1 Exhibit 99.1 |

Safe Harbor This presentation may contain forward-looking statements about Allscripts Healthcare Solutions that involve risks and uncertainties. These statements are developed by combining currently available information with Allscripts’ beliefs and assumptions. Forward-looking statements do not guarantee future performance. Because Allscripts cannot predict all of the risks and uncertainties that may affect it, or control the ones it does predict, Allscripts’ actual results may be materially different from the results expressed in its forward-looking statements. For a more complete discussion of the risks, uncertainties and assumptions that may affect Allscripts, see the Company's Annual Report on Form 10-K for the year ended December 31, 2004, available at www.sec.gov. 2 |

Company Overview Physicians rely on our products to improve the quality of healthcare they provide Our integrated product lines provide clinical information and automate physicians’ most basic workflows such as documentation, prescription writing and charge capturing We deliver broad and diverse solutions – Clinical Solutions Group – Physicians Interactive Group – Medication Solutions Group Allscripts Provides Clinical Software, Connectivity and Information Solutions To Physicians 4 |

Experienced Management Team IDX, ChannelHealth President, Clinical Solutions President, Clinical Solutions LAURIE MCGRAW LAURIE MCGRAW CaremarkRx, IBM President, Physicians Interactive President, Physicians Interactive MARK THIERER MARK THIERER Previous Previous Experience Experience Role Role Name Name Federated Foods, Arthur Andersen & Co. President, Medication Services President, Medication Services JOHN CULL JOHN CULL Lante Corporation, PriceWaterhouseCoopers Chief Financial Officer Chief Financial Officer BILL DAVIS BILL DAVIS HBOC & Company, Enterprise Systems Chief Operating Officer Chief Operating Officer JOE CAREY JOE CAREY Douglas Elliman-Beitler, City Financial Bancorp President President LEE SHAPIRO LEE SHAPIRO Enterprise Systems, CCC Information Systems Chief Executive Officer Chief Executive Officer GLEN TULLMAN GLEN TULLMAN 5 |

Our Vision Physicians Control 80% of $1.8 Trillion To Become an Indispensable Part of the Way Physicians Practice Medicine Annual Healthcare Spend 6 |

Our Vision To Become an Indispensable Part of the Way Physicians Practice Medicine We deliver solutions that Healthcare. 7 |

Investment Highlights Allscripts is a leading provider of ambulatory EHR solutions, a $5+ billion market opportunity A4 acquisition expands our EHR leadership to small and mid-sized physician practices and provides leading practice management solution Emergency department and care management solutions ensure continuity of care from hospital to ambulatory EHR Strong financial momentum and revenue visibility provide operating leverage 8 |

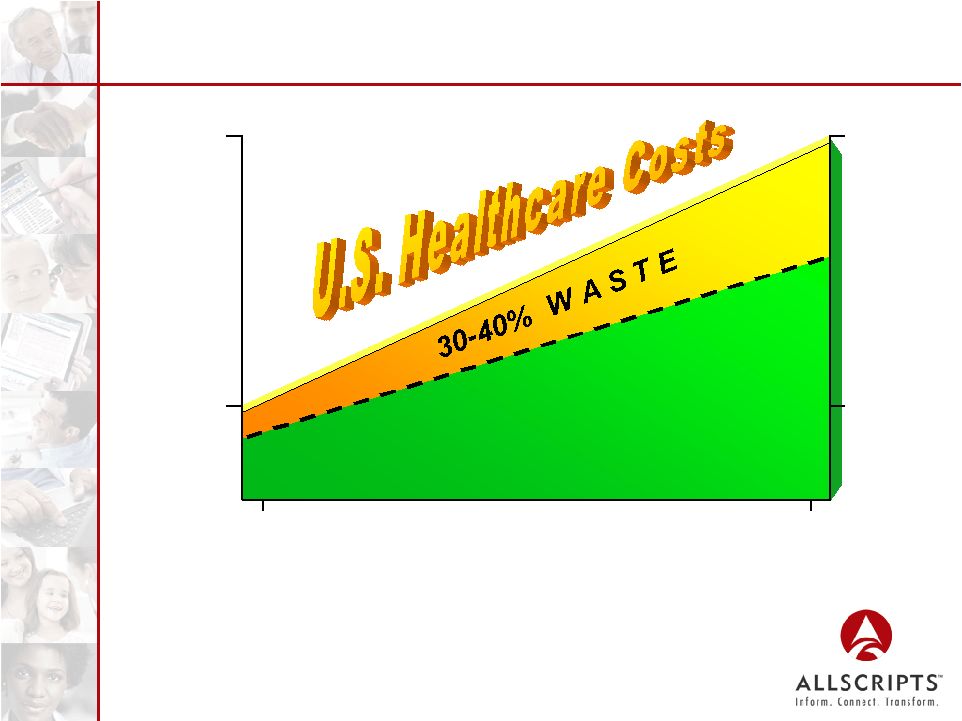

Fundamental Problem In Healthcare 2004 2014 16% 22% $1.8 $3.5 The U.S. is No.1 in the world in healthcare expenditures, but no better than 16th in medical outcomes ($ in Trillions) (% of GDP) 9 |

Fundamental Problem In Healthcare 10 |

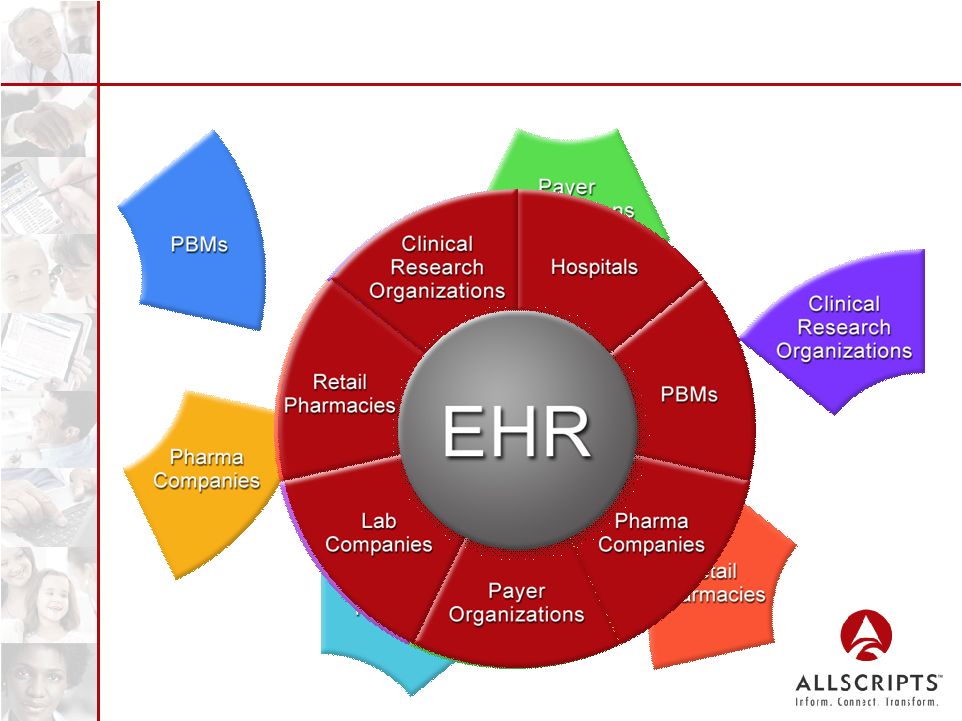

What Is The Solution? CONNECTING 11 |

Large and Growing Market Opportunity Small to mid-sized practices represent largest number of physicians Practice management solutions provide complementary product offering with significant incremental market opportunity Ambulatory EHR Market is ~$5+ Billion Opportunity ~550,000 U.S. Physicians ~85% Remaining EHR Market Opportunity x ~$12,500 Initial Investment per Physician x ~$5+ Billion Opportunity = 12 |

Allscripts Competitive Strengths Significant installed base World-class technologies that enable industry-leading solutions Rapid return on investment Strong partnerships and strategic alliances Experienced employee base 13 |

Allscripts: The EHR of Choice Academic Medical Groups Specialty Groups Multi-Specialty Groups Integrated Delivery Networks Over 2,000 Leading Clinics Nationwide 16 |

Delivering Value Through Diversified Solutions e-Prescribing e-Prescribing Personal Health Record Personal Health Record Medication Dispensing Medication Dispensing e-Detailing e-Detailing Adherence/ Compliance Adherence/ Compliance Document Imaging Document Imaging Electronic Health Record Electronic Health Record 14 |

Delivering Results Generates Clinical Trial Revenue Holston Medical Group $3M/Yr. in Clinical Trial Revenue Delivers on Pay for Performance Facey Medical $1.2M P4P Payout from Blue Cross Produces e-Prescribing Savings Sierra Health $5M in Savings via eRx Reduces Resources in Medical Records George Washington Univ. Medical Faculty Associates Reduction of 20 FTEs in Medical Records Reduces/Eliminates Transcription Central Utah Clinic $1M in Savings in Year 1 ($20K/MD) Enhances Documentation University of Tennessee Medical Group Avg. Gross Charges Increases by > $30/Patient Visit 15 |

Strength of Our Partnerships 17 |

Renegotiated IDX Agreement A win for OUR Customers, IDX/GE, and Allscripts Preserves the best attributes of the original agreement Allscripts remains preferred choice for IDX customers Allscripts can now offer its own integrated EHR and practice management solutions Allscripts remains the safe choice for IDX customers with over 140 existing sites “Physician groups choose Allscripts because of the referencable customer base, leading product, and a successful implementation track record, not because of a piece of paper signed 5 years ago.” 18 |

Our Industry Leadership Leadership Council Founding Member and Named to Executive Committee Steering Group for Connecting Communities for Health Initiative Work Group for EHR Certification Process Provided Expert Testimony on e-Prescribing Named to HIMSS Ambulatory Steering EHR Committee 19 |

Our Industry Leadership Leadership Council Founding Member and Named to Executive Committee Steering Group for Connecting Communities for Health Initiative Work Group for EHR Certification Process Provided Expert Testimony on e-Prescribing Named to HIMSS Ambulatory Steering EHR Committee Our Leadership Translates into Benefits for Our Clients Our Leadership Translates into Benefits for Our Clients George Washington University Medical Faculty Associates Received Prestigious HIMSS ‘Article of the Year’ Award 2 Clients to Participate in HHS e-Prescribing Pilot - Testing Standards and Interoperability Grant Awarded to Allscripts Client to Test Laboratory Interoperability and Connectivity Standards George Washington University Medical Faculty Associates Received Prestigious HIMSS ‘Article of the Year’ Award 2 Clients to Participate in HHS e-Prescribing Pilot - Testing Standards and Interoperability Grant Awarded to Allscripts Client to Test Laboratory Interoperability and Connectivity Standards 20 |

Leadership In A Revolutionary Market “No one will be practicing medicine in America ten years from now without an Electronic Health Record… That’s why I believe so strongly in what Allscripts is doing.” – Newt Gingrich; Founder of the Center for Health Transformation 21 |

A4 Acquisition: Strategic Benefits Expand product and service offerings – Fully integrated EHR and practice management solutions for small and mid-sized physician groups – Complementary acute care solutions Increase market penetration – Double the size of our salesforce – Add over 1,500 physician clinics nationally Accelerate financial performance – Double our clinical software revenues – Natural gross margin expansion – Accretive on CASH basis in 2006 and on GAAP basis in 2007 22 |

Ambulatory Market Share Large Physician Practices (>25) Segment EHR Practice Management Mid-Sized Physician Practices (10-24) Independent & Small Physician Practices (<10) Specialty Groups Profitable Leadership In Each Segment 23 |

Strategies For Growth Broaden Physician Base Broaden Physician Base Enhance Physician Utilization Enhance Physician Utilization Continue Product Innovation Continue Product Innovation Leverage Brand Recognition Leverage Brand Recognition Pursue Strategic Opportunities Pursue Strategic Opportunities Aggressively pursue physician practices in all markets In-depth training and customer support Scalable and modular Rapid implementation Broader functionality Publicity and media campaigns Government driving awareness Continue to pursue complementary businesses and assets Continue to build strategic relationships 24 |

Key Takeaways 1. The time is now 2. Our physician focus is key to transforming healthcare 3. We are a leader in the core growth markets in which we compete 4. Competitive advantage: driving utilization and results We’re just getting started! 25 |

Financial Overview 26 |

Proven Track Record Record bookings 2005 Was A Breakthrough Year for Allscripts! Record backlog Record revenues Record gross margins Record cash flows from operations Record net income 27 |

Proven Track Record Record bookings 2005 Was A Breakthrough Year for Allscripts! Record backlog Record revenues Record gross margins Record cash flows from operations Record net income 27 |

Consistent Revenue Growth ($ in Millions) $0 $20 $40 $60 $80 $100 $120 $140 $160 2002 2003 2004 2005 2006(E) $78.8 $85.8 $100.8 $120.6 $145.0 28 Pre-packaged Medications Information Services Clinical Software and Related Services * Growth segments include Clinical Software and Related Services and Information Services |

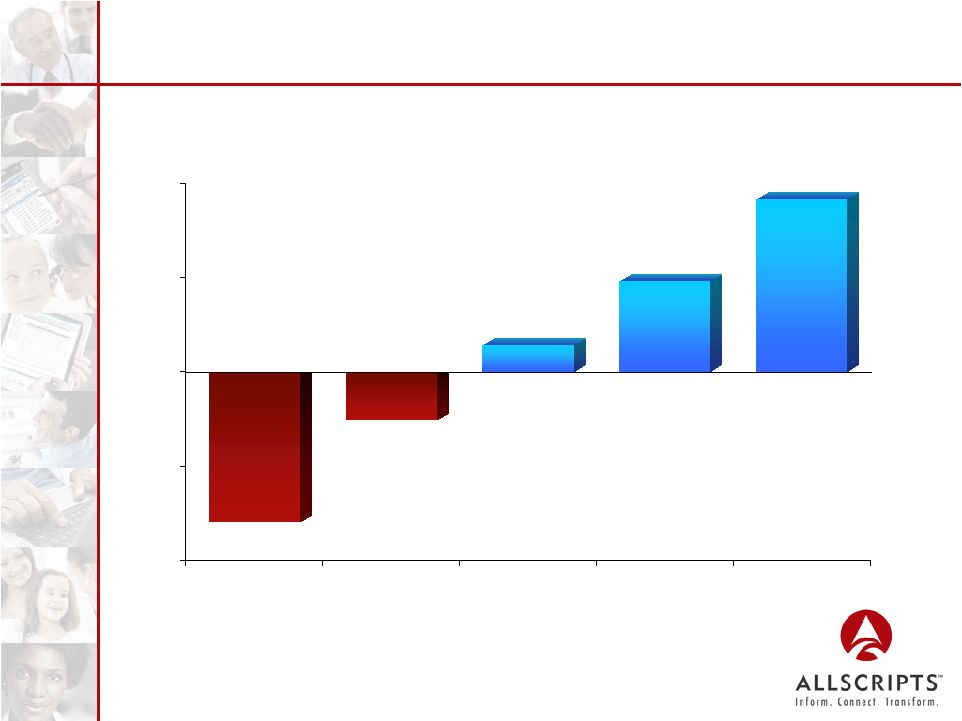

Operating Leverage Drives Strong Earnings Growth * Excludes stock-based compensation ($0.50) ($0.25) $0.00 $0.25 $0.50 2002 2003 2004 2005* 2006*(E) ($0.40) ($0.13) $0.07 $0.24 $0.45 - $0.47 29 |

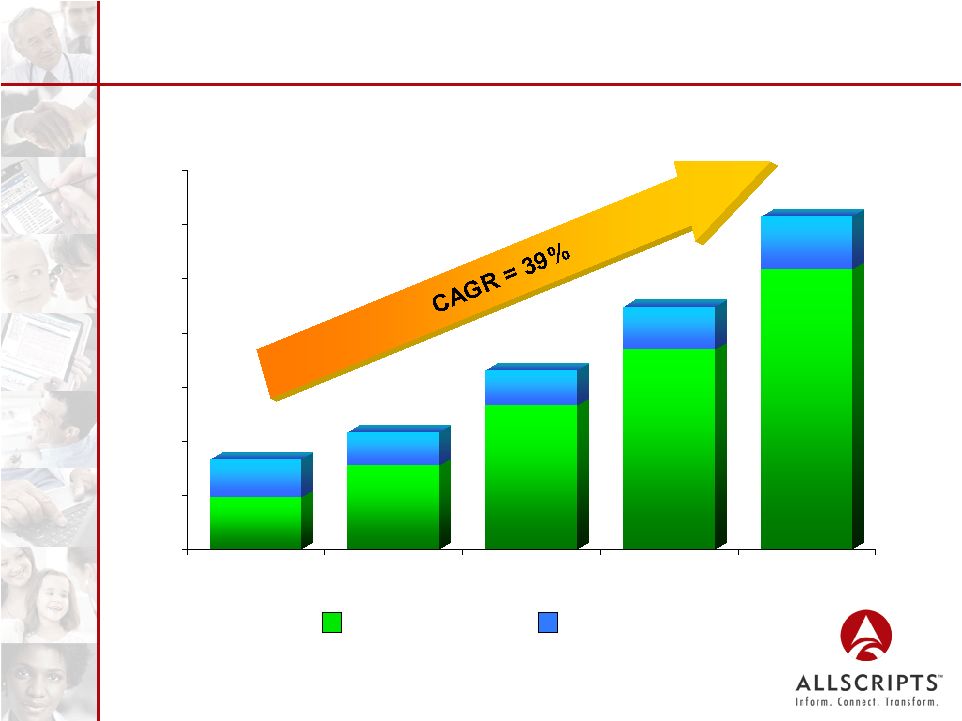

$0 $20 $40 $60 $80 $100 $120 $140 2002 2003 2004 2005 2006(E) Solid Bookings Growth Information Services Clinical Software and Related Services $33.3 $43.1 $65.9 $89.5 $123.0 ($ in Millions) 30 |

Clear Visibility through Growing Backlog $0 $20 $40 $60 $80 $100 2002 2003 2004 2005 $35.0 $46.3 $67.1 $91.2 ($ in Millions) 31 Information Services Clinical Software and Related Services |

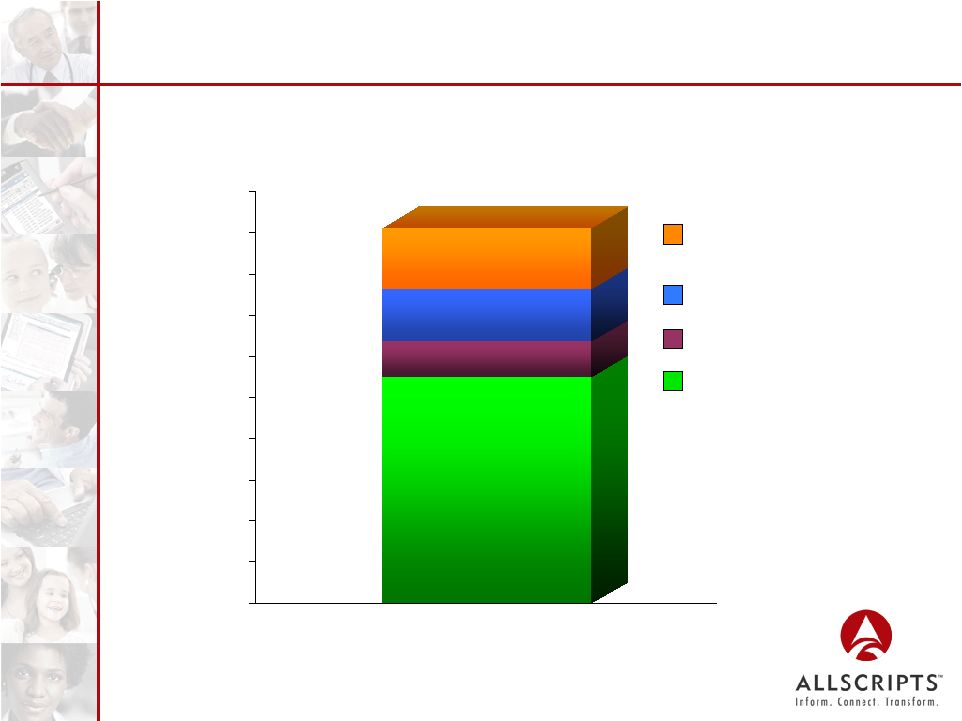

$0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $91.2 Million Diversified Backlog Provides Stability $55.1 $55.1 $8.5 $8.5 $12.8 $12.8 $14.8 $14.8 ($ in Millions) As of 12/31/05 Clinical Software Maintenance Support Information Services Clinical Software Subscriptions Clinical Software License/ Implementation Fees 32 |

A4 Acquisition: Financial Highlights Cost: ~ $275 million – $215 million cash and 3.5 million common shares A4 Health Systems delivers strong financial performance Enhances revenue mix with a greater emphasis on the clinical software segment Accelerate financial performance – Accretive to Allscripts on CASH basis in 2006 and on GAAP basis in 2007 33 |

Accelerated Growth Through A4 Revenues: Software & Related Services Prepackaged Medications Information Services Total Revenues Gross Profit Income from Operations EBITDA Net Income Earnings per Share: Basic Diluted ($ in Millions) Historical Allscripts 9/30/04 $29.8 35.4 9.3 74.5 30.3 1.7 5.2 $1.7 $0.04 $0.04 Historical Allscripts 9/30/05 Pro Forma Combined $46.9 32.8 6.6 86.3 39.2 6.1 10.9 $6.3 $0.16 $0.15 Historical A4 $55.9 – – 55.9 32.5 11.3 12.5 $8.1 $102.8 32.8 6.6 142.2 71.7 7.3 23.4 $3.6 $0.07 $0.07 Nine months ended 34 |

Financial Strength Cash & Marketable Securities Accounts Receivable, Net Other Assets Total Assets Accounts Payable & Accrued Liabilities Deferred Revenue Convertible Debt Other Liabilities Total Liabilities Stockholders’ Equity Total Liabilities & Stockholders’ Equity ($ in Millions) $146.1 29.2 45.7 $221.0 $22.4 17.3 82.5 0.3 $122.5 98.4 $221.0 Historical Allscripts As of 12/31/05 $136.0 26.8 45.1 $207.9 $16.0 15.1 82.5 0.4 $114.0 93.9 $207.9 Historical Allscripts As of 9/30/05 $52.5 37.6 318.7 $408.8 $23.4 27.3 82.5 4.1 $137.3 271.5 $408.8 Pro Forma Combined Cash & Marketable Securities Accounts Receivable, Net Other Assets Total Assets Accounts Payable & Accrued Liabilities Deferred Revenue Convertible Debt Other Liabilities Total Liabilities Stockholders’ Equity Total Liabilities & Stockholders’ Equity 35 |

Summary World-Class Technologies World-Class Technologies Return On Investment Return On Investment Our People Our People Proven Track Record Proven Track Record Strong Partnerships Strong Partnerships Leading Provider of Clinical Solutions Leading Provider of Clinical Solutions Physician-centric Physician-centric Well-positioned for Growth and Sustained Profitability 37 |

37 |