UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended September 30, 2013

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number 000-50924

BEACON ROOFING SUPPLY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 36-4173371 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

Address of principal executive offices:505 Huntmar Park Drive, Suite 300, Herndon, VA 20170

Registrant's telephone number, including area code:(571) 323-3939

Securities registered pursuant to section 12(b) of the Act:

| Common Stock, $0.01 par value | | The NASDAQ Global Select Market |

| (Title of each class) | | (Name of each exchange on which registered) |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YESx NO¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer," “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer x | Accelerated filer ¨ |

| Non-accelerated filer ¨ (do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ No x

The aggregate market value of the voting stock (common stock) held by non-affiliates of the registrant as of the end of the second quarter ended March 31, 2013 was$1,878,622,217.

The number of shares of common stock outstanding as of November 1, 2013 was 48,997,267.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III (Items 10, 11, 12, 13 and 14) will be incorporated by reference from the Registrant's definitive proxy statement (to be filed pursuant to Regulation 14A).

Table of Contents

BEACON ROOFING SUPPLY, INC.

Index to Annual Report

on Form 10-K

Year Ended September 30, 2013

| PART I | | | | 4 |

| Item 1. | | Business | | 4 |

| Item 1A. | | Risk Factors | | 13 |

| Item 1B. | | Unresolved Staff Comments | | 15 |

| Item 2. | | Properties | | 15 |

| Item 3. | | Legal Proceedings | | 16 |

| Item 4. | | Mine Safety Disclosures | | 16 |

| | | | | |

| PART II | | | | 17 |

| Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 17 |

| Item 6. | | Selected Financial Data | | 19 |

| Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 20 |

| Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | 36 |

| Item 8. | | Financial Statements and Supplementary Data | | 38 |

| Item 9. | | Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | | 61 |

| Item 9A. | | Controls and Procedures | | 61 |

| Item 9B. | | Other Information | | 63 |

| | | | | |

| PART III | | | | 64 |

| | | | | |

| PART IV | | | | 64 |

| Item 15. | | Exhibits and Financial Statement Schedules | | 64 |

Forward-looking statements

The matters discussed in this Form 10-K that are forward-looking statements are based on current management expectations that involve substantial risks and uncertainties, which could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. These statements can be identified by the fact that they do not relate strictly to historical or current facts. They use words such as "aim," "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "plan," "project," "should," "will be," "will continue," "will likely result," "would" and other words and terms of similar meaning in conjunction with a discussion of future operating or financial performance. You should read statements that contain these words carefully, because they discuss our future expectations, contain projections of our future results of operations or of our financial position or state other "forward-looking" information.

We believe that it is important to communicate our future expectations to our investors. However, there are events in the future that we are not able to accurately predict or control. The factors listed under Item 1A, Risk Factors, as well as any cautionary language in this Form 10-K, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Although we believe that our expectations are based on reasonable assumptions, actual results may differ materially from those in the forward looking statements as a result of various factors, including, but not limited to, those described under Item 1A, Risk Factors and elsewhere in this Form 10-K.

Forward-looking statements speak only as of the date of this Form 10-K. Except as required under federal securities laws and the rules and regulations of the SEC, we do not have any intention, and do not undertake, to update any forward-looking statements to reflect events or circumstances arising after the date of this Form 10-K, whether as a result of new information, future events or otherwise. As a result of these risks and uncertainties, readers are cautioned not to place undue reliance on the forward-looking statements included in this Form 10-K or that may be made elsewhere from time to time by or on behalf of us. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

PART I

ITEM 1. BUSINESS

Overview

We are one of the largest distributors of residential and non-residential roofing materials in the United States and Canada. We also distribute other complementary building materials, including siding, windows, specialty lumber products and waterproofing systems for residential and nonresidential building exteriors. As of September 30, 2013, we operated 236 branches in 39 states and 6 Canadian provinces, carrying up to 11,000 SKUs at each branch and serving more than 47,000 customers. We are a leading distributor of roofing materials in key metropolitan markets in the Northeast, Mid-Atlantic, Midwest, Central Plains, West, South and Southwest regions of the United States and across Canada.

For the fiscal year ended September 30, 2013 (“fiscal year 2013” or “2013”), residential roofing products comprised 49% of our sales, non-residential roofing products accounted for 37% of our sales, and siding, waterproofing systems, windows, specialty lumber and other exterior building products provided the remaining 14% of our sales. Approximately 92% of our net sales were in the United States.

We also provide our customers a comprehensive array of value-added services, including:

| · | Advice and assistance to contractors throughout the construction process, including product identification, specification and technical support; |

| · | Job site delivery, rooftop loading and logistical services; |

| · | Tapered insulation design and layout services; |

| · | Metal fabrication and related metal roofing design and layout services; |

| · | Marketing support, including project leads for contractors. |

We believe the additional services we provide strengthen our relationships with our customers and distinguish us from our competition. The vast majority of orders require at least some of these services. Our ability to provide these services efficiently and reliably can save contractors time and money. We also believe that our value-added services enable us to achieve attractive gross profit margins on our product sales. We have earned a reputation for a high level of product availability and experienced and professional employees who provide high-quality service, including timely, accurate and safe delivery of products.

Our diverse customer base generally includes a significant portion of the residential and non-residential roofing contractors in most of the markets in which we operate. These roofing contractors are typically involved on a local basis in the replacement, or re-roofing, component of the roofing industry. We utilize a branch-based operating model in which branches maintain local customer relationships but benefit from our centralized functions such as information technology, accounting, financial reporting, credit, purchasing, legal and tax services. This business model allows us to provide customers with specialized products and personalized local services tailored to a geographic region, while benefiting from the resources and scale efficiencies of a national distributor.

We have achieved our growth through a combination of 25 strategic and complementary acquisitions between fiscal years 2004 and 2013, opening new branch locations and broadening our product offering. In 2013, we acquired 19 branches and opened ten new branches and closed two branches. We have grown from $652.9 million in sales in fiscal year 2004 to $2.241 billion in sales in fiscal year 2013, which represents a ten-year compound annual growth rate of 13.1%. Our internal growth, which includes growth from existing and newly opened branches but excludes growth from acquired branches, averaged 4.7% per annum over the same period. Acquired branches are excluded from internal growth measures until they have been under our ownership for at least four full fiscal quarters at the start of the reporting period. During this period, we opened 46 new branch locations (of which we have only closed five), while our same store sales increased an average of 1.7% per annum. Same store sales are defined as the aggregate sales from branches open for the entire comparable annual periods. Income from operations has increased from $34.7 million in fiscal year 2004 to $129.7 million in fiscal year 2013, which represents a ten-year compound annual growth rate of 14.1%. We believe that our proven business model can continue to deliver industry-leading growth and operating profit margins.

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge on our website atwww.beaconroofingsupply.com as soon as reasonably practical after we electronically file such reports with, or furnish them to, the Securities and Exchange Commission.

History

Our predecessor, Beacon Sales Company, Inc., was founded in Charlestown, Massachusetts (part of Boston) in 1928. In 1984, when Beacon Sales Company was acquired by a group of individual investors, Beacon operated three distribution facilities and generated approximately $16 million in annual revenue. In August 1997, Code, Hennessy & Simmons III, L.P., a Chicago-based private equity fund, and certain members of management, purchased Beacon Sales Company to use it as a platform to acquire leading regional roofing materials distributors throughout the United States and Canada. At the time of the purchase in 1997, Beacon Sales Company operated seven branches in New England and generated approximately $72 million of annual revenue, primarily from the sale of non-residential roofing products. Since 1997 and through fiscal year 2013, we made 31 strategic and complementary acquisitions and opened 51 new branches (of which we only closed five). We have also expanded our product offerings to offer more residential roofing products and complementary exterior building materials and related services. Our strategic acquisitions, new branch openings, and product line extensions have increased the diversity of both our customer base and our local market focus, while generating cost savings through increased purchasing power and lower overhead expenses as a percentage of net sales. We completed an initial public offering ("IPO") and became a public company in September 2004, and completed a follow-on stock offering in December 2005.

We were incorporated in Delaware in 1997. Our principal executive offices are located at 505 Huntmar Park Drive, Suite 300, Herndon, Virginia 20170 and our telephone number is (571) 323-3939. Our Internet website address is www.beaconroofingsupply.com.

U.S. Industry Overview

The U.S. roofing market was estimated to be valued at approximately $20.2 billion in 2012 and is projected to grow 6.2% annually through 2017 to $27.2 billion, according to a 2013 industry report published by The Freedonia Group. This will be a turnaround from the 2007-2012 period, when roofing demand declined as building construction spending dropped during the 2007-2009 recession and its aftermath. Going forward, rebounding building construction expenditures will drive advances. The new residential market is expected to see the most rapid gains as housing starts rise from their depressed 2012 base.

The U.S. roofing market can be separated into two categories: the residential roofing market and the non-residential roofing market. The residential roofing market accounted for approximately 58% of the total U.S. market by unit volume (48.4% of total dollar demand) in 2012. Through 2017, residential roofing construction in dollars is expected to grow at 8.0%, which is much faster than the non-residential roofing construction growth rate of 4.3%, as new residential construction is projected to continue to recover from the low levels experienced from the 2007-2009 recession and its aftermath.

Traditionally, over 75% of expenditures in the roofing market are for re-roofing projects, with the balance being for new construction. Because of the depressed level of new construction and damage caused by Hurricane Sandy and other storms, re-roofing represented over 85% of the expenditures for roofing in 2012. Re-roofing projects are generally considered maintenance and repair expenditures and are less likely than new construction projects to be postponed during periods of recession or slow economic growth. As a result, demand for roofing products is less volatile than overall demand for construction products.

Regional variations in economic activity influence the level of demand for roofing products across the United States. Of particular importance are regional differences in the level of new home construction and renovation, since the residential market for roofing products accounts for approximately 58% of unit demand. Demographic trends, including population growth and migration, contribute to the regional variations through their influence on regional housing starts and existing home sales.

Roofing distributors

Wholesale distribution is the dominant distribution channel for both residential and nonresidential roofing products. Wholesale roofing product distributors serve the important role of facilitating the purchasing relationships between roofing materials manufacturers and thousands of contractors. Wholesale distributors can maintain localized inventories, extend trade credit, give product advice and provide delivery and logistics services.

Despite some recent consolidation, the roofing materials distribution industry remains highly fragmented. The industry is characterized by a large number of small and local regional participants. As a result of their small size, many of these distributors lack the corporate, operating and IT infrastructure required to compete effectively.

Residential roofing market

Within the residential roofing market, the re-roofing market is currently more than six times the size of the new roofing market, accounting for approximately 86% of the residential roofing unit demand in 2012 compared to a historic long-term rate of about 75%.

Driving the demand for re-roofing is an aging U.S. housing stock. Over 61% of the U.S. housing stock was built prior to 1980, with the median age of homes in 2012 at 37 years old. Asphalt shingles dominate the residential roofing market, with an approximate 85% share, and historically have had an expected average useful life of 15 to 20 years. Residential roofing demand is forecast to grow 4.5% per year to 163.5 million squares through 2017.

A number of other factors can also generate re-roofing demand, including one-time weather damage and homeowners looking to upgrade their homes. In addition, sales of existing homes can affect re-roofing demand, as some renovation decisions are made by sellers preparing their houses for sale and others are made by new owners within the first two years of occupancy.

Within the new construction portion of the residential roofing market, housing starts together with larger average roof sizes have supported prior growth in new residential roofing demand. Demand for roofing installed in new residential construction and additions to existing structures is forecast to grow over 15% annually to 37.5 million squares in 2017. This will be a turnaround from the 2007-2012 period, when roofing demand dropped at a double-digit annual pace as housing starts declined precipitously during the 2007-2009 recession. Going forward, new residential roofing demand will be driven by the expected rebound in housing starts from their low 2012 level.

Non-residential roofing market

Non-residential roofing demand is forecast to advance 2% per year to 104.5 million squares through 2017. Gains will be driven by the non-residential new construction, which is expected to see 8% annual gains during that time. Growth will be spurred by the strong rebound in office and commercial and institutional construction expenditures and continuing increases in industrial construction spending.

In 2012, re-roofing projects represented approximately 84% of the total non-residential demand. As with residential re-roofing, non-residential re-roofing activity tends to be less cyclical than new construction and depends, in part, upon the types of materials on existing roofs, their expected lifespan and intervening factors such as wind or water damage.

The non-residential roofing market includes an office and commercial market, an industrial market, and an institutional market. Office and commercial roofing projects is the single largest component of the non-residential roofing market at 51%. Industrial roofing projects represent 21% of non-residential roofing product sales, while institutional projects and others make up the remaining 28% of non-residential roofing demand.

Complementary building products

Demand for complementary building products such as siding, windows and doors for both the residential and non-residential markets has been at historically low levels in recent years, consistent with the downturns in the new construction markets and in the overall economy. Unlike the roofing industry, demand for these products is more discretionary and influenced much greater by the new construction markets.

These complementary products are a major component of the overall building products market. The U.S. siding market was approximately $8.2 billion in 2011, while the U.S. window and door industry was approximately $26.5 billion in 2012, the most recent information available to us. Both of these markets have been negatively impacted by the low level of new housing starts in recent years, but are expected to grow at an annual rate of approximately 8% over the next five years.

Our Strengths

We believe the sales and earnings growth we have achieved over time has been and will continue to be driven by our primary competitive strengths, which include the following:

| · | National scope combined with regional expertise. We believe we are the second largest roofing materials distributor in the United States and Canada. We utilize a branch-based operating model in which branches maintain local customer relationships but benefit from centralized functions such as information technology, accounting, financial reporting, credit, purchasing, legal and tax services. This allows us to provide customers with specialized products and personalized local services tailored to a geographic region, while benefiting from the resources and scale efficiencies of a national distributor. |

| · | Diversified business model that reduces impact of economic downturns. We believe that our business is meaningfully protected in an economic downturn because of a high concentration of non-discretionary re-roofing business; the mix of our sales between residential and non-residential products; our geographic and customer diversity; and our financial and operational ability to expand our business and obtain market share. |

| · | Superior customer service. We believe that our high level of customer service and support differentiates us from our competitors. We employ experienced salespeople who provide technical advice and assistance in properly identifying products for various applications. We also provide services such as safe and timely job site delivery, logistical support and marketing assistance. We believe that the services provided by our employees improve our customers' efficiency and profitability which, in turn, strengthens our customer relationships. |

| · | Strong platform for growth and acquisition. Over the period from 1997 through 2013, we increased revenue at rates well in excess of the overall growth in the roofing materials distribution industry. We have expanded our business through strategic acquisitions, new branch openings, and the diversification of our product offering. We have generally improved the financial and operating performance of our acquired companies and helped them to grow their businesses following acquisition. |

| · | Sophisticated IT platform. All of our locations, except for one fabrication facility, operate on the same management information systems. We have made a significant investment in our information systems, which we believe are among the most advanced in the roofing distribution industry. These systems provide us with a consistent platform across all of our operations and help us to achieve operating efficiencies in purchasing, pricing and inventory management and a high level of customer service. Our systems have substantial capacity to handle our future growth plans without requiring significant additional investment. |

| · | Industry-leading management team. We believe that our key personnel, including branch managers, regional vice presidents and executive officers, are among the most experienced members of the roofing industry. |

| · | Extensive product offering and strong supplier relationships. We have a product offering of approximately 11,000 SKUs, representing an extensive assortment of high-quality branded products. We believe that this product offering has been a significant factor in attracting and retaining many of our customers. Because of our significant scale, product expertise and reputation in the markets that we serve, we have established strong ties to the major roofing materials manufacturers and are able to achieve substantial volume discounts. |

Growth Strategies

Our objective is to become the preferred supplier of roofing and other exterior building product materials in the U.S. and Canadian markets while continuing to increase our revenue base and maximize our profitability. We plan to attain these goals by executing the following strategies:

| · | Pursue acquisitions of regional market-leading roofing materials distributors. Acquisitions are an important component of our growth strategy. We believe there are significant opportunities to further grow our business through disciplined, strategic acquisitions. With only a few large, well-capitalized competitors in the industry, we believe we can continue to build on our distribution platform by successfully acquiring additional roofing materials distributors. Between 2003 and 2013, we successfully integrated 25 strategic and complementary acquisitions. |

| · | Expand through new branch openings. Significant opportunities exist to expand or intensify our geographic focus by opening additional branches in contiguous or existing regions. Since 1997, we have successfully entered numerous markets through greenfield expansion. Our typical strategy with respect to greenfield opportunities is to open branches: (1) within our existing markets; (2) where existing customers have expanded into new markets; or (3) in areas that have limited or no acquisition candidates and are a good fit with our business model. At times, we have acquired small distributors with one to three branches to fill in existing regions. |

| · | Expand product and service offerings. We believe that continuing to increase the breadth of our product line and customer services are effective methods of increasing sales to current customers and attracting new customers. We work closely with customers and suppliers to identify new building products and services, including varieties of windows, siding, waterproofing systems, insulation and metal fabrication. In addition, we believe we can expand our business by introducing products currently only sold in certain of our markets into some of our other markets. We also believe we can expand particular product sales that are stronger in certain of our markets into markets where those products have not sold as well (e.g., expanding nonresidential roofing sales into markets that sell mostly residential roofing). |

Products and Services

Products

The ability to provide a broad range of products is essential in roofing materials distribution. We carry one of the most extensive arrays of high-quality branded products in the industry, enabling us to deliver a wide variety of products to our customers on a timely basis. We are able to fulfill the vast majority of our warehouse orders through the breadth and depth of the inventories at our branches. Our product portfolio includes residential and non-residential roofing products as well as complementary building products such as siding, windows and specialty lumber products. Our product lines are designed to meet the requirements of both residential and non-residential roofing contractors.

| Product Portfolio |

Residential

Roofing Products | | Non-Residential

Roofing Products | | Complementary

Building Products |

| Asphalt shingles | | Single-ply roofing | | Siding | | Windows/Doors |

| Synthetic slate and tile | | Asphalt | | Vinyl siding | | Vinyl windows |

| Clay tile | | Metal | | Cedar siding | | Aluminum windows |

| Concrete tile | | Modified bitumen | | Fiber cement siding | | Wood windows |

| Slate | | Build-up roofing | | Soffits | | Wood doors |

| Nail base insulation | | Cements and coatings | | House wraps | | Patio doors |

| Metal roofing | | Insulation – flat stock & tapered | | Vapor barriers | | Skylights |

| Felt | | | Stone veneer | | |

| Wood shingles and shakes | | Commercial fasteners | | | | |

| Nails and fasteners | | Metal edges and flashings | | Other | | Specialty Lumber |

| Metal edgings and flashings | | Sky lights, smoke and roof hatches | | Water proofing | | Redwood |

| | | Building insulation | | Red cedar decking |

| Prefabricated flashings | | Sheet metal (copper, aluminum and steel) | | Air barrier systems | | Pressure treated lumber |

| Ridges and soffit vents | | | Gypsum | | Fire treated plywood |

| Gutters and downspouts | | Other accessories | | Moldings | | Synthetic decking |

| Other accessories | | | | Patio covers | | PVC trim boards |

| | | | | Cultured stone | | Synthetic |

| | | | | | | Millwork |

| | | | | | | Custom millwork |

The products that we distribute are supplied by the industry's leading manufacturers of high-quality roofing materials and related products, such as Alcoa, Atlas, BPCO, Carlisle, CertainTeed, Continental Materials, Dow, Firestone, GAF Materials, IKO, James Hardie, Johns Manville, Mid-States Asphalt, Owens Corning, Simonton, Tamko and Revere Copper.

In the residential market, asphalt shingles comprise the largest share of the products we sell. We believe that we have also developed a service platform in the residential roofing market by distributing products such as high-end shingles, copper gutters and metal roofing products, as well as specialty lumber products for residential applications, including redwood, white and red cedar shingles, and red cedar siding. Additionally, we distribute gutters, downspouts, tools, nails, vinyl siding, windows, decking and related exterior shelter products to meet the expansive needs of our customers.

In the non-residential market, single-ply roofing systems and the associated insulation products comprise the largest share of our product offering. Our single-ply roofing systems consist primarily of Ethylene Propylene Diene Monomer (synthetic rubber) or EPDM and Thermoplastic Olefin or TPO, along with other roofing materials and related components. In addition to the broad range of single-ply roofing components, we sell asphaltic membranes and the insulation required in most non-residential roofing applications, such as tapered insulation. Our remaining non-residential products include metal roofing and flashings, fasteners, fabrics, coatings, roof drains, modified bitumen, built-up roofing and asphalt.

Services

We emphasize superior value-added services to our customers. We employ a knowledgeable staff of salespeople. Our sales personnel possess in-depth knowledge of roofing materials and applications and are capable of providing technical advice and assistance to contractors throughout the re-roofing and construction process. In particular, we support our customers with the following value-added services:

| · | Advice and assistance on product identification, specification and technical support; |

| · | timely job site delivery, rooftop loading and logistical services; |

| · | tapered insulation design and related layout services; |

| · | metal fabrication and related metal roofing design and layout services; |

| · | marketing support, including project leads for contractors. |

Customers

Our diverse customer base consists of more than 47,000 contractors, home builders, building owners, and other resellers primarily in the Northeast, Mid-Atlantic, Midwest, Central Plains, West, South and Southwest regions of the United States and across Canada. Our typical customer base varies by end market, with relatively small contractors in the residential market and small to large-sized contractors in the non-residential market. To a lesser extent, our customer base in a market can include general contractors, retailers and building materials suppliers.

As evidenced by the fact that a significant number of our customers have relied on us or our predecessors as their vendor of choice for decades, we believe that we have strong customer relationships that our competitors cannot easily displace or replicate. No single customer accounts for more than 2% of our revenues.

Sales and Marketing

Sales strategy

Our sales strategy is to provide a comprehensive array of high-quality products and superior value-added services to residential and non-residential roofing contractors reliably, accurately and on time. We fulfill approximately 98% of our warehouse orders through our in-stock inventory as a result of the breadth and depth of our inventory maintained at our local branches. We believe that our focus on providing both superior value-added services and accurate and rapid order fulfillment enables us to attract and retain customers.

Sales organization

We have attracted and retained an experienced sales force of about 1,180 people who are responsible for generating revenue at the local branch level. The expertise of our salespeople helps us to increase sales to existing customers and add new customers.

Each of our branches is headed by a branch manager, who also functions as the branch's sales manager. In addition, each branch generally employs one to four outside salespeople and one to five inside salespeople who report to their branch manager. Branches that focus primarily on the residential market typically staff a larger number of outside salespeople.

The primary responsibilities of our outside salespeople are to prospect for new customers and increase sales to existing customers. One of the ways our outside salespeople accomplish these objectives is by reviewing information from our proprietary LogicTrack software system, which extracts job and bid information from construction reports and other industry news services. The system extracts information on construction projects in our local markets from those industry services. Once a construction project is identified, our design and estimating team creates job quotes, which, along with pertinent bid and job information, are readily available to our salespeople through LogicTrack. Our outside salespeople then contact potential customers in an effort to solicit their interest in participating with us in the identified project. Throughout this process, LogicTrack maintains a record of quoting activity, due dates, and other data to allow tracking of the projects and efficient follow-up. By seeking a contractor to “partner with” on a bid, we increase the likelihood that such contractor will purchase their roofing materials and related products from us in the event that the contractor is selected for the project.

To complement our outside sales force, we have built an experienced and technically proficient inside sales staff that provides vital product expertise to our customers. Our inside sales force is responsible for fielding incoming orders, providing pricing quotations and responding to customer inquiries.

In addition to our outside and inside sales forces, we represent certain manufacturers for particular manufacturers' products. Currently, we have developed relationships with Carlisle and Owens Corning on this basis and employ representatives who act as liaisons (on behalf of property owners, architects, specifiers and consultants) between these roofing materials manufacturers and professional contractors.

Marketing

In order to capitalize on established customer relationships and locally developed brands, we have maintained the trade names of most of the businesses that we have acquired. These trade names—such Alabama Roofing Supply, Beacon Roofing Supply Canada Company, Beacon Sales Company, Best Distributing Company, Cassady Pierce, Coastal Metal Service, Construction Materials Supply, Dealers Choice, Enercon Products, Entrepot de la Toiture, Ford Wholesale Company, Fowler & Peth, Groupe Bédard, JGA Beacon, Lafayette Wood Works, McClure Johnston, Mississippi Roofing supply, North Coast Roofing Systems, Pacific Supply, Posi-Slope, Posi-Pentes, Quality Roofing Supply, Roof Depot, RSM Supply, Shelter Distribution, Southern Roof Center, Structural Materials, The Roof Center, West End Roofing, Siding & Windows — are well-known in the local markets in which the respective branches compete and are associated with high-quality products and customer service.

As a supplement to the efforts of our sales force, each of our branches communicates with residential and non-residential contractors in their local markets through newsletters, direct mail, social media and the Internet. In order to build and strengthen relationships with customers and vendors, we offer exclusive promotions and sponsor our own regional trade shows, which feature general business and roofing seminars for our customers and product demonstrations by our vendors. In addition, we attend numerous industry trade shows throughout the regions in which we compete, and we are an active member of the National Roofing Contractors Association, as well as certain regional contractors' associations.

Purchasing and Suppliers

Our status as a leader in our core geographic markets, as well as our reputation in the industry, has allowed us to forge strong relationships with numerous manufacturers of roofing materials and related products, including Alcoa, Atlas, BPCO, Carlisle, CertainTeed, Continental Materials, Dow, Firestone, GAF Materials, IKO, James Hardie, Johns Manville, Mid-States Asphalt, Owens Corning, Simonton, Tamko and Revere Copper.

We are viewed by our suppliers as a key distributor due to our industry expertise, past growth and profitability, significant market share, financial strength, and the substantial volume of products that we distribute.

We manage the procurement of products through our national headquarters and regional offices, allowing us to take advantage of both our scale and local market conditions. We believe this enables us to purchase products more economically than most of our competitors. Product is shipped directly by the manufacturers to our branches or customers.

Operations

Facilities

Our network of 236 branches as of September 30, 2013 serves metropolitan areas in 39 states and 6 Canadian provinces. This network has enabled us to effectively and efficiently serve a broad customer base and to achieve a leading market position in each of our core geographic markets.

Operations

Our branch-based model provides each location with a significant amount of autonomy to operate within the parameters of our overall business model. Operations at each branch are tailored to meet local customer needs. Depending on the market, branches carry from about 2,000 to 11,000 SKUs.

Branch managers are responsible for sales, pricing and staffing activities, and have full operational control of customer service and deliveries. We provide our branch managers with significant incentives that allow them to share in the profitability of their respective branches as well as in the company as a whole. Personnel at our regional and corporate operations assist the branches with, among other things, product procurement, credit and safety services, fleet management, information systems support, contract management, accounting, treasury and legal services, human resources, benefits administration and sales and use tax services.

Distribution fulfillment process

Our distribution fulfillment process is initiated upon receiving a request for a contract job order or direct product order from a contractor. Under a contract job order, a contractor typically requests roofing or other construction materials and technical support services. The contractor discusses the project's requirements with a salesperson and the salesperson provides a price quotation for the package of products and services. Subsequently, the salesperson processes the order and we deliver the products to the customer's job site.

Fleet

Our distribution infrastructure supports over 590,000 deliveries annually. To accomplish this, we maintained a dedicated owned fleet of 771 straight trucks, 305 tractors and 624 trailers as of September 30, 2013. Nearly all of our delivery vehicles are equipped with specialized equipment, including 894 truck-mounted forklifts, cranes, hydraulic booms and conveyors, which are necessary to deliver products to rooftop job sites in an efficient and safe manner and in accordance with our customers’ requirements.

Our branches typically focus on providing materials to customers who are located within a two-hour radius of their respective facilities. Our branches generally make deliveries each business day.

Management information systems

We have fully integrated management information systems across our locations. Acquired businesses are moved to our IT platform as soon as feasible following acquisition. Our systems support every major internal operational function, except payroll, providing complete integration of purchasing, receiving, order processing, shipping, inventory management, sales analysis and accounting. The same databases are shared within the systems, allowing our branches to easily acquire products from other branches or schedule deliveries by other branches, greatly enhancing our customer service. Our systems also include a sophisticated pricing matrix which allows us to refine pricing by region, branch, customer and customer type, or even a specific customer project. In addition, our systems allow us to centrally monitor all branch and regional performance as often as daily. We have centralized many functions to leverage our growing size, including accounts payable, insurance, payroll, employee benefits, vendor relations, and banking.

All of our branches are connected to our IBM AS400 computer network by secure Internet connections or private data lines. We maintain a second IBM AS400 as a disaster recovery system, and information is backed up to this system throughout each business day. We have the capability of electronically switching our domestic operations to the disaster recovery system.

We have financial reporting packages for branches and regions that allow them to compare branch by branch financial performance, which we believe is essential to operating each branch efficiently and more profitably. We also utilize a monthly benchmarking report that enables comparison of all of our branches' and regions’ performance in critical areas.

We place purchase orders electronically with some of our major vendors. The vendors then transmit their invoices electronically to us. Our system automatically matches these invoices with the related purchase orders and then schedules the associated payment. We also have the capability to handle customer processing electronically, although most customers prefer ordering through our sales force.

We completed a “paperless copy” process in 2012 whereby we scan or receive many financial, credit and other documents into a database for purposes of internal approvals, online viewing and auditing. Additionally, we initiated an Internet portal that allows customers to access their invoice history and make online payments.

Government Regulations

We are subject to regulation by various federal, state, provincial and local agencies. These agencies include the Environmental Protection Agency, Department of Transportation, Interstate Commerce Commission, Occupational Safety and Health Administration and Department of Labor and Equal Employment Opportunity Commission. We believe we are in compliance in all material respects with existing applicable statutes and regulations affecting environmental issues and our employment, workplace health and workplace safety practices.

In 2012, the U.S. Supreme Court upheld the majority of the provisions in the Patient Protection and Affordable Care Act (the “Act”). The Act places requirements on employers to provide a minimum level of benefits to employees and assesses penalties on employers if the benefits do not meet the required minimum level or if the cost of coverage to employees exceeds affordability thresholds specified in the Act. The minimum benefits and affordability requirements take effect in 2014. The Act also imposes an excise tax beginning in 2018 on plans whose average cost exceeds specified amounts. We have analyzed the effects on us from the provisions of the Act and we do not currently anticipate a significant financial impact.

Competition

Although we are one of the two largest roofing materials distributors in the United States and Canada, the U.S. roofing supply industry is highly competitive. The vast majority of our competition comes from local and regional roofing supply distributors, and, to a much lesser extent, other building supply distributors and "big box" retailers. Among distributors, we compete against a small number of large distributors and many small and local privately-owned distributors. The principal competitive factors in our business include, but are not limited to, the availability of materials and supplies; technical product knowledge and expertise; advisory or other service capabilities; pricing of products; and availability of credit and capital. We generally compete on the basis of the quality of our services, product quality and, to a lesser extent, price.

Employees

As of September 30, 2013, we had 2,999 employees, consisting of 803 in sales and marketing, 377 in branch management, including supervisors, 1,380 warehouse workers, helpers and drivers, and 439 general and administrative personnel. Approximately 338 employees were added in 2012 from our acquisitions. We believe that our employee relations are good. As of September 30, 2013, 45 employees were represented by labor unions.

Order Backlog

Order backlog is not a material aspect of our business and no material portion of our business is subject to government contracts.

Seasonality

In general, sales and net income are highest during our first, third and fourth fiscal quarters, which represent the peak months of construction and re-roofing, especially in our branches in the northern and mid-western regions of the U.S. and in Canada. Our sales are substantially lower during the second quarter, when we usually incur net losses. These quarterly fluctuations have diminished as we have diversified further into the southern and western regions of the U.S.

Geographic Data

For geographic data about our business, please see Note 14 to our Consolidated Financial Statements included elsewhere in this Form 10-K.

ITEM 1A. RISK FACTORS

You should carefully consider the risks and uncertainties described below and other information included in this Form 10-K in evaluating us and our business. If any of the events described below occur, our business and financial results could be adversely affected in a material way. This could cause the trading price of our common stock to decline, perhaps significantly.

We may not be able to effectively integrate newly acquired businesses into our operations or achieve expected profitability from our acquisitions.

Our growth strategy includes acquiring other distributors of roofing materials and complementary products. Acquisitions involve numerous risks, including:

| · | unforeseen difficulties in integrating operations, technologies, services, accounting and personnel; |

| · | diversion of financial and management resources from existing operations; |

| · | unforeseen difficulties related to entering geographic regions where we do not have prior experience; |

| · | potential loss of key employees; |

| · | unforeseen liabilities associated with businesses acquired; and |

| · | inability to generate sufficient revenue to offset acquisition or investment costs. |

As a result, if we fail to evaluate and execute acquisitions properly, we might not achieve the anticipated benefits of such acquisitions and we may incur costs in excess of what we anticipate. These risks would likely be greater in the case of larger acquisitions.

We may not be able to successfully identify acquisition candidates, which would slow our growth rate.

We continually seek additional acquisition candidates in selected markets and from time to time engage in exploratory discussions with potential candidates. If we are not successful in finding attractive acquisition candidates whom we can acquire on satisfactory terms, or if we cannot complete acquisitions that we identify, it is unlikely that we will sustain the historical growth rates of our business.

An inability to obtain the products that we distribute could result in lost revenues and reduced margins and damage relationships with customers.

We distribute roofing and other exterior building materials that are manufactured by a number of major suppliers. Although we believe that our relationships with our suppliers are strong and that we would have access to similar products from competing suppliers should products be unavailable from current sources, any disruption in our sources of supply, particularly of the most commonly sold items, could result in a loss of revenues and reduced margins and damage relationships with customers. Supply shortages may occur as a result of unanticipated demand or production or delivery difficulties. When shortages occur, roofing material suppliers often allocate products among distributors.

Loss of key personnel or our inability to attract and retain new qualified personnel could hurt our ability to operate and grow successfully.

Our success will continue to depend to a significant extent on our executive officers and key management personnel, including our divisional executive vice presidents and regional vice presidents. We do not have key man life insurance covering any of our executive officers. We may not be able to retain our executive officers and key personnel or attract additional qualified management. The loss of any of our executive officers or other key management personnel, or our inability to recruit and retain qualified personnel, could hurt our ability to operate and make it difficult to execute our acquisition and internal growth strategies.

A change in vendor rebates could adversely affect our income and gross margins.

The terms on which we purchase product from many of our vendors entitle us to receive a rebate based on the volume of our purchases. These rebates effectively reduce our costs for products. If market conditions change, vendors may adversely change the terms of some or all of these programs. Although these changes would not affect the net recorded costs of product already purchased, it may lower our gross margins on products we sell and therefore the income we realize on such sales in future periods.

Cyclicality in our business could result in lower revenues and reduced profitability.

We sell a portion of our products for new residential and non-residential construction. The strength of these markets depends on new housing starts and business investment, which are a function of many factors beyond our control, including credit and capital availability, interest rates, employment levels and consumer confidence. Economic downturns in the regions and markets we serve could result in lower revenues and, since many of our expenses are fixed, lower profitability. The challenging economic conditions in recent years, including tighter credit markets, influenced new commercial projects and, to a lesser extent, re-roofing projects, and may continue to negatively affect expenditures for non-residential roofing in the near term.

Seasonality in the construction and re-roofing industry generally results in second quarter losses.

Our second quarter is typically affected adversely by winter construction cycles and cold weather patterns as the levels of activity in the new construction and re-roofing markets decrease. Because many of our expenses remain relatively fixed throughout the year, we generally record a loss during our second quarter. We expect that these seasonal variations will continue in the near future.

If we encounter difficulties with our management information systems, we could experience problems with inventory, collections, customer service, cost control and business plan execution.

We believe our management information systems are a competitive advantage in maintaining our leadership position in the roofing distribution industry. However, if we experience problems with our management information systems, we could experience, among other things, product shortages and/or an increase in accounts receivable aging. Any failure by us to properly maintain and protect our management information systems could adversely impact our ability to attract and serve customers and could cause us to incur higher operating costs and experience delays in the execution of our business plan.

Since we rely heavily on information technology both in serving our customers and in our enterprise infrastructure in order to achieve our objectives, we may be vulnerable to damage or intrusion from a variety of cyber-attacks including computer viruses, worms or other malicious software programs that access our systems. Despite the precautions we take to mitigate the risks of such events, an attack on our enterprise information technology system could result in theft or disclosure of our proprietary or confidential information or a breach of confidential customer or employee information. Such events could have an adverse impact on revenue, harm our reputation, and cause us to incur legal liability and costs, which could be significant, to address and remediate such events and related security concerns.

An impairment of goodwill and/or other intangible assets could reduce net income.

Acquisitions frequently result in the recording of goodwill and other intangible assets. At September 30, 2013, goodwill represented approximately 35% of our total assets. Goodwill is not amortized for financial reporting purposes and is subject to impairment testing at least annually using a fair-value based approach. The identification and measurement of goodwill impairment involves the estimation of the fair value of our reporting units. Our accounting for impairment contains uncertainty because management must use judgment in determining appropriate assumptions to be used in the measurement of fair value. We determine the fair values of our reporting units by using both a market and income approach.

We evaluate the recoverability of goodwill for impairment in between our annual tests when events or changes in circumstances indicate that the carrying amount of goodwill may not be recoverable. Any impairment of goodwill will reduce net income in the period in which the impairment is recognized.

We might need to raise additional capital, which may not be available, thus limiting our growth prospects.

We may require additional future equity or further debt financing in order to consummate an acquisition; for additional working capital for expansion; or if we suffer more than seasonally expected losses. In the event such additional equity or debt financing is unavailable to us, we may be unable to expand or make acquisitions and our stock price may decline as a result of the perception that we have more limited growth prospects.

Major disruptions in the capital and credit markets may impact both the availability of credit and business conditions.

If the financial institutions that have extended credit commitments to us are adversely affected by major disruptions in the capital and credit markets, they may become unable to fund borrowings under those credit commitments. This could have an adverse impact on our financial condition since we need to borrow funds at times for working capital, acquisitions, capital expenditures and other corporate purposes.

Major disruptions in the capital and credit markets could also lead to broader economic downturns, which could result in lower demand for our products and increased incidence of customers’ inability to pay their accounts. Additional customer bankruptcies or similar events caused by such broader downturns may result in a higher level of bad debt expense than we have historically experienced. Also, our suppliers may potentially be impacted, causing potential disruptions or delays of product availability. These events would adversely impact our results of operations, cash flows and financial position.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

As of November 1, 2013, we lease 211 facilities, including our headquarters and other support facilities, throughout the United States and Canada. These leased facilities range in size from approximately 2,000 square feet to 137,000 square feet. In addition, we own 14 sales/warehouse facilities located in Manchester, New Hampshire; Reading, Pennsylvania; Montreal, Quebec (2); Sainte-Foy, Quebec; Delson, Quebec; Trois Rivieres, Quebec; Salisbury, Maryland; Hartford, Connecticut; Cranston, Rhode Island; Lancaster, Pennsylvania; Jacksonville, Florida; Easton, Maryland; and Manassas, Virginia. These owned facilities range in size from 11,500 square feet to 68,000 square feet. All of the owned properties are mortgaged to our senior lenders. We believe that our properties are in good operating condition and adequately serve our current business operations.

In October 2013, we opened two additional branches. As of November 1, 2013, we operated 238 branches, a few with multiple leased facilities or combined facilities, and eight other facilities were located in the following states and provinces:

| | | Number of | | | | |

| State | | Branches | | | Other | |

| Alabama | | | 4 | | | | | |

| Arkansas | | | 4 | | | | | |

| California | | | 15 | | | | | |

| Colorado | | | 7 | | | | | |

| Connecticut | | | 2 | | | | 1 | |

| Delaware | | | 2 | | | | | |

| Florida | | | 8 | | | | 1 | |

| Georgia | | | 8 | | | | | |

| Illinois | | | 7 | | | | | |

| Indiana | | | 6 | | | | | |

| Iowa | | | 1 | | | | | |

| Kansas | | | 4 | | | | | |

| Kentucky | | | 4 | | | | | |

| Louisiana | | | 5 | | | | 1 | |

| Maine | | | 1 | | | | | |

| Maryland | | | 14 | | | | 1 | |

| Massachusetts | | | 10 | | | | | |

| Michigan | | | 2 | | | | | |

| Minnesota | | | 2 | | | | | |

| Mississippi | | | 2 | | | | | |

| Missouri | | | 8 | | | | | |

| Nebraska | | | 5 | | | | | |

| New Hampshire | | | 1 | | | | | |

| New Jersey | | | 1 | | | | | |

| New Mexico | | | 1 | | | | | |

| New York | | | 1 | | | | | |

| North Carolina | | | 11 | | | | 1 | |

| Ohio | | | 4 | | | | | |

| Oklahoma | | | 3 | | | | | |

| Pennsylvania | | | 27 | | | | | |

| Rhode Island | | | 1 | | | | | |

| South Carolina | | | 5 | | | | | |

| South Dakota | | | 1 | | | | | |

| Tennessee | | | 5 | | | | | |

| Texas | | | 20 | | | | | |

| Vermont | | | 1 | | | | | |

| Virginia | | | 9 | | | | 2 | |

| West Virginia | | | 5 | | | | | |

| Wyoming | | | 2 | | | | | |

| Subtotal—U.S. | | | 219 | | | | 7 | |

| | | | | | | | | |

| Canadian Provinces | | | | | | | | |

| Alberta | | | 3 | | | | | |

| Saskatchewan | | | 2 | | | | | |

| British Columbia | | | 3 | | | | | |

| Ontario | | | 5 | | | | 1 | |

| Quebec | | | 5 | | | | | |

| Nova Scotia | | | 1 | | | | | |

| Subtotal—Canada | | | 19 | | | | 1 | |

ITEM 3. LEGAL PROCEEDINGS

From time to time, we are involved in lawsuits that are brought against us in the normal course of business. We are not currently a party to any legal proceedings that would be expected, either individually or in the aggregate, to have a material adverse effect on our business or financial condition.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock trades on the NASDAQ Global Select Market (the “NASDAQ”) under the symbol “BECN”. The following table lists quarterly information on the price range of our common stock based on the high and low reported sale prices for our common stock as reported by NASDAQ for the periods indicated below:

| | | High | | | Low | |

| | | | | | | |

| Year ended September 30, 2012: | | | | | | | | |

| | | | | | | | | |

| First quarter | | $ | 20.84 | | | $ | 15.34 | |

| Second quarter | | $ | 26.93 | | | $ | 20.23 | |

| Third quarter | | $ | 27.29 | | | $ | 22.93 | |

| Fourth quarter | | $ | 30.41 | | | $ | 24.09 | |

| | | | | | | | | |

| Year ended September 30, 2013: | | | | | | | | |

| | | | | | | | | |

| First quarter | | $ | 33.41 | | | $ | 27.70 | |

| Second quarter | | $ | 39.68 | | | $ | 33.28 | |

| Third quarter | | $ | 42.00 | | | $ | 35.22 | |

| Fourth quarter | | $ | 42.28 | | | $ | 34.82 | |

There were 71 holders of record of our common stock as of November 1, 2013.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

No purchases of our equity securities were made by us or any affiliated entity during the fourth quarter of the year ended September 30, 2013.

Recent Sales of Unregistered Securities

None.

Dividends

We have not paid cash dividends on our common stock and do not anticipate paying dividends in the foreseeable future. Our board of directors currently intends to retain any future earnings for reinvestment in our growing business. Our revolving credit facilities currently prohibit the payment of dividends without the prior written consent of our lenders. Any future determination to pay dividends will also be at the discretion of our board of directors and will be dependent upon our results of operations and cash flows, our financial position and capital requirements, general business conditions, legal, tax, regulatory and any contractual restrictions on the payment of dividends, and any other factors our board of directors deems relevant.

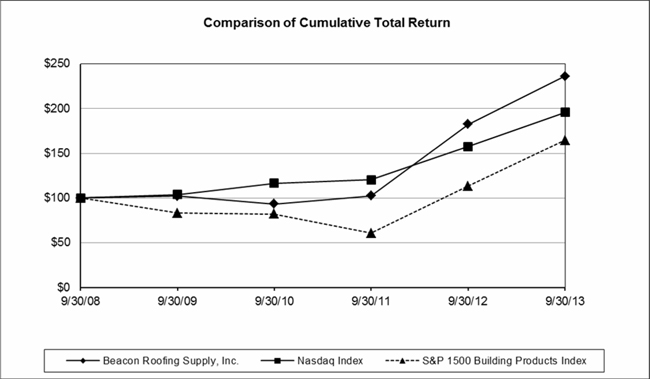

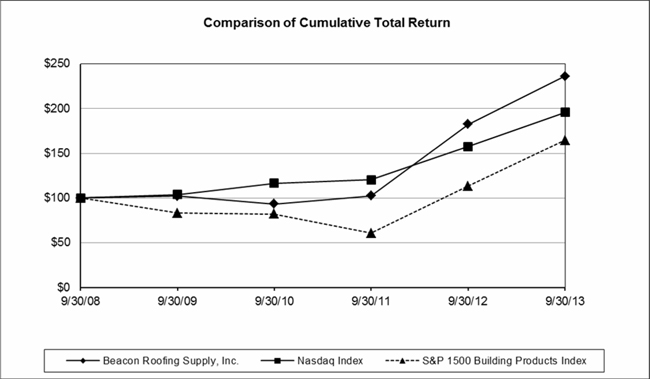

Performance Graph

The following graph compares the cumulative total shareholder return (including reinvestment of dividends) of Beacon Roofing Supply, Inc.'s common stock based on its market prices, beginning with the start of fiscal year 2009 and each fiscal year thereafter, with (i) the Nasdaq Index and (ii) the S&P 1500 Building Products Index.

The line graph assumes that $100 was invested in our common stock, the Nasdaq Index and the S&P 1500 Building Products Index on September 30, 2008. The closing price of our common stock on September 30, 2013 was $36.87. The stock price performance of Beacon Roofing Supply, Inc.'s common stock depicted in the graph above represents past performance only and is not necessarily indicative of future performance.

ITEM 6. SELECTED FINANCIAL DATA

You should read the following selected financial information together with our financial statements and related notes and "Management's discussion and analysis of financial condition and results of operations" also included in this Form 10-K. We have derived the statement of operations data for the years ended September 30, 2013, September 30, 2012 and September 30, 2011, and the balance sheet information at September 30, 2013 and September 30, 2012, from our audited financial statements included in this Form 10-K. We have derived the statements of operations data for the years ended September 30, 2010 and September 30, 2009, and the balance sheet data at September 30, 2011, September 30, 2010 and September 30, 2009, from our audited financial statements not included in this Form 10-K.

Statement of operations data

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| (dollars in thousands, except per share amounts) | | | | | | | | | | | | | |

| Net sales | | $ | 2,240,723 | | | $ | 2,043,658 | | | $ | 1,817,423 | | | $ | 1,609,969 | | | $ | 1,733,967 | |

| Cost of products sold | | | 1,709,326 | | | | 1,542,254 | | | | 1,397,798 | | | | 1,249,869 | | | | 1,322,845 | |

| | | | | | | | | | | | | | | | | | | | | |

| Gross profit | | | 531,397 | | | | 501,404 | | | | 419,625 | | | | 360,100 | | | | 411,122 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating expenses | | | 401,676 | | | | 357,732 | | | | 315,883 | | | | 286,583 | | | | 301,913 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from operations | | | 129,721 | | | | 143,672 | | | | 103,742 | | | | 73,517 | | | | 109,209 | |

| Interest expense, financing costs and other | | | (8,247 | ) | | | (17,173 | ) | | | (13,364 | ) | | | (18,210 | ) | | | (22,887 | ) |

| Income taxes | | | (48,867 | ) | | | (50,934 | ) | | | (31,158 | ) | | | (20,781 | ) | | | (33,904 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 72,607 | | | $ | 75,565 | | | $ | 59,220 | | | $ | 34,526 | | | $ | 52,418 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income per share | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 1.50 | | | $ | 1.62 | | | $ | 1.29 | | | $ | 0.76 | | | $ | 1.16 | |

| Diluted | | $ | 1.47 | | | $ | 1.58 | | | $ | 1.27 | | | $ | 0.75 | | | $ | 1.15 | |

| Weighted average shares outstanding | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 48,472,240 | | | | 46,718,948 | | | | 45,919,198 | | | | 45,480,922 | | | | 45,007,313 | |

| Diluted | | | 49,385,335 | | | | 47,840,967 | | | | 46,753,152 | | | | 46,031,593 | | | | 45,493,786 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other financial and operating data: | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | $ | 30,415 | | | $ | 24,353 | | | $ | 25,060 | | | $ | 27,773 | | | $ | 30,389 | |

| Capital expenditures (excluding acquisitions) | | $ | 26,120 | | | $ | 17,404 | | | $ | 14,433 | | | $ | 10,268 | | | $ | 14,277 | |

| Number of branches at end of period | | | 236 | | | | 209 | | | | 185 | | | | 179 | | | | 172 | |

Balance sheet data

| | | September 30, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| (dollars in thousands) | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 47,027 | | | $ | 40,205 | | | $ | 143,027 | | | $ | 117,136 | | | $ | 82,742 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 1,338,696 | | | $ | 1,216,982 | | | $ | 1,156,964 | | | $ | 1,042,189 | | | $ | 1,040,786 | |

| | | | | | | | | | | | | | | | | | | | | |

| Borrowings under revolving lines of credit, current portions of long-term debt and other obligations | | $ | 62,524 | | | $ | 56,932 | | | $ | 15,605 | | | $ | 15,734 | | | $ | 15,092 | |

| | | | | | | | | | | | | | | | | | | | | |

| Long-term debt, net of current portions: | | | | | | | | | | | | | | | | | | | | |

| Senior notes payable and other obligations | | $ | 196,875 | | | $ | 208,125 | | | $ | 301,544 | | | $ | 311,771 | | | $ | 322,090 | |

| Other long-term obligations | | | 12,726 | | | | 12,750 | | | | 9,967 | | | | 11,910 | | | | 16,257 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | $ | 209,601 | | | $ | 220,875 | | | $ | 311,511 | | | $ | 323,681 | | | $ | 338,347 | |

| | | | | | | | | | | | | | | | | | | | | |

| Stockholders' equity | | $ | 754,356 | | | $ | 651,962 | | | $ | 538,427 | | | $ | 468,844 | | | $ | 423,573 | |

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our consolidated financial statements and related notes and other financial information appearing elsewhere in this Form 10-K. In addition to historical information, the following discussion and other parts of this Form 10-K contain forward-looking information that involves risks and uncertainties. Our actual results could differ materially from those anticipated by this forward-looking information due to the factors discussed under "Risk factors," "Forward-looking statements" and elsewhere in this Form 10-K. Certain tabular information will not foot due to rounding.

Overview

We are one of the largest distributors of residential and non-residential roofing materials in the United States and Canada. We are also a distributor of other building materials, including siding, windows, specialty lumber products and waterproofing systems for residential and nonresidential building exteriors. We purchase products from a large number of manufacturers and then distribute these goods to a customer base consisting of contractors and, to a lesser extent, general contractors, retailers and building material suppliers.

Depending on the market, each of our branches carries from about 2,000 to 11,000 SKUs, totaling to more than 200,000 SKUs throughout our network of 236 branches across the United States and Canada. In fiscal year 2013, approximately 92% of our net sales were in the United States. We stock one of the most extensive assortments of high-quality branded products in the industry, enabling us to deliver products to our customers on a timely basis.

Execution of the operating plan at each of our branches drives our financial results. Revenues are impacted by the relative strength of the residential and non-residential roofing markets we serve. We strive for an appropriate mix of residential, non-residential and complementary product sales in all of our regions but allow each of our branches to influence its own marketing plan and mix of products based upon its local market. We differentiate ourselves from the competition by providing many customer services such as job site delivery, tapered insulation layouts and design and metal fabrication, and by providing credit. We consider customer relations and our employees' knowledge of roofing and exterior building materials to be important to our ability to increase customer loyalty and maintain customer satisfaction. We invest significant resources in training our employees in sales techniques, management skills and product knowledge. While we consider these attributes important drivers of our business, we also continually pay close attention to controlling operating costs.

Our growth strategy includes both internal growth (opening branches, growing sales with existing customers, adding new customers and introducing new products) and acquisition growth. Our main acquisition strategy is to target market leaders in geographic areas that we do not service or that complement our existing operations in an area. The following transactions highlight our recent success delivering on our growth strategy:

| · | We have continued to focus on organic greenfield growth with the opening of 10 new branches in 2013, four new branches in 2012 and three new branches in 2011. These 17 new branch locations in the past three years have allowed us to strategically penetrate deeper into many of our existing markets and enter into new markets. Additionally in October 2013, we continued to accelerate our greenfield activity by opening two new branches bringing our branch count as of November 1, 2013 to 238. |

| · | In December 2012, we acquired Ford Wholesale Co., a distributor of residential and commercial roofing and related accessories with three locations in Northern California. This acquisition provided entry into a new geographic market with no branch overlap with our existing operations. |

| · | In November 2012, we acquired McClure-Johnston a distributor of residential and commercial roofing products and related accessories, which was headquartered in the Pittsburgh area and had 14 branches at the time of acquisition, including eight in Pennsylvania, three in West Virginia, one in Western Maryland and two in Georgia. This acquisition complemented an existing market in which we previously had operations, allowing us to capture more of the localized market share. |

| · | In July 2012, we acquired Structural Materials Co. ("Structural"), a distributor of residential and commercial roofing products and related accessories headquartered in Santa Ana, CA. Structural has six locations in Los Angeles and Orange Counties and in the surrounding areas, which we integrated into our existing Pacific Supply region in Southern California. |

| · | In May 2011, we acquired Enercon Products Inc. (“Enercon”), a roofing distributor with six locations in Western Canada. Headquartered within its branch in Edmonton, Enercon also has branches in Calgary, Regina and Saskatoon and two branches in Vancouver. This acquisition provided entry into a new geographic market with no branch overlap with our existing operations. |

General

We sell all materials necessary to install, replace and repair residential and non-residential roofs, including:

| · | Metal roofing and accessories; |

| · | Fasteners, coatings and cements; and |

| · | Other roofing accessories. |

We also sell complementary building products such as:

| · | Doors, windows and millwork; |

| · | Wood and fiber cement siding; |

| · | Residential insulation; and |

The following is a summary of our net sales by product group (in thousands) for the last three full fiscal years (“2013”, “2012” and “2011”). Percentages may not total due to rounding.

| | | Year Ended September 30, | |

| | | 2013 | | | 2012 | | | 2011 | |

| | | Net Sales | | | Mix | | | Net Sales | | | Mix | | | Net Sales | | | Mix | |

| (dollars in thousands) | | | | | | | | | | | | | | | | | | |

| Residential roofing products | | $ | 1,100,508 | | | | 49.1 | % | | $ | 1,023,547 | | | | 50.1 | % | | $ | 849,970 | | | | 46.8 | % |

| Non-residential roofing products | | | 822,726 | | | | 36.7 | % | | | 757,906 | | | | 37.1 | % | | | 718,145 | | | | 39.5 | % |

| Complementary building products | | | 317,489 | | | | 14.2 | % | | | 262,205 | | | | 12.8 | % | | | 249,308 | | | | 13.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $ | 2,240,723 | | | | 100.0 | % | | $ | 2,043,658 | | | | 100.0 | % | | $ | 1,817,423 | | | | 100.0 | % |

We have over 47,000 customers, none of which individually represent more than 2% of our total net sales. Many of our customers are small to mid-size contractors with relatively limited capital resources. We maintain strict credit review and approval policies, which has helped to keep losses from uncollectible customer receivables within our expectations. Bad debt expense in 2013 was less than 0.1% due primarily to continued improvement in the economy and credit environment. Bad debt expense in 2012 was in line with our normal historical levels at approximately 0.2% of net sales, while bad debts in 2011 were slightly higher than normal levels at 0.4% of net sales but still within our tolerance in consideration of the recovering economy.

Our expenses consist primarily of the cost of products purchased for resale, labor, fleet, occupancy, and selling and administrative expenses. We compete for business and may respond to competitive pressures at times by lowering prices in order to maintain our market share.

We opened 10 new branches in 2013, four new branches in 2012 and three in 2011. While we slowed the pace of new branch openings following the economic downturn that began in 2007, we began increasing our greenfield activity in 2013 which we expect to continue through 2014 as part of our continued growth strategy. Typically, when we open a new branch, we transfer a certain level of existing business from an existing branch to the new branch. This allows the new branch to commence with a base business and also allows the existing branch to target other growth opportunities.

In managing our business, we consider all growth, including the opening of new branches, to be internal (organic) growth unless it results from an acquisition. When we refer to growth in existing markets or internal growth, we include growth from existing and newly opened branches but exclude growth from acquired branches until they have been under our ownership for at least four full fiscal quarters at the start of the fiscal reporting period. When we refer to regions, we are referring to our geographic regions. At September 30, 2013, we had a total of 236 branches in operation. Our existing market calculations for 2013 include 196 branches and exclude 40 branches because they were acquired after the start of last year. Acquired markets for 2013 include Cassady Pierce, Structural Materials, CRS, McClure-Johnston, Ford Wholesale, Construction Materials Supply, The Roofing Connection and Fowler & Peth (See Note 4 to the Consolidated Financial Statements).

When we refer to our net product costs, we are referring to our invoice cost less the impact of short-term buying programs (also referred to as “special buys” given the manner in which they are offered).

Results of operations

The following discussion compares our results of operations for 2013, 2012 and 2011.

The following table presents information derived from our consolidated statements of operations expressed as a percentage of net sales for each of the respective the periods indicated. Percentages may not total due to rounding.

| | | Year ended September 30, | |

| | | 2013 | | | 2012 | | | 2011 | |

| | | | | | | | | | |

| Net sales | | | 100.0 | % | | | 100.0 | % | | | 100.0 | |

| Cost of products sold | | | 76.3 | | | | 75.5 | | | | 76.9 | |

| | | | | | | | | | | | | |

| Gross profit | | | 23.7 | | | | 24.5 | | | | 23.1 | |

| | | | | | | | | | | | | |

| Operating expenses | | | 17.9 | | | | 17.5 | | | | 17.4 | |

| | | | | | | | | | | | | |

| Income from operations | | | 5.8 | | | | 7.0 | | | | 5.7 | |

| Interest expense, financing costs and other | | | (0.4 | ) | | | (0.8 | ) | | | (0.7 | ) |

| | | | | | | | | | | | | |

| Income before income taxes | | | 5.4 | | | | 6.2 | | | | 5.0 | |