UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

| | |

For the quarterly period ended March 31, 2006 |

| | |

OR |

| | |

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

1-16725

(Commission file number)

PRINCIPAL FINANCIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

Delaware | | 42-1520346 |

(State or other jurisdiction of | | (I.R.S. Employer |

incorporation or organization) | | Identification Number) |

711 High Street, Des Moines, Iowa 50392

(Address of principal executive offices)

(515) 247-5111

(Registrant’s telephone number, including area code)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ý Accelerated Filer o Non-accelerated Filer o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No ý

The total number of shares of the registrant’s Common Stock, $0.01 par value, outstanding as of April 26, 2006 was 276,975,346.

PRINCIPAL FINANCIAL GROUP, INC.

TABLE OF CONTENTS

1

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

Principal Financial Group, Inc.

Consolidated Statements of Financial Position

| | March 31,

2006 | | December 31,

2005 | |

| | (Unaudited) | | | |

| | (in millions) | |

Assets | | | | | |

Fixed maturities, available-for-sale | | $ | 42,516.4 | | $ | 42,117.2 | |

Fixed maturities, trading | | 165.8 | | 113.2 | |

Equity securities, available-for-sale | | 722.4 | | 724.4 | |

Equity securities, trading | | 95.6 | | 90.3 | |

Mortgage loans | | 11,326.7 | | 11,484.3 | |

Real estate | | 1,009.8 | | 999.4 | |

Policy loans | | 838.0 | | 827.7 | |

Other investments | | 1,199.8 | | 1,113.5 | |

Total investments | | 57,874.5 | | 57,470.0 | |

Cash and cash equivalents | | 1,608.2 | | 1,641.3 | |

Accrued investment income | | 700.1 | | 682.7 | |

Premiums due and other receivables | | 673.6 | | 592.7 | |

Deferred policy acquisition costs | | 2,308.1 | | 2,174.1 | |

Property and equipment | | 420.6 | | 419.8 | |

Goodwill | | 299.2 | | 282.3 | |

Other intangibles | | 209.3 | | 202.6 | |

Separate account assets | | 66,343.4 | | 62,070.0 | |

Other assets | | 1,537.5 | | 1,499.9 | |

Total assets | | $ | 131,974.5 | | $ | 127,035.4 | |

Liabilities | | | | | |

Contractholder funds | | $ | 34,552.3 | | $ | 33,612.1 | |

Future policy benefits and claims | | 16,894.3 | | 16,825.5 | |

Other policyholder funds | | 653.3 | | 657.1 | |

Short-term debt | | 396.4 | | 476.4 | |

Long-term debt | | 893.6 | | 898.8 | |

Income taxes currently payable | | 0.5 | | — | |

Deferred income taxes | | 711.6 | | 974.8 | |

Separate account liabilities | | 66,343.4 | | 62,070.0 | |

Other liabilities | | 3,930.4 | | 3,713.5 | |

Total liabilities | | $ | 124,375.8 | | $ | 119,228.2 | |

2

Principal Financial Group, Inc.

Consolidated Statements of Financial Position (continued)

| | March 31,

2006 | | December 31,

2005 | |

| | (Unaudited) | | | |

| | (in millions) | |

Stockholders’ equity | | | | | |

Series A preferred stock, par value $.01 per share with liquidation preference of $100 per share - 3.0 million shares authorized, issued and outstanding in 2006 and 2005 | | $ | — | | $ | — | |

Series B preferred stock, par value $.01 per share with liquidation preference of $25 per share - 10.0 million shares authorized, issued and outstanding in 2006 and 2005 | | 0.1 | | 0.1 | |

Common stock, par value $.01 per share - 2,500.0 million shares authorized, 381.7 million and 381.3 million shares issued, and 277.6 million and 280.6 million shares outstanding in 2006 and 2005, respectively | | 3.8 | | 3.8 | |

Additional paid-in capital | | 8,024.8 | | 8,000.0 | |

Retained earnings | | 2,294.3 | | 2,008.6 | |

Accumulated other comprehensive income | | 639.3 | | 994.8 | |

Treasury stock, at cost (104.1 million and 100.7 million shares in 2006 and 2005, respectively) | | (3,363.6 | ) | (3,200.1 | ) |

Total stockholders’ equity | | 7,598.7 | | 7,807.2 | |

Total liabilities and stockholders’ equity | | $ | 131,974.5 | | $ | 127,035.4 | |

See accompanying notes.

3

Principal Financial Group, Inc.

Consolidated Statements of Operations

(Unaudited)

| | For the three months ended

March 31, | |

| | 2006 | | 2005 | |

| | (in millions,

except per share data) | |

Revenues | | | | | |

Premiums and other considerations | | $ | 1,041.8 | | $ | 934.1 | |

Fees and other revenues | | 448.8 | | 417.2 | |

Net investment income | | 852.2 | | 793.9 | |

Net realized/unrealized capital gains (losses) | | 48.9 | | (1.5 | ) |

Total revenues | | 2,391.7 | | 2,143.7 | |

Expenses | | | | | |

Benefits, claims, and settlement expenses | | 1,341.8 | | 1,234.3 | |

Dividends to policyholders | | 71.9 | | 72.9 | |

Operating expenses | | 604.4 | | 556.9 | |

Total expenses | | 2,018.1 | | 1,864.1 | |

Income from continuing operations before income taxes | | 373.6 | | 279.6 | |

Income taxes | | 79.7 | | 74.7 | |

Income from continuing operations, net of related income taxes | | 293.9 | | 204.9 | |

Income from discontinued operations, net of related income taxes | | — | | 0.6 | |

Net income | | 293.9 | | 205.5 | |

Preferred stock dividends | | 8.2 | | — | |

Net income available to common stockholders | | $ | 285.7 | | $ | 205.5 | |

Earnings per common share | | | | | |

Basic earnings per common share: | | | | | |

Income from continuing operations, net of related income taxes | | $ | 1.02 | | $ | 0.68 | |

Income from discontinued operations, net of related income taxes | | — | | 0.01 | |

Net income | | $ | 1.02 | | $ | 0.69 | |

Diluted earnings per common share: | | | | | |

Income from continuing operations, net of related income taxes | | $ | 1.01 | | $ | 0.68 | |

Income from discontinued operations, net of related income taxes | | — | | ¾ | |

Net income | | $ | 1.01 | | $ | 0.68 | |

See accompanying notes.

4

Principal Financial Group, Inc.

Consolidated Statements of Stockholders’ Equity

(Unaudited)

| | Series A

preferred

stock | | Series B

preferred

stock | | Common

stock | | Additional

paid-in

capital | | Retained

earnings | | Accumulated

other

comprehensive

income | | Treasury

stock | | Total

stockholders’

equity | |

| | (in millions) | |

Balances at January 1, 2005 | | $ | — | | $ | — | | $ | 3.8 | | $ | 7,269.4 | | $ | 1,289.5 | | $ | 1,313.3 | | $ | (2,331.7 | ) | $ | 7,544.3 | |

Common stock issued | | — | | — | | — | | 13.7 | | — | | — | | — | | 13.7 | |

Stock-based compensation, and additional related tax benefits | | — | | — | | — | | 11.1 | | — | | — | | — | | 11.1 | |

Treasury stock acquired, common | | — | | — | | — | | ¾ | | — | | — | | (164.6 | ) | (164.6 | ) |

Comprehensive loss: | | — | | — | | | | | | | | | | | | | |

Net income | | — | | — | | — | | — | | 205.5 | | — | | — | | 205.5 | |

Net unrealized losses | | — | | — | | — | | — | | — | | (406.7 | ) | — | | (406.7 | ) |

Provision for deferred income taxes | | — | | — | | — | | — | | — | | 147.8 | | — | | 147.8 | |

Foreign currency translation adjustment, net of related income taxes | | — | | — | | — | | — | | — | | (8.0 | ) | — | | (8.0 | ) |

Comprehensive loss | | | | | | | | | | | | | | | | (61.4 | ) |

Balances at March 31, 2005 | | $ | — | | $ | — | | $ | 3.8 | | $ | 7,294.2 | | $ | 1,495.0 | | $ | 1,046.4 | | $ | (2,496.3 | ) | $ | 7,343.1 | |

| | | | | | | | | | | | | | | | | |

Balances at January 1, 2006 | | $ | — | | $ | 0.1 | | $ | 3.8 | | $ | 8,000.0 | | $ | 2,008.6 | | $ | 994.8 | | $ | (3,200.1 | ) | $ | 7,807.2 | |

Common stock issued | | — | | — | | — | | 11.7 | | — | | — | | — | | 11.7 | |

Capital transactions of equity method investee, net of related income taxes | | — | | — | | — | | 0.4 | | — | | — | | — | | 0.4 | |

Stock-based compensation, and additional related tax benefits | | — | | — | | — | | 12.7 | | — | | — | | — | | 12.7 | |

Treasury stock acquired, common | | — | | — | | — | | — | | — | | — | | (163.5 | ) | (163.5 | ) |

Dividends to preferred stockholders | | — | | — | | — | | — | | (8.2 | ) | — | | — | | (8.2 | ) |

Comprehensive loss: | | | | | | | | | | | | | | | | | |

Net income | | — | | — | | — | | — | | 293.9 | | — | | — | | 293.9 | |

Net unrealized losses | | — | | — | | — | | — | | — | | (533.9 | ) | — | | (533.9 | ) |

Provision for deferred income taxes | | — | | — | | — | | — | | — | | 181.1 | | — | | 181.1 | |

Foreign currency translation adjustment, net of related income taxes | | — | | — | | — | | — | | — | | (2.7 | ) | — | | (2.7 | ) |

Comprehensive loss | | | | | | | | | | | | | | | | (61.6 | ) |

Balances at March 31, 2006 | | $ | — | | $ | 0.1 | | $ | 3.8 | | $ | 8,024.8 | | $ | 2,294.3 | | $ | 639.3 | | $ | (3,363.6 | ) | $ | 7,598.7 | |

5

Principal Financial Group, Inc.

Consolidated Statements of Cash Flows

(Unaudited)

| | For three months ended

March 31, | |

| | 2006 | | 2005 | |

| | | | (As Restated -

See Note 1) | |

| | (in millions) | |

Operating activities | | | | | |

Net income | | $ | 293.9 | | $ | 205.5 | |

Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | | | |

Income from discontinued operations, net of related income taxes | | — | | (0.6 | ) |

Amortization of deferred policy acquisition costs | | 71.8 | | 62.2 | |

Additions to deferred policy acquisition costs | | (120.5 | ) | (127.7 | ) |

Accrued investment income | | (17.4 | ) | 2.5 | |

Net cash flows from trading securities | | (55.9 | ) | — | |

Premiums due and other receivables | | (15.8 | ) | 6.3 | |

Contractholder and policyholder liabilities and dividends | | 282.1 | | 389.7 | |

Current and deferred income taxes | | 36.3 | | (417.6 | ) |

Net realized/unrealized capital (gains) losses | | (48.9 | ) | 1.5 | |

Depreciation and amortization expense | | 23.4 | | 25.3 | |

Mortgage loans held for sale, acquired or originated | | (209.6 | ) | (476.5 | ) |

Mortgage loans held for sale, sold or repaid, net of gain | | 339.7 | | 416.2 | |

Real estate acquired through operating activities | | (4.9 | ) | (15.5 | ) |

Real estate sold through operating activities | | 0.9 | | 0.7 | |

Stock-based compensation | | 12.3 | | 11.2 | |

Other | | (162.0 | ) | (161.4 | ) |

Net adjustments | | 131.5 | | (283.7 | ) |

Net cash provided by (used in) operating activities | | 425.4 | | (78.2 | ) |

Investing activities | | | | | |

Available-for-sale securities: | | | | | |

Purchases | | (2,390.3 | ) | (1,979.8 | ) |

Sales | | 373.3 | | 468.5 | |

Maturities | | 947.3 | | 1,296.5 | |

Mortgage loans acquired or originated | | (593.5 | ) | (539.5 | ) |

Mortgage loans sold or repaid | | 609.0 | | 478.4 | |

Real estate acquired | | (13.1 | ) | (9.8 | ) |

Real estate sold | | 0.9 | | 63.8 | |

Net purchases of property and equipment | | (12.5 | ) | (21.6 | ) |

Purchases of interest in subsidiaries, net of cash acquired | | (5.5 | ) | (52.9 | ) |

Net change in other investments | | 96.8 | | (3.0 | ) |

Net cash used in investing activities | | $ | (987.6 | ) | $ | (299.4 | ) |

6

Principal Financial Group, Inc.

Consolidated Statements of Cash Flows (continued)

(Unaudited)

| | For the three months ended,

March 31, | |

| | 2006 | | 2005 | |

| | | | (As Restated -

See Note 1) | |

| | (in millions) | |

Financing activities | | | | | |

Issuance of common stock | | $ | 11.7 | | $ | 13.7 | |

Acquisition and sales of treasury stock, net | | (163.5 | ) | (164.6 | ) |

Proceeds from financing element derivatives | | 40.6 | | 42.8 | |

Payments for financing element derivatives | | (38.3 | ) | (31.1 | ) |

Excess tax benefits from share-based payment arrangements | | 0.6 | | — | |

Dividends to preferred stockholders | | (8.2 | ) | — | |

Issuance of long-term debt | | 0.2 | | 7.7 | |

Principal repayments of long-term debt | | (0.6 | ) | (0.8 | ) |

Net proceeds (repayments) of short-term borrowings | | (78.8 | ) | 477.1 | |

Investment contract deposits | | 2,760.6 | | 2,036.8 | |

Investment contract withdrawals | | (2,012.5 | ) | (1,905.3 | ) |

Net increase (decrease) in banking operation deposits | | 17.3 | | (4.4 | ) |

Net cash provided by financing activities | | 529.1 | | 471.9 | |

Discontinued operations | | | | | |

Net cash provided by operating activities | | — | | 1.7 | |

Net cash provided by discontinued operations | | — | | 1.7 | |

Net increase (decrease) in cash and cash equivalents | | (33.1 | ) | 96.0 | |

Cash and cash equivalents at beginning of period | | 1,641.3 | | 452.2 | |

Cash and cash equivalents at end of period | | $ | 1,608.2 | | $ | 548.5 | |

Cash and cash equivalents of discontinued operations included above | | | | | |

At beginning of period | | $ | — | | $ | 1.9 | |

At end of period | | $ | — | | $ | 3.6 | |

See accompanying notes

7

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements

March 31, 2006

(Unaudited)

1. Nature of Operations and Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements of Principal Financial Group, Inc. (“PFG”), its majority-owned subsidiaries and its consolidated variable interest entities (“VIE”), have been prepared in conformity with accounting principles generally accepted in the U.S. (“U.S. GAAP”) for interim financial statements and with the instructions to Form 10-Q and Article 10 of Regulation S-X. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three months ended March 31, 2006, are not necessarily indicative of the results that may be expected for the year ended December 31, 2006. These interim unaudited consolidated financial statements should be read in conjunction with our annual audited financial statements as of December 31, 2005, included in our Form 10-K for the year ended December 31, 2005, filed with the United States Securities and Exchange Commission (“SEC”). The accompanying consolidated statement of financial position at December 31, 2005, has been derived from the audited consolidated statement of financial position but does not include all of the information and footnotes required by U.S. GAAP for complete financial statements.

Restatement

For the year ended December 31, 2005, we separately disclosed the operating, investing and financing portions of the cash flows attributable to our discontinued operations, which in the prior interim periods were excluded from the statement of cash flows. We have restated the statements of cash flows for the interim periods of 2005 to include and separately disclose the operating, investing, and financing portions of the cash flows attributable to our discontinued operations.

Recent Accounting Pronouncements

On March 17, 2006, the Financial Accounting Standards Board (the “FASB”) issued Statement of Financial Accounting Standards (“SFAS”) No. 156, Accounting for Servicing of Financial Assets (“SFAS 156”), which amends SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities (“SFAS 140”). This Statement (1) requires an entity to recognize a servicing asset or liability each time it undertakes an obligation to service a financial asset by entering into a servicing contract in specified situations, (2) requires all separately recognized servicing assets and liabilities to be initially measured at fair value, (3) for subsequent measurement of each class of separately recognized servicing assets and liabilities, an entity can elect either the amortization or fair value measurement method, (4) permits a one-time reclassification of available-for-sale (“AFS”) securities to trading securities by an entity with recognized servicing rights, without calling into question the treatment of other AFS securities, provided the AFS securities are identified in some manner as offsetting the entity’s exposure to changes in fair value of servicing assets or liabilities that a servicer elects to subsequently measure at fair value, and (5) requires separate presentation of servicing assets and liabilities measured at fair value in the statement of financial position and also requires additional disclosures. The initial measurement requirements of this statement should be applied prospectively to all transactions entered into after the fiscal year beginning after September 15, 2006. The election related to the subsequent measurement of servicing assets and liabilities is also effective the first fiscal year beginning after September 15, 2006. We are currently evaluating the impact this guidance will have on our consolidated financial statements.

8

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

1. Nature of Operations and Significant Accounting Policies (continued)

On February 16, 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Financial Instruments – an amendment of FASB Statements No. 133 and 140 (“SFAS 155”), which amends SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities (“SFAS 133”) and SFAS 140. SFAS 155 (1) permits fair value remeasurement for any hybrid financial instrument that contains an embedded derivative that otherwise would require bifurcation, (2) clarifies which interest-only and principal-only strips are not subject to the requirements of SFAS 133, (3) establishes a requirement to evaluate interests in securitized financial assets to identify interests that are freestanding derivatives or that are hybrid financial instruments that contain an embedded derivative requiring bifurcation, (4) clarifies that concentrations of credit risk in the form of subordination are not embedded derivatives, and (5) amends SFAS 140 to eliminate the prohibition on a qualifying special-purpose entity from holding a derivative financial instrument that pertains to a beneficial interest other than another derivative financial instrument. This Statement is effective for all financial instruments acquired or issued after the beginning of an entity’s fiscal year that begins after September 15, 2006. At adoption, the fair value election may also be applied to hybrid financial instruments that have been bifurcated under SFAS 133 prior to adoption of this Statement. Any changes resulting from the adoption of this Statement should be recognized as a cumulative effect adjustment to beginning retained earnings. We are currently evaluating the impact this guidance will have on our consolidated financial statements.

On December 16, 2004, the FASB issued SFAS No. 123 (revised 2004), Share-Based Payment (“SFAS 123R”). SFAS 123R requires all share-based payments to employees to be recognized at fair value in the financial statements. SFAS 123R replaces SFAS No. 123, Accounting for Stock-Based Compensation (“SFAS 123”), supersedes APB Opinion No. 25, Accounting for Stock Issued to Employees (“APB 25”), and SFAS No. 148, Accounting for Stock-Based Compensation-Transition and Disclosure - an Amendment of FASB Statement No. 123 and amends SFAS No. 95, Statement of Cash Flows. On April 14, 2005, the SEC approved a new rule delaying the effective date of SFAS 123R to annual periods that begin after June 15, 2005. Accordingly, we adopted SFAS 123R effective January 1, 2006 using the modified-prospective method.

It is appropriate to recognize compensation cost either immediately for stock awards granted to retirement eligible employees, or over the period from the grant date to the date retirement eligibility is achieved, if retirement eligibility is expected to occur during the nominal vesting period. Our approach was to follow the widespread practice of recognizing compensation cost over the explicit service period (up to the date of actual retirement). For any awards that are granted after our adoption of SFAS 123R on January 1, 2006, we recognize compensation cost through the period that the employee first becomes eligible to retire and is no longer required to provide service to earn the award. If we had applied the nonsubstantive vesting provisions of SFAS 123R to awards granted prior to January 1, 2006, our consolidated financial statements would not have been materially impacted.

SFAS 123R requires that the benefits of tax deductions in excess of recognized compensation cost be reported as a financing cash flow, rather than as an operating cash flow. This requirement will reduce net operating cash flows and increase net financing cash flows in periods after the effective date. While the company cannot estimate what those amounts will be in the future, (because they depend on, among other things, when employees exercise stock options), the amount of operating cash flows recognized for the three months ended March 31, 2006, for such excess tax deductions, was $0.6 million.

Under the modified-prospective method, any excess income tax deduction realized for awards accounted for under SFAS 123R (regardless of the type of award or the jurisdiction in which the tax benefit is generated) is eligible to absorb write-offs of deferred income tax assets for any awards accounted for under SFAS 123R. SFAS 123R does not require separate pools of excess income tax benefits for separate types of awards, rather the excess income tax benefits of employee and nonemployee awards may be combined in a single pool of excess tax benefits. Our policy is to pool the employee and nonemployee awards together in this manner. Deferred income tax asset write-offs resulting from deficient deductions on employee awards may be offset against previous excess income tax benefits arising from nonemployee awards, and vice versa.

9

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

1. Nature of Operations and Significant Accounting Policies (continued)

This Statement did not have a material impact on our consolidated financial statements as we began expensing all stock options using a fair-value based method effective for the year beginning January 1, 2002. In addition, any stock options granted prior to January 1, 2002 were fully vested at the time of adoption of SFAS 123R. We use the Black-Scholes formula to estimate the value of stock options granted to employees. We applied the prospective method of transition as prescribed by SFAS 123 when we elected to begin expensing stock-based compensation in 2002. The cumulative effect of the change in accounting principle as a result of adopting this Statement is immaterial. Therefore, the pre-tax cumulative effect of the change in accounting principle is reflected in operating expenses.

Separate Accounts

As of March 31, 2006 and December 31, 2005, the separate accounts include a separate account valued at $713.1 million and $726.6 million, respectively, which primarily includes shares of our stock that were allocated and issued to eligible participants of qualified employee benefit plans administered by us as part of the policy credits issued under our 2001 demutualization. These shares are included in both basic and diluted earnings per share calculations. The separate account shares are recorded at fair value and are reported as separate account assets and separate account liabilities in the consolidated statements of financial position. Changes in fair value of the separate account shares are reflected in both the separate account assets and separate account liabilities and do not impact our results of operations.

2. Federal Income Taxes

The effective income tax rate on income from continuing operations for the three months ended March 31, 2006 is lower than the prevailing corporate federal income tax rate primarily due to income tax deductions allowed for corporate dividends received, a favorable court ruling on a contested Internal Revenue Service issue for 1991 and later years, and interest exclusion from taxable income. The effective income tax rate on income from continuing operations for the three months ended March 31, 2005 is lower than the prevailing corporate federal income tax rate primarily due to income tax deductions allowed for corporate dividends received and interest exclusion from taxable income.

3. Employee and Agent Benefits

Effective January 1, 2006, we made changes to our retirement program, including the Principal Select Saving Plan (“401(k)”), the Principal Pension Plan (“Pension Plan”) and the corresponding nonqualified plans. The qualified and nonqualified pension plans’ changes include a reduction to the traditional and cash balance formulas, a change in the early retirement factors, and the removal of the cost of living adjustments for traditional benefits earned after January 1, 2006. The qualified and nonqualified 401(k) plans’ company match increased from 50% of a 6% deferral to 75% of an 8% deferral. The Pension Plan changes reduced the Pension Plan expense in 2006, while the 401(k) changes increased the 401(k) expense.

10

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

3. Employee and Agent Benefits (continued)

Components of net periodic benefit cost (income):

| | Pension benefits | | Other postretirement

benefits | |

| | For the three months ended

March 31, | | For the three months ended

March 31, | |

| | 2006 | | 2005 | | 2006 | | 2005 | |

| | (in millions) | |

Service cost | | $ | 11.7 | | $ | 12.4 | | $ | 2.4 | | $ | 2.5 | |

Interest cost | | 20.4 | | 19.4 | | 4.0 | | 4.2 | |

Expected return on plan assets | | (26.3 | ) | (24.1 | ) | (8.1 | ) | (7.3 | ) |

Amortization of prior service cost (benefit) | | (2.2 | ) | 0.4 | | (0.6 | ) | (0.6 | ) |

Recognized net actuarial loss | | 5.1 | | 4.1 | | — | | 0.1 | |

Net periodic benefit cost | | $ | 8.7 | | $ | 12.2 | | $ | (2.3 | ) | $ | (1.1 | ) |

Contributions

We anticipate contributing $0.4 million in 2006 to fund our other postretirement benefit plans. We contributed $0.1 million during the three months ended March 31, 2006.

Our funding policy for the qualified pension plan is to fund the plan annually in an amount at least equal to the minimum annual contribution required under the Employee Retirement Income Security Act (“ERISA”) and, generally, not greater than the maximum amount that can be deducted for federal income tax purposes. The minimum annual contribution for 2006 will be zero so we will not be required to fund the qualified pension plan during 2006. However, it is possible that we may fund the qualified and nonqualified plans in 2006 in the range of $10.0 million to $50.0 million. During the three months ended March 31, 2006, no contributions were made to the plans.

11

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

4. Contingencies, Guarantees and Indemnifications

Litigation

We are regularly involved in litigation, both as a defendant and as a plaintiff, but primarily as a defendant. Litigation naming us as a defendant ordinarily arises out of our business operations as a provider of asset management and accumulation products and services, life, health and disability insurance. Some of the lawsuits are class actions, or purport to be, and some include claims for punitive damages. In addition, regulatory bodies, such as state insurance departments, the SEC, the National Association of Securities Dealers, Inc., the Department of Labor and other regulatory bodies regularly make inquiries and conduct examinations or investigations concerning our compliance with, among other things, insurance laws, securities laws, ERISA and laws governing the activities of broker-dealers.

Several lawsuits have been filed against other insurance companies and insurance brokers alleging improper conduct relating to the payment and non-disclosure of contingent compensation and bid-rigging activity. Several of these suits were filed as purported class actions. Several state attorneys general and insurance regulators have initiated industry-wide inquiries or other actions relating to compensation arrangements between insurance brokers and insurance companies and other industry issues. We received a subpoena on March 3, 2005 from the Office of the Attorney General of the State of New York seeking information on compensation agreements associated with the sale of retirement products. On January 13, 2006, we received a subpoena and a set of interrogatories from the Office of the Attorney General of the State of Connecticut seeking information and documents relating to payment of contingent compensation to brokers and actions in restraint of trade in the sale of group annuities. We are cooperating with these inquiries. We have received requests from regulators and other governmental authorities relating to industry issues and may receive such requests in the future.

On December 23, 2004, a lawsuit was filed in Iowa state court against us and our wholly owned subsidiaries, Principal Life Insurance Company, Inc. (“Principal Life”) and Principal Financial Services, Inc., on behalf of a proposed class comprised of the settlement class in the Principal Life sales practices class action settlement, which was approved in April 2001 by the United States District Court for the Southern District of Iowa. This more recent lawsuit claims that the treatment of the settlement costs of that sales practices litigation in relation to the allocation of demutualization consideration to Principal Life policyholders was inappropriate. Demutualization allocation was done pursuant to the terms of a plan of demutualization approved by the policyholders in July 2001 and Insurance Commissioner of the State of Iowa in August 2001. The lawsuit further claims that such allocation was not accurately described to policyholders during the demutualization process and is a breach of the sales practices settlement. On January 27, 2005, we filed a notice to remove the action from state court to the United States District Court for the Southern District of Iowa. On July 22, 2005, the plaintiff’s motion to remand the action to state court was denied, and our motion to dismiss the lawsuit was granted. On September 21, 2005, the plaintiff’s motion to alter or amend the judgment was denied. On October 4, 2005, the plaintiff filed a notice of appeal to the United State Court of Appeals for the Eighth Circuit.

A lawsuit was filed against us, Principal Life, and Principal Financial Services, Inc. in the United States District Court for the Southern District of Iowa on October 31, 2005, but the plaintiff dismissed the case without prejudice on March 17, 2006. The claims and allegations in the lawsuit were substantially the same as those in the December 23, 2004 lawsuit, but the proposed class was limited to those members of the settlement class in the Principal Life sales practices class action settlement who did not own annuities and who received demutualization consideration in the form of cash under the plan of demutualization.

12

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

4. Contingencies, Guarantees and Indemnifications (continued)

While the outcome of any pending or future litigation cannot be predicted, management does not believe that any pending litigation will have a material adverse effect on our business or financial position. The outcome of litigation is always uncertain, and unforeseen results can occur. It is possible that such outcomes could materially affect net income in a particular quarter or annual period.

Guarantees and Indemnifications

In the normal course of business, we have provided guarantees to third parties primarily related to a former subsidiary, joint ventures and industrial revenue bonds. These agreements generally expire from 2005 through 2019. The maximum exposure under these agreements as of March 31, 2006, was approximately $174.0 million; however, we believe the likelihood is remote that material payments will be required and therefore have not accrued for a liability on our consolidated statements of financial position. Should we be required to perform under these guarantees, we generally could recover a portion of the loss from third parties through recourse provisions included in agreements with such parties, the sale of assets held as collateral that can be liquidated in the event that performance is required under the guarantees or other recourse generally available to us, therefore, such guarantees would not result in a material adverse effect on our business or financial position. It is possible that such outcomes could materially affect net income in a particular quarter or annual period. The fair value of such guarantees is not material.

In connection with the 2002 sale of BT Financial Group, we agreed to indemnify the purchaser, Westpac Banking Corporation (“Westpac”), for among other things, the costs associated with potential late filings made by BT Financial Group in New Zealand prior to Westpac’s ownership, up to a maximum of A$250.0 million Australian dollars (approximately U.S. $179.0 million as of March 31, 2006). New Zealand securities regulations allow Australian issuers to issue their securities in New Zealand provided that certain documents are appropriately filed with the New Zealand Registrar of Companies. Specifically, the regulations require that any amendments to constitutions and compliance plans be filed in New Zealand. In April 2003, the New Zealand Securities Commission opined that such late filings would result in certain New Zealand investors having a right to return of their investment plus interest at 10% per annum from the date of investment. This technical issue affected many in the industry.

On December 24, 2004, Westpac lodged several warranty and indemnification claims related to the sale of BT Financial Group. The claims aggregated approximately A$50.0 million Australian dollars (approximately U.S. $36.0 million as of March 31, 2006) with the majority of the claims (approximately A$45.0 million Australian dollars, or U.S. $32.0 million as of March 31, 2006) related to fund pricing and accounting issues around a tax asset called future income tax benefit (“FITB”). FITB is an asset used in calculating unit pricing of funds. Westpac claimed that BT Financial Group incorrectly accrued FITB assets in valuing asset portfolios of BT funds in Australia and New Zealand and that, as a result, fund values were overstated.

The claims made by Westpac related to both indemnifications were settled and paid by us in 2006. This settlement did not have a material impact on net income.

13

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

4. Contingencies, Guarantees and Indemnifications (continued)

We are also subject to various other indemnification obligations issued in conjunction with certain transactions, primarily the sale of Principal Residential Mortgage, Inc. and other divestitures, acquisitions and financing transactions whose terms range in duration and often are not explicitly defined. Certain portions of these indemnifications may be capped, while other portions are not subject to such limitations; therefore, the overall maximum amount of the obligation under the indemnifications cannot be reasonably estimated. While we are unable to estimate with certainty the ultimate legal and financial liability with respect to these indemnifications, we believe the likelihood is remote that material payments would be required under such indemnifications and therefore such indemnifications would not result in a material adverse effect on our business or financial position. It is possible that such outcomes could materially affect net income in a particular quarter or annual period. The fair value of such indemnifications is not material.

5. Stockholders’ Equity

Reconciliation of Outstanding Shares

| | Series A

Preferred

Stock | | Series B

Preferred

Stock | | Common

Stock | |

| | (in millions) | |

Outstanding shares at January 1, 2005 | | — | | — | | 300.6 | |

Shares issued | | — | | — | | 0.4 | |

Treasury stock acquired | | — | | — | | (4.2 | ) |

Outstanding shares at March 31, 2005 | | — | | — | | 296.8 | |

| | | | | | | |

Outstanding shares at January 1, 2006 | | 3.0 | | 10.0 | | 280.6 | |

Shares issued | | — | | — | | 0.4 | |

Treasury stock acquired | | — | | — | | (3.4 | ) |

Outstanding shares at March 31, 2006 | | 3.0 | | 10.0 | | 277.6 | |

14

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

6. Comprehensive Loss

Comprehensive loss is as follows:

| | For the three months ended

March 31, | |

| | 2006 | | 2005 | |

| | (in millions) | |

Comprehensive loss: | | | | | |

Net income | | $ | 293.9 | | $ | 205.5 | |

Net change in unrealized gains and losses on fixed maturities, available-for-sale | | (743.3 | ) | (532.5 | ) |

Net change in unrealized gains and losses on equity securities, available-for-sale | | 1.3 | | (6.3 | ) |

Net change in unrealized gains and losses on equity method subsidiaries and minority interest adjustments | | 69.5 | | 0.3 | |

Adjustments for assumed changes in amortization patterns: | | | | | |

Deferred policy acquisition costs | | 87.7 | | 43.6 | |

Sales inducements | | 4.5 | | 3.6 | |

Unearned revenue reserves | | (3.8 | ) | 7.1 | |

Net change in unrealized gains and losses on derivative instruments | | 16.5 | | 24.6 | |

Adjustments to unrealized gains and losses for Closed Block policyholder dividend obligation | | 33.7 | | 52.9 | |

Change in net foreign currency translation adjustment | | 1.4 | | (9.0 | ) |

Provision for deferred income tax benefit | | 177.0 | | 148.8 | |

Comprehensive loss | | $ | (61.6 | ) | $ | (61.4 | ) |

15

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

7. Segment Information

We provide financial products and services through the following segments: U.S. Asset Management and Accumulation, International Asset Management and Accumulation and Life and Health Insurance. In addition, there is a Corporate and Other segment. The segments are managed and reported separately because they provide different products and services, have different strategies or have different markets and distribution channels.

The U.S. Asset Management and Accumulation segment provides retirement and related financial products and services primarily to businesses, their employees and other individuals and provides asset management services to our asset accumulation business, the life and health insurance operations, the Corporate and Other segment and third-party clients.

The International Asset Management and Accumulation segment consists of Principal International operations in Chile, Mexico, Hong Kong, Brazil, India, China, and Malaysia. We focus on countries with favorable demographics and a trend toward private sector defined contribution pension systems. We entered these countries through acquisitions, start-up operations and joint ventures.

The Life and Health insurance segment provides individual life insurance, group health insurance and specialty benefits, which consists of group dental and vision insurance, individual and group disability insurance and group life insurance, throughout the United States.

The Corporate and Other segment manages the assets representing capital that has not been allocated to any other segment. Financial results of the Corporate and Other segment primarily reflect our financing activities (including interest expense), income on capital not allocated to other segments, inter-segment eliminations, income tax risks and certain income, expenses and other after-tax adjustments not allocated to the segments based on the nature of such items.

Management uses segment operating earnings for goal setting, determining employee compensation and evaluating performance on a basis comparable to that used by securities analysts. We determine segment operating earnings by adjusting U.S. GAAP net income available to common stockholders for net realized/unrealized capital gains and losses, as adjusted, and other after-tax adjustments which management believes are not indicative of overall operating trends. Net realized/unrealized capital gains and losses, as adjusted, are net of income taxes, related changes in the amortization pattern of DPAC and sales inducements, recognition of front-end fee revenues for sales charges on pension products and services, net realized capital gains and losses distributed, minority interest capital gains and losses and certain market value adjustments to fee revenues. Segment operating revenues exclude net realized/unrealized capital gains and their impact on recognition of front-end fee revenues and certain market value adjustments to fee revenues and include operating revenues from real estate properties that qualify for discontinued operations treatment under SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets. While these items may be significant components in understanding and assessing the consolidated financial performance, management believes the presentation of segment operating earnings enhances the understanding of our results of operations by highlighting earnings attributable to the normal, ongoing operations of the business.

The accounting policies of the segments are consistent with the accounting policies for the consolidated financial statements, with the exception of income tax allocation. The Corporate and Other segment functions to absorb the risk inherent in interpreting and applying tax law. The segments are allocated tax adjustments consistent with our tax position. The Corporate and Other segment results reflect any differences between the tax returns and the estimated resolution of any disputes.

16

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

7. Segment Information (continued)

The following tables summarize selected financial information by segment and reconcile segment totals to those reported in the consolidated financial statements:

| | March 31,

2006 | | December 31,

2005 | |

| | (in millions) | |

Assets: | | | | | |

U.S. Asset Management and Accumulation | | $ | 108,307.9 | | $ | 103,506.1 | |

International Asset Management and Accumulation | | 6,978.7 | | 6,856.2 | |

Life and Health Insurance | | 14,090.4 | | 14,080.2 | |

Corporate and Other | | 2,597.5 | | 2,592.9 | |

Total consolidated assets | | $ | 131,974.5 | | $ | 127,035.4 | |

| | For the three months ended

March 31, | |

| | 2006 | | 2005 | |

| | (in millions) | |

Operating revenues by segment: | | | | | |

U.S. Asset Management and Accumulation | | $ | 1,049.8 | | $ | 957.3 | |

International Asset Management and Accumulation | | 143.4 | | 132.8 | |

Life and Health Insurance | | 1,159.6 | | 1,068.6 | |

Corporate and Other | | (9.7 | ) | (10.1 | ) |

Total segment operating revenues | | 2,343.1 | | 2,148.6 | |

Add: | | | | | |

Net realized/unrealized capital gains (losses), including recognition of front-end fee revenues and certain market value adjustments to fee revenues | | 48.6 | | (4.0 | ) |

Subtract: | | | | | |

Operating revenues from discontinued real estate investments | | — | | 0.9 | |

Total revenues per consolidated statements of operations | | $ | 2,391.7 | | $ | 2,143.7 | |

Operating earnings (loss) by segment, net of related income taxes: | | | | | |

U.S. Asset Management and Accumulation | | $ | 157.8 | | $ | 138.6 | |

International Asset Management and Accumulation | | 17.6 | | 9.5 | |

Life and Health Insurance | | 70.4 | | 69.5 | |

Corporate and Other | | (5.6 | ) | (8.4 | ) |

Total segment operating earnings, net of related income taxes | | 240.2 | | 209.2 | |

Net realized/unrealized capital gains (losses), as adjusted | | 24.9 | | (3.7 | ) |

Other after-tax adjustments (1) | | 20.6 | | ¾ | |

Net income available to common stockholders per consolidated statements of operations | | $ | 285.7 | | $ | 205.5 | |

(1) In 2006, other after-tax adjustments of $20.6 million included the positive effect of a favorable court ruling on a contested IRS issue.

17

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

8. Stock-Based Compensation Plans

As of March 31, 2006, we have the 2005 Stock Incentive Plan, the Employee Stock Purchase Plan, the 2005 Directors Stock Plan, the Stock Incentive Plan, the Directors Stock Plan and the Long-Term Performance Plan. As of May 17, 2005, no new grants will be made under the Stock Incentive Plan, the Directors Stock Plan or the Long-Term Performance Plan (“Stock-Based Compensation Plans”). Under the terms of the 2005 Stock Incentive Plan, grants may be nonqualified stock options, incentive stock options qualifying under Section 422 of the Internal Revenue Code, restricted stock, restricted stock units, stock appreciation rights, performance shares, performance units, or other stock based awards. The 2005 Directors Stock Plan provides for the grant of nonqualified stock options, restricted stock, restricted stock units, or other stock-based awards to our nonemployee directors. To date, we have not granted any incentive stock options, restricted stock, or performance units.

As of March 31, 2006, the maximum number of new shares of common stock that were available for grant under the 2005 Stock Incentive Plan and the 2005 Directors Stock Plan was 21.5 million.

The compensation cost that was charged against income for the Stock-Based Compensation Plans was $11.6 million and $7.3 million, and the related income tax benefit recognized in the income statement was $3.4 million and $2.1 million for the three months ended March 31, 2006 and 2005, respectively. For awards with graded vesting, we use an accelerated expense attribution method. The total compensation cost capitalized as part of the cost of an asset was $0.9 million and $0.2 million for the three months ended March 31, 2006 and 2005, respectively.

Nonqualified Stock Options

We issue nonqualified stock options under the 2005 Directors Stock Plan, Directors Stock Plan, 2005 Stock Incentive Plan, and Stock Incentive Plan. Nonqualified stock options are treated as an equity award.

Non-qualified stock options were granted to certain employees under the Stock Incentive Plan and the 2005 Stock Incentive Plan. Total options granted under the Stock Incentive Plan and the 2005 Stock Incentive Plan were 2.1 million and 2.7 million for the three months ended March 31, 2006 and 2005, respectively. Options outstanding under the Stock Incentive Plan and the 2005 Stock Incentive Plan were granted at an exercise price equal to the market value of our common stock on the date of grant, and expire ten years after the grant date. These options are treated as an equity award and have graded or cliff vesting over a three-year period.

Non-qualified stock options granted under the Directors stock plans have an exercise price equal to the fair market value of the common stock on the date of the grant and a contractual term equal to the earlier of five years from the date the participant ceases to provide service or the tenth anniversary of the date the option was granted. Beginning with the 2003 grant, options become exercisable in four approximately equal installments on the three, six and nine month anniversaries of the grant date, and on the date that the Director’s full term of office expires. There were no options granted during the three months ended March 31, 2006 or 2005.

The fair value of stock options is estimated using the Black-Scholes option pricing model that uses the assumptions noted in the following table. Expected volatilities are based on historical volatility of our stock and other factors. Due to our limited public company history, we use peer data to estimate option exercise and employee termination within the valuation model. Separate groups of employees that have similar historical exercise behavior are considered separately for valuation purposes. The expected term of options granted is estimated based on peer data and represents the period of time that options granted are expected to be outstanding. The risk-free rate for periods within the expected life of the option is based on the U.S. Treasury risk free interest rate in effect at the time of grant.

Cash received from option exercise under all share-based payment arrangements for the three months ended March 31, 2006 was $6.1 million. The actual tax benefits realized for the tax deductions for option exercise of the share-based payment arrangements were $3.4 million for the three months ended March 31, 2006.

18

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

8. Stock-Based Compensation Plans (continued).

The following is a summary of assumptions for the stock options:

| | For the three months ended

March 31, | |

Options | | 2006 | | 2005 | |

Dividend yield | | 1.32 | % | 1.41 | % |

Expected volatility | | 16.2 | % | 19.1 | % |

Risk-free interest rate | | 4.6 | % | 4.1 | % |

Expected life (in years) | | 6 | | 6 | |

The weighted-average estimated fair value of stock options granted during the three months ended March 31, 2006 and 2005, using the Black-Scholes option valuation model was $11.40 and $9.17 per share, respectively.

The following is a summary of the status of all of our stock option plans for the three months ended March 31, 2006:

| | | | Weighted-average | | Intrinsic | |

| | Number of options | | exercise price | | Value | |

| | (in millions) | | | | (in millions) | |

Options outstanding at January 1, 2006 | | 7.8 | | $ | 33.06 | | | |

Granted | | 2.1 | | 49.25 | | | |

Exercised | | 0.2 | | 29.44 | | | |

Canceled | | — | | — | | | |

Options outstanding at March 31, 2006 | | 9.7 | | $ | 36.62 | | $117.7 | |

Vested or expected to vest at March 31, 2006 | | 9.2 | | $ | 36.20 | | $116.2 | |

Options exercisable at March 31, 2006 | | 5.2 | | $ | 30.86 | | $93.1 | |

The total intrinsic value of options exercised during the three months ended March 31, 2006 and 2005 was $4.1 million and $3.3 million, respectively.

The following is a summary of weighted-average remaining contractual lives for stock options outstanding and the range of exercise prices on the stock options as of March 31, 2006.

Range of exercise prices | | Number of

options

outstanding | | Weighted-average

remaining

contractual life | |

| | (in millions) | | | |

$22.33 - $28.93 | | 3.0 | | 6 | |

$29.10 - $35.54 | | 0.3 | | 7 | |

$35.73 - $44.13 | | 4.3 | | 8 | |

$46.40 - $49.25 | | 2.1 | | 10 | |

$22.33 - $49.25 | | 9.7 | | 8 | |

The weighted-average remaining contractual lives for stock options exercisable is approximately 7 years as of March 31, 2006.

19

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

8. Stock-Based Compensation Plans (continued)

Performance Share Awards

Beginning in 2006, we granted performance share awards to certain employees. The performance share awards are treated as an equity award and cliff vest at the end of the service period. The performance shares earned, and paid in shares, depend upon the participant’s continued employment through the performance period and our performance against three-year goals set at the beginning of the performance period. A return on equity objective and an earnings per share objective must be achieved for any of the performance shares to be earned. If the performance requirements are not met, the performance shares will be forfeited and no compensation cost is recognized and any previously recognized compensation cost is reversed. There is no maximum contractual term on these awards. As of March 31, 2006, there were $37.2 million of total unrecognized compensation costs related to nonvested performance share awards granted. The cost is expected to be recognized over a weighted-average service period of approximately 3 years.

The fair value of performance share awards is determined based on the closing stock price of our shares on the grant date. The weighted-average grant-date fair value of performance share awards granted during the three months ended March 31, 2006 was $49.25. Because no performance share awards vested, the intrinsic value is $0.0 million for the three months ended March 31, 2006.

The following is a summary of activity for the nonvested performance share awards:

| | Number of

performance share

awards | | Weighted-average

grant-date fair value | |

| | (in millions) | | | |

Nonvested performance share awards at January 1, 2006 | | ¾ | | $ | — | |

Granted | | 0.8 | | 49.25 | |

Vested | | ¾ | | ¾ | |

Forfeited | | ¾ | | ¾ | |

Nonvested performance share awards at March 31, 2006 | | 0.8 | | $ | 49.25 | |

Restricted Stock Units

We issue restricted stock units under the 2005 Directors Stock Plan, Directors Stock Plan, 2005 Stock Incentive Plan, and Stock Incentive Plan. Restricted stock units are treated as an equity award. The fair value of restricted stock units is determined based on the closing stock price of our common shares on the grant date. There is no maximum contractual term on these awards.

Restricted stock units were issued to certain employees and agents pursuant to the Stock Incentive Plan and 2005 Stock Incentive Plan. Under these plans, awards have a graded or cliff vesting over a three-year service period. When service for the Company ceases, all vesting stops and unvested units are forfeited.

Beginning in 2005, pursuant to the 2005 Directors Stock Plan, restricted stock units are now granted to each director in office immediately following each annual meeting of stockholders and to each person who becomes a member of the Board other than on the date of the annual meeting of stockholders. Prior to this time, awards of restricted stock units were granted pursuant to the Directors Stock Plan on the date of each Board member’s election or re-election date. Under the 2005 Directors Stock Plan, awards are granted on an annual basis and cliff vest over the one-year service period. Non-vested awards under the prior plan have graded vesting over a three-year service period. When service to the Company ceases, all vesting stops and unvested units are forfeited.

20

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

8. Stock-Based Compensation Plans (continued)

For the three months ended March 31, 2006 and 2005, 0.2 million and 0.4 million restricted stock units were granted, respectively. The weighted-average grant-date fair value of restricted stock units granted during the three months ended March 31, 2006 and 2005 was $49.23 and $39.02, respectively.

As of March 31, 2006, there were $19.5 million of total unrecognized compensation costs related to nonvested restricted stock unit awards granted under these plans. The cost is expected to be recognized over a weighted-average period of approximately 2 years. The total intrinsic value of restricted stock units vested during the three months ended March 31, 2006 and 2005 was $3.4 million and $0.9 million, respectively.

The following is a summary of activity for the nonvested restricted stock units:

| | Number of

restricted stock

units | | Weighted-average

grant-date fair value | |

| | (in millions) | | | |

Nonvested restricted stock units at January 1, 2006 | | 0.9 | | $ | 36.71 | |

Granted | | 0.2 | | 49.23 | |

Vested | | 0.1 | | 37.28 | |

Forfeited | | — | | 39.16 | |

Nonvested restricted stock units at March 31, 2006 | | 1.0 | | $ | 39.04 | |

Employee Stock Purchase Plan

Under our Employee Stock Purchase Plan, participating employees have the opportunity to purchase shares of our common stock on a quarterly basis. Employees may purchase up to $25,000 worth of company stock each year. Employees may purchase shares of our common stock at a price equal to 85% of the shares’ fair market value as of the beginning or end of the quarter, whichever is lower. Under the Employee Stock Purchase Plan, employees purchased 0.3 million shares during the three months ended March 31, 2006 and 2005.

We recognize compensation expense for the fair value of the 15% discount granted to employees participating in the employee stock purchase plan in the quarter of grant. Shares of the Employee Stock Purchase Plan are treated as an equity award. The weighted-average fair value of stock purchased during the three months ended March 31, 2006 and 2005 was $8.23 and $5.77, respectively. The total intrinsic value of the Employee Stock Purchase Plan settled during the three months ended March 31, 2006 and 2005 was $2.2 million and $1.6 million, respectively.

The maximum number of shares of common stock that we may issue under the Employee Stock Purchase Plan is 2% of the number of shares outstanding immediately following the completion of the Initial Public Offering. As of March 31, 2006, a total of 3.7 million of new shares are available to be made issuable by us for this plan.

21

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

8. Stock-Based Compensation Plans (continued)

Long-Term Performance Plan

We also maintain the Long-Term Performance Plan, which provides the opportunity for eligible executives to receive additional awards if specified minimum corporate performance objectives are achieved over a three-year period. This plan utilizes stock as an option for payment and is treated as a liability award during vesting and a liability award or equity award subsequent to vesting, based on the participant payment election. Effective with stockholder approval of the 2005 Stock Incentive Plan, no further grants will be made under the Long-Term Performance Plan, and any future awards earned under the Long-Term Performance Plan will be issued under the 2005 Stock Incentive Plan. As of the year ended December 31, 2005, all awards under this plan were fully vested and no awards were granted under this plan in 2006 or 2005. There is no maximum contractual term on these awards.

The amount of cash used to settle Long-Term Performance Plan units granted was $10.6 million and $6.1 million for the three months ended March 31, 2006 and 2005, respectively. The total intrinsic value of Long-Term Performance Plan units settled during the three months ended March 31, 2006 and 2005 was $11.1 million and $6.3 million, respectively.

The fair value of Long-Term Performance Plan liability units is determined as of each reporting period based on the Black-Scholes option pricing model that uses the assumptions noted in the following table:

Long-Term Performance Plan | | For the three

months ended

March 31,

2006 | |

Dividend yield | | — | % |

Expected volatility | | 12.3 | % |

Risk-free interest rate | | 4.7 | % |

Expected life (in years) | | 3 | |

Stock Appreciation Rights

In 2004 and 2003, stock appreciation rights were issued to agents meeting certain production requirements. Since our stock appreciation rights settle in cash, they are treated as a liability award and have graded vesting over a three-year-period. The maximum contractual term is ten years. There were no stock appreciation rights granted during the three months ended March 31, 2006 and 2005, respectively. The amount of cash used to settle stock appreciation rights granted was $0.1 million and $0.0 million for the three months ended March 31, 2006 and 2005, respectively.

The fair value of each stock appreciation right is estimated for each reporting period using the Black-Scholes option pricing model that uses the assumptions noted in the following table. Expected volatilities are based on historical volatility of our stock and other factors. We use historical data and other factors to estimate exercise and employee termination within the valuation model. The expected term of stock appreciation rights granted represents the period of time that stock appreciation rights granted are expected to be outstanding. The risk-free rate for periods within the expected life of the option is based on the U.S. Treasury risk free interest rate in effect at the time of measurement.

22

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

8. Stock-Based Compensation Plans (continued)

The following is a summary of assumptions for the stock appreciation rights:

Stock Appreciation Rights | | For the three

months ended

March 31,

2006 | |

Dividend yield | | 1.31 | % |

Expected volatility | | 14.3 | % |

Risk-free interest rate | | 4.7 | % |

Expected life (in years) | | 4 | |

As of March 31, 2006, there were $0.0 million of total unrecognized compensation costs related to nonvested stock appreciation rights awards granted under these plans. The weighted-average estimated fair value of stock appreciation rights outstanding during the three months ended March 31, 2006, using the Black-Scholes option valuation model was $20.25 per share. For periods prior to adoption of SFAS 123R, we valued stock appreciation rights using the intrinsic value method. The total intrinsic value of stock appreciation rights exercised during the three months ended March 31, 2006 and 2005 was $0.1 million and $0.0 million, respectively.

9. Earnings Per Common Share

The computations of the basic and diluted per share amounts for our continuing operations were as follows:

| | For three months ended | |

| | March 31, | |

| | 2006 | | 2005 | |

| | (in millions, except

per share data) | |

Income from continuing operations, net of related income taxes | | $ | 293.9 | | $ | 204.9 | |

Subtract: | | | | | |

Preferred stock dividends | | 8.2 | | — | |

Income from continuing operations available to common stockholders, net of related income taxes | | $ | 285.7 | | $ | 204.9 | |

Weighted-average shares outstanding: | | | | | |

Basic | | 279.4 | | 299.5 | |

Dilutive effects: | | | | | |

Stock options | | 1.9 | | 1.4 | |

Restricted stock units | | 0.6 | | 0.3 | |

Diluted | | 281.9 | | 301.2 | |

Income from continuing operations per common share: | | | | | |

Basic | | $ | 1.02 | | $ | 0.68 | |

Diluted | | $ | 1.01 | | $ | 0.68 | |

| | | | | | | | |

23

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

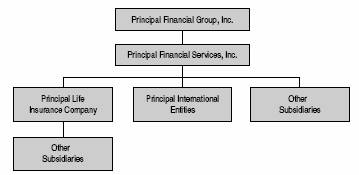

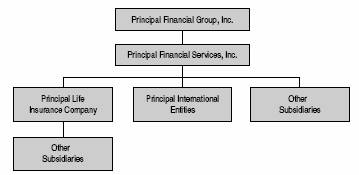

10. Condensed Consolidating Financial Information

Principal Life has established special purpose entities to issue secured medium-term notes. Under the program, the payment obligations of principal and interest on the notes are secured by funding agreements issued by Principal Life. Principal Life’s payment obligations on the funding agreements are fully and unconditionally guaranteed by Principal Financial Group, Inc. All of the outstanding stock of Principal Life is indirectly owned by Principal Financial Group, Inc. and Principal Financial Group, Inc. is the only guarantor of the payment obligations of the funding agreements.

We received a subpoena on March 31, 2005 from the Attorney General of West Virginia for documents and other information relating to funding agreement-backed securities, special purpose vehicles related to funding agreement-backed securities, and related subjects. A response has been sent. We understand that other U.S.-based life insurers that have funding agreement-backed note programs such as our on-going programs have received similar subpoenas from the Attorney General of West Virginia. Other than the subpoena, we have received no notification of any pending or threatened investigation or other proceeding by West Virginia governmental authorities involving funding agreement-backed securities.

The following tables set forth condensed consolidating financial information of Principal Life and Principal Financial Group, Inc. as of March 31, 2006 and December 31, 2005, and for the three months ended March 31, 2006 and 2005.

24

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

10. Condensed Consolidating Financial Information (continued)

Condensed Consolidating Statements of Financial Position

March 31, 2006

| | Principal

Financial

Group, Inc.

Parent Only | | Principal Life

Insurance

Company

Only | | Principal Financial

Services, Inc. and

Other Subsidiaries

Combined | | Eliminations | | Principal

Financial

Group, Inc.

Consolidated | |

| | (in millions) | |

Assets | | | | | | | | | | | |

Fixed maturities, available-for-sale | | $ | — | | $ | 39,077.6 | | $ | 4,196.0 | | $ | (757.2 | ) | $ | 42,516.4 | |

Fixed maturities, trading | | — | | 29.2 | | 136.6 | | ¾ | | 165.8 | |

Equity securities, available-for-sale | | — | | 647.7 | | 74.7 | | ¾ | | 722.4 | |

Equity securities, trading | | — | | 9.6 | | 86.0 | | ¾ | | 95.6 | |

Mortgage loans | | — | | 9,431.4 | | 2,227.9 | | (332.6 | ) | 11,326.7 | |

Real estate | | — | | 425.0 | | 584.8 | | — | | 1,009.8 | |

Policy loans | | — | | 838.0 | | — | | — | | 838.0 | |

Investment in unconsolidated entities | | 7,054.1 | | 303.5 | | 4,787.1 | | (11,840.8 | ) | 303.9 | |

Other investments | | 10.0 | | 2,290.1 | | 123.3 | | (1,527.5 | ) | 895.9 | |

Cash and cash equivalents | | 112.3 | | 888.5 | | 640.5 | | (33.1 | ) | 1,608.2 | |

Accrued investment income | | — | | 647.5 | | 58.1 | | (5.5 | ) | 700.1 | |

Premiums due and other receivables | | 425.0 | | 660.0 | | 124.5 | | (535.9 | ) | 673.6 | |

Deferred policy acquisition costs | | — | | 2,195.7 | | 112.4 | | — | | 2,308.1 | |

Property and equipment | | — | | 398.5 | | 22.1 | | — | | 420.6 | |

Goodwill | | — | | 77.2 | | 222.0 | | — | | 299.2 | |

Other intangibles | | — | | 39.2 | | 170.1 | | — | | 209.3 | |

Separate account assets | | — | | 62,834.1 | | 3,516.2 | | (6.9 | ) | 66,343.4 | |

Other assets | | — | | 1,090.1 | | 226.2 | | (221.2 | ) | 1,537.5 | |

Total assets | | $ | 7,601.4 | | $ | 121,882.9 | | $ | 17,308.5 | | $ | (14,818.3 | ) | $ | 131,974.5 | |

Liabilities | | | | | | | | | | | |

Contractholder funds | | $ | — | | $ | 34,737.2 | | $ | 13.9 | | $ | (198.8 | ) | $ | 34,552.3 | |

Future policy benefits and claims | | — | | 14,718.7 | | 2,175.6 | | — | | 16,894.3 | |

Other policyholder funds | | — | | 649.9 | | 3.4 | | — | | 653.3 | |

Short-term debt | | — | | 147.6 | | 337.3 | | (88.5 | ) | 396.4 | |

Long-term debt | | — | | 247.5 | | 1,305.2 | | (659.1 | ) | 893.6 | |

Income taxes currently payable | | (1.7 | ) | (303.4 | ) | 24.9 | | 280.7 | | 0.5 | |

Deferred income taxes | | 2.4 | | 483.2 | | 222.8 | | 3.2 | | 711.6 | |

Separate account liabilities | | — | | 62,834.1 | | 3,516.2 | | (6.9 | ) | 66,343.4 | |

Other liabilities | | 2.0 | | 1,829.4 | | 2,655.1 | | (556.1 | ) | 3,930.4 | |

Total liabilities | | 2.7 | | 115,344.2 | | 10,254.4 | | (1,225.5 | ) | 124,375.8 | |

Stockholders’ equity | | | | | | | | | | | |

Series A preferred stock | | — | | — | | — | | — | | — | |

Series B preferred stock | | 0.1 | | — | | — | | — | | 0.1 | |

Common stock | | 3.8 | | 2.5 | | — | | (2.5 | ) | 3.8 | |

Additional paid-in capital | | 8,024.8 | | 5,365.1 | | 7,082.8 | | (12,447.9 | ) | 8,024.8 | |

Retained earnings (deficit) | | 2,294.3 | | 720.7 | | (661.5 | ) | (59.2 | ) | 2,294.3 | |

Accumulated other comprehensive income | | 639.3 | | 450.4 | | 632.8 | | (1,083.2 | ) | 639.3 | |

Treasury stock, at cost | | (3,363.6 | ) | — | | — | | — | | (3,363.6 | ) |

Total stockholders’ equity | | 7,598.7 | | 6,538.7 | | 7,054.1 | | (13,592.8 | ) | 7,598.7 | |

Total liabilities and stockholders’ equity | | $ | 7,601.4 | | $ | 121,882.9 | | $ | 17,308.5 | | $ | (14,818.3 | ) | $ | 131,974.5 | |

25

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

10. Condensed Consolidating Financial Information (continued)

Condensed Consolidating Statements of Financial Position

December 31, 2005

| | Principal

Financial

Group, Inc.

Parent Only | | Principal Life

Insurance

Company

Only | | Principal Financial

Services, Inc. and

Other Subsidiaries

Combined | | Eliminations | | Principal

Financial

Group, Inc.

Consolidated | |

| | (in millions) | |

Assets | | | | | | | | | | | |

Fixed maturities, available-for-sale | | $ | — | | $ | 38,886.6 | | $ | 3,896.5 | | $ | (665.9 | ) | $ | 42,117.2 | |

Fixed maturities, trading | | — | | 18.9 | | 94.3 | | ¾ | | 113.2 | |

Equity securities, available-for-sale | | — | | 658.8 | | 65.6 | | ¾ | | 724.4 | |

Equity securities, trading | | — | | — | | 90.3 | | ¾ | | 90.3 | |

Mortgage loans | | — | | 9,448.9 | | 2,365.5 | | (330.1 | ) | 11,484.3 | |

Real estate | | — | | 412.8 | | 586.6 | | — | | 999.4 | |

Policy loans | | — | | 827.7 | | — | | — | | 827.7 | |

Investment in unconsolidated entities | | 7,784.2 | | 275.6 | | 5,515.1 | | (13,311.0 | ) | 263.9 | |

Other investments | | — | | 2,041.8 | | 129.6 | | (1,321.8 | ) | 849.6 | |

Cash and cash equivalents | | 21.6 | | 1,261.9 | | 542.3 | | (184.5 | ) | 1,641.3 | |

Accrued investment income | | — | | 638.8 | | 48.5 | | (4.6 | ) | 682.7 | |

Premiums due and other receivables | | — | | 589.2 | | 112.7 | | (109.2 | ) | 592.7 | |

Deferred policy acquisition costs | | — | | 2,069.9 | | 104.2 | | — | | 2,174.1 | |

Property and equipment | | — | | 397.2 | | 22.6 | | — | | 419.8 | |

Goodwill | | — | | 50.4 | | 231.9 | | — | | 282.3 | |

Other intangibles | | — | | 39.2 | | 163.4 | | — | | 202.6 | |

Separate account assets | | — | | 58,670.7 | | 3,415.5 | | (16.2 | ) | 62,070.0 | |

Other assets | | 3.5 | | 1,361.4 | | 258.1 | | (123.1 | ) | 1,499.9 | |

Total assets | | $ | 7,809.3 | | $ | 117,649.8 | | $ | 17,642.7 | | $ | (16,066.4 | ) | $ | 127,035.4 | |

Liabilities | | | | | | | | | | | |

Contractholder funds | | $ | — | | $ | 33,797.0 | | $ | 13.5 | | $ | (198.4 | ) | $ | 33,612.1 | |

Future policy benefits and claims | | — | | 14,650.3 | | 2,175.2 | | — | | 16,825.5 | |

Other policyholder funds | | — | | 654.1 | | 3.0 | | — | | 657.1 | |

Short-term debt | | — | | — | | 565.6 | | (89.2 | ) | 476.4 | |

Long-term debt | | — | | 241.9 | | 1,223.9 | | (567.0 | ) | 898.8 | |

Income taxes currently payable | | — | | — | | 0.3 | | (0.3 | ) | — | |

Deferred income taxes | | — | | 753.1 | | 237.1 | | (15.4 | ) | 974.8 | |

Separate account liabilities | | — | | 58,670.7 | | 3,415.5 | | (16.2 | ) | 62,070.0 | |

Other liabilities | | 2.1 | | 1,800.1 | | 2,224.4 | | (313.1 | ) | 3,713.5 | |

Total liabilities | | 2.1 | | 110,567.2 | | 9,858.5 | | (1,199.6 | ) | 119,228.2 | |

Stockholders’ equity | | | | | | | | | | | |

Series A preferred stock | | ¾ | | — | | — | | — | | ¾ | |

Serice B preferred stock | | 0.1 | | — | | — | | — | | 0.1 | |

Common stock | | 3.8 | | 2.5 | | — | | (2.5 | ) | 3.8 | |

Additional paid-in capital | | 8,000.0 | | 5,354.8 | | 7,071.3 | | (12,426.1 | ) | 8,000.0 | |

Retained earnings (deficit) | | 2,008.6 | | 870.4 | | (281.9 | ) | (588.5 | ) | 2,008.6 | |

Accumulated other comprehensive income | | 994.8 | | 854.9 | | 994.8 | | (1,849.7 | ) | 994.8 | |

Treasury stock, at cost | | (3,200.1 | ) | — | | — | | — | | (3,200.1 | ) |

Total stockholders’ equity | | 7,807.2 | | 7,082.6 | | 7,784.2 | | (14,866.8 | ) | 7,807.2 | |

Total liabilities and stockholders’ equity | | $ | 7,809.3 | | $ | 117,649.8 | | $ | 17,642.7 | | $ | (16,066.4 | ) | $ | 127,035.4 | |

26

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

10. Condensed Consolidating Financial Information (continued)

Condensed Consolidating Statements of Operations

For the three months ended March 31, 2006

| | Principal

Financial

Group, Inc.

Parent Only | | Principal Life

Insurance

Company

Only | | Principal

Financial

Services, Inc. and

Other

Subsidiaries

Combined | | Eliminations | | Principal

Financial

Group, Inc.

Consolidated | |

| | (in millions) | |

Revenues | | | | | | | | | | | |

Premiums and other considerations | | $ | — | | $ | 967.2 | | $ | 74.6 | | $ | — | | $ | 1,041.8 | |

Fees and other revenues | | — | | 312.8 | | 204.9 | | (68.9 | ) | 448.8 | |

Net investment income | | 0.3 | | 769.2 | | 88.9 | | (6.2 | ) | 852.2 | |

Net realized/unrealized capital gains | | — | | — | | 49.3 | | (0.4 | ) | 48.9 | |

Total revenues | | 0.3 | | 2,049.2 | | 417.7 | | (75.5 | ) | 2,391.7 | |

Expenses | | | | | | | | | | | |

Benefits, claims, and settlement expenses | | — | | 1,249.4 | | 95.6 | | (3.2 | ) | 1,341.8 | |

Dividends to policyholders | | — | | 71.9 | | — | | — | | 71.9 | |

Operating expenses | | 2.7 | | 466.9 | | 193.2 | | (58.4 | ) | 604.4 | |

Total expenses | | 2.7 | | 1,788.2 | | 288.8 | | (61.6 | ) | 2,018.1 | |

| | | | | | | | | | | |

Income (loss) from continuing operations before income taxes | | (2.4 | ) | 261.0 | | 128.9 | | (13.9 | ) | 373.6 | |

| | | | | | | | | | | |

Income taxes (benefits) | | (0.9 | ) | 49.1 | | 31.9 | | (0.4 | ) | 79.7 | |

Equity in the net income of subsidiaries | | 295.4 | | 63.3 | | 198.4 | | (557.1 | ) | — | |

| | | | | | | | | | | |

Net income | | 293.9 | | 275.2 | | 295.4 | | (570.6 | ) | 293.9 | |

Preferred stock dividends | | 8.2 | | — | | — | | — | | 8.2 | |

Net income available to common stockholders | | $ | 285.7 | | $ | 275.2 | | $ | 295.4 | | $ | (570.6 | ) | $ | 285.7 | |

27

Principal Financial Group, Inc.

Notes to Consolidated Financial Statements (continued)

March 31, 2006

(Unaudited)

10. Condensed Consolidating Financial Information (continued)

Condensed Consolidating Statements of Operations

For the three months ended March 31, 2005

| | Principal

Financial

Group, Inc.

Parent Only | | Principal Life

Insurance

Company

Only | | Principal Financial

Services, Inc. and

Other

Subsidiaries

Combined | | Eliminations | | Principal

Financial

Group, Inc.

Consolidated | |

| | (in millions) | |

Revenues | | | | | | | | | | | |

Premiums and other considerations | | $ | — | | $ | 846.7 | | $ | 87.4 | | $ | — | | $ | 934.1 | |

Fees and other revenues | | — | | 286.3 | | 194.5 | | (63.6 | ) | 417.2 | |

Net investment income | | 0.6 | | 738.6 | | 50.8 | | 3.9 | | 793.9 | |

Net realized/unrealized capital losses | | — | | (1.7 | ) | (0.1 | ) | 0.3 | | (1.5 | ) |

Total revenues | | 0.6 | | 1,869.9 | | 332.6 | | (59.4 | ) | 2,143.7 | |

Expenses | | | | | | | | | | | |

Benefits, claims, and settlement expenses | | — | | 1,139.9 | | 97.1 | | (2.7 | ) | 1,234.3 | |

Dividends to policyholders | | — | | 72.9 | | — | | — | | 72.9 | |

Operating expenses | | 3.0 | | 425.6 | | 184.1 | | (55.8 | ) | 556.9 | |

Total expenses | | 3.0 | | 1,638.4 | | 281.2 | | (58.5 | ) | 1,864.1 | |

| | | | | | | | | | | |