UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED JANUARY 31, 2007 |

| | |

| OR |

| | |

| o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM _______________ TO _______________ |

COMMISSION FILE NO. 000-31701

Bowlin Travel Centers, Inc.

(Name of the registrant as specified in its charter)

NEVADA | 85-0473277 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

150 LOUISIANA NE, ALBUQUERQUE, NM | 87108 |

| (Address of principal executive offices) | (Zip Code) |

| | |

Registrant’s telephone number, including area code: 505-266-5985

| SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE EXCHANGE ACT: |

| | | |

| NONE |

(Title of class) |

| SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE EXCHANGE ACT: |

| | | |

| Title of each class | | Name of each exchange on which registered |

| | |

| Common Stock, $.001 Par Value | | OTC.BB |

| |

|

| |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer (as defined in Rule 12b-2 of the Exchange Act):

| | | | |

| | Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý |

| | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant at July 31, 2006 was $2,929,405.

The number of shares of Common Stock, $.001 par value, outstanding as of April 27, 2007: 4,583,348

Forward-Looking Statements

Certain statements in this Annual Report on Form 10-K constitute forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and should be read in conjunction with the Financial Statements of Bowlin Travel Centers, Inc., a Nevada corporation (the “Company” or “Bowlin Travel Centers”). Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause the Company’s actual results to differ materially from those contained in these forward-looking statements, including those set forth under the heading “RISK FACTORS” under ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS and the risks and other factors described elsewhere. The cautionary factors, risks and other factors presented should not be construed as exhaustive. The Company assumes no obligation to update these forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking statements.

PART I

Company Overview

The Company operates travel centers dedicated to serving the traveling public in rural and smaller metropolitan areas of the Southwestern United States. The Company’s tradition of serving the public dates back to 1912, when the founder, Claude M. Bowlin, started trading goods and services with Native Americans in New Mexico. Bowlin Travel Centers currently operates twelve full-service travel centers along interstate highways in Arizona and New Mexico. Two of the Company’s travel centers are held for sale; one of the Company’s travel centers has a letter of intent with the Pueblo of Laguna and is scheduled to close on April 30, 2007 (see “Recent Developments” and “Subsequent Events” for further information). The Company advertises its travel centers through a network of approximately 300 outdoor advertising display faces. The Company’s travel centers offer brand name food, gasoline and a variety of unique Southwestern merchandise to the traveling public.

The Company was formed on August 8, 2000, as a wholly owned subsidiary of Bowlin Outdoor Advertising and Travel Centers Incorporated (“Bowlin Outdoor”). Pursuant to a Contribution Agreement, dated as of November 1, 2000, Bowlin Outdoor contributed substantially all of the assets and liabilities directly related to its travel centers business to Bowlin Travel Centers.

Prior to August 8, 2000, the Company’s travel centers were owned and operated as a business segment of Bowlin Outdoor. Bowlin Outdoor operated two business segments: travel centers and outdoor advertising. Bowlin Outdoor’s common stock was traded on the American Stock Exchange and was a public reporting company. On January 30, 2001, the Company became an independent company through a spin-off transaction whereby shares of the Company’s common stock were distributed to the shareholders of Bowlin Outdoor.

Recent Developments

On February 1, 2006, the Company began wholesaling gasoline to three new independent wholesale locations. Two of the independent wholesalers will sell ExxonMobil petroleum products. The other independent wholesaler will sell CITGO petroleum products. All three contracts with these sholesalers have a five-year term beginning February 1, 2006. All of the contracts can terminate subject to the occurrence of certain events including bankruptcy or breach of the agreement, or termination by ExxonMobil or CITGO of their petroleum marketing activities in the Company’s distribution area or with a 30 day notification to the Company. The terms of the contracts require the three independent wholesalers to purchase a maximum gallon quantity of 105% of the preceding calendar year’s gallons purchased. There are no minimum gallon quantity requirements for any of the three contracts. The Company has entered into a retail supply agreement with Arizona Fuel Distributors which will replace CITGO. See “Subsequent Events” for further information.

At the beginning of the Company’s third quarter, the independent CITGO wholesaler de-branded; therefore, the Company no longer wholesales to this location. The potential loss of income to the Company for fiscal year ending January 31, 2007 is approximately $3,000.

On August 15, 2006, the Company entered into promissory note with C. C. Bess in the amount of $53,000. The promissory note has a stated rate of interest of 8.5% and is payable in monthly installments of $680 for five years.

On August 15, 2006, the Company sold vacant land located south of Las Cruces, New Mexico to Larjon, LLC for $26,500 cash and a note receivable of $108,500. The note receivable has a stated rate of interest of 9.0% and is payable in quarterly installments of $6,797 for five years. The property sold had a carrying value of $104,000 and the costs incurred to sell the land were $630. The gain on the sale of the land was $30,370 of which $5,961 was recognized initially and $24,409 was deferred. In accordance with FAS 66, the gain was deferred because the minimum initial investment by the buyer was less than the required 20% initial investment expressed as a percentage of the sales value (FAS 66, paragraph 54). Therefore, the gain will be recognized into income using the installment method as payments are received. The deferred gain is reflected as a reduction to the note receivable in the accompanying balance sheet.

On August 15, 2006, the Company sold two lots of vacant land located south of Las Cruces, New Mexico to Teak, LLC for $26,500 cash and two notes receivable of $54,250 each. Both notes receivable have a stated rate of interest of 9.0% and both are payable in quarterly installments of $3,398 for five years. The property sold had a carrying value of $96,530 and the costs incurred to sell the land were $844. The gain on the sale of the land was $37,626 of which $7,386 was recognized initially and $30,240 was deferred. In accordance with FAS 66, the gain was deferred because the minimum initial investment by the buyer was less than the required 20% initial investment expressed as a percentage of the sales value (FAS 66, paragraph 54). Therefore, the gain will be recognized into income using the installment method as payments are received. The deferred gain is reflected as a reduction to the note receivable in the accompanying balance sheet.

On September 29, 2006, the Company changed the terms of its agreements with its primary lender, Bank of the West. The agreements modified the Company’s $4,870,101 debt with Bank of the West from a variable rate of interest to a variable rate of interest subject to annual adjustment every five years, currently set at 7.26% for the next five years. In accordance with EITF Issue No. 96-19, “Debtor’s Accounting for a Modification or Exchange of Debt Instruments,” the present value of the cash flows under the terms of the modified debt was less than 10% from the present value of the remaining cash flows under the terms of the original debt. Therefore, the modification of terms was not considered substantially different and there was no debt extinguishment.

On October 10, 2006, the Company entered into a second addendum to a lease by and between the Company and Michele Prince, Successor Trustee of the Janet H. Prince Revocable Trust U/T/A dated May 5, 1994 (the “Owner”). The original term of the lease was twenty-six (26) years, commencing on August 1, 1986 and ending on July 31, 2012. On December 1, 2002, there was an addendum to the lease granting the Company an exclusive, irrevocable option and right of purchase of the leased premises for $100,000 paid to the Owner immediately and purchase price of $700,000. The option and right of purchase of the leased premises expires on or before April 30, 2012. The second addendum specifies that the Owner may exercise the option at any time prior to the expiration of the option term. In addition, the Company paid the Owner $100,000 and the Owner agreed to reduce the purchase price to $600,000 and advance the Company’s option date to April 30, 2011.

On November 1, 2006, the Company entered into a retail supply agreement with Jackson Oil, a division of Jacksons Food Stores, Inc. to purchase ChevronTexaco brand fuels for the Company’s three Arizona retail locations. The agreement was terminated January 10, 2007. The Company has entered into a retail supply agreement with Arizona Fuel Distributors which will replace Jackson Oil. See “Subsequent Events” for further information.

During the fourth quarter of the Company’s fiscal year 2007, property, fixtures and equipment located 4 miles north of Alamogordo were listed for sale and therefore have been identified as a component as defined in FAS Statement No. 144 - Accounting for Impairment or Disposal of Long-Lived Assets (as amended). The carrying value of the property, fixtures and equipment of approximately $667,000 and $677,000 have been reclassified as assets held for sale in the January 31, 2007 and January 31, 2006 balance sheets, respectively. The results of operations of ($28,517), ($17,128) and ($31,072) for the twelve months ended January 31, 2007, 2006 and 2005, respectively, have been reclassified to loss from discontinued operations of a component, net of the related income tax benefit.

Subsequent Events

On November 27, 2006, the Company entered into a purchase agreement with Maxwell & Associates Real Estate Holdings, LLC to sell property, fixtures and equipment located in Edgewood, New Mexico. The contract sales price is $1,300,000 including a $25,000 earnest deposit. Closing was scheduled on or before January 30, 2007. Closing was extended until February 20, 2007. The extension date expired and the $25,000 earnest deposit was advanced to the Company. The property, fixtures and equipment remain for sale and therefore has been identified as a component as defined in FAS Statement No. 144 - Accounting for Impairment or Disposal of Long-Lived Assets (as amended). The carrying value of the property, fixtures and equipment of approximately $499,000 and $521,000 have been reclassified as assets held for sale in the January 31, 2007 and January 31, 2006 balance sheets, respectively. The results of operations of ($119,148), ($89,596) and ($80,882) for the twelve months ended January 31, 2007, 2006 and 2005, respectively, have been reclassified to loss from discontinued operations of a component, net of the related income tax benefit.

On November 27, 2006, the Company entered into a letter of intent with the Pueblo of Laguna to sell property, fixtures and equipment located 17 miles west of Albuquerque, New Mexico at the Rio Puerco exit. The letter of intent sales price is $2,500,000 including a $100,000 earnest deposit. Closing was scheduled on or before January 30, 2007. Closing has been extended to April 30, 2007. The Company expects a gain on the sale of approximately $900,000. The carrying value of the property, fixtures and equipment of approximately $1,393,000 and the related debt, $549,000 and $1,466,000 and the related debt, $602,000 have been reclassified as assets held for sale in the January 31, 2007 and January 31, 2006 balance sheets, respectively. The estimated cost of the sale is approximately $207,000. The operations of this location have been identified as a component as defined in FAS Statement No. 144 - Accounting for the Impairment of Disposal of Long-Lived Assets (as amended). Accordingly, the results of operations ($56,226), ($82,439) and ($108,691) for the twelve months ended January 31, 2007, 2006 and 2005, respectively, have been reclassified to loss from discontinued operations of a component, net the related income tax benefit.

The Company entered into a retail supply agreement with Arizona Fuel Distributors, L.L.C. to purchase Mobil and Shell brand fuels for the Company’s three Arizona retail locations. The retail supply agreement for Mobil brand fuels is for a period of ten years beginning on March 20, 2007 and shall continue on a month to month basis until terminated by the Company. The Company may terminate the agreement after the term has expiried by giving thirty days advance written notice to Arizona Fuel Distributors, L.L.C. The retail agreement for Shell brand fuels is for a period of ten years beginning on March 20, 2007 and shall continue on a month to month basis until a new agreement is executed or Arizona Fuel Distributors, L.L.C. terminates or does not renew the agreement in accordance with applicable law. There are no minimum or maximum gallons purchase requirements for the Company. The Company’s CITGO distribution agreement that the three Arizona retail locations operate under ends March 31, 2007 as CITGO terminated its petroleum marketing activities in the Company’s distribution area.

On March 31, 2007 the distribution franchise agreement with CITGO was mutually cancelled in compliance with the provisions of the Petroleum Marketing Practices Act. CITGO terminated its petroleum marketing activities in the Company’s distribution area.

Industry Overview

The travel services industry in which the Company competes includes convenience stores that may or may not offer gasoline, and fast food and full-service restaurants located along rural interstate highways. The Company believes that the current trend in the travel services industry is toward strategic pairings at a single location of complementary products that are noncompetitive, such as brand name gasoline and brand name fast food restaurants. This concept, known as “co-branding,” has recently seen greater acceptance by both traditional operators and larger petroleum companies. The travel services industry has also been characterized in recent periods by consolidation or closure of smaller operators. The convenience store industry includes both traditional operators that focus primarily on the sale of food and beverages but also offer gasoline, and large petroleum companies that offer food and beverages primarily to attract gasoline customers.

The restaurant segment of the travel services industry is highly competitive, most notably in the areas of consistency of quality, variety, price, location, speed of service and effectiveness of marketing. The major chains are aggressively increasing market penetration by opening new restaurants, including restaurants at “special sites” such as retail centers, travel centers and gasoline outlets. Smaller quick-service restaurant chains and franchise operations are focusing on brand and image enhancement and co-branding strategies.

Business Strategy

The Company’s business strategy is to capture a greater market share of the interstate traveler market in Arizona and New Mexico by offering name brand recognized food service operations and gasoline, and unique Southwestern souvenirs and gifts, at a single location and at competitive prices delivered with a high standard of service.

The Company’s travel centers are strategically located along well-traveled interstate highways in Arizona and New Mexico where there are generally few gas stations, convenience stores or restaurants. The Company operates five full-service restaurants which are less than half of the Company’s twelve travel centers, under the Dairy Queen/Brazier or Dairy Queen trade names. All of the Company’s twelve travel centers sell convenience store food such as chips, nuts, cookies and prepackaged sandwiches along with a variety of bottled and canned drinks.

The Company’s travel centers offer brand name gasoline such as ExxonMobil and CITGO. The Company is an authorized distributor of ExxonMobil and CITGO petroleum products. Seven of the Company’s New Mexico locations are ExxonMobil stations, one of the Company’s New Mexico locations is a CITGO station and three of its Arizona locations are CITGO stations. At this time, one of the Company’s New Mexico locations does not offer gasoline. The Company’s CITGO distribution agreement for the four retail locations ends March 31, 2007 as CITGO terminated its petroleum marketing activities in the Company’s distribution area. As of March 20, 2007, one of the Arizona stores has been re-branded Mobil and two of the Arizona stores have re-branded Shell as a result of the Company entering into a retail supply agreement with Arizona Fuel Distributors, L.L.C. As of January 31, 2007, the New Mexico CITGO location discontinued gasoline sales.

The Company’s billboard advertising for its travel centers emphasizes the wide range of unique Southwestern souvenirs and gifts available at the travel centers, as well as the availability of gasoline and food. Merchandise at each of the Company’s stores is offered at prices intended to suit the budgets and tastes of a diverse traveling population. The merchandise ranges from inexpensive Southwestern gifts and souvenirs to unique handcrafted jewelry, rugs, pottery, and other gifts.

Growth Strategy

Travel Centers

The Company is committed to developing its travel center operations by evaluating the performance of each location. Locations that consistently under perform are identified and strategies are prepared to appropriately deal with poor performing travel centers. In addition, the Company intends to explore the possibilities of acquiring or building additional travel centers.

The Company believes that the co-branding concept implemented at its travel centers has resulted in increased revenues, and intends to pursue opportunities to acquire rights to additional brand name products, primarily brand name food.

The Company intends to continue to offer high quality brand name food and products in a clean, safe environment designed to appeal to travelers on interstate highways.

The Company intends to continue to increase sales at existing locations through ongoing renovation and upgrading of facilities, including gasoline sales by focusing on the marketing of ExxonMobil and Shell gasoline brands through its travel center outlets.

The Company has been wholesaling gasoline since 1997. Since 1997, revenues from wholesaling gasoline have accounted for an average of approximately 8.9% of gross revenues. Other than purchasing gas for retail sales through its travel centers, during the fiscal year ended January 31, 2007, the Company had three independent ExxonMobil wholesale customers and one independent CITGO wholesale customer. At the beginning of the Company’s third quarter, the independent CITGO wholesale customer debranded; therefore the Company no longer wholesales to this location. The Company anticipates expanding its current level of gasoline wholesaling and is marketing its wholesaling business. See “Business Operations - Gasoline Wholesaling”.

Business Operations

The Company sells food, gasoline and merchandise through its twelve travel centers located along two interstate highways (I-10 and I-40) in Arizona and New Mexico. These are key highways for travel to numerous tourist and recreational destinations as well as arteries for regional traffic among major Southwestern cities. All of the Company’s travel centers are open every day of the year except Christmas.

Each of the Company’s travel centers maintains a distinct, theme-oriented atmosphere. In addition to the Southwestern merchandise it purchases from Native American tribes, the Company also imports approximately 650 items from Mexico, including handmade blankets, earthen pottery and wood items. Additional goods, novelties and imprinted merchandise are imported from several Pacific Rim countries. The Company has long-standing relationships with many of its vendors and suppliers. While the Company has no formal agreements with any of its vendors and suppliers of Southwestern merchandise and items from Mexico, the Company believes that there are adequate resources outside of those that are regularly used so that the Company could continue to provide these items even if it were unable to use its regular sources.

The Company sells food at five of its twelve travel centers under the Dairy Queen and Dairy Queen/Brazier brand names. All of the Company’s twelve travel centers sell convenience store food such as chips, nuts, cookies and prepackaged sandwiches along with a variety of bottled and canned drinks.

The Company’s terms of its agreements with Dairy Queen obligate the Company to pay a franchise royalty and in some instances a promotion fee, each equal to a percentage of gross sales revenues from products sold, as well as comply with certain provisions governing the operation of the franchised stores. The Company is obligated to pay Dairy Queen franchise fees of 4.0% and advertising fees of 2.25% of its sales of their products in New Mexico. In Arizona, the Company is obligated to pay Dairy Queen franchise fees of 4.0% of its sales of their products and advertising fees of 2.25% of its sales products not to exceed the maximum of $15,000.

The Company currently operates five Dairy Queens at its travel centers. It has individual franchise agreements for each Dairy Queen operated at the travel centers. None of these agreements are exclusive nor do they prevent the Company from entering into agreements with other food franchisors. Several of the agreements have different termination provisions and are effective for different terms. Under three of the Dairy Queen agreements, the term continues until the Company elects to terminate it with 60 days prior written notice, or if the Company or Dairy Queen elect to terminate the agreement because the other has breached the agreement and has not cured that breach within 14 days of notice of the breach. The other two Dairy Queen agreements are for specific terms. One of those Dairy Queen agreements, entered into February 1, 1984, is for a term of 25 years and the other, entered into on November 18, 1986, is for a term of 20 years plus an additional 5 years per an extension agreement dated June 29, 1987. The Company may not terminate either of these agreements unless it gives notice to Dairy Queen that it is in breach of the agreement and Dairy Queen has not cured that breach within thirty days of our notice. Dairy Queen may terminate either of these agreements if it delivers notice to the Company that it is in breach of the agreement and it does not cure that breach within 14 days of that notice.

The Company continuously monitors and upgrades its travel center facilities to maintain a high level of comfort, quality and appearance. Periodic improvements typically include new awnings and facings, new signage and enhanced lighting, furnishings, buildings and parking lot improvements.

The Company is an authorized ExxonMobil and CITGO distributor. The Company sells ExxonMobil gasoline at seven of its New Mexico travel centers, and CITGO gasoline at three of its Arizona travel centers and one New Mexico location. One of the Company’s New Mexico locations does not offer gasoline. The Company’s CITGO distribution agreement for the three Arizona retail locations ends March 31, 2007, as CITGO terminated its petroleum marketing activities in the Company’s distribution area. As of March 20, 2007, one of the Arizona stores has re-branded Mobil and two of the Arizona stores have re-branded Shell as a result of the Company entering into a retail supply agreement with Arizona Fuel Distributors, L.L.C. As of January 31, 2007, the New Mexico CITGO location discontinued gasoline sales.

The fact that the Company is an authorized ExxonMobil, and was an authorized CITGO distributor through March 31, 2007, has significance in the Company’s industry. The Company’s CITGO distribution agreement ends March 31, 2007 as CITGO terminated its petroleum marketing activities in the Company’s distribution area. As licensed distributors for ExxonMobil and CITGO during the past fiscal year, the Company purchased gasoline directly from ExxonMobil and CITGO as direct marketers at the lowest wholesale prices they offer. Prior to becoming a licensed distributor, the Company purchased gasoline through other distributors, paying a distributor’s markup price. This required the Company to negotiate and enter into agreements with other distributors to try to purchase gasoline at the lowest possible price. The ExxonMobil and CITGO distribution agreement allows the Company to streamline its gasoline supply arrangements and take advantage of volume-driven pricing by consolidating purchases from these suppliers. The Company has entered into a retail supply agreement to replace the CITGO brand with Arizona Fuel Distributors, L.L.C. and as a result of purchasing gasoline, will pay a distributor’s markup price of $0.015 cents per gallon purchased.

The ExxonMobil distribution agreement had a five-year term beginning September 1, 2005, and expiring October 31, 2010. The CITGO distribution agreement has an initial three-year term beginning February 1, 2001 and expiring January 31, 2004, and automatically renewed for a three-year term through 2007. ExxonMobil’s and CITGO’s ability to terminate or refuse to renew the agreement is subject to the occurrence of certain events set forth in the Petroleum Marketing Practices Act, which includes bankruptcy, or breach of the agreement, or termination by ExxonMobil or CITGO of its petroleum marketing activities in the Company’s distribution area. CITGO has terminated its petroleum marketing activities in the Company’s distribution area effective March 31, 2007. ExxonMobil and CITGO may terminate or refuse to renew these agreements only if it terminates or refuses to renew the agreement in compliance with the Petroleum Marketing Practices Act.

The Company’s agreements with ExxonMobil, and CITGO through March 31, 2007, do not prohibit it from entering into similar arrangements with other petroleum companies. The terms of the distribution agreements require the Company to purchase certain monthly minimum quantities of gasoline during the term of the agreement, which includes gasoline purchased for sale at its travel centers. For fiscal year ending January 31, 2007, the amount of required CITGO gasoline purchases ranged from a low of 126,000 gallons to a high of 280,500 gallons per month. The amount of required ExxonMobil gasoline purchases is a minimum of three million gallons per year. For ExxonMobil, the maximum monthly volume for the current month is the greater of actual volume in the prior month or the actual volume in the current month of the prior year. The Company determines the amount of gasoline it will purchase under the agreements based on what it believes its needs will be for gasoline, including seasonal demands. These determinations are based on historical sales and internal forecasts. During the term of the prior of the ExxonMobil distribution agreement, purchases of ExxonMobil met the minimum quantities for contract years ended March 31, 2004 and March 31, 2005. The ExxonMobil agreement was renewed for a term beginning on September 1, 2005 and ending on August 31, 2010. During the term of the current ExxonMobil distribution agreement, purchases met the minimum quantities. The Company is on target to meet its required three million gallons for the contract year ending August 31, 2007. Since the effective date of the CITGO agreement, purchases did not meet the minimum quantities for the first three years, met the minimum quantities for contract year ended January 31, 2005, but have not met the minimum quantities for contract years ended January 31, 2006 and January 31, 2007. There are no penalties associated with not meeting the minimum quantities for ExxonMobil or CITGO. Additionally, the minimum quantities can be increased or decreased, as applicable, to accommodate additional travel centers, or losses of travel centers.

In addition to the requirement to purchase minimum amounts under the ExxonMobil and CITGO distribution agreements, the Company is also required to pay a processing fee of approximately 3% of the value of the sale for purchases of gasoline made by customers using a credit card.

Gasoline Wholesaling

On February 1, 2006, the Company began wholesaling gasoline to three new independent wholesale locations. Two of the independent wholesalers will sell ExxonMobil petroleum products. The other independent wholesaler will sell CITGO petroleum products. All three contracts have a five-year term beginning February 1, 2006. All of the contracts with the wholesalers can terminate subject to the occurrence of certain events including bankruptcy or breach of the agreement, or termination by ExxonMobil or CITGO of its peteroleum marketing activities in the Company’s distribution area or with a 30 day notification to the Company. The terms of the contracts require the three independent wholesalers to purchase a maximum gallon quantity of 105% of the preceding calendar year gallons purchased. There are no minimum gallon quantity requirements for any of the three contracts.

At the beginning of the Company’s third quarter, the independent CITGO wholesale customer debranded; therefore the Company no longer wholesales to this location.

The Company has an existing independent ExxonMobil wholesale location.

Over the past five years, wholesaling of gasoline has accounted for, on average, approximately 11.6% of overall revenues. The Company anticipates expanding its current level of gasoline wholesaling and is marketing its wholesaling business. Below is a table that shows the revenues generated from gasoline wholesaling, total revenues for the periods reflected, and the percentage total of overall revenues attributable to gasoline wholesaling.

Gasoline wholesaling revenues as a percentage of Gross Revenues from continuintg operatons (unaudited):

Fiscal Year Ended January 31, | Gross Revenues from Continuing Operations | Revenue from Gasoline Wholesaling | Percentage of Gross Revenues attributable to Gasoline Wholesaling |

| 2003 | $18,859,000 | $2,126,000 | 11.27% |

| 2004 | $19,337,000 | $1,789,000 | 9.25% |

| 2005 | $20,336,000 | $1,754,000 | 8.63% |

| 2006 | $23,442,000 | $1,636,000 | 6.98% |

| 2007 | $27,973,000 | $6,049,000 | 21.6% |

The increase in the percentage of gross revenues attributable to gasoline wholesaling is attributable to the three new independent wholesale locations with one of the independent wholesale locations debranding at the beginning of the Company’s third quarter (see “Recent Developments” and “Gasoline Wholesaling” for further information).

The cost of goods sold as a percentage of gross revenues for gasoline wholesaling is approximately 99.6%.

Competition

The Company faces competition at its travel centers from quick-service and full-service restaurants, convenience stores, gift shops and, to some extent, from truck stops located along interstate highways in Arizona and New Mexico. Large petroleum companies operate some of the travel centers that the Company competes with, while many others are small independently owned operations that do not offer brand name food service or gasoline. Giant Industries, Inc., a refiner and marketer of petroleum products, operates two travel centers, one in Arizona and one in New Mexico, which are high volume diesel fueling and large truck repair facilities that also include small shopping malls, full-service restaurants, convenience stores, fast food restaurants and gift shops. The Company’s principal competition from truck stops includes Love’s Country Stores, Inc., Petro Corporation and Flying J. Many convenience stores are operated by large, national chains that are substantially larger, better capitalized and have greater name recognition and access to greater financial and other resources than the Company. Although the Company faces substantial competition, the Company believes that few of its competitors offer the same breadth of products and services dedicated to the traveling public that the Company offers.

Employees

As of January 31, 2007, the Company had approximately 134 full-time and 20 part-time employees; 42 were located in Arizona, 112 were located in New Mexico. None of the Company’s employees are covered by a collective bargaining agreement and the Company believes that relations with its employees are good.

Regulation

The Company’s operations are subject to regulation for dispensing gasoline, maintaining mobile homes, dispensing food, sales of fireworks, sales of cactus, operating outdoor advertising signs, waste disposal and air quality control. The Company also must maintain registration of company vehicles, general business licenses and corporate licenses.

The Company is subject to federal, state and local laws and regulations governing the use, storage, handling, and disposal of petroleum products. The risk of accidental contamination to the environment or injury cannot be eliminated. In the event of such an accident, the Company could be held liable for any damages that result and any such liability could exceed available resources. The Company could be required to incur significant costs to comply with environmental laws and regulations that may be enacted in the future.

Each food service operation is subject to licensing and regulation by a number of governmental authorities relating to health, safety, cleanliness and food handling. The Company’s food service operations are also subject to federal and state laws governing such matters as working conditions, overtime, tip credits and minimum wages. The Company believes that operations at its travel centers comply in all material respects with applicable licensing and regulatory requirements; however, future changes in existing regulations or the adoption of additional regulations could result in material increases in operating costs.

Travel center operations are also subject to extensive laws and regulations governing the sale of tobacco, and in New Mexico travel centers, the sale of fireworks. Such regulations include certain mandatory licensing procedures and ongoing compliance measures, as well as special sales tax measures. These regulations are subject to change and future modifications may result in decreased revenues or profit margins at the Company’s travel centers as a result of such changes.

Nearly all licenses and registrations are subject to renewal each year. The Company is not aware of any reason it would be unable to renew any of its licenses and registrations. The Company estimates that the total cost spent on an annual basis for all licenses and registrations is less than $15,000.

The Company anticipates that in the next twelve months the regulating agencies will develop regulations for above ground storage of fuel and anticipate that because of its expenditures and compliance, ongoing costs for compliance should be approximately $3,000.

Trademarks

The Company operates its travel centers under a number of its own trademarks such as The Thing, Butterfield Station and Bowlin’s Running Indian, as well as certain trademarks owned by third parties and licensed to the Company, such as the Dairy Queen, Dairy Queen/Brazier, ExxonMobil and CITGO trademarks. The Company’s right to use the trademarks Dairy Queen, Dairy Queen/Brazier, ExxonMobil and CITGO are derived from the agreements entered into with these companies, and these rights expire when those agreements expire or are terminated. The Company’s CITGO distribution agreement ends March 31, 2007, as CITGO terminated its petroleum marketing activities in the Company’s distribution area. The Company has a Federal trademark for “BOWLIN” that is effective through 2008. All other rights to trade names that the Company uses in its operations are protected through common law or state rights granted through a registration process. The Company believes that its trademark rights will not materially limit competition with its travel centers. The Company also believes that, other than its Federal trademark for “BOWLIN”, none of the trademarks owned are material to overall business; however, the loss of one or more of our licensed trademarks could have an adverse effect.

Trademark / Trade Name | Where Registered | Expiration of Registration |

| BOWLIN | United States Patent and Trademark Office | October 27, 2008 |

| Bowlin’s Running Indian | New Mexico | March 30, 2014 |

| Bowlin Travel Centers | Arizona | April 24, 2011 |

In May 2005, the Company copyrighted various artworks with the US Copyright Office. The copyrights remain in effect for 95 years from the publication date or 120 years from the date of creation whichever is shorter. The copyrights have varying dates of creation and publication.

The Company does not provide forecasts of potential future financial performance. While management is optimistic about long-term prospects, the following issues and uncertainties, among others, should be considered in evaluating our growth outlook.

This Form 10-K contains forward-looking statements that involve risks and uncertainties. You should not rely on these forward-looking statements. The Company uses words such as “anticipate,” “believe,” “plan,” “expect,” “future,” “intend” and similar expressions to identify such forward-looking statements. This Form 10-K also contains forward-looking statements attributed to certain third parties relating to their estimates regarding the travel center industry, among other things. You should not place undue reliance on those forward-looking statements. Actual results could differ materially from those anticipated in the forward-looking statements for many reasons, including the risks faced described below and elsewhere in this Form 10-K.

The Company’s shares of common stock are traded on the OTC Bulletin Board and will likely be subject to significant price volatility and an illiquid market.

The Company’s shares trade on the OTC Bulletin Board. In order to purchase and sell shares of the Company’s common stock on the OTC Bulletin Board, you must use one of the market makers then making a market in the stock. Because of the wide variance in the BID and ASK spreads, there is significant risk that an investor that sold shares on the OTC Bulletin Board would sell them for a price that was significantly lower than the price at which the shares could be purchased, and vice versa. The number of shares traded to date indicates that the market for the Company’s shares of common stock is illiquid which could make it difficult to purchase or sell shares.

The Company might be subject to financial and other restrictive covenants upon operations if unable to secure additional financing.

There can be no assurance that any additional financing will be available in the future on terms acceptable to the Company. The Company anticipates that any financing secured could impose certain financial and other restrictive covenants upon operations.

There is no assurance that the Company will be able to successfully expand business.

The Company intends to continue to explore the possibilities of acquiring or building additional travel centers. Although existing operations are based primarily in the Southwest, current expansion plans include consideration of acquisition opportunities in both the Southwest and other geographic regions of the United States. However, there can be no assurance that suitable acquisitions can be identified, and the Company will likely face competition from other companies for available acquisition opportunities. Any such acquisition would be subject to negotiation of definitive agreements, appropriate financing arrangements and performance of due diligence. There can be no assurance that the Company will be able to complete such acquisitions, obtain acceptable financing, or any required consent of our bank lenders, or that such acquisitions, if completed, can be integrated successfully into existing operations. The success of an expansion program will depend on a number of factors, including the availability of sufficient capital, the identification of appropriate expansion opportunities, the Company’s ability to attract and retain qualified employees and management, and the continuing profitability of existing operations. There can be no assurance that the Company will achieve its planned expansion or that any expansion will be profitable.

The Company’s use of petroleum products subjects it to various laws and regulations, and exposes it to substantial risks.

The Company is subject to federal, state and local laws and regulations governing the use, storage, handling, and disposal of petroleum products. The risk of accidental contamination to the environment or injury cannot be eliminated. In the event of such an accident, the Company could be held liable for any damages that result and any such liability could exceed available resources. The Company could be required to incur significant costs to comply with environmental laws and regulations that may be enacted in the future.

Because all of the Company’s travel centers are located in Arizona and New Mexico, a downturn in the economic conditions in the Southwestern United States could adversely affect business operations and financial conditions.

The Company’s travel centers are located only in Arizona and New Mexico. The Company relies on the business generated from travelers and patrons within these two states, and those traveling through these states. Risks from economic downturns are not diversified or spread out across several regions. Because of the geographic concentration of the Company’s travel centers, business may be adversely affected in the event of a downturn in general economic conditions in the Southwestern United States generally, or in Arizona or New Mexico.

The Company’s distribution and franchise agreements may prevent the Company from pursuing alternate business opportunities, which could limit the Company’s sales and growth potential.

The Company is dependent on a number of third party relationships under which it offers brand name and other products at its travel centers. These brand name relationships include distributorship relationships with ExxonMobil and CITGO and existing franchise agreements with Dairy Queen/Brazier. The Company’s existing operations and plans for future growth anticipate the continued existence of such relationships.

The ExxonMobil distribution agreement has a five-year term beginning September 1, 2005 and expiring October 31, 2010. The CITGO distribution agreement has an initial three-year term beginning February 2, 2001 and expiring January 31, 2004, and automatically renews for a three-year term through 2007. ExxonMobil’s and CITGO’s ability to terminate or refuse to renew the agreement with the Company is subject to the occurrence of certain events set forth in the Petroleum Marketing Practices Act, which includes bankruptcy, or breach of the agreement by the Company, or termination by ExxonMobil or CITGO of its petroleum marketing activities in the Company’s distribution area. ExxonMobil and CITGO may terminate or refuse to renew these agreements only if it terminates or refuses to renew the agreement in compliance with the Petroleum Marketing Practices Act. The Company’s CITGO distribution agreement ends March 31, 2007, as CITGO terminated its petroleum marketing activities in the Company’s distribution area.

Under three of the Company’s Dairy Queen agreements, the term continues until the Company elects to terminate it with 60 days prior written notice, or if the Company or Dairy Queen elect to terminate the agreement because the other has breached the agreement and has not cured that breach within 14 days of notice of the breach. The other two Dairy Queen agreements are for specific terms. One of those Dairy Queen agreements, entered into February 1, 1984, is for a term of 25 years and the other, entered into on November 18, 1986, is for a term of 20 years plus an additional 5 years per an extension agreement dated June 29, 1987. The Company may not terminate either of these agreements unless it gives notice to Dairy Queen that they are in breach of the agreement and Dairy Queen has not cured that breach within thirty days of notice. Dairy Queen may terminate either of these agreements if they deliver notice to the Company that it is in breach of the agreement and does not cure that breach within 14 days of that notice.

There can be no assurance that the agreements that govern these relationships will not be terminated (for greater detail regarding the terms of these agreements, see “Item I. Business Operations”). Several of these agreements contain provisions that prohibit the Company from offering additional products or services that are competitive to those of its suppliers. There can be no assurance that adherence to existing agreements will not prevent the Company from pursuing opportunities that management would otherwise deem advisable. These agreements may limit the Company’s ability to seek additional sales or growth opportunities. In addition, there are no material early termination provisions under any of the franchise or petroleum distribution agreements.

The Company also relies upon several at-will relationships with various third parties for much of its souvenir and gift merchandise. There can be no assurance that the Company will be able to maintain relationships with suppliers of suitable merchandise at appropriate prices and in sufficient quantities.

If the Company is not able to successfully compete in its industry it could have an adverse impact on business operations or financial condition.

The Company’s travel centers face competition from:

major and independent oil companies;

independent service station operators;

national and independent operators of restaurants, diners and other eating establishments; and

national and independent operators of convenience stores and other retail outlets.

Some of the Company’s competitors, including major oil companies and convenience store operators, are substantially larger, better capitalized, and have greater name recognition and access to greater resources than the Company does. There can be no assurance that the Company’s travel centers will be able to compete successfully in their respective markets in the future.

The Company’s operating results may fluctuate, which makes results difficult to predict and could have an adverse effect on the Company’s results from period to period.

The Company’s travel center operations are subject to seasonal fluctuations, and revenues may be affected by many factors, including weather, holidays and the price of alternative travel modes.

The Company’s travel center operations are subject to seasonal fluctuations. The first quarter of the Company’s fiscal year is typically the weakest. The second quarter is normally the Company’s strongest due to the summer being the Company’s peak season. The third quarter is not as strong due to the end of summer. The fourth quarter is generally weak but is partially offset by Holiday sales. Therefore, throughout the Company’s fiscal year, revenues and earnings may experience substantial fluctuations from quarter to quarter. These fluctuations could result in periods of decreased cash flow that might cause the Company to use its lending sources, or to secure additional financing, in order to cover expenses during those periods. This could increase the interest expense of the Company’s operations and decrease net income and have a material adverse effect on business and results of operations.

The Company is subject to numerous governmental regulations, including those related to food handling, fireworks sales, tobacco sales, and underground storage tanks.

Each of the Company’s food service operations is subject to licensing and regulation by a number of governmental authorities, including regulations relating to health, safety, cleanliness and food handling, as well as federal and state laws governing such matters as working conditions, overtime, tip credits and minimum wages. The Company’s travel center operations are also subject to extensive laws and regulations governing the sale of tobacco and fireworks in New Mexico travel centers. In addition, the Company has incurred ongoing costs to comply with federal, state and local environmental laws and regulations, primarily relating to underground storage tanks. These costs include assessment, compliance, and remediation costs, as well as certain ongoing capital expenditures relating to gasoline dispensing operations.

Such regulations include certain mandatory licensing procedures and the ongoing compliance measures, as well as special sales tax measures. Any failure to comply with applicable regulations, or the adoption of additional regulations or changes in existing regulations could impose additional compliance costs, require a cessation of certain activities or otherwise have a material adverse effect on business and results of operations.

Nevada law, the Company’s charter documents and the Company’s current capitalization may impede or discourage a takeover, which could affect the price of our stock.

In the Company’s Articles of Incorporation, pursuant to Nevada Revised Statues Section 78.378, the Company elected not to be governed by the provisions of Nevada Revised Statutes Section 78.378 to 78.3793, inclusive. Pursuant to Nevada Revised Statutes Section 78.434, the Company also elected not to be governed by the provisions of Nevada Revised Statutes Sections 78.411 to 78.444, inclusive. These statutes are sometimes referred to as “interested stockholder” statutes and their purpose is to limit the way in which a stockholder may effect a business combination with the corporation without board or stockholder approval. Because the Company has elected not to be governed by these statutes, a person or entity could attempt a takeover, or attempt to acquire a controlling interest of, and effect a business combination with, Bowlin Travel Centers without the restrictions of these Nevada Revised Statutes provisions.

However, the Company’s Board of Directors has the authority to issue up to ten million (10,000,000) shares of common stock, $.001 par value, and up to one million (1,000,000) shares of preferred stock, $.001 par value, in one or more series, and to determine the price, rights, preferences and privileges of the shares of each such series without any further vote or action by the stockholders. The rights of the holders of common stock will be subject to, and may be adversely affected by, the rights of the holders of any shares of preferred stock that may be issued in the future. The issuance of preferred stock could have the effect of making it more difficult for a third party to acquire a majority of the outstanding voting stock of the Company, thereby delaying, deferring or preventing a change of control of the Company.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

Not applicable.

As of January 31, 2007, the Company operated twelve travel centers, nine of which are in New Mexico and three of which are in Arizona. The Company owns the real estate and improvements where seven of its travel centers are located, all of which are subject to mortgages. Five of the Company’s existing travel centers are located on real estate that the Company leases from various third parties. These leases have terms ranging from five to thirty-one years, assuming exercise by the Company of all renewal options available under certain leases.

The Company’s principal executive offices occupy approximately 20,000 square feet of space owned by the Company in Albuquerque, New Mexico. The Company owns its principal office space which is subject to a mortgage. The Company owns a central warehouse and distribution facility occupying approximately 44,000 square feet in Las Cruces, New Mexico which is subject to a mortgage. The Company believes that its headquarters and warehouse facilities are adequate for its operations for the foreseeable future.

The following table lists the locations of the Company’s facilities as of the date of this report, the size of such facilities and whether they are leased or owned.

Retail Location, Continuing Operations | | Size of Property | | Own/ Lease |

| | | | | |

| Akela Flats Trading Post | | 6,100 sq. ft. | | Own |

| 20 miles east of Deming NM on I-10 | | | | |

| | | | | |

| Bluewater DQ Travel Center | | 6,500 sq. ft. | | Own |

| 10 miles west of Grants NM on I-40 | | | | |

| | | | | |

| Butterfield Station DQ Travel Center | | 10,400 sq. ft. | | Own |

| 20 miles west of Deming NM on I-10 | | | | |

| | | | | |

| Continental Divide Trading Post | | 8,000 sq. ft. | | Lease |

| 20 miles east of Lordsburg NM on I-10 | | | | |

| | | | | |

| Flying C Ranch DQ Travel Center | | 10,400 sq. ft. | | Own |

| 40 miles west of Santa Rosa NM on I-10 | | | | |

| | | | | |

| Old West Trading Post | | 8,200 sq. ft. | | Lease |

| 15 miles west of Las Cruces NM on I-10 | | | | |

| | | | | |

| Picacho Peak DQ Travel Center | | 6,300 sq. ft. | | Lease |

| 45 miles west of Tucson AZ on I-10 | | | | |

| | | | | |

| Picacho Peak Plaza | | 10,800 sq. ft. | | Lease |

| 45 miles west of Tucson AZ on I-10 | | | | |

| | | | | |

| The Thing DQ Travel Center | | 9,400 sq. ft. | | Lease |

| 17 miles east of Benson AZ on I-10 | | | | |

Retail Location, Discontinued Operations | | Size of Property | | Own/ Lease |

| | | | | |

| Alamogordo Running Indian Trading Post | | 3,800 sq. ft. | | Own |

| 4 miles north of Alamogordo NM on US70 | | | | |

| | | | | |

| Rio Puerco Outpost | | 5,000 sq. ft. | | Own |

| 17 miles west of Albuquerque NM on I-40 | | | | |

| | | | | |

| Edgewood Travel Center | | 2,800 sq. ft. | | Own |

| I-40 at Edgewood NM Interchange | | | | |

The Company from time to time may be involved in litigation in the ordinary course of business, including disputes involving employment claims and construction matters. The Company is not currently a party to any lawsuit or proceeding which, in the opinion of management, is likely to have a material adverse effect on the Company’s business operations or financial condition.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

The Company did not submit any matters to a vote of security holders in the fourth quarter of fiscal 2007.

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES |

As of April 27, 2007, there were 4,583,348 shares of common stock of Bowlin Travel Centers, Inc. outstanding. There are no outstanding options or warrants to purchase, or securities convertible into shares of common stock of Bowlin Travel Centers, Inc. Shares of the common stock of the Company are traded on the OTC Bulletin Board under the symbol “BWTL”. On April 24, 2007, there were approximately 26 holders of record of the Company’s common stock. The following table sets forth the high and low sales prices for the Company’s common stock for each quarter during the past two fiscal years. These over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not necessarily represent actual transactions. The Company made no purchases of its equity securities in the fourth quarter of fiscal 2007.

Fiscal Year Ended January 31, 2006 | | High | | Low |

| | | | | |

| Fiscal Quarter Ended 4/30 | | $1.93 | | $1.85 |

| Fiscal Quarter Ended 7/31 | | $2.00 | | $1.90 |

| Fiscal Quarter Ended 10/31 | | $2.00 | | $1.50 |

| Fiscal Quarter Ended 1/31 | | $1.95 | | $1.50 |

Fiscal Year Ended January 31, 2007 | | High | | Low |

| | | | | |

| Fiscal Quarter Ended 4/30 | | $1.85 | | $1.51 |

| Fiscal Quarter Ended 7/31 | | $2.25 | | $1.60 |

| Fiscal Quarter Ended 10/31 | | $2.00 | | $1.59 |

| Fiscal Quarter Ended 1/31 | | $2.80 | | $1.60 |

The Company is authorized to issue up to 10,000,000 shares of common stock, par value $.001 per share, and up to 1,000,000 shares of preferred stock, par value $.001. Holders of shares of common stock are entitled to one vote per share on all matters to be voted on by stockholders and do not have cumulative voting rights. Subject to the rights of holders of outstanding shares of preferred stock, if any, the holders of common stock are entitled to receive such dividends, if any, as may be declared from time to time by the Board of Directors at its discretion from funds legally available therefore, and upon liquidation, dissolution, or winding up are entitled to receive all assets available for distribution to the stockholders. The common stock has no preemptive or other subscription rights, and there are no conversion rights or redemption or sinking fund provisions with respect to such shares. All of the outstanding shares of common stock are fully paid and nonassessable. Since becoming a publicly traded company, the Company has not paid dividends. Any declaration or payment of dividends by the Company would be subject to the discretion of the Board of Directors.

In the Company’s Articles of Incorporation, pursuant to Nevada Revised Statues Section 78.378, the Company elected not to be governed by the provisions of Nevada Revised Statutes Section 78.378 to 78.3793, inclusive. Pursuant to Nevada Revised Statutes Section 78.434, the Company also elected not to be governed by the provisions of Nevada Revised Statutes Sections 78.411 to 78.444, inclusive. These statutes are sometimes referred to as “interested stockholder” statutes and their purpose is to limit the way in which a stockholder may effect a business combination with the corporation without board or stockholder approval. Because the Company has elected not to be governed by these statutes, a person or entity could attempt a takeover, or attempt to acquire a controlling interest of, and effect a business combination with, Bowlin Travel Centers without the restrictions of these Nevada Revised Statutes provisions. See, also, “Risk Factors - Nevada law, the Company’s charter documents and the Company’s current capitalization may impede or discourage a takeover, which could affect the price of our stock”.

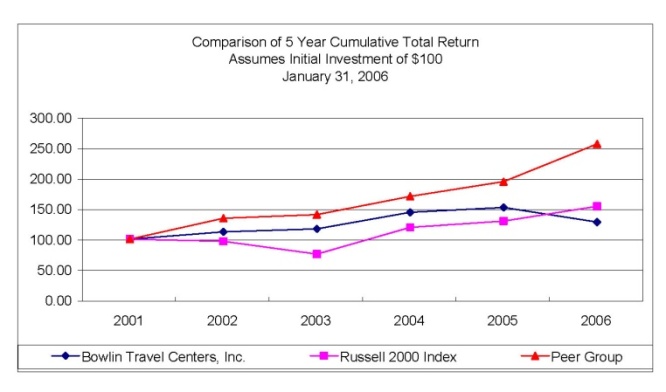

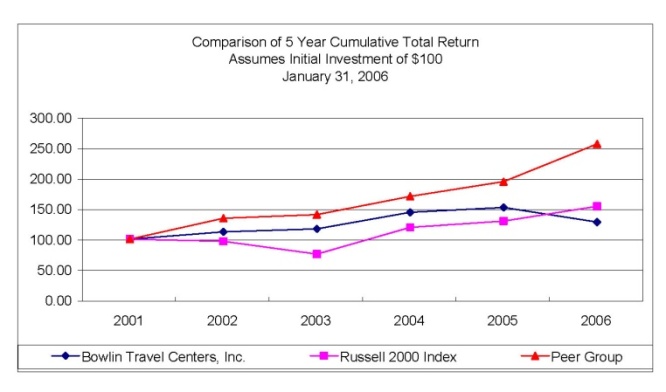

Stock Performance Graph

The line graph below compares the cumulative total return of the Company’s common stock with the cumulative total return of the Russell 2000 and a Company defined peer group for the period from February 1, 2001 through January 31, 2006 (including the reinvestment of dividends, if any). The following graph assumes a $100 investment on February 1, 2001, the date the Company’s stock began trading on the OTC Bulletin Board. Price data for the Company’s common stock is based on the closing bid price for the relevant measurement dates as reported by the OTC bulletin board (which quotation represent prices between dealers and do not include retail markup, markdown or commissions and may not reflect actual transitions).

The performance graph below shall not be deemed incorporated by reference into any filing under, and shall not otherwise be deemed filed under, either the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference.

| | | | | 02/01/01 | | 01/31/02 | | 01/31/03 | | 01/31/04 | | 1/31/05 | | 1/31/06 |

| | | | | | | | | | | | | | | |

| Bowlin Travel Centers, Inc. | | Return% | | | | 12.00 | | 4.29 | | 23.29 | | 5.56 | | -15.79 |

| | | Cum $ | | $ 100.00 | | $ 112.00 | | $ 116.80 | | $ 144.01 | | $ 152.02 | | $128.01 |

| Russell 2000 Index | | Return% | | | | -3.52 | | -21.87 | | 58.03 | | 8.67 | | 18.90 |

| | | Cum $ | | $ 100.00 | | $ 96.48 | | $ 75.38 | | $ 119.12 | | $ 129.45 | | $153.92 |

| Peer Group Only | | Return% | | | | 34.25 | | 4.41 | | 21.32 | | 14.37 | | 31.70 |

| | | Cum $ | | $ 100.00 | | $ 134.25 | | $ 140.16 | | $ 170.05 | | $ 194.48 | | $256.13 |

| ITEM 6. | SELECTED FINANCIAL DATA |

The selected financial data presented below are derived from the audited financial statements of the Company for the five years ended January 31, 2007. The data presented below should be read in conjunction with the audited financial statements, related notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations included herein.

SELECTED FINANACIAL DATA | |

| | | | | | | | | | | | |

| | | YEARS ENDED JANUARY 31, | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

STATEMENT OF INCOME DATA: | | | | | | | | | | | | | | | | |

| Net sales from continuing operations | | | 27,973,253 | | | 23,442,062 | | | 20,336,205 | | | 17,873,359 | | | 17,115,255 | |

| Net sales from discontinued operations | | $ | 3,727,505 | | $ | 4,416,108 | | $ | 3,740,258 | | $ | 3,722,000 | | $ | 5,184,861 | |

| Total net sales | | $ | 31,700,758 | | $ | 27,858,170 | | $ | 24,076,463 | | $ | 21,595,359 | | $ | 22,300,116 | |

| | | | | | | | | | | | | | | | | |

| Net income from continuing operations | | $ | 808,079 | | $ | 839,516 | | $ | 659,572 | | $ | 679,289 | | $ | 585,412 | |

| Net loss from discontinued operations | | | (203,891 | ) | | (189,163 | ) | | (220,645 | ) | | (185,395 | ) | | (78,154 | ) |

| Total net income | | $ | 604,188 | | $ | 650,353 | | $ | 438,927 | | $ | 493,894 | | $ | 507,258 | |

| | | | | | | | | | | | | | | | | |

EARNINGS (LOSS) PER SHARE: | | | | | | | | | | | | | | | | |

| Continuing operations | | $ | 0.17 | | $ | 0.18 | | $ | 0.14 | | $ | 0.15 | | $ | 0.13 | |

| Discontinued operations | | | (0.04 | ) | | (0.04 | ) | | (0.04 | ) | | (0.04 | ) | | (0.02 | ) |

| Total operations | | $ | 0.13 | | $ | 0.14 | | $ | 0.10 | | $ | 0.11 | | $ | 0.11 | |

| | | | | | | | | | | | | | | | | |

BALANCE SHEET DATA (at end of period): | | | | | | | | | | | | |

| Assets of continuing operations | | $ | 17,447,621 | | $ | 17,143,814 | | $ | 17,278,802 | | $ | 14,599,078 | | $ | 13,653,363 | |

| Assets of discontinued operations | | | 2,558,747 | | | 2,664,128 | | | 2,806,342 | | | 2,857,028 | | | 2,730,025 | |

| Total assets | | $ | 20,006,368 | | $ | 19,807,942 | | $ | 20,085,144 | | $ | 17,456,106 | | $ | 16,383,388 | |

| | | | | | | | | | | | | | | | | |

Long-term debt, including current maturities, continuing operations | | $ | 4,378,504 | | $ | 4,724,471 | | $ | 5,200,706 | | $ | 3,415,006 | | $ | 3,216,487 | |

Long-term debt, including current maturities, discontinued operations | | | 548,654 | | | 589,738 | | | 643,660 | | | 729,613 | | | 830,153 | |

| Total long-term debt, including current maturities | | $ | 4,927,158 | | $ | 5,314,209 | | $ | 5,844,366 | | $ | 4,144,619 | | $ | 4,046,640 | |

On January 18, 2005, the Company opened a new state-of-the-art travel center in Picacho, Arizona. Strategically located on I-10 between metropolitan Phoenix and Tucson, the new facility has 10,000 square feet of retail space, a convenience department for gourmet coffee and snacks with a large screen plasma TV with satellite news plus a state-of-the-art super-pumper gasoline facility offering CITGO brand gasoline.

The Company’s new state-of-the art travel center in Picacho, Arizona operated its first fiscal year for the twelve months ended January 31, 2006. Therefore, the following tables present additional financial information of income and expense items derived from the Statements of Operations for twelve months ended January 31, 2006 and 2005 for comparison of all stores, same stores and Picahco stores.

Same store financial data excludes the Company’s newly opened location, Picacho Peak Plaza as well as the existing Picacho Peak but does not include restaurant sales, as the new facility does not have a restaurant operation. For the twelve months ended January 31, 2006, the sales of the new facility impacted the existing facility, with a negative impact on overall operating income. A discussion of the new and existing Picacho Peak facilities follow the same store discussion.

| | | Twelve Months Ended January 31, 2006 | |

| | All Stores** | | Same Store* | | Picacho Stores | |

Selected Statement of Operations Data: | | | | | | | |

(in thousands, except per share data) | | | | | | | |

| | | | | | | | |

| Gross sales | | $ | 23,442,062 | | $ | 18,732,836 | | $ | 4,709,226 | |

| Discounts on sales | | | (189,806 | ) | | (171,191 | ) | | (18,615 | ) |

| Net sales | | | 23,252,256 | | | 18,561,645 | | | 4,690,611 | |

| Cost of goods sold | | | 14,394,561 | | | 10,998,212 | | | 3,396,349 | |

| Gross profit | | | 8,857,695 | | | 7,563,433 | | | 1,294,262 | |

| General and administrative expenses | | | (6,923,694 | ) | | (5,743,645 | ) | | (1,180,049 | ) |

| Depreciation and amortization | | | (740,839 | ) | | (524,063 | ) | | (216,776 | ) |

| Operating income (loss) | | | 1,193,162 | | | 1,295,725 | | | (102,563 | ) |

| Non-operating income (expense): | | | | | | | | | | |

| Interest income | | | 69,385 | | | 69,385 | | | — | |

| Gain on sale of property and equipment | | | 196,593 | | | 196,593 | | | — | |

| Rental income | | | 173,546 | | | 162,546 | | | 11,000 | |

| Interest expense | | | (322,134 | ) | | (153,423 | ) | | (168,711 | ) |

| Total non-operating income (expense) | | | 117,390 | | | 275,101 | | | (157,711 | ) |

| Income (loss) before income taxes | | $ | 1,310,552 | | $ | 1,570,826 | | $ | (260,274 | ) |

| ____________ | | | | | | | | | | |

| * Excludes both Picacho Peak stores for fiscal year 2006. |

| | | Twelve Months Ended January 31, 2005 | |

| | All Stores** | | Same Store* | | Picacho Store | |

Selected Statement of Operations Data: | | | | | | | | | | |

(in thousands, except per share data) | | | | | | | | | | |

| | | | | | | | | | | |

| Gross sales | | $ | 20,336,205 | | $ | 17,343,731 | | $ | 2,992,474 | |

| Discounts on sales | | | (185,464 | ) | | (172,253 | ) | | (13,211 | ) |

| Net sales | | | 20,150,741 | | | 17,171,478 | | | 2,979,263 | |

| Cost of goods sold | | | 12,160,035 | | | 9,990,611 | | | 2,169,424 | |

| Gross profit | | | 7,990,706 | | | 7,180,867 | | | 809,839 | |

| General and administrative expenses | | | (6,396,465 | ) | | (5,717,583 | ) | | (678,882 | ) |

| Depreciation and amortization | | | (567,802 | ) | | (517,000 | ) | | (50,802 | ) |

| Operating income (loss) | | | 1,026,439 | | | 946,284 | | | 80,155 | |

| Non-operating income (expense): | | | | | | | | | | |

| Interest income | | | 45,075 | | | 45,075 | | | — | |

| Gain on sale of property and equipment | | | 2,997 | | | 2,997 | | | — | |

| Rental income | | | 176,225 | | | 170,760 | | | 5,465 | |

| Miscellaneous | | | 370 | | | 370 | | | — | |

| Interest expense | | | (132,611 | ) | | (121,174 | ) | | (11,437 | ) |

| Total non-operating income (expense) | | | 92,056 | | | 98,028 | | | (5,972 | ) |

| Income (loss) before income taxes | | $ | 1,118,495 | | $ | 1,044,312 | | $ | 74,183 | |

| ____________ | | | | | | | | | | |

| * Excludes the Picacho Peak store for fiscal year 2005. |

| ** Excludes discontinued operations for fiscal years 2006 and 2005. |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Overview

The following is a discussion of the financial condition as of January 31, 2007 and 2006 and results of operations of the Company as of and for the three fiscal years ended January 31, 2007, 2006 and 2005. This discussion should be read in conjunction with the Financial Statements of the Company and the related notes included elsewhere in this Form 10-K. References to specific years refer to the Company’s fiscal year ending January 31 of such year.

The forward-looking statements included in Management’s Discussion and Analysis of Financial Condition and Results of Operations reflect management’s best judgement based on factors currently known and involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including but not limited to, those discussed.

The Company’s gross retail sales include merchandise, retail gasoline sales, restaurant sales and wholesale gasoline sales. Each of the Company’s travel center locations retail a variety of unique Southwestern souvenirs and gifts. Eleven of the twelve retail operations retail gasoline. Five of the Company’s twelve locations have full-service restaurants that operate under the Dairy Queen/Brazier or Dairy Queen brand names. The merchandise, gasoline and restaurant retail sales are all a part of the Company’s ongoing retail business and have been aggregated.

The Company wholesales gasoline to four independent third party locations. Three of the independent third party wholesale locations sell ExxonMobil gasoline and one independent third party location sells CITGO gasoline. At the beginning of the Company’s third quarter, the independent CITGO wholesale customer debranded; therefore the Company no longer wholesales to this location. The wholesale gasoline does not meet the operating segment definition criteria of paragraph 10(b) of FAS 131, as the Company does not review wholesale gasoline operating results for decision making about resource allocation. Therefore, wholesale gasoline sales have been aggregated with the Company’s business activities.

Fiscal Year Ended January 31, 2007 (Fiscal 2007) Compared to Fiscal Year Ended January 31, 2006 (Fiscal 2006)

Gross sales from continuing operations at the Company’s travel centers increased by 19.3% to $27.973 million for the twelve months ended January 31, 2007, from $23.442 million for the twelve months ended January 31, 2006. Merchandise sales from continuing operations decreased 2.6% to $9.426 million for the twelve months ended January 31, 2007, from $9.680 million for the twelve months ended January 31, 2006. The decrease is due to a decrease in general merchandise sales, a decrease in fireworks sales as a result of bans in New Mexico due to summertime drought conditions, a decrease in cigarette sales due to a voluntary Company ban on cigarettes during summertime drought conditions, partially offset by an increase in t-shirt and convenience store sales. In addition, gas prices continue to impact travel. During the last quarter of the fiscal year 2007, severe snowstorms on Interstate 40 where four of the Company’s New Mexico locations are positioned impacted sales. Retail gasoline sales from continuing operations increased 3.8% to $10.101 million for the twelve months ended January 31, 2007, from $9.731 million for the same period in 2006. The increase is due to market price increases as the average gallon of gasoline retailed for $2.80 for the twelve months ended January 31, 2007, compared to $2.52 for the twelve months ended January 31, 2006, partially offset by a decrease in gallons sold of approximately 254,000 gallons. Restaurant sales from continuing operations increased 0.1% to $2.397 million for the twelve months ended January 31, 2007, from $2.395 million for the twelve months ended January 31, 2006. The increase is primarily due to an increase in retail prices partially offset by decreases in sales at two of the Company’s Dairy Queen locations. Wholesale gasoline sales to independent retailers increased 269.7% to $6.049 million for the twelve months ended January 31, 2007, from $1.636 million for the twelve months ended January 31, 2006. The increase is primarily due to the addition of four independent wholesale locations for the twelve months ended January 31, 2007, with one independent wholesale location de-branding during the Company’s third quarter.

Cost of goods sold from continuing operations increased 31.4% to $18.910 million for the twelve months ended January 31, 2007, from $14.395 million for the twelve months ended January 31, 2006. Merchandise cost of goods from continuing operations decreased 6.2% to $3.196 million for the twelve months ended January 31, 2007, from $3.407 million for the twelve months ended January 31, 2006. This decrease is related to the decrease in sales as well as realizing better markups as a result of volume purchasing. Retail gasoline cost of goods from continuing operations increased 4.2% to $9.018 million for the twelve months ended January 31, 2007, from $8.651 million for the twelve months ended January 31, 2006. The increase corresponds to market price increases and is partially offset by a decrease in gallons sold. Restaurant cost of goods from continuing operations decreased 8.6% to $673,000 for the twelve months ended January 31, 2007, from $736,000 for the twelve months ended January 31, 2006. The decrease is primarily due to better inventory control. Wholesale gasoline cost of goods increased 276.2% to $6.023 million for the twelve months ended January 31, 2007, from $1.601 million for the twelve months ended January 31, 2006. The increase is primarily due to the addition of four independent wholesale locations for the twelve months ended January 31, 2007, with one independent wholesale location de-branding during the Company’s third quarter. In addition, the increase in wholesale gasoline cost of goods exceeds the increase in sales due to one wholesale location that had better markups in the prior period that is not present in the current period. Cost of goods sold from continuing operations as a percentage of gross revenues increased to 67.6% for the twelve months ended January 31, 2007, as compared to 61.4% for the twelve months ended January 31, 2006.

Gross profit from continuing operations decreased 0.2% to $8.841 million for the twelve months ended January 31, 2007, from $8.858 million for the twelve months ended January 31, 2006. The decrease is primarily attributable to a decrease in merchandise sales and increases in customer discounts.

General and administrative expenses for continuing operations consist of salaries, bonuses and commissions for travel center personnel, property costs and repairs and maintenance. General and administrative expenses for continuing operations also include executive and administrative compensation and benefits, accounting, legal and investor relations fees. General and administrative expenses from continuing operations increased 2.7% to $7.110 million for the twelve months ended January 31, 2007, from $6.924 million for the twelve months ended January 31, 2006. The increase is primarily due to sign repairs and maintenance, general repair and maintenance, repair and maintenance related to excessive summertime rain that caused excessive weeds and unusually heavy wintertime snow needing to be removed. The increase in general and administrative expenses is partially offset by decreases in personnel related costs, health insurance and freight as a result of volume purchasing.

Depreciation and amortization expense from continuing operations increased 2.3% to $758,000 for the twelve months ended January 31, 2007, from $741,000 for the twelve months ended January 31, 2006. The increase is associated with certain asset additions for the twelve months ended January 31, 2007 offset by some assets becoming fully depreciated.

The above factors contributed to an overall decrease in income from continuing operations of 18.5% to $972,000 for the twelve months ended January 31, 2007, compared to operating income of $1.193 million for the twelve months ended January 31, 2006.