SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [X] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Sec. 240.14a-12 |

FRANKLIN GLOBAL TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| | | | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

| | 1. | Title of each class of securities to which transaction applies: | |

| | | | |

| | 2. | Aggregate number of securities to which transaction applies: | |

| | | | |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4. | Proposed maximum aggregate value of transaction: | |

| | | | |

| | 5. | Total fee paid: | |

| | | | |

| [ ] | Fee paid previously with preliminary proxy materials. |

| | | | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | |

| | 1) | Amount Previously Paid: | |

| | | | |

| | | | |

| | | | |

| | 2) | Form, Schedule or Registration Statement No.: | |

| | | | |

| | | | |

| | | | |

| | 3) | Filing Party: | |

| | | | |

| | | | |

| | | | |

| | 4) | Date Filed: | |

| | | | |

| | | | |

|  | FUND PROXY FACT SHEET FOR: |

FRANKLIN GLOBAL REAL ESTATE FUND

| SPECIALMEETINGIMPORTANTDATES | | SPECIALMEETINGLOCATION |

| Record Date | JANUARY 4, 2018 | | OFFICES OF FRANKLIN TEMPLETON INVESTMENTS |

| Mail Date | FEBRUARY 2, 2018 | | ONE FRANKLIN PARKWAY |

| Meeting Date | APRIL 6, 2018 @ 2:00 PM PDT | | SAN MATEO, CALIFORNIA 94403 |

| ADDITIONALINFORMATION | | CONTACTINFORMATION |

| CUSIP | SEE PAGE 4 | | Inbound Line | 1-800-755-3105 |

| Ticker | SEE PAGE 4 | | Website | www.franklintempleton.com |

Note: Capitalized terms used herein and not defined herein are used with the meanings given them in the Franklin Global Real Estate Fund Prospectus/Proxy Statement.

What are Shareholders being asked to vote on?

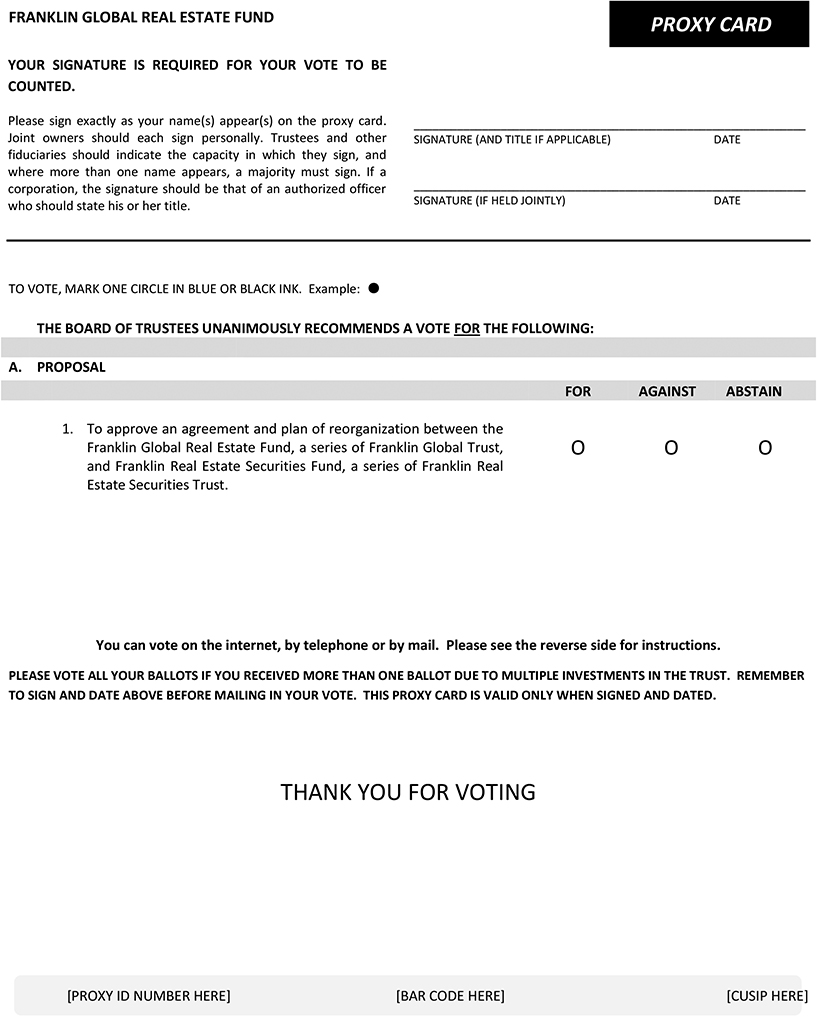

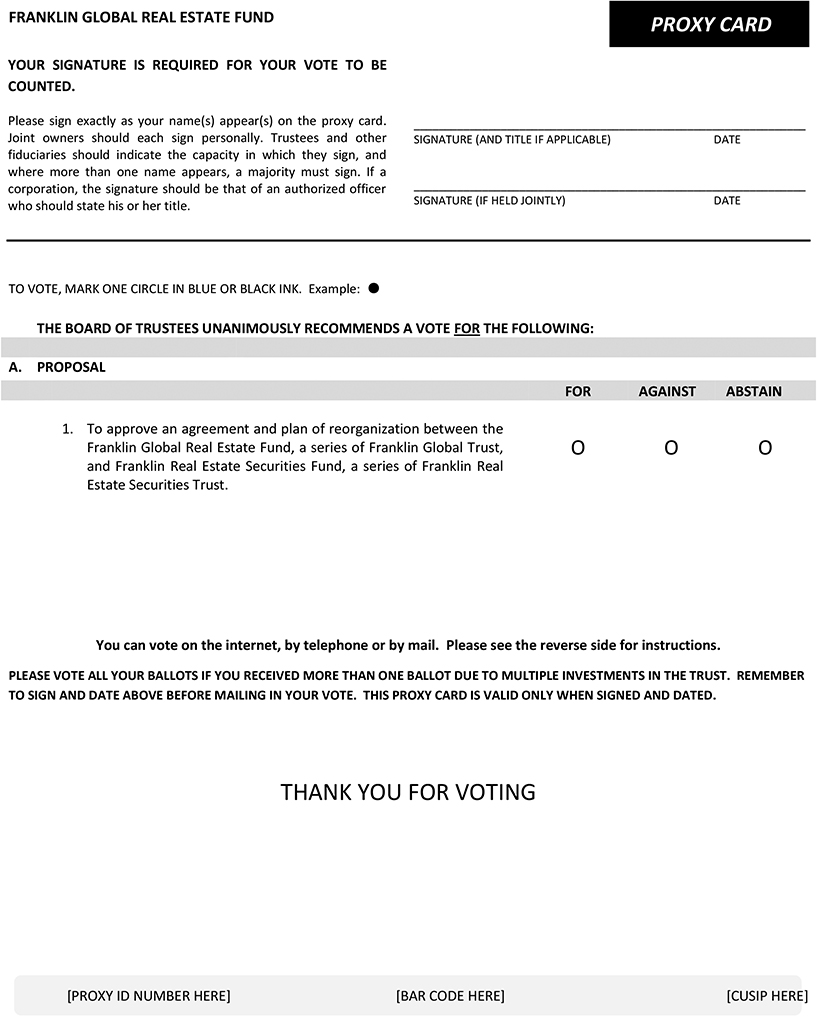

PROPOSAL 1: To approve an Agreement and Plan of Reorganization (the “Plan”) between the Franklin Global Real Estate Fund (the “Global Real Estate Fund”), a series of the Franklin Global Trust, and the Franklin Real Estate Securities Fund (the “Real Estate Securities Fund”), a series of Franklin Real Estate Securities Trust (“FREST”), that provides for: (i) the acquisition of substantially all of the assets of the Global Real Estate Fund by the Real Estate Securities Fund in exchange solely for shares of the Real Estate Securities Fund, (ii) the distribution of such shares to the shareholders of the Global Real Estate Fund, and (iii) the complete liquidation and dissolution of the Global Real Estate Fund.

BOARD OF TRUSTEES UNANIMOUS RECOMMENDATION – FOR

Why are shareholders being asked to approve an Agreement and Plan of Reorganization?

At a meeting of the Board of the Trust on October 24, 2017, Management recommended to the Board that it approve the reorganization of the Global Real Estate Fund with and into the Real Estate Securities Fund. Management recommended the Transaction because of the similar investment goals, and generally similar principal investment strategies and risks of the Funds and the fact that the Transaction may benefit shareholders of the Global Real Estate Fund by enabling them to be investors in a fund with a larger asset size, lower annual fund operating expenses, and higher average annual total returns for the three-, five- and ten-year periods.

How will the Transaction affect me?

If the Transaction is completed, you will cease to be a shareholder of the Global Real Estate Fund and you will become a shareholder of the Real Estate Securities Fund. Because the Funds have different net asset values per share, the number of Real Estate Securities Fund Shares that you receive will likely be different than the number of shares of the Global Real Estate Fund that you own, but the total value of your investment will be the same immediately before and after the exchange.

| For Internal Distribution Only | Page 1 |

Will the Funds’ investment management fees increase as a result of the Reorganization?

Both Funds are subject to an asset-based management fee structure with different fee breakpoints. The investment management fee ratio currently paid by the Real Estate Securities Fund is lower than the fee paid by the Global Real Estate Fund.

The overall annual investment management fee ratio for the Real Estate Securities Fund is currently 0.50%. The overall annual investment management fee ratio for the Global Real Estate Fund is currently 1.00%.

Will the Investment Goal, Strategies, Policies and Risks change as a result of the Reorganization?

Similar Investment Goals. Both Funds’ fundamental investment goal is total return. The Global Real Estate Fund has a fundamental investment goal of high total return, and the Real Estate Securities Fund has a fundamental investment goal to maximize total return.

Similar Principal Investment Strategies. The Global Real Estate Fund and the Real Estate Securities Fund have generally similar principal investment strategies but there are some differences.

| • | Under normal market conditions, the Global Real Estate Fund invests at least 80% of its net assets in securities of companies located anywhere in the world that operate in the real estate sector. |

| • | Under normal market conditions, the Real Estate Securities Fund invests at least 80% of its net assets in equity securities of companies operating in the real estate industry predominantly in the United States but may invest up to 10% of its total assets in securities of foreign issuers and in American, European and global depository receipts. |

| • | A significant portion (approximately 52% as of October 31, 2017) of the Global Real Estate Fund’s portfolio is comprised of securities of companies domiciled in the United States, while 100% of the Real Estate Securities Fund’s portfolio is comprised of securities companies domiciled in the United States as of October 31, 2017) |

Same Fundamental Investment Policies (i.e., a policy changeable only by shareholders’ vote):The Funds have the same fundamental investment restrictions regarding borrowing money, acting as underwriter, making loans, purchasing or selling real estate or physical commodities, issuing senior securities, concentrating in an industry, and purchasing the securities of any one issuer.

Similar Investment Risks. Investments in both Funds involve risks common to most mutual funds. You could lose money by investing in either Fund. Both Funds invest predominantly in securities of companies that operate in the real estate sector or industry. Thus, for the most part, they are subject to the same risks such as risks of investing in real estate securities, REITS and foreign securities along with market and management risk. The Global Real Estate Fund, unlike the Real Estate Securities Fund is also subject to liquidity and derivative instruments risk.

Will there be any Repositioning of the Global Real Estate Fund’s Portfolio Assets?

The Investment Manager currently estimates that a significant portion of the Global Real Estate Fund’s portfolio assets (approximately 47%, based on portfolio assets as of October 31, 2017, and valued at approximately $68 million) may be sold in connection with the Transaction as distinct from normal portfolio turnover, in order to comply with the Real Estate Securities Fund’s investment policies. Such sales would consist primarily of the Global Real Estate Fund’s holdings of issuers not domiciled in the United States. The Investment Manager expects that the Real Estate Securities Fund will retain, after the Transaction, a majority of the current U.S. portfolio holdings of the Global Real Estate Fund. Such repositioning of the Global Real Estate Fund’s portfolio assets may occur before or after the closing of the Transaction. These sales may result in the realization of capital gains, which to the extent not offset by available capital loss carryovers, would be distributed to shareholders. It is not anticipated that sales of a portion of the portfolio assets prior to the closing of the Transaction should result in any material amounts of capital gains to be distributed to shareholders of the Global Real Estate Fund. If the sale of such portfolio assets were to occur after the closing of the Transaction, the ability of the combined Real Estate Securities Fund to fully use the Global Real Estate Fund’s capital loss carryovers as of the closing to offset the resulting capital gains might be limited, and shareholders of the Real Estate Securities Fund may receive a greater amount of capital gain distributions than they would have had if the Transaction had not occurred. Transaction costs also may be incurred due to the repositioning of the portfolio. The Investment Manager believes that these portfolio transaction costs will be immaterial in amount (i.e., less than 0.01% (1 basis point) of annual fund operating expenses).

| For Internal Distribution Only | Page 2 |

How do the distribution and purchase procedures of the Funds compare?

Shares of the Global Real Estate Fund and the Real Estate Securities Fund are sold on a continuous basis by Franklin Templeton Distributors, Inc. (“Distributors”). Distribution and purchase procedures are the same for each Fund.

How do the redemption procedures and exchange privileges of the Funds compare?

The Funds have the same redemption procedures and exchange privileges.

What is the anticipated timing of the Transaction?

The Meeting is scheduled to occur on April 6, 2018. If the necessary approval is obtained, the Transaction will likely be completed on or about April 27, 2018.

What are the federal income tax consequences of the Transaction?

The Transaction is intended to qualify as a tax-free reorganization for federal income tax purposes, and the delivery of a legal opinion to that effect is a condition of closing the Transaction, although there can be no assurance that the Internal Revenue Service (“IRS”) will adopt a similar position.

What happens if the Transaction is not approved?

If the Transaction is not approved by the Global Real Estate Fund’s shareholders or does not close for any reason, such shareholders will remain shareholders of the Global Real Estate Fund, and the Global Real Estate Fund will continue to operate. The Board then will consider such other actions as it deems necessary or appropriate, including possible liquidation, for the Global Real Estate Fund.

Who will bear the costs associated with the Reorganization?

Each Fund will pay 25% of the expenses of the Transaction, including proxy solicitation costs. Franklin Templeton Institutional, LLC (“FT Institutional” or the “Investment Manager”) will pay the remaining 50% of such expenses. AST Fund Solutions is mentioned on page 9 of the Proxy Statement.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL 1

| For Internal Distribution Only | Page 3 |

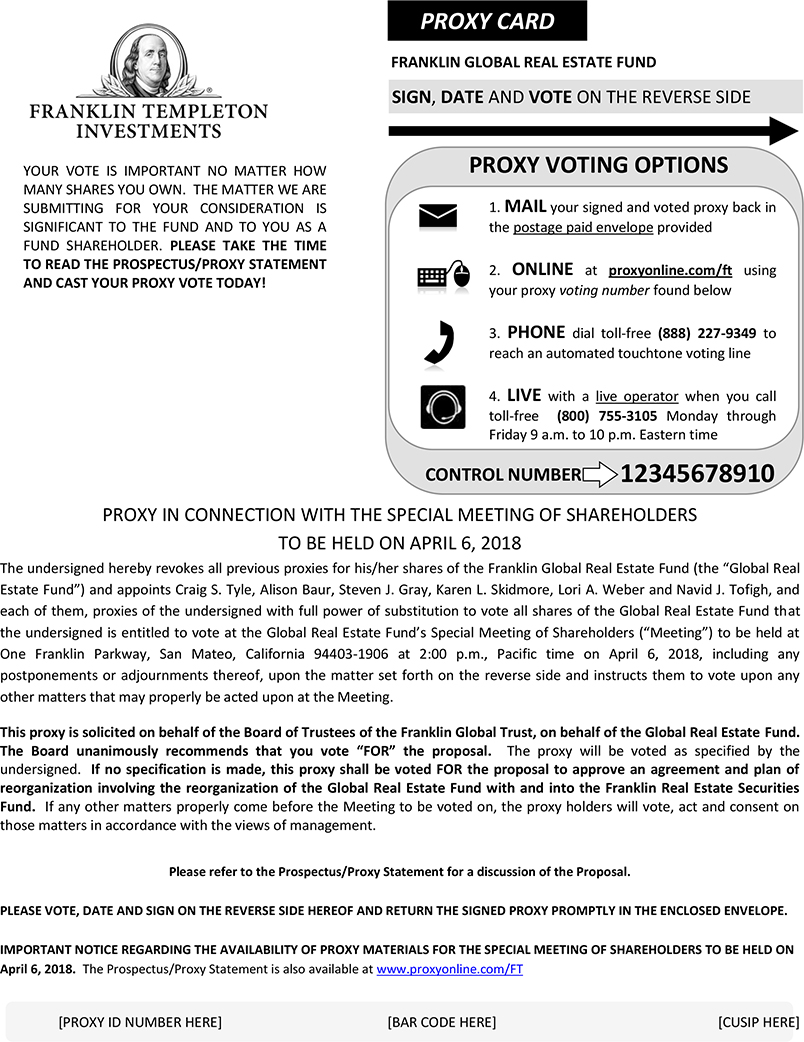

| PHONE: | To cast your vote by telephone with a proxy specialist, call the toll-free number found on your proxy card. Representatives are available to take your voting instructions Monday through Friday 9:00 a.m. to 10:00 p.m. Eastern Time and Saturday from 10:00 a.m. to 4:00 p.m. Eastern Time. |

| MAIL: | To vote your proxy by mail, check the appropriate voting box on the proxy card, sign and date the card and return it in the enclosed postage-paid envelope. |

| TOUCH-TONE: | To cast your vote via atouch-tone voting line, call the toll-free number and enter thecontrol number found on your proxy card. |

| INTERNET: | To vote via the Internet, go to the website on your proxy card and enter thecontrol numberfound on the proxy card. |

Proxy Materials Are Available Online At:www.proxyonline.com/docs/FranklinTempletonProxy

| NAME OF FUND | CUSIP | CLASS | TICKER |

| Franklin Global Real Estate Fund | 353533797 | A | FGRRX |

| Franklin Global Real Estate Fund | 353533789 | C | FCGRX |

| Franklin Global Real Estate Fund | 353533656 | R6 | FGGRX |

| Franklin Global Real Estate Fund | 353533771 | Advisor | FVGRX |

| For Internal Distribution Only | Page 4 |

| Franklin Global Real Estate Fund Level I Script (CONFIRM RECEIPT OF PROXY MATERIAL) |

Good(morning, afternoon, evening), my name is(AGENT’S FULL NAME).

May I please speak with(SHAREHOLDER’S FULL NAME)?

(Re-Greet If Necessary)

I am calling on a recorded line regarding your current investment with the Franklin Global Real Estate Fund with Franklin Templeton Investments and the proxy materials for the Special Meeting of Shareholders scheduled to take place on April 6, 2018 that was recently mailed to you.

Have you had the opportunity to review the information?

(Pause for response)

If “Yes” or positive response:

If you’re not able to attend the meeting, I can record your voting instructions by phone.

Your Board of Trustees has unanimously recommended a vote “For” the proposal.

If “No” or negative response:

I would be happy to review the meeting agenda with you and record your vote by phone; however, your Board of Trustees has unanimously recommended a vote “For” the proposal.

Would you like to vote along with the Board’s recommendation?

(Pause For Response)

(Review Voting Options with Shareholder If Necessary)

If we identify any additional accounts you own with the Franklin Global Real Estate Fund before the meeting takes place, would you like to vote those accounts in the same manner as well?

(Pause For Response)

*Confirmation – I am recording your(Recap Voting Instructions).

For confirmation purposes:

| • | Please state your full name.(Pause) |

| • | According to our records, you reside in (city, state, zip code).(Pause) |

| • | To ensure that we have the correct address for the written confirmation, please state your street address.(Pause) |

Thank you. You will receive written confirmation of your vote within 3 to 5 business days. Upon receipt, please review and retain for your records. If you should have any questions please call the toll free number listed on the confirmation. Mr. /Ms. ___________, your vote is important and your time is greatly appreciated. Thank you and have a good(morning, afternoon, evening.)

| FOR INTERNAL DISTRIBUTION ONLY | Updated 1-29-2018 |

Franklin Global Real Estate Fund

Level I Machine Script

Hello.

I am calling on behalf of your investment with the Franklin Global Real Estate Fund at Franklin Templeton Investments.

The Special Meeting of Shareholders is scheduled to take place on April 6, 2018. All shareholders are being asked to consider and vote on an important matter, the reorganization of the fund. As of today your vote has not been registered.

Please contact us as soon as possible at 1-800-755-3105 Monday through Friday between the hours of 9:00am and 10:00pm Eastern Time.

Your vote is very important. Thank you and have a Good Day.

Dear First Name Last Name,

You are receiving this email because you have elected to receive Proxy Materials via electronic delivery. To vote, please sign into your account atfranklintempleton.com and select "Vote My Proxy" from the "I AM HERE TO" menu.

Proxy Materials are available for the following shareholders' meeting:

| • | Special Meeting of Shareholders of Franklin Global Real Estate Fund |

| • | Meeting Date: April 6, 2018 |

| • | For shareholders as of January 4, 2018 |

HOW TO VOTE:

Because electronic Proxy Materials do not include a proxy card that you can mail in, you will need to cast your vote through the Internet or by touchtone telephone using the CONTROL NUMBER(S) below.

| • | To vote with a live agent or for questions, call (800) 755-3105. |

| • | To vote through the Internet, sign in to your online account and follow the on-screen instructions. |

| • | To vote by touchtone telephone, call 888-227-9349, and follow the recorded instructions. |

Franklin Global Real Estate Fund

| CONTROL NUMBER: | 133111744822 |

| CONTROL NUMBER: | 133112088037 |

| CONTROL NUMBER: | 133111832250 |

ADDITIONAL INFORMATION:

To access the electronic Proxy Materials, you may need Adobe Acrobat Reader software. This software is available for download at no cost athttp://www.adobe.com Downloading time may be slow. To request a paper copy of Proxy Materials relating to this proxy, please call (800) 755-3105. There is no charge to you for requesting a paper copy. Please make your request for a copy on or before March 23, 2018 to facilitate timely delivery of the materials.

Thank you for choosing eDelivery. We look forward to serving your investment needs in years to come.

Best regards,

Franklin Templeton Investor Services, LLC

Ian McCoy

Senior Vice President | Visitfranklintempleton.com

to access account information, fund performance, market commentary and more. |

You may contact us with any questions by email or call us at (800) 632-2301.

If you'd like to update your eDelivery options,sign in to your account and select "Change Delivery Options."

We do not send unsolicited emails asking our customers for private information such as Social Security numbers or account numbers. Any such request should be reported to us immediately at (800) 632-2301. Learn more aboutemail safety andonline security.

To make sure our emails to you aren't directed to your bulk or junk mail folders, please addonlineservices@franklintempleton.com to your email address book.

© Copyright 1999-2015. Franklin Templeton Investments. All rights reserved.