QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

KANBAY INTERNATIONAL, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

KANBAY INTERNATIONAL, INC.

6400 Shafer Court, Suite 100

Rosemont, Illinois 60018

May 2, 2005

Dear Kanbay Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Kanbay International, Inc. to be held at 8:30 a.m. local time on Tuesday, June 14, 2005, at The Westin O'Hare Hotel, 6100 North River Road, Rosemont, Illinois 60018.

The purpose of the meeting is to consider and vote upon proposals to (i) elect three directors who have been nominated for election, (ii) ratify the appointment of our independent registered public accounting firm for 2005 and (iii) transact such other business as may properly come before the meeting.

Whether or not you plan to attend the meeting and regardless of the number of shares you own, it is important that your shares be represented at the meeting. After reading the enclosed proxy statement, please promptly mark, sign, date and return the enclosed proxy card in the prepaid envelope to assure that your shares will be represented.

The board of directors and management appreciate your continued confidence in Kanbay, and look forward to seeing you at the annual meeting.

KANBAY INTERNATIONAL, INC.

6400 Shafer Court, Suite 100

Rosemont, Illinois 60018

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held June 14, 2005

May 2, 2005

Dear Kanbay Stockholder:

We are notifying you that the annual meeting of stockholders of Kanbay International, Inc. will be held at 8:30 a.m. local time on Tuesday, June 14, 2005 at The Westin O'Hare Hotel, 6100 North River Road, Rosemont, Illinois 60018 for the following purposes:

1. To elect three directors, each for a term of three years.

2. To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2005.

3. To transact other business properly coming before the meeting.

Each of these matters is described in further detail in the enclosed proxy statement. We also have enclosed a copy of our 2004 Annual Report. We are initially mailing this notice of annual meeting, the proxy statement and the enclosed proxy card to our stockholders on or about May 2, 2005.

Only stockholders of record at the close of business on April 18, 2005 are entitled to vote at the meeting and any postponements or adjournments of the meeting. A complete list of these stockholders will be available at our principal executive offices prior to the meeting.

Whether or not you plan to attend the meeting, please complete the enclosed proxy card and return it in the envelope provided as promptly as possible or vote electronically through the Internet or by telephone. Your proxy can be withdrawn by you at any time before it is voted.

By order of the Board of Directors,

WILLIAM F. WEISSMAN

Executive Vice President, Chief Financial Officer and Secretary

Table of Contents

| I. | | ABOUT THE MEETING | | 1 |

| | | What is the purpose of the annual meeting? | | 1 |

| | | What are our voting recommendations? | | 1 |

| | | Who is entitled to vote? | | 1 |

| | | What constitutes a quorum? | | 1 |

| | | How do I vote? | | 1 |

| | | Can I revoke my proxy or change my vote after I return my proxy card or after I vote electronically or by telephone? | | 2 |

| | | What vote is required to approve each matter that comes before the meeting? | | 2 |

| | | What happens if additional proposals are presented at the meeting? | | 2 |

| | | Who will bear the costs of soliciting votes for the meeting? | | 2 |

II. |

|

PROPOSALS TO BE VOTED ON |

|

3 |

| | | Proposal 1—Election of Directors | | 3 |

| | | Proposal 2—Ratification of the Selection of Independent Registered

Public Accounting Firm | | 3 |

III. |

|

BOARD OF DIRECTORS |

|

3 |

| | | Board Structure and Composition | | 3 |

| | | Independent Directors | | 6 |

| | | Committees of the Board of Directors | | 6 |

| | | Code of Ethics | | 8 |

| | | Criteria for Nominating Directors | | 8 |

| | | Director Compensation | | 9 |

| | | Compensation Committee Interlocks and Insider Participation | | 10 |

IV. |

|

STOCK OWNERSHIP |

|

10 |

| | | Security Ownership of Certain Beneficial Owners and Management | | 10 |

| | | Section 16(a) Beneficial Ownership Reporting Compliance | | 13 |

V. |

|

EXECUTIVE COMPENSATION |

|

13 |

| | | Executive Officers | | 13 |

| | | Summary Compensation Table | | 14 |

| | | Option Grants in Last Fiscal Year | | 15 |

| | | Aggregate Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values | | 16 |

| | | Severance Agreements | | 16 |

| | | Securities Authorized for Issuance under Equity Compensation Plans | | 17 |

| | | Stock Option Plan | | 17 |

| | | Stock Incentive Plan | | 17 |

| | | Global Leadership Bonus Plan | | 18 |

| | | Employee Stock Purchase Plan | | 19 |

| | | 401(k) Plan | | 19 |

| | | Report of the Compensation Committee on Executive Compensation | | 20 |

VI. |

|

PERFORMANCE GRAPH |

|

22 |

VII. |

|

CERTAIN TRANSACTIONS |

|

22 |

i

VIII. |

|

FEES OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

AND AUDIT COMMITTEE REPORT |

|

24 |

| | | Fees Billed by Independent Registered Public Accounting Firm | | 24 |

| | | Report of the Audit Committee | | 25 |

IX. |

|

2006 ANNUAL MEETING OF STOCKHOLDERS |

|

26 |

X. |

|

"HOUSEHOLDING" OF PROXY MATERIALS |

|

26 |

XI. |

|

VOTING THROUGH THE INTERNET OR BY TELEPHONE |

|

26 |

ii

KANBAY INTERNATIONAL, INC.

6400 Shafer Court, Suite 100

Rosemont, Illinois 60018

PROXY STATEMENT

The Board of Directors of Kanbay International, Inc. is asking for your proxy for use at the annual meeting of our stockholders to be held at 8:30 a.m. local time on Tuesday, June 14, 2005, at The Westin O'Hare Hotel, 6100 North River Road, Rosemont, Illinois 60018, and at any postponements or adjournments of the meeting. We are initially mailing this proxy statement and the enclosed proxy card to our stockholders on or about May 2, 2005.

I. ABOUT THE MEETING

At our annual meeting, stockholders will act upon the matters outlined in the accompanying notice of annual meeting, including the election of three directors and the ratification of the selection of our independent registered public accounting firm.

Our board of directors recommends that you vote your shares "FOR" the election of each of the nominees named below under "Proposal 1—Election of Directors" and "FOR" the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm discussed below under "Proposal 2—Ratification of the Selection of Independent Registered Public Accounting Firm."

Only stockholders of record at the close of business on the record date, April 18, 2005, are entitled to receive notice of the annual meeting and to vote the shares of common stock that they held on the record date at the meeting, and any postponements or adjournments of the meeting. Each outstanding share of common stock entitles its holder to cast one vote, without cumulation, on each matter to be voted on.

If a majority of the shares outstanding on the record date are present at the annual meeting, either in person or by proxy, we will have a quorum at the meeting permitting the conduct of business at the meeting. As of the record date, we had 33,978,767 shares of common stock outstanding and entitled to vote. Any shares represented by proxies that are marked to abstain from voting on a proposal will be counted as present for purposes of determining whether we have a quorum. If a broker, bank, custodian, nominee or other record holder of our common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular matter, the shares held by that record holder (referred to as "broker non-votes") will also be counted as present in determining whether we have a quorum.

You may vote in person at the annual meeting or you may vote by proxy. You may vote by proxy by completing, signing, dating and mailing the enclosed proxy card or by telephone or through the Internet using the instructions set forth on the enclosed proxy card. The Internet and telephone voting

1

system for stockholders of record will close at 11:59 p.m., Eastern Standard Time, on Monday, June 13, 2005. If you vote by proxy, the individuals named on the proxy card as proxy holders will vote your shares in the manner you indicate. If you sign and return the proxy card without indicating your instructions, your shares will be voted "FOR:"

- •

- the election of the three nominees named below under "Proposal 1—Election of Directors;" and

- •

- the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2005 discussed below under "Proposal 2—Ratification of the Selection of Independent Registered Public Accounting Firm."

Can I revoke my proxy or change my vote after I return my proxy card or after I vote electronically

or by telephone?

Yes. Even after you have submitted your proxy, you may revoke your proxy or change your vote at any time before the proxy is voted at the annual meeting by delivering to our Secretary a written notice of revocation or a properly signed proxy bearing a later date, or by attending the annual meeting and voting in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request. To revoke a proxy previously submitted electronically through the Internet or by telephone, you may simply vote again at a later date, using the same procedures, in which case the later submitted vote will be recorded and the earlier vote revoked.

Director nominees must receive the affirmative vote of a plurality of the votes cast at the meeting by stockholders entitled to vote thereon, meaning that the three nominees for director with the most votes will be elected. The ratification of the selection of our independent registered public accounting firm requires the affirmative vote of a majority of the votes cast at the meeting in person or by proxy by stockholders entitled to vote thereon. Abstentions and broker non-votes will not be counted for purposes of determining whether an item has received the requisite number of votes for approval.

Other than the matters described in this proxy statement, we do not expect any additional matters to be presented for a vote at the annual meeting. If you vote by proxy, your proxy grants the persons named as proxy holders the discretion to vote your shares on any additional matters properly presented for a vote at the meeting.

Certain directors, officers and employees, who will not receive any additional compensation for such activities, may solicit proxies by personal interview, mail, telephone or electronic communication. We will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our stockholders. We shall bear all costs of solicitation.

2

II. PROPOSALS TO BE VOTED ON

Our board of directors is currently comprised of eight directors. Our certificate of incorporation provides for a classified board of directors consisting of three classes of the same or nearly the same number. The nominees for director this year are: Cyprian D'Souza, B. Douglas Morriss and Harry C. Gambill. Information about the director nominees, the continuing directors and our board of directors is contained in the section of this proxy statement entitled "Board of Directors—Board Structure and Composition."

In the event a nominee is not available to serve for any reason when the election occurs, it is intended that the proxies will be voted for the election of the other nominees and may be voted for any substitute nominee. Our board of directors has no reason to believe that any of the nominees will not be a candidate or, if elected, will be unable or unwilling to serve as a director.

Our board of directors recommends that you vote "FOR" the election of Cyprian D'Souza, B. Douglas Morriss and Harry C. Gambill.

Ernst & Young LLP audited our financial statements for our fiscal year ended December 31, 2004, and has been selected by the audit committee of our board of directors to audit our financial statements for fiscal year ending December 31, 2005. A representative of Ernst & Young LLP is expected to attend our annual meeting, where he or she will have the opportunity to make a statement, if he or she desires, and will be available to respond to appropriate questions.

Stockholder ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm is not required by our by-laws or otherwise. However, we are submitting the selection of Ernst & Young LLP to our stockholders for ratification as a matter of good corporate practice. If our stockholders fail to ratify the selection, our audit committee will review its future selection of independent registered public accounting firms. Even if the selection is ratified, the audit committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of our company and our stockholders.

For information regarding audit and other fees billed by Ernst & Young LLP for services rendered with respect to fiscal years 2004 and 2003, see the section of this proxy statement entitled "Fees of Independent Registered Public Accounting Firm and Audit Committee Report—Fees Billed by Independent Registered Public Accounting Firm."

Our board of directors recommends that you vote "FOR" the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm.

III. BOARD OF DIRECTORS

Our board of directors is currently comprised of eight directors. Our certificate of incorporation provides for a classified board of directors consisting of three classes of the same or nearly the same number.

- •

- Cyprian D'Souza, B. Douglas Morriss and Harry C. Gambill serve in the class with a term that expires on the date of the upcoming annual meeting of stockholders.

- •

- Mark L. Gordon, Michael E. Mikolajczyk and Raymond J. Spencer serve in the class with a term that expires on the date of the annual meeting of stockholders to be held in 2006.

3

- •

- Donald R. Caldwell and Kenneth M. Harvey serve in the class with a term that expires on the date of the annual meeting of stockholders to be held in 2007.

Upon the expiration of the term of each class of directors, directors of that class may be re-elected for a three-year term at the annual meeting of stockholders in the year in which their term expires. Our certificate of incorporation provides that the authorized number of directors may be changed only by resolution of the board of directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the total number of directors. Our certificate of incorporation also provides that our board of directors may fill any vacancy created by the resignation of a director or the increase in the size of the board of directors.

Nominees for election at this meeting for terms expiring in 2008:

Cyprian D'Souza, 49, has served as a director and Chief People Officer since 1995, and also serves as the Managing Director of our Indian subsidiary. Mr. D'Souza joined Kanbay in 1993 as the Joint Managing Director of our Indian subsidiary. In 1995, he led the development of our offshore delivery center in Pune, India. Prior to joining Kanbay, Mr. D'Souza was employed by the Institute of Cultural Affairs (ICA), a not-for-profit development organization. When he left ICA in 1989, he was a member of the Executive Council of ICA and was responsible for governance, strategy and operations at ICA. In 1989, Mr. D'Souza started an independent consulting firm focused on organizational transformation, with clients that included Morgan Stanley, Dupont, KPMG Peat Marwick, the TATA group of companies, Pepsi and Kanbay. Mr. D'Souza previously served on various boards of the JK Group (India) of companies and currently serves as a director of the Mercedes Benz Education Academy.

B. Douglas Morriss, 42, has been a director since December 2003. Since January 1999, Mr. Morriss has served as Chairman and Chief Executive Officer of Morriss Holdings Inc., a family holding company, and several other private investments and family controlled private equity holdings. Mr. Morriss is the Manager of each of Kanbay Acquisition, L.L.C. and Kanbay Investment, L.L.C., which were both investors in Kanbay in 2004. In addition, Mr. Morriss is Chairman of Acartha Group and a general partner of both Hela Capital Partners, Gryphon Investments I and II and the various funds that these companies manage. From 1998 to 2000, Mr. Morriss was the managing member of MIC Aircraft, LLC, an entity involved in aircraft operations. He was replaced as managing member in 2000. Within two years following Mr. Morriss' departure, MIC Aircraft, LLC filed for bankruptcy under Chapter 11 of the United States Bankruptcy Code. Mr. Morriss serves on the boards of directors of LoBue Holdings, Inc., Multiplus Finance S.A., X.Eye, Inc., Eskye, Inc., Cirqit Corp. and Campus Door. Mr. Morriss is also a director of LoBue Associates, Inc. In 2004, LoBue Associates provided certain services to us. See "Certain Transactions" for additional information.

Harry C. Gambill, 59, has been a director since March 2005. Since April 1992, Mr. Gambill has served as the Chief Executive Officer/President of Trans Union LLC, a company engaged in the business of providing consumer credit reporting services, analytic models and real estate settlement services. Mr. Gambill joined Trans Union in 1985 as Vice President/General Manager of the Chicago Division. Mr. Gambill was a past Chairman of the Consumer Data Industry Association, and a former Director of Damian Services Corp., a temporary staffing technology company. Mr. Gambill currently serves on the board of directors of Acxiom Corporation. Mr. Gambill holds degrees in business administration and economics from Arkansas State University and is a member of the ASU Business School Advisory Board.

Directors whose terms continue until 2006:

Raymond J. Spencer, 54, one of our founders and our first employee, has served as Chairman and Chief Executive Officer, or an equivalent position, since our inception. From 1970 to 1989, Mr. Spencer

4

was employed by the Institute of Cultural Affairs (ICA), a not-for-profit development organization. At ICA, Mr. Spencer was the country head for India from 1970 to 1976 and was later involved in worldwide fundraising, government relations and investment operations. From 1984 to 1989, Mr. Spencer served as Chairman of Lens International, Inc., a management consulting firm. Mr. Spencer is a director of Scan Web Biomedical, Inc. In 2002, we provided certain services to Scan Web. See "Certain transactions" for additional information.

Mark L. Gordon, 54, has been a director since August 1998. Mr. Gordon is an attorney with the law firm of Gordon & Glickson LLC where he has been a member or an equivalent position since August 1979 and currently serves as its Chairman. Mr. Gordon currently serves on the boards of directors of DiamondCluster International, Inc., The Rehabilitation Institute of Chicago and the Medical Research Institute Council of Chicago's Children's Memorial Hospital.

Michael E. Mikolajczyk, 53, has been a director since March 2004. Mr. Mikolajczyk was elected by our former preferred stockholders pursuant to our certificate of incorporation in effect prior to its amendment and restatement in connection with our initial public offering. Mr. Mikolajczyk co-founded DiamondCluster International, Inc. in April 1994 and has continuously served as a member of its board of directors. From April 1994 until his departure in August 2001, Mr. Mikolajczyk served in a number of capacities, including Vice Chairman, President, Secretary and Chief Financial and Administrative Officer. Following his departure from DiamondCluster until August 2004, Mr. Mikolajczyk was an independent consultant. Since September 2004, Mr. Mikolajczyk has served as managing director of Catalyst Capital Management, LLC, a private investment firm. Prior to Mr. Mikolajczyk's service with DiamondCluster, Mr. Mikolajczyk held several senior financial and corporate development positions at MCI Telecommunications Corporation.

Directors whose terms continue until 2007:

Donald R. Caldwell, 58, has been a director since August 1998. Mr. Caldwell was elected by our former preferred stockholders pursuant to our certificate of incorporation in effect prior to its amendment and restatement in connection with our initial public offering. Since April 1999, Mr. Caldwell has been Chairman and Chief Executive Officer of Cross Atlantic Capital Partners Inc., which manages three venture capital funds, including The Co-Investment 2000 Fund, L.P., and Cross Atlantic Technology Fund II, L.P., which are both investors in Kanbay. From February 1996 to March 1999, Mr. Caldwell was President and Chief Operating Officer of Safeguard Scientifics, Inc. Mr. Caldwell currently serves on the boards of directors of DiamondCluster International, Inc., Quaker Chemical Corporation, Sealegs Corporation Ltd., Voxware, Inc., Haverford Trust Company, MDL Capital Management Inc., Brainspark plc, Mobile Cohesion Limited, Management Dynamics, Inc., Rubicon Technology, Inc. and the Committee on Economic Development. Mr. Caldwell is also the Chairman of the Pennsylvania Academy of the Fine Arts and the Arts & Business Council of Greater Philadelphia and the Vice Chairman of the Greater Philadelphia Tourism Marketing Corporation.

Kenneth M. Harvey, 44, has been a director since September 2000. Mr. Harvey has been elected pursuant to voting rights granted to Household Investment Funding, Inc., an affiliate of Household International, under our Second Amended and Restated Stockholders' Agreement, as amended. Mr. Harvey was appointed Group Chief Information Officer of HSBC Holdings plc, the ultimate parent company of Household International, on October 31, 2003. Mr. Harvey served as Group Executive—Chief Information Officer of Household International from July 2002 to October 31, 2003 and as Managing Director—Chief Information Officer of Household International from 1999 to July 2002. See "Certain Transactions" for additional information.

5

The board of directors has determined that four of our eight directors, Messrs. Caldwell, Mikolajczyk, Morriss and Gambill, are "independent directors" as defined in Rule 4200 of the Nasdaq Marketplace Rules and as defined in applicable rules by the Securities and Exchange Commission ("SEC"). Rule 4350 of the Nasdaq Marketplace Rules requires that a majority of our board of directors be composed of independent directors. From our initial public offering in July 2004 until December 31, 2004, four of our seven directors were independent under the Nasdaq rules. On January 3, 2005, we notified Nasdaq that we no longer had a majority of independent directors because Mark L. Gordon had ceased to be an independent director. Mr. Gordon is a member of the law firm of Gordon & Glickson LLC ("G&G"), which provided legal services to us during 2004. The payments for these services by us to G&G exceeded 5% of G&G's consolidated gross revenues for 2004. Rule 4350 requires that we take action to ensure that a majority of our board of directors is composed of independent directors by the upcoming annual meeting.

On March 21, 2005, we appointed Harry C. Gambill, an independent director, to our board of directors. As a result, four of our eight directors are independent. Our board of directors is in the process of identifying and evaluating independent director candidates for appointment to the 2007 class of directors prior to the upcoming annual meeting, which would result in five of our nine directors being independent. If we are unable to appoint an additional independent director prior to the upcoming annual meeting, one of our directors who is not independent will step down form his position on our board of directors, which would result in four of our seven directors being independent. In either event, we intend to have a majority of independent directors by the upcoming annual meeting in accordance with Rule 4350.

Our independent directors hold meetings in executive session, at which only independent directors are present. Stockholders and third parties may communicate with our independent directors through the Chairman of the nominating and corporate governance committee, c/o the Secretary of our company at our offices at 6400 Shafer Court, Suite 100, Rosemont, Illinois 60018.

Our board of directors has four standing committees: an audit committee, compensation committee, executive committee and nominating and corporate governance committee. During 2004, the board of directors held six meetings and took action by written consent three times. None of our directors attended fewer than 75% of all the meetings of the board and those committees on which he served during 2004. Stockholders and third parties may communicate with our board of directors through the Chairman of the Board, c/o the Secretary of our company at our offices at 6400 Shafer Court, Suite 100, Rosemont, Illinois 60018.

Audit Committee. Our audit committee consists of Messrs. Caldwell, Mikolajczyk and Morriss. Mr. Mikolajczyk serves as the chairman of our audit committee. The audit committee oversees our financial reporting processes and reviews and recommends to the board internal accounting and financial controls, accounting principles and auditing practices to be employed in the preparation and review of our financial statements. The audit committee makes recommendations to the board concerning the engagement of independent registered public accountants to audit our annual financial statements and the scope of and plans for the audit to be undertaken by such accountants. The audit committee pre-approves the audit services and permissible non-audit services to be performed by such accountants and may take appropriate actions to ensure the independence of such accountants. The audit committee is also responsible for approving related party transactions. Our board of directors has determined that each member of our audit committee meets the independence requirements under the Sarbanes-Oxley Act of 2002, The Nasdaq Stock Market, Inc. and the rules and regulations of the SEC.

6

Mr. Mikolajczyk is our audit committee financial expert, as that term is defined under the SEC rules implementing Section 407 of the Sarbanes-Oxley Act of 2002.

The audit committee operates under a written charter, a current copy of which is attached to this proxy statement asAppendix A and is available on our website, www.kanbay.com. The audit committee has established procedures for the receipt, retention and treatment of complaints received regarding accounting, internal accounting controls or auditing matters. The audit committee met four times during 2004 and has met three times since the year end with respect to the audit of our fiscal year 2004 financial statements and related matters.

Compensation Committee. Our compensation committee consists of Messrs. Caldwell, Harvey and Mikolajczyk. Mr. Caldwell serves as the chairman of our compensation committee. The compensation committee reviews and recommends to the board policies, practices and procedures relating to the compensation of our chief executive officer, senior management team and directors and the establishment and administration of any new incentive compensation plans. The compensation committee has authority to administer our stock option plan, stock incentive plan and stock purchase plan and make policy recommendations from time to time with respect to our benefit plans. Our board of directors has determined that Messrs. Caldwell and Mikolajczyk meet the independence requirements under the Sarbanes-Oxley Act of 2002, The Nasdaq Stock Market, Inc. and the rules and regulations of the SEC. In addition, each of Mr. Caldwell and Mr. Mikolajczyk is an "outside director," as that term is defined in Section 162(m) of the Internal Revenue Code, and is a "non-employee" director within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934.

The compensation committee operates under a written charter, a current copy of which is available on our website, www.kanbay.com. The compensation committee met four times and took action by written consent once during 2004. The compensation committee also met once in March 2005 with respect to the payment of 2004 annual bonuses pursuant to our 2004 Global Leadership Bonus Plan.

Immediately following the upcoming annual meeting, our board of directors intends to re-constitute the membership of our compensation committee so that it is composed entirely of independent directors.

Nominating and Corporate Governance Committee. Our nominating and corporate governance committee consists of Messrs. Gordon, Harvey and Morriss. Mr. Gordon serves as the chairman of our nominating and corporate governance committee. The nominating and corporate governance committee assists the board of directors with its responsibilities regarding:

- •

- the identification of individuals qualified to become board members;

- •

- the selection of the director nominees for the next annual meeting of stockholders;

- •

- the selection of director candidates to fill any vacancies on the board of directors;

- •

- the performance, composition, duties and responsibilities of the board and the committees of the board;

- •

- succession planning for the chief executive officer; and

- •

- the operation of the board with respect to corporate governance matters.

Our board of directors has determined that Mr. Morriss meets the independence requirements under the Sarbanes-Oxley Act of 2002, The Nasdaq Stock Market, Inc. and the rules and regulations of the SEC.

The nominating and corporate governance committee operates under a written charter, a current copy of which is available on our website, www.kanbay.com. The nominating and corporate governance

7

committee did not meet during 2004 and has met once since the year end with respect to the appointment of Mr. Gambill and the nomination of the director nominees.

Our independent directors acted in conjunction with our nominating and corporate governance committee to approve and recommend the nomination of Messrs. D'Souza, Morriss and Gambill as the director nominees to the board of directors because our nominating and corporate governance committee was not composed entirely of independent directors.

Immediately following the upcoming annual meeting, our board of directors intends to re-constitute the membership of our nominating and corporate governance committee so that it is composed entirely of independent directors.

Executive Committee. Our executive committee consists of Messrs. Caldwell, Gordon and Spencer. Mr. Spencer serves as the chairman of our executive committee. The executive committee has the power to manage our business and affairs to the extent delegated to it by the board of directors, including, but not limited to:

- •

- borrowing money and issuing bonds, notes and other obligations and evidences of indebtedness;

- •

- determining questions of general policy with regard to our business;

- •

- making recommendations as to the declaration of dividends;

- •

- investing our funds in the purchase, acquisition, selling and disposing of stocks, bonds and other securities;

- •

- appointing agents; and

- •

- supervising our financial affairs.

We have established a Conflict of Interest and Business Ethics Policy that applies to our officers, directors and employees. We have also established a Code of Ethics for Senior Financial Officers that applies to our Chief Executive Officer, Chief Financial Officer and Controller. A current copy of the Conflict of Interest and Business Ethics Policy and the Code of Ethics for Senior Financial Officers is available on our website, www.kanbay.com.

The nominating and corporate governance committee of our board of directors considers candidates to fill new directorships created by expansion and vacancies that may occur and makes recommendations to the board of directors with respect to such candidates. The committee considers all relevant qualifications of candidates for board membership, including factors such as industry knowledge and experience, international, public company, academic or regulatory experience, financial expertise, diversity, current employment and other board memberships, and whether the candidate will be independent under the listing standards of the Nasdaq National Market. In the case of incumbent directors whose terms of office are set to expire, the committee will also review such director's overall service to us during their term and any relationships and transactions that might impair such director's independence.

In 2004, the committee did not pay a fee to any third party to assist in the process of identifying or evaluating potential director candidates. However, we may pay a fee to a third party to identify or evaluate potential director nominees in the future if the need arises.

8

We have not received director candidate recommendations from any of our stockholders. Any recommendations received by stockholders will be evaluated by the committee in the same manner that potential director nominees suggested by board members, management or other parties are evaluated.

Our by-laws provide that nominations for the election of directors at our annual meeting may be made by our board of directors or any stockholder entitled to vote for the election of directors generally who complies with the procedures set forth in the by-laws and who is a stockholder of record at the time notice is delivered to us. Any stockholder entitled to vote in the election of directors generally may nominate a person for election to the board of directors at our annual meeting only if timely notice of such stockholder's intent to make such nomination has been given in writing to our Secretary at our offices at 6400 Shafer Court, Suite 100, Rosemont, Illinois 60018.

To be timely, a stockholder nomination for a director to be elected at our annual meeting must be received at our principal executive offices not less than sixty (60) nor more than ninety (90) days prior to the first anniversary of the preceding year's annual meeting of stockholders, except that, if the date of the annual meeting is changed by more than thirty (30) days from such anniversary date, notice by the stockholder to be timely must be received no later than the close of business on the tenth (10th) day following the earlier of the day on which notice of the date of the meeting was mailed or public disclosure of the meeting was made.

In 2004, non-employee directors were compensated pursuant to our Outside Director Compensation Plan, which provides that each of our non-employee directors who chairs a committee receives an annual retainer of $15,000, and each of our other non-employee directors receives an annual retainer of $10,000.

Each non-employee director receives a fee of $2,000 for each board meeting attended. Each non-employee director also receives a $500 fee for attending a committee meeting by telephone when such meeting lasts less than four hours. In addition, each non-employee director who attends a committee meeting in person or participates via telephone in a meeting that lasts for over four hours receives a fee of $1,000. However, if a non-employee director attends a committee meeting that occurs on the same day as a board meeting, or attends two or more committee meetings in person on the same day, then the director receives a fee of $500 for each additional meeting or meetings attended.

Non-employee directors are reimbursed for their expenses incurred in attending meetings. We may offer each non-employee director the opportunity to defer all or any portion of the annual retainer and/or meeting fees.

Pursuant to the Outside Director Compensation Plan, each non-employee director may receive options to purchase shares of our common stock according to the terms of our Stock Incentive Plan. In July 2004, our non-employee directors received options to purchase 37,254 shares of common stock in connection with the closing of our initial public offering. In March 2005, Mr. Gambill received options to purchase 37,254 shares of common stock in connection with his appointment to our board of directors. The options granted to the non-employee directors vest in annual installments over a period of three years as long as the non-employee director's service continues.

Each year, each non-employee director may also receive discretionary options to purchase shares of our common stock based on our performance. All options granted to non-employee directors will be granted with an exercise price equal to the fair market value of the common stock on the date of the grant and will generally vest in annual installments over three years as long as the non-employee director's service continues.

9

Since March 2004, the compensation committee has been composed of Messrs. Caldwell, Harvey and Mikolajczyk. None of Messrs. Caldwell, Harvey or Mikolajczyk serves, or has at any time served, as an officer or employee of us or any of our subsidiaries. None of our executive officers has served as a member of the compensation committee, or other committee serving an equivalent function, of any other entity, one of whose executive officers served as a member of our compensation committee.

Kenneth M. Harvey, one of the members of our compensation committee, is Group Chief Information Officer for HSBC Holdings plc, the ultimate parent company of Household International, which is our largest client. During 2004, Household International (and its affiliates within the HSBC Group) made payments to us and our subsidiaries for services representing approximately 55.6% of our revenues for 2004. As of December 31, 2004, our accounts receivable from Household International (and its affiliates within the HSBC Group) represented approximately 27.2% of our net accounts receivable as of such date. Under the consulting agreement with Household International, we perform a broad range of information systems services for various business units within the HSBC Group. We have agreed, and may in the future agree, to charge discounted rates for certain engagements under this agreement. These discounts have historically varied based on the type and size of our engagements. For example, we have discounted, and may in the future discount, our rates on larger engagements as compared to comparable engagements of a smaller size. We believe that the rates, terms and provisions contained in this agreement are comparable to those that we could have obtained through negotiations with an unrelated party.

Scott R. Graflund, who was a member of our compensation committee until his resignation from our board of directors in March 2004, was a Managing Director of Morgan Stanley & Co. Incorporated. During 2004, Morgan Stanley and its affiliates made payments to us and our subsidiaries for services representing approximately 10.3% of our revenues for 2004. As of December 31, 2004, our accounts receivable from Morgan Stanley represented approximately 13.3% of our net accounts receivable as of such date. Under the consulting agreement with Morgan Stanley, we perform systems analysis and design, computer programming and other consulting services. We have agreed, and may in the future agree, to charge discounted rates for certain engagements under this agreement. These discounts have historically varied based on the type and size of our engagements. For example, we have discounted, and may in the future discount, our rates on larger engagements as compared to comparable engagements of a smaller size. We believe that the rates, terms and provisions contained in this agreement are comparable to those that we could have obtained through negotiations with an unrelated party.

10

IV. STOCK OWNERSHIP

The following table sets forth certain information regarding the beneficial ownership of our common stock as of December 31, 2004 (except as indicated below) by:

- •

- all persons known by us to own beneficially 5% or more of our outstanding common stock;

- •

- each of our directors and director nominees;

- •

- each of the named executive officers listed in the "Executive Compensation—Summary Compensation Table" section of this proxy statement; and

- •

- all of our directors, director nominees and executive officers as a group.

Unless otherwise indicated, each stockholder listed below has sole voting and investment power with respect to the shares of common stock beneficially owned by such stockholder.

Name and Address

| | Number of Shares

Beneficially Owned(1)

| | Approximate

Percent of Class(1)

| |

|---|

| CERTAIN BENEFICIAL OWNERS: | | | | | |

Household Investment Funding, Inc.

2700 Sanders Road

Prospect Heights, IL 60070 | | 5,128,304 | | 15.3 | % |

The Co-Investment 2000 Fund, L.P.

5 Radnor Corporate Center, Suite 555

100 Matsonford Road

Radnor, PA 19087(2) | | 1,971,290 | | 6.0 | % |

Kanbay Acquisition, L.L.C.

c/o Kanbay Capital, L.L.C., its Manager

18500 Edison Avenue

Chesterfield, MO 63005(3) | | 3,260,741 | | 9.9 | % |

FMR Corp.

82 Devonshire Street

Boston, Massachusetts 02109 | | 1,986,208 | | 6.0 | % |

DIRECTORS, DIRECTOR NOMINEES AND EXECUTIVE OFFICERS: |

|

|

|

|

|

| Raymond J. Spencer | | 1,750,145 | | 5.3 | % |

| William F. Weissman | | 129,077 | | * | |

| Jean A. Cholka | | 173,037 | | * | |

| Cyprian D'Souza | | 320,414 | | 1.0 | % |

| Shrihari Gokhale | | 87,426 | | * | |

| Mark L. Gordon(4) | | 97,035 | | * | |

| Donald R. Caldwell(5) | | 2,375,093 | | 7.2 | % |

| Kenneth M. Harvey(6) | | — | | * | |

| B. Douglas Morriss(7) | | 3,905,013 | | 11.8 | % |

| Michael E. Mikolajczyk | | 17,300 | | * | |

| Harry C. Gambill | | — | | * | |

| All directors, director nominees and executive officers as a group (13 persons) | | 9,018,466 | | 27.3 | % |

- *

- = less than 1%

11

- (1)

- "Beneficial ownership" means any person who, directly or indirectly, has or shares voting or investment power with respect to a security or has the right to acquire such power within 60 days. Shares of common stock subject to options or warrants that are currently exercisable or exercisable within 60 days of December 31, 2004 are deemed outstanding for computing the ownership percentage of the person holding such options or warrants, but are not deemed outstanding for computing the ownership percentage of any other person. The amounts and percentages are based upon 32,989,935 shares of our common stock outstanding as of December 31, 2004.

- (2)

- The voting and investment power as to the shares held by The Co-Investment 2000 Fund, L.P. is shared among the members of an investment committee that consists of employees of Cross Atlantic Capital Partners, Inc. Donald R. Caldwell, one of our directors, is a member of the investment committee. Consequently, Mr. Caldwell shares voting and investment power as to the shares with the other members of the investment committee.

- (3)

- B. Douglas Morriss, one of our directors, is the manager of Kanbay Capital, L.L.C., which is the manager of Kanbay Acquisition, L.L.C. ("Kanbay Acquisition"), and, in such capacity, had sole voting and investment power as to the shares held by Kanbay Acquisition. On February 2, 2005, Kanbay Acquisition distributed all of its 3,260,741 shares of our common stock to its members on a pro rata basis based on their interest in Kanbay Acquisition and for no additional consideration. The B. Douglas Morriss Irrevocable Trust (the "Morriss Trust") received 924,035 shares of our common stock upon the distribution by Kanbay Acquisition.

- (4)

- Includes the shares of common stock held by Gordon & Glickson LLC. Mr. Gordon is Chairman of Gordon & Glickson LLC and shares voting and investment power as to the shares of common stock held by Gordon & Glickson LLC and the options to purchase shares of common stock held by Mr. Gordon with other members of Gordon & Glickson LLC.

- (5)

- Includes the 1,971,290 shares of common stock held by The Co-Investment 2000 Fund, L.P., 341,422 shares of common stock held by Cross Atlantic Technology Fund II, L.P., 6,500 shares of common stock held by Cross Atlantic Capital Partners, Inc. and options to purchase 55,881 shares of common stock held by Mr. Caldwell. The voting and investment power as to the shares held by The Co-Investment 2000 Fund, L.P. and Cross Atlantic Technology Fund II, L.P. is shared among the members of two separate investment committees that consist of employees of Cross Atlantic Capital Partners, Inc. Mr. Caldwell is a member of each investment committee. Consequently, Mr. Caldwell shares voting and investment power as to these shares with the other members of the investment committees. Mr. Caldwell is the Chairman and sole shareholder of Cross Atlantic Capital Partners, Inc.

- (6)

- Excludes the shares of common stock held by Household Investment Funding, Inc. Mr. Harvey is Group Chief Information Officer for HSBC Holdings plc, the ultimate parent company of Household Investment Funding, Inc., but does not have voting or dispositive power as to these shares.

- (7)

- Includes the 3,260,741 shares of common stock held by Kanbay Acquisition and 644,272 shares of common stock held by Kanbay Investment, L.L.C. ("Kanbay Investment"). Mr. Morriss is the manager of each of Kanbay Investment and Kanbay Capital, L.L.C., which is the manager of Kanbay Acquisition, and, in such capacities, has sole voting and investment power as to these shares. On February 1, 2005, Kanbay Investment distributed 371,565 shares of our common stock to certain of its members on a pro rata basis based on their respective interests and for no additional consideration. On February 2, 2005, Kanbay Acquisition distributed all of its 3,260,741 shares of our common stock to its members on a pro rata basis based on their respective interests and for no additional consideration. The Morriss Trust received 2,915 shares of our common stock upon the distribution by Kanbay Investment and 924,035 shares of our common stock upon the distribution by Kanbay Acquisition.

12

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and holders of more than 10% of our common stock to file with the SEC reports regarding their ownership and changes in ownership of our common stock. Based solely on our review of the reports furnished to us, we believe that all of our directors and executive officers have complied with all Section 16(a) filing requirements for 2004.

V. EXECUTIVE COMPENSATION

The following table sets forth certain information concerning each of our executive officers:

Name

| | Age

| | Position(s)

|

|---|

| Raymond J. Spencer | | 54 | | Chairman and Chief Executive Officer |

| William F. Weissman | | 46 | | Executive Vice President, Chief Financial Officer and Secretary |

| Jean A. Cholka | | 47 | | Executive Vice President—Global Sales, Marketing and Strategy |

| Cyprian D'Souza | | 49 | | Chief People Officer |

| Shrihari Gokhale | | 42 | | Executive Vice President—Global Client Services |

| Roy K. Stansbury | | 53 | | Executive Vice President—Global HSBC Services |

| Aparna U. Katre | | 42 | | Executive Vice President—Global Business Innovation |

Raymond J. Spencer, see the section of this proxy statement entitled "Board of Directors—Board Structure and Composition."

William F. Weissman joined us in 1995 as Vice President and Chief Financial Officer. Mr. Weissman has been responsible for our finance, legal and administration functions since 2000 and has served as Secretary since August 2000. Mr. Weissman held similar senior positions in, and served as a Manager of, Kanbay LLC (our immediate predecessor company) from December 1997 to August 2000. Since January 2005, Mr. Weissman has served as Executive Vice President, Chief Financial Officer and Secretary.

Jean A. Cholka joined us in January 1999 as Vice President—Human Resources and served as Vice President—Delivery from October 2000 to April 2001, President—Kanbay North America from April 2001 to January 2003 and Vice President—Global Client Management from January 2003 to January 2005. Since January 2005, Ms. Cholka has served as Executive Vice President—Marketing, Sales and Strategy.

Cyprian D'Souza, see the section of this proxy statement entitled "Board of Directors—Board Structure and Composition."

Shrihari Gokhale joined us in February 2001 as Vice President—Global Services Delivery. Since January 2005, Mr. Gokhale has served as Executive Vice President—Global Client Services. Prior to joining us, Mr. Gokhale was employed by Scient (formerly iXL) as Director—Strategy Practice for Boston from January 2000 to February 2001 and Accenture (formerly Andersen Consulting) as Senior Manager—Strategy Services from August 1997 to January 2000.

Roy K. Stansbury joined us in 1994 as Executive Vice President and was responsible for our North American delivery organization from January 1998 to August 2000. Mr. Stansbury has managed our

13

relationships with HSBC and Morgan Stanley from September 2000 and since January 2005 has served as Executive Vice President—Global HSBC Services. Prior to joining us, Mr. Stansbury was employed by Dupont Asia Pacific from 1986 to 1994 where he was responsible for high-performance work systems.

Aparna U. Katre joined us in 1996 as Projects Manager and served as General Manager—Delivery from 1998 to 2000. Ms. Katre served as Vice President and Chief Process Officer from April 2001 to December 2004. Since January 2005, Ms. Katre has served as Executive Vice President—Global Business Innovation.

The following table sets forth information regarding the compensation paid to our chief executive officer and each of our four most highly compensated executive officers for the fiscal years ended December 31, 2004 and 2003. These individuals are referred to as our "named executive officers" elsewhere in this proxy statement.

| |

| |

| |

| | Long Term

Compensation

| |

| |

|---|

| | Annual Compensation

| | Awards

| |

| |

|---|

Name and Principal Position

| | Fiscal

Year

| | Salary($)

| | Bonus($)

| | Securities

Underlying

Options(#)

| | All Other

Compensation($)

| |

|---|

Raymond J. Spencer

Chairman and Chief Executive Officer | | 2004

2003 | | 425,000

425,000 | | 340,000

212,500 | | 186,270

— | | 14,009

15,070 | (1)

(1) |

William F. Weissman

Executive Vice President, Chief

Financial Officer and Secretary |

|

2004

2003 |

|

238,493

197,000 |

|

150,000

103,000 |

|

139,703

— |

|

5,548

5,073 |

(2)

(2) |

Jean A. Cholka

Executive Vice President—Global Sales,

Marketing and Strategy |

|

2004

2003 |

|

229,985

225,000 |

|

148,320

90,000 |

|

139,703

— |

|

5,548

4,940 |

(3)

(3) |

Cyprian D'Souza

Chief People Officer |

|

2004

2003 |

|

230,000

218,000 |

|

95,564

109,000 |

|

139,703

— |

|

—

— |

|

Shrihari Gokhale

Executive Vice President—Global

Services Delivery |

|

2004

2003 |

|

215,000

206,000 |

|

84,313

103,000 |

|

139,703

— |

|

—

— |

|

- (1)

- Consists of the payment of life insurance premiums of $348 and $348, supplemental life insurance premiums of $8,461 and $9,922 and matching 401(k) contributions of $5,200 and $4,800 in the fiscal years ended December 31, 2004 and 2003, respectively.

- (2)

- Consists of the payment of life insurance premiums of $348 and $348 and matching 401(k) contributions of $5,200 and $4,725 in the fiscal years ended December 31, 2004 and 2003, respectively.

- (3)

- Consists of the payment of life insurance premiums of $348 and $348 and matching 401(k) contributions of $5,200 and $4,725 in the fiscal years ended December 31, 2004 and 2003, respectively.

14

The following table sets forth individual grants of stock options made to the named executive officers during 2004.

| |

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rate of Stock Price Appreciation for Option Term($)(3)

|

|---|

| | Individual Grants

|

|---|

Name and Principal Position

| | Number of Securities Underlying Options

Granted(#)(1)

| | % of Total Options

Granted to

Employees in Fiscal Year

| | Exercise

Price Per

Share($)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Raymond J. Spencer | | 186,270 | | 4.4 | % | 13.00 | | (2 | ) | 1,075,138 | | 2,555,792 |

| William F. Weissman | | 139,703 | | 3.3 | % | 13.00 | | (2 | ) | 806,357 | | 1,916,851 |

| Jean A. Cholka | | 139,703 | | 3.3 | % | 13.00 | | (2 | ) | 806,357 | | 1,916,851 |

| Cyprian D'Souza | | 139,703 | | 3.3 | % | 13.00 | | (2 | ) | 806,357 | | 1,916,851 |

| Shrihari Gokhale | | 139,703 | | 3.3 | % | 13.00 | | (2 | ) | 806,357 | | 1,916,851 |

- (1)

- On July 22, 2004, our board of directors granted options to purchase 4,197,498 shares of our common stock to our directors, officers and employees under our Stock Incentive Plan. These options have an exercise price equal to the initial public offering price of $13.00. Of these options, 745,082 were granted to our named executive officers. The options granted to the named executive officers vest in equal daily installments over a period of four years beginning on July 23, 2004.

- (2)

- These options expire in 25% annual installments beginning on July 22, 2010.

- (3)

- These amounts represent hypothetical gains that could be achieved on the respective options if exercised at the end of the option terms. These amounts represent certain assumed rates of appreciation in the value of our common stock calculated from $13.00, our initial public offering price. The 5% and 10% annual rates of stock price appreciation are mandated by the SEC and do not represent our estimates or a projection of the future price of our common stock. Actual gains, if any, on stock option exercises and common stock holdings depend on the future performance of our common stock.

15

The following table sets forth information regarding the value of stock options exercised during 2004 and the value of unexercised stock options held as of December 31, 2004 by each of our named executive officers.

| |

| |

| | Number of Securities

Underlying Unexercised

Options at December 31, 2004 (#)

| | Value of Unexercised

In-the-Money Options at

December 31, 2004 ($)(1)

|

|---|

| | Shares

Acquired on

Exercise (#)

| | Value

Realized ($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Raymond J. Spencer | | — | | — | | 300,059 | | 351,886 | | 8,157,358 | | 8,217,033 |

William F. Weissman |

|

65,381 |

|

1,673,629 |

|

109,370 |

|

152,154 |

|

3,030,142 |

|

3,051,051 |

Jean A. Cholka |

|

76,370 |

|

1,930,957 |

|

144,016 |

|

161,468 |

|

4,057,184 |

|

3,326,828 |

Cyprian D'Souza |

|

112,840 |

|

2,844,453 |

|

153,183 |

|

152,154 |

|

4,311,058 |

|

3,051,051 |

Shrihari Gokhale |

|

54,019 |

|

1,340,152 |

|

45,292 |

|

170,781 |

|

1,116,524 |

|

3,602,576 |

- (1)

- This column indicates the aggregate amount by which the market value of our common stock on December 31, 2004 exceeded the options' exercise price, based on the closing per share sales price of our common stock on the Nasdaq National Market on December 31, 2004 of $31.30.

In July 2004, we entered into severance agreements with Mr. Spencer, Mr. Weissman, Ms. Cholka, Mr. D'Souza and Mr. Gokhale. The severance agreements are designed to retain the dedication of these executives and reduce distractions by providing them with severance benefits in the event of certain terminations of employment. Under the severance agreements, when the termination of employment occurs in connection with a "change in control" (as defined in the severance agreement), each of these executives is entitled to severance benefits if the executive voluntarily terminates his or her employment only with "good reason" (as defined in the severance agreement) within 18 months after the change in control. These executives are also entitled to severance if we terminate the executive's employment without "cause" (as defined in the severance agreement), whether or not a change of control has occurred. If there is no change in control, each of these executives is entitled to severance benefits only if we terminate the executive without cause. In the case of Mr. Spencer, he is also entitled to severance benefits if he terminates his employment with good reason at any time. In addition, in the event any of these executives are subject to an excise tax under the Internal Revenue Code for receiving these severance benefits, we will pay the executive an additional amount so that the executive is placed in the same after-tax position with respect to the severance benefits as if this excise tax were not imposed.

The severance benefits under the severance agreements include a cash severance payment, continued health insurance for a set period of time and immediate vesting of all stock options granted under our stock option plan and stock incentive plan. For the executives other than Mr. Spencer, the cash severance payment equals one and one-half times the sum of the executive's base salary and target bonus, and health insurance is continued for 18 months. For Mr. Spencer, the cash severance payment equals two times the sum of Mr. Spencer's base salary and target bonus, and health insurance is continued for 24 months.

16

The following table sets forth information regarding the number of securities authorized for issuance under our equity compensation plans as of December 31, 2004.

Plan Category

| | Number of securities to

be issued upon exercise

of outstanding options

| | Weighted-average

exercise price of

outstanding

options

| | Number of securities

remaining available for

future issuance under

equity compensation plans

|

|---|

| Equity compensation plans approved by security holders | | 8,188,383 | | $ | 7.65 | | 1,662,979 |

In addition, as of December 31, 2004, there were 500,000 shares available for issuance under our Employee Stock Purchase Plan, which is an equity compensation plan approved by security holders. There are no equity compensation plans that have not been approved by security holders.

The Kanbay International 1998 Non-Qualified Option Plan was originally adopted in November 1998 and renamed in August 2000. Although options remain outstanding pursuant to this plan, no future options may be granted under this plan. No stock options have been granted to employees under this plan since the establishment of our 2000 stock option plan. As of December 31, 2004, non-qualified options to purchase 2,168,016 shares of common stock were outstanding under our Non-Qualified Option Plan.

Historically, we maintained a 2000 stock option plan under which we have granted stock options to certain of our employees, directors and consultants. We adopted and our stockholders approved our Stock Incentive Plan in June 2004. Our Stock Incentive Plan amended and restated our 2000 stock option plan, effective upon the closing of our initial public offering in July 2004. As of December 31, 2004, options to purchase 6,020,367 shares of common stock were outstanding under our Stock Incentive Plan. Our Stock Incentive Plan permits awards of nonqualified stock options, incentive stock options, stock appreciation rights, restricted stock, restricted stock units, and performance shares. In addition, our Stock Incentive Plan provides an opportunity for the deferral of salary and bonuses into restricted stock units and the deferral of gains or payments due upon the vesting or exercise of awards under our stock incentive plan.

In July 2004, our board of directors granted options to purchase 4,197,498 shares of our common stock at an exercise price equal to the initial public offering price of $13.00 under our Stock Incentive Plan. Of these options, 931,352 were granted to our non-employee directors and the named executive officers. The options granted to the non-employee directors vest in annual installments over a three-year period, and the options granted to the named executive officers vest in equal daily

17

installments over a four-year period. These options were allocated among the non-employee directors and named executive officers as follows:

Name

| | Number of Options

|

|---|

| Non-Employee Director | | |

| Donald R. Caldwell | | 37,254 |

| Mark L. Gordon | | 37,254 |

| Kenneth M. Harvey | | 37,254 |

| B. Douglas Morriss | | 37,254 |

| Michael E. Mikolajczyk | | 37,254 |

Name

| | Number of Options

|

|---|

| Named Executive Officer | | |

| Raymond J. Spencer | | 186,270 |

| William F. Weissman | | 139,703 |

| Jean A. Cholka | | 139,703 |

| Cyprian D'Souza | | 139,703 |

| Shrihari Gokhale | | 139,703 |

We adopted our 2004 Global Leadership Bonus Plan in June 2004. The 2004 Global Leadership Bonus Plan provides for the payment of performance bonuses to the named executive officers in order to align the goals of the named executive officers with our business goals and objectives and to reward the named executive officers for meeting certain performance targets. Our compensation committee has the discretion to pay part or all of the performance bonus to the named executive officers in shares of our common stock.

In March 2005, we approved cash bonus payments for the 2004 fiscal year to be paid to the named executive officers under our 2004 Global Leadership Bonus Plan. Pursuant to the 2004 Global Leadership Bonus Plan, each executive officer was eligible to receive a bonus award in an amount equal to a specified percentage of his or her annual base salary if certain performance targets were achieved during 2004. These performance targets included the achievement of certain net profit, total revenue, non-related party revenue and margin objectives. Based on the achievement of the performance targets, the total bonuses earned by each executive officer for 2004 were as follows:

Name

| | 2004 Cash Bonus

|

|---|

| Named Executive Officer | | | |

| Raymond J. Spencer | | $ | 340,000 |

| William F. Weissman | | $ | 100,000 |

| Jean A. Cholka | | $ | 148,320 |

| Cyprian D'Souza | | $ | 95,564 |

| Shrihari Gokhale | | $ | 84,313 |

In March 2005, we approved the 2005 Global Leadership Bonus Plan. Pursuant to the 2005 Global Leadership Bonus Plan, the named executive officers are eligible to receive bonus awards in an amount equal to a specified percentage of his or her annual base salary upon the achievement of certain performance targets. These performance targets include the achievement of certain net profit, non-related party revenue and new business development objectives.

18

We adopted and our stockholders approved our Employee Stock Purchase Plan in June 2004. The plan became effective on January 1, 2005. The plan is designed to allow eligible employees to purchase shares of our common stock at a discount, at semi-annual intervals, with accumulated payroll deductions. We initially reserved 500,000 shares of our common stock for issuance under the Employee Stock Purchase Plan.

We have adopted a 401(k) retirement savings plan. All of our employees, other than non-resident alien employees with no income from U.S. sources, are eligible to participate in the plan on the first day of the calendar quarter after attaining age 21. An eligible employee may elect to make pretax salary deferral contributions to the plan of up to 15% of his or her total annual compensation. We may make matching contributions on behalf of each participant who makes pretax salary deferral contributions.

In 2004, Mr. Spencer, Mr. Weissman and Ms. Cholka each received matching contributions in the 401(k) Plan based on 2004 contributions in the amount of $5,200. In 2003, Mr. Spencer, Mr. Weissman and Ms. Cholka received matching contributions in the 401(k) Plan based on 2003 contributions in the amounts of $4,800, $4,725 and $4,725, respectively.

19

The following report of the compensation committee and the performance graph included elsewhere in this proxy statement do not constitute soliciting material and should not be deemed filed or incorporated by reference into any other of our filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate this report or the performance graph by reference therein.

Our compensation committee is composed of three directors of our board of directors, Messrs. Caldwell, Mikolajczyk and Harvey. Each of Messrs. Caldwell and Mikolajczyk is (1) "independent" under the applicable requirements of the Nasdaq National Market (2) a "non-employee director" within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934 and (3) an "outside director" within the meaning of Section 162(m) of the Internal Revenue Code. The compensation committee is responsible for reviewing our executive compensation philosophy and approving with our board of directors our executive compensation structure. Set forth below in full is the Report of the Compensation Committee regarding compensation earned by our executive officers for 2004. For 2004, our independent directors acted in conjunction with the committee with respect to the compensation of our executive officers because the committee was not composed entirely of independent directors.

Our executive compensation philosophy is to optimize our profitability and growth through compensation and incentives that are consistent with our objectives and that link the interests of our executive officers with our stockholders. Our executive compensation is intended to provide value to our executive officers based on our performance versus revenue and profit targets and other financial measures, our long-term financial performance and our total return to stockholders. Our philosophy is further intended to enhance our ability to motivate, attract and retain the services of executive officers that make significant contributions to our success and to allow those executive officers to share in that success. The philosophy is designed to provide executive officers with competitive compensation that maintains a balance between cash and stock compensation and provides compensation tied to both annual and long-term performance, as well as the creation of stockholder value.

Salary. The annual salary for each executive officer was reviewed and, in certain cases, increased at levels consistent with increases in the annual salaries generally awarded to other comparably performing peer executives. Year-to-year adjustments to each executive officer's base salary were determined by an assessment of his or her sustained performance against his or her individual job responsibilities, including the impact of such performance on our business and financial results.

Cash Bonuses. Cash bonuses were paid to our executive officers under our 2004 Global Leadership Bonus Plan. The bonuses were based on achieving certain annual performance targets. Each executive officer was eligible to receive a bonus payment in an amount equal to a specified percentage of his or her annual salary if the established performance targets were achieved during the fiscal year. These performance targets included the achievement of certain net profit, total revenue, non-related party revenue and margin objectives.

Long-Term Compensation. We awarded long-term compensation in 2004 under our Stock Incentive Plan in the form of stock option awards. These stock options will only produce value to our executive officers if the price of our stock appreciates from the initial public offering price of $13.00 per share, thereby linking the interests of executive officers with those of our stockholders. Stock options granted to our named executive officers vest in equal daily installments over a four-year period

20

and will expire in 25% annual installments beginning 10 years from the original grant date unless the named executive officer's employment terminates prior to such date.

The committee reviewed the corporate goals and objectives relevant to Mr. Spencer's compensation and approved the compensation, including the bonus and stock option awards, for Mr. Spencer. In determining Mr. Spencer's compensation for 2004, the committee considered our performance based on certain financial measures, the value of similar awards to chief executive officers of comparable companies, the awards given to Mr. Spencer in past years and other appropriate factors. The committee also considered Mr. Spencer's contributions to us, particularly in connection with our initial public offering, and his role in implementing strategic and financial initiatives designed to augment our business development and growth efforts.

We believe that Mr. Spencer's experience, dedication and industry knowledge have been important to our ongoing growth and, in particular, have been important to our ability to accomplish our initial public offering in July 2004. For the fiscal year ended December 31, 2004, Mr. Spencer received an annual salary of $425,000, and a performance bonus of $340,000. In July 2004, our board of directors also granted to Mr. Spencer options to purchase shares of our common stock at an exercise price equal to the initial public offering price of $13.00 under the Stock Incentive Plan. In addition, Mr. Spencer received other compensation in the form of payment of life insurance and supplemental life insurance premiums and 401(k) matching contributions. We believe Mr. Spencer's total compensation, including salary, bonus and long-term incentives, is at a level competitive with chief executive officer salaries within the information technology industry. As our Chief Executive Officer, Mr. Spencer is focused on building long-term success, and as a significant stockholder, his personal wealth is tied directly to the creation of stockholder value. In our view, Mr. Spencer's total compensation for 2004 properly reflected our performance and his performance.

Section 162(m) of the Internal Revenue Code limits the deduction for federal income tax purposes of certain compensation paid in any year by a publicly-held corporation to its chief executive office and its four other highest compensated officers to $1 million per executive (the "$1 million cap"). The $1 million cap does not apply to "performance-based" compensation plans as defined under Section 162(m). We believe that our Stock Incentive Plan qualifies as a "performance-based" plan that is not subject to the $1 million cap. We believe we can continue to preserve related federal income tax deductions, although individual exceptions may occur.

Respectfully submitted by the Compensation Committee,

21

VI. PERFORMANCE GRAPH

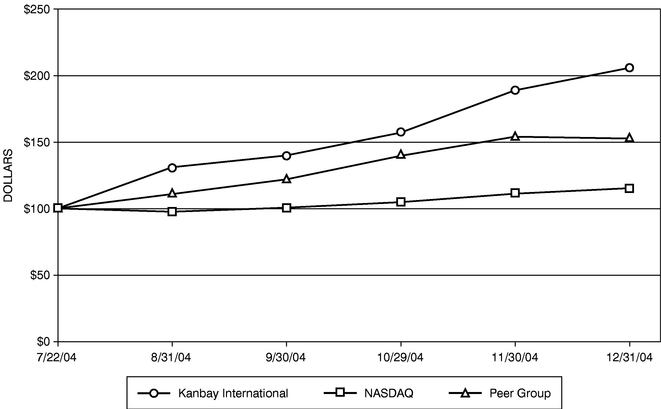

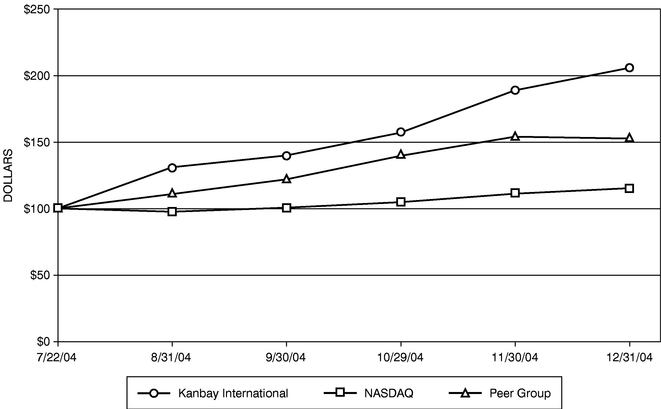

The following graph illustrates the cumulative total stockholder return on our common stock during the period from July 22, 2004, which is the date our common stock was initially listed on the Nasdaq National Market, through December 31, 2004 and compares it with the cumulative total return on the NASDAQ Composite Index and a Peer Group Index consisting of Infosys Technologies Ltd., Covansys Corporation, Cognizant Technology Solutions Corporation, Syntel Inc. and Wipro Ltd. The comparison assumes $100 was invested on July 22, 2004 in our common stock and in each of the foregoing indices and assumes reinvestment of dividends, if any. The performance shown is not necessarily indicative of future performance.

Dollar Value of $100 Invested on July 22, 2004

| | July 22,

2004

| | Aug. 31,

2004

| | Sept. 30,

2004

| | Oct. 29,

2004

| | Nov. 30,

2004

| | Dec. 31,

2004

|

|---|

| Kanbay International, Inc. | | 100.00 | | 130.99 | | 139.87 | | 157.17 | | 189.01 | | 205.92 |

Nasdaq Composite Index |

|

100.00 |

|

97.30 |

|

100.41 |

|

104.55 |

|

111.00 |

|

115.16 |

Peer Group Index |

|

100.00 |

|

110.68 |

|

121.99 |

|

139.64 |

|

153.98 |

|

152.65 |

VII. CERTAIN TRANSACTIONS

�� Raymond J. Spencer, our Chairman and Chief Executive Officer, is a director of and holds a 22% equity interest in Scan Web Biomedical, Inc. In 2002, Scan Web made payments to us for advisory, development, integration and other services totaling approximately $162,000. We did not perform any services for Scan Web in 2003 or 2004. We believe that the rates, terms and provisions contained in our agreement with Scan Web are comparable to those that we could have obtained through negotiations with an unrelated party.

22