DECEMBER 1, 2021 2021 Stephens Annual Investment Conference Exhibit 99.2

Disclosure notice This presentation contains information about management's view of the Company's future expectations, plans and prospects that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. In addition, oral statements made by our directors, officers and employees to the investor and analyst communities, media representatives and others, depending upon their nature, may also constitute forward-looking statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historic or current facts and often use words such as “anticipate,” “estimate,” “expect,” “believe,” “will likely result,” “outlook,” “project” and other words and expressions of similar meaning. Investors are cautioned not to place undue reliance on forward-looking statements. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including, but not limited to, those set forth in the "Risk Factors" section of the Company's Form 10-K for the fiscal year ended September 30, 2021 and subsequent filings with the U.S. Securities and Exchange Commission. The Company may not succeed in addressing these and other risks. Consequently, all forward-looking statements in this presentation are qualified by the factors, risks and uncertainties contained therein. In addition, the forward-looking statements included in this presentation represent the Company's views as of the date of this presentation and these views could change. However, while the Company may elect to update these forward-looking statements at some point, the Company specifically disclaims any obligation to do so, other than as required by federal securities laws. These forward-looking statements should not be relied upon as representing the Company's views as of any date subsequent to the date of this presentation. This presentation contains references to certain financial measures that are not presented in accordance with United States Generally Accepted Accounting Principles (“GAAP"). The Company uses non-GAAP financial measures to evaluate financial performance, analyze underlying business trends and establish operational goals and forecasts that are used when allocating resources. The Company believes these non-GAAP financial measures permit investors to better understand changes over comparative periods by providing financial results that are unaffected by certain items that are not indicative of ongoing operating performance. While the Company believes these measures are useful to investors when evaluating performance, they are not prepared and presented in accordance with GAAP, and therefore should be considered supplemental in nature. The Company’s non-GAAP financial measures should not be considered in isolation or as a substitute for other financial performance measures presented in accordance with GAAP. These non-GAAP financial measures may have material limitations including, but not limited to, the exclusion of certain costs without a corresponding reduction of net income for the income generated by the assets to which the excluded costs relate. In addition, these non-GAAP financial measures may differ from similarly titled measures presented by other companies. A reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measure can be found in the Appendix as well as Company’s latest Form 8-K, filed with the SEC on December 1, 2021.

Generated record net sales, net income and Adjusted EBITDA* in Fiscal 2021 Capturing market tailwinds and leveraged price execution, while managing costs Successfully navigating challenging supply chains to effectively serve our customers Produced organic growth across all three lines of business (LOB) in Fiscal 2021 Created new analytics to support sales, pricing and operations at a local level Focus on bottom quintile branches yielded results with sales growth ~15% YoY & >$50M bottom line contribution in Fiscal 2021 Successfully closed divestitures of non-core Interiors and Solar businesses1 Returned Beacon to exteriors focus with significant exposure to attractive non-discretionary R&R demand, and Resi / Non-resi markets Strengthened balance sheet providing capacity to invest in growth Interiors divestiture proceeds & refi transactions provided for debt reduction, lengthened maturities, lower cash interest Filled and onboarded key leadership positions and sharpened focus on strategic initiatives Additions of high-caliber talent at executive level and across the organization Four strategic initiatives designed to improve growth, efficiency and profitability drove tangible results Enhanced ESG efforts and continued to work safely during COVID resurgence Renewed our core values, reduced our carbon footprint and recognized diverse leaders in our industry Announced February 2022 Investor Day focused on the Beacon Ambition Recently announced change to calendar reporting year facilitates upcoming announcements of multi-year targets Reflections on 2021 *Non-GAAP measure; see Appendix for definition and reconciliation Note: All full year information and comparisons reflect Continuing Operations (1) Interiors divestiture closed on February 10, 2021 and the Solar divestiture closed on December 1, 2021 Transformational actions in FY’21 have set the stage for our long-term ambition

Strategic initiatives (Fiscal Q4 update) Pricing analytics & execution support capabilities Targeted strategies focused on winning high-growth segments Organic Growth Branch Operating Performance Improve operating performance of lowest quintile branches Drive operating efficiencies across network Raise customer service levels Develop high caliber talent in logistics & field operations Opportunity for $50-100M inventory reduction Beacon OTC® Network Most complete digital offering within building products distribution Important value-add for customers Digital Platform Customer retention & new account focus contributed to top-line growth YoY National accounts up ~25% in FY’21 led by our homebuilding customers ~50% growth in active users versus prior year quarter FY’21 digital sales achieved ~13% of total; Ahead of prior year exit rate Launched PRO+ & becn.com integrated digital experience State-of-the-art Houston hub opened in October with product flow designed for efficiency and capacity EPA SmartWay Partner status accelerating adoption of fuel-saving practices Bottom quintile branch initiative driving improvement across the P&L FY’21 sales growth faster than the company rate and contributed >$50M bottom line improvement Strategies focused on achieving top-line growth and bottom-line efficiency

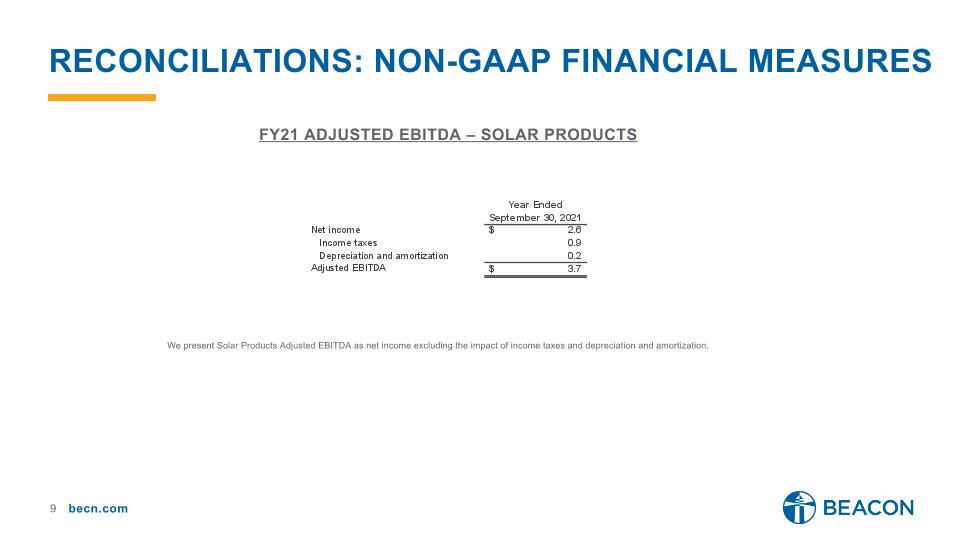

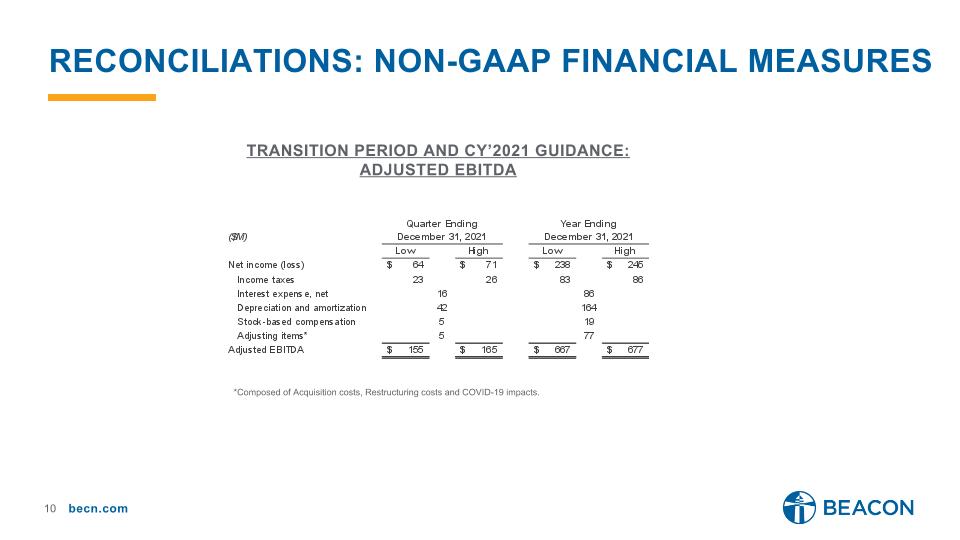

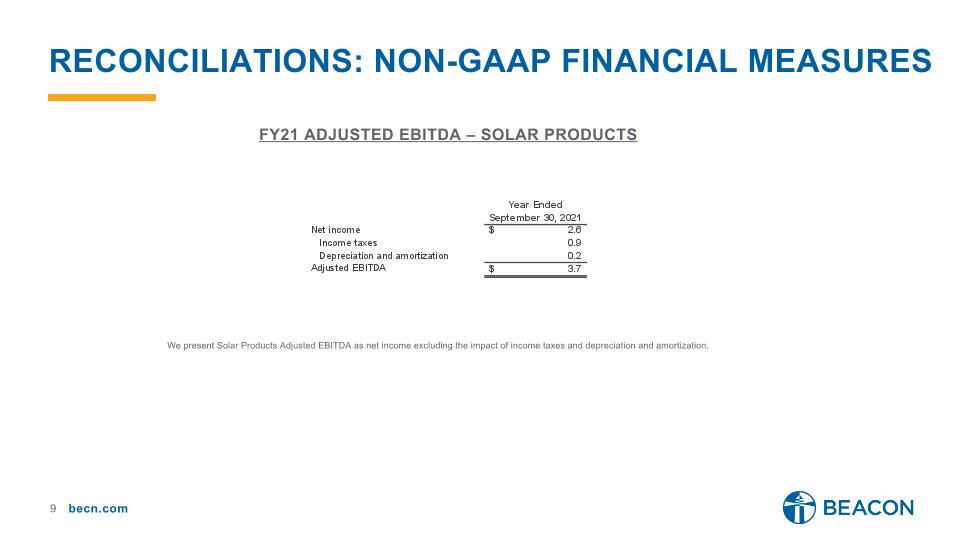

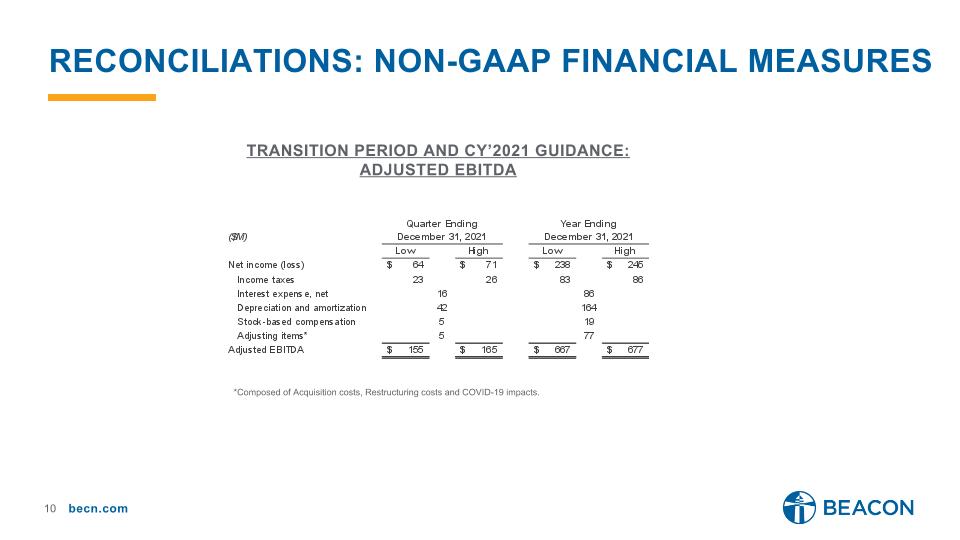

Solar divestiture’s impact on Beacon financials Fiscal 2021 net sales of ~$110M, <$5M impact on Adjusted EBITDA* Solar was dilutive to Company GM% and EBITDA margins Guidance announced on Fiscal Q4 earnings call, updated for QTD performance CY’Q4 net sales growth of +MSD YoY including the benefits of the 11/1 acquisition of Midway Wholesale - Combined October and November daily sales growth of HSD vs PY CY’Q4 gross margins expected to be up ~100 bps vs. the prior year period - Gross margin performance dependent on the pace of inventory profit roll-off and mix CY’Q4 Adj. EBITDA* expected to be $155M – 165M; CY’21 Adj. EBITDA* expected to be $667M – $677M - Strength of QTD sales performance expected to yield Adjusted EBITDA near the top of the range Closing thoughts *Non-GAAP measure; see Appendix for definition and reconciliation Note: All quarterly information, forecasts and comparisons reflect Continuing Operations We look forward to a strong finish to calendar 2021

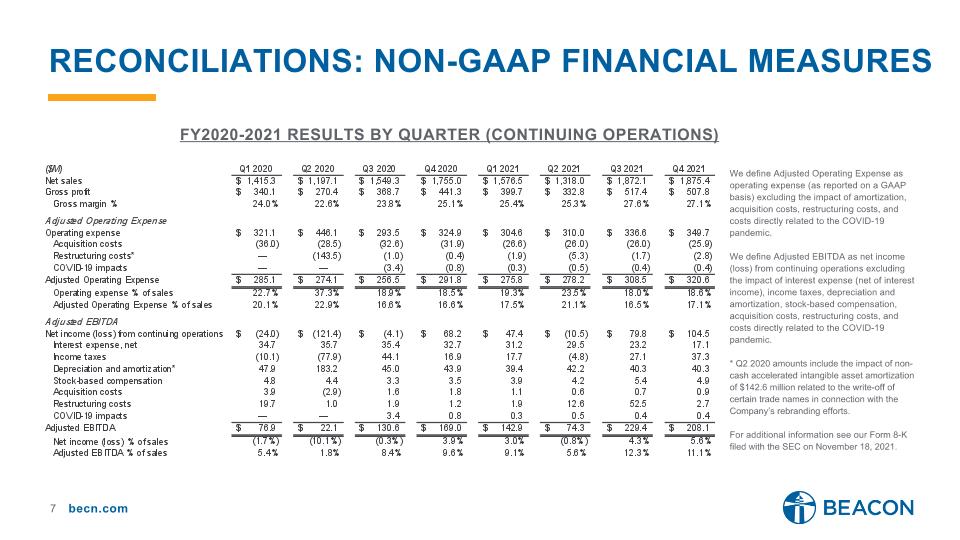

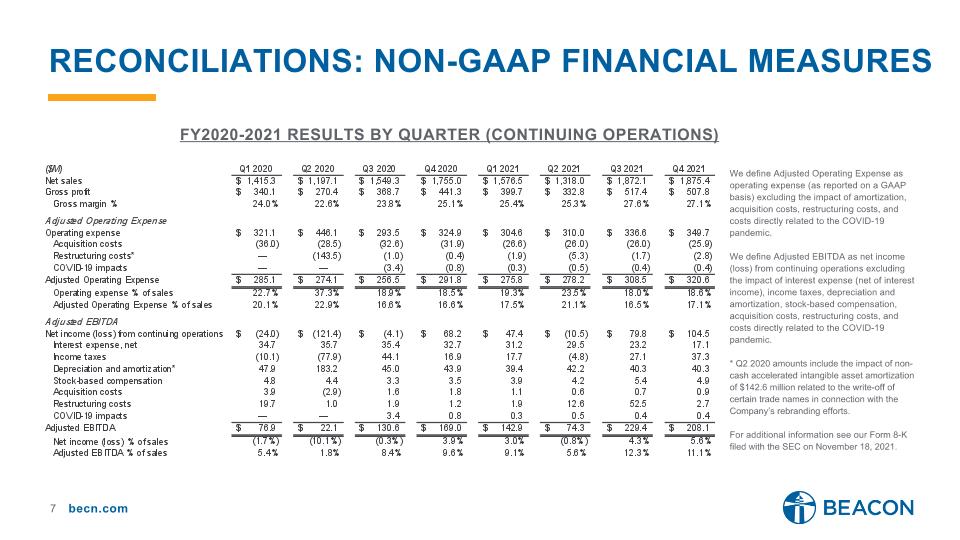

Reconciliations: non-gaap financial measures FY2020-2021 results by Quarter (Continuing operations) We define Adjusted Operating Expense as operating expense (as reported on a GAAP basis) excluding the impact of amortization, acquisition costs, restructuring costs, and costs directly related to the COVID-19 pandemic. We define Adjusted EBITDA as net income (loss) from continuing operations excluding the impact of interest expense (net of interest income), income taxes, depreciation and amortization, stock-based compensation, acquisition costs, restructuring costs, and costs directly related to the COVID-19 pandemic. * Q2 2020 amounts include the impact of non-cash accelerated intangible asset amortization of $142.6 million related to the write-off of certain trade names in connection with the Company’s rebranding efforts. For additional information see our Form 8-K filed with the SEC on November 18, 2021.

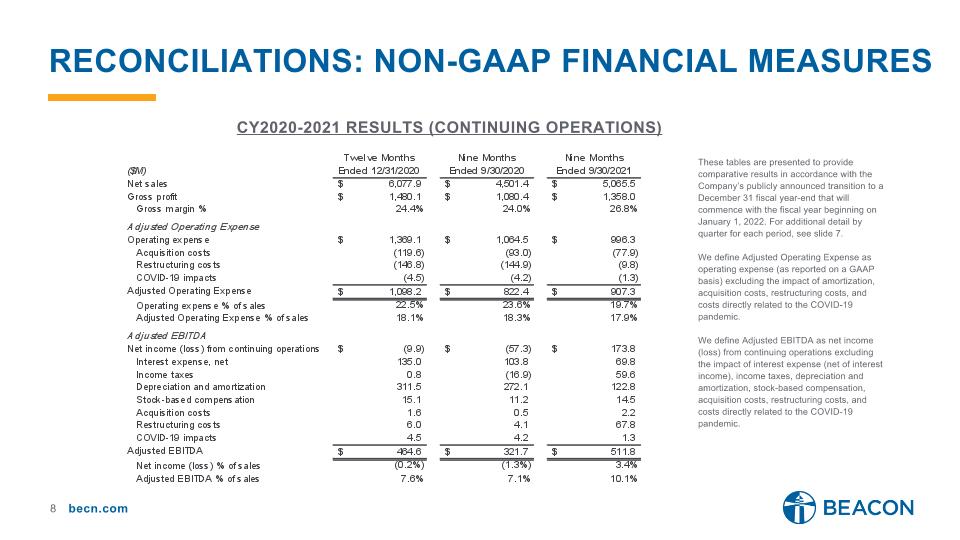

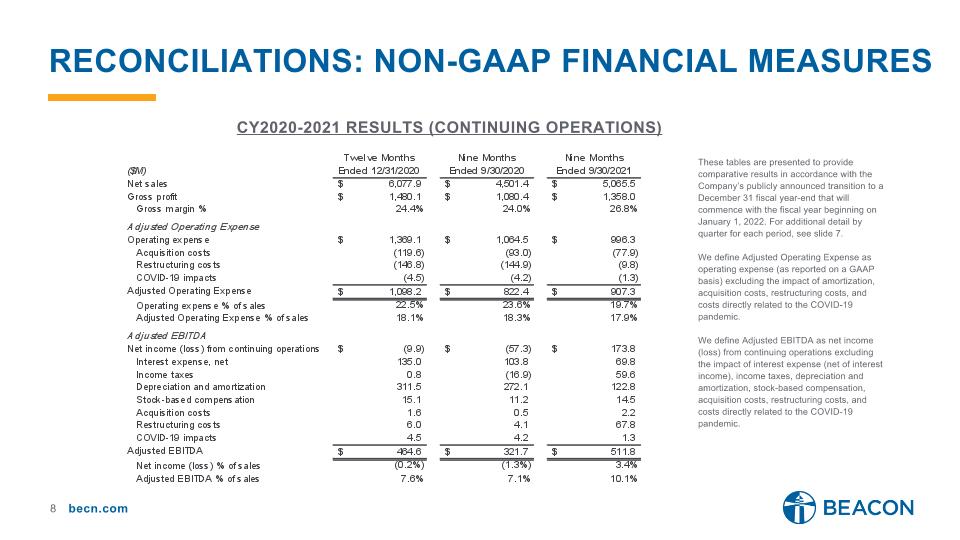

Reconciliations: non-gaap financial measures CY2020-2021 results (Continuing operations) These tables are presented to provide comparative results in accordance with the Company’s publicly announced transition to a December 31 fiscal year-end that will commence with the fiscal year beginning on January 1, 2022. For additional detail by quarter for each period, see slide 7. We define Adjusted Operating Expense as operating expense (as reported on a GAAP basis) excluding the impact of amortization, acquisition costs, restructuring costs, and costs directly related to the COVID-19 pandemic. We define Adjusted EBITDA as net income (loss) from continuing operations excluding the impact of interest expense (net of interest income), income taxes, depreciation and amortization, stock-based compensation, acquisition costs, restructuring costs, and costs directly related to the COVID-19 pandemic.

Reconciliations: non-gaap financial measures FY21 ADJUSTED EBITDA – SOLAR PRODUCTS We present Solar Products Adjusted EBITDA as net income excluding the impact of income taxes and depreciation and amortization.

Reconciliations: non-gaap financial measures *Composed of Acquisition costs, Restructuring costs and COVID-19 impacts. TRANSITION PERIOD AND CY’2021 guidance: Adjusted ebitda