This presentation contains nLIGHT, Inc. proprietary information. No part of it may be circulated, quoted, or reproduced for distribution without prior written approval from nLIGHT, Inc. Earnings Presentation Q1 2021 May 6, 2021

2 Certain statements in this presentation are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Words such as “outlook,” “guidance,” “expects,” “intends,” “projects,” “plans,” “believes,” “estimates,” “targets,” “anticipates,” and similar expressions may identify these forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements regarding expected revenues, gross margin, and Adjusted EBITDA and our expectations regarding customer demand for our products, operating results, and financial position, as well as any other statement that does not directly relate to any historical or current fact. Forward-looking statements are based on our current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties and changes in circumstances that are difficult to predict. Many factors could cause actual results to differ materially and adversely from these forward-looking statements, including but not limited to: (1) the impact on our sales and operations of public health crises in China, the United States or internationally, including the COVID-19 pandemic, (2) our ability to generate sufficient revenues to achieve or maintain profitability in the future, (3) fluctuations in our quarterly results of operations and other operating measures, (4) downturns in the markets we serve could materially adversely affect our revenues and profitability, (5) our high levels of fixed costs and inventory levels may harm our gross profits and results of operations in the event that demand for our products declines or we maintain excess inventory levels, (6) the competitiveness of the markets for our products, (7) our substantial sales and operations in China, which expose us to risks inherent in doing business there, (8) the effect of current and potential tariffs and global trade policies on the cost of our products, (9) our manufacturing capacity and operations may not be appropriate for future levels of demand, (10) our reliance on a small number of customers for a significant portion of our revenues, and (11) the risk that we may be unable to protect our proprietary technology and intellectual property rights. Additional information concerning these and other factors can be found in nLIGHT's filings with the Securities and Exchange Commission (the “SEC”), including other risks, relevant factors and uncertainties identified in the “Risk Factors” section of nLIGHT’s most recent Annual Report on Form 10-K or subsequent filings with the SEC. nLIGHT undertakes no obligation to update publicly or revise any forward-looking statements contained herein to reflect future events or developments, except as required by law. This presentation includes certain non-GAAP financial measures as defined by the SEC rules, including Adjusted EBITDA, non-GAAP net income (loss) and non-GAAP net income (loss) per share (diluted). These non-GAAP financial measures are provided in addition to, and not as a substitute for or superior to measures of financial performance prepared in accordance with U.S. GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP financial measures differently or may use other measure to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. As required by Regulation G, we have provided a reconciliation of those measures to the most directly comparable GAAP measures, which is available in the appendix. This presentation may also contain estimates, projections and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry and our business. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified the accuracy and completeness of the information obtained by third parties included in this presentation. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the products, solutions and services of nLIGHT, Inc. Safe Harbor Statement

3 • 42% growth (year-over-year) and expanding profitability in Q1 – $61 million of Q1 revenue with growth (y-o-y) in all market segments (Microfabrication, Industrial, Aerospace and Defense) – $6.0 million of Q1 Adjusted EBITDA (vs. $0.2 million in Q1 2020) • Strong secular drivers for lasers • Continued execution of strategy to expand sales in ROW Industrial and Aerospace & Defense • Healthy demand environment from our customers globally Q1 21 Business Highlights

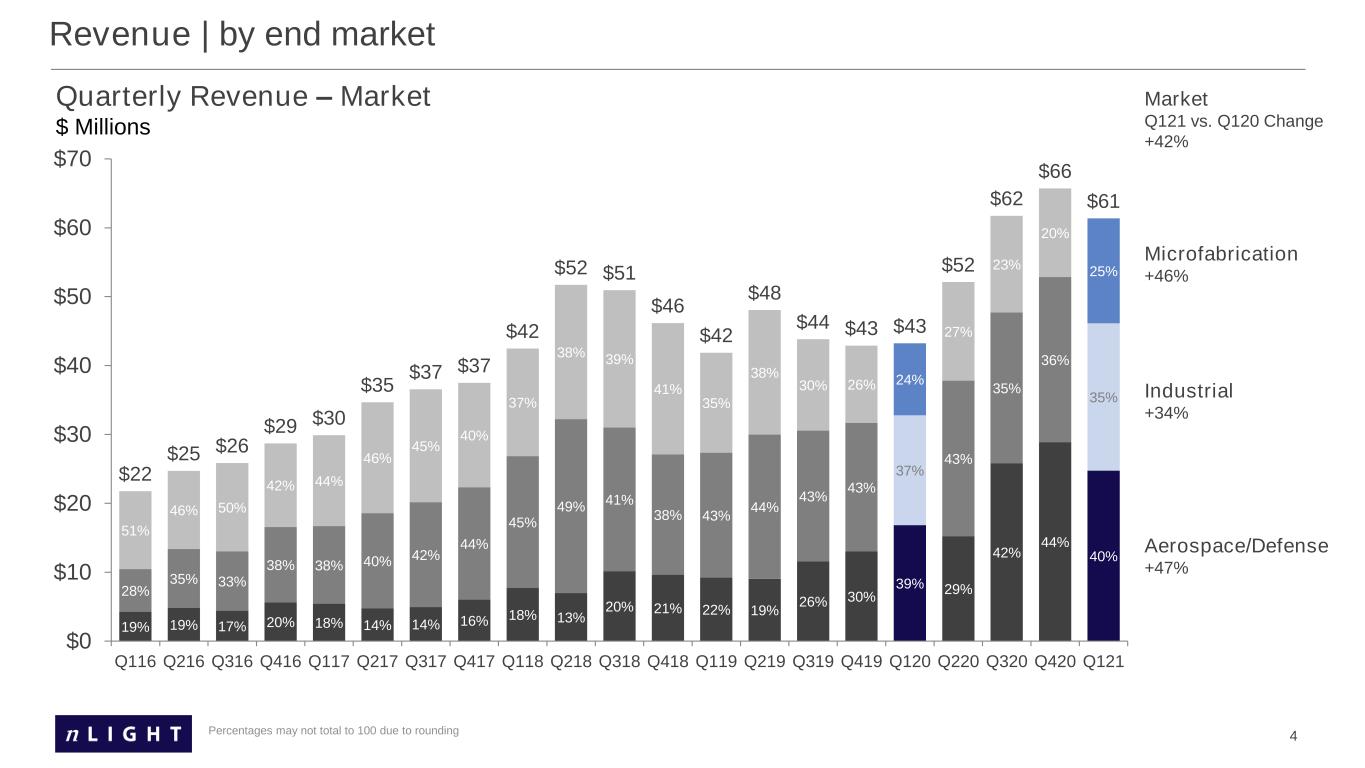

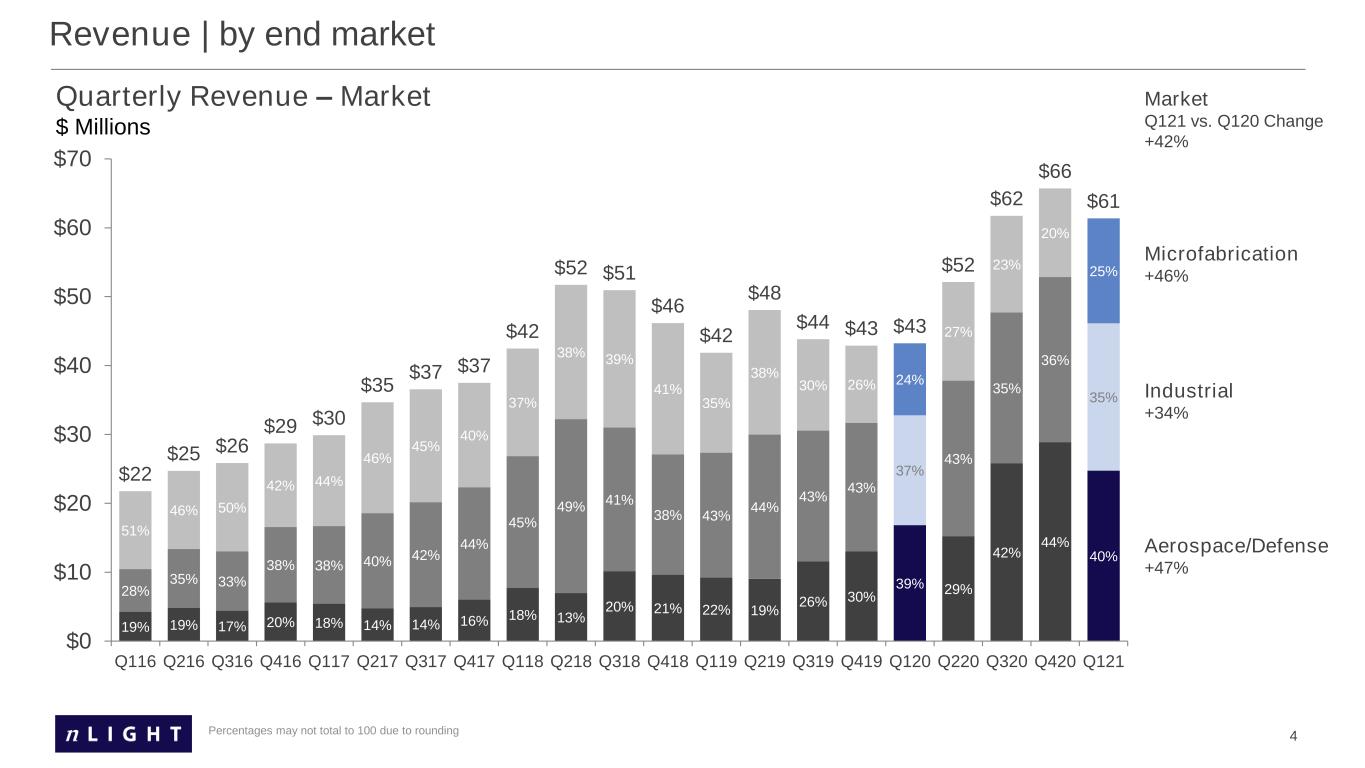

4 Quarterly Revenue – Market $ Millions 19% 19% 17% 20% 18% 14% 14% 16% 18% 13% 20% 21% 22% 19% 26% 30% 39% 29% 42% 44% 40% 28% 35% 33% 38% 38% 40% 42% 44% 45% 49% 41% 38% 43% 44% 43% 43% 37% 43% 35% 36% 35% 51% 46% 50% 42% 44% 46% 45% 40% 37% 38% 39% 41% 35% 38% 30% 26% 24% 27% 23% 20% 25% $22 $25 $26 $29 $30 $35 $37 $37 $42 $52 $51 $46 $42 $48 $44 $43 $43 $52 $62 $66 $61 $0 $10 $20 $30 $40 $50 $60 $70 Q116 Q216 Q316 Q416 Q117 Q217 Q317 Q417 Q118 Q218 Q318 Q418 Q119 Q219 Q319 Q419 Q120 Q220 Q320 Q420 Q121 Revenue | by end market Microfabrication +46% Industrial +34% Aerospace/Defense +47% Market Q121 vs. Q120 Change +42% Percentages may not total to 100 due to rounding

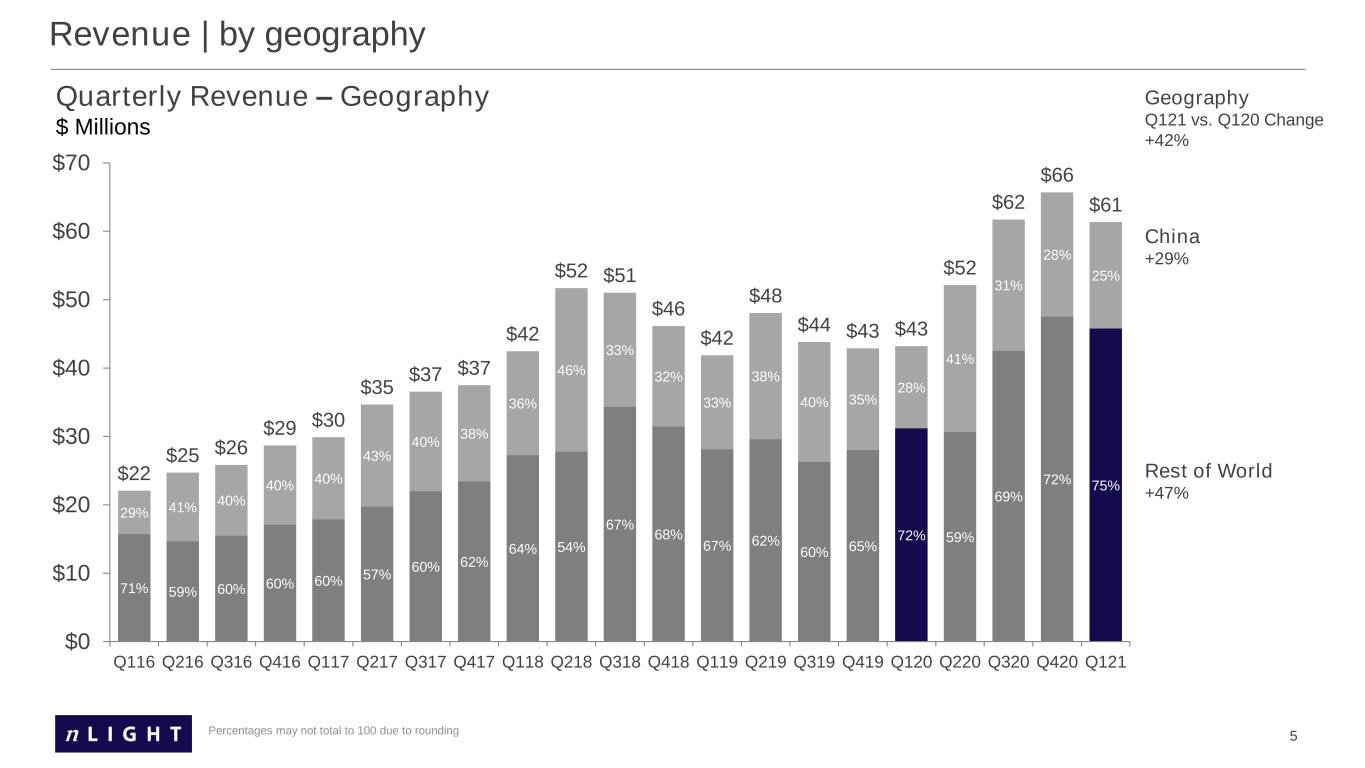

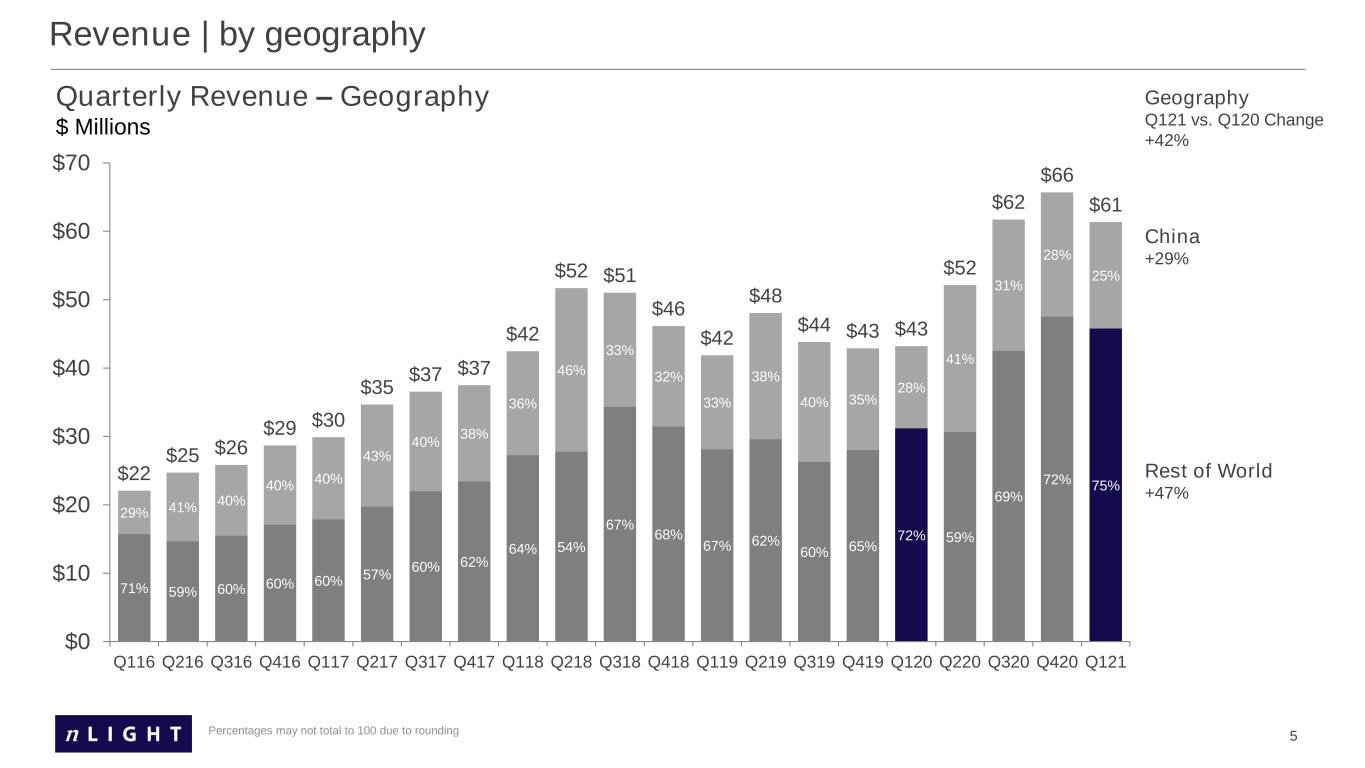

5 71% 59% 60% 60% 60% 57% 60% 62% 64% 54% 67% 68% 67% 62% 60% 65% 72% 59% 69% 72% 75% 29% 41% 40% 40% 40% 43% 40% 38% 36% 46% 33% 32% 33% 38% 40% 35% 28% 41% 31% 28% 25% $22 $25 $26 $29 $30 $35 $37 $37 $42 $52 $51 $46 $42 $48 $44 $43 $43 $52 $62 $66 $61 $0 $10 $20 $30 $40 $50 $60 $70 Q116 Q216 Q316 Q416 Q117 Q217 Q317 Q417 Q118 Q218 Q318 Q418 Q119 Q219 Q319 Q419 Q120 Q220 Q320 Q420 Q121 Revenue | by geography Quarterly Revenue – Geography $ Millions China +29% Rest of World +47% Percentages may not total to 100 due to rounding Geography Q121 vs. Q120 Change +42%

Financial Update

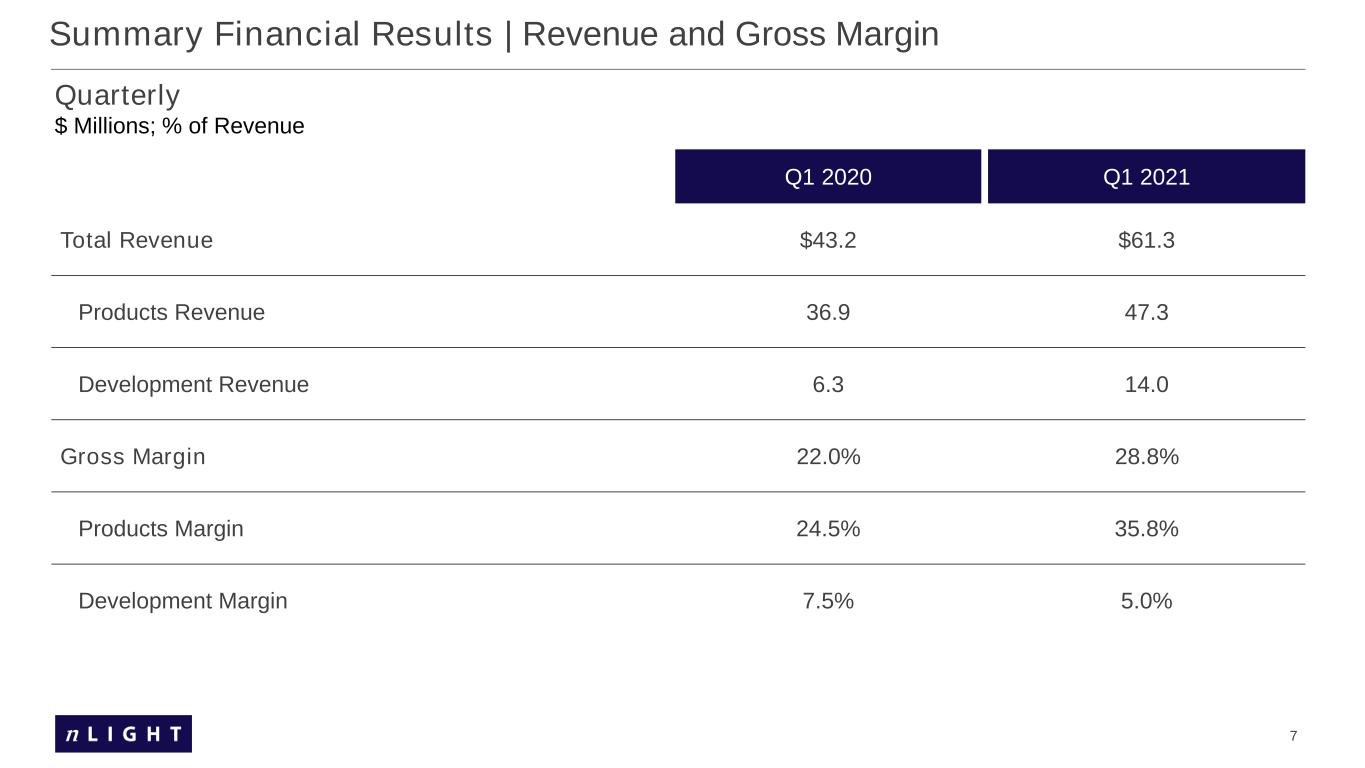

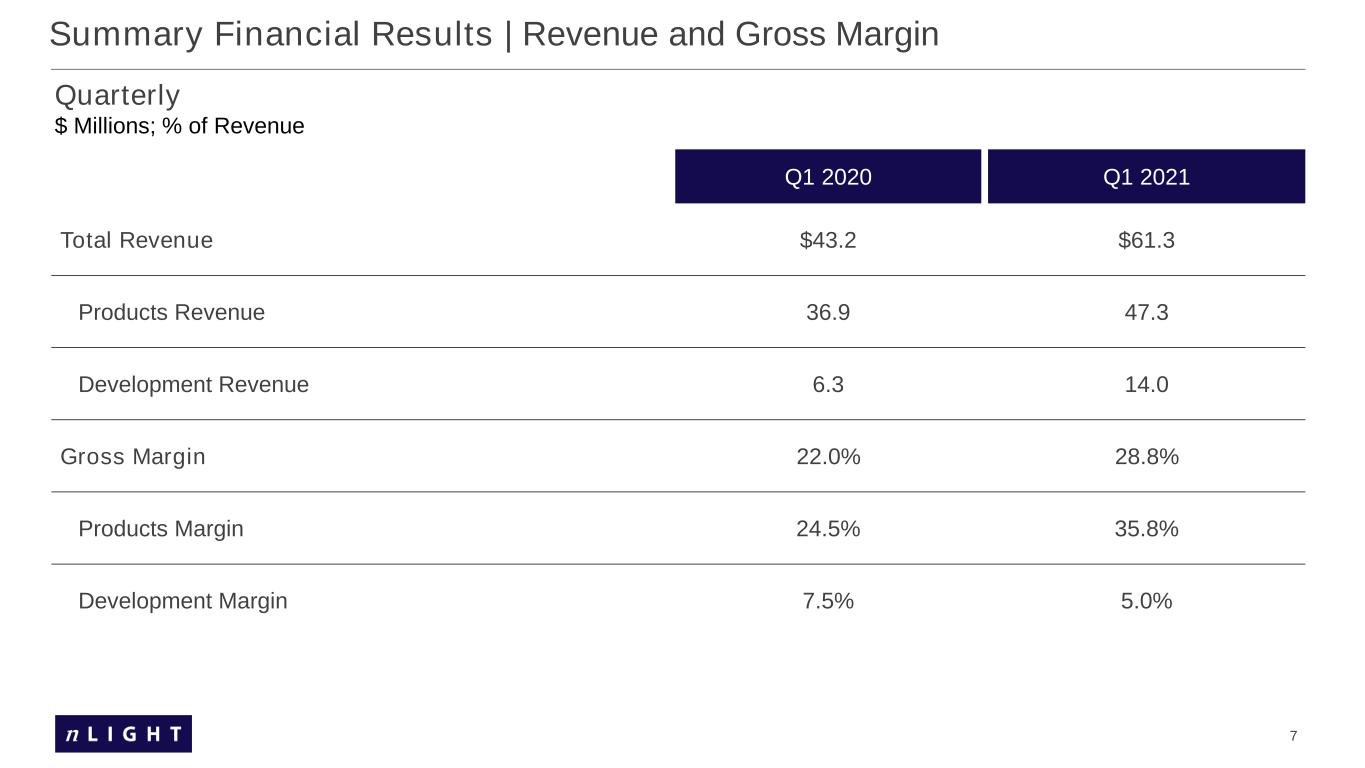

7 Summary Financial Results | Revenue and Gross Margin Quarterly $ Millions; % of Revenue Q1 2020 Q1 2021 Total Revenue $43.2 $61.3 Products Revenue 36.9 47.3 Development Revenue 6.3 14.0 Gross Margin 22.0% 28.8% Products Margin 24.5% 35.8% Development Margin 7.5% 5.0%

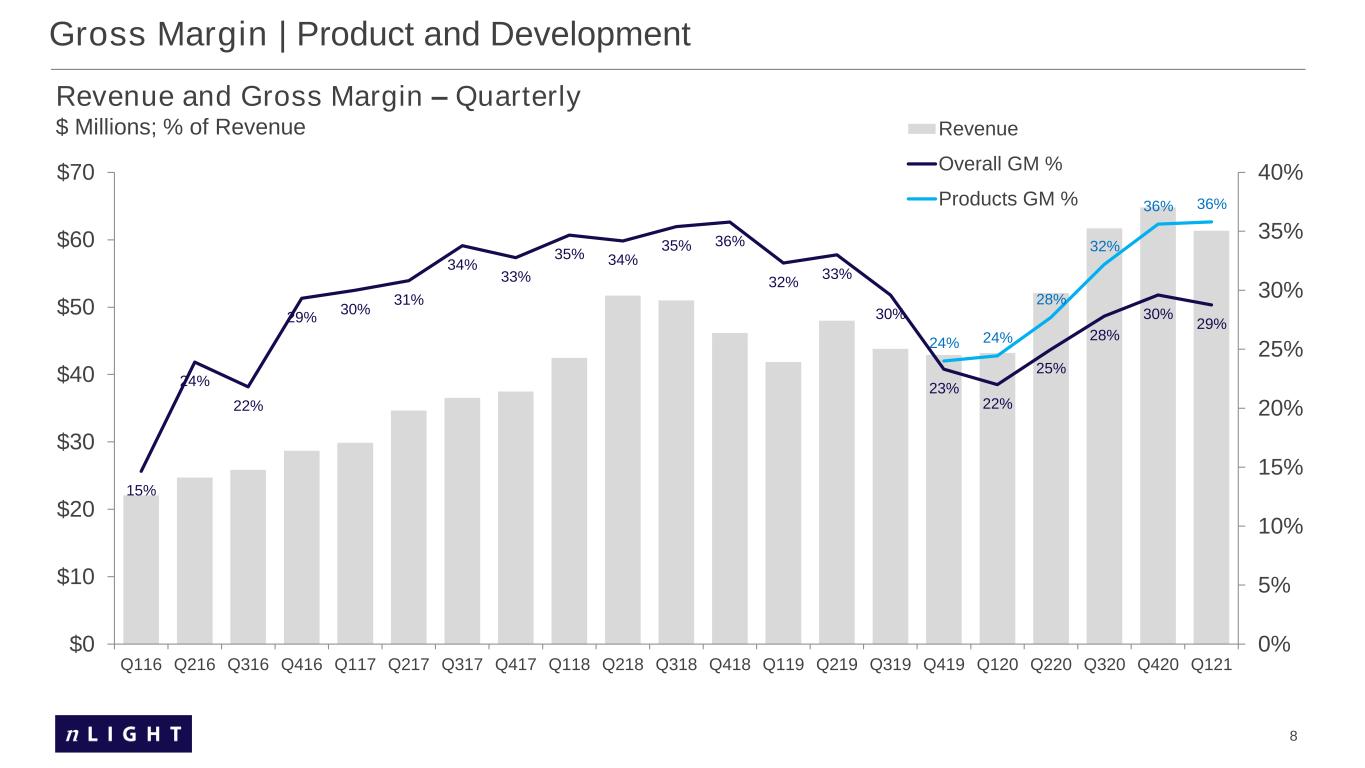

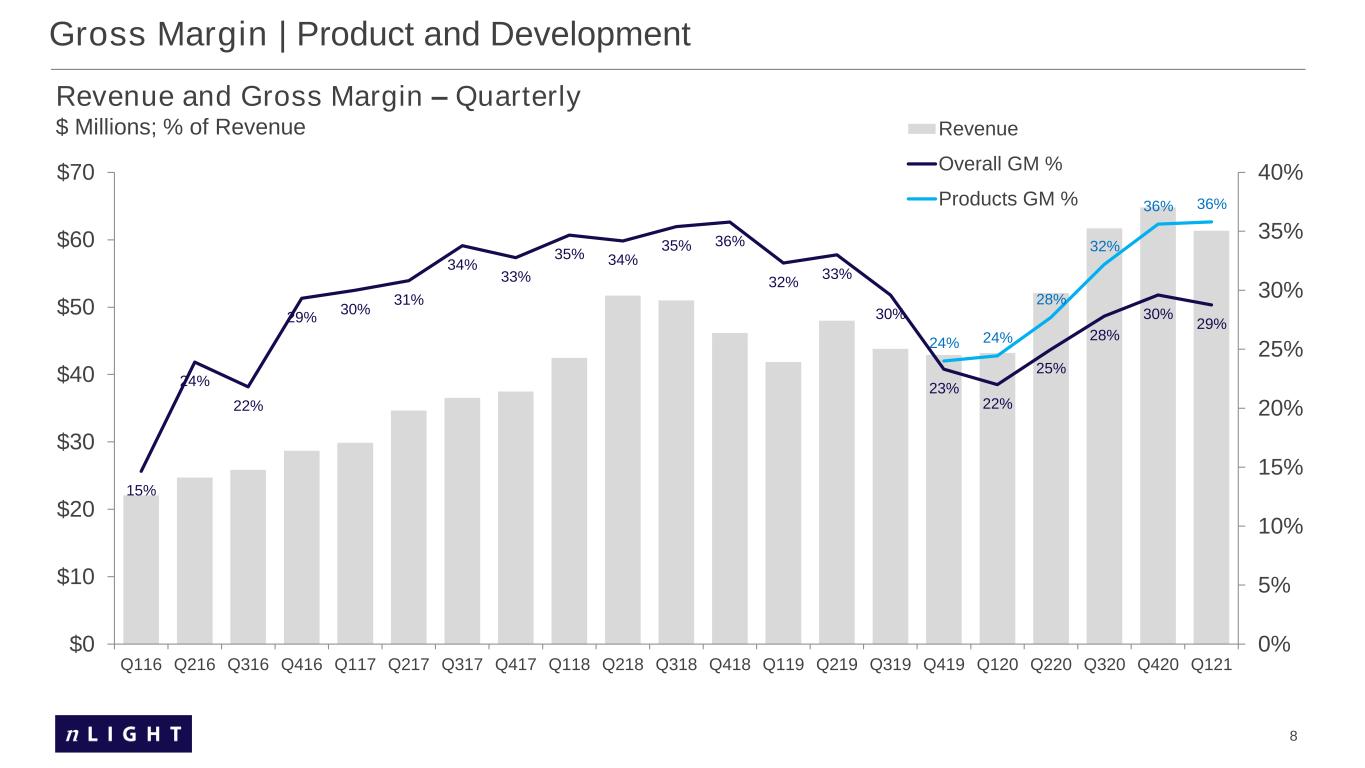

8 Gross Margin | Product and Development Revenue and Gross Margin – Quarterly $ Millions; % of Revenue 15% 24% 22% 29% 30% 31% 34% 33% 35% 34% 35% 36% 32% 33% 30% 23% 22% 25% 28% 30% 29% 24% 24% 28% 32% 36% 36% 0% 5% 10% 15% 20% 25% 30% 35% 40% $0 $10 $20 $30 $40 $50 $60 $70 Q116 Q216 Q316 Q416 Q117 Q217 Q317 Q417 Q118 Q218 Q318 Q418 Q119 Q219 Q319 Q419 Q120 Q220 Q320 Q420 Q121 Revenue Overall GM % Products GM %

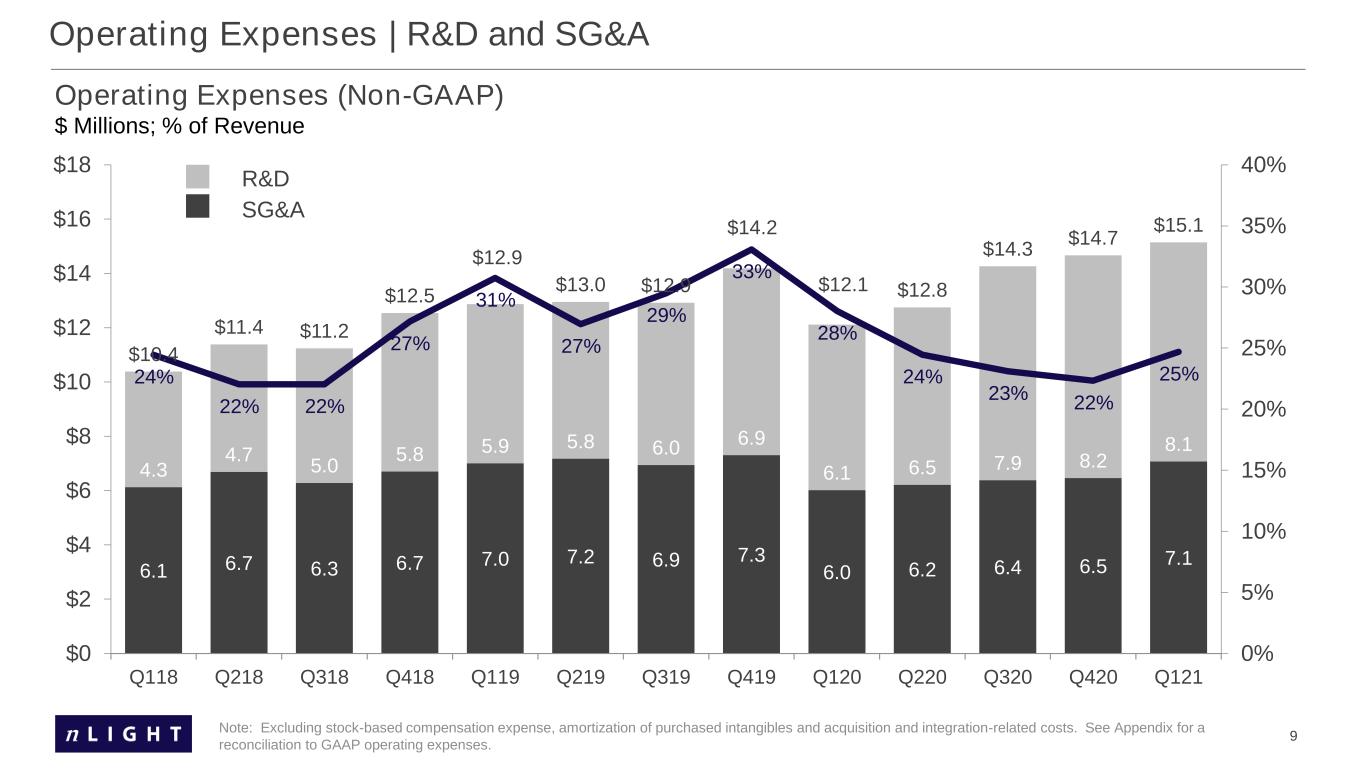

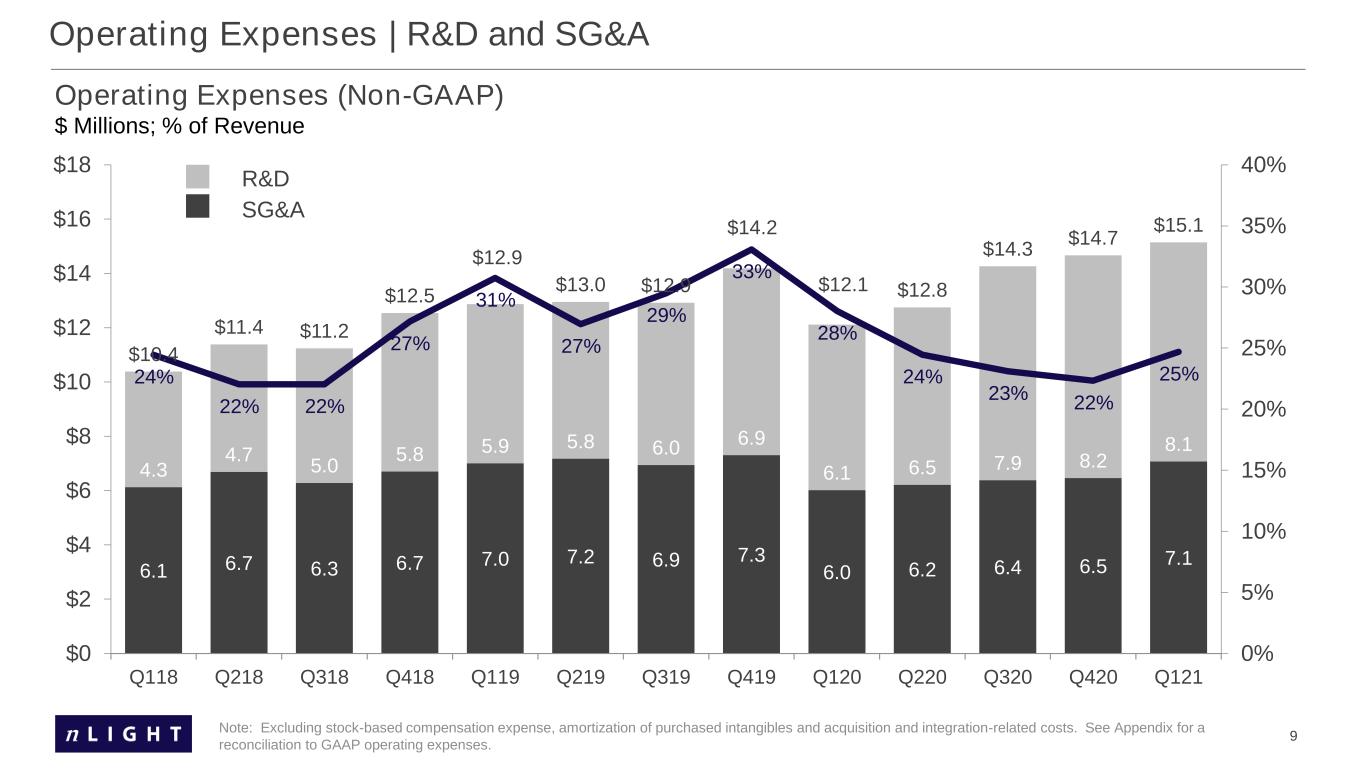

9 6.1 6.7 6.3 6.7 7.0 7.2 6.9 7.3 6.0 6.2 6.4 6.5 7.1 4.3 4.7 5.0 5.8 5.9 5.8 6.0 6.9 6.1 6.5 7.9 8.2 8.1 $10.4 $11.4 $11.2 $12.5 $12.9 $13.0 $12.9 $14.2 $12.1 $12.8 $14.3 $14.7 $15.1 24% 22% 22% 27% 31% 27% 29% 33% 28% 24% 23% 22% 25% 0% 5% 10% 15% 20% 25% 30% 35% 40% $0 $2 $4 $6 $8 $10 $12 $14 $16 $18 Q118 Q218 Q318 Q418 Q119 Q219 Q319 Q419 Q120 Q220 Q320 Q420 Q121 Operating Expenses (Non-GAAP) $ Millions; % of Revenue Note: Excluding stock-based compensation expense, amortization of purchased intangibles and acquisition and integration-related costs. See Appendix for a reconciliation to GAAP operating expenses. Operating Expenses | R&D and SG&A SG&A R&D

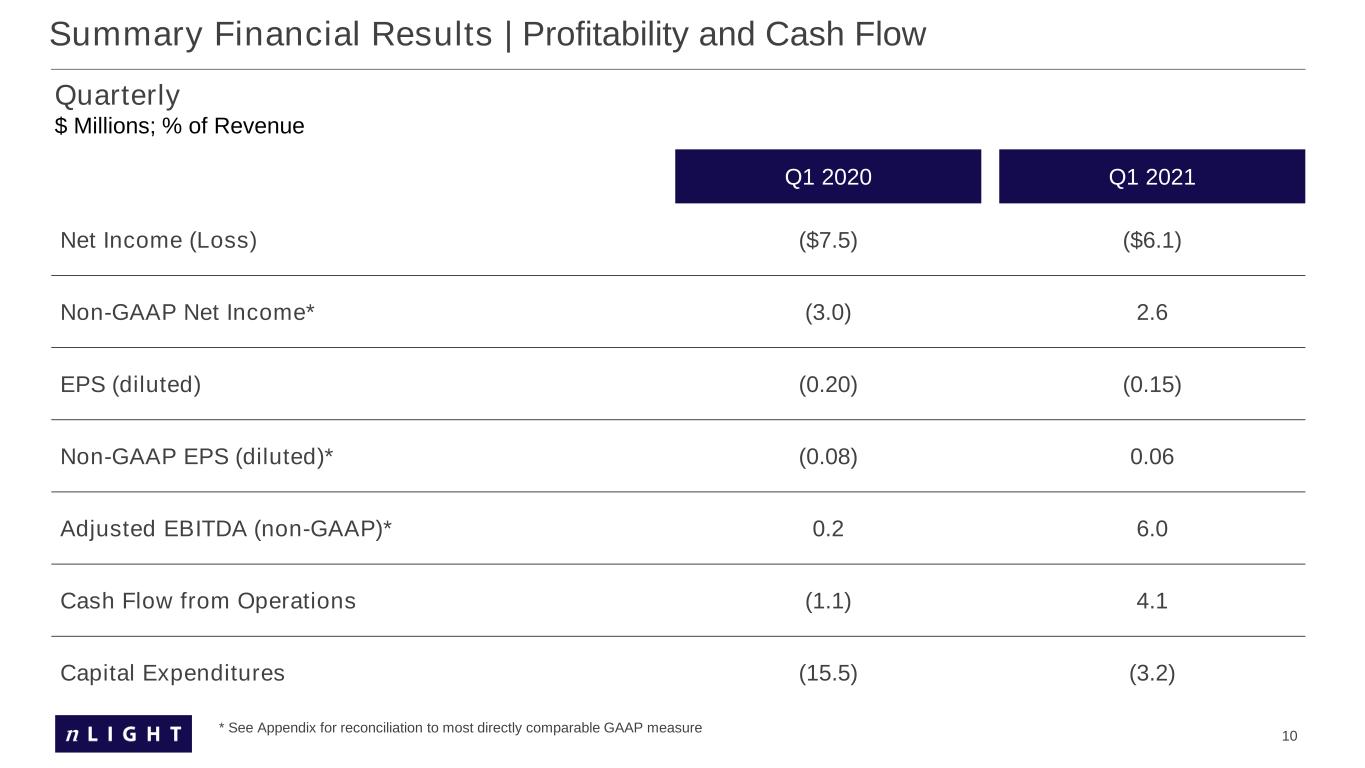

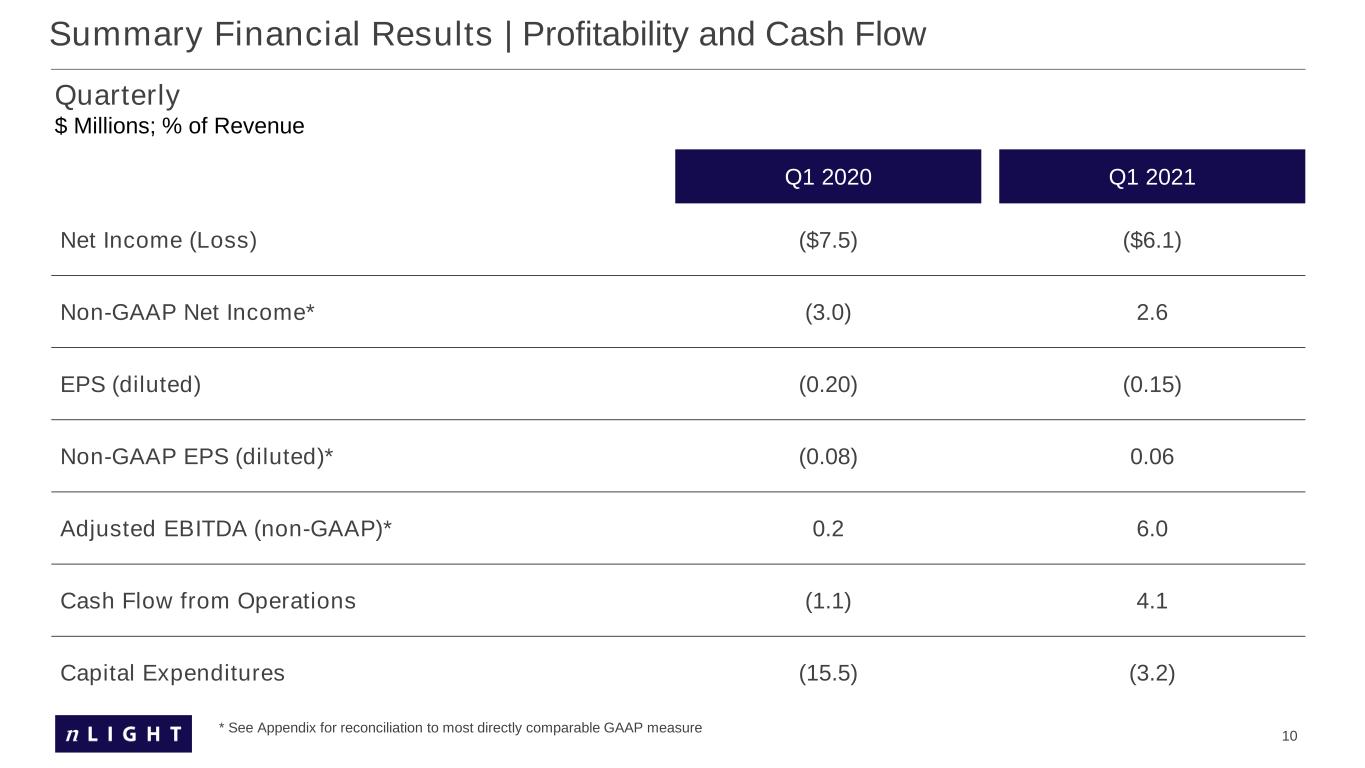

10 * See Appendix for reconciliation to most directly comparable GAAP measure Q1 2020 Q1 2021 Net Income (Loss) ($7.5) ($6.1) Non-GAAP Net Income* (3.0) 2.6 EPS (diluted) (0.20) (0.15) Non-GAAP EPS (diluted)* (0.08) 0.06 Adjusted EBITDA (non-GAAP)* 0.2 6.0 Cash Flow from Operations (1.1) 4.1 Capital Expenditures (15.5) (3.2) Summary Financial Results | Profitability and Cash Flow Quarterly $ Millions; % of Revenue

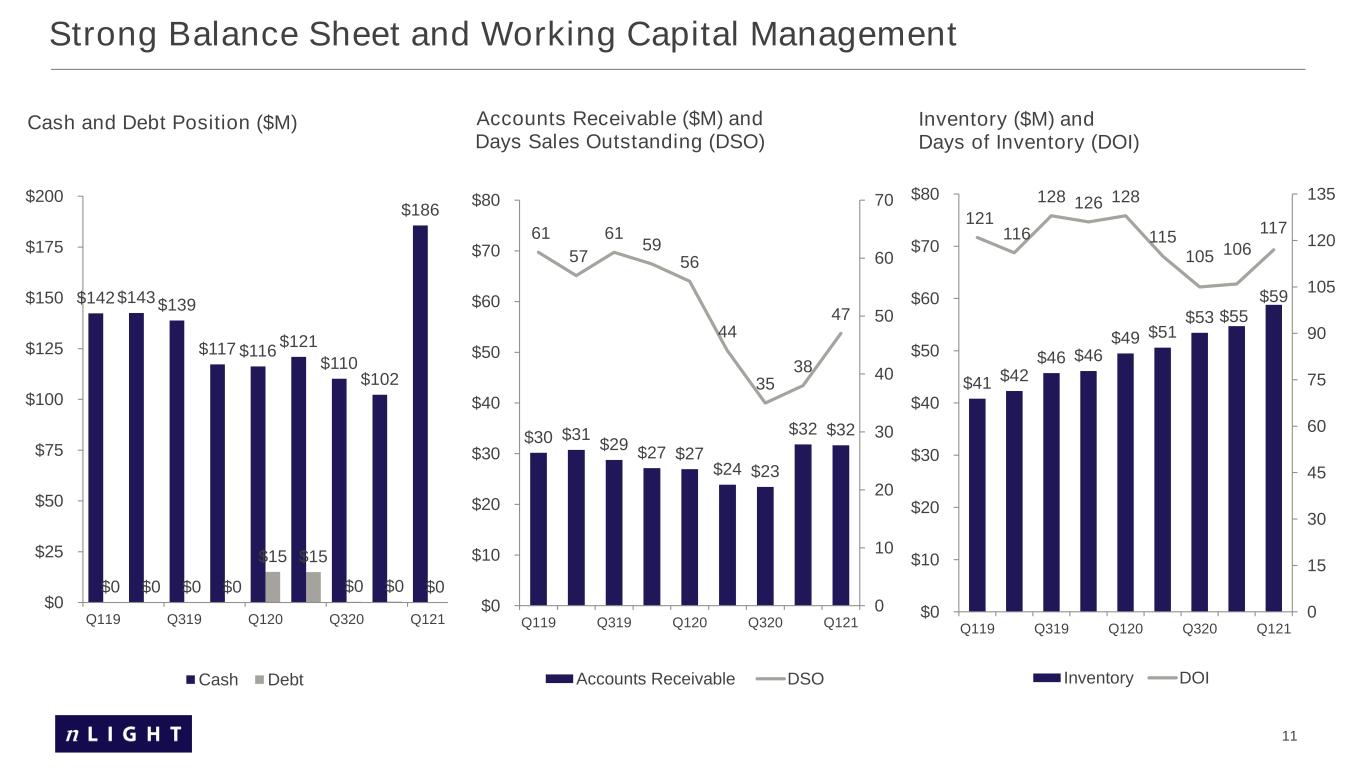

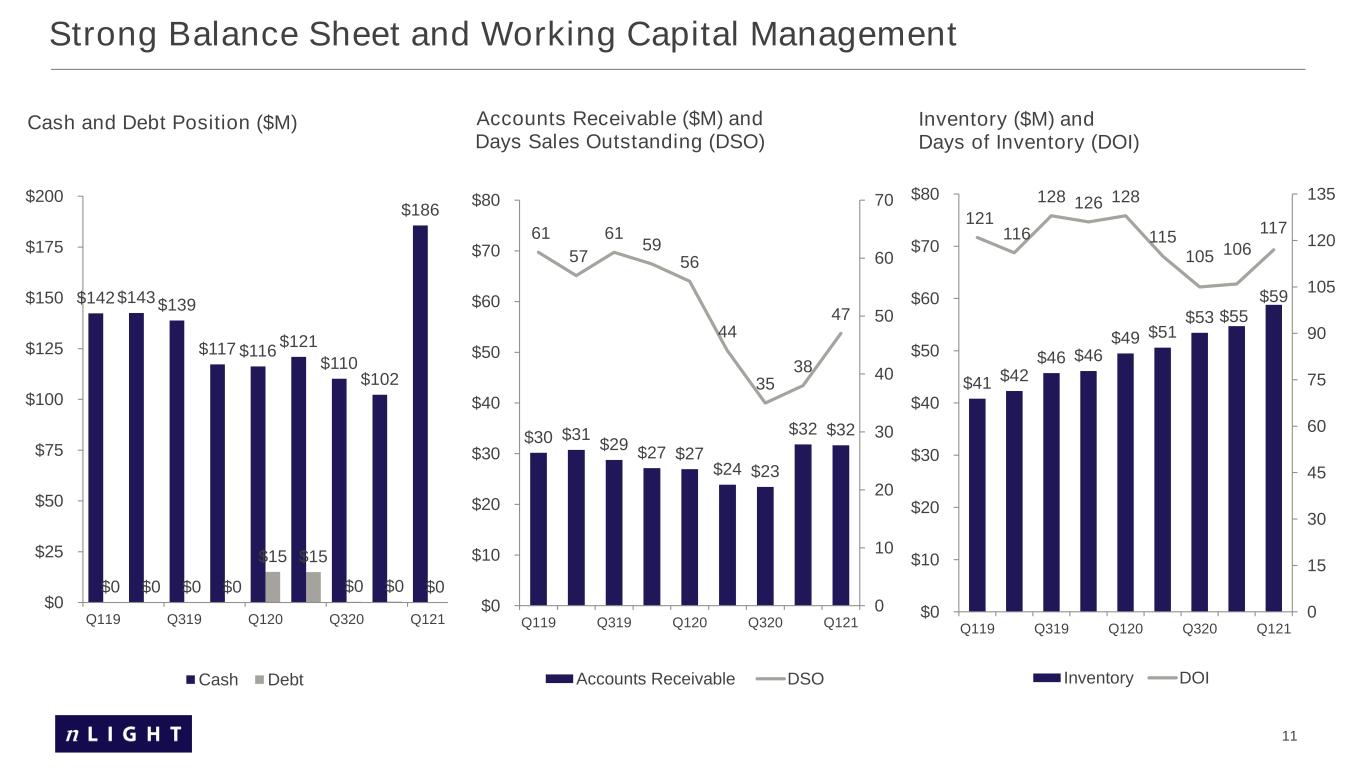

11 Strong Balance Sheet and Working Capital Management $41 $42 $46 $46 $49 $51 $53 $55 $59 121 116 128 126 128 115 105 106 117 0 15 30 45 60 75 90 105 120 135 $0 $10 $20 $30 $40 $50 $60 $70 $80 Q119 Q319 Q120 Q320 Q121 Inventory ($M) and Days of Inventory (DOI) Inventory DOI $30 $31 $29 $27 $27 $24 $23 $32 $32 61 57 61 59 56 44 35 38 47 0 10 20 30 40 50 60 70 $0 $10 $20 $30 $40 $50 $60 $70 $80 Q119 Q319 Q120 Q320 Q121 Accounts Receivable ($M) and Days Sales Outstanding (DSO) Accounts Receivable DSO $142 $143 $139 $117 $116 $121 $110 $102 $186 $0 $0 $0 $0 $15 $15 $0 $0 $0 $0 $25 $50 $75 $100 $125 $150 $175 $200 Q119 Q319 Q120 Q320 Q121 Cash and Debt Position ($M) Cash Debt

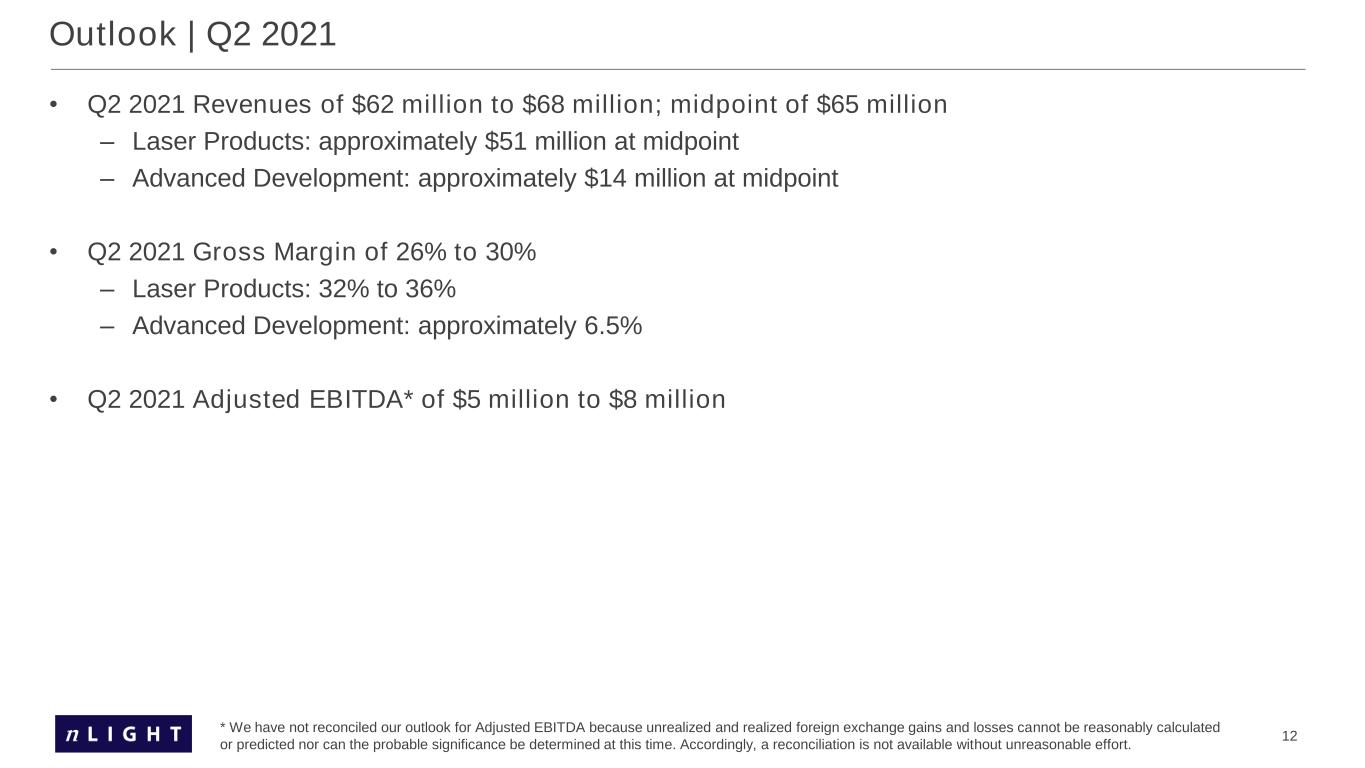

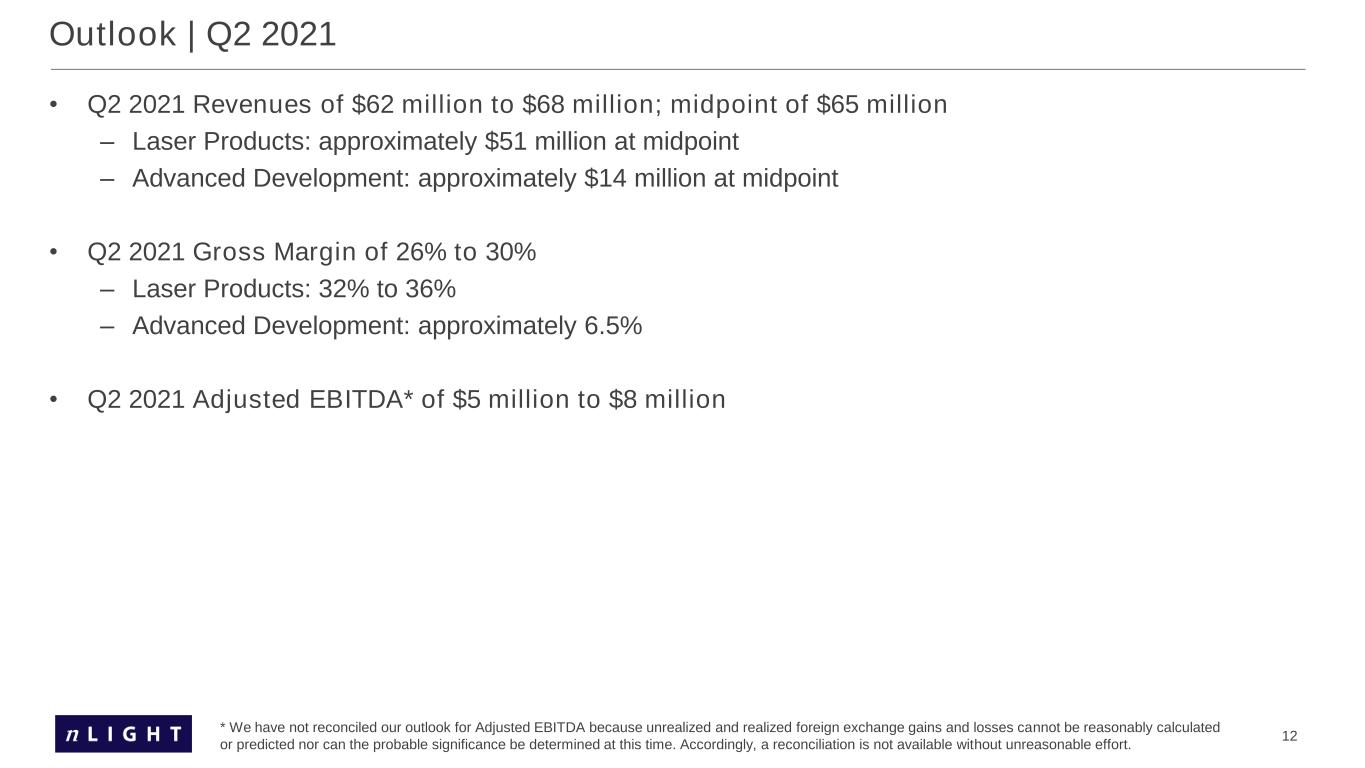

12 • Q2 2021 Revenues of $62 million to $68 million; midpoint of $65 million – Laser Products: approximately $51 million at midpoint – Advanced Development: approximately $14 million at midpoint • Q2 2021 Gross Margin of 26% to 30% – Laser Products: 32% to 36% – Advanced Development: approximately 6.5% • Q2 2021 Adjusted EBITDA* of $5 million to $8 million Outlook | Q2 2021 * We have not reconciled our outlook for Adjusted EBITDA because unrealized and realized foreign exchange gains and losses cannot be reasonably calculated or predicted nor can the probable significance be determined at this time. Accordingly, a reconciliation is not available without unreasonable effort.

Appendix

15 Supplemental Information | Revenue and Gross Margin nLIGHT, Inc. (in thousands, except per share amounts) Revenue: Products 42,467$ 51,705$ 51,025$ 46,162$ 191,359$ 41,861$ 48,048$ 43,814$ 40,336$ 174,059$ 36,930$ 45,104$ 51,117$ 51,690$ 184,841$ 47,335$ Development - - - - - - - - 2,560 2,560 6,285 7,034 10,615 14,014 37,948 14,010 Total revenue 42,467 51,705 51,025 46,162 191,359 41,861 48,048 43,814 42,896 176,619 43,215 52,138 61,732 65,704 222,789 61,345 Cost of revenue: Products 27,738 34,026 32,978 29,656 124,398 28,347 32,177 30,852 30,637 122,013 27,900 32,597 34,645 33,113 128,255 30,395 Development - - - - - - - - 2,267 2,267 5,814 6,485 9,927 12,944 35,170 13,305 Total cost of revenue 27,738 34,026 32,978 29,656 124,398 28,347 32,177 30,852 32,904 124,280 33,714 39,082 44,572 46,057 163,425 43,700 Gross profit: Products 14,729 17,679 18,047 16,506 66,961 13,514 15,871 12,962 9,699 52,046 9,030 12,507 16,472 18,577 56,586 16,940 Development - - - - - - - - 293 293 471 549 688 1,070 2,778 705 Total gross profit 14,729 17,679 18,047 16,506 66,961 13,514 15,871 12,962 9,992 52,339 9,501 13,056 17,160 19,647 59,364 17,645 Gross margin: Products 34.7% 34.2% 35.4% 35.8% 35.0% 32.3% 33.0% 29.6% 24.0% 29.9% 24.5% 27.7% 32.2% 35.9% 30.6% 35.8% Development - - - - - - - - 11.4% 11.4% 7.5% 7.8% 6.5% 7.6% 7.3% 5.0% Total gross margin 34.7% 34.2% 35.4% 35.8% 35.0% 32.3% 33.0% 29.6% 23.3% 29.6% 22.0% 25.0% 27.8% 29.9% 26.6% 28.8% Q1 2018 2019 Q1 Q2 Q3 Q4Total TotalQ4Q3Q2 2020 Q1 Q2 Q3 Q4 Total 2021 Q1

16 GAAP to Non-GAAP Reconciliation | Operating Expenses nLIGHT, Inc. (in thousands, except per share amounts) GAAP research and development ("R&D") expense 4,283$ 4,898$ 5,475$ 6,398$ 21,054$ 6,422$ 6,494$ 6,402$ 8,819$ 28,137$ 8,538$ 9,472$ 11,126$ 12,028$ 41,164$ 11,710$ Non-GAAP adjustments: Stock-based compensation in R&D (25) (200) (513) (555) (1,293) (558) (711) (424) (1,606) (3,299) (1,782) (2,275) (2,545) (3,101) (9,703) (2,918) Amortization of purchased intangibles - - - - - - - - (328) (328) (656) (656) (696) (716) (2,724) (717) Non-GAAP R&D expense 4,258 4,698 4,962 5,843 19,761 5,864 5,783 5,978 6,885 24,510 6,100 6,541 7,885 8,211 28,737 8,075 GAAP selling, general and administrative ("SG&A") expense 6,238 7,232 7,485 7,889 28,844 8,144 8,572 7,256 10,139 34,111 7,700 9,633 10,010 11,905 39,248 11,714 Non-GAAP adjustments: Stock-based compensation in SG&A (115) (544) (1,207) (1,190) (3,056) (1,142) (1,403) (315) (2,370) (5,230) (1,636) (3,423) (3,633) (5,448) (14,140) (4,645) Acqusition and integration-related costs - - - - - - - - (470) (470) (50) - - - (50) - Non-GAAP SG&A expense 6,123 6,688 6,278 6,699 25,788 7,002 7,169 6,941 7,299 28,411 6,014 6,210 6,377 6,457 25,058 7,069 Q1 2018 2019 Q1 Q2 Q3 Q4Total TotalQ4Q3Q2 2020 Q1 Q2 Q3 Q4 Total 2021 Q1

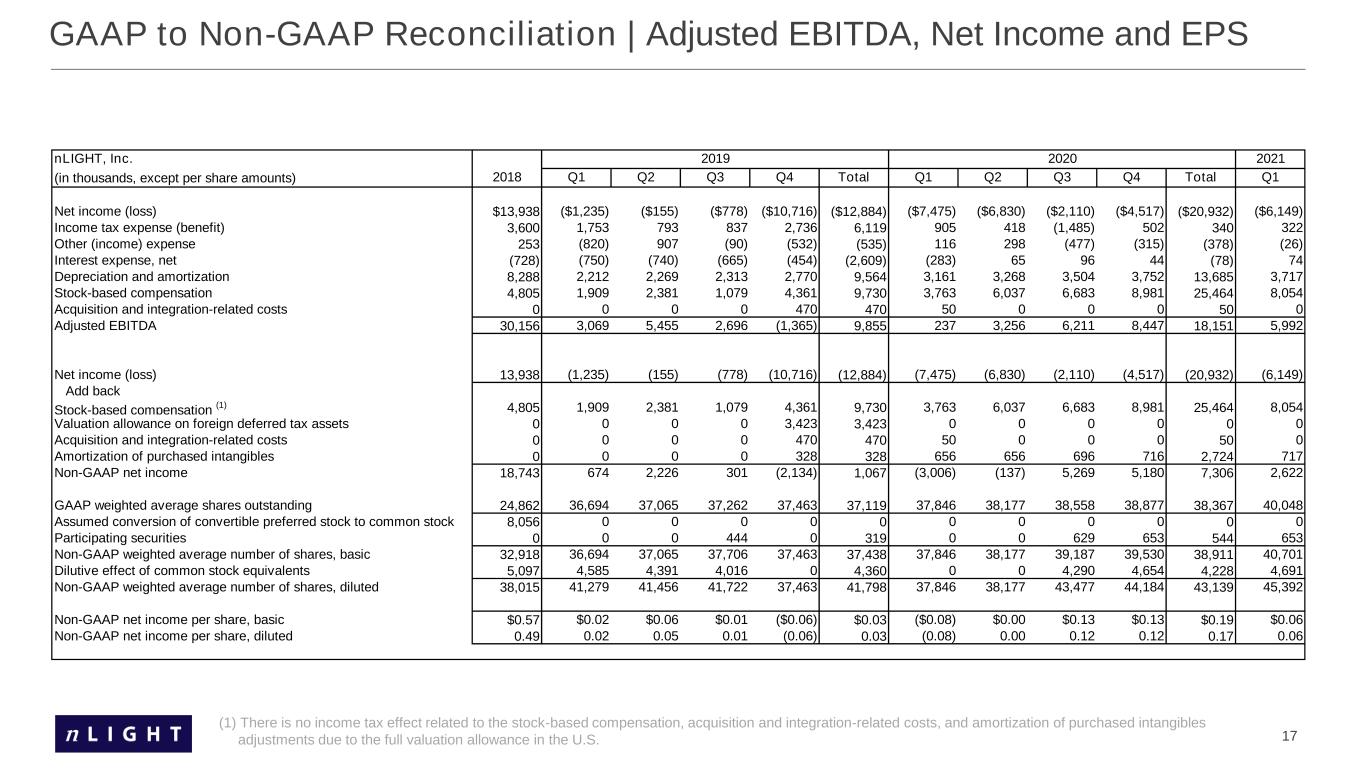

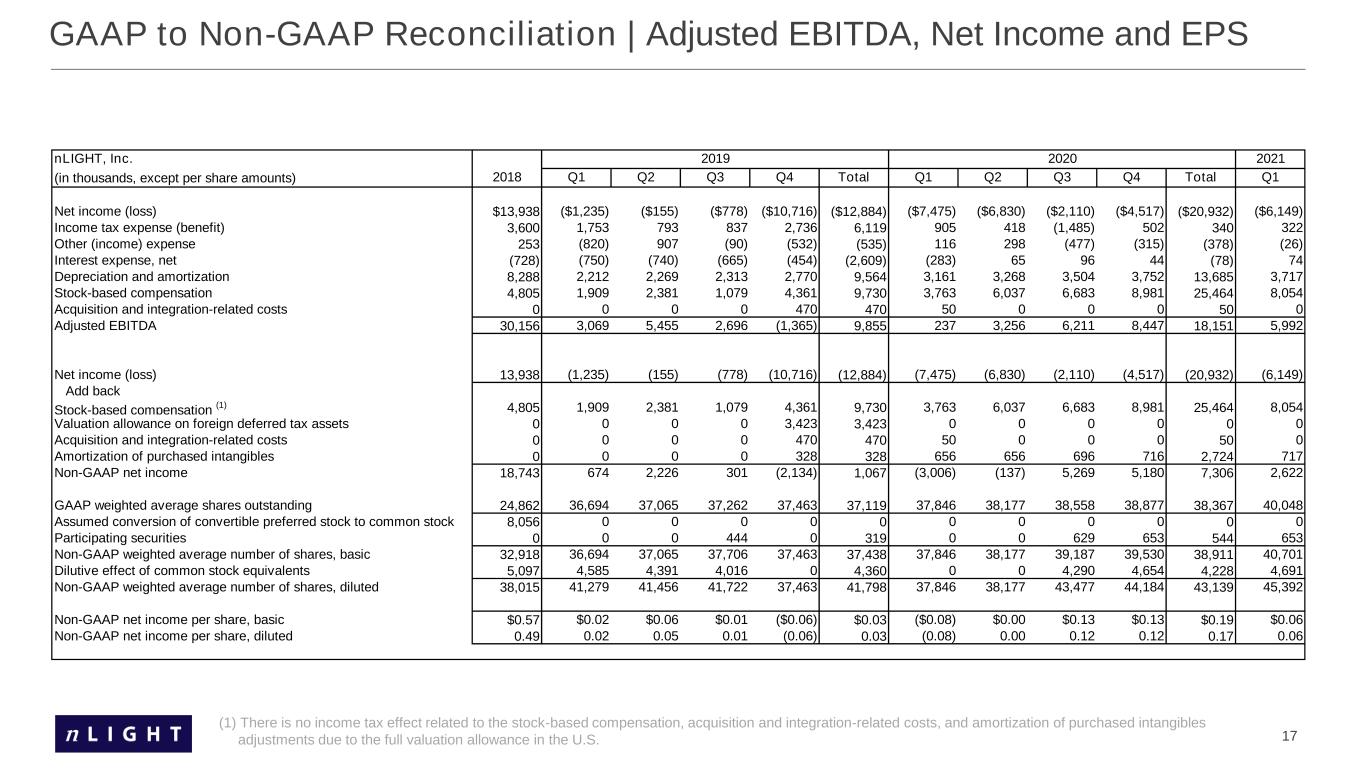

17 (1) There is no income tax effect related to the stock-based compensation, acquisition and integration-related costs, and amortization of purchased intangibles adjustments due to the full valuation allowance in the U.S. GAAP to Non-GAAP Reconciliation | Adjusted EBITDA, Net Income and EPS nLIGHT, Inc. 2019 2020 2021 (in thousands, except per share amounts) 2018 Q1 Q2 Q3 Q4 Total Q1 Q2 Q3 Q4 Total Q1 Net income (loss) $13,938 ($1,235) ($155) ($778) ($10,716) ($12,884) ($7,475) ($6,830) ($2,110) ($4,517) ($20,932) ($6,149) Income tax expense (benefit) 3,600 1,753 793 837 2,736 6,119 905 418 (1,485) 502 340 322 Other (income) expense 253 (820) 907 (90) (532) (535) 116 298 (477) (315) (378) (26) Interest expense, net (728) (750) (740) (665) (454) (2,609) (283) 65 96 44 (78) 74 Depreciation and amortization 8,288 2,212 2,269 2,313 2,770 9,564 3,161 3,268 3,504 3,752 13,685 3,717 Stock-based compensation 4,805 1,909 2,381 1,079 4,361 9,730 3,763 6,037 6,683 8,981 25,464 8,054 Acquisition and integration-related costs 0 0 0 0 470 470 50 0 0 0 50 0 Adjusted EBITDA 30,156 3,069 5,455 2,696 (1,365) 9,855 237 3,256 6,211 8,447 18,151 5,992 Net income (loss) 13,938 (1,235) (155) (778) (10,716) (12,884) (7,475) (6,830) (2,110) (4,517) (20,932) (6,149) Add back Stock-based compensation (1) 4,805 1,909 2,381 1,079 4,361 9,730 3,763 6,037 6,683 8,981 25,464 8,054 Valuation allowance on foreign deferred tax assets 0 0 0 0 3,423 3,423 0 0 0 0 0 0 Acquisition and integration-related costs 0 0 0 0 470 470 50 0 0 0 50 0 Amortization of purchased intangibles 0 0 0 0 328 328 656 656 696 716 2,724 717 Non-GAAP net income 18,743 674 2,226 301 (2,134) 1,067 (3,006) (137) 5,269 5,180 7,306 2,622 GAAP weighted average shares outstanding 24,862 36,694 37,065 37,262 37,463 37,119 37,846 38,177 38,558 38,877 38,367 40,048 Assumed conversion of convertible preferred stock to common stock 8,056 0 0 0 0 0 0 0 0 0 0 0 Participating securities 0 0 0 444 0 319 0 0 629 653 544 653 Non-GAAP weighted average number of shares, basic 32,918 36,694 37,065 37,706 37,463 37,438 37,846 38,177 39,187 39,530 38,911 40,701 Dilutive effect of common stock equivalents 5,097 4,585 4,391 4,016 0 4,360 0 0 4,290 4,654 4,228 4,691 Non-GAAP weighted average number of shares, diluted 38,015 41,279 41,456 41,722 37,463 41,798 37,846 38,177 43,477 44,184 43,139 45,392 Non-GAAP net income per share, basic $0.57 $0.02 $0.06 $0.01 ($0.06) $0.03 ($0.08) $0.00 $0.13 $0.13 $0.19 $0.06 Non-GAAP net income per share, diluted 0.49 0.02 0.05 0.01 (0.06) 0.03 (0.08) 0.00 0.12 0.12 0.17 0.06

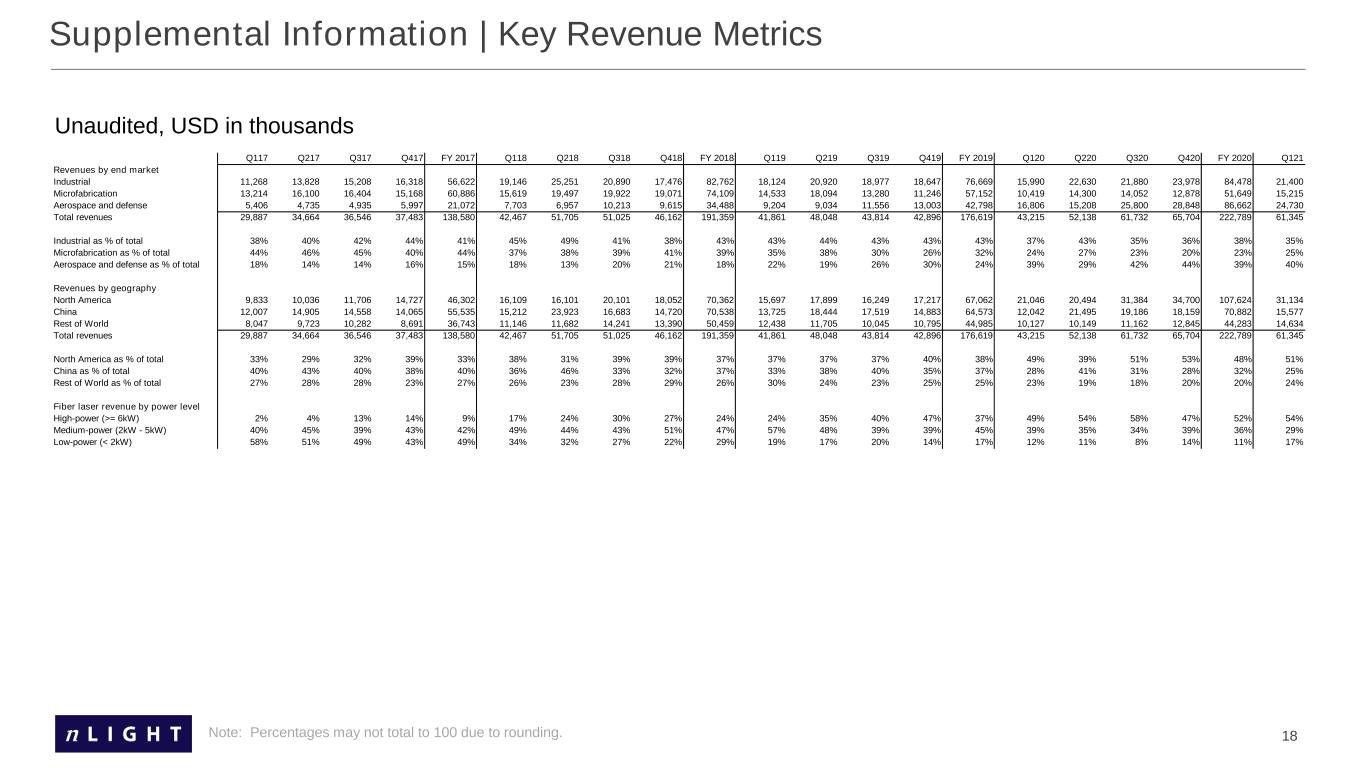

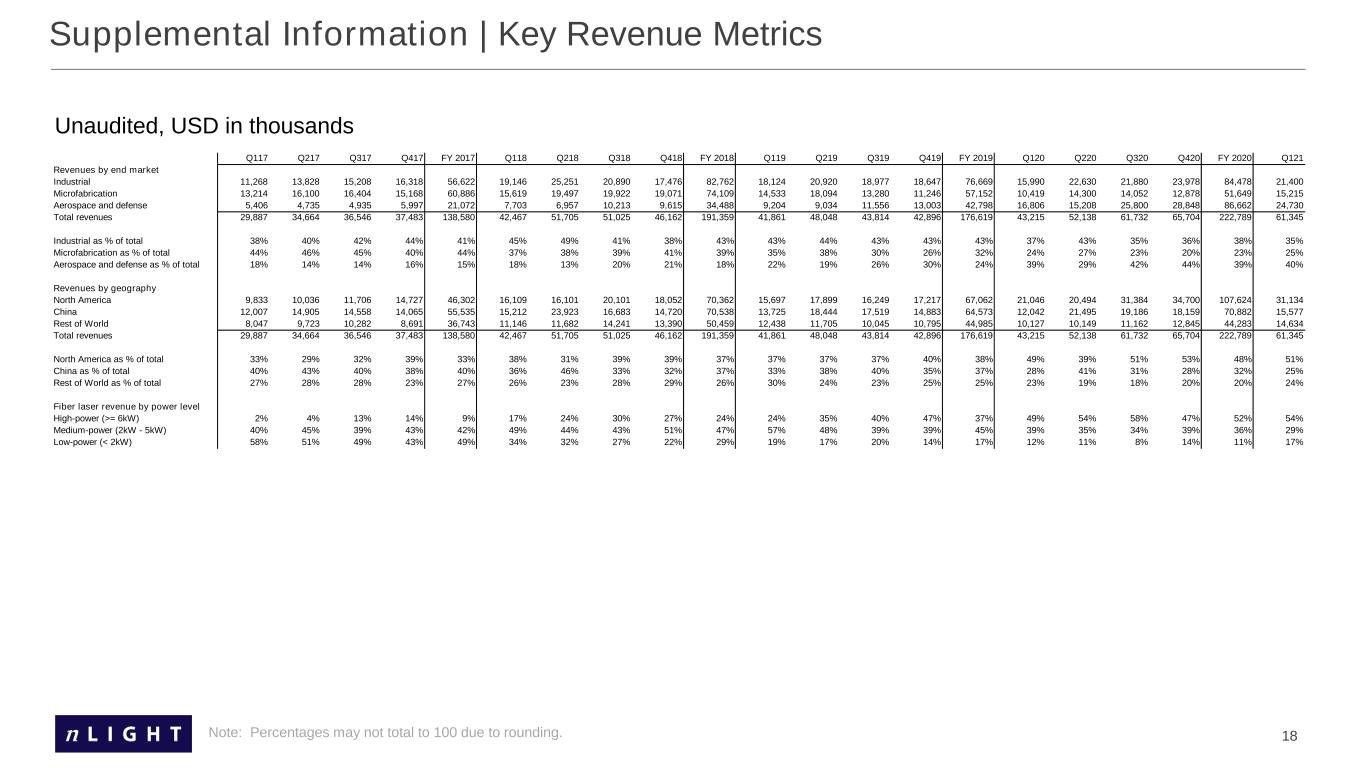

18 Unaudited, USD in thousands Supplemental Information | Key Revenue Metrics Note: Percentages may not total to 100 due to rounding. Q117 Q217 Q317 Q417 FY 2017 Q118 Q218 Q318 Q418 FY 2018 Q119 Q219 Q319 Q419 FY 2019 Q120 Q220 Q320 Q420 FY 2020 Q121 Revenues by end market Industrial 11,268 13,828 15,208 16,318 56,622 19,146 25,251 20,890 17,476 82,762 18,124 20,920 18,977 18,647 76,669 15,990 22,630 21,880 23,978 84,478 21,400 Microfabrication 13,214 16,100 16,404 15,168 60,886 15,619 19,497 19,922 19,071 74,109 14,533 18,094 13,280 11,246 57,152 10,419 14,300 14,052 12,878 51,649 15,215 Aerospace and defense 5,406 4,735 4,935 5,997 21,072 7,703 6,957 10,213 9,615 34,488 9,204 9,034 11,556 13,003 42,798 16,806 15,208 25,800 28,848 86,662 24,730 Total revenues 29,887 34,664 36,546 37,483 138,580 42,467 51,705 51,025 46,162 191,359 41,861 48,048 43,814 42,896 176,619 43,215 52,138 61,732 65,704 222,789 61,345 Industrial as % of total 38% 40% 42% 44% 41% 45% 49% 41% 38% 43% 43% 44% 43% 43% 43% 37% 43% 35% 36% 38% 35% Microfabrication as % of total 44% 46% 45% 40% 44% 37% 38% 39% 41% 39% 35% 38% 30% 26% 32% 24% 27% 23% 20% 23% 25% Aerospace and defense as % of total 18% 14% 14% 16% 15% 18% 13% 20% 21% 18% 22% 19% 26% 30% 24% 39% 29% 42% 44% 39% 40% Revenues by geography North America 9,833 10,036 11,706 14,727 46,302 16,109 16,101 20,101 18,052 70,362 15,697 17,899 16,249 17,217 67,062 21,046 20,494 31,384 34,700 107,624 31,134 China 12,007 14,905 14,558 14,065 55,535 15,212 23,923 16,683 14,720 70,538 13,725 18,444 17,519 14,883 64,573 12,042 21,495 19,186 18,159 70,882 15,577 Rest of World 8,047 9,723 10,282 8,691 36,743 11,146 11,682 14,241 13,390 50,459 12,438 11,705 10,045 10,795 44,985 10,127 10,149 11,162 12,845 44,283 14,634 Total revenues 29,887 34,664 36,546 37,483 138,580 42,467 51,705 51,025 46,162 191,359 41,861 48,048 43,814 42,896 176,619 43,215 52,138 61,732 65,704 222,789 61,345 North America as % of total 33% 29% 32% 39% 33% 38% 31% 39% 39% 37% 37% 37% 37% 40% 38% 49% 39% 51% 53% 48% 51% China as % of total 40% 43% 40% 38% 40% 36% 46% 33% 32% 37% 33% 38% 40% 35% 37% 28% 41% 31% 28% 32% 25% Rest of World as % of total 27% 28% 28% 23% 27% 26% 23% 28% 29% 26% 30% 24% 23% 25% 25% 23% 19% 18% 20% 20% 24% Fiber laser revenue by power level High-power (>= 6kW) 2% 4% 13% 14% 9% 17% 24% 30% 27% 24% 24% 35% 40% 47% 37% 49% 54% 58% 47% 52% 54% Medium-power (2kW - 5kW) 40% 45% 39% 43% 42% 49% 44% 43% 51% 47% 57% 48% 39% 39% 45% 39% 35% 34% 39% 36% 29% Low-power (< 2kW) 58% 51% 49% 43% 49% 34% 32% 27% 22% 29% 19% 17% 20% 14% 17% 12% 11% 8% 14% 11% 17%

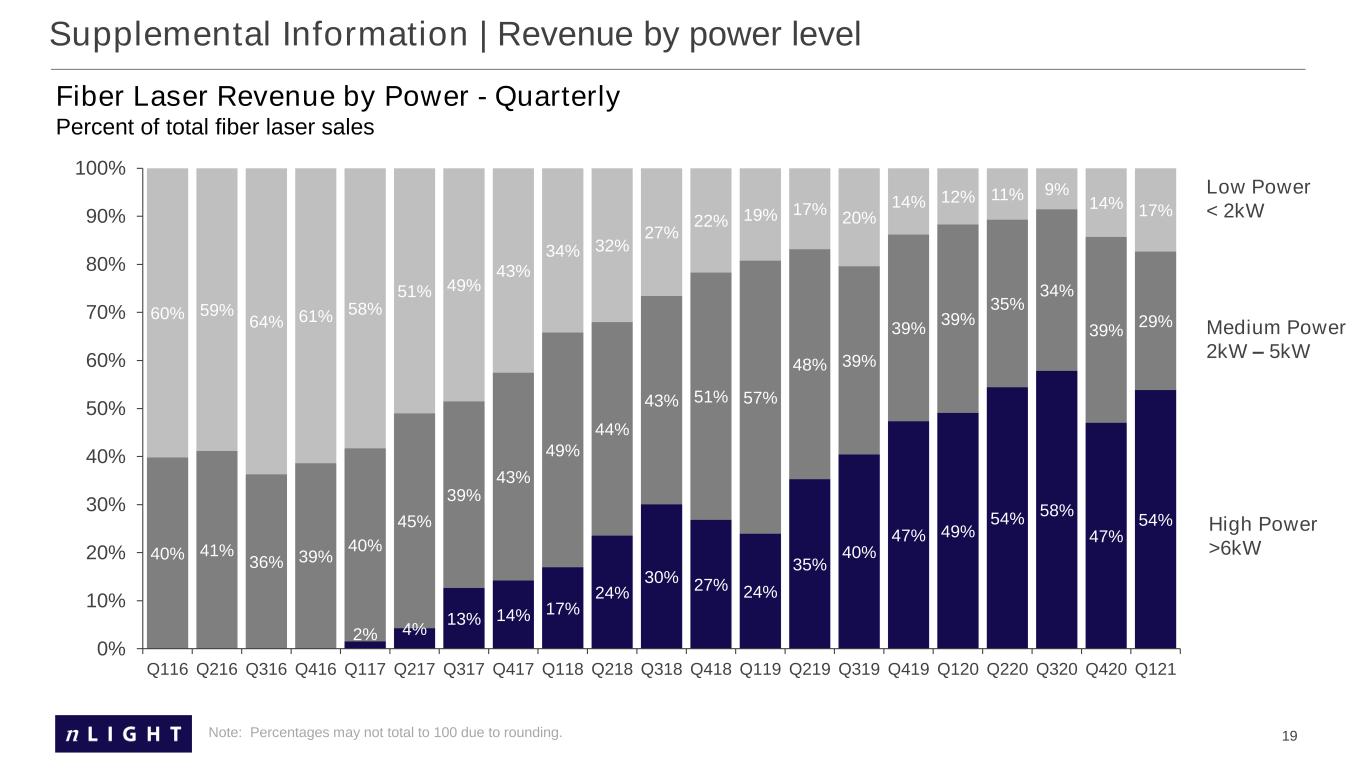

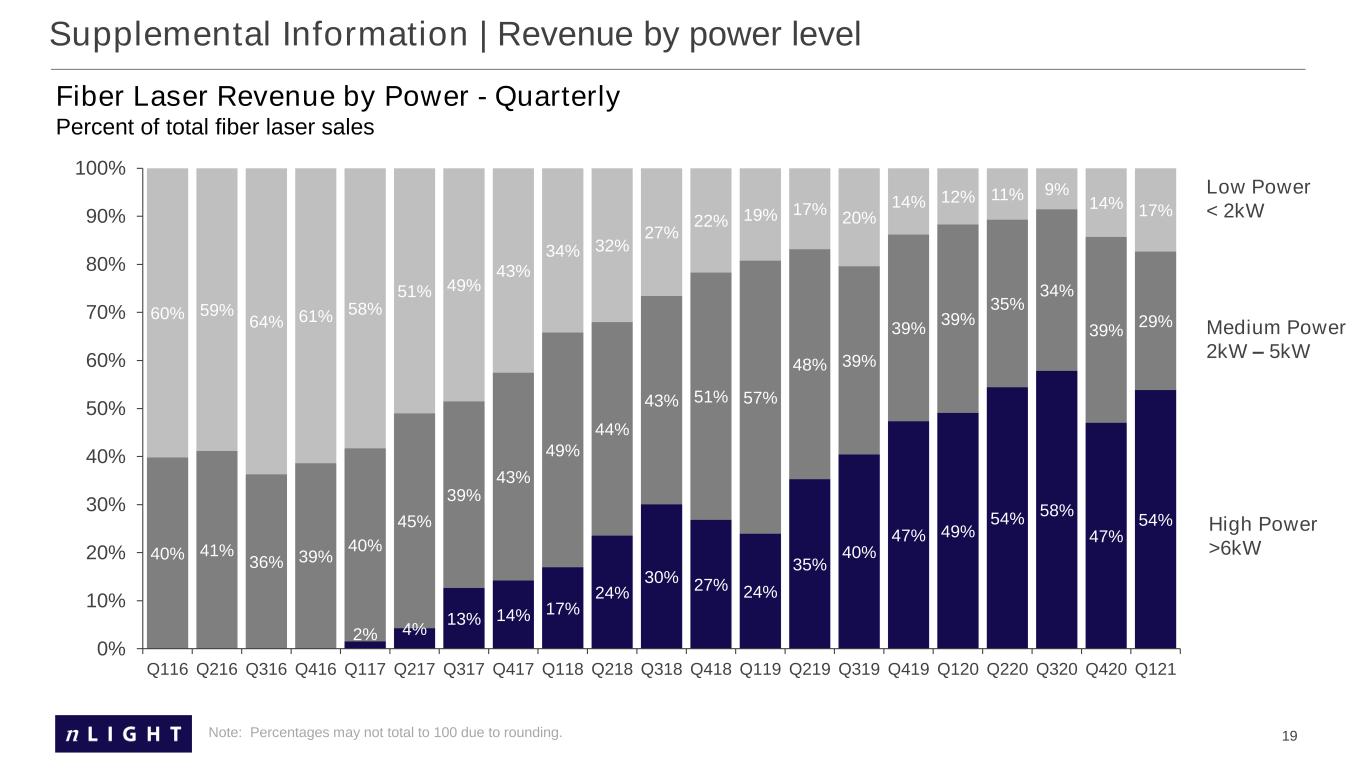

19 Supplemental Information | Revenue by power level 2% 4% 13% 14% 17% 24% 30% 27% 24% 35% 40% 47% 49% 54% 58% 47% 54% 40% 41% 36% 39% 40% 45% 39% 43% 49% 44% 43% 51% 57% 48% 39% 39% 39% 35% 34% 39% 29% 60% 59% 64% 61% 58% 51% 49% 43% 34% 32% 27% 22% 19% 17% 20% 14% 12% 11% 9% 14% 17% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Q116 Q216 Q316 Q416 Q117 Q217 Q317 Q417 Q118 Q218 Q318 Q418 Q119 Q219 Q319 Q419 Q120 Q220 Q320 Q420 Q121 Fiber Laser Revenue by Power - Quarterly Percent of total fiber laser sales High Power >6kW Low Power < 2kW Medium Power 2kW – 5kW Note: Percentages may not total to 100 due to rounding.