See notes to consolidated financial statements.

Cash payments for interest (net of amounts capitalized) were $nil for the years ended December 31, 2003, 2002 and 2001, respectively. Income taxes paid amounted to $2.7 million, $2.1 million and $0.8 million for the years ended December 31, 2003, 2002 and 2001, respectively.

Back to Contents

New Skies Satellites N.V. and subsidiaries

Notes to consolidated financial statements

Years ended December 31, 2003, 2002 and 2001

1. Description and formation of the business

Business description

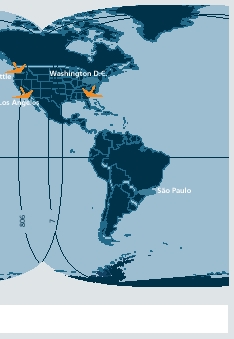

New Skies Satellites N.V. and subsidiaries (collectively the ‘company’) is an independent, global satellite communications company. The company owns and operates five satellites in geosynchronous orbit that provide capacity to various entities throughout the world for the global public telecommunications, broadcasting, Internet and corporate business network market sectors. During 2003, one of the satellites, the NSS-513 was retired and the NSS-6 satellite entered commercial service. A further satellite, the NSS-8, is currently under construction, with a projected launch date in the first quarter of 2005.

Formation and asset transfer

The company was formed on April 23, 1998 as a corporation organized under the laws of The Netherlands, with headquarters in The Hague, through the issuance of 90 million shares of common stock to International Telecommunications Satellite Organization (INTELSAT) for 9.0 million Dutch Guilders (or approximately $4.6 million) to carry on the satellite communication business associated with the satellites contributed by INTELSAT. The company and INTELSAT then entered into a subscription agreement (the ‘Subscription Agreement’). Under the Subscription Agreement dated November 30, 1998 INTELSAT received an additional 10 million of the company’s shares and in exchange, the company received certain assets including five in-orbit satellites and assumed certain liabilities (the ‘Asset Transfer’). Immediately after the Asset Transfer, INTELSAT distributed 90 percent of its shares in the company to its investment shareholders. Following distribution of these shares, INTELSAT held 10 percent of the stock through a passive, non-voting trust and no longer controlled the company. In February 2000, INTELSAT distributed the remaining shares to its investment shareholders.

At the Asset Transfer, the company and INTELSAT also entered into various other agreements including a space segment capacity, a satellite communications services and a transition services agreement. For the year ended December 31, 2001, $4.1 million of operating expenses were incurred under the terms of these agreements. In September 2001, the last of these agreements expired.

INTELSAT also procured from the company space segment capacity to fulfill the needs of certain INTELSAT contracts. During the year ended December 31, 2001 approximately 9 percent of the company’s revenues were derived from these service agreements. On January 16, 2002 INTELSAT assigned all of these remaining service agreements to the company.

2. Summary of significant accounting policies

The accompanying consolidated financial statements have been prepared following accounting principles generally accepted in the United States of America (‘U.S. GAAP’). Amounts are reported in thousands of U.S. dollars, unless indicated otherwise. Certain amounts reported in 2002 and 2001 have been reclassified to conform to the 2003 financial statement classification. The following are the significant accounting policies used by the company:

Principles of consolidation

The consolidated financial statements include the accounts of the company and its wholly owned domestic and foreign subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation.

Functional currency

Substantially all of the company’s revenues, capital expenditures and operating expenses are denominated in U.S. dollars. Accordingly, the U.S. dollar has been adopted as the functional currency. Transactions in other currencies are translated into the functional currency using rates that are in effect at the transaction date.

Foreign currency translation

The company’s reporting currency is the U.S. dollar. Assets and liabilities of foreign subsidiaries with a functional currency other than the U.S. dollar are translated into U.S. dollars at exchange rates prevailing at the balance sheet date. Revenues and costs relating to the operations of such subsidiaries are translated at average exchange rates during the period. Resulting translation adjustments are directly recorded in shareholders’ equity as a component of accumulated other comprehensive income (loss).

Use of estimates

The preparation of financial statements requires management to make estimates and assumptions that affect: (1) the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and (2) the reported amounts of expenses during the reporting period. Actual results could differ from those estimates.

Revenue recognition

Telecommunications revenues result from utilization charges that are recognized on a straight-line basis over the period during which the satellite services are provided. Deferred revenues represent the unearned balances remaining from amounts received from customers pursuant to prepayment options as set out in transponder service agreements. These amounts are recorded as revenues on a straight-line basis over the period during which these prepaid satellite services are provided.

Cash and cash equivalents

The company considers temporary investments with original maturities of three months or less when purchased to be cash equivalents.

Communications, plant and other property

Communications, plant and other property are carried at historical cost and consist primarily of the costs of spacecraft construction and launch, including capitalized performance payments, launch insurance premiums, capitalized interest, and costs directly associated with monitoring and support of spacecraft construction. Communication support and other equipment primarily relates to the company’s teleport and tracking, telemetry, command and control (TTC&M) infrastructure. Interest expense in the accompanying statements of operations is net of capitalized interest of $1.9 million, $1.6 million, and $1.4 million for the years ended December 31, 2003, 2002 and 2001, respectively.

| | | 31 |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

New Skies Satellites N.V. and subsidiaries

Notes to consolidated financial statements

Years ended December 31, 2003, 2002 and 2001

Upon commencement of commercial operation, communications, plant and other property are depreciated on a straight-line basis over the following estimated useful lives (see Note 3):

|

|

|

| | Years | |

|

|

|

| Spacecraft and launch costs | 12.5 - 14.0 | |

| Communication support and other | 3 - 7 | |

| Buildings | 30 | |

|

|

|

The company estimates the useful lives of the satellites based on a number of factors, and reviews these life expectancy estimates periodically taking into consideration each satellite’s actual in-orbit performance. The two most important factors are the length of time during which a satellite’s on-board propellant is projected to permit maneuvers to keep the satellite in geosynchronous orbit and the expected performance of satellite components. Reductions in the estimated useful lives of the satellites would result in additional depreciation expense in future periods.

Goodwill

As of January 1, 2002, the company adopted Statement of Financial Accounting Standards (SFAS) No. 142, Goodwill and Other Intangible Assets, which no longer requires the amortization of goodwill. Instead, SFAS No. 142 requires an evaluation of goodwill for impairment upon adoption of this Standard, as well as subsequent evaluations on an annual basis, and more frequently if circumstances indicate a possible impairment. This impairment test is comprised of two steps. The initial step is designed to identify potential goodwill impairment by comparing an estimate of the fair value of the applicable reporting unit to its carrying value, including goodwill. If the carrying value exceeds fair value, a second step is performed, which compares the implied fair value of the applicable reporting unit’s goodwill with the carrying amount of that goodwill, to measure the amount of goodwill impairment, if any.

The company’s goodwill resulted from the purchase of New Skies Networks Pty Limited. Upon adoption of SFAS No. 142, the company performed a transitional impairment test on its goodwill. As a result of this impairment test, the company recorded an impairment charge of $23.4 million, equivalent to the carrying amount of goodwill as of the date of the test, which is classified as a cumulative effect of a change in accounting principle in 2002.

The reconciliation of reported net income (loss) and earnings (loss) per share to adjusted net income (loss) and earnings (loss) per share for the years ended December 31, 2003, 2002 and 2001 was as follows (in thousands of U.S. dollars, except per share amounts):

|

|

|

|

|

|

|

| | 2003 | | 2002 | | 2001 | |

|

|

|

|

|

|

|

| Net income (loss), as reported | $ | 11,835 | | $ | (4,645 | ) | $ | 33,068 | |

| Add: goodwill amortization | | – | | | – | | | 2,760 | |

|

|

|

|

|

|

|

|

|

|

| Adjusted net income (loss) | $ | 11,835 | | $ | (4,645 | ) | $ | 35,828 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Basic and diluted earnings (loss) per share, as reported | $ | 0.10 | | $ | (0.04 | ) | $ | 0.25 | |

| Add: goodwill amortization | | – | | | – | | | 0.02 | |

|

|

|

|

|

|

|

|

|

|

| Adjusted basic and diluted earnings (loss) per share | $ | 0.10 | | $ | (0.04 | ) | $ | 0.27 | |

|

|

|

|

|

|

|

|

|

|

Upon adoption of SFAS No. 142, the transition provisions of SFAS No. 141, Business Combinations, also became applicable. These transition provisions specify criteria for determining whether an acquired intangible asset should be recognized separately from goodwill. The company did not have any intangible assets recognized separately from goodwill as of January 1, 2001 and did not purchase any intangible assets during the years ended December 31, 2003 and 2002.

Unsuccessful launches and satellite failures

In the event of an unsuccessful launch or total in-orbit satellite failure, all unamortized costs that are not recoverable under launch or in-orbit insurance are recorded as an operating expense.

Impairment of long-lived assets

The company’s long-lived assets, which are comprised primarily of its in-service satellite fleet, are tested for recoverability whenever events or changes in circumstances indicate that its carrying value may not be recoverable. Impairment can arise from complete failure or partial failure of the satellites as well as a change in expected cash flows. Such impairment tests are based on a comparison of estimated undiscounted future cash flows to the recorded value of the asset. If impairment is indicated, the asset value will be written down to fair value based upon discounted cash flows, using an appropriate discount rate.

Satellite performance incentives

The company has certain contracts with its satellite manufacturers that require the company to make incentive payments over the orbital design life of the satellites. The company records the present value of such payments as a liability and capitalizes these costs in the cost of the satellite.

Income taxes

The company accounts for income taxes under the provisions of SFAS No. 109, Accounting for Income Taxes. Under this method, deferred tax assets and liabilities are recognized for the future tax consequences of temporary differences between the carrying amounts and tax bases of assets and liabilities. Valuation allowances are provided against assets if it is more likely than not that they will not be realized.

| 32 | |

New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

Net earnings (loss) per share

Basic net earnings (loss) per share is computed by dividing net income (loss) by the weighted average ordinary shares outstanding. Diluted earnings (loss) per share reflects the potential dilution that could occur if options issued under New Skies stock option plans were exercised.

A summary of the weighted average number of shares and incremental shares used in the calculation of earnings (loss) per share for 2003, 2002 and 2001 follows:

|

|

|

|

|

| | Years ended December 31, | |

| | (in thousands) | |

|

|

|

|

|

| | 2003 | | 2002 | | 2001 | |

|

|

|

|

|

|

|

| Basic weighted average shares outstanding | 119,499 | | 130,342 | | 130,569 | |

| Weighted average incremental shares | 1,179 | | – | | 141 | |

|

|

|

|

|

|

|

| Adjusted weighted average shares outstanding | 120,678 | | 130,342 | | 130,710 | |

|

|

|

|

|

|

|

The difference in the weighted average number of shares outstanding and the adjusted weighted average number of shares outstanding resulted in no difference between basic and diluted earnings per share for 2003, 2002 and 2001.

For the purpose of calculating diluted earnings per share after cumulative effect of change in accounting principle in 2002, approximately 307,000 potentially dilutive common shares relating to outstanding stock options have been excluded from the calculation of adjusted weighted average shares outstanding as their inclusion would have had an anti-dilutive effect due to the net loss in that year.

Stock compensation

SFAS No. 123, Accounting for Stock-Based Compensation, encourages but does not require companies to record compensation cost for stock-based employee compensation plans at fair value. For periods through December 31, 2002 the company elected to account for stock-based compensation using the intrinsic value method prescribed in Accounting Principles Board (APB) Opinion No. 25, Accounting for Stock Issued to Employees, and related interpretations, and has adopted the disclosure-only provisions of SFAS No. 123. Accordingly, compensation cost for stock options was measured as the excess, if any, of the estimated fair market value of the company’s stock at the date of the grant over the amount an employee must pay to acquire the stock.

Effective January 1, 2003 the company adopted the fair value based method of recording stock options consistent with SFAS No. 123, Accounting for Stock-Based Compensation, for all employee stock options granted subsequent to fiscal year-end 2002, using the ‘prospective method’ with guidance provided from SFAS No. 148, Accounting for Stock-Based Compensation – Transition and Disclosure. All employee stock option grants made in fiscal 2003 and in future years will be expensed over the stock option vesting period based on the fair value of the stock option at the date of grant.

The following table presents the effects on net income (loss) and earnings (loss) per share had the company applied the fair value recognition provisions of SFAS No. 123 for all stock-based compensation awards:

|

|

|

| (in thousands of U.S. dollars, except earnings per share data) |

|

|

|

| | | 2003 | | | 2002 | | | 2001 | |

|

|

|

|

|

|

|

|

|

|

| Net income (loss), as reported | $ | 11,835 | | $ | (4,645 | ) | $ | 33,068 | |

| Add: Stock-based employee compensation expense | | | | | | | | | |

| included in reported net income, net of taxes: | | | | | | | | | |

| Executive incentive plan | | – | | | – | | | 324 | |

| Stock option plans | | 306 | | | 352 | | | 473 | |

| Incentive stock plan | | 1,222 | | | 428 | | | – | |

|

|

|

|

|

|

|

|

|

|

| | | 1,528 | | | 780 | | | 797 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Less: Total stock-based employee compensation expense determined | | | | | | | | | |

| under fair value based method for all awards, net of taxes | | | | | | | | | |

| Executive incentive plan | | – | | | – | | | (324 | ) |

| Stock option plans | | (3,770 | ) | | (4,781 | ) | | (5,170 | ) |

| Incentive stock plan | | (1,222 | ) | | (428 | ) | | – | |

|

|

|

|

|

|

|

|

|

|

| | | (4,992 | ) | | (5,209 | ) | | (5,494 | ) |

|

|

|

|

|

|

|

|

|

|

| Pro forma net income (loss) | $ | 8,371 | | $ | (9,074 | ) | $ | 28,371 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Basic and diluted earnings per share: | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

| As reported | $ | 0.10 | | $ | (0.04 | ) | $ | 0.25 | |

| Pro forma | | 0.07 | | | (0.07 | ) | | 0.22 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| 33 |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

New Skies Satellites N.V. and subsidiaries

Notes to consolidated financial statements

Years ended December 31, 2003, 2002 and 2001

The weighted average fair value of stock options granted during 2003, 2002 and 2001 was $1.97, $2.01 and $3.14, respectively.

The company estimated the fair value of stock options using the Black Scholes option-pricing model with the following assumptions:

|

|

|

|

|

|

|

| | 2003 | | 2002 | | 2001 | |

|

|

|

|

|

|

|

| Expected life | 5 years | | 5 years | | 5 years | |

| Interest rate | 3% | | 3.75% | | 4.5% | |

| Volatility | 40% | | 40% | | 30% | |

| Assumed forfeitures | 10% | | 10% | | 10% | |

|

|

|

|

|

|

|

Fair value of financial instruments

The company’s financial instruments consist of accounts receivable, accounts payable, and satellite performance incentives. The current carrying amounts of such instruments are considered reasonable estimates of the fair market value of these instruments due to the short maturity of these items or as a result of the current market interest rates accruing on these instruments.

Comprehensive income (loss)

Comprehensive income (loss) includes net income (loss) and translation adjustments that were recognized directly in equity. Translation adjustments of $3.1 million, $4.8 million and $(2.4) million for the years ended December 31, 2003, 2002 and 2001, respectively, were incurred and consequently comprehensive income in these years is equal to $14.9 million, $0.2 million and $30.6 million, respectively.

Recently issued accounting standards

In January 2003, the Financial Accounting Standards Board (FASB) issued Interpretation No. (FIN) 46, Consolidation of Variable Interest Entities an interpretation of ARB No. 51. FIN 46 requires the consolidation of a variable interest entity (VIE) where an equity investor achieves a controlling financial interest through arrangements other than voting interests, and it is determined that the investor will absorb a majority of the expected losses and/or receive the majority of residual returns of the VIE. In October 2003, the FASB deferred the effective date for the consolidation of VIEs created prior to February 1, 2003 to December 31, 2003 for calendar year-end companies, with earlier application encouraged. The company adopted FIN 46 as of its original effective date of July 1, 2003 for entities created prior to February 1, 2003. The adoption of FIN 46 did not have a material impact on the consolidated financial statements.

In April 2003, the FASB issued SFAS No. 149, Amendment of Statement 133 on Derivative Instruments and Hedging Activities. SFAS No. 149 amends and clarifies the accounting for derivative instruments, including certain derivative instruments embedded in other contracts, and for hedging activities under SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities. SFAS No. 149 is generally effective for contracts entered into or modified after June 30, 2003 and for hedging relationships designated after June 30, 2003. The adoption of SFAS No. 149 did not have a material impact on the consolidated financial statements.

In May 2003, the FASB issued SFAS No. 150, Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity. SFAS No. 150 establishes standards for how an issuer classifies and measures certain financial instruments with characteristics of both liabilities and equity. SFAS No. 150 requires that certain financial instruments be classified as liabilities that were previously considered equity. The adoption of SFAS No. 150 did not have a material impact on the consolidated financial statements.

3. Communications, plant and other property

Communications, plant and other property consisted of the following (in thousands of U.S. dollars):

|

|

|

| | December 31, | |

|

|

|

| | 2003 | | 2002 | |

|

|

|

|

|

| Spacecraft and launch costs | $ | 1,213,712 | | $ | 1,002,083 | |

| Construction-in-progress | | 174,551 | | | 395,976 | |

| Communication support and other | | 79,960 | | | 71,547 | |

| Buildings | | 24,581 | | | 23,736 | |

|

|

|

|

|

|

|

| | | 1,492,804 | | | 1,493,342 | |

| Less: accumulated depreciation | | 466,224 | | | 435,223 | |

|

|

|

|

|

|

|

| Total | $ | 1,026,580 | | $ | 1,058,119 | |

|

|

|

|

|

|

|

During 2003 one satellite, the NSS-513, was retired and another, the NSS-6, entered commercial service. The NSS-513 was fully depreciated at the date it was retired. Consequently, this resulted in a decrease in both the cost basis of assets and accumulated depreciation by $69.8 million.

Construction-in-progress relates primarily to satellites under construction and related launch services.

Upon acceptance of a spacecraft from a satellite manufacturer, the net present value of performance incentive payments is recorded as a part of the historical cost of the satellite. In 2003, for the NSS-6 satellite and in 2002, for the NSS-7 satellite, $21.9 million and $20.5 million, respectively, were capitalized in respect of these amounts.

| 34 | |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

| 4. | Contractual commitments |

| In further development and operation of the company’s global commercial communications satellite system, significant additional expenditures are anticipated. At December 31, 2003, the company had a contract for the construction, development and launch of the NSS-8 satellite with future committed payments on this program totaling $35.4 million and $11.4 million for each of the years ending December 31, 2004 and 2005, respectively. Additional commitments (‘satellite incentives’) totaling $18.1 million will also fall due over the design life of this satellite to the extent that the satellite operates successfully throughout that time. |

The company has recorded a liability of $9.7 million at December 31, 2003 representing the present value, at a weighted average discount rate of 6.5%, for incentive payments on the NSS-5, NSS-703 and NSS-806 satellites which were in service at December 31, 2003. Incentive payments of $3.6 million, $3.2 million, $1.4 million, $1.4 million, $0.9 million and $0.9 million are due in the years ending December 31, 2004, 2005, 2006, 2007, 2008, and 2009 and thereafter, respectively.

The company has recorded an additional liability of $38.5 million at December 31, 2003 representing incentive payments, before interest, on the NSS-6 and NSS-7 satellites requiring payments of $3.5 million in each of the five years ending December 31, 2008 and $21.0 million in the years thereafter. A variable interest charge equivalent to LIBOR plus 1% on the outstanding principal will also be incurred on these payments.

Other commitments as of December 31, 2003, primarily relating to telecommunication infrastructure and office facilities, are as follows:

|

|

| (in thousands of U.S. dollars) | |

|

|

|

|

| 2004 | $ | 19,772 | |

| 2005 | | 4,075 | |

| 2006 | | 3,101 | |

| 2007 | | 1,917 | |

| 2008 | | 1,170 | |

| 2009 and thereafter | | 1,840 | |

|

|

|

|

| Total commitments | $ | 31,875 | |

|

|

|

|

Rental expenses under operating leases were $1.2 million, $1.3 million and $1.2 million for the years ended December 31, 2003, 2002 and 2001, respectively.

| 5. | Income taxes |

| The company is in negotiations with the Dutch tax authorities to determine the fair value (tax basis) of the assets contributed by INTELSAT. While the final determination of the tax basis of these assets has not been agreed, we have made a preliminary valuation of these assets. The difference between the book and estimated tax bases of the contributed assets gives rise to a deferred tax asset, which approximated $15.6 million at December 1, 1998, the date of the Asset Transfer. To the extent that the final tax value of the contributed assets differs from this estimate, a corresponding adjustment will be made to the deferred tax asset and additional paid-in capital. |

The company’s provision for income taxes consists of the following:

|

|

|

|

| | | (in thousands of U.S. dollars) | |

|

|

|

|

|

|

|

|

|

|

| | | 2003 | | | 2002 | | | 2001 | |

|

|

|

|

|

|

|

|

|

|

| Current domestic | $ | 4,062 | | $ | 7,270 | | $ | 16,032 | |

| Current foreign | | 1,656 | | | 1,816 | | | 1,950 | |

| Deferred domestic | | 643 | | | 1,120 | | | 1,164 | |

| Deferred foreign | | 296 | | | 300 | | | 218 | |

|

|

|

|

|

|

|

|

|

|

| Total income tax provision | $ | 6,657 | | $ | 10,506 | | $ | 19,364 | |

|

|

|

|

|

|

|

|

|

|

The income tax provision is computed in the financial statements at 36.0%, 35.9% and 36.9% for the years ended December 31, 2003, 2002 and 2001, respectively, as compared with the Netherlands statutory rate of 34.5% for 2003 and 2002 and 35% for 2001. The company’s provision for income taxes differs from the statutory rate by 1.5%, 1.4% and 1.9% for 2003, 2002 and 2001, respectively, due to the permanent differences arising from certain non-deductible amounts.

Deferred income tax assets as of December 31, 2003 and 2002, arise from the tax effect of the difference in the tax and book basis of communications, plant and other property of $8.7 million and $10.1 million, respectively, and from timing differences arising from stock compensation of $0.7 million and $0.2 million, respectively. Management believes that it is more likely than not that the results of future operations will generate sufficient taxable income to realize the deferred tax assets.

In addition, the tax effect of the difference in the tax and book basis of communications, plant and other property has also resulted in certain deferred income tax liabilities as of December 31, 2003 and 2002 totaling $0.8 million and $0.6 million, respectively and, in respect of deferred financing fees of $0.2 million and $0.3 million, respectively.

| | | 35 |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

New Skies Satellites N.V. and subsidiaries

Notes to consolidated financial statements

Years ended December 31, 2003, 2002 and 2001

| 6. | Financing arrangements |

| Available credit facility |

| In August 2000, the company negotiated an unsecured credit facility providing up to $300 million in available credit through December 31, 2003, $200 million through June 30, 2004 and $100 million through December 31, 2004. At December 31, 2004 any outstanding borrowings on the facility must be repaid in full. Borrowings under the facility bear interest at an adjustable rate based on LIBOR for the associated period of draw-down plus an applicable margin. |

At December 31, 2003, a one-month draw-down under the facility would bear interest at 1.6% per annum. In addition, a commitment fee of 0.225% is paid on the unused revolving credit amount. At December 31, 2003 there were no amounts outstanding under this facility.

| 7. | Share capital |

| The Shareholders have authorized the issuance of up to 227,530,000 governance preference shares at a par value of €0.05 per share. The Shareholders also approved an option right to an independent foundation (the ‘Foundation’) to purchase governance preference shares. Under this option, if certain preconditions are satisfied, the Foundation may acquire up to the number of then outstanding ordinary and financing preference shares at the time of the purchase, less one. The shares will be issued at par upon a payment of 25% of the par value. The object of the Foundation is to own and vote the company’s preference shares in order to protect the interests of the company and its ordinary shareholders. No governance preference shares have been issued. |

In October 2002, the Supervisory Board authorized the purchase of up to 10% of then outstanding shares, or approximately 13 million ordinary shares. The company repurchased 5,194,030 ordinary shares in 2002 and a further 7,862,994 shares in 2003, completing the buyback program in September 2003 at an average cost per share of $4.14. On November 3, 2003 all of the 12,951,921 treasury shares held were retired.

| 8. | Significant customers |

| Certain shareholders are the principal customers of the company. These shareholders who own in aggregate 35% of the company’s shares at December 31, 2003 accounted for approximately 49%, 54% and 49% of total revenues for years ended December 31, 2003, 2002 and 2001, respectively. |

The company has one customer who is also a shareholder in 2003 representing more than 10% of revenues. This significant customer represented 15%, 19% and 15% of total revenues for the years ended December 31, 2003, 2002 and 2001, respectively.

| 9. | Retirement and incentive plans |

Defined contribution pension plan |

| The company has defined contribution plans for substantially all company employees. The company matches a portion of the employee contribution. Total compensation expense related to the defined contribution plans approximated $1.1 million for each of the years ended December 31, 2003, 2002 and 2001, respectively. |

Stock-based compensation

| Executive incentive plan |

| In 1998, the company executed a long-term incentive plan (the ‘Executive Plan’) with the former chief executive officer. The total compensation awarded in relation to the Executive Plan was $2.3 million. The company recognized $1.1 million of compensation expense for the year ended December 31, 2001 under the Executive Plan. |

| |

| Stock option plans |

| The Supervisory Board of Directors adopted the 1999 Stock Option Plan as amended (‘Stock Plan’) effective January 1, 1999. The Supervisory Board can administer the Stock Plan itself or through a committee of the Supervisory Board or can appoint a foundation to administer the plan. At no time can the number of options issued under the Stock Plan exceed 10% of the issued common stock of the company unless the Board amends the Stock Plan. All grants under the plan, including option grants and incentive stock plan grants, are subject to an aggregate limitation, which was increased in 2002 to a total of 13,057,024 ordinary shares reflecting 10% of the issued ordinary shares as of the date of the amendment. As of December 31, 2003, the total number of shares available for grant was 5,302,877. |

The Board utilized independent valuations performed by KPMG Corporate Finance in establishing the estimated fair value of the common shares underlying each of the options that have been granted under the Stock Plan in the period prior to the company’s Initial Public Offering (IPO) in 2000. Options granted subsequent to the IPO were based on the fair market value at the date of grant. The options have a maximum term of 10 years. All options vest in three equal, annual installments.

The terms of the stock option plan for the Supervisory Board (the ‘Directors Plan’) are similar to those of the 1999 Stock Option Plan. The options have a term of ten years and vest ratably in three equal, annual installments. At the annual meeting of shareholders in the years 2003, 2002 and 2001, the Shareholders approved grants to members of the Supervisory Board of options to acquire 63,433, 46,450 and 89,659 shares, respectively.

| 36 |  | |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

The following table presents a summary of the company’s share option activity and related information for the years ended December 31, 2003, 2002 and 2001:

|

|

|

|

|

| | | | Weighted | |

| Options | average |

| outstanding | exercise price |

|

|

|

|

|

| Outstanding, January 1, 2001 | 3,541,040 | | $ | 8.45 | |

| | | | | | |

| Granted | 1,534,849 | | | 9.02 | |

| Exercised | (8,905 | ) | | 7.50 | |

| Forfeited | (162,682 | ) | | 9.14 | |

|

|

|

|

|

|

| Outstanding, December 31, 2001 | 4,904,302 | | | 8.61 | |

|

|

|

|

|

|

| | | | | | |

| Granted | 2,525,847 | | | 4.95 | |

| Exercised | – | | | – | |

| Forfeited | (519,520 | ) | | 7.77 | |

|

|

|

|

|

|

| Outstanding, December 31, 2002 | 6,910,629 | | | 7.35 | |

|

|

|

|

|

|

| | | | | | |

| Granted | 742,848 | | | 4.99 | |

| Exercised | (71,332 | ) | | 4.96 | |

| Forfeited | (1,094,532 | ) | | 7.99 | |

|

|

|

|

|

|

| Outstanding, December 31, 2003 | 6,487,613 | | $ | 6.98 | |

|

|

|

|

|

|

Additional information regarding options outstanding at December 31, 2003 is as follows:

|

|

|

|

|

|

|

| | | Options outstanding | | | Exercisable options | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | Weighted average | | | | | | | |

| Range of | remaining |

| exercise prices | Number | contractual life | Number | Weighted average |

| per share | outstanding | (years) | exercisable | exercise price |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| | $ 3.50 - 5.00 | | | 2,491,168 | | | 8.4 | | | | 654,402 | | | $ | 4.92 | |

| | 5.01 - 6.50 | | | 274,210 | | | 9.3 | | | | 18,386 | | | | 5.67 | |

| | 6.51 - 8.00 | | | 2,033,389 | | | 5.3 | | | | 1,997,409 | | | | 7.49 | |

| | 8.01 - 9.50 | | | 1,130,836 | | | 6.9 | | | | 804,534 | | | | 9.21 | |

| | 9.51 - 11.00 | | | 558,010 | | | 6.3 | | | | 526,143 | | | | 10.83 | |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| | | | | | 6,487,613 | | | 7.0 | | | | 4,000,874 | | | $ | 7.85 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For periods up to and including December 31, 2002 the company recorded compensation related to stock options using the intrinsic value method prescribed by APB No. 25, Accounting for Stock Issued to Employees, and related interpretations.

Effective January 1, 2003 the company adopted SFAS No. 123, Accounting for Stock-Based Compensation, for all employee stock option grants issued subsequent to December 31, 2002 using the ‘prospective method’ with guidance provided from SFAS No. 148, Accounting for Stock-Based Compensation – Transition and Disclosure. SFAS No. 123 defines the fair value method of accounting for stock-based compensation awards to employees and non-employees and requires that the fair value of stock-based awards be calculated through the use of an option pricing model.

The company recognized $0.3 million, $0.4 million and $0.5 million of compensation expense for the years ended December 31, 2003, 2002 and 2001, respectively under the stock option plans.

| Incentive stock plan |

| In 2003 and 2002, the members of the Management Board and certain other employees received rights to acquire an aggregate of 653,765 and 233,736 ordinary shares, respectively. These rights are similar to restricted stock grants which entitle (and require) the individual to purchase the shares specified in the grant at a price per share equal to the nominal value (€0.05). The purchase of shares under each grant is to be settled in three equal installments within 30 days of the designated settlement dates, which generally are the first, second and third anniversary of the date of grant. The grants are governed by a plan administered by the Supervisory Board. At the date of grant, the weighted average fair value of awards made in 2003 and 2002 was $4.80 and $5.34 per share, respectively. |

| | | 37 |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

New Skies Satellites N.V. and subsidiaries

Notes to consolidated financial statements

Years ended December 31, 2003, 2002 and 2001

Under the plan the size of a grant to an eligible recipient is determined at the discretion of the plan administrator. All grants under the plan along with grants under the stock option plans, are subject to the aggregate limitation of 13,057,024 ordinary shares previously described. Grants may be extinguished under certain limited circumstances if the individual recipient ceases to be an employee of the company.

In 2003 and 2002, the Shareholders also approved grants to the members of the Supervisory Board of rights to acquire an aggregate of 25,373 and 18,583 ordinary shares, respectively, with similar entitlements and obligations as rights granted to the Management Board and other employees described above. At the date of grant, the weighted average fair value of these awards was $6.03 and $5.49 per share, respectively.

The company recognized $1.9 million and $0.7 million of compensation expense for the years ended December 31, 2003 and 2002, respectively under the Incentive Stock Plan.

| 10. | Business segments and geographic information |

| The company monitors its operations as a single enterprise and therefore believes that it has one operating segment, which is telecommunication satellite services. |

The geographic source of revenues, based on the billing addresses of customers, for the three years ended December 31, 2003 is as follows:

|

|

|

|

|

| | (in thousands of U.S. dollars) | |

|

|

|

|

|

| | | 2003 | | | 2002 | | | 2001 | |

|

|

|

|

|

|

|

|

|

|

| North America | $ | 76,426 | | $ | 74,861 | | $ | 72,043 | |

| Europe (including Commonwealth of Independent States) | | 47,910 | | | 48,847 | | | 56,086 | |

| India, Middle East and Africa | | 45,282 | | | 36,170 | | | 28,899 | |

| Latin America | | 27,929 | | | 24,577 | | | 34,094 | |

| Asia Pacific | | 17,353 | | | 16,069 | | | 17,906 | |

|

|

|

|

|

|

|

|

|

|

| Total | $ | 214,900 | | $ | 200,524 | | $ | 209,028 | |

|

|

|

|

|

|

|

|

|

|

The company’s satellites that represent over 90 percent of the cost of communications, plant and other property are in geosynchronous orbit and consequently are not attributable to any geographic location. Of the remaining assets, the majority are located in Europe.

| 38 | | |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

Introduction to statutory financial statements

In accordance with the requirements of Part 9, Book 2 of the Netherlands Civil Code, the company’s Statutory financial statements consist of the company standalone financial statements of New Skies Satellites N.V. and its consolidated financial statements (as presented in pages 26 through 38). In this section, both the company standalone financial statements and the additional footnote disclosures that are required for the consolidated financial statements by Part 9, Book 2 of the Netherlands Civil Code, are included. These additional footnote disclosures relate to:

| • | movements in communications, plant and other property; |

| | |

| • | movements in, and a listing of, participations in group companies; |

| | |

| • | personnel and remuneration information; and |

| | |

| • | significant provisions from the Articles of Association. |

The Statutory financial statements are prepared in accordance with the accounting policies set out in Note 2 to the consolidated financial statements with the exception of the accounting for goodwill. Under Dutch GAAP, goodwill is amortized within the consolidated and standalone accounts on a straight-line basis over a period of 10 years. Under U.S. GAAP goodwill is no longer amortized but tested annually for impairment. Dutch GAAP therefore differs from U.S. GAAP for goodwill treatment. On January 1, 2002 goodwill was tested for impairment and fully written off under Dutch GAAP. In all other respects, there are no other reconciling differences between Dutch and U.S. GAAP and therefore net income and shareholders’ equity are consistent under both sets of accounting principles.

The company standalone financial statements should be read in conjunction with the Notes to the Consolidated Financial Statements, however, it should be noted that certain information reflected therein should not be read in conjunction with the company standalone financial statements because it reflects information on a consolidated basis. The information that is not applicable is as follows:

| • | Note 4. ‘Contractual Commitments’; |

| | |

| • | Note 5. ‘Income Taxes’; |

| | |

| • | Note 8. ‘Significant Customers’; |

| | |

| • | ‘Defined Contribution Plan’ section and Statement of Financial Accounting Standards No.123, Accounting for Stock-Based Compensation disclosure within the section ‘Stock Option Plans’ in Note 9. ‘Retirement and Incentive Plans’; and |

| | |

| • | Note 10. ‘Business Segments and Geographic Information’. |

| | | 39 |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

New Skies Satellites N.V.

Consolidated and company balance sheets

(in thousands of U.S. dollars, except share data)

|

|

|

|

|

| | December 31, 2003 | | December 31, 2002 | |

|

|

|

|

|

| | | | New Skies | | | | New Skies | |

| | Satellites N.V. | | Satellites N.V. |

| New Skies | and | New Skies | and |

| Satellites N.V. | Subsidiaries | Satellites N.V. | Subsidiaries |

|

|

|

|

|

|

|

|

|

| | | | | | | | | |

| Assets | | | | | | | | | | | | |

| Fixed assets | | | | | | | | | | | | |

| Tangible fixed assets | | | | | | | | | | | | |

| Communications, plant and other property, net (Note 2) | $ | 991,419 | | $ | 1,026,580 | | $ | 1,021,143 | | $ | 1,058,119 | |

| | | | | | | | | | | | | |

| Financial fixed assets | | | | | | | | | | | | |

| Participations in group companies (Note 3) | | 20,910 | | | – | | | 13,377 | | | – | |

| Deferred tax assets | | 8,542 | | | 8,748 | | | 9,836 | | | 10,087 | |

| Other assets | | 585 | | | 603 | | | 1,103 | | | 1,226 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total fixed assets | | 1,021,456 | | | 1,035,931 | | | 1,045,459 | | | 1,069,432 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

| Current assets | | | | | | | | | | | | |

| Receivables | | | | | | | | | | | | |

| Trade receivables | | 38,413 | | | 41,870 | | | 37,759 | | | 39,109 | |

| Amounts due from participating interests | | 13,918 | | | – | | | 24,105 | | | – | |

| Prepaid expenses and other assets | | 13,129 | | | 14,782 | | | 9,644 | | | 11,111 | |

| Cash and cash equivalents | | 19,545 | | | 23,253 | | | 2,892 | | | 8,329 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets | | 85,005 | | | 79,905 | | | 74,400 | | | 58,549 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Assets | $ | 1,106,461 | | $ | 1,115,836 | | $ | 1,119,859 | | $ | 1,127,981 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | |

| Equity and Liabilities | | | | | | | | | | | | |

| Shareholders’ equity | | | | | | | | | | | | |

| Governance preference shares (227,530,000 shares authorized, | | | | | | | | | | | | |

| par value €0.05; none issued) | $ | – | | $ | – | | $ | – | | $ | – | |

| Cumulative preferred financing shares (22,753,000 | | | | | | | | | | | | |

| shares authorized, par value €0.05; none issued) | | – | | | – | | | – | | | – | |

| Ordinary Shares (204,777,000 shares authorized, par value | | | | | | | | | | | | |

| €0.05; 117,668,652 and 130,570,241 issued, respectively) | | 5,431 | | | 5,431 | | | 6,026 | | | 6,026 | |

| Additional paid-in capital | | 926,109 | | | 926,109 | | | 977,506 | | | 977,506 | |

| Retained earnings | | 67,854 | | | 67,854 | | | 56,019 | | | 56,019 | |

| Unearned compensation | | (179 | ) | | (179 | ) | | (685 | ) | | (685 | ) |

| Accumulated other comprehensive income (loss) | | 2,575 | | | 2,575 | | | (492 | ) | | (492 | ) |

| Treasury stock, at cost (5,194,030 ordinary shares) | | – | | | – | | | (19,341 | ) | | (19,341 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total shareholders’ equity | | 1,001,790 | | | 1,001,790 | | | 1,019,033 | | | 1,019,033 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term liabilities | | | | | | | | | | | | |

| Satellite performance incentives | | 41,727 | | | 41,727 | | | 27,639 | | | 27,639 | |

| Deferred revenues and other liabilities | | 7,888 | | | 7,888 | | | 8,351 | | | 8,351 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total long-term liabilities | | 49,615 | | | 49,615 | | | 35,990 | | | 35,990 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities | | | | | | | | | | | | |

| Short-term debt | | – | | | – | | | 10,000 | | | 10,000 | |

| Satellite performance incentives | | 6,429 | | | 6,429 | | | 6,218 | | | 6,218 | |

| Deferred revenues and other liabilities | | 6,014 | | | 8,138 | | | 8,043 | | | 8,994 | |

| Accounts payable and accrued liabilities | | 11,460 | | | 17,518 | | | 12,931 | | | 18,396 | |

| Income taxes payable | | 31,153 | | | 32,346 | | | 27,644 | | | 29,350 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities | | 55,056 | | | 64,431 | | | 64,836 | | | 72,958 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities | | 104,671 | | | 114,046 | | | 100,826 | | | 108,948 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Equity and Liabilities | $ | 1,106,461 | | $ | 1,115,836 | | $ | 1,119,859 | | $ | 1,127,981 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

| See notes to company standalone financial statements. | |

| | | | | | | | | | | | | |

| 40 | | |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

New Skies Satellites N.V.

Consolidated and company statements of operations

(in thousands of U.S. dollars)

|

|

|

|

|

| | Year ended | | Year ended | |

| December 31, 2003 | December 31, 2002 |

|

|

|

|

|

| | | | New Skies | | | | New Skies | |

| | Satellites N.V. | | Satellites N.V. |

New Skies | and | New Skies | and |

Satellites N.V. | Subsidiaries | Satellites N.V. | Subsidiaries |

|

|

|

|

|

|

|

|

|

| | | | | | | | | |

| Revenues | $ | 205,595 | | $ | 214,900 | | $ | 194,483 | | $ | 200,524 | |

| Operating expenses: | | | | | | | | | | | | |

| Cost of operations | | 53,910 | | | 53,219 | | | 52,471 | | | 50,714 | |

| Selling, general and administrative | | 46,628 | | | 42,063 | | | 46,439 | | | 39,490 | |

| Depreciation | | 92,309 | | | 99,899 | | | 73,759 | | | 80,574 | |

|

|

|

|

|

|

|

|

|

| Total operating expenses | | 192,847 | | | 195,181 | | | 172,669 | | | 170,778 | |

|

|

|

|

|

|

|

|

|

| Goodwill impairment | | – | | | – | | | (23,375 | ) | | (23,375 | ) |

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

| Operating income (loss) | | 12,748 | | | 19,719 | | | (1,561 | ) | | 6,371 | |

| Interest expense and other, net | | 1,227 | | | 1,227 | | | 329 | | | 510 | |

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

| Income before income tax expense | | 11,521 | | | 18,492 | | | (1,890 | ) | | 5,861 | |

| Income tax expense (Note 5) | | 4,152 | | | 6,657 | | | 8,299 | | | 10,506 | |

| Equity in income of subsidiaries | | 4,466 | | | – | | | 5,544 | | | – | |

|

|

|

|

|

|

|

|

|

| Net income (loss) | $ | 11,835 | | $ | 11,835 | | $ | (4,645 | ) | $ | (4,645 | ) |

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

| See notes to company standalone financial statements. | | | | | | | | | | | | |

| | | 41 |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

New Skies Satellites N.V.

Notes to statutory financial statements

Years ended December 31, 2003 and 2002

1. Summary of significant accounting policies

Significant accounting policies

The accounting policies used in the preparation of the company Financial Statements are the same as those used in the preparation of the Consolidated Financial Statements. Please refer to the Notes to the Consolidated Financial Statements. In addition to those accounting policies, the following accounting policies for the company Financial Statements are described below.

Presentation of amounts

The accompanying financial statements include the company and consolidated accounts of New Skies Satellites N.V. The company follows accounting policies that conform with those generally accepted in the United States of America (‘U.S. GAAP’) and in the Netherlands (‘Dutch GAAP’). The company believes that its application of GAAP is in accordance with accounting principles generally accepted in The Netherlands and that these financial statements are in accordance with the legal requirements for the financial statements as included in Part 9, Book 2 of The Netherlands Civil Code.

Participations in group companies

Investments in subsidiaries are valued using the equity method of accounting.

Presentation

Certain amounts reported in 2002 have been reclassified to conform to the 2003 financial statement classification.

2. Changes in communications, plant and other property

Changes in communications, plant and other property assets for New Skies Satellites N.V. on a stand alone and consolidated basis were as follows:

| New Skies Satellites N.V. | | | | | | | | |

|

|

|

|

|

|

|

|

|

| | | | | | | | (in thousands of U.S. dollars) | |

|

|

|

|

|

|

|

|

|

| Historical Cost | Spacecraft and launch costs | | Construction in-progress | | Communication support and other | | Buildings | | Total | |

|

|

|

|

|

|

|

|

|

|

|

| Balance, January 1, 2003 | $ | 1,002,083 | | $ | 395,976 | | $ | 33,436 | | $ | 12,079 | | $ | 1,443,574 | |

| | | | | | | | | | | | | | | | |

| Additions | | 23,994 | | | 36,013 | | | 2,006 | | | 572 | | | 62,585 | |

| Re-classifications | | 257,438 | | | (257,438 | ) | | – | | | – | | | – | |

| Retirements | | (69,803 | ) | | – | | | – | | | – | | | (69,803 | ) |

|

|

|

|

|

|

|

|

|

|

|

| Balance, December 31, 2003 | $ | 1,213,712 | | $ | 174,551 | | $ | 35,442 | | $ | 12,651 | | $ | 1,436,356 | |

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | | | |

| Accumulated Depreciation | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

| Balance, January 1, 2003 | $ | 408,896 | | $ | – | | $ | 11,979 | | $ | 1,556 | | $ | 422,431 | |

| | | | | | | | | | | | | | | | |

| Additions | | 87,134 | | | – | | | 4,613 | | | 562 | | | 92,309 | |

| Retirements | | (69,803 | ) | | – | | | – | | | – | | | (69,803 | ) |

|

|

|

|

|

|

|

|

|

|

|

| Balance, December 31, 2003 | $ | 426,227 | | $ | – | | $ | 16,592 | | $ | 2,118 | | $ | 444,937 | |

|

|

|

|

|

|

|

|

|

|

|

| Net book value, December 31, 2003 | $ | 787,485 | | $ | 174,551 | | $ | 18,850 | | $ | 10,533 | | $ | 991,419 | |

|

|

|

|

|

|

|

|

|

|

|

| Net book value, December 31, 2002 | $ | 593,187 | | $ | 395,976 | | $ | 21,457 | | $ | 10,523 | | $ | 1,021,143 | |

|

|

|

|

|

|

|

|

|

|

|

| 42 | | |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

| New Skies Satellites N.V. and subsidiaries | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | (in thousands of U.S. dollars) | |

|

|

|

|

|

|

|

|

|

| Historical Cost | Spacecraft and launch costs | | Construction in-progress | | Communication support and other | | Buildings | | Total | |

|

|

|

|

|

|

|

|

|

|

|

| Balance, January 1, 2003 | $ | 1,002,083 | | $ | 395,976 | | $ | 71,547 | | $ | 23,736 | | $ | 1,493,342 | |

| | | | | | | | | | | | | | | | |

| Additions | | 23,994 | | | 36,013 | | | 3,706 | | | 1,664 | | | 65,377 | |

| Re-classifications | | 257,438 | | | (257,438 | ) | | – | | | – | | | – | |

| Retirements | | (69,803 | ) | | – | | | – | | | (819 | ) | | (70,622 | ) |

| Cumulative translation adjustments | | – | | | – | | | 4,707 | | | – | | | 4,707 | |

|

|

|

|

|

|

|

|

|

|

|

| Balance, December 31, 2003 | $ | 1,213,712 | | $ | 174,551 | | $ | 79,960 | | $ | 24,581 | | $ | 1,492,804 | |

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | | | |

| Accumulated Depreciation | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

| Balance, January 1, 2003 | $ | 408,896 | | $ | – | | $ | 23,341 | | $ | 2,986 | | $ | 435,223 | |

| | | | | | | | | | | | | | | | |

| Additions | | 87,134 | | | – | | | 11,462 | | | 1,303 | | | 99,899 | |

| Retirements | | (69,803 | ) | | – | | | – | | | (819 | ) | | (70,622 | ) |

| Cumulative translation adjustments | | – | | | – | | | 1,724 | | | – | | | 1,724 | |

|

|

|

|

|

|

|

|

|

|

|

| Balance, December 31, 2003 | $ | 426,227 | | | – | | $ | 36,527 | | $ | 3,470 | | $ | 466,224 | |

|

|

|

|

|

|

|

|

|

|

|

| Net Book Value, December 31, 2003 | $ | 787,485 | | $ | 174,551 | | $ | 43,433 | | $ | 21,111 | | $ | 1,026,580 | |

|

|

|

|

|

|

|

|

|

|

|

| Net Book Value, December 31, 2002 | $ | 593,187 | | $ | 395,976 | | $ | 48,206 | | $ | 20,750 | | $ | 1,058,119 | |

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | | | |

| 3. Participations in group companies | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | (in thousands of U.S. dollars) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | 2003 | | | 2002 | |

|

|

|

|

|

|

|

|

|

|

|

| Balance, January 1 | | | | | | | | | | $ | 13,377 | | $ | 26,378 | |

| Equity in earnings of subsidiaries | | | | | | | | | | | 4,466 | | | 5,544 | |

| Goodwill impairment | | | | | | | | | | | – | | | (23,375 | ) |

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | 17,843 | | | 8,547 | |

| Cumulative translation adjustment | | | | | | | | | �� | | 3,067 | | | 4,830 | |

|

|

|

|

|

|

|

|

|

|

|

| Balance, December 31 | | | | | | | | | | $ | 20,910 | | $ | 13,377 | |

|

|

|

|

|

|

|

|

|

|

|

During 2002 an impairment test was performed on the goodwill from the purchase of New Skies Networks Pty Limited. The outcome of the test resulted in a goodwill write-off of $23.4 million.

4. Contractual commitments

In further development and operation of the company’s global commercial communications satellite system, significant additional expenditures are anticipated. At December 31, 2003, the company had a contract for the construction, development and launch of the NSS-8 satellite with future committed payments on this program totaling $35.4 million and $11.4 million for each of the years ending December 31, 2004 and 2005, respectively. Additional commitments (‘satellite incentives’) totaling $18.1 million will also fall due over the design life of this satellite to the extent that the satellite operates successfully throughout that time.

The company has recorded a liability of $9.7 million at December 31, 2003 representing the present value, at a weighted average discount rate of 6.5%, for incentive payments on the NSS-5, NSS-703 and NSS-806 satellites which were in service at December 31, 2003. Incentive payments of $3.6 million, $3.2 million, $1.4 million, $1.4 million, $0.9 million and $0.9 million are due in the years ending December 31, 2004, 2005, 2006, 2007, 2008, and 2009 and thereafter, respectively.

The company has recorded an additional liability of $38.5 million at December 31, 2003 representing incentive payments, before interest, on the NSS-6 and NSS-7 satellites requiring payments of $3.5 million in each of the five years ending December 31, 2008 and $21.0 million in the years thereafter. A variable interest charge equivalent to LIBOR plus 1% on the outstanding principal will also be incurred on these payments.

| | | 43 |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

New Skies Satellites N.V.

Notes to statutory financial statements

Years ended December 31, 2003 and 2002Other commitments as of December 31, 2003, primarily relating to telecommunication infrastructure and office facilities, are as follows:

|

|

|

| | (in thousands of U.S. dollars) | |

|

|

|

| 2004 | | | | $ | 18,098 | |

| 2005 | | | | | 2,670 | |

| 2006 | | | | | 1,714 | |

| 2007 | | | | | 1,189 | |

| 2008 | | | | | 658 | |

| 2009 and thereafter | | | | | 942 | |

|

|

|

|

|

|

|

| Total commitments | | | | $ | 25,271 | |

|

|

|

|

|

|

|

| | | | | | | |

| 5. Income tax | | | | | | |

| New Skies Satellites consolidated provision for income taxes consists of the following: | | | | | | |

| | | | | | | |

|

|

|

|

|

|

|

| | | (in thousands of U.S. dollars) | |

|

|

|

|

| | | 2003 | | | 2002 | |

|

|

|

|

|

|

|

| Income tax provision – Holding company | $ | 4,152 | | $ | 8,299 | |

| Income tax provision – Subsidiaries | | 2,505 | | | 2,207 | |

|

|

|

|

|

|

|

| Income tax provision – consolidated | $ | 6,657 | | $ | 10,506 | |

|

|

|

|

|

|

|

| | | | | | | |

| 6. Personnel and remuneration | | | | | | |

| Personnel expenses for New Skies Satellites N.V. can be summarized as follows: | | | | | | |

| | | | | | | |

|

|

|

|

|

|

|

| | | (in thousands of U.S. dollars) | |

|

|

|

|

| | | 2003 | | | 2002 | |

|

|

|

|

|

|

|

| Wages and salaries | $ | 25,896 | | $ | 18,984 | |

| Social securities | | 619 | | | 633 | |

| Pension costs | | 728 | | | 672 | |

|

|

|

|

|

|

|

| Total | $ | 27,243 | | $ | 20,289 | |

|

|

|

|

|

|

|

During 2003, certain staff relocated to the Netherlands from the London office and as a result, personnel employed in the Netherlands grew to 155 at December 31, 2003 as compared to 146 at December 31, 2002. Wages and salaries are net of capitalized amounts and inclusive of stock compensation expenditures.

The average number of staff employed by the group during 2003 and 2002 were 263 and 262, respectively, and the total number of personnel employed per sector were:

| | As of December 31, | |

|

|

|

| | 2003 | | 2002 | |

|

|

|

|

|

| Engineering and operations | 120 | | 121 | |

| Sales and marketing | 76 | | 76 | |

| Other | 66 | | 67 | |

|

|

|

|

|

| Total | 262 | | 264 | |

|

|

|

|

|

| 44 | | |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

In 2003, the total remuneration of the individual members of the Supervisory Board were as follows:

|

|

|

| Supervisory Board | (in thousands of U.S. dollars) | |

|

|

|

| T.M. Seddon | $ | 84 | |

| J.W. Kolb | | 52 | |

| L. Ruspantini | | 50 | |

| G.D. Mueller | | 50 | |

| C. Séguin | | 49 | |

| A.S. Ganguly | | 44 | |

| S.K. Fung | | 43 | |

| N. Kroes | | 41 | |

| D. Wear (until November 1, 2003) | | 25 | |

|

|

|

|

| Total | $ | 438 | |

|

|

|

|

As a result of Mr. D. Wear passing away, his Supervisory Board directorship ended on November 1, 2003. He was not replaced.

Total remuneration of the Management Board, including pension costs and any other amounts earned as a non-Management Board member for the year ended December 31, 2003, is summarized as follows:

|

|

|

|

|

|

|

|

|

| Management Board | | | | | | | (in thousands of U.S. dollars) | |

|

|

|

|

|

|

|

|

|

| | Base Salary | | Bonus(1) | | Pension | | Other | | Total | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| D.S. Goldberg | $ | 500 | | $ | 168 | | $ | 30 | | $ | 17 | | $ | 715 | |

| A.M. Browne | | 451 | | | 95 | | | 34 | | | 15 | | | 595 | |

| S.J. Stott | | 354 | | | 74 | | | 32 | | | 14 | | | 474 | |

| T.L. Cowart | | 265 | | | 56 | | | 16 | | | 15 | | | 352 | |

| R. Jockin (resigned July 31, 2003) | | 160 | | | – | | | 12 | | | 429 | | | 601 | |

| M.J. Dent (resigned August 18, 2003) | | 222 | | | 68 | | | 12 | | | 30 | | | 332 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total | $ | 1,952 | | $ | 461 | | $ | 136 | | $ | 520 | | $ | 3,069 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) | The bonus for year 2003 performance was subject to Supervisory Board approval and is based on attainment of certain pre-defined company performance criteria. The Supervisory Board approved the bonus in February 2003. |

Two Management Board members resigned from their positions during the year and were not replaced as of December 31, 2003. Ms M.J. Dent resigned on August 18, 2003 but continued to work for the company in an advisory role on a part time basis. Mr R. Jockin resigned on July 31, 2003 and left the company at that time. A payment of $420,000 was made to Mr Jockin upon his departure in lieu of notice, bonus and other entitlements.

The Supervisory Directors and members of Management Board also have rights to acquire ordinary shares. These rights are similar to restricted stock grants, which entitle (and require) the individual to purchase a pre-determined number of shares at a price per share equal to nominal value (€0.05), and the purchase of shares subject to each grant is to be settled in three equal installments within 30 days of the designated settlement dates, which are generally the first, second and third anniversary of the date of grant.

| | | 45 |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

New Skies Satellites N.V.

Notes to statutory financial statements

Years ended December 31, 2003 and 2002

The following table illustrates the number of shares outstanding at December 31, 2003 and 2002 subject to these rights agreements including those issued in 2003 to members of the Supervisory Board and Management Board:

|

|

|

|

|

|

|

|

|

|

|

| | Beginning of | | | | | | Cancelled / | | | |

| Supervisory Board | year | | Granted | | Exercised | | forfeited | | End of year | |

|

|

|

|

|

|

|

|

|

|

|

| T.M. Seddon | 3,643 | | 4,975 | | (1,214 | ) | – | | 7,404 | |

| J.W. Kolb | 1,822 | | 2,488 | | (607 | ) | – | | 3,703 | |

| L. Ruspantini | 1,822 | | 2,488 | | (607 | ) | – | | 3,703 | |

| G.D. Mueller | 1,822 | | 2,488 | | (607 | ) | – | | 3,703 | |

| C. Séguin | 2,004 | | 2,735 | | (668 | ) | – | | 4,071 | |

| A.S. Ganguly | 1,822 | | 2,488 | | (607 | ) | – | | 3,703 | |

| S.K. Fung | 1,822 | | 2,488 | | (607 | ) | – | | 3,703 | |

| N. Kroes | 2,004 | | 2,735 | | (668 | ) | – | | 4,071 | |

| D. Wear (until November 1, 2003) | 1,822 | | 2,488 | | (607 | ) | (3,703 | ) | – | |

|

|

|

|

|

|

|

|

|

|

|

| Total | 18,583 | | 25,373 | | (6,192 | ) | (3,703 | ) | 34,061 | |

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

| | Beginning of | | | | | | Cancelled / | | | |

| Management Board | year | | Granted | | Exercised | | forfeited | | End of year | |

|

|

|

|

|

|

|

|

|

|

|

| D.S. Goldberg | 108,000 | | 77,253 | | (36,000 | ) | – | | 149,253 | |

| A.M. Browne | 32,505 | | 40,000 | | (10,835 | ) | – | | 61,670 | |

| S.J. Stott | 24,468 | | 30,000 | | (8,156 | ) | – | | 46,312 | |

| R. Jockin (resigned July 31, 2003) | 19,255 | | – | | (6,418 | ) | (12,837 | ) | – | |

| M.J. Dent (resigned August 18, 2003) | 26,579 | | 10,000 | | (8,859 | ) | – | | 27,720 | |

| T.L. Cowart | 22,929 | | 23,000 | | (7,643 | ) | – | | 38,286 | |

|

|

|

|

|

|

|

|

|

|

|

| Total | 233,736 | | 180,253 | | (77,911 | ) | (12,837 | ) | 323,241 | |

|

|

|

|

|

|

|

|

|

|

|

In addition the following tables set forth the information regarding outstanding stock option grants for each member of the Supervisory and Management Board under the company’s stock option plans. Options are granted to both Supervisory and Management Board members as a means of aligning the interests of management with those of shareholders.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supervisory Board | Beginning of year | | Granted | | Exercised | | Cancelled / forfeited | | | | End of year | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | | | | | | | | | Weighted | |

| | Weighted | | Weighted | | Weighted | | Weighted | | Weighted | average |

| | average | | average | | average | | average | | average | remaining |

| | share | | share | | share | | share | | share | contractual |

| Number | price | Number | price | Number | price | Number | price | Number | price | lives |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| T.M. Seddon | 64,299 | | $ | 7.27 | | 12,437 | | $ | 6.03 | | – | | $ | – | | – | | $ | – | | 76,736 | | $ | 7.07 | | 6.7 | |

| J.W. Kolb | 44,934 | | | 7.40 | | 6,219 | | | 6.03 | | – | | | – | | – | | | – | | 51,153 | | | 7.23 | | 6.3 | |

| L. Ruspantini | 42,274 | | | 7.39 | | 6,219 | | | 6.03 | | – | | | – | | – | | | – | | 48,493 | | | 7.22 | | 6.3 | |

| G.D. Mueller | 13,344 | | | 6.56 | | 6,219 | | | 6.03 | | – | | | – | | – | | | – | | 19,563 | | | 6.39 | | 8.3 | |

| C. Séguin | 46,498 | | | 7.39 | | 6,841 | | | 6.03 | | – | | | – | | – | | | – | | 53,339 | | | 7.22 | | 6.3 | |

| A.S. Ganguly | 4,554 | | | 5.49 | | 6,219 | | | 6.03 | | – | | | – | | – | | | – | | 10,773 | | | 5.80 | | 9.0 | |

| S.K. Fung | 28,944 | | | 7.34 | | 6,219 | | | 6.03 | | – | | | – | | – | | | – | | 35,163 | | | 7.11 | | 7.1 | |

| N. Kroes | 31,838 | | | 7.34 | | 6,841 | | | 6.03 | | – | | | – | | – | | | – | | 38,679 | | | 7.11 | | 7.1 | |

| D. Wear (until | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| November 1, 2003) | 13,344 | | | 6.56 | | 6,219 | | | 6.03 | | – | | | – | | 12,185 | | | 6.16 | | 7,378 | | | 6.78 | | 0.1 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total | 290,029 | | $ | 7.25 | | 63,433 | | $ | 6.03 | | – | | $ | – | | 12,185 | | $ | 6.16 | | 341,277 | | $ | 7.06 | | 6.8 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 46 | | |

| New Skies Satellites N.V. Annual Report 2003 |

Back to Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Management Board | Beginning of

year | | Granted | | Exercised | | Cancelled/

forfeited | | End of year | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | Weighted | |

| | | | Weighted | | | | Weighted | | | | Weighted | | | | Weighted | | | | Weighted | | average | |

| | | | average | | | | average | | | | average | | | | average | | | | average | | remaining | |

| | | | share | | | | share | | | | share | | | | share | | | | share | | contractual | |

| | Number | | price | | Number | | price | | Number | | price | | Number | | price | | Number | | price | | lives | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| D.S. Goldberg | 379,840 | | $ | 8.31 | | 193,133 | | $ | 4.66 | | – | | $ | – | | – | | $ | – | | 572,973 | | $ | 7.08 | | 6.8 | |

| A.M. Browne | 506,712 | | | 7.77 | | 100,000 | | | 4.66 | | – | | | – | | – | | | – | | 606,712 | | | 7.26 | | 6.5 | |

| S.J. Stott | 310,600 | | | 7.60 | | 75,000 | | | 4.66 | | – | | | – | | – | | | – | | 385,600 | | | 7.03 | | 6.9 | |

| T.L. Cowart | 245,772 | | | 7.50 | | 55,000 | | | 4.66 | | – | | | – | | – | | | – | | 300,772 | | | 6.98 | | 6.9 | |

| R. Jockin | 200,292 | | | 7.91 | | – | | | – | | – | | | – | | 200,292 | | | 7.91 | | – | | | – | | – | |

| M.J. Dent | 202,218 | | | 7.95 | | 25,000 | | | 4.66 | | – | | | – | | – | | | – | | 227,218 | | | 7.59 | | 7.3 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total | 1,845,434 | | $ | 7.85 | | 448,133 | | $ | 4.66 | | – | | $ | – | | 200,292 | | $ | 7.91 | | 2,093,275 | | $ | 7.16 | | 6.8 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | |

| 7. | Business segments and geographic information |

| The company monitors its operations as a single enterprise and therefore believes that it has one operating segment, which is telecommunication satellite services. |

| |

| The geographic source of the company’s revenues, based on the billing addresses of the customers, for the years ended December 31, 2003 and 2002 is as follows: |

| | | | | | | |

|

|

|

|

|

|

|

| | (in thousands of U.S. dollars) | |

|

|

|

|

|

|

|

| | | 2003 | | | 2002 | |

|

|

|

|

|

|

|