UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant¨ Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Waste Industries USA, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

WASTE INDUSTRIES USA, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 25, 2005

To The Shareholders of Waste Industries USA, Inc.

The Annual Meeting of Shareholders of Waste Industries USA, Inc., a North Carolina corporation, will be held at the North Raleigh Hilton, 3415 Wake Forest Road, Raleigh, North Carolina, on Tuesday, May 25, 2005 at 4:00 p.m., for the following purposes:

| | • | | to elect a board of six directors; |

| | • | | to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005; and |

| | • | | to act upon such other matters as may properly come before the meeting or any adjournment thereof. |

These matters are more fully described in the attached proxy statement.

The Board of Directors has fixed the close of business on April 20, 2005 as the record date for the determination of shareholders entitled to notice of and to vote at the meeting or any adjournment thereof. We cordially invite you to attend the meeting in person. However, to assure your representation at the meeting, please mark, sign, date and return the enclosed proxy card as promptly as possible in the enclosed postage-prepaid envelope. If you attend the meeting you may vote in person, even if you returned a proxy.

Our proxy statement and proxy are included, along with our Annual Report to Shareholders for the fiscal year ended December 31, 2004.

IMPORTANT—YOUR PROXY IS ENCLOSED

Whether or not you plan to attend the meeting, please execute and promptly return the enclosed proxy in the enclosed envelope. No postage is required for mailing in the United States.

By Order of the Board of Directors

Lonnie C. Poole, Jr.,

Chairman of the Board

Raleigh, North Carolina

April 29, 2005

WASTE INDUSTRIES USA, INC.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

May 25, 2004

INFORMATION CONCERNING SOLICITATION AND VOTING

The enclosed proxy is solicited by the Board of Directors of Waste Industries USA, Inc., a North Carolina corporation, for use at our Annual Meeting of Shareholders to be held at the North Raleigh Hilton, 3415 Wake Forest Road, Raleigh, North Carolina, at 4:00 p.m. on Wednesday, May 25, 2005, and any adjournment thereof. We will bear the cost of soliciting proxies. In addition to solicitation of proxies by mail, employees of our company, without extra pay, might solicit proxies personally or by telephone. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy materials to beneficial owners and seeking instruction with respect thereto. The mailing address of our principal executive offices is 3301 Benson Drive, Suite 601, Raleigh, North Carolina 27609. Copies of this proxy statement and accompanying proxy card were mailed to shareholders on or about April 29, 2005.

Revocability of Proxies

Any shareholder giving a proxy has the power to revoke it at any time before it is voted by giving a later proxy or written notice to us (Attention: D. Stephen Grissom, Chief Financial Officer), or by attending the meeting and voting in person.

Voting

When the enclosed proxy is properly executed and returned (and not subsequently properly revoked), the shares it represents will be voted in accordance with the directions indicated thereon, or, if no direction is indicated thereon, it will be voted:

(1) FOR the election of the six nominees for director identified below;

(2) FOR ratification of the appointment of Deloitte & Touche LLP, Raleigh, North Carolina, as our independent registered public accounting firm for the fiscal year ending December 31, 2005; and

(3) in the discretion of the proxies with respect to any other matters properly brought before the shareholders at the meeting.

Vote Required

In accordance with North Carolina law, broker non-votes, abstentions and votes withheld from any director will be counted for purposes of determining the presence or absence of a quorum for the transaction of business. Broker non-votes, abstentions and withheld votes, if any, are not treated as votes cast and, therefore, will have no effect on the proposal to elect directors or the proposal to ratify the appointment of Deloitte & Touche.

The six nominees receiving the highest number of affirmative votes of the shares present or represented and entitled to vote at the meeting shall be elected as directors. Shareholders do not have cumulative voting rights.

The affirmative vote of the holders of a majority of the shares of our common stock present or represented and voting on this proposal at the meeting shall constitute ratification of the appointment of Deloitte & Touche.

1

Record Date

Only the holders of record of our common stock at the close of business on the record date, April 20, 2005, are entitled to notice of and to vote at the meeting. On the record date, 13,653,180 shares of our common stock were outstanding. Shareholders will be entitled to one vote for each share of common stock held on the record date.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Nominees

Our bylaws provide that the number of directors constituting our Board of Directors shall be no less than five and no more than nine. Our Board of Directors or our shareholders can set the number of directors within this range. The number of directors is currently six and all stand for reelection. Therefore, six directors are to be elected to serve for one year, or until the election and qualification of their successors.

We intend to vote proxies FOR all of the nominees named below, unless a shareholder specifically instructs in his or her proxy that his or her vote is to be withheld from one or more of the nominees. If any of the nominees is unable or declines to serve as a director at the time of the meeting, the individuals named in the enclosed proxy may exercise their discretion to vote for any substitute proposed by the Board of Directors. We do not anticipate that any nominee listed below will be unable or will decline to serve as a director.

| | | | |

Name of Director Nominee

| | Age

| | Director Since

|

Lonnie C. Poole, Jr. | | 67 | | 1970 |

Jim W. Perry | | 60 | | 1974 |

Paul F. Hardiman | | 63 | | 2002 |

Glenn E. Futrell | | 63 | | 2003 |

James R. Talton, Jr. | | 62 | | 2003 |

James A. Walker | | 58 | | 2004 |

Except for Lonnie C. Poole, Jr., who is the father of Lonnie C. Poole, III, our Vice President, Corporate Development, none of our directors or executive officers is related by blood, marriage or adoption to any other director or any executive officer.

The Board of Directors has affirmatively determined that current directors Glenn E. Futrell, Paul F. Hardiman, James R. Talton, Jr. and James A. Walker are independent as defined in Rule 4200(a)(15) of Nasdaq’s listing standards. Because of their current employment with our company, current directors Jim W. Perry and Lonnie C. Poole, Jr. are not independent.

Lonnie C. Poole, Jr. founded our company in 1970, has served as Chairman of the Board of Directors since that time and served as Chief Executive Officer from 1970 until June 30, 2002. Mr. Poole holds a B.S. in Civil Engineering from North Carolina State University and an M.B.A. from the University of North Carolina at Chapel Hill. Mr. Poole has more than 35 years experience in the solid waste industry. He has served in the Environmental Industry Association, a non-profit business association established to, among other things, inform, educate and assist its members in cost-effective, safe and environmentally responsible management of waste (“EIA”, formerly the National Solid Waste Management Association or the “NSWMA”) in the following positions: Chairman; Vice Chairman; Board Member; and State Chapter Chairman. Mr. Poole has received the EIA’s member of the year award and was inducted into the EIA Hall of Fame in 1994. Mr. Poole was a founding Director and first Chairman of the Environmental Research and Education Foundation located in Alexandria, Virginia, and is now a member of its Board of Directors. In addition, Mr. Poole is a past President of the Occonneechee Council of the Boy Scouts of America and continues to serve on the Council Board of Directors. Mr. Poole is also a member of the Board of Directors for the North Carolina State University Foundation and currently serves as its Vice Chairman.

2

Jim W. Perry joined us in 1971, has served as our Chief Executive Officer since July 2002, has served as our President since 1987 and as a director since 1974. Mr. Perry served as our Chief Operating Officer from 1987 until April 2002. Mr. Perry holds a B.S. in Agricultural and Biological Engineering from North Carolina State University and an M.S. in Systems Management from the University of Southern California. Mr. Perry has more than 30 years experience in the solid waste industry and has received the Distinguished Service Award from the NSWMA. In addition, Mr. Perry has served in the Carolinas Chapter of NSWMA as Chairman and on the Membership Committee. Mr. Perry was inducted into the EIA Hall of Fame in 1997.

Paul F. Hardiman has served as a director of our company since June 2002. Mr. Hardiman retired in 2002 as a Managing Director at FleetBoston Corp. During his 36-year career with FleetBoston and its predecessor company, Bank of Boston, Mr. Hardiman held a variety of management positions in the Bank’s Commercial Banking and Specialized Financing activities. He also served as Chairman of Bank of Boston, Canada, a banking and factoring company located in Toronto and Montreal. In 1989, he established the Bank’s Environmental Financing Group, the first of its kind in the country, to provide capital and banking support to the solid waste industry. Mr. Hardiman holds a B.A. in Economics from Boston College and an M.B.A. in Accounting and Finance from Amos Tuck School, Dartmouth College.

Glenn E. Futrell has served as a director of our company since May 2003. Mr. Futrell is the President and owner of Roanoke Properties Limited Partnership, a real estate development company, in Manteo, North Carolina. From 1973 to 1987, he was President and Chief Executive Officer of Soil & Material Engineers, which specialized in geotechnical engineering, environmental engineering and hazardous waste cleaning, and which was sold to Westinghouse in December 1987. Mr. Futrell served as President of Westinghouse Environmental & Geotechnical Services, a subsidiary of Westinghouse, from 1988 to 1990. Mr. Futrell holds a B.S.C.E. and an M.S.C.E. in Civil Engineering from North Carolina State University. He serves on the Board of the North Carolina State Engineering Foundation. Since June 2000, Mr. Futrell has served as a director of North State Bancorp, a publicly traded bank holding company headquartered in Raleigh, North Carolina.

James R. Talton, Jr. has served as a director of our company since May 2003. Mr. Talton has been the Chairman of Impact Design-Build, Inc. since 2000. Prior to that he was an audit partner and managing partner with KPMG LLP in Raleigh, North Carolina, from 1986 to 1999, and was with KPMG LLP in Greenville, South Carolina from 1969 to 1986. Mr. Talton holds a B.A. in Business Administration from East Carolina University. He serves on the Board of Trustees of East Carolina University. Since March 2001, Mr. Talton has served as a director of Datastream Systems, Inc., a publicly traded provider of asset management software, integrated procurement and support services, headquartered in Greenville, South Carolina.

James A. Walker is Chairman of The Advisory Group, LLC, which provides, among other services, consulting services on real estate investment sales and acquisitions, a position he has held since 1997. From 1984 until 1997, he was the Chief Executive Officer of North Hills, Inc., a $350 million diversified real estate company in Raleigh. From 1968 to 1984, he was with KPMG Peat Marwick, rising to partner-in-charge of the private business practice in the Raleigh office. Mr. Walker holds a B.S. in Business Administration from East Carolina University. He graduated from the Harvard Business School Owner-President Management Program in 1985.

The Board of Directors has unanimously approved and recommends that shareholders vote “FOR” the election of the nominees listed above.

PROPOSAL NO. 2 —

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board of Directors has appointed the firm of Deloitte & Touche LLP, Raleigh, North Carolina, to serve as our independent registered public accounting firm for the fiscal year ending

3

December 31, 2005. Our Board of Directors recommends that the shareholders ratify this appointment. We are not obligated by law to seek shareholder ratification of our selection of Deloitte & Touche as our independent auditors. However, we are submitting the selection to you as a matter of good corporate practice. If our shareholders do not ratify the appointment of Deloitte & Touche, the Audit Committee will reconsider its selection.

Deloitte & Touche has audited our accounts since 1983 and has advised us that it does not have, and has not had, any direct or indirect financial interest in our company or subsidiaries in any capacity other than that of serving as independent auditors. Representatives of Deloitte & Touche are expected to attend the meeting. They will have an opportunity to make a statement, if they desire to do so, and will also be available to respond to appropriate questions.

Audit Fees. Deloitte & Touche billed us aggregate fees of $645,660 and $330,736 for professional services rendered for the audit of our annual financial statements for fiscal years 2004 and 2003, respectively, and for reviews of the financial statements included in our quarterly reports on Form 10-Q for the first three quarters of those fiscal years.

Audit-Related Fees. Deloitte & Touche billed us aggregate fees of $42,880 and $44,504 for professional services that were reasonably related to their performance of their audit and review of our quarterly financial statements in fiscal years 2004 and 2003, respectively. These services included a benefit plan audit and accounting consultation.

Tax Fees. Deloitte & Touche billed us aggregate fees of $233,390 and $255,403 in fiscal years 2004 and 2003, respectively, for services rendered for general tax consulting activities and the preparation of our tax returns in those fiscal years.

All Other Fees. Deloitte & Touche billed us aggregate fees of $9,338 in fiscal year 2004 for valuation services. We did not engage Deloitte & Touche in fiscal year 2003 to perform any other services.

In considering the nature of the services provided by Deloitte & Touche as discussed above, the Audit Committee determined that such services are compatible with the provision of independent audit services. The Audit Committee discussed these services with Deloitte & Touche and our management to determine that they are permitted under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as well as the American Institute of Certified Public Accountants.

Although the Audit Committee does not have formal pre-approval policies and procedures in place, it pre-approved all of the services performed by Deloitte & Touche as discussed above, as required by SEC regulation.

The Board of Directors unanimously recommends a vote “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent auditors for the fiscal year ending December 31, 2005.

4

OTHER INFORMATION

Principal Shareholders

The following table sets forth certain information regarding the ownership of shares of our common stock as of March 31, 2005 by (1) each person known by us to beneficially own more than 5% of the outstanding shares of common stock, (2) each director of our company, (3) each of the Named Executive Officers, as listed under “— Executive Compensation — Summary Compensation” below, and (4) all directors and executive officers of our company as a group.

This table is based upon information supplied by our officers, directors and principal shareholders and from Schedules 13D and 13G filed with the SEC. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, each of the shareholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Share ownership in each case includes shares issuable upon exercise of options that may be exercised within 60 days after the record date for purposes of computing the percentage of common stock owned by such person but not for purposes of computing the percentage owned by any other person. Applicable percentages are based on 13,650,380 shares outstanding on March 31, 2005. Except as listed otherwise, the address of each listed stockholder is 3301 Benson Drive, Suite 601, Raleigh, North Carolina 27609.

| | | | | |

Name

| | Shares

Beneficially

Owned

| | Percentage

Owned

| |

| | |

Dimensional Fund Advisors Inc (1) 1299 Ocean Avenue, 11th Floor Santa Monica, California 90401 | | 851,100 | | 6.23 | % |

| | |

Lonnie C. Poole, Jr. (2) | | 4,292,131 | | 31.44 | % |

| | |

Lonnie C. Poole, III (3) | | 2,949,107 | | 21.60 | % |

| | |

Scott J. Poole (4) 2408 Mt. Vernon Church Road Raleigh, North Carolina 27614 | | 2,559,809 | | 18.75 | % |

| | |

Jim W. Perry (5) | | 1,427,900 | | 10.46 | % |

| | |

Glenn E. Futrell (6) | | 6,104 | | * | |

| | |

Paul F. Hardiman (7) | | 8,921 | | * | |

| | |

James R. Talton, Jr. (8) | | 3,956 | | * | |

| | |

James A. Walker | | 1,862 | | * | |

| | |

Harry M. Habets (9) | | 22,718 | | * | |

| | |

D. Stephen Grissom (10) | | 23,223 | | * | |

| | |

William J. Hanley (11) | | 17,296 | | * | |

| | |

All directors and executive officers as a group (11 persons) (12) | | 7,800,102 | | 57.06 | % |

| (1) | | As reported in Schedule 13G filed on February 9, 2005. The Schedule 13G filed by Dimensional Fund Advisors Inc. does not list any natural persons having voting and/or investment powers over the securities held of record by Dimensional Fund Advisors Inc. |

| (2) | | Includes 41,727 shares underlying vested options, 31,000 shares owned by Mr. Poole’s wife, 163,320 shares held by an investment partnership of which Mr. Poole serves as a general partner, 50,903 owned by a |

5

| | charitable foundation of which Mr. Poole’s wife is the trustee, 29,467 shares held in trust for the benefit of Mr. Poole’s grandchildren and great-grandchildren and for which he serves as the trustee, and 1,741,729 shares held by three grantor trusts of which Lonnie C. Poole, III and Scott J. Poole, Mr. Poole’s children, are beneficiaries and/or trustees. |

| (3) | | Includes 16,860 shares underlying vested options, 29,467 shares held in trust by Lonnie C. Poole, Jr. and for the benefit of Mr. Poole’s children and grandchildren, 1,210,000 shares held by a trust of which Mr. Poole is a co-trustee and beneficiary, 265,864 shares held by a trust of which he is a beneficiary with shared investment power, and 265,865 shares held by a trust of which Mr. Poole is the trustee. |

| (4) | | Includes 1,210,000 shares held by a trust of which Mr. Poole is a co-trustee and beneficiary, 265,865 shares held by a trust of which he is a beneficiary with shared investment power, and 265,864 shares held by a trust of which Mr. Poole is the trustee. |

| (5) | | Includes 6,221 shares underlying vested options. |

| (6) | | Includes 3,059 shares underlying vested options. |

| (7) | | Includes 5,515 shares underlying vested options. |

| (8) | | Includes 3,059 shares underlying vested options. |

| (9) | | Includes 3,603 shares underlying vested options. |

| (10) | | Includes 17,723 shares underlying vested options. |

| (11) | | Includes 17,296 shares underlying vested options. |

| (12) | | Includes the shares and shares underlying vested options discussed in footnotes (2) - (11). |

Information Concerning the Board of Directors and Its Committees

The business of our company is under the general management of the Board of Directors as provided by the laws of North Carolina and our bylaws. During the fiscal year ended December 31, 2004, the Board of Directors held four formal meetings, excluding actions by unanimous written consent. Each member of the Board attended at least 75% of all of the fiscal 2004 meetings of the Board of Directors and Board committees of which he was a member.

The Board of Directors has an Audit Committee, a Compensation Committee and a Nominating Committee. The Audit Committee currently consists of James R. Talton, Jr., Chairman, Paul F. Hardiman and James A. Walker. During 2004, the Audit Committee held six formal meetings, excluding actions by unanimous written consent. The Audit Committee hires our independent registered public accounting firm and reviews the results and scope of the audit and other services provided by our independent registered public accounting firm.

The Compensation Committee currently consists of Glenn E. Futrell, Chairman, Paul F. Hardiman and James A. Walker. During 2004, the Compensation Committee held three formal meetings. The Compensation Committee makes recommendations to the Board of Directors regarding salaries and incentive compensation for our officers, and administers our stock plan.

The Nominating Committee currently consists of James A. Walker, Chairman, Glenn E. Futrell and James R. Talton, Jr. Formed on July 22, 2004, the Nominating Committee did not hold any formal meetings in 2004. The Nominating Committee makes recommendations to the Board of Directors regarding potential new board candidates.

6

EXECUTIVE OFFICERS

The following table sets forth certain information concerning our executive officers as of February 28, 2005:

| | | | |

Name

| | Age (as of 02/29/05)

| | Position with our Company and Business Experience for Last Five Years

|

Lonnie C. Poole, Jr. | | 67 | | Chairman since 1970; Chief Executive Officer from 1970 until June 30, 2002. |

| | |

Jim W. Perry | | 60 | | Chief Executive Officer since July 2002; President since 1987; Chief Operating Officer from 1987 until April 2002. |

| | |

D. Stephen Grissom | | 52 | | Vice President and Chief Financial Officer since September 2001; prior to that, Managing Partner of JSG Properties, Raleigh, North Carolina from 2000 until 2001; prior to that, Chief Financial Officer of Austin Quality Foods, Inc., Cary, North Carolina from 1982 to 2000. |

| | |

Harry M. Habets | | 55 | | Vice President and Chief Operating Officer since April 2002; President and Chief Operating Officer from August 1999 to March 2002 of EarthCare Company, a solid and liquid waste company, in Dallas, Texas; prior to that, 14 years with Waste Management, Inc., Oakbrook, Illinois, including positions as Vice President of International Operations and Regions Vice President/Manager for collection, recycling and landfill disposal services in the Southeast. |

| | |

William J. Hanley | | 51 | | Vice President, Corporate General Sales Manager since April 2001; prior to that, 8 years with Waste Management, Inc., Morrisville, Pennsylvania, including positions as Sales Manager, General Sales Manager and Regional Sales Manager. |

| | |

Lonnie C. Poole, III | | 43 | | Vice President, Corporate Development since July 2002; Director of Support Services from 1995 to July 2002; Director of Risk Management from 1990 to 1995. |

From July 1999 to April 2002, Mr. Habets served as President and Chief Operating Officer of EarthCare Company, a publicly traded solid and liquid waste company, headquartered in Dallas, Texas. EarthCare filed for bankruptcy in April 2002. EarthCare was founded in 1997 and lost money every year in which it operated. The chairman of EarthCare recruited Mr. Habets to join EarthCare in 1999 to help turn the company around. The chairman of EarthCare was the founder of a large successful solid waste company. EarthCare was never able to raise the capital necessary to effect a turnaround and filed for bankruptcy in April 2002. Mr. Habets had announced his intention to resign in March 2002, which he tendered in March 2002.

7

Executive Compensation

Summary Compensation

The following table sets forth all compensation paid by us for services rendered to us in all capacities for the fiscal years ended December 31, 2002, 2003, and 2004 to our Chief Executive Officer, our Chairman and our other executive officers who earned at least $100,000. We refer to these executive officers as the Named Executive Officers. Amounts are shown as received in the year for which the compensation was earned, even if it was paid or granted in the subsequent year.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | |

| | | | | | Annual Compensation

| | Long-Term Compensation

| | |

Name and Principal Position

| | Fiscal Year

| | | Salary

| | Bonus

| | Stock Options (Shares)

| | All Other Compensation(1)

|

Lonnie C. Poole, Jr. (3) Chairman | | 2004

2003

2002 |

(2) | | $

$

$ | 317,766

300,000

266,240 | | $

$

$ | 165,000

-0-

121,037 | | 9,705

17,911

17,360 | | $

$

$ | 10,536

1,104,403

4,784 |

| | | | | |

Jim W. Perry (4) President and Chief Executive Officer | | 2004

2003

2002 |

(2) | | $

$

$ | 300,000

279,995

252,375 | | $

$

$ | 210,462

25,700

101,197 | | 13,876

18,241

15,392 | | $

$

$ | 37,641

239,450

9,950 |

| | | | | |

Harry M. Habets (5) Vice President and Chief Operating Officer | | 2004

2003

2002 |

| | $

$

$ | 251,159

229,846

155,769 | | $

$

$ | 65,347

13,618

42,064 | | 9,956

12,610

15,000 | | $

$

$ | 2,486

9,322

1,200 |

| | | | | |

D. Stephen Grissom Vice President, Chief Financial Officer and Secretary | | 2004

2003

2002 |

| | $

$

$ | 174,233

157,846

153,000 | | $

$

$ | 29,964

5,898

14,425 | | 6,272

8,026

8,931 | | $

$

$ | 5,459

5,067

3,017 |

| | | | | |

William J. Hanley Vice President, Corporate General Sales Manager | | 2004

2003

2002 |

| | $

$

$ | 128,269

116,923

111,154 | | $

$

$ | 29,842

18,038

15,608 | | 5,124

6,573

7,303 | | $

$

$ | 9,863

8,134

1,200 |

| | | | | |

Lonnie C. Poole, III Vice President, Corporate Development | | 2004

2003

2002 |

| | $

$

$ | 129,808

116,711

98,000 | | $

$

$ | 29,843

18,153

18,535 | | 4,846

6,145

6,996 | | $

$

$ | 4,492

4,218

7,114 |

| (1) | | Includes for Mr. Poole Jr.: |

| | • | | life insurance premiums paid by us on executive group life insurance coverage in excess of $50,000 payable to Mr. Poole Jr. or his family as follows: $1,143 and $1,524 in 2003 and 2004, respectively; |

| | • | | 401(k) plan contributions of $2,100 and $2,700 in 2003 and 2004, respectively; and |

| | • | | for 2003, loan forgiveness of $687,313 and interest refunded and forgiven of $329,443, both grossed up for payroll tax paid by our company, as part of the termination of the insurance program discussed under “Certain Transactions”. |

Includes for Mr. Perry:

| | • | | life insurance premiums paid by us on executive group policy insurance coverage in excess of $50,000 payable to Mr. Perry or his family as follows: $2,800, $538 and $1,501 in 2002, 2003 and 2004 respectively; |

| | • | | 401(k) plan contributions of $7,150, $7,800 and $8,450 in 2002, 2003 and 2004, respectively; and |

| | • | | for 2003, loan forgiveness of $130,865 and interest refunded and forgiven of $72,090, both grossed up for payroll tax paid by our company, as part of the termination of the insurance program discussed under “Certain Transactions”. |

8

Includes for Mr. Habets:

| | • | | life insurance premiums paid by us on executive group policy insurance coverage in excess of $50,000 payable to Mr. Habets or his family as follows: $299 and $895 in 2003 and 2004, respectively; |

| | • | | 401(k) plan contributions of $3,972 and $8,102 in 2003 and 2004, respectively; and |

| | • | | mileage allowance of $5,051 and $3,489 in 2003 and 2004, respectively. |

Includes for Mr. Grissom:

| | • | | life insurance premiums paid by us on executive group policy insurance coverage in excess of $50,000 payable to Mr. Grissom or his family as follows: $1,200 $311 and $296 in 2002, 2003 and 2004, respectively; and |

| | • | | 401(k) plan contributions of $4,756 and $5,164 in 2003 and 2004, respectively. |

Includes for Mr. Hanley:

| | • | | life insurance premiums paid by us on executive group policy insurance coverage in excess of $50,000 payable to Mr. Hanley or his family as follows: $1,200 , $219 and $183 in 2002, 2003 and 2004, respectively; |

| | • | | 401(k) plan contributions of $5,262 in 2004; and |

| | • | | mileage allowance of $7,915 and $4,418 in 2003 and 2004, respectively. |

Includes for Mr. Poole III:

| | • | | life insurance premiums paid by us on executive group policy insurance coverage in excess of $50,000 payable to Mr. Poole or his family as follows: $3,000, $140 and $80 in 2002, 2003 and 2004, respectively; and |

| | • | | 401(k) plan contributions of $4,114, $3,797 and $4,114 in 2002, 2003 and 2004, respectively. |

| (2) | | Does not include loans to Mr. Poole or Mr. Perry or the value of insurance policies purchased with those loans as part of an alternative compensation program begun in 1999 and terminated in 2002 as discussed in “Certain Transactions”. |

| (3) | | Mr. Poole served as Chief Executive Officer until June 30, 2002. |

| (4) | | Mr. Perry became our Chief Executive Officer on July 1, 2002. |

| (5) | | Mr. Habets was employed by us beginning on April 12, 2002. |

Option Grants, Exercises and Holdings and Fiscal Year-End Option Values

The following table sets forth certain information concerning all grants of stock options made during the year ended December 31, 2004 to the Named Executive Officers, including stock options granted for service in 2003:

OPTION/SAR GRANTS IN LAST FISCAL YEAR

| | | | | | | | | | | | | | | | |

Name

| | Number of

Securities

Underlying

Options/ SARs

Granted(1)

| | % of Total

Options/ SARs

Granted to

Employees

in Fiscal

Year

| | | Exercise

or Base

Price ($/Share)

| | Expiration

Date

| | Potential Realizable

Value at Assumed

Annual Rates of

Stock Price

Appreciation for

Option Term (1)

|

| | | | | | 5%

| | 10%

|

Lonnie C. Poole, Jr. | | 17,911 | | 9.1 | % | | $ | 11.792 | | 5/4/09 | | $ | 33,847 | | $ | 98,021 |

Jim W. Perry | | 18,241 | | 9.2 | % | | $ | 11.792 | | 5/4/09 | | $ | 34,471 | | $ | 99,827 |

Harry M. Habets | | 12,610 | | 6.4 | % | | $ | 10.72 | | 5/4/09 | | $ | 37,348 | | $ | 82,528 |

D. Stephen Grissom | | 8,026 | | 4.1 | % | | $ | 10.72 | | 5/4/09 | | $ | 23,771 | | $ | 52,527 |

William J. Hanley | | 6,573 | | 3.3 | % | | $ | 10.72 | | 5/4/09 | | $ | 19,468 | | $ | 43,018 |

Lonnie C. Poole, III | | 6,145 | | 3.1 | % | | $ | 11.792 | | 5/4/09 | | $ | 11,612 | | $ | 33,630 |

| (1) | | Potential realizable value is based on the assumption that our common stock will appreciate at the annual rate shown, compounded annually, from the date of grant until the expiration of the option term. These amounts are calculated for SEC-mandated disclosure purposes and do not reflect our estimate of future stock prices. |

9

The following table sets forth certain information concerning the number and value of unexercised options held by the Named Executive Officers as of December 31, 2004:

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR-END OPTION VALUES

| | | | | | | | | | | | | | | |

Name

| | Shares

Acquired

on

Exercise

| | Value

Realized(1)

| | Number of Securities Underlying Unexercised

Options at December 31, 2004

| | Value of Unexercised In-the-Money Options At December 31, 2004 (2)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Lonnie C. Poole, Jr. | | -0- | | $ | -0- | | 32,328 | | 33,951 | | $ | 174,775 | | $ | 95,575 |

Jim W. Perry | | -0- | | $ | -0- | | 21,236 | | 32,318 | | $ | 75,367 | | $ | 85,385 |

Harry M. Habets | | -0- | | $ | -0- | | 9,375 | | 18,235 | | $ | 56,250 | | $ | 54,935 |

D. Stephen Grissom | | -0- | | $ | -0- | | 13,099 | | 15,858 | | $ | 81,017 | | $ | 60,313 |

William J. Hanley | | -0- | | $ | -0- | | 14,739 | | 11,137 | | $ | 90,423 | | $ | 37,742 |

Lonnie C. Poole, III | | -0- | | $ | -0- | | 17,412 | | 12,287 | | $ | 62,776 | | $ | 36,103 |

| (1) | | Market value of our common stock on the exercise date, as quoted on the Nasdaq National Market System, minus the exercise price. |

| (2) | | Market value of our common stock at December 31, 2004 ($12.40 per share), as quoted on the Nasdaq National Market System, minus the exercise price. Options are considered in-the-money if the market value of the shares covered thereby is greater than the exercise price. |

Compensation of Directors

In 2004, our employee directors received no compensation for service as members of the Board of Directors. In 2004, our non-employee directors received an annual retainer fee in cash or stock equal in value to $15,000, plus $1,000 in cash or stock at the option of the individual director for attending each meeting of the Board of Directors and each Board of Directors’ committee meeting unless attendance was by telephone for which a fee of $500 was paid, in addition to reimbursement of out-of-pocket expenses for attendance.

Our non-employee directors also receive options to purchase shares of our common stock in an amount equal to $7,000 per year. The actual number of options is calculated as of year-end by using the Black-Scholes method of valuation. The exercise price of the options is the fair market value on the date of grant. Directors must serve until the end of the year to receive the grant of options. For service in 2004, we granted to our non-employee directors options on an aggregate of 6,462 shares of our common stock with an exercise price of $10.72 per share.

James R. Talton, Jr. serves as the Chairman of our Audit Committee for which he received an annual fee of $10,000 in 2004, and which was in addition to his regular directors fees. We also reimbursed Mr. Talton for his out-of-pocket expenses in performing his duties for this committee.

Report of the Compensation Committee on Executive Compensation

The following statement made by the Compensation Committee shall not be deemed incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, and shall not otherwise be deemed filed under either of those Acts.

The Compensation Committee is responsible for making recommendations to the Board of Directors concerning executive compensation, including base salaries, bonuses and awards of stock options. The Compensation Committee currently consists of Messrs. Glenn E. Futrell, Paul F. Hardiman and James A. Walker, each of whom is a non-employee director of our company and independent as defined by Nasdaq.

10

In determining the compensation of our executive officers, the Compensation Committee takes into account all factors which it considers relevant, including business conditions in general and in our lines of business during the year, our performance during the year in light of such conditions, the market compensation for executives of similar background and experience, and the performance of the specific executive officer under consideration and the business area for which such executive officer is responsible.

To the extent readily determinable, another factor the Compensation Committee considers when determining compensation is the anticipated tax treatment to us and to the executive officer of various payments and benefits. For example, some types of compensation plans and their deductibility by us depend upon the timing of an executive officer’s vesting or exercise of previously granted rights. Further interpretation of, and changes in, the tax laws and other factors beyond the Compensation Committee’s control also could affect the deductibility of compensation.

In 2002, the Compensation Committee hired an independent compensation consulting firm to advise it on our company’s and our industry’s compensation practices. The Compensation Committee followed the advice of this consultant in establishing the compensation of our executive officers for 2004 and 2005.

Compensation Philosophy. Generally, the structure of each executive compensation package is weighted towards incentive forms of compensation so that the executive’s interests are aligned with the interests of our shareholders. The Compensation Committee believes that granting stock options provides an additional incentive to executive officers to continue in our service and gives them an interest similar to shareholders in our success. The compensation program for executive officers in 2004 consisted of grants of stock options and incentive bonuses, in addition to base salaries and reimbursement of certain costs and expenses. The components of our executive compensation program are discussed below.

Base Salaries. The Committee annually reviews the base salaries of our executive officers. The base salaries for our executive officers for fiscal 2004 were established by the Committee at the beginning of that fiscal year. In addition to considering the factors listed in the foregoing section that support our executive compensation program generally, the Committee reviews the responsibilities of the specific executive position and the experience and knowledge of the individual in that position. The Committee also measures individual performance based upon a number of factors, including a measurement of our company’s historic and recent financial and operational performance and the individual’s contribution to that performance, the individual’s performance on non-financial goals and other contributions of the individual to our company’s success, and gives each of these factors relatively equal weight without confining its analysis to a rigorous formula. As is typical of most corporations, the actual payment of base salary is not conditioned upon the achievement of any predetermined performance target.

Cash Incentive Compensation. Cash bonuses established for our executive officers are intended to motivate the individual to work hard to achieve our financial and operational performance goals or to otherwise incent the individual to aim for a high level of achievement on our behalf in the coming year. In 2004, our Chief Executive Officer could receive a cash bonus of up to 100% of his base salary, while the cash bonus opportunity for other executive officers ranged from 40% to 60% of base salary. For service in 2004, we paid cash bonuses to our executive officers based on the achievement of our objectives established in the beginning of 2004.

Long-Term Incentive Compensation. Our company’s long-term incentive compensation consists of our stock option plan. Each year the Committee considers granting awards under our stock option plan. The Committee’s decision to grant stock options is discretionary and largely determined by individual performance, strategic accomplishments, the degree to which an incentive for long-term performance would benefit our company, as well as the number of shares and options already held by the executive officer. Option grant decisions may also be based upon outstanding individual performance, job promotions and the assumption of greater responsibility within our company. All executives are eligible to participate in our stock plans. We believe that placing a portion of our executives’ total compensation in the form of stock options achieves three objectives. It aligns the interest of our executives with those of our shareholders, gives executives a significant

11

long-term interest in our company’s success and helps us retain key executives. Options generally vest over four years based on continued employment. Options are granted at fair market value on the date of grant.

Benefits. We believe that we must offer a competitive benefits program to attract and retain key executives. During fiscal 2004, we provided the same medical and other benefits to our executive officers that are generally available to our other employees.

Compensation of the Chief Executive Officer. Jim W. Perry has served as our Chief Executive Officer since July 1, 2002. The compensation of Mr. Perry as our Chief Executive Officer was and is based on the same elements and measures of performance as the compensation for our other executive officers. The Committee approved a base salary for Mr. Perry for fiscal 2004 and 2005, based on the same factors as were considered in determining the base salaries of our other executive officers.

In 2004, we paid Mr. Perry a cash base salary of $300,000 for his services as our Chief Executive Officer. The Compensation Committee has approved a base salary of $309,000 for Mr. Perry for fiscal 2005.

In 2004, our Chief Executive Officer’s cash bonus was based on the extent to which our company met the earnings per share growth goals established by the Compensation Committee at the beginning of the year. We achieved 36.0% of the established goals. Mr. Perry was eligible to receive a cash bonus equal to 91.0% of his base salary and for service in 2004 was paid a cash bonus of $110,000. The same performance goals were established for the determination of options to be granted to our Chief Executive Officer.

In addition to the compensation arrangements discussed above, starting in 1999, in lieu of part of Mr. Perry’s annual cash compensation, we began making advances to him to pay the annual premiums on a life insurance policy purchased in 1999. This insurance arrangement was designed to provide him a means to diversify his investment assets without his having to sell shares of our common stock. This program also was designed to provide for the repayment of the loans from the increase in cash value or death benefits under the policy.

The Sarbanes-Oxley Act of 2002, which was enacted on July 30, 2002, prohibits a public company from making loans to its directors and executive officers. Any loan made prior to passage of the Act, such as those made to Mr. Perry, may remain outstanding, but may not be extended or modified in any material fashion. There has been no rulemaking or governmental guidance issued on this provision of the Sarbanes-Oxley Act. As the Act is written, the advance by us of the annual premiums on the policy could be considered new loans. As a result, in August 2002, we decided not to advance Mr. Perry any more premium amounts to pay for the policy.

As a result of the impact of the Sarbanes-Oxley Act and recent tax law changes on the funding requirements of these types of arrangements, on December 30, 2003, we entered into an agreement with Mr. Perry whereby he assigned to us his insurance policy as partial repayment of his loans and we forgave the remainder. The net accumulated account value of the policy at that time was approximately $101,033. This amount was credited against Mr. Perry’s loans due to us, and the remaining balance of approximately $128,967 was forgiven and treated as income to Mr. Perry. To compensate him for the lost value alternative of the compensation arrangement, we granted him a bonus of $100,000 in 2004. A more detailed discussion of Mr. Perry’s loans is found at “Certain Transactions”. We entered into a similar arrangement with our former Chief Executive Officer, Lonnie C. Poole, Jr., which also is discussed under “Certain Transactions.”

The Compensation Committee believes that the forms of compensation, as described above, represent fair compensation structures for the annual services for Mr. Perry and the other executive officers in their respective capacities.

| | |

| Submitted by: | | Compensation Committee Glenn E. Futrell, Chairman Paul F. Hardiman James A. Walker |

12

Compensation Committee Interlocks and Insider Participation

Members of the Compensation Committee of the Board of Directors during 2004 were Paul L. Brunswick, Chairman, who ceased to be a director on May 25, 2004, Paul F. Hardiman and James R. Talton, Jr. After Mr. Brunswick’s retirement, Mr. Glenn E. Futrell was appointed as Chairman and Mr. James A Walker replaced Mr. James R. Talton, Jr., none of whom was at any time during the fiscal year ended December 31, 2004 or at any other time an officer or employee of our company, except for Mr. Brunswick who served as our acting Chief Financial Officer from June 2001 to September 2001. No executive officer of our company serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Board of Directors or the Compensation Committee of our company.

Deferred Compensation Plan

We have a deferred compensation plan available for key employees designated by our Compensation Committee to participate in the plan. A participant may elect to defer up to $20,000 of his annual cash compensation. We will match 65% of the amount deferred, up to a maximum of 6% of the participant’s cash compensation. We also may make discretionary contributions. A participant is immediately vested in his contributions. Vesting for our contributions begins after the first year and occurs at the rate of 20% annually thereafter. Vesting is not accelerated by an employee’s death or the termination of the plan. We invest all contributions on behalf of the participant. Upon termination of employment, a participant is entitled to receive 120 equal monthly payments, based on the amount in his account. In the event the return on the participant’s account for the entire time it has been invested does not equal 6%, we will add the shortfall to the account balance. We have the right to terminate the plan at any time, but any termination will not affect the balance of any account or our obligation to honor the accounts in place at the time of termination. To date, Lonnie C. Poole, III is the only Named Executive Officer who participates in this plan and the amounts contributed by us to his account for his deferrals in 2001, 2002 and 2003 are included in the table under the heading “Executive Compensation—Summary Compensation Table.”

Change in Control Agreements

We have entered into change of control agreements with each of our Chief Executive Officer, Jim W. Perry, our Chief Financial Officer, D. Stephen Grissom, our Chief Operating Officer, Harry M. Habets, our Corporate General Sales Manager, William J. Hanley, and our Vice President, Corporate Development, Lonnie C. Poole, III. Each agreement provides that if the officer is terminated within two years after a change in control other than “for cause” (as defined in the agreement) or if the officer terminates his employment for “good reason” (as defined in the agreement) after a change in control, the officer shall be entitled to receive one year’s salary and benefits plus an amount equal to the average of the annual bonuses paid to the officer for the two fiscal years prior to the change of control. In addition, upon a change in control, all of the officer’s unvested stock options will automatically vest in full.

13

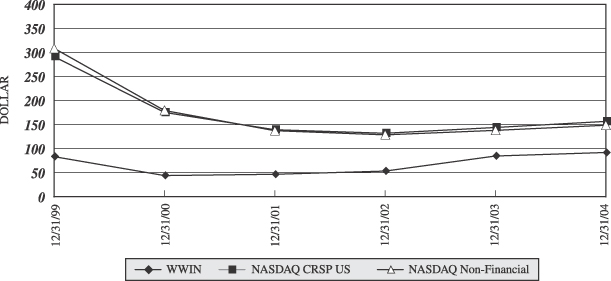

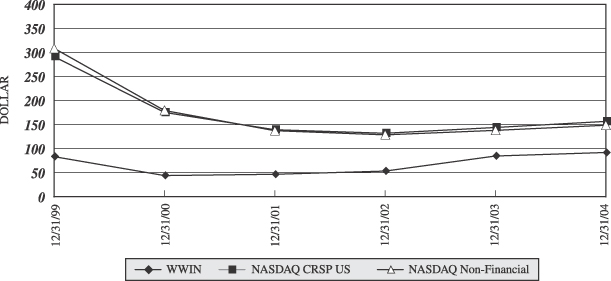

Performance Graph

The following line graph and table illustrate the cumulative total shareholder return on our common stock over the last five fiscal years, beginning on January 1, 2000 and ending on December 31, 2004 and the cumulative total return over the same period of (1) the CRSP Total Market Return Index of the Nasdaq Stock Market and (2) the CRSP Nasdaq Non-Financial Stocks Total Return Index. The CRSP is the Center for Research in Securities Prices at the University of Chicago. The graph assumes an initial investment of $100 and reinvestment of all dividends.

Certain Transactions

From December 1999 through April 2002, we made loans in each of those years to Lonnie C. Poole, Jr. and Jim W. Perry. The aggregate principal amount of Mr. Poole’s loans was $1,418,000, and the aggregate principal amount of Mr. Perry’s loans was $230,000. These loans were made as advances to pay premiums on life insurance policies purchased by Mr. Poole and Mr. Perry. The insurance policies were contractual obligations of Mr. Perry and Mr. Poole under which additional annual premiums had to be paid by them for them to realize the full benefit of the policies. As a result of the impact of the Sarbanes-Oxley Act and tax law changes on the funding requirements of these types of arrangements, in December 2003, we entered into an agreement with each of Mr. Poole and Mr. Perry whereby each officer assigned to us his respective insurance policies as partial repayment of his loans and we forgave the remainder of the loans. The cash surrender values of the insurance policies to us totaled approximately $530,000. The loans to Mr. Perry and Mr. Poole were represented by promissory notes that were the full recourse obligations of Mr. Poole and Mr. Perry, respectively. The notes bore interest at 7% per annum, were payable on our demand and had no set maturity date. Interest was payable annually. As additional security, the premiums we advanced under the notes were secured by a collateral assignment of the policies’ proceeds and the surrender values of the policies. Prior to December 26, 2003, we carried the loans as receivables on our books. The outstanding principal amount of the loans was $230,000 for Mr. Perry and $1,417,998.11 for Mr. Poole as of December 25, 2003.

Although the loans were in compliance with the Sarbanes-Oxley Act, the Compensation Committee and the Board of Directors determined to restructure the arrangements because of the issues raised by Sarbanes-Oxley and recent tax law changes on the funding requirements of these types of arrangements. On December 26, 2003 and December 30, 2003, respectively, we entered into an agreement with each of Mr. Poole and Mr. Perry under which Mr. Poole assigned his two insurance policies and Mr. Perry assigned his one insurance policy to us as a partial repayment of his respective loans and we forgave the remainder of each loan. Pursuant to the agreements,

14

we also refunded all interest paid by Mr. Poole and Mr. Perry from the inception of the loans through December 31, 2002 and forgave all interest accrued on the loans in 2003. In addition, we agreed to gross-up the amount of the refunded interest by the amount of income taxes attributable thereto.

The net accumulated account values of Mr. Poole’s policies on December 26, 2003, the date of his assignment, were approximately $740,651. This amount was credited against Mr. Poole’s loans due to us, and the remaining balance of approximately $677,347 was forgiven and treated as income to Mr. Poole. In January 2005, we sold to Mr. Poole his policies for aggregate consideration with a value of $385,905 on September 30, 2004, which was the cash value of the policies on that date and the date on which the sale was deemed to occur in accordance with our Board’s approval of the transaction.

The net accumulated account value of Mr. Perry’s policy on December 30, 2003, the date of his assignment, was approximately $101,033. This amount was credited against Mr. Perry’s loans due to us, and the remaining balance of approximately $128,967 was forgiven and treated as income to Mr. Perry.

In 1998, we were offered the opportunity to purchase two tracts of land that had potential as a regional solid waste disposal facility. We had been looking for a landfill site and this land was one of several sites we were considering. The owners of the land were unwilling to extend a purchase option for a period long enough to enable us to determine the feasibility of the site as a regional solid waste disposal facility and to obtain the necessary franchise from the county in which the landfill would be located and permits from the state in which the landfill would be located. Our general practice is not to acquire property for which we do not have a plan for development in the short-term and for which we have not obtained, to the extent practicable, a site suitability determination and the necessary franchise and permits. Rather than forego this potential opportunity, management determined that it was in our best interest for an unrelated third party to purchase and hold the land until such time as we were able to develop a plan and obtain a site suitability determination and a franchise and permits for the landfill. After management was unable to identify a third party willing to undertake this endeavor in the very little time available, a limited liability company, or LLC, owned by a trust controlled by Lonnie C. Poole, III, our Vice President, and Scott J. Poole, sons of Lonnie C. Poole, Jr., the Chairman of the Board of Directors, purchased the land in December 1998. As is customary for us when evaluating disposal sites, we have incurred normal engineering, legal, marketing, consulting and other due diligence expenses to determine site feasibility, but we have no obligation to purchase the site. The costs of acquiring and carrying the site have been borne entirely by the LLC. If, after the completion and analysis of the site suitability determination, we determine the landfill is feasible and we are able to obtain a franchise for the facility and reasonably believe that the necessary permits could be obtained, we will have the option to purchase the site from the LLC upon negotiated terms, which terms would be reviewed and approved by a majority of our disinterested directors and, if deemed necessary, by a majority of disinterested shareholders voting on the transaction, as a condition to any purchase.

In 1998, we purchased TransWaste Services, Inc. from Thomas C. Cannon, a former director of the Company. Mr. Cannon remained President of TransWaste, one of our wholly-owned subsidiaries, until his resignation effective October 1, 2002. Mr. Cannon was elected to our Board of Directors in 2000 and served on the Board through May 24, 2004. At the time of our acquisition of TransWaste from Mr. Cannon, he owned, and still owns, a 50% interest in a company that is developing a construction and demolition solid waste, or C&D, landfill. Simultaneously with our purchase of TransWaste, and in order for us to position TransWaste to realize the potential benefit of that future landfill, TransWaste entered into an agreement with the company that is 50% owned by Mr. Cannon whereby, upon the satisfaction of certain conditions, that company has the option to sell the landfill to TransWaste for $8,000,000 or to accept C&D waste from TransWaste or any affiliate at a per ton rate that is favorable to TransWaste for ten years. None of these conditions has been satisfied, so TransWaste has neither acquired, nor is it disposing of waste at, the proposed landfill. On August 20, 2004, TransWaste filed a complaint for declaratory relief asking the court to determine that the agreement between the two companies is unenforceable for, among other reasons, failure to satisfy such conditions within a reasonable amount of time.

Lonnie C. Poole, III is a member of a limited liability company that owns the building in Raleigh, North Carolina in which we lease our headquarters office space. The lease was entered into in June of 1999 with a term

15

of 10 years. Rental expense related to this lease was $509,000 in 2004. The lease is on terms comparable to those with third parties.

Nasdaq rules and our own Code of Business Conduct require that the Audit Committee or another independent committee of our Board approve any transaction between our company and a director or executive officer that exceeds $60,000.

Report of the Audit Committee

The Audit Committee is composed of three directors. The Board of Directors has determined that the members of the Audit Committee are independent as defined in Rule 4200(a)(15) of Nasdaq’s listing standards. The Board of Directors also has determined that each of James A. Walker and James R. Talton is an “audit committee financial expert” as defined in Item 401(h) of Regulation S-K.

The Audit Committee operates under a written charter, which was amended in February 2003 to conform the charter to the requirements of the Sarbanes-Oxley Act. A copy of our Audit Committee charter was provided to our shareholders in the proxy statement for our 2003 annual meeting of shareholders.

The Audit Committee reviews our company’s financial reporting process on behalf of our Board of Directors. Management of our company has the primary responsibility for our financial statements and the reporting process, including the system of internal controls and procedures for financial reporting. Management has represented to the Audit Committee that our company’s audited consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America and fairly present, in all material respects, the financial condition, results of operations and cash flows of our company as of and for the periods presented in the financial statements.

The Audit Committee meets with our management and Deloitte & Touche, our independent registered public accounting firm, to review our financial reporting and performance. During those meetings in 2004, the Audit Committee reviewed and discussed, among other things:

| | • | | the appointment of Deloitte & Touche as our independent registered public accounting firm; |

| | • | | the impact of the Sarbanes-Oxley Act of 2002, including new reporting obligations and auditing matters; |

| | • | | management’s evaluations of our internal controls and disclosure controls and procedures; |

| | • | | the annual audit by Deloitte & Touche, including risk assessments; and |

| | • | | our significant accounting policies. |

The Audit Committee also met in private sessions with Deloitte & Touche in 2004. During the private sessions, the Audit Committee confirmed that Deloitte & Touche was satisfied with the positions taken by management in the presentation of our financial results. Late in the preparation of our Annual Report on Form 10-K, Deloitte & Touche noted matters involving our internal controls that it considered to be reportable conditions, and together a material weakness, under the interim standards of the Public Company Accounting Oversight Board. The reportable conditions are discussed in Item 9A of our Annual Report of Form 10-K. The Audit Committee has reviewed and discussed our audited financial statements for the fiscal year ended December 31, 2004 with management and Deloitte & Touche, as well as our disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our Annual Report on Form 10-K for 2004. This discussion included among other things:

| | • | | critical accounting policies and practices used in the preparation of our financial statements; |

| | • | | any significant audit adjustments proposed by Deloitte & Touche; |

| | • | | confirmation that there were no matters of significant disagreement between our management and Deloitte & Touche during the audit; and |

| | • | | other matters required to be discussed by Statements of Auditing Standards. |

16

The Audit Committee also has discussed with Deloitte & Touche the matters required to be discussed by Statement on Auditing Standards No. 61, as modified or supplemented. The Audit Committee has received the written disclosures and the letter from Deloitte & Touche required by Independence Standards Board Standard No. 1, as modified or supplemented, and has discussed with Deloitte & Touche its independence.

Based on the reviews and discussions described herein, among other things, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K for fiscal 2004.

| | |

| Submitted by: | | The Audit Committee James R. Talton, Chairman Paul F. Hardiman James A. Walker |

This Audit Committee Report shall not be deemed to be filed with the SEC or incorporated by reference into any of our previous or future filings with the SEC, except as otherwise explicitly specified by us in any such filing.

Section 16(a) Beneficial Ownership Reporting Compliance

Pursuant to Section 16(a) of the Securities Exchange Act, our directors and executive officers are required to file reports with the SEC indicating their holdings of and transactions in our equity securities. To our knowledge, based solely on our review of the copies of such reports furnished to us and written representations that no other reports were required, there were no reports required under Section 16(a) of the Exchange Act which were not timely filed during the fiscal year ended December 31, 2004, except as follows: Glenn E. Futrell and James A. Walker each inadvertently failed to report the grant of 180 shares of common stock for director fees on November 12, 2004, for which the required report was filed on Form 4 on April 26, 2005.

CORPORATE GOVERNANCE

We have adopted a Code of Business Conduct that is designed to promote the highest standards of ethical conduct by our directors and employees. The Code of Business Conduct requires that our directors and employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner, and otherwise act with integrity and in our company’s best interest. In addition, we have adopted a Code of Ethics for our chief executive officer, chief financial officer, chief accounting officer or controller, or persons performing similar functions for our company.

As a mechanism to encourage compliance with the Code of Business Conduct and the Code of Ethics, we have established procedures to receive, retain, and address complaints received regarding accounting or auditing matters. These procedures ensure that individuals may submit concerns regarding questionable accounting or auditing matters in a confidential and anonymous manner.

Although we do not have a formal written policy regarding Board member attendance at our annual meetings of shareholders, we encourage our directors to attend those meetings. All of the then current directors attended the 2004 annual meeting.

17

DIRECTOR NOMINATIONS

The Nominating Committee considers and makes recommendations to the Board all director nominations. For the 2005 meeting, the Board determined the slate of director nominees proposed for election by the shareholders. In the past, the Board of Directors considered and made all director nominations. The Nominating Committee also will recommend to the Board any director nominees to be elected by the Board to fill interim director vacancies.

In selecting the slate of directors being proposed to shareholders at the 2005 meeting, the Nominating Committee considered the following criteria in selecting nominees: personal qualities and characteristics, accomplishments, and reputation in the business community; financial, regulatory, and business experience; ability and willingness to commit adequate time to Board and committee matters; fit of the individual’s skills with those of other directors and potential directors in building a Board that is effective and responsive to our needs; independence; and any other factors the Nominating Committee deems relevant, including background, experience, and other demographics.

To identify nominees, the Nominating Committee relies on personal contacts. We have not previously used an independent search firm to identify nominees.

The Nominating Committee will consider director nominees recommended by shareholders. A shareholder may submit a nomination for director by delivering to the Nominating Committee Chairman, James A. Walker, a written notice stating the name and age of each nominee, the nominee’s principal occupation, and the number of shares of our common stock he or she beneficially owns. The written consent of the nominee to serve as a director must also be provided by the shareholder making the nomination. To be considered by the Nominating Committee for inclusion in the slate of directors nominated in a proxy statement, a shareholder should submit his or her proposal by February 28 of any year.

Each member of the Nominating Committee is independent in accordance with Nasdaq Rule 4200(a)(15).

SHAREHOLDER COMMUNICATIONS

Shareholders and other interested parties may communicate with the Board by writing to Jim W. Perry, our President and Chief Executive Officer, at 3301 Benson Drive, Suite 601, Raleigh, North Carolina 27609. Mr. Perry will relay such communications to the Board of Directors.

DEADLINE FOR SHAREHOLDER PROPOSALS

In accordance with federal securities laws, shareholders having proposals that they desire to present at next year’s annual meeting of our shareholders should, if they desire that such proposals be included in our proxy statement relating to such meeting, submit such proposals in time to be received by us not later than January 3, 2006. To be so included, all such submissions must comply with the requirements of Rule 14a-8 promulgated under the Securities Exchange Act and the Board of Directors directs the close attention of interested shareholders to that rule. In addition, management’s proxy holders will have discretion to vote proxies given to them on any shareholder proposal of which we do not have notice prior to March 16, 2006. Proposals should be mailed to the Corporate Secretary, Waste Industries USA, Inc., 3301 Benson Drive, Suite 601, Raleigh, North Carolina 27609.

OTHER MATTERS

The Board of Directors knows of no other business to be brought before the meeting, but intends that, as to any such other business, the shares will be voted pursuant to the proxy in accordance with the best judgment of the person or persons acting thereunder.

18

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

WASTE INDUSTRIES USA, INC.

3301 Benson Drive, Suite 601

Raleigh, North Carolina 27609

PROXY FOR ANNUAL MEETING OF SHAREHOLDERS

May 25, 2005

The undersigned hereby appoints Lonnie C. Poole, Jr. and D. Stephen Grissom, and each of them, as proxies, each with full power of substitution, and hereby authorizes them to represent and to vote, as designated below, all the shares of common stock of Waste Industries USA, Inc., a North Carolina corporation, held of record by the undersigned on April 20, 2005, at the Annual Meeting of Shareholders to be held at the North Raleigh Hilton, 3415 Wake Forest Road, Raleigh, North Carolina, on May 25, 2005, or at any adjournment(s) thereof. The following proposals to be brought before the meeting are more specifically described in the accompanying proxy statement.

(1) Election of Directors:

[ ] FOR ALL NOMINEES LISTED BELOW [] WITHHOLD AUTHORITY TO VOTE FOR (except as marked to the contrary below) ALL NOMINEES LISTED BELOW

INSTRUCTION: TO WITHHOLD AUTHORITY TO VOTE FOR ANY INDIVIDUAL NOMINEE STRIKE A LINE THROUGH THE NOMINEE’S NAME BELOW:

Glenn E. Futrell Paul F. Hardiman James R. Talton, Jr. James A. Walker

(outside directors)

Lonnie C. Poole, Jr. Jim W. Perry

(Chairman of the Board) (CEO & President)

(2) To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the company for the fiscal year ending December 31, 2005:

[ ] VOTE FOR [ ] VOTE AGAINST [ ] ABSTAIN

(3) In their discretion, to vote upon such other matters as may properly come before the meeting:

[ ] GRANT AUTHORITY [ ] WITHHOLD AUTHORITY

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE THIS PROXY WILL BE VOTED FOR MANAGEMENT’S SLATE OF NOMINEES FOR DIRECTOR LISTED ABOVE, FOR PROPOSAL 2, AND IN THE DISCRETION OF THE PROXIES NAMED HEREIN ON ANY OTHER MATTER AS MAY PROPERLY COME BEFORE THE MEETING.

Signature

Signature, if held Jointly

Please date and sign exactly as your name appears on your stock certificate. Joint owners should each sign. Trustees, custodians, executors and others signing in a representative capacity should indicate that capacity.

Date: , 2005

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE WHETHER OR NOT YOU PLAN TO BE PRESENT AT THE MEETING. IF YOU ATTEND THE MEETING, YOU CAN VOTE EITHER IN PERSON OR BY YOUR PROXY.