UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10173

Morgan Stanley All Star Growth Fund

(Exact name of registrant as specified in charter)

1221 Avenue of the Americas, New York, New York 10020

(Address of principal executive offices) (Zip code)

Ronald E. Robison

1221 Avenue of the Americas, New York, New York 10020

(Name and address of agent for service)

Registrant's telephone number, including area code: 212-762-4000

Date of fiscal year end: July 31, 2003

Date of reporting period: July 31, 2003

Item 1 - Report to Stockholders

Welcome, Shareholder:

In this report, you'll learn about how your investment in Morgan Stanley All Star Growth Fund performed during the annual period. The portfolio management team will provide an overview of the market conditions, and discuss some of the factors that helped or hindered performance during the reporting period. In addition, this report includes the Fund's financial statements and a list of Fund investments, as well as other information.

| This material must be preceded or accompanied by a prospectus for the fund being offered. Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and, therefore, the value of the Fund shares may be less than what you paid for them. Accordingly you can lose money investing in this Fund. |

|  |

|  |

| Fund Report |

| For the year ended July 31, 2003 |

|  |

Total Return for the 12-month period ended July 31, 2003

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Class A |  |  |  | Class B |  |  |  | Class C |  |  |  | Class D |  |  |  | S&P

500

Index1 |  |  |  | Lipper

Multi-Cap

Growth Funds

Index2 |

| 8.11% |  |  |  | | 7.37 | % |  |  |  | | 7.37 | % |  |  |  | | 8.42 | % |  |  |  | | 10.65 | % |  |  |  | | 15.61 | % |

|

| The performance of the Fund's four share classes varies because each has different expenses. The Fund's total return figures assume the reinvestment of all distributions, but do no reflect the deduction of any applicable sales charges. Such costs would lower performance. Past performance is no guarantee of future results. See Performance Summary for standardized performance information. |

Market Conditions

In the early stages of the 12-month period ended July 31, 2003, the long-anticipated economic recovery appeared reluctant to surface. Despite interest rates at historically low levels, corporate earnings failed to rebound as quickly as had been expected. Uncertainty over the likelihood and timing of the potential war with Iraq only worsened investor sentiment in the first months of 2003. Once it was clear that the military campaign would end successfully, however, the stock market rose rapidly, led especially by technology, telecommunications and other stocks offering higher risk and increased growth potential.

Although investors grew optimistic about the positive impact of increased fiscal and monetary stimulus toward the end of the period, economic indicators remained mixed. On the positive side, the manufacturing sector saw new orders outpacing production increases, leading to order backlogs. Business capital expenditures rose in the second quarter with the largest quarter-over-quarter increase since the second quarter of 2000. The University of Michigan index of consumer sentiment posted a slight improvement, reflecting improved expectations. Yet despite the recent decline in unemployment claims, the employment situation remains a concern.

Performance Analysis

The Fund's underperformance relative to its benchmark, the S&P 500 Index, resulted primarily from stock selection in various sectors. Holdings in technology hardware and equipment detracted from relative performance, though an overweighting in the information technology sector helped somewhat. Selection among banks, diversified financials and insurance companies also had a negative effect, as did the Fund's underweighting in financials. Other detractors included certain capital good companies, particularly in aerospace and defense.

The Fund's performance was helped by stock selection and an overweighting in the consumer discretionary area. Positive contributors in that sector were found in hotels and restaurants, consumer durables, apparel and gaming. The Fund also benefited from strong selection in health care, especially in the pharmaceuticals, biotechnology and health care equipment and services industries. An underweighting in the consumer staples sector also had a positive effect during the period.

On April 24, 2003 the Board of Trustees approved an Agreement and Plan of Reorganization by and between the Fund and Morgan Stanley American Opportunities Fund pursuant to which substantially all of the assets of the Fund would be combined with those of American Opportunities Fund and shareholders of the Fund would become shareholders of American Opportunities Fund, receiving shares of American Opportunities Fund equal to the value of their holdings in the Fund. Each shareholder of the Fund will receive the Class of shares of American Opportunities Fund that corresponds to the Class of shares of the Fund currently held by that

2

shareholder. The Reorganization is subject to the approval of shareholders of the Fund at a special meeting of shareholders initially scheduled to be held on September 17, 2003 and subsequently adjourned to September 30, 2003. A proxy statement formally detailing the proposal, the reasons for the Trustees' action and information concerning American Opportunities Fund was distributed to shareholders of the Fund.

|  |  |  |  |  |  |

| TOP 10 HOLDINGS |  | |

| Microsoft |  | | 2.8 | % |

| Pfizer |  | | 2.4 | |

| Citigroup |  | | 2.0 | |

| Wal Mart Stores |  | | 1.9 | |

| General Electric |  | | 1.8 | |

| Intel |  | | 1.8 | |

| Cisco Systems |  | | 1.7 | |

| Amgen Inc. |  | | 1.6 | |

| 3M |  | | 1.3 | |

| Interactive Corp |  | | 1.2 | |

|

|  |  |  |  |  |  |

| TOP FIVE INDUSTRIES |  | |

| Packaged Software |  | | 5.8 | % |

| Biotechnology |  | | 5.6 | |

| Semiconductors |  | | 5.1 | |

| Pharmaceuticals: Major |  | | 4.8 | |

| Medical Specialties |  | | 4.4 | |

|

| Data as of July 31, 2003. Subject to change daily. All percentages are as a percentage of net assets. Provided for informational purposes only and should not be deemed as a recommendation to buy the securities mentioned. Morgan Stanley is a full-service securities firm engaged in securities trading and brokerage activities, investment banking, research and analysis, financing and financial advisory services. |

Investment Strategy

|  |  |

| • | The Fund utilizes a multi-manager investment approach whereby separate portions of the Fund's assets are managed according to four different investment strategies, each based on the distinct investment style of the portfolio management team. |

|  |  |

| • | The four investment strategies include: (1) The Mid-Cap Strategy, (2) The Selected Focus Strategy, (3) The Aggressive Growth Strategy and (4) The Sector Rotation Strategy. |

Annual Householding Notice

To reduce printing and mailing costs, the Fund attempts to eliminate duplicate mailings to the same address. The Fund delivers a single copy of certain shareholder documents including shareholder reports, prospectuses and proxy materials to investors with the same last name and who reside at the same address. Your participation in this program will continue for an unlimited period of time, unless you instruct us otherwise. You can request multiple copies of these documents by calling (800) 350-6414, 8:00 am to 8:00 pm, ET. Once our Customer Service Center has received your instructions, we will begin sending individual copies for each account within 30 days.

Proxy Voting Policies and Procedures

A description of the Fund's policies and procedures with respect to the voting of proxies relating to the Fund's portfolio securities is available without charge, upon request, by calling (800) 869-NEWS. This information is also available on the Securities and Exchange Commission's website at http://www.sec.gov.

3

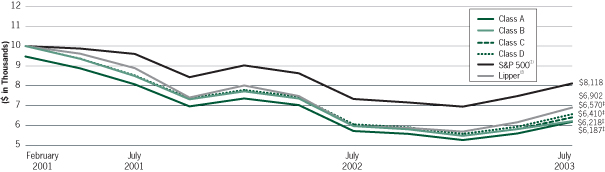

Performance of a $10,000 Investment

| Past performance is not predictive of future returns. Investment return and principal value will fluctuate. When you sell fund shares, they may be worth less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance for Class A, Class B, Class C, and Class D shares will vary due to differences in sales charges and expenses. |

4

Average Annual Total Returns — Period Ended July 31, 2003

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  |  | Class A Shares*

(since 02/26/01) |  |  |  | Class B Shares**

(since 02/26/01) |  |  |  | Class C Shares†

(since 02/26/01) |  |  |  | Class D Shares††

(since 02/26/01) |

| Symbol |  |  |  | ALLAX |  |  |  | ALLBX |  |  |  | ALLCX |  |  |  | ALLDX |

| 1 Year |  |  |  | | 8.11% | 3 |  |  |  | | 7.37% | 3 |  |  |  | | 7.37% | 3 |  |  |  | | 8.42% | 3 |

| |  |  |  | | 2.44 | 4 |  |  |  | | 2.37 | 4 |  |  |  | | 6.37 | 4 |  |  |  | | | |

| Since Inception |  |  |  | | (16.13) | 3 |  |  |  | | (16.77) | 3 |  |  |  | | (16.77) | 3 |  |  |  | | (15.92) | 3 |

| |  |  |  | | (17.97) | 4 |  |  |  | | (17.81) | 4 |  |  |  | | (16.77) | 4 |  |  |  | | | |

|

Notes on Performance

| (1) | The Standard and Poor's 500 Index (S&P 500®) is a broad-based index, the performance of which is based on the performance of 500 widely-held common stocks chosen for market size, liquidity and industry group representation. The Index does not include any expenses, sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index. |

| (2) | The Lipper Multi-Cap Growth Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper Multi-Cap Growth Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. |

| (3) | Figure shown assumes reinvestment of all distributions and does not reflect the deduction of any sales charges. |

| (4) | Figure shown assumes reinvestment of all distributions and the deduction of the maximum applicable sales charge. See the Fund's current prospectus for complete details on fees and sales charges. |

| * | The maximum front-end sales charge for Class A is 5.25%. |

| ** | The maximum contingent deferred sales charge (CDSC) for Class B is 5.0%. The CDSC declines to 0% after six years. |

| † | The maximum contingent deferred sales charge for Class C is 1.0% for shares redeemed within one year of purchase. |

| †† | Class D has no sales charge. |

| ‡ | Closing value assuming a complete redemption on July 31, 2003. |

5

Morgan Stanley All Star Growth Fund

Portfolio of Investments  July 31, 2003

July 31, 2003

|  |  |  |  |  |  |  |  |  |  |

NUMBER OF

SHARES |  | |  | VALUE |

| | | |  | Common Stocks (96.4%) |  |

| | | |  | Advertising/Marketing Services (0.2%) |  |

| | 8,700 | |  | Getty Images, Inc.* |  | $ | 331,731 | |

| | | |  | Air Freight/Couriers (0.4%) |  |

| | 5,700 | |  | C.H. Robinson Worldwide, Inc. |  | | 210,444 | |

| | 3,000 | |  | Expeditors International of Washington, Inc. |  | | 101,730 | |

| | 8,000 | |  | FedEx Corp. |  | | 515,120 | |

| | | |  | |  | | 827,294 | |

| | | |  | Airlines (0.3%) |  |

| | 14,800 | |  | JetBlue Airways Corp.* |  | | 674,288 | |

| | | |  | Apparel/Footwear (1.1%) |  |

| | 27,050 | |  | Coach, Inc.* |  | | 1,433,650 | |

| | 11,400 | |  | Liz Claiborne, Inc. |  | | 392,502 | |

| | 11,900 | |  | Reebok International Ltd.* |  | | 391,510 | |

| | | |  | |  | | 2,217,662 | |

| | | |  | Apparel/Footwear Retail (1.1%) |  |

| | 22,825 | |  | Abercrombie & Fitch Co. (Class A)* |  | | 732,454 | |

| | 23,500 | |  | Chico's FAS, Inc.* |  | | 638,025 | |

| | 22,700 | |  | Gap, Inc. (The) |  | | 408,373 | |

| | 8,400 | |  | Hot Topic, Inc.* |  | | 242,760 | |

| | 10,400 | |  | TJX Companies, Inc. (The) |  | | 202,280 | |

| | | |  | |  | | 2,223,892 | |

| | | |  | Auto Parts: O.E.M. (0.3%) |  |

| | 3,900 | |  | Eaton Corp. |  | | 328,263 | |

| | 4,200 | |  | Magna International Inc. (Class A) (Canada) |  | | 319,536 | |

| | | |  | |  | | 647,799 | |

| | | |  | Beverages: Alcoholic (0.2%) |  |

| | 7,150 | |  | Anheuser-Busch Companies, Inc. |  | | 370,513 | |

| | | |  | Beverages: Non-Alcoholic (0.9%) |  |

| | 32,900 | |  | Coca-Cola Co. (The) |  | | 1,479,513 | |

| | 9,600 | |  | Cott Corp. (Canada)* |  | | 218,208 | |

| | | |  | |  | | 1,697,721 | |

| | | |  | Biotechnology (5.6%) |  |

| | 45,420 | |  | Amgen Inc.* |  | $ | 3,160,324 | |

| | 10,950 | |  | Amylin Pharmaceuticals, Inc.* |  | | 262,471 | |

| | 19,000 | |  | Celgene Corp.* |  | | 695,590 | |

| | 3,100 | |  | CV Therapeutics, Inc.* |  | | 110,639 | |

| | 14,400 | |  | Genentech, Inc.* |  | | 1,162,800 | |

| | 17,750 | |  | Genzyme Corp.* |  | | 895,310 | |

| | 25,800 | |  | Gilead Sciences, Inc.* |  | | 1,768,590 | |

| | 17,900 | |  | ICOS Corp.* |  | | 780,798 | |

| | 8,800 | |  | Invitrogen Corp.* |  | | 455,840 | |

| | 7,100 | |  | Ligand Pharmaceuticals Inc. (Class B)* |  | | 91,093 | |

| | 4,400 | |  | Martek Biosciences Corp.* |  | | 213,492 | |

| | 14,850 | |  | MedImmune, Inc.* |  | | 581,971 | |

| | 4,700 | |  | Neurocrine Biosciences, Inc.* |  | | 252,296 | |

| | 16,325 | |  | NPS Pharmaceuticals, Inc.* |  | | 416,777 | |

| | | |  | |  | | 10,847,991 | |

| | | |  | Broadcasting (2.3%) |  |

| | 1,550 | |  | Citadel Broadcasting Corp.* |  | | 29,450 | |

| | 41,150 | |  | Clear Channel Communications, Inc. |  | | 1,685,092 | |

| | 31,975 | |  | Radio One, Inc. (Class D)* |  | | 530,465 | |

| | 53,175 | |  | Univision Communications Inc. (Class A)* |  | | 1,659,060 | |

| | 10,625 | |  | Westwood One, Inc.* |  | | 324,487 | |

| | 23,100 | |  | XM Satellite Radio Holdings Inc. (Class A)* |  | | 317,625 | |

| | | |  | |  | | 4,546,179 | |

| | | |  | Cable/Satellite TV (0.8%) |  |

| | 11,900 | |  | Cablevision Systems New York Group (Class A)* |  | | 253,470 | |

| | 30,500 | |  | Comcast Corp. (Class A)* |  | | 924,760 | |

| | 11,900 | |  | EchoStar Communications Corp. (Class A)* |  | | 431,613 | |

| | | |  | |  | | 1,609,843 | |

|

See Notes to Financial Statements

6

Morgan Stanley All Star Growth Fund

Portfolio of Investments  July 31, 2003 continued

July 31, 2003 continued

|  |  |  |  |  |  |  |  |  |  |

NUMBER OF

SHARES |  | |  | VALUE |

| | | |  | Casino/Gaming (1.7%) |  |

| | 42,630 | |  | GTECH Holdings Corp. |  | $ | 1,644,239 | |

| | 48,400 | |  | International Game Technology |  | | 1,231,780 | |

| | 6,200 | |  | MGM Mirage* |  | | 212,660 | |

| | 9,900 | |  | Station Casinos, Inc.* |  | | 287,100 | |

| | | |  | |  | | 3,375,779 | |

| | | |  | Chemicals: Specialty (0.3%) |  |

| | 4,200 | |  | Air Products & Chemicals, Inc. |  | | 195,216 | |

| | 5,400 | |  | Praxair, Inc. |  | | 349,164 | |

| | | |  | |  | | 544,380 | |

| | | |  | Commercial Printing/Forms (0.1%) |  |

| | 8,700 | |  | Donnelley (R.R.) & Sons Co. |  | | 230,202 | |

| | | |  | Computer Communications (2.3%) |  |

| | 168,900 | |  | Cisco Systems, Inc.* |  | | 3,296,928 | |

| | 7,075 | |  | Emulex Corp.* |  | | 143,976 | |

| | 17,900 | |  | Foundry Networks, Inc.* |  | | 322,916 | |

| | 33,900 | |  | Juniper Networks, Inc.* |  | | 489,177 | |

| | 14,300 | |  | McDATA Corp. (Class A)* |  | | 154,583 | |

| | 600 | |  | NETGEAR, Inc.* |  | | 10,603 | |

| | | |  | |  | | 4,418,183 | |

| | | |  | Computer Peripherals (1.1%) |  |

| | 6,000 | |  | Avid Technology, Inc.* |  | | 278,760 | |

| | 31,700 | |  | EMC Corp.* |  | | 337,288 | |

| | 12,500 | |  | Maxtor Corp.* |  | | 125,000 | |

| | 34,150 | |  | Network Appliance, Inc.* |  | | 545,717 | |

| | 21,800 | |  | Seagate Technology, Inc. (Cayman Islands)* |  | | 475,240 | |

| | 9,000 | |  | Storage Technology Corp.* |  | | 239,760 | |

| | 3,000 | |  | Zebra Technologies Corp. (Class A)* |  | | 232,740 | |

| | | |  | |  | | 2,234,505 | |

| | | |  | Computer Processing

Hardware (1.4%) |  |

| | 47,650 | |  | Dell Inc.* |  | | 1,604,852 | |

| | 55,000 | |  | Hewlett-Packard Co. |  | | 1,164,350 | |

| | | |  | |  | | 2,769,202 | |

| | | |  | Containers/Packaging (0.3%) |  |

| | 10,375 | |  | Sealed Air Corp.* |  | $ | 495,199 | |

| | | |  | Contract Drilling (0.5%) |  |

| | 8,500 | |  | Nabors Industries, Ltd. (ADR) (Bermuda)* |  | | 304,300 | |

| | 8,600 | |  | Patterson-UTI Energy, Inc.* |  | | 237,360 | |

| | 14,800 | |  | Pride International, Inc.* |  | | 243,904 | |

| | 6,800 | |  | Rowan Companies, Inc.* |  | | 149,260 | |

| | | |  | |  | | 934,824 | |

| | | |  | Data Processing Services (0.7%) |  |

| | 12,800 | |  | CheckFree Corp.* |  | | 344,448 | |

| | 12,750 | |  | First Data Corp. |  | | 481,440 | |

| | 8,600 | |  | Global Payments Inc. |  | | 302,806 | |

| | 8,475 | |  | SunGard Data Systems Inc.* |  | | 222,384 | |

| | | |  | |  | | 1,351,078 | |

| | | |  | Department Stores (0.1%) |  |

| | 2,900 | |  | Federated Department Stores, Inc. |  | | 116,029 | |

| | | |  | Discount Stores (3.0%) |  |

| | 16,400 | |  | Costco Wholesale Corp.* |  | | 607,620 | |

| | 46,975 | |  | Dollar General Corp. |  | | 864,340 | |

| | 17,500 | |  | Dollar Tree Stores, Inc.* |  | | 641,900 | |

| | 67,650 | |  | Wal-Mart Stores, Inc.** |  | | 3,782,311 | |

| | | |  | |  | | 5,896,171 | |

| | | |  | Electronic Components (1.2%) |  |

| | 4,000 | |  | Amphenol Corp. (Class A)* |  | | 216,000 | |

| | 8,700 | |  | Jabil Circuit, Inc.* |  | | 200,535 | |

| | 11,500 | |  | OmniVision Technologies, Inc.* |  | | 466,785 | |

| | 14,725 | |  | QLogic Corp.* |  | | 620,659 | |

| | 15,000 | |  | SanDisk Corp.* |  | | 850,350 | |

| | | |  | |  | | 2,354,329 | |

| | | |  | Electronic Distributors (0.1%) |  |

| | 4,025 | |  | CDW Corp.* |  | | 192,717 | |

|

See Notes to Financial Statements

7

Morgan Stanley All Star Growth Fund

Portfolio of Investments  July 31, 2003 continued

July 31, 2003 continued

|  |  |  |  |  |  |  |  |  |  |

NUMBER OF

SHARES |  | |  | VALUE |

| | | |  | Electronic Equipment/

Instruments (0.4%) |  |

| | 13,700 | |  | Rockwell Automation, Inc. |  | $ | 354,008 | |

| | 13,900 | |  | Scientific-Atlanta, Inc. |  | | 421,031 | |

| | | |  | |  | | 775,039 | |

| | | |  | Electronic Production

Equipment (1.6%) |  |

| | 10,100 | |  | Amkor Technology, Inc.* |  | | 148,167 | |

| | 42,350 | |  | Applied Materials, Inc.* |  | | 825,825 | |

| | 14,100 | |  | ASML Holding NV (Netherlands)* |  | | 182,454 | |

| | 17,700 | |  | KLA-Tencor Corp.* |  | | 914,205 | |

| | 19,700 | |  | Lam Research Corp.* |  | | 428,672 | |

| | 9,100 | |  | Novellus Systems, Inc.* |  | | 325,871 | |

| | 5,225 | |  | Synopsys, Inc.* |  | | 326,615 | |

| | | |  | |  | | 3,151,809 | |

| | | |  | Electronics/Appliance Stores (0.5%) |  |

| | 22,700 | |  | Best Buy Co., Inc.* |  | | 990,855 | |

| | | |  | Electronics/Appliances (0.3%) |  |

| | 8,125 | |  | Harman International Industries, Inc. |  | | 679,250 | |

| | | |  | Finance/Rental/Leasing (0.6%) |  |

| | 6,000 | |  | Capital One Financial Corp. |  | | 287,460 | |

| | 10,375 | |  | Doral Financial Corp. (Puerto Rico) |  | | 455,462 | |

| | 8,800 | |  | MBNA Corp. |  | | 196,152 | |

| | 7,200 | |  | SLM Corp. |  | | 298,512 | |

| | | |  | |  | | 1,237,586 | |

| | | |  | Financial Conglomerates (3.7%) |  |

| | 31,475 | |  | American Express Co. |  | | 1,390,251 | |

| | 8,000 | |  | Brascan Corp. (Class A) (Canada) |  | | 197,600 | |

| | 88,850 | |  | Citigroup Inc.** |  | | 3,980,480 | |

| | 37,150 | |  | J.P. Morgan Chase & Co. |  | | 1,302,107 | |

| | 6,000 | |  | UBS AG (ADR) (Registered Shares) (Switzerland) |  | | 349,800 | |

| | | |  | |  | | 7,220,238 | |

| | | |  | Financial Publishing/Services (0.4%) |  |

| | 20,600 | |  | Interactive Data Corp.* |  | $ | 344,226 | |

| | 9,300 | |  | Moody's Corp. |  | | 480,996 | |

| | | |  | |  | | 825,222 | |

| | | |  | Food Retail (0.1%) |  |

| | 2,700 | |  | Whole Foods Market, Inc.* |  | | 137,635 | |

| | | |  | Food: Major Diversified (0.4%) |  |

| | 17,900 | |  | PepsiCo, Inc. |  | | 824,653 | |

| | | |  | Food: Meat/Fish/Dairy (0.3%) |  |

| | 18,000 | |  | Dean Foods Co.* |  | | 538,740 | |

| | | |  | Gas Distributors (0.2%) |  |

| | 11,900 | |  | Questar Corp. |  | | 380,205 | |

| | 2,800 | |  | UGI Corp. |  | | 88,396 | |

| | | |  | |  | | 468,601 | |

| | | |  | Home Building (0.3%) |  |

| | 2,600 | |  | Lennar Corp. (Class A) |  | | 169,494 | |

| | 975 | |  | NVR, Inc.* |  | | 398,775 | |

| | | |  | |  | | 568,269 | |

| | | |  | Home Furnishings (0.1%) |  |

| | 3,500 | |  | Mohawk Industries, Inc.* |  | | 235,935 | |

| | | |  | Home Improvement Chains (1.1%) |  |

| | 55,900 | |  | Home Depot, Inc. (The) |  | | 1,744,080 | |

| | 9,300 | |  | Lowe's Companies, Inc. |  | | 442,308 | |

| | | |  | |  | | 2,186,388 | |

| | | |  | Hotels/Resorts/Cruiselines (0.6%) |  |

| | 7,800 | |  | Carnival Corp. (Panama) |  | | 267,618 | |

| | 8,900 | |  | Hilton Hotels Corp. |  | | 129,940 | |

| | 22,700 | |  | Royal Caribbean Cruises Ltd. (Liberia) |  | | 663,975 | |

| | 4,100 | |  | Starwood Hotels & Resorts Worldwide, Inc. |  | | 133,660 | |

| | | |  | |  | | 1,195,193 | |

| | | |  | Household/Personal Care (1.4%) |  |

| | 7,800 | |  | Avon Products, Inc. |  | | 486,642 | |

| | 24,950 | |  | Procter & Gamble Co. (The) |  | | 2,192,356 | |

| | | |  | |  | | 2,678,998 | |

|

See Notes to Financial Statements

8

Morgan Stanley All Star Growth Fund

Portfolio of Investments  July 31, 2003 continued

July 31, 2003 continued

|  |  |  |  |  |  |  |  |  |  |

NUMBER OF

SHARES |  | |  | VALUE |

| | | |  | Industrial Conglomerates (3.5%) |  |

| | 18,350 | |  | 3M Co. |  | $ | 2,572,670 | |

| | 126,800 | |  | General Electric Co. |  | | 3,606,192 | |

| | 5,500 | |  | Ingersoll-Rand Co., Ltd.

(Class A) (Bermuda) |  | | 298,320 | |

| | 3,400 | |  | United Technologies Corp. |  | | 255,782 | |

| | | |  | |  | | 6,732,964 | |

| | | |  | Industrial Machinery (0.1%) |  |

| | 3,000 | |  | Graco Inc. |  | | 109,350 | |

| | | |  | Industrial Specialties (0.3%) |  |

| | 24,000 | |  | Ecolab Inc. |  | | 593,040 | |

| | | |  | Information Technology

Services (1.2%) |  |

| | 11,800 | |  | Accenture Ltd. (Class A) (Bermuda)* |  | | 229,156 | |

| | 11,300 | |  | Amdocs Ltd.* |  | | 230,294 | |

| | 16,200 | |  | Citrix Systems, Inc.* |  | | 294,030 | |

| | 17,950 | |  | International Business Machines Corp. |  | | 1,458,437 | |

| | 8,225 | |  | PeopleSoft, Inc.* |  | | 137,111 | |

| | | |  | |  | | 2,349,028 | |

| | | |  | Insurance Brokers/Services (0.1%) |  |

| | 5,808 | |  | ChoicePoint Inc.* |  | | 221,517 | |

| | | |  | Integrated Oil (1.2%) |  |

| | 53,800 | |  | Exxon Mobil Corp. |  | | 1,914,204 | |

| | 3,700 | |  | Murphy Oil Corp. |  | | 182,706 | |

| | 9,700 | |  | Suncor Energy, Inc. (Canada) |  | | 176,831 | |

| | | |  | |  | | 2,273,741 | |

| | | |  | Internet Retail (1.9%) |  |

| | 25,500 | |  | Amazon.com, Inc.* |  | | 1,063,860 | |

| | 59,595 | |  | InterActiveCorp* |  | | 2,411,810 | |

| | 8,100 | |  | Netflix Inc.* |  | | 212,220 | |

| | | |  | |  | | 3,687,890 | |

| | | |  | Internet Software/Services (1.2%) |  |

| | 20,600 | |  | BEA Systems, Inc.* |  | | 271,920 | |

| | 8,300 | |  | Digital River, Inc.* |  | | 178,284 | |

| | 29,725 | |  | Siebel Systems, Inc.* |  | | 278,820 | |

| | 7,100 | |  | VeriSign, Inc.* |  | $ | 94,785 | |

| | 47,600 | |  | Yahoo! Inc.* |  | | 1,481,788 | |

| | | |  | |  | | 2,305,597 | |

| | | |  | Investment Banks/Brokers (1.8%) |  |

| | 13,700 | |  | Goldman Sachs Group, Inc. (The) |  | | 1,193,818 | |

| | 12,000 | |  | Legg Mason, Inc. |  | | 840,000 | |

| | 13,600 | |  | Lehman Brothers Holdings, Inc. |  | | 860,472 | |

| | 11,000 | |  | Merrill Lynch & Co., Inc. |  | | 598,070 | |

| | | |  | |  | | 3,492,360 | |

| | | |  | Investment Managers (0.5%) |  |

| | 6,875 | |  | Affiliated Managers Group, Inc.* |  | | 449,763 | |

| | 17,000 | |  | Janus Capital Group Inc. |  | | 297,500 | |

| | 5,700 | |  | Price (T.) Rowe Group, Inc. |  | | 231,363 | |

| | | |  | |  | | 978,626 | |

| | | |  | Major Banks (2.2%) |  |

| | 16,000 | |  | Bank of America Corp. |  | | 1,321,120 | |

| | 22,750 | |  | Bank of New York Co., Inc. (The) |  | | 685,230 | |

| | 13,500 | |  | Wachovia Corp. |  | | 589,815 | |

| | 32,600 | |  | Wells Fargo & Co. |  | | 1,647,278 | |

| | | |  | |  | | 4,243,443 | |

| | | |  | Managed Health Care (3.5%) |  |

| | 21,700 | |  | Aetna Inc. |  | | 1,337,154 | |

| | 14,600 | |  | Anthem, Inc.* |  | | 1,102,446 | |

| | 22,150 | |  | Caremark Rx, Inc.* |  | | 554,193 | |

| | 10,400 | |  | Coventry Health Care, Inc.* |  | | 560,248 | |

| | 11,100 | |  | Health Net Inc.* |  | | 381,174 | |

| | 11,600 | |  | Mid Atlantic Medical Services, Inc.* |  | | 630,808 | |

| | 36,950 | |  | UnitedHealth Group Inc. |  | | 1,924,726 | |

| | 5,300 | |  | WellPoint Health Networks, Inc.* |  | | 443,345 | |

| | | |  | |  | | 6,934,094 | |

|

See Notes to Financial Statements

9

Morgan Stanley All Star Growth Fund

Portfolio of Investments  July 31, 2003 continued

July 31, 2003 continued

|  |  |  |  |  |  |  |  |  |  |

NUMBER OF

SHARES |  | |  | VALUE |

| | | |  | Media Conglomerates (0.5%) |  |

| | 16,300 | |  | News Corporation Ltd. (The) (ADR) (Australia) |  | $ | 495,683 | |

| | 9,400 | |  | Viacom, Inc. (Class B) (Non-Voting)* |  | | 409,088 | |

| | | |  | |  | | 904,771 | |

| | | |  | Medical Distributors (0.1%) |  |

| | 4,200 | |  | Henry Schein, Inc.* |  | | 245,448 | |

| | | |  | Medical Specialties (4.4%) |  |

| | 5,700 | |  | Becton, Dickinson & Co. |  | | 208,791 | |

| | 1,600 | |  | Bio-Rad Laboratories, Inc. (Class A)* |  | | 89,600 | |

| | 28,500 | |  | Boston Scientific Corp.* |  | | 1,802,055 | |

| | 5,600 | |  | Cyberonics Inc.* |  | | 167,104 | |

| | 19,300 | |  | Guidant Corp. |  | | 911,346 | |

| | 4,500 | |  | INAMED Corp.* |  | | 298,800 | |

| | 31,050 | |  | Medtronic, Inc. |  | | 1,599,075 | |

| | 4,300 | |  | Millipore Corp.* |  | | 191,307 | |

| | 9,000 | |  | Pall Corp. |  | | 203,130 | |

| | 13,300 | |  | St. Jude Medical, Inc.* |  | | 713,545 | |

| | 29,750 | |  | Varian Medical Systems, Inc.* |  | | 1,825,460 | |

| | 11,525 | |  | Zimmer Holdings, Inc.* |  | | 551,010 | |

| | | |  | |  | | 8,561,223 | |

| | | |  | Medical/Nursing Services (0.2%) |  |

| | 8,475 | |  | Lincare Holdings, Inc.* |  | | 308,490 | |

| | | |  | Metal Fabrications (0.1%) |  |

| | 7,300 | |  | Chicago Bridge & Iron Company N.V. (Netherlands) |  | | 180,018 | |

| | | |  | Miscellaneous Commercial

Services (0.7%) |  |

| | 15,400 | |  | Corporate Executive Board Co. (The)* |  | | 668,668 | |

| | 7,300 | |  | Fair Isaac Corp. |  | | 394,492 | |

| | 10,325 | |  | Iron Mountain Inc.* |  | | 377,895 | |

| | | |  | |  | | 1,441,055 | |

| | | |  | Miscellaneous

Manufacturing (0.3%) |  |

| | 2,900 | |  | Danaher Corp. |  | $ | 209,380 | |

| | 11,000 | |  | Dover Corp. |  | | 402,710 | |

| | | |  | |  | | 612,090 | |

| | | |  | Movies/Entertainment (0.3%) |  |

| | 6,900 | |  | Fox Entertainment Group, Inc. (Class A)* |  | | 208,863 | |

| | 5,575 | |  | Pixar, Inc.* |  | | 377,985 | |

| | | |  | |  | | 586,848 | |

| | | |  | Multi-Line Insurance (1.1%) |  |

| | 33,350 | |  | American International Group, Inc. |  | | 2,141,070 | |

| | | |  | Oil & Gas Production (0.8%) |  |

| | 4,875 | |  | Apache Corp. |  | | 302,055 | |

| | 4,700 | |  | Burlington Resources Inc. |  | | 216,999 | |

| | 4,900 | |  | Devon Energy Corp. |  | | 232,113 | |

| | 16,425 | |  | Pioneer Natural Resources Co.* |  | | 394,200 | |

| | 5,600 | |  | Pogo Producing Co. |  | | 236,880 | |

| | 13,800 | |  | XTO Energy Inc. |  | | 266,340 | |

| | | |  | |  | | 1,648,587 | |

| | | |  | Oilfield Services/

Equipment (1.5%) |  |

| | 24,300 | |  | Baker Hughes Inc. |  | | 763,263 | |

| | 26,225 | |  | BJ Services Co.* |  | | 898,206 | |

| | 2,300 | |  | Cooper Cameron Corp.* |  | | 109,963 | |

| | 2,600 | |  | Schlumberger Ltd. |  | | 117,182 | |

| | 29,525 | |  | Smith International, Inc.* |  | | 1,058,176 | |

| | | |  | |  | | 2,946,790 | |

| | | |  | Other Consumer Services (2.4%) |  |

| | 10,900 | |  | Apollo Group, Inc. (Class A)* |  | | 705,884 | |

| | 6,000 | |  | Career Education Corp.* |  | | 500,400 | |

| | 3,100 | |  | Corinthian Colleges, Inc.* |  | | 169,291 | |

| | 15,900 | |  | DeVry, Inc.* |  | | 406,086 | |

| | 20,400 | |  | eBay Inc.* |  | | 2,186,880 | |

|

See Notes to Financial Statements

10

Morgan Stanley All Star Growth Fund

Portfolio of Investments  July 31, 2003 continued

July 31, 2003 continued

|  |  |  |  |  |  |  |  |  |  |

NUMBER OF

SHARES |  | |  | VALUE |

| | 6,400 | |  | ITT Educational Services, Inc.* |  | $ | 251,072 | |

| | 9,945 | |  | Weight Watchers International, Inc.* |  | | 446,531 | |

| | | |  | |  | | 4,666,144 | |

| | | |  | Other Metals/Minerals (0.3%) |  |

| | 6,100 | |  | Inco Ltd. (Canada)* |  | | 142,191 | |

| | 4,800 | |  | Phelps Dodge Corp.* |  | | 202,512 | |

| | 7,186 | |  | Rio Tinto PLC (United Kingdom) |  | | 149,200 | |

| | | |  | |  | | 493,903 | |

| | | |  | Packaged Software (5.8%) |  |

| | 9,000 | |  | Adobe Systems Inc. |  | | 294,120 | |

| | 5,300 | |  | Cognos, Inc. (Canada)* |  | | 143,418 | |

| | 19,800 | |  | Computer Associates International, Inc. |  | | 503,910 | |

| | 24,100 | |  | Mercury Interactive Corp.* |  | | 948,576 | |

| | 24,500 | |  | Micromuse Inc.* |  | | 175,910 | |

| | 207,700 | |  | Microsoft Corp. |  | | 5,483,280 | |

| | 15,800 | |  | NetIQ Corp.* |  | | 171,746 | |

| | 23,600 | |  | Network Associates, Inc.* |  | | 266,680 | |

| | 102,700 | |  | Oracle Corp.* |  | | 1,232,400 | |

| | 875 | |  | Quest Software, Inc.* |  | | 7,743 | |

| | 1,150 | |  | SAP AG (Germany) |  | | 135,588 | |

| | 15,700 | |  | Symantec Corp.* |  | | 734,289 | |

| | 37,625 | |  | VERITAS Software Corp.* |  | | 1,158,850 | |

| | | |  | |  | | 11,256,510 | |

| | | |  | Personnel Services (0.3%) |  |

| | 19,400 | |  | Monster Worldwide Inc.* |  | | 515,070 | |

| | | |  | Pharmaceuticals: Generic Drugs (0.3%) |  |

| | 4,300 | |  | Taro Pharmaceuticals Industries Ltd. (Israel)* |  | | 234,651 | |

| | 8,700 | |  | Watson Pharmaceuticals, Inc.* |  | | 347,478 | |

| | | |  | |  | | 582,129 | |

| | | |  | Pharmaceuticals: Major (4.8%) |  |

| | 18,700 | |  | Johnson & Johnson |  | | 968,473 | |

| | 15,500 | |  | Lilly (Eli) & Co. |  | | 1,020,520 | |

| | 22,200 | |  | Merck & Co., Inc. |  | $ | 1,227,216 | |

| | 138,175 | |  | Pfizer Inc. |  | | 4,609,518 | |

| | 32,425 | |  | Wyeth |  | | 1,477,932 | |

| | | |  | |  | | 9,303,659 | |

| | | |  | Pharmaceuticals: Other (1.5%) |  |

| | 8,100 | |  | Allergan, Inc. |  | | 651,888 | |

| | 5,600 | |  | Biovail Corp. (Canada)* |  | | 214,984 | |

| | 18,100 | |  | Endo Pharmaceuticals Holdings, Inc.* |  | | 281,817 | |

| | 4,400 | |  | Forest Laboratories, Inc.* |  | | 210,672 | |

| | 1,203 | |  | Galen Holdings PLC (ADR) (United Kingdom) |  | | 48,986 | |

| | 25,200 | |  | Teva Pharmaceutical Industries Ltd. (ADR) (Israel) |  | | 1,444,968 | |

| | | |  | |  | | 2,853,315 | |

| | | |  | Precious Metals (1.0%) |  |

| | 11,700 | |  | Freeport-McMoRan Copper & Gold, Inc. (Class B) |  | | 313,443 | |

| | 18,000 | |  | Glamis Gold Ltd. (Canada)* |  | | 226,800 | |

| | 10,900 | |  | Goldcorp Inc. (Canada) |  | | 132,108 | |

| | 37,800 | |  | Newmont Mining Corp. |  | | 1,364,580 | |

| | | |  | |  | | 2,036,931 | |

| | | |  | Property – Casualty Insurers (0.4%) |  |

| | 2,900 | |  | Everest Re Group, Ltd. (Bermuda) |  | | 219,153 | |

| | 960 | |  | White Mountains Insurance Group, Ltd. (Bermuda) |  | | 364,320 | |

| | 2,400 | |  | XL Capital Ltd. (Class A) (Cayman Islands) |  | | 190,800 | |

| | | |  | |  | | 774,273 | |

| | | |  | Recreational Products (1.0%) |  |

| | 8,500 | |  | Brunswick Corp. |  | | 229,075 | |

| | 14,325 | |  | Electronic Arts Inc.* |  | | 1,203,300 | |

| | 14,900 | |  | Hasbro, Inc. |  | | 280,865 | |

| | 10,100 | |  | Mattel, Inc. |  | | 196,243 | |

| | | |  | |  | | 1,909,483 | |

|

See Notes to Financial Statements

11

Morgan Stanley All Star Growth Fund

Portfolio of Investments  July 31, 2003 continued

July 31, 2003 continued

|  |  |  |  |  |  |  |  |  |  |

NUMBER OF

SHARES |  | |  | VALUE |

| | | |  | Restaurants (0.9%) |  |

| | 1,300 | |  | Applebee's International, Inc. |  | $ | 41,470 | |

| | 5,900 | |  | CBRL Group, Inc. |  | | 207,916 | |

| | 8,075 | |  | Krispy Kreme Doughnuts, Inc.* |  | | 352,555 | |

| | 7,900 | |  | Outback Steakhouse, Inc. |  | | 295,065 | |

| | 9,400 | |  | P.F. Chang's China Bistro, Inc.* |  | | 454,772 | |

| | 8,000 | |  | Sonic Corp.* |  | | 195,520 | |

| | 9,300 | |  | Starbucks Corp.* |  | | 254,169 | |

| | | |  | |  | | 1,801,467 | |

| | | |  | Savings Banks (0.4%) |  |

| | 3,000 | |  | Golden West Financial Corp. |  | | 247,800 | |

| | 11,400 | |  | New York Community Bancorp, Inc. |  | | 340,860 | |

| | 12,500 | |  | Sovereign Bancorp, Inc. |  | | 224,250 | |

| | | |  | |  | | 812,910 | |

| | | |  | Semiconductors (5.1%) |  |

| | 59,900 | |  | Agere Systems Inc. (Class A)* |  | | 168,319 | |

| | 21,225 | |  | Altera Corp.* |  | | 408,369 | |

| | 3,100 | |  | Analog Devices, Inc.* |  | | 117,645 | |

| | 20,900 | |  | Broadcom Corp. (Class A)* |  | | 423,643 | |

| | 16,800 | |  | Cypress Semiconductor Corp.* |  | | 234,864 | |

| | 16,050 | |  | Integrated Circuit Systems, Inc.* |  | | 482,303 | |

| | 140,850 | |  | Intel Corp. |  | | 3,514,208 | |

| | 29,350 | |  | Intersil Corp. (Class A)* |  | | 723,771 | |

| | 30,150 | |  | Linear Technology Corp. |  | | 1,111,932 | |

| | 28,250 | |  | Marvell Technology Group Ltd. (Bermuda)* |  | | 993,270 | |

| | 9,900 | |  | Maxim Integrated Products, Inc. |  | | 386,892 | |

| | 7,900 | |  | Microchip Technology Inc. |  | | 208,244 | |

| | 4,500 | |  | Micron Technology, Inc.* |  | | 65,880 | |

| | 13,300 | |  | PMC - - Sierra, Inc.* |  | | 163,058 | |

| | 32,184 | |  | Taiwan Semiconductor Manufacturing Co. Ltd. (ADR) (Taiwan)* |  | $ | 321,840 | |

| | 35,300 | |  | Texas Instruments Inc. |  | | 666,111 | |

| | | |  | |  | | 9,990,349 | |

| | | |  | Services to the Health Industry (0.7%) |  |

| | 11,700 | |  | AdvancePCS* |  | | 443,313 | |

| | 7,800 | |  | Laboratory Corp. of America Holdings* |  | | 247,806 | |

| | 15,350 | |  | Stericycle, Inc.* |  | | 692,746 | |

| | | |  | |  | | 1,383,865 | |

| | | |  | Specialty Insurance (0.4%) |  |

| | 8,600 | |  | Fidelity National Financial, Inc. |  | | 246,734 | |

| | 525 | |  | Markel Corp.* |  | | 142,007 | |

| | 6,900 | |  | Radian Group, Inc. |  | | 322,989 | |

| | | |  | |  | | 711,730 | |

| | | |  | Specialty Stores (1.1%) |  |

| | 2,900 | |  | Advance Auto Parts, Inc.* |  | | 196,997 | |

| | 2,850 | |  | AutoZone, Inc.* |  | | 237,291 | |

| | 19,050 | |  | Bed Bath & Beyond Inc.* |  | | 739,712 | |

| | 8,300 | |  | CarMax Inc.* |  | | 294,650 | |

| | 13,150 | |  | Staples, Inc.* |  | | 264,841 | |

| | 11,000 | |  | Tiffany & Co. |  | | 377,960 | |

| | | |  | |  | | 2,111,451 | |

| | | |  | Specialty Telecommunications (0.7%) |  |

| | 33,200 | |  | American Tower Corp. (Class A)* |  | | 302,120 | |

| | 7,800 | |  | Citizens Communications Co.* |  | | 92,430 | |

| | 38,200 | |  | Crown Castle International Corp.* |  | | 378,180 | |

| | 23,600 | |  | IDT Corp. (Class B)* |  | | 426,452 | |

| | 4,150 | |  | NTL Inc.* |  | | 173,512 | |

| | | |  | |  | | 1,372,694 | |

|

See Notes to Financial Statements

12

Morgan Stanley All Star Growth Fund

Portfolio of Investments  July 31, 2003 continued

July 31, 2003 continued

|  |  |  |  |  |  |  |  |  |  |

NUMBER OF

SHARES |  | |  | VALUE |

| | | |  | Telecommunication Equipment (1.5%) |  |

| | 4,600 | |  | ADTRAN, Inc. |  | $ | 224,664 | |

| | 17,487 | |  | Alcatel S.A. (France)* |  | | 175,186 | |

| | 22,800 | |  | Comverse Technology, Inc.* |  | | 336,300 | |

| | 75,300 | |  | Corning Inc.* |  | | 612,942 | |

| | 56,900 | |  | Nokia Corp. (ADR) (Finland) |  | | 870,570 | |

| | 15,900 | |  | UTStarcom, Inc.* |  | | 676,863 | |

| | | |  | |  | | 2,896,525 | |

| | | |  | Tobacco (0.8%) |  |

| | 38,500 | |  | Altria Group, Inc. |  | | 1,540,385 | |

| | | |  | Trucking (0.1%) |  |

| | 1,900 | |  | Landstar System, Inc.* |  | | 121,904 | |

| | | |  | Trucks/Construction/Farm

Machinery (0.4%) |  |

| | 10,200 | |  | PACCAR, Inc. |  | | 787,440 | |

| | | |  | Wholesale Distributors (0.1%) |  |

| | 7,300 | |  | Fisher Scientific International, Inc.* |  | | 275,940 | |

| | | |  | |

| | | |  | Wireless Telecommunications (0.9%) |  |

| | 21,100 | |  | AT&T Wireless Services Inc.* |  | | 179,983 | |

| | 46,400 | |  | Nextel Communications, Inc. (Class A)* |  | | 847,264 | |

| | 34,400 | |  | Vodafone Group PLC (ADR) (United Kingdom) |  | | 652,912 | |

| | | |  | |  | | 1,680,159 | |

| | | |  | Total Common Stocks

(Cost $162,215,713) |  | | 187,998,198 | |

|

|  |  |  |  |  |  |  |  |  |  |

PRINCIPAL

AMOUNT IN

THOUSANDS |  | |  | |

| | | |  | Short-Term Investment (4.7%)

Repurchase Agreement |  |

| $ | 9,136 | |  | Joint repurchase agreement account 1.11% due 08/01/03 (dated 07/31/03; proceeds $9,136,282) (a) (Cost $9,136,000) |  | | 9,136,000 | |

|

|  |  |  |  |  |  |  |  |  |  |

Total Investments

(Cost $171,351,713) (b)(c) |  | | 101.1 | % |  | $ | 197,134,198 | |

| Liabilities in Excess of Other Assets |  | | (1.1 | ) |  | | (2,105,762 | ) |

| Net Assets |  | | 100.0 | % |  | $ | 195,028,436 | |

|

| ADR | American Depository Receipt. |

| * | Non-income producing security. |

| ** | A portion of these securities are physically segregated in connection with open futures contracts. |

| (a) | Collateralized by federal agency and U.S. Treasury obligations. |

| (b) | Securities have been designated as collateral in an amount equal to $2,736,159 in connection with open futures and forward contracts. |

| (c) | The aggregate cost for federal income tax purposes is $185,967,768. The aggregate gross unrealized appreciation is $12,370,487 and the aggregate gross unrealized depreciation is $1,204,057, resulting in net unrealized appreciation of $11,166,430. |

Forward Foreign Currency Contract Open at July 31, 2003:

Currency Abbreviation :

|  |

| EUR | Euro. |

Futures Contracts Open at July 31, 2003:

See Notes to Financial Statements

13

Morgan Stanley All Star Growth Fund

Financial Statements

Statement of Assets and Liabilities

July 31, 2003

|  |  |  |  |  |  |

| Assets: |  | | | |

Investments in securities, at value

(cost $171,351,713) |  | $ | 197,134,198 | |

| Receivable for: |  | | | |

| Investments sold |  | | 5,733,016 | |

| Shares of beneficial interest sold |  | | 87,211 | |

| Dividends |  | | 84,676 | |

| Prepaid expenses and other assets |  | | 210,499 | |

| Total Assets |  | | 203,249,600 | |

| Liabilities: |  | | | |

| Payable for: |  | | | |

| Investments purchased |  | | 6,955,015 | |

| Shares of beneficial interest redeemed |  | | 396,413 | |

| Distribution fee |  | | 153,826 | |

| Investment management fee |  | | 125,866 | |

| Payable to bank |  | | 244,510 | |

| Accrued expenses and other payables |  | | 345,534 | |

| Total Liabilities |  | | 8,221,164 | |

| Net Assets |  | $ | 195,028,436 | |

| Composition of Net Assets: |  | | | |

| Paid-in-capital |  | $ | 367,215,411 | |

| Net unrealized appreciation |  | | 25,775,368 | |

| Accumulated net investment loss |  | | (4,839 | ) |

| Accumulated net realized loss |  | | (197,957,504 | ) |

| Net Assets |  | $ | 195,028,436 | |

| Class A Shares: |  | | | |

| Net Assets |  | $ | 15,601,687 | |

| Shares Outstanding (unlimited authorized, $.01 par value) |  | | 2,390,687 | |

| Net Asset Value Per Share |  | $ | 6.53 | |

| Maximum Offering Price Per Share, |  | | | |

| (net asset value plus 5.54% of net asset value) |  | $ | 6.89 | |

| Class B Shares: |  | | | |

| Net Assets |  | $ | 150,874,623 | |

| Shares Outstanding (unlimited authorized, $.01 par value) |  | | 23,546,699 | |

| Net Asset Value Per Share |  | $ | 6.41 | |

| Class C Shares: |  | | | |

| Net Assets |  | $ | 23,995,729 | |

| Shares Outstanding (unlimited authorized, $.01 par value) |  | | 3,744,943 | |

| Net Asset Value Per Share |  | $ | 6.41 | |

| Class D Shares: |  | | | |

| Net Assets |  | $ | 4,556,397 | |

| Shares Outstanding (unlimited authorized, $.01 par value) |  | | 694,024 | |

| Net Asset Value Per Share |  | $ | 6.57 | |

|

Statement of Operations

For the year ended July 31, 2003

|  |  |  |  |  |  |

| Net Investment Loss: |  | | | |

| Income |  | | | |

| Dividends (net of $6,486 foreign withholding tax) |  | $ | 1,526,093 | |

| Interest |  | | 144,682 | |

| Total Income |  | | 1,670,775 | |

| Expenses |  | | | |

| Distribution fee (Class A shares) |  | | 39,912 | |

| Distribution fee (Class B shares) |  | | 1,589,334 | |

| Distribution fee (Class C shares) |  | | 255,248 | |

| Investment management fee |  | | 1,544,806 | |

| Transfer agent fees and expenses |  | | 710,930 | |

| Shareholder reports and notices |  | | 269,594 | |

| Professional fees |  | | 106,137 | |

| Custodian fees |  | | 63,299 | |

| Registration fees |  | | 52,173 | |

| Trustees' fees and expenses |  | | 12,713 | |

| Other |  | | 11,140 | |

| Total Expenses |  | | 4,655,286 | |

| Net Investment Loss |  | | (2,984,511 | ) |

| Net Realized and Unrealized Gain (Loss): |  | | | |

| Net Realized Gain/Loss on: |  | | | |

| Investments |  | | (35,492,453 | ) |

| Futures contracts |  | | 79,721 | |

| Foreign exchange transactions |  | | (22 | ) |

| Net Realized Loss |  | | (35,412,754 | ) |

| Net change in unrealized appreciation/depreciation on: |  | | | |

| Investments |  | | 49,508,850 | |

| Futures contracts |  | | (7,293 | ) |

| Net translation of other assets and liabilities denominated in foreign currencies |  | | 692 | |

| Net Appreciation |  | | 49,502,249 | |

| Net Gain |  | | 14,089,495 | |

| Net Increase |  | $ | 11,104,984 | |

|

See Notes to Financial Statements

14

Morgan Stanley All Star Growth Fund

Financial Statements continued

Statement of Changes in Net Assets

|  |  |  |  |  |  |  |  |  |  |

| |  | FOR THE YEAR

ENDED

JULY 31, 2003 |  | FOR THE YEAR

ENDED

JULY 31, 2002 |

| Increase (Decrease) in Net Assets: |  | | | |  | | | |

| Operations: |  | | | |  | | | |

| Net investment loss |  | $ | (2,984,511 | ) |  | $ | (5,059,979 | ) |

| Net realized loss |  | | (35,412,754 | ) |  | | (102,807,265 | ) |

| Net change in unrealized appreciation/depreciation |  | | 49,502,249 | |  | | (12,138,549 | ) |

| Net Increase (Decrease) |  | | 11,104,984 | |  | | (120,005,793 | ) |

| Net decrease from transactions in shares of beneficial interest |  | | (65,549,541 | ) |  | | (75,623,311 | ) |

| Net Decrease |  | | (54,444,557 | ) |  | | (195,629,104 | ) |

| Net Assets: |  | | | |  | | | |

| Beginning of period |  | | 249,472,993 | |  | | 445,102,097 | |

| End of Period |  | | | |  | | | |

| (Including accumulated net investment loss of $4,839 and undistributed net investment income of $656, respectively) |  | $ | 195,028,436 | |  | $ | 249,472,993 | |

|

See Notes to Financial Statements

15

Morgan Stanley All Star Growth Fund

Notes to Financial Statements  July 31, 2003

July 31, 2003

1. Organization and Accounting Policies

Morgan Stanley All Star Growth Fund (the "Fund") is registered under the Investment Company Act of 1940, as amended (the "Act"), as a non-diversified, open-end management investment company. The Fund's investment objective is long-term growth of capital. The Fund seeks to achieve its objective by investing primarily in common stocks of companies that are believed to offer the potential for superior growth. The Fund was organized as a Massachusetts business trust on October 5, 2000 and commenced operations on February 26, 2001.

The Fund offers Class A shares, Class B shares, Class C shares and Class D shares. The four classes are substantially the same except that most Class A shares are subject to a sales charge imposed at the time of purchase and some Class A shares, and most Class B shares and Class C shares are subject to a contingent deferred sales charge imposed on shares redeemed within one year, six years and one year, respectively. Class D shares are not subject to a sales charge. Additionally, Class A shares, Class B shares and Class C shares incur distribution expenses.

The following is a summary of significant accounting policies:

A. Valuation of Investments — (1) an equity portfolio security listed or traded on the New York or American Stock Exchange or other exchange is valued at its latest sale price prior to the time when assets are valued; if there were no sales that day, the security is valued at the mean between the last reported bid and asked price; (2) an equity portfolio security listed or traded on the Nasdaq is valued at the Nasdaq Official Closing Price; if there were no sales that day, the security is valued at the mean between the last reported bid and asked price; (3) all other equity portfolio securities for which over-the-counter market quotations are readily available are valued at the mean between the last reported bid and asked price. In cases where a security is traded on more than one exchange, the security is valued on the exchange designated as the primary market; (4) for equity securities traded on foreign exchanges, the last reported sale price or the latest bid price may be used if there were no sales on a particular day; (5) futures are valued at the latest price published by the commodities exchange on which they trade; (6) when market quotations are not readily available or Morgan Stanley Investment Advisors Inc. (the "Investment Manager") or Van Kampen Asset Management Inc. (the "Sub-Advisor"), an affiliate of the Investment Manager, determines that the latest sale price, the bid price or the mean between the last reported bid and asked price do not reflect a security's market value, portfolio securities are valued at their fair value as determined in good faith under procedures established by and under the general supervision of the Fund's Trustees; (7) certain portfolio securities may be valued by an outside pricing service approved by the Fund's Trustees; and (8) short-term debt securities having a maturity date of more than sixty days at time of purchase are valued on a mark-to-market basis until sixty days prior to maturity and thereafter at amortized cost based on their value on the 61st day. Short-term debt securities having a maturity date of sixty days or less at the time of purchase are valued at amortized cost.

16

Morgan Stanley All Star Growth Fund

Notes to Financial Statements  July 31, 2003 continued

July 31, 2003 continued

B. Accounting for Investments — Security transactions are accounted for on the trade date (date the order to buy or sell is executed). Realized gains and losses on security transactions are determined by the identified cost method. Dividend income and other distributions are recorded on the ex-dividend date. Discounts are accreted and premiums are amortized over the life of the respective securities. Interest income is accrued daily.

C. Repurchase Agreements — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the Fund, along with other affiliated entities managed by the Investment Manager, may transfer uninvested cash balances into one or more joint repurchase agreement accounts. These balances are invested in one or more repurchase agreements and are collateralized by cash, U.S. Treasury or federal agency obligations. The Fund may also invest directly with institutions in repurchase agreements. The Fund's custodian receives the collateral, which is marked-to-market daily to determine that the value of the collateral does not decrease below the repurchase price plus accrued interest.

D. Multiple Class Allocations — Investment income, expenses (other than distribution fees), and realized and unrealized gains and losses are allocated to each class of shares based upon the relative net asset value on the date such items are recognized. Distribution fees are charged directly to the respective class.

E. Futures Contracts — A futures contract is an agreement between two parties to buy and sell financial instruments or contracts based on financial indices at a set price on a future date. Upon entering into such a contract, the Fund is required to pledge to the broker cash, U.S. Government securities or other liquid portfolio securities equal to the minimum initial margin requirements of the applicable futures exchange. Pursuant to the contract, the Fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in the value of the contract. Such receipts or payments known as variation margin are recorded by the Fund as unrealized gains and losses. Upon closing of the contract, the Fund realizes a gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed.

F. Foreign Currency Translation and Forward Foreign Currency Contracts — The books and records of the Fund are maintained in U.S. dollars as follows: (1) the foreign currency market value of investment securities, other assets and liabilities and forward foreign currency contracts ("forward contracts") are translated at the exchange rates prevailing at the end of the period; and (2) purchases, sales, income and expenses are translated at the exchange rates prevailing on the respective dates of such transactions. The resultant exchange gains and losses are recorded as realized and unrealized gain/loss on foreign exchange transactions. Pursuant to U.S. Federal income tax regulations, certain foreign exchange gains/losses included in realized and unrealized gain/loss are included in or are a reduction of ordinary income for federal income tax purposes. The Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the changes in the market prices of the securities. Forward contracts are valued daily at the appropriate exchange rates. The resultant unrealized exchange gains and

17

Morgan Stanley All Star Growth Fund

Notes to Financial Statements  July 31, 2003 continued

July 31, 2003 continued

losses are recorded as unrealized foreign currency gain or loss. The Fund records realized gains or losses on delivery of the currency or at the time the forward contract is extinguished (compensated) by entering into a closing transaction prior to delivery.

G. Federal Income Tax Policy — It is the Fund's policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Accordingly, no federal income tax provision is required.

H. Dividends and Distributions to Shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

I. Use of Estimates — The preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates.

2. Investment Management and Sub-Advisory Agreements

Pursuant to an Investment Management Agreement, the Fund pays the Investment Manager a management fee, accrued daily and payable monthly, by applying the annual rate of 0.75% to the net assets of the Fund determined as of the close of each business day.

Under a Sub-Advisory Agreement between the Sub-Advisor and the Investment Manager, the Sub-Advisor provides the Fund with investment advice and portfolio management relating to the Fund's investments in securities, subject to the overall supervision of the Investment Manager. As compensation for its services provided pursuant to the Sub-Advisory Agreement, the Investment Manager pays the Sub-Advisor compensation, calculated by applying the annual rate of 0.60% to the portion of the Fund's average daily net assets managed by the Sub-Advisor.

3. Plan of Distribution

Shares of the Fund are distributed by Morgan Stanley Distributors Inc. (the "Distributor"), an affiliate of the Investment Manager and Sub-Advisor. The Fund has adopted a Plan of Distribution (the "Plan") pursuant to Rule 12b-1 under the Act. The Plan provides that the Fund will pay the Distributor a fee which is accrued daily and paid monthly at the following annual rates: (i) Class A – up to 0.25% of the average daily net assets of Class A; (ii) Class B – 1.0% of the average daily net assets of Class B; and (iii) Class C – up to 1.0% of the average daily net assets of Class C.

In the case of Class B shares, provided that the Plan continues in effect, any cumulative expenses incurred by the Distributor but not yet recovered may be recovered through the payment of future distribution fees from the Fund pursuant to the Plan and contingent deferred sales charges paid by investors upon redemption of Class B shares. Although there is no legal obligation for the Fund to pay expenses incurred in excess of

18

Morgan Stanley All Star Growth Fund

Notes to Financial Statements  July 31, 2003 continued

July 31, 2003 continued

payments made to the Distributor under the Plan and the proceeds of contingent deferred sales charges paid by investors upon redemption of shares, if for any reason the Plan is terminated, the Trustees will consider at that time the manner in which to treat such expenses. The Distributor has advised the Fund that such excess amounts totaled $20,805,819 at July 31, 2003.

In the case of Class A shares and Class C shares, expenses incurred pursuant to the Plan in any calendar year in excess of 0.25% or 1.0% of the average daily net assets of Class A or Class C, respectively, will not be reimbursed by the Fund through payments in any subsequent year, except that expenses representing a gross sales credit to Morgan Stanley Financial Advisors or other selected broker-dealer representatives may be reimbursed in the subsequent calendar year. For the year ended July 31, 2003, the distribution fee was accrued for Class A shares and Class C shares at the annual rate of 0.24% and 1.0%, respectively.

The Distributor has informed the Fund that for the year ended July 31, 2003, it received contingent deferred sales charges from certain redemptions of the Fund's Class B shares and Class C shares of $893,227 and $3,589, respectively and received $14,841 in front-end sales charges from sales of the Fund's Class A shares. The respective shareholders pay such charges which are not an expense of the Fund.

4. Security Transactions and Transactions with Affiliates

The cost of purchases and proceeds from sales of portfolio securities, excluding short-term investments, for the year ended July 31, 2003 aggregated $391,832,715 and $462,529,209, respectively. Included in the aforementioned transactions are purchases and sales of $289,552 and $266,276, respectively, for portfolio transactions with other Morgan Stanley funds, including a realized gain of $3,191.

For the year ended July 31, 2003 the fund incurred brokerage commissions of $42,654 with Morgan Stanley & Co., Inc., an affiliate of the Investment Manager and Distributor, for portfolio transactions executed on behalf of the Fund. At July 31, 2003, the Fund's receivable for investments sold included unsettled trades with Morgan Stanley & Co., Inc. of $748,297.

Morgan Stanley Trust, an affiliate of the Investment Manager and Distributor, is the Fund's transfer agent. At July 31, 2003, the Fund had transfer agent fees and expenses payable of approximately $7,900.

5. Purposes of and Risks Relating to Certain Financial Instruments

The Fund may enter into forward contracts to facilitate settlement of foreign currency denominated portfolio transactions or to manage foreign currency exposure associated with foreign currency denominated securities.

To hedge against adverse interest rate, foreign currency and market risks, the Fund may purchase and sell interest rate, currency and index futures ("futures contracts").

19

Morgan Stanley All Star Growth Fund

Notes to Financial Statements  July 31, 2003 continued

July 31, 2003 continued

Forward contracts and futures contracts involve elements of market risk in excess of the amounts reflected in the Statement of Assets and Liabilities. The Fund bears the risk of an unfavorable change in the foreign exchange rates underlying the forward contracts. Risks may also arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.

At July 31, 2003, the Fund had outstanding forward contracts and outstanding futures contracts.

6. Shares of Beneficial Interest

Transactions in shares of beneficial interest were as follows:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | FOR THE YEAR

ENDED

JULY 31, 2003 |  | FOR THE YEAR

ENDED

JULY 31, 2002 |  |

| |  | SHARES |  | AMOUNT |  | SHARES |  | AMOUNT |

| CLASS A SHARES |  | | | |  | | | |  | | | |  | | | |

| Sold |  | | 262,004 | |  | $ | 1,538,669 | |  | | 689,884 | |  | $ | 5,238,133 | |

| Redeemed |  | | (1,165,796 | ) |  | | (6,791,833 | ) |  | | (1,649,342 | ) |  | | (12,103,465 | ) |

| Net decrease – Class A |  | | (903,792 | ) |  | | (5,253,164 | ) |  | | (959,458 | ) |  | | (6,865,332 | ) |

| CLASS B SHARES |  | | | |  | | | |  | | | |  | | | |

| Sold |  | | 1,474,601 | |  | | 8,577,739 | |  | | 5,629,974 | |  | | 42,663,763 | |

| Redeemed |  | | (10,042,289 | ) |  | | (58,037,848 | ) |  | | (12,678,341 | ) |  | | (91,654,404 | ) |

| Net decrease – Class B |  | | (8,567,688 | ) |  | | (49,460,109 | ) |  | | (7,048,367 | ) |  | | (48,990,641 | ) |

| CLASS C SHARES |  | | | |  | | | |  | | | |  | | | |

| Sold |  | | 239,873 | |  | | 1,395,441 | |  | | 832,084 | |  | | 6,264,431 | |

| Redeemed |  | | (1,569,591 | ) |  | | (9,143,731 | ) |  | | (2,257,359 | ) |  | | (16,439,877 | ) |

| Net decrease – Class C |  | | (1,329,718 | ) |  | | (7,748,290 | ) |  | | (1,425,275 | ) |  | | (10,175,446 | ) |

| CLASS D SHARES |  | | | |  | | | |  | | | |  | | | |

| Sold |  | | 62,165 | |  | | 378,007 | |  | | 204,558 | |  | | 1,533,822 | |

| Redeemed |  | | (584,889 | ) |  | | (3,465,985 | ) |  | | (1,484,051 | ) |  | | (11,125,714 | ) |

| Net decrease – Class D |  | | (522,724 | ) |  | | (3,087,978 | ) |  | | (1,279,493 | ) |  | | (9,591,892 | ) |

| Net decrease in Fund |  | | (11,323,922 | ) |  | $ | (65,549,541 | ) |  | | (10,712,593 | ) |  | $ | (75,623,311 | ) |

|

7. Federal Income Tax Status

The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations which may differ from generally accepted accounting principles. These "book/tax" differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences do not require reclassification.

20

Morgan Stanley All Star Growth Fund

Notes to Financial Statements  July 31, 2003 continued

July 31, 2003 continued

Dividends and distributions which exceed net investment income and net realized capital gains for tax purposes are reported as distributions of paid-in-capital.

As of July 31, 2003, the tax-basis components of accumulated losses were as follows:

|  |  |  |  |  |  |

| Net accumulated earnings |  | | — | |

| Capital loss carryforward* |  | $ | (167,459,106 | ) |

| Post-October losses |  | | (15,889,636 | ) |

| Net unrealized appreciation |  | | 11,161,767 | |

| Total accumulated losses |  | $ | (172,186,975 | ) |

|

* As of July 31, 2003, the Fund had a net capital loss carryforward of $167,459,106 of which $94,809,071 will expire on July 31, 2010 and $72,650,035 will expire on July 31, 2011 to offset future capital gains to the extent provided by regulations.

As of July 31, 2003, the Fund had temporary book/tax differences primarily attributable to post-October losses (capital losses incurred after October 31 within the taxable year which are deemed to arise on the first business day of the Fund's next taxable year) and capital loss deferrals on wash sales and permanent book/tax differences primarily attributable to a net operating loss and a nondeductible expense. To reflect reclassifications arising from the permanent differences paid-in-capital was charged $2,990,768, accumulated net investment loss was credited $2,979,016 and accumulated net realized loss was credited $11,752.

8. Fund Merger

On April 24, 2003, the Trustees of Morgan Stanley American Opportunities Fund ("American Opportunities") and the Fund approved a Plan of Reorganization whereby the Fund would be merged into American Opportunities. The Plan of Reorganization is subject to the consent of the Fund's shareholders at a special meeting scheduled to be held on September 30, 2003. If approved, the assets of American Opportunities would be combined with the assets of the Fund and shareholders of the Fund would become shareholders of American Opportunities, receiving shares of the corresponding class of American Opportunities equal to the value of their holdings in the Fund.

21

Morgan Stanley All Star Growth Fund

Financial Highlights

Selected ratios and per share data for a share of beneficial interest outstanding throughout each period:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | FOR THE YEAR

ENDED

JULY 31, 2003 |  | FOR THE YEAR

ENDED

JULY 31, 2002 |  | FOR THE PERIOD

FEBRUARY 26, 2001*

THROUGH

JULY 31, 2001 |

| Class A Shares |

| Selected Per Share Data: |

| Net asset value, beginning of period |  | $ | 6.04 | |  | $ | 8.52 | |  | $ | 10.00 | |

| Income (loss) from investment operations: |

| Net investment loss‡ |  | | (0.05 | ) |  | | (0.05 | ) |  | | (0.02 | ) |

| Net realized and unrealized gain (loss) |  | | 0.54 | |  | | (2.43 | ) |  | | (1.46 | ) |

| Total income (loss) from investment operations |  | | 0.49 | |  | | (2.48 | ) |  | | (1.48 | ) |

| Net asset value, end of period |  | $ | 6.53 | |  | $ | 6.04 | |  | $ | 8.52 | |

| Total Return† |  | | 8.11 | % |  | | (29.11 | )% |  | | (14.80) | % (1) |

| Ratios to Average Net Assets(3): |  | | | |  | | | |  | | | |

| Expenses |  | | 1.59 | % |  | | 1.38 | % |  | | 1.37 | %(2) |

| Net investment loss |  | | (0.78 | )% |  | | (0.73 | )% |  | | (0.44) | % (2) |

| Supplemental Data: |  | | | |  | | | |  | | | |

| Net assets, end of period, in thousands |  | | $15,602 | |  | | $19,898 | |  | | $36,225 | |

| Portfolio turnover rate |  | | 198 | % |  | | 242 | % |  | | 106 | %(1) |

|

| * | Commencement of operations. |

| ‡ | The per share amounts were computed using an average number of shares outstanding during the period. |

| † | Does not reflect the deduction of sales charge. Calculated based on the net asset value as of the last business day of the period. |

| (1) | Not annualized. |

| (2) | Annualized. |

| (3) | Reflects overall Fund ratios for investment income and non-class specific expenses. |

See Notes to Financial Statements

22

Morgan Stanley All Star Growth Fund

Financial Highlights continued

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | FOR THE YEAR

ENDED

JULY 31, 2003 |  | FOR THE YEAR

ENDED

JULY 31, 2002 |  | FOR THE PERIOD

FEBRUARY 26, 2001*

THROUGH

JULY 31, 2001 |

| Class B Shares |  | | | |  | | | |  | | | |

| Selected Per Share Data: |  | | | |  | | | |  | | | |

| Net asset value, beginning of period |  | $ | 5.97 | |  | $ | 8.49 | |  | $ | 10.00 | |

| Income (loss) from investment operations: |  | | | |  | | | |  | | | |

| Net investment loss‡ |  | | (0.09 | ) |  | | (0.11 | ) |  | | (0.05 | ) |

| Net realized and unrealized gain (loss) |  | | 0.53 | |  | | (2.41 | ) |  | | (1.46 | ) |

| Total income (loss) from investment operations |  | | 0.44 | |  | | (2.52 | ) |  | | (1.51 | ) |

| Net asset value, end of period |  | $ | 6.41 | |  | $ | 5.97 | |  | $ | 8.49 | |

| Total Return† |  | | 7.37 | % |  | | (29.68 | )% |  | | (15.10) | % (1) |

| Ratios to Average Net Assets(3): |

| Expenses |  | | 2.35 | % |  | | 2.13 | % |  | | 2.12 | %(2) |

| Net investment loss |  | | (1.54 | )% |  | | (1.48 | )% |  | | (1.19) | % (2) |

| Supplemental Data: |  | | | |  | | | |  | | | |

| Net assets, end of period, in thousands |  | | $150,875 | |  | | $191,879 | |  | | $332,425 | |

| Portfolio turnover rate |  | | 198 | % |  | | 242 | % |  | | 106 | %(1) |

|

| * | Commencement of operations. |

| ‡ | The per share amounts were computed using an average number of shares outstanding during the period. |

| † | Does not reflect the deduction of sales charge. Calculated based on the net asset value as of the last business day of the period. |

| (1) | Not annualized. |

| (2) | Annualized. |

| (3) | Reflects overall Fund ratios for investment income and non-class specific expenses. |

See Notes to Financial Statements

23

Morgan Stanley All Star Growth Fund

Financial Highlights continued

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | FOR THE YEAR

ENDED

JULY 31, 2003 |  | FOR THE YEAR

ENDED

JULY 31, 2002 |  | FOR THE PERIOD

FEBRUARY 26, 2001*

THROUGH

JULY 31, 2001 |

| Class C Shares |  | | | |  | | | |  | | | |

| Selected Per Share Data: |  | | | |  | | | |  | | | |

| Net asset value, beginning of period |  | $ | 5.97 | |  | $ | 8.49 | |  | $ | 10.00 | |

| Income (loss) from investment operations: |  | | | |  | | | |  | | | |

| Net investment loss‡ |  | | (0.09 | ) |  | | (0.11 | ) |  | | (0.05 | ) |

| Net realized and unrealized gain (loss) |  | | 0.53 | |  | | (2.41 | ) |  | | (1.46 | ) |

| Total income (loss) from investment operations |  | | 0.44 | |  | | (2.52 | ) |  | | (1.51 | ) |

| Net asset value, end of period |  | $ | 6.41 | |  | $ | 5.97 | |  | $ | 8.49 | |

| Total Return† |  | | 7.37 | % |  | | (29.68 | )% |  | | (15.10) | % (1) |

| Ratios to Average Net Assets(3): |  | | | |  | | | |  | | | |

| Expenses |  | | 2.35 | % |  | | 2.13 | % |  | | 2.12 | %(2) |

| Net investment loss |  | | (1.54 | )% |  | | (1.48 | )% |  | | (1.19) | % (2) |

| Supplemental Data: |  | | | |  | | | |  | | | |

| Net assets, end of period, in thousands |  | | $23,996 | |  | | $30,321 | |  | | $55,173 | |

| Portfolio turnover rate |  | | 198 | % |  | | 242 | % |  | | 106 | %(1) |

|

| * | Commencement of operations. |

| ‡ | The per share amounts were computed using an average number of shares outstanding during the period. |

| † | Does not reflect the deduction of sales charge. Calculated based on the net asset value as of the last business day of the period. |

| (1) | Not annualized. |

| (2) | Annualized. |

| (3) | Reflects overall Fund ratios for investment income and non-class specific expenses. |

See Notes to Financial Statements

24

Morgan Stanley All Star Growth Fund

Financial Highlights continued

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | FOR THE YEAR

ENDED

JULY 31, 2003 |  | FOR THE YEAR

ENDED

JULY 31, 2002 |  | FOR THE PERIOD

FEBRUARY 26, 2001*

THROUGH

JULY 31, 2001 |

| Class D Shares |  | | | |  | | | |  | | | |

| Selected Per Share Data: |  | | | |  | | | |  | | | |

| Net asset value, beginning of period |  | $ | 6.06 | |  | $ | 8.52 | |  | $ | 10.00 | |

| Income (loss) from investment operations: |  | | | |  | | | |  | | | |

| Net investment loss‡ |  | | (0.03 | ) |  | | (0.04 | ) |  | | (0.01 | ) |

| Net realized and unrealized gain (loss) |  | | 0.54 | |  | | (2.42 | ) |  | | (1.47 | ) |

| Total income (loss) from investment operations |  | | 0.51 | |  | | (2.46 | ) |  | | (1.48 | ) |

| Net asset value, end of period |  | $ | 6.57 | |  | $ | 6.06 | |  | $ | 8.52 | |

| Total Return† |  | | 8.42 | % |  | | (28.87 | )% |  | | (14.80) | % (1) |

| Ratios to Average Net Assets(3): |  | | | |  | | | |  | | | |

| Expenses |  | | 1.35 | % |  | | 1.13 | % |  | | 1.12 | %(2) |

| Net investment loss |  | | (0.54 | )% |  | | (0.48 | )% |  | | (0.19) | % (2) |

| Supplemental Data: |  | | | |  | | | |  | | | |

| Net assets, end of period, in thousands |  | | $4,556 | |  | | $7,375 | |  | | $21,280 | |

| Portfolio turnover rate |  | | 198 | % |  | | 242 | % |  | | 106 | %(1) |

|

| * | Commencement of operations. |

| ‡ | The per share amounts were computed using an average number of shares outstanding during the period. |

| † | Calculated based on the net asset value as of the last business day of the period. |

| (1) | Not annualized. |

| (2) | Annualized. |

| (3) | Reflects overall Fund ratios for investment income and non-class specific expenses. |

See Notes to Financial Statements

25

Morgan Stanley All Star Growth Fund

Independent Auditors' Report

To the Shareholders and Board of Trustees of

Morgan Stanley All Star Growth Fund:

We have audited the accompanying statement of assets and liabilities of Morgan Stanley All Star Growth Fund (the "Fund"), including the portfolio of investments, as of July 31, 2003, and the related statements of operations for the year then ended and changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of July 31, 2003, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Morgan Stanley All Star Growth Fund as of July 31, 2003, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP

New York, New York

September 26, 2003

26

Morgan Stanley All Star Growth Fund

Trustee and Officer Information

Independent Trustees:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Name, Age and Address of

Independent Trustee |  | Position(s) Held with Registrant |  | Term of

Office and

Length of

Time

Served* |  | Principal Occupation(s)

During Past 5 Years** |  | Number of Portfolios

in Fund Complex Overseen by Trustee*** |  | Other Directorships Held by Trustee |

Michael Bozic (62)

c/o Mayer, Brown, Rowe & Maw LLP Counsel to the Independent Directors

1675 Broadway

New York, NY

|  | Trustee

|  | Since

April 1994 |  | Retired; Director or Trustee of the Retail Funds and TCW/DW Term Trust 2003 (since April 1994) and the Institutional Funds (since July 2003); formerly Vice Chairman of Kmart Corporation (December 1998-October 2000), Chairman and Chief Executive Officer of Levitz Furniture Corporation (November 1995-November 1998) and President and Chief Executive Officer of Hills Department Stores (May 1991-July 1995); formerly variously Chairman, Chief Executive Officer, President and Chief Operating Officer (1987-1991) of the Sears Merchandise Group of Sears, Roebuck & Co. |  | 216 |  | Director of Weirton Steel Corporation.

|

Edwin J. Garn (70)

c/o Summit Ventures LLC

1 Utah Center

201 S. Main Street

Salt Lake City, UT

|  | Trustee

|  | Since January 1993 |  | Director or Trustee of the Retail Funds and TCW/DW Term Trust 2003 (since January 1993) and the Institutional Funds (since July 2003); member of the Utah Regional Advisory Board of Pacific Corp.; formerly United States Senator (R-Utah) (1974-1992) and Chairman, Senate Banking Committee (1980-1986), Mayor of Salt Lake City, Utah (1971-1974), Astronaut, Space Shuttle Discovery (April 12-19, 1985), and Vice Chairman, Huntsman Corporation (chemical company). |  | 216 |  | Director of Franklin Covey (time management systems), BMW Bank of North America, Inc. (industrial loan corporation), United Space Alliance (joint venture between Lockheed Martin and the Boeing Company) and Nuskin Asia Pacific (multilevel marketing); member of the board of various civic and charitable organizations.

|

Wayne E. Hedien (69)

c/o Mayer, Brown, Rowe & Maw LLP

Counsel to the Independent Directors

1675 Broadway

New York, NY

|  | Trustee