- MDRX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Veradigm (MDRX) 8-KCreating a Clear Leader

Filed: 20 Mar 08, 12:00am

Creating a Clear Leader in Physician Solutions Presentation to Analysts March 20, 2008 |

A Clear Leader in Physician Solutions 2 Forward Looking Statements This communication contains forward-looking statements. Those forward-looking statements include all statements other than those made solely with respect to historical fact. Forward-looking statements may be identified by words such as “believes”, “expects”, “anticipates”, “estimates”, “projects”, “intends”, “should”, “seeks”, “future”, continue”, or the negative of such terms, or other comparable terminology. Such statements include, but are not limited to, statements about the expected benefits of the transaction involving Allscripts, MHS and Misys, including potential synergies and cost savings, future financial and operating results, and the combined company’s plans and objectives. In addition, statements made in this communication about anticipated financial results, future operational improvements and results or regulatory approvals are also forward-looking statements. Such forward-looking statements are subject to numerous risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to vary materially from those expressed in or indicated by them. Factors that could cause actual results to differ materially include, but are not limited to: (1) the occurrence of any event, development, change or other circumstances that could give rise to the termination of the merger agreement; (2) the outcome of any legal proceedings that have been or may be instituted against Allscripts, Misys or MHS and others following announcement of entering into the merger agreement; (3) the inability to complete the proposed transaction due to the failure to obtain stockholder or shareholder approval or the failure of any party to satisfy other conditions to completion of the proposed transaction, including the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the receipt of other required regulatory approvals; (4) risks that the proposed transaction disrupts current plans and operations and potential difficulties in employee retention as a result of the merger; (5) the ability to recognize the benefits of the merger; (6) legislative, regulatory and economic developments; and (7) other factors described in filings with the SEC. Many of the factors that will determine the outcome of the subject matter of this communication are beyond Allscripts’, Misys’ and MHS’ ability to control or predict. Allscripts can give no assurance that any of the transactions related to the merger will be completed or that the conditions to the merger will be satisfied. Allscripts undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. Allscripts is not responsible for updating the information contained in this communication beyond the published date, or for changes made to this communication by wire services or Internet service providers. |

A Clear Leader in Physician Solutions 3 Additional Information and Where to Find It This communication is being made in respect of the proposed business combination involving Allscripts, Inc. (“Allscripts”) and Misys Healthcare Systems LLC (“MHS”), a wholly owned subsidiary of Misys plc (“Misys”). In connection with this proposed transaction, Allscripts intends to file with the Securities and Exchange Commission (the “SEC”) a preliminary proxy statement, a definitive proxy statement and other related materials, and Misys intends to file a shareholder circular with the Financial Services Authority in the United Kingdom. The definitive proxy statement will be mailed to the stockholders of Allscripts, and the shareholder circular will be mailed to the shareholders of Misys. BEFORE MAKING ANY DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THESE DOCUMENTS AND OTHER RELEVANT MATERIALS WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE PROPOSED TRANSACTION. Investors and security holders can obtain copies of Allscripts’ materials (and all other offer documents filed with the SEC) when available, at no charge on the SEC’s website: www.sec.gov. Copies can also be obtained at no charge by directing a request for such materials to Allscripts at 222 Merchandise Mart Plaza, Suite 2024, Chicago, Illinois 60654, Attention: Lee Shapiro, Secretary, or to Misys at 125 Kensington High Street, London W8 5SF, United Kingdom, Attention: Group General Counsel & Company Secretary. Investors and security holders may also read and copy any reports, statements and other information filed by Allscripts with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room. Allscripts’ directors, executive officers and other members of management and employees may, under the rules of the SEC, be deemed to be participants in the solicitation of proxies from the stockholders of Allscripts in favor of the proposed transaction. Information about Allscripts, its directors and its executive officers, and their ownership of Allscripts’ securities, is set forth in its proxy statement for the 2007 Annual Meeting of Stockholders of the Company, which was filed with the SEC on April 30, 2007. Additional information regarding the interests of those persons may be obtained by reading the proxy statement and other relevant materials to be filed with the SEC when they become available. |

A Clear Leader in Physician Solutions 4 Agenda Bill Davis, CFO of Allscripts CFO designate of Allscripts-Misys Synergies and Allscripts-Misys Financials Glen Tullman, CEO of Allscripts CEO designate of Allscripts-Misys Allscripts-Misys: A Clear Leader |

A Clear Leader in Physician Solutions 5 Transaction Summary Allscripts-Misys Healthcare Company Name Four to Six Months Expected Closing $330m Cash (approximately $4.90 per share) Retain their shares in MDRX NASDAQ listing maintained Allscripts Shareholders Receive Misys plc: 54.5% Allscripts: 45.5% Pro Forma Ownership Glen Tullman - CEO designate Bill Davis - CFO designate Mike Lawrie - Executive Chairman designate Management Allscripts to Merge with Misys Healthcare Misys to pay $330m Structure Fully diluted shares Note: All ownership percentages and per share amounts are calculated on a fully diluted basis |

A Clear Leader in Physician Solutions 6 A Transformational Deal • Misys and Allscripts will each combine their respective healthcare businesses into Allscripts-Misys • Misys will also transfer $330m in cash to Allscripts-Misys resulting in a 54.5% ownership interest (on a fully diluted basis) for Misys in Allscripts-Misys • Allscripts shareholders will receive a special dividend of $330m • Cash will be financed by new banking facilities and a placing underwritten by ValueAct Capital Management LLC • Allscripts-Misys Healthcare will be quoted on the NASDAQ • Misys plc will remain quoted on the LSE |

A Clear Leader in Physician Solutions 7 A Clear Leader in Physician IT Solutions • “The perfect match in the perfect market”: Top rated EHR + market share leader for PM in the growing small/mid-sized physician group market • Highly rated, innovative products in every market segment in which we compete (small/mid/large) • Experienced and proven management team • Creates revenue/cost synergies and near-term value accretion for Allscripts-Misys • High recurring revenue visibility and strong potential profit growth • Strong growth potential in a growing market A clear leader in clinical software, information and connectivity solutions |

A Clear Leader in Physician Solutions 8 8 A Vision… Every day in the U.S. approximately 150,000 physicians will log on to a screen that says “Allscripts-Misys” Source: Allscripts and Misys Estimates |

A Clear Leader in Physician Solutions 9 Today’s Physician IT Market – An Opportunity Clinical / Electronic Health Records • The Market… – Highly fragmented market with over 300 participants – Historically divided between core practice management and clinical vendors – Paradigm shift to complex clinical system driving IT decisions and consolidation in the ambulatory markets • Allscripts-Misys… – A footprint of approximately 150,000 physicians – A complete portfolio of integrated solutions, products and services Core Practice Management Epic GE NextGen Sage eCw |

A Clear Leader in Physician Solutions 10 A Proven Approach… Practice Management System Electronic Health Record Installed Base (2008) = 113,000 MDs Primarily in Small-Mid Sized Practices 2001: Allscripts Gained Exclusive Partnership to Market Allscripts EHR to IDX PM Base 2008: Allscripts Gains Exclusive Opportunity to Market Allscripts EHR to Misys PM Base Installed Base (2001) = 138,000 MDs Primarily in Larger Practices |

A Clear Leader in Physician Solutions 11 Market Opportunity – ~ 500,000 U.S. Practicing Physicians – x 80% EHR Market Opportunity – x ~$12,000 Initial Investment/Physician – = ~$5 Billion Opportunity Electronic Health Record (EHR) Market = ~ $5 Billion Practice Management (PM) Market = ~ $1 Billion/Yr. ~10% to 20% of PM Systems Replaced/Yr. Software Maintenance Agreement (SMA) = ~ $1 Billion/Yr. Transactions = ~ $1 to 2 Billion/Yr. American Presidential candidates see technology as the answer to a better healthcare delivery system |

A Clear Leader in Physician Solutions 12 The Market Segments in Which We Compete Large Practices/ AMCs/Hospitals 25<200 MDs Mid-Sized Practices 10<24 MDs Small Practices 1<10 MDs Key: Limited Presence Leader EHR Practice Mgmt. e-Prescribing Connectivity Solutions Allscripts Misys Allscripts- Misys Source: Allscripts and Misys Assessment |

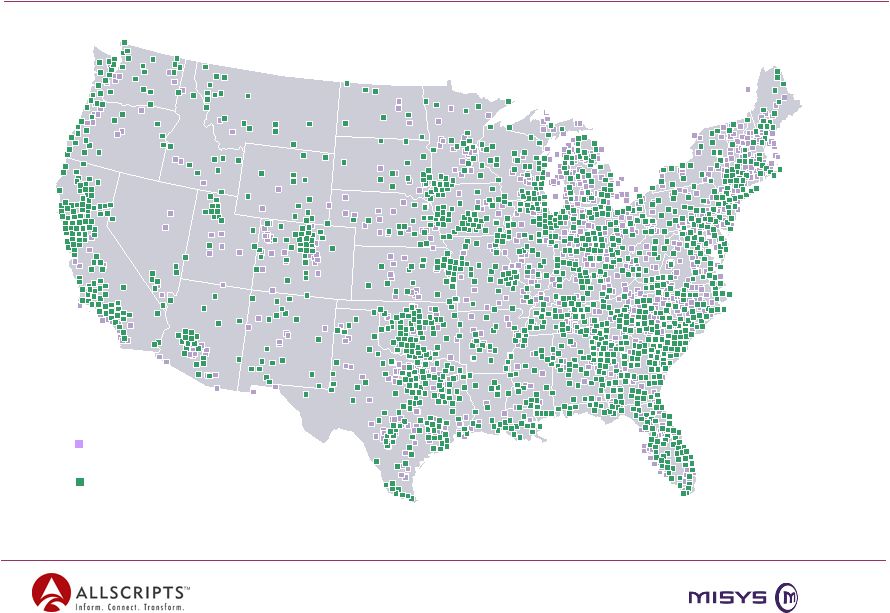

A Clear Leader in Physician Solutions 13 The Largest Client Footprint in the U.S. Allscripts Misys 110,000 Physicians, 18,000 Medical Practices, 600 Homecare Agencies |

A Clear Leader in Physician Solutions 14 The Largest Client Footprint in the U.S. Allscripts-Misys Approximately 150,000 Physicians and 700+ Hospitals Across the U.S. |

A Clear Leader in Physician Solutions 15 Product Strategy • Overall Approach: We will support all products • The Opportunity: $1 Billion opportunity selling Allscripts EHR into Misys PM installed base (currently < 20% penetrated) • EHR Sales in the Small Office Market: In addition, we believe there is an opportunity with MyWay as an ASP solution for small practices |

A Clear Leader in Physician Solutions 16 Compelling Strategic Rationale • Covers approximately 1 out of 3 of all physicians in America* • Brings together leaders in PM and EHR • Ability to network across healthcare from the emergency department to the ambulatory settings • Large installed base to sell leading EHR and other products into • Ability to help drive industry and technical standards for functionality and interoperability • Creates a “hub” from which we can sell into an existing Misys PM base, similar to the successful IDX strategy Leader in EHR and PM Highly Complementary Businesses • Significant opportunity for revenue and cost synergies through cross-selling and rationalisation of overlapping functions • Drives long-term top and bottom line growth • Stability through a high percentage of recurring revenue Powerful Strategic Financial Rationale * Allscripts and Misys Estimates |

A Clear Leader in Physician Solutions 17 Creates a Clear Leader: Allscripts-Misys A clear leader in clinical software, information and connectivity solutions that empower physicians to deliver healthcare safely, efficiently and effectively + |

A Clear Leader in Physician Solutions 18 18 About Misys • 4,500 Employees Serving 120 Countries • $902m in Revenue (Fiscal 2007) – Misys plc • LSE: MSY • Market Leader in Banking and Treasury and Capital markets worldwide with over 1,200 banks and financial institutions • Significant Market Presence in Healthcare – Practice Management – Claims Management – Electronic Health Records – 110,000 Physicians – $376m in Revenue (Fiscal 2007) – Misys Healthcare |

A Clear Leader in Physician Solutions 19 Transaction Summary Allscripts-Misys Healthcare Company Name Four to Six Months Expected Closing $330m Cash (approximately $4.90 per share) Retain their Shares in MDRX NASDAQ listing maintained Allscripts Shareholders Receive Misys plc: 54.5% Allscripts: 45.5% Pro Forma Ownership Glen Tullman - CEO designate Bill Davis - CFO designate Mike Lawrie - Executive Chairman designate Management Allscripts to Merge with Misys Healthcare Misys to pay $330m Structure Fully diluted shares Note: All ownership percentages and per share amounts are calculated on a fully diluted basis |

A Clear Leader in Physician Solutions 20 Understanding the Combined Enterprise Value ~$790 to 840mm Total Contribution $330mm Cash Contribution ~$460 to 510mm 1 Misys Healthcare Business (for 54.5% ownership share) Misys plc contributed the following for a 54.5% stake in Allscripts-Misys This implies a combined enterprise value of ~ $1.4 to 1.5 billion (1) Misys Healthcare enterprise value based on applying a range of revenue multiples (~1.2x – 1.4x) to Misys Healthcare’s FY2007A revenue of $376 million. |

A Clear Leader in Physician Solutions 21 Understanding the Combined Enterprise Value ~$40m ~$345m Allscripts Stand-Alone (2008) ~$85m to 90m Adjusted Earnings ~$720 to $725m Revenue Combined Pro-Forma (2008) What this implies for current Allscripts equity holders Implied Enterprise Value = $1.4 to $1.5 billion ~$970 to $1,100m Total Value ~$14.30 to $16.20 Implied Per Share Value (67.8m shares) $330m + Dividend ~$640 to $680m Allscripts Shareholder Portion of Implied Enterprise Value 1 Represents point estimate within guidance range provided by company 2 Adjusted earnings = net income + stock-based compensation and deal related amortization, both net of tax 3 Assumes $15 to $20m of first year synergies, pre-tax 2 1 3 |

A Clear Leader in Physician Solutions 22 Allscripts shareholders receive approximately $4.90 per share in cash and 45.5% ownership position in Allscripts-Misys Annual cost synergies $15-$20m expected in first year following transaction close Allscripts-Misys Long-Term Growth Profile Low double digit top line growth Better visibility and higher percentage of stable, recurring revenue Up to $25m to $30m in annual cost savings within three years Revenue synergies from cross-selling to respective install bases Increased operating leverage expected to result in mid-teens EPS growth Value Creation |

A Clear Leader in Physician Solutions 23 Significant and Realizable Synergy Opportunity Cost synergies of $15m to $20m expected in first year following transaction close Up to $25m to $30m in annual cost savings within the next few years Main drivers of cost synergies include: Overhead, R&D, Marketing, Administrative Functions Revenue synergies expected from cross- selling into respective client bases Increased operating leverage expected to result in mid teens EPS growth Projected Cost Synergies $15 - $20m $25 - $30m First Year Run Rate |

A Clear Leader in Physician Solutions 24 Receive US antitrust clearance Complete the carve-out financial audits File the US proxy Distribute the shareholder circular for Misys plc shareholders Shareholder vote from both Misys plc and Allscripts shareholders Significant transaction costs will be recognized by Allscripts in Q1 Expected to close in four to six months Roadmap to Completion |

A Clear Leader in Physician Solutions 25 Q&A |