1 Third Quarter 2021 November 3, 2021

2 Forward Looking Statements This presentation contains forward-looking statements of Lumos Pharma, Inc. (the “Company”) that involve substantial risks and uncertainties. All such statements contained in this presentation are forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. The words “forecast,” “projected,” "guidance," "upcoming," "will," “would,” "plan," “intend,” "anticipate," "approximate," "expect," “potential,” “imminent,” or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include, among others, the ability of prior research results to forecast the performance of therapeutic agents in the clinic, anticipated business development activities, anticipated market reception to our treatment regimen for PGHD and other indications, plans related to initiation and execution of clinical trials; plans related to moving additional indications into clinical development; future financial performance, results of operations, cash position and sufficiency of capital resources to fund its operating requirements; and any other statements other than statements of historical fact. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that the Company makes due to a number of important factors, including the effects of pandemics or other widespread health problems, the outcome of our future interactions with regulatory authorities, our ability to project future cash utilization and reserves needed for contingent future liabilities and business operations, the ability to obtain the necessary patient enrollment for our product candidate in a timely manner, the ability to successfully develop our product candidate, the timing and ability of Lumos to raise additional equity capital as needed and other risks that could cause actual results to differ materially from those matters expressed in or implied by such forward-looking statements as discussed in "Risk Factors" and elsewhere in Lumos Pharma’s Annual Report on Form 10-K for the year ended December 31, 2020 and other reports filed with the SEC. The forward-looking statements in this presentation represent the Company’s views as of the date of this presentation. The Company anticipates that subsequent events and developments will cause their views to change. However, while it may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. You should, therefore, not rely on these forward-looking statements as representing the Company’s views as of any date subsequent to the date of this presentation. 11.3.21

3 Agenda • Lisa Miller, Senior Director of Investor Relations • Rick Hawkins, Chief Executive Officer & Chairman • Rick Hawkins, Chief Executive Officer & Chairman • John McKew, PhD, President & Chief Scientific Officer • David B. Karpf, MD, Chief Medical Officer • Lori Lawley, Chief Financial Officer • Lori Lawley, Chief Financial Officer

4 LUM-201 Program Pipeline Study Pre-Clinical Phase 1 Phase 2 Phase 3 Status LUM-201 (Ibutamoren) In PGHD Phase 2 Ongoing Phase 2 trial with 6-month data readout expected in second half of 2023 Long-term extension Proposed long-term extension study for OraGrowtH Trials PK/PD trial Pharmacokinetic/Pharmacodynamic (PK/PD) trial open and recruiting patients Lumos is evaluating additional indications for LUM-201 for Phase 2 studies Small for Gestational Age Prader-Willi Syndrome Turner Syndrome Idiopathic Short Stature PGHD Pediatric Growth Hormone Deficiency

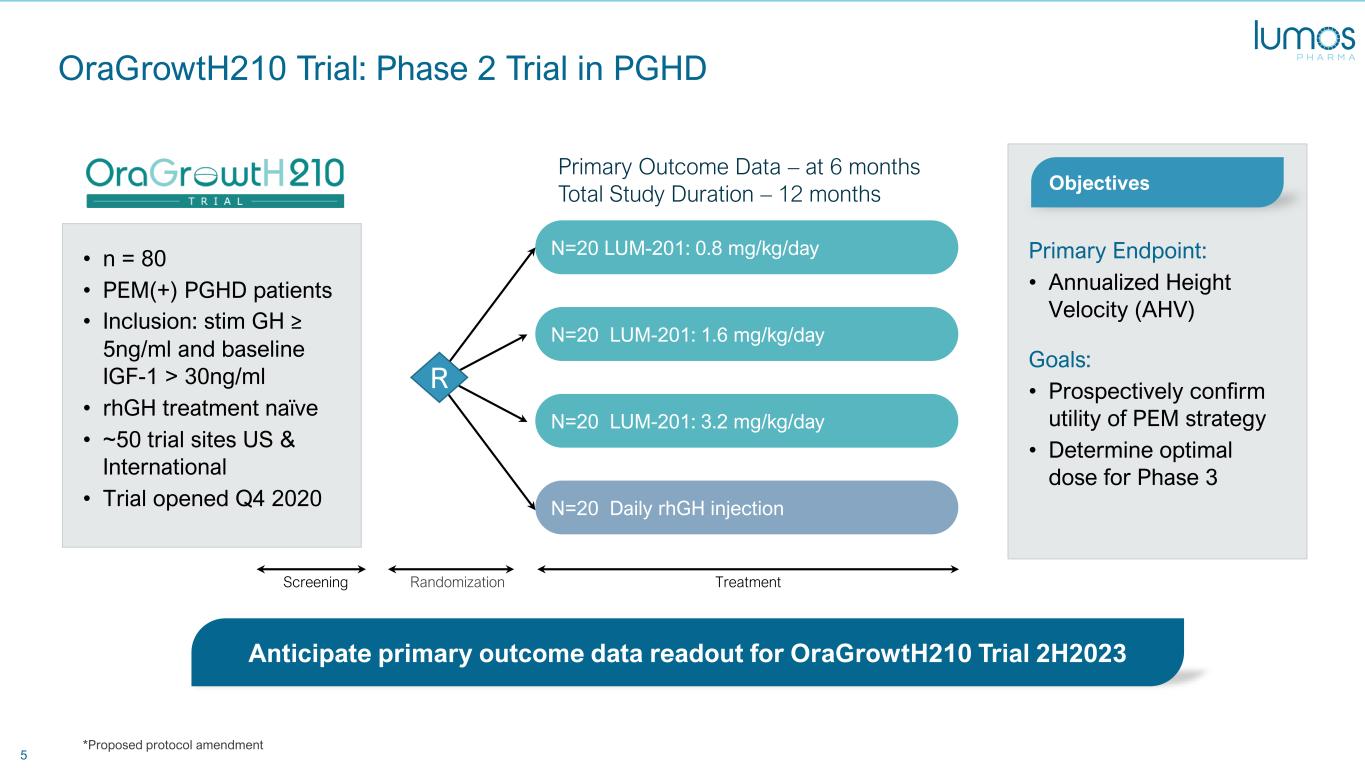

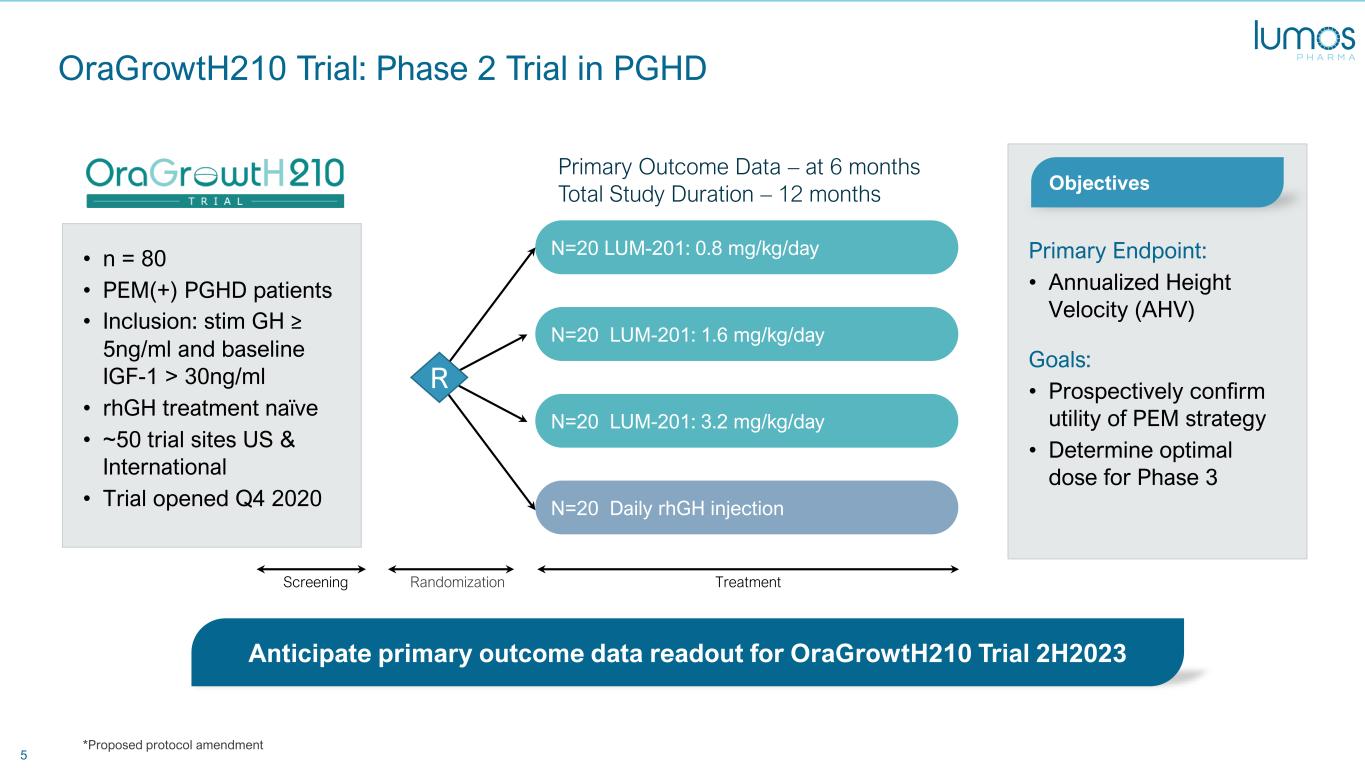

5 OraGrowtH210 Trial: Phase 2 Trial in PGHD N=20 Daily rhGH injection N=20 LUM-201: 3.2 mg/kg/day N=20 LUM-201: 1.6 mg/kg/day N=20 LUM-201: 0.8 mg/kg/day • n = 80 • PEM(+) PGHD patients • Inclusion: stim GH ≥ 5ng/ml and baseline IGF-1 > 30ng/ml • rhGH treatment naïve • ~50 trial sites US & International • Trial opened Q4 2020 Primary Endpoint: • Annualized Height Velocity (AHV) Goals: • Prospectively confirm utility of PEM strategy • Determine optimal dose for Phase 3 Anticipate primary outcome data readout for OraGrowtH210 Trial 2H2023 Primary Outcome Data – at 6 months Total Study Duration – 12 months Objectives TreatmentRandomizationScreening R *Proposed protocol amendment

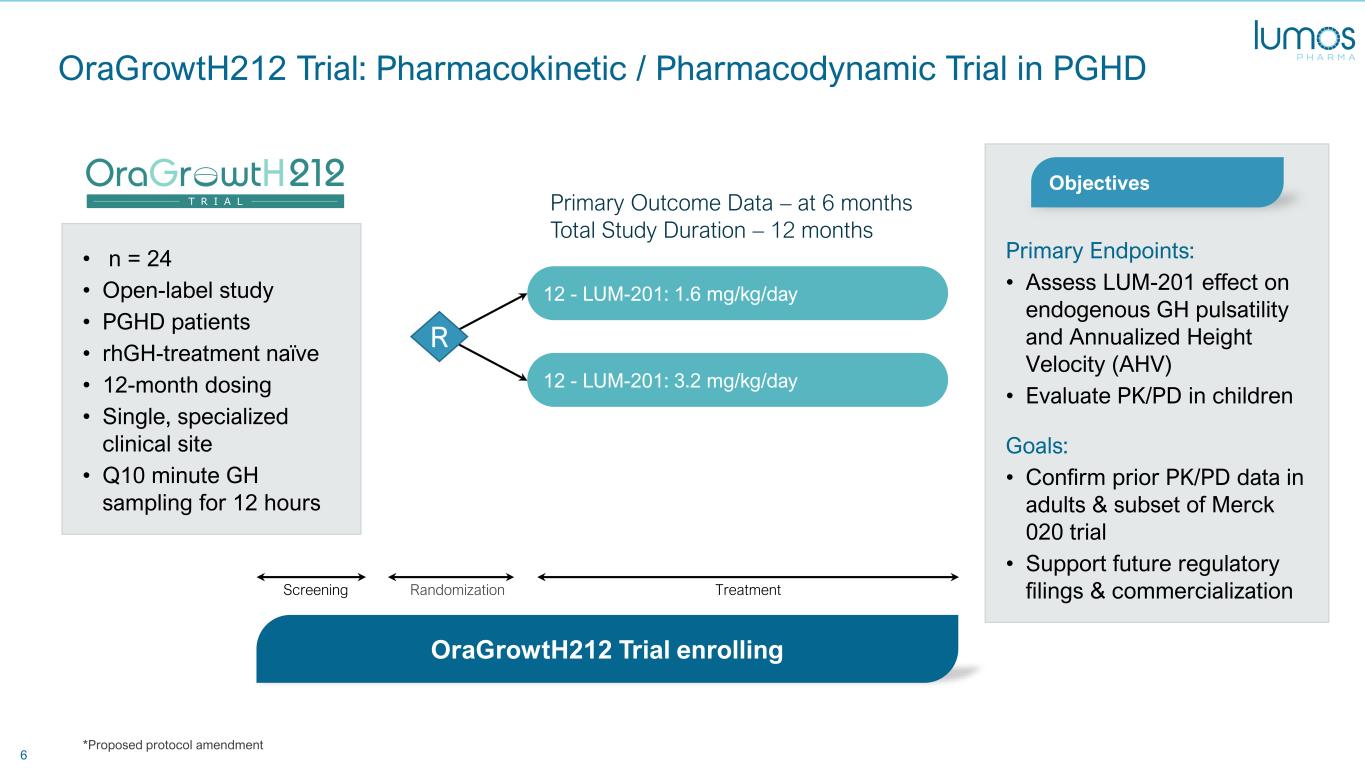

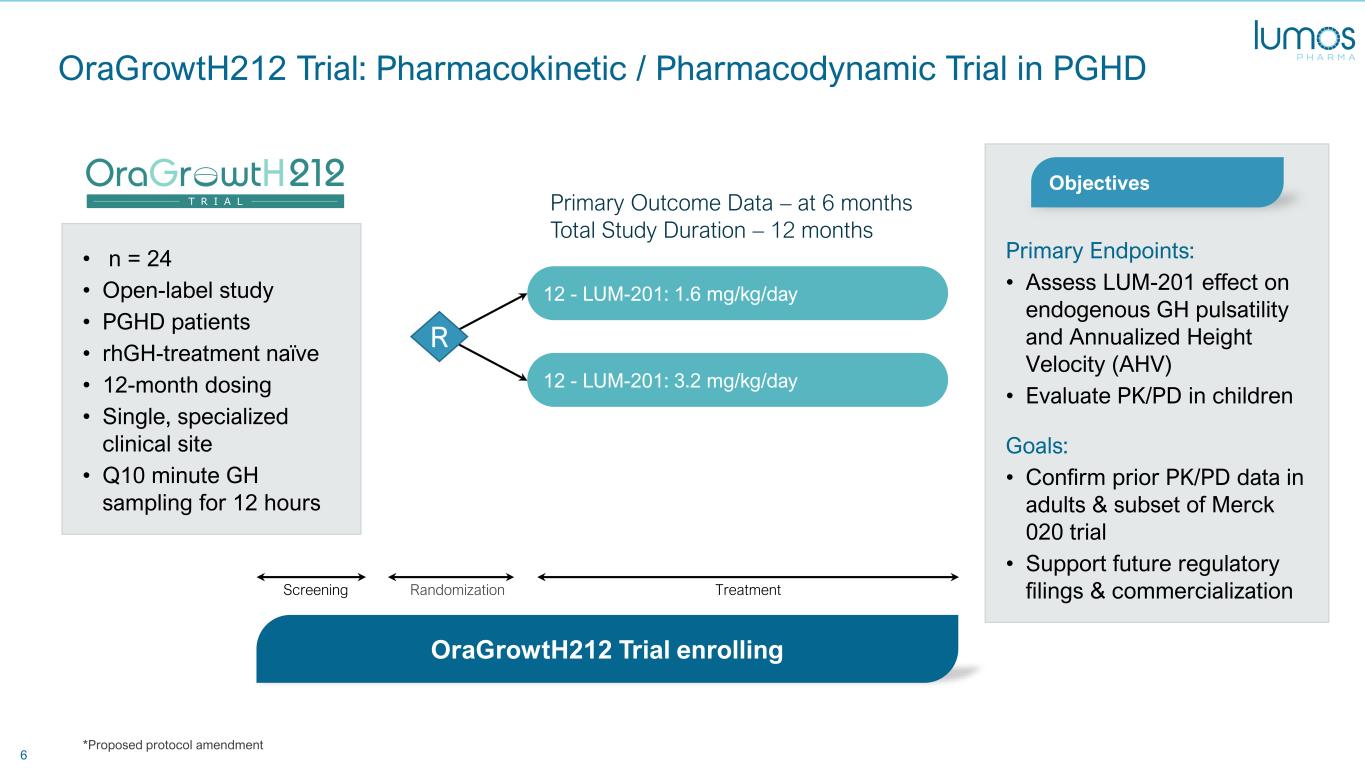

6 • n = 24 • Open-label study • PGHD patients • rhGH-treatment naïve • 12-month dosing • Single, specialized clinical site • Q10 minute GH sampling for 12 hours OraGrowtH212 Trial: Pharmacokinetic / Pharmacodynamic Trial in PGHD Primary Endpoints: • Assess LUM-201 effect on endogenous GH pulsatility and Annualized Height Velocity (AHV) • Evaluate PK/PD in children Goals: • Confirm prior PK/PD data in adults & subset of Merck 020 trial • Support future regulatory filings & commercialization OraGrowtH212 Trial enrolling Objectives 12 - LUM-201: 3.2 mg/kg/day 12 - LUM-201: 1.6 mg/kg/day R TreatmentRandomizationScreening Primary Outcome Data – at 6 months Total Study Duration – 12 months *Proposed protocol amendment

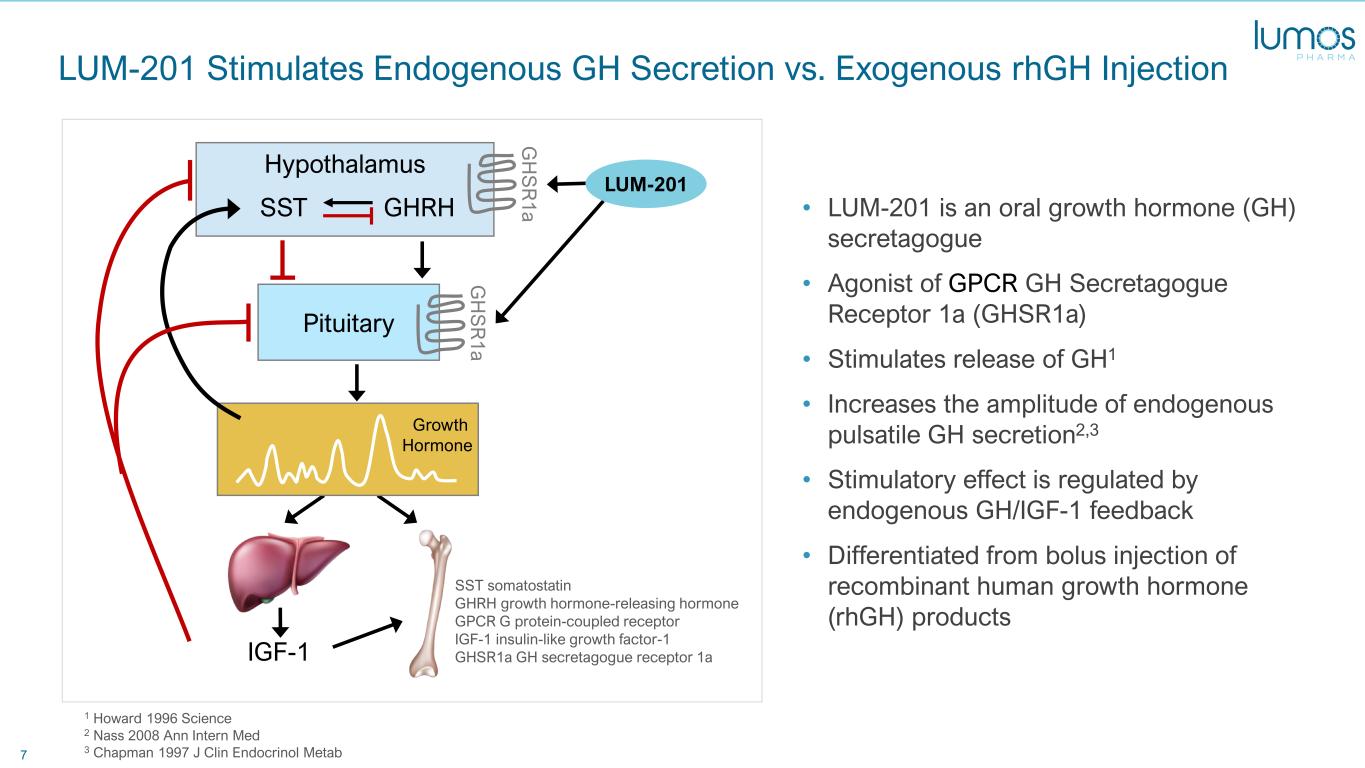

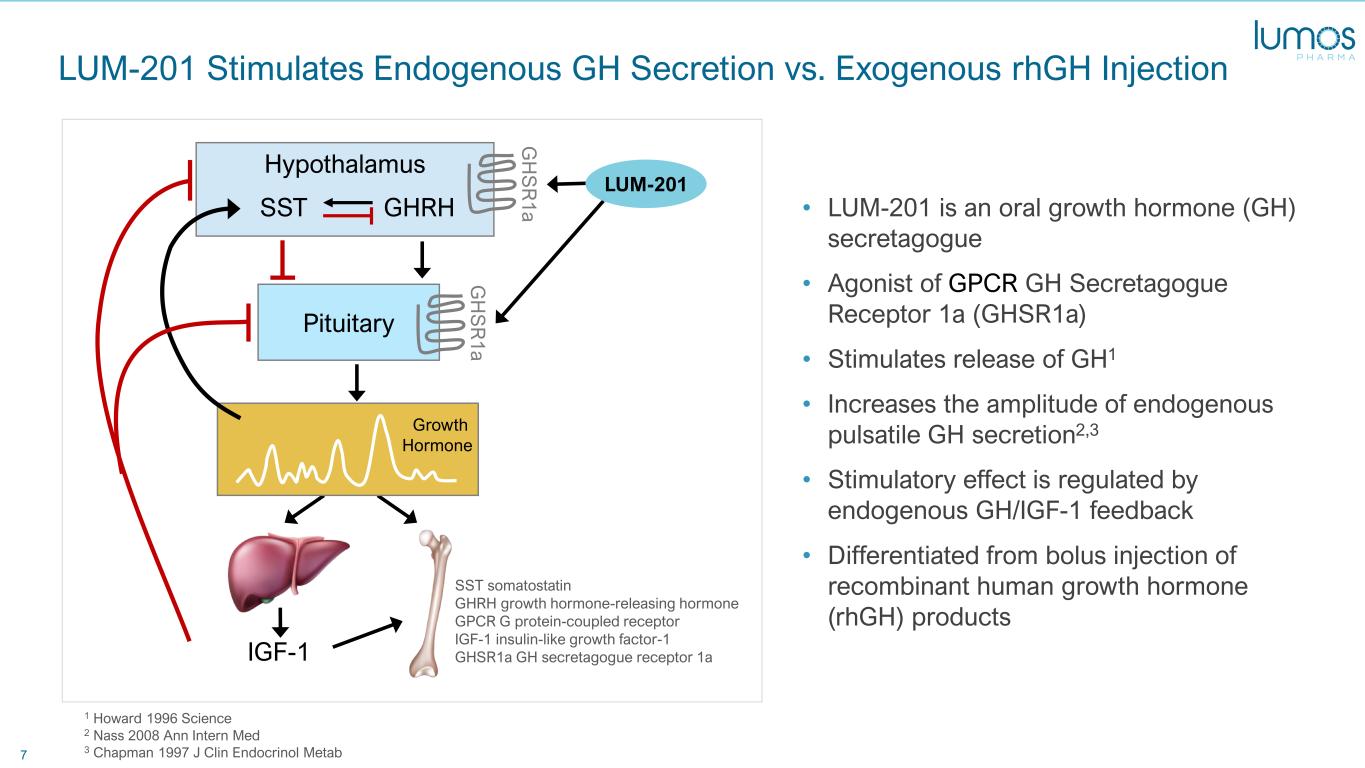

7 LUM-201 Stimulates Endogenous GH Secretion vs. Exogenous rhGH Injection • LUM-201 is an oral growth hormone (GH) secretagogue • Agonist of GPCR GH Secretagogue Receptor 1a (GHSR1a) • Stimulates release of GH1 • Increases the amplitude of endogenous pulsatile GH secretion2,3 • Stimulatory effect is regulated by endogenous GH/IGF-1 feedback • Differentiated from bolus injection of recombinant human growth hormone (rhGH) products 1 Howard 1996 Science 2 Nass 2008 Ann Intern Med 3 Chapman 1997 J Clin Endocrinol Metab Pituitary IGF-1 Hypothalamus G H S R 1 a G H S R 1 a Growth Hormone SST GHRH SST somatostatin GHRH growth hormone-releasing hormone GPCR G protein-coupled receptor IGF-1 insulin-like growth factor-1 GHSR1a GH secretagogue receptor 1a LUM-201

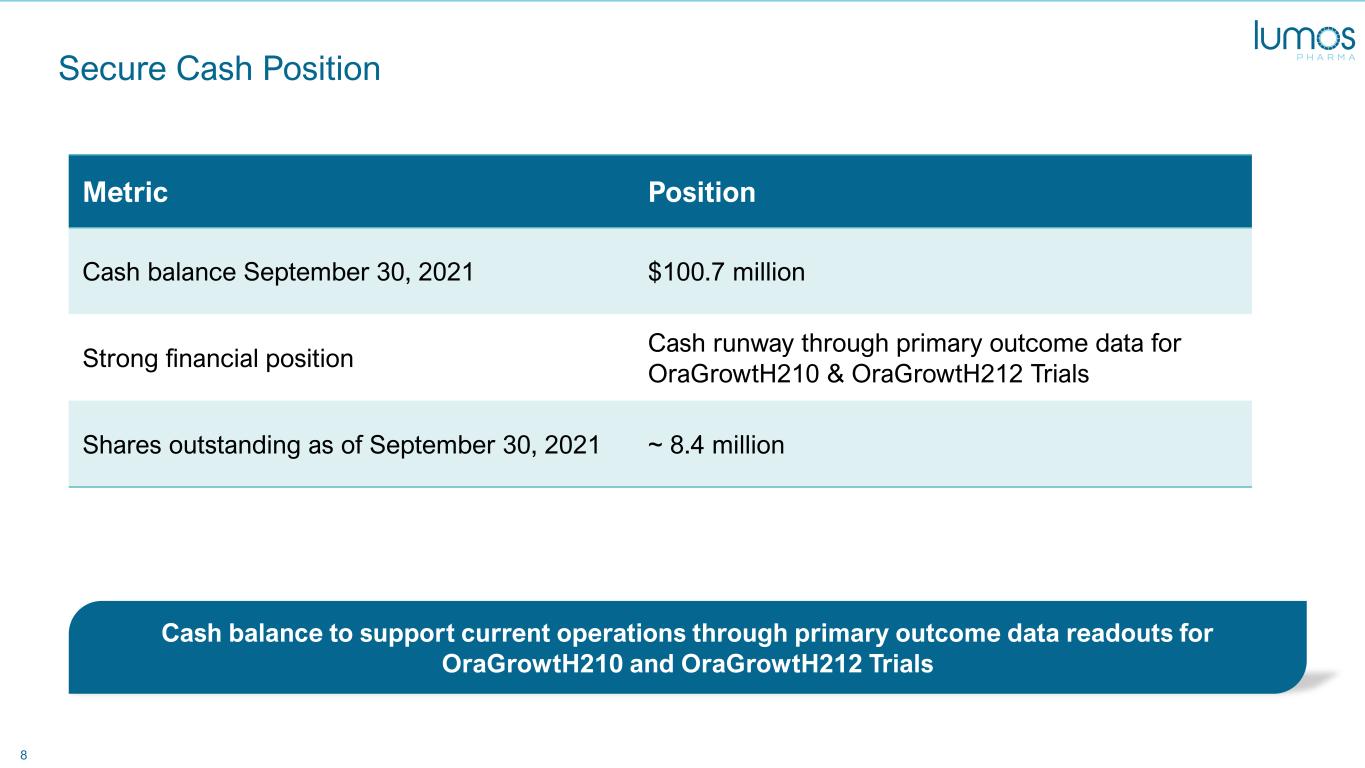

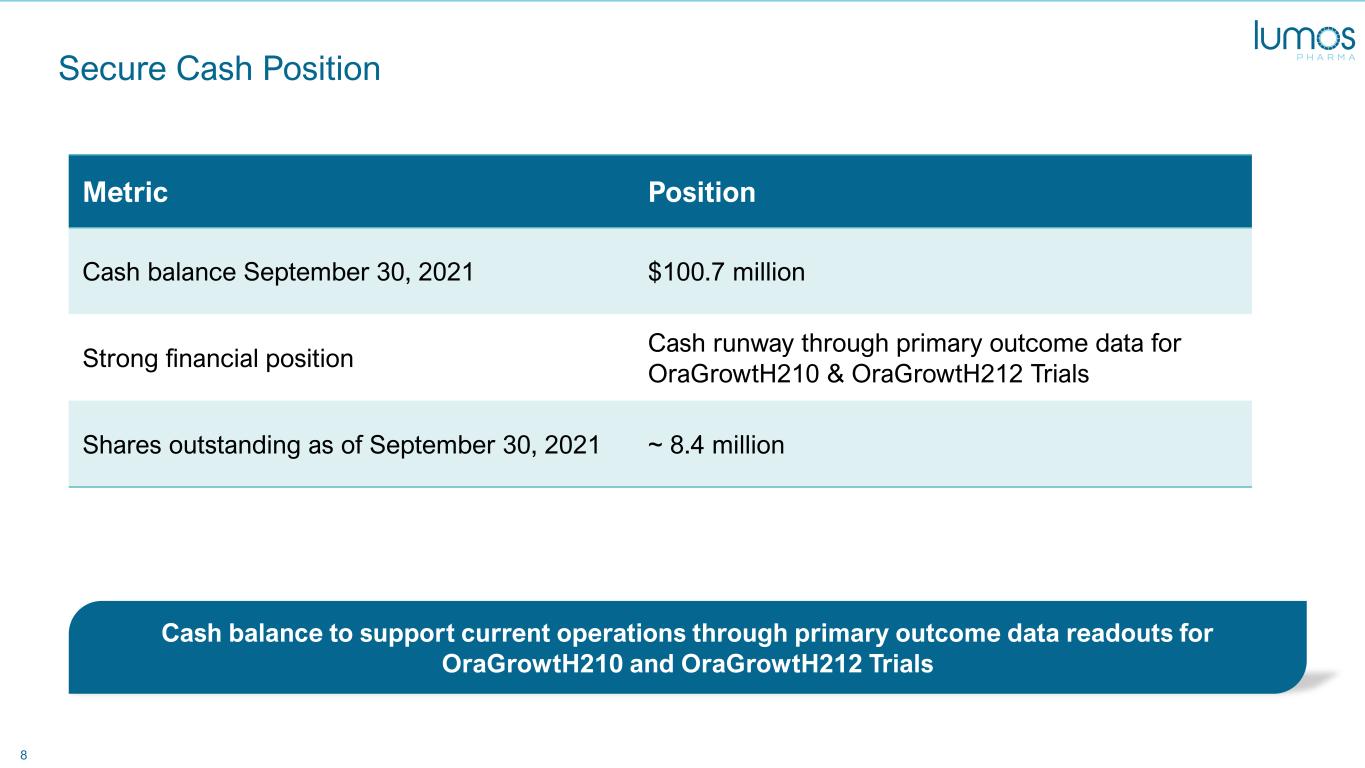

8 Secure Cash Position Metric Position Cash balance September 30, 2021 $100.7 million Strong financial position Cash runway through primary outcome data for OraGrowtH210 & OraGrowtH212 Trials Shares outstanding as of September 30, 2021 ~ 8.4 million Cash balance to support current operations through primary outcome data readouts for OraGrowtH210 and OraGrowtH212 Trials

9 Investment Highlights PGHD = Pediatric Growth Hormone Deficiency * USA, Germany, France, Italy, Spain, UK, Japan (Grandview Research, Growth Hormone Market Forecast, 2019) Late-stage Rare Disease Asset Pipeline in a Product Experienced Management Solid Financial Position • Novel oral therapeutic asset, LUM-201, for growth hormone deficiency disorders • Phase 2 OraGrowtH210 Trial in PGHD – Enrolling with primary outcome data 2H2023 • PK/PD OraGrowtH212 Trial in PGHD – Open-label trial currently enrolling • Current market for initial indication, PGHD, is $1.2 billion* • Multiple potential follow-on indications represent up to additional $2.2 billion • Potential to disrupt injectable treatment regimen for significant subset of patients • Established track record of performance in rare disease drug development • Business development acumen with expertise in licensing pipeline assets • Cash balance of $100.7 million at close of Q3 2021 • Cash runway through primary outcome data for OraGrowtH210 & OraGrowtH212 Trials • High quality, long-term investors