UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended November 30, 2022 or | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ________________

Commission file number: 001-9610

| | | | | | | | | | | | | | | | | | | | |

| Carnival Corporation | | Carnival plc |

(Exact name of registrant as

specified in its charter) | (Exact name of registrant as

specified in its charter) |

| | | | | |

| Republic of Panama | England and Wales |

(State or other jurisdiction of

incorporation or organization) | (State or other jurisdiction of

incorporation or organization) |

| | | | | |

| 59-1562976 | 98-0357772 |

| (I.R.S. Employer Identification No.) | (I.R.S. Employer Identification No.) |

| | | | | |

| 3655 N.W. 87th Avenue | Carnival House, 100 Harbour Parade, |

| Miami, | Florida | 33178-2428 | Southampton | SO15 1ST, | United Kingdom |

(Address of principal

executive offices

and zip code) | (Address of principal

executive offices

and zip code) |

Commission file number: 001-15136

| | | | | | | | | | | | | | |

| (305) | 599-2600 | | 011 | 44 23 8065 5000 |

(Registrant’s telephone number,

including area code) | | (Registrant’s telephone number,

including area code) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock ($0.01 par value) | CCL | New York Stock Exchange, Inc. |

| Ordinary Shares each represented by American Depositary Shares ($1.66 par value), Special Voting Share, GBP 1.00 par value and Trust Shares of beneficial interest in the P&O Princess Special Voting Trust | CUK | New York Stock Exchange, Inc. |

| 1.000% Senior Notes due 2029 | CUK29 | New York Stock Exchange LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrants are well-known seasoned issuers, as defined in Rule 405 of the Securities Act.

Yes ☑ No ☐

Indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☑

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrants have submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrants were required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrants are large accelerated filers, accelerated filers, non-accelerated filers, smaller reporting companies, or emerging growth companies. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filers | ☑ | Accelerated filers | ☐ | Non-accelerated filers | ☐ | Smaller reporting companies | ☐ | Emerging growth companies | ☐ |

If emerging growth companies, indicate by check mark if the registrants have elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☑ No ☐

Indicate by check mark whether the registrants are shell companies (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold was $12.1 billion as of the last business day of the registrant’s most recently completed second fiscal quarter.

At January 12, 2023, Carnival Corporation had outstanding 1,113,479,515 shares of its Common Stock, $0.01 par value.

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold was $2.3 billion as of the last business day of the registrant’s most recently completed second fiscal quarter.

At January 12, 2023, Carnival plc had outstanding 186,136,095 Ordinary Shares $1.66 par value, one Special Voting Share GBP 1.00 par value and 1,113,479,515 Trust Shares of beneficial interest in the P&O Princess Special Voting Trust.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the 2022 Annual Report and 2023 joint definitive Proxy Statement are incorporated by reference into Part II and Part III of this report.

CARNIVAL CORPORATION & PLC

FORM 10-K

FOR THE FISCAL YEAR ENDED NOVEMBER 30, 2022

TABLE OF CONTENTS | | | | | | | | |

| | |

| PART I | | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| | | | | | | | |

| Item 4. | | |

| | |

| PART II | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| PART III | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| PART IV | | |

| Item 15. | | |

| Item 16. | | |

DOCUMENTS INCORPORATED BY REFERENCE

The information described below and contained in the Registrants’ 2022 Annual Report to shareholders to be furnished to the U.S. Securities and Exchange Commission pursuant to Rule 14a-3(b) of the Securities Exchange Act of 1934 is shown in Exhibit 13 and is incorporated by reference into this joint 2022 Annual Report on Form 10-K (“Form 10-K”).

Part and Item of the Form 10-K

Part II

Item 5. Market for Registrants’ Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Market Information, Holders and Performance Graph.

Item 6. Reserved.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Item 8. Financial Statements and Supplementary Data.

Portions of the Registrants’ 2023 joint definitive Proxy Statement, to be filed with the U.S. Securities and Exchange Commission, are incorporated by reference into this Form 10-K under the items described below.

Part and Item of the Form 10-K

Part III

Item 10. Directors, Executive Officers and Corporate Governance.

Item 11. Executive Compensation.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

Item 13. Certain Relationships and Related Transactions, and Director Independence.

Item 14. Principal Accountant Fees and Services.

PART I

Item 1. Business.

A. Overview

I.Summary

Carnival Corporation was incorporated in Panama in 1974 and Carnival plc was incorporated in England and Wales in 2000. Carnival Corporation and Carnival plc operate a dual listed company (“DLC”), whereby the businesses of Carnival Corporation and Carnival plc are combined through a number of contracts and through provisions in Carnival Corporation’s Articles of Incorporation and By-Laws and Carnival plc’s Articles of Association. The two companies operate as if they are a single economic enterprise with a single executive management team and identical Boards of Directors, but each has retained its separate legal identity. Carnival Corporation and Carnival plc are both public companies with separate stock exchange listings and their own shareholders. Together with their consolidated subsidiaries, Carnival Corporation and Carnival plc are referred to collectively in this Form 10-K as “Carnival Corporation & plc,” “company,” “our,” “us” and “we.” We are the largest global cruise company and among the largest leisure travel companies with a portfolio of world-class cruise lines. With operations in North America, Australia, Europe and Asia, our portfolio features - AIDA Cruises, Carnival Cruise Line, Costa Cruises, Cunard, Holland America Line, Princess Cruises, P&O Cruises (Australia), P&O Cruises (UK) and Seabourn.

II.Mission (Purpose), Vision, Values and Priorities

Mission (Purpose)

To deliver unforgettable happiness to our guests by providing extraordinary cruise vacations, while honoring the integrity of every ocean we sail, place we visit and life we touch.

Vision

As the global leader in the cruise industry, we will lead the way in innovative and sustainable cruising to deliver memorable vacations and build borderless connections.

Culture Essentials (our Core Values)

•Speak Up - Our voice is our strength. Every one of us, regardless of level or role, speaks up when we have questions, comments, concerns, or new ideas. If we see something wrong or that doesn’t seem right, we say something and trust our voices will be heard without fear of retaliation.

•Respect & Protect - The health, safety and well-being of our people and the planet are vital. We choose to take decisive actions to respect and protect every life we touch, the places we sail and the laws that govern us.

•Empower - We and our team members have the time, tools and support we need to do our best work. We’re empowered to take personal ownership and accountability to succeed, and we take pride in our work.

•Improve - Our business is built on forward motion. We have the courage to dream big, driving innovation and continuous improvement in guest and team member experiences, operations, compliance, sustainability and beyond.

•Listen & Learn - We listen actively and seek to understand before responding, because the more perspectives we have, the better decisions we make. We value and respect the words and ideas of others, keeping an open mind, and learning from our successes and failures.

•Communicate - We openly share our knowledge, skills and information across brands, functions and the entire company to further our collective success. Together we champion our mission, vision, values and company priorities.

Priorities

Ensure each of our world-class brands owns its space in the vacation market by delivering extraordinary experiences tailored to its guests.

We understand vacation expectations and preferences vary widely among our diverse audience of potential guests. To fulfill our mission, and in the process achieve outstanding guest satisfaction levels, industry-leading demand and greatly improved pricing, each of our brands must carve out a distinct identity for delivering cruise experiences. Our brands must effectively market their uniqueness to existing and potential guests and deliver on their promise across the entire guest journey.

Become travel and leisure’s employer of choice.

We celebrate our diverse team of over 160,000 team members representing approximately 150 countries and are committed to providing a welcoming and inclusive environment where people from different backgrounds, experiences and walks of life can succeed. We care deeply for our team members and must always cultivate an atmosphere of openness, respect and trust. We know our team members are at the heart of inspiring unforgettable happiness, so we strive to be the world’s number-one choice for hospitality, travel and leisure careers.

Maintain our commitment to seek excellence in compliance, environmental protection and in looking after the safety, health and well-being of every life we touch.

Achieving our mission depends on being good corporate citizens and stewards of the environment. Safeguarding the planet we call home, our guests, the communities we serve, and our Carnival family, and complying with the laws and regulations that govern our business, is vital to our success.

Set the pace with the industry’s smartest solutions that deliver on our sustainability roadmap to 2030.

Our earth, ecosystem and environment mean everything to us. Without the incredible communities and scenic spaces we operate in, our mission of inspiring unforgettable happiness would be impossible. We’re determined to lead the way in sustainable cruising by promoting positive climate action, contributing to a circular economy, partnering with the communities we sail to and from and reducing our carbon footprint. To do this, we are investing in technology upgrades and fleet improvements, piloting alternative fuel types, optimizing itineraries and cultivating a workforce that mirrors the diversity of the communities we encounter along the way.

Strengthen our balance sheet and deliver long-term shareholder value.

In recent years, travel and leisure has endured volatility unlike anything seen in modern history, including unique obstacles that disproportionally affected the cruise industry. With our operations now approaching full strength and the continued support of our guests, team members, investors and other stakeholders, we are focused on our financial fitness. We’re determined to drive revenue, operate effectively and efficiently at scale, generate record levels of cash from operations and invest our capital wisely. We believe this will allow us to responsibly reduce our debt over time and return to strong profitability and investment-grade credit ratings.

B. Global Cruise Industry

I. Overview

In the face of the global impact of COVID-19, we paused our guest cruise operations in March 2020 and began resuming guest cruise operations in 2021. As of November 30, 2022, 97% of our capacity is currently serving guests.

We believe cruising offers a broad range of products and services to suit vacationing guests of many ages, backgrounds and interests. Each brand in our portfolio meets the needs of a unique set of consumer psychographics and vacation needs which allows us to penetrate large addressable customer segments. The mobility of cruise ships enables us to move our vessels between regions in order to meet changing demand across different geographic areas.

Cruise brands can be broadly classified as offering contemporary, premium and luxury cruise experiences. The contemporary experience has a more casual ambiance and historically includes cruises that last seven days or less. The premium experience emphasizes quality, comfort, style and more destination-focused itineraries and appeals to those who are more affluent. The premium experience generally includes cruises that last from seven to 14 days. The luxury experience is usually characterized by very high standards of accommodation and service, smaller vessel size and exotic itineraries to ports that are inaccessible by larger ships. We have product and service offerings in each of these three broad classifications.

II. Passenger Capacity by Ocean Going Vessels

| | | | | | | | | | | | | | |

| | Passenger Capacity as of December 31 (a) (b) |

| Calendar Year | | Global Cruise

Industry (c) | | Carnival

Corporation & plc |

| 2019 | | 589,820 | | | 254,010 | |

| 2020 | | 607,500 | | | 246,450 | |

| 2021 | | 636,270 | | | 253,950 | |

| 2022 | | 663,970 | | | 259,060 | |

| 2023 | | 701,490 | | | 263,730 | |

| 2024 | | 729,820 | | | 268,050 | |

| 2025 | | 764,440 | | | 272,360 | |

(a)Includes ships which have resumed guest cruise operations and ships expected to resume guest cruise operations.

2023 - 2025 excludes four ships which will be removed from our fleet. 2023-2025 data is estimated based on announced newbuilds and ship retirements and does not include an estimate for unannounced ship retirements.

(b)In accordance with cruise industry practice, passenger capacity is calculated based on the assumption of two passengers per cabin even though some cabins can accommodate three or more passengers.

(c)Global cruise industry data was obtained from Cruise Industry News.

C. Our Global Cruise Business

I. Segment Information | | | | | | | | | | | | | | | | | | | |

| Ships in Service or Expected to Return to Service as of November 30, 2022 (a) |

| Passenger Capacity | | | | Percentage of Total Capacity | | Number of Cruise Ships |

| North America and Australia (“NAA”) Segment | | | | | | | |

| Carnival Cruise Line | 75,530 | (b) | | | 30 | % | | 24 |

| Princess Cruises | 46,280 | | | | 18 | | | 15 |

| Holland America Line | 22,920 | | | | 9 | | | 11 |

| P&O Cruises (Australia) | 7,230 | | | | 3 | | | 3 |

| Seabourn | 2,840 | | | | 1 | | | 6 |

| 154,800 | | | | 61 | | | 59 | |

| | | | | | | |

| Europe and Asia (“EA”) Segment | | | | | |

| Costa Cruises (“Costa”) | 39,580 | (b) (c) | | | 16 | | | 11 |

| AIDA Cruises (“AIDA”) | 33,540 | (d) | | | 13 | | | 12 |

| P&O Cruises (UK) | 19,020 | | | | 7 | | | 6 |

| Cunard | 6,820 | | | | 3 | | | 3 |

| 98,960 | | | | 39 | | | 32 | |

| 253,760 | | | | 100 | % | | 91 | |

(a)As of January 12, 2023, includes three Costa ships, with a passenger capacity of 10,880, which are not in guest cruise operations and are expected to return to service.

(b)Costa Venezia with a passenger capacity of 4,200 and Costa Firenze with a passenger capacity of 4,240 will be transferred to Carnival Cruise Line in 2023 and 2024, respectively.

(c)Excludes Costa Magica, with a passenger capacity of 2,700, which will not resume guest cruise operations. Includes Costa Fortuna, with a passenger capacity of 2,700, which is expected to stop guest cruise operations in April 2023.

(d)Excludes AIDAvita, with a passenger capacity of 1,270, which will not resume guest cruise operations. Includes AIDAaura, with a passenger capacity of 1,270, which is expected to stop guest cruise operations in September 2023.

We also have a Cruise Support segment that includes our portfolio of leading port destinations and other services, all of which are operated for the benefit of our cruise brands.

In addition to our cruise operations, we own Holland America Princess Alaska Tours, the leading tour company in Alaska and the Canadian Yukon, which complements our Alaska cruise operations. Our tour company owns and operates hotels, lodges, glass-domed railcars and motorcoaches which comprise our Tour and Other segment.

II. Passengers Carried

In 2022, we carried 7.7 million passengers, consisting of 5.6 million carried by our NAA segment and 2.1 million carried by our EA segment, which was lower than our historical levels as a result of the pause and subsequent resumption of our guest cruise operations. In 2019, our most recent full year of guest cruise operations, our brands carried 12.9 million passengers, 8.6 million carried by our NAA segment and 4.2 million carried by our EA segment.

III. Ships Under Contract for Construction

As of November 30, 2022, we have a total of 6 cruise ships expected to be delivered through 2025. Our ship construction contracts are with Fincantieri and MARIOTTI in Italy and Meyer Werft in Germany.

| | | | | | | | | | | |

| Expected Delivery Date | | Passenger Capacity

Lower Berth |

| Carnival Cruise Line | | | |

| | | |

Carnival Jubilee (a) | December 2023 | | 5,370 | |

| Princess Cruises | | | |

Sun Princess (a) | January 2024 | | 4,320 | |

| Newbuild (a) | July 2025 | | 4,320 | |

| Seabourn | | | |

| Seabourn Pursuit | July 2023 | | 260 | |

| P&O Cruises (UK) | | | |

Arvia (a) | December 2022 | | 5,290 | |

| Cunard | | | |

| Queen Anne | April 2024 | | 3,000 | |

(a)Powered by LNG

IV. Cruise Brands

Carnival Cruise Line is “The World’s Most Popular Cruise Line®” and has provided multi-generational family entertainment at exceptional value to its guests for 50 years. Carnival Cruise Line creates an environment where guests can be their most playful selves on ships that are designed to inspire the experience of bringing people together, with limitless opportunities for guests to create their own fun. Carnival Cruise Line is teaming up with Costa Cruises to create a new concept for Carnival’s North American guests when Carnival Fun Italian StyleTM debuts in the spring of 2023. Carnival Fun Italian StyleTM will marry the great service, food and entertainment that Carnival’s guests enjoy with Costa’s Italian design features.

For over 55 years, Princess has sailed the world connecting guests to what matters most – the people they love, the people they meet and the destinations they visit. Princess delivers effortless, personalized cruising thanks to the Princess Medallion, a revolutionary wearable that anticipates guests’ needs, wants and desires so guests can enjoy more of what they love.

Holland America Line has been exploring the world for 150 years and was the first cruise line to offer adventures in Alaska and Yukon. Its fleet offers an ideal mid-sized ship experience. Holland America Line’s ships feature a diverse range of enriching experiences focused on destination exploration and personalized travel. Live music at sea fills each evening at Music Walk, and dining venues feature exclusive selections from a Culinary Council of world-famous chefs.

For 90 years, P&O Cruises (Australia) has taken Australians & New Zealanders on dream holidays to the most incredible destinations along the Australian coast as well as the idyllic South Pacific. The home-grown cruise line delivers a holiday with great entertainment, world-class dining and unforgettable onboard experiences. Delivered in the Aussie way, guests can choose to do everything, or nothing at all, with P&O Cruises (Australia).

Seabourn, the most modern luxury fleet at sea, sails to legendary cities and less-traveled ports. Its smaller, more intimate ships allow guests to discover the unexpected—about the world and about themselves. Guests enjoy ocean-front suites and epicurean dining is theirs on demand. With nearly one team member for every guest, its guests make meaningful connections. With Seabourn, they go further, deeper and experience luxury in action. On a voyage so seamless, so all-inclusive and so far beyond compare, guests never want it to end.

For more than 70 years, Costa’s ships have sailed the seas of the world, offering a diverse choice of cruise holidays. Costa primarily serves guests from Continental Europe, enriching them through the exploration of the most beautiful destinations on

five continents. Costa brings a modern Italian lifestyle to its ships and provides guests with a true European experience that embodies a uniquely Italian passion for life through warm hospitality, entertainment and gastronomy, that makes Costa different from any other cruise experience.

AIDA is the leading and most recognized brand in the German cruise market. AIDA delivers unique travel experiences with modern comfort, where guests of all ages feel at home and enjoy consistently excellent service accompanied by the AIDA smile. Guests across generations enjoy the German-inspired modern premium lifestyle cruise experience with a wide variety of culinary delights, first-class entertainment, unforgettable shore excursions, numerous sports activities, and spacious wellness areas to relax.

P&O Cruises (UK) is Britain’s biggest cruise line, welcoming guests to extraordinary travel experiences designed in a distinctively British way - through a blend of discovery, relaxation and exceptional service catered towards British tastes. P&O Cruises (UK)’s fleet of premium ships deliver authentic travel experiences around the globe, combining style, quality and innovation with a sense of occasion and attention to detail, to create a truly memorable holiday.

For over 180 years, the iconic Cunard fleet has perfected the timeless art of luxury ocean travel. While onboard, Cunard guests experience unique signature moments, from Cunard’s white gloved afternoon tea service to spectacular gala evening balls to its renowned Insights Speaker program. Guest expectations are exceeded through Cunard’s exemplary White Star Service®. From the moment a guest steps onboard, every detail of their voyage is curated to ensure they feel special and are inspired by unique events. Onboard Cunard, guests are free to do as much or as little as they please.

V. Principal Source Geographic Areas

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Carnival Corporation & plc

Cruise Guests Carried | | |

| (in thousands) | | 2022 | | 2021 | | 2019 | | Brands Mainly Serving |

| United States and Canada | | 5,140 | | 660 | | 7,170 | | Carnival Cruise Line, Princess Cruises, Holland America Line, Seabourn and Cunard |

| Continental Europe | | 1,610 | | 390 | | 2,590 | | Costa and AIDA |

| United Kingdom | | 660 | | 170 | | 780 | | P&O Cruises (UK) and Cunard |

| Australia and New Zealand | | 230 | | 0 | | 920 | | Carnival Cruise Line, Princess Cruises and

P&O Cruises (Australia) |

| Asia | | 10 | | — | | 1,110 | | Princess Cruises and Costa |

| Other | | 80 | | 10 | | 300 | | |

| Total | | 7,730 | | 1,220 | | 12,870 | | |

As a result of the resumption of guest cruise operations, data for 2022 and 2021 is not representative of a full year of operations. Due to the pause of our guest cruise operations, data for 2020 is not meaningful and is not included in the table. We have provided 2019 data as it is our most recent full year of guest cruise operations.

VI. Cruise Programs

| | | | | | | | | | | | | | | | | | | | |

| | Carnival Corporation & plc

Percentage of Passenger Capacity by Itinerary |

| | 2022 | | 2021 | | 2019 |

| Caribbean | | 34 | % | | 32 | % | | 32 | % |

| Europe without Mediterranean | | 20 | | | 23 | | | 14 | |

| Mediterranean | | 18 | | | 29 | | | 13 | |

| Alaska | | 8 | | | 4 | | | 6 | |

| Australia and New Zealand | | 3 | | | — | | | 7 | |

| China | | — | | | — | | | 4 | |

| Other | | 18 | | | 12 | | | 25 | |

| | 100 | % | | 100 | % | | 100 | % |

Due to the resumption of guest cruise operations, data for 2022 and 2021 is not representative of a full year of operations. Due to the pause of our guest cruise operations, data for 2020 is not meaningful and is not included in the table. We have provided 2019 data as it is our most recent full year of guest cruise operations.

VII. Cruise Pricing and Payment Terms

Each of our cruise brands publishes prices for the upcoming seasons primarily through the internet, although published materials such as direct mailings are also used. Our brands have multiple pricing levels that vary by source market, category of guest accommodation, ship, season, duration and itinerary. Cruise prices frequently change in a dynamic pricing environment and are impacted by a number of factors, including the number of available cabins for sale in the marketplace and the level of guest demand. We offer a variety of special promotions, including early booking, past guest recognition and travel agent programs.

Our bookings are generally taken several months in advance of the cruise departure date. Generally, the longer the cruise itinerary the further in advance the bookings are made. This lead time allows us to manage our prices in relation to demand for available cabins through the use of advanced revenue management capabilities and other initiatives.

The cruise ticket price typically includes the following:

• Accommodations

• Most meals, including snacks at numerous venues

• Access to amenities such as swimming pools, water slides, water parks, whirlpools, a health club, and sun decks

• Child care and supervised youth programs

• Entertainment, such as theatrical and comedy shows, live music and nightclubs

• Visits to multiple destinations

We offer value added packages to induce ticket sales to guests and groups and to encourage advance purchase of certain onboard items. These packages are bundled with cruise tickets and sold to guests for a single price rather than as a separate package and may include one or more of the following:

| | | | | |

| • Beverage packages | • Internet packages |

| • Shore excursions | • Photo packages |

| • Air packages | • Onboard spending credits |

| • Specialty restaurants | • Service charges |

Our brands’ payment terms generally require that a guest pay a deposit to confirm their reservation and then pay the balance due before the departure date.

VIII. Seasonality

Our passenger ticket revenues are seasonal. Historically, demand for cruises has been greatest during our third quarter, which includes the Northern Hemisphere summer months. This higher demand during the third quarter typically results in higher ticket prices and occupancy levels and, accordingly, the largest share of our operating income is typically earned during this period. This historical trend was disrupted in 2020 by the pause and in 2021 and 2022 by the subsequent resumption of our guest cruise operations. In addition, substantially all of Holland America Princess Alaska Tours’ revenue and net income (loss) is generated from May through September in conjunction with Alaska’s cruise season.

IX. Onboard and Other Revenues

Onboard and other activities are provided either directly by us or by independent concessionaires, from which we receive either a percentage of their revenues or a fee. Concession revenues do not have direct expenses because the costs and services incurred for concession revenues are borne by our concessionaires. In 2022, we earned 42% of our cruise revenues from onboard and other revenue goods and services including: | | | | | |

• Beverage sales | • Internet and communication services |

• Casino gaming | • Full service spas |

• Shore excursions | • Specialty restaurants |

• Retail sales | • Art sales |

• Photo sales | • Laundry and dry cleaning services |

In 2019, our most recent full year of guest cruise operations, we earned 30% of our cruise revenues from onboard and other revenues.

X. Marketing Activities

Guest feedback and research support the development of our overall marketing and business strategies to drive demand for cruises and increase the number of first-time cruisers. Our goal has always been to increase consumer awareness for cruise vacations and further grow our share of their vacation spend. We measure and evaluate key drivers of guest loyalty and their satisfaction with our products and services that provide valuable insights about guests’ cruise experiences. We closely monitor our net promoter scores, which reflect the likelihood that our guests will recommend our brands’ cruise products and services to friends and family, including those new-to-cruise.

During 2022, in connection with the resumption of guest cruise operations, we increased our marketing and advertising programs after significantly reducing both during 2020 and 2021. Our brands have comprehensive marketing and advertising programs across diverse mediums to promote their products and services to vacationers and our travel agent partners. Each brand’s marketing activities have generally been designed to reach a local region in the local language. We are focused on driving further brand differentiation and clarity around each of our brand’s optimal target segments, ensuring that our creative marketing speaks to each brand’s target audience and launching more effective digital performance marketing and lead generation approaches. Our marketing efforts historically have allowed us to attract new guests online by leveraging the reach and impact of digital marketing and social media. Over time, we have invested in new marketing technologies to deliver more engaging and personalized communications. This has helped us cultivate guests as advocates of our brands, ships, itineraries and onboard products and services.

Substantially all of our cruise brands offer past guest recognition programs that reward repeat guests with special incentives such as reduced fares, gifts, onboard activity discounts, complimentary laundry and internet services, expedited ship embarkation and disembarkation and special onboard activities.

XI. Sales Channels

We sell our cruises through travel agents, tour operators, company vacation planners and our websites. Our individual cruise brands’ relationships with their travel agent partners are generally independent of each of our other brands. Our travel agents relationships are generally not exclusive and travel agents generally receive a base commission, plus the potential of additional commissions, including discounts or complimentary tour conductor cabins, based on the achievement of pre-defined sales volumes.

Travel agent partners are an integral part of our long-term cruise distribution network and are critical to our success. We utilize local sales teams to motivate travel agents to support our products and services with competitive pricing, promotional policies and joint marketing and advertising programs. During 2022, no group of travel agencies under common control accounted for 10% or more of our revenues. We also employ a wide variety of educational programs, including websites, seminars and videos, to train agents on our cruise brands and their products and services. In 2022, we held a variety of virtual and in-person trainings and educational programs to continue to support and develop our travel agent partners, including ship visits to familiarize our travel agent partners with our enhanced health and safety protocols.

All of our brands have internet booking engines to allow travel agents to book our cruises. Additionally, all of our cruise brands have their own consumer websites that provide access to information about their products and services to users and enable their guests to quickly and easily book cruises and other products and services online. These sites interface with our brands’ social networks, blogs and other social media sites, which allow them to develop greater contact and interaction with their guests before, during and after their cruise. We also employ vacation planners who support our sales initiatives by offering our guests one-on-one cruise planning expertise and other services.

XII. Human Capital Management and Employees

Our shipboard and shoreside employees are sourced from approximately 150 countries. In connection with our resumption of guest cruise operations in 2022, we increased the number of employees onboard our ships from the reduced levels during 2021 and 2020. In 2022, we had an average of 75,000 employees onboard our ships, excluding employees on leave. Our shoreside operations had an annual average of 10,000 full-time and 2,000 part-time/seasonal employees. In 2019, our most recent full year of guest cruise operations, we had an average of 92,000 employees on our ships, excluding employees on leave and our shoreside operations had an annual average of 12,000 full-time and 2,000 part-time/seasonal employees. Holland America Princess Alaska Tours significantly increases its work force during the late spring and summer months in connection with Alaska’s cruise season.

Gender Diversity:

| | | | | | | | | | | |

| Approximate Average for 2022 (a) |

| Female | | Male |

| Shoreside Employees | 7,000 | | 5,000 |

| Shipboard Employees | 13,000 | | 62,000 |

| Total Employees | 20,000 | | 67,000 |

| | | | | | | | | | | |

| As of November 30, 2022 |

| Female | | Male |

| Boards of Directors | 4 | | 9 |

| Non-Director Senior Management and Company Secretary | 6 | | 7 |

| Non-Director Senior Management and Company Secretary Direct Reports | 27 | | 57 |

(a) These amounts are approximations and at times, fluctuate significantly due to the seasonality of our business.

We have entered into agreements with unions covering certain employees on our ships and in our shoreside hotel and transportation operations. The percentages of our shipboard and shoreside employees that are represented by collective bargaining agreements are 55% and 24%, respectively. We consider our employee and union relationships to be strong.

A team of highly motivated and engaged employees is key to providing extraordinary cruise vacations. To facilitate the recruitment, development and retention of our valuable employees, we strive to make Carnival Corporation & plc a diverse, inclusive and safe workplace, with opportunities for our employees to grow and develop in their careers.

a.Talent Development

We believe in the investment in our team members through the training and development of both shoreside and shipboard employees. We leverage a combination of virtual and in-person training to ensure that our teams are well-prepared to carry out their individual and collective responsibilities.

For our shipboard employees, our goal is to be a leader in delivering high quality professional maritime training, as evidenced by the Arison Maritime Center. The Center is home to the Center for Simulator Maritime Training (“CSMART”). The leading-edge CSMART Academy features the most advanced bridge and engine room simulator technology and equipment available, with the capacity to provide annual professional training for all our bridge, engineering and environmental officers. CSMART participants receive a maritime training experience that fosters advanced knowledge and skills development, critical thinking and problem solving; all in a professional learning environment where our corporate culture is reinforced. CSMART also offers training related to liquefied natural gas (“LNG”) technology as well as an environmental officer training program and additional environmental courses for bridge and engineering officers to further enhance our training on environmental awareness and protection.

b.Succession Planning

Our Boards of Directors believe that planning for succession is an important function. Our multi-brand structure enhances our succession planning process. At the corporate level, a highly-skilled management team oversees a collection of cruise brands. We continually strive to foster the professional development of management and team members in other critical roles. As a result, we have developed a very experienced and strong group of leaders, with their performance subject to ongoing monitoring and evaluation, as potential successors to all of our executive positions, including our CEO.

In August 2022, Josh Weinstein, previously our Chief Operations Officer, was appointed President, CEO and Chief Climate Officer. Josh Weinstein has a long history of success in critical senior-level roles for our company. In his most recent assignment for the past two years as Chief Operations Officer he oversaw all major operational functions including global maritime, global ports and destinations, global sourcing, global IT and global auditing. During this time, he also oversaw Carnival UK, the operating company for P&O Cruises (UK) and Cunard, which he previously managed directly for three years as president. Prior to his role with Carnival UK, he was our company’s treasurer for 10 years.

XIII. Port Destinations and Private Islands

We operate a portfolio of port destinations and private islands enabling us to offer exceptional guest experiences by creating a wide variety of high quality destinations around the world that are uniquely tailored to our guests’ preferences. In addition, to secure preferential berth access to third-party ports, we enter into berthing agreements and commitments.

In May 2022, Carnival Cruise Line broke ground on its new Carnival Grand Bahama cruise port destination, expected to open in 2025 and located on the south side of Grand Bahama Island. The new cruise port development will include a pier able to accommodate up to two of our largest ships simultaneously, welcoming guests to a stunning beach and further expanding our experience offerings for our guests. Additionally, our investment in this cruise port destination will support our efforts to design more energy efficient itineraries based on its strategic location. Carnival Grand Bahama will be an important addition to our current portfolio of six corporate operated ports and destinations in the Caribbean:

•Puerta Maya in Cozumel, Mexico

•Grand Turk Cruise Center in Turks & Caicos

•Mahogany Bay in Isla Roatan, Honduras

•Amber Cove in the Dominican Republic

•Half Moon Cay, a private island in The Bahamas

•Princess Cay, a private island in The Bahamas

XIV. Ethics and Compliance

We believe a strong ethics and compliance culture is imperative for the success of any company. Our compliance framework includes a Global Ethics and Compliance (“GE&C”) department, which is led by our Chief Risk and Compliance Officer who leads the effort to promote and monitor a strong ethics and compliance culture throughout the company. The main responsibilities of the GE&C department are to collaboratively:

•Identify, assess, monitor, prevent, detect and report on compliance risk

•Ensure compliance accountabilities and responsibilities are clear across the company

•Promote a strong culture of ethics and compliance

•Drive ethics and compliance continuous improvements

To further heighten the focus on ethics and compliance, our Boards of Directors have Compliance Committees, which oversee the GE&C department and maintain regular communications with our Chief Risk and Compliance Officer.

XV. Sustainability

We strive to be a company that people want to work for and to be an exemplary global corporate citizen. Our commitment and actions to keep our guests and crew members safe and well, protect the environment, develop and provide opportunities for our workforce, strengthen stakeholder relations and enhance both the communities where we work as well as the port communities that our ships visit, are reflective of our brands’ core values and vital to our success.

In 2021, we established goals for 2030 which incorporate six key focus areas listed below that align with elements of the United Nation’s Sustainable Development Goals and build on the momentum of our successful achievement of our 2020 sustainability goals.

Sustainability Goals Progress

The tables below represent our progress on each of our six key focus areas:

| | | | | | | | |

| 2030 Climate Action Goals | Status (a) | Our Progress |

Achieve 20% carbon intensity reduction relative to our 2019 baseline measured in both grams of CO2e per ALB-km and kilograms of CO2e per ALBD | On Track | Achieved 2% carbon intensity reduction on an ALB-km basis and 4% on an ALBD basis. For ships in guest cruise operations, achieved 11% carbon intensity reduction on an ALB-km basis and 13% on an ALBD basis |

| Reduce absolute particulate matter air emissions by 50% relative to our 2015 baseline | Achieved | |

| Increase fleet shore power connection capability to 60% of the fleet | On Track | 57% of the fleet has shore power connection capability |

| Expand our LNG program | On Track | Seven LNG ships across the fleet |

| Optimize the reach and performance of our Advanced Air Quality System program | On Track | 93% of the fleet has Advanced Air Quality Systems installed (b) |

| Expand battery, fuel cell and biofuel capabilities | Ongoing | Piloted the use of biofuels as a replacement for fossil fuel on two ships |

| Reduce Scope 3 (indirect) emissions associated with food procurement and waste management | Ongoing | Completed an inventory of our Scope 3 emissions. Following the Greenhouse Gas Protocol, we estimate that our Scope 3 emissions represent approximately half of our total emissions |

| Identify carbon offset options only when energy efficiency options have been exhausted | Ongoing | Continuing to monitor the carbon offset market and options, as well as exploring carbon capture and storage opportunities |

| | | | | | | | |

| 2030 Circular Economy Goals | Status (a) | Our Progress |

| Achieve 50% single-use plastic item reduction in 2021 | Achieved | |

| Achieve 30% unit food waste reduction by 2022 and 50% unit food waste reduction by 2030 | • 2022 goal achieved

• 2030 goal on track |

•Established interim goal to achieve 40% unit food waste reduction by 2025 |

| Increase Advanced Waste Water Treatment System coverage to >75% of our fleet capacity | On Track | Achieved 64% coverage of fleet capacity |

| Send a larger percentage of waste to waste-to-energy facilities where practical | Ongoing | Completed a baseline of our waste programs in the U.S. |

| Partner with primary vendors to reduce upstream packaging volumes | Ongoing | Completed a packaging reduction pilot program with our primary engine supplier and achieved a reduction of approximately 44% |

| | | | | | | | |

| 2030 Good Health and Well-Being Goals | Status (a) | Our Progress |

| Committed to continued job creation | Ongoing | •Increased the number of employees on board our ships from the reduced levels during the pause in guest cruise operations •Opened and filled a significant number of shoreside positions |

| Establish measurable Company Culture metrics and set annual improvement targets | Ongoing | Established Company Culture metrics with semi-annual Culture surveys and are in the process of establishing improvement targets |

| Implement global well-being standards by 2023 | Ongoing | •Continued to work with authorities to arrange for COVID-19 vaccinations and boosters for our crew members, many of whom may not have had access to vaccines •Maintained and evolved onboard public health protocols to reflect the changing nature of the pandemic while protecting our guests and crew members responsibly |

| Reduce the number of guest and crew work-related injuries | Ongoing | Continued to implement initiatives to prevent guest and crew injuries |

| | | | | | | | |

| 2030 Sustainable Tourism Goals | Status (a) | Our Progress |

Animal Welfare – responsible sourcing •Achieve 100% cage free eggs by the end of 2025. •Achieve 100% responsible chicken sourcing by the end of 2025 •Achieve 100% gestation crate-free pork by the end of 2025

| On Track | Continued to work with our supply chain and met our glidepath targets for FY2022 - achieved 58% cage free eggs, 25% responsible chicken and 29% gestation crate-free pork purchases |

| Establish partnerships with destinations focused on sustainable economic development, preservation of local traditions, and capacity management | Ongoing | •Broke ground on a new cruise port destination on Grand Bahama Island, which is expected to open in 2025. The new port will provide business opportunities for the residents of Grand Bahama with an estimated 1,000 local jobs •Working with ports of Miami, Galveston, Barcelona, Savona and Genoa to support their shore power development efforts •Joined the Alaska Green Corridor partnership to explore methods to accelerate the reduction of greenhouse gas emissions •Costa Cruises continued with the “Traditions in the Future” project which supports the preservation of traditional arts and crafts to a new generation of artisans |

| Continue to support disaster resilience, relief, and recovery efforts | Ongoing | •Provided temporary housing for 1,500 Ukrainian refugees on a Holland America Line ship for five months •Launched brand specific projects and provided overall support to our Ukrainian crew members and their families |

| Build stronger community relationships in our employment bases and destinations via employee volunteering programs | Ongoing | Conducted multiple costal cleanups involving shipboard- and shoreside employees and partners in various locations around the world |

| | | | | | | | |

| 2030 Biodiversity and Conservation Goals | Status (a) | Our Progress |

| Support biodiversity and conservation initiatives through select NGO partnerships | Ongoing | Continued working with the Ocean 100 Dialogues to support ocean stewardship with a focus on climate change and biodiversity |

| Conduct audits and monitor animal encounter excursions regularly | Ongoing | Published Animal Welfare Statement for Excursions & Experiences on our website |

| | | | | | | | |

| 2030 Diversity, Equity and Inclusion Goals | Status (a) | Our Progress |

| Ensure our overall shipboard and shoreside employee base reflects the diversity of the world | Ongoing | Continued to employ shipboard crew members from approximately 150 countries around the world |

| Expand shipboard and shoreside diversity, equity, and inclusion across all ranks and departments | Ongoing | •Half of the global direct reports to our CEO are women •Named as one of the World’s Top Female-Friendly Companies by Forbes •Named as one of the World’s Best Employers by Forbes •Recognized as one of America’s Best Employers for Diversity by Forbes •Named among Best Companies for Latinos to Work by Latino Leaders Magazine •Earned a perfect score of 100 from the Human Rights Campaign (HRC) and designation as one of the Best Places to Work for LGBTQ+ equality |

(a)On Track - Quantifiable/numerical goals that are showing a positive trend towards achieving the goal.

Ongoing - Qualitative/non-numerical goals which are currently in progress.

(b)Excluding LNG ships.

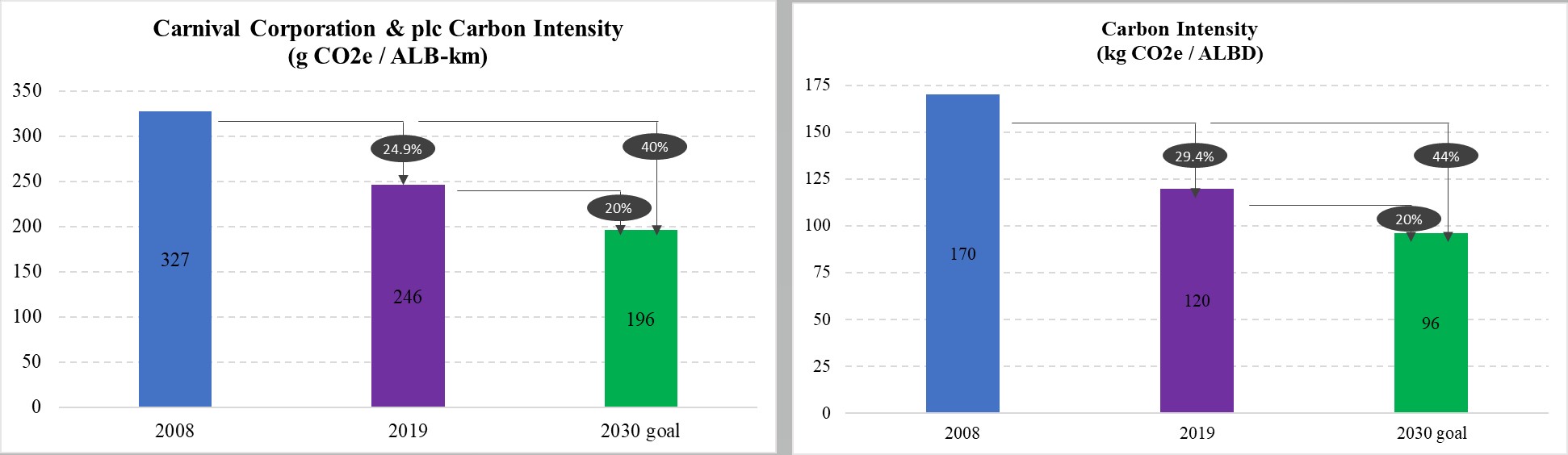

A key focus of our sustainability efforts is climate action, which includes our commitment to reduce carbon emissions and our aspiration to achieve net carbon-neutral operations. We have made significant progress towards our 2030 carbon intensity reduction goals of 40% from a 2008 baseline, measured in both grams of CO2e per available lower berth kilometer (“ALB-km”) and kilograms of CO2e per available lower berth day (“ALBD”). During 2022, we updated the baseline year for both goals to 2019 from 2008. Both 2030 goals now require a 20% improvement from 2019. With the updated baseline year, we strengthened our 2030 goal measured in kilograms of CO2e per ALBD since the initial 2030 goal would only have required a further 15% reduction from 2019 levels. Our goal measured in grams of CO2e per ALB-km remains the same. In addition, this new baseline year helps us better communicate recent progress against our climate goals to our investors and stakeholders as well as modernize our disclosures in alignment with developing best practice and reporting standards.

We plan to achieve our 2030 carbon intensity goals based on the following planned actions:

•The delivery of larger-more efficient ships, as part of our ongoing newbuild program, some of which will replace existing ships in our fleet

•Designing more energy-efficient itineraries

•Investing in port and destination projects

•Continuing to invest in new technologies and energy efficiency projects for our existing fleet; since 2016, we have invested over $350 million

We have considered the above planned actions in connection with the preparation of our financial statements and any estimates used in the preparation of our financial statements, include projections (where applicable) consistent with the above planned actions.

In addition to our 2030 sustainability goals, we are committed to continuing our reduction of carbon emissions and have aspirations to achieve net carbon-neutral operations by 2050, well ahead of current International Maritime Organization (“IMO”) targets. While fossil fuels are currently the only viable option for our industry, we are closely monitoring technology developments and partnering with key organizations to help identify and scale new technologies not yet ready for the cruise industry. For example, we are piloting maritime scale battery technology and methanol powered fuel cells and working with classification societies and other stakeholders to assess lower carbon fuel options for cruise ships, which includes methanol, bioLNG, eLNG, hydrogen, and biofuels. During 2022, we piloted the use of biofuel as a replacement for fossil fuel on two of our ships. AIDAprima became the first larger-scale cruise ship to be powered with a blend of marine biofuel, made from 100% sustainable raw materials, and marine gasoil (“MGO”). Additionally, Holland America Line completed two pilots on Volendam, one using a blend of marine biofuel and another using 100% biofuel, becoming the first larger-scale cruise ship to be powered 100% by biofuel. The certified biofuels used in these pilots offer environmental benefits compared to using fossil fuels alone through their lifecycle CO2 reductions. These biofuels can be used in existing ship engines without modifications to the engine or fuel infrastructure, including on ships already in service. While alternative fuels may provide a path to decarbonization for the maritime industry, there are significant supply challenges that must be resolved before viability is reached. We are working with suppliers to encourage investment in a reliable supply infrastructure.

During 2022, we also announced the global rollout of Service Power Packages, a comprehensive set of technology upgrades, which will be implemented over the next several years across a portion of the fleet. These upgrades include the following elements designed to reduce both fuel usage and greenhouse gas (“GHG”) emissions while also contributing to cost savings:

•Comprehensive upgrades to each ship’s hotel HVAC systems

•Technical systems upgrades on each ship

•State-of-the-art LED lighting systems

•Remote monitoring and optimization of energy usage and performance

The Service Power Package upgrades are part of our ongoing energy efficiency investment program and are expected to further improve energy savings and reduce fuel consumption. Upon completion, these upgrades are expected to deliver an average of 5-10% fuel savings per ship.

In addition, we have five Air Lubrication Systems (“ALS”) currently operating in our fleet, we are currently installing ALS on six ships and we are planning at least eight more installations. ALS cushion the flat bottom of a ship’s hull with air bubbles, which reduces the ship’s frictional resistance and the propulsive power required to drive the ship through the water, which is expected to generate approximately 5% savings in fuel consumption and reductions in carbon emissions on ALS equipped ships.

As part of our plan for carbon footprint reduction, we have 11 LNG powered cruise ships that are expected to join the fleet through 2025, including seven ships already in operation as of November 30, 2022. In total, these ships are expected to represent 20% of our total future capacity by summer 2025. All of our LNG ships also have the capability to run on conventional fuels. The price of LNG in certain markets has been unattractive compared to other alternatives, and as such, at times we use conventional fuels to power our LNG ships.

LNG is a fossil fuel and generates carbon emissions. Its direct CO2 emissions are lower than those of conventional fuels and it emits effectively zero sulfur oxides (only the sulfur in the pilot fuel is present), reducing nitrogen oxides by 85% and particulate matter by 95%-100%. The types of engines that we use are subject to small amounts of methane slip (the passage of un-combusted methane through the engine). There are different views relating to the measurement of the environmental impact of LNG, including the methane slip. Our disclosures report our emissions, including methane slip, as part of our total carbon emissions (reported as CO2e) using the 100-year global warming potential time frame and measured on a “tank to wake” basis. We are working closely with our engine manufacturers and other technology providers to further mitigate methane slip, and have recently joined the Methane Abatement in Maritime (“MAM”) Innovation Initiative, where we will partner with other major maritime players to seek solutions for this challenge.

We pioneered the use of Advanced Air Quality Systems on board our ships to aid in the reduction of sulfur and lifecycle GHG emissions and are promoting the use of shore power. Shore power enables our ships to use shoreside electric power, where available, while in port rather than running their engines to power their onboard services, resulting in reduced ship air emissions. We have continued our work with several local port authorities to utilize cruise ship shore power connections.

As part of our sustainability strategy, we have voluntarily reported our carbon footprint via the CDP (formerly, the Carbon Disclosure Project) each year since 2006. The CDP rates companies on the depth and scope of their disclosures and the quality of their reporting. We developed a GHG inventory management plan in 2010 in accordance with the requirements of International Organization for Standardization (“ISO”) 14064-1:2018(E) standard and The Greenhouse Gas Protocol. Our submission includes details of our most recently compiled emissions data and reduction efforts, along with the results of an independent, third-party verification of our GHG emissions inventory. We also disclose our water stewardship through the CDP water program.

Carnival Corporation & plc’s environmental management system is certified in accordance with the ISO 14001:2015 Environmental Management System standard.

We voluntarily publish Sustainability Reports that address governance, stakeholder engagement, environmental, labor, human rights, society, product responsibility, economic and other sustainability-related issues and performance indicators. These reports, which are not incorporated in this document but can be viewed at www.carnivalcorp.com, www.carnivalplc.com and www.carnivalsustainability.com, were developed in accordance with the Global Reporting Initiative (“GRI”) Standards, the global standard for sustainability reporting.

a. Climate-Related Financial Disclosures

Under the UK Listing Rule LR 9.8.6R, Carnival plc is required to report certain climate-related financial disclosures for the year ended November 30, 2022, and with a goal towards transparency and consistent disclosure amongst our filings and stakeholders, we are including the UK required disclosures in our Form 10-K filing. Accordingly, we set out below our climate-related financial disclosures fully consistent with 10 out of the 11 Task Force on Climate-Related Financial Disclosures (“TCFD”) Recommendations and Recommended disclosures. For Metrics and Targets recommended disclosures b), we are partially consistent, as further work is underway to fully measure and disclose our Scope 3 GHG emissions, which we expect to disclose in our 2023 Strategic Report. Our consistency with the TCFD’s four pillars, Governance, Strategy, Risk Management and Metrics and Targets, and the recommendations thereof, are represented in the table below.

| | | | | | | | |

| TCFD Pillar | Recommended disclosures | Section Reference |

| Governance | a) Describe the Boards’ oversight of climate-related risks and opportunities. | Governance |

| b) Describe management’s role in assessing and managing climate-related risks and opportunities. |

| Strategy | a) Describe the climate-related risks and opportunities the organisation has identified over the short, medium, and long term. | Strategy: Qualitative scenario analysis |

| b) Describe the impact of climate-related risks and opportunities on the organisation’s businesses, strategy, and financial planning. | Strategy: Quantitative Scenario Analysis |

| c) Describe the resilience of the organisation’s strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario. |

| Risk Management | a) Describe the organisation’s processes for identifying and assessing climate-related risks. | Risk Management: Climate Risk and Opportunity Identification, Owner Assignment and Assessment |

| b) Describe the organisation’s processes for managing climate-related risks. | Risk Management: Climate Risk and Opportunity Monitoring, Management and Reporting |

| c) Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organisation’s overall risk management. | Risk Management: Integration into our overall risk management |

| Metrics and Targets | a) Disclose the metrics used by the organisation to assess climate-related risks and opportunities in line with its strategy and risk management process. | Metrics and Targets |

| b) Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 GHG emissions, and the related risks. |

| c) Describe the targets used by the organisation to manage climate-related risks and opportunities and performance against targets. |

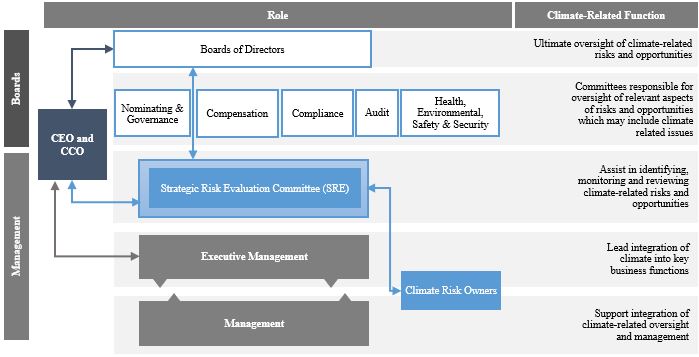

Governance

The Chief Climate Officer (“CCO”) and the Boards of Directors are responsible for the oversight of climate-related matters and are directly supported by members of executive management. In addition, the CCO and the Boards of Directors set the tone at the top with regards to embedding a climate risk culture through fulfilling their responsibilities as outlined in the climate risk management framework.

In January 2022, the Boards of Directors appointed Arnold Donald, President and CEO at the time, to the additional role of CCO. In August 2022, Josh Weinstein, our Chief Operations Officer assumed the roles of President, CEO and CCO. The CCO leads the identification of climate-related risks and opportunities and oversees how these are embedded in our strategic decision-making and risk management processes.

To further support our climate-related efforts, we created a Strategic Risk Evaluation (“SRE”) Committee. The SRE Committee consists of members of executive management and an advisor and reports to the CEO, who in turn, reports to the Boards of Directors. At its establishment in January 2022, the SRE Committee was comprised of David Bernstein (Chief Financial Officer), Josh Weinstein (then Chief Operations Officer), William Burke (Chief Maritime Officer), and Stein Kruse (Advisor to the CEO & Chair of the Boards). Following the August 2022 changes in leadership, Richard Brilliant (Chief Risk and Compliance Officer) was added to the SRE Committee, David Bernstein was appointed as Chair of the SRE Committee, and Josh Weinstein, who remained on the SRE Committee, assumed the role of CCO. The primary responsibility of the SRE Committee is to assist the CCO in fulfilling his responsibility to identify, monitor and review the management of climate-related risks and opportunities. Common recurring activities of the SRE Committee include:

•Discussing climate considerations in the planning processes to further support its focus on decarbonization, such as the recently adopted Corporate Itinerary Decarbonization Reviews.

•Considering if any new climate risks or opportunities should be included in the list of identified climate risks and opportunities.

•Ensuring appropriate assignment of identified climate risks and opportunities to risk owners, who are responsible for their day-to-day evaluation and management.

•Obtaining at least annual reporting from the risk owners on the monitoring and management of identified risks and opportunities and reviewing, scrutinizing and challenging management of climate risks and opportunities.

•Reviewing and approving the climate risk management framework.

An SRE Committee Charter was adopted and 12 SRE Committee meetings have taken place between its creation in January 2022 and November 2022. From these discussions, the SRE Committee has provided a quarterly update to the Boards of Directors on climate-related matters such as:

•Resetting our GHG baseline year to 2019 from 2008 and a strengthening of our 2030 goals relative to the new baseline.

•Establishment of a climate risk framework.

•Completion of the qualitative and quantitative scenario analysis assessments.

•Commissioning of the port analysis study.

Board Education Program

To enable the CCO and Boards of Directors to fulfil their responsibility to oversee climate-related risks and opportunities, a Board Environmental, Social and Governance (“ESG”) and TCFD education program has been established, with core education components and optional self-study courses. This ESG and TCFD education program has been developed with support from external advisors and the Senior Independent Director. The core education components of the program were completed in November 2022. An annual refresher education program, including updates to ESG and TCFD considerations, has been established.

Strategy

During 2022, we performed a qualitative and quantitative scenario analysis to assess our climate-related risks and opportunities over the short, medium and long term.

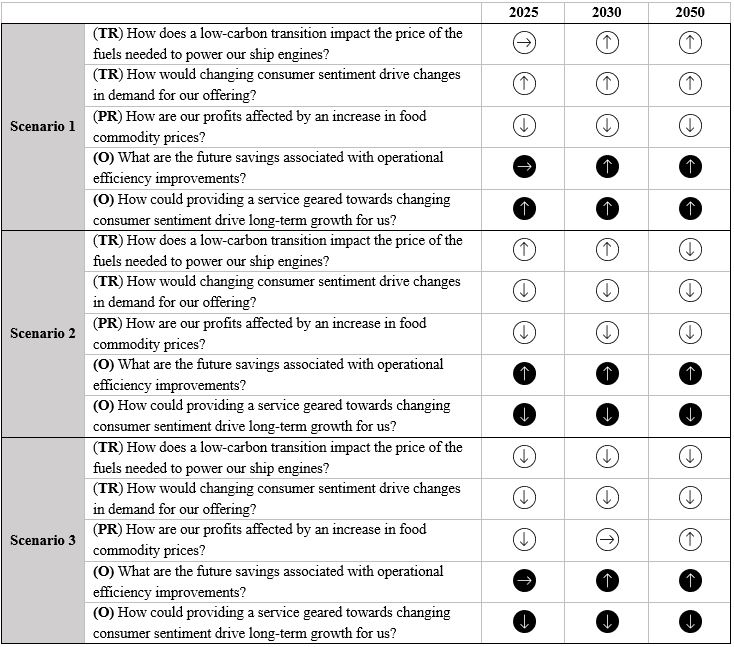

Qualitative scenario analysis

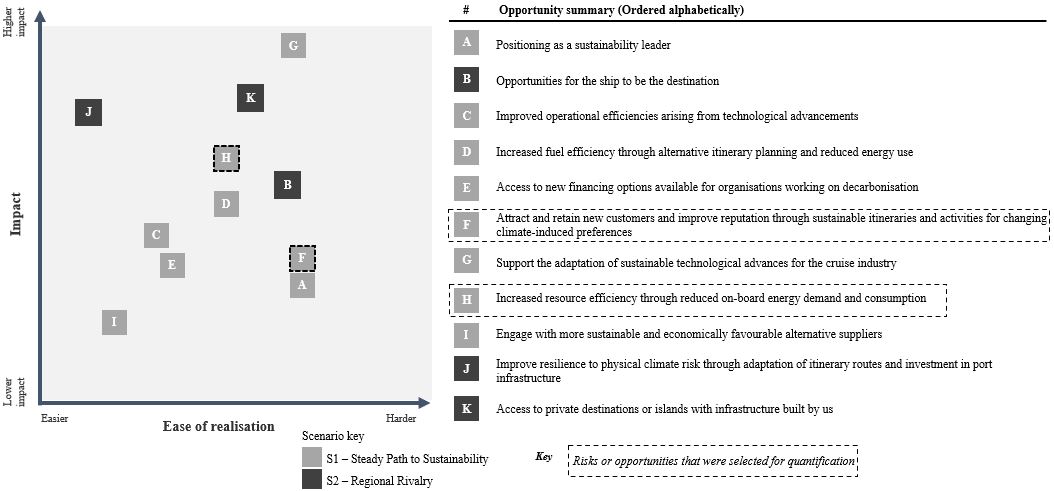

We qualitatively applied two (and quantitatively applied three) distinct plausible climate scenarios, global warming limited to below 1.5oC above pre-industrial levels by 2100 “Steady Path to Sustainability” and global warming of 2.8oC above pre-industrial levels by 2100 “Regional Rivalry.” The scenarios were used to generate the climate-related risks and opportunities listed in the table below.

As part of our qualitative scenario analysis, a series of workshops with the SRE Committee and a cross-section of management was conducted to identify material climate-related risks and opportunities, based on likelihood and degree of potential financial impact, over the following time horizons:

•Present – 2025 (short-term) - consistent with the period we use for our short-term planning

•2025 – 2035 (medium-term) - aligns with our existing sustainability goals

•2035 – 2050 (long-term) - consistent with the useful life of our ships

Following the workshops, the SRE Committee selected certain risks and opportunities for further assessment and quantification. The process of selecting these risks and opportunities included an in-depth assessment by each participant of the proposed risks and opportunities. The process incorporated the use of a feasibility matrix and subsequent group discussion to arrive at consensus on which risks and opportunities were most appropriate for quantification. Feasibility was evaluated on the availability of internal and external climate-related data, the estimated number of assumptions required and the magnitude of impact and likelihood of occurrence.

Climate-related risks identified through qualitative scenario analysis

Our initial selected risks and opportunities for quantification are in bold:

| | | | | | | | |

| TCFD risk categories | Risk summary | Impact time horizon |

| Markets and Products / Shifting Markets (1) | Cruising no longer aligns to consumers’ climate values | Medium Term |

| Reduced availability and access to fuel* | Long Term |

| Unable to meet climate-related requirements reduces access to capital / insurance | Medium Term |

| Policy and Legal (1) | Increased costs driven by climate-related regulations* | Short-Medium Term |

| Risk is that cruising (as a carbon-intensive industry) is severely restricted or subject to bans | Medium Term |

| Reputation (1) | Failure to attract and retain talent due to climate credentials | Medium Term |

| Increased demand for reducing carbon-intensive practices | Short Term |

| Technology (1) | Lack of viable low carbon technology to replace fossil fuels | Medium Term |

| Physical | Chronic climate change impacting supply chain availability and price | Medium Term with expected increases in the Long Term |

| Itineraries are not viable due to extreme weather and/or sea level rise | Medium Term with expected increases in the Long Term |

(1) Transition Risks

*Due to the similar nature of these risks, we have combined them for the quantitative analysis into a combined risk: “How does a low-carbon transition impact the price of the fuels needed to power our ship engines?”

Climate-related opportunities identified through qualitative scenario analysis

| | | | | | | | |

| TCFD opportunity categories | Opportunity summary | Realisation time horizon |

| Energy Source | Support the adaptation of sustainable technological advances for the cruise industry | Medium Term |

| Market Access | Access to new financing options available for organisations working on decarbonisation | Short-Medium Term |

| Access to private destinations or islands with infrastructure built by us | Short-Medium Term |

| Attract and retain new customers and improve reputation through sustainable itineraries and activities for changing climate-induced preferences | Short-Medium Term |

| Positioning as a sustainability leader | Short-Medium Term |

| Products & Services | Opportunities for the ship to be the destination | Long Term |

| Resilience | Engage with more sustainable and economically favourable alternative suppliers | Short Term |

| Improve resilience to physical climate risk through adaptation of itinerary routes and investment in port infrastructure | Short Term |

| Resource Efficiency | Improved operational efficiencies arising from technological advancements | Medium Term |

| Increased fuel efficiency through alternative itinerary planning and reduced energy use | Short - Medium Term |

| Increased resource efficiency through reduced on-board energy demand and consumption | Medium Term |

We presently consider transition risks to be the most significant in terms of likelihood and impact. The risks with the highest impact and likelihood of occurrence are associated with the transition to a low-carbon emission future, in a scenario where low-carbon technologies do not exist, or where we have not been able to access these technologies and where we have reduced availability and access to fuel.

The climate-related opportunities with the highest impact are a mix of mitigation and adaptation opportunities. These include the positive impacts of supporting the adaptation of sustainable technological advances for our business, improved operational efficiencies from technological advancements, and more energy efficient itineraries from investing in port and destination projects.

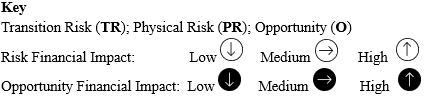

Quantitative Scenario Analysis

We quantitatively applied three distinct plausible climate scenarios to determine the potential impacts of the risks and opportunities assessed. Using transition scenario assumptions from the International Energy Agency (“IEA”) and climate and transition scenarios from the Intergovernmental Panel on Climate Change (“IPCC”), we utilised two interlocking types of pathways, the Representative Concentration Pathways (“RCPs”) and Shared Socioeconomic Pathways (“SSPs”) to create three sets of scenarios to understand the relative materiality and possible range of impacts to the business from the selected climate-related risks and opportunities under different potential futures.

Scenario 1: Steady Path to Sustainability (average temperature increase limited to 1.5°C above pre-industrial levels by 2100) SSP1 / RCP1.9

| | |

| Under this scenario, the world takes the rapid and strong policy measures required to meet the ambition of the 2015 Paris Agreement (keep mean annual temperature rise well below 2°C warming above pre-industrial levels by 2100). Under this scenario, low carbon technologies take over from fossil-fuels, and reduced economic growth is also important for reaching net zero emissions by 2050 |

We selected this scenario, as it provides us insight into a low-carbon world that would benefit us and our Climate Action Goals. Under this scenario, transition risks identified are material and our resilience is dependent on our ability to effectively adopt low carbon technologies. This would help us adhere to increasing decarbonization requirements, including existing and emerging regulations, consumer preferences, and talent market expectations. Our most impactful opportunity is the enhancement of our reputation and competitiveness, by supporting the adaptation of sustainable technological advances for the cruise industry. This would also further help us to mitigate our transition risks.

Scenario 2: Regional Rivalry (average temperature increase limited to below 2.8°C above pre-industrial levels by 2100) SSP3 / RCP7.0

| | |

| This scenario explores a possible route in which the world is seeing an emergence of tribalism and nationalism. Low international priority for addressing environmental concerns leads to strong environmental degradation in some regions. The combination of impeded development and limited environmental concern results in poor progress toward climate sustainability. Growing resource intensity and fossil fuel dependency along with difficulty in achieving international cooperation and slow technological change imply high challenges to mitigation. |

We selected this scenario, as it provides an indication of the world we would operate in if we do not achieve the Paris Agreement target. This scenario presents a higher emissions future where physical risks are material. Business resilience under this scenario is dependent on our ability to adapt to extreme weather events and chronic physical risks. Under this scenario we can remain resilient by taking advantage of the mobility of our cruise ships, which enables us to move our vessels between regions and adapt itineraries in cases of extreme weather events. Additionally, based on a study performed, we are well placed to respond to increased physical risks at our new port development projects, see Investment in Port and Destination Projects.

Scenario 3: Fossil-fueled growth (average temperature increase limited to below 4°C above pre-industrial levels by 2100) SSP5 / RCP8.5

| | |

| The 4°C scenario explores a possible route in which as countries emerge from the coronavirus pandemic, governments around the world focus on restoring growth through direct support to fossil fuels and reverting to the tried and tested methods of the past. |

This scenario presents the highest emissions future where physical risks have the potential to be most significant and would therefore allow us to model the impact of these extreme climate risks. Akin to Scenario 2, business resilience under Scenario 3 will be dependent on our ability to adapt to extreme weather events and chronic physical risks as well as the impacts to our supply chain across different geographical areas. Our experience with the current supply chain crisis suggests that under this scenario, we would be resilient to these supply chain risks given our ability to adapt to supply chain disruptions.

Key assumptions and limitations

The results of our quantitative scenario analysis have a high degree of uncertainty as there are assumptions made for all modelling inputs. This means that results should be taken as an indicative "order of risk". Furthermore, the analysis assumes that the future conditions from climate change are shifted to today to contextualize impacts in relation to the current business size. The analysis does not include:

•Forward-looking forecasting of our business operations; or

•Potential mitigation or adaptation measures that could be taken either by us, or by other parties over the period considered (e.g., sustainable ship fuel development, governments building flood defenses).

Estimations and projections

We completed several scenario analyses over three time horizons (2025, 2030, and 2050). Any assumption made about fuel prices acknowledges the current energy crisis and assumes that by 2025, oil prices will stabilize in line with IEA price projections. We have also projected physical and transition risks at a global level due to the high mobility of our assets.

The degree of potential impact was determined on a linear scale range of “Low”, having no material impact or “High” having a material impact on Carnival Corporation & plc’s financial statements.

Results of the Quantitative Scenario Analysis: Potential Impact on Operating Income

How does a low-carbon transition impact the price of the fuels needed to power our ship engines?

While fossil fuels are currently the only viable option for our industry at present, we are closely monitoring technology developments and partnering with key organizations to help identify and scale new technologies not yet ready for the cruise industry. Refer to XV. Sustainability.

How would changing consumer sentiments drive changes in demand for our offering?

To mitigate the impact of this risk, our short and medium-term decarbonization goals focus on reducing carbon emissions per ALBD and carbon emissions per ALB-km. In addition, we are committed to our reduction of carbon emissions and have aspirations to be net carbon-neutral ship operations by 2050. Refer to XV. Sustainability.

How are our profits affected by an increase in commodity prices?