UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10157

Franklin Global Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Alison Baur, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code:

(650)312-2000

Date of fiscal year end: 7/31

Date of reporting period: 7/31/24

Explanatory Note:

The Registrant is filing this amendment to its Form N-CSR for the period ended July 31, 2024, originally filed with the Securities and Exchange Commission on September 30, 2024 (Accession Number 0001133228-24-009198), for the purpose of refiling to include within Item 7 the Financial Statements and Financial Highlights of Franklin Emerging Market Debt Opportunities Fund, as series of Franklin Global Trust. Except as set forth above, no other changes have been made to the Form N-CSR, and this amended filing does not amend, update or change any other items or disclosure found in the Form N-CSR.

Item 1. Reports to Stockholders.

| a.) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1). |

| b.) | Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. |

| | Not Applicable. |

| | |

Franklin International Growth Fund | |

| Class A [FNGAX] |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin International Growth Fund for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class A | $114 | 1.11% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Class A shares of Franklin International Growth Fund returned 6.00%. The Fund compares its performance to the MSCI EAFE Index-NR, which returned 11.21% for the same period.

| |

Top contributors to performance: |

| ↑ | Information technology holding, Keywords Studios, a U.K.-listed provider of creative, technical and player-support services to the video game industry, on the news that it may be acquired by a European private equity group |

| ↑ | In financials, U.K.-based asset management firm Intermediate Capital Group following fiscal 2024 results that exceeded consensus estimates |

| ↑ | Shares of CyberArk Software, a provider of identity security software solutions based in the U.S., after the company reported first-quarter 2024 financials that exceeded both revenue and earnings consensus estimates |

| |

Top detractors from performance: |

| ↓ | Shares of Evotec, a German biotechnology contract development and manufacturing company, as management’s outlook for 2024 profit was more cautious than consensus expectations |

| ↓ | In financials, shares of the Dutch online payments firm Adyen moved lower after its first half 2023 financial report indicated slowing growth in North America |

| ↓ | Genmab, a Danish biotechnology company, as investors expected the phase-out of its treatment for multiple myeloma, Darzalex, to restrain future revenue growth |

| Franklin International Growth Fund | PAGE 1 | 429-ATSR-0924 |

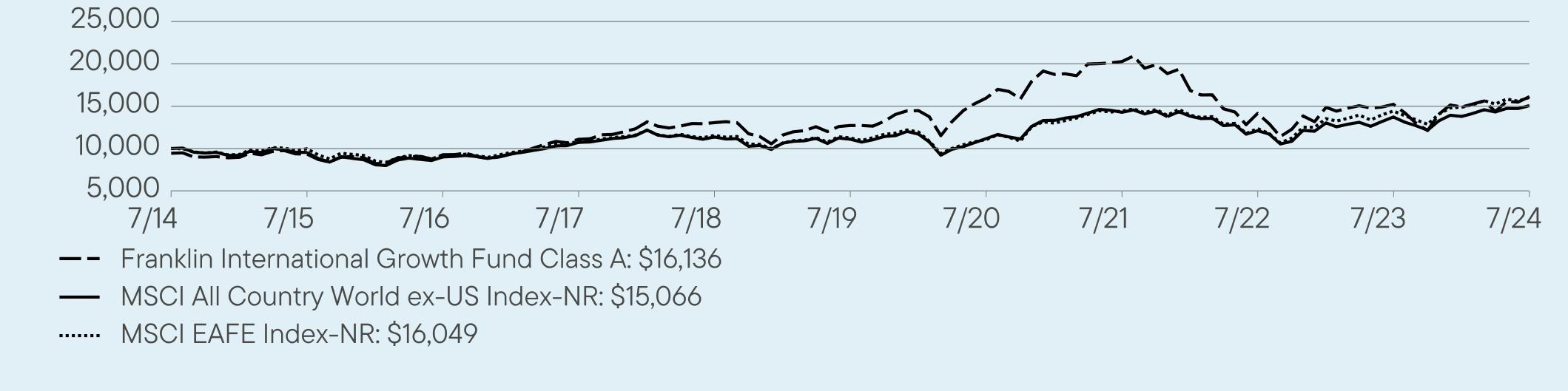

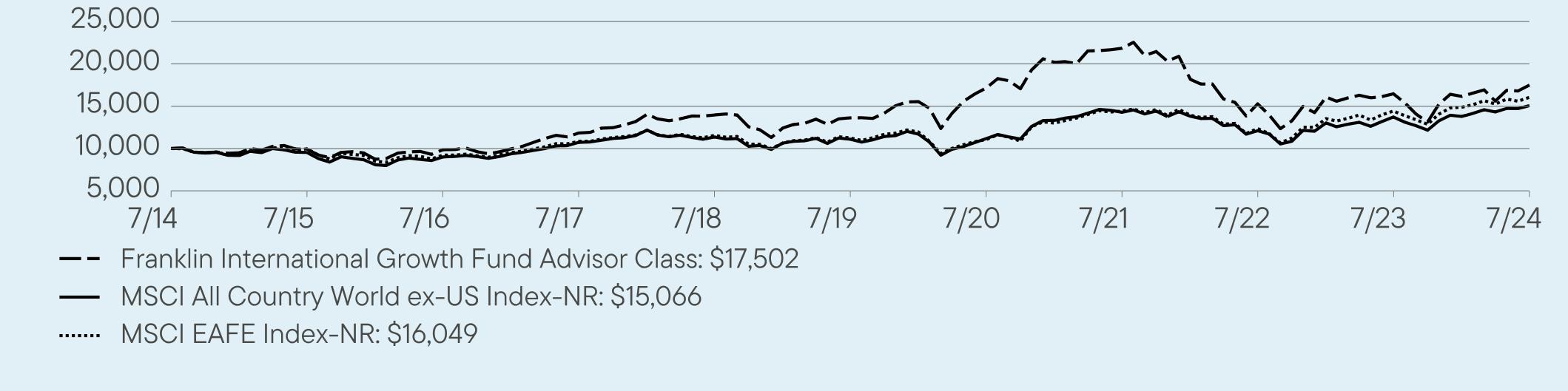

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – ($9,450 AFTER MAXIMUM APPLICABLE SALES CHARGE) –

Class A 7/31/2014 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Class A | 6.00 | 4.87 | 5.49 |

Class A (with sales charge) | 0.17 | 3.69 | 4.90 |

MSCI All Country World ex-US Index-NR | 9.75 | 6.29 | 4.18 |

MSCI EAFE Index-NR | 11.21 | 7.35 | 4.84 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

Performance for periods prior to September 10, 2018, has been restated to reflect the current maximum sales charge, which is lower than the maximum sales charge prior to that date.

For current month-end performance, please call Franklin Templeton at (800) DIAL BEN/342-5236 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $1,016,026,021 |

Total Number of Portfolio Holdings* | 34 |

Total Management Fee Paid | $7,848,350 |

Portfolio Turnover Rate | 17.56% |

| * | Does not include derivatives, except purchased options, if any. |

| Franklin International Growth Fund | PAGE 2 | 429-ATSR-0924 |

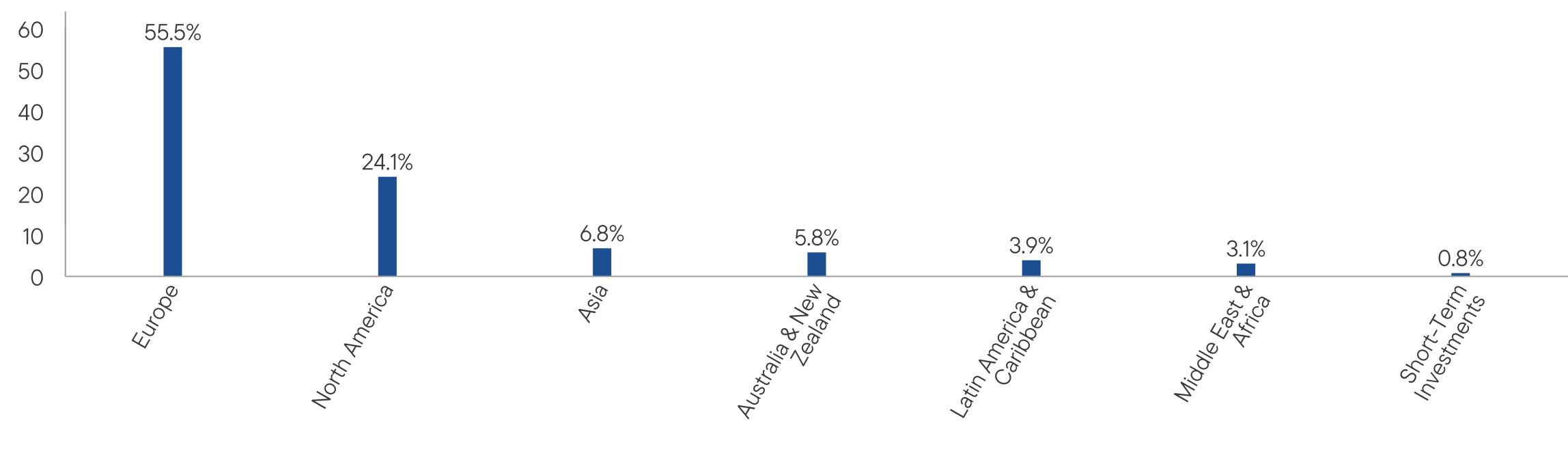

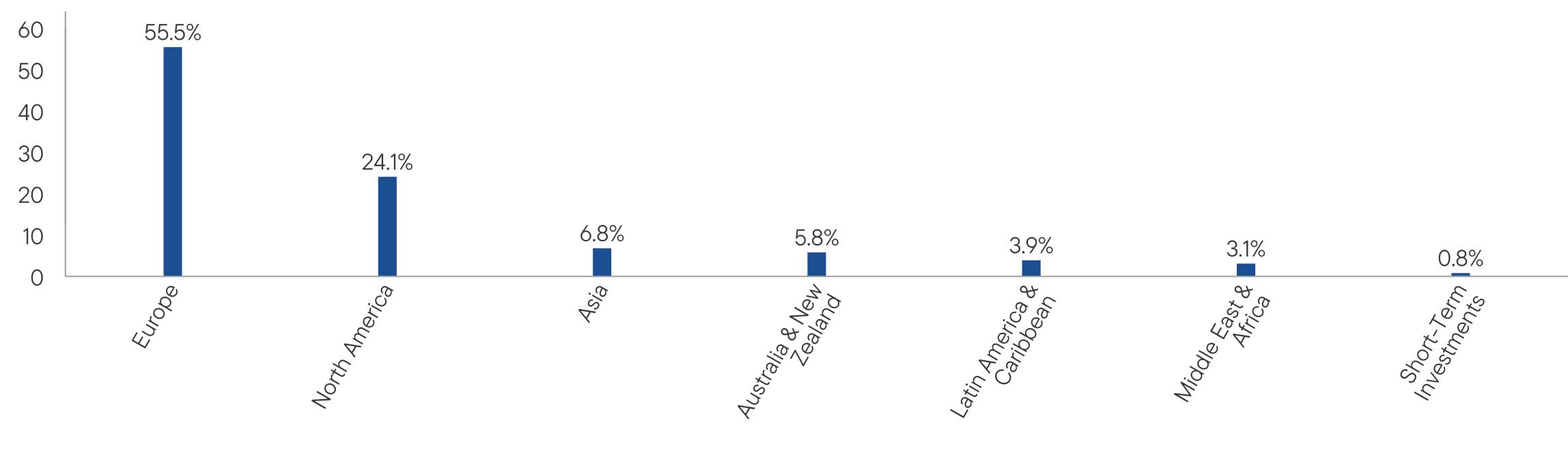

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

HOW HAS THE FUND CHANGED?

On December 1, 2023, disclosure was added to the Fund’s principal investment strategies to reflect the Fund’s increased exposure to securities in the health care sector.

Related disclosure regarding the risks of investing in securities in the health care sector was also added to the Fund’s principal risks.

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December 1, 2024, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or prospectus@franklintempleton.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) DIAL BEN/342-5236. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Franklin International Growth Fund | PAGE 3 | 429-ATSR-0924 |

9450934492691109613063127201596620274141541521816136100009543901410727113641110611179142851210513728150661000099739221108601155511255110661442112356144311604955.524.16.85.83.93.10.8

| | |

Franklin International Growth Fund | |

| Class C [FNGDX] |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin International Growth Fund for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class C | $191 | 1.86% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Class C shares of Franklin International Growth Fund returned 5.19%. The Fund compares its performance to the MSCI EAFE Index-NR, which returned 11.21% for the same period.

| |

Top contributors to performance: |

| ↑ | Information technology holding, Keywords Studios, a U.K.-listed provider of creative, technical and player-support services to the video game industry, on the news that it may be acquired by a European private equity group |

| ↑ | In financials, U.K.-based asset management firm Intermediate Capital Group following fiscal 2024 results that exceeded consensus estimates |

| ↑ | Shares of CyberArk Software, a provider of identity security software solutions based in the U.S., after the company reported first-quarter 2024 financials that exceeded both revenue and earnings consensus estimates |

| |

Top detractors from performance: |

| ↓ | Shares of Evotec, a German biotechnology contract development and manufacturing company, as management’s outlook for 2024 profit was more cautious than consensus expectations |

| ↓ | In financials, shares of the Dutch online payments firm Adyen moved lower after its first half 2023 financial report indicated slowing growth in North America |

| ↓ | Genmab, a Danish biotechnology company, as investors expected the phase-out of its treatment for multiple myeloma, Darzalex, to restrain future revenue growth |

| Franklin International Growth Fund | PAGE 1 | 248-ATSR-0924 |

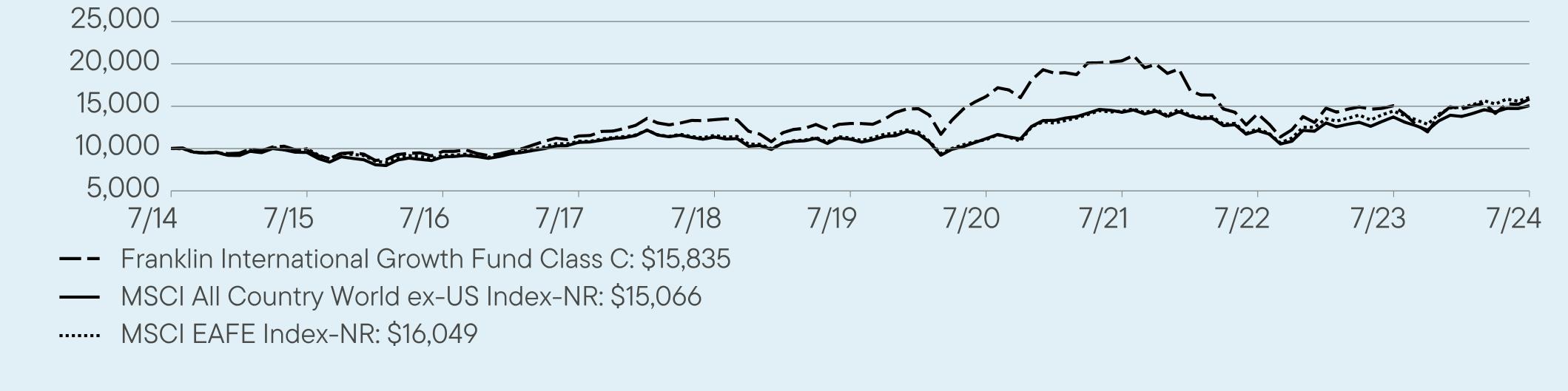

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class C 7/31/2014 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Class C | 5.19 | 4.09 | 4.70 |

Class C (with sales charge) | 4.19 | 4.09 | 4.70 |

MSCI All Country World ex-US Index-NR | 9.75 | 6.29 | 4.18 |

MSCI EAFE Index-NR | 11.21 | 7.35 | 4.84 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) DIAL BEN/342-5236 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $1,016,026,021 |

Total Number of Portfolio Holdings* | 34 |

Total Management Fee Paid | $7,848,350 |

Portfolio Turnover Rate | 17.56% |

| * | Does not include derivatives, except purchased options, if any. |

| Franklin International Growth Fund | PAGE 2 | 248-ATSR-0924 |

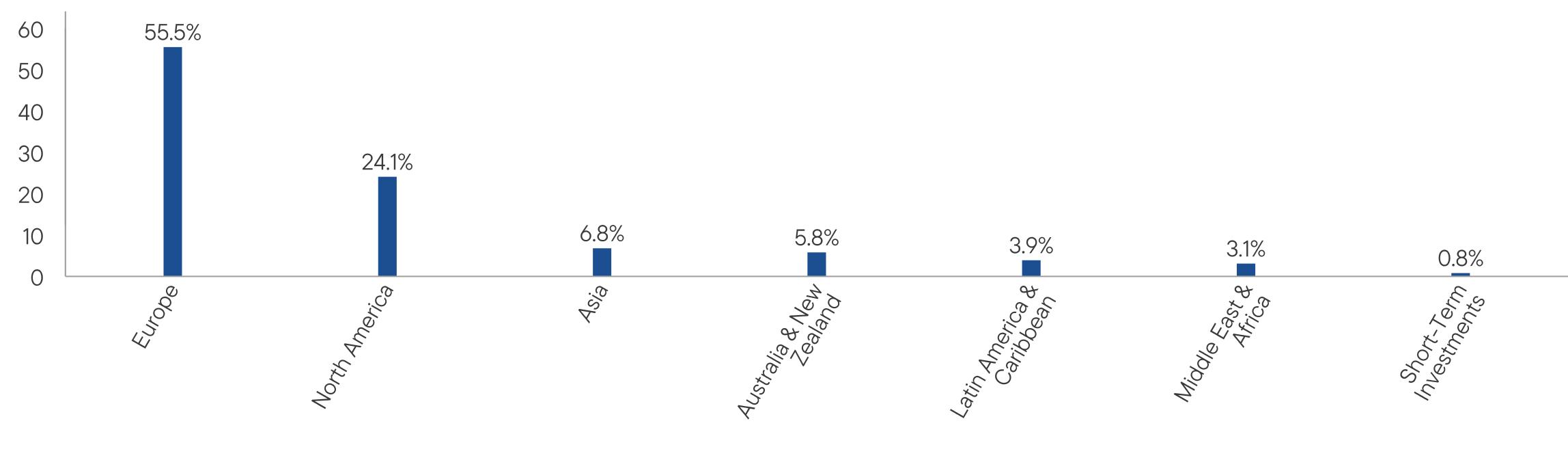

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

HOW HAS THE FUND CHANGED?

On December 1, 2023, disclosure was added to the Fund’s principal investment strategies to reflect the Fund’s increased exposure to securities in the health care sector.

Related disclosure regarding the risks of investing in securities in the health care sector was also added to the Fund’s principal risks.

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December 1, 2024, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or prospectus@franklintempleton.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) DIAL BEN/342-5236. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Franklin International Growth Fund | PAGE 3 | 248-ATSR-0924 |

10000981696631148513410129621615420360141031505415835100009543901410727113641110611179142851210513728150661000099739221108601155511255110661442112356144311604955.524.16.85.83.93.10.8

| | |

Franklin International Growth Fund | |

| Class R [FNGRX] |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin International Growth Fund for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class R | $140 | 1.36% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Class R shares of Franklin International Growth Fund returned 5.74%. The Fund compares its performance to the MSCI EAFE Index-NR, which returned 11.21% for the same period.

| |

Top contributors to performance: |

| ↑ | Information technology holding, Keywords Studios, a U.K.-listed provider of creative, technical and player-support services to the video game industry, on the news that it may be acquired by a European private equity group |

| ↑ | In financials, U.K.-based asset management firm Intermediate Capital Group following fiscal 2024 results that exceeded consensus estimates |

| ↑ | Shares of CyberArk Software, a provider of identity security software solutions based in the U.S., after the company reported first-quarter 2024 financials that exceeded both revenue and earnings consensus estimates |

| |

Top detractors from performance: |

| ↓ | Shares of Evotec, a German biotechnology contract development and manufacturing company, as management’s outlook for 2024 profit was more cautious than consensus expectations |

| ↓ | In financials, shares of the Dutch online payments firm Adyen moved lower after its first half 2023 financial report indicated slowing growth in North America |

| ↓ | Genmab, a Danish biotechnology company, as investors expected the phase-out of its treatment for multiple myeloma, Darzalex, to restrain future revenue growth |

| Franklin International Growth Fund | PAGE 1 | 868-ATSR-0924 |

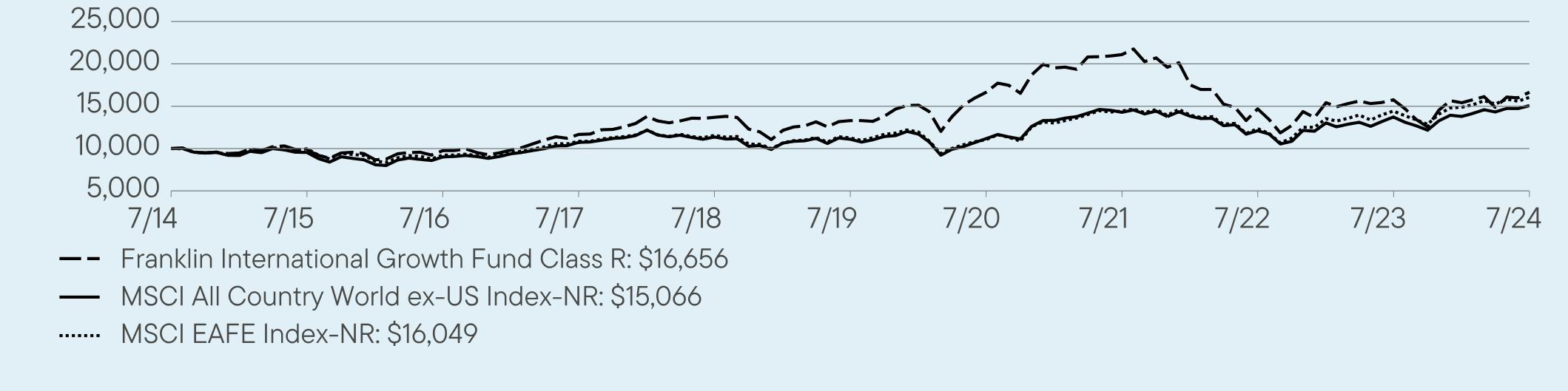

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class R 7/31/2014 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Class R | 5.74 | 4.61 | 5.23 |

MSCI All Country World ex-US Index-NR | 9.75 | 6.29 | 4.18 |

MSCI EAFE Index-NR | 11.21 | 7.35 | 4.84 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) DIAL BEN/342-5236 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $1,016,026,021 |

Total Number of Portfolio Holdings* | 34 |

Total Management Fee Paid | $7,848,350 |

Portfolio Turnover Rate | 17.56% |

| * | Does not include derivatives, except purchased options, if any. |

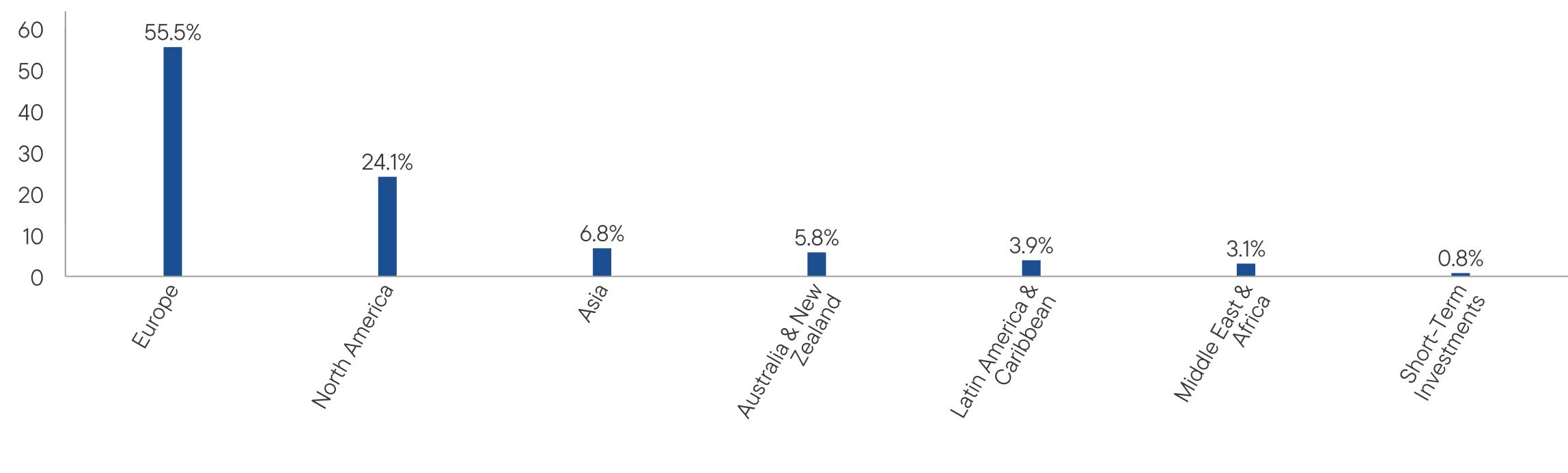

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| Franklin International Growth Fund | PAGE 2 | 868-ATSR-0924 |

HOW HAS THE FUND CHANGED?

On December 1, 2023, disclosure was added to the Fund’s principal investment strategies to reflect the Fund’s increased exposure to securities in the health care sector.

Related disclosure regarding the risks of investing in securities in the health care sector was also added to the Fund’s principal risks.

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December 1, 2024, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or prospectus@franklintempleton.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) DIAL BEN/342-5236. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Franklin International Growth Fund | PAGE 3 | 868-ATSR-0924 |

10000986997601166713690132961665221097146891575216656100009543901410727113641110611179142851210513728150661000099739221108601155511255110661442112356144311604955.524.16.85.83.93.10.8

| | |

Franklin International Growth Fund | |

| Class R6 [FILRX] |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin International Growth Fund for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class R6 | $77 | 0.75% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Class R6 shares of Franklin International Growth Fund returned 6.35%. The Fund compares its performance to the MSCI EAFE Index-NR, which returned 11.21% for the same period.

| |

Top contributors to performance: |

| ↑ | Information technology holding, Keywords Studios, a U.K.-listed provider of creative, technical and player-support services to the video game industry, on the news that it may be acquired by a European private equity group |

| ↑ | In financials, U.K.-based asset management firm Intermediate Capital Group following fiscal 2024 results that exceeded consensus estimates |

| ↑ | Shares of CyberArk Software, a provider of identity security software solutions based in the U.S., after the company reported first-quarter 2024 financials that exceeded both revenue and earnings consensus estimates |

| |

Top detractors from performance: |

| ↓ | Shares of Evotec, a German biotechnology contract development and manufacturing company, as management’s outlook for 2024 profit was more cautious than consensus expectations |

| ↓ | In financials, shares of the Dutch online payments firm Adyen moved lower after its first half 2023 financial report indicated slowing growth in North America |

| ↓ | Genmab, a Danish biotechnology company, as investors expected the phase-out of its treatment for multiple myeloma, Darzalex, to restrain future revenue growth |

| Franklin International Growth Fund | PAGE 1 | 368-ATSR-0924 |

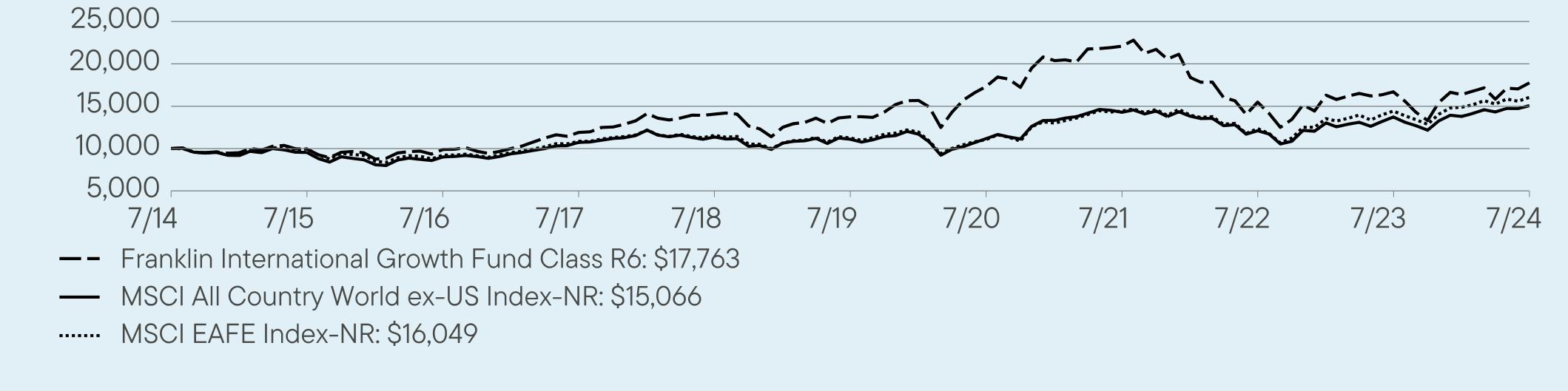

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class R6 7/31/2014 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Class R6 | 6.35 | 5.26 | 5.91 |

MSCI All Country World ex-US Index-NR | 9.75 | 6.29 | 4.18 |

MSCI EAFE Index-NR | 11.21 | 7.35 | 4.84 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) DIAL BEN/342-5236 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $1,016,026,021 |

Total Number of Portfolio Holdings* | 34 |

Total Management Fee Paid | $7,848,350 |

Portfolio Turnover Rate | 17.56% |

| * | Does not include derivatives, except purchased options, if any. |

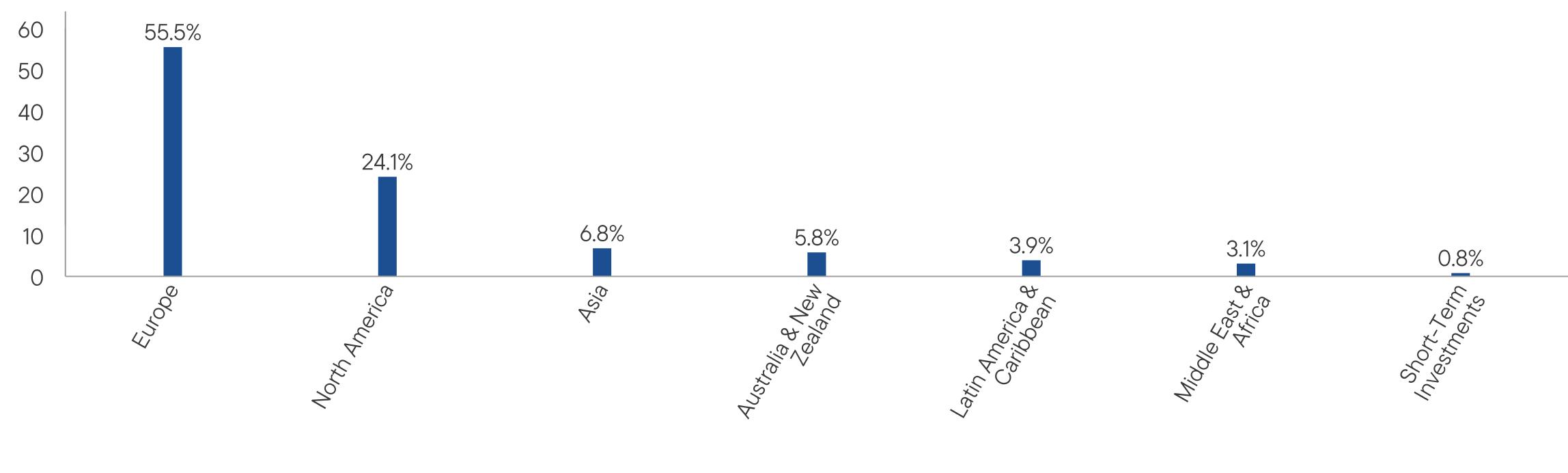

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| Franklin International Growth Fund | PAGE 2 | 368-ATSR-0924 |

HOW HAS THE FUND CHANGED?

On December 1, 2023, disclosure was added to the Fund’s principal investment strategies to reflect the Fund’s increased exposure to securities in the health care sector.

Related disclosure regarding the risks of investing in securities in the health care sector was also added to the Fund’s principal risks.

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December 1, 2024, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or prospectus@franklintempleton.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) DIAL BEN/342-5236. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Franklin International Growth Fund | PAGE 3 | 368-ATSR-0924 |

10000993898991190514066137481733422089154781670217763100009543901410727113641110611179142851210513728150661000099739221108601155511255110661442112356144311604955.524.16.85.83.93.10.8

| | |

Franklin International Growth Fund | |

| Advisor Class [FNGZX] |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin International Growth Fund for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Advisor Class | $89 | 0.86% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Advisor Class shares of Franklin International Growth Fund returned 6.26%. The Fund compares its performance to the MSCI EAFE Index-NR, which returned 11.21% for the same period.

| |

Top contributors to performance: |

| ↑ | Information technology holding, Keywords Studios, a U.K.-listed provider of creative, technical and player-support services to the video game industry, on the news that it may be acquired by a European private equity group |

| ↑ | In financials, U.K.-based asset management firm Intermediate Capital Group following fiscal 2024 results that exceeded consensus estimates |

| ↑ | Shares of CyberArk Software, a provider of identity security software solutions based in the U.S., after the company reported first-quarter 2024 financials that exceeded both revenue and earnings consensus estimates |

| |

Top detractors from performance: |

| ↓ | Shares of Evotec, a German biotechnology contract development and manufacturing company, as management’s outlook for 2024 profit was more cautious than consensus expectations |

| ↓ | In financials, shares of the Dutch online payments firm Adyen moved lower after its first half 2023 financial report indicated slowing growth in North America |

| ↓ | Genmab, a Danish biotechnology company, as investors expected the phase-out of its treatment for multiple myeloma, Darzalex, to restrain future revenue growth |

| Franklin International Growth Fund | PAGE 1 | 649-ATSR-0924 |

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Advisor Class 7/31/2014 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Advisor Class | 6.26 | 5.13 | 5.76 |

MSCI All Country World ex-US Index-NR | 9.75 | 6.29 | 4.18 |

MSCI EAFE Index-NR | 11.21 | 7.35 | 4.84 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) DIAL BEN/342-5236 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $1,016,026,021 |

Total Number of Portfolio Holdings* | 34 |

Total Management Fee Paid | $7,848,350 |

Portfolio Turnover Rate | 17.56% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| Franklin International Growth Fund | PAGE 2 | 649-ATSR-0924 |

HOW HAS THE FUND CHANGED?

On December 1, 2023, disclosure was added to the Fund’s principal investment strategies to reflect the Fund’s increased exposure to securities in the health care sector.

Related disclosure regarding the risks of investing in securities in the health care sector was also added to the Fund’s principal risks.

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December 1, 2024, at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or prospectus@franklintempleton.com.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) DIAL BEN/342-5236. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Franklin International Growth Fund | PAGE 3 | 649-ATSR-0924 |

10000992598631183913968136261715521840152801647217502100009543901410727113641110611179142851210513728150661000099739221108601155511255110661442112356144311604955.524.16.85.83.93.10.8

| | |

Franklin Emerging Market Debt Opportunities Fund | |

| Advisor Class [FEMDX] |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin Emerging Market Debt Opportunities Fund for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 321-8563.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Advisor Class | $107 | 1.00% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Advisor Class shares of Franklin Emerging Market Debt Opportunities Fund returned 13.78%. The Fund compares its performance to the JP Morgan EMBI Global Diversified Index, the JP Morgan EMBI Global Diversified ex-GCC Index, the JP Morgan GBI-EM Broad Diversified Index benchmark and the ICE BofA Emerging Market Corporate Plus (USD Hedged) Index, which returned 9.18%, 10.08%, 0.71% and 8.88%, respectively, for the same period.

| |

Top contributors to performance: |

| ↑ | Allocation to Surinamese U.S.-dollar bonds, the prices of which increased on the back of the country’s finalizing its U.S. $675 million debt exchange |

| ↑ | Allocation to Mozambique U.S.-dollar bonds, as the Fund received compensation following a settlement with Credit Suisse/UBS bank |

| |

Top detractors from performance: |

| ↓ | Exposure to the Brazilian real, which weakened due to the unwinding of investor positioning |

| ↓ | Exposure to the Mexican peso, which depreciated amid volatility related to the presidential and legislative elections |

Use of derivatives and the impact on performance:

Currency derivatives, used to hedge the portfolio’s eastern European currency exposure back to the euro, provided a minimal contribution.

| Franklin Emerging Market Debt Opportunities Fund | PAGE 1 | 699-ATSR-0924 |

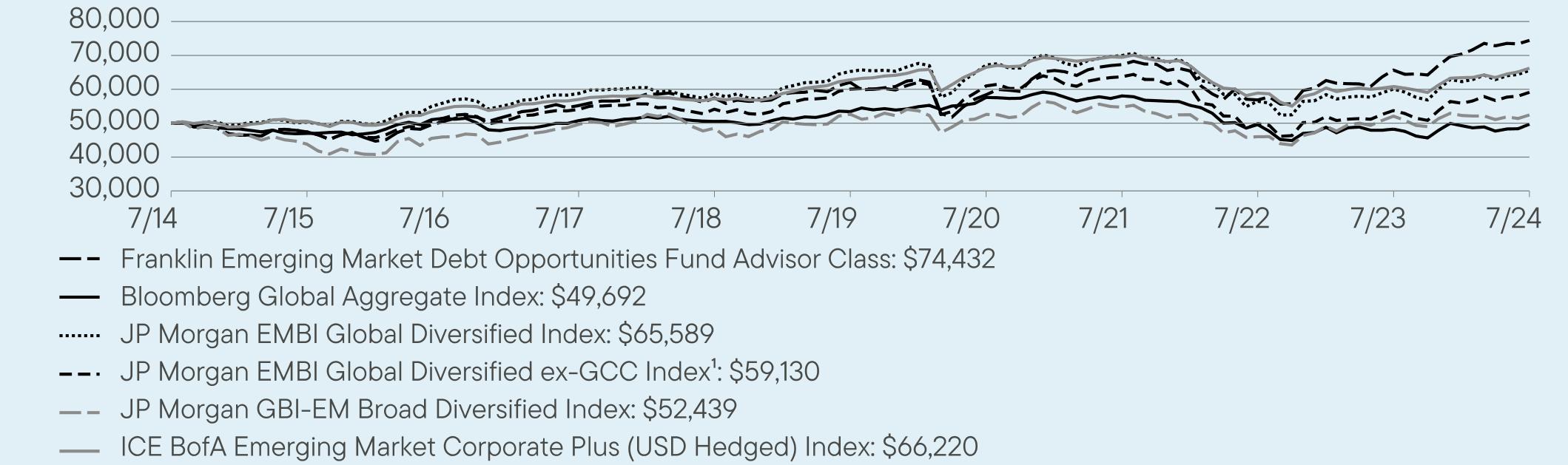

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $50,000 INVESTMENT – Advisor Class 7/31/2014 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | | |

| | 1 Year | 5 Year | 10 Year |

Advisor Class | 13.78 | 3.71 | 4.06 |

Bloomberg Global Aggregate Index | 3.00 | -1.43 | -0.06 |

JP Morgan EMBI Global Diversified Index | 9.18 | 0.10 | 2.75 |

JP Morgan EMBI Global Diversified ex-GCC Index1 | 10.08 | -0.31 | N/A |

JP Morgan GBI-EM Broad Diversified Index | 0.71 | -0.08 | 0.48 |

ICE BofA Emerging Market Corporate Plus (USD Hedged) Index | 8.88 | 1.07 | 2.85 |

| 1 | Due to data availability, performance for the JPM EMBI Global Diversified ex-GCC Index is shown starting 12/31/15 using the Fund’s value on that date. Values prior to 12/31/2015 reflect the performance of the Fund. |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) 321-8563 or visit https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $68,317,824 |

Total Number of Portfolio Holdings* | 98 |

Total Management Fee Paid | $275,120 |

Portfolio Turnover Rate | 75.07% |

| * | Does not include derivatives, except purchased options, if any. |

| Franklin Emerging Market Debt Opportunities Fund | PAGE 2 | 699-ATSR-0924 |

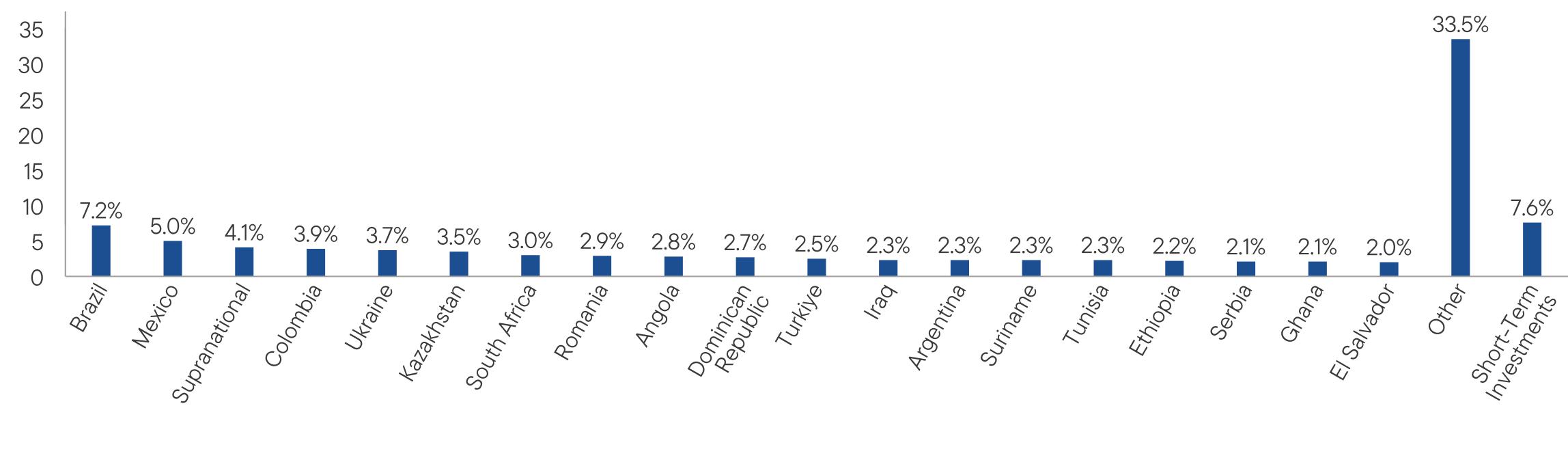

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

HOUSEHOLDING

You will receive the Fund’s shareholder reports every six months. In addition, you will receive an annual updated summary prospectus (detail prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the shareholder reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 321-8563. At any time, you may view current prospectuses/summary prospectuses and shareholder reports on our website. If you choose, you may receive these documents through electronic delivery.

| Franklin Emerging Market Debt Opportunities Fund | PAGE 3 | 699-ATSR-0924 |

5000047420504615520257432620505840167294568536567274432500004698051418507625051653410576015805349587482454969250000503015594458763588056526167200699635647760072655895000047420514505407254121600526101563707498605371759130500004381945948496434849852651525905473346008520695243950000505905425057019572596278466525694495887660819662207.25.04.13.93.73.53.02.92.82.72.52.32.32.32.32.22.12.12.033.57.6

Item 2. Code of Ethics.

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

(c) N/A

(d) N/A

(f) Pursuant to Item 19(a)(1), the Registrant is attaching as an exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is Mary C. Choksi and she is “independent” as defined under the relevant Securities and Exchange Commission Rules and Releases.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the principal accountant in connection with statutory and regulatory filings or engagements were $115,550 for the fiscal year ended July 31, 2024, and $108,118 for the fiscal year ended July 31, 2023.

(b) Audit-Related Fees

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of Item 4.

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant that are reasonably related to the performance of the audit of their financial statements.

(c) Tax Fees

There were no fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant for tax compliance, tax advice and tax planning.

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant for tax compliance, tax advice and tax planning were $140,000 for the fiscal year ended July 31, 2024, and $289,850 for the fiscal year ended July 31, 2023. The services for which these fees were paid included tax compliance services related to year-end and global access to tax platform International Tax View.

(d) All Other Fees

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant not reported in paragraphs (a)-(c) of Item 4 were $0 for the fiscal year ended July 31, 2024, and $579 for the fiscal year ended July 31, 2023. The services for which these fees were paid included review of materials provided to the fund Board in connection with the investment management contract renewal process.

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant not reported in paragraphs (a)-(c) of Item 4 were $197,871 for the fiscal year ended July 31, 2024 and $359,815 for the fiscal year ended July 31, 2023. The services for which these fees were paid included compliance examination for Investment Advisor Act

rule 206-4 (2), professional services relating to the readiness assessment over Greenhouse Gas Emissions and Energy, professional fees in connection with SOC 1 Reports, professional fees relating to security counts and fees in connection with license for accounting and business knowledge platform Viewpoint.

(e) (1) The registrant’s audit committee is directly responsible for approving the services to be provided by the auditors, including:

| (i) | pre-approval of all audit and audit related services; |

| (ii) | pre-approval of all non-audit related services to be provided to the Fund by the auditors; |

(iii) pre-approval of all non-audit related services to be provided to the registrant by the auditors to the registrant’s investment adviser or to any entity that controls, is controlled by or is under common control with the registrant’s investment adviser and that provides ongoing services to the registrant where the non-audit services relate directly to the operations or financial reporting of the registrant; and

(iv) establishment by the audit committee, if deemed necessary or appropriate, as an alternative to committee pre-approval of services to be provided by the auditors, as required by paragraphs (ii) and (iii) above, of policies and procedures to permit such services to be pre-approved by other means, such as through establishment of guidelines or by action of a designated member or members of the committee; provided the policies and procedures are detailed as to the particular service and the committee is informed of each service and such policies and procedures do not include delegation of audit committee responsibilities, as contemplated under the Securities Exchange Act of 1934, to management; subject, in the case of (ii) through (iv), to any waivers, exceptions or exemptions that may be available under applicable law or rules.

(e) (2) None of the services provided to the registrant described in paragraphs (b)-(d) of Item 4 were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of regulation S-X.

(f) No disclosures are required by this Item 4(f).

(g) The aggregate non-audit fees paid to the principal accountant for services rendered by the principal accountant to the registrant and the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant were $337,871 for the fiscal year ended July 31, 2024, and $650,244 for the fiscal year ended July 31, 2023.

(h) The registrant’s audit committee of the board has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) N/A

(j) N/A

Item 5. Audit Committee of Listed Registrants. N/A

Item 6. Schedule of Investments.

(a) Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR.

(b) N/A

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Franklin

International

Growth

Fund

Financial

Statements

and

Other

Important

Information

Annual

|

July 31, 2024

Financial

Statements

and

Other

Important

Information—Annual

Financial

Highlights

and

Schedule

of

Investments

2

Financial

Statements

9

Notes

to

Financial

Statements

13

Report

of

Independent

Registered

Public

Accounting

Firm

22

Tax

Information

23

Changes

In

and

Disagreements

with

Accountants

24

Results

of

Meeting(s)

of

Shareholders

24

Remuneration

Paid

to

Directors,

Officers

and

Others

24

Board

Approval

of

Management

and

Subadvisory

Agreements

24

Financial

Highlights

Franklin

International

Growth

Fund

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

L

a

Year

Ended

July

31,

2024

2023

2022

2021

2020

Class

A

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$16.49

$15.60

$22.76

$18.34

$14.62

Income

from

investment

operations

a

:

Net

investment

income

(loss)

b

....................

(—)

c

—

c

(0.06)

(0.09)

(0.04)

Net

realized

and

unrealized

gains

(losses)

...........

0.99

1.14

(6.72)

4.99

3.78

Total

from

investment

operations

....................

0.99

1.14

(6.78)

4.90

3.74

Less

distributions

from:

Net

investment

income

..........................

—

—

(0.17)

—

(0.02)

Net

realized

gains

.............................

—

(0.25)

(0.21)

(0.48)

—

Total

distributions

...............................

—

(0.25)

(0.38)

(0.48)

(0.02)

Net

asset

value,

end

of

year

.......................

$17.48

$16.49

$15.60

$22.76

$18.34

Total

return

d

...................................

6.00%

7.52%

(30.19)%

26.98%

25.52%

Ratios

to

average

net

assets

Expenses

before

waiver

and

payments

by

affiliates

......

1.19%

1.16%

1.15%

1.13%

1.17%

Expenses

net

of

waiver

and

payments

by

affiliates

.......

1.11%

1.11%

e

1.11%

1.11%

e

1.10%

e

Net

investment

income

(loss)

......................

(0.02)%

0.01%

(0.32)%

(0.41)%

(0.25)%

Supplemental

data

Net

assets,

end

of

year

(000’s)

.....................

$397,432

$462,018

$528,966

$961,676

$579,893

Portfolio

turnover

rate

............................

17.56%

18.23%

17.92%

14.47%

37.51%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Amount

rounds

to

less

than

$0.01

per

share.

d

Total

return

does

not

reflect

sales

commissions

or

contingent

deferred

sales

charges,

if

applicable.

e

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

Global

Trust

Financial

Highlights

Franklin

International

Growth

Fund

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

Year

Ended

July

31,

2024

2023

2022

2021

2020

Class

C

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$15.41

$14.70

$21.48

$17.46

$14.00

Income

from

investment

operations

a

:

Net

investment

(loss)

b

..........................

(0.11)

(0.11)

(0.20)

(0.23)

(0.15)

Net

realized

and

unrealized

gains

(losses)

...........

0.91

1.07

(6.34)

4.73

3.61

Total

from

investment

operations

....................

0.80

0.96

(6.54)

4.50

3.46

Less

distributions

from:

Net

investment

income

..........................

—

—

(0.03)

—

—

Net

realized

gains

.............................

—

(0.25)

(0.21)

(0.48)

—

Total

distributions

...............................

—

(0.25)

(0.24)

(0.48)

—

Net

asset

value,

end

of

year

.......................

$16.21

$15.41

$14.70

$21.48

$17.46

Total

return

c

...................................

5.19%

6.74%

(30.73)%

26.04%

24.63%

Ratios

to

average

net

assets

Expenses

before

waiver

and

payments

by

affiliates

......

1.94%

1.91%

1.90%

1.88%

1.92%

Expenses

net

of

waiver

and

payments

by

affiliates

.......

1.86%

1.86%

d

1.86%

1.86%

d

1.85%

d

Net

investment

(loss)

............................

(0.78)%

(0.74)%

(1.08)%

(1.15)%

(0.98)%

Supplemental

data

Net

assets,

end

of

year

(000’s)

.....................

$22,189

$27,894

$32,663

$62,560

$39,440

Portfolio

turnover

rate

............................

17.56%

18.23%

17.92%

14.47%

37.51%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Total

return

does

not

reflect

sales

commissions

or

contingent

deferred

sales

charges,

if

applicable.

d

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

Global

Trust

Financial

Highlights

Franklin

International

Growth

Fund

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Year

Ended

July

31,

2024

2023

2022

2021

2020

Class

R

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$16.20

$15.37

$22.48

$18.16

$14.50

Income

from

investment

operations

a

:

Net

investment

(loss)

b

..........................

(0.04)

(0.04)

(0.10)

(0.12)

(0.07)

Net

realized

and

unrealized

gains

(losses)

...........

0.97

1.12

(6.64)

4.92

3.73

Total

from

investment

operations

....................

0.93

1.08

(6.74)

4.80

3.66

Less

distributions

from:

Net

investment

income

..........................

—

—

(0.16)

—

—

Net

realized

gains

.............................

—

(0.25)

(0.21)

(0.48)

—

Total

distributions

...............................

—

(0.25)

(0.37)

(0.48)

—

Net

asset

value,

end

of

year

.......................

$17.13

$16.20

$15.37

$22.48

$18.16

Total

return

....................................

5.74%

7.24%

(30.37)%

26.69%

25.24%

Ratios

to

average

net

assets

Expenses

before

waiver

and

payments

by

affiliates

......

1.44%

1.41%

1.40%

1.38%

1.41%

Expenses

net

of

waiver

and

payments

by

affiliates

.......

1.36%

1.36%

c

1.36%

1.35%

c

1.35%

c

Net

investment

(loss)

............................

(0.27)%

(0.24)%

(0.55)%

(0.58)%

(0.45)%

Supplemental

data

Net

assets,

end

of

year

(000’s)

.....................

$4,702

$5,594

$5,940

$8,630

$2,365

Portfolio

turnover

rate

............................

17.56%

18.23%

17.92%

14.47%

37.51%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

Global

Trust

Financial

Highlights

Franklin

International

Growth

Fund

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

Year

Ended

July

31,

2024

2023

2022

2021

2020

Class

R6

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$16.68

$15.72

$22.94

$18.44

$14.69

Income

from

investment

operations

a

:

Net

investment

income

(loss)

b

....................

0.04

0.06

0.01

(0.01)

0.03

Net

realized

and

unrealized

gains

(losses)

...........

1.02

1.15

(6.76)

5.01

3.79

Total

from

investment

operations

....................

1.06

1.21

(6.75)

5.00

3.82

Less

distributions

from:

Net

investment

income

..........................

—

—

(0.26)

(0.02)

(0.07)

Net

realized

gains

.............................

—

(0.25)

(0.21)

(0.48)

—

Total

distributions

...............................

—

(0.25)

(0.47)

(0.50)

(0.07)

Net

asset

value,

end

of

year

.......................

$17.74

$16.68

$15.72

$22.94

$18.44

Total

return

....................................

6.35%

7.91%

(29.93)%

27.44%

26.08%

Ratios

to

average

net

assets

Expenses

before

waiver

and

payments

by

affiliates

......

0.82%

0.81%

0.80%

0.78%

0.81%

Expenses

net

of

waiver

and

payments

by

affiliates

.......

0.75%

0.75%

c

0.75%

0.73%

c

0.71%

c

Net

investment

income

(loss)

......................

0.28%

0.39%

0.04%

(0.03)%

0.17%

Supplemental

data

Net

assets,

end

of

year

(000’s)

.....................

$191,179

$321,629

$346,328

$548,647

$379,331

Portfolio

turnover

rate

............................

17.56%

18.23%

17.92%

14.47%

37.51%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

Global

Trust

Financial

Highlights

Franklin

International

Growth

Fund

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Year

Ended

July

31,

2024

2023

2022

2021

2020

Advisor

Class

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$16.62

$15.68

$22.89

$18.40

$14.66

Income

from

investment

operations

a

:

Net

investment

income

(loss)

b

....................

0.02

0.04

(0.01)

(0.04)

—

c

Net

realized

and

unrealized

gains

(losses)

...........

1.02

1.15

(6.76)

5.01

3.79

Total

from

investment

operations

....................

1.04

1.19

(6.77)

4.97

3.79

Less

distributions

from:

Net

investment

income

..........................

—

—

(0.23)

(—)

c

(0.05)

Net

realized

gains

.............................

—

(0.25)

(0.21)

(0.48)

—

Total

distributions

...............................

—

(0.25)

(0.44)

(0.48)

(0.05)

Net

asset

value,

end

of

year

.......................

$17.66

$16.62

$15.68

$22.89

$18.40

Total

return

....................................

6.26%

7.80%

(30.04)%

27.31%

25.90%

Ratios

to

average

net

assets

Expenses

before

waiver

and

payments

by

affiliates

......

0.94%

0.91%

0.90%

0.88%

0.92%

Expenses

net

of

waiver

and

payments

by

affiliates

.......

0.86%

0.86%

d

0.86%

0.86%

d

0.85%

d

Net

investment

income

(loss)

......................

0.16%

0.26%

(0.07)%

(0.17)%

0.03%

Supplemental

data

Net

assets,

end

of

year

(000’s)

.....................

$400,524

$784,288

$975,415

$1,665,974

$1,158,652

Portfolio

turnover

rate

............................

17.56%

18.23%

17.92%

14.47%

37.51%

a

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

b

Based

on

average

daily

shares

outstanding.

c

Amount

rounds

to

less

than

$0.01

per

share.

d

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Schedule

of

Investments,

July

31,

2024

Franklin

International

Growth

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Common

Stocks

97.9%

Aerospace

&

Defense

3.6%

MTU

Aero

Engines

AG

...............................

Germany

128,000

$

36,244,958

Air

Freight

&

Logistics

3.9%

DSV

A/S

..........................................

Denmark

215,000

39,440,898

Biotechnology

5.8%

CSL

Ltd.

..........................................

United

States

150,000

30,439,822

a

Genmab

A/S

.......................................

Denmark

100,000

28,247,369

58,687,191

Broadline

Retail

3.9%

a

MercadoLibre,

Inc.

..................................

Brazil

23,500

39,219,150

Capital

Markets

6.4%

Intermediate

Capital

Group

plc

.........................

United

Kingdom

1,220,503

34,445,464

Macquarie

Group

Ltd.

................................

Australia

220,000

30,273,024

64,718,488

Chemicals

4.7%

DSM-Firmenich

AG

..................................

Switzerland

90,000

11,490,203

Sika

AG

..........................................

Switzerland

118,000

35,830,788

47,320,991

Containers

&

Packaging

3.0%

SIG

Group

AG

.....................................

Switzerland

1,450,000

30,453,602

Entertainment

3.5%

CTS

Eventim

AG

&

Co.

KGaA

..........................

Germany

400,933

35,315,712

Health

Care

Equipment

&

Supplies

6.4%

Alcon,

Inc.

.........................................

United

States

395,800

37,480,435

Cochlear

Ltd.

......................................

Australia

122,000

27,562,389

65,042,824

Hotels,

Restaurants

&

Leisure

3.1%

Amadeus

IT

Group

SA

...............................

Spain

485,860

31,999,171

Interactive

Media

&

Services

1.2%

b

Scout24

SE

,

144A

,

Reg

S

.............................

Germany

160,000

12,649,200

IT

Services

9.3%

Keywords

Studios

plc

................................

Ireland

2,105,991

64,641,620

a

Shopify,

Inc.

,

A

.....................................

Canada

490,000

29,988,000

94,629,620

Life

Sciences

Tools

&

Services

5.1%

a

Evotec

SE

.........................................

Germany

2,450,000

23,085,339

Tecan

Group

AG

....................................

Switzerland

78,000

29,129,787

52,215,126

Machinery

4.2%

Interroll

Holding

AG

..................................

Switzerland

9,341

30,186,161

b

VAT

Group

AG

,

144A

,

Reg

S

...........................

Switzerland

26,000

13,031,019

43,217,180

Pharmaceuticals

3.8%

Daiichi

Sankyo

Co.

Ltd.

...............................

Japan

942,500

38,385,850

Professional

Services

3.5%

Experian

plc

.......................................

United

States

750,000

35,379,495

Semiconductors

&

Semiconductor

Equipment

6.4%

ASML

Holding

NV

...................................

Netherlands

33,000

30,728,656

Franklin

Global

Trust

Schedule

of

Investments

Franklin

International

Growth

Fund

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

See

Abbreviations

on

page

21.

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Common

Stocks

(continued)

Semiconductors

&

Semiconductor

Equipment

(continued)

Disco

Corp.

........................................

Japan

90,000

$

30,095,716

a

Nova

Ltd.

.........................................

Israel

20,000

4,129,400

64,953,772

Software

14.1%

a

CyberArk

Software

Ltd.

...............................

United

States

143,813

36,870,777

a

Kinaxis,

Inc.

.......................................

Canada

334,700

41,171,845

a

Monday.com

Ltd.

....................................

United

States

130,000

29,875,300

a

Nice

Ltd.

,

ADR

.....................................

Israel

150,000

27,150,000

SAP

SE

..........................................

Germany

40,000

8,456,812

143,524,734

Textiles,

Apparel

&

Luxury

Goods

3.2%

Puma

SE

.........................................

Germany

650,000

32,255,029

Trading

Companies

&

Distributors

2.8%

RS

Group

plc

......................................

United

Kingdom

2,750,000

28,886,494

Total

Common

Stocks

(Cost

$

745,140,671

)

...................................

994,539,485

Short

Term

Investments

0.8%

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Money

Market

Funds

0.8%

c,d

Institutional

Fiduciary

Trust

-

Money

Market

Portfolio

,

5.002

%

..

United

States

8,423,880

8,423,880

Total

Money

Market

Funds

(Cost

$

8,423,880

)

.................................

8,423,880

Total

Short

Term

Investments

(Cost

$

8,423,880

)

...............................

8,423,880

a

Total

Investments

(Cost

$

753,564,551

)

98.7

%

.................................

$1,002,963,365

Other

Assets,

less

Liabilities

1.3

%

...........................................

13,062,656

Net

Assets

100.0%

.........................................................

$1,016,026,021

a

a

a

a

Non-income

producing.

b

Security

was

purchased

pursuant

to

Rule

144A

or

Regulation

S

under

the

Securities

Act

of

1933.

144A

securities

may

be

sold

in

transactions

exempt

from

registration

only

to

qualified

institutional

buyers

or

in

a

public

offering

registered

under

the

Securities

Act

of

1933.

Regulation

S

securities

cannot

be

sold

in

the

United

States

without

either

an

effective

registration

statement

filed

pursuant

to

the

Securities

Act

of

1933,

or

pursuant

to

an

exemption

from

registration.

At

July

31,

2024,

the

aggregate

value

of

these

securities

was

$25,680,219,

representing

2.5%

of

net

assets.

c

See

Note

3(f)

regarding

investments

in

affiliated

management

investment

companies.

d

The

rate

shown

is

the

annualized

seven-day

effective

yield

at

period

end.

Franklin

Global

Trust

Financial

Statements

Statement

of

Assets

and

Liabilities

July

31,

2024

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

Franklin

International

Growth

Fund

Assets:

Investments

in

securities:

Cost

-

Unaffiliated

issuers

...................................................................

$745,140,671

Cost

-

Non-controlled

affiliates

(Note

3f)

........................................................

8,423,880

Value

-

Unaffiliated

issuers

..................................................................

$994,539,485

Value

-

Non-controlled

affiliates

(Note

3f)

........................................................

8,423,880

Foreign

currency,

at

value

(cost

$1,002)

..........................................................

991

Receivables:

Investment

securities

sold

...................................................................

12,503,464

Capital

shares

sold

........................................................................

286,544

Dividends

...............................................................................

2,708,002

Total

assets

..........................................................................

1,018,462,366

Liabilities:

Payables:

Investment

securities

purchased

..............................................................

4,116

Capital

shares

redeemed

...................................................................

1,020,889

Management

fees

.........................................................................

635,734

Distribution