Searchable text section of graphics shown above

[LOGO]

Kanbay International, Inc.

Acquisition of Adjoined Consulting, Inc.

Investor Presentation

February 13, 2006

© Kanbay Incorporated - All Rights Reserved

Forward Looking Statements

This presentation contains statements relating to projections or future results. These statements are forward-looking statements under the federal securities laws. We can give no assurance that any projections or future results discussed in these statements will be achieved. Any forward-looking statements represent our views only as of today and should not be relied upon as representing our views as of any subsequent date. These statements are subject to a variety of risks and uncertainties that could cause our actual results to differ materially from the statements contained in this release. For a discussion of important factors that could affect our actual results, please refer to our SEC filings, including the “Risk Factors” disclosure in our Form 10-K for the year ended December 31, 2004.

This presentation also contains forward-looking statements that involve risks and uncertainties relating to whether and when the acquisition of Adjoined will be consummated. The closing of the transaction and the closing date are subject to the satisfaction of agreed upon closing conditions could result in a failure of or delay in closing the transaction. Kanbay assumes no obligation to update forward-looking statements.

[LOGO]

2

Presentation of Non-GAAP Financial Measure

Kanbay presents revenue excluding the impact of the sale of the products business, which is a non-GAAP financial measure, in the text of this press release and the accompanying supplementary financial information. The Company’s management uses revenue excluding the impact of the sale of the products business to evaluate the quarterly and annual growth in the services business. In addition, this non-GAAP financial measure facilitates management’s internal comparisons to competitors’ growth in their services business. This non-GAAP financial information is provided as additional information for investors and is not in accordance with, or an alternative to, GAAP. In addition, the non-GAAP financial information provided may be different than similar measures used by other companies. However, the Company’s management believes this non-GAAP measure provides useful information to investors, potential investors, securities analysts and others so each group can evaluate the Company’s current and future growth in the services business in the same manner as management if they so chose. A reconciliation from revenue to revenue excluding the impact of the sale of the products business has been provided in the accompanying supplementary financial information.

3

Agenda

1. Introductions

2. Q4 2005 and Full Year Results

3. Transaction Overview

4. Introduction to Adjoined

5. Transaction Rationale

6. Q1 2006 and 2006 Guidance

7. Summary

8. Q&A

4

Kanbay 4Q’05 Highlights

• $61.0 million revenues and $0.24 EPS

• Exceeded company expectations; strong momentum for 2006

• 4% sequential growth consistent with seasonal industry factors

• Strong related party growth

• Strong gross margins (48.7%) and operating margins (18.6%)

• Conclusion:

• Core business strong

• Company executing on previously outlined strategy

5

Kanbay Full Year 2005 Highlights

• $230.5 million revenues and $0.88 EPS

• Record performance in both revenue and earnings

• Revenue growth of 26% consistent with long-term objectives

• Third party revenue grew 48% (excluding product business divestiture)

• Kanbay’s value proposition to related parties continues unabated: 24% Y/Y growth

• Continued operating margin expansion

• Demonstrating offshore leverage and ability to scale

• Strong foundation to continue executing on strategy

• Deep domain knowledge

• Delivery through an unparalleled global delivery platform

• Additional highlights

• Over 1,500 net associates added

• 59% increase in number of active clients

6

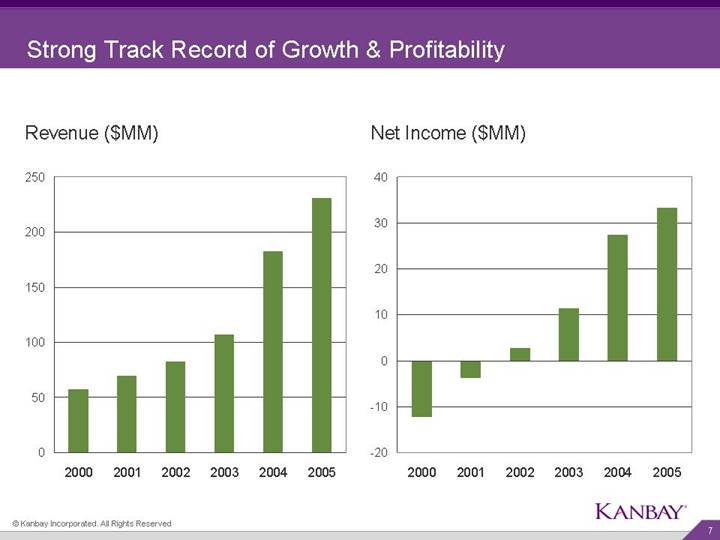

Strong Track Record of Growth & Profitability

Revenue ($MM) | | Net Income ($MM) |

| | |

[CHART] | | [CHART] |

7

Acquisition of Adjoined: Transaction Overview

Summary | | • A definitive agreement to acquire 100% of Adjoined’s stock for approximately $165 million, consisting of approximately $95.7 million in cash and approximately $69.3 million in Kanbay common stock |

| | |

Strategic Rationale | | • Enhances revenue diversification and facilitates achievement of third party revenue growth • Adds second strong industry vertical • Consumer & Industrial Products• Complements Kanbay’s existing portfolio of services and adds horizontal domain expertise • Strategy services, technology integration, outsourcing• Creates a solution provider with strong consulting capabilities and Tier 1 delivery capabilities within a highly agile, flexible and responsive service organization. • Allows combined entity to compete on a larger scale • Combination transforms the industry perception of what constitutes a best-of-breed single source provider of integrated business process automation/improvement |

| | |

Financial Impact | | • Cash accretive in 2006 and income accretive on a run-rate basis within 12 months including conservative synergy assumptions |

| | |

Timing | | • Expect to close transaction mid-March following receipt of regulatory approvals and other customary conditions |

8

Transaction Financial Highlights

• Earnings Impact (includes conservative synergy assumptions):

• Immediately accretive in 2006 on a cash basis

• Book EPS effected by the dilutive impact of amortization of intangibles in 2006

• Expected to be income accretive on a run-rate basis within 12 months

• Valuation Rationale

• Outstanding growth profile

• Valuation favorable with comparable transactions

• Bank Financing Details

• Secured $125 million debt facility

• Consists of $50 million term loan and $75 million revolver

• Size and structure of facility is designed to ensure ample liquidity

9

Introduction to Adjoined

Mid-sized provider of strategic operational consulting, technology integration and outsourcing services to Global 2000 clients

Company Snapshot

• Founded in 2000

• Privately-held

• A fast growing & profitable company

• 2005 revenue: $95.3 million

• Profitable since 2001

• 5 year revenue CAGR: 55%

Staff & Management

• Average industry consultant experience more than 10 years

• 500+ employees

• Headquartered in Miami, Florida

• Management

• Top-tier management consulting & system integrator backgrounds

• Unique vertical industry & P&L management experience

• Non-compete agreement & long-term incentive plan

10

Focused, vertical industry expertise

• Primary – Consumer & Industrial Products

• Secondary – Financial Services

Vertical focus & broad horizontal offerings will enhance end-to-end service delivery.

End-to-end service offerings

Strategy Services/ Consulting

• Supply Chain Management

• Customer Value Management

• Research Services

Technology Integration

• Customer Relationship Management

• Enterprise Resource Management

• SAP and Oracle

• Business Intelligence

• Enterprise Architecture

Outsourcing

• Infrastructure Management

• Application Management & Support

• 1 of 9 certified SAP hosting partners in US

11

• Complementary business philosophy and strategy

• Deep vertical domain expertise and complementary industry relationships in the financial services industry

• Strong consulting capabilities and balanced blend of technology integration and outsourcing will enhance Kanbay’s service offerings

• Valuable and scalable intellectual property

• History of consistent and strong profitable growth

• Attractive financial profile in terms of margins, business mix and profitability

• Outstanding organization measured by experience, depth, academic/professional pedigrees and tenure of leadership team

• Robust infrastructure and strong internal systems

12

Transaction Rationale – Why Do A Deal?

• Kanbay has built an outstanding global delivery model that can be leveraged to enter new markets

• Opportunity to enhance shareholder value by increasing scale and market presence

• Provides entry into a second strong vertical

• Provide further revenue diversification away from related party revenue sources

• Existing size and scale of Adjoined allows Kanbay to complete a single transformational deal without the broader execution risk of multiple smaller acquisitions

• Create additional momentum to attract and retain outstanding industry talent globally

This transaction is an extension of Kanbay’s business strategy.

13

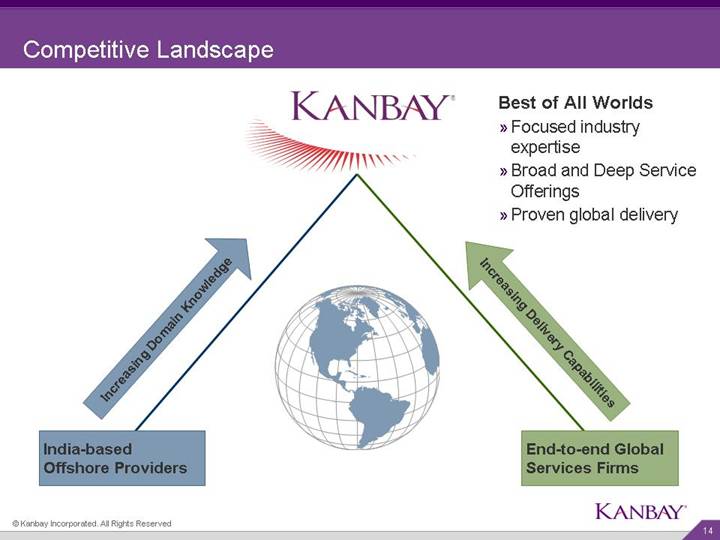

Competitive Landscape

[LOGO]

Best of All Worlds

• Focused industry expertise

• Broad and Deep Service Offerings

• Proven global delivery

Increasing Domain Knowledge | | | | Increasing Delivery Capabilities |

| [GRAPHIC] | |

| | | |

India-based Offshore Providers | | | | End-to-end Global Services Firms |

14

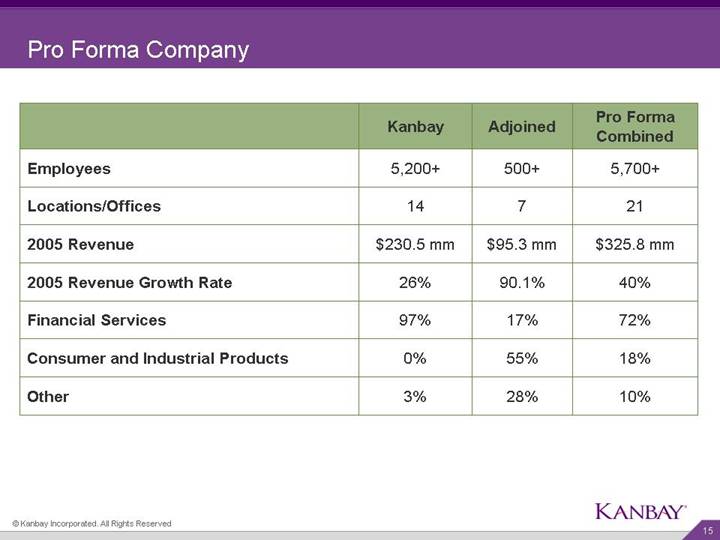

Pro Forma Company

| | Kanbay | | Adjoined | | Pro Forma

Combined | |

Employees | | 5,200+ | | 500+ | | 5,700+ | |

Locations/Offices | | 14 | | 7 | | 21 | |

2005 Revenue | | $ | 230.5 mm | | $ | 95.3 mm | | $ | 325.8 mm | |

2005 Revenue Growth Rate | | 26 | % | 90.1 | % | 40 | % |

Financial Services | | 97 | % | 17 | % | 72 | % |

Consumer and Industrial Products | | 0 | % | 55 | % | 18 | % |

Other | | 3 | % | 28 | % | 10 | % |

| | | | | | | | | | |

15

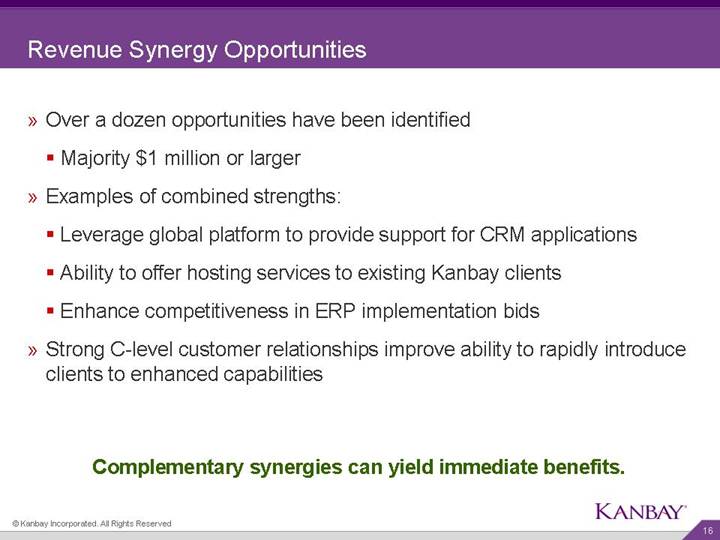

Revenue Synergy Opportunities

• Over a dozen opportunities have been identified

• Majority $1 million or larger

• Examples of combined strengths:

• Leverage global platform to provide support for CRM applications

• Ability to offer hosting services to existing Kanbay clients

• Enhance competitiveness in ERP implementation bids

• Strong C-level customer relationships improve ability to rapidly introduce clients to enhanced capabilities

Complementary synergies can yield immediate benefits.

16

Investor Highlights

• Will increase revenue diversity and reduce client concentration

• Addresses emphasis on adding third party revenue growth opportunities

• Additional vertical expertise and horizontal customer offerings

• Potential to enhance margins by further leveraging offshore resources

• Complementary organizational and sales structures

• Adds management depth

Kanbay will have the ability to address the full spectrum of services in the IT Services industry.

17

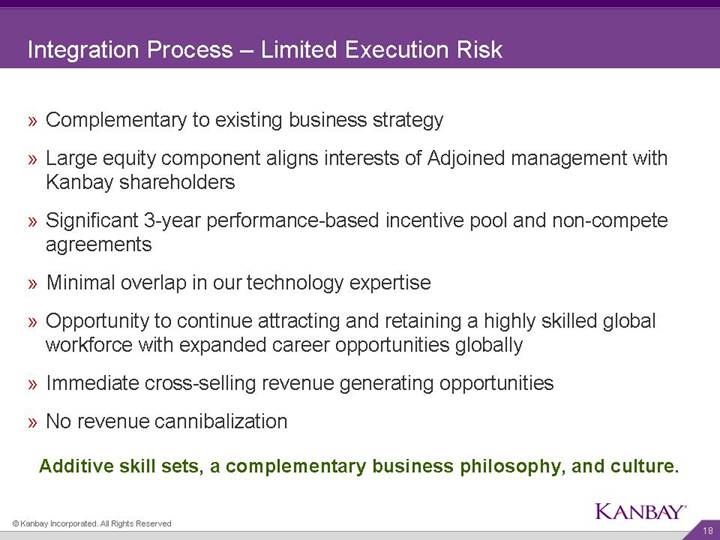

Integration Process – Limited Execution Risk

• Complementary to existing business strategy

• Large equity component aligns interests of Adjoined management with Kanbay shareholders

• Significant 3-year performance-based incentive pool and non-compete agreements

• Minimal overlap in our technology expertise

• Opportunity to continue attracting and retaining a highly skilled global workforce with expanded career opportunities globally

• Immediate cross-selling revenue generating opportunities

• No revenue cannibalization

Additive skill sets, a complementary business philosophy, and culture.

18

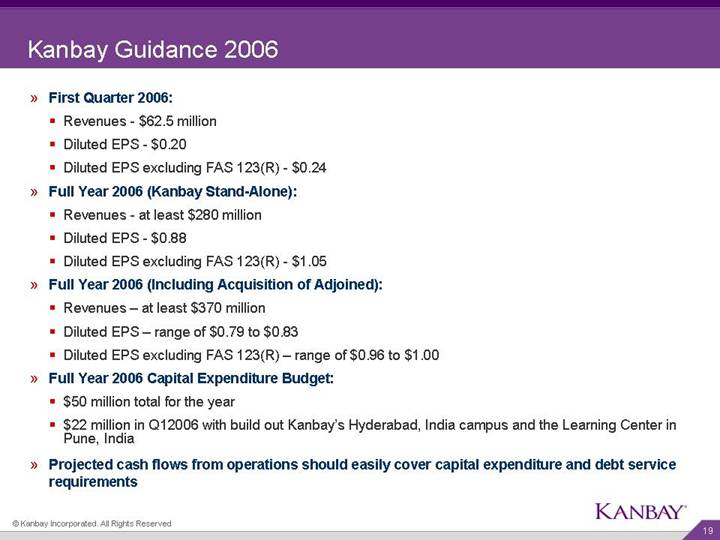

Kanbay Guidance 2006

• First Quarter 2006:

• Revenues - - $62.5 million

• Diluted EPS - $0.20

• Diluted EPS excluding FAS 123(R) - $0.24

• Full Year 2006 (Kanbay Stand-Alone):

• Revenues - - at least $280 million

• Diluted EPS - $0.88

• Diluted EPS excluding FAS 123(R) - $1.05

• Full Year 2006 (Including Acquisition of Adjoined):

• Revenues – at least $370 million

• Diluted EPS – range of $0.79 to $0.83

• Diluted EPS excluding FAS 123(R) – range of $0.96 to $1.00

• Full Year 2006 Capital Expenditure Budget:

• $50 million total for the year

• $22 million in Q12006 with build out Kanbay’s Hyderabad, India campus and the Learning Center in Pune, India

• Projected cash flows from operations should easily cover capital expenditure and debt service requirements

19

Summary

• Financial Performance

• Strong performance in 2005

• Positive momentum going into 2006

• 2006 outlook is consistent with previous long-term objectives

• Industry transforming acquisition

• An extension and acceleration of a proven strategy

• High quality organization with solid past performance

• Strong focus on financial discipline

• Complementary growth opportunities

• Vertical and horizontal expansion and ability to increase market share

• Immediate joint business development opportunities identified

• Will diversify Kanbay’s customer base and client concentration

• Enhances quality and accelerates third party revenue growth

Will create a Tier 1 professional services firm capable of offering Global 1000 customers a truly agile, highly integrated suite of strategic solutions through a proven global delivery platform.

20