ALLSCRIPTS ™

Inform. Connect. Transform.

Safe Harbor

This presentation may contain forward-looking statements about Allscripts Healthcare Solutions that involve risks and uncertainties. These statements are developed by combining currently available information with Allscripts’ beliefs and assumptions. Forward-looking statements do not guarantee future performance. Because Allscripts cannot predict all of the risks and uncertainties that may affect it, or control the ones it does predict, Allscripts’ actual results may be materially different from the results expressed in its forward-looking statements. For a more complete discussion of the risks, uncertainties and assumptions that may affect Allscripts, see the Company’s 2003 Annual Report on Form 10-K, available at www.sec.gov.

What We Do & Who We Are . . .

We Provide

Clinical Software, Connectivity & Information Solutions To Physicians 340 Employees Public (Nasdaq: MDRX) Financial Strength

- $ 128+ Million in Cash Reserves

- $ 100+ Million in 2004 Revenue

- Diversified/Multiple Revenue Streams

- The Leader in High Growth Markets

Culture

- Fast Moving, Client-Focused and Innovative

Our Vision

To Become an Indispensable Part of the Way Physicians Practice Medicine

Why?

Physicians Control 80% of a $1.6 Trillion Annual Spend

Our Solutions

Clinical Solutions Group

TouchWorks™

TouchChart™

TouchScript™

Impact.MD®

Physicians Interactive Group

Physicians Interactive™

Patients Interactive™

iHealth

Medication Services Group

Allscripts Direct

Clinical Solutions:

EHR Market Opportunity

$5 Billion Market

The Market Has “Tipped”

< 25% Penetration of Mid to Large Size Groups

50% of Groups Purchasing in Next 18 Months*

Average deal size was approximately $500,000 in 2004

Pipeline continues to grow. We also expect average deal size to grow and include individual deals in $3 to $5 million range over the next 12 to 18 mo.

What Changed?

Tools & Technology Are Better, Less Expensive

Physician’s Willingness To Adopt Technology

Political, Payors, PBM, Patient Trends

Results (Proven, Measurable ROI)

Market has Crossed the Chasm

•source: PricewatershouseCoopers Study

Clinical Solutions:

Allscripts EHR – Competitive Advantages

Physician-Centric Approach

IDX Alliance: Preferred Access to 70% of Large Groups

Modular Approach Drives Rapid Adoption and ROI

Independent, Documented Return-On-Investment

Strong Reference Sites

Partners Play A Key Role In Our Solution and Connections

Organizing & Leading the Ambulatory Market

Clinical Solutions:

Allscripts EHR - Results

Sales Growth In Excess of 52%

Client Satisfaction: 96% Would Recommend TouchWorks

Ranked #1 in KLAS, the “Consumer Reports’ of Healthcare, for Ambulatory EHR

Ranked #1 at TEPR Competition

Microsoft HUG Awards

CUMC Saves $1,000,000 in First Year of TouchWorks Use

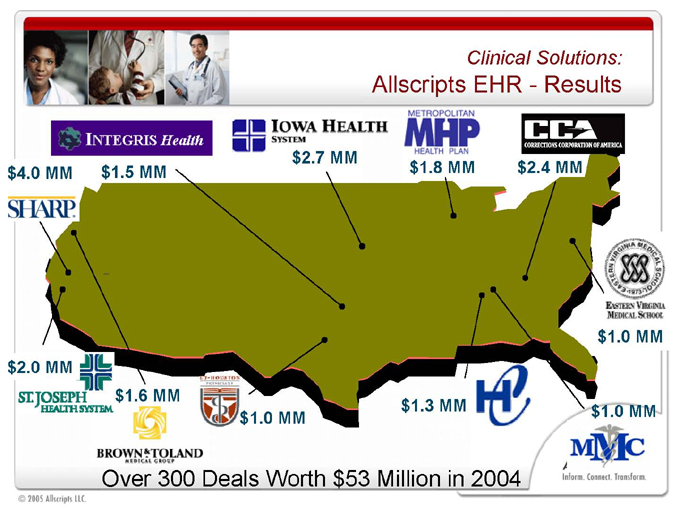

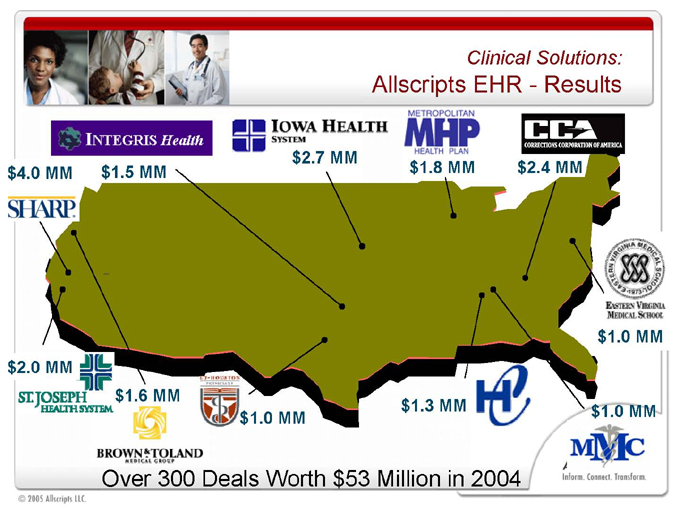

Clinical Solutions:

Allscripts EHR - Results

$2.7 MM

$4.0 MM

$1.5 MM

$1.8 MM

$2.4 MM

$1.0 MM

$2.0 MM

$1.6 MM

$1.3 MM

$1.0 MM

$1.0 MM

Over 300 Deals Worth $53 Million in 2004

Clinical Solutions:

Allscripts EHR – Results

$2.7 MM

$1.5 MM

$1.8 MM

$2.4 MM

$4.0 MM

$1.0 MM

$2.0 MM

$1.6 MM

$1.3 MM

$1.0 MM

$1.0 MM

Over 300 Deals Worth $53 Million in 2004

Clinical Solutions:

e-Prescribing Market Opportunity

3 Billion Prescriptions/Year Written on Paper in the US

Less than 16 million prescriptions written electronically today. AHS processing approximately 50%

Significant Backing from Payors

Federal government

Managed care

Impact Proven and Understood

Increased use of generics, formulary compliance

Improvement on patient safety, IOM Study

Entry point to broader opportunity

Upgrade to Full Suite: TouchWorks & Impact.EMR

Access to recurring transactions (approx. $1.5 million in 2004)

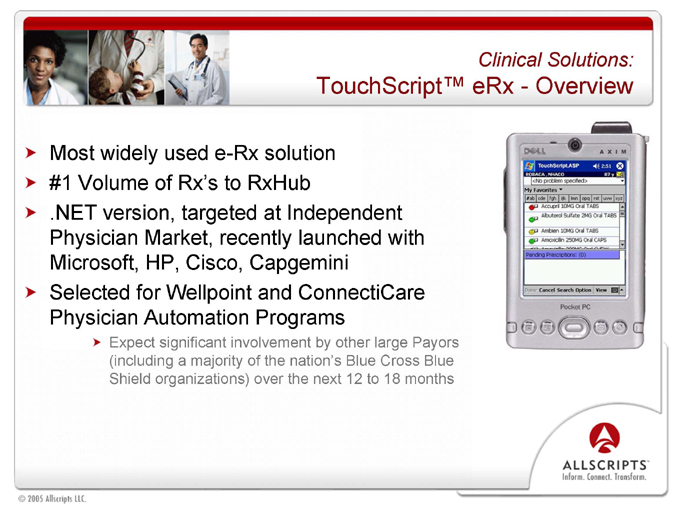

Clinical Solutions:

TouchScript™ eRx - Overview

Most widely used e-Rx solution

#1 Volume of Rx’s to RxHub

.NET version, targeted at Independent Physician Market, recently launched with Microsoft, HP, Cisco, Capgemini

Selected for Wellpoint and ConnectiCare Physician Automation Programs

Expect significant involvement by other large Payors (including a majority of the nation’s Blue Cross Blue Shield organizations) over the next 12 to 18 months

Physicians Interactive:

Opportunity

The Opportunity

Pharma Industry Marketing Spend = $15 Billion/Year

Current Market for Online Product Education ~$250mm

The Pharma Challenge

Goal = Educate/Influence ~ 200,000 HVP’s

Challenge = HVP’s Crunched For Time

43% of Pharma Detail Calls End at Receptionist

50% of Detail Calls Last < 2 Minutes

Physicians Interactive:

- Results

Pioneer/Leading Provider of e-Detailing and Other Online Solutions

Blue Chip Client Base

39 Pharmaceutical, Biotech & Medical Device Companies

8 of Top 10 Pharmaceutical Companies

More Programs Delivered

400 Programs for 100 Brands

59 International Programs in 8 Countries

Significant Footprint with Physicians

60,000 Unique Physician Participants in U.S.

> 250,000 Educational Sessions Completed

Medication Services:

Results

Legacy Business

Continued Increases In Gross Margin

Strength in Occupational Health Centers

Strength in Employers On-Site Delivery

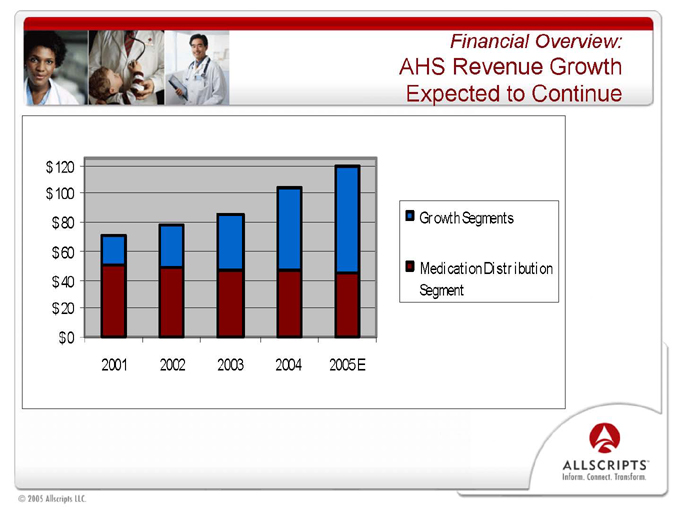

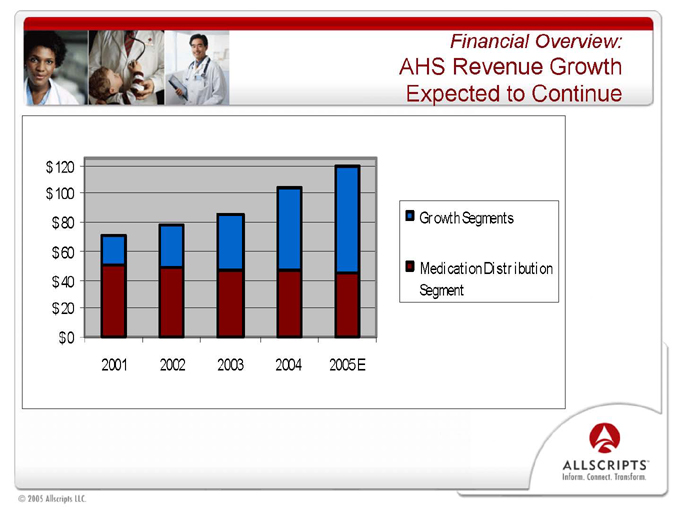

Financial Overview:

AHS Revenue Growth Expected to Continue

$120 $100 $80 $60 $40 $20 $0

2001 2002 2003 2004 2005 E

Growth Segments

Medication Distribution Segment

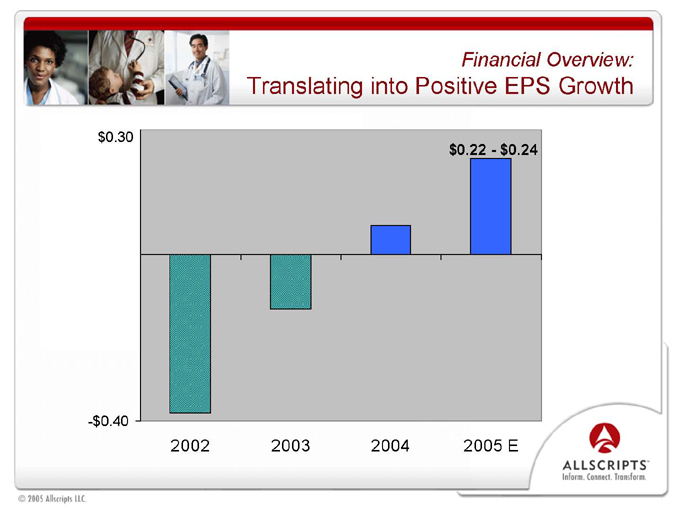

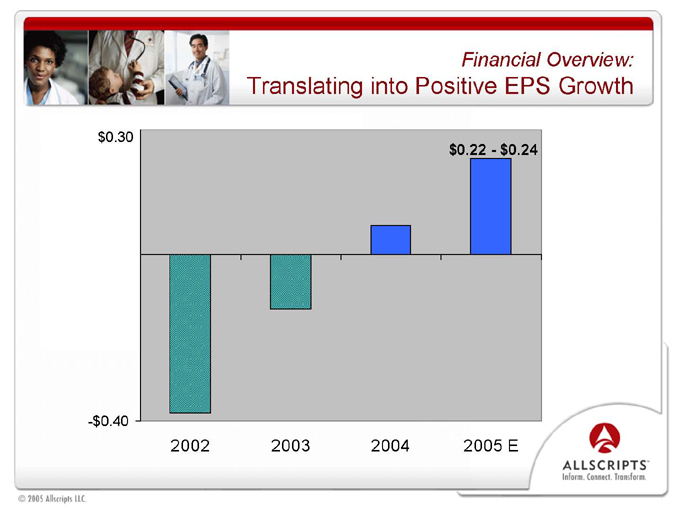

Financial Overview:

Translating into Positive EPS Growth

$0.30

-$0.40

$0.22 - $0.24

2002 2003 2004 2005 E

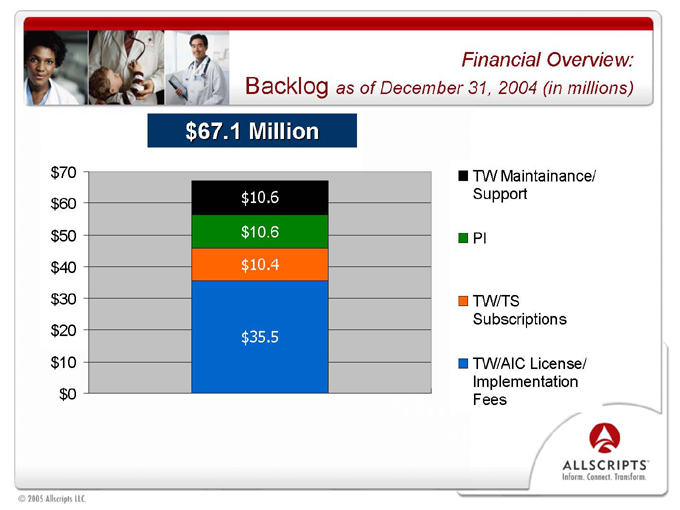

Financial Overview:

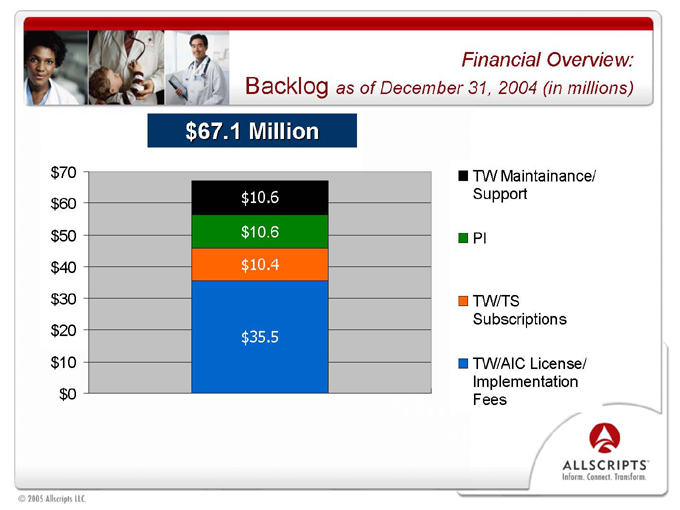

Backlog as of December 31, 2004 (in millions)

$67.1 Million

$70 $60 $50 $40 $30 $20 $10 $0

$10.6 $10.4 $35.5

TW Maintainance/ Support

PI

TW/TS Subscriptions

TW/AIC License/Implementation Fees

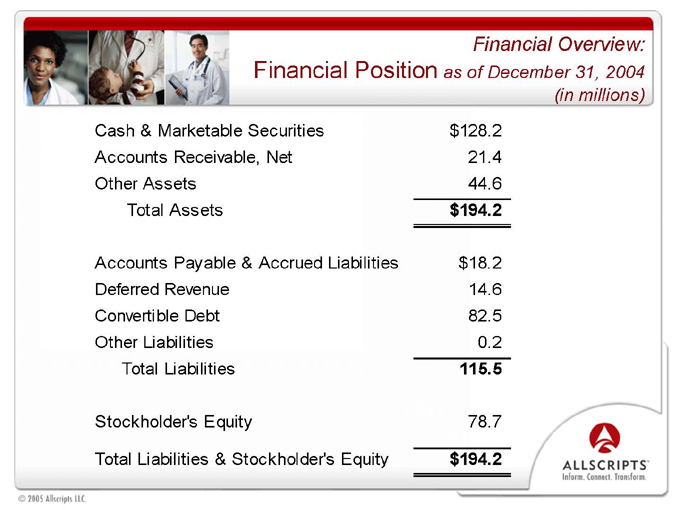

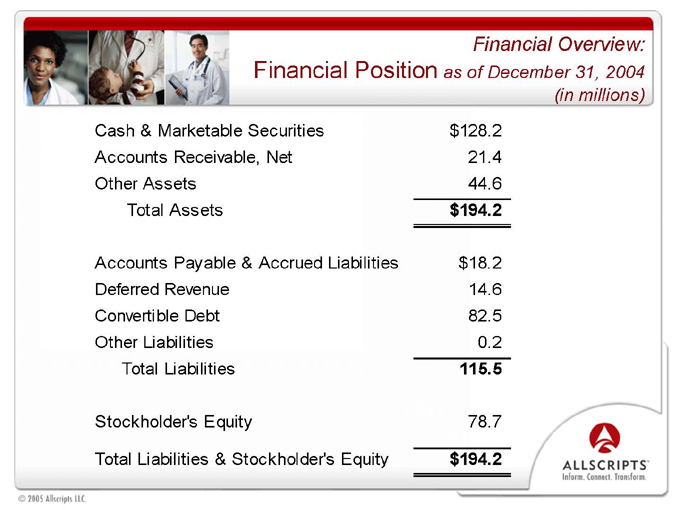

Financial Overview:

Financial Position as of December 31, 2004 (in millions)

Cash & Marketable Securities $128.2

Accounts Receivable, Net 21.4

Other Assets 44.6

Total Assets $194.2

Accounts Payable & Accrued Liabilities $18.2

Deferred Revenue 14.6

Convertible Debt 82.5

Other Liabilities 0.2

Total Liabilities 115.5

Stockholder’s Equity 78.7

Total Liabilities & Stockholder’s Equity $194.2

Summary

Physician-Centric

Competitive Advantage In Key Markets

Leadership Position in All Businesses

Strong Sales Momentum in Growing Markets

Strong Financial Position

People

Bottom Line

Well Positioned for Growth and Sustained Profitability

Allscripts Healthcare Solutions