 | |

| O'Reilly Automotive, Inc., 4.70%, 6/15/32 | 1,380,000 | | 1,338,057 | |

| | 3,415,933 | |

| Thrifts and Mortgage Finance — 0.3% | | |

Nationwide Building Society, 1.00%, 8/28/25(2) | 2,260,000 | | 2,026,632 | |

| Water Utilities — 0.1% | | |

| Essential Utilities, Inc., 2.70%, 4/15/30 | 560,000 | | 470,951 | |

TOTAL CORPORATE BONDS (Cost $113,060,144) | | 107,852,722 | |

| U.S. GOVERNMENT AGENCY SECURITIES — 8.3% | | |

| FHLMC, 6.25%, 7/15/32 | 15,050,000 | | 17,566,220 | |

| FNMA, 6.625%, 11/15/30 | 27,000,000 | | 31,681,831 | |

| Tennessee Valley Authority, 4.70%, 7/15/33 | 2,400,000 | | 2,413,598 | |

TOTAL U.S. GOVERNMENT AGENCY SECURITIES (Cost $54,094,991) | | 51,661,649 | |

| COLLATERALIZED MORTGAGE OBLIGATIONS — 6.5% | | |

| Private Sponsor Collateralized Mortgage Obligations — 6.3% |

| ABN Amro Mortgage Corp., Series 2003-4, Class A4, 5.50%, 3/25/33 | 18,060 | | 16,065 | |

Agate Bay Mortgage Loan Trust, Series 2015-7, Class A3, VRN, 3.50%, 10/25/45(2) | 175,712 | | 156,704 | |

Agate Bay Mortgage Loan Trust, Series 2016-1, Class A3, VRN, 3.50%, 12/25/45(2) | 196,074 | | 179,620 | |

Angel Oak Mortgage Trust, Series 2019-4, Class A3, SEQ, VRN, 3.30%, 7/26/49(2) | 27,709 | | 27,536 | |

Angel Oak Mortgage Trust, Series 2019-5, Class A3, VRN, 2.92%, 10/25/49(2) | 331,488 | | 314,153 | |

Angel Oak Mortgage Trust, Series 2019-6, Class A3, SEQ, VRN, 2.93%, 11/25/59(2) | 357,930 | | 340,025 | |

Arroyo Mortgage Trust, Series 2021-1R, Class A2, VRN, 1.48%, 10/25/48(2) | 517,126 | | 412,976 | |

Arroyo Mortgage Trust, Series 2021-1R, Class A3, VRN, 1.64%, 10/25/48(2) | 421,866 | | 338,274 | |

Bellemeade Re Ltd., Series 2019-3A, Class M1C, VRN, 6.34%, (1-month LIBOR plus 1.95%), 7/25/29(2) | 3,045,000 | | 3,018,837 | |

Bellemeade Re Ltd., Series 2021-2A, Class M1C, VRN, 5.78%, (30-day average SOFR plus 1.85%), 6/25/31(2) | 3,200,000 | | 2,934,606 | |

Bellemeade Re Ltd., Series 2021-3A, Class M1A, VRN, 4.93%, (30-day average SOFR plus 1.00%), 9/25/31(2) | 1,930,069 | | 1,906,130 | |

| Cendant Mortgage Capital LLC, Series 2003-6, Class A3, 5.25%, 7/25/33 | 98,688 | | 93,864 | |

Chase Mortgage Finance Corp., Series 2021-CL1, Class M1, VRN, 5.13%, (30-day average SOFR plus 1.20%), 2/25/50(2) | 586,891 | | 514,567 | |

CHNGE Mortgage Trust, Series 2022-3, Class A1, SEQ, VRN, 5.00%, 5/25/67(2) | 926,536 | | 905,732 | |

Credit Suisse Mortgage Trust, Series 2015-WIN1, Class A10, VRN, 3.50%, 12/25/44(2) | 243,907 | | 219,209 | |

Credit Suisse Mortgage Trust, Series 2021-NQM2, Class A3, SEQ, VRN, 1.54%, 2/25/66(2) | 461,913 | | 370,419 | |

| | | | | | | | |

| Principal

Amount/Shares | Value |

Deephaven Residential Mortgage Trust, Series 2020-2, Class A3, SEQ, 2.86%, 5/25/65(2) | $ | 2,225,000 | | $ | 2,141,145 | |

Deephaven Residential Mortgage Trust, Series 2021-3, Class A3, VRN, 1.55%, 8/25/66(2) | 1,450,230 | | 1,168,068 | |

Farm Mortgage Trust, Series 2021-1, Class A, VRN, 2.18%, 1/25/51(2) | 3,242,114 | | 2,687,266 | |

Imperial Fund Mortgage Trust, Series 2021-NQM1, Class A3, SEQ, VRN, 1.62%, 6/25/56(2) | 530,931 | | 423,239 | |

JP Morgan Mortgage Trust, Series 2014-5, Class A1, VRN, 2.79%, 10/25/29(2) | 644,104 | | 602,961 | |

JP Morgan Mortgage Trust, Series 2016-1, Class A7, SEQ, VRN, 3.50%, 5/25/46(2) | 1,247,273 | | 1,112,272 | |

JP Morgan Mortgage Trust, Series 2017-1, Class A2, VRN, 3.45%, 1/25/47(2) | 602,527 | | 522,087 | |

New Residential Mortgage Loan Trust, Series 2020-NQM2, Class A2, SEQ, VRN, 2.89%, 5/24/60(2) | 2,090,000 | | 1,815,512 | |

Sequoia Mortgage Trust, Series 2017-7, Class A7, SEQ, VRN, 3.50%, 10/25/47(2) | 834,027 | | 729,510 | |

Sequoia Mortgage Trust, Series 2019-4, Class A7, SEQ, VRN, 3.50%, 11/25/49(2) | 3,839,677 | | 3,350,848 | |

SG Residential Mortgage Trust, Series 2021-1, Class A3, SEQ, VRN, 1.56%, 7/25/61(2) | 1,224,748 | | 983,819 | |

STAR Trust, Series 2021-1, Class A1, SEQ, VRN, 1.22%, 5/25/65(2) | 1,357,724 | | 1,232,802 | |

Starwood Mortgage Residential Trust, Series 2020-2, Class B1E, VRN, 3.00%, 4/25/60(2) | 3,765,000 | | 3,320,995 | |

Verus Securitization Trust, Series 2020-1, Class A3, SEQ, 2.72%, 1/25/60(2) | 1,382,118 | | 1,303,011 | |

Verus Securitization Trust, Series 2021-1, Class A3, VRN, 1.16%, 1/25/66(2) | 1,179,716 | | 948,422 | |

Verus Securitization Trust, Series 2021-5, Class A3, VRN, 1.37%, 9/25/66(2) | 1,515,899 | | 1,156,550 | |

Verus Securitization Trust, Series 2022-3, Class A3, VRN, 4.13%, 2/25/67(2) | 3,407,542 | | 3,052,138 | |

Vista Point Securitization Trust, Series 2020-2, Class A3, VRN, 2.50%, 4/25/65(2) | 554,342 | | 464,927 | |

| WaMu Mortgage Pass-Through Certificates Trust, Series 2003-S11, Class 3A5, Series 2003-S11, Class 3A5, 5.95%, 11/25/33 | 77,539 | | 69,900 | |

| | 38,834,189 | |

| U.S. Government Agency Collateralized Mortgage Obligations — 0.2% |

| FNMA, Series 2014-C02, Class 2M2, VRN, 6.99%, (1-month LIBOR plus 2.60%), 5/25/24 | 425,530 | | 425,265 | |

FNMA, Series 2022-R03, Class 1M1, VRN, 6.03%, (30-day average SOFR plus 2.10%), 3/25/42(2) | 1,001,884 | | 995,426 | |

| | 1,420,691 | |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $45,433,182) | | 40,254,880 | |

| COLLATERALIZED LOAN OBLIGATIONS — 5.0% | | |

Ares XXXIX CLO Ltd., Series 2016-39A, Class BR2, VRN, 5.79%, (3-month LIBOR plus 1.60%), 4/18/31(2) | 3,500,000 | | 3,374,025 | |

BDS Ltd., Series 2020-FL6, Class C, VRN, 6.17%, (30-day average SOFR plus 2.36%), 9/15/35(2) | 1,206,925 | | 1,182,836 | |

Bean Creek CLO Ltd., Series 2015-1A, Class AR, VRN, 5.26%, (3-month LIBOR plus 1.02%), 4/20/31(2) | 1,750,000 | | 1,713,859 | |

BXMT Ltd., Series 2020-FL2, Class B, VRN, 5.84%, (1-month SOFR plus 1.51%), 2/15/38(2) | 2,400,000 | | 2,340,124 | |

Carlyle Global Market Strategies CLO Ltd., Series 2012-4A, Class CR3, VRN, 6.92%, (3-month LIBOR plus 2.60%), 4/22/32(2) | 1,700,000 | | 1,618,521 | |

| | | | | | | | |

| Principal

Amount/Shares | Value |

Dryden Senior Loan Fund, Series 2016-43A, Class B2R2, 3.09%, 4/20/34(2) | $ | 3,000,000 | | $ | 2,512,609 | |

Goldentree Loan Opportunities X Ltd., Series 2015-10A, Class AR, VRN, 5.36%, (3-month LIBOR plus 1.12%), 7/20/31(2) | 1,700,000 | | 1,678,666 | |

KKR CLO Ltd., Series 2022A, Class A, VRN, 5.39%, (3-month LIBOR plus 1.15%), 7/20/31(2) | 2,250,000 | | 2,213,591 | |

KKR Static CLO I Ltd., Series 2022-1A, Class B, VRN, 5.08%, (3-month SOFR plus 2.60%), 7/20/31(2) | 2,200,000 | | 2,117,968 | |

Magnetite XXIX Ltd., Series 2021-29A, Class B, VRN, 5.48%, (3-month LIBOR plus 1.40%), 1/15/34(2) | 2,600,000 | | 2,514,827 | |

Marathon CLO Ltd., Series 2021-17A, Class B2, 4.03%, 1/20/35(2) | 3,000,000 | | 2,385,315 | |

MF1 Ltd., Series 2021-FL7, Class AS, VRN, 5.79%, (1-month LIBOR plus 1.45%), 10/16/36(2) | 812,000 | | 776,608 | |

Palmer Square CLO Ltd., Series 2014-1A, Class A1R2, VRN, 5.21%, (3-month LIBOR plus 1.13%), 1/17/31(2) | 1,250,000 | | 1,238,345 | |

Rockford Tower CLO Ltd., Series 2020-1A, Class B, VRN, 6.04%, (3-month LIBOR plus 1.80%), 1/20/32(2) | 1,800,000 | | 1,747,309 | |

Shelter Growth Issuer Ltd., Series 2022-FL4, Class A, VRN, 6.62%, (1-month SOFR plus 2.30%), 6/17/37(2) | 2,000,000 | | 1,956,283 | |

Wellfleet CLO Ltd., Series 2022-1A, Class B2, 4.78%, 4/15/34(2) | 2,000,000 | | 1,839,577 | |

TOTAL COLLATERALIZED LOAN OBLIGATIONS (Cost $33,127,324) | | 31,210,463 | |

| ASSET-BACKED SECURITIES — 4.7% | | |

Aligned Data Centers Issuer LLC, Series 2021-1A, Class B, 2.48%, 8/15/46(2) | 3,600,000 | | 2,955,590 | |

Blackbird Capital Aircraft, Series 2021-1A, Class A, SEQ, 2.44%, 7/15/46(2) | 1,192,461 | | 980,765 | |

BRE Grand Islander Timeshare Issuer LLC, Series 2017-1A, Class A, SEQ, 2.94%, 5/25/29(2) | 225,390 | | 217,603 | |

Cologix Canadian Issuer LP, Series 2022-1CAN, Class A2, SEQ, 4.94%, 1/25/52(2) | CAD | 2,950,000 | | 1,991,097 | |

FirstKey Homes Trust, Series 2020-SFR2, Class D, 1.97%, 10/19/37(2) | $ | 1,500,000 | | 1,316,047 | |

Global SC Finance VII Srl, Series 2020-1A, Class A, SEQ, 2.17%, 10/17/40(2) | 1,350,235 | | 1,198,218 | |

Global SC Finance VII Srl, Series 2021-1A, Class A, SEQ, 1.86%, 4/17/41(2) | 2,081,814 | | 1,795,597 | |

Global SC Finance VII Srl, Series 2021-2A, Class A, SEQ, 1.95%, 8/17/41(2) | 1,048,645 | | 910,136 | |

Goodgreen Trust, Series 2020-1A, Class A, SEQ, 2.63%, 4/15/55(2) | 1,003,230 | | 827,424 | |

Goodgreen Trust, Series 2021-1A, Class A, SEQ, 2.66%, 10/15/56(2) | 659,682 | | 536,179 | |

Hilton Grand Vacations Trust, Series 2017-AA, Class A, SEQ, 2.66%, 12/26/28(2) | 603,445 | | 594,104 | |

Hilton Grand Vacations Trust, Series 2019-AA, Class B, 2.54%, 7/25/33(2) | 1,059,042 | | 987,330 | |

Mosaic Solar Loan Trust, Series 2021-1A, Class A, SEQ, 1.51%, 12/20/46(2) | 1,698,575 | | 1,338,673 | |

Progress Residential Trust, Series 2021-SFR1, Class D, 1.81%, 4/17/38(2) | 1,500,000 | | 1,273,879 | |

Progress Residential Trust, Series 2021-SFR2, Class C, 2.00%, 4/19/38(2) | 7,625,000 | | 6,562,134 | |

Progress Residential Trust, Series 2021-SFR8, Class E1, 2.38%, 10/17/38(2) | 800,000 | | 660,016 | |

ServiceMaster Funding LLC, Series 2020-1, Class A2I, SEQ, 2.84%, 1/30/51(2) | 1,842,188 | | 1,483,201 | |

Sierra Timeshare Receivables Funding LLC, Series 2019-3A, Class B, 2.75%, 8/20/36(2) | 1,324,718 | | 1,250,062 | |

| | | | | | | | |

| Principal

Amount/Shares | Value |

Sierra Timeshare Receivables Funding LLC, Series 2021-1A, Class B, 1.34%, 11/20/37(2) | $ | 2,220,414 | | $ | 2,032,618 | |

TOTAL ASSET-BACKED SECURITIES (Cost $33,534,491) | | 28,910,673 | |

| COMMERCIAL MORTGAGE-BACKED SECURITIES — 2.5% |

BX Commercial Mortgage Trust, Series 2019-2A, Class D, VRN, 3.55%, 3/11/44(2) | 2,113,000 | | 1,592,641 | |

BX Commercial Mortgage Trust, Series 2021-VOLT, Class E, VRN, 6.32%, (1-month LIBOR plus 2.00%), 9/15/36(2) | 1,900,000 | | 1,772,678 | |

BX Commercial Mortgage Trust, Series 2021-VOLT, Class F, VRN, 6.72%, (1-month LIBOR plus 2.40%), 9/15/36(2) | 2,200,000 | | 2,031,627 | |

Credit Suisse Mortgage Capital Certificates, Series 2019-ICE4, Class B, VRN, 5.55%, (1-month LIBOR plus 1.23%), 5/15/36(2) | 1,375,000 | | 1,351,812 | |

Credit Suisse Mortgage Capital Certificates, Series 2019-ICE4, Class D, VRN, 5.92%, (1-month LIBOR plus 1.60%), 5/15/36(2) | 3,306,000 | | 3,240,490 | |

Extended Stay America Trust, Series 2021-ESH, Class E, VRN, 7.17%, (1-month LIBOR plus 2.85%), 7/15/38(2) | 2,540,052 | | 2,426,802 | |

J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2018-AON, Class A, SEQ, 4.13%, 7/5/31(2) | 3,055,000 | | 2,866,019 | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES (Cost $16,553,221) | | 15,282,069 | |

| MUNICIPAL SECURITIES — 0.1% | | |

Golden State Tobacco Securitization Corp. Rev., 2.75%, 6/1/34

(Cost $1,125,924) | 1,120,000 | | 901,044 | |

| SHORT-TERM INVESTMENTS — 2.3% | | |

Money Market Funds† | | |

| State Street Institutional U.S. Government Money Market Fund, Premier Class | 23,844 | | 23,844 | |

| Repurchase Agreements — 2.3% | | |

| BMO Capital Markets Corp., (collateralized by various U.S. Treasury obligations, 0.375% - 0.50%, 9/15/24 - 5/31/27, valued at $2,066,352), in a joint trading account at 4.20%, dated 12/30/22, due 1/3/23 (Delivery value $2,029,020) | | 2,028,074 | |

| Fixed Income Clearing Corp., (collateralized by various U.S. Treasury obligations, 1.375%, 11/15/31, valued at $12,709,217), at 4.26%, dated 12/30/22, due 1/3/23 (Delivery value $12,465,898) | | 12,460,000 | |

| | 14,488,074 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $14,511,918) | | 14,511,918 | |

TOTAL INVESTMENT SECURITIES—98.9% (Cost $683,265,239) | | 615,192,108 | |

| OTHER ASSETS AND LIABILITIES — 1.1% | | 6,814,615 | |

| TOTAL NET ASSETS — 100.0% | | $ | 622,006,723 | |

| | | | | | | | | | | | | | | | | | | | |

| FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS |

| Currency Purchased | Currency Sold | Counterparty | Settlement

Date | Unrealized

Appreciation

(Depreciation) |

| USD | 2,020,290 | | CAD | 2,746,719 | | Morgan Stanley | 3/15/23 | $ | (9,443) | |

| | | | | | | | | | | | | | |

| FUTURES CONTRACTS PURCHASED |

| Reference Entity | Contracts | Expiration Date | Notional

Amount | Unrealized

Appreciation

(Depreciation)^ |

| U.S. Treasury 2-Year Notes | 63 | March 2023 | $ | 12,919,922 | | $ | (51,560) | |

| U.S. Treasury 5-Year Notes | 14 | March 2023 | 1,511,016 | | (16,215) | |

| U.S. Treasury 10-Year Notes | 19 | March 2023 | 2,133,640 | | (20,681) | |

| U.S. Treasury 10-Year Ultra Notes | 13 | March 2023 | 1,537,656 | | (20,135) | |

| U.S. Treasury Ultra Bonds | 12 | March 2023 | 1,611,750 | | (46,523) | |

| | | $ | 19,713,984 | | $ | (155,114) | |

^Amount represents value and unrealized appreciation (depreciation).

| | | | | | | | | | | | | | | | | | | | | | | |

| CENTRALLY CLEARED TOTAL RETURN SWAP AGREEMENTS |

Floating Rate Index | Pay/Receive Floating Rate Index at Termination | Fixed

Rate | Termination

Date | Notional

Amount | Premiums

Paid

(Received) | Unrealized

Appreciation

(Depreciation) | Value |

| CPURNSA | Receive | 2.90% | 10/11/23 | $ | 14,150,000 | | $ | 403 | | $ | (11,950) | | $ | (11,547) | |

| CPURNSA | Receive | 2.88% | 12/2/23 | $ | 10,000,000 | | 471 | | (8,195) | | (7,724) | |

| CPURNSA | Receive | 2.21% | 1/19/24 | $ | 22,000,000 | | 575 | | 2,178,594 | | 2,179,169 | |

| CPURNSA | Receive | 2.27% | 1/26/24 | $ | 5,000,000 | | 517 | | 486,223 | | 486,740 | |

| CPURNSA | Receive | 1.78% | 6/6/24 | $ | 19,000,000 | | (654) | | 2,185,614 | | 2,184,960 | |

| CPURNSA | Receive | 1.71% | 6/20/24 | $ | 12,600,000 | | (600) | | 1,475,708 | | 1,475,108 | |

| CPURNSA | Receive | 1.86% | 7/30/24 | $ | 12,500,000 | | (601) | | 1,365,535 | | 1,364,934 | |

| CPURNSA | Receive | 1.86% | 8/1/24 | $ | 13,600,000 | | (610) | | 1,486,978 | | 1,486,368 | |

| CPURNSA | Receive | 1.08% | 6/4/25 | $ | 4,000,000 | | 524 | | 625,632 | | 626,156 | |

| CPURNSA | Receive | 2.24% | 1/12/26 | $ | 9,000,000 | | 555 | | 912,958 | | 913,513 | |

| CPURNSA | Receive | 2.70% | 8/27/26 | $ | 15,000,000 | | 592 | | 830,824 | | 831,416 | |

| CPURNSA | Receive | 2.15% | 11/20/27 | $ | 5,000,000 | | (554) | | 551,510 | | 550,956 | |

| CPURNSA | Receive | 2.31% | 3/28/28 | $ | 11,500,000 | | (625) | | 1,040,478 | | 1,039,853 | |

| CPURNSA | Receive | 1.80% | 10/21/29 | $ | 6,100,000 | | (566) | | 879,463 | | 878,897 | |

| CPURNSA | Receive | 1.88% | 11/21/29 | $ | 1,000,000 | | (516) | | 137,751 | | 137,235 | |

| CPURNSA | Receive | 1.87% | 11/25/29 | $ | 5,000,000 | | (554) | | 692,079 | | 691,525 | |

| CPURNSA | Receive | 1.29% | 5/19/30 | $ | 3,000,000 | | 532 | | 578,028 | | 578,560 | |

| CPURNSA | Receive | 1.63% | 6/25/30 | $ | 8,000,000 | | 587 | | 1,394,324 | | 1,394,911 | |

| CPURNSA | Receive | 2.50% | 9/3/31 | $ | 10,000,000 | | 608 | | 635,724 | | 636,332 | |

| | | | | $ | 84 | | $ | 17,437,278 | | $ | 17,437,362 | |

| | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN SWAP AGREEMENTS |

| Counterparty | Floating Rate Index | Pay/Receive Floating Rate Index at Termination | Fixed

Rate | Termination

Date | Notional

Amount | Value* |

Bank of America N.A.(3) | CPURNSA | Receive | 2.53% | 8/19/24 | $ | 4,000,000 | | $ | 87,051 | |

Bank of America N.A.(3) | CPURNSA | Receive | 1.79% | 8/27/25 | $ | 3,000,000 | | 387,664 | |

Bank of America N.A.(3) | CPURNSA | Receive | 2.24% | 4/11/27 | $ | 7,000,000 | | 665,691 | |

Bank of America N.A.(3) | CPURNSA | Receive | 2.22% | 4/13/27 | $ | 1,750,000 | | 170,342 | |

Bank of America N.A.(3) | CPURNSA | Receive | 2.24% | 4/28/27 | $ | 4,000,000 | | 383,737 | |

| Barclays Bank PLC | CPURNSA | Receive | 2.59% | 7/23/24 | $ | 2,300,000 | | 34,114 | |

| Barclays Bank PLC | CPURNSA | Receive | 2.39% | 9/19/24 | $ | 6,000,000 | | 234,197 | |

| Barclays Bank PLC | CPURNSA | Receive | 2.36% | 9/29/24 | $ | 6,500,000 | | 273,014 | |

| Barclays Bank PLC | CPURNSA | Receive | 2.31% | 9/30/24 | $ | 3,600,000 | | 173,214 | |

| Barclays Bank PLC | CPURNSA | Receive | 2.90% | 12/21/27 | $ | 15,100,000 | | (1,931,908) | |

| Barclays Bank PLC | CPURNSA | Receive | 2.78% | 7/2/44 | $ | 3,600,000 | | (281,072) | |

| Goldman Sachs & Co. | CPURNSA | Receive | 1.87% | 5/23/26 | $ | 1,500,000 | | 210,867 | |

| Goldman Sachs & Co. | CPURNSA | Receive | 1.92% | 5/31/26 | $ | 13,000,000 | | 1,750,821 | |

| Goldman Sachs & Co. | CPURNSA | Receive | 1.77% | 6/16/26 | $ | 12,500,000 | | 1,866,418 | |

| Goldman Sachs & Co. | CPURNSA | Receive | 2.25% | 11/15/26 | $ | 2,500,000 | | 245,811 | |

| Goldman Sachs & Co. | CPURNSA | Receive | 2.28% | 11/16/26 | $ | 2,500,000 | | 236,355 | |

| | | | | | $ | 4,506,316 | |

*Amount represents value and unrealized appreciation (depreciation).

| | | | | | | | |

| NOTES TO SCHEDULE OF INVESTMENTS |

| CAD | – | Canadian Dollar |

| CPURNSA | – | U.S. Consumer Price Index Urban Consumers Not Seasonally Adjusted Index |

| FHLMC | – | Federal Home Loan Mortgage Corporation |

| FNMA | – | Federal National Mortgage Association |

| LIBOR | – | London Interbank Offered Rate |

| SEQ | – | Sequential Payer |

| SOFR | – | Secured Overnight Financing Rate |

| USD | – | United States Dollar |

| VRN | – | Variable Rate Note. The rate adjusts periodically based upon the terms set forth in the security’s offering documents. The rate shown is effective at the period end and the reference rate and spread, if any, is indicated. The security's effective maturity date may be shorter than the final maturity date shown. |

†Category is less than 0.05% of total net assets.

(1)Security, or a portion thereof, has been pledged at the custodian bank or with a broker for collateral requirements on forward foreign currency exchange contracts, futures contracts and/or swap agreements. At the period end, the aggregate value of securities pledged was $6,695,844.

(2)Security was purchased pursuant to Rule 144A or Section 4(2) under the Securities Act of 1933 and may be sold in transactions exempt from registration, normally to qualified institutional investors. The aggregate value of these securities at the period end was $131,485,452, which represented 21.1% of total net assets.

(3)Collateral has been received at the custodian for collateral requirements on swap agreements. At the period end, the aggregate value of securities received was $1,919,568.

See Notes to Financial Statements.

| | |

| Statement of Assets and Liabilities |

| | | | | |

| DECEMBER 31, 2022 | |

| Assets | |

| Investment securities, at value (cost of $683,265,239) | $ | 615,192,108 | |

| Cash | 4,290,000 | |

| Receivable for capital shares sold | 156,488 | |

| Receivable for variation margin on swap agreements | 34,586 | |

| Swap agreements, at value | 6,719,296 | |

| Interest and dividends receivable | 3,104,883 | |

| 629,497,361 | |

| |

| Liabilities | |

| Payable for collateral received for swap agreements | 4,290,000 | |

| Payable for capital shares redeemed | 598,328 | |

| Payable for variation margin on futures contracts | 20,531 | |

| Unrealized depreciation on forward foreign currency exchange contracts | 9,443 | |

| Swap agreements, at value | 2,212,980 | |

| Accrued management fees | 247,037 | |

| Distribution fees payable | 112,319 | |

| 7,490,638 | |

| |

| Net Assets | $ | 622,006,723 | |

| |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $ | 696,531,481 | |

| Distributable earnings | (74,524,758) | |

| $ | 622,006,723 | |

| | | | | | | | | | | |

| Net Assets | Shares Outstanding | Net Asset Value Per Share |

| Class I, $0.01 Par Value | $102,826,732 | 10,943,574 | $9.40 |

| Class II, $0.01 Par Value | $519,179,991 | 55,410,190 | $9.37 |

See Notes to Financial Statements.

| | | | | |

| YEAR ENDED DECEMBER 31, 2022 | |

| Investment Income (Loss) | |

| Income: | |

| Interest | $ | 37,976,098 | |

| Dividends | 198,594 | |

| 38,174,692 | |

| |

| Expenses: | |

| Management fees | 3,246,665 | |

| Interest expense | 400,959 | |

| Distribution fees - Class II | 1,495,731 | |

| Directors' fees and expenses | 45,656 | |

| 5,189,011 | |

| |

| Net investment income (loss) | 32,985,681 | |

| |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

| Investment transactions | (27,749,484) | |

| Forward foreign currency exchange contract transactions | 94,875 | |

| Futures contract transactions | (2,333,770) | |

| Swap agreement transactions | 5,323,788 | |

| Foreign currency translation transactions | 19,646 | |

| (24,644,945) | |

| |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments | (111,925,259) | |

| Forward foreign currency exchange contracts | 56,914 | |

| Futures contracts | (20,366) | |

| Swap agreements | 3,042,730 | |

| Translation of assets and liabilities in foreign currencies | (265) | |

| (108,846,246) | |

| |

| Net realized and unrealized gain (loss) | (133,491,191) | |

| |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | (100,505,510) | |

See Notes to Financial Statements.

| | |

| Statement of Changes in Net Assets |

| | | | | | | | |

| YEARS ENDED DECEMBER 31, 2022 AND DECEMBER 31, 2021 |

| Increase (Decrease) in Net Assets | December 31, 2022 | December 31, 2021 |

| Operations | | |

| Net investment income (loss) | $ | 32,985,681 | | $ | 23,347,560 | |

| Net realized gain (loss) | (24,644,945) | | 9,774,191 | |

| Change in net unrealized appreciation (depreciation) | (108,846,246) | | 11,824,676 | |

| Net increase (decrease) in net assets resulting from operations | (100,505,510) | | 44,946,427 | |

| | |

| Distributions to Shareholders | | |

| From earnings: | | |

| Class I | (5,892,222) | | (4,341,348) | |

| Class II | (31,912,391) | | (18,818,265) | |

| From tax return of capital: | | |

| Class I | (305,839) | | |

| Class II | (1,656,433) | | |

| Decrease in net assets from distributions | (39,766,885) | | (23,159,613) | |

| | |

| Capital Share Transactions | | |

| Net increase (decrease) in net assets from capital share transactions (Note 5) | (28,353,483) | | 131,499,953 | |

| | |

| Net increase (decrease) in net assets | (168,625,878) | | 153,286,767 | |

| | |

| Net Assets | | |

| Beginning of period | 790,632,601 | | 637,345,834 | |

| End of period | $ | 622,006,723 | | $ | 790,632,601 | |

See Notes to Financial Statements.

| | |

| Notes to Financial Statements |

DECEMBER 31, 2022

1. Organization

American Century Variable Portfolios II, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. VP Inflation Protection Fund (the fund) is the sole fund issued by the corporation. The fund’s investment objective is to pursue long-term total return using a strategy that seeks to protect against U.S. inflation. The fund offers Class I and Class II.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value (NAV) per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The value of investments of the fund is determined by American Century Investment Management, Inc. (ACIM) (the investment advisor), as the valuation designee, pursuant to its valuation policies and procedures. The Board of Directors oversees the valuation designee and reviews its valuation policies and procedures at least annually.

Fixed income securities are valued at the evaluated mean as provided by independent pricing services or at the mean of the most recent bid and asked prices as provided by investment dealers. Corporate bonds, U.S. Treasury and Government Agency securities, convertible bonds, municipal securities, and sovereign governments and agencies are valued using market models that consider trade data, quotations from dealers and active market makers, relevant yield curve and spread data, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information. Mortgage-related and asset-backed securities are valued based on models that consider trade data, prepayment and default projections, benchmark yield and spread data and estimated cash flows of each tranche of the issuer. Collateralized loan obligations are valued based on discounted cash flow models that consider trade and economic data, prepayment assumptions and default projections. Commercial paper is valued using a curve-based approach that considers money market rates for specific instruments, programs, currencies and maturity points from a variety of active market makers. Fixed income securities initially expressed in local currencies are translated into U.S. dollars at the mean of the appropriate currency exchange rate at the close of the NYSE as provided by an independent pricing service.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are generally valued at the closing price of such securities on the exchange where primarily traded or at the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices may be used. Securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price.

Open-end management investment companies are valued at the reported NAV per share. Repurchase agreements are valued at cost, which approximates fair value. Exchange-traded futures contracts are valued at the settlement price as provided by the appropriate exchange. Swap agreements are valued at an evaluated mean as provided by independent pricing services or independent brokers. Forward foreign currency exchange contracts are valued at the mean of the appropriate forward exchange rate at the close of the NYSE as provided by an independent pricing service.

If the valuation designee determines that the market price for a portfolio security is not readily available or is believed by the valuation designee to be unreliable, such security is valued at fair value as determined in good faith by the valuation designee, in accordance with its policies and procedures. Circumstances that may cause the fund to determine that market quotations are not available or reliable include, but are not limited to: when there is a significant event subsequent to the market quotation; trading in a security has been halted during the trading day; or trading in a security is insufficient or did not take place due to a closure or holiday.

The valuation designee monitors for significant events occurring after the close of an investment’s primary exchange but before the fund’s NAV per share is determined. Significant events may include, but are not limited to: corporate announcements and transactions; regulatory news, governmental action and political unrest that could impact a specific investment or an investment sector; or armed conflicts, natural disasters and similar events that could affect investments in a specific country or region. The valuation designee also monitors for significant fluctuations between domestic and foreign markets, as evidenced by the U.S. market or such other indicators that it deems appropriate. The valuation designee may apply a model-derived factor to the closing price of equity securities traded on foreign securities exchanges. The factor is based on observable market data as provided by an independent pricing service.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Interest income is recorded on the accrual basis and includes paydown gain (loss) and accretion of discounts and amortization of premiums. Inflation adjustments related to inflation-linked debt securities are reflected as interest income. Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that ACIM has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Segregated Assets — In accordance with the 1940 Act, the fund segregates assets on its books and records to cover certain types of investment securities and other financial instruments. ACIM monitors, on a daily basis, the securities segregated to ensure the fund designates a sufficient amount of liquid assets, marked-to-market daily. The fund may also receive assets or be required to pledge assets at the custodian bank or with a broker for collateral requirements. The fund may incur charges or earn income on posted collateral balances, which are reflected in interest expenses or interest income, respectively.

Income Tax Status — It is the fund's policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid quarterly. Distributions from net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation's investment advisor, ACIM, the corporation's distributor, American Century Investment Services, Inc. (ACIS), and the corporation's transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC.

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that ACIM will pay all expenses of managing and operating the fund, except brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), extraordinary expenses, and expenses incurred in connection with the provision of shareholder services and distribution services under a plan adopted pursuant to Rule 12b-1 under the 1940 Act. The fee is computed and accrued daily based on each class's daily net assets and paid monthly in arrears. The fee consists of (1) an Investment Category Fee based on the daily net assets of the fund and certain other accounts managed by the investment advisor that are in the same broad investment category as the fund and (2) a Complex Fee based on the assets of all funds in the American Century Investments family of funds that have the same investment advisor and distributor as the fund. For purposes of determining the Investment Category Fee and Complex Fee, the assets of funds managed by the investment advisor that invest exclusively in the shares of other funds (funds of funds) are not included. The rates for the Investment Category Fee range from 0.1625% to 0.2800% and the rates for the Complex Fee range from 0.2500% to 0.3100%. The effective annual management fee for each class for the period ended December 31, 2022 was 0.46%.

Distribution Fees — The Board of Directors has adopted the Master Distribution Plan (the plan) for Class II, pursuant to Rule 12b-1 of the 1940 Act. The plan provides that Class II will pay ACIS an annual distribution fee equal to 0.25%. The fee is computed and accrued daily based on the Class II daily net assets and paid monthly in arrears. The distribution fee provides compensation for expenses incurred in connection with distributing shares of Class II including, but not limited to, payments to brokers, dealers, and financial institutions that have entered into sales agreements with respect to shares of the fund. Fees incurred under the plan during the period ended December 31, 2022 are detailed in the Statement of Operations.

Directors' Fees and Expenses — The Board of Directors is responsible for overseeing the investment advisor’s management and operations of the fund. The directors receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. The fund's officers do not receive compensation from the fund.

Interfund Transactions — The fund may enter into security transactions with other American Century Investments funds and other client accounts of the investment advisor, in accordance with the 1940 Act rules and procedures adopted by the Board of Directors. The rules and procedures require, among other things, that these transactions be effected at the independent current market price of the security. There were no interfund transactions during the period.

4. Investment Transactions

Purchases of investment securities, excluding short-term investments, for the period ended December 31, 2022 totaled $566,793,930, of which $330,905,657 represented U.S. Treasury and Government Agency obligations.

Sales of investment securities, excluding short-term investments, for the period ended December 31, 2022 totaled $589,396,311, of which $322,147,703 represented U.S. Treasury and Government Agency obligations.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

| | | | | | | | | | | | | | |

| Year ended

December 31, 2022 | Year ended

December 31, 2021 |

| Shares | Amount | Shares | Amount |

| Class I/Shares Authorized | 250,000,000 | | | 250,000,000 | | |

| Sold | 3,322,007 | | $ | 34,615,177 | | 3,896,496 | | $ | 43,686,957 | |

| Issued in reinvestment of distributions | 627,219 | | 6,198,061 | | 387,606 | | 4,341,348 | |

| Redeemed | (4,045,151) | | (42,707,940) | | (4,331,274) | | (48,717,092) | |

| (95,925) | | (1,894,702) | | (47,172) | | (688,787) | |

| Class II/Shares Authorized | 250,000,000 | | | 250,000,000 | | |

| Sold | 15,533,515 | | 164,008,291 | | 19,780,250 | | 221,657,584 | |

| Issued in reinvestment of distributions | 3,403,558 | | 33,568,824 | | 1,682,191 | | 18,818,265 | |

| Redeemed | (21,687,471) | | (224,035,896) | | (9,667,657) | | (108,287,109) | |

| (2,750,398) | | (26,458,781) | | 11,794,784 | | 132,188,740 | |

| Net increase (decrease) | (2,846,323) | | $ | (28,353,483) | | 11,747,612 | | $ | 131,499,953 | |

6. Fair Value Measurements

The fund's investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

•Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments.

•Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in local currencies that are adjusted through translation into U.S. dollars.

•Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions).

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund's portfolio holdings.

| | | | | | | | | | | |

| Level 1 | Level 2 | Level 3 |

| Assets | | | |

| Investment Securities | | | |

| U.S. Treasury Securities | — | | $ | 324,606,690 | | — | |

| Corporate Bonds | — | | 107,852,722 | | — | |

| U.S. Government Agency Securities | — | | 51,661,649 | | — | |

| Collateralized Mortgage Obligations | — | | 40,254,880 | | — | |

| Collateralized Loan Obligations | — | | 31,210,463 | | — | |

| Asset-Backed Securities | — | | 28,910,673 | | — | |

| Commercial Mortgage-Backed Securities | — | | 15,282,069 | | — | |

| Municipal Securities | — | | 901,044 | | — | |

| Short-Term Investments | $ | 23,844 | | 14,488,074 | | — | |

| $ | 23,844 | | $ | 615,168,264 | | — | |

| Other Financial Instruments | | | |

| Swap Agreements | — | | $ | 24,175,929 | | — | |

| | | |

| Liabilities | | | |

| Other Financial Instruments | | | |

| Futures Contracts | $ | 155,114 | | — | | — | |

| Swap Agreements | — | | $ | 2,232,251 | | — | |

| Forward Foreign Currency Exchange Contracts | — | | 9,443 | | — | |

| $ | 155,114 | | $ | 2,241,694 | | — | |

7. Derivative Instruments

Foreign Currency Risk — The fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The value of foreign investments held by a fund may be significantly affected by changes in foreign currency exchange rates. The dollar value of a foreign security generally decreases when the value of the dollar rises against the foreign currency in which the security is denominated and tends to increase when the value of the dollar declines against such foreign currency. A fund may enter into forward foreign currency exchange contracts to reduce a fund's exposure to foreign currency exchange rate fluctuations or to gain exposure to the fluctuations in the value of foreign currencies. The net U.S. dollar value of foreign currency underlying all contractual commitments held by a fund and the resulting unrealized appreciation or depreciation are determined daily. Realized gain or loss is recorded upon settlement of the contract. Net realized and unrealized gains or losses occurring during the holding period of forward foreign currency exchange contracts are a component of net realized gain (loss) on forward foreign currency exchange contract transactions and change in net unrealized appreciation (depreciation) on forward foreign currency exchange contracts, respectively. A fund bears the risk of an unfavorable change in the foreign currency exchange rate underlying the forward contract. Additionally, losses, up to the fair value, may arise if the counterparties do not perform under the contract terms. The fund's average U.S. dollar exposure to foreign currency risk derivative instruments held during the period was $4,626,217.

Interest Rate Risk — The fund is subject to interest rate risk in the normal course of pursuing its investment objectives. The value of bonds generally declines as interest rates rise. A fund may enter into futures contracts based on a bond index or a specific underlying security. A fund may purchase futures contracts to gain exposure to increases in market value or sell futures contracts to protect against a decline in market value. Upon entering into a futures contract, a fund will segregate cash, cash equivalents or other appropriate liquid securities on its records in amounts sufficient to meet requirements. Subsequent payments (variation margin) are made or received daily, in cash, by a fund. The variation margin is equal to the daily change in the contract value and is recorded as unrealized gains and losses. A fund recognizes a realized gain or loss when the futures contract is closed or expires. Net realized and unrealized gains or losses occurring during the holding period of futures contracts are a component of net realized gain (loss) on futures contract transactions and change in net unrealized appreciation (depreciation) on futures contracts, respectively. One of the risks of entering into futures contracts is the possibility that the change in value of the contract may not correlate with the changes in value of the underlying securities. The fund's average notional exposure to interest rate risk derivative instruments held during the period was $16,275,912 futures contracts purchased and $17,596,417 futures contracts sold.

Other Contracts — A fund may enter into total return swap agreements in order to attempt to obtain or preserve a particular return or spread at a lower cost than obtaining a return or spread through purchases and/or sales of instruments in other markets or gain exposure to certain markets in the most economical way possible. A fund will segregate cash, cash equivalents or other appropriate liquid securities on its records in amounts sufficient to meet requirements. Changes in value, including the periodic amounts of interest to be paid or received on swap agreements, are recorded as unrealized appreciation (depreciation) on swap agreements. Upon entering into a centrally cleared swap, a fund is required to deposit cash or securities (initial margin) with a financial intermediary in an amount equal to a certain percentage of the notional amount. Subsequent payments (variation margin) are made or received daily, in cash, by a fund. The variation margin is equal to the daily change in the value and is a component of unrealized gains and losses. Realized gain or loss is recorded upon receipt or payment of a periodic settlement or termination of swap agreements. Net realized and unrealized gains or losses occurring during the holding period of swap agreements are a component of net realized gain (loss) on swap agreement transactions and change in net unrealized appreciation (depreciation) on swap agreements, respectively. The risks of entering into swap agreements include the possible lack of liquidity, failure of the counterparty to meet its obligations, and that there may be unfavorable changes in the underlying investments or instruments, including inflationary risk. The fund's average notional amount held during the period was $286,654,167.

Value of Derivative Instruments as of December 31, 2022

| | | | | | | | | | | | | | |

| Asset Derivatives | Liability Derivatives |

| Type of Risk Exposure | Location on Statement of Assets and Liabilities | Value | Location on Statement of Assets and Liabilities | Value |

| Foreign Currency Risk | Unrealized appreciation on forward foreign currency exchange contracts | — | | Unrealized depreciation on forward foreign currency exchange contracts | $ | 9,443 | |

| Interest Rate Risk | Receivable for variation margin on futures contracts* | — | | Payable for variation margin on futures contracts* | 20,531 | |

| Other Contracts | Receivable for variation margin on swap agreements* | $ | 34,586 | | Payable for variation margin on swap agreements* | — | |

| Other Contracts | Swap agreements | 6,719,296 | | Swap agreements | 2,212,980 | |

| | $ | 6,753,882 | | | $ | 2,242,954 | |

*Included in the unrealized appreciation (depreciation) on futures contracts or centrally cleared swap agreements, as applicable, as reported in the Schedule of Investments.

Effect of Derivative Instruments on the Statement of Operations for the Year Ended December 31, 2022

| | | | | | | | | | | | | | |

| Net Realized Gain (Loss) | Change in Net Unrealized Appreciation (Depreciation) |

| Type of Risk Exposure | Location on Statement of Operations | Value | Location on Statement of Operations | Value |

| Foreign Currency Risk | Net realized gain (loss) on forward foreign currency exchange contract transactions | $ | 94,875 | | Change in net unrealized appreciation (depreciation) on forward foreign currency exchange contracts | $ | 56,914 | |

| Interest Rate Risk | Net realized gain (loss) on futures contract transactions | (2,333,770) | | Change in net unrealized appreciation (depreciation) on futures contracts | (20,366) | |

| Other Contracts | Net realized gain (loss) on swap agreement transactions | 5,323,788 | | Change in net unrealized appreciation (depreciation) on swap agreements | 3,042,730 | |

| | $ | 3,084,893 | | | $ | 3,079,278 | |

Counterparty Risk — The fund is subject to counterparty risk, or the risk that an institution will fail to perform its obligations to the fund. The investment advisor attempts to minimize counterparty risk prior to entering into transactions by performing extensive reviews of the creditworthiness of all potential counterparties. The fund may also enter into agreements that provide provisions for legally enforceable master netting arrangements to manage the credit risk between counterparties related to forward foreign currency exchange contracts and/or over-the-counter swap agreements. A master netting arrangement provides for the net settlement of multiple contracts with a single counterparty through a single payment in the event of default or termination of any one contract. To mitigate counterparty risk, the fund may receive assets or be required to pledge assets at the custodian bank or with a broker as designated under prescribed collateral provisions.

The fund does not offset assets and liabilities subject to master netting arrangements on the Statement of Assets and Liabilities for financial reporting purposes. The fund’s asset derivatives and liability derivatives that are subject to legally enforceable offsetting arrangements as of period end were as follows:

| | | | | | | | | | | | | | |

| Counterparty | Gross Amount

on Statement

of Assets

and Liabilities | Amount

Eligible

for Offset | Collateral | Net

Exposure* |

| Assets | | | | |

| Bank of America N.A. | $ | 1,694,485 | | — | | $ | (1,694,485) | | — | |

| Barclays Bank PLC | 714,539 | | $ | (714,539) | | — | | — | |

| Goldman Sachs & Co. | 4,310,272 | | — | | (4,290,000) | | $ | 20,272 | |

| $ | 6,719,296 | | $ | (714,539) | | $ | (5,984,485) | | $ | 20,272 | |

| | | | |

| Liabilities | | | | |

| Barclays Bank PLC | $ | 2,212,980 | | $ | (714,539) | | $ | (1,498,441) | | — | |

| Morgan Stanley | 9,443 | | — | | — | | $ | 9,443 | |

| $ | 2,222,423 | | $ | (714,539) | | $ | (1,498,441) | | $ | 9,443 | |

*The net exposure represents the amount receivable from the counterparty or amount payable to the counterparty in the event of default or termination.

8. Risk Factors