UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10183

BRIGHTHOUSE FUNDS TRUST I

(Exact name of registrant as specified in charter)

One Financial Center

Boston, MA 02111

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Michael P. Lawlor c/o Brighthouse Investment Advisers, LLC One Financial Center Boston, MA 02111 | | Brian McCabe, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199 |

Registrant’s telephone number, including area code: 617-578-4036

Date of fiscal year end: December 31

Date of reporting period: January 1, 2017 through June 30, 2017

This N-CSR filing is only with respect to the Invesco Balanced-Risk Allocation Portfolio’s semi-annual report.

| Item 1: | Report to Shareholders. |

The following is an amended copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”):

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Managed by Invesco Advisers, Inc.

Portfolio Manager Commentary*

PERFORMANCE

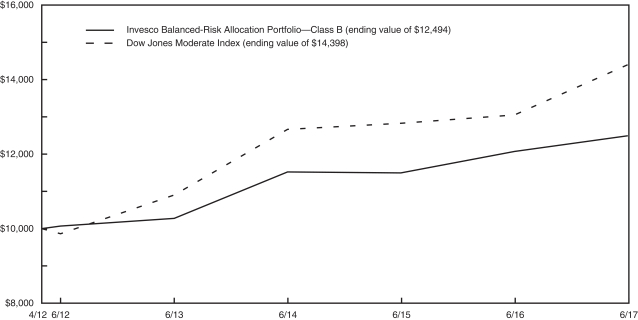

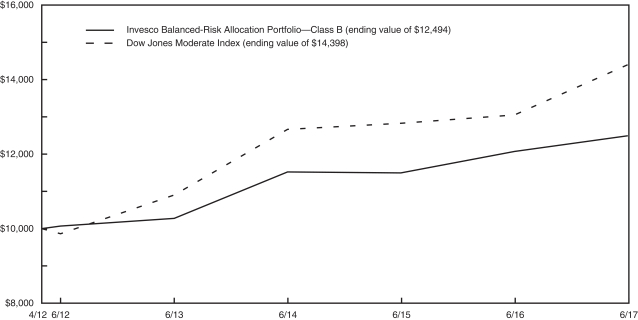

For the six months ended June 30, 2017, the Class B shares of the Invesco Balanced-Risk Allocation Portfolio returned 2.07%. The Portfolio’s benchmark, the Dow Jones Moderate Index1, returned 7.27%.

MARKET ENVIRONMENT / CONDITIONS

One of the effects of the continuing aggressive monetary policy, coupled with the absence of effective fiscal policy measures, is wealth inequality and the subsequent rise in populism and nationalism that we experienced in 2016. The first half of 2017 witnessed some abatement of anti-establishment politics with Emmanuel Macron winning in France and Geert Wilders losing the Dutch election; however, the one year anniversary of Brexit, Britain’s referendum vote to leave the European Union (“E.U.”), still finds politics in turmoil after an early call for elections by British Prime Minister Theresa May left her pro-Brexit Tory government without a majority. Another effect is the bloated balance sheets of the major central banks, which now find themselves an ever-larger owner of outstanding bond issues and facing the risk that they will not have sufficient dosage to aid their economies when the next recession inevitably arrives. Withdrawing the aid may prove to be more difficult than its administration; nevertheless, global stock markets continued to surge but slow growth, low inflation and political uncertainty provided a lift to bonds. Commodities declined as oversupplied agriculture and energy complexes overwhelmed gains in industrial metals and precious metals.

PORTFOLIO REVIEW / PERIOD END POSITIONING

The Invesco Balanced-Risk Allocation Portfolio strategically balances the amount of risk exposure to equities, fixed income and commodities and targets a strategic risk level of 8%. This is intended to limit the impact of surprise outcomes on the Portfolio. Secondarily, the Portfolio tactically shifts from the strategic equal risk in order to emphasize those assets that are more likely to outperform cash on a monthly basis. Tactical allocation is applied at the individual asset level and aggregated with the strategic allocation allowing the Portfolio risk target to fluctuate between 6% and 10%.

Positive absolute performance from the strategic and tactical equity exposures as well as strategic bond exposures drove results for the reporting period. Strategic and tactical commodity exposures and tactical bond exposures detracted from absolute performance. The Portfolio’s relative underperformance occurred from the commodity and fixed income exposures.

Stocks had a great first half as all six of our market exposures rallied, with Hong Kong, Europe, U.S. large caps and Japan being the leading markets followed by the U.K. and U.S. small caps. Hong Kong stocks led results as signs of economic stability in China, along with appealing valuations, translated into flows from the mainland. European stocks benefitted from a pickup in manufacturing, low borrowing costs and the euro’s competitive exchange rate. U.S. large cap stocks had gains, but narrow breadth is a growing concern as leadership is becoming more concentrated in a handful of Technology stocks. Furthermore, President Trump’s inability to get the Republican majority to fast track his economic agenda has begun to temper enthusiasm. The smaller company Russell 2000 Index surged after Trump’s election, and was our leading market for 2016, but it ended the first half of 2017 as the weakest performer given uncertainty over fiscal policy reforms. A populist revolt against E.U. regulation led to the U.K.’s decision to Brexit a year ago but the country’s economy has not imploded as many opponents had forecasted. The weaker British pound has aided the country’s stock market as a competitive currency provides exporters an advantage in sales and earnings.

Overall, tactical shifts within the equity sleeve were additive to results as the Portfolio maintained an overweight to the asset class during the entire first half of the calendar year.

Despite low first quarter Gross Domestic Product (GDP) and inflation, the U.S. Federal Reserve (the “Fed”) raised rates in March and June. While the data may not have strongly supported a need to notch interest rates higher, the Fed may be attempting to slowly withdraw their heavy dosage of monetary stimulus. Additionally, the Fed has indicated that they could start reducing their balance sheet as early as later this year while the European Central Bank has been hinting at a taper of their stimulus program despite an inflation rate that refuses to cooperate. Political discord in the U.S. aided bonds early in the year as the focus turned to Russian intrigue, while the initial failure of the U.S. House of Representative to pass health care reform subdued enthusiasm for proposed tax cuts. Later in the period, weakness in commodities, especially energy, further reduced inflationary expectations and bond yields. All six bond markets with the exception of Germany had gains for the first half, led by the U.S. and the commodity-oriented economy of Australia. U.K. and U.S. bond markets gained with further help from geopolitical conflicts arising in North Korea and the Middle East. The Japanese bond markets had modest price advances, with only an incremental benefit to results, as their low absolute yields have led to a reduced allocation.

Tactical exposure detracted from overall results as the Portfolio maintained a targeted risk contribution below the strategic threshold when bond yields receded (and prices advanced), particularly during the second quarter.

Commodities gave back much of their 2016 gains, with 2017 shaping up to be a battle between the profits in metals complexes and losses in the oversupplied energy and agriculture complexes. The energy markets have once again grabbed the headlines as Organization of the Petroleum Exporting Countries (“OPEC”) extended their 2016 production cut into 2018, but high existing inventory levels and increasing production from Iraq, Nigeria, Libya and the U.S. continue to force prices lower. All energy exposures declined, but unleaded gasoline was hit hardest, with stock levels in the U.S.

BHFTI-1

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Managed by Invesco Advisers, Inc.

Portfolio Manager Commentary*—(Continued)

(recorded in April) well above their five-year average. Exceptionally good weather in North and South America has hurt grain prices, especially the soy complex, as Brazil is on track to harvest a record soybean crop. Sugar was the worst performer within agriculture as 2016 deficits have been quickly restored while demand has faded. Cotton was a bright spot as rising global demand for higher quality U.S. crops put a lift under prices. Industrial metals rose on a resurgence in Chinese economic data and early period enthusiasm for President Trump’s infrastructure agenda. The complex got the biggest boost from aluminum, which further benefitted from Chinese plans to cut production in an effort to reduce pollution. Precious metals had the largest gains. Strength in the complex resulted from numerous factors, including the fading strength of the U.S. dollar, inflation showing marginal increases and long yields remaining stubbornly low. Fears of geopolitical strife including European elections and potential military conflict in North Korea also provided support.

Tactical shifts among the various commodities hurt performance mainly due to losses in energy, sugar and soy exposures as our models had favorable readings while underlying prices reversed.

Tactical positioning at the end of the period maintained overweights to all six equity markets but with reductions in the U.K., U.S. large caps and Europe. Positioning in bonds moved to underweight across all six markets. In commodities, the posture in agriculture shifted from defensive to constructive. In energy, every exposure was underweight except for heating oil which was neutral. In metals, the overweights to gold and silver weakened while overweights to copper has strengthened and the overweight to aluminum has been maintained.

Please note that the Portfolio is principally implemented with derivative instruments that include futures, commodity-linked notes and total return swaps. Therefore, all or most of the performance of the strategy, both positive and negative, can be attributed to these instruments. Derivatives can be a more liquid and cost-effective way to gain exposure to asset classes. Additionally, the leverage used in the strategy is inherent in these instruments. All derivatives performed as expected during the period.

Scott Wolle

Mark Ahnrud

Chris Devine

Scott Hixon

Christian Ulrich

Portfolio Managers

Invesco Advisers, Inc.

* This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are subject to change at any time based upon economic, market, or other conditions and the subadvisory firm undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Portfolio’s trading intent. Information about the Portfolio’s holdings, asset allocation or country diversification is historical and is not an indication of future Portfolio composition, which may vary. Direct investment in any index is not possible. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Portfolio may pay. If these additional fees were reflected, performance would have been lower.

BHFTI-2

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

A $10,000 INVESTMENT COMPARED TO THE DOW JONES MODERATE INDEX

SIX MONTH RETURN & AVERAGE ANNUAL RETURNS (%) AS OF JUNE 30, 2017

| | | | | | | | | | | | | | | | |

| | | 6 Month | | | 1 Year | | | 5 Year | | | Since Inception2 | |

| Invesco Balanced-Risk Allocation Portfolio | | | | | | | | | | | | | | | | |

Class B | | | 2.07 | | | | 3.49 | | | | 4.41 | | | | 4.38 | |

| Dow Jones Moderate Index | | | 7.27 | | | | 10.35 | | | | 7.87 | | | | 7.28 | |

1 The Dow Jones Moderate Index is a total return index designed to provide asset allocation strategists with a target risk benchmark. Each month, the index adjusts its weighting of stocks, bonds, and cash indices (both domestic and foreign) such that the risk of that combination will have 60% of the risk of an all equity portfolio.

2 Inception date of the Class B shares is 4/23/2012. Index since inception return is based on the Portfolio’s inception date.

Portfolio performance is calculated including reinvestment of all income and capital gain distributions. Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, separate account or administrative charges of variable annuity or life insurance contracts or any additional expenses that participants may bear relating to the operations of their plans. If these charges were included, the returns would be lower. The performance of any index referenced above has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. Direct investment in any index is not possible.

This information represents past performance and is not indicative of future results. Investment return and principal value may fluctuate so that shares, upon redemption, may be worth more or less than the original cost.

PORTFOLIO COMPOSITION AS OF JUNE 30, 2017

Exposures by Asset Class*

| | | | |

| | | % of

Net Assets | |

| Global Developed Bonds | | | 53.9 | |

| Global Developed Equities | | | 40.7 | |

| Commodities - Production Weighted | | | 28.7 | |

| | |

| * The percentages noted above are based on the notional amounts by asset class as a percentage of net assets |

BHFTI-3

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Understanding Your Portfolio’s Expenses (Unaudited)

Shareholder Expense Example

As a shareholder of the Portfolio, you incur ongoing costs, including management fees; distribution and service (12b-1) fees; and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) (referred to as “expenses”) of investing in the Portfolio and compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2017 through June 30, 2017.

Actual Expenses

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested in the Portfolio, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees or charges of your variable insurance product or any additional expenses that participants in certain eligible qualified plans may bear relating to the operations of their plan. Therefore, the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these other costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

Invesco Balanced-Risk Allocation Portfolio | | | | Annualized

Expense

Ratio | | | Beginning

Account Value

January 1,

2017 | | | Ending

Account Value

June 30,

2017 | | | Expenses Paid

During Period**

January 1, 2017

to

June 30,

2017 | |

Class B(a) | | Actual | | | 0.87 | % | | $ | 1,000.00 | | | $ | 1,020.70 | | | $ | 4.36 | |

| | Hypothetical* | | | 0.87 | % | | $ | 1,000.00 | | | $ | 1,020.48 | | | $ | 4.36 | |

* Hypothetical assumes a rate of return of 5% per year before expenses.

** Expenses paid are equal to the Portfolio’s annualized expense ratio for the most recent six month period, as shown above, multiplied by the average account value over the period, multiplied by the number of days (181 days) in the most recent fiscal half-year, divided by 365 (to reflect the one-half year period).

(a) The annualized expense ratio shown reflects the impact of the management fee waiver as described in Note 7 of the Notes to Consolidated Financial Statements.

BHFTI-4

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Consolidated§ Schedule of Investments as of June 30, 2017 (Unaudited)

U.S. Treasury & Government Agencies—2.5% of Net Assets

| | | | | | | | |

| Security Description | | Principal

Amount* | | | Value | |

|

| U.S. Treasury—2.5% | |

U.S. Treasury Floating Rate Notes

1.177%, 07/31/18 (a) | | | 8,310,000 | | | $ | 8,324,950 | |

1.193%, 04/30/18 (a) | | | 22,092,000 | | | | 22,129,556 | |

1.275%, 01/31/18 (a) | | | 11,050,000 | | | | 11,068,940 | |

| | | | | | | | |

Total U.S. Treasury & Government Agencies

(Cost $41,451,998) | | | | | | | 41,523,446 | |

| | | | | | | | |

|

| Commodity-Linked Securities—1.8% | |

Canadian Imperial Bank of Commerce Commodity Linked EMTN, U.S. Federal Funds (Effective) Rate minus 0.020% (linked to Canadian Imperial Bank of Commerce Custom 5 Agriculture Commodity Index, multiplied by 2), 08/22/17 (144A) (a) | | | 9,270,000 | | | | 6,679,396 | |

Cargill, Inc. Commodity Linked Note, one month LIBOR Rate minus 0.010% (linked to Monthly Rebalance Commodity Excess Return Index, multiplied by 2), 08/14/17 (144A) (a) | | | 17,930,000 | | | | 13,610,662 | |

Royal Bank of Canada Commodity Linked Note, U.S. Federal Funds (Effective) Rate minus 0.040% (linked to Royal Bank of Canada Enhanced Agriculture Basket 04 Excess Return Index, multiplied by 2), 08/15/17 (144A) (a) | | | 12,150,000 | | | | 9,390,722 | |

| | | | | | | | |

Total Commodity-Linked Securities

(Cost $39,350,000) | | | | | | | 29,680,780 | |

| | | | | | | | |

|

| Short-Term Investments—93.7% | |

|

| Certificate of Deposit—9.4% | |

Banco del Estado de Chile

1.120%, 07/12/17 (b) | | | 27,000,000 | | | | 26,999,201 | |

Bank of Nova Scotia

1.589%, 07/14/17 (b) | | | 32,000,000 | | | | 32,005,440 | |

KBC Bank NV

1.140%, 07/26/17 (b) | | | 35,000,000 | | | | 35,003,408 | |

Natixis (NY)

1.280%, 09/01/17 (b) | | | 30,000,000 | | | | 30,004,129 | |

Sumitomo Mitsui Trust Bank, Ltd. (NY)

1.170%, 07/03/17 (b) | | | 31,000,000 | | | | 30,999,989 | |

| | | | | | | | |

| | | | | | | 155,012,167 | |

| | | | | | | | |

|

| Commercial Paper—56.3% | |

American Honda Finance Corp.

0.976%, 07/21/17 (b) | | | 40,000,000 | | | | 39,974,007 | |

Apple, Inc.

0.759%, 07/05/17 (b) | | | 25,000,000 | | | | 24,996,292 | |

0.891%, 07/18/17 (b) | | | 20,000,000 | | | | 19,989,180 | |

0.966%, 07/21/17 (b) | | | 10,000,000 | | | | 9,993,677 | |

Bennington Sark Capital Co. LLC

1.194%, 07/17/17 (b) | | | 15,000,000 | | | | 14,991,465 | |

BMW U.S. Capital LLC

1.067%, 07/19/17 (b) | | | 20,000,000 | | | | 19,988,252 | |

|

| Commercial Paper—(Continued) | |

Charta LLC

1.286%, 09/22/17 (b) | | | 37,000,000 | | | | 36,887,421 | |

Coca-Cola Co. (The)

0.791%, 07/07/17 (b) | | | 25,000,000 | | | | 24,994,799 | |

1.127%, 08/24/17 (b) | | | 20,000,000 | | | | 19,966,175 | |

Collateralized Commercial Paper Co. LLC

0.974%, 07/05/17 (b) | | | 30,000,000 | | | | 29,995,050 | |

DBS Bank, Ltd.

1.306%, 09/20/17 (b) | | | 35,000,000 | | | | 34,902,580 | |

Exxon Mobil Corp.

1.116%, 08/22/17 (b) | | | 40,000,000 | | | | 39,934,044 | |

Fairway Finance Co. LLC

1.073%, 07/21/17 (b) | | | 30,000,000 | | | | 29,978,720 | |

Johnson & Johnson

1.012%, 07/17/17 (b) | | | 40,000,000 | | | | 39,979,581 | |

L’Oreal U.S.A., Inc.

0.996%, 07/11/17 (b) | | | 30,000,000 | | | | 29,990,146 | |

1.041%, 07/17/17 (b) | | | 14,350,000 | | | | 14,342,675 | |

Manhattan Asset Funding Co. LLC

1.247%, 08/25/17 (b) | | | 35,000,000 | | | | 34,931,563 | |

Nestle Capital Corp.

1.179%, 10/11/17 (b) | | | 19,848,000 | | | | 19,780,026 | |

Novartis Finance Corp.

0.615%, 07/03/17 (b) | | | 21,000,000 | | | | 20,998,136 | |

NRW Bank

0.908%, 07/06/17 (b) | | | 27,000,000 | | | | 26,994,829 | |

1.018%, 07/12/17 (b) | | | 5,000,000 | | | | 4,998,072 | |

Old Line Funding LLC

1.365%, 11/06/17 (b) | | | 40,000,000 | | | | 39,805,210 | |

PACCAR Financial Corp.

1.100%, 07/31/17 (b) | | | 31,500,000 | | | | 31,467,965 | |

PepsiCo, Inc.

1.024%, 07/21/17 (b) | | | 25,000,000 | | | | 24,983,754 | |

1.064%, 08/18/17 (b) | | | 20,000,000 | | | | 19,969,157 | |

Regency Market No. 1 LLC

1.198%, 07/25/17 (b) | | | 10,000,000 | | | | 9,991,479 | |

Ridgefield Funding Co. LLC

1.253%, 09/11/17 (b) | | | 35,055,000 | | | | 34,964,510 | |

Siemens Capital Co. LLC

1.186%, 09/26/17 (b) | | | 30,000,000 | | | | 29,916,547 | |

Societe Generale

1.300%, 08/31/17 (b) | | | 35,000,000 | | | | 34,927,486 | |

Toronto-Dominion Bank (The)

1.307%, 09/25/17 (b) | | | 25,000,000 | | | | 24,925,204 | |

Total Capital Canada, Ltd.

0.974%, 07/13/17 (b) | | | 20,000,000 | | | | 19,991,637 | |

Unilever Capital Corp.

0.831%, 07/10/17 (b) | | | 25,000,000 | | | | 24,992,333 | |

Victory Receivables Corp.

1.286%, 09/20/17 (b) | | | 40,000,000 | | | | 39,864,973 | |

Wal-Mart Stores, Inc.

0.995%, 07/10/17 (b) | | | 30,000,000 | | | | 29,991,050 | |

1.070%, 07/24/17 (b) | | | 20,000,000 | | | | 19,985,520 | |

| | | | | | | | |

| | | | | | | 924,383,515 | |

| | | | | | | | |

§See Note 2 of the notes to consolidated financial statements.

See accompanying notes to consolidated financial statements.

BHFTI-5

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Consolidated§ Schedule of Investments as of June 30, 2017 (Unaudited)

Short-Term Investments—(Continued)

| | | | | | | | |

| Security Description | | Shares/ Principal

Amount* | | | Value | |

|

| Municipals—2.1% | |

Columbus Regional Airport Authority, Revenue Bonds

0.960%, 04/01/35 (a) | | | 21,000,000 | | | $ | 21,000,000 | |

County of Emery, Utah, Revenue Bonds

0.900%, 11/01/24 (a) | | | 13,300,000 | | | | 13,300,000 | |

| | | | | | | | |

| | | | | | | 34,300,000 | |

| | | | | | | | |

|

| Mutual Funds—19.3% | |

STIC (Global Series) plc - U.S. Dollar Liquidity Portfolio, Institutional Class 1.000% (c) (d) | | | 258,374,328 | | | | 258,374,328 | |

STIT-Government & Agency Portfolio, Institutional Class 0.030% (c) (d) | | | 34,805,554 | | | | 34,805,554 | |

STIT-Treasury Portfolio Institutional Class 0.935% (c) (d) | | | 23,203,703 | | | | 23,203,703 | |

| | | | | | | | |

| | | | | | | 316,383,585 | |

| | | | | | | | |

|

| U.S. Treasury—6.6% | |

U.S. Treasury Bills

0.562%, 08/17/17 (b) (e) | | | 5,370,000 | | | | 5,363,932 | |

0.570%, 07/06/17 (b) (e) | | | 32,230,000 | | | | 32,227,969 | |

0.584%, 07/27/17 (b) (e) | | | 20,740,000 | | | | 20,728,655 | |

0.906%, 10/05/17 (b) (e) | | | 13,500,000 | | | | 13,464,225 | |

1.085%, 12/07/17 (b) (e) | | | 26,780,000 | | | | 26,655,045 | |

1.110%, 12/14/17 (b) | | | 10,730,000 | | | | 10,677,820 | |

| | | | | | | | |

| | | | | | | 109,117,646 | |

| | | | | | | | |

Total Short-Term Investments

(Cost $1,539,236,589) | | | | | | | 1,539,196,913 | |

| | | | | | | | |

Total Investments—98.0%

(Cost $1,620,038,587) (f) | | | | | | | 1,610,401,139 | |

Other assets and liabilities (net)—2.0% | | | | | | | 32,110,465 | |

| | | | | | | | |

| Net Assets—100.0% | | | | | | $ | 1,642,511,604 | |

| | | | | | | | |

| | | | |

| * | | Principal amount stated in U.S. dollars unless otherwise noted. |

| (a) | | Variable or floating rate security. The stated rate represents the rate at June 30, 2017. Maturity date shown for callable securities reflects the earliest possible call date. |

| (b) | | The rate shown represents current yield to maturity. |

| (c) | | The rate shown represents the annualized seven-day yield as of June 30, 2017. |

| (d) | | Affiliated Issuer. (See Note 8 of the Notes to Consolidated Financial Statements for a summary of transactions in securities of affiliated issuers.) |

| (e) | | All or a portion of the security was pledged as collateral against open futures contracts. As of June 30, 2017, the market value of securities pledged was $61,589,547. |

| (f) | | As of June 30, 2017, the aggregate cost of investments was $1,620,038,587. The aggregate unrealized appreciation and depreciation of investments were $104,134 and $(9,741,582), respectively, resulting in net unrealized depreciation of $(9,637,448). |

| (144A)— | | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of June 30, 2017, the market value of 144A securities was $29,680,780, which is 1.8% of net assets. |

| (EMTN)— | | Euro-Medium Term Note |

| (LIBOR)— | | London InterBank Offered Rate |

Futures Contracts

| | | | | | | | | | | | | | | | | | | | |

Futures Contracts—Long | | Expiration

Date | | | Number of

Contracts | | | Notional

Amount | | | Unrealized

Appreciation/

(Depreciation) | |

Australian 10 Year Treasury Bond Futures | | | 09/15/17 | | | | 2,485 | | | | AUD | | | | 325,812,625 | | | $ | (3,537,209 | ) |

Brent Crude Oil Futures | | | 11/30/17 | | | | 414 | | | | USD | | | | 21,454,060 | | | | (816,160 | ) |

Canada Government Bond 10 Year Futures | | | 09/20/17 | | | | 3,342 | | | | CAD | | | | 482,549,927 | | | | (9,894,993 | ) |

Euro Stoxx 50 Index Futures | | | 09/15/17 | | | | 3,385 | | | | EUR | | | | 120,303,828 | | | | (4,756,457 | ) |

Euro-Bund Futures | | | 09/07/17 | | | | 913 | | | | EUR | | | | 150,271,041 | | | | (2,836,792 | ) |

FTSE 100 Index Futures | | | 09/15/17 | | | | 1,375 | | | | GBP | | | | 102,380,353 | | | | (3,641,620 | ) |

Gasoline RBOB Futures | | | 07/31/17 | | | | 557 | | | | USD | | | | 33,168,390 | | | | 2,243,108 | |

Hang Seng Index Futures | | | 07/28/17 | | | | 615 | | | | HKD | | | | 788,324,709 | | | | (203,134 | ) |

Japanese Government 10 Year Bond Futures | | | 09/12/17 | | | | 13 | | | | JPY | | | | 1,958,333,000 | | | | (61,374 | ) |

New York Harbor ULSD Futures | | | 07/31/17 | | | | 187 | | | | USD | | | | 11,815,427 | | | | (167,160 | ) |

Russell 2000 Index Mini Futures | | | 09/15/17 | | | | 1,305 | | | | USD | | | | 92,977,910 | | | | (694,835 | ) |

S&P 500 Index E-Mini Futures | | | 09/15/17 | | | | 933 | | | | USD | | | | 113,374,363 | | | | (439,378 | ) |

Silver Futures | | | 09/27/17 | | | | 542 | | | | USD | | | | 44,873,434 | | | | 185,736 | |

§See Note 2 of the notes to consolidated financial statements.

See accompanying notes to consolidated financial statements.

BHFTI-6

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Consolidated§ Schedule of Investments as of June 30, 2017 (Unaudited)

Futures Contracts—(Continued)

| | | | | | | | | | | | | | | | | | | | |

Futures Contracts—Long | | Expiration

Date | | | Number of

Contracts | | | Notional

Amount | | | Unrealized

Appreciation/

(Depreciation) | |

TOPIX Index Futures | | | 09/07/17 | | | | 1,020 | | | | JPY | | | | 16,270,061,820 | | | $ | 1,486,892 | |

U.S. Treasury Long Bond Futures | | | 09/20/17 | | | | 1,040 | | | | USD | | | | 158,966,543 | | | | 868,457 | |

United Kingdom Long Gilt Bond Futures | | | 09/27/17 | | | | 2,160 | | | | GBP | | | | 275,641,630 | | | | (5,744,363 | ) |

WTI Light Sweet Crude Oil Futures | | | 11/17/17 | | | | 329 | | | | USD | | | | 16,198,545 | | | | (719,095 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Unrealized Depreciation | | | $ | (28,728,377 | ) |

| | | | | | | | | | | | | | | | | | | | |

Swap Agreements

OTC Total Return Swaps

| | | | | | | | | | | | | | | | | | | | | | |

Fixed

Rate | | Maturity

Date | | Counterparty | | Underlying Reference

Instrument | | Notional

Amount | | | Market

Value | | | Upfront

Premium

Paid/(Received) | | | Unrealized

Appreciation/

(Depreciation) | |

| 0.300% | | 12/21/17 | | Macquarie Bank, Ltd. | | Aluminum Dynamic Selection Index | | USD | 15,236,444 | | | $ | 466,348 | | | $ | — | | | $ | 466,348 | |

| 0.280% | | 09/18/17 | | Barclays Bank plc | | Aluminum Excess Return Index | | USD | 4,725,939 | | | | — | | | | — | | | | — | |

| 0.330% | | 10/23/17 | | Barclays Bank plc | | Barclays Commodity Strategy 1452 Excess Return Index | | USD | 29,377,864 | | | | 1,412,333 | | | | — | | | | 1,412,333 | |

| 0.450% | | 07/07/17 | | Barclays Bank plc | | Barclays Commodity Strategy 1719 Excess Return Index | | USD | 6,874,829 | | | | 57,715 | | | | — | | | | 57,715 | |

| 0.300% | | 04/10/18 | | Canadian Imperial Bank of Commerce | | CIBC Dynamic Roll LME Copper Excess Return Index | | USD | 33,724,086 | | | | 937,905 | | | | — | | | | 937,905 | |

| 0.120% | | 01/12/18 | | Cargill, Inc. | | Single Commodity Excess Return Index | | USD | 22,851,925 | | | | — | | | | — | | | | — | |

| 0.400% | | 10/07/17 | | Goldman Sachs International | | Goldman Sachs Alpha Basket B823 Excess Return Strategy | | USD | 39,646,560 | | | | (333,645 | ) | | | — | | | | (333,645 | ) |

| 0.000% | | 07/31/17 | | Goldman Sachs International | | Hang Seng Index | | HKD | 269,325,716 | | | | (87,508 | ) | | | — | | | | (87,508 | ) |

| 0.250% | | 04/25/18 | | JPMorgan Chase Bank N.A. | | JPMorgan Beta Contag Gas Oil Excess Return Index | | USD | 13,097,573 | | | | 639,285 | | | | — | | | | 639,285 | |

| 0.250% | | 08/17/17 | | Bank of America N.A. | | MLCX Natural Gas Annual Excess Return Index | | USD | 16,631,174 | | | | — | | | | — | | | | — | |

| 0.140% | | 06/27/18 | | Bank of America N.A. | | Merrill Lynch Gold Excess Return Index | | USD | 28,970,589 | | | | (106,881 | ) | | | — | | | | (106,881 | ) |

| 0.470% | | 10/07/17 | | Cargill, Inc. | | Monthly Rebalance Commodity Excess Return Index | | USD | 43,237,218 | | | | — | | | | — | | | | — | |

| 0.380% | | 10/16/17 | | Morgan Stanley Capital Services LLC | | S&P GSCI Aluminum Dynamic Roll Index | | USD | 22,963,005 | | | | 639,630 | | | | — | | | | 639,630 | |

| 0.090% | | 10/16/17 | | JPMorgan Chase Bank N.A. | | S&P GSCI Gold Index Excess Return | | USD | 23,229,932 | | | | (132,023 | ) | | | — | | | | (132,023 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

Totals | | | $ | 3,493,159 | | | $ | — | | | $ | 3,493,159 | |

| | | | | | | | | | | | | |

| Securities | in the amount of $1,410,064 have been received at the custodian bank as collateral for OTC swap contracts. |

Index Information:

Barclays Commodity Strategy 1719 Excess Return Index—a commodity index that provide exposure to future contracts on Copper.

Barclays Commodity Strategy 1452 Excess Return Index—a commodity index that provide exposure to future contracts on Cocoa, Coffee, Corn, Cotton, Lean Hogs, Live Cattle, Soybeans, Soybean Meal, Soybean Oil, Sugar and Wheat.

Goldman Sachs Alpha Basket B823 Excess Return Strategy—a basket of indices that provide exposure to various components of the agriculture markets. The underlying commodities comprising the indices are: Cocoa, Coffee, Corn, Cotton, Lean Hogs, Live Cattle, Soybean Meal, Soybean Oil, Soybeans, Sugar and Wheat.

Monthly Rebalance Commodity Excess Return Index—commodity index composed of futures contracts on Cocoa, Coffee ‘C’, Corn, Cotton No.2, Lean Hogs,Live Cattle, Soybean Meal, Soybean Oil, Soybeans, Sugar No.11 and Wheat.

Single Commodity Excess Return Index—commodity index that provides exposure to futures contracts on Gold.

§See Note 2 of the notes to consolidated financial statements.

See accompanying notes to consolidated financial statements.

BHFTI-7

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Consolidated§ Schedule of Investments as of June 30, 2017 (Unaudited)

| | |

| (AUD)— | | Australian Dollar |

| (CAD)— | | Canadian Dollar |

| (EUR)— | | Euro |

| (GBP)— | | British Pound |

| (HKD)— | | Hong Kong Dollar |

| (JPY)— | | Japanese Yen |

| (USD)— | | United States Dollar |

Fair Value Hierarchy

Accounting principles generally accepted in the United States of America (“GAAP”) define fair market value as the price that the Portfolio would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. It establishes a fair value hierarchy that prioritizes inputs to valuation methods and requires disclosure of the fair value hierarchy, separately for each major category of assets and liabilities, that segregates fair value measurements into three levels. Levels 1, 2 and 3 of the fair value hierarchy are defined as follows:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are either active or inactive; inputs other than quoted prices that are observable such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks, default rates, or other market corroborated inputs)

Level 3 - significant unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are unavailable (including the Portfolio’s own assumptions used in determining the fair value of investments and derivative financial instruments)

The inputs or methodologies used for valuing investments are not necessarily an indication of the risk associated with investing in them. Changes to the inputs or methodologies used may result in transfers between levels, which will be recognized as of the beginning of the reporting period. Information on transfers between Level 1 and Level 2, if any, will be disclosed following the fair value hierarchy table below. A reconciliation of Level 3 securities, if any, will also be disclosed following the fair value hierarchy table. For more information about the Portfolio’s policy regarding the valuation of investments, please refer to the Notes to Consolidated Financial Statements.

The following table summarizes the fair value hierarchy of the Portfolio’s investments as of June 30, 2017:

| | | | | | | | | | | | | | | | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Total U.S. Treasury & Government Agencies* | | $ | — | | | $ | 41,523,446 | | | $ | — | | | $ | 41,523,446 | |

Total Commodity-Linked Securities | | | — | | | | 29,680,780 | | | | — | | | | 29,680,780 | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

Certificate of Deposit | | | — | | | | 155,012,167 | | | | — | | | | 155,012,167 | |

Commercial Paper | | | — | | | | 924,383,515 | | | | — | | | | 924,383,515 | |

Municipals | | | — | | | | 34,300,000 | | | | — | | | | 34,300,000 | |

Mutual Funds | | | 316,383,585 | | | | — | | | | — | | | | 316,383,585 | |

U.S. Treasury | | | — | | | | 109,117,646 | | | | — | | | | 109,117,646 | |

Total Short-Term Investments | | | 316,383,585 | | | | 1,222,813,328 | | | | — | | | | 1,539,196,913 | |

Total Investments | | $ | 316,383,585 | | | $ | 1,294,017,554 | | | $ | — | | | $ | 1,610,401,139 | |

| | | | | | | | | | | | | | | | | |

| Futures Contracts | | | | | | | | | | | | | | | | |

Futures Contracts (Unrealized Appreciation) | | $ | 4,784,193 | | | $ | — | | | $ | — | | | $ | 4,784,193 | |

Futures Contracts (Unrealized Depreciation) | | | (33,512,570 | ) | | | — | | | | — | | | | (33,512,570 | ) |

Total Futures Contracts | | $ | (28,728,377 | ) | | $ | — | | | $ | — | | | $ | (28,728,377 | ) |

| OTC Swap Contracts | | | | | | | | | | | | | | | | |

OTC Swap Contracts at Value (Assets) | | $ | — | | | $ | 4,153,216 | | | $ | — | | | $ | 4,153,216 | |

OTC Swap Contracts at Value (Liabilities) | | | — | | | | (660,057 | ) | | | — | | | | (660,057 | ) |

Total OTC Swap Contracts | | $ | — | | | $ | 3,493,159 | | | $ | — | | | $ | 3,493,159 | |

| | | | |

| * | | See Consolidated Schedule of Investments for additional detailed categorizations. |

§See Note 2 of the notes to consolidated financial statements.

See accompanying notes to consolidated financial statements.

BHFTI-8

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Consolidated§ Statement of Assets and Liabilities

June 30, 2017 (Unaudited)

| | | | |

Assets | |

Investments at value (a) | | $ | 1,294,017,554 | |

Affiliated investments at value (b) | | | 316,383,585 | |

Cash | | | 3,247,586 | |

Cash collateral (c) | | | 47,522,002 | |

OTC swap contracts at market value | | | 4,153,216 | |

Receivable for: | | | | |

Fund shares sold | | | 133,969 | |

Interest | | | 484,774 | |

| | | | |

Total Assets | | | 1,665,942,686 | |

Liabilities | | | | |

OTC swap contracts at market value | | | 660,057 | |

Cash collateral for OTC swap contracts | | | 12,300,003 | |

Payables for: | | | | |

Variation margin on futures contracts | | | 7,998,390 | |

OTC swap contracts | | | 657,466 | |

Fund shares redeemed | | | 251,051 | |

Interest on OTC swap contracts | | | 52,182 | |

Accrued Expenses: | | | | |

Management fees | | | 811,066 | |

Distribution and service fees | | | 343,061 | |

Deferred trustees’ fees | | | 90,943 | |

Other expenses | | | 266,863 | |

| | | | |

Total Liabilities | | | 23,431,082 | |

| | | | |

Net Assets | | $ | 1,642,511,604 | |

| | | | |

Net Assets Consist of: | | | | |

Paid in surplus | | $ | 1,610,224,695 | |

Distributions in excess of net investment income | | | (451,614 | ) |

Accumulated net realized gain | | | 67,793,738 | |

Unrealized depreciation on investments, futures contracts, swap contracts and foreign currency transactions | | | (35,055,215 | ) |

| | | | |

Net Assets | | $ | 1,642,511,604 | |

| | | | |

Net Assets | | | | |

Class B | | $ | 1,642,511,604 | |

Capital Shares Outstanding* | | | | |

Class B | | | 172,362,582 | |

Net Asset Value, Offering Price and Redemption Price Per Share | | | | |

Class B | | $ | 9.53 | |

| | | | |

| * | | The Portfolio is authorized to issue an unlimited number of shares. |

| (a) | | Identified cost of investments, excluding affiliated investments, was $1,303,655,002. |

| (b) | | Identified cost of affiliated investments was $316,383,585. |

| (c) | | Includes collateral of $8,740,000 for forward foreign currency exchange contracts, $25,182,002 for OTC swap contracts and $13,600,000 for futures contracts. |

Consolidated§ Statement of Operations

Six Months Ended June 30, 2017 (Unaudited)

| | | | |

Investment Income | |

Dividends from affiliated investments | | $ | 1,411,783 | |

Interest (a) | | | 5,518,610 | |

| | | | |

Total investment income | | | 6,930,393 | |

Expenses | |

Management fees | | | 5,129,607 | |

Administration fees | | | 50,458 | |

Custodian and accounting fees | | | 66,916 | |

Distribution and service fees—Class B | | | 2,034,026 | |

Audit and tax services | | | 41,348 | |

Legal | | | 20,784 | |

Trustees’ fees and expenses | | | 26,454 | |

Shareholder reporting | | | 29,299 | |

Insurance | | | 4,637 | |

Miscellaneous | | | 9,128 | |

| | | | |

Total expenses | | | 7,412,657 | |

Less management fee waiver | | | (312,382 | ) |

| | | | |

Net expenses | | | 7,100,275 | |

| | | | |

Net Investment Loss | | | (169,882 | ) |

| | | | |

Net Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

Investments | | | (11 | ) |

Futures contracts | | | 84,677,965 | |

Swap contracts | | | (9,212,571 | ) |

Foreign currency transactions | | | (367,338 | ) |

| | | | |

Net realized gain | | | 75,098,045 | |

| | | | |

| Net change in unrealized appreciation (depreciation) on: | |

Investments | | | (5,486,980 | ) |

Futures contracts | | | (41,828,051 | ) |

Swap contracts | | | 5,424,182 | |

Foreign currency transactions | | | (174,582 | ) |

| | | | |

Net change in unrealized depreciation | | | (42,065,431 | ) |

| | | | |

Net realized and unrealized gain | | | 33,032,614 | |

| | | | |

Net Increase in Net Assets From Operations | | $ | 32,862,732 | |

| | | | |

| | | | |

| (a) | | Net of foreign withholding taxes of $24,359. |

§See Note 2 of the notes to consolidated financial statements.

See accompanying notes to consolidated financial statements.

BHFTI-9

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Consolidated§ Statements of Changes in Net Assets

| | | | | | | | |

| | | Six Months Ended

June 30,

2017

(Unaudited) | | | Year Ended

December 31,

2016 | |

Increase (Decrease) in Net Assets: | | | | | | | | |

From Operations | | | | | | | | |

Net investment loss | | $ | (169,882 | ) | | $ | (5,606,782 | ) |

Net realized gain | | | 75,098,045 | | | | 147,736,141 | |

Net change in unrealized appreciation (depreciation) | | | (42,065,431 | ) | | | 6,768,674 | |

| | | | | | | | |

Increase in net assets from operations | | | 32,862,732 | | | | 148,898,033 | |

| | | | | | | | |

From Distributions to Shareholders | | | | | | | | |

Net investment income | | | | | | | | |

Class B | | | (61,587,538 | ) | | | (2,081,473 | ) |

Net realized capital gains | | | | | | | | |

Class B | | | (85,371,984 | ) | | | 0 | |

| | | | | | | | |

Total distributions | | | (146,959,522 | ) | | | (2,081,473 | ) |

| | | | | | | | |

Increase in net assets from capital share transactions | | | 229,428,542 | | | | 93,119,831 | |

| | | | | | | | |

Total increase in net assets | | | 115,331,752 | | | | 239,936,391 | |

|

Net Assets | |

Beginning of period | | | 1,527,179,852 | | | | 1,287,243,461 | |

| | | | | | | | |

End of period | | $ | 1,642,511,604 | | | $ | 1,527,179,852 | |

| | | | | | | | |

|

Undistributed (distributions in excess of) net investment income | |

End of period | | $ | (451,614 | ) | | $ | 61,305,806 | |

| | | | | | | | |

Other Information:

Capital Shares

Transactions in capital shares were as follows:

| | | | | | | | | | | | | | | | |

| | | Six Months Ended

June 30, 2017

(Unaudited) | | | Year Ended

December 31, 2016 | |

| | | Shares | | | Value | | | Shares | | | Value | |

Class B | | | | | | | | | | | | | | | | |

Sales | | | 12,862,124 | | | $ | 133,918,662 | | | | 18,721,832 | | | $ | 188,187,097 | |

Reinvestments | | | 15,244,764 | | | | 146,959,522 | | | | 210,462 | | | | 2,081,473 | |

Redemptions | | | (4,946,310 | ) | | | (51,449,642 | ) | | | (9,959,073 | ) | | | (97,148,739 | ) |

| | | | | | | | | | | | | | | | |

Net increase | | | 23,160,578 | | | $ | 229,428,542 | | | | 8,973,221 | | | $ | 93,119,831 | |

| | | | | | | | | | | | | | | | |

Increase derived from capital shares transactions | | | | | | $ | 229,428,542 | | | | | | | $ | 93,119,831 | |

| | | | | | | | | | | | | | | | |

§See Note 2 of the notes to consolidated financial statements.

See accompanying notes to consolidated financial statements.

BHFTI-10

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Consolidated§ Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| Selected per share data | |

| | | Class B | |

| | | Six Months

Ended

June 30,

2017

(Unaudited) | | | Year Ended December 31, | |

| | | | 2016 | | | 2015

| | | 2014

| | | 2013

| | | 2012(a) | |

Net Asset Value, Beginning of Period | | $ | 10.24 | | | $ | 9.18 | | | $ | 10.64 | | | $ | 10.58 | | | $ | 10.49 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (Loss) from Investment Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss (b) | | | (0.00 | )(c) | | | (0.04 | ) | | | (0.08 | ) | | | (0.08 | ) | | | (0.08 | ) | | | (0.06 | ) |

Net realized and unrealized gain (loss) on investments | | | 0.22 | | | | 1.12 | | | | (0.32 | ) | | | 0.65 | | | | 0.27 | | | | 0.69 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.22 | | | | 1.08 | | | | (0.40 | ) | | | 0.57 | | | | 0.19 | | | | 0.63 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (0.39 | ) | | | (0.02 | ) | | | (0.30 | ) | | | 0.00 | | | | 0.00 | | | | (0.03 | ) |

Distributions from net realized capital gains | | | (0.54 | ) | | | 0.00 | | | | (0.76 | ) | | | (0.51 | ) | | | (0.10 | ) | | | (0.11 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.93 | ) | | | (0.02 | ) | | | (1.06 | ) | | | (0.51 | ) | | | (0.10 | ) | | | (0.14 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 9.53 | | | $ | 10.24 | | | $ | 9.18 | | | $ | 10.64 | | | $ | 10.58 | | | $ | 10.49 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return (%) (d) | | | 2.07 | (e) | | | 11.72 | | | | (4.20 | ) | | | 5.58 | | | | 1.86 | | | | 6.34 | (e) |

| | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Gross ratio of expenses to average net assets (%) | | | 0.91 | (f) | | | 0.92 | | | | 0.92 | | | | 0.94 | | | | 0.93 | | | | 1.03 | (f) |

Gross ratio of expenses to average net assets excluding interest expense (%) | | | 0.91 | (f) | | | 0.92 | | | | 0.92 | | | | 0.93 | | | | 0.91 | | | | 1.03 | (f) |

Net ratio of expenses to average net assets (%) (g)(i) | | | 0.87 | (f) | | | 0.89 | | | | 0.89 | | | | 0.91 | | | | 0.90 | | | | 0.90 | (f) |

Net ratio of expenses to average net assets excluding interest expense (%) (g)(i) | | | 0.87 | (f) | | | 0.89 | | | | 0.89 | | | | 0.90 | | | | 0.88 | | | | 0.90 | (f) |

Ratio of net investment loss to average net assets (%) | | | (0.02 | )(f) | | | (0.40 | ) | | | (0.76 | ) | | | (0.78 | ) | | | (0.76 | ) | | | (0.80 | )(f) |

Portfolio turnover rate (%) | | | 21 | (e) | | | 137 | | | | 40 | | | | 44 | | | | 34 | | | | 0 | (h) |

Net assets, end of period (in millions) | | $ | 1,642.5 | | | $ | 1,527.2 | | | $ | 1,287.2 | | | $ | 1,351.3 | | | $ | 1,340.5 | | | $ | 973.1 | |

| | | | |

| (a) | | Commencement of operations was April 23, 2012. |

| (b) | | Per share amounts based on average shares outstanding during the period. |

| (c) | | Net investment loss was less than $0.01. |

| (d) | | Total return does not reflect any insurance, sales, separate account or administrative charges of variable annuity or life insurance contracts or any additional expenses that contract owners may bear under their variable contracts. If these charges were included, the returns would be lower. |

| (e) | | Periods less than one year are not computed on an annualized basis. |

| (f) | | Computed on an annualized basis. |

| (g) | | Includes the effects of management fee waivers (see Note 7 of the Notes to Consolidated Financial Statements). |

| (h) | | There were no long-term sale transactions during the period ended December 31, 2012. |

| (i) | | The effect of the voluntary portion of the waivers on the net ratio of expenses to average net assets was 0.01% for the six months ended June 30, 2017. (see Note 7 of the Notes to Consolidated Financial Statements). |

§See Note 2 of the notes to consolidated financial statements.

See accompanying notes to consolidated financial statements.

BHFTI-11

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Notes to Consolidated Financial Statements—June 30, 2017 (Unaudited)

1. Organization

Brighthouse Funds Trust I (the “Trust”) is organized as a Delaware statutory trust and registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust, which is managed by Brighthouse Investment Advisers, LLC (“Brighthouse Investment Advisers” or the “Adviser”) (formerly, MetLife Advisers, LLC), currently offers forty-five series, each of which operates as a distinct investment vehicle of the Trust. The series included in this report is Invesco Balanced-Risk Allocation Portfolio (the “Portfolio”), which is non-diversified. Shares in the Portfolio are not offered directly to the general public and are currently available only to separate accounts established by Metropolitan Life Insurance Company (“MetLife”) and life insurance companies affiliated with the Adviser.

The Portfolio has registered one class of shares: Class B shares. Class B shares are currently offered by the Portfolio.

2. Consolidation of Subsidiary—Invesco Balanced-Risk Allocation Portfolio, Ltd.

The Portfolio may invest up to 25% of its total assets in the Invesco Balanced-Risk Allocation Portfolio, Ltd., which is a wholly-owned and controlled subsidiary of the Portfolio that is organized under the laws of the Cayman Islands as an exempted company (the “Subsidiary”). The Portfolio invests in the Subsidiary in order to gain exposure to the commodities market within the limitations of the federal tax laws, rules and regulations that apply to regulated investment companies.

The Portfolio has obtained an opinion from legal counsel to the effect that the annual net profit, if any, realized by the Subsidiary and imputed for income tax purposes to the Portfolio should constitute “qualifying income” for purposes of the Portfolio remaining qualified as a regulated investment company for U.S federal income tax purposes. It is possible that the Internal Revenue Service or a court could disagree with the legal opinion obtained by the Portfolio.

The Subsidiary’s inception date is April 23, 2012 and it may invest in commodity derivatives, exchange-traded notes, exchange-traded funds, cash and cash equivalents, including money market funds affiliated with Invesco Advisers, Inc. (the “Subadviser”). Unlike the Portfolio, the Subsidiary may invest without limitation in commodity-linked derivatives; however, the Subsidiary complies with the same 1940 Act asset coverage requirements with respect to its investments in commodity-linked derivatives that are applicable to the Portfolio’s transactions in derivatives. In addition, to the extent applicable to the investment activities of the Subsidiary, the Subsidiary is subject to the same fundamental investment restrictions and follows the same compliance policies and procedures as the Portfolio.

By investing in the Subsidiary, the Portfolio is indirectly exposed to the risks associated with the Subsidiary’s investments. The commodity-related instruments held by the Subsidiary are subject to commodities risk. There can be no assurance that the investment objective of the Subsidiary will be achieved. The Subsidiary is not registered under the 1940 Act and is not subject to all the investor protections of the 1940 Act. The Portfolio, however, wholly owns and controls the Subsidiary, and the Portfolio and Subsidiary are both managed by the Subadviser, making it unlikely that the Subsidiary will take action contrary to the interests of the Portfolio and its shareholders. Changes in the laws of the United States and/or Cayman Islands could result in the inability of the Portfolio and/or the Subsidiary to operate as described in the Portfolio’s prospectus and could adversely affect the Portfolio. For example, the Cayman Islands does not currently impose any income, corporate or capital gains tax, estate duty, inheritance tax, gift tax or withholding tax on the Subsidiary. If Cayman Islands law changes such that the Subsidiary must pay Cayman Islands taxes, Portfolio shareholders would likely suffer decreased investment returns.

The consolidated Schedule of Investments, Statement of Assets and Liabilities, Statement of Operations, Statements of Changes in Net Assets and the Financial Highlights of the Portfolio include the accounts of the Subsidiary. As of June 30, 2017, the Portfolio held $401,741,895 in the Subsidiary, representing 24.2% of the Portfolio’s total assets. All inter-company accounts and transactions have been eliminated in consolidation for the Portfolio. The Subsidiary has a fiscal year end of December 31st for financial statement consolidation purposes and a nonconforming tax year end of November 30th.

3. Significant Accounting Policies

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the consolidated financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates. In the preparation of these consolidated financial statements, management has evaluated events and transactions subsequent to June 30, 2017 through the date the consolidated financial statements were issued.

The Portfolio is an investment company and follows the accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946—Financial Services—Investment Companies and Topic 820—Fair Value Measurement. The following is a summary of significant accounting policies consistently followed by the Portfolio in the preparation of its consolidated financial statements.

BHFTI-12

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Notes to Consolidated Financial Statements—June 30, 2017—(Continued)

Investment Valuation and Fair Value Measurements - Debt securities, including corporate, convertible and municipal bonds and notes; obligations of the U.S. Treasury and U.S. government agencies; foreign sovereign issues; and non-U.S. bonds, are generally valued on the basis of evaluated or composite bid quotations obtained from independent pricing services and/or brokers and dealers selected by the Adviser (each a “pricing service”), pursuant to the authorization of and subject to general oversight by the Board of Trustees of the Trust (the “Board” or “Trustees”). Such pricing services may use matrix pricing, which considers observable inputs including, among other things, issuer details, maturity dates, interest rates, yield curves, rates of prepayment, credit risks/spreads, default rates, reported trades, broker dealer quotes and quoted prices for similar assets. Short-term obligations with a remaining maturity of sixty days or less may be valued at amortized cost in the absence of market quotes, so long as the amortized cost value of such short-term debt instrument is approximately the same as the fair value of the instrument as determined without the use of amortized cost valuation. Floating rate loans are generally valued on the basis of an evaluated or composite average of aggregate bid and ask quotations supplied by brokers or dealers, as obtained from the pricing service. Securities that use similar valuation techniques and inputs as described above are generally categorized as Level 2 within the fair value hierarchy.

Investments in registered open-end management investment companies are valued at reported net asset value (“NAV”) per share on the valuation date and are categorized as Level 1 within the fair value hierarchy.

Investments in unregistered open-end management investment companies are reported at NAV per share on the valuation date and are categorized as Level 1 within the fair value heirarchy provided the NAV is observable, calculated daily and are the value at which both purchases and sales will be conducted.

Foreign currency forward contracts are valued through an independent pricing service by interpolating between forward and spot currency rates in the London foreign exchange markets as of a designated hour on a valuation day. These contracts are generally categorized as Level 2 within the fair value hierarchy.

Options, whether on securities, indices, futures contracts, or otherwise, traded on exchanges are valued at the last sale price available as of the close of business on a valuation day or, if there is no such price available, at the last reported bid price. These types of options are categorized as Level 1 within the fair value hierarchy. Futures contracts that are traded on commodity exchanges are valued at their settlement prices established by the exchanges on which they are traded as of the close of such exchanges and are categorized as Level 1 within the fair value hierarchy.

Swap contracts (other than centrally cleared swaps) are marked-to-market daily based on quotations and prices supplied by market makers, broker-dealers and other pricing services. Such quotations and prices are derived utilizing observable data, including the underlying reference securities or indices, credit spread quotations and expected default recovery rates determined by the pricing service. These contracts are generally categorized as Level 2 within the fair value hierarchy.

Centrally cleared swaps listed or traded on a multilateral or trade facility platform, such as a registered exchange, are valued at the daily settlement price determined by the respective exchange or a pricing service when the exchange price is not available. For centrally cleared credit default swaps, the clearing facility requires its members to provide actionable price levels across complete term structures. These levels along with external third-party prices are used to produce daily settlement prices. These securities are categorized as Level 2 within the fair value hierarchy. Centrally cleared interest rate swaps are valued using a pricing model that references the underlying rates, including the overnight index swap rate and London Interbank Offered Rate (“LIBOR”) forward rate to produce the daily settlement price. These securities are categorized as Level 2 within the fair value hierarchy.

If no current market value quotation or other observable inputs are readily available or market value quotations are deemed to be unreliable for an investment, the fair value of the investment will be determined in accordance with procedures approved by, and under the general supervision of, the Board. In such a circumstance, the Board will be assisted in its responsibility to determine the fair value of an investment by the Valuation Committee (“Committee”) of Brighthouse Investment Advisers. The Committee provides general pricing oversight and fair value pricing determinations related to portfolio securities and meets on a regular basis to review reports relating to the valuation of the securities in the Portfolio. The Board has delegated to State Street Bank and Trust Company, the Trust’s custodian (“custodian”), the responsibility for calculating the NAVs of the Trust’s Portfolios. The Committee is responsible for overseeing the calculation of the NAVs of the Portfolios by the custodian. The Committee also periodically reviews pricing services, including the pricing services providing fair value pricing for the Portfolio’s foreign securities, and is responsible for overseeing the correction of pricing errors and addressing other pricing issues that arise in the ordinary course of business, such as making real-time fair value determinations, as necessary.

No single standard for determining the fair value of an investment can be set forth because fair value depends upon the facts and circumstances with respect to each investment. Information relating to any relevant factors may be obtained by the Committee from any appropriate source, including the subadviser of the Portfolio, the custodian, a pricing service, market maker and/or broker for such security or the issuer. Appropriate methodologies for determining fair value under particular circumstances may include: matrix pricing, a discounted cash flow analysis, comparisons of securities with comparable characteristics, value based on multiples of earnings, discount from market price of similar marketable securities, or a combination of these and other methods.

BHFTI-13

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Notes to Consolidated Financial Statements—June 30, 2017—(Continued)

Investment Transactions and Related Investment Income - Portfolio security transactions are recorded on the trade date. Dividend income is recorded on the ex-dividend date or, for certain foreign securities, when notified. Interest income, which includes amortization of premium and accretion of discount on debt securities, is recorded on the accrual basis. Realized gains and losses on investments are determined on the identified cost basis, which is the same basis used for federal income tax purposes. Foreign income and foreign capital gains on some foreign securities may be subject to foreign taxes, which are accrued as applicable. These foreign taxes have been provided for in accordance with the Portfolio’s understanding of the applicable countries’ tax rules and rates.

Foreign Currency Translation - The books and records of the Portfolio are maintained in U.S. dollars. The values of securities, currencies, and other assets and liabilities denominated in currencies other than the U.S. dollar are translated into U.S. dollars based upon foreign exchange rates prevailing at the end of the period. Purchases and sales of investment securities, income, and expenses are translated on the respective dates of such transactions. Because the values of investment securities are translated at the foreign exchange rates prevailing at the end of the period, that portion of the results of operations arising from changes in exchange rates and that portion of the results of operations reflecting fluctuations arising from changes in market prices of the investment securities are not separated. Such fluctuations are included in the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from activity in forward foreign currency exchange contracts, sales of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded by the Portfolio and the U.S. dollar-equivalent of the amounts actually received or paid by the Portfolio. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investment securities, resulting from changes in foreign exchange rates.

Dividends and Distributions to Shareholders - The Portfolio records dividends and distributions on the ex-dividend date. Net realized gains from securities transactions (if any) are generally distributed annually to shareholders. The timing and characterization of certain income and capital gains distributions are determined in accordance with federal tax regulations that may differ from GAAP. Permanent book and tax basis differences relating to shareholder distributions will result in reclassification between under/over distributed net investment income, accumulated net realized gains/losses, and paid-in surplus. Book-tax differences are primarily due to futures transactions, foreign currency transactions, swap transactions, premium amortization and controlled foreign corporations. These adjustments have no impact on net assets or the results of operations.

Income Taxes - It is the Portfolio’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended, and regulations thereunder, applicable to regulated investment companies, and to distribute, with respect to each taxable year, all of its taxable income to shareholders. Therefore, no federal income tax provision is required. The Portfolio files U.S. federal tax returns. No income tax returns are currently under examination. The Portfolio’s federal tax returns remain subject to examination by the Internal Revenue Service for three fiscal years after the returns are filed. As of June 30, 2017, the Portfolio had no uncertain tax positions that would require financial statement recognition, or de-recognition or disclosure.

When-Issued and Delayed-Delivery Securities - The Portfolio may purchase securities on a when-issued or delayed-delivery basis. Settlement of such transactions normally occurs within a month or more after the purchase commitment is made. The Portfolio may purchase securities under such conditions only with the intention of actually acquiring them, but may enter into a separate agreement to sell the securities before the settlement date. Since the value of securities purchased may fluctuate prior to settlement, the Portfolio may be required to pay more at settlement than the security is worth. In addition, the purchaser is not entitled to any of the interest earned prior to settlement.

Upon making a commitment to purchase a security on a when-issued or delayed-delivery basis, the Portfolio will hold liquid assets in a segregated account with the Portfolio’s custodian, or set aside liquid assets in the Portfolio’s records, worth at least the equivalent of the amount due. The liquid assets will be monitored on a daily basis and adjusted as necessary to maintain the necessary value.

Repurchase Agreements - The Portfolio may enter into repurchase agreements, under the terms of a Master Repurchase Agreement (“MRA”), with selected commercial banks and broker-dealers, under which the Portfolio acquires securities as collateral and agrees to resell the securities at an agreed-upon time and at an agreed-upon price. The Portfolio, through the custodian or a subcustodian, under a tri-party repurchase agreement, receives delivery of the underlying securities collateralizing any repurchase agreements. It is the Portfolio’s policy that the market value of the collateral be equal to at least 100% of the repurchase price in the case of a repurchase agreement of one-day duration and equal to at least 102% of the repurchase price in the case of all other repurchase agreements. In the event of default or failure by a party to perform an obligation in connection with any repurchase transaction, the MRA gives the non-defaulting party the right to set-off claims and to apply property held by it in connection with any repurchase transaction against obligations owed to it. The Portfolio had no outstanding repurchase agreements at June 30, 2017.

4. Investments in Derivative Instruments

Futures Contracts - The Portfolio may buy and sell futures contracts as a hedge, to maintain investment exposure to a target asset class or to enhance return. The Portfolio may be subject to fluctuations in equity prices, interest rates, commodity prices, and foreign

BHFTI-14

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Notes to Consolidated Financial Statements—June 30, 2017—(Continued)

currency exchange rates in the normal course of pursuing its investment objective. Futures contracts are standardized agreements to buy or sell a security, or deliver a final cash settlement price in connection with an index, interest rate, currency, or other asset. The Portfolio must deposit an amount (“initial margin”) equal to a certain percentage of the face value of the futures contract. The initial margin may be in the form of cash or securities, which is returned when the Portfolio’s obligations under the contract have been satisfied. If cash is deposited as the initial margin, it is shown as cash collateral on the Consolidated Statement of Assets and Liabilities. Futures contracts are marked-to-market daily, and subsequent payments (“variation margin”) are made or received by the Portfolio depending on whether unrealized gains or losses are incurred. These amounts are reflected as receivables or payables on the Consolidated Statement of Assets and Liabilities and as a component of net change in unrealized appreciation/depreciation on the Consolidated Statement of Operations. When the contract is closed or expires, the Portfolio records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. Risks of entering into futures contracts (and related options) include the possibility that the market for these instruments may be illiquid and that a change in the value of the contract or option may not correlate perfectly with changes in the value of the underlying instrument. If futures contracts are exchange-traded, the exchange’s clearinghouse, as counterparty to all exchange-traded futures, guarantees the futures contracts against default. For OTC futures, the Portfolio’s ability to terminate the positions may be more limited than in the case of exchange-traded positions and may also involve the risk that securities dealers participating in such transactions would fail to meet their obligations to the Portfolio.

Commodity Futures Contracts and Swaps on Commodity Futures Contracts - The Subsidiary will invest primarily in commodity futures and swaps on commodity futures. Exposure to the commodities markets may subject the Portfolio to greater volatility than investments in traditional securities. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity.

Swap Agreements - The Portfolio may enter into swap agreements in which the Portfolio and a counterparty agree to either make periodic net payments on a specified notional amount or net payment upon termination. Swap agreements are either privately negotiated in the OTC market (“OTC swaps”) or executed in a multilateral or other trade facility platform, such as a registered commodities exchange (“centrally cleared swaps”). The Portfolio may enter into swap agreements for the purposes of managing exposure to interest rate, credit or market risk, or for other purposes. In connection with these agreements, securities or cash may be paid or received, as applicable, by the Portfolio as collateral or margin in accordance with the terms of the respective swap agreements to provide assets of value and recourse in the event of default or bankruptcy/insolvency. Securities posted by the Portfolio as collateral for swap contracts are identified in the Consolidated Schedule of Investments and restricted cash, if any, is reflected on the Consolidated Statement of Assets and Liabilities.

Centrally Cleared Swaps: Clearinghouses currently offer clearing derivative transactions which include interest rate and credit derivatives. In a cleared derivative transaction, a Portfolio typically enters into the transaction with a financial institution counterparty, and performance of the transaction is effectively guaranteed by a central clearinghouse, thereby reducing or eliminating the Portfolio’s exposure to the credit risk of the original counterparty. The Portfolio typically will be required to post specified levels of margin with the clearinghouse or at the instruction of the clearinghouse; the margin required by a clearinghouse may be greater than the margin the Portfolio would be required to post in an uncleared derivative transaction.

Swap agreements are marked-to-market daily. The fair value of an OTC swap is reflected on the Consolidated Statement of Assets and Liabilities. The changes in value, if any, are reflected as a component of net change in unrealized appreciation/depreciation on the Consolidated Statement of Operations. Daily changes in valuation of centrally cleared swaps, if any, are recorded as a receivable or payable for variation margin on the Consolidated Statement of Assets and Liabilities and as a component of unrealized appreciation/depreciation on the Consolidated Statement of Operations. Upfront payments paid or received upon entering into the swap agreement compensate for differences between the stated terms of the swap agreement and prevailing market conditions (such as credit spreads, currency exchange rates, interest rates, and other relevant factors). Upon termination or maturity of the swap, upfront premiums are recorded as realized gains or losses on the Consolidated Statement of Operations. A liquidation payment received or made at the termination of the swap is recorded as realized gain or loss on the Consolidated Statement of Operations. Net periodic payments received or paid by the Portfolio are included as part of realized gains or losses on the Consolidated Statement of Operations.

Swap transactions involve, to varying degrees, elements of interest rate, credit, and market risk in excess of the amounts recognized in the Consolidated Statement of Assets and Liabilities. Such risks involve the possibility that there will be no liquid market for these agreements, that the counterparty to the agreements may default on its obligation to perform, or that there may be unfavorable changes in market conditions or interest rates. In addition, entering into swap agreements involves documentation risk resulting from the possibility that the parties to a swap agreement may disagree as to the meaning of contractual terms in the agreement. The Portfolio may enter into swap transactions with counterparties in accordance with guidelines established by the Board. These guidelines provide for a minimum credit rating for each counterparty and various credit enhancement techniques (for example, collateralization of amounts due from counterparties) to limit exposure to counterparties that have lower credit ratings. A Portfolio’s maximum risk of loss from counterparty credit risk is the discounted value of the net cash flows to be received from the counterparty over the contract’s remaining life, to the extent that amount is positive, or the fair value of the contract. The risk may be mitigated by

BHFTI-15

Brighthouse Funds Trust I

Invesco Balanced-Risk Allocation Portfolio

Notes to Consolidated Financial Statements—June 30, 2017—(Continued)

having a master netting arrangement between the Portfolio and the counterparty and by the posting of collateral by the counterparty to cover the Portfolio’s exposure to the counterparty. Counterparty risk related to centrally-cleared swaps is mitigated due to the protection against defaults provided by the exchange on which these contracts trade.

Currency Swaps: The Portfolio may enter into currency swap agreements to gain or mitigate exposure to currency risk. A currency swap is an agreement to exchange cash flows on a notional amount of two or more currencies based on the relative value differential among them. Such swaps may involve initial and final exchanges that correspond to the agreed upon notional amount. Currency swaps usually involve the delivery of the entire principal value of one designated currency in exchange for the other designated currency. Therefore, the entire principal value of a currency swap is subject to the risk that the other party to the swap will default on its contractual delivery obligations. If there is a default by the counterparty, the Portfolio may have contractual remedies pursuant to the agreements related to the transaction.