Exhibit 99

NASDAQ: BECN 1 December 14, 2016 New York City 2016 Investor Day

NASDAQ: BECN 2 Paul Isabella President and CEO Company Overview and Strategy

Investor Day | 2016 NASDAQ: BECN Investor Day - Morning (10AM - Noon) 3 Paul Isabella President and CEO Company Overview and Strategy Eric Swank Executive VP, East Division Chief Sales and Marketing Officer Sales & Marketing Munroe Best Executive VP, South Division South Division Development and RSG Integration Brendan Daly Executive VP and Chief Supply Chain Officer Supply Chain All Beacon Executives Morning Q&A

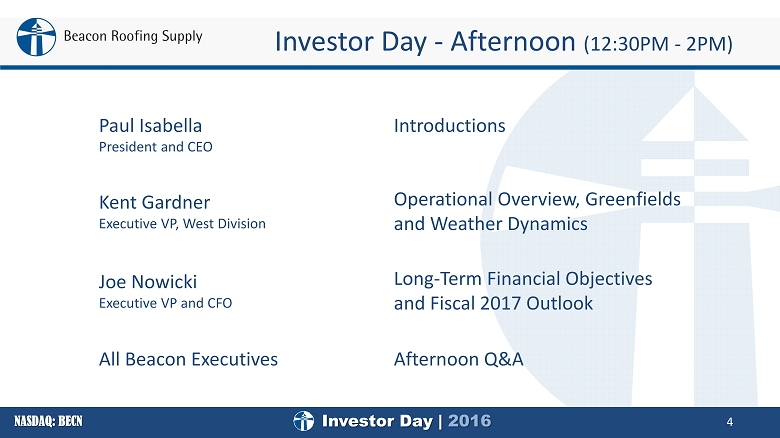

Investor Day | 2016 NASDAQ: BECN Investor Day - Afternoon ( 12:30PM - 2PM) 4 Paul Isabella President and CEO Introductions Kent Gardner Executive VP, West Division Operational Overview, Greenfields and Weather Dynamics Joe Nowicki Executive VP and CFO Long - Term Financial Objectives and Fiscal 2017 Outlook All Beacon Executives Afternoon Q&A

Investor Day | 2016 NASDAQ: BECN Forward Looking Statements 5 This presentation contains information about management's view of the Company's future expectations, plans and prospects that constitute forward - looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995 . Actual results may differ materially from those indicated by such forward - looking statements as a result of various important factors, including, but not limited to, those set forth in the "Risk Factors" section of the Company's latest Form 10 - K . In addition, the forward - looking statements included in this presentation represent the Company's views as of the date of this presentation and these views could change . However, while the Company may elect to update these forward - looking statements at some point, the Company specifically disclaims any obligation to do so, other than as required by federal securities laws . These forward - looking statements should not be relied upon as representing the Company's views as of any date subsequent to the date of this presentation . This presentation contains references to certain financial measures that are not presented in accordance with generally accepted accounting principles (“GAAP") . The Company utilizes non - GAAP financial measures to analyze and report operating results that are unaffected by differences in capital structures, capital investment cycles, and varying ages of related assets . Although the Company believes these measures provide a useful representation of performance, non - GAAP financial measures should not be considered in isolation or as a substitute for any items calculated in accordance with GAAP . A reconciliation of these non - GAAP financial measures to their most directly comparable GAAP financial measure can be found in the Appendix to this presentation as well as Company’s latest Form 8 - K, filed with the SEC on November 21 , 2016 .

Investor Day | 2016 NASDAQ: BECN Financial Strength Profitable Growth Customer Service Excellence Leadership Advantage Exceptional Shareholder Returns Strategic Priorities 6

Investor Day | 2016 NASDAQ: BECN • A leader in many key metropolitan markets in the United States & across Canada • 369 branches across 46 U.S. states and 6 Canadian provinces • Serving nearly 67,000 customers with a broad product offering up to 46,000 SKU’s • End market demand fueled by repair (approx. 80 %) versus new construction • Strong long - term historical performance • Historical sales CAGR = 16.6% • Historical operating income CAGR = 16.2% • Historical operating margin averages 5.0% - 6.0% • Opened 75 new greenfield locations since the IPO • Successfully completed 37 acquisitions since our IPO in 2004 • In October 2015, acquired 85 - branch Roofing Supply Group (RSG) for $1.1 billion • Other Q1‘16 acquisitions: RCI Roofing Supply Company, Inc ., Roofing and Insulation Supply (RIS) and Statewide Wholesale • Q3‘16 acquisitions : Lyf - Tym Building Products, Atlantic Building Products, Fox Brothers Company and Woodfeathers , Inc. Beacon Overview 7 $0.7 $1.5 $1.8 $ 1.6 $ 2.0 $2.3 $4.1 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 Sales ($ in billions) Sources: Freedonia and Company Estimates

Investor Day | 2016 NASDAQ: BECN A 12 - Year Success Story 8 IPO Current Initial Public Offering September 22, 2004 at $8.67 Stock price at $47.10. Cumulative return of 443% versus S&P 500 at 103 %* 66 branches in 12 states, 3 Canadian provinces 369 branches in 46 states, 6 Canadian provinces ~1,200 employees 5,000+ employees FY2004 sales: $653 million FY2016 sales: $4.1 billion FY2004 adjusted EBITDA: $52mm FY2016 adjusted EBITDA: $347mm *As of 12/9/2016

Investor Day | 2016 NASDAQ: BECN Understanding the Backdrop for 12 - Years of Success 9 (200) 300 800 1,300 1,800 Single Family Housing Starts 0 1 2 3 4 # Hurricanes Category 2+ at Landfall - 100 200 300 400 500 600 Non - Residential Structures 0 50 100 150 200 U.S. Asphalt Shingle Market (MM of Squares) Re-Roof Demand New Construction Major Storms 154 155 129 135 120 108 122 118 143 144 161 173 111 107 112 Sources: Asphalt Roofing Manufacturers Association (ARMA), Owens Corning, US Census Bureau, NOAA, Bureau of Economic Analysis (B EA) and Company Estimates

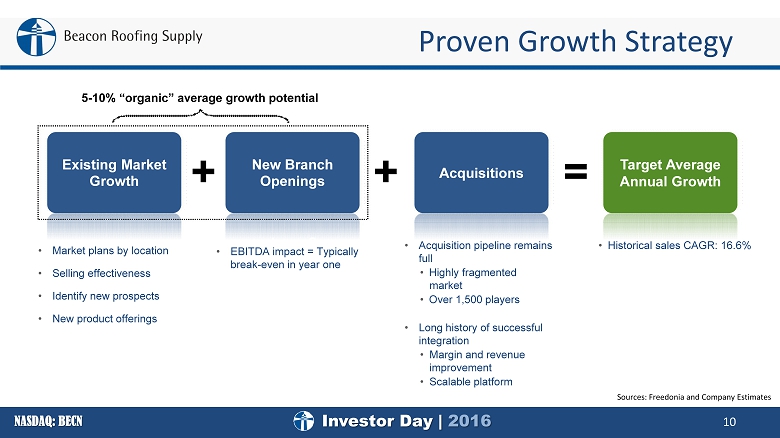

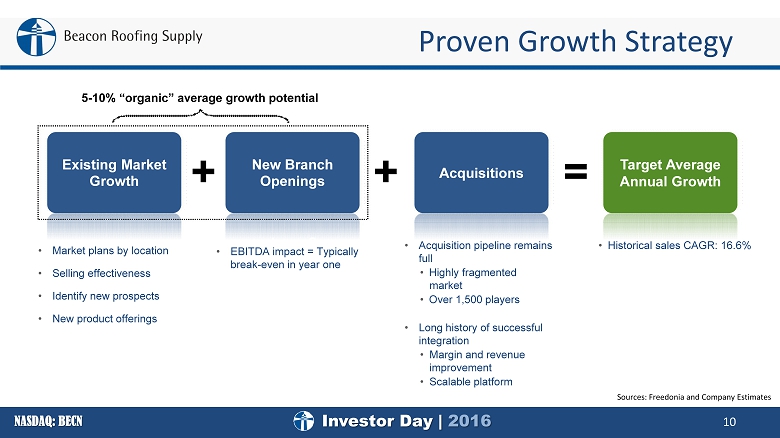

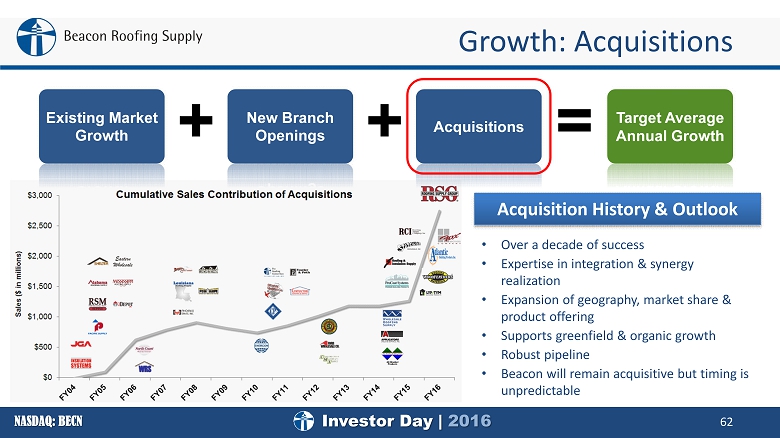

Investor Day | 2016 NASDAQ: BECN Existing Market Growth New Branch Openings Acquisitions Target Average Annual Growth + + = 5 - 10% “organic” average growth potential 10 • Market plans by location • Selling effectiveness • Identify new prospects • New product offerings • Acquisition pipeline remains full • Highly fragmented market • Over 1,500 players • Long history of successful integration • Margin and revenue improvement • Scalable platform • Historical sales CAGR: 16.6% • EBITDA impact = Typically break - even in year one Proven Growth Strategy Sources: Freedonia and Company Estimates

Investor Day | 2016 NASDAQ: BECN Substantial, Growing Geographic Base 11 138 155 178 175 172 179 194 224 238 270 272 368 0 50 100 150 200 250 300 350 400 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Number of Branch Locations at Year End

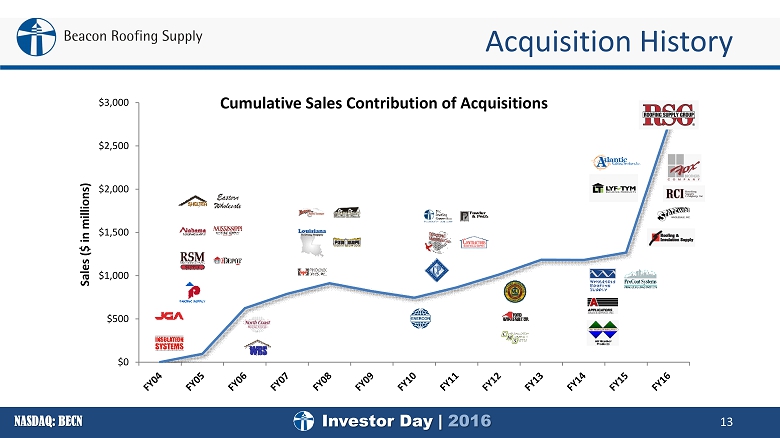

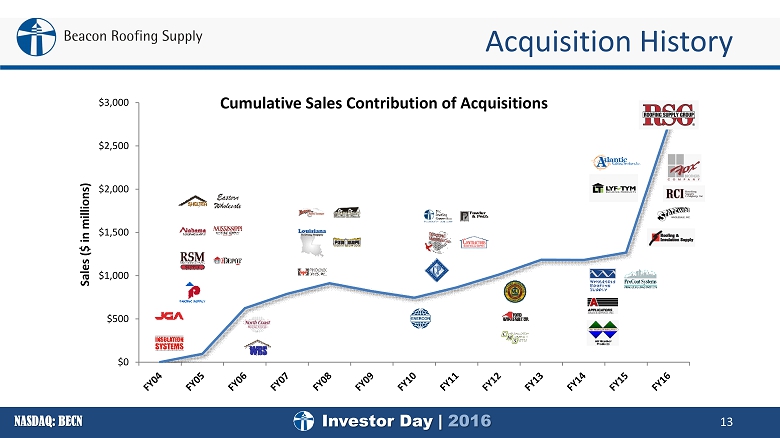

Investor Day | 2016 NASDAQ: BECN • 37 acquisitions since IPO including 8 transactions in FY2016 • Diverse strategy • Fill - in geographic p urchases • Product l ine d iversification • Underpenetrated g eographies • Large transactions • Unique long - term cultivation of relationships Acquisition Strategy 12

Investor Day | 2016 NASDAQ: BECN Acquisition History 13 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Sales ($ in millions) Cumulative Sales Contribution of Acquisitions

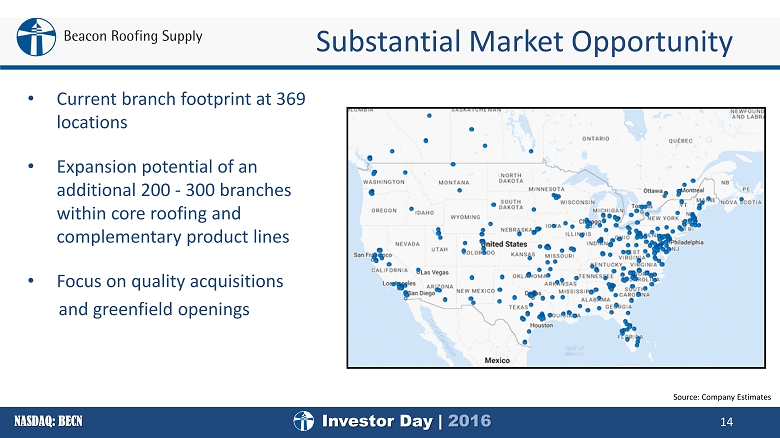

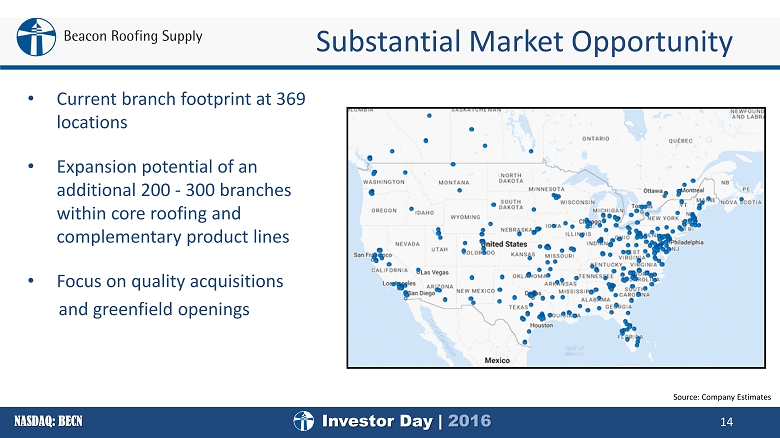

Investor Day | 2016 NASDAQ: BECN • Current branch footprint at 369 locations • Expansion potential of an additional 200 - 300 branches within core roofing and complementary product lines • F ocus on quality acquisitions and greenfield openings Substantial Market Opportunity 14 Source: Company Estimates

Investor Day | 2016 NASDAQ: BECN Expanding Product Lines 15 FY16 Product Line Mix RESIDENTIAL ROOFING 53.0% COMPLEMENTARY 14.6% NON - RESIDENTIAL ROOFING 32.4%

Investor Day | 2016 NASDAQ: BECN Expanding Product Lines 16 FY16 Product Line Mix RESIDENTIAL ROOFING 53.0% COMPLEMENTARY 14.6% NON - RESIDENTIAL ROOFING 32.4%

Investor Day | 2016 NASDAQ: BECN Leading Brands 17 BUILDING INSULATION WATERPROOFING COMMERCIAL ROOFING DECKING & RAILING VINYL & FIBER CEMENT SIDING WINDOWS & DOORS RESIDENTIAL ROOFING

Investor Day | 2016 NASDAQ: BECN • Recent years’ market growth has increased the addressable size • Market forecasted to increase with economic recovery • Four largest distributors have ~50% share of roofing market • C omplementary products segment is diverse and a growth opportunity • Focus on share growth and expansion of addressable market Market Size 18 Product Type 2016 Estimated Market Size Residential Roofing $15B Non - Residential Roofing $11B Total Roofing $26B Complementary Products ~ $25B Sources: Freedonia and Company Estimates

Investor Day | 2016 NASDAQ: BECN • Re - roofing/repair represents ~80% of demand for commercial and residential • 94 % of U.S. re - roofing demand is non - discretionary and insulated from broader economic conditions • New construction is a smaller component (15 - 20% of demand) Re - Roofing i s Key Demand Driver 19 0 20 40 60 80 100 120 140 160 180 200 Millions Of Squares Asphalt Shingle Shipments 40% 25% 27% 2% 3% 3% Drivers of Re - Roofing Demand LEAKS OLD WEATHER DAMAGE DETERIORATING UPGRADE APPEARANCE OTHER Sources: ARMA, 3M, Freedonia and Company Estimates

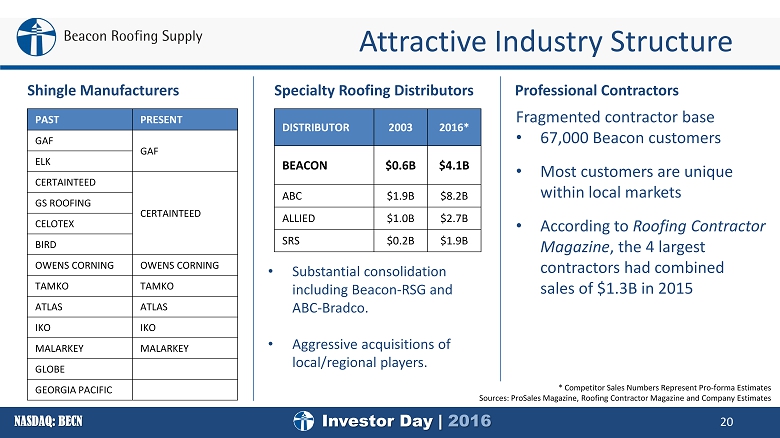

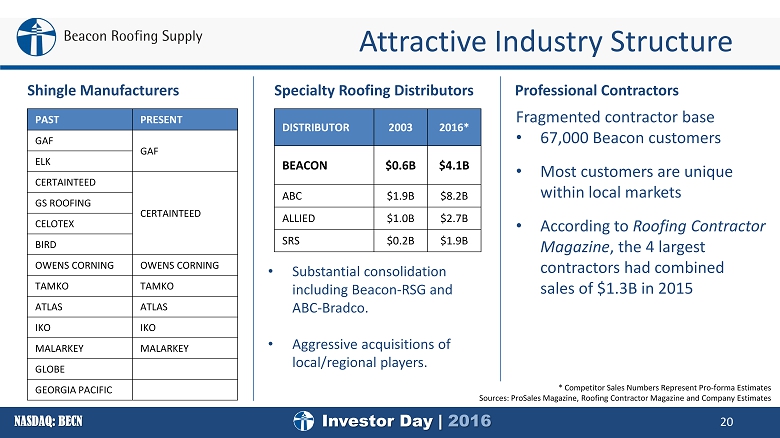

Investor Day | 2016 NASDAQ: BECN Attractive Industry Structure 20 PAST PRESENT GAF GAF ELK CERTAINTEED CERTAINTEED GS ROOFING CELOTEX BIRD OWENS CORNING OWENS CORNING TAMKO TAMKO ATLAS ATLAS IKO IKO MALARKEY MALARKEY GLOBE GEORGIA PACIFIC Shingle Manufacturers DISTRIBUTOR 2003 2016* BEACON $0.6B $4.1B ABC $1.9B $8.2B ALLIED $1.0B $2.7B SRS $0.2B $1.9B Specialty Roofing Distributors • Substantial consolidation including Beacon - RSG and ABC - Bradco . • Aggressive acquisitions of local/regional players. Professional Contractors Fragmented contractor base • 67,000 Beacon customers • Most customers are unique within local markets • According to Roofing Contractor Magazine , the 4 largest contractors had combined sales of $1.3B in 2015 * Competitor Sales Numbers Represent Pro - forma Estimates Sources: ProSales Magazine, Roofing Contractor Magazine and Company Estimates

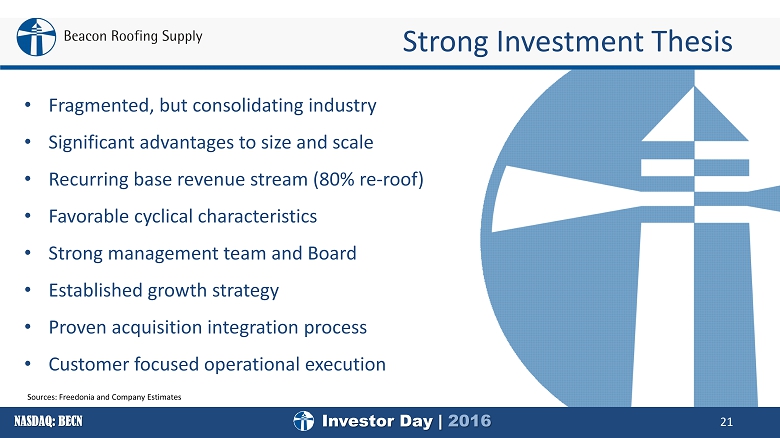

Investor Day | 2016 NASDAQ: BECN 21 • Fragmented, but consolidating industry • Significant advantages to size and scale • Recurring base revenue stream (80% re - roof) • Favorable cyclical characteristics • Strong management team and Board • Established growth strategy • Proven acquisition integration process • Customer focused operational execution Strong Investment Thesis Sources: Freedonia and Company Estimates

Investor Day | 2016 NASDAQ: BECN Investor Day - Morning (10AM - Noon) 22 Paul Isabella President and CEO Company Overview and Strategy Eric Swank Executive VP, East Division Chief Sales and Marketing Officer Sales & Marketing Munroe Best Executive VP, South Division South Division Development and RSG Integration Brendan Daly Executive VP and Chief Supply Chain Officer Supply Chain All Beacon Executives Morning Q&A

Investor Day | 2016 NASDAQ: BECN Investor Day - Afternoon ( 12:30PM - 2PM) 23 Paul Isabella President and CEO Introductions Kent Gardner Executive VP, West Division Operational Overview, Greenfields and Weather Dynamics Joe Nowicki Executive VP and CFO Long - Term Financial Objectives and Fiscal 2017 Outlook All Beacon Executives Afternoon Q&A

NASDAQ: BECN 24 Eric Swank Executive VP, East Division Chief Sales and Marketing Officer Sales & Marketing

Investor Day | 2016 NASDAQ: BECN 25 • Selling Effectiveness Model • Key Organic Growth Elements • Leveraging Industry Trends & Technology • Private Label • Residential Roofing • Non - Residential Roofing • Complementary Products Agenda

Investor Day | 2016 NASDAQ: BECN Talent Management Training Accountability • Employer Branding • Recruitment & Staffing • University Relationships • Sales Trainees Sales Pillars Sales OPS Recognized as the most skilled and technically capable salesforce in the industry Vision Tools & Resources • Quickstart Onboarding • Sales Process • Product Knowledge • Technology • Org. & People Review • OSR Expectations • Strong Analytics • Leadership Engagement • Goals & Metrics • Local Sales Plans • Sales & Ops Alignment • Sales Leadership • Career Paths • Recognition & Rewards Goal Setting & Business Plan Processes Results Oriented / Strong Work Ethic / Perseverance / Passion / Frugality / Credibility / Teamwork / Discipline Values Goal Consistently Outperform The Market Organizational Support 26 Selling Effectiveness Model

Investor Day | 2016 NASDAQ: BECN CRM • Access to Beacon 24/7 from desktop or mobile device • Online order with complete product catalog • Ease of doing business while increasing branch efficiency • Benefits for key stakeholders - Customers - Vendor partners - Beacon 27 Accelerate Productivity Make Insightful Decisions Close More Deals Get More Leads CRM E - Commerce Leveraging Industry Trends & Technology

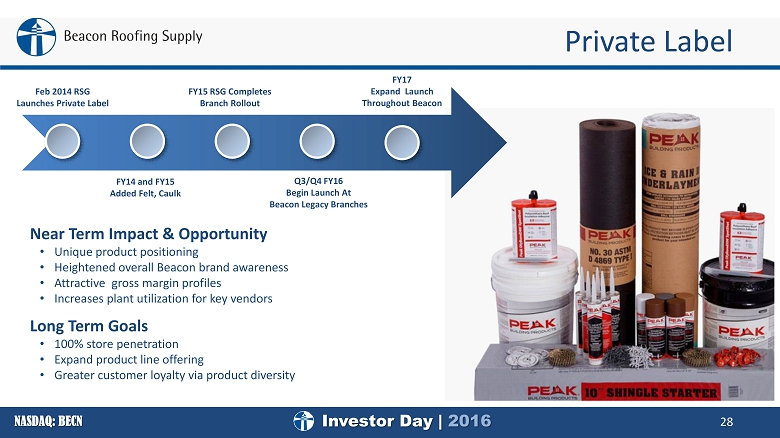

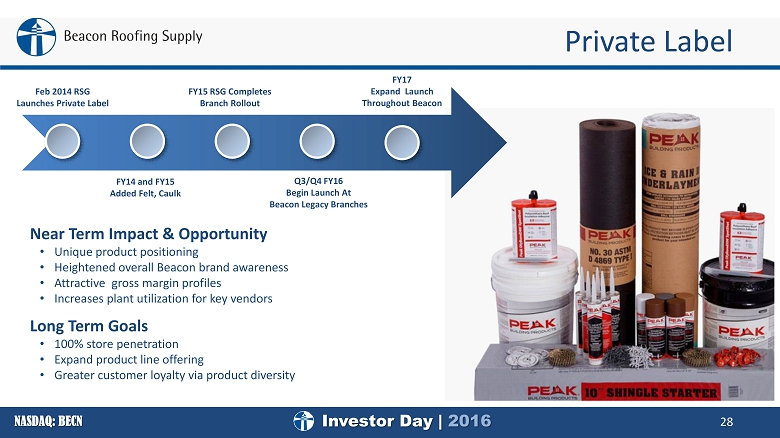

Investor Day | 2016 NASDAQ: BECN Near Term Impact & Opportunity • Unique product positioning • Heightened overall Beacon brand awareness • Attractive gross margin profiles • Increases plant utilization for key vendors Long Term Goals • 100% store penetration • Expand product line offering • Greater customer loyalty via product diversity 28 Feb 2014 RSG Launches Private Label Q3/Q4 FY16 Begin Launch At Beacon Legacy Branches FY14 and FY15 Added Felt, Caulk FY15 RSG Completes Branch Rollout FY17 Expand Launch Throughout Beacon Private Label

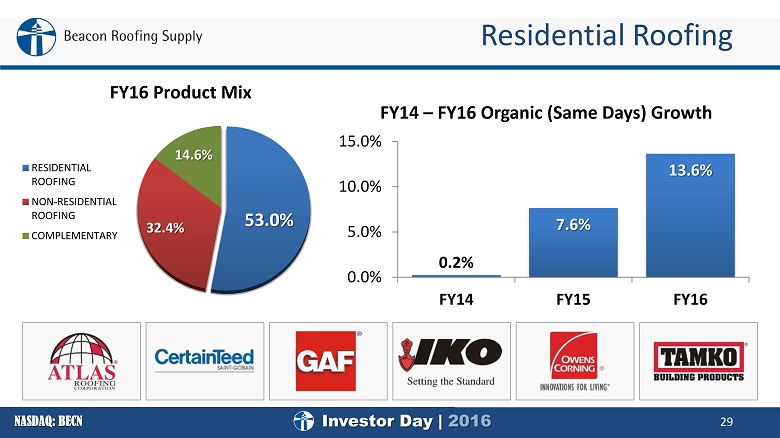

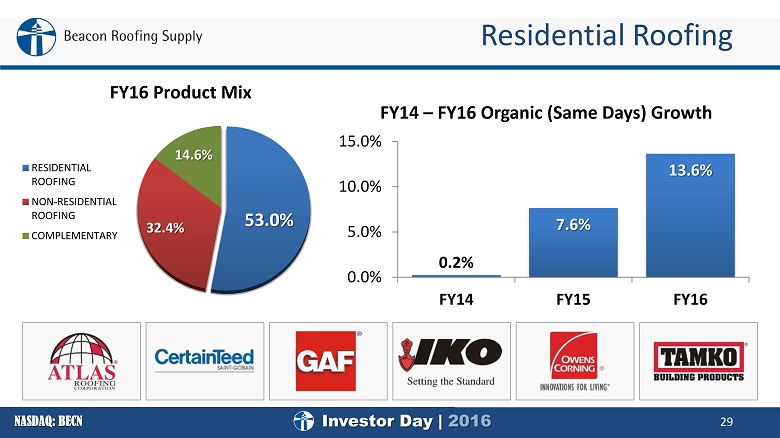

Investor Day | 2016 NASDAQ: BECN FY16 Product Mix Residential Roofing 29 53.0% 32.4% 14.6% RESIDENTIAL ROOFING NON-RESIDENTIAL ROOFING COMPLEMENTARY 0.2% 7.6% 13.6% 0.0% 5.0% 10.0% 15.0% FY14 FY15 FY16 FY14 – FY16 Organic (Same Days) Growth

Investor Day | 2016 NASDAQ: BECN Residential Roofing 30 • Attractive RSG Acquisition • Residential roofing: 62 % of 2014 sales • Significantly expanded Beacon’s geographic footprint in southern and western United States • Beacon 2016 Footprint vs. Top ARMA States • 48% of Beacon locations are in Top 10 ARMA states • FY16 acquisitions & greenfields added 55 locations in top 10 ARMA states • Recent Acquisitions Targeted Key Residential Roofing States • These states accounted for 31% of 2015 ARMA shipments • ARMA Rank #1 Texas: RSG • ARMA Rank #5 North Carolina: Lyf - Tym • ARMA Rank #8 Michigan: Fox Brothers • ARMA Rank #9 Colorado: RCI and Statewide Wholesale • ARMA Rank #10 Pennsylvania: Atlantic Building Products • ARMA Rank #15 Washington: Woodfeathers Source: ARMA

Investor Day | 2016 NASDAQ: BECN FY16 Product Mix Non - Residential Roofing 31 53.0% 32.4% 14.6% RESIDENTIAL ROOFING NON-RESIDENTIAL ROOFING COMPLEMENTARY 6.0% 0.4% 4.5% 0.0% 2.0% 4.0% 6.0% 8.0% FY14 FY15 FY16 FY14 – FY16 Organic (Same Days) Growth

Investor Day | 2016 NASDAQ: BECN Non - Residential Roofing 32 • Increased Number of Non - Residential Locations (FY16 vs. FY15) • ~7% growth in number of locations selling $500K or more • ~4% growth in number of locations selling $1M or more • Why Contractors Choose Beacon • Technical experts in the field • Proprietary lead generation and project tracking software • Engineering services • Fleet capabilities • Strong relationships with key vendors

Investor Day | 2016 NASDAQ: BECN FY16 Product Mix Complementary Products 33 4.7% 4.6% 7.6% 0.0% 2.0% 4.0% 6.0% 8.0% FY14 FY15 FY16 FY14 – FY16 Organic (Same Days) Growth 53.0% 32.4% 14.6% RESIDENTIAL ROOFING NON-RESIDENTIAL ROOFING COMPLEMENTARY

Investor Day | 2016 NASDAQ: BECN Complementary Products 34 • Statewide • Woodfeathers • 2016 Strategic Complementary Acquisitions • Cross - sell opportunities: • RSG • RCI • Proven platforms: • Lyf - Tym : 100% complementary product offering • Atlantic: 100 % complementary product offering • Fox : Complementary market leader with built - in residential roofing capabilities • RIS: Building insulation market leader • Beacon 2016 Footprint vs. Top VSI States • 30% of Beacon locations are in Top 10 VSI states • Acquisitions & greenfields added 26 locations in Top 10 VSI states in FY16 Sources: Vinyl Siding Institute (VSI) and Company Estimates

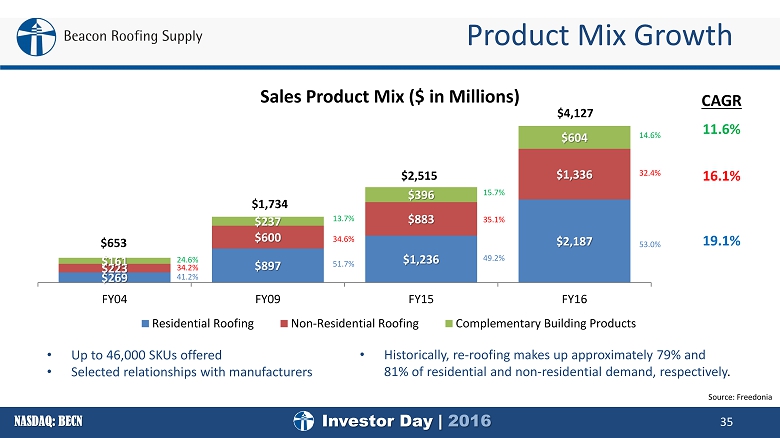

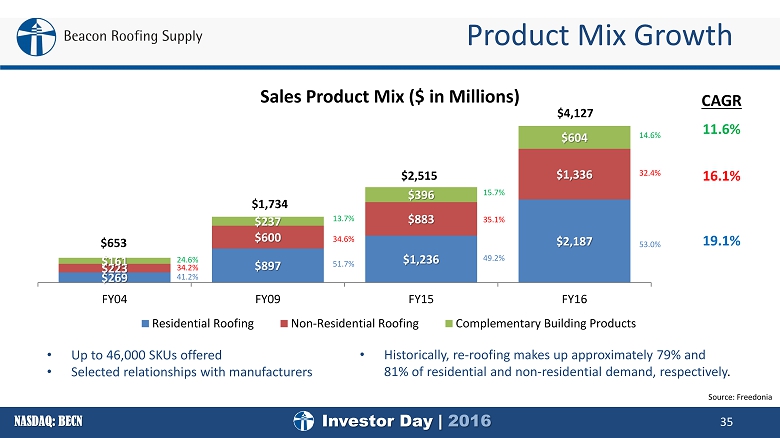

Investor Day | 2016 NASDAQ: BECN Product Mix Growth 35 • Up to 46,000 SKUs offered • Selected relationships with manufacturers Sales Product Mix ($ in Millions) $269 $897 $1,236 $2,187 $223 $600 $883 $1,336 $161 $237 $396 $604 FY04 FY09 FY15 FY16 Residential Roofing Non-Residential Roofing Complementary Building Products $653 $1,734 $2,515 $4,127 41.2% 34.2% 24.6% 51.7% 34.6% 13.7% 49.2% 35.1% 15.7% 53.0% 32.4% 14.6% CAGR 11.6% 16.1% 19.1% Source: Freedonia • Historically, re - roofing makes up approximately 79% and 81% of residential and non - residential demand, respectively .

NASDAQ: BECN 36 Munroe Best Executive VP, South Division South Division Development and RSG Integration

Investor Day | 2016 NASDAQ: BECN South Division Growth 37 • Strategic Plan Execution • R esults Oriented • People - Our Competitive Advantage Beacon Legacy RSG Acquisition Greenfield Acquisition 2013 44 Locations 2016 95 Locations

Investor Day | 2016 NASDAQ: BECN South Division Growth Levers 38 • New Product Launches • Cross - Selling Opportunities • Acquisition Leverage • New Customer Segment • Atlanta • Tampa • Charlotte 35 Locations Serving A Combined Population Of Over 15.3 M • Orlando • Nashville 2014 2015 Asphalt Shingle Demand 106M Units 112M Units Source: ARMA and U.S. Census 2 17 FY09 FY11 FY13 FY15 FY16 Complementary Products Expansion Florida Location Expansion Major Market Density Growing The Base

Investor Day | 2016 NASDAQ: BECN 39 RSG Integration

Investor Day | 2016 NASDAQ: BECN RSG Integration 40 0 10 20 30 40 50 60 2016E 2017E 2018E $ Millions RSG Synergies Original Cost Synergy Goals Current Cost Synergy Goals • Beacon announced definitive agreement to purchase RSG • Assembled integration team with subject matter experts from Beacon and RSG • Completed debt offering in connection with RSG purchase • Closed on acquisition of RSG • Day 1 leadership established - organization structure announced • Executive road show and communication rhythm initiated • Synergy work begins - branch consolidations / c orporate headcount reductions • Combined sales tracking initiated • Synergy work continues • First wave of Mincron systems integration • CRM training begins • Finalize procurement consolidations • Account remapping completed • CRM roll out begins • Wave 2 - 4 of systems integrations completed • Synergy work continues JUL - 15 AUG/SEPT 15 OCT - 15 NOV - 15 DEC - 15 JAN - 16 FEB / APR - 16 • Active internal and external communication • Organization and systems integration • Focus on customer retention and positioning for growth

Investor Day | 2016 NASDAQ: BECN RSG Integration Next Steps 41 Continue Focus on Employees • Internal and external communication • Develop our people for career growth • Further “One Company. One Vision.” path Benchmark • Continue to deliver on the synergies • Refine daily and monthly routines Pivot Towards Growth • Protect the base business • Continue integration of growth strategies • Leverage expanded national geography 1 2 3

NASDAQ: BECN 42 Supply Chain Brendan Daly Executive VP & Chief Supply Chain Officer

Investor Day | 2016 NASDAQ: BECN $501 $532 $528 $595 $1,016 24.5% 23.7% 22.7% 23.7% 24.5% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% $0 $200 $400 $600 $800 $1,000 $1,200 Gross margin % Gross profit ($ in millions) Gross Margin 43 Soft residential demand & harsh winter weather drove pricing pressure Favorable mix and synergies from the RSG transaction drove gains

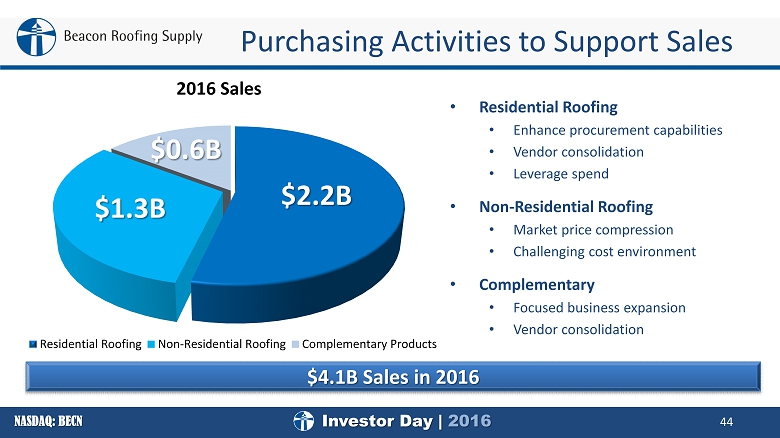

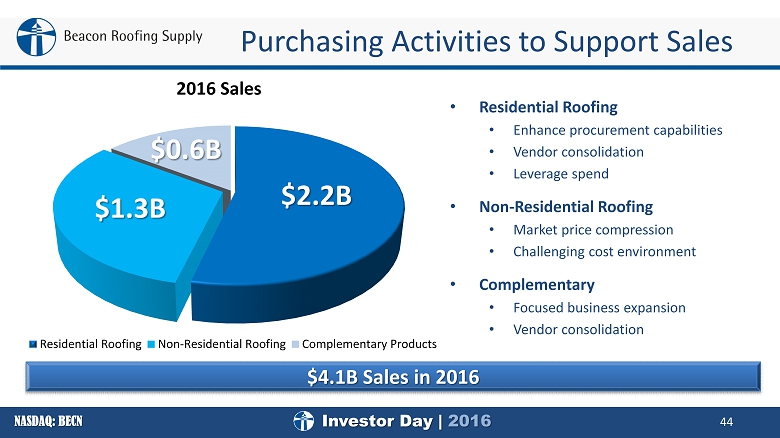

Investor Day | 2016 NASDAQ: BECN $4.1B Sales in 2016 2016 Sales 44 • Residential Roofing • Enhance procurement capabilities • Vendor consolidation • Leverage spend • Non - Residential Roofing • Market price compression • Challenging cost environment • Complementary • Focused business expansion • Vendor consolidation Purchasing Activities to Support Sales $ 2.2B $ 1.3B $ 0.6B Residential Roofing Non-Residential Roofing Complementary Products

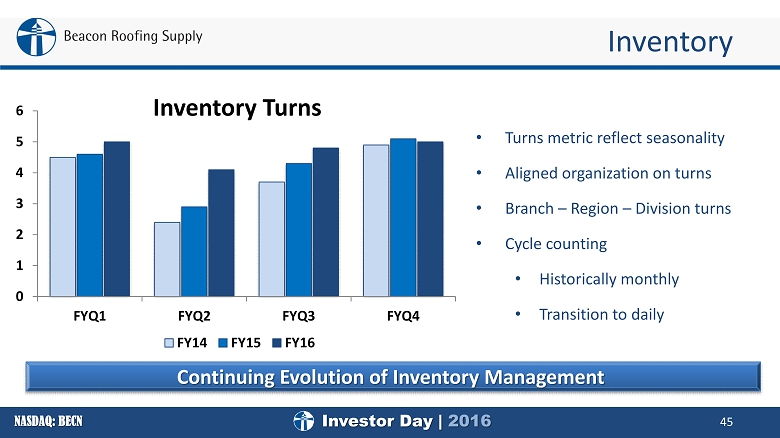

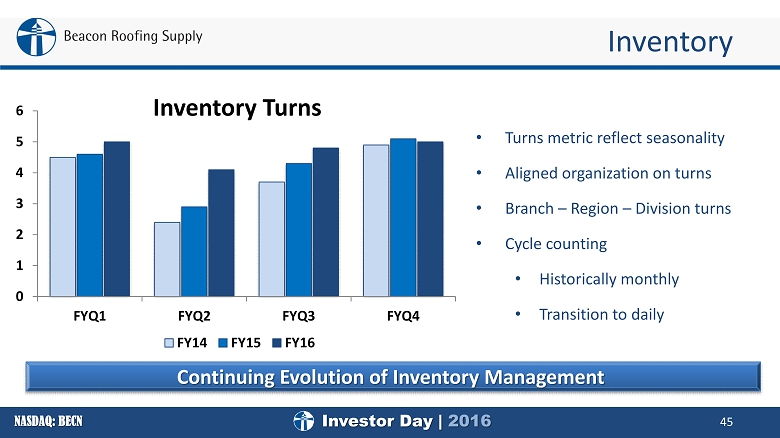

Investor Day | 2016 NASDAQ: BECN Inventory 45 • Turns metric reflect seasonality • Aligned organization on turns • Branch – Region – Division turns • Cycle counting • Historically monthly • Transition to daily Continuing Evolution of Inventory Management 0 1 2 3 4 5 6 FYQ1 FYQ2 FYQ3 FYQ4 Inventory Turns FY14 FY15 FY16

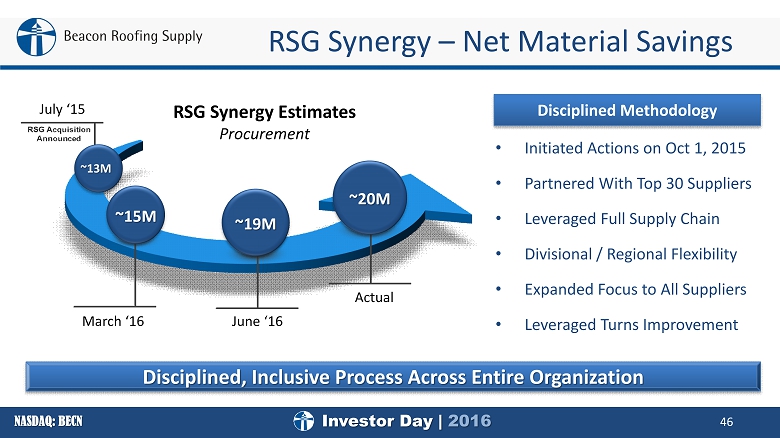

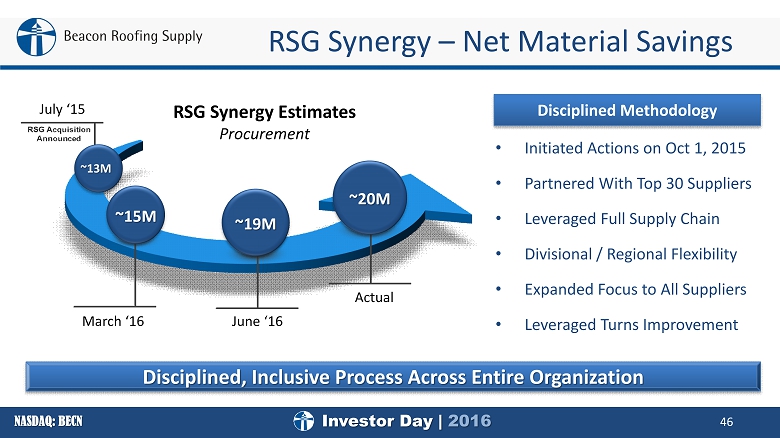

Investor Day | 2016 NASDAQ: BECN RSG Synergy – Net Material Savings 46 Disciplined Methodology RSG Synergy Estimates Procurement Disciplined, Inclusive Process Across Entire Organization • Initiated Actions on Oct 1, 2015 • Partnered With Top 30 Suppliers • Leveraged Full Supply Chain • Divisional / Regional Flexibility • Expanded Focus to All Suppliers • Leveraged Turns Improvement ~13M ~15M ~19M ~20M July ‘15 March ‘16 June ‘16 Actual

Investor Day | 2016 NASDAQ: BECN Easy To Do Business With 47 Agreements: Standard Terms, Effective Reporting Ordering: EDI Cost Data, Standard Units of Measure, Ease of Returns Receiving: Bar Coding, Green Packaging, Standard Documentation Invoicing: EDI Invoicing, Simple Credits, Shared Logistics Selling: Clear Labeling, Tech Support, Marketing Programs, Sales Leads Focus on Developing Key Relationships With Vendor Partners

Investor Day | 2016 NASDAQ: BECN 48 Long Term 23.5% - 25.5% Future Opportunities Current State • Strong , enabled supply chain team • Capable procurement methodologies • Focused centralized purchasing actions • Core inventory processes implemented • Base productivity programs for indirect/logistics Future State • Net exporter of talent to organization • Best in class procurement / robust training program • Fully leveraged, divisionally focused central purchasing • Optimized inventory processes for accuracy and velocity • Culturally embedded continuous improvement

NASDAQ: BECN 49 Morning Q&A All Beacon Executives 2016 Investor Day

NASDAQ: BECN 50 Lunch Break 12:00 PM – 12:30 PM 2016 Investor Day

NASDAQ: BECN 51 Kent Gardner Executive VP, West Division Operational Overview, Greenfields and Weather Dynamics

Investor Day | 2016 NASDAQ: BECN Agenda 52 • Branch Operations • Growth: Greenfields & Acquisitions • Weather Dynamics

Investor Day | 2016 NASDAQ: BECN Branch Operations: People 53 • Distribution Leadership Program ( DLP ) • Troops to Trucks • Rising Stars • 655 – Branch & Assistant Branch Managers • 2,465 Drivers, Delivery H elpers, Warehouse Workers • 674 – Inside Sales • 648 – Outside Sales Values Hiring & Training Programs Operational Employees x Results Oriented x Strong Work Ethic x Credibility x Discipline x Teamwork

Investor Day | 2016 NASDAQ: BECN • Safety Leadership • Inventory Control • Shipping / Receiving / Invoicing • Sales Leadership • Lead strategic i nitiatives • CRM adoption • Everyone sells Branch Operations: Branch Manager 54 Branch Manager Responsibilities

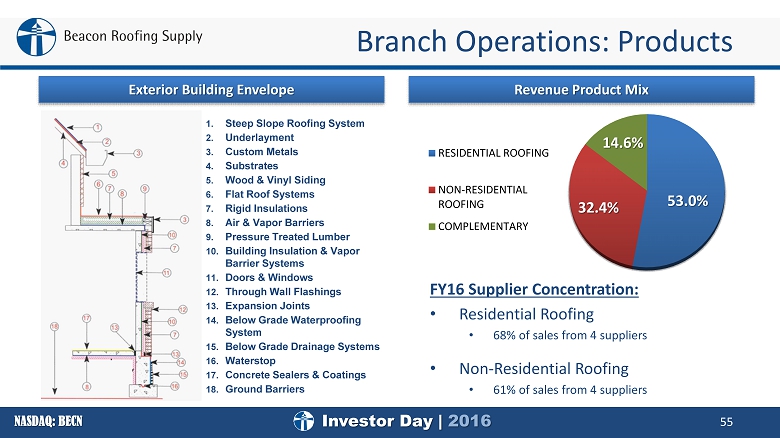

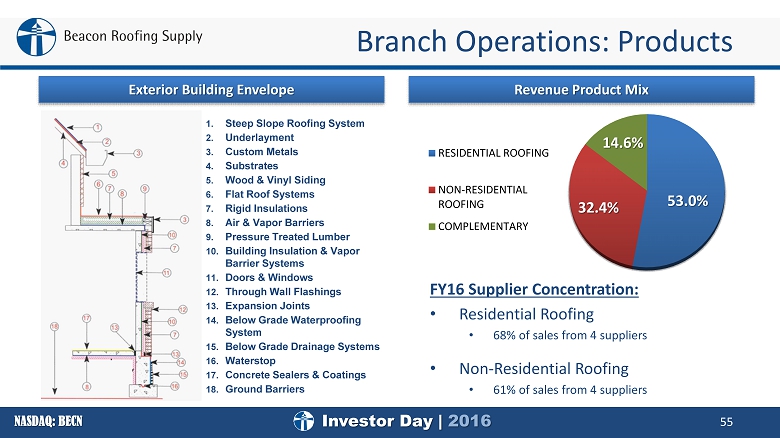

Investor Day | 2016 NASDAQ: BECN FY16 Supplier Concentration: • Residential Roofing • 68% of sales from 4 suppliers • Non - Residential Roofing • 61% of sales from 4 suppliers Branch Operations: Products 55 Exterior Building Envelope 1. Steep Slope Roofing System 2. Underlayment 3. Custom Metals 4. Substrates 5. Wood & Vinyl Siding 6. Flat Roof Systems 7. Rigid Insulations 8. Air & Vapor Barriers 9. Pressure Treated Lumber 10. Building Insulation & Vapor Barrier Systems 11. Doors & Windows 12. Through Wall Flashings 13. Expansion Joints 14. Below Grade Waterproofing System 15. Below Grade Drainage Systems 16. Waterstop 17. Concrete Sealers & Coatings 18. Ground Barriers Revenue Product Mix 53.0% 32.4% 14.6% RESIDENTIAL ROOFING NON-RESIDENTIAL ROOFING COMPLEMENTARY

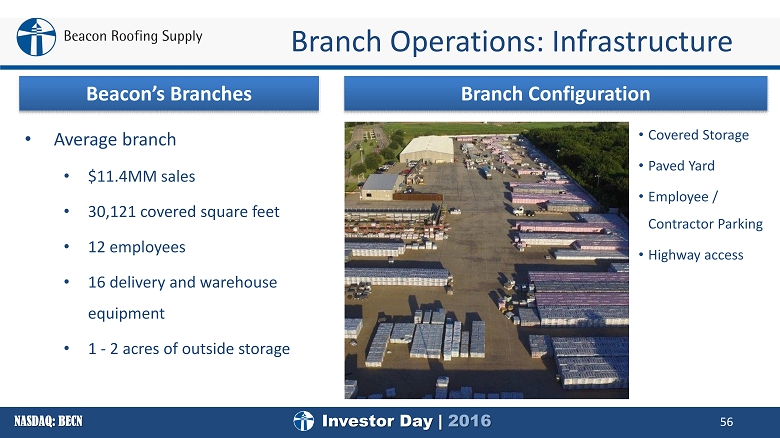

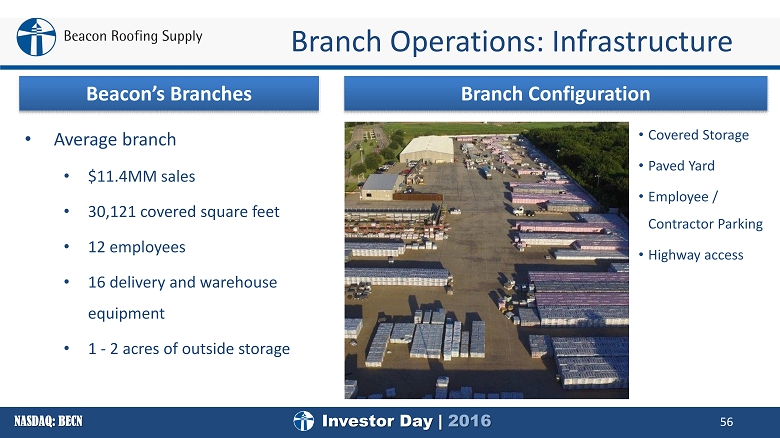

Investor Day | 2016 NASDAQ: BECN Branch Operations: Infrastructure 56 Beacon’s Branches • Average branch • $11.4MM sales • 30,121 covered square feet • 12 employees • 16 delivery and warehouse equipment • 1 - 2 acres of outside storage Branch Configuration • Covered Storage • Paved Yard • Employee / Contractor Parking • Highway access

Investor Day | 2016 NASDAQ: BECN 57 Beacon’s Fleet • 1,389 straight trucks • 538 tractors • 993 trailers • 1,216 warehouse forklifts • 1,656 units of specialized equipment: – Truck - mounted forklifts – Cranes – Hydraulic booms – Conveyors Branch Operations: Infrastructure

Investor Day | 2016 NASDAQ: BECN Branch Operations: Opportunities 58 People • DLP , Rising Star and other programs • Continued branch manager development Products • Vendor relationships • Inventory turns Infrastructure • Branch optimization

Investor Day | 2016 NASDAQ: BECN Growth: Greenfields 59 Adjacent Stand - Alone Storm • Defend position and profitability in existing markets • Open new submarket or product line • Increase market share • Continue sequential expansion • Efficiencies through shared oversight and leveraging assets • Brand expansion into white space markets • Zero market cannibalization • 100+ miles from existing branch • Support for traveling customer base • Temporary openings to quickly capitalize on storm activity • Reduced operating costs through repositioned assets • Limited capital spend through transfers from existing branches • Can shift to permanent branch if opportunity remains post - storm Existing Market Growth New Branch Openings Acquisitions Target Average Annual Growth + + =

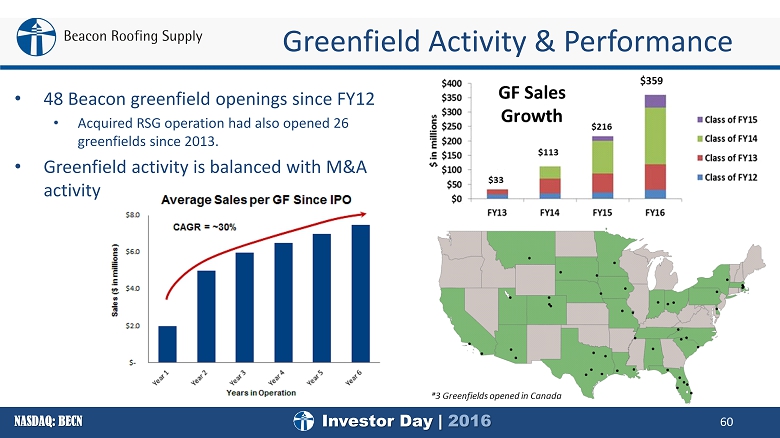

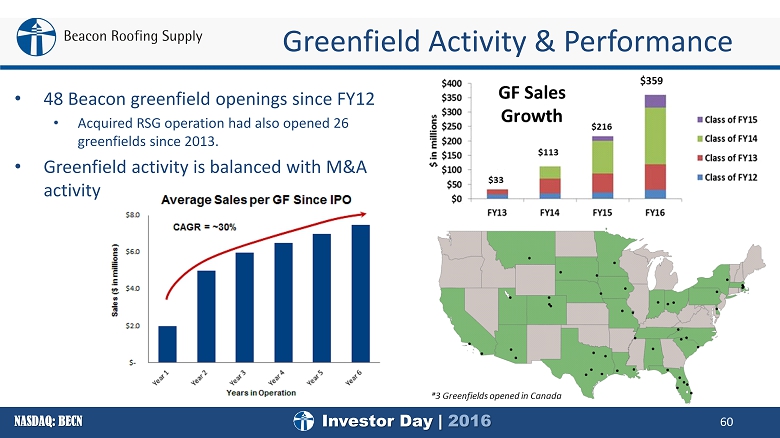

Investor Day | 2016 NASDAQ: BECN • 48 Beacon greenfield openings since FY12 • Acquired RSG operation had also opened 26 greenfields since 2013. • Greenfield activity is balanced with M&A activity Greenfield Activity & Performance 60

Investor Day | 2016 NASDAQ: BECN Greenfields will continue to be a strategic growth driver • Current footprint still allows for growth • 5 - 10 greenfields currently planned for FY17 Greenfield Expansion Opportunity 61

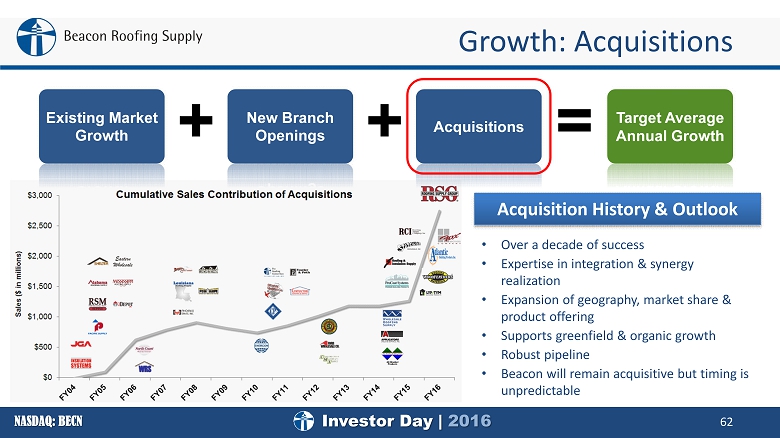

Investor Day | 2016 NASDAQ: BECN • Over a decade of success • Expertise in integration & synergy realization • Expansion of geography, market share & product offering • Supports greenfield & o rganic growth • Robust pipeline • Beacon will remain acquisitive but timing is unpredictable Growth: Acquisitions 62 Existing Market Growth New Branch Openings Acquisitions Target Average Annual Growth + + = Acquisition History & Outlook

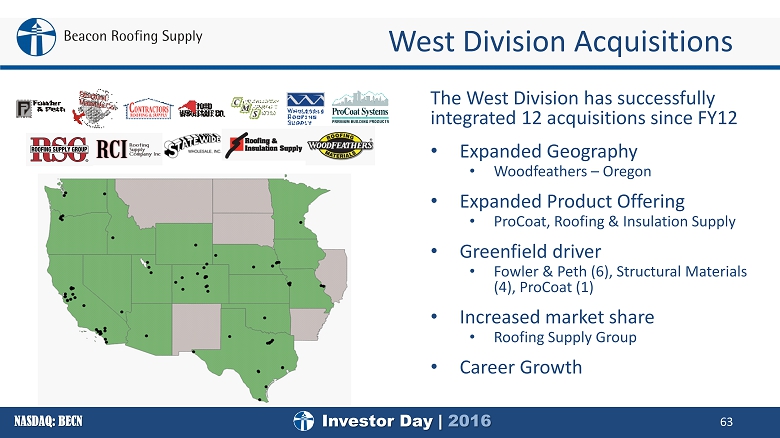

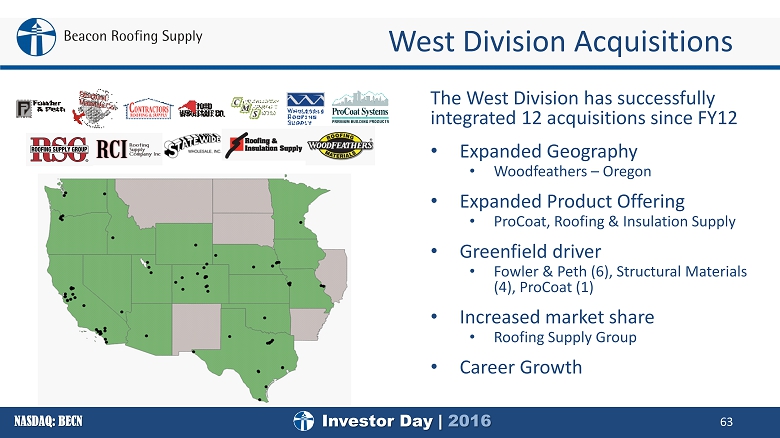

Investor Day | 2016 NASDAQ: BECN T he West Division has successfully integrated 12 acquisitions since FY12 • Expanded Geography • Woodfeathers – Oregon • Expanded Product Offering • ProCoat, Roofing & Insulation Supply • Greenfield driver • Fowler & Peth (6), Structural Materials (4), ProCoat (1) • Increased market share • Roofing Supply Group • Career Growth West Division Acquisitions 63

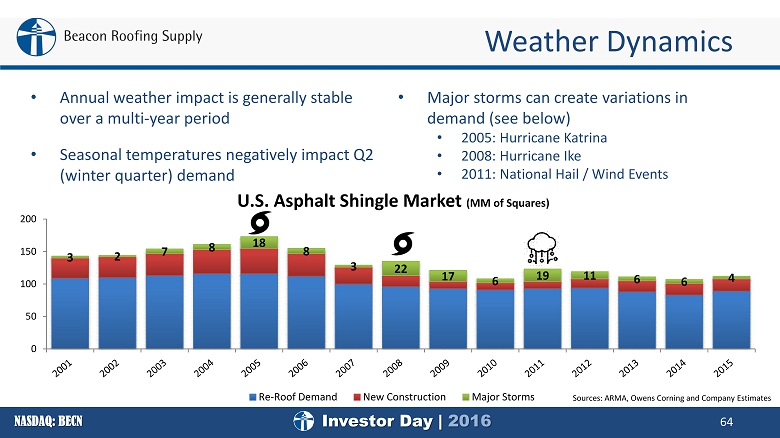

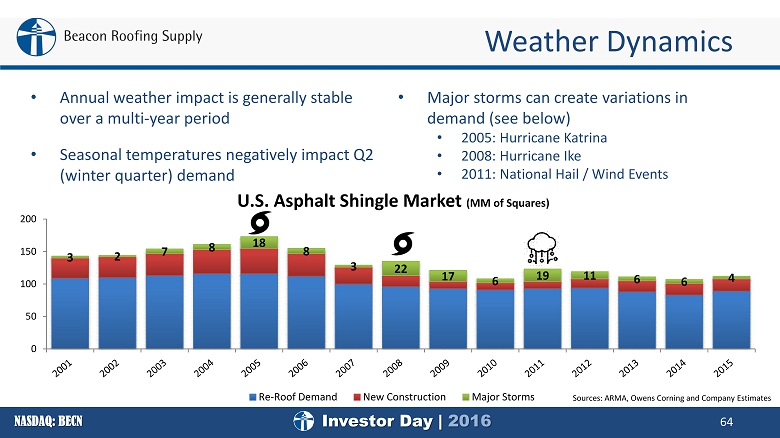

Investor Day | 2016 NASDAQ: BECN Weather Dynamics 64 • Annual weather impact is generally stable over a multi - year period • Seasonal temperatures negatively impact Q2 (winter quarter) demand • Major storms can create variations in demand (see below) • 2005: Hurricane Katrina • 2008: Hurricane Ike • 2011: National Hail / Wind Events 3 2 7 8 18 8 3 22 17 6 19 11 6 6 4 0 50 100 150 200 U.S. Asphalt Shingle Market (MM of Squares) Re-Roof Demand New Construction Major Storms Sources: ARMA, Owens Corning and Company Estimates

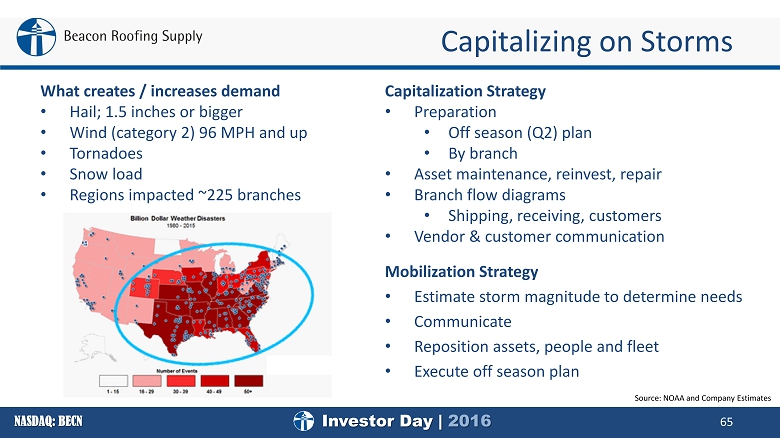

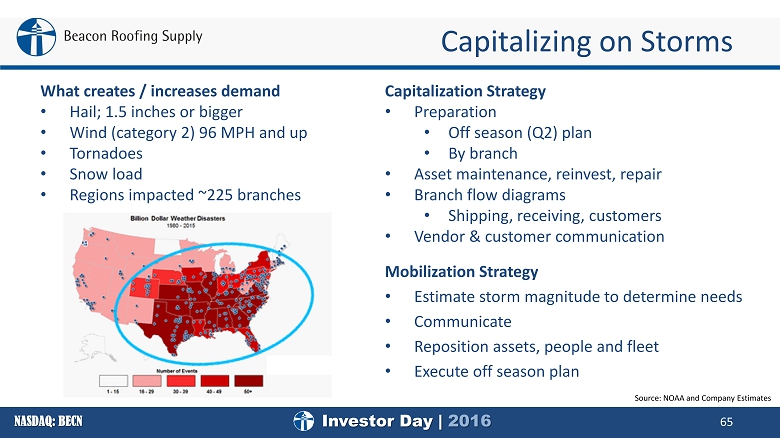

Investor Day | 2016 NASDAQ: BECN Capitalizing on Storms 65 Capitalization Strategy • Preparation • Off season (Q2) plan • By branch • Asset maintenance, reinvest, repair • Branch flow diagrams • Shipping, receiving, customers • Vendor & customer communication Mobilization Strategy • Estimate storm magnitude to determine needs • Communicate • Reposition assets, people and fleet • Execute off season plan What creates / increases demand • Hail; 1.5 inches or bigger • Wind (category 2) 96 MPH and up • Tornadoes • Snow load • Regions impacted ~ 225 branches Source: NOAA and Company Estimates

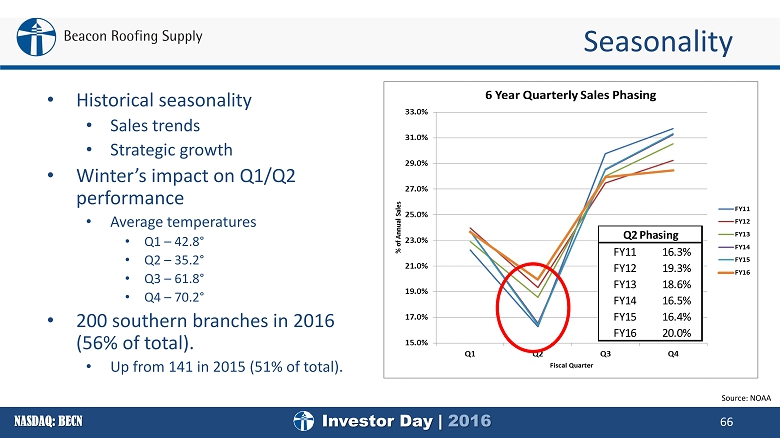

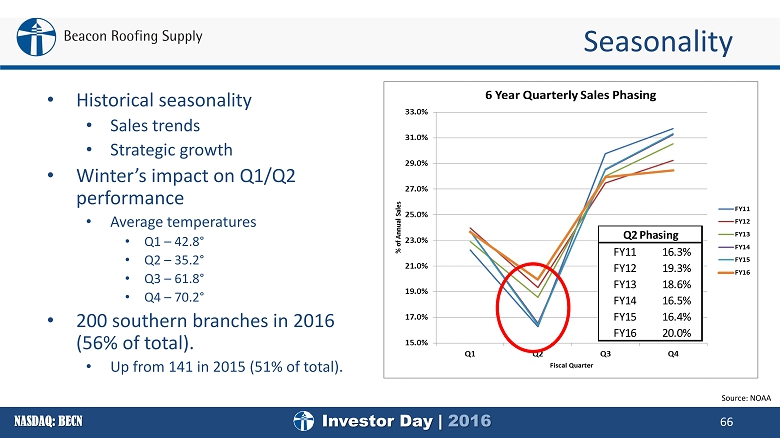

Investor Day | 2016 NASDAQ: BECN • Historical seasonality • Sales trends • Strategic growth • Winter’s impact on Q1/Q2 performance • Average temperatures • Q1 – 42.8 ° • Q2 – 35.2 ° • Q3 – 61.8 ° • Q4 – 70.2 ° • 200 southern branches in 2016 (56% of total). • Up from 141 in 2015 (51% of total). Seasonality 66 FY11 16.3% FY12 19.3% FY13 18.6% FY14 16.5% FY15 16.4% FY16 20.0% Q2 Phasing Source: NOAA

Investor Day | 2016 NASDAQ: BECN Improved Geographic Footprint 67 State Prior to 10 - 1 - 15 Current % Growth TX 24 36 50% PA 26 28 8% CA 16 24 50% NC 13 22 69% FL 12 17 42% CO 10 14 40% GA 8 14 75% MD 14 14 - MA 11 13 18% VA 9 13 44% MO 8 10 25% States With Largest Beacon Footprint Warm Climate / Year Round Roofing

NASDAQ: BECN 68 Joe Nowicki Executive VP & Chief Financial Officer Long - Term Growth and Fiscal 2017 Year Outlook

Investor Day | 2016 NASDAQ: BECN Key Strategic Tenets 69 • Attractive industry structure with substantial market growth opportunity • Growth strategy supported by multiple initiatives • Selling effectiveness model that drives market over - performance • Proven acquisition integration process • Disciplined supply chain model • Operational best practices across the network • Established greenfield development program

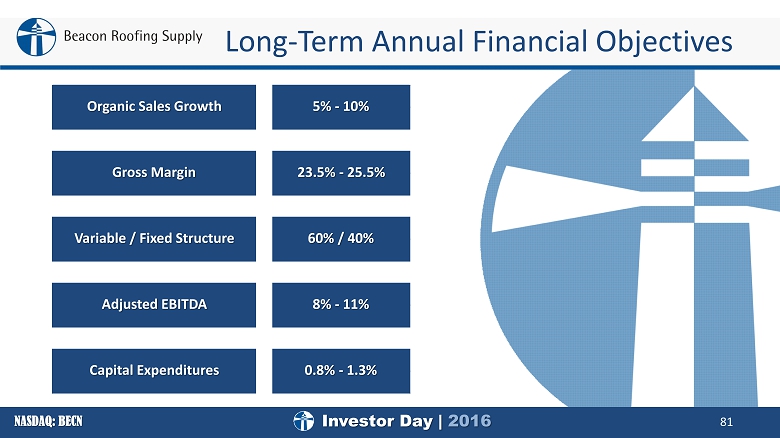

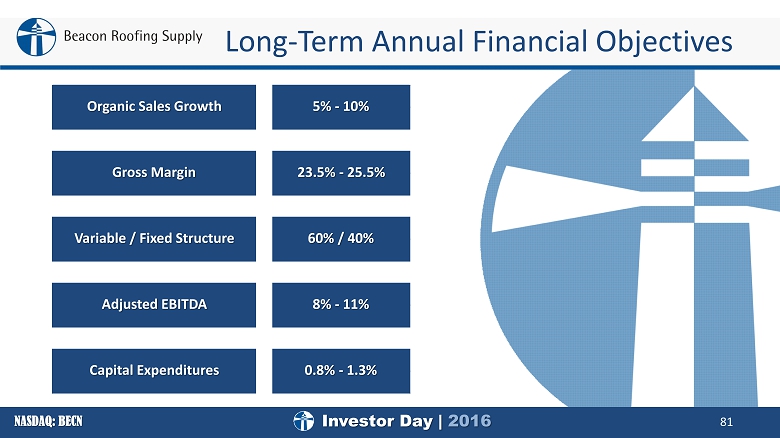

Investor Day | 2016 NASDAQ: BECN Long - Term Annual Financial Objectives 70 Capital Expenditures 23.5% - 25.5% 60% / 40% 8% - 11% 0.8% - 1.3% Organic Sales Growth 5% - 10% Gross Margin Variable / Fixed Structure Adjusted EBITDA

Investor Day | 2016 NASDAQ: BECN Long - Term Revenue Growth Outlook 71 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 Net Sales Since IPO Annual Sales Growth Market Growth 3% - 6% Market O utperformance 2% - 4% Organic Growth 5% - 10% + Acquisitions = Total Long Term Sales Growth

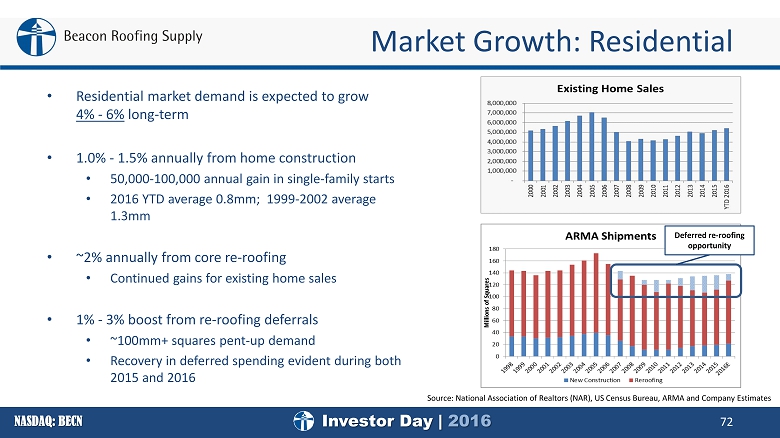

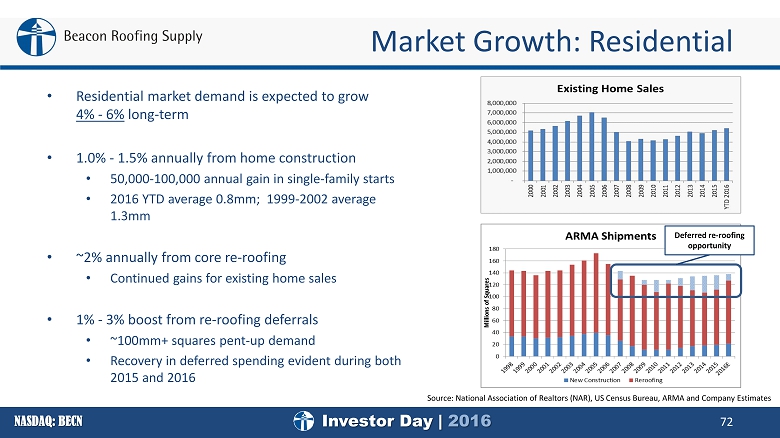

Investor Day | 2016 NASDAQ: BECN • R esidential market demand is expected to grow 4% - 6% long - term • 1.0% - 1.5 % annually from home construction • 50,000 - 100,000 annual gain in single - family starts • 2016 YTD average 0.8mm; 1999 - 2002 average 1.3mm • ~2% annually from core re - roofing • Continued gains for existing home sales • 1% - 3 % boost from re - roofing deferrals • ~100mm + squares pent - up demand • Recovery in deferred spending evident during both 2015 and 2016 Market Growth: Residential 72 Source: National Association of Realtors (NAR), US Census Bureau, ARMA and Company Estimates Deferred re - roofing opportunity

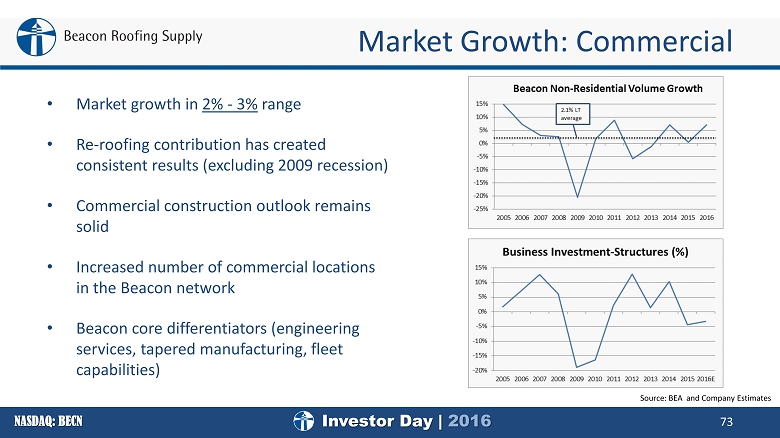

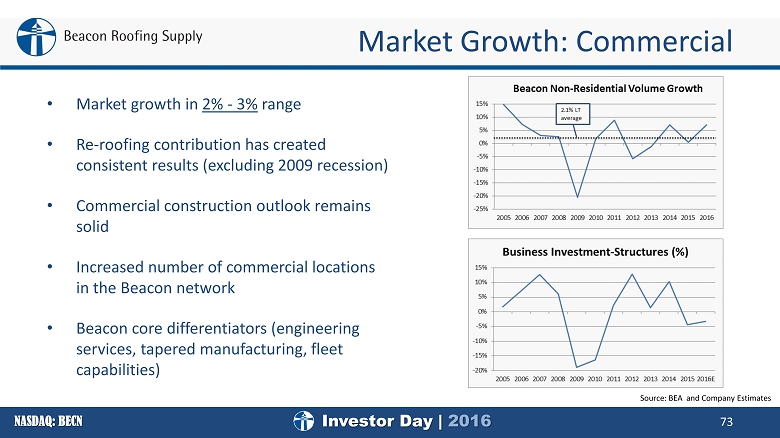

Investor Day | 2016 NASDAQ: BECN • Market growth in 2% - 3% range • Re - roofing contribution has created consistent results (excluding 2009 recession) • Commercial construction outlook remains solid • I ncreased number of commercial locations in the Beacon network • Beacon core differentiators (engineering services, tapered manufacturing, fleet capabilities) Market Growth: Commercial 73 Source: BEA and Company Estimates

Investor Day | 2016 NASDAQ: BECN • Favorable cyclical backdrop supports 5% - 6 % end market gains • Primary product lines are siding, windows and doors • Less weather sensitivity than other product lines, but greater economic cyclicality • Growth driven by home improvement and new construction Market Growth: Complementary 74 Source: US Census Bureau, National Association of Home Builders (NAHB)

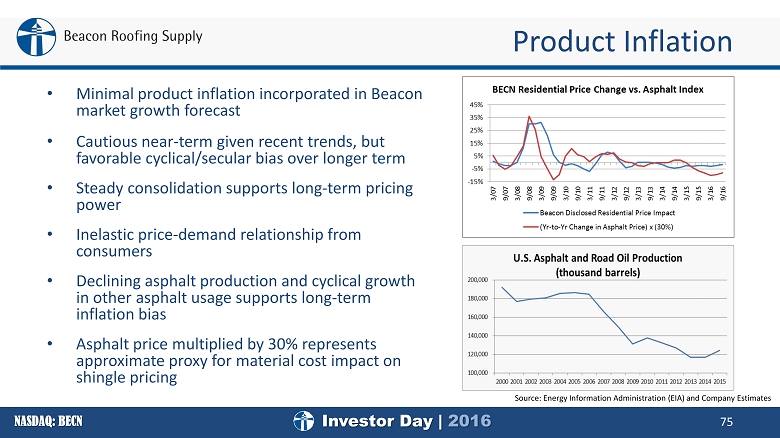

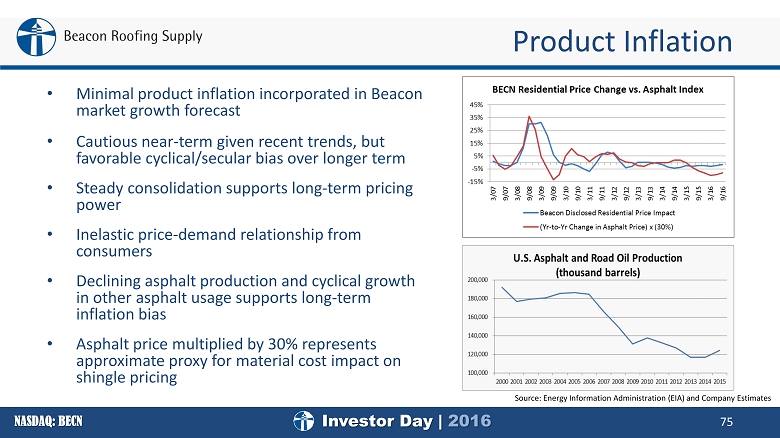

Investor Day | 2016 NASDAQ: BECN • Minimal product inflation incorporated in Beacon market growth forecast • Cautious near - term given recent trends, but favorable cyclical/secular bias over longer term • Steady consolidation supports long - term pricing power • Inelastic price - demand relationship from consumers • Declining asphalt production and cyclical growth in other asphalt usage supports long - term inflation bias • Asphalt price multiplied by 30% represents approximate proxy for material cost impact on shingle pricing Product Inflation 75 Source: Energy Information Administration (EIA) and Company Estimates

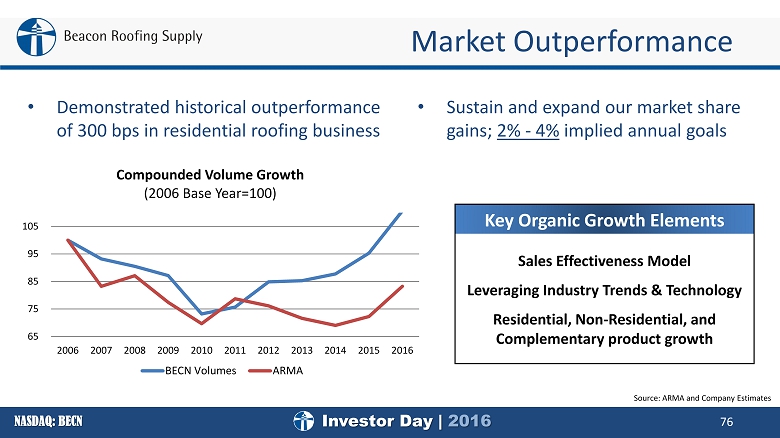

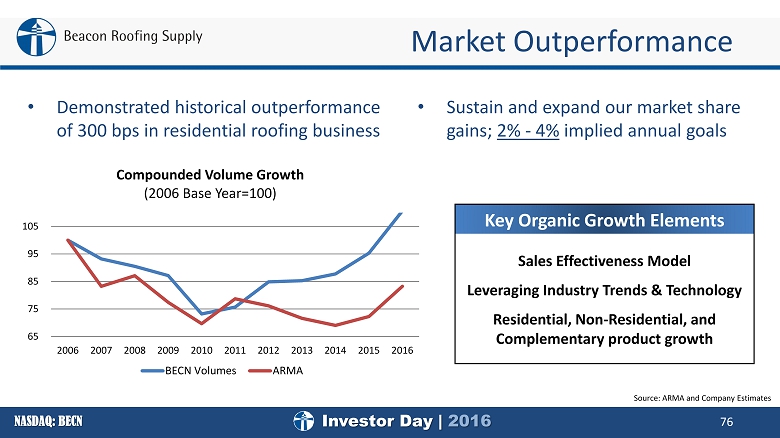

Investor Day | 2016 NASDAQ: BECN • Sustain and expand our market share gains; 2% - 4% implied annual goals Market Outperformance 76 • Demonstrated historical outperformance of 300 bps in residential roofing business Key Organic Growth Elements Sales Effectiveness Model Leveraging Industry Trends & Technology Residential, Non - Residential, and Complementary product growth 65 75 85 95 105 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Compounded Volume Growth ( 2006 Base Year=100) BECN Volumes ARMA Source: ARMA and Company Estimates

Investor Day | 2016 NASDAQ: BECN Greenfield Growth 77 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 # Opens 3 6 6 8 1 3 0 3 4 10 26 6 1 0 5 10 15 20 25 30 Greenfield Openings By Year • Plan to open 5 - 10 annually • New branch openings remain an important part of the Beacon organic growth story Greenfield Sales Growth

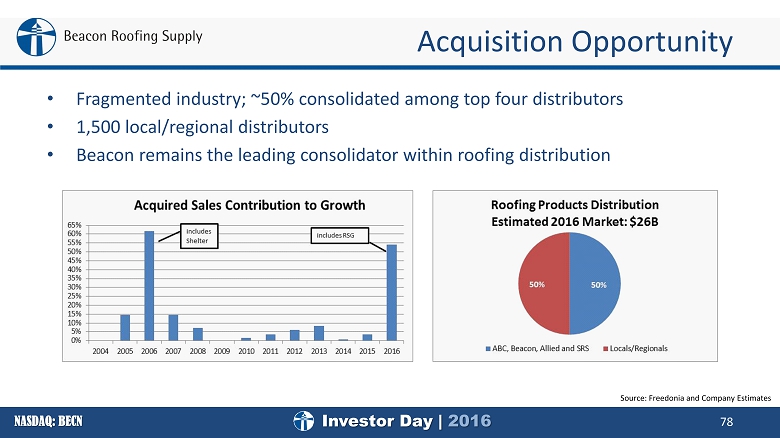

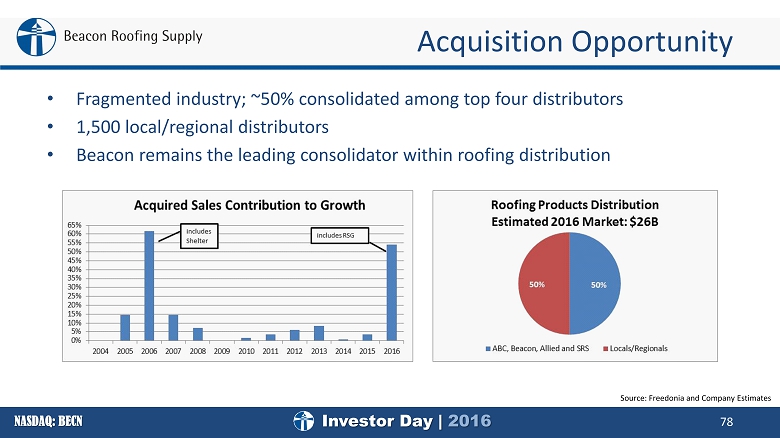

Investor Day | 2016 NASDAQ: BECN • Fragmented industry; ~50% consolidated among top four distributors • 1,500 local/regional distributors • Beacon remains the leading consolidator within roofing distribution Acquisition Opportunity 78 Source: Freedonia and Company Estimates

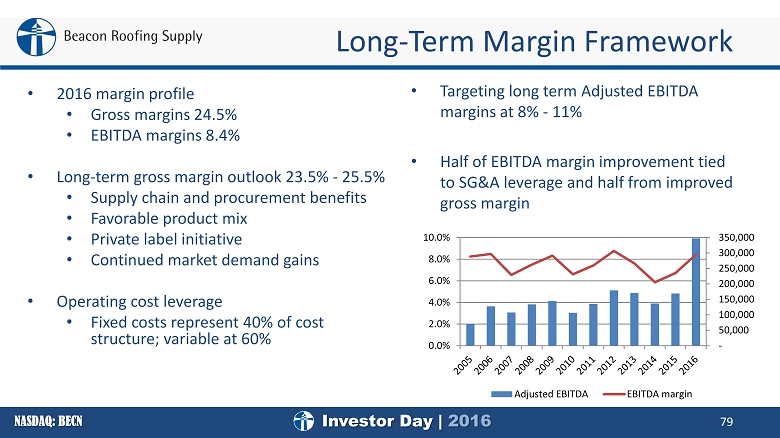

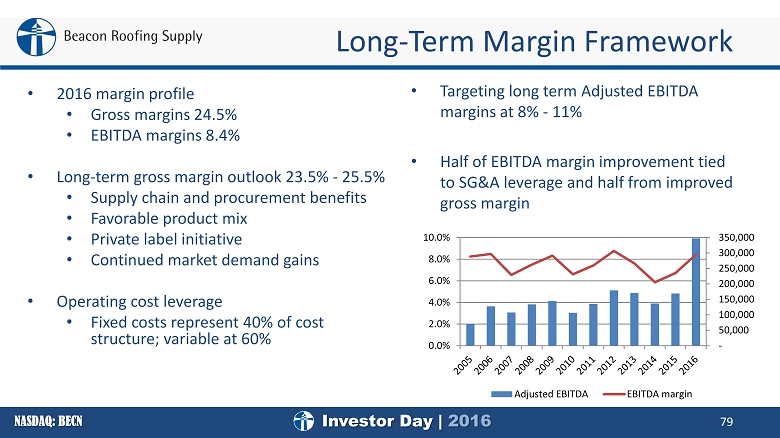

Investor Day | 2016 NASDAQ: BECN • 2016 margin profile • Gross margins 24.5% • EBITDA margins 8.4% • Long - term gross margin outlook 23.5% - 25.5% • Supply chain and procurement benefits • Favorable product mix • Private label initiative • Continued market demand gains • Operating cost leverage • Fixed costs represent 40% of cost structure; variable at 60% Long - Term Margin Framework 79 • Targeting long term Adjusted EBITDA margins at 8% - 11% • Half of EBITDA margin improvement tied to SG&A leverage and half from improved gross margin - 50,000 100,000 150,000 200,000 250,000 300,000 350,000 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% Adjusted EBITDA EBITDA margin

Investor Day | 2016 NASDAQ: BECN Demonstrated SG&A Leverage 80 16.5% 17.0% 17.5% 18.0% 18.5% 19.0% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Percentage of Sales Operating Cost Comparison SG&A SG&A (excluding amortization) *Above numbers represent GAAP, except for FY15 - FY16 excluding non - recurring RSG integration related expenses • Amortization averaged 0.68% of sales in the 10 years 2016 - 2015 • Due primarily to the purchase of RSG, amortization increased to 1.65% of sales in FY2016 • Based on the mid - point of our current 2017 sales projection, full GAAP amortization in 2017 will be 1.80 - 1.85% of sales • Assuming no additional acquisitions, intangible amortization peaks in 2017

Investor Day | 2016 NASDAQ: BECN Long - Term Annual Financial Objectives 81 Capital Expenditures 23.5% - 25.5% 60% / 40% 8% - 11% 0.8% - 1.3% Organic Sales Growth 5% - 10% Gross Margin Variable / Fixed Structure Adjusted EBITDA

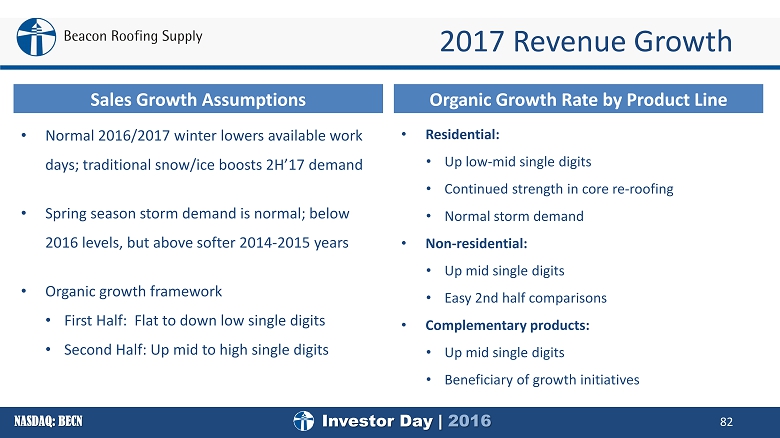

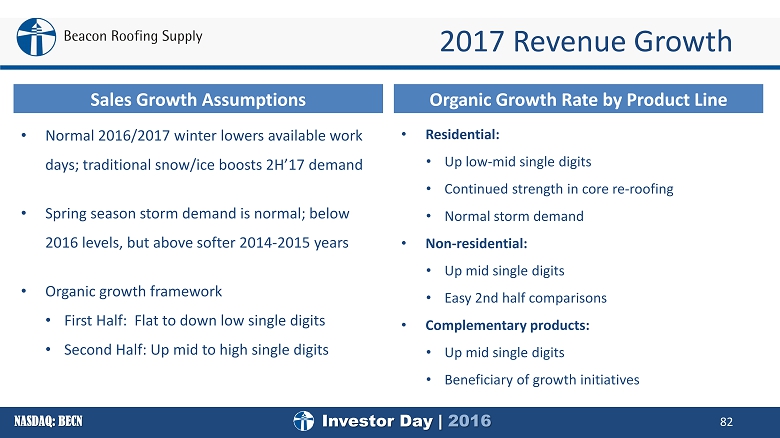

Investor Day | 2016 NASDAQ: BECN 2017 Revenue Growth 82 Sales Growth Assumptions • Normal 2016/2017 winter lowers available work days; traditional snow/ice boosts 2H’17 demand • Spring season storm demand is normal; below 2016 levels, but above softer 2014 - 2015 years • Organic growth framework • First Half: Flat to down low single digits • Second Half: Up mid to high single digits Organic Growth Rate by Product Line • Residential: • Up low - mid single digits • Continued strength in core re - roofing • Normal storm demand • Non - residential: • Up mid single digits • Easy 2nd half comparisons • Complementary products: • Up mid single digits • Beneficiary of growth initiatives

Investor Day | 2016 NASDAQ: BECN 2017 Margin Expectations 83 • Gross Margins • Targeting 24.5% - 24.6%, levels flat to +10 bps vs. 2016 • Positives: Full - year procurement synergies, corporate structural advances, private label, complementary products expansion, greenfield maturation • Headwinds: Competitive pricing pressures, product mix shift • Operating Costs • Adjusted SG&A: 20 - 40 bps improvement versus 2016 • Positives: Full - year RSG synergies, fixed cost leverage, operating cost efficiencies • Headwinds: Higher D&A, growth oriented investments

Investor Day | 2016 NASDAQ: BECN Balance Sheet Metrics 84 4.3x 3.6x 3.3x 2.0x 10/1/2015 Proforma 3/31/2016 9/30/2016 FY18 Goal Net Debt Leverage 1.6% 0.8% 0.6% 0.8% - 1.3% 2014 2015 2016 Long Term Capital Expenditures as % of Sales 20.6% 18.6% 18.5% 17.5 - 18.5% 2014 2015 2016 Long Term Working Capital as % of Sales 0 1 2 3 4 5 6 FYQ1 FYQ2 FYQ3 FYQ4 Inventory Turns FY14 FY15 FY16

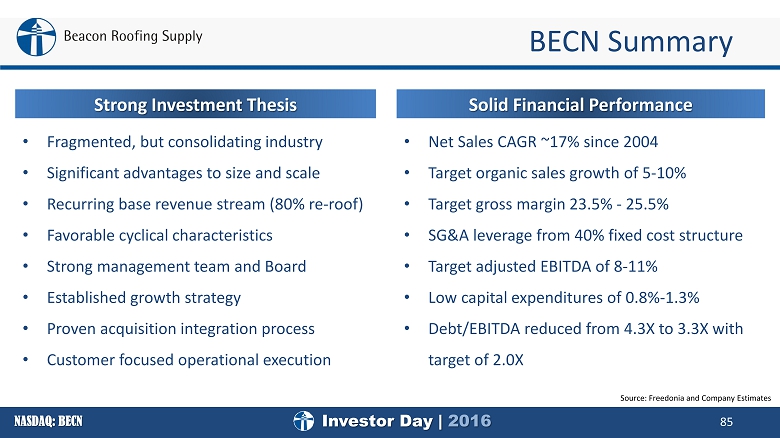

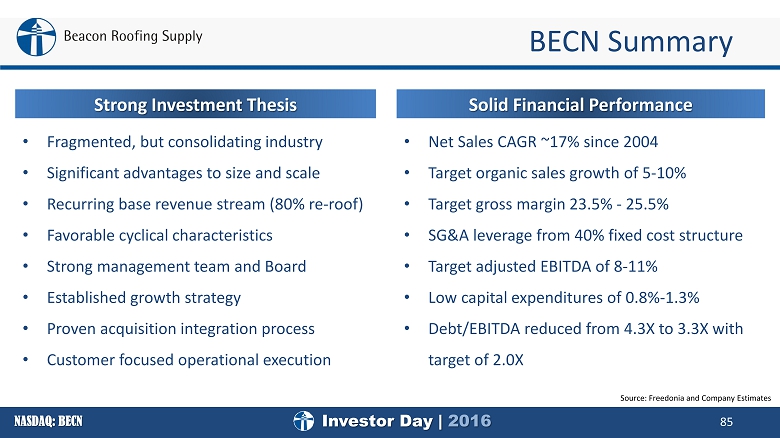

Investor Day | 2016 NASDAQ: BECN 85 Strong Investment Thesis Solid Financial Performance • Fragmented, but consolidating industry • Significant advantages to size and scale • Recurring base revenue stream (80% re - roof) • Favorable cyclical characteristics • Strong management team and Board • Established growth strategy • Proven acquisition integration process • Customer focused operational execution • Net Sales CAGR ~17% since 2004 • Target organic sales growth of 5 - 10% • Target gross margin 23.5% - 25.5% • SG&A leverage from 40% fixed cost structure • Target adjusted EBITDA of 8 - 11% • Low capital expenditures of 0.8% - 1.3% • Debt/EBITDA reduced from 4.3X to 3.3X with target of 2.0X BECN Summary Source: Freedonia and Company Estimates

NASDAQ: BECN 86 Afternoon Q&A All Beacon Executives 2016 Investor Day